Osmium Investor Day December 3, 2015

Except for statements of historical fact, the information presented herein may constitute forward looking statements within the meaning of and subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "expect," "estimate," "anticipate," "intend," “goal,“ “strategy,” "believe," and similar expressions and variations thereof. Such forward-looking statements include statements regarding the intent, belief, current expectations or projections about future events of Spark Networks, Inc. Readers are cautioned that these forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Spark Networks, Inc. to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include without limitation, general economic and business conditions, the loss of market share, changes in the competitive landscape, failure to keep up with technological advances and other factors over which Spark Networks, Inc. has little or no control. Spark Networks, Inc. undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date hereof. Use of Non-GAAP Measures: The Company reports Adjusted EBITDA and Free Cash Flow as supplemental measures to generally accepted accounting principles ("GAAP"). These non-GAAP measures are some of the primary metrics by which we evaluate the performance of our businesses, budget, forecast and compensate management. We believe these measures provide management and investors with a consistent view, period to period, of the core earnings generated from on-going operations. Adjusted EBITDA excludes the impact of: (i) non-cash items such as stock-based compensation, asset impairments, non-cash currency translation adjustments related to an inter-company loan and (ii) one-time items that have not occurred in the past two years and are not expected to recur in the next two years. Free Cash Flow reflects operating cash flow less capital expenditures and capitalized wages. Adjusted EBITDA and Free Cash Flow should not be construed as substitutes for net income (loss) (as determined in accordance with GAAP) for the purpose of analyzing our operating performance or financial position, as Adjusted EBITDA and Free Cash Flow are not defined by GAAP. Safe Harbor

We are committed to growing the business and doing so profitably. Our two largest brands, JDate and ChristianMingle, occupy differentiated and defensible positions in the high-growth Dating industry. We have made a number of significant investments in the last twelve months in mobile, desktop, and a new management team. Key Takeaways

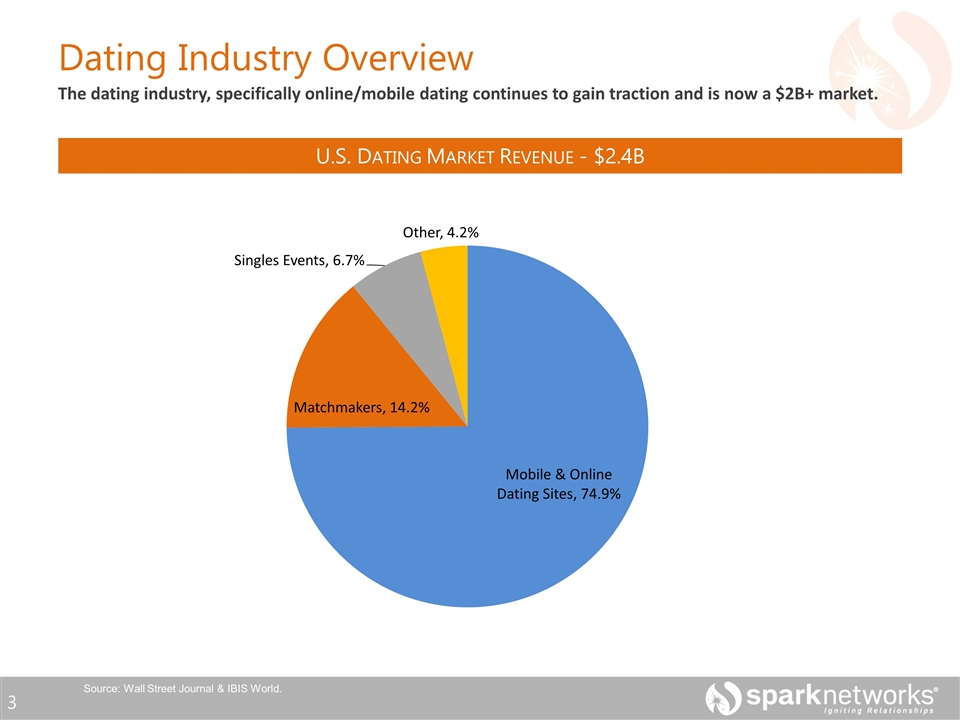

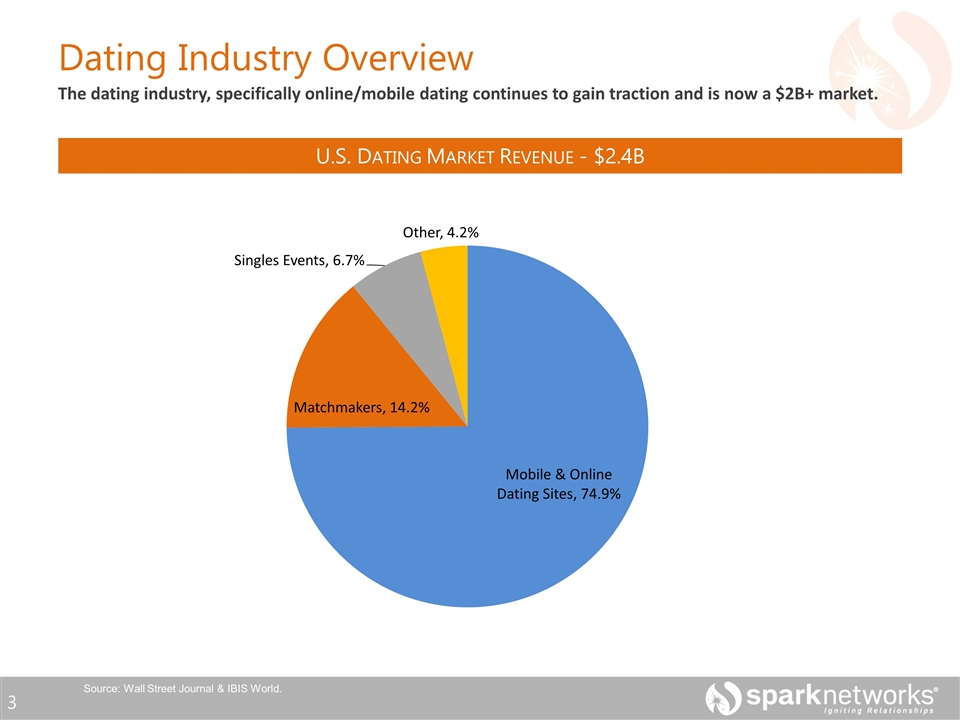

U.S. DATING MARKET REVENUE - $2.4B The dating industry, specifically online/mobile dating continues to gain traction and is now a $2B+ market. Dating Industry Overview Source: Wall Street Journal & IBIS World.

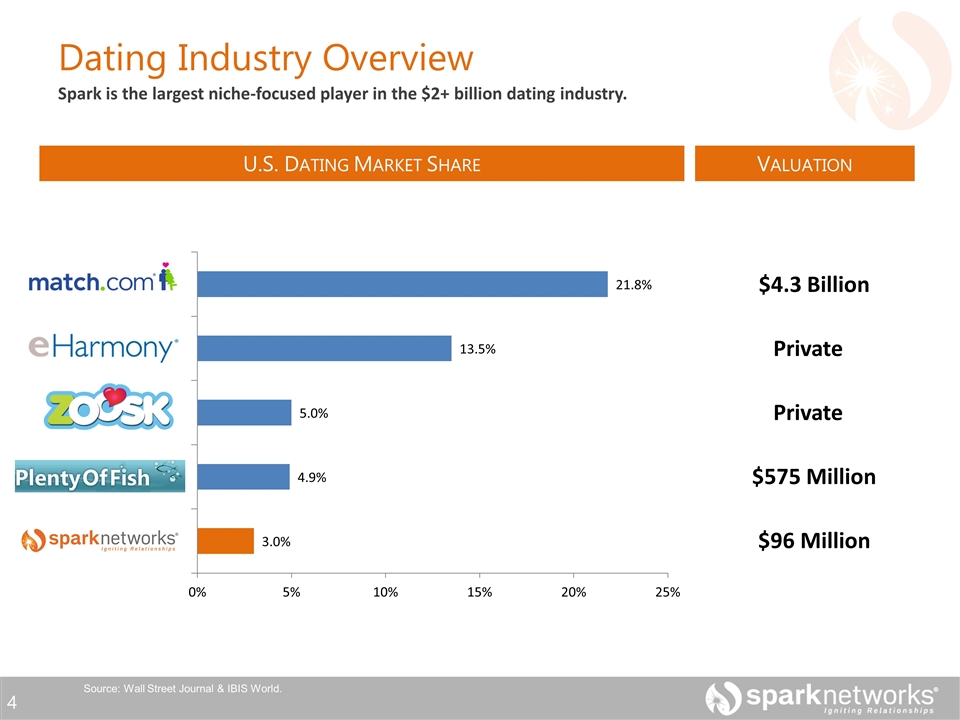

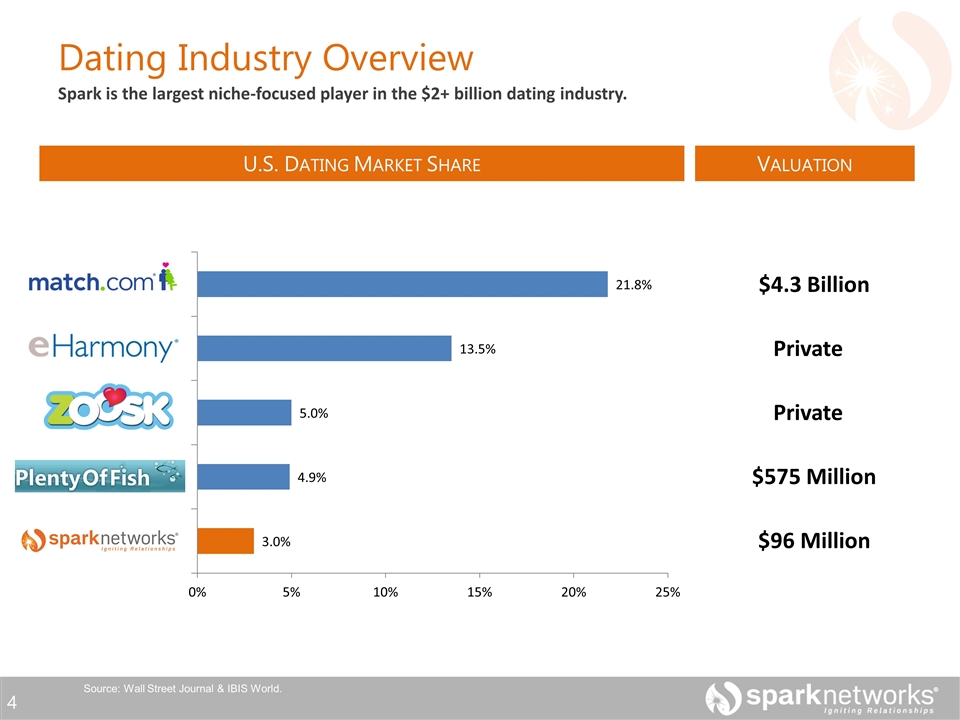

Spark is the largest niche-focused player in the $2+ billion dating industry. Dating Industry Overview Source: Wall Street Journal & IBIS World. U.S. DATING MARKET SHARE VALUATION $4.3 Billion $96 Million $575 Million Private Private

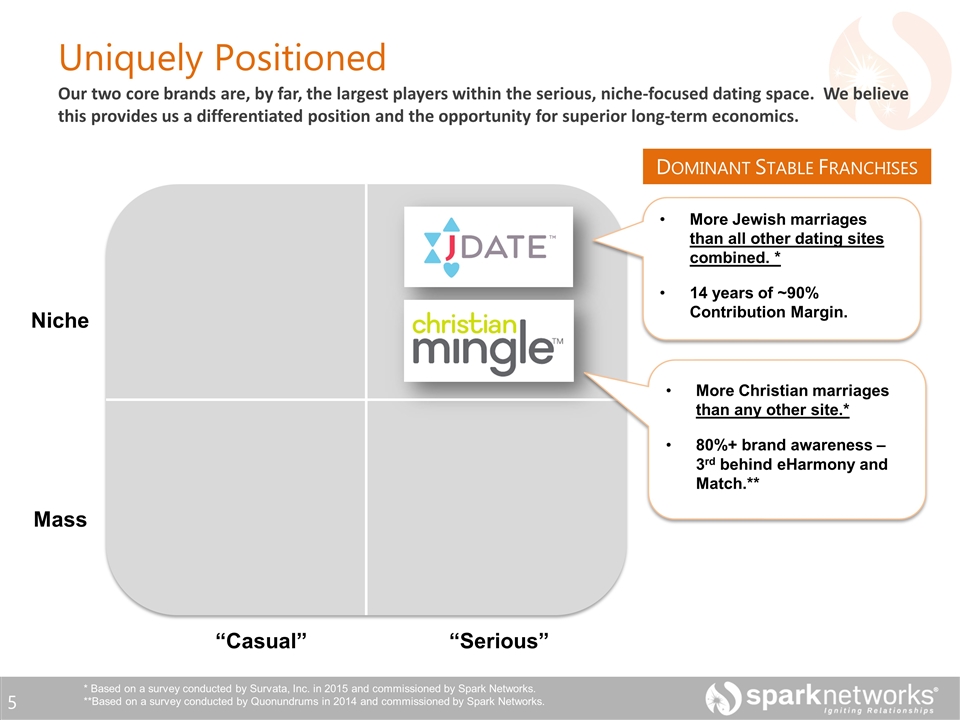

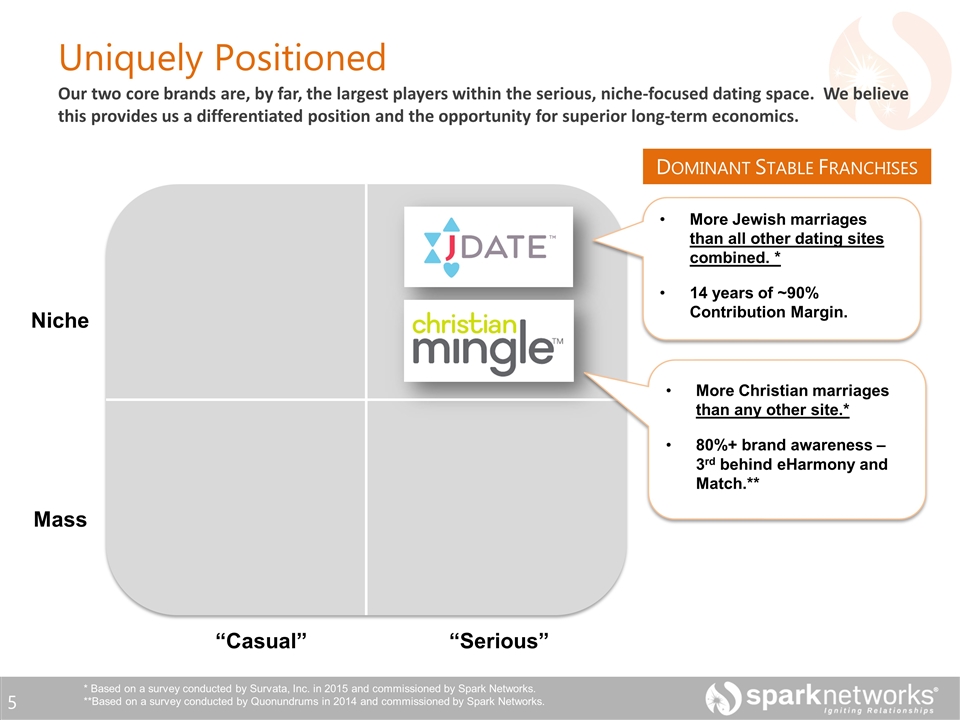

Uniquely Positioned “Casual” “Serious” Mass Niche Our two core brands are, by far, the largest players within the serious, niche-focused dating space. We believe this provides us a differentiated position and the opportunity for superior long-term economics. DOMINANT STABLE FRANCHISES More Jewish marriages than all other dating sites combined. * 14 years of ~90% Contribution Margin. More Christian marriages than any other site.* 80%+ brand awareness – 3rd behind eHarmony and Match.** * Based on a survey conducted by Survata, Inc. in 2015 and commissioned by Spark Networks. **Based on a survey conducted by Quonundrums in 2014 and commissioned by Spark Networks.

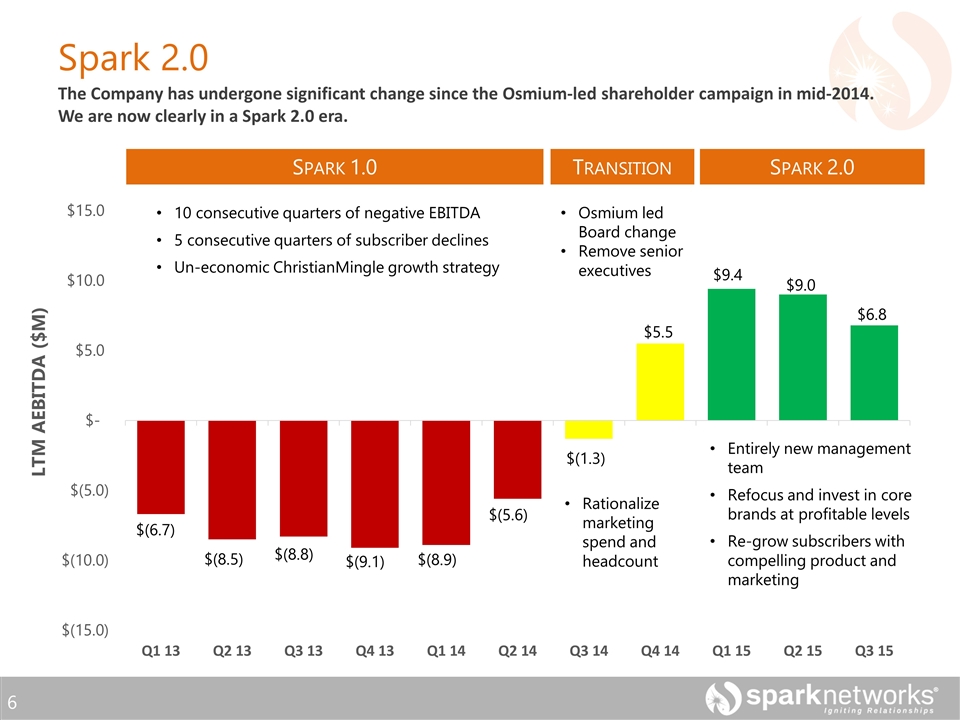

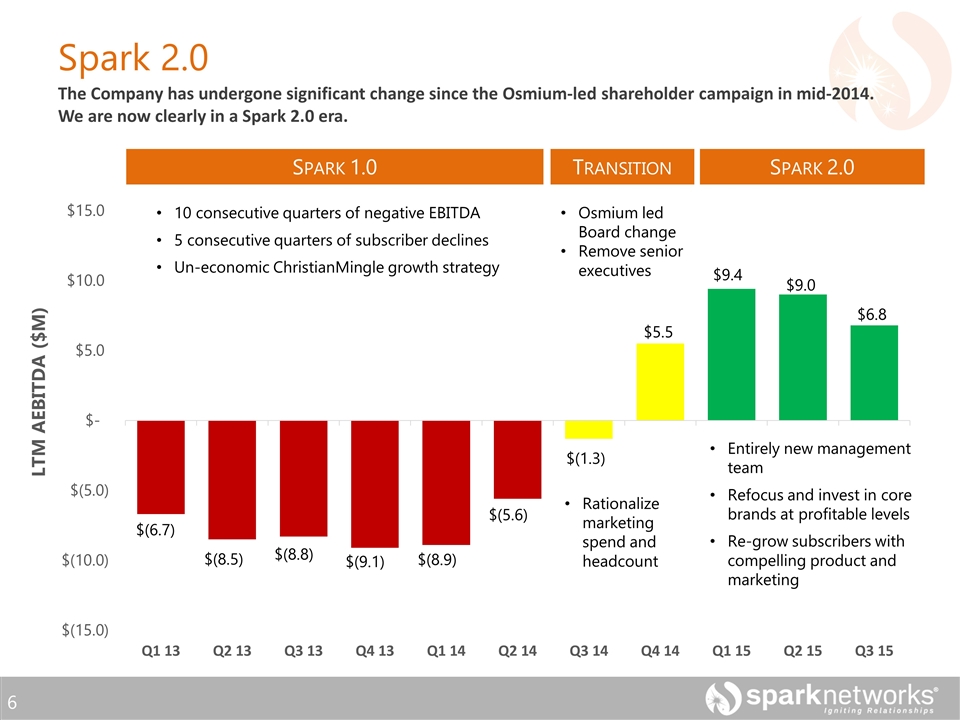

Spark 2.0 10 consecutive quarters of negative EBITDA 5 consecutive quarters of subscriber declines Un-economic ChristianMingle growth strategy Rationalize marketing spend and headcount Entirely new management team Refocus and invest in core brands at profitable levels Re-grow subscribers with compelling product and marketing The Company has undergone significant change since the Osmium-led shareholder campaign in mid-2014. We are now clearly in a Spark 2.0 era. LTM AEBITDA ($M) $(6.7) $(8.5) $(8.8) $(9.1) $(8.9) $(5.6) $(1.3) $5.5 $9.4 $9.0 $6.8 SPARK 2.0 TRANSITION SPARK 1.0 Osmium led Board change Remove senior executives

2.0…What Have we achieved so far?

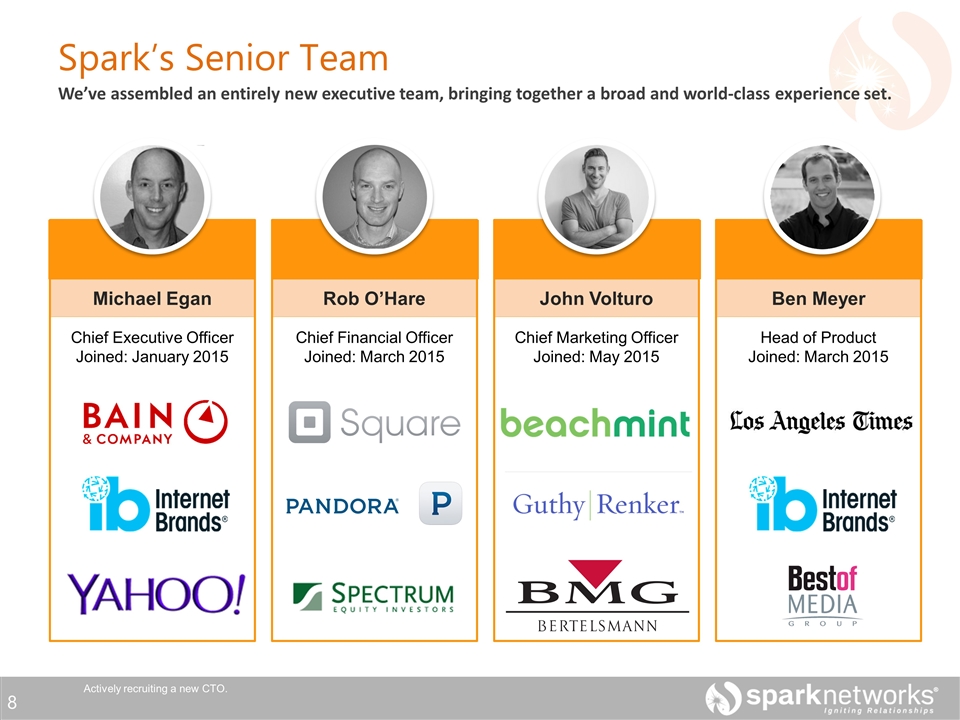

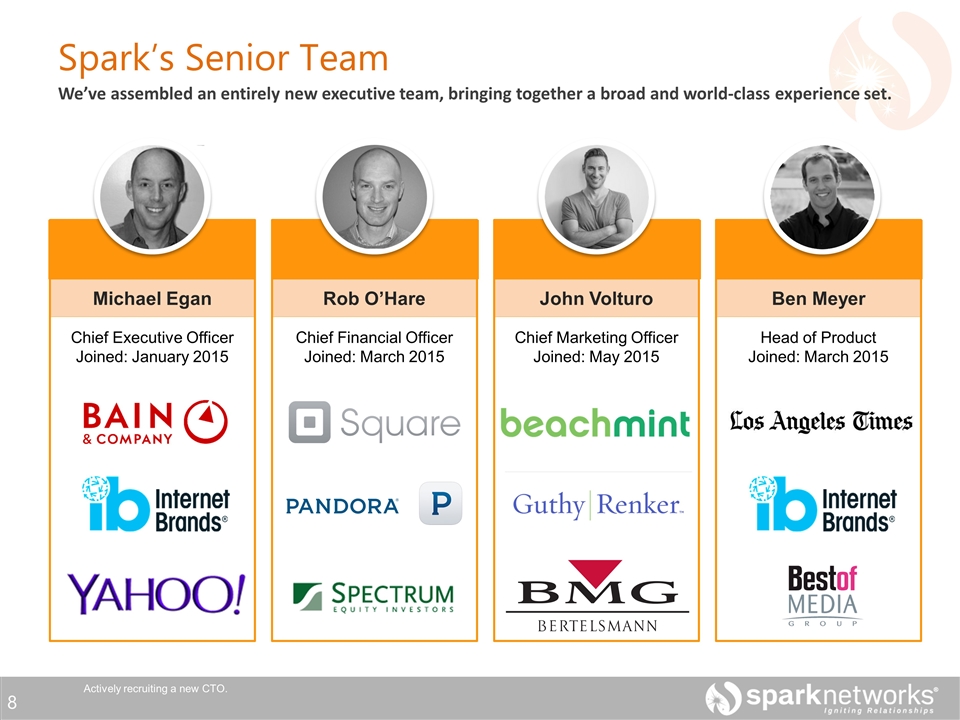

John Volturo Chief Marketing Officer Joined: May 2015 Rob O’Hare Chief Financial Officer Joined: March 2015 Spark’s Senior Team We’ve assembled an entirely new executive team, bringing together a broad and world-class experience set. Actively recruiting a new CTO. Michael Egan Chief Executive Officer Joined: January 2015 Ben Meyer Head of Product Joined: March 2015

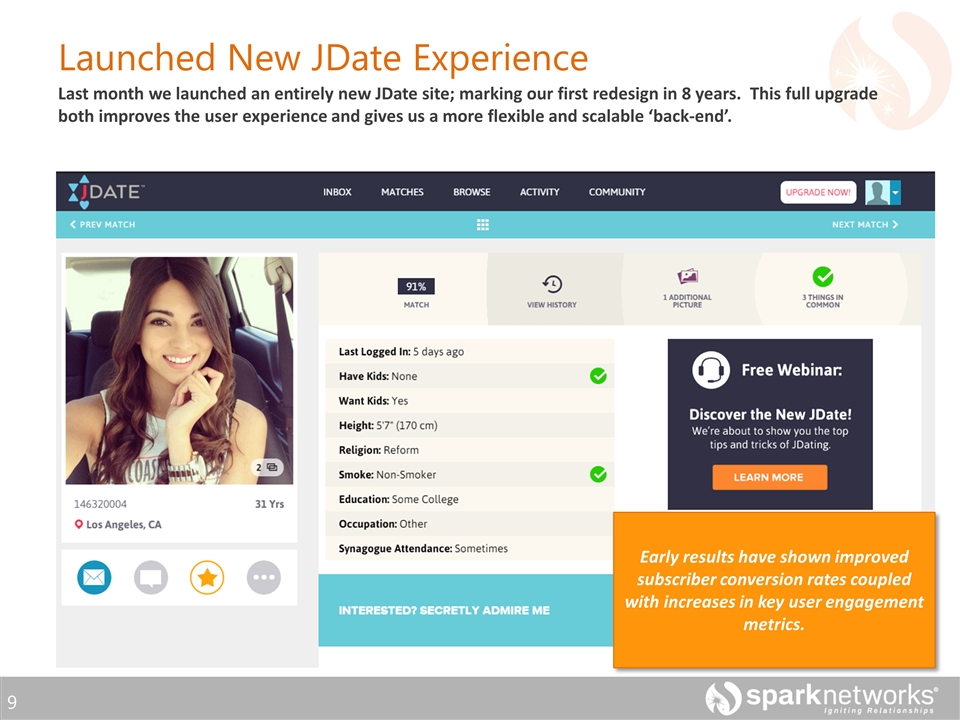

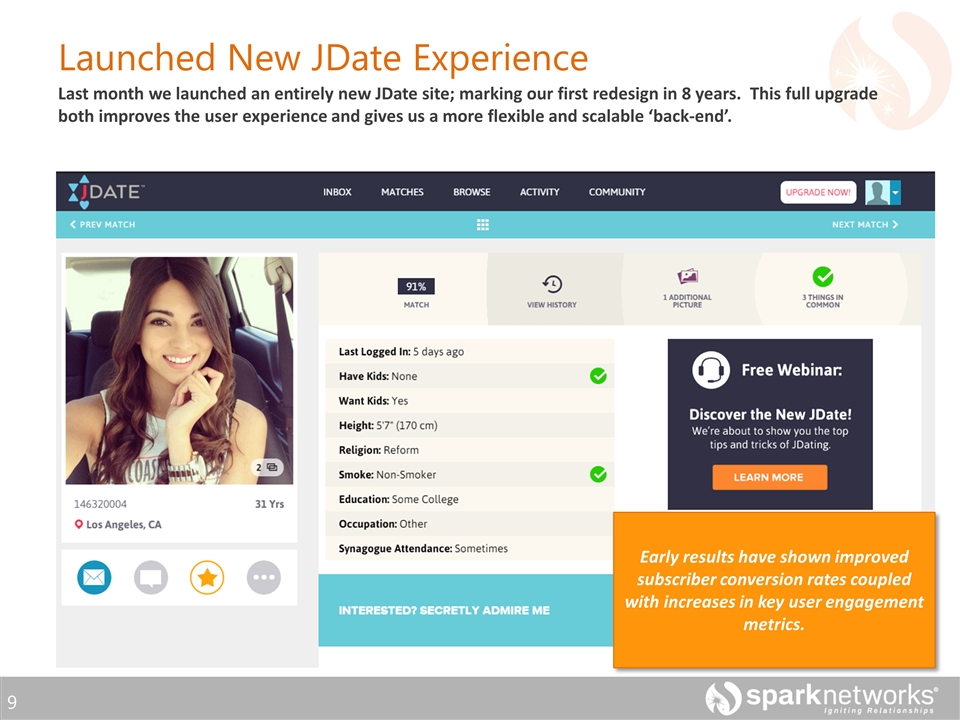

Launched New JDate Experience Last month we launched an entirely new JDate site; marking our first redesign in 8 years. This full upgrade both improves the user experience and gives us a more flexible and scalable ‘back-end’. Early results have shown improved subscriber conversion rates coupled with increases in key user engagement metrics.

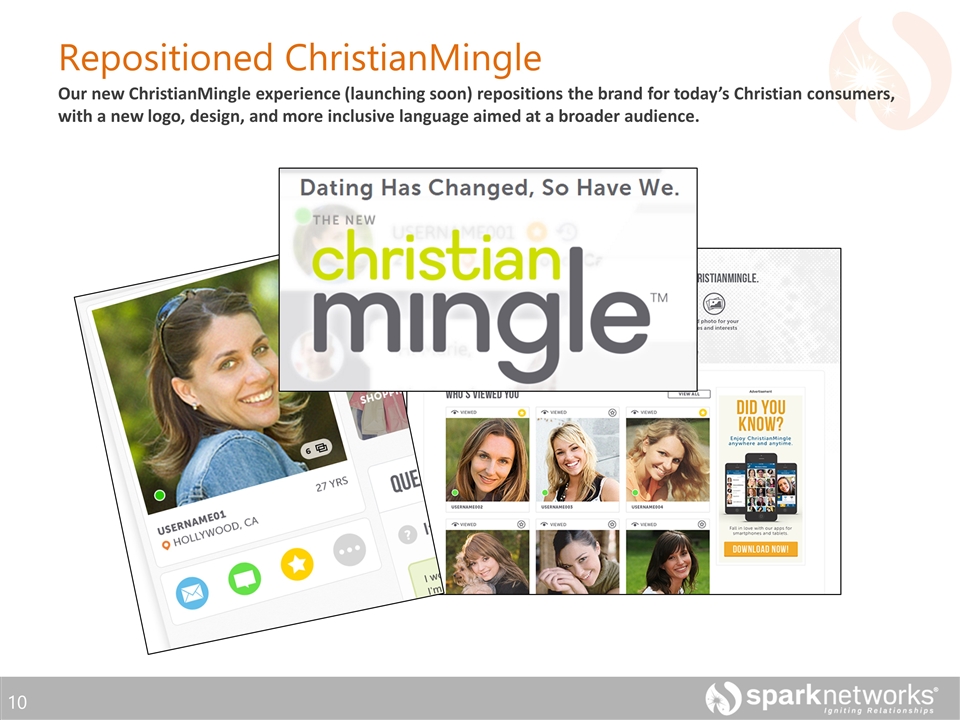

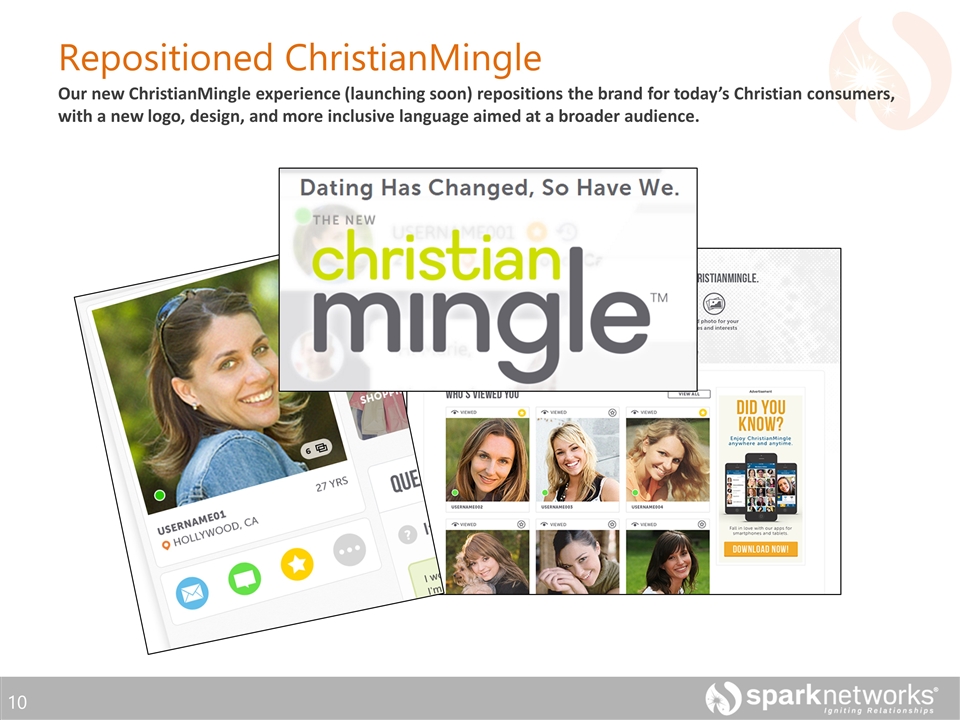

Repositioned ChristianMingle Our new ChristianMingle experience (launching soon) repositions the brand for today’s Christian consumers, with a new logo, design, and more inclusive language aimed at a broader audience.

BEFORE New Product Design Our new products are not only contemporary but help to focus user attention on key aspects of success. AFTER

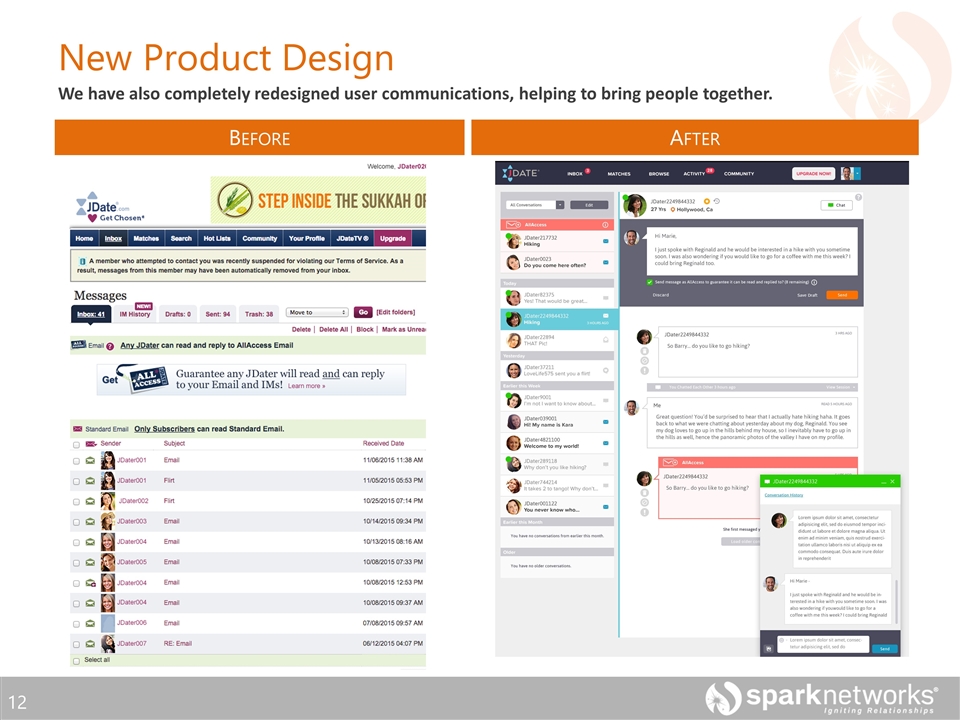

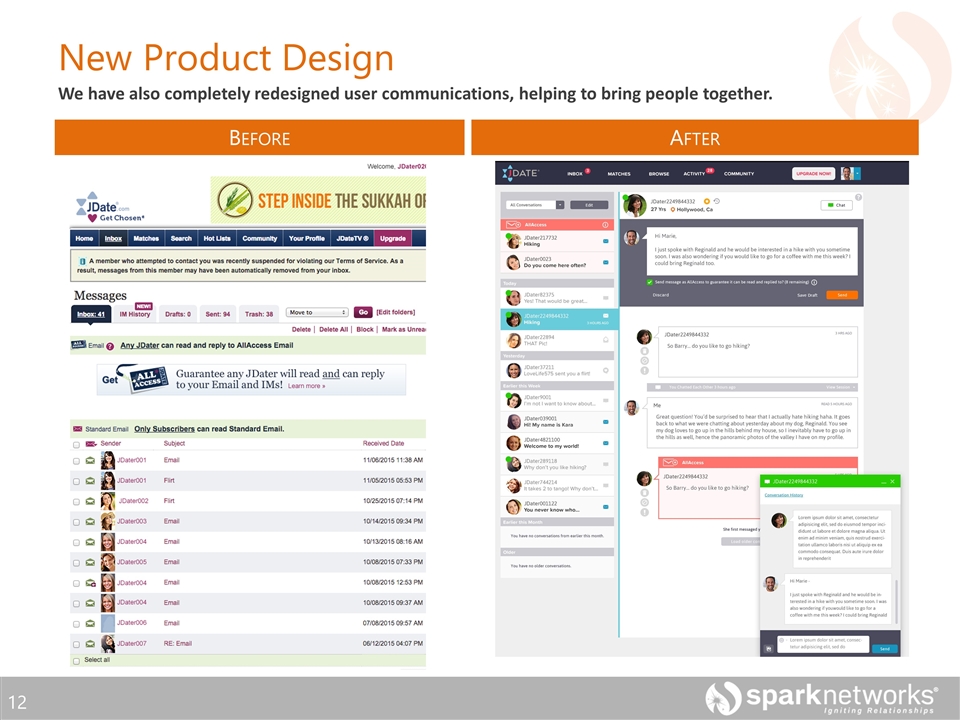

BEFORE AFTER New Product Design We have also completely redesigned user communications, helping to bring people together.

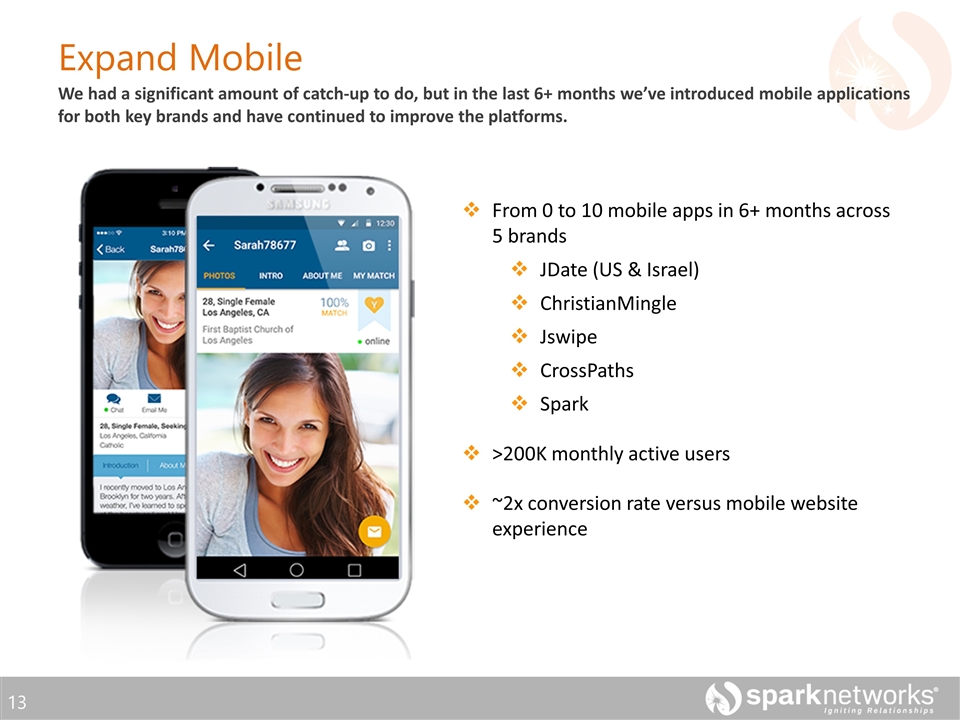

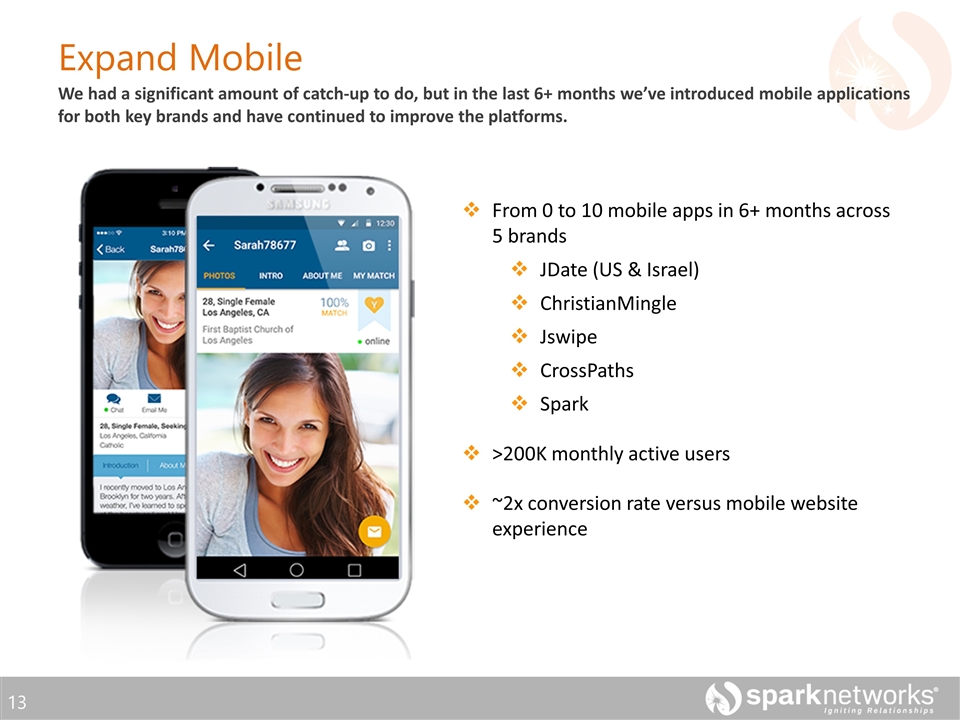

Expand Mobile We had a significant amount of catch-up to do, but in the last 6+ months we’ve introduced mobile applications for both key brands and have continued to improve the platforms. From 0 to 10 mobile apps in 6+ months across 5 brands JDate (US & Israel) ChristianMingle Jswipe CrossPaths Spark >200K monthly active users ~2x conversion rate versus mobile website experience

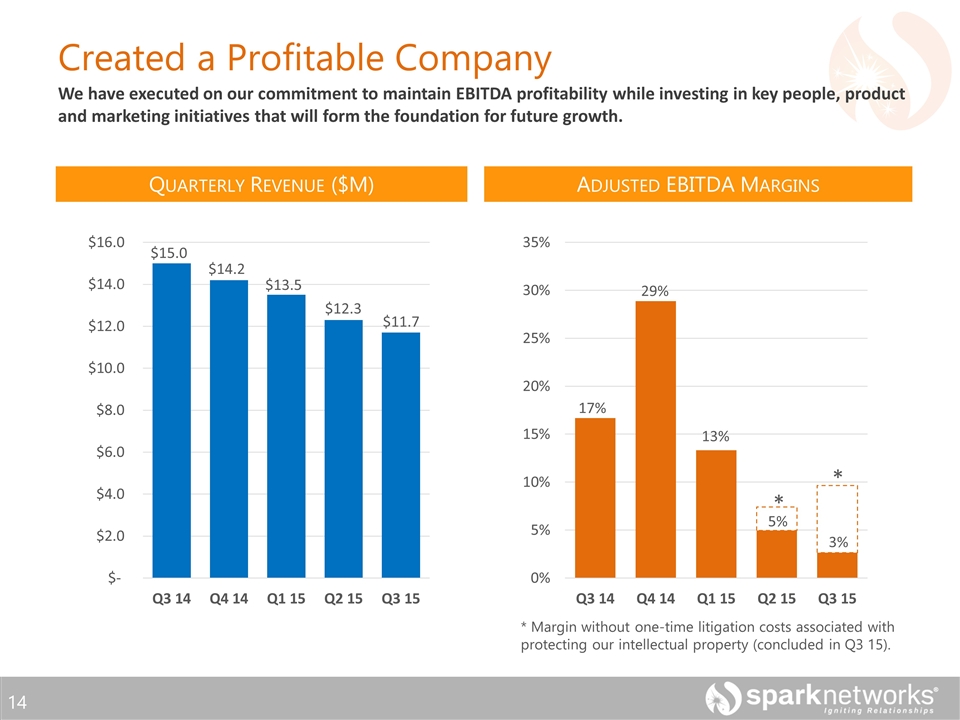

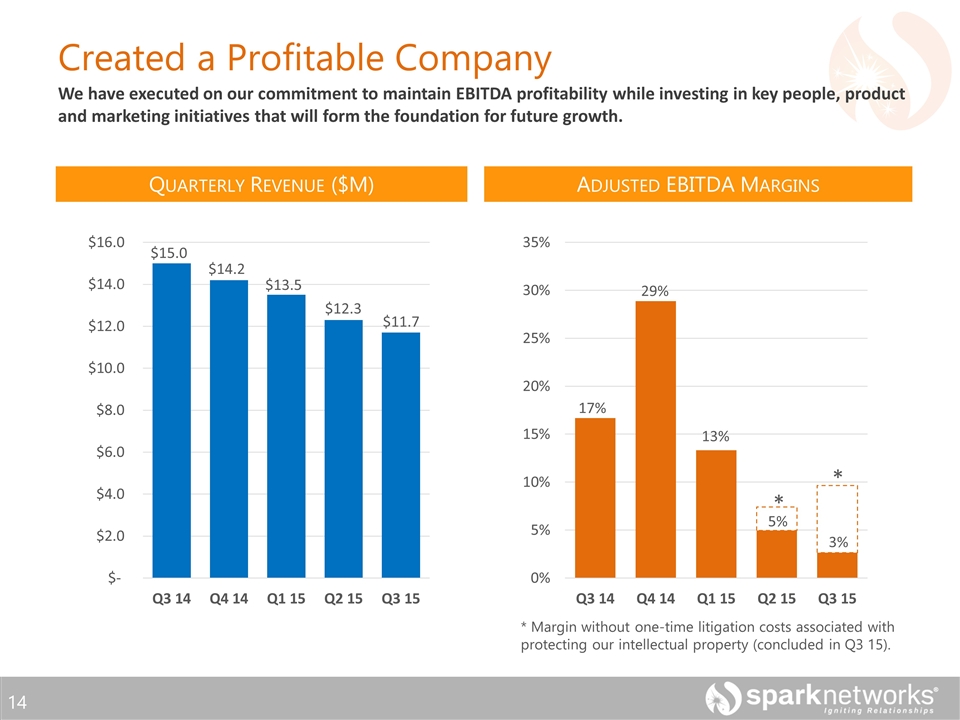

Created a Profitable Company * * * Margin without one-time litigation costs associated with protecting our intellectual property (concluded in Q3 15). We have executed on our commitment to maintain EBITDA profitability while investing in key people, product and marketing initiatives that will form the foundation for future growth. $15.0 $14.2 $13.5 $12.3 $11.7 17% 29% 13% 5% 3% QUARTERLY REVENUE ($M) ADJUSTED EBITDA MARGINS

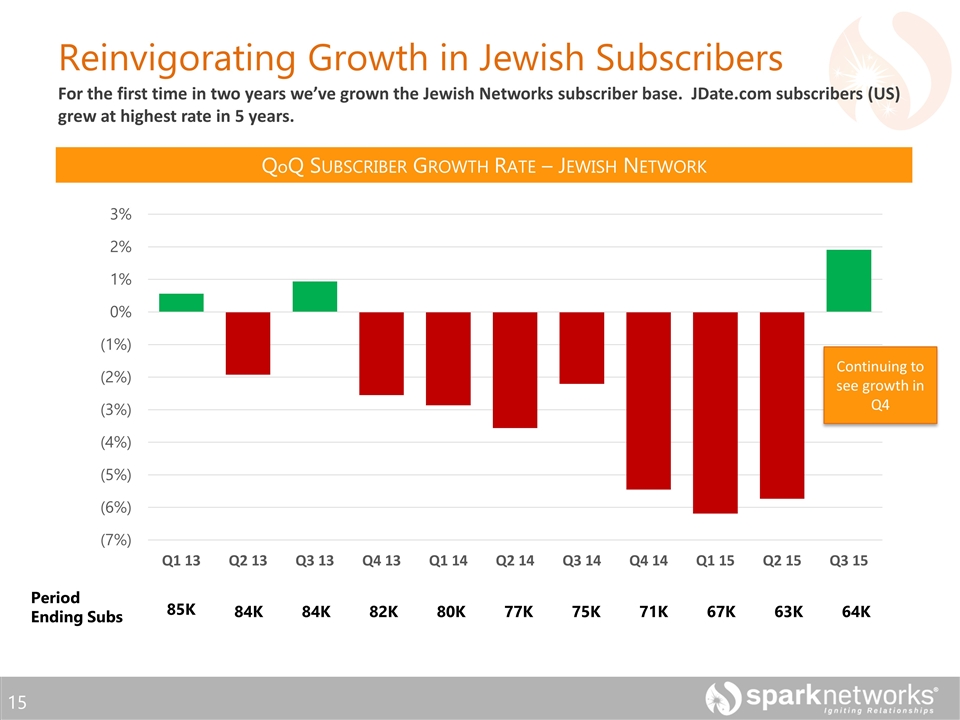

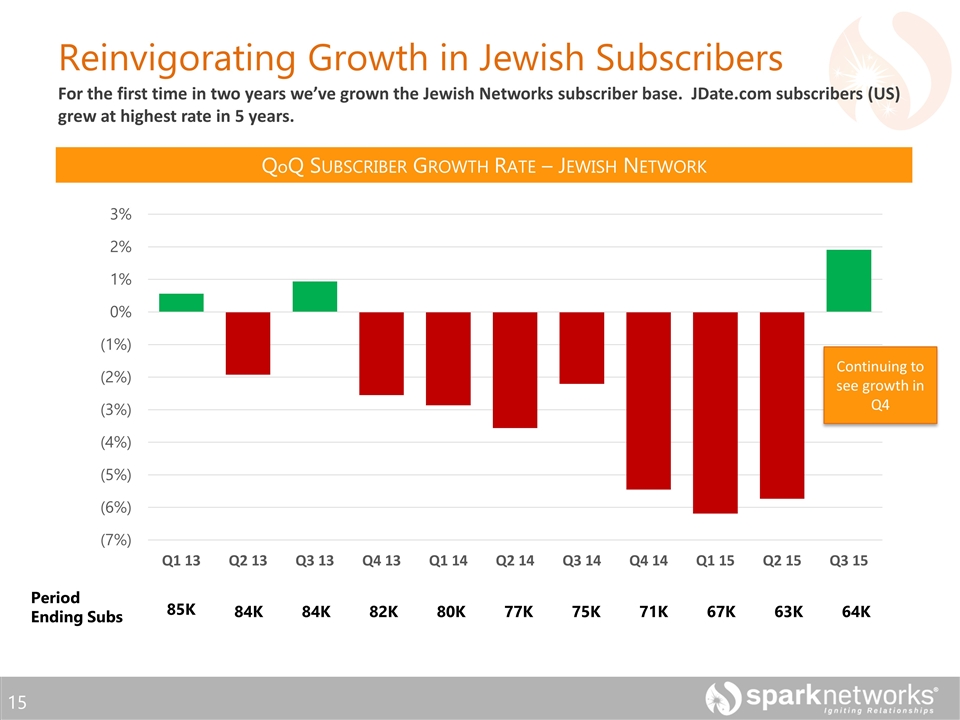

Reinvigorating Growth in Jewish Subscribers 85K 84K 84K 82K 80K 77K 75K 71K 67K 63K 64K Period Ending Subs QoQ SUBSCRIBER GROWTH RATE – JEWISH NETWORK For the first time in two years we’ve grown the Jewish Networks subscriber base. JDate.com subscribers (US) grew at highest rate in 5 years. Continuing to see growth in Q4

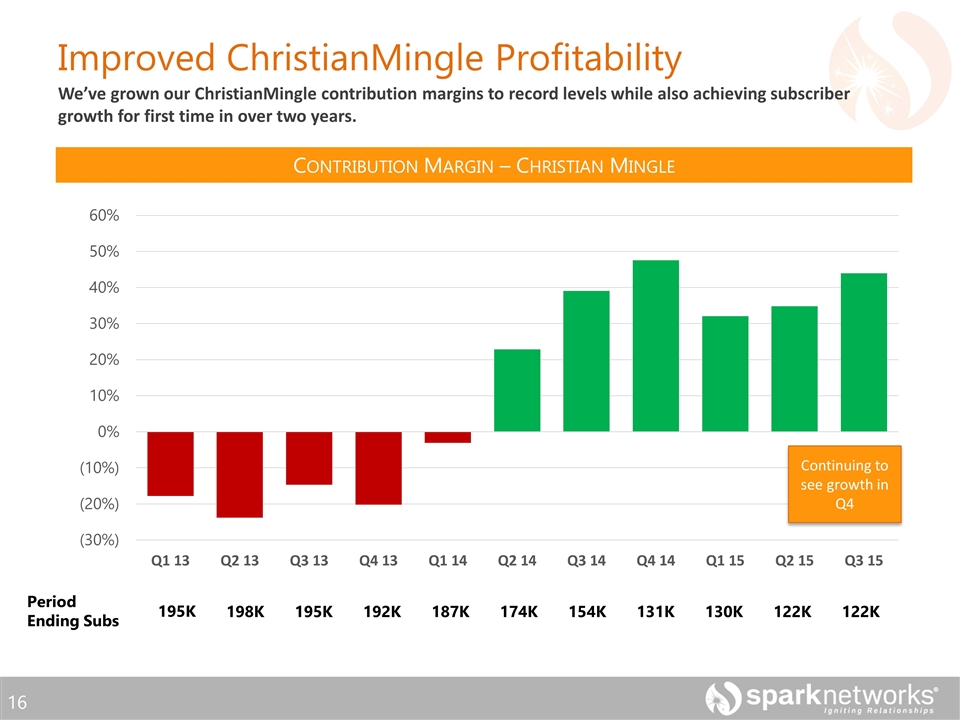

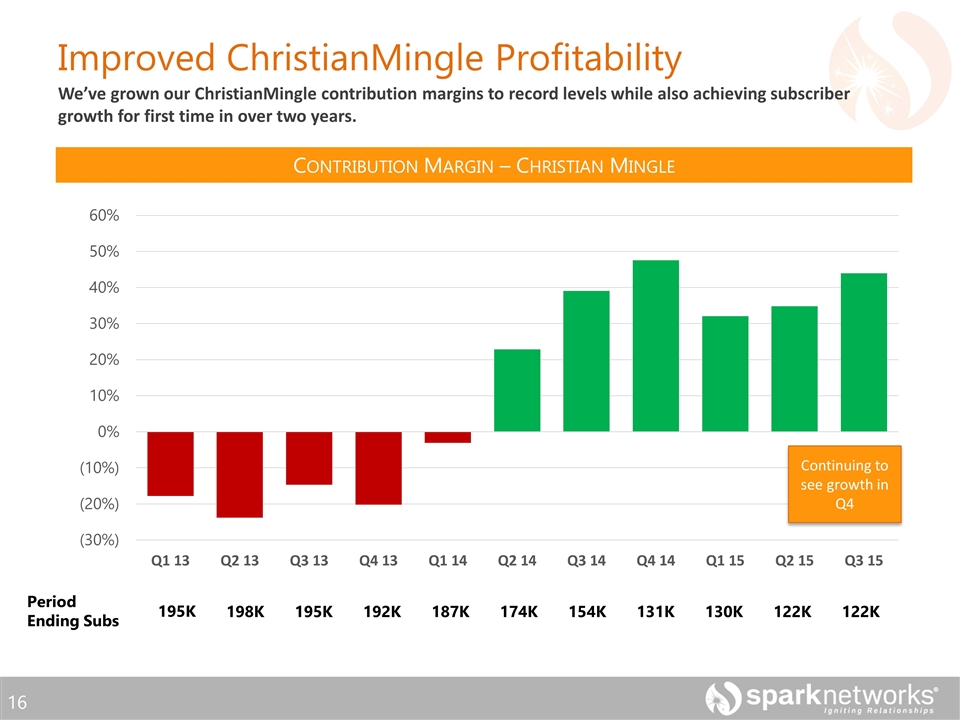

Improved ChristianMingle Profitability 195K 198K 195K 192K 187K 174K 154K 131K 130K 122K 122K Period Ending Subs We’ve grown our ChristianMingle contribution margins to record levels while also achieving subscriber growth for first time in over two years. Continuing to see growth in Q4 CONTRIBUTION MARGIN – CHRISTIAN MINGLE

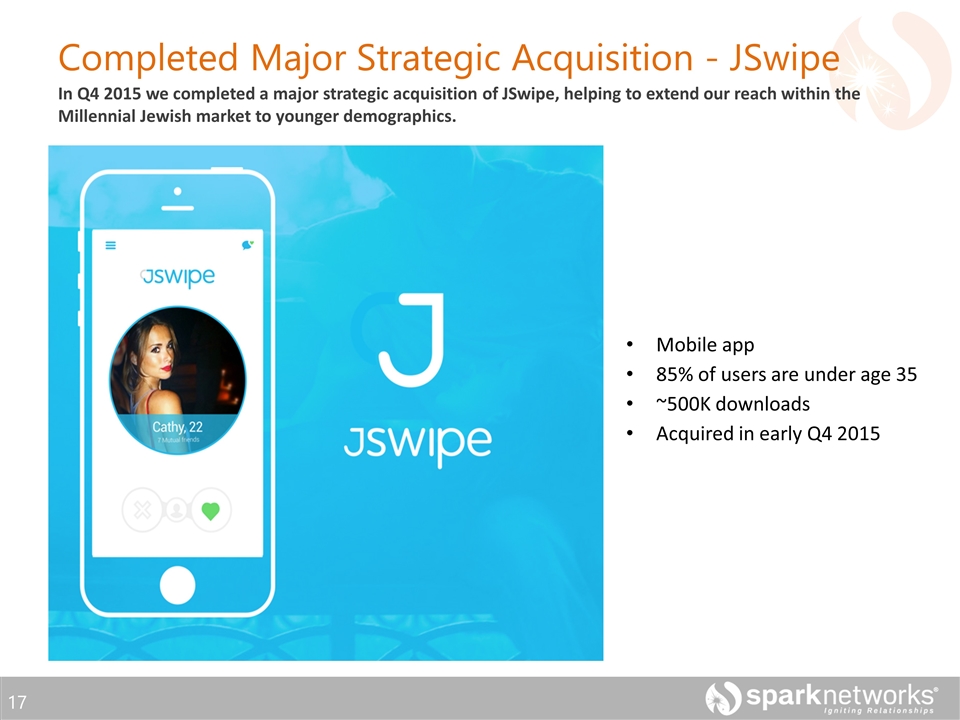

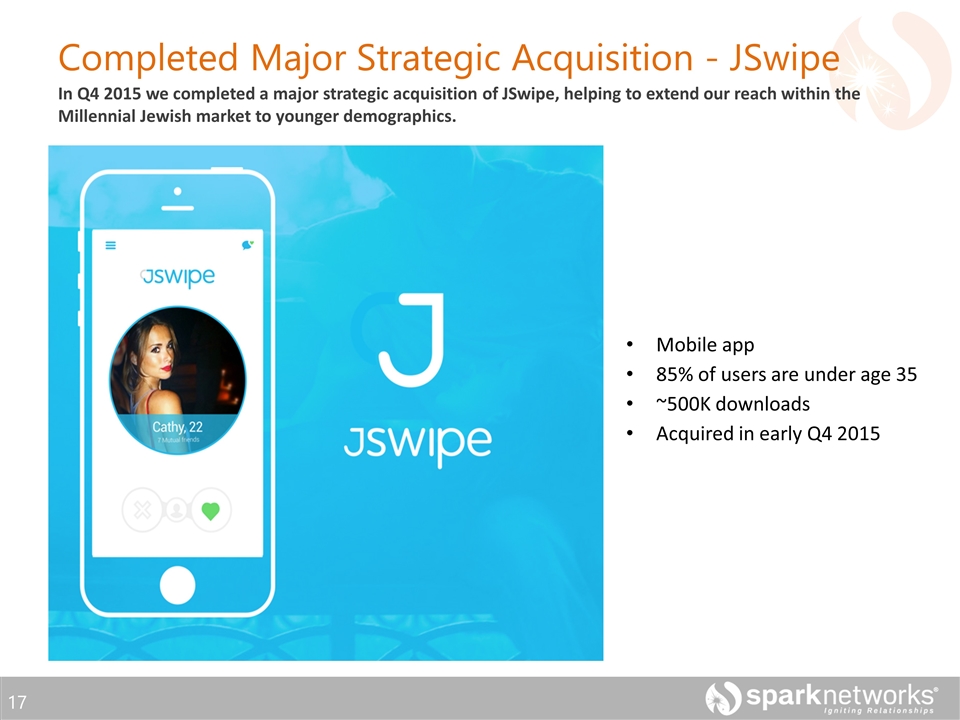

Completed Major Strategic Acquisition - JSwipe Mobile app 85% of users are under age 35 ~500K downloads Acquired in early Q4 2015 In Q4 2015 we completed a major strategic acquisition of JSwipe, helping to extend our reach within the Millennial Jewish market to younger demographics.

Where are we heading?

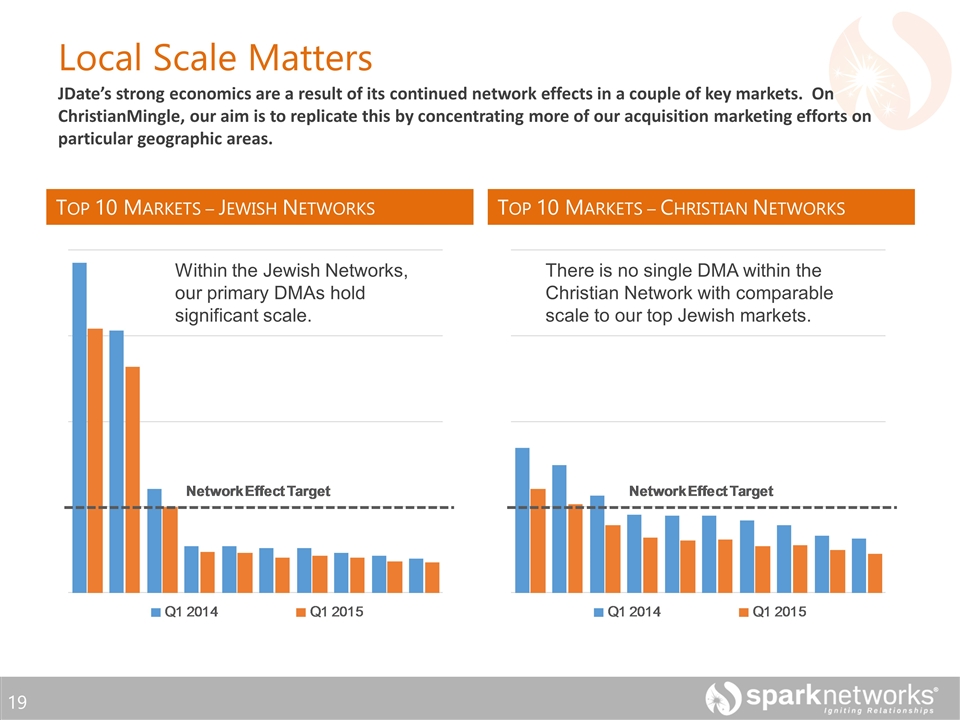

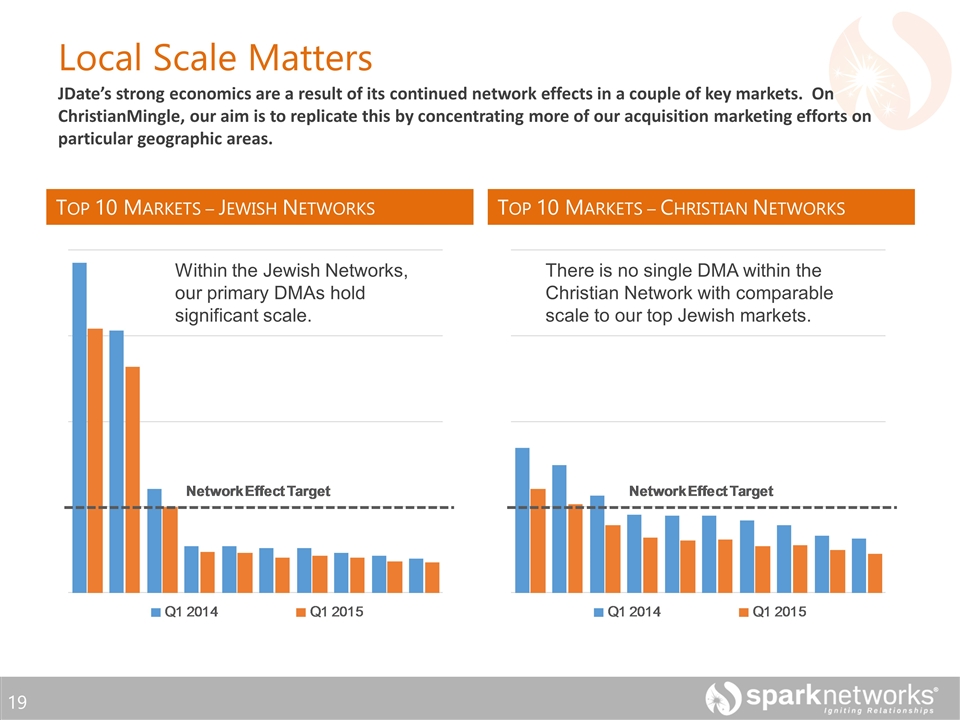

Within the Jewish Networks, our primary DMAs hold significant scale. There is no single DMA within the Christian Network with comparable scale to our top Jewish markets. JDate’s strong economics are a result of its continued network effects in a couple of key markets. On ChristianMingle, our aim is to replicate this by concentrating more of our acquisition marketing efforts on particular geographic areas. Local Scale Matters TOP 10 MARKETS – JEWISH NETWORKS TOP 10 MARKETS – CHRISTIAN NETWORKS

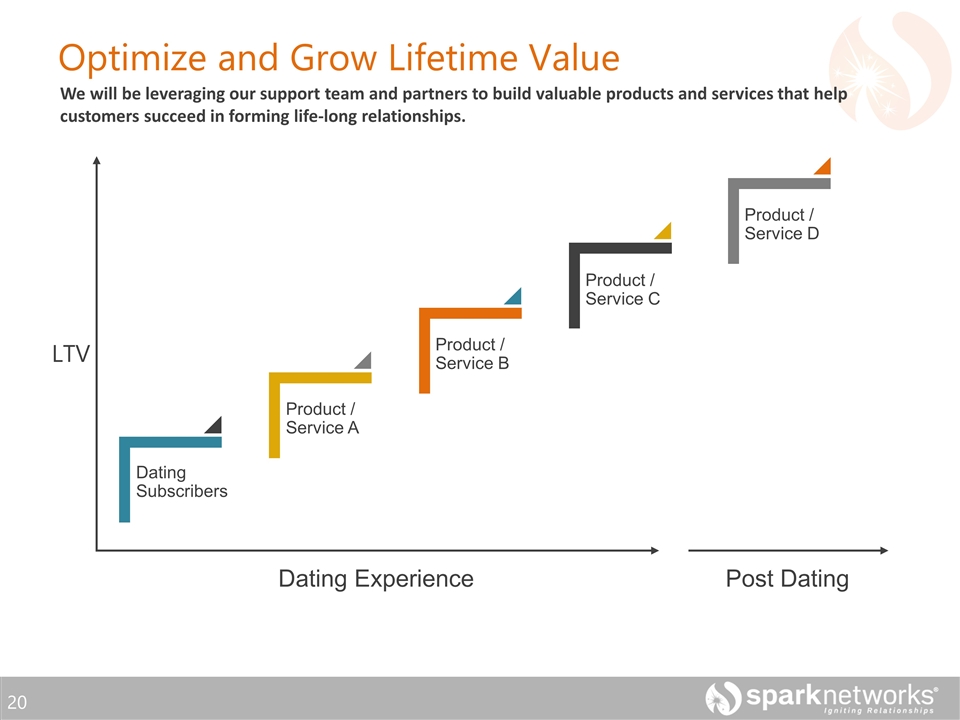

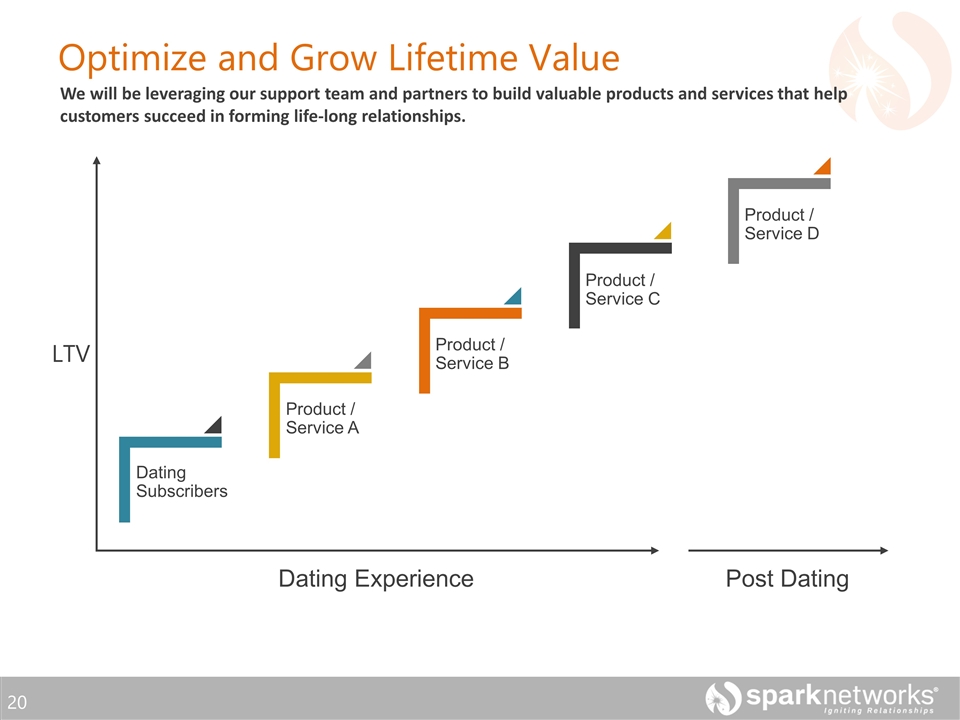

Optimize and Grow Lifetime Value We will be leveraging our support team and partners to build valuable products and services that help customers succeed in forming life-long relationships. Dating Subscribers Product / Service A Product / Service B Product / Service C Product / Service D Dating Experience Post Dating LTV

Growing a Relationship Platform Our two core communities are geared towards serious relationships that are centered around faith and thus we are uniquely positioned to both provide consumers with valuable relationship knowledge as well as partnering with relevant congregations. Knowledge Church / Synagogue Community

Continued Community Improvements Continue to build out the largest online community of single Christians & Jews: Make the sites authentic and relevant to a broad spectrum of the community Provide industry leading user experience Connect with users wherever they are – mobile, tablet, desktop Support success by providing robust customer service and safety With a new, consolidated platform in place we can now more rapidly optimize our core community products – improving user experience, matching capabilities, and optimizing conversions. Church / Synagogue Community Knowledge

Value-added Content & Curriculum Provide content and curriculum that help people develop life-long relationships Develop valuable, engaging content that can be used individually or via church / synagogue groups Develop and deliver small group and personalized coaching that helps customers succeed within the community Provide platform for easy access In partnership with leading relationship and religious experts we are building out value-added (freemium) content that is geared towards helping people develop and sustain positive relationships. Church / Synagogue Community Knowledge

Partnering with Religious Communities Support local churches / synagogues as they seek to equip their single members Provide materials to build engaging singles ministries Allow churches / synagogues to support congregation through micro-communities on our sites Our partnerships with local churches / synagogues not only helps them provide needed value to their singles congregations but it acts as a grass-roots feeder into our communities. Church / Synagogue Community Knowledge

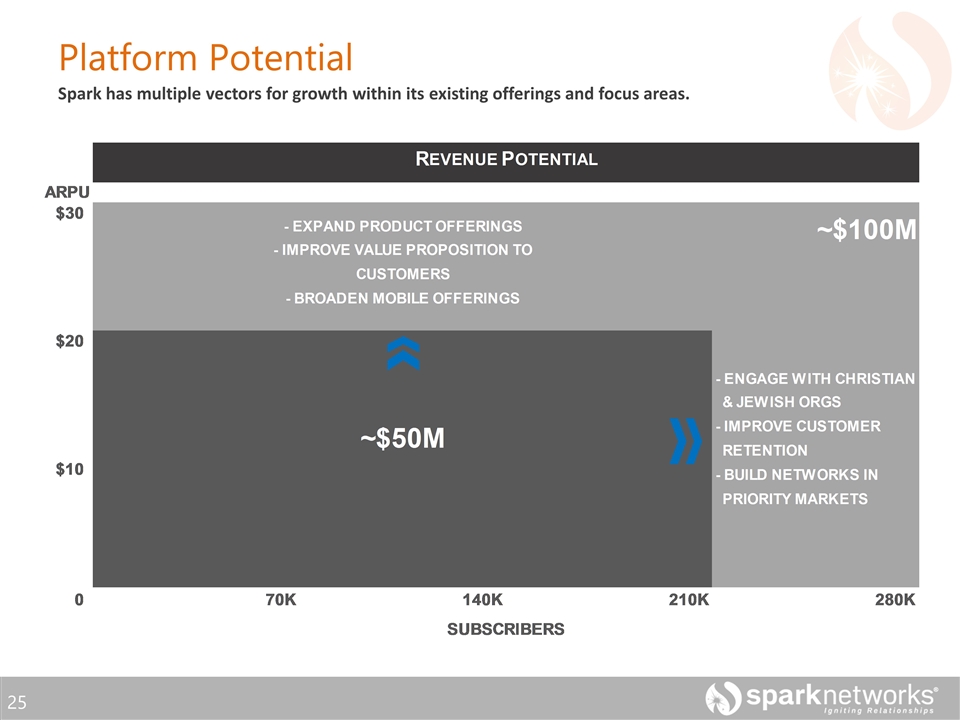

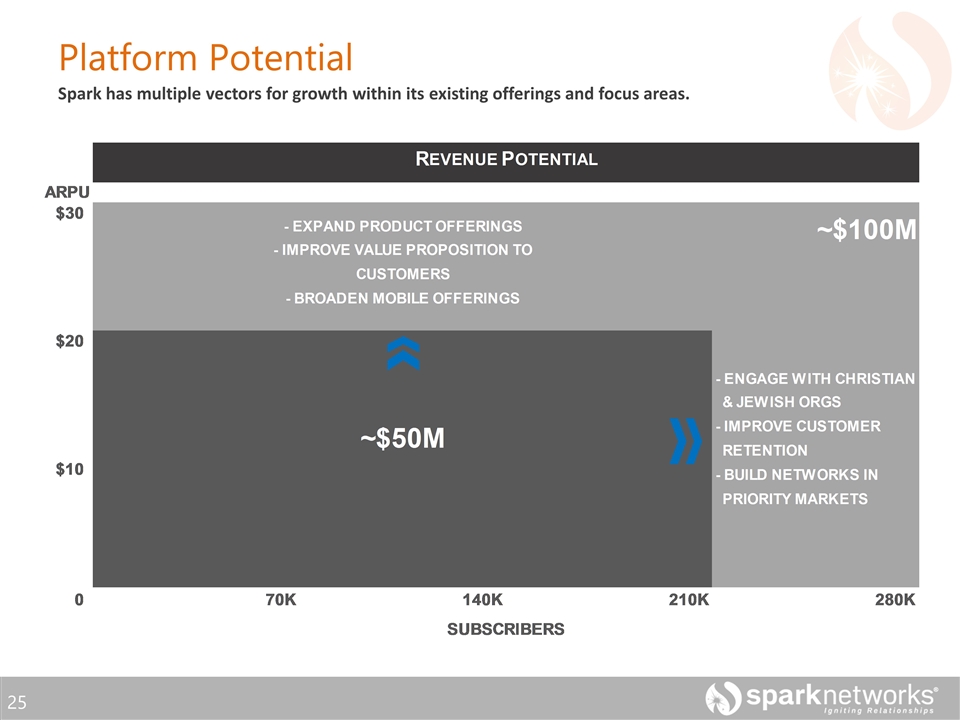

Spark has multiple vectors for growth within its existing offerings and focus areas. Platform Potential

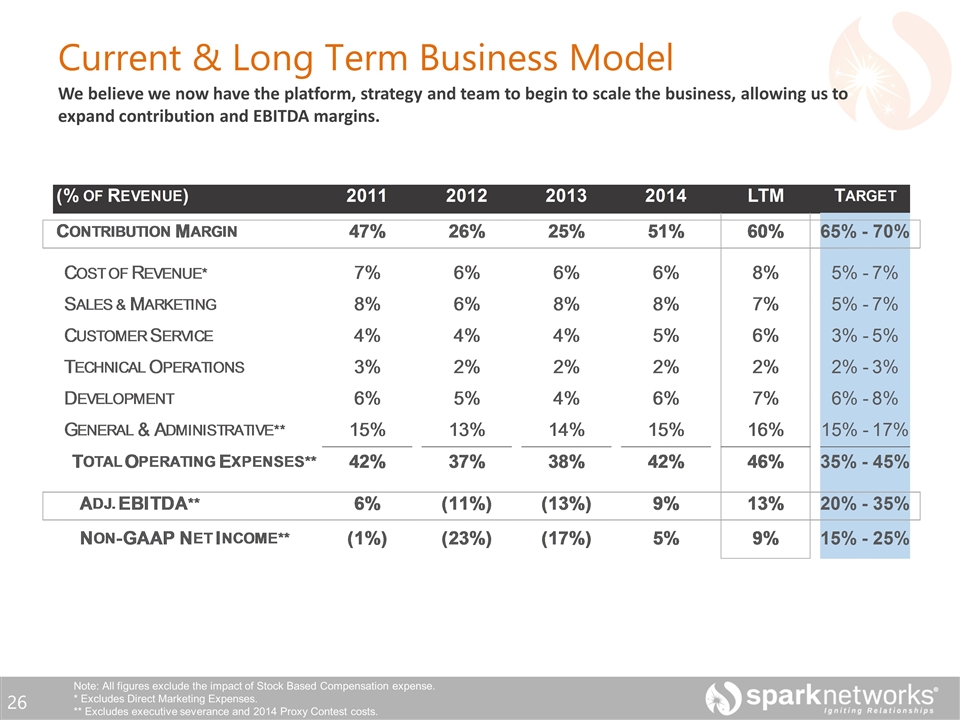

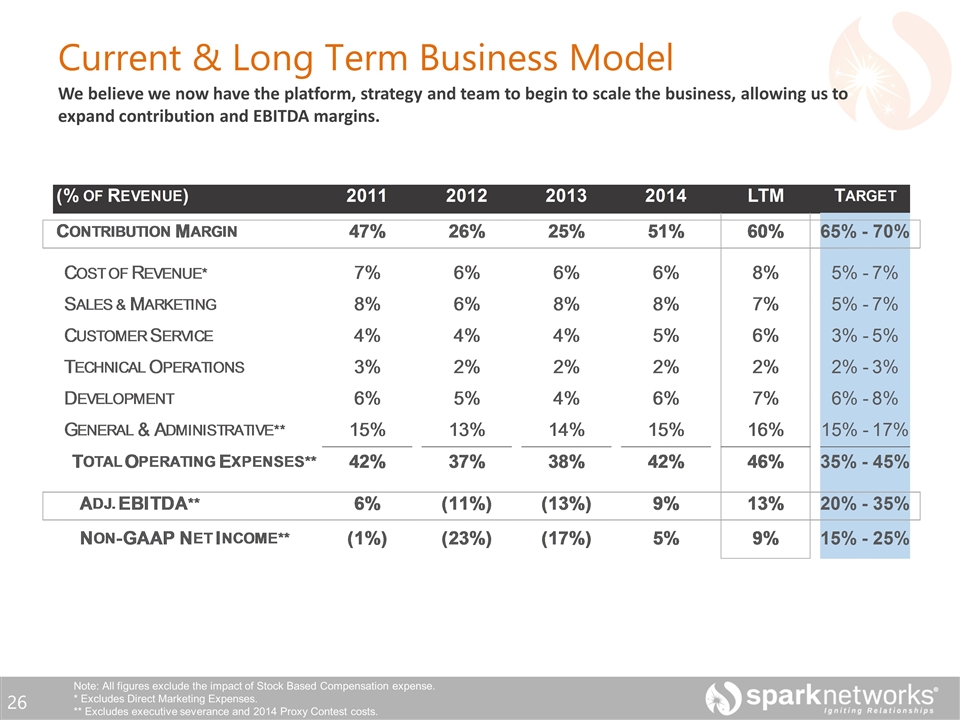

We believe we now have the platform, strategy and team to begin to scale the business, allowing us to expand contribution and EBITDA margins. Current & Long Term Business Model Note: All figures exclude the impact of Stock Based Compensation expense. * Excludes Direct Marketing Expenses. ** Excludes executive severance and 2014 Proxy Contest costs.