UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| | | | |

Filed by the Registrant x |

| Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

| | | |

| SONOS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

January 18, 2019

To Our Stockholders:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Sonos, Inc. The meeting will be held at 614 Chapala Street, Santa Barbara, CA 93101 on February 27, 2019 at 11:00 a.m. Pacific Time.

The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement. The Annual Meeting materials include the notice, the proxy statement, our annual report and the proxy card, each of which is enclosed.

Your vote is important. Whether or not you plan to attend the Annual Meeting, to ensure that your shares will be represented, please cast your vote as soon as possible via the internet or by phone, or, if you received a paper proxy card and voting instructions by mail, by completing and returning the enclosed proxy card in the postage-prepaid envelope. Your vote by proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend in person. Returning the proxy does not affect your right to attend the Annual Meeting and to vote your shares in person.

Sincerely

Patrick Spence

Chief Executive Officer and Director

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, you are encouraged to submit your proxy and voting instructions via the internet or by phone, or, if you received a paper proxy card and voting instructions by mail, you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. You may do so automatically by voting in person at the Annual Meeting, or by delivering to us a written notice of revocation or a duly executed proxy bearing a date later than the date of the proxy being revoked.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON FEBRUARY 27, 2019: THE PROXY STATEMENT AND ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM.

SONOS, INC.

614 Chapala Street

Santa Barbara, CA 93101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

January 18, 2019

|

| | | |

| Time and Date: | | February 27, 2019 at 11:00 a.m. Pacific Time |

| Place: | | 614 Chapala Street, Santa Barbara, CA 93101 |

| Items of Business: | | 1. | Elect the three Class I directors listed in the accompanying proxy statement, each to serve a three-year term expiring at the 2022 Annual Meeting of Stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. |

| | | 2. | Ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Sonos, Inc. for the fiscal year ending September 28, 2019. |

| | | 3. | Hold an advisory vote on the frequency of future advisory votes on named executive officer compensation. |

| | | 4. | Transact any other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| Record Date: | | Only stockholders of record at the close of business on January 10, 2019 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. |

| Proxy Voting: | | Each share of common stock that you own represents one vote. For questions regarding your stock ownership, you may contact us through our website at https://investors.sonos.com or, if you are a registered holder, contact our transfer agent, American Stock Transfer & Trust Company, LLC, through its website at www.astfinancial.com or by phone at (800) 937-5449. |

This notice of the Annual Meeting, proxy statement and form of proxy are being distributed and made available on or about January 18, 2019.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy via the internet or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

By Order of the Board of Directors,

Edward Lazarus

Chief Legal Officer and Corporate Secretary

Santa Barbara, California

January 18, 2019

SONOS, INC.

PROXY STATEMENT FOR 2019 ANNUAL MEETING OF STOCKHOLDERS

SONOS, INC.

614 Chapala Street

Santa Barbara, CA 93101

PROXY STATEMENT FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS

January 18, 2019

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors of Sonos, Inc. (“we,” “us,” “our company” or “Sonos”) for use at our 2019 Annual Meeting of Stockholders (the “Annual Meeting”), to be held at 614 Chapala Street, Santa Barbara, CA 93101 on February 27, 2019 at 11:00 a.m. Pacific Time, and any adjournment or postponement thereof. Beginning on or about January 18, 2019, a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) containing instructions on how to access this proxy statement for the Annual Meeting (this “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended September 29, 2018 (the “Annual Report”) is being mailed to our stockholders. Our fiscal year ended September 29, 2018 is also referred to herein as “fiscal 2018.”

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with U.S. Securities and Exchange Commission (“SEC”) rules, we are using the internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability with instructions for accessing the proxy materials, including this Proxy Statement and our Annual Report, and voting via the internet or by phone. The Notice of Internet Availability also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient and less costly, and helps in conserving natural resources.

GENERAL INFORMATION ABOUT THE MEETING

Purpose of the Annual Meeting

You are receiving this Proxy Statement because our board of directors is soliciting your proxy to vote your shares at the Annual Meeting with respect to the proposals described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you pursuant to the rules and regulations of the SEC and is designed to assist you in voting your shares.

Record Date; Quorum

Only holders of record of our common stock at the close of business on January 10, 2019 (the “Record Date”) will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 100,473,088 shares of our common stock outstanding and entitled to vote. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our headquarters.

The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy.

Proposals Scheduled to be Voted on at the Annual Meeting

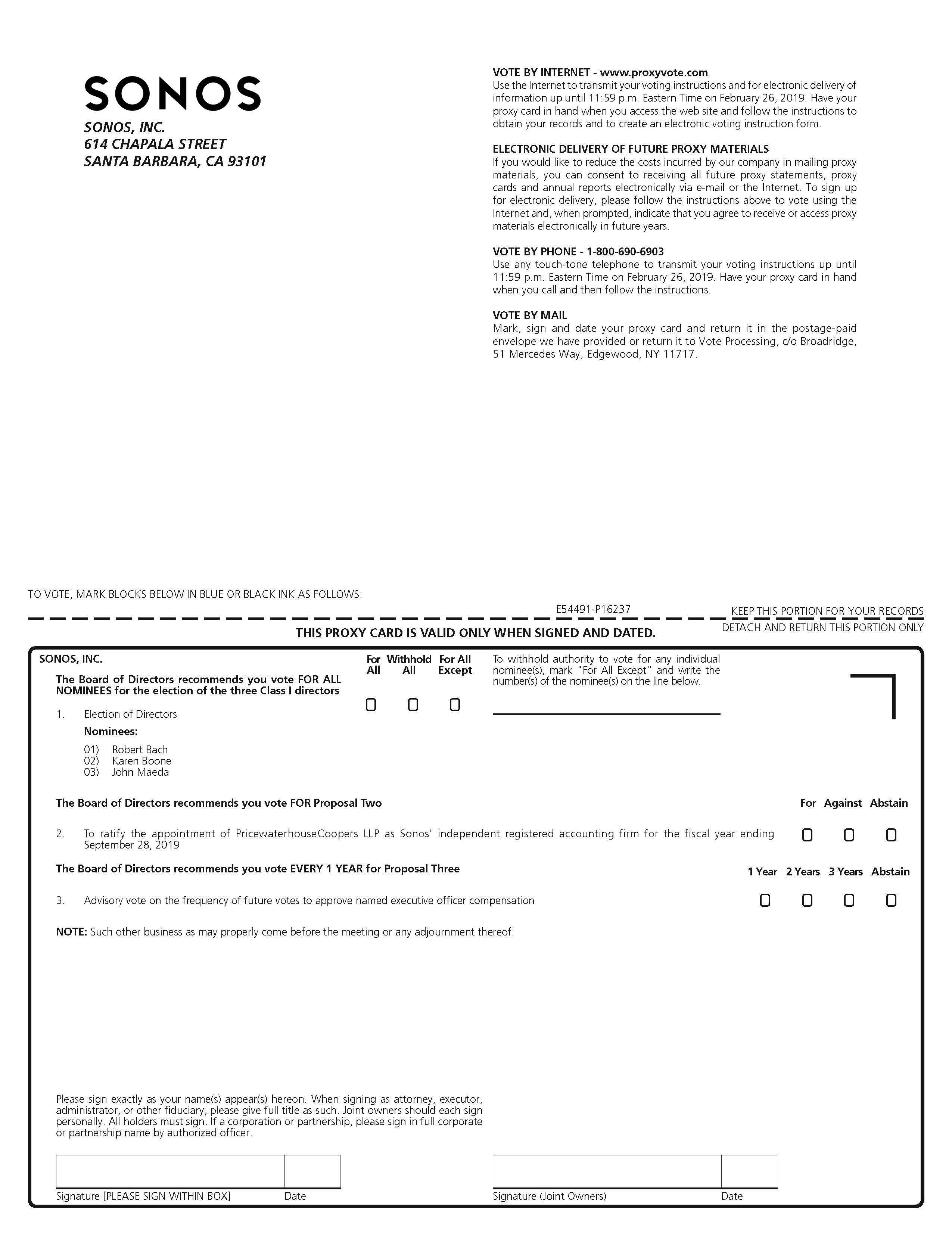

Proposal One. The election of each of the three Class I directors set forth in Proposal One to serve for a term of three years or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

Proposal Two. The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 28, 2019.

Proposal Three. An advisory vote on the frequency of future advisory votes on named executive officer compensation.

Voting Rights; Required Vote

In deciding all matters at the Annual Meeting, each share of our common stock as of the close of business on the Record Date represents one vote. We do not have cumulative voting rights for the election of directors. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee or other nominee.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting or vote via the internet or by phone, or, if you request or receive paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee

If, on the Record Date, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Approval Threshold of Each Vote

For Proposal One, each director will be elected by a plurality of the votes cast, which means that the three individuals nominated for election to our board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may vote “FOR ALL NOMINEES,” to “WITHHOLD AUTHORITY FOR ALL NOMINEES” or “FOR ALL EXCEPT” one or any of the nominees you specify.

For Proposal Two, ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 28, 2019 will be obtained if the number of votes cast “FOR” the proposal at the Annual Meeting represents a majority of the votes cast by stockholders.

For Proposal Three, the frequency receiving the greatest number of votes cast by stockholders will be considered the advisory vote of our stockholders. You may vote to hold such advisory votes “EVERY YEAR,” “EVERY TWO YEARS” or “EVERY THREE YEARS,” or you may “ABSTAIN.”

Abstentions (i.e. shares present at the Annual Meeting and marked “abstain”) are deemed to be shares presented or represented by proxy and entitled to vote, and are counted for purposes of determining whether a quorum is present. Abstentions have no effect on Proposals One and Three and the same effect as a vote against Proposal Two.

Broker Non-Votes

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted either because (i) the broker did not receive voting instructions from the beneficial owner or (ii) the broker lacked discretionary authority to vote the shares. A broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner

of those shares. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters.

At the Annual Meeting, only Proposal Two is considered a routine matter. Brokers have discretionary authority to vote shares that are beneficially owned on Proposal Two. If a broker chooses not to vote shares for or against Proposal Two, it would have the same effect as an abstention.

Proposals One and Three are considered non-routine matters. Broker non-votes are not deemed to be shares entitled to vote on Proposals One and Three, and will have no effect on Proposals One and Three, other than for purposes of determining whether a quorum is present. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

Recommendations of Our Board of Directors on Each of the Proposals Scheduled to be Voted on at the Annual Meeting

Our board of directors recommends that you vote your shares:

| |

| • | “FOR ALL NOMINEES” for the election of the three Class I directors set forth in Proposal One; |

| |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 28, 2019 for Proposal Two; and |

| |

| • | “EVERY YEAR” for the frequency of future advisory votes on named executive officer compensation. |

Voting Instructions; Voting of Proxies

If you are a stockholder of record, you may:

| |

| • | Vote in person—stockholders who attend the Annual Meeting may vote in person; |

| |

| • | Vote by phone—in order to do so, please call the number printed on your proxy card; |

| |

| • | Vote via the internet—in order to do so, please follow the instructions shown on your proxy card by 11:59 p.m. Eastern Time on February 26, 2019; or |

| |

| • | Vote by mail—if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and promptly return it in the envelope provided or, if the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Your completed, signed and dated proxy card must be received prior to the Annual Meeting. |

Votes submitted via the internet must be received by 11:59 p.m. Eastern Time on February 26, 2019. Submitting your proxy via the internet or by phone, or, if you request or receive a paper proxy card, by mail, will not affect your right to vote in person should you decide to attend the Annual Meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct your nominee on how to vote your shares.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above.

If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card via the internet or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any other information furnished to stockholders. Following the original mailing of the proxy materials, we and our agents, including directors, officers and other employees, without additional compensation, may solicit proxies by mail, email, telephone, facsimile, by other similar means or in person. Following the original mailing of the proxy materials, we will request brokers, custodians, nominees and other record holders to forward copies of the proxy materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, upon the request of the record holders, we will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote via the internet or by phone, you are responsible for any internet access or phone charges you may incur.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

| |

| • | delivering to our Corporate Secretary by mail a written notice stating that the proxy is revoked; |

| |

| • | signing and delivering a proxy bearing a later date; |

| |

| • | voting again via the internet no later than 11:59 p.m. Eastern Time on February 26, 2019; or |

| |

| • | attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

We have a strong commitment to good corporate governance practices. These practices provide an important framework within which our board of directors, its committees and our management can pursue our strategic objectives in order to promote the interests of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions and other policies for the governance of our company. Our Corporate Governance Guidelines are available without charge on the Investor Relations section of our website, which is located at https://investors.sonos.com, by clicking on “Governance Documents” in the “Corporate Governance” section of our website. Our Corporate Governance Guidelines are subject to modification from time to time by our board of directors pursuant to the recommendations of our nominating and corporate governance committee.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our board of directors shall be free to choose its Chairperson in any way that it considers in the best interests of our company, and that our nominating and corporate governance committee periodically considers the leadership structure of our board of directors and makes such recommendations to our board of directors with respect thereto as appropriate. Our Corporate Governance Guidelines also provide that, when the positions of Chairperson and Chief Executive Officer are held by the same person, our board of directors shall designate a “lead independent director” by a majority vote of the independent directors. In cases in which the Chairperson and Chief Executive Officer are the same person, the Chairperson schedules and sets the agenda for meetings of our board of directors in consultation with the lead independent director, and the Chairperson, or if the Chairperson is not present, the lead independent director, chairs such meetings. The responsibilities of the lead independent director include: (i) presiding at executive sessions of independent directors; (ii) serving as a liaison between the Chairperson and the independent directors; (iii) consulting with the Chairperson regarding the information sent to our board of directors in connection with its meetings; (iv) having the authority to call meetings of our board of directors and meetings of the independent directors; (v) being available under appropriate circumstances for consultation and direct communication with stockholders; and (vi) performing such other functions and responsibilities as requested by our board of directors from time to time.

Currently, our board of directors believes that it should maintain flexibility to select the Chairperson of our board of directors and adjust our board leadership structure from time to time. Our board of directors has not selected a lead independent director because the positions of Chairperson and Chief Executive Officer are not held by the same person. Our board of directors believes that we and our stockholders currently are best served by having Michelangelo Volpi, an independent director, serve as Chairperson. Separating the positions of Chief Executive Officer and Chairperson allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairperson to lead our board of directors in its fundamental role of providing independent advice to and oversight of management. Mr. Volpi has been the Chairperson of our board of directors since November 2010, and Patrick Spence has served as our Chief Executive Officer and as a member of the board of directors since January 2017. Both Mr. Volpi and Mr. Spence were selected to serve in their respective positions due to their extensive experience managing technology companies.

Our board of directors believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of our board of directors and sound corporate governance policies and practices.

Our Board of Directors’ Role in Risk Oversight

Our board of directors as a whole has responsibility for risk oversight, although the committees of our board of directors oversee and review risk areas that are particularly relevant to them. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board of directors and to our personnel who are responsible for risk assessment and information about the identification, assessment and management of critical risks, and our management’s risk mitigation strategies. These areas of focus include economic, operational, financial (accounting, credit, investment, liquidity and tax), competitive, legal, regulatory, cybersecurity, privacy, compliance and reputational risks. Our board of directors reviews strategic and operational risk in the context of discussions, question and answer sessions and reports from the management team at each regular board meeting, receives reports on all significant committee activities at each regular board meeting and evaluates the risks inherent in significant transactions. Our audit committee assists our board in fulfilling its oversight responsibilities with respect to risk management.

Each committee of our board of directors meets with key management personnel and representatives of outside advisors to oversee risks associated with their respective principal areas of focus. Our audit committee reviews our major financial risk exposures, our internal control over financial reporting, our disclosure controls and procedures, legal and regulatory compliance and, among other things, discusses with management and our independent auditor guidelines and policies with respect to risk assessment and risk management. Our audit committee also reviews matters relating to cybersecurity and data privacy and security and reports to our board of directors regarding such matters. Our compensation committee evaluates our major compensation-related risk exposures and the steps management has taken to monitor or mitigate such exposures. Our nominating and corporate governance committee assesses risks relating to our corporate governance practices, the independence of our board of directors and reviews and discusses the narrative disclosure regarding our board of directors’ leadership structure and role in risk oversight. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Independence of Directors

The listing rules of The Nasdaq Stock Market (“Nasdaq”) generally require that a majority of the members of a listed company’s board of directors be independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in such member’s capacity as a member of the audit committee, the board of directors or any other board committee (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors conducts an annual review of the independence of our directors. Our board of directors has determined that none of the members of our board of directors other than Mr. Spence has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of the members of our board of directors other than Mr. Spence is “independent” as that term is defined under the rules of Nasdaq. Our board of directors has also determined that all members of our audit committee, compensation committee and nominating and corporate governance committee are independent and satisfy the relevant SEC and Nasdaq independence requirements for such committees.

Committees of Our Board of Directors

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our board of directors. Copies of the charters for each committee are available on the Investor Relations section of our website, which is located at https://investors.sonos.com, by clicking on “Governance Documents” in the “Corporate Governance” section of our website. Members serve on these committees until (i) they resign from their respective committee, (ii) they no longer serve as a director or (iii) as otherwise determined by our board of directors.

Audit Committee

Our audit committee is composed of Karen Boone, who is the chairperson of our audit committee, Robert Bach and Julius Genachowski. The composition of our audit committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Each member of our audit committee is financially literate. In addition, our board of directors has determined that Ms. Boone is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”). This designation does not impose any duties, obligations or liabilities that are greater than those generally imposed on members of our audit committee and our board of directors. Our audit committee, among other things:

| |

| • | selects a firm to serve as the independent registered public accounting firm to audit our financial statements; |

| |

| • | helps to ensure the independence of the independent registered public accounting firm; |

| |

| • | discusses the scope and results of the audit with the independent registered public accounting firm, and reviews, with management and the independent accountants, our interim and year-end operating results; |

| |

| • | develops procedures for employees to anonymously submit concerns about questionable accounting or audit matters; |

| |

| • | considers the adequacy of our internal accounting controls and audit procedures; |

| |

| • | reviews and approves any proposed transaction between our company and any related party; and |

| |

| • | approves the fees and other compensation to be paid to our independent registered public accounting firm, and pre-approves all audit and non-audit related services provided by our independent registered public accounting firm. |

Compensation Committee

Our compensation committee is composed of Brittany Bagley, who is the chairperson of our compensation committee, Thomas Conrad and John Maeda. The composition of our compensation committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Each member of this committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our compensation committee, among other things:

| |

| • | reviews and determines the compensation of our executive officers and recommends to our board of directors the compensation for our directors; |

| |

| • | administers our stock and equity incentive plans; |

| |

| • | reviews and makes recommendations to our board of directors with respect to incentive compensation and equity plans; and |

| |

| • | establishes and reviews general policies relating to compensation and benefits of our employees. |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is composed of Mr. Genachowski, who is the chairperson of our nominating and corporate governance committee, and Mr. Volpi. The composition of our nominating and corporate governance committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Our nominating and corporate governance committee, among other things:

| |

| • | identifies, evaluates and recommends nominees to our board of directors and committees of our board of directors; |

| |

| • | conducts searches for appropriate directors; |

| |

| • | evaluates the performance of our board of directors and of individual directors; |

| |

| • | considers and makes recommendations to the board of directors regarding the composition of the board and its committees; |

| |

| • | reviews developments in corporate governance practices; |

| |

| • | evaluates the adequacy of our corporate governance practices and reporting; and |

| |

| • | makes recommendations to our board of directors concerning corporate governance matters. |

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee during the fiscal year ended September 29, 2018 included Ms. Bagley, Mr. Conrad and Mr. Maeda. None of the members of our compensation committee in fiscal 2018 was at any time during fiscal 2018 or at any other time one of our officers or employees, and none had or have any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. During fiscal 2018, none of our executive officers served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation committee.

Board and Committee Meetings and Attendance

Our board of directors and its committees meet regularly throughout the year, and also hold special meetings and act by written consent from time to time. During fiscal 2018: (i) our board of directors met five times and acted by unanimous written consent four times; (ii) our audit committee met five times; (iii) our compensation committee met eight times and acted by unanimous written consent four times; and (iv) our nominating and corporate governance committee met two times.

During fiscal 2018, each member of our board of directors attended at least 75% of the aggregate of all meetings of our board of directors and of all meetings of committees of our board of directors on which such member served that were held during the period in which such director served.

Board Attendance at Annual Meeting of Stockholders

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. Prior to the completion of our initial public offering (“IPO”) in August 2018, we did not have a policy regarding director attendance at our annual meetings of stockholders.

Presiding Director of Non-Employee Director Meetings

The non-employee directors meet in regularly scheduled executive sessions without management to promote open and honest discussion. Mr. Volpi, as the Chairperson of our board of directors, is the presiding director at these meetings.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors or a specific member of our board of directors (including our Chairperson or lead independent director, if any) may do so by letters addressed to the attention of our Corporate Secretary.

All communications are reviewed by the Corporate Secretary and provided to the members of our board of directors as appropriate. Unsolicited items, sales materials, abusive, threatening or otherwise inappropriate materials and other routine items and items unrelated to the duties and responsibilities of our board of directors will not be provided to directors.

The address for these communications is:

Sonos, Inc.

614 Chapala Street

Santa Barbara, CA 93101

Attn: Corporate Secretary

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of the members of our board of directors, officers and employees. Our Code of Business Conduct and Ethics is posted on the Investor Relations section of our website, which is located at https://investors.sonos.com, by clicking on “Governance Documents” in the “Corporate Governance” section of our website. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics by posting such information on our website at the location specified above.

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of our nominating and corporate governance committee in accordance with its charter, our restated certificate of incorporation and restated bylaws, our Corporate Governance Guidelines and the criteria approved by our board of directors regarding director candidate qualifications. In recommending candidates for nomination, our nominating and corporate governance committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate and, in addition, our nominating and corporate committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Additional information regarding the process for properly submitting stockholder nominations for candidates for nomination to our board of directors is set forth below under “Stockholder Proposals to Be Presented at Next Annual Meeting.”

Director Qualifications

With the goal of developing a diverse, experienced and highly qualified board of directors, our nominating and corporate governance committee is responsible for developing and recommending to our board of directors the desired qualifications, expertise and characteristics of members of our board of directors, including any specific minimum qualifications that the committee believes must be met by a committee-recommended nominee for membership on our board of directors and any specific qualities or skills that the committee believes are necessary for one or more of the members of our board of directors to possess.

Because the identification, evaluation and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our board of directors from time to time, our board of directors has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and Nasdaq listing requirements and the provisions of our restated certificate of incorporation and restated bylaws, our Corporate Governance Guidelines and the charters of the committees of our board of directors. When considering nominees, our nominating and corporate governance committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, diversity, skills, financial and other expertise, breadth of experience, knowledge about our business or industry and ability to devote adequate time and effort to responsibilities of our board of directors in the context of its existing composition. Through the nomination process, our nominating and corporate governance committee seeks to promote board membership that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds and other characteristics that are expected to contribute to our board of directors’ overall effectiveness. The brief biographical description of each director set forth in Proposal One below includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our board of directors at this time.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our board of directors currently consists of eight directors and is divided into three classes, with staggered three-year terms, pursuant to our restated certificate of incorporation and our restated bylaws. Directors in Class I will stand for election at the Annual Meeting. The terms of office of directors in Class II and Class III expire at our Annual Meetings of Stockholders to be held in 2020 and 2021, respectively. At the recommendation of our nominating and corporate governance committee, our board of directors proposes that each of the three Class I nominees named below, each of whom is currently serving as a director in Class I, be elected as a Class I director for a three-year term expiring at our 2022 Annual Meeting of Stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

Shares represented by proxies will be voted “FOR” the election of each of the three nominees named below, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this Proxy Statement and to serve if elected. Proxies may not be voted for more than three directors. Stockholders may not cumulate votes for the election of directors.

Nominees to Our Board of Directors

The nominees and their ages, occupations and lengths of service on our board of directors as of January 18, 2019 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

|

| | | | | | |

| Name | | Age | | Position | | Director Since |

Robert Bach (1) | | 57 | | Director and Director Nominee | | August 2011 |

Karen Boone (1) | | 45 | | Director and Director Nominee | | June 2017 |

John Maeda (2) | | 52 | | Director and Director Nominee | | June 2012 |

(1) Member of our audit committee

(2) Member of our compensation committee

Robert Bach has served as a member of our board of directors since August 2011. Mr. Bach previously held various roles at Microsoft Corporation, a technology company, from 1988 until his retirement in 2010. At Microsoft, Mr. Bach served as the President of Entertainment and Devices from 2006 to 2010 and as Senior Vice President of the Home and Entertainment Division from 2000 to 2006, in addition to numerous other leadership positions during his tenure at Microsoft. Mr. Bach holds a B.A. in economics from the University of North Carolina at Chapel Hill and an M.B.A. from the Stanford University Graduate School of Business. Mr. Bach was selected to serve as a member of our board of directors due to his experience in developing and bringing to market internet-based products that rely on hardware, software and services.

Karen Boone has served as a member of our board of directors since June 2017. Ms. Boone was previously the President, Chief Financial and Administrative Officer of Restoration Hardware, Inc., a home furnishings company, from May 2014 until August 2018. Ms. Boone previously served as Restoration Hardware’s Chief Financial Officer from June 2012 to May 2014. Prior to Restoration Hardware, from 1996 to June 2012, Ms. Boone served in various roles at Deloitte & Touche LLP, an accounting and consulting firm, most recently as an Audit Partner. Ms. Boone holds a B.S. in business economics from the University of California, Davis. Ms. Boone was selected to serve as a member of our board of directors due to her extensive accounting and management experience.

John Maeda has served as a member of our board of directors since June 2012. Mr. Maeda currently serves as the Global Head of Computational Design and Inclusion at Automattic, Inc., a web development company, a position he has held since August 2016. Before Automattic, Mr. Maeda served as a Design Partner at Kleiner Perkins Caufield & Byers, a venture capital firm, from December 2013 to August 2016. Prior to Kleiner Perkins, Mr. Maeda served as the President of the Rhode Island School of Design from June 2008 to January 2014, and as a Professor at the Massachusetts Institute of Technology from 1996 to 2008. Mr. Maeda continues to serve as a Strategic Advisor to Kleiner Perkins and also serves on the board of directors of Wieden+Kennedy, a global advertising firm. Mr. Maeda previously served as a Technical Advisory Board Member for Google Inc. He holds an S.M. and an S.B. in electrical engineering and computer science from the Massachusetts Institute of Technology, a Ph.D. in design science from the University of Tsukuba and an M.B.A. from the W.P. Carey School of Business at Arizona State University. Mr. Maeda was selected to serve as a member of our board of directors due to his extensive experience in product design and marketing, and his commitment to bringing diversity and inclusion into design.

Continuing Directors

The directors who are serving for terms that end following the Annual Meeting and their ages, occupations and lengths of service on our board of directors as of January 18, 2019 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

|

| | | | | | |

| Name | | Age | | Position | | Director Since |

| Class II Directors: | | | | | | |

Thomas Conrad (1) | | 49 | | Director | | March 2017 |

Julius Genachowski (2) (3) | | 56 | | Director | | September 2013 |

Michelangelo Volpi (3) | | 52 | | Director and Chairperson | | March 2010 |

| Class III Directors: | | | | | | |

| Patrick Spence | | 44 | | Chief Executive Officer and Director | | January 2017 |

Brittany Bagley (1) | | 35 | | Director | | September 2017 |

(1) Member of our compensation committee

(2) Member of our audit committee

(3) Member of our nominating and corporate governance committee

Brittany Bagley has served as a member of our board of directors since September 2017. Ms. Bagley currently serves as a Managing Director of Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, “KKR”), a global investment firm, a position she has held since December 2017, and previously served in other roles at KKR from July 2007 to December 2017. Prior to joining KKR, Ms. Bagley was an Analyst at The Goldman Sachs Group, Inc., an investment banking firm. She holds a B.A. from Brown University. Ms. Bagley was selected to serve as a member of our board of directors due to her depth of experience in financial and investment matters and experience with a broad range of technology companies.

Thomas Conrad has served as a member of our board of directors since March 2017. Mr. Conrad was most recently the Vice President of Product at Snap Inc., a camera company, a position he held from March 2016 to March 2018. Prior to Snap, Mr. Conrad served as the Chief Technology Officer of Pandora Media, Inc., a streaming music service company, from July 2004 to June 2014, and as the Executive Vice President of Product from July 2004 to March 2014. Mr. Conrad holds a B.S.E in computer science from the University of Michigan. Mr. Conrad was selected to serve as a member of our board of directors due to his management experience and his experience in the development of music-based technology products.

Julius Genachowski has served as a member of our board of directors since September 2013. Mr. Genachowski is currently a Managing Director and Partner of The Carlyle Group, a global alternative asset management firm, a position he has held since January 2014. Previously, Mr. Genachowski served as the Chairman of the U.S. Federal Communications Commission from June 2009 to May 2013. Mr. Genachowski has held senior executive positions at IAC/InterActiveCorp, an internet and media company, and has also served as a director of or advisor to various companies. Mr. Genachowski currently serves on the boards of directors of Mastercard Incorporated and Sprint Corporation. He also served on the President's Intelligence Advisory Board under President Obama. Mr. Genachowski holds a B.A. in history from Columbia University and a J.D. from Harvard Law School, and served as a law clerk to U.S. Supreme Court Justice David H. Souter. Mr. Genachowski was selected to serve on our board of directors due to his experience in the technology, communications and media industries, his expertise in regulatory matters, his global perspective and his experience serving on the boards of directors of public companies.

Patrick Spence has served as our Chief Executive Officer and as a member of our board of directors since January 2017, and as our President since July 2016. Previously, Mr. Spence served as our Chief Commercial Officer from June 2012 to June 2016. Prior to Sonos, Mr. Spence spent 14 years at Research In Motion Limited, a consumer electronics company and the developer of the BlackBerry device, in a variety of senior roles, including most recently serving as the Senior Vice President and the Managing Director of Global Sales and Regional Marketing from August 2011 until June 2012. Mr. Spence holds a B.A. in business administration from the Ivey Business School at the University of Western Ontario. Mr. Spence was selected to serve as a member of our board of directors due to the perspective and experience he brings as our Chief Executive Officer and due to his extensive experience in senior leadership positions at technology and other companies.

Michelangelo Volpi has served as a member of our board of directors since March 2010 and as the Chairperson of our board of directors since November 2010. Since July 2009, Mr. Volpi has served as a General Partner of Index Ventures, a venture capital firm. From June 2007 to July 2009, Mr. Volpi served as the Chief Executive Officer of Joost N.V., an internet premium

video services company. From 1994 to June 2007, Mr. Volpi served in various executive roles at Cisco Systems, Inc., a networking and telecommunications company. Mr. Volpi currently serves on the boards of directors of Exor N.V., Fiat Chrysler Automobiles N.V., Zuora, Inc. and Elastic N.V. Mr. Volpi previously served on the board of directors of Hortonworks, Inc. from October 2011 to January 2019 and on the board of directors of Pure Storage, Inc. from April 2014 to October 2018. Mr. Volpi holds a B.S. in mechanical engineering and an M.S. in manufacturing systems engineering from Stanford University and an M.B.A. from the Stanford University Graduate School of Business. Mr. Volpi was selected to serve as a member of our board of directors due to his extensive experience in senior leadership positions at technology and other companies.

There are no family relationships among our directors and executive officers.

Director Compensation

Director Compensation Table

The following table presents the total compensation for each person who served as a non-employee member of our board of directors during the fiscal year ended September 29, 2018. Mr. Spence is not included in the table below, as he is employed as our Chief Executive Officer and receives no compensation for his service as director. The compensation received by Mr. Spence as an employee is shown in “Executive Compensation—Summary Compensation Table” below.

|

| | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | | Stock Option Awards ($) (1) (2) | | Total ($) |

| Robert Bach | | 60,000 | | | 43,108 | | | 103,108 |

| Brittany Bagley | | 65,000 | | | — | | | 65,000 |

| Karen Boone | | 65,000 | | | — | | | 65,000 |

| Thomas Conrad | | 60,000 | | | — | | | 60,000 |

| Julius Genachowksi | | 75,000 | | | 43,108 | | | 118,108 |

| John Maeda | | 60,000 | | | 43,108 | | | 103,108 |

Michelangelo Volpi (3) | | — | | | — | | | — |

| |

| (1) | The amounts reported in this column represent the aggregate grant date fair value of the stock options granted under our 2003 Stock Plan to our directors during fiscal 2018, as computed in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718 (“ASC 718”). The amounts reported in this column reflect the accounting value for these equity awards and do not correspond to the actual economic value that may be received by our directors from such awards, which will vary depending on the performance of our common stock. |

| |

| (2) | Our non-employee directors held the following number of stock options as of September 29, 2018: |

|

| | | |

| | Name | | Shares Subject to Outstanding Stock Options |

| | Robert Bach | | 226,434 |

| | Brittany Bagley | | — |

| | Karen Boone | | 31,766 |

| | Thomas Conrad | | 31,766 |

| | Julius Genachowski | | 114,376 |

| | John Maeda | | 36,674 |

| | Michelangelo Volpi | | — |

| |

| (3) | Mr. Volpi declined to accept any compensation for his service on our board of directors in fiscal 2018. |

Non-Employee Director Compensation Arrangements

Beginning with fiscal 2018, we pay each non-employee director an annual retainer fee of $50,000 for service on our board of directors and additional annual retainer fees for services as follows:

| |

| • | $15,000 for the chair of our audit committee and $10,000 for each of its other members; |

| |

| • | $15,000 for the chair of our compensation committee and $10,000 for each of its other members; and |

| |

| • | $15,000 for the chair of our nominating and corporate governance committee and $10,000 for each of its other members. |

Pursuant to a policy adopted by our board of directors, each non-employee director who first becomes a member of our board of directors after our IPO will be granted restricted stock units (“RSUs”) having a fair market value on the grant date equal to $175,000. Following each annual meeting of stockholders, each non-employee director will be granted additional RSUs having a fair market value on the date of grant equal to $175,000, subject to proration for directors who join our board of directors and receive an initial grant in the same 12-month cycle. In each case, the number of shares of our common stock for which the grant of RSUs is settleable is determined by dividing $175,000 by the trailing 30-day average of the closing price of our common stock on The Nasdaq Global Select Market. Each grant of RSUs will vest over one year in four equal quarterly installments following the date of grant, unless determined otherwise by our board of directors or our compensation committee. RSUs granted to non-employee directors under the policy described above will accelerate and vest in full in the event of a change of control, subject to the terms of our 2018 Equity Incentive Plan.

We also reimburse our directors for their reasonable out-of-pocket expenses in connection with attending meetings of our board of directors and committees.

Director Share Ownership Guidelines Policy

For a description of the Share Ownership Guidelines Policy that applies to our directors, please see “Executive Compensation—Executive and Director Share Ownership Guidelines Policy” below.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR ALL NOMINEES” FOR THE ELECTION OF THE THREE CLASS I DIRECTORS SET FORTH IN THIS PROPOSAL ONE.

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has selected PricewaterhouseCoopers LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending September 28, 2019 and recommends that our stockholders vote for the ratification of such selection. The ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending September 28, 2019 requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting. In the event that PricewaterhouseCoopers LLP is not ratified by our stockholders, the audit committee will review its future selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

PricewaterhouseCoopers LLP audited our financial statements for the fiscal year ended September 29, 2018. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and they will be given an opportunity to make a statement at the Annual Meeting if they desire to do so, and will be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees and Services

We regularly review the services and fees from our independent registered public accounting firm. These services and fees are also reviewed with our audit committee annually. In accordance with standard policy, PricewaterhouseCoopers LLP periodically rotates the individuals who are responsible for our audit. In addition to performing the audit of our consolidated financial statements, PricewaterhouseCoopers LLP provided various other services during the fiscal years ended September 29, 2018 and September 30, 2017. Our audit committee has determined that PricewaterhouseCoopers LLP’s provision of these services, which are described below, does not impair PricewaterhouseCoopers LLP’s independence from us. During the years ended September 29, 2018 and September 30, 2017, fees for services provided by PricewaterhouseCoopers LLP were as follows:

|

| | | | | | | | |

| | | Fiscal Year Ended |

| | | September 29, 2018 | | September 30, 2017 |

Audit fees (1) | | $ | 2,678,796 |

| | $ | 1,342,908 |

|

Tax fees (2) | | | 6,369 |

| | | 84,285 |

|

Other fees (3) | | | 1,800 |

| | | 59,300 |

|

| Total fees | | $ | 2,686,965 |

| | $ | 1,486,493 |

|

| |

| (1) | Consists of fees rendered in connection with the audit of our consolidated financial statements, including audited financial statements presented in our annual report on Form 10-K, review of the interim consolidated financial statements included in our quarterly reports and services normally provided in connection with regulatory filings. Also consists of professional services rendered in connection with our Registration Statement on Form S-1 related to our IPO completed in August 2018. |

| |

| (2) | Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal, state and international tax compliance, as well as technical tax advice related to federal and state income tax matters, assistance with sales tax and assistance with tax audits. |

| |

| (3) | Consists of fees for services other than the services reported in audit fees, audit-related fees and tax fees. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm, the scope of services provided by our independent registered public accounting firm and the fees for the services to be performed. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by our independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were approved by our audit committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL TWO.

PROPOSAL THREE: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION

In accordance with The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the Exchange Act, we must provide our stockholders with the opportunity to make a non-binding, advisory vote on the frequency of future advisory votes on named executive officer compensation (the “Say-On-Frequency Vote”). The non-binding, advisory Say-On-Frequency Vote must be submitted to our stockholders at least once every six years.

We are asking stockholders to indicate whether they prefer to cast future advisory votes on named executive officer compensation “EVERY YEAR,” “EVERY TWO YEARS” or “EVERY THREE YEARS.” Stockholders may also abstain from voting on this proposal. The frequency that receives the greatest number of votes cast by stockholders will be considered the advisory vote of our stockholders.

Our board of directors values the opinions of our stockholders and will consider the result of the Say-On-Frequency Vote in determining the frequency with which we will hold future advisory votes on named executive officer compensation. However, the Say-On-Pay Frequency Vote is not binding. Our board of directors may determine that it is in the best interests of Sonos and our stockholders to hold an advisory vote on named executive officer compensation more or less frequently than the frequency that is selected by our stockholders.

After careful consideration, our board of directors recommends that future non-binding advisory votes on the compensation of our named executive officers be held every year.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR “EVERY YEAR”

FOR THE SAY-ON-FREQUENCY VOTE.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of December 31, 2018 by:

| |

| • | each stockholder known by us to be the beneficial owner of more than 5% of our common stock; |

| |

| • | each of our non-employee directors and director nominees; |

| |

| • | each of our named executive officers; and |

| |

| • | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned by them, subject to community property laws where applicable. Shares of our common stock subject to stock options that are currently exercisable or exercisable within 60 days of December 31, 2018 and shares issuable upon the settlement of RSUs that will vest within 60 days of December 31, 2018 are deemed to be outstanding and to be beneficially owned by the person holding the stock options for the purpose of computing the percentage ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Percentage ownership of our common stock is based on 100,248,663 shares of our common stock outstanding on December 31, 2018. Unless otherwise indicated, the address of each of the individuals and entities named below is c/o Sonos, Inc., 614 Chapala Street, Santa Barbara, CA 93101.

|

| | | | |

| Name of Beneficial Owner | | Number of Shares Beneficially Owned | | Percentage of Shares Beneficially Owned |

| 5% Stockholders: | | | | |

KKR Stream Holdings LLC (1) | | 21,845,682 | | 21.8 |

Entities affiliated with Index Ventures (2) | | 12,084,250 | | 12.1 |

| John MacFarlane | | 7,215,758 | | 7.2 |

Valdur Koha and affiliated entities (3) | | 5,810,354 | | 5.8 |

| Non-Employee Directors and Nominees: | | | | |

Robert Bach (4) | | 416,120 | | * |

Brittany Bagley (5) | | — | | — |

Karen Boone (6) | | 13,234 | | * |

Thomas Conrad (7) | | 15,220 | | * |

Julius Genachowski (8) | | 113,384 | | * |

John Maeda (9) | | 68,384 | | * |

Michelangelo Volpi (10) | | 12,084,358 | | 12.1 |

| Named Executive Officers: | | | | |

Patrick Spence (11) | | 1,499,829 | | 1.5 |

Michael Giannetto (12) | | 653,394 | | * |

Joy Howard (13) | | 199,368 | | * |

Nicholas Millington (14) | | 1,037,738 | | 1.0 |

Matthew Siegel (15) | | 101,462 | | * |

All executive officers and directors as a group (11 persons) (16) | | 16,003,123 | | 15.4 |

| |

| (1) | Each of KKR 2006 Fund L.P. (as the managing member of KKR Stream Holdings LLC), KKR Associates 2006 L.P. (as the general partner of KKR 2006 Fund L.P.), KKR 2006 GP LLC (as the general partner of KKR Associates 2006 L.P.), KKR Fund Holdings L.P. (as the designated member of KKR 2006 GP LLC), KKR Fund Holdings GP Limited (as a general partner of KKR Fund Holdings L.P.), KKR Group Holdings Corp. (as a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP Limited), KKR & Co. Inc. (as the sole shareholder of KKR Group Holdings Corp.), KKR Management LLC (as the controlling shareholder of KKR & Co. Inc.) and Messrs. Henry R. Kravis and George R. Roberts (as the designated members of KKR Management LLC and the managers of KKR 2006 GP LLC) may be deemed to be the |

beneficial owners having shared voting and dispositive power with respect to the shares owned by KKR Stream Holdings LLC. The principal business address of each of the entities and persons listed in this footnote, except Mr. Roberts, is c/o Kohlberg Kravis Roberts & Co. L.P., 9 West 57th Street, Suite 4200, New York, New York 10019. The principal business address of Mr. Roberts is c/o Kohlberg Kravis Roberts & Co. L.P., 2800 Sand Hill Road, Suite 200, Menlo Park, CA 94025.

| |

| (2) | Consists of (i) 10,931,734 shares held by Index Ventures Growth I (Jersey), L.P. (“Index I”), (ii) 1,092,096 shares held by Index Ventures Growth I Parallel Entrepreneur Fund (Jersey), L.P. (“Index I Parallel”) and (iii) 60,420 shares held by Yucca (Jersey) S.L.P. (“Yucca”). Index Venture Growth Associates I Limited (“IVGA I”) is the managing general partner of Index I and Index I Parallel and has the sole voting and investment power with respect to the shares held by Index I and Index I Parallel. Yucca is a co-investment vehicle that is contractually required to mirror the investment of Index I and Index I Parallel. Nigel Greenwood, Ian Henderson, Sinéad Meehan, Bernard Dallé, Phil Balderson and David Hall are the directors of IVGA I and may be deemed to have shared voting, investment and dispositive power with respect to the shares held by these entities. Mr. Volpi, who is a member of our board of directors, is a partner within the Index Ventures group. The principal business address for Index I, Index I Parallel and Yucca is 44 Esplanade, St. Helier, Jersey JE1 EFG, United Kingdom. |

| |

| (3) | Consists of (i) 2,172,696 shares held by The Koha Family Irrevocable Trust—1999 GST Exempt, of which Mr. Koha is a trustee, (ii) 1,276,848 shares held by Mr. Koha individually, (iii) 1,102,752 shares held by The Koha Family Irrevocable Trust—1999 GST Taxable, of which Mr. Koha is a trustee, (iv) 578,702 shares held by The Irene M Koha Marital Trust—1999, of which Mr. Koha is a trustee, (v) 500,000 shares held by The Koha Dynasty Trust—2000, of which Mr. Koha is a trustee, and (vi) 179,356 shares held by The Valdur Koha Trust—1999, of which Mr. Koha is a beneficiary and a trustee. |

| |

| (4) | Consists of (i) 97,148 shares held by Mr. Bach individually, (ii) 70,386 shares held by Mr. Bach and Pauline Bach, as community property with right of survivorship, (iii) 12,000 shares held by the Robert J. Bach 2013 Annuity Trust, for which Mr. Bach serves as a trustee, (iv) 16,000 shares held by the Pauline M. Bach 2016 Annuity Trust, of which Mr. Bach’s spouse is a beneficiary, (v) 12,000 shares held by the Pauline M. Bach 2013 Annuity Trust, of which Mr. Bach’s spouse is a beneficiary, and (vi) 208,586 shares subject to stock options held by Mr. Bach that are exercisable within 60 days of December 31, 2018. |

| |

| (5) | The principal business address of Ms. Bagley is c/o Kohlberg Kravis Roberts & Co. L.P., 2800 Sand Hill Road, Suite 200, Menlo Park, CA 94025. |

| |

| (6) | Consists of 13,234 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (7) | Consists of 15,220 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (8) | Consists of (i) 20,000 shares and (ii) 93,384 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (9) | Consists of (i) 52,702 shares and (ii) 15,682 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (10) | Consists of (i) 12,084,250 shares held by entities affiliated with Index Ventures, as further described in footnote 2 above, and (ii) 108 shares held by the Volpi-Cupal Family Trust, of which Mr. Volpi is a trustee. The principal business address of Mr. Volpi is c/o Index Ventures, 44 Esplanade, St. Helier, Jersey JE1 EFG, United Kingdom. |

| |

| (11) | Consists of (i) 1,476,202 shares subject to stock options that are exercisable within 60 days of December 31, 2018 and (ii) 23,627 shares issuable upon the settlement of RSUs that will vest within 60 days of December 31, 2018. |

| |

| (12) | Consists of 653,394 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (13) | Consists of 199,368 shares subject to stock options that are exercisable within 60 days of December 31, 2018. Ms. Howard ceased serving as Chief Marketing Officer in May 2018. |

| |

| (14) | Consists of (i) 103,714 shares and (ii) 934,024 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (15) | Consists of 101,462 shares subject to stock options that are exercisable within 60 days of December 31, 2018. |

| |

| (16) | Consists of (i) 12,468,308 shares, (ii) 3,511,188 shares subject to stock options that are exercisable within 60 days of December 31, 2018 and (iii) 23,627 shares issuable upon the settlement of RSUs that will vest within 60 days of December 31, 2018, each of which are held by our named executive officers and directors as a group. Does not include the beneficial ownership of either Edward Lazarus or Anna Fraser, each of whom became an executive officer subsequent to December 31, 2018. |

EXECUTIVE OFFICERS

Our executive officers and their ages as of January 18, 2019 and positions with Sonos are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

|

| | | | |

| Name | | Age | | Position |

| Patrick Spence | | 44 | | Chief Executive Officer and Director |

| Michael Giannetto | | 55 | | Chief Financial Officer |

| Anna Fraser | | 37 | | Chief People Officer |

| Edward Lazarus | | 59 | | Chief Legal Officer and Corporate Secretary |

| Nicholas Millington | | 42 | | Chief Product Officer |

| Matthew Siegel | | 45 | | Chief Commercial Officer |

Our board of directors chooses our executive officers, who then serve at the discretion of our board of directors. There is no family relationship between any of the directors or executive officers and any of our other directors or executive officers.

Patrick Spence. For a brief biography of Mr. Spence, please see “Proposal One: Election of Directors—Continuing Directors.”

Michael Giannetto has served as our Chief Financial Officer since October 2012. From September 2008 to June 2011, Mr. Giannetto served as the Chief Financial Officer of Vistaprint N.V., an online provider of business and consumer printing products and services, and served as the Senior Vice President of Finance of Vistaprint from May 2003 to August 2008. Prior to Vistaprint, Mr. Giannetto served in various financial leadership roles at ePresence, Inc., EMC Corporation and Data General Corporation. Mr. Giannetto holds a B.S. in accounting from Bentley University and an M.B.A. from the F.W. Olin Graduate School of Business at Babson College.

Anna Fraser has served as our Chief People Officer since January 2017. Prior to Sonos, from September 2007 to January 2017, Ms. Fraser served as the Director and Chief of Staff for People Operations of Google Inc., a technology company, where she was responsible for people strategy and employee experience. Ms. Fraser holds a B.A. in sociology from Harvard University.

Edward Lazarus has served as our Chief Legal Officer and Corporate Secretary since January 2019. From January 2013 to December 2018, Mr. Lazarus served as the Executive Vice President, General Counsel and Corporate Secretary of Tribune Media Company. Prior to Tribune, Mr. Lazarus worked as an independent consultant and attorney from February 2012 to January 2013 and served as the Chief of Staff to the Chairman of the Federal Communications Commission June 2009 to February 2012. From 2000 to 2009, Mr. Lazarus practiced law at Akin Gump Strauss Hauer & Feld LLP. Mr. Lazarus holds a B.A. from Yale University and a J.D. from Yale Law School.

Nicholas Millington has served as our Chief Product Officer since February 2017. Mr. Millington previously served as our Vice President and Chief of Staff of Product from February 2010 to January 2017, as our Director of Advanced Development and Architecture from November 2006 to February 2010 and as our Director of Software Development from April 2003 to October 2006. Prior to Sonos, from June 1998 to April 2003, Mr. Millington served as a Software Design Engineer Lead, SharePoint for Microsoft Corporation, a technology company. Mr. Millington holds a B.S.E. in electrical engineering from Duke University.

Matthew Siegel has served as our Chief Commercial Officer since September 2017. Prior to Sonos, from April 2014 to August 2017, Mr. Siegel served as the Vice President General Manager of Digital Commerce of Nike, Inc., a sportswear and athletic apparel company. From December 2008 to February 2014, Mr. Siegel was an Executive Vice President Digital Commerce at Ann, Inc., a national clothing retailer. Mr. Siegel holds a B.S. in communications studies from Northwestern University.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis describes the material elements of our executive compensation program for our principal executive officer, our principal financial officer and our three other most highly compensated executive officers (our “named executive officers”) for fiscal 2018:

| |

| • | Patrick Spence, our Chief Executive Officer; |

| |

| • | Michael Giannetto, our Chief Financial Officer; |

| |

| • | Joy Howard, our former Chief Marketing Officer; |

| |

| • | Nicholas Millington, our Chief Product Officer; and |

| |

| • | Matthew Siegel, our Chief Commercial Officer. |

Philosophy and Context for Executive Compensation

We believe our executive compensation program has been designed to motivate, reward, attract and retain the talent necessary to ensure our continued success as Sonos evolves. The program seeks to align executive compensation with our short- and long-term objectives, business strategy, financial performance and long-term value creation for our stockholders. In addition, our compensation model has historically emphasized a “One Sonos” approach, with an emphasis on the success of Sonos as a whole and a goal of sharing our success with all of our employees.

Pre-IPO Executive Pay Strategy

Prior to our IPO, we used a pay program design that was heavily oriented toward equity rather than cash in order to achieve a strong alignment between our executives (which we define as the direct reports of our Chief Executive Officer), employees and stockholders. Specifically:

| |

| • | Base salaries were set at or below the competitive market levels for many of our executives, and we did not have a history of annual adjustments; |

| |

| • | Annual bonus targets were set at 15% of salary for all employees in the company, including our named executive officers; and |

| |

| • | Bonus awards prior to fiscal 2018 were based on a discretionary evaluation of company and individual performance. |

Post-IPO Evolution of Our Pay Practices