Shareholder Letter Q3 2021 November 8, 2021 Exhibit 99.2

To Our Shareholders: In October we hosted our annual Roblox Developers Conference (RDC) at the Fort Mason Center in San Francisco. This three-day event is an opportunity for us to celebrate our global community of creators and developers, highlight platform and community trends and technological advancements, and outline our vision for the future of Roblox. The in-person and virtual conference brought together more than 900 attend- ees from 50 countries worldwide. We utilized Guilded, our recently acquired communications platform, to host the RDC participants who connected in con- current voice chat groups. During our keynote presentations, Roblox founder and CEO David Baszucki gave an overview of key focus areas within the company, sharing progress to date and a vision going forward, including Spatial Voice Developer Beta. CTO Daniel Sturman shared several updates about the platform and highlighted the advancements the company made throughout the year to give developers the tools and resources they need to build the next generation of experiences on the Roblox platform. Shortly after RDC, we launched the Layered Clothing Studio Beta, which enables developers to apply any combination of clothing to the avatars in their own experiences and opens the door to greater possibilities for self-expression. Our developer community builds the content that powers our global platform, and sharing this time with them is invaluable. We believe that their ability to continue creating ever more engaging experiences for the nearly 50 million daily users on Roblox is a significant driver of the results we are sharing with you today. The strength of our unique developer community is reflected in the healthy year-over-year growth we experienced in Q3 2021, particularly as these results are compared to the extraordinary growth we saw in 2020. It’s clear that even as users revert back to pre-pandemic routines and behaviors, Roblox remains an important part of their day.

Q3 Operational Highlights Developers In the third quarter 2021, Roblox continued to add new global developers to the community. This talented group understands the unique value proposition that Roblox o!ers, including free tools, infrastructure, moderation, language translation, and access to a large and growing global audience. During the quarter, developers and creators earned $130.0 million in Developer Exchange Fees, up 52% from Q3 2020. We remain on track to exceed our goal of delivering half a billion dollars to developers in 2021. Growing the overall pool of capital available to developers enables more of them to build businesses on top of the Roblox platform while inspiring the creativity that is so important to deepening the unique amount of high quality content on Roblox. Content We continue to see a dynamic and growing variety of content on Roblox that reflects our platform’s social nature. In particular, we have more relevant “aged up” content on Roblox, defined as experiences where the majority of users are aged 13+. As of September 30, 2021, 28% of the top 1,000 experiences qualified as “aged up,” a significant increase from 10% of the top 1,000 experiences last year. Music In Q3 2021, we achieved several notable milestones. First, we hosted our inaugural Launch Party with the BMG label for their chart-topping artist KSI, which attracted more than 17 million visits. Next, we hosted our second virtual concert. The event, with the Grammy award-winning Twenty One Pilots, incorporated some of Roblox’s newest technology and was the most interactive virtual concert to-date, featuring many engaging mini games during the songs and the first-ever dynamic setlist dictated by fans in real-time. The concert posted more than 1 million hours of engagement from users in 160 countries. Nearly 14 million users acquired Twenty One Pilots virtual merchandise which was available in our catalog during September. Third, we debuted Roblox Listening Parties which allow artists to launch, and users to stream, entire

albums within Roblox experiences. Our first Listening Party featured Grammy-nominated artist Poppy, whose music was played across nine di!erent experiences. She also did virtual meet and greets with fans within each experience. Finally, Roblox reached an agreement with the National Music Publishers Association that now enables global publishers to pursue new creative and commercial opportunities on Roblox. Brand Partnerships Brands are increasingly recognizing the value of building experiences on Roblox. “Vans World” was introduced as a persistent experience in the metaverse on September 1, 2021 and leveraged some of Roblox’s latest game engine technology such as its augmented physics layer that helps achieve the true sensation of skateboarding. The experience provides users with the ability to customize their own shoes and skateboards and purchase digital merchandise for their avatars that can be worn in other Roblox experiences. Vans World had approximately 40 million visits in September. Finally, partnering with Netflix, we premiered the first, full-length episode of the new season of Bakugan, a popular anime series. The immersive Bakugan world saw over 2.5 million unique users in one month and demonstrated that users are interested in consuming full-length media in the virtual world. Talent As of September 30, 2021, we had 1,435 employees, up 66% from 865 employees at this time last year. Engineering and product talent still comprise approximately 80% of our employee base. Strategic Transactions During Q3 we completed three important transactions and welcomed the talented teams from Guilded, Humen, and Bash Video. Guilded is building a communications platform to connect gaming communities. The team at Humen.ai seeks to democratize generative AI technologies to bring people together. As part of Roblox, they will focus on avatar creation and animation. The team from Bash have a long history building developer communities and are focusing their skills on the Roblox developers.

Q3 Financial Results For more information, please refer to our Q3 2021 earnings release and supplemental materials accessible at ir.roblox.com. Revenue in Q3 2021 was $509.3 million, an increase of 102% over Q3 2020. Cost of revenue totaled $130.0 million, up 98% year over year. Personnel costs, excluding stock-based compensation, were $102.8 million, up 87% year over year driven by the increase in headcount and growth in contractors. As mentioned, developer exchange fees were $130.0 million versus $85.5 million in the same quarter last year, an increase of 52%. Certain infrastructure and trust & safety spending, which excludes personnel costs, stock-based compensation, and depreciation, was $82.6 million, up from $52.0 million in Q3 2020. Net loss attributable to common stockholders, which includes a portion of the net loss attributable to our Luobu subsidiary, was $74.0 million, compared to a net loss attributable to common stockholders of $48.6 million last year. Our net losses increased due to the higher levels of expense required to support the growth of the business and the fact that we defer a significant amount of revenue to later periods. Since our investment decisions are generally based on levels of non-GAAP bookings, we expect to continue to report net losses for the foreseeable future even as we anticipate generating net cash from operating activities. Bookings grew 28% to $637.8 million compared to $496.5 million last year. A reminder that to calculate bookings, we take revenue ($509.3 million) and add the change in deferred revenue and other adjustments for the period ($128.5 million). That sum gives us the cash generated in the quarter related to Robux purchased. Note that at the time users purchase Robux from us, we pay Apple, Google, and other merchants. To calculate the cash outflow related to bookings we add to cost of revenue ($130.0 million) the change in deferred cost of revenue (-$26.7 million) associated with the amount of deferred revenue. These changes in deferred amounts can be found in our statement of cash flows. Net cash provided by operating activities was $181.2 million, a decrease of 2% from $185.2 million in the same period a year ago. The decline was a result of

Key Metrics - Q3 2021 As of the quarter ended September 30, 2021, Roblox attracted an average of 47.3 million daily active users (DAUs) which was 31% higher than in Q3 of 2020 and was 2.6x larger than in Q3 of 2019. Approximately 50.4% of the users were over the age of 13, compared to 44.5% last year. User growth in Q3 2021 was highest in the Asia Pacific region, growing 75% over last year. APAC users now represent 20% of DAUs. Users spent 11.2 billion hours engaged on the Roblox platform in Q3 of 2021, up 28% from Q3 in 2020 and up 3x over Q3 of 2019. In Q3 of 2021, 51.2% of engagement was from users over the age of 13, up from 40.8% two years ago. Engagement growth was highest in the Asia Pacific region, growing 89% over last year. APAC users represent approximately 22% of global engagement. Average bookings per daily active user (ABPDAU) was $13.49 in Q3 2021, compared to $13.73 last year. The small decline was due to a shift in the geographic mix of our user base. aggressive investments in our developer community and engineering and product talent. These increased investments and the concomitant, modest reduction in cash flow were planned and expected. We have been talking about both since we listed the company back in March. During the quarter we generated free cash flow of $170.6 million, and we had $1.9 billion of cash and cash equivalents as of September 30, 2021. In October, we issued $1 billion aggregate principal amount of 3.875% senior unsecured notes due 2030. Net proceeds will be used for general corporate purposes. Adjusted EBITDA, a measure of operating performance used in the covenant calculations specified in the indenture related to our 3.875% senior unsecured notes due 2030, was $135.7 million in Q3 2021 compared to $161.0 million in Q3 2020.

Key Metrics - October 2021 As most of you know, we experienced a platform-wide outage the afternoon of October 28 that continued through the afternoon of October 31. In the interest of one of our core values of Respecting the Community, throughout those three days (approximately 70 hours) we communicated on Twitter and via our corporate blog. We point you to those sources for background. We are in the process of preparing a more detailed root cause analysis that we will share when complete. We also plan to address the outage next week during our investor day. Those 70 hours were di"cult for our users and for the millions of Roblox creators, many of whom generate their primary source of income from Roblox. We committed to compensating developers for their lost income and credited developer accounts accordingly. Since we were very late in the month, and given that we have a lot of historical data around engagement and spending on weekends and specifically around Halloween, we believe we were able to make thoughtful and accurate estimates about what our key October metrics - DAUs, hours of engagement, bookings, and developer earnings - would have been had we not experienced the outage. We used our estimate of what bookings would have been to calculate the developer compensation figure that was ultimately paid. Through the first 27 days of October (prior to the outage), average DAUs were 50.5 million, an increase of 43% over the same period in 2020. Given the outage, actual average DAUs for the full month of October dropped to 47.1 million. Average DAUs for the full month of October 2020 were 35.5 million. Through the first 27 days of October, cumulative hours of engagement were 3.2 billion, up 41% over the same period in 2020. Actual cumulative hours of engagement for the full month of October were 3.4 billion. Hours of engagement for the full month of October 2020 were 2.7 billion. Through the first 27 days of October, bookings were estimated to be between $177 - $179 million, an increase of 30% - 34% over the same period in 2020. Actual bookings for the entire month of October were estimated to be between $189 - $192 million. Bookings for the full month of October 2020 were $165.1 million.

Earnings Q&A Session Roblox will host a live Q&A session to answer questions regarding their third quarter 2021 results on Tuesday, November 9, 2021 at 5:30 a.m. Pacific Time. The live webcast and Q&A session will be open to the public at ir.roblox.com and we invite you to join us and to visit our investor relations website at ir.roblox.com to review supplemental information. We estimated that lost bookings during the outage period was $25 million. In addition, there were $6 million of bookings received during the outage (primarily from prepaid cards) for which our developers were not compensated, for a total of $31 million. We applied a 22% payout ratio to the $31 million of uncompensated bookings and estimated the earnings loss for developers during the outage to be $6.8 million. That amount will be credited to developer accounts as mentioned above. Closing out October metrics, GAAP revenue for the full month of October 2021 was estimated to be between $177 - $180 million. GAAP revenue for the full month of October 2020 was $94.7 million. Finally, a reminder that we will hold an Investor Day on November 16th starting at 8 a.m. Pacific Time. The event is at maximum capacity but we hope that you will be able to join us via livestream at ir.roblox.com.

Forward-Looking Statements This letter, the live webcast and Q&A session which will be held at 5:30 a.m., Pacific Time on November 9, 2021 contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our future financial performance, business strategy, plans and new platform features, development of new technologies and developer tools, investment in the developer community and our talent, payments to developers, our ability to bring new music, recording artists and brands to the platform, the success of events on our platform, investments in international growth, the development of the metaverse, Investor Day and October financial performance and operational metrics. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections, as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “likely,” “believe,” “hope,” “target,” “project,” “plan,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could di!er materially from those stated or implied in our forward-looking statements due to a number of factors, including but not limited to risks detailed in our filings with the Securities and Exchange Commission (the “SEC”), including in our Quarterly Report on Form 10-Q filed for the fiscal quarter ended June 30, 2021 and other filings and reports we make with the SEC from time to time. In particular, the following factors, among others, could cause results to di!er materially from those expressed or implied by such forward-looking statements: our ability to successfully execute our business and growth strategy; the su"ciency of our cash and cash equivalents to meet our liquidity needs; the impact of our senior notes and any future indebtedness on our business, financial condition and results of operations; the demand for our platform in general; our ability to increase our number of new users and revenue generated from users; our ability to retain and expand our user base; the impact on our business of the COVID-19 pandemic restrictions and the easing of those restrictions as vaccinations become more prevalent; the fluctuation of our results of operations and our key business measures on a quarterly basis in future periods; our ability to successfully develop and deploy new technologies to address the needs of our users; our ability to maintain and enhance our brand and reputation; our ability to hire and retain talent; news or social media coverage about Roblox, including but not limited to coverage that presents, or relies on, inaccurate, misleading, incomplete, or otherwise damaging information; any breach or access to user or third-party data; and our ability to maintain the security and availability of our platform. Additional information regarding these and other risks and uncertainties that could cause actual results to di!er materially from our expectations is included in the reports we have filed or will file with the SEC, including our Quarterly Report Form 10-Q for the fiscal quarter ended June 30, 2021. The forward-looking statements included in this letter and the webcast represent our views as of the date of this letter. We anticipate that subsequent events and developments will cause our views to change. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release. Past performance is not necessarily indicative of future results.

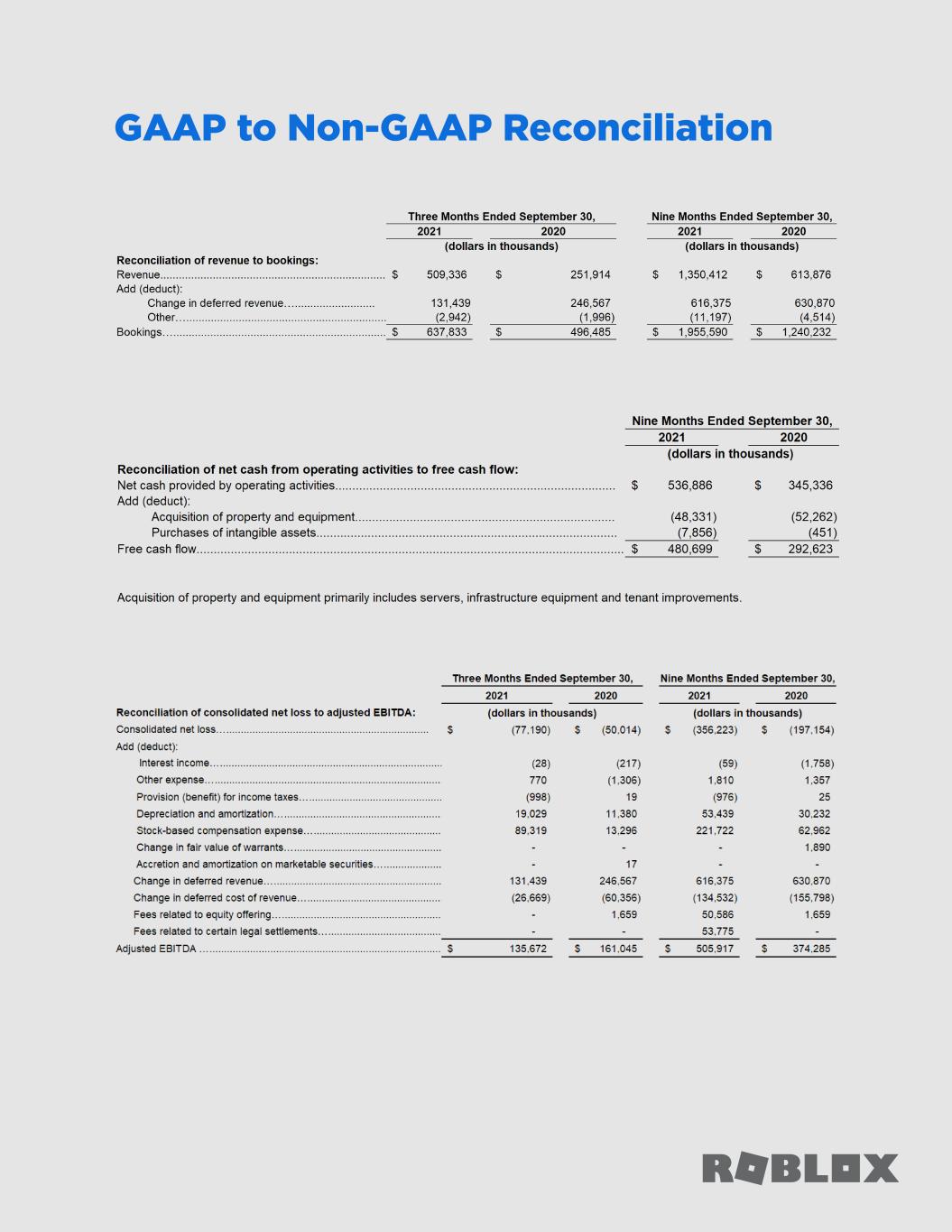

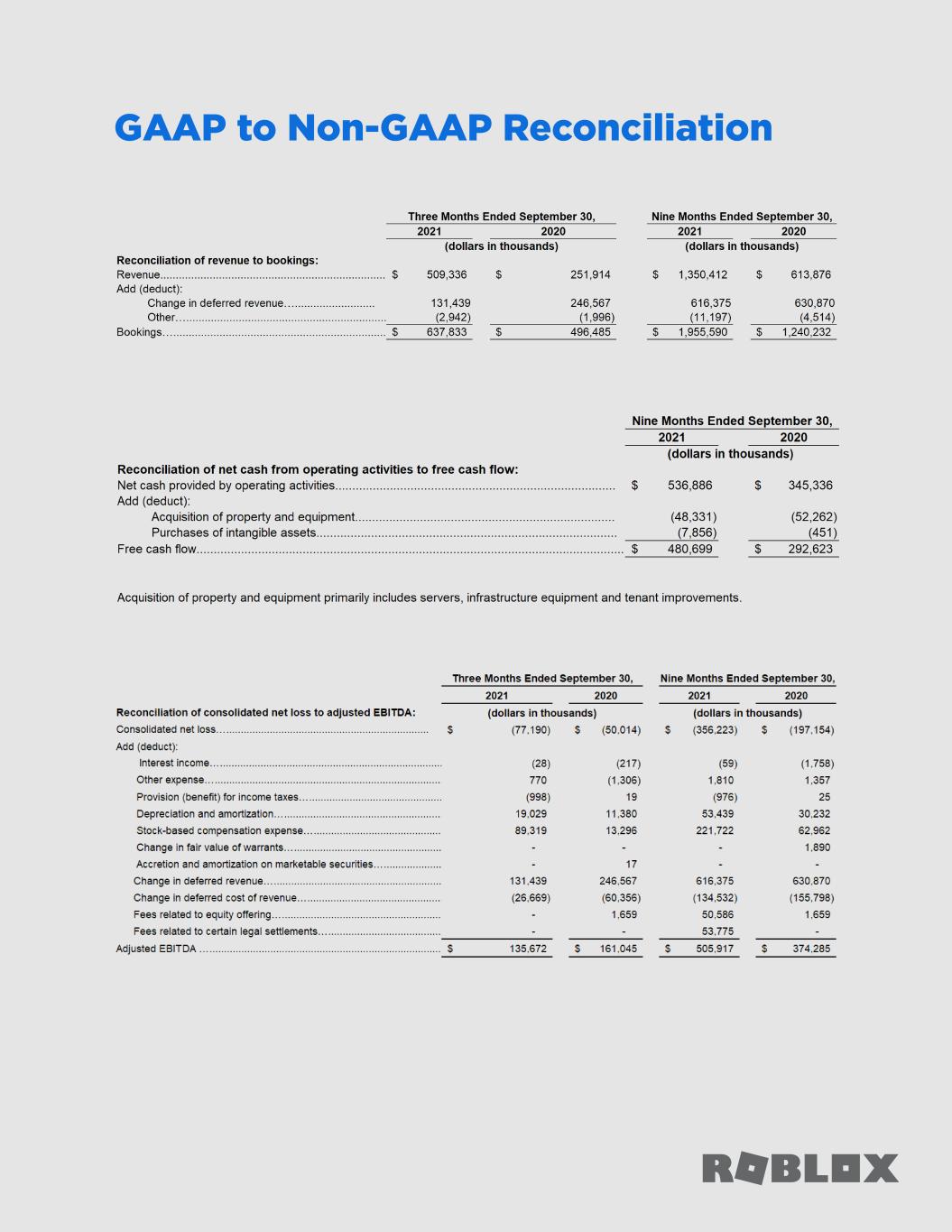

Non-GAAP Financial Metrics This letter contains the non-GAAP financial measures bookings, free cash flow, and adjusted EBITDA. We use this non-GAAP financial information to evaluate our ongoing operations, for internal planning and forecasting purposes, and ongoing operating trends for purposes of analyzing the covenants specified in the indenture governing our senior notes due 2030. We believe that this non-GAAP financial information may be helpful to investors because it provides consistency and comparability with past financial performance. Bookings is defined as revenue plus the change in deferred revenue during the period and other non-cash adjustments. Bookings is equal to the amount of virtual currency purchased by users in a given period of measurement. We believe bookings provide a timelier indication of trends in our operating results that are not necessarily reflected in our revenue as a result of the fact that we recognize the majority of revenue over the estimated average lifetime of a paying user. The change in deferred revenue constitutes the vast majority of the reconciling di!erence from revenue to bookings. By removing these non-cash adjustments, we are able to measure and monitor our business performance based on the timing of actual transactions with our users and the cash that is generated from these transactions. Free cash flow represents the net cash provided by operating activities less purchases of property, equipment, and intangible assets. We believe that free cash flow is a useful indicator of our unit economics and liquidity that provides information to management and investors about the amount of cash generated from our core operations that, after the purchases of property, equipment, and intangible assets, can be used for strategic initiatives, including investing in our business, making strategic acquisitions, and strengthening our balance sheet. Adjusted EBITDA is a measure of operating performance used in certain covenant calculations specified in the indenture governing our senior notes due 2030 that is not calculated in accordance with GAAP and may not conform to the calculation of EBITDA in other circumstances. Adjusted EBITDA should not be considered as a substitute for net loss as determined in accordance with GAAP. We believe that, when considered together with reported amounts, Adjusted EBITDA is useful to investors and management in understanding our ongoing operations and ongoing operating trends for purposes of analyzing the covenants specified in the indenture governing our senior notes due 2030. Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures di!erently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial information as a tool for comparison. As a result, our non-GAAP financial information is presented for supplemental informational purposes only and should not be considered in isolation from, or as a substitute for financial information presented in accordance with GAAP. A reconciliation table of the most comparable GAAP financial measure to each non-GAAP financial measure used in this letter is included at the end of this letter. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view these non-GAAP measures in conjunction with the most directly comparable GAAP financial measure.

GAAP to Non-GAAP Reconciliation