united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21720

Northern Lights Fund Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Eric Kane, Gemini Fund Services, LLC.

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 12/31

Date of reporting period: 12/31/21

Amended to correct the dates after the signatures on the initial filing. There is no change to the financial statements and no impact to the documents made available to shareholders.

Item 1. Reports to Stockholders.

Dear Fellow Shareholders:

Happy New Year! As we turn the page on the calendar, we once again reflect on a year that presented many challenges. Yet, except for a few brief sell-offs, the stock market turned in a solid performance in 2021. The S&P 500 gained 28.71% for the year. The Dow Jones Industrial Average (DJIA) gained 20.95% in 2021, while the Nasdaq Composite gained 21.4%. The Biondo Focus Fund had a very weak second half and finished the year up 6.32%. This return is after the reduction of fees.

Over the course of the year, it is our opinion that investors brushed off news that could have derailed stocks in years past. A contested presidential election, historically high inflation, supply chain disruptions, forecasts calling for a correction (that never appeared) — none of these events stopped stocks from posting all-time highs. Not even the still-raging global COVID-19 pandemic, or its Delta and Omicron variants.

In fact, the S&P 500 posted 70 all-time highs in 2021, a record that’s second only to 1995. The 2021 market was bifurcated with an initial surge in some high-flying growth stocks, but then many of those names fell hard, and some of the big-cap names in the S&P 500 turned in super-charged performances. Cyclically sensitive stocks strongly outpaced more economically defensive ones. Oil and other commodity prices surged. Energy was the top performer of the major sectors in 2021, up 48%, its best increase ever.

The Fund underperformed in the face of the COVID-19 pandemic due to stock selection and sector weightings. The Fund has an overweight position in technology as well as healthcare, and little to no exposure to areas such as energy, real estate and financials. The market saw significant money flows into those stocks, as part of the reflation trade, as the pandemic eased off during the summer months. Later in the year, as the Omicron variant took root, asset flows trended significantly toward more safe haven sectors of the equity markets. The Fund has limited exposure to these areas.

We believe the Fund benefited from strong performances from a few of our holdings, such as Apple, Alphabet and SVB Financial. The major detractors from performance were Reata Pharmaceuticals, Block (formerly Square), Iovance Biotherapeutics and Exact Sciences. Reata Pharmaceuticals was down significantly due to negative drug trial data from its main drug. Block traded down along with many other financial technology stocks. Iovance Biotherapeutics suffered from poor drug trial results and delays, and Exact Sciences felt COVID’s impact on hospital visits. Derivative activity had some positive impact on performance, as the Fund held options positions in Boeing and Abiomed.

Significant purchases in the year include Teladoc Health, a leading telehealth company, NVIDIA, a maker of graphic processors, Moderna, a biopharmaceutical company focusing on MRNA medicines, BioCryst Pharmaceuticals, a biopharmaceutical company that makes novel medicines for a variety of diseases, Shopify, a leading e-commerce platform, and ShockWave Medical, a medical device company focusing on cardiovascular indications. We also sold positions in several companies, including SalesForce.com, Alibaba Group, Vertex Pharmaceuticals, ServiceNow, Boeing and Reata Pharmaceuticals.

In our opinion, the very robust economic recovery gave investors a big reason to remain optimistic. There has been a really strong fundamental story unfolding from a macroeconomic perspective. With the economic expansion, as well as the bull market, only being a few months old when 2021 began, the market’s performance isn’t so surprising - and could very well continue.

1

The labor market recovery has been particularly notable. Since April 2020, the US has added 18.5 million nonfarm jobs, and the number of people filing for unemployment claims has recently reached a 52-year low. Dynamics have also swung in favor of workers over their employers, which has emboldened millions of workers to quit their jobs at unprecedented rates, or demand higher wages. Upward economic mobility has long been at the heart of the “American Dream” and has returned with a vengeance.

The stock market in 2021 also benefited from a very accommodative Federal Reserve. Throughout the year, the Fed kept interest rates near zero and continued pumping billions of dollars into markets each month. This not only encouraged investors to seek out assets with higher returns, like stocks, but also contributed to higher inflation.

It was indeed inflation, and its potential impact on economic growth and the stock market, that was one of the biggest stories of 2021. The year ended with the Consumer Price Index (CPI) rising at the fastest pace since the early 1980s, meaning that it’s likely the first time that many consumers and investors have dealt with this type of inflation.

Investors are keenly aware that the Fed’s support will undoubtedly come to an end. The big question on Wall Street for much of 2021 was when that would ultimately happen. The Fed has indicated plans to increase the fed funds rate at least three times in the new year to temper inflation. This could happen as early as March, and would be the Fed’s first rate hike since 2018. As the Fed eases up its support, investors may once again focus more on whether the fundamentals that drive stock prices—the pace of economic growth and corporate earnings— can support another year of double-digit gains.

From our perspective as portfolio managers, we are focused on whether a major shift in sentiment is occurring. Particularly, whether growth stocks will finally take a back seat to more value names. As we write, a major selloff has been in play, with growth stocks in the crosshairs. The NASDAQ, which is predominately made up of high-growth tech stocks, has started the year with a significant decline. The “Santa Claus” rally, that saw tech stocks rally the last few days of 2021, has quickly reversed itself to start 2022.

This rotation out of higher valuation growth stocks began late in the third quarter of 2021, and persisted through the fourth quarter. Much of this was driven by a compression in valuation as interest rates rose, the Fed signaling a much tougher stance on its accommodative policies for 2022, and market participants’ fears of higher inflation, which further impacts interest rates.

From a technical analysis perspective, we have seen the relative performance of value improve dramatically relative to growth. This is evident when comparing the relative performance of certain sectors – such as regional banks (value) versus technology software (growth) or in analyzing the Russell 1000 Value Index relative to the Russell 1000 Growth Index. While this relative outperformance began in September of 2020, it accelerated during the fourth quarter of 2021 and appears to be persistent.

Many different arguments can be made for value outperforming growth going forward, but the simplest may also be the most valid – a cyclical reversion to the mean. Growth has outperformed value over the last 10 years or so, during this unprecedented run of ultra-low interest rates. The biggest headwind to value’s performance has been the Fed’s Quantitative Easing and falling interest rates, but during periods of rising rates, value generally has outperformed. When rising inflation expectations are added to the mix, the signal for value outperformance is more compelling.

2

A few sectors have been showing a positive relative trend. Energy, basic materials, transports, and some financials, in particular, have been trending positive. These are all cyclical groups, and also have general positive exposure to reflationary trends. Inflation, incidentally, in isolation, is not a bad word. The real risk to markets is too much inflation hurting consumer confidence, or producing fear of uncontained inflation. This is not necessarily what markets seem to be pricing. If markets were worried about either of the above, defensive sectors and/or growth stocks would be leading. Instead, we are seeing cyclicals lead.

We believe it is important to consider these factors over the long term. Market dynamics, such as a major sector rotation, don’t happen overnight. They produce many ups and downs and false starts. The expectations of a first interest rate cut during a tightening cycle usually creates waves, but don’t often indicate a discernible trend.

We appreciate the trust and confidence that you have placed in our firm and wish you great health and prosperity in 2022.

Very Truly Yours,

|  |  |

| Scott A. Goginsky | Joseph P. Biondo | Joseph R. Biondo |

| Partner | Chief Executive Officer | Founder |

| Research Analyst | Chief Investment Officer | Senior Portfolio Manager |

| Portfolio Manager | Portfolio Manager |

Sources: Index returns – Forbes, Bloomberg; Fund returns – Gemini Fund Svcs, Bloomberg; Sector performance – CNBC; Labor market, CPI – Forbes; Growth vs. value – JP Morgan

Past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end is available by calling 877-BIONDOS.

6124-NLD-01282022

3

The Biondo Focus Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

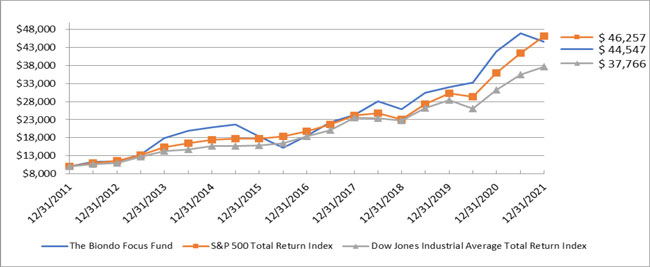

The Fund’s performance figures* for the periods ended December 31, 2021, compared to its benchmarks:

| Annualized | ||||

| Inception**- | ||||

| One | Annualized | Annualized | December 31, | |

| Year | Five Year | Ten Year | 2021 | |

| The Biondo Focus Fund - Investor Shares | 6.32% | 19.14% | 16.11% | 11.09% |

| Dow Jones Industrial Average Total Return Index | 20.95% | 15.51% | 14.21% | 13.62% |

| S&P 500 Total Return Index | 28.71% | 18.47% | 16.55% | 14.96% |

Comparison of the Change in Value of a $10,000 Investment ***

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Per the fee table in the Fund’s April 30, 2021 prospectus, the Fund’s total annual operating expense ratio before waivers is 1.67%. Shares redeemed within 30 days of purchase are subject to a redemption fee of 2.00%. For performance information current to the most recent month-end, please call 1-800-672-9152. |

| ** | Inception date is March 17, 2010. |

The Dow Jones Industrial Average Total Return Index represents large and well-known U.S. companies and covers all industries with the exception of Transportation and Utilities. Investors cannot invest directly in an index.

The S&P 500 Total Return Index is an unmanaged capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregated market value of the 500 stocks representing all major industries. Investors cannot invest directly in an index.

| *** | The Fund’s fiscal year end changed from January 31 to December 31, effective February 1, 2012. |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

4

The Biondo Focus Fund

PORTFOLIO REVIEW (Unaudited) (Continued)

December 31, 2021

The Fund’s top ten holdings by sector are as follows, as of December 31, 2021:

| Sectors | % of Net Assets | |||

| Medical Equipment & Devices | 33.7 | % | ||

| Technology Services | 12.9 | % | ||

| Technology Hardware | 12.7 | % | ||

| Software | 11.5 | % | ||

| Banking | 4.8 | % | ||

| Internet Media & Services | 4.8 | % | ||

| Biotech & Pharma | 4.7 | % | ||

| E-Commerce Discretionary | 4.4 | % | ||

| Retail - Discretionary | 3.9 | % | ||

| Semiconductors | 3.1 | % | ||

| Other, Cash & Cash Equivalents | 3.5 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

5

| BIONDO FOCUS FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 97.1% | ||||||||

| BANKING - 4.8% | ||||||||

| 5,375 | SVB Financial Group(a) | $ | 3,645,540 | |||||

| BIOTECH & PHARMA - 4.7% | ||||||||

| 90,000 | BioCryst Pharmaceuticals, Inc.(a) | 1,246,500 | ||||||

| 55,000 | Iovance Biotherapeutics, Inc.(a) | 1,049,950 | ||||||

| 5,000 | Moderna, Inc.(a) | 1,269,900 | ||||||

| 3,566,350 | ||||||||

| E-COMMERCE DISCRETIONARY - 4.4% | ||||||||

| 1,000 | Amazon.com, Inc.(a) | 3,334,340 | ||||||

| HEALTH CARE FACILITIES & SERVICES - 0.6% | ||||||||

| 5,000 | Teladoc Health, Inc.(a) | 459,100 | ||||||

| INTERNET MEDIA & SERVICES - 4.8% | ||||||||

| 1,250 | Alphabet, Inc., Class A(a) | 3,621,300 | ||||||

| MEDICAL EQUIPMENT & DEVICES - 33.7% | ||||||||

| 20,000 | ABIOMED, Inc.(a) | 7,183,400 | ||||||

| 28,200 | Edwards Lifesciences Corporation(a) | 3,653,310 | ||||||

| 20,000 | Exact Sciences Corporation(a) | 1,556,600 | ||||||

| 9,500 | Illumina, Inc.(a) (d) | 3,614,180 | ||||||

| 22,500 | Intuitive Surgical, Inc.(a) (d) | 8,084,250 | ||||||

| 7,500 | Shockwave Medical, Inc.(a) | 1,337,475 | ||||||

| 25,429,215 | ||||||||

| RETAIL - DISCRETIONARY - 3.9% | ||||||||

| 200,000 | Bed Bath & Beyond, Inc.(a) | 2,916,000 | ||||||

| SEMICONDUCTORS - 3.1% | ||||||||

| 8,000 | NVIDIA Corporation | 2,352,880 | ||||||

| SOFTWARE - 11.5% | ||||||||

| 6,500 | Adobe, Inc.(a) | 3,685,890 | ||||||

| 9,500 | Atlassian Corp plc, Class A(a) | 3,622,255 | ||||||

6

| BIONDO FOCUS FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | Fair Value | |||||||||||||||||

| COMMON STOCKS — 97.1% (Continued) | ||||||||||||||||||

| SOFTWARE - 11.5% (Continued) | ||||||||||||||||||

| 1,000 | Shopify, Inc., Class A(a) | $ | 1,377,390 | |||||||||||||||

| 8,685,535 | ||||||||||||||||||

| TECHNOLOGY HARDWARE - 12.7% | ||||||||||||||||||

| 54,000 | Apple, Inc. (d) | 9,588,780 | ||||||||||||||||

| TECHNOLOGY SERVICES - 12.9% | ||||||||||||||||||

| 27,500 | Block, Inc., Class A (a) | 4,441,525 | ||||||||||||||||

| 15,000 | Mastercard, Inc., Class A (d) | 5,389,800 | ||||||||||||||||

| 9,831,325 | ||||||||||||||||||

| TOTAL COMMON STOCKS (Cost $28,627,938) | 73,430,365 | |||||||||||||||||

| SHORT-TERM INVESTMENTS — 1.4% | ||||||||||||||||||

| MONEY MARKET FUNDS - 1.4% | ||||||||||||||||||

| 1,058,544 | First American Treasury Obligations Fund, Class X, 0.01% (Cost $1,058,544)(b) | 1,058,544 | ||||||||||||||||

| Contracts(c) | Expiration Date | Exercise Price | Notional Value | |||||||||||||||

| EQUITY OPTIONS PURCHASED - 1.1% | ||||||||||||||||||

| CALL OPTIONS PURCHASED - 1.1% | ||||||||||||||||||

| 40 | ABIOMED, Inc. | 01/21/2022 | $ | 150 | $ | 600,000 | 837,000 | |||||||||||

| TOTAL CALL OPTIONS PURCHASED (Cost - $188,082) | ||||||||||||||||||

| TOTAL INVESTMENTS - 99.6% (Cost $29,874,564) | $ | 75,325,909 | ||||||||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES- 0.4% | 340,120 | |||||||||||||||||

| NET ASSETS - 100.0% | $ | 75,666,029 | ||||||||||||||||

PLC Public Limited Company

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

| (c) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

| (d) | All or portion of the security is pledged as collateral for the line of credit. Total value pledged securities at December 31, 2021 is $16,735,265. See Note 6. |

See accompanying notes which are an integral part of these financial statements.

7

| The Biondo Focus Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2021 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 29,874,564 | ||

| At value | $ | 75,325,909 | ||

| Receivable for Fund shares sold | 11,543 | |||

| Receivable for investments sold | 428,059 | |||

| Dividends and interest receivable | 11 | |||

| Prepaid expenses & other assets | 15,492 | |||

| TOTAL ASSETS | 75,781,014 | |||

| LIABILITIES | ||||

| Payable for Fund shares redeemed | 1,500 | |||

| Investment advisory fees payable | 55,879 | |||

| Payable to related parties | 17,335 | |||

| Distribution (12b-1) fees payable | 15,918 | |||

| Accrued expenses and other liabilities | 24,353 | |||

| TOTAL LIABILITIES | 114,985 | |||

| NET ASSETS | $ | 75,666,029 | ||

| Net Assets Consist Of: | ||||

| Paid in capital ($0 par value, unlimited shares authorized) | $ | 32,830,166 | ||

| Accumulated earnings | 42,835,863 | |||

| NET ASSETS | $ | 75,666,029 | ||

| Net Asset Value Per Share: | ||||

| Investor Class Shares: | ||||

| Net Assets | $ | 75,666,029 | ||

| Shares of beneficial interest outstanding | 3,288,753 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | $ | 23.01 |

| (a) | Redemptions of shares held less than 30 days may be assessed a redemption fee of 2.00%. |

See accompanying notes which are an integral part of these financial statements.

8

| The Biondo Focus Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2021 |

| INVESTMENT INCOME | ||||

| Dividends | $ | 74,715 | ||

| Interest | 169 | |||

| TOTAL INVESTMENT INCOME | 74,884 | |||

| EXPENSES | ||||

| Investment advisory fees | 790,299 | |||

| Distribution (12b-1) fees - Investor Class | 197,575 | |||

| Administration fees | 102,752 | |||

| Transfer agent fees | 35,040 | |||

| Fund accounting fees | 31,224 | |||

| Compliance officer fees | 20,390 | |||

| Registration fees | 17,506 | |||

| Audit fees | 17,410 | |||

| Trustees’ fees and expenses | 12,816 | |||

| Custody fees | 12,127 | |||

| Legal fees | 11,393 | |||

| Shareholder reporting expense | 7,194 | |||

| Insurance expense | 3,115 | |||

| Other expenses | 1,387 | |||

| TOTAL EXPENSES | 1,260,228 | |||

| Less: Fees waived by the Advisor | (74,752 | ) | ||

| NET EXPENSES | 1,185,476 | |||

| NET INVESTMENT LOSS | (1,110,592 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized gain on transactions from: | ||||

| Investments | 2,348,946 | |||

| Options written | 1,781,006 | |||

| Net realized gain | 4,129,952 | |||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments | 1,857,379 | |||

| Net change in unrealized appreciation (depreciation) | 1,857,379 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 5,987,331 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 4,876,739 |

See accompanying notes which are an integral part of these financial statements.

9

| The Biondo Focus Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| December 31, 2021 | December 31, 2020 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (1,110,592 | ) | $ | (865,589 | ) | ||

| Net realized gain from investments and options written (a) | 4,129,952 | 3,863,878 | ||||||

| Net change in unrealized appreciation (depreciation) of investments and options written (a) | 1,857,379 | 14,906,393 | ||||||

| Net increase in net assets resulting from operations | 4,876,739 | 17,904,682 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total distributions paid | (5,666,914 | ) | (3,784,258 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold | 3,330,630 | 2,886,907 | ||||||

| Net asset value of shares issued in reinvestment of distributions | 5,622,520 | 3,749,113 | ||||||

| Payments for shares redeemed | (8,141,430 | ) | (9,472,194 | ) | ||||

| Redemption fee proceeds | 542 | 742 | ||||||

| Net increase (decrease) in net assets from shares of beneficial interest | 812,262 | (2,835,432 | ) | |||||

| TOTAL INCREASE IN NET ASSETS | 22,087 | 11,284,992 | ||||||

| NET ASSETS | ||||||||

| Beginning of Year | 75,643,942 | 64,358,950 | ||||||

| End of Year | $ | 75,666,029 | $ | 75,643,942 | ||||

| SHARE ACTIVITY - INVESTOR CLASS | ||||||||

| Shares Sold | 134,575 | 150,200 | ||||||

| Shares Reinvested | 239,154 | 169,337 | ||||||

| Shares Redeemed | (324,599 | ) | (490,783 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | 49,130 | (171,246 | ) | |||||

| (a) | Net realized gain from investments and options written and Net change in unrealized appreciation (depreciation) of investments and options written for the year ended December 31, 2020 have been restated. See Note 12 for more information. |

See accompanying notes which are an integral part of these financial statements.

10

| The Biondo Focus Fund |

| FINANCIAL HIGHLIGHTS |

The table sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| Investor Class | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | ||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net asset value, beginning of year | $ | 23.35 | $ | 18.87 | $ | 16.72 | $ | 16.74 | $ | 14.40 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment loss (1) | (0.35 | ) | (0.27 | ) | (0.20 | ) | (0.25 | ) | (0.38 | ) | ||||||||||

| Net realized and unrealized gain on investments and option transactions | 1.86 | 5.98 | 4.11 | 1.37 | (7) | 4.90 | ||||||||||||||

| Total income from investment operations | 1.51 | 5.71 | 3.91 | 1.12 | 4.52 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net realized gains | (1.85 | ) | (1.23 | ) | (1.76 | ) | (1.14 | ) | (2.18 | ) | ||||||||||

| Total distributions | (1.85 | ) | (1.23 | ) | (1.76 | ) | (1.14 | ) | (2.18 | ) | ||||||||||

| Paid-in-Capital from redemption fees (1,2) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net asset value, end of year | $ | 23.01 | $ | 23.35 | $ | 18.87 | $ | 16.72 | $ | 16.74 | ||||||||||

| Total return (3) | 6.32 | % | 30.62 | % | 23.67 | % (5) | 6.47 | % (5) | 31.29 | % (5) | ||||||||||

| Net assets, end of year (in 000s) | $ | 75,666 | $ | 75,644 | $ | 64,359 | $ | 56,495 | $ | 27,336 | ||||||||||

| Ratio of gross expenses to average net assets including interest expense (4) | 1.59 | % | 1.66 | % | 1.65 | % | 1.98 | % | 2.75 | % | ||||||||||

| Ratio of gross expenses to average net assets excluding interest expense (4) | 1.59 | % | 1.66 | % | 1.65 | % | 1.93 | % | 2.45 | % | ||||||||||

| Ratio of net expenses to average net assets including interest expense | 1.50 | % | 1.50 | % | 1.50 | % | 1.78 | % | 2.55 | % | ||||||||||

| Ratio of net expenses to average net assets excluding interest expense | 1.50 | % | 1.50 | % | 1.50 | % | 1.73 | % (6) | 2.25 | % | ||||||||||

| Ratio of net investment loss to average net assets | (1.41 | )% | (1.34 | )% | (1.08 | )% | (1.34 | )% | (2.20 | )% | ||||||||||

| Portfolio turnover rate | 21 | % | 29 | % | 43 | % | 56 | % | 48 | % | ||||||||||

| (1) | Per share amounts calculated using average shares method which appropriately presents the per share data for the period. |

| (2) | Amount represents less than $0.01 per share. |

| (3) | Total return represents aggregate total return based on Net Asset Value. Total returns would have been lower absent waived fees and reimbursed expenses. Total returns are historical in nature and assume changes in share price. The returns shown exclude the effect of applicable redemption fees. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers by the advisor. |

| (5) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently, the net asset value for financial reporting purposes and the returns based upon those net asset may differ from the net asset values and returns for shareholder processing. |

| (6) | Effective June 1, 2018, the expense limitation was reduced to 1.50%. |

| (7) | Net realized and unrealized gain on investments and option transactions does not accord with the amount reported in the Statement of Operations for the year ended December 31, 2018 due to the timing of shareholder subscriptions and redemptions relative to fluctuating net asset values during the year. |

See accompanying notes which are an integral part of these financial statements.

11

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS

December 31, 2021

| 1. | ORGANIZATION |

The Biondo Focus Fund (the “Fund”) is a non-diversified series of shares of beneficial interest of Northern Lights Fund Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on January 19, 2005. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund currently offers Investor Class shares.

The Fund seeks long- term capital appreciation, which it pursues by investing primarily in a combination of long and short positions in (1) common stock of US companies of any capitalization; (2) American Depositary Receipts (“ADRs”) representing common stock of foreign companies; (3) investment grade fixed income securities; (4) exchange-traded funds (“ETFs”) that invest primarily in (i) common stocks of US companies, (ii) ADRs or (iii) investment grade fixed income securities; and (5) options on common stock, ADRs and ETFs.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update (“ASU”) 2013-08.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”) . In the absence of a sale, such securities shall be valued at the mean between the current bid and ask prices on the primary exchange on the day of valuation. Options contracts listed on a securities exchange or board of trade for which market quotations are readily available shall be valued at the last quoted sales price or, in the absence of a sale, at the mean between the current bid and ask prices on the day of valuation. Option contracts not listed on a securities exchange or board of trade for which over-the-counter market quotations are not readily available shall be valued at the mean between the current bid and ask prices on the day of valuation. Index options shall be valued at the mean between the current bid and ask prices on the day of valuation. Debt securities (other than short term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) using methods which include current market quotations from a major market maker in the securities and based on methods which include the consideration of yields or prices of securities of comparable quality, coupon, maturity and type. The independent pricing service does not distinguish between smaller-sized bond positions known as “odd lots” and larger institutional-sized bond positions known as “round lots”. The Fund may “fair value” a particular bond if the advisor does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Short -term debt obligations with remaining maturities in excess of sixty days are valued at current market prices by an independent pricing service approved by the Board. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost. Investments in open-end investment companies are valued at net asset value.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more

12

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board has also engaged a third party valuation firm to attend valuation meetings held by the Trust, review minutes of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process. As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the advisor, the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an ask price is available; the spread between bid and ask prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private placements or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

13

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of December 31, 2021 for the Fund’s investments measured at fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 73,430,365 | $ | — | $ | — | $ | 73,430,365 | ||||||||

| Short-Term Investments | 1,058,544 | — | — | 1,058,544 | ||||||||||||

| Call Options Purchased | — | 837,000 | — | 837,000 | ||||||||||||

| Total | $ | 74,488,909 | $ | 837,000 | $ | — | $ | 75,325,909 | ||||||||

The Fund did not hold any Level 3 securities during the year.

| * | Refer to the Schedule of Investments for security classifications. |

Security Transactions and Related Income – Security transactions are accounted for on the trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Exchange-Traded Funds – The Fund may invest in exchange-traded funds (“ETFs”). An ETF is a type of open-end fund, however, unlike a mutual fund, its shares are bought and sold on a securities exchange at market price and only certain financial institutions called authorized participants may buy and redeem shares of the ETF at net asset value. ETF shares can trade at either a premium or discount to net asset value. Each ETF like a mutual fund is subject to specific risks depending on the type of strategy (actively managed or passively tracking an index) and the composition of its underlying holdings. Investing in an ETF involves substantially the same risks as investing directly in the ETF’s underlying holdings. ETFs pay fees and incur operating expenses, which reduce the total return earned by the ETFs from their underlying holdings. An ETF may not achieve its investment objective or execute its investment strategy effectively, which may adversely affect the Fund’s performance.

Dividends and Distributions to Shareholders – Dividends from net investment income and distributable net realized capital gains, if any, are declared and paid annually. Dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may

14

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions to shareholders are recorded on the ex-dividend date.

Federal Income Taxes – The Fund complies with the requirements of the Internal Revenue Code applicable to regulated investment companies and distributes all of its taxable income to its shareholders. Therefore, no provision for federal income tax is required. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years (December 2018 - December 2020), or expected to be taken in the Fund’s 2021 tax returns. The Fund identifies its major tax jurisdictions as U.S. federal, Ohio (Nebraska in prior years) and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Options Transactions – The Fund is subject to equity price risk in the normal course of pursuing its investment objectives and may purchase or sell options to help hedge against this risk.

The Fund may write call options only if it (i) owns an offsetting position in the underlying security or (ii) has an absolute or immediate right to acquire that security without additional cash consideration or exchange of other securities held in its portfolio.

When the Fund writes a call option, an amount equal to the premium received is included in the Statement of Assets and Liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current market value of the option. If an option expires on its stipulated expiration date or if the Fund enters into a closing purchase transaction, a gain or loss is realized. If a written call option is exercised, a gain or loss is realized for the sale of the underlying security and the proceeds from the sale are increased by the premium originally received. As writer of an option, the Fund has no control over whether the option will be exercised and, as a result, retain the market risk of an unfavorable change in the price of the security underlying the written option.

The Fund may purchase put and call options. Call options are purchased to hedge against an increase in the value of securities held in the Fund’s portfolio. If such an increase occurs, the call options will permit the Fund to purchase the securities underlying such options at the exercise price, not at the current market price. Put options are purchased to hedge against a decline in the value of securities held in a Fund’s portfolio. If such a decline occurs, the put options will permit the Fund to sell the securities underlying such options at the exercise price, or to close out the options at a profit. The premium paid for a put or call option plus any transaction costs will reduce the benefit, if any, realized by the Fund upon exercise of the option, and, unless the price of the underlying security rises or declines sufficiently, the option may expire worthless to the Fund. In addition, in the event that the price of the security in connection with which an option was purchased moves in a direction favorable to the Fund, the benefits realized by the Fund as a result of such favorable movement will be reduced by the amount of the premium paid for the option and related transaction costs. Written and purchased options are non-income producing securities. With purchased options, there is minimal counterparty credit risk to the Fund since these options are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded options, guarantees against a possible default.

15

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

The following is a summary of the effect of derivative transactions on the Fund’s Statement of Assets and Liabilities as of December 31, 2021.

| Assets: | ||||||

| Location of Derivative on | ||||||

| Contract Type/ Primary Risk Exposure | Statement of Assets and Liabilities | Value | ||||

| Equity Contract/ Equity Price Risk | Investments securities, at value | $ | 837,000 | |||

The following is a summary of the effect of derivative instruments on the Fund’s Statement of Operations for the year ended December 31, 2021.

| Net Realized Gain | Unrealized | |||||||||||||

| Net Realized Gain | on transactions | Appreciation | ||||||||||||

| Contract Type/ Primary Risk | on transactions | from Options | (Depreciation) on | |||||||||||

| Exposure | Investment Type | from Investments | Written | Investments | ||||||||||

| Equity Contract/ Equity Price Risk | Options Purchased | $ | 122,207 | $ | — | $ | (5,080 | ) | ||||||

| Equity Contract/ Equity Price Risk | Options Written | — | 1,781,006 | — | ||||||||||

The amounts of realized and changes in unrealized gains and losses on derivative instruments during the period as disclosed in the Statement of Operations serve as indicators of the volume of derivative activity.

Sector Risk – The value of securities from a specific sector can be more volatile than the market as a whole and may be subject to economic or regulatory risks different than the economy as a whole.

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting year. Actual results could differ from those estimates.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses which are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable (as determined by the Board), taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

16

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

| 3. | INVESTMENT TRANSACTIONS |

For the year ended December 31, 2021, cost of purchases and proceeds from sales of portfolio securities, other than short-term investments and U.S. Government securities, amounted to the following:

| Purchases | Sales | |||||

| $ | 15,437,834 | $ | 18,170,628 | |||

| 4. | AGGREGATE TAX UNREALIZED APPRECIATION AND DEPRECIATION |

At December 31, 2021 the aggregate cost for federal tax purposes, which differs from fair value by net unrealized appreciation(depreciation) of securities, are as follows:

| Gross Unrealized | Gross Unrealized | Net Unrealized | ||||||||||||

| Tax Cost | Appreciation | Depreciation | Appreciation | |||||||||||

| $ | 29,874,564 | $ | 46,610,132 | $ | (1,158,787 | ) | $ | 45,451,345 | ||||||

| 5. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Biondo Investment Advisors, LLC serves as the Fund’s investment advisor (the “Advisor”). Pursuant to an investment advisory agreement between the Advisor and the Trust, on behalf of the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor a management fee, computed and accrued daily and paid monthly, at an annual rate of 1.00% the Fund’s average daily net assets. For the year ended December 31, 2021, the Advisor earned fees of $790,299 for its service to the Fund.

Effective March 27, 2019, pursuant to a written contract (the “Waiver Agreement”), the Advisor has agreed, at least until April 30, 2022, to waive a portion of its advisory fee and has agreed to reimburse a portion of the Fund’s other expenses to the extent necessary so that the total expenses incurred by the Fund (excluding any front-end or contingent deferred loads; brokerage fees and commissions; acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); borrowing costs (such as interest and dividend expense on securities sold short); taxes; and extraordinary expenses such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Advisor)) does not exceed 1.50% per annum of the Fund’s average daily net assets. This amount will herein be referred to as the “expense limitation.” For the year ended December 31, 2021, the Advisor waived fees in the amount of $74,752 for the Fund pursuant to the Waiver Agreement and a prior expense limitation agreement.

If the Advisor waives any fee or reimburses any expense pursuant to the Waiver Agreement (or a prior expense limitation agreement), and the Fund’s operating expenses are subsequently lower than its expense limitation, the Advisor shall be entitled to reimbursement by the Fund for such waived fees or reimbursed expenses provided that such reimbursement does not cause the Fund’s expenses to exceed the expense limitation. If operating expenses subsequently exceed the expense limitation, the reimbursements for the Fund shall be suspended. The Advisor may seek reimbursement only for expenses waived or paid by it during the three years or prior to such reimbursement; provided, however, that such expenses may only be reimbursed to the extent they were waived or paid after the date of the Waiver Agreement (or any similar agreement). The Board may terminate this expense reimbursement arrangement at any time.

17

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

As of December 31, 2021, the Advisor had $266,228 of waived expenses that may be recovered by the following dates:

| December 31, 2022 | December 31, 2023 | December 31, 2024 | Total | |||||||||||

| $ | 85,957 | $ | 105,519 | $ | 74,752 | $ | 266,228 | |||||||

The Trust, with respect to the Fund, has adopted the Trust’s Master Distribution and Shareholder Servicing Plan (or “Plan”) for Investor Class shares. The Plan provides that a monthly service fee is calculated by the Fund at an annual rate of 0.25% of the average daily net assets attributable to the Investor Class shares for the Fund. Pursuant to the Plan, the Fund may compensate the securities dealers or other financial intermediaries, financial institutions, investment advisors, and others for activities primarily intended to result in the sale of Fund shares and for maintenance and personal service provided to existing shareholders. The Plan further provides for periodic payments to brokers, dealers and other financial intermediaries, including insurance companies, for providing shareholder services and for promotional and other sales-related costs. During the year ended December 31, 2021, the Fund was charged $197,575 pursuant to the Plan.

Northern Lights Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. For the year ended December 31, 2021, the Distributor received no underwriting commissions.

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus Fund Solutions, LLC (“UFS”)

UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to a separate servicing agreement with UFS, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”)

NLCS, an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Blu Giant, LLC (“Blu Giant”)

Blu Giant, an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

| 6. | BANK LINE OF CREDIT |

The Fund has a secured $5,000,000 bank line of credit through Lakeland Bank (the “Bank”) for the purpose of investment purchases, subject to the limitations of the 1940 Act for borrowings. The Fund has until June 1, 2022 to pay back the line of credit. Borrowings under this arrangement bear interest at the greater of i) the lender’s prime rate minus 0.50% or ii) 3.25% per annum at the time of borrowing. During the year ended December 31, 2021, the Fund had no outstanding borrowings.

18

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

As collateral security for the bank line of credit, the Fund grants the Bank a first position security interest in and lien on all securities of any kind or description pledged by the Fund. As of December 31, 2021, the Fund had $16,735,265 in securities pledged as collateral for the line of credit.

| 7. | REDEMPTION FEES |

The Fund may assess a short-term redemption fee of 2.00% of the total redemption amount if shareholders sell their shares after holding them for less than 30 days. The redemption fee is paid directly to the Fund. For the year ended December 31, 2021 the Fund assessed $542 in redemption fees.

| 8. | CONCENTRATION |

As of December 31, 2021, the Biondo Focus Fund had 33.7% of the value of net assets invested in stocks within the Medical Equipment & Devices sector.

| 9. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of December 31, 2021, National Financial Services LLC held approximately 88.2% of the Fund. The Fund has no knowledge as to whether all or any portion of the shares owned of record by National Financial Services LLC are also owned beneficially.

| 10. | TAX COMPONENTS OF CAPITAL |

The tax character of fund distributions paid for the years ended December 31, 2021 and December 31, 2020 was as follows:

| Fiscal Year Ended | Fiscal Year Ended | |||||||

| December 31, 2021 | December 31, 2020 | |||||||

| Ordinary Income | $ | 707,731 | $ | — | ||||

| Long-Term Capital Gains | 4,959,183 | 3,870,984 | ||||||

| $ | 5,666,914 | $ | 3,870,984 | |||||

Tax equalization allows a Fund to treat as distribution that portion of redemption proceeds representing a redeeming shareholder’s portion of undistributed taxable and net capital gains. Tax equalization allows a Fund to treat as distribution that portion of redemption The Fund utilized equalization in the amount of $86,726, which resulted in a difference between tax distributions and book distributions as disclosed on the Statement of Changes for the year ended December 31, 2020. Net investment income and net realized gains(losses), as disclosed on the Statements of Operations and net assets were not affected by these reclassifications.

As of December 31, 2021, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Post October Loss | Other | Net | Total | |||||||||||

| and | Book/Tax | Unrealized | Accumulated | |||||||||||

| Late Year Loss | Differences | Appreciation | Earnings | |||||||||||

| $ | (1,454,237 | ) | $ | (1,161,245 | ) | $ | 45,451,345 | $ | 42,835,863 | |||||

19

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

The difference between book basis and tax basis accumulated net investment loss, unrealized appreciation and accumulated net realized gains from security and options transactions is primarily attributable to the tax deferral of losses on straddles. Amounts listed under other book/tax differences are primarily attributable to the tax deferral of losses on straddles.

Capital losses incurred after October 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such capital losses of $1,454,237.

Permanent book and tax differences, primarily attributable to the tax treatment of net operating losses, and tax adjustments for prior year tax returns, resulted in reclassification for the Fund for the year ended December 31, 2021 as follows:

| Accumulated | ||||||

| Paid In Capital | Earnings (Losses) | |||||

| $ | (455,248 | ) | $ | 455,248 | ||

| 11. | MARKET AND GEOPOLITICAL RISK |

The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility and may have long term effects on both the U.S. and global financial markets. The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, has had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

| 12. | FINANCIAL STATEMENT RESTATEMENT |

During the fiscal year ended December 31, 2021, it was determined that the Fund had improperly accounted for the sale of a security occurring during the fiscal year ended December 31, 2020. Accordingly, the Fund has restated the Statement of Changes in Net Assets for the fiscal year ended December 31, 2020, which resulted in an increase in “Net Change in Unrealized Appreciation (Depreciation) on Investments” and a decrease in “Net Realized Gain from Investments and Options Written” in the amount of $2,287,488. Such restatement did not impact the Fund’s net assets.

20

The Biondo Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

December 31, 2021

| 13. | NEW REGULATORY UPDATES |

In October 2020, the Securities and Exchange Commission (the “SEC”) adopted new regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). The Funds will be required to comply with Rule 18f-4 by August 19, 2022. Once implemented, Rule 18f-4 will impose limits on the amount of derivatives a fund can enter into, eliminate the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, treat derivatives as senior securities and require funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. The Funds are currently evaluating the impact, if any, of this provision.

| 14. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

21

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Northern Lights Fund Trust

and the Shareholders of The Biondo Focus Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of The Biondo Focus Fund, a series of shares of beneficial interest in Northern Lights Fund Trust (the “Fund”), including the schedule of investments, as of December 31, 2021, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

22

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2021 by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Northern Lights Fund Trust since 2006.

Philadelphia, Pennsylvania

February 25, 2022

23

The Biondo Focus Fund

EXPENSE EXAMPLES (Unaudited)

December 31, 2021

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2021 through December 31, 2021.

Actual Expenses

The “Actual” line in the table below provides information about actual account values and actual expenses. You may use the information below together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line in the table below provides information about hypothetical account values and hypothetical expenses based on the Biondo Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending | Expenses Paid | Expense Ratio | |

| Account Value | Account Value | During Period* | During Period | |

| Actual | 7/1/21 | 12/31/21 | 7/1/21- 12/31/21 | 7/1/21- 12/31/21 |

| The Biondo Focus Fund | $1,000.00 | $ 949.30 | $7.37 | 1.50% |

| Beginning | Ending | Expenses Paid | Expense Ratio | |

| Account Value | Account Value | During Period** | During Period | |

| sHypothetical (5% return before expenses) | 7/1/21 | 12/31/21 | 7/1/21- 12/31/21 | 7/1/21- 12/31/21 |

| The Biondo Focus Fund | $1,000.00 | $1,017.64 | $7.63 | 1.50% |

| * | “Actual” expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (365). |

| ** | “Hypothetical” expense information for each Fund is presented on the basis of the full one-half year period to enable comparison to other funds. Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (365). |

24

Biondo Investment Advisors, LLC (Adviser to Biondo Focus Fund)*

In connection with the regular meeting held on September 21-23, 2021 of the Board of Trustees (the “Trustees” or the “Board”) of the Northern Lights Fund Trust (the “Trust”), including a majority of the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended, discussed the re -approval of an investment advisory agreement (the “Advisory Agreement”) between Biondo Investment Advisors, LLC (“Biondo”) and the Trusts, with respect to the Biondo Focus Fund (the “Fund”). In considering the re-approval of the Advisory Agreement, the Board received materials specifically relating to the Advisory Agreement.

The Trustees were assisted by independent legal counsel throughout the Advisory Agreement review process. The Trustees relied upon the advice of independent legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Advisory Agreement and the weight to be given to each such factor. The conclusions reached by the Trustees were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the Advisory Agreement.

Nature, Extent, and Quality of Services. The Board noted that Biondo was founded in 2004 and managed approximately $814 million in assets as of June 30, 2021 and provided a wide range of personalized financial planning and advisory services to individuals and institutional clients. The Board noted the background information of the key investment professionals servicing the Fund and expressed their satisfaction with the team’s educational background and financial industry experience. The Board reviewed Biondo’s investment process, including its research and due-diligence process. The Board acknowledged that Biondo’s investment process was based on fundamental research and analysis, focusing on companies with a minimum market cap of $1 billion that had the potential to produce high earnings growth. The Board noted that the Fund was a concentrated equity portfolio and utilized options to hedge risks posed to the Fund by market volatility. They discussed Biondo’s broker selection criteria, noting Biondo’s assessment of broker dealers based on the quality of services, including pricing and commissions, research provided, quality of trade executions and overall operational services. The Board acknowledged that Biondo reported no material compliance or litigation issues since its last renewal of the Advisory Agreement. The Board concluded that Biondo was expected to continue providing a high level of quality service to the Fund and its shareholders.

Performance. The Board noted the Fund was a 2-star Morningstar fund and its total assets had increased approximately $20 million from the year prior. The Board commented that the Fund returned 40.91% over the one-year period, and outperformed its peer group and Morningstar category median, as well as its benchmark. The Board discussed the Fund’s Sharpe and Sortino ratios. The Board observed that the Fund underperformed its peer group median and Morningstar category median over the three-year period, but outperformed its peer group median, Morningstar category median, and benchmark over the five-year period. The Board

25

concluded that Biondo had been consistent in implementing the Fund’s strategy since its inception and had shown its ability to produce positive returns and should be given the opportunity to continue to seek positive performance for shareholders.

Fees and Expenses. The Board noted that the Fund’s net expense ratio of 1.50% was higher than its Morningstar category median and average, as well as its peer group median and average. The Board commented that the Fund’s gross expense ratio of 1.66% was lower than the category high. The Board also observed that Biondo’s advisory fee of 1.00% was higher than its Morningstar category median and average, as well as its peer group median and average, but lower than the category high. The Board considered Biondo’s explanation that concentration, the use of derivatives, the use of leverage, research, and the complexity of the Fund’s strategy explained the higher Fund advisory fees . The Board noted that the shareholders benefited from the expense limitation agreement. After discussion, the Board concluded that the advisory fee was not unreasonable.

Profitability. The Board reviewed the profitability analysis provided by Biondo. The Board noted that Biondo reported a modest profit in terms of actual dollars due to its relationship with the Fund. The Board concluded that Biondo’s profitability in relation to the advisory services rendered to the Fund were not excessive.

Economies of Scale. The Board considered whether economies of scale had been reached with respect to the management of the Fund. The Board noted that Biondo had indicated a willingness to continue to evaluate the appropriateness of breakpoints when the Fund reached higher assets. The Board agreed that in light of the expense limitation agreement in place, and Biondo’s willingness to consider breakpoints in the future, the absence of breakpoints at this time was acceptable.

Conclusion. Having requested and received such information from Biondo as the Board believed to be reasonably necessary to evaluate the terms of the Advisory Agreement and as assisted by the advice of counsel, the Board concluded that the fee structures were not unreasonable and that renewal of the Advisory Agreement with Biondo was in the best interests of the shareholders of the Fund.

| * | Due to the timing of the contract renewal schedule, these deliberations may or may not relate to the current performance results of the Fund. |

26

The Biondo Focus Fund

SUPPLEMENTAL INFORMATION (Unaudited)

December 31, 2021

The Trustees and the executive officers of the Trust are listed below with their present positions with the Trust and principal occupations over at least the last five years. The business address of each Trustee and Officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. All correspondence to the Trustees and Officers should be directed to c/o Ultimus Fund Solutions, LLC, P.O. Box 541150, Omaha, Nebraska 68154.

Independent Trustees

| Name, Address and Year of Birth | Position/Term of Office* | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex** Overseen by Trustee | Other Directorships held by Trustee During the Past Five Years |

| Mark Garbin Born in 1951 | Trustee Since 2013 | Managing Principal, Coherent Capital Management LLC (since 2007). | 1 | Northern Lights Fund Trust (for series not affiliated with the Funds since 2013); Two Roads Shared Trust (since 2012); Forethought Variable Insurance Trust (since 2013); Northern Lights Variable Trust (since 2013); OHA Mortgage Strategies Fund (offshore), Ltd. (2014-2017); and Altegris KKR Commitments Master Fund (since 2014); Carlyle Tactical Private Credit Fund (since March 2018) and Independent Director OHA CLO Enhanced Equity II Genpar LLP (since June 2021). |

| Mark D. Gersten Born in 1950 | Trustee Since 2013 | Independent Consultant (since 2012). | 1 | Northern Lights Fund Trust (for series not affiliated with the Funds since 2013); Northern Lights Variable Trust (since 2013); Two Roads Shared Trust (since 2012); Altegris KKR Commitments Master Fund (since 2014); previously, Ramius Archview Credit and Distressed Fund (2015-2017); and Schroder Global Series Trust (2012 to 2017). |

| Anthony J. Hertl Born in 1950 | Trustee Since 2005; Chairman of the Board since 2013 | Retired, previously held several positions in a major Wall Street firm including Capital Markets Controller, Director of Global Taxation, and CFO of the Specialty Finance Group. | 1 | Northern Lights Fund Trust (for series not affiliated with the Funds since 2005); Northern Lights Variable Trust (since 2006); Alternative Strategies Fund (since 2010); Satuit Capital Management Trust (2007-2019). |

| Gary W. Lanzen Born in 1954 | Trustee Since 2005 | Retired (since 2012). Formerly, Founder, President, and Chief Investment Officer, Orizon Investment Counsel, Inc. (2000-2012). | 1 | Northern Lights Fund Trust (for series not affiliated with the Funds since 2005) Northern Lights Variable Trust (since 2006); AdvisorOne Funds (since 2003); Alternative Strategies Fund (since 2010); and previously, CLA Strategic Allocation Fund (2014-2015). |

| John V. Palancia Born in 1954 | Trustee Since 2011 | Retired (since 2011). Formerly, Director of Futures Operations, Merrill Lynch, Pierce, Fenner & Smith Inc. (1975-2011). | 1 | Northern Lights Fund Trust (for series not affiliated with the Funds since 2011); Northern Lights Fund Trust III (since February 2012); Alternative Strategies Fund (since 2012) and Northern Lights Variable Trust (since 2011). |

| Mark H. Taylor Born in 1964 | Trustee Since 2007; Chairman of the Audit Committee since 2013 | Director, Lynn Pippenger School of Accountancy Muma College of Business, University of South Florida, Tampa FL (since 2019); Chair, Department of Accountancy and Andrew D. Braden Professor of Accounting and Auditing, Weatherhead School of Management, Case Western Reserve University (2009-2019); Vice President-Finance, American Accounting Association (2017-2020); President, Auditing Section of the American Accounting Association (2012-15). AICPA Auditing Standards Board Member (2009-2012). | 1 | Northern Lights Fund Trust (for series not affiliated with the Funds since 2007); Alternative Strategies Fund (since 2010); Northern Lights Fund Trust III (since 2012); and Northern Lights Variable Trust (since 2007). |

12/31/21 – NLFT_v1

27

The Biondo Focus Fund

SUPPLEMENTAL INFORMATION (Unaudited) (Continued)

December 31, 2021

Officers

| Name, Address and Year of Birth | Position/Term of Office* | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex** Overseen by Trustee | Other Directorships held by Trustee During the Past Five Years |

| Kevin E. Wolf Born in 1969 | President Since June 2017 | Executive Vice President, Head of Fund Administration, and Product; Ultimus Fund Solutions, LLC (since 2020); Vice President of The Ultimus Group, LLC (since 2019); Executive Vice President, Gemini Fund Services, LLC (2019-2020); President, Gemini Fund Services, LLC (2012-2019); Treasurer of the Trust (2006-June 2017. | N/A | N/A |