Table of contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 1, 2022

or

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-38603

SONOS, INC.

(Exact name of Registrant as specified in its charter)

| | | |

Delaware | | | 03-0479476 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

614 Chapala Street | Santa Barbara | CA | 93101 |

(Address of principal executive offices) | | | (Zip code) |

805-965-3001

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.001 par value | | SONO | | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act (Check one):

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging Growth Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the shares of SONO common stock held by non-affiliates of the registrant as of April 1, 2022, the last business day of the registrant's most recently completed second fiscal quarter, was $2,517.8 million based on the closing price of $27.68 as reported by The Nasdaq Global Select Market System.

As of November 7, 2022, the registrant had 126,685,545 shares of common stock outstanding, $0.001 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference certain information from the registrant’s definitive proxy statement (the "2023 Proxy Statement") relating to its 2023 Annual Meeting of Stockholders. The 2023 Proxy Statement will be filed with the United States Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of contents

TABLE OF CONTENTS

2

Table of contents

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical fact contained in this Annual Report on Form 10-K, including statements regarding future operations, are forward-looking statements. In some cases, forward-looking statements may be identified by words such as "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "could," "would," "expect," "objective," "plan," "potential," "seek," "grow," "target," "if," and similar expressions intended to identify forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the section titled "Risk Factors" set forth in Part I, Item 1A of this Annual Report on Form 10-K and in our other filings with the Securities and Exchange Commission (the "SEC"). Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Annual Report on Form 10-K may not occur, and actual results may differ materially and adversely from those anticipated or implied in the forward-looking statements. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our expectations regarding our results of operations, including gross margin, financial condition and cash flows;

•our expectations regarding the development and expansion of our business;

•anticipated trends, challenges and opportunities in our business and in the markets in which we operate;

•competitors and competition in our markets;

•our ability to maintain and promote our brand and expand brand awareness;

•our ability to successfully develop and introduce new products;

•our ability to manage our international operations;

•the effects of tariffs, trade barriers and retaliatory trade measures;

•our ability to expand our customer base and expand sales to existing customers;

•our expectations regarding development of our direct-to-consumer sales channels;

•expansion of our partner network;

•the macroeconomic environment and our ability to navigate it;

•the impact of the COVID-19 pandemic on our business and our response to it;

•our ability to retain and hire necessary employees and staff our operations appropriately;

•the timing and amount of certain expenses and our ability to achieve operating leverage over time; and

•our ability to maintain, protect and enhance our intellectual property.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we do not intend to update any of these forward-looking statements after the date of this Annual Report on Form 10-K or to conform these statements to actual results or revised expectations.

You should read this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

3

Table of contents

PART I

Item 1: Business

Overview

Sonos is one of the world's leading sound experience brands.

We pioneered multi-room, wireless audio products, debuting the world’s first multi-room wireless sound system in 2005. Today, our products include wireless, portable, and home theater speakers, components, and accessories to address consumers’ evolving audio needs. We are known for delivering unparalleled sound, thoughtful design aesthetic, simplicity of use, and an open platform. Our platform has attracted a broad range of more than 130 streaming content providers, such as Apple Music, Spotify, Deezer, and Pandora. These partners find value in our independent platform and access to our millions of desirable and engaged customers. We frequently introduce new services and features across our platform, providing our customers with enhanced functionality, improved sound, and an enriched user experience. We are committed to continuous technological innovation as reflected in our growing global patent portfolio. We believe our patents comprise the foundational intellectual property for wireless multi-room and other audio technologies.

Our innovative products, seamless customer experience, and expanding global footprint have driven 17 consecutive years of sustained revenue growth since our first product launch. Our growth is driven by both new customers buying our products as well as existing customers continuing to add products to their Sonos systems. In fiscal 2022, existing customers accounted for approximately 44% of new product registrations. As of October 1, 2022, we had a total of nearly 41.8 million products registered in approximately 14.0 million households globally, including the addition of approximately 1.4 million new households during fiscal 2022. Our customers have typically purchased additional Sonos products over time. As of October 1, 2022, 60% of our 14.0 million households had registered more than one Sonos product. As of October 1, 2022, our households own 3.0 products on average. We also estimate that our customers listened to 12.8 billion hours, excluding Bluetooth listening, of audio content using our products in fiscal 2022, which represents 5.5% growth from fiscal 2021.

4

Table of contents

Our Products

We generate revenue from sales of our Sonos speaker products, including wireless speakers and home theater speakers, from our Sonos system products, which largely comprises our component products, and from partner products and other revenue, including partnerships with IKEA and Sonance, Sonos and third-party accessories, licensing, advertising, and subscription revenue. Our portfolio of products encourages customers to uniquely tailor their Sonos sound systems to best meet their sound and design preferences.

•Sonos speakers. Sonos speakers comprises our wireless speakers and home theater products, including:

| | |

Product | Launch Date | Description |

Sub Mini | October 2022 | Our wireless subwoofer which delivers powerful, balanced bass, rich, clear low end frequencies, in a compact cylindrical design. |

Ray | June 2022 | Our smallest, smart soundbar for TV, music, and more. |

Beam (Gen 2) | October 2021 | Our smart, compact soundbar for TV, music, and more, with support for Dolby Atmos. Originally introduced as Beam (Gen 1) in June 2018. |

Roam Colors Roam SL Roam | May 2022 March 2022 April 2021 | Our ultra-portable smart speaker with Bluetooth and WiFi for listening on the go and at home. Originally introduced as Roam in April 2021 |

Arc | June 2020 | Our premium smart soundbar for TV, movies, music, gaming, and more, with support for Dolby Atmos. Replaced Playbar, our first smart soundbar released in April 2013 and Playbase, our powerful sound base for TVs released in 2017. |

Five | June 2020 | Our high fidelity speaker for superior sound. Originally launched as Play:5 (Gen 1) in November 2009 and completely redesigned in November 2015 as Play:5 (Gen 2). |

Sub (Gen 3) | June 2020 | Our wireless subwoofer for deep bass. Originally introduced as Sub (Gen 1) in June 2012. |

Move | September 2019 | Our durable, battery-powered smart speaker for outdoor and indoor listening. |

One SL | September 2019 | Our powerful microphone-free speaker for music and more. Replaced Play:1 which was introduced in October 2013. |

One | October 2017 | Our powerful smart speaker with voice control built in. |

•Sonos System Products. Sonos system products comprises our component and other products which allow customers to convert third-party wired systems, stereo systems and home theater set-ups into our easy-to-use, wirelessly controlled streaming music system, including:

| | |

Product | Launch Date | Description |

Port | September 2019 | Our versatile streaming component for stereos or receivers. Replaced Connect which launched in January 2007. |

Amp | February 2019 | Our versatile amplifier powering all our customers’ entertainment. Replaced Connect: Amp which launched in September 2012. |

5

Table of contents

•Partner Products and Other Revenue. Partner products and other revenue categories comprise products sold in connection with our partnerships, accessories, professional services, licensing, and advertising revenue. Products in this category comprise accessories that allow our customers to integrate our products seamlessly into their homes as well as products manufactured by and/or sold by our partners, including:

| | |

Product | Launch Date | Description |

Audi Partnership | April 2021 | Our first-ever automotive audio partnership delivering Sonos-tuned premium sound experience for the Q4 e-tron and further models including the A1, Q2, and Q3. |

Sonos Radio HD | November 2020 | Our ad-free, high-definition streaming tier of our streaming radio service, Sonos Radio. |

Sonos Radio | April 2020 | Our free, ad-supported streaming radio experience bringing together more than 60,000 stations from multiple streaming partners alongside original programming from Sonos. |

Sonos Architectural by Sonance | February 2019 | Our collection of installed passive speakers for indoor and outdoor use designed and optimized for Amp in partnership with Sonance, including in-ceiling, in-wall, and outdoor speakers. |

IKEA module units | Various | Hardware and embedded software integrated into final products manufactured and sold by IKEA. Current IKEA products include SYMFONISK picture frame, bookshelf speaker, and speaker lamp. |

Accessories | Various | Our custom-designed stands, mounts, shelves, cables, chargers, and more. |

6

Table of contents

Our Software

Our proprietary software is the foundation of the Sonos sound system and further differentiates our products and services from those of our competitors.

In June 2020, we introduced Sonos S2, a powerful new app and operating system to enable a new generation of Sonos products and experiences, which includes new features, usability updates, and more personalization while also enabling higher resolution audio technologies for music and home theater. In June 2022, we introduced Sonos Voice Control, the first voice experience purpose-built for listening to and controlling your music on Sonos speakers. Designed with privacy at its core, Sonos Voice Control is the simplest way to control your music, offering complete command of your Sonos system using only your voice. Sonos Voice Control works on every voice-capable Sonos speaker, processing requests entirely on the Sonos device.

Our software provides the following key benefits:

•Multi-room experience. Our system enables our speakers to work individually or together in synchronized playback groups, powered by wireless network and Bluetooth capabilities to route and play audio optimally.

•Open platform for content partners. Our platform enables customers to easily search and browse for content from a list of more than 130 content partners from around the world including stations, artists, albums, podcasts, audio books, and more. Content partners can connect to Sonos via our platform and find a new and growing audience for their catalogs.

•Intuitive and flexible control. Our customers can control their experiences through the Sonos app, voice control, from Sonos devices directly, or an expanding number of third-party apps and smart devices. As our customers navigate across different controllers, our technology synchronizes the control experience across the Sonos platform to deliver the music and entertainment experience they desire.

•Smart audio tuning. Our Trueplay technology uses the microphones on an iOS device to analyze room attributes, speaker placement and other acoustic factors to improve sound quality. We also developed Automatic TruePlay to deliver the same audio tuning experience, directly using the microphones integrated to our speakers and make this available to iOS and Android users.

•Continuous Improvement. Our software platform and cloud service enables feature enhancements and delivery of new experiences on an ongoing basis. As a result, the Sonos experience improves for customers over time.

Our Partner Ecosystem

We have built a platform that attracts partners to enable our customers to play content from their preferred services. Our platform has attracted a broad range of more than 130 streaming content providers and span across content, control, and third-party applications:

•Content. We partner with a broad range of content providers, such as streaming music services, internet radio stations, and podcast services, allowing our customers to enjoy their audio content from whichever source they desire.

•Control. We provide our customers with multiple options to control their home audio experiences, including voice control and direct control from within selected streaming music service apps. Our platform is the first to offer consumers the ability to buy a single smart speaker with more than one voice assistant choice. Our voice-enabled speaker products have Amazon Alexa and Google Assistant functionality, and in June 2022, we introduced Sonos Voice Control.

•Third-party partnerships. We partner with third-party developers to build new applications and services on top of the Sonos platform, increasing customer engagement and creating new experiences for our customers, such as architectural in-ceiling, in-wall and outdoor speakers in partnership with Sonance, picture frame, bookshelf and table lamp speakers in partnership with IKEA, and automotive sound in partnership with Audi.

Research and Development

Our research and development team develops new hardware products, software and services, while continually improving and enhancing our existing software and hardware products to address customer demands and emerging trends. Our teams have worked on features and enhancements to the Sonos system including developments to the Sonos app, product setup, Trueplay tuning, the ability to use Alexa or Google voice services, and Sonos Voice Control. Our audio team has developed a series of acoustic technologies which enabled us to create speakers that produce high-fidelity sound. In April 2022, we added a talented group of employees to our research and development team through our acquisition of Mayht, a Netherlands-based company, which invented a new approach to audio transducers. We expect that the addition of this team and its strategic technology will help transform and enhance our product portfolio.

7

Table of contents

Our wireless and radio team established world-class wireless performance that enabled multi-room experience, wireless surround sound, and many other applications. Our industrial design and mechanical engineering teams developed a cohesive, unique family of products across multiple categories and use-cases such as home theater, all-in-one, and portable. These products demonstrate a range of proprietary manufacturing and design details, logo application techniques, and assembly architecture. The products and software we develop require significant technical knowledge and expertise to develop at a competitive pace. We believe our research and development capabilities and our intellectual property differentiates us from our competitors. We intend to continue to significantly invest in research and development to bring new products and software to market and expand our platform and capabilities.

Sales and Marketing

We sell our products primarily through over 10,000 third-party physical retail stores and our products are distributed in more than 60 countries. The majority of our sales are transacted through traditional physical retailers, including on their websites. We also sell through online retailers, to custom installers who bundle our products with services that they sell to their customers, and directly through our website sonos.com.

We invest in customer experience and customer relationship management to drive loyalty, word-of-mouth marketing and sustainable, profitable growth. Our marketing investments are focused on driving profitable growth through advertising, public relations and brand promotion activities, including digital platforms, sponsorships, collaborations, brand activations, and channel marketing. We continue to invest significant resources in our marketing and brand development efforts, including investing in capital expenditures on product displays to support our channel marketing through our retail partners.

Manufacturing, Logistics and Fulfillment

We outsource the manufacturing of our speakers and components to contract manufacturers, who produce our products based on our design specifications. Our products are manufactured by contract manufacturers in China and Malaysia, and in fiscal 2022, we began further diversifying our supply chain into Vietnam. In accordance with our agreements with our contract manufacturers, they will enter into purchase orders with their upstream suppliers for component inventory necessary to manufacture our products, based on our demand forecasts.

The vast majority of our products are shipped to our third-party warehouses which are then shipped to our distributors, retailers, and directly to our customers. Our third-party warehouses are located in the United States in California and Pennsylvania, as well as internationally in Australia, Canada, the Netherlands, China, Japan, and the United Kingdom.

We use a small number of logistics providers for substantially all of our product delivery to both distributors and retailers. This approach generally allows us to reduce order fulfillment time, reduce shipping costs, and improve inventory flexibility.

Our Competitive Strengths

The proliferation of streaming services, the rapid expansion of digital audio content types, and the rise in voice assistants are significantly changing audio consumption habits and increasing demand for easy, premium, integrated audio experiences. As a leading sound system for consumers, content partners and developers, Sonos is capitalizing on the large market opportunity created by these dynamics. We believe the following combination of capabilities and features of our business model distinguish us from our competitors and position us well to capitalize on our opportunities:

•Leading sound system. We have developed and refined our sound system over the last 19 years. Our effort has resulted in significant consumer awareness and market share among home audio professionals. For example, a 2022 product study by CE Pro ranked Sonos as the leading brand in the wireless speakers, soundbar, and subwoofer categories. Our 93% share in the wireless speaker category among these industry professionals significantly outpaces our competitors.

•Proprietary Sonos app and software platform. We offer our customers a mobile app that controls the Sonos sound system and the entire listening experience. Customers can stream different audio content to speakers in different rooms or the same audio content synchronized throughout the entire home. Additionally, the Sonos app enables universal search, the ability to search for audio content across streaming services and owned content so that customers can easily find, play, or curate music.

8

Table of contents

•Platform enables freedom of choice for consumers. Our broad and growing network of partners provides access to voice control, streaming music, internet radio, podcasts, and audiobook content, enabling consumers with freedom of choice in content and services. Our platform attracts a broad set of content providers, including leading streaming music services and third-party developers.

•Differentiated consumer experience creates engaged households who often repeat purchases. We deliver a differentiated customer experience to millions of households every day, cultivating a long-term passionate and engaged customer base. This engagement with our products, and our ability to continuously improve and enhance the functionality of our existing products through software updates, can help drive momentum in our flywheel as customers add products to their Sonos sound systems. We generate significant revenue and profits from existing customers purchasing additional products to expand their Sonos sound systems. In fiscal 2022, existing households represented approximately 44% of new product registrations. We have proven our ability to profitably develop new experiences that drive existing customers to add additional products to their home, while continuing to add new homes. We believe that we have yet to fully realize the lifetime value of our customer base and this aspect of our financial model will continue to contribute to our ability to achieve sustainable, profitable growth over the long term.

•Commitment to innovation drives continuous improvement. We have made significant investments in research and development since our inception and believe that we own the foundational intellectual property of wireless multi-room and other audio technologies. Our patent portfolio continues to grow each year. We were included in the Intellectual Property Owners Association "Top 300 Patent Owners" report for calendar year 2021. As of calendar year 2021, we held approximately 1,150 issued patents in the United States versus approximately 15 in 2011.

Our Growth Strategies

Key elements of our growth strategy include:

•Continued introduction of innovative products and services and expansion into new categories. To address our market opportunity, we have developed a long-term roadmap to deliver innovative products, services and software enhancements, and expand into new categories. We intend to continue to introduce products and services across multiple categories designed for enjoyment in all the places and spaces that our customers listen to audio content, including outside of the home, as well as business and enterprise customers. Executing on our roadmap will position us to acquire new customers, increase sales to existing customers, and improve the customer experience.

•Expansion of direct-to-consumer efforts and building relationships with existing channel partners and prospective customers. We are focused on reaching and converting prospective customers through third-party retail stores, e-commerce retailers, our website sonos.com, and custom installers of home audio systems. We expect that our direct-to-consumer channel will continue to contribute to our growth. We intend to continue to build direct relationships with current and prospective customers through sonos.com and the Sonos app to drive direct sales. In fiscal 2022, we generated 22.5% of total revenue through our direct-to-consumer channel, primarily sonos.com. While we seek to increase sales through our direct-to-consumer sales channel, we expect that our third-party retailers will continue to be an important part of our ecosystem. We will continue to seek retail partners that can deliver differentiated in-store experiences to support customer demand for product demonstrations. Additionally, we intend to expand and strengthen our partnerships with custom installers who are valuable to our customer base and contribute to our new household growth. For example, a 2022 product survey by CE Pro ranked Sonos as the leading brand in the wireless speakers, soundbar, and subwoofer categories. Our 93% share in the wireless speakers category among these industry professionals significantly outpaces our competitors. In fiscal 2022, we generated 21.2% of total revenue through our installer solutions channel.

•Expand partner ecosystem to enhance platform. We intend to deepen our relationships with our current partners and expand our partner ecosystem by providing our customers access to streaming music services, voice assistants, internet radio, podcasts and audiobook content.

•Increase brand awareness in existing geographic markets. We intend to increase our household penetration rates in our existing geographic markets by increasing brand awareness, expanding our product offerings and growing our partner ecosystem.

•Expansion into new geographic markets. Geographic expansion represents a growth opportunity in currently underserved countries. We intend to expand into new countries over time by employing country-specific marketing campaigns and distribution channels.

9

Table of contents

Factors Affecting Performance

New Product Introductions. Since 2005, we have released products in multiple audio categories. We intend to introduce new products that appeal to a broad set of consumers, as well as bring our differentiated listening platform and experience to all the places and spaces where our customers listen to the breadth of audio content available, including inside and outside their homes.

Seasonality. Historically, we have typically experienced the highest levels of revenue in the first fiscal quarter of the year coinciding with the holiday shopping season and our promotional activities. Our promotional discounting activity is typically higher in the first fiscal quarter as well, which negatively impacts gross margin during this period. However, our higher sales volume in the holiday shopping season has historically resulted in a higher operating margin in the first fiscal quarter due to positive operating leverage.

Ability to Sell Additional Products to Existing Customers. Our existing customers typically increase the number of Sonos products in their homes. In fiscal 2022, existing households represented approximately 44% of new product registrations. As we execute on our product roadmap to address evolving consumer preferences, we believe we can expand the number of products in our customers’ homes. Our ability to sell additional products to existing customers is a key part of our business model, as follow-on purchases indicate high customer engagement and satisfaction, decrease the likelihood of competitive substitution, and result in higher customer lifetime value. We will continue to innovate and invest in product development in order to enhance customer experience and drive sales of additional products to existing customers.

Expansion of Partner Ecosystem. Expanding and maintaining strong relationships with our partners will remain important to our success. Our ability to develop, manufacture, and sell voice-enabled speakers that deliver differentiated consumer experiences will be a critical driver of our future performance, particularly as we compete in a larger market with an expanding number of competitors. We currently compete with, and will continue to compete with, companies that have greater resources than we do, many of which have brought voice-enabled speakers to market. To date, our agreements with these partners have all been on a royalty-free basis. We believe our partner ecosystem improves customer experience, attracting more customers to Sonos, which in turn attracts more partners to the platform, further enhancing customer experience. We believe partners choose to be part of the Sonos platform because it provides access to a large, engaged customer base on a global scale. We look to partner with a wide variety of streaming music services, voice assistants, connected home integrators, content creators, and podcast providers. We have also partnered with certain companies in the development of our own voice-enabled products, while also bringing to market our own voice assistant focused specifically on the audio experience. Our competitiveness in the voice-enabled speaker market will depend on successful investment in research and development, market acceptance of our products and our ability to maintain and benefit from our technology partnerships.

As competition increases, we believe our ability to give users the freedom to choose across a broad set of streaming services and voice control partners will be an important key differentiating factor.

Channel Strategy. We believe growing our own e-commerce channel will continue to be important to supporting our overall growth and profitability as consumers continue the shift from physical to online sales channels. We are investing in our e-commerce capabilities and in-app experience to drive direct sales. In fiscal 2022, sales through our direct-to-consumer channel, primarily through sonos.com, represented 22.5% of our revenue in fiscal 2022, and 24.2% in fiscal 2021. Sales through our direct-to-consumer channel decreased 5.1% in fiscal 2022 and increased 46.5% in fiscal 2021.

While we seek to increase sales through our direct-to-consumer sales channel, we expect that our partnerships with third-party retailers and custom installers will continue to be an important part of our ecosystem. We will continue to seek retail partners that can deliver differentiated in-store experiences to support customer demand for product demonstrations. Additionally, we intend to expand and strengthen our partnerships with custom installers who are valuable to our customer base and contribute to our new household growth. In fiscal 2022, we generated 21.2% of total revenue through our installer solutions channel. Our physical retail distribution relies on third-party retailers and our ability to maintain our diversified manufacturing footprint and base of component suppliers in support of production efficiency and flexibility across our global supply chain.

International Expansion. Our products are sold in more than 60 countries, and in fiscal 2022, 45.0% of our revenue was generated outside the United States. Our international growth will depend on our ability to generate sales from the global population of consumers, develop international distribution channels, and diversify our partner ecosystem to appeal to a more global audience. We are committed to strengthening our brand in global markets and our future success will depend in part on our growth in international markets.

Investing in Product and Software Development. Our investments in product and software development consist primarily of expenses in the personnel who support our research and development efforts and capital expenditures for new tooling and production line equipment to manufacture and test our products. We believe that our financial performance will significantly depend on the effectiveness of our investments to design and introduce innovative new products and services and enhance existing products and

10

Table of contents

software. If we fail to innovate and expand our product and software offerings or fail to maintain high standards of quality in our products, our brand, market position and revenue will be adversely affected. Further, if our development efforts are not successful, we will not recover the investments made.

Investing in Sales and Marketing. We continue to invest resources in our marketing and brand development efforts. Our marketing investments are focused on increasing brand awareness through advertising, public relations and brand promotion activities. While we maintain a base level of investment throughout the year, significant increases in spending are highly correlated with the holiday shopping season, new product launches, and software introductions. We also invest in capital expenditures on product displays to support our retail channel partners. Sales and marketing investments are typically incurred in advance of any revenue benefits from these activities.

Competition

We compete against established, audio-focused sellers of speakers and sound systems such as Bose, Samsung (and its subsidiaries Harman International and JBL), Sony, Bang & Olufsen, and Masimo (and its subsidiary Sound United that owns, among others, the Denon, Polk Audio and Bowers and Wilkens brands), and against developers of voice-enabled speakers and other voice-enabled products such as Amazon, Apple, and Google. In some cases, our competitors are also our partners in our product development and resale and distribution channels. Many of our competitors have significant market share, diversified product lines, well-established supply and distribution systems, strong worldwide brand recognition, loyal customer bases and significant financial, marketing, research, development and other resources.

The principal competitive factors in our market include:

•brand awareness and reputation;

•breadth of product offering;

•multi-room and wireless capabilities;

•product quality and design;

•ease of setup and use; and

•network of technology and content partners.

We believe we compete favorably with our competitors on the basis of the factors described above.

Intellectual Property

Intellectual property is an important aspect of our business, and we seek protection for our intellectual property as appropriate. To establish and protect our proprietary rights, we rely upon a combination of patent, copyright, trade secret and trademark laws, and contractual restrictions such as confidentiality agreements, licenses and intellectual property assignment agreements. We maintain a policy requiring our employees, contractors, consultants and other third parties to enter into confidentiality and proprietary rights agreements to control access to our proprietary information. These laws, procedures and restrictions provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated. There is no guarantee that we will prevail on any patent infringement claims against third parties. Furthermore, the laws of certain countries do not protect proprietary rights to the same extent as the laws of the United States, and we therefore may be unable to protect our proprietary technology in certain jurisdictions.

Sonos is a leading innovator that holds a comprehensive portfolio of intellectual property rights, including patents, trade secrets, copyrights, trademarks, service marks, trade dress and other forms of intellectual property rights in the U.S. and various other countries. Sonos’ patent portfolio, in particular, has been recognized as one of the strongest in consumer electronics. Our patents and patent applications relate to hardware, software, networking, accessories, and services, and include technology for the ability to stream content for playback wirelessly to one or more rooms in the home or business. It also includes technology for enabling a wide range of experiences and audio technologies that are important to the Sonos platform and enjoyed by millions of people every day across the globe. Experiences covered by our patents include simple system setup, seamless integration with other platforms and services, balanced

11

Table of contents

sound, voice interactions and control, as well as experiences unique to home theater to name a few. We regularly file patent applications in the U.S. and throughout the world to protect our innovations and technology that come from areas such as research, development, and design. Our patents expire at various times and no single patent or other intellectual property right is solely responsible for protecting Sonos’ products and services. Sonos continues to invest in protecting its expanding innovation through ongoing development of its patent portfolio. In addition to its own intellectual property, Sonos also enters into licensing agreements with our third-party partners to provide access to a broad range of technology, services, and content for our customers.

In January 2020, the Company filed a complaint with the U.S. International Trade Commission ("ITC") against Alphabet Inc. ("Alphabet") and Google LLC ("Google") and a counterpart lawsuit in the U.S. District Court for the Central District of California against Google alleging infringement of five Sonos patents. In September 2020, the Company filed another lawsuit against Google alleging infringement of an additional four Sonos patents. This lawsuit is currently pending in U.S. District Court for the Northern District of California. In December 2020, the Company filed another lawsuit against Google Germany Gmbh and Google Ireland Ltd. in the regional court of Hamburg, Germany, alleging infringement of a Sonos patent. Starting in 2020, Google has responded by filing patent infringement lawsuits against the Company in the ITC, U.S. District Court for the Northern District of California, Canada, Germany, France, and the Netherlands, and patent infringement lawsuits against the Company’s subsidiary, Sonos Europe B.V., in Germany, France, and the Netherlands. See Note 13. Commitments and Contingencies of the notes to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K for further details.

While we believe that our active patents and patent applications are an important aspect of our business, we also rely heavily on the innovative skills, technical competence and marketing abilities of our personnel.

Human Capital

Sonos is dedicated to creating the ultimate listening experience for our customers, and our employees are critical to achieving this mission. In order to continue to design innovative experiences and products, and compete and succeed in our highly competitive and rapidly evolving market, it is crucial that we continue to attract and retain experienced employees. As part of these efforts, we strive to offer a competitive compensation and benefits program, foster a community where everyone feels included and empowered to do their best work, and give employees the opportunity to give back to their communities and make a social impact.

As of October 1, 2022, we had 1,844 full-time employees. Of our full-time employees, 1,312 were in the United States and 532 were in our international locations. Other than our employees in France and the Netherlands, none of our employees are represented by a labor union or covered by a collective bargaining agreement.

Compensation and Benefits Program. Our compensation program is designed to attract and reward talented individuals who possess the skills necessary to support our business objectives, assist in the achievement of our strategic goals and create long-term value for our stockholders. We provide employees with compensation packages that include base salary, annual incentive bonuses, and long-term equity awards ("RSUs") tied to the value of our stock price. We believe that a compensation program with both short-term and long-term awards provides fair and competitive compensation and aligns employee and stockholder interests, including by incentivizing business and individual performance (pay for performance), motivating based on long-term company performance and integrating compensation with our business plans. In addition to cash and equity compensation, we also offer employees benefits such as life and health (medical, dental & vision) insurance, paid time off, paid parental leave, and a 401(k) plan.

Diversity, Equity and Inclusion. At Sonos, we believe that music and sound is universal and connects us as people, and we strive to build products that move everyone. To do this, we are committed to building an equitable and inclusive environment where diverse teams build more creative solutions, drive better results, innovate and bring their authentic selves to work each day. We monitor the representation of women and racially or ethnically diverse team members at different levels throughout the company and disclose the composition of our team in our annual Listen Better Report, which is our corporate social responsibility report available on the Investor Relations section of our website.

As an organization, we’ve committed to annual diversity, equity and inclusion goals to increase representation at all levels and foster greater connection and belonging at Sonos. To accomplish these goals, we’re implementing initiatives to help us reach these goals, including:

•holding management directly accountable in creating a more diverse and inclusive environment by designating 10% of the annual cash incentive plan for management for diversity, equity and inclusion goals;

•examining our hiring practices to ensure we source the best talent from the widest available pool;

12

Table of contents

•intentional listening to our employee resource groups who provide critical insight into the experience of underrepresented groups at Sonos and across our industry;

•frequent review of our policies and practices to ensure an equitable experience for all;

•coupling our hiring goals with a focus on retention, employee engagement, and inclusive leadership;

•implementing mentoring and allyship programs that connect employees to key support systems across Sonos; and

•deepening our organizational acumen around allyship, unconscious bias, and equity.

Community Involvement. We aim to enhance the communities where we live and work, and believe that this commitment helps in our efforts to attract and retain employees. We offer employees the opportunity to give back both through our Sonos Soundwaves program, which partners with leading non-profits, and our Sonos Cares program, which offers employees paid volunteer time each year.

Corporate Information

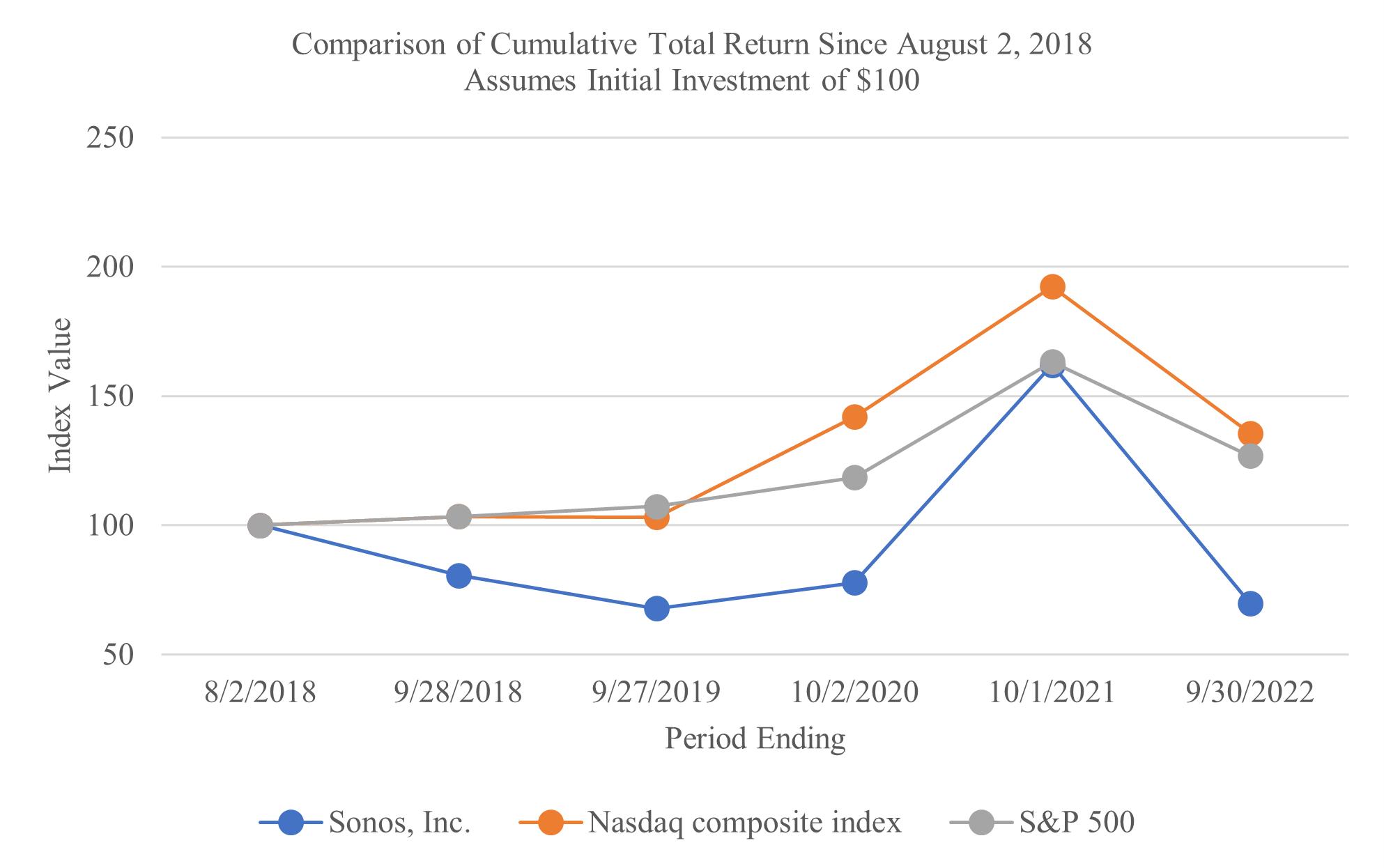

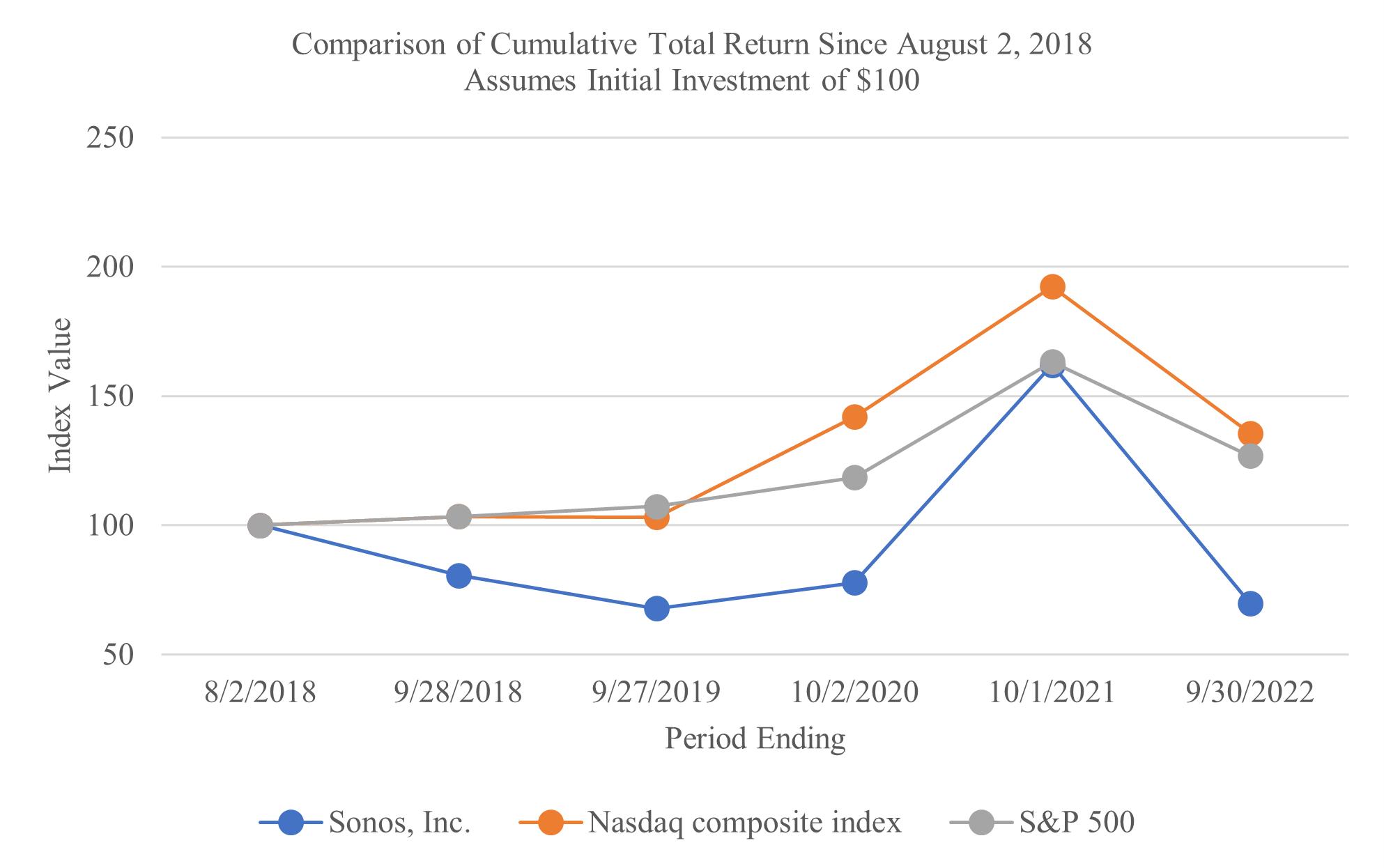

We incorporated in Delaware in August 2002 as Rincon Audio, Inc. and we changed our name to Sonos, Inc. in May 2004. We completed the initial public offering ("IPO") of our common stock in August 2018 and our common stock is listed on The Nasdaq Global Select Market under the symbol of "SONO." Our principal executive offices are located at 614 Chapala Street, Santa Barbara, California 93101, and our telephone number is (805) 965-3001.

Our website address is www.sonos.com. The information on, or that can be accessed through, our website is not incorporated by reference into this Annual Report on Form 10-K. Investors should not rely on any such information in deciding whether to purchase our common stock.

Sonos, the Sonos logo, Sonos One, Sonos One SL, Sonos Five, Sonos Beam, Play:1, Play:5, Playbase, Playbar, Sonos Arc, Amp, Sub, Sonos Move, Port, Boost, Ray, Sonos Ray, Sonos Roam, Sonos Voice Control, Trueplay, Sub Mini, Sonos Sub Mini, Mayht and our other registered or common law trademarks, tradenames or service marks appearing in this Annual Report on Form 10-K are our property. Solely for convenience, our trademarks, tradenames, and service marks referred to in this Annual Report on Form 10-K appear without the ®, ™ and SM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, tradenames and service marks. This Annual Report on Form 10-K contains additional trademarks, tradenames and service marks of other companies that are the property of their respective owners.

Available Information

We make available, free of charge through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Sections 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act"), as amended, as soon as reasonably practicable after they have been electronically filed with, or furnished to, the SEC.

The SEC maintains an internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as the other information in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes, and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before making an investment decision. The occurrence of any of the events or developments described below could materially and adversely affect our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently believe are not material may also impair our business, financial condition, results of operations and growth prospects.

Economic, Industry and Strategic Risk

Our business has been, and could in the future be, adversely affected by the ongoing COVID-19 pandemic.

13

Table of contents

The COVID-19 pandemic and related mitigation measures have adversely affected our business and operating results and may continue to impact us in the future. During the pandemic, consistent with its effects industry-wide, our supply chain has experienced disruptions, including lockdowns, port congestion, component supply-related challenges, and inflationary pressures, which may continue in the future. Supply chain challenges have increased our component and shipping and logistics costs, caused delayed product availability, and impacted our ability to forecast and meet product demand, procure certain components, and effectively manage our inventory levels, all of which has and could in the future, materially and adversely affected our business, results of operations, financial position, and cash flows. Although some pandemic-related impacts on our business have abated, they may emerge or intensify again given the uncertain course of the pandemic and its effects.

COVID-19 has also negatively impacted the global economy to date, including by contributing to significant global economic uncertainty. The duration and severity of the economic impacts of COVID-19 are unknown and may be prolonged and extend beyond the easing of mitigation measures, the widespread availability of vaccines and treatments or any eventual containment of the spread of COVID-19. In particular, any recession, depression, inflationary pressures, or other sustained adverse market event resulting from, among other causes, COVID-19 may result in high levels of unemployment and associated loss of personal income, decreased consumer confidence, and lower discretionary spending, which could materially and adversely affect our business, results of operations, financial position, and cash flows.

The extent of the impact of the COVID-19 pandemic on our business and operating results is uncertain and difficult to predict and will depend on factors outside of our control, including efforts to contain the spread of COVID-19, any resurgence of infections or any variants that may emerge and the impact of the pandemic on the global economy. Moreover, we have experienced increased demand for our products during much of the COVID-19 pandemic and we cannot predict how or whether the easing of COVID-19 mitigation measures will impact demand for our products or shift consumer spending habits in general. During the second half of fiscal 2022, we saw a softening of consumer demand in part as a result of a shift in consumer spending from purchasing goods to purchasing services and it is uncertain whether such shift will continue.

The home audio and consumer electronics industries are highly competitive.

The markets in which we operate are extremely competitive and rapidly evolving, and we expect that competition will intensify in the future. Our competition includes established, well-known sellers of speakers and sound systems such as Bose, Samsung (and its subsidiaries Harman International and JBL), Sony, Bang & Olufsen and Masimo (and its subsidiary Sound United that owns, among others, the Denon, Polk Audio and Bowers and Wilkens brands), and developers of voice-enabled speakers and systems such as Amazon, Apple and Google. We could also face competition from new market entrants, some of whom might be current partners of ours.

In order to deliver products that appeal to changing and increasingly diverse consumer preferences and to overcome the fact that a relatively high percentage of consumers may already own or use products that they perceive to be similar to those that we offer, we must develop superior technology, anticipate increasingly diverse consumer tastes and rapidly develop attractive products with competitive selling prices. In addition, many of our current and potential partners have business objectives that may drive them to sell their speaker products at a significant discount compared to ours. Amazon and Google, for example, both currently offer their speaker products at significantly lower prices than our speaker products. Many of these partners may subsidize these prices and seek to monetize their customers through the sale of additional services rather than the speakers themselves. Even if we are able to efficiently develop and offer innovative products at competitive selling prices, our operating results and financial condition may be adversely impacted if we are unable to effectively anticipate and counter the ongoing price erosion that frequently affects consumer products or if the average selling prices of our products decrease faster than we are able to reduce our manufacturing costs.

Most of our competitors have greater financial, technical and marketing resources available to them than those available to us, and, as a result, they may develop competing products that cause the demand for our products to decline. Our competitors have established, or may establish, cooperative relationships among themselves or with third parties to increase the abilities of their products to address the needs of our prospective customers, and other companies may enter our markets by entering into strategic relationships with our competitors. A failure to effectively anticipate and respond to these established and new competitors may adversely impact our business and operating results.

Further, our current and prospective competitors may consolidate with each other or acquire companies that will allow them to develop products that better compete with our products, which would intensify the competition that we face and may also disrupt or lead to termination of our distribution, technology and content partnerships. For example, if one of our competitors were to acquire one of our content partners, the consolidated company may decide to disable the streaming functionality of its service with our products.

If we are unable to compete with these consolidated companies or if consolidation in the market disrupts our partnerships or reduces the number of companies we partner with, our business would be adversely affected.

14

Table of contents

To remain competitive and stimulate consumer demand, we must successfully manage frequent new product introductions and transitions.

Due to the quickly evolving and highly competitive nature of the home audio and broader consumer electronics industry, we must frequently introduce new products, enhance existing products and effectively stimulate customer demand for new and upgraded products in both mature and developing markets. For example, in June 2022 we introduced Ray, our compact soundbar and in September 2022 we introduced Sub Mini, the smaller of our two wireless subwoofer offerings. The successful introduction of these products and any new products depends on a number of factors, such as the timely completion of development efforts to correspond with limited windows for market introduction. We face significant challenges in managing the risks associated with new product introductions and production ramp-up issues, including accurately forecasting initial consumer demand, effectively managing any third-party strategic alliances or collaborative partnerships related to new product development or commercialization, as well as the risk that new products may have quality or other defects in the early stages of introduction or may not achieve the market acceptance necessary to generate sufficient revenue. New and upgraded products can also affect the sales and profitability of existing products. Accordingly, if we cannot properly manage the introduction of new products, our operating results and financial condition may be adversely impacted, particularly if the cadence of new product introductions increases as we expect.

Although we have achieved profitability, our business is impacted by a number of factors, including those outside of our control like the global economy, and we may not be able to sustain or increase our profitability and expect to incur increased operating costs in the future.

Although we achieved profitability starting in the fiscal year ended October 2, 2021, we may not be able to maintain or grow our profitability. We have experienced net losses in the past and may incur net losses in the future. We had an accumulated deficit of $2.5 million as of October 1, 2022.

We expect our operating expenses to increase in the future as we expand our operations and execute on our product roadmap and strategy. We plan to make significant future expenditures related to the expansion of our business and our product offerings, including investments in:

•research and development to continue to introduce innovative new products, enhance existing products and improve our customers’ listening experience;

•sales and marketing to expand our global brand awareness, promote new products, increase our customer base and expand sales within our existing customer base; and

•legal, accounting, information technology and other administrative expenses to sustain our operations as a public company.

In order to maintain or grow our profitability, we need to continue to increase our revenue and we cannot assure you that we will be able to do so, particularly during times of global economic, social and political uncertainty. For example, demand for our products was impacted in the second half of fiscal 2022, and in the future may be impacted, by uncertainty in the economic environment including the potential for an extended global recession, continued inflationary pressures, or, in certain markets, foreign currency exchange rate fluctuations, including those resulting from the Russian invasion of Ukraine. Our ability to achieve revenue growth will depend in part on our ability to execute on our product roadmap and our strategy and to determine the market opportunity for new products. New product introductions may adversely impact our gross margin in the near to intermediate term due to the frequency of these product introductions and their anticipated increased share of our overall product volume. The expansion of our business and product offerings also places a continuous and significant strain on our management, operational and financial resources. In the event that we are unable to grow our revenue, or in the event that revenue grows more slowly than we expect, our operating results could be adversely affected, and our stock price could be harmed.

Our investments in research and development may not yield the results expected.

Our business operates in intensely competitive markets characterized by changing consumer preferences and rapid technological innovation. Due to advanced technological innovation and the relative ease of technology imitation, new products tend to become standardized more rapidly, leading to more intense competition and ongoing price erosion. In order to strengthen the competitiveness of our products in this environment, we continue to invest heavily in research and development. However, these investments may not yield the innovation or the results expected on a timely basis, or our competitors may surpass us in technological innovation, hindering our ability to timely commercialize new and competitive products that meet the needs and demands of the market, which consequently may adversely impact our operating results as well as our reputation.

If we are not successful in continuing to expand our direct-to-consumer sales channel by driving consumer traffic and consumer purchases through our website, our business and results of operations could be harmed.

15

Table of contents

We have invested significant resources in our direct-to-consumer sales channel, primarily through our website, and our future growth relies, in part, on our continued ability to attract consumers to this channel, which has and will continue to require significant expenditures in marketing, software development and infrastructure. If we are unable to continue to drive traffic to, and increase sales through, our website, our business and results of operations could be harmed. The continued success of direct-to-consumer sales through our website is subject to risks associated with e-commerce, many of which are outside of our control. Our inability to adequately respond to these risks and uncertainties or to successfully maintain and expand our direct-to-consumer business via our website may have an adverse impact on our results of operations.

If we are unable to accurately anticipate market demand for our products, we may have difficulty managing our production and inventory and our operating results could be harmed.

We must forecast production and inventory needs in advance with our suppliers and manufacturers; our ability to do so accurately could be affected by many factors, including changes in customer demand and spending patterns, new product introductions, sales promotions, channel inventory levels, uncertainties related to the COVID-19 pandemic, Russia's invasion of Ukraine, and general economic conditions, including inflation and the potential for an extended global recession. If demand does not meet our forecast, excess product inventory could force us to write-down or write-off inventory or to sell the excess inventory at discounted prices, which could cause our gross margin to suffer and impair the strength of our brand. In addition, excess inventory may result in reduced working capital, which could adversely affect our ability to invest in other important areas of our business such as marketing and product development. If our channel partners have excess inventory of our products, they may decrease their purchases of our products in subsequent periods. If demand exceeds our forecast, as it did in parts of fiscal 2022, and we do not have sufficient inventory to meet this demand, we may experience decreased revenue or customer dissatisfaction as a result of any continued inventory shortages or we may have to rapidly increase production which may result in reduced manufacturing quality and customer satisfaction as well as higher supply and manufacturing costs that would lower our gross margin. Any of these scenarios could adversely impact our operating results and financial condition.

Our efforts to expand beyond our core product offerings and offer products with wider applications may not succeed and could adversely impact our business.

We may seek to expand beyond our core sound systems and develop products that have wider applications outside of home sound, such as commercial or office. Developing these products would require us to devote substantial additional resources, and our ability to succeed in developing such products to address such markets is unproven. It is likely that we would need to hire additional personnel, partner with new third parties and incur considerable research and development expenses to pursue such an expansion successfully. We may have less familiarity with consumer preferences for these products and less product or category knowledge, and we could encounter difficulties in attracting new customers due to lower levels of consumer familiarity with our brand. As a result, we may not be successful in future efforts to achieve profitability from new markets, services or new types of products, and our ability to generate revenue from our existing products may suffer. If any such expansion does not enhance our ability to maintain or grow our revenue or recover any associated development costs, our operating results could be adversely affected.

We experience seasonal demand for our products, and if our sales in high-demand periods are below our forecasts, our overall financial condition and operating results could be adversely affected.

Given the seasonal nature of our sales, accurate forecasting is critical to our business. Our fiscal year ends on the Saturday closest to September 30, the holiday shopping season occurs in the first quarter of our fiscal year and the typically slower summer months occur in the fourth quarter of our fiscal year. Historically, our revenue has been significantly higher in our first fiscal quarter due to increased consumer spending patterns during the holiday season. Any shortfalls in expected first fiscal quarter revenue, due to macroeconomic conditions like the potential for an extended global recession, product release patterns, a decline in the effectiveness of our promotional activities, supply chain disruptions, inflationary pressures or for any other reason, could cause our annual operating results to suffer

16

Table of contents

significantly. In addition, if we fail to accurately forecast customer demand for the holiday season, we may experience excess inventory levels or a shortage of products available for sale, which could further harm our financial condition and operating results.

The success of our business depends in part on the continued growth of the voice-enabled speaker market and our ability to establish and maintain market share.

We have increasingly focused our product roadmap on voice-enabled speakers. We introduced our first voice-enabled speaker, Sonos One, in October 2017, our first voice-enabled home theater speaker, Sonos Beam, in July 2018, our first Bluetooth-enabled portable speaker with voice control, Sonos Move, in September 2019, and our voice-enabled premium home theater speaker, Sonos Arc, in June 2020. In April 2021, we introduced Roam, our portable smart speaker. In May 2022, we introduced Sonos Voice Control, our proprietary voice assistant, on all of our voice-enabled speakers. If the voice-enabled speaker markets do not continue to grow or grow in unpredictable ways, our revenue may fall short of expectations and our operating results may be harmed, particularly since we incur substantial costs to introduce new products in advance of anticipated sales. Additionally, even if the market for voice-enabled speakers does continue to grow, we may not be successful in developing and selling speakers that appeal to consumers or gain sufficient market acceptance. To succeed in this market, we will need to design, produce and sell innovative and compelling products and partner with other businesses that enable us to capitalize on new technologies, some of which have developed or may develop and sell voice-enabled speaker products of their own as further described herein.

If market demand for streaming music does not grow as anticipated or the availability and quality of streaming services does not continue to increase, our business could be adversely affected.

A large proportion of our customer base uses our products to listen to content via subscription-based streaming music services. Accordingly, we believe our future revenue growth will depend in significant part on the continued expansion of the market for streaming music. The success of the streaming music market depends on the quality, reliability and adoption of streaming technology and on the continued success of streaming music services such as Apple Music, Spotify, Deezer, and Pandora. If the streaming music market in general fails to expand or if the streaming services that we partner with are not successful, demand for our products may suffer and our operating results may be adversely affected.

If we are unable to protect our intellectual property, the value of our brand and other intangible assets may be diminished, and our business may be adversely affected.

We rely and expect to continue to rely on a combination of confidentiality and license agreements with our employees, consultants and third parties with whom we have relationships, as well as patent, trademark, copyright and trade secret protection laws, to protect our proprietary rights. In the United States and certain other countries, we have filed various applications for certain aspects of our intellectual property, most notably patents. However, third parties may knowingly or unknowingly infringe our proprietary rights or challenge our proprietary rights, pending and future patent and trademark applications may not be approved, and we may not be able to prevent infringement without incurring substantial expense. Such infringement could have a material adverse effect on our brand, business, financial condition and results of operations. We have initiated legal proceedings to protect our intellectual property rights, and we may file additional actions in the future. For example, in January 2020 we filed a complaint with the ITC against Alphabet and Google and a counterpart lawsuit in the U.S. District Court for the Central District of California against Google alleging infringement of five Sonos patents, and in September 2020 we filed another lawsuit against Google alleging infringement of an additional four Sonos patents. The cost of defending our intellectual property has been and may in the future be substantial, and there is no assurance we will be successful. Our business could be adversely affected as a result of any such actions, or a finding that any patents-in-suit are invalid or unenforceable. These actions have led and may in the future lead to additional counterclaims or actions against us, which are expensive to defend against and for which there can be no assurance of a favorable outcome. For example, Google has responded to our legal proceedings by filing multiple patent infringement lawsuits against us in the U.S. District Court for the Northern District of California, cases against us in the ITC and patent infringement lawsuits against us and our subsidiary Sonos Europe B.V. in various foreign jurisdictions. Further, parties we bring legal action against could retaliate through non-litigious means, which could harm our ability to compete against such parties or to enter new markets.

In addition, the regulations of certain foreign countries do not protect our intellectual property rights to the same extent as the laws of the United States. As our brand grows, we may discover unauthorized products in the marketplace that are counterfeit reproductions of our products. If we are unsuccessful in pursuing producers or sellers of counterfeit products, continued sales of these products could adversely impact our brand, business, financial condition and results of operations.

We currently are, and may continue to be, subject to intellectual property rights claims and other litigation which are expensive to support, and if resolved adversely, could have a significant impact on us and our stockholders.

17

Table of contents

Companies in the consumer electronics industries own large numbers of patents, copyrights, trademarks, domain names and trade secrets, and frequently enter into litigation based on allegations of infringement, misappropriation or other violations of intellectual property or other rights. As we gain an increasingly high profile and face more intense competition in our markets, and as we introduce more products and services, including through acquisitions and through partners, the possibility of intellectual property rights claims against us grows. Our technologies may not be able to withstand any third-party claims or rights against their use, and we may be subject to litigation and disputes. The costs of supporting such litigation and disputes are considerable, and there can be no assurance that a favorable outcome would be obtained. We may be required to settle such litigation and disputes, or we may be subject to an unfavorable judgment in a trial, and the terms of a settlement or judgment against us may be unfavorable and require us to cease some or all our operations, limit our ability to use certain technologies, pay substantial amounts to the other party or issue additional shares of our capital stock to the other party, which would dilute our existing stockholders. Further, if we are found to have engaged in practices that are in violation of a third party’s rights, we may have to negotiate a license to continue such practices, which may not be available on reasonable or favorable terms, or may have to develop alternative, non-infringing technology or discontinue the practices altogether. In the event that these practices relate to an acquisition or a partner, we may not be successful in exercising any indemnification rights available to us under our agreements or in recovering damages in the event that we are successful. Each of these efforts could require significant effort and expense and ultimately may not be successful.

If we are not able to maintain and enhance the value and reputation of our brand, or if our reputation is otherwise harmed, our business and operating results could be adversely affected.

Our continued success depends on our reputation for providing high-quality products and consumer experiences, and the “Sonos” name is critical to preserving and expanding our business. Our brand and reputation are dependent on a number of factors, including our marketing efforts, product quality, and trademark protection efforts, each of which requires significant expenditures.

The value of our brand could also be severely damaged by isolated incidents, which may be outside of our control. For example, in the United States, we rely on custom installers of home audio systems for a significant portion of our sales but maintain no control over the quality of their work and thus could suffer damage to our brand or business to the extent such installations are unsatisfactory or defective. Any damage to our brand or reputation may adversely affect our business, financial condition and operating results.

Conflicts with our channel and distribution partners could harm our business and operating results.

Several of our existing products compete, and products that we may offer in the future could compete, with the product offerings of some of our significant channel and distribution partners who have greater financial and technical resources than we do. To the extent products offered by our partners compete with our products, they may choose to market and promote their own products over ours or could end our partnerships and cease selling or promoting our products entirely. Any reduction in our ability to place and promote our products, or increased competition for available shelf or website placement, especially during peak retail periods, such as the holiday shopping season, would require us to increase our marketing expenditures and to seek other distribution channels to promote our products. If we are unable to effectively sell our products due to conflicts with our distribution partners or the inability to find alternative distribution channels, our business would be harmed.

The expansion of our direct-to-consumer channel could alienate some of our channel partners and cause a reduction in product sales from these partners. Channel partners may perceive themselves to be at a disadvantage based on the direct-to-consumer sales offered through our website. Due to these and other factors, conflicts in our sales channels could arise and cause channel partners to divert resources away from the promotion and sale of our products. Further, to the extent we use our mobile app to increase traffic to our website and increase direct-to-consumer sales, we will rely on application marketplaces such as the Apple App Store and Google Play to drive downloads of our mobile app. Apple and Google, both of which sell products that compete with ours, may choose to use their marketplaces to promote their competing products over our products or may make access to our mobile app more difficult. Any of these situations could adversely impact our business and results of operations.

18

Table of contents

Competition with our technology partners could harm our business and operating results.