Investor Presentation January 2017 Exhibit 99.1

Certain statements in this presentation are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and may include, but are not limited to, statements about sales levels, acquisitions, restructuring, profitability and anticipated synergies, expenses and cash outflows. All forward-looking statements involve risks and uncertainties. All statements contained herein that are not clearly historical in nature are forward-looking, and words such as "believe," "anticipate," "expect," "estimate," "may," "will," "should," "continue," "plans,“ “potential,” "intends," "likely," or other similar words or phrases are generally intended to identify forward-looking statements. Any forward-looking statement contained herein, in press releases, written statements or documents filed with the Securities and Exchange Commission, or in Koppers communications with and discussions with investors and analysts in the normal course of business through meetings, phone calls and conference calls, regarding expectations with respect to sales, earnings, cash flows, operating efficiencies, restructurings, the benefits of acquisitions and divestitures or other matters as well as financings and debt reduction, are subject to known and unknown risks, uncertainties and contingencies. Many of these risks, uncertainties and contingencies are beyond our control, and may cause actual results, performance or achievements to differ materially from anticipated results, performance or achievements. Factors that might affect such forward-looking statements, include, among other things, the impact of changes in commodity prices, such as oil and copper, on product margins; general economic and business conditions; potential difficulties in protecting our intellectual property; the ratings on our debt and our ability to repay or refinance outstanding indebtedness; our ability to operate within the limitations of our debt covenants; potential impairment of our goodwill and/or long-lived assets; demand for Koppers goods and services; competitive conditions; interest rate and foreign currency rate fluctuations; availability of key raw materials and unfavorable resolution of claims against us, as well as those discussed more fully elsewhere in this presentation and in documents filed with the Securities and Exchange Commission by Koppers, particularly our latest annual report on Form 10-K and subsequent filings. Any forward-looking statements in this presentation speak only as of the date of this presentation, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Note: There are non-GAAP amounts in this presentation for which reconciliations to GAAP are provided in the Appendix section, as well as the company’s quarterly financial news releases, which are posted to the website at www.koppers.com along with this presentation. To access the reconciliations in the quarterly financial news releases, go to the company’s homepage, select “Investor Relations” and then “News Releases”. Forward Looking Statement

Leroy M. Ball President and Chief Executive Officer Michael J. Zugay Chief Financial Officer Management Representatives

Company Overview

Global leader in oil and water-borne preservatives serving many market applications for treated wood Successfully transitioning from a business built on producing carbon pitch to serve global aluminum industry into an enterprise centered on the preservation and enhancement of wood Knowledge of wood preservation is a core competency Largest integrated producer of wood treatment preservatives for North American railroad crosstie industry Performance Chemicals wood treatment preservatives serve various industrial, agricultural and residential markets Strategy continues to build momentum; continue to evaluate opportunities to optimize product portfolio and capital structure Systematic approach of reducing dependence on highly cyclical industries tied to oil and aluminum Continuing to de-emphasize CMC as a standalone business Wood treatment technologies are at the heart of our value creation model Investment Thesis

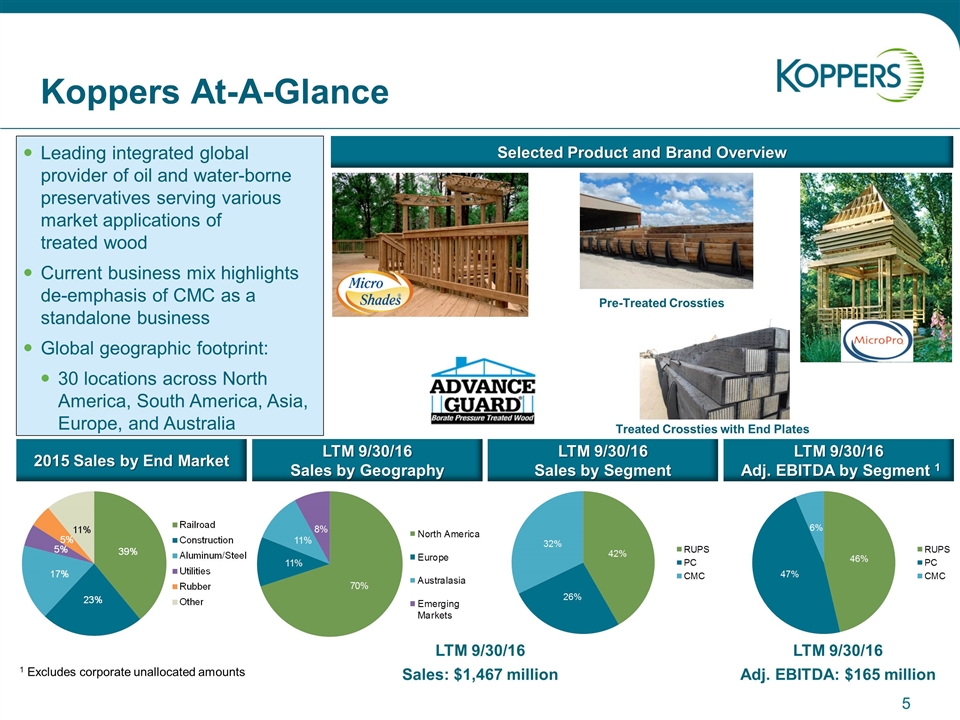

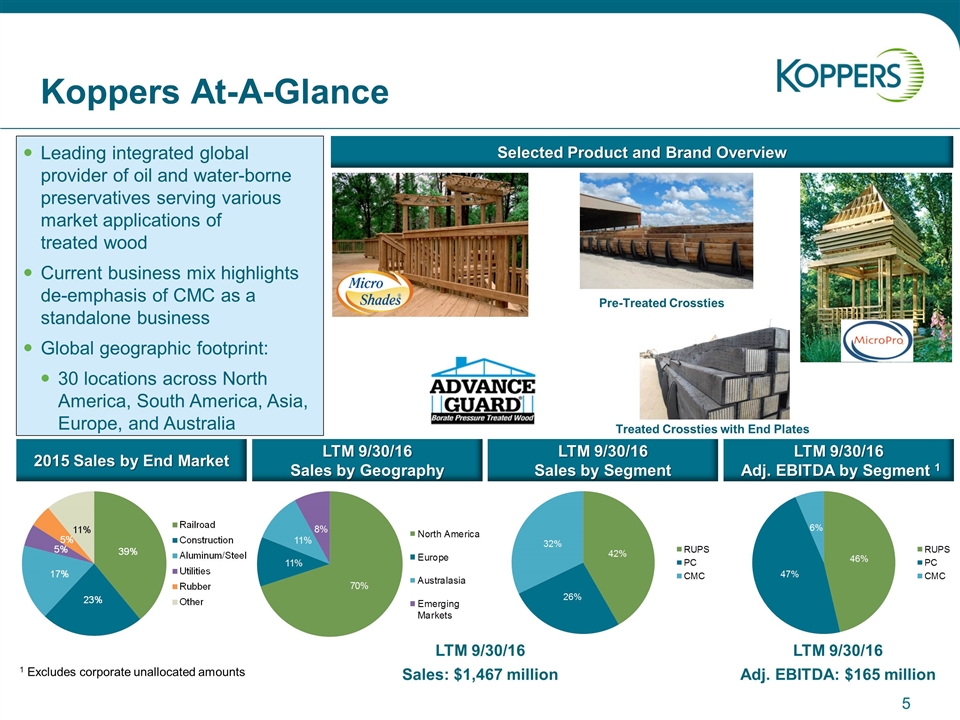

Koppers At-A-Glance Leading integrated global provider of oil and water-borne preservatives serving various market applications of treated wood Current business mix highlights de-emphasis of CMC as a standalone business Global geographic footprint: 30 locations across North America, South America, Asia, Europe, and Australia Selected Product and Brand Overview LTM 9/30/16 Adj. EBITDA: $165 million 1 Excludes corporate unallocated amounts LTM 9/30/16 Adj. EBITDA by Segment 1 LTM 9/30/16 Sales by Segment LTM 9/30/16 Sales: $1,467 million Pre-Treated Crossties Treated Crossties with End Plates 2015 Sales by End Market LTM 9/30/16 Sales by Geography

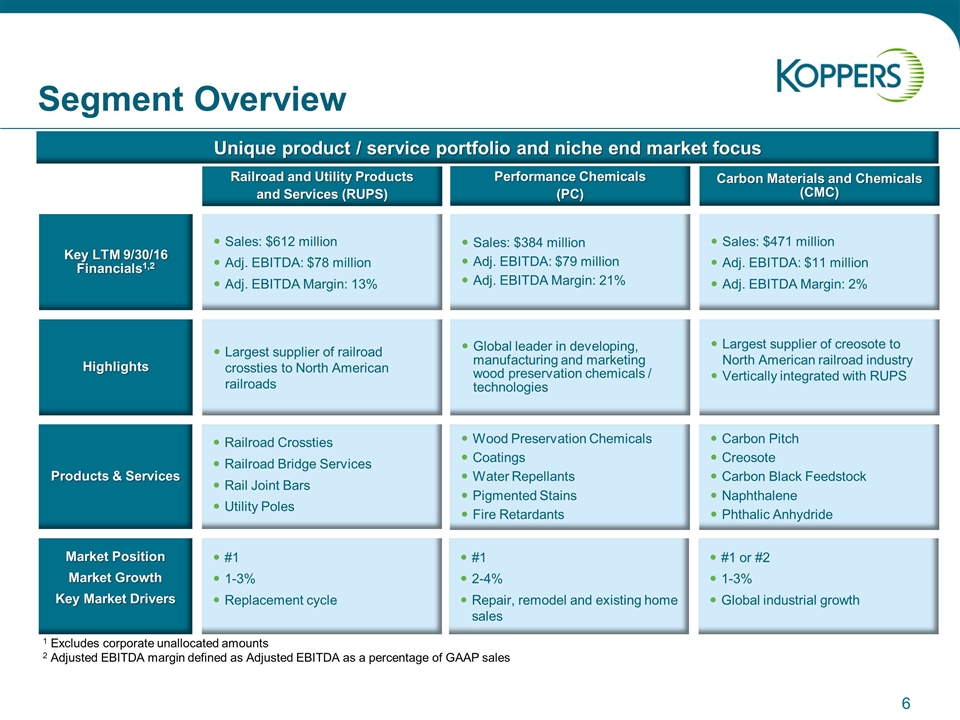

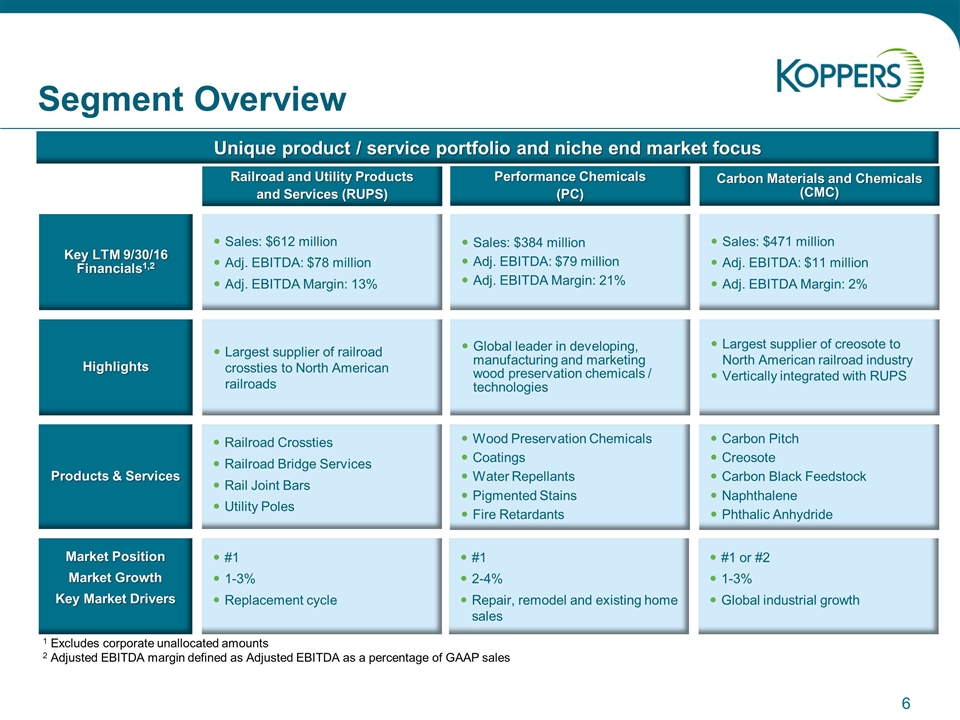

Carbon Materials and Chemicals (CMC) Performance Chemicals (PC) Railroad and Utility Products and Services (RUPS) Products & Services Carbon Pitch Creosote Carbon Black Feedstock Naphthalene Phthalic Anhydride Wood Preservation Chemicals Coatings Water Repellants Pigmented Stains Fire Retardants Railroad Crossties Railroad Bridge Services Rail Joint Bars Utility Poles Segment Overview Key LTM 9/30/16 Financials1,2 Sales: $471 million Adj. EBITDA: $11 million Adj. EBITDA Margin: 2% Sales: $384 million Adj. EBITDA: $79 million Adj. EBITDA Margin: 21% Sales: $612 million Adj. EBITDA: $78 million Adj. EBITDA Margin: 13% Highlights Largest supplier of creosote to North American railroad industry Vertically integrated with RUPS Global leader in developing, manufacturing and marketing wood preservation chemicals / technologies Largest supplier of railroad crossties to North American railroads R: 0 G: 112 B: 139 R: 112 G: 155 B: 180 R: 170 G: 70 B: 70 R: 128 G: 100 B: 162 R: 247 G: 150 B: 70 R: 75 G: 172 B: 198 Market Position Market Growth Key Market Drivers #1 or #2 1-3% Global industrial growth asdf #1 2-4% Repair, remodel and existing home sales #1 1-3% Replacement cycle asdf 1 Excludes corporate unallocated amounts 2 Adjusted EBITDA margin defined as Adjusted EBITDA as a percentage of GAAP sales Unique product / service portfolio and niche end market focus

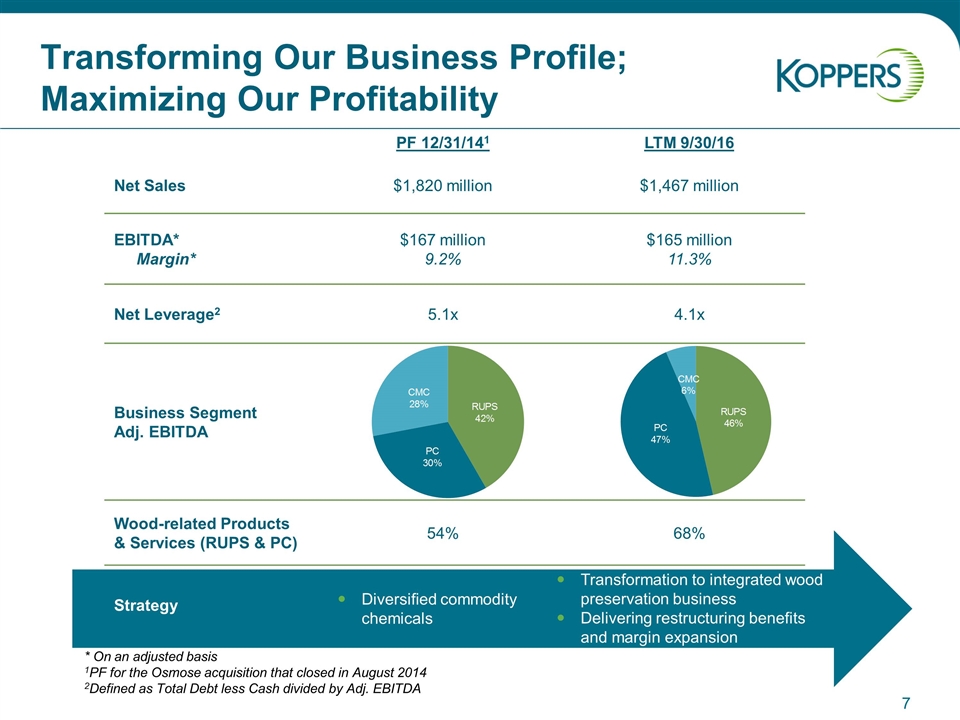

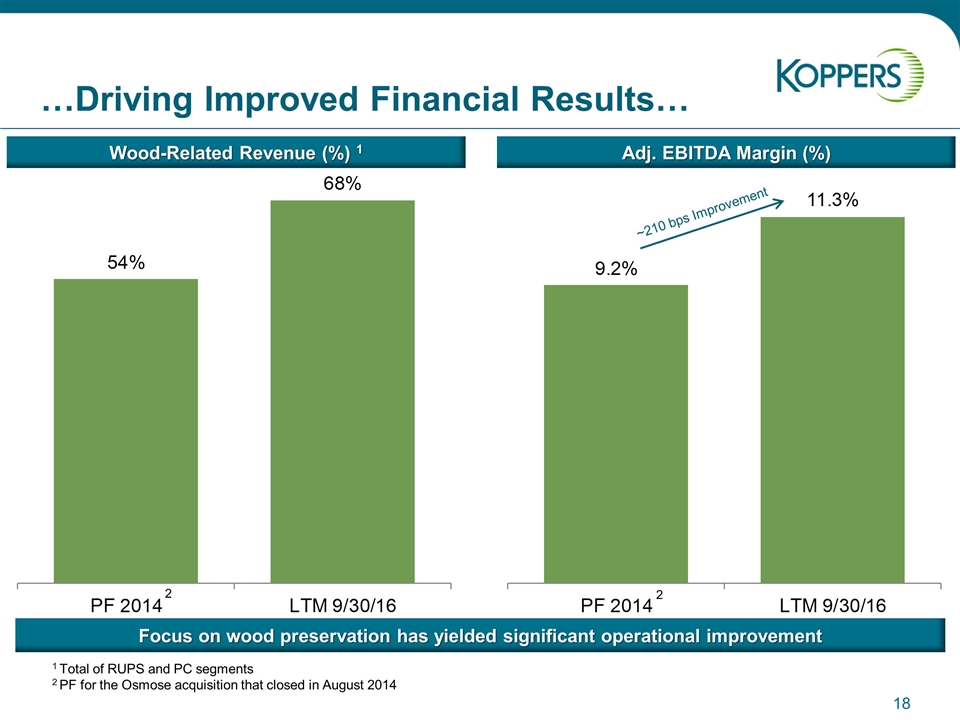

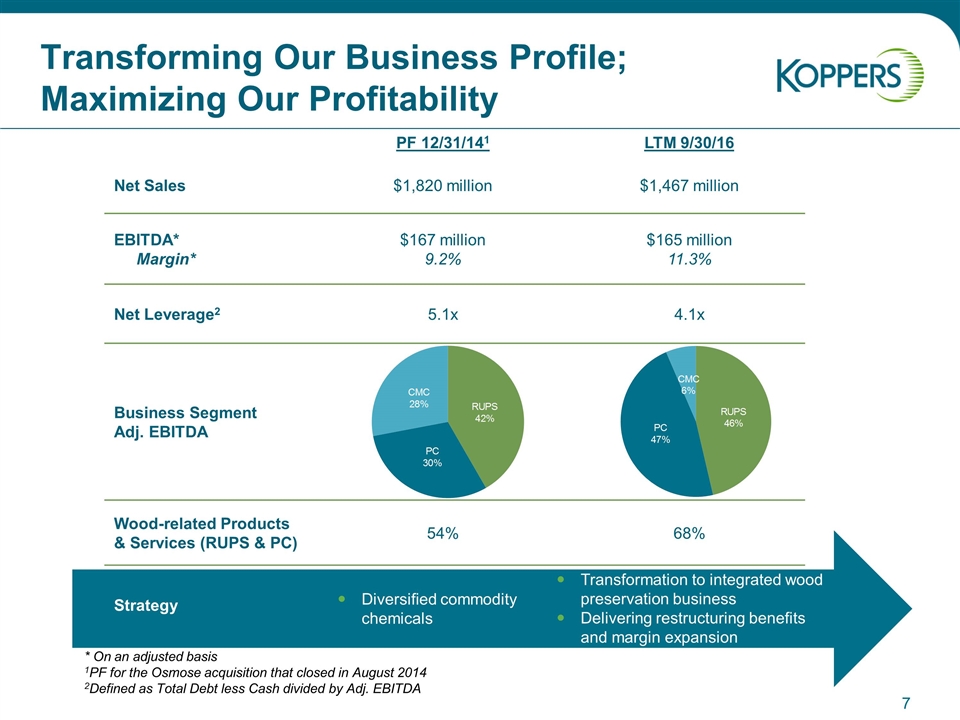

PF 12/31/141 LTM 9/30/16 Net Sales $1,820 million $1,467 million EBITDA* Margin* $167 million 9.2% $165 million 11.3% Net Leverage2 5.1x 4.1x Business Segment Adj. EBITDA Wood-related Products & Services (RUPS & PC) 54% 68% Transforming Our Business Profile; Maximizing Our Profitability * On an adjusted basis 1PF for the Osmose acquisition that closed in August 2014 2Defined as Total Debt less Cash divided by Adj. EBITDA Diversified commodity chemicals Transformation to integrated wood preservation business Delivering restructuring benefits and margin expansion Strategy

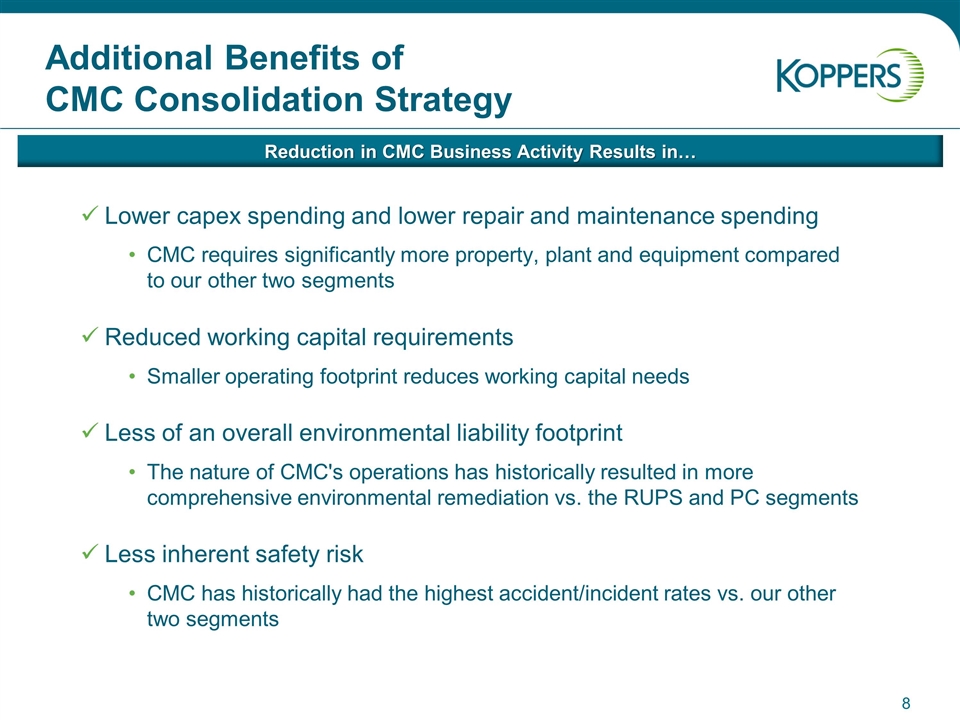

Additional Benefits of CMC Consolidation Strategy Lower capex spending and lower repair and maintenance spending CMC requires significantly more property, plant and equipment compared to our other two segments Reduced working capital requirements Smaller operating footprint reduces working capital needs Less of an overall environmental liability footprint The nature of CMC's operations has historically resulted in more comprehensive environmental remediation vs. the RUPS and PC segments Less inherent safety risk CMC has historically had the highest accident/incident rates vs. our other two segments Reduction in CMC Business Activity Results in…

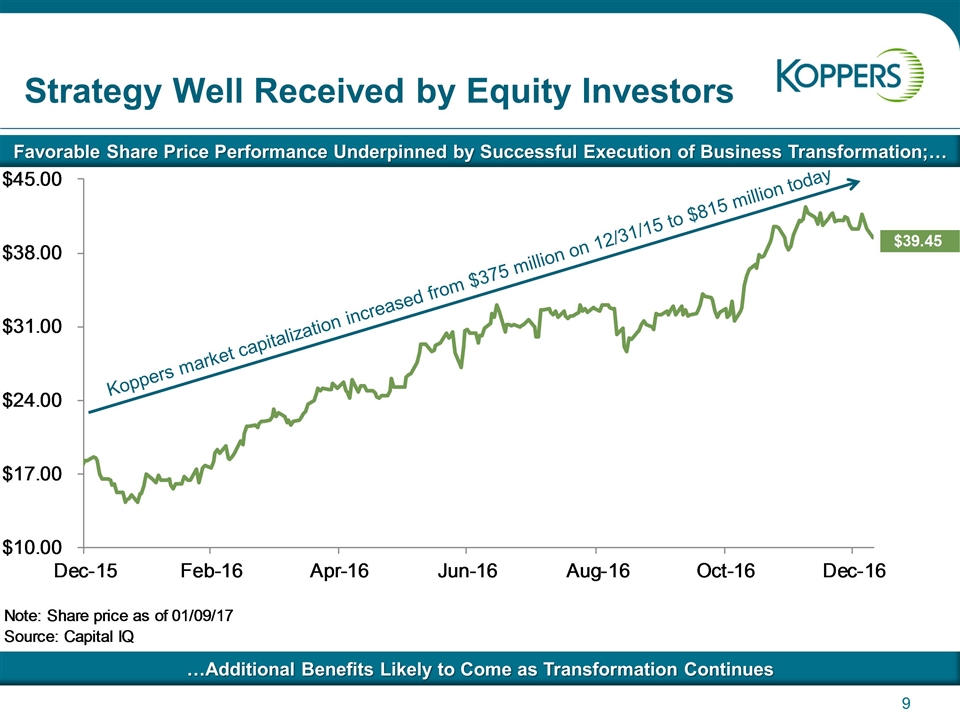

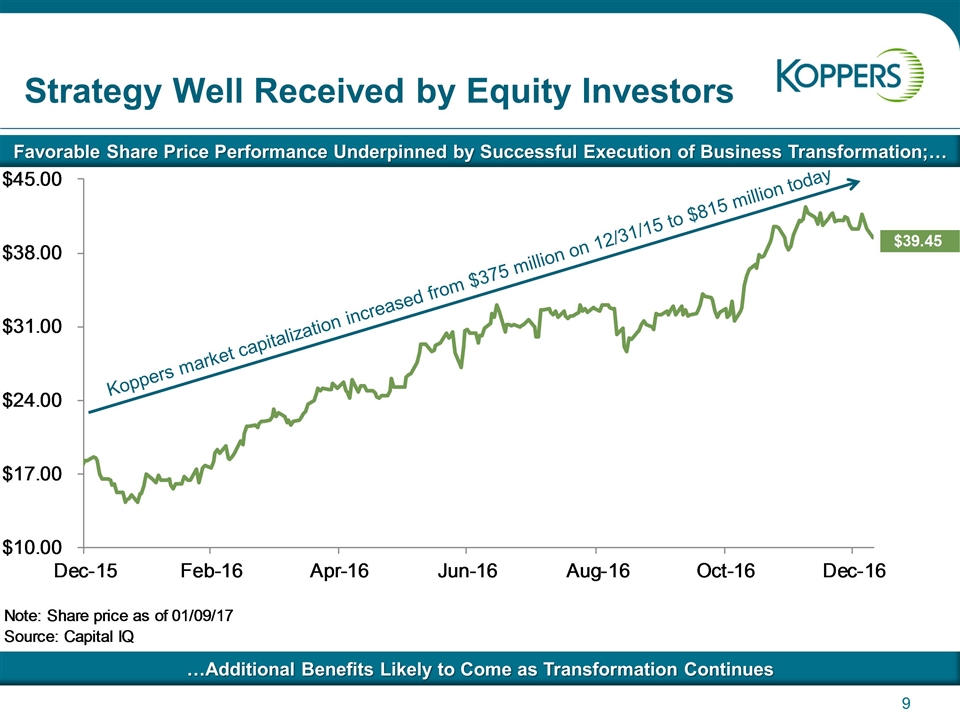

Strategy Well Received by Equity Investors Koppers market capitalization increased from $375 million on 12/31/15 to $815 million today Favorable Share Price Performance Underpinned by Successful Execution of Business Transformation;… …Additional Benefits Likely to Come as Transformation Continues

Zero Harm Focus Achieved certification in American Chemistry Council’s Responsible Care® initiative across 18 global facilities and corporate headquarters Received awards from BNSF Railway, Canadian National Railway and Union Pacific Railroad for excellence in chemical transportation safety performance 12 operating locations achieved a zero total recordable rate in 2015 Auckland Christchurch Darlington Denver Geelong Houston Hubbell KCCC Longford Millington Mt. Gambier Scunthorpe ZERO IS POSSIBLE! Safety Statistics YTD 9/30/16 2015 2014 2013 2012 Days Away (DA) 0.94 1.21 0.76 0.90 0.72 Days Away / Restricted Transfer (DART) 2.06 1.90 2.03 1.69 1.66 Total Recordable Rate (TRR) 3.12 3.45 3.91 3.71 3.99

Key Investment Highlights

Long-Term Contracts with Key Customers Consistent Free Cash Flow Generation and Deleveraging Key Investment Highlights Leading Global Producer of Wood Preservation and Enhancement Products Attractive End Markets with Stable Growth Prospects Over the Cycle Vertically Integrated, Strategically Located Footprint Successfully Repositioned the Business, Driving Improved Financial Results

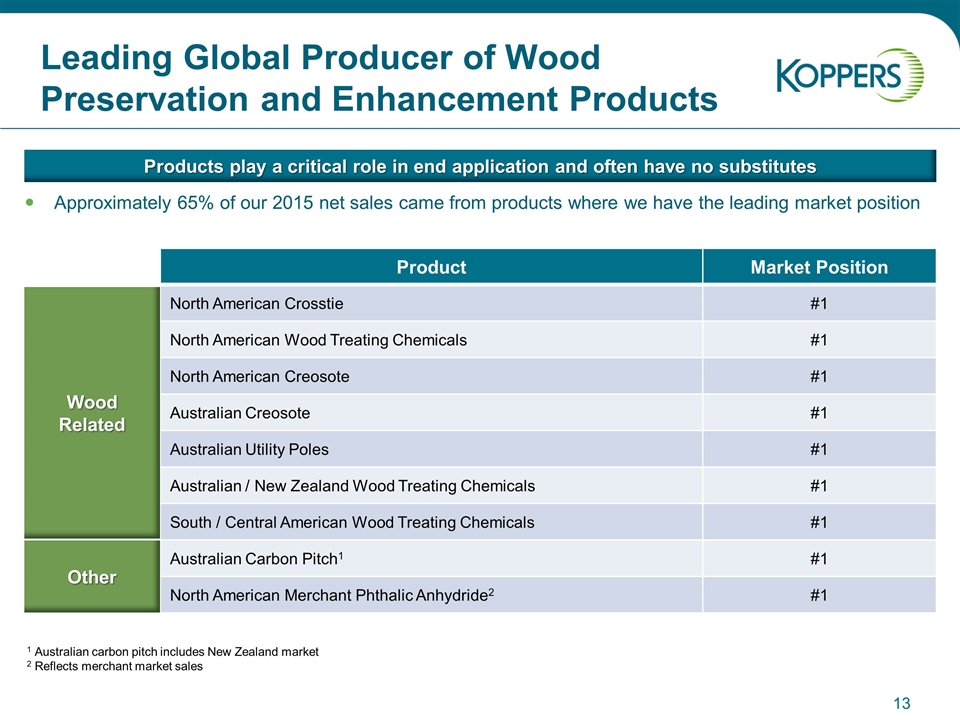

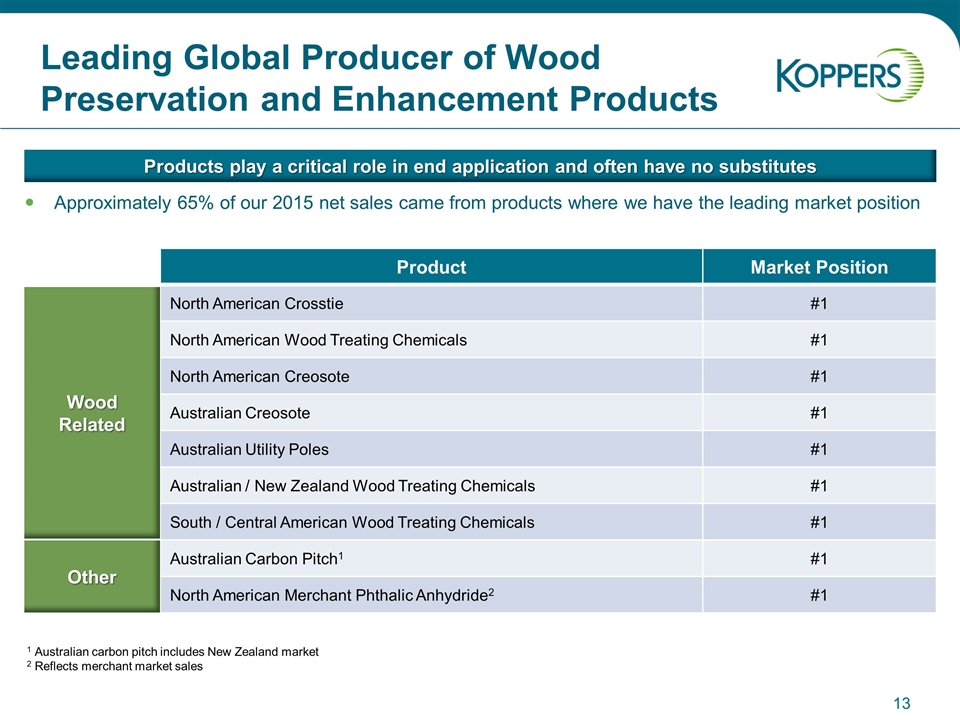

Approximately 65% of our 2015 net sales came from products where we have the leading market position Leading Global Producer of Wood Preservation and Enhancement Products Product Market Position North American Crosstie #1 North American Wood Treating Chemicals #1 North American Creosote #1 Australian Creosote #1 Australian Utility Poles #1 Australian / New Zealand Wood Treating Chemicals #1 South / Central American Wood Treating Chemicals #1 Australian Carbon Pitch1 #1 North American Merchant Phthalic Anhydride2 #1 Products play a critical role in end application and often have no substitutes 1 Australian carbon pitch includes New Zealand market 2 Reflects merchant market sales Wood Related Other

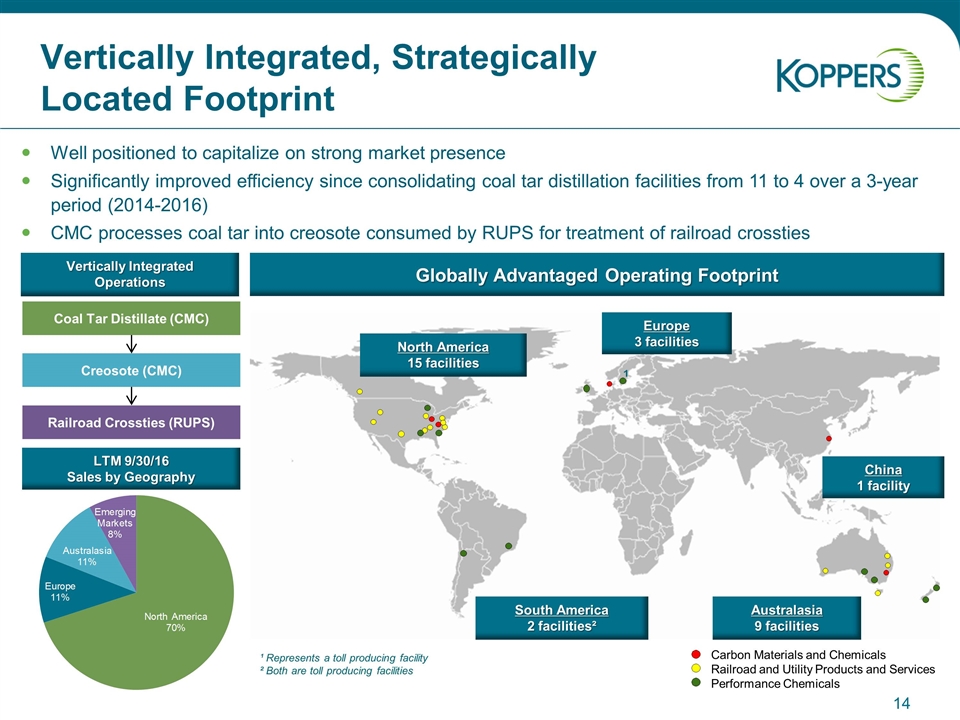

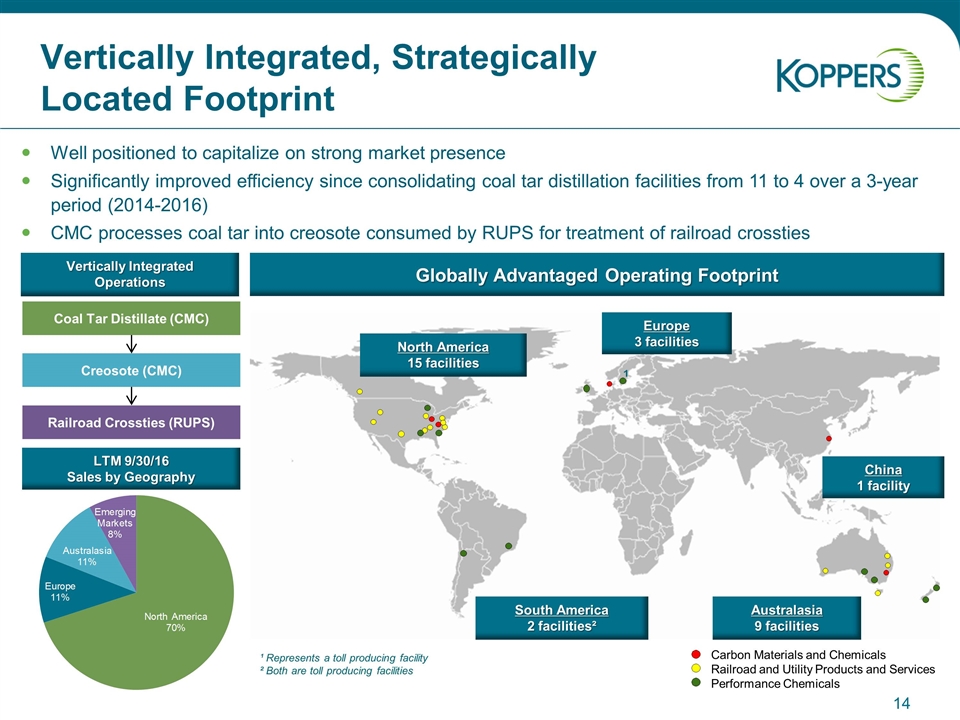

Vertically Integrated, Strategically Located Footprint Well positioned to capitalize on strong market presence Significantly improved efficiency since consolidating coal tar distillation facilities from 11 to 4 over a 3-year period (2014-2016) CMC processes coal tar into creosote consumed by RUPS for treatment of railroad crossties Europe 3 facilities North America 15 facilities China 1 facility Vertically Integrated Operations South America 2 facilities² ¹ Represents a toll producing facility ² Both are toll producing facilities Carbon Materials and Chemicals Railroad and Utility Products and Services Performance Chemicals Globally Advantaged Operating Footprint Coal Tar Distillate (CMC) Australasia 9 facilities Creosote (CMC) Railroad Crossties (RUPS) LTM 9/30/16 Sales by Geography ¹

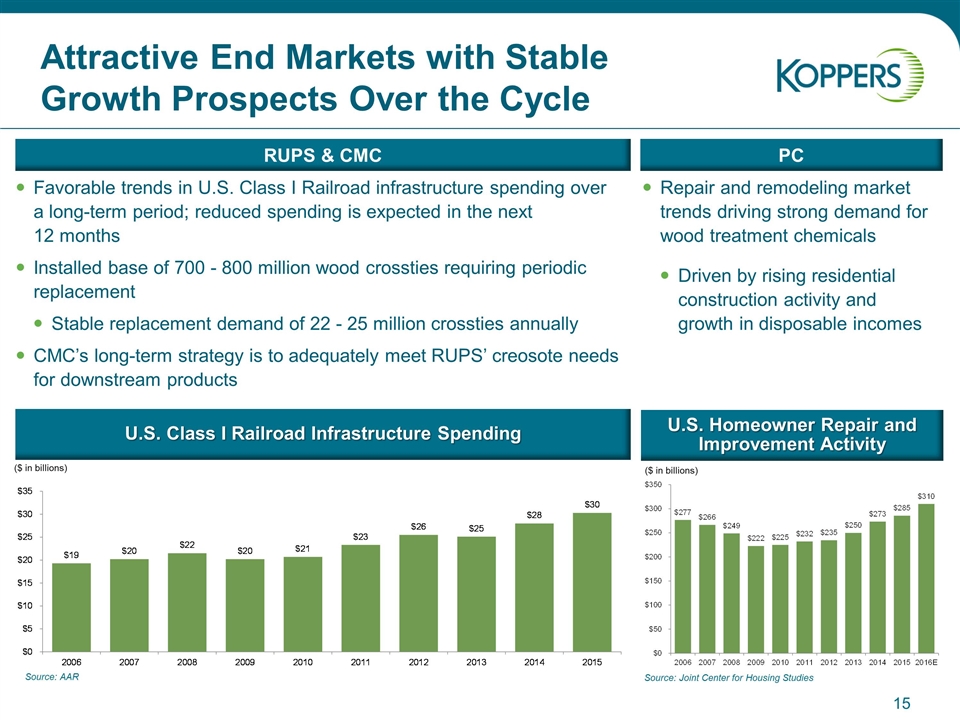

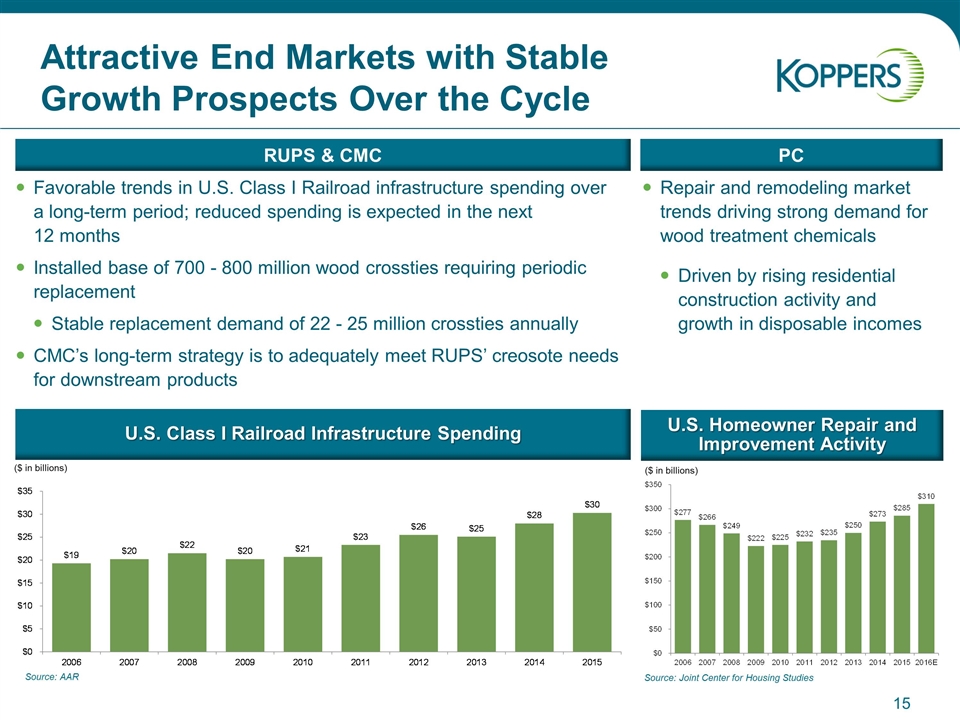

Attractive End Markets with Stable Growth Prospects Over the Cycle Favorable trends in U.S. Class I Railroad infrastructure spending over a long-term period; reduced spending is expected in the next 12 months Installed base of 700 - 800 million wood crossties requiring periodic replacement Stable replacement demand of 22 - 25 million crossties annually CMC’s long-term strategy is to adequately meet RUPS’ creosote needs for downstream products U.S. Homeowner Repair and Improvement Activity ($ in billions) RUPS & CMC U.S. Class I Railroad Infrastructure Spending Source: Joint Center for Housing Studies Source: AAR PC Repair and remodeling market trends driving strong demand for wood treatment chemicals Driven by rising residential construction activity and growth in disposable incomes ($ in billions)

70% of 2015 North American RUPS sales are served under long-term contracts Currently supplies all 7 of the North American Class I railroads and have contracts with all of them Supplies 9 of the 10 largest lumber treating companies in the U.S., in addition to the top 3 lumber treating companies in Canada Deploys a key risk mitigation strategy to hedge underlying copper prices, a key raw material, associated with processing PC products 100% of RUPS’ creosote supply comes from CMC Long-Term Contracts with Key Customers Key customers include railroad, wood preservation and other blue chip industrial companies

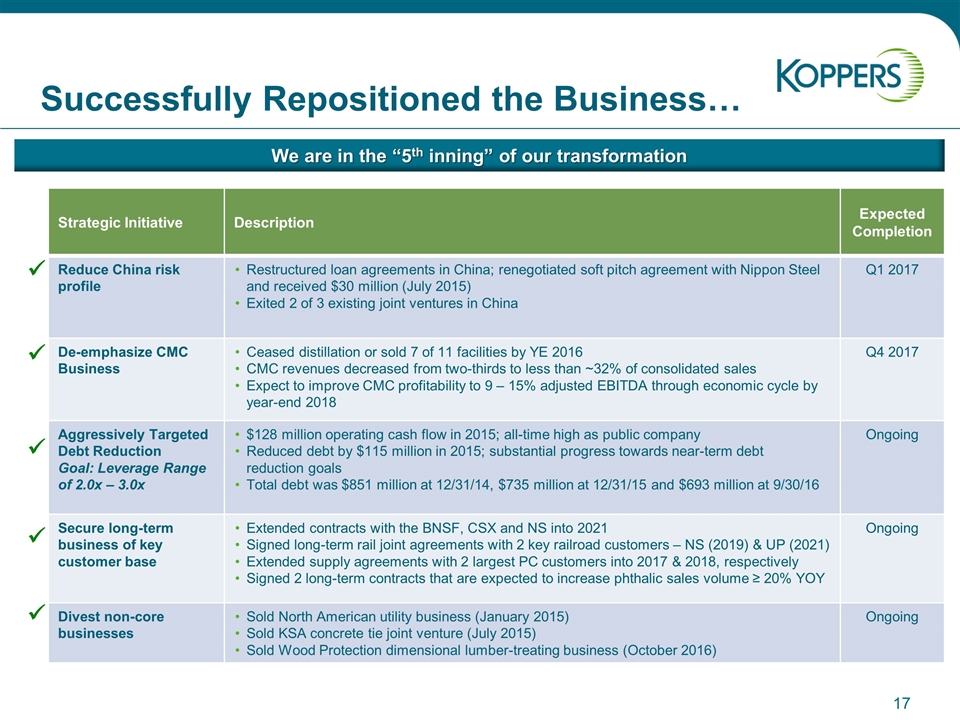

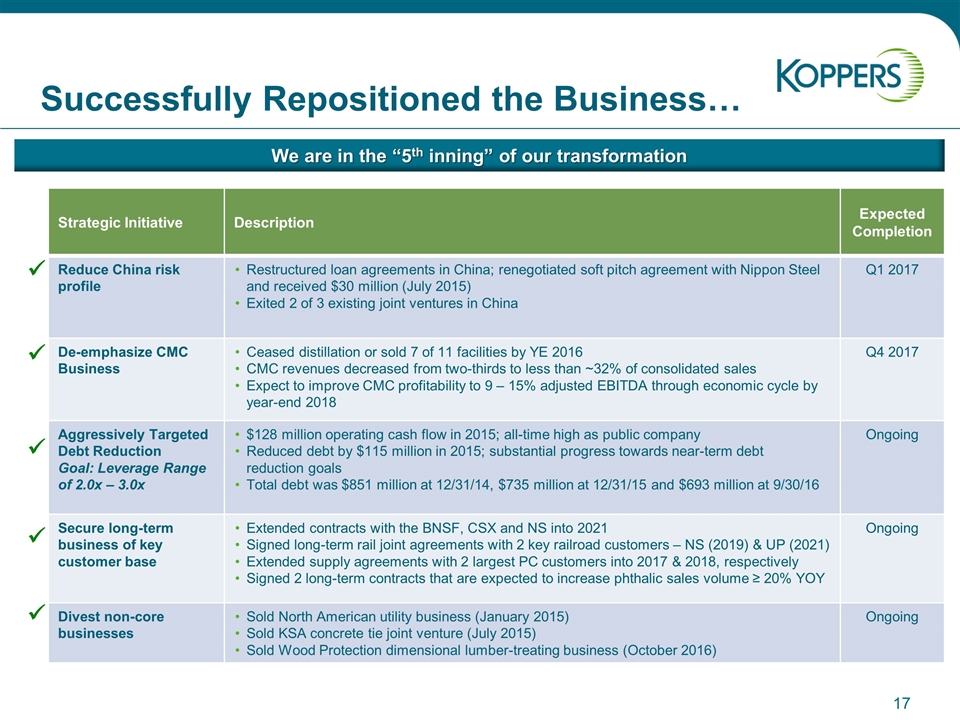

We are in the “5th inning” of our transformation Strategic Initiative Description Expected Completion Reduce China risk profile Restructured loan agreements in China; renegotiated soft pitch agreement with Nippon Steel and received $30 million (July 2015) Exited 2 of 3 existing joint ventures in China Q1 2017 De-emphasize CMC Business Ceased distillation or sold 7 of 11 facilities by YE 2016 CMC revenues decreased from two-thirds to less than ~32% of consolidated sales Expect to improve CMC profitability to 9 – 15% adjusted EBITDA through economic cycle by year-end 2018 Q4 2017 Aggressively Targeted Debt Reduction Goal: Leverage Range of 2.0x – 3.0x $128 million operating cash flow in 2015; all-time high as public company Reduced debt by $115 million in 2015; substantial progress towards near-term debt reduction goals Total debt was $851 million at 12/31/14, $735 million at 12/31/15 and $693 million at 9/30/16 Ongoing Secure long-term business of key customer base Extended contracts with the BNSF, CSX and NS into 2021 Signed long-term rail joint agreements with 2 key railroad customers – NS (2019) & UP (2021) Extended supply agreements with 2 largest PC customers into 2017 & 2018, respectively Signed 2 long-term contracts that are expected to increase phthalic sales volume ≥ 20% YOY Ongoing Divest non-core businesses Sold North American utility business (January 2015) Sold KSA concrete tie joint venture (July 2015) Sold Wood Protection dimensional lumber-treating business (October 2016) Ongoing ü ü ü ü ü Successfully Repositioned the Business…

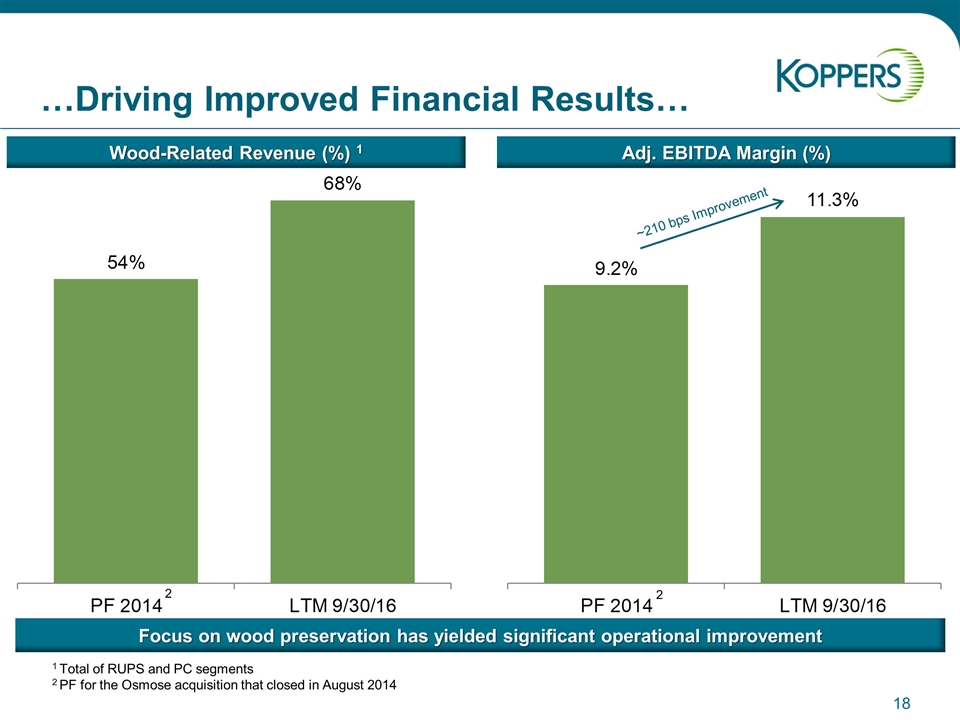

…Driving Improved Financial Results… ~210 bps Improvement Wood-Related Revenue (%) 1 Adj. EBITDA Margin (%) 1 Total of RUPS and PC segments 2 PF for the Osmose acquisition that closed in August 2014 2 2 Focus on wood preservation has yielded significant operational improvement

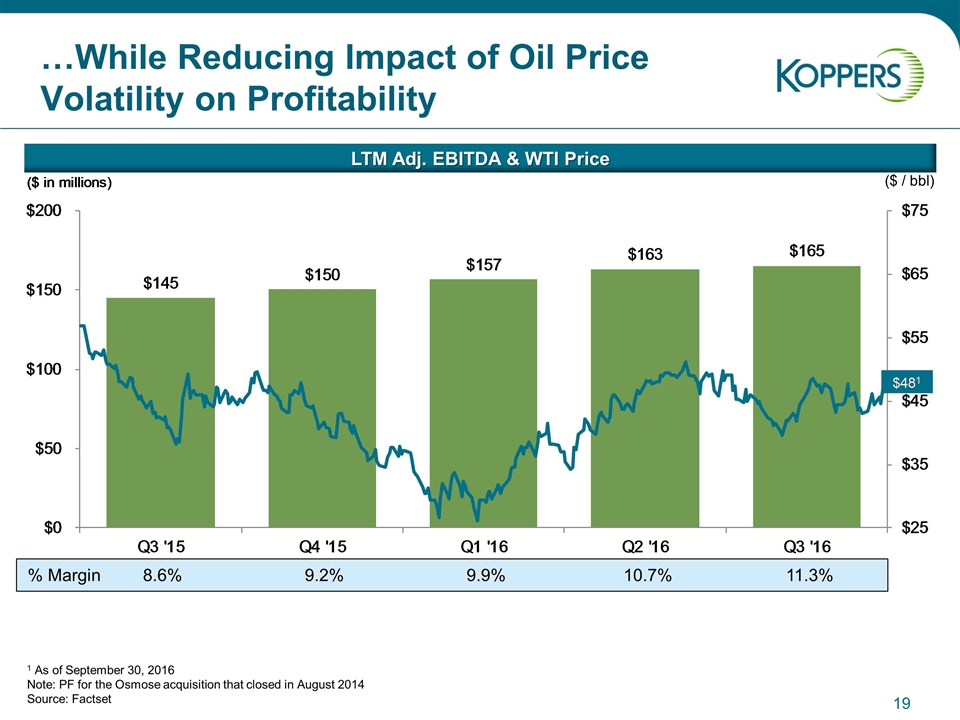

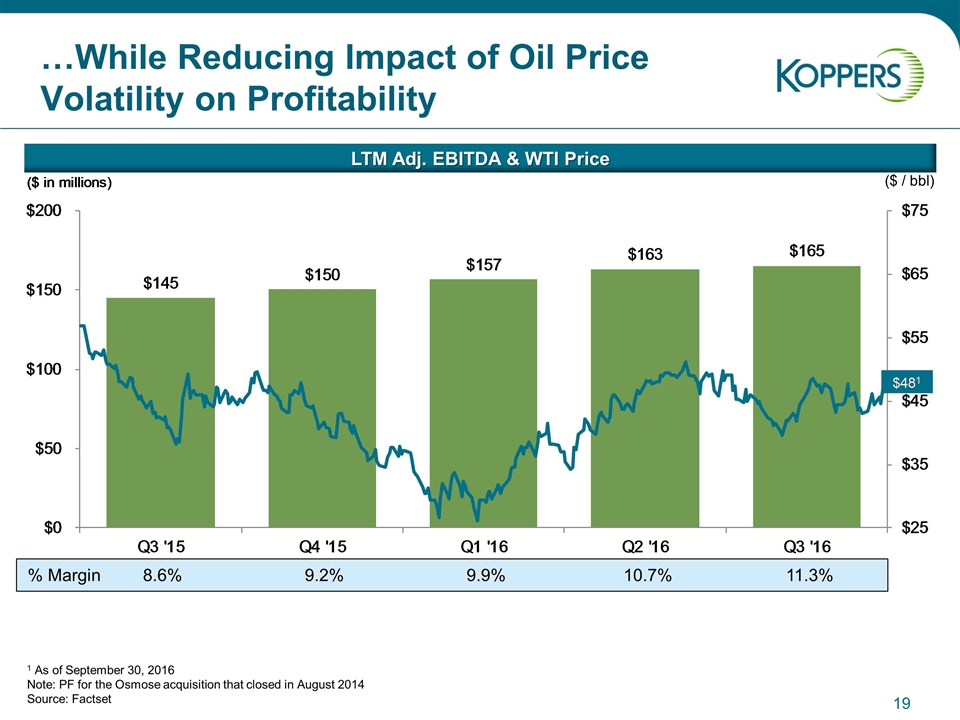

…While Reducing Impact of Oil Price Volatility on Profitability LTM Adj. EBITDA & WTI Price 1 As of September 30, 2016 Note: PF for the Osmose acquisition that closed in August 2014 Source: Factset 8.6% 9.2% 9.9% 10.7% 11.3% % Margin ($ / bbl)

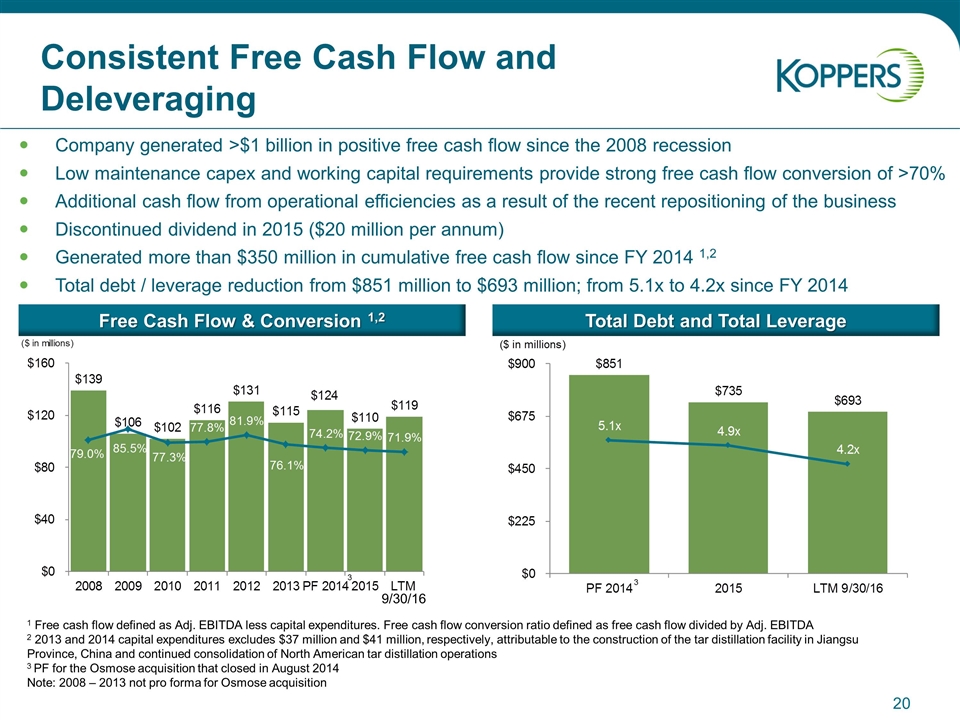

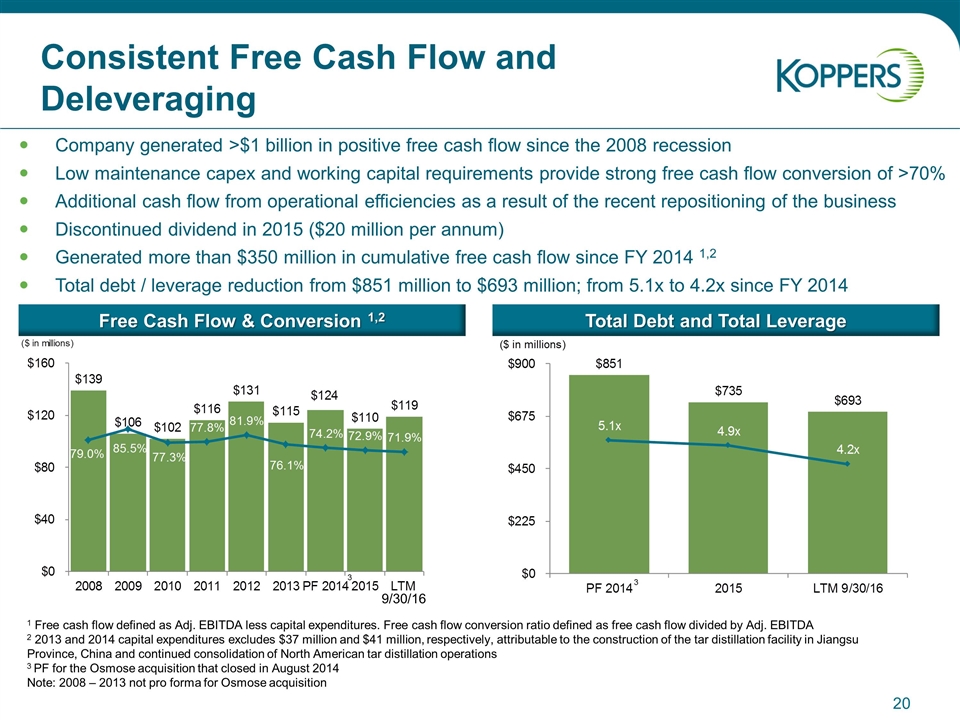

Company generated >$1 billion in positive free cash flow since the 2008 recession Low maintenance capex and working capital requirements provide strong free cash flow conversion of >70% Additional cash flow from operational efficiencies as a result of the recent repositioning of the business Discontinued dividend in 2015 ($20 million per annum) Generated more than $350 million in cumulative free cash flow since FY 2014 1,2 Total debt / leverage reduction from $851 million to $693 million; from 5.1x to 4.2x since FY 2014 Consistent Free Cash Flow and Deleveraging Free Cash Flow & Conversion 1,2 Total Debt and Total Leverage 1 Free cash flow defined as Adj. EBITDA less capital expenditures. Free cash flow conversion ratio defined as free cash flow divided by Adj. EBITDA 2 2013 and 2014 capital expenditures excludes $37 million and $41 million, respectively, attributable to the construction of the tar distillation facility in Jiangsu Province, China and continued consolidation of North American tar distillation operations 3 PF for the Osmose acquisition that closed in August 2014 Note: 2008 – 2013 not pro forma for Osmose acquisition 9/30/16 3 3

Long-Term Contracts with Key Customers Consistent Free Cash Flow Generation and Deleveraging Key Investment Highlights Leading Global Producer of Wood Preservation and Enhancement Products Attractive End Markets with Stable Growth Prospects Over the Cycle Vertically Integrated, Strategically Located Footprint Successfully Repositioned the Business, Driving Improved Financial Results

Business Strategy & Financial Overview

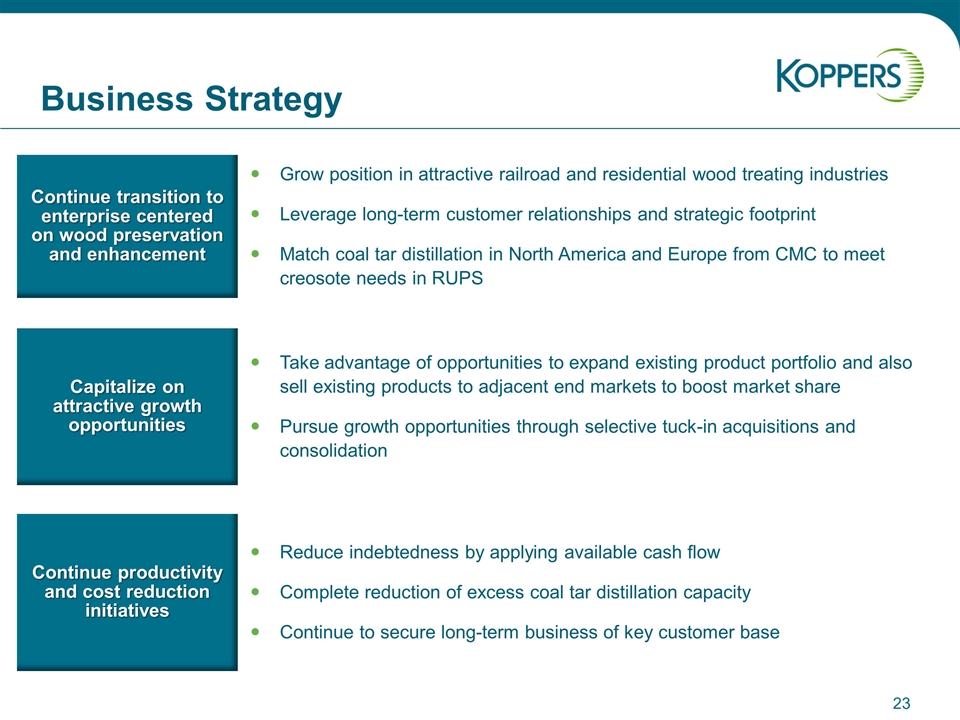

Business Strategy Continue transition to enterprise centered on wood preservation and enhancement Grow position in attractive railroad and residential wood treating industries Leverage long-term customer relationships and strategic footprint Match coal tar distillation in North America and Europe from CMC to meet creosote needs in RUPS Capitalize on attractive growth opportunities Take advantage of opportunities to expand existing product portfolio and also sell existing products to adjacent end markets to boost market share Pursue growth opportunities through selective tuck-in acquisitions and consolidation Continue productivity and cost reduction initiatives Reduce indebtedness by applying available cash flow Complete reduction of excess coal tar distillation capacity Continue to secure long-term business of key customer base

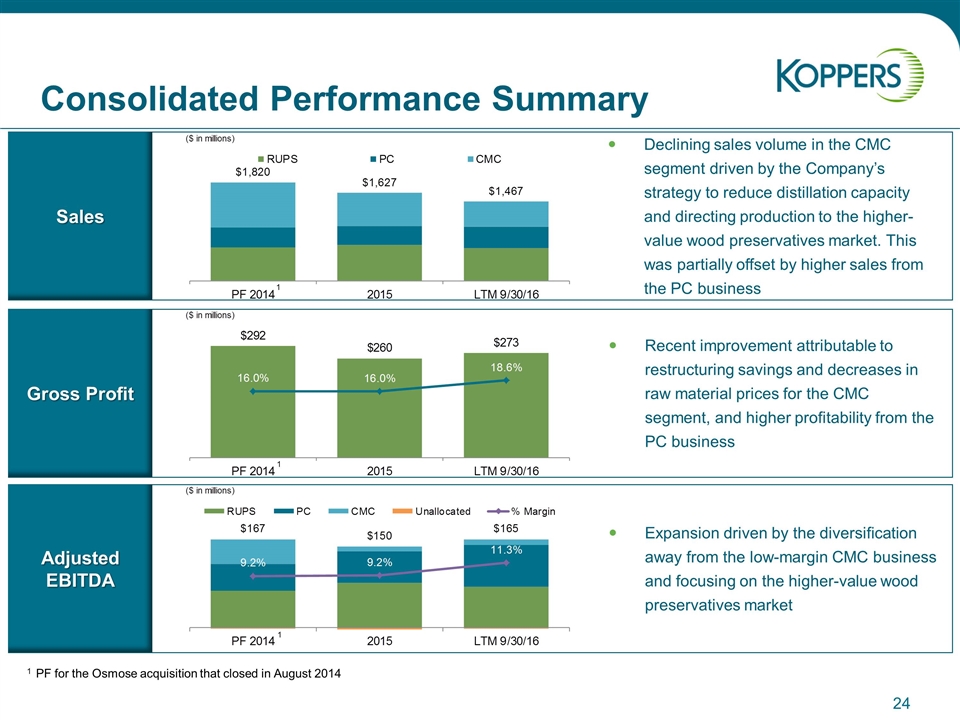

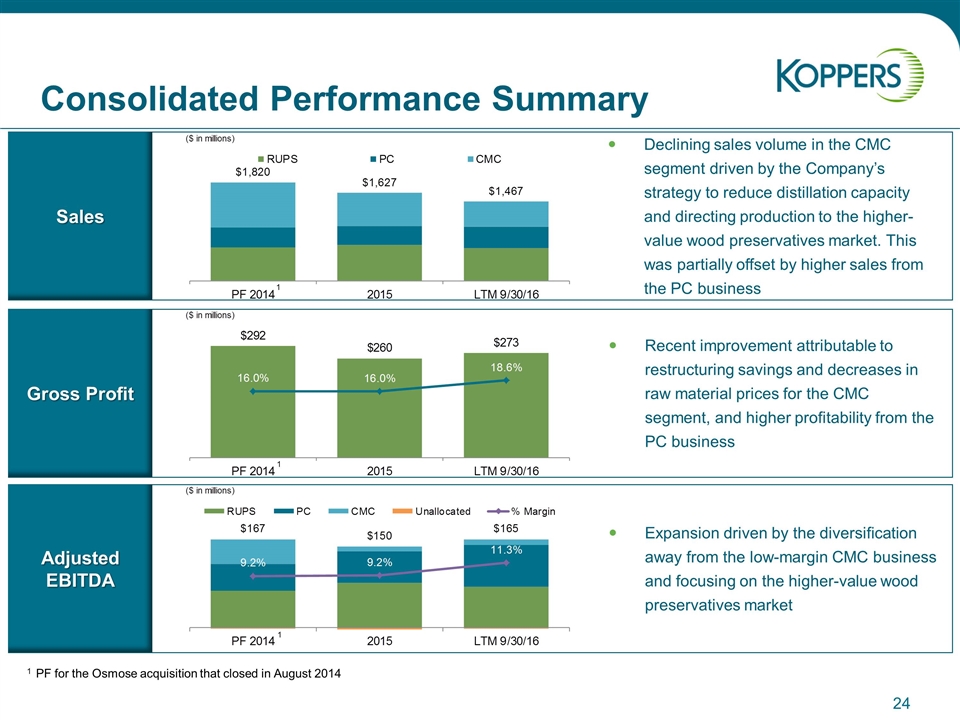

Expansion driven by the diversification away from the low-margin CMC business and focusing on the higher-value wood preservatives market Consolidated Performance Summary Declining sales volume in the CMC segment driven by the Company’s strategy to reduce distillation capacity and directing production to the higher-value wood preservatives market. This was partially offset by higher sales from the PC business Sales Adjusted EBITDA Gross Profit Recent improvement attributable to restructuring savings and decreases in raw material prices for the CMC segment, and higher profitability from the PC business 1 PF for the Osmose acquisition that closed in August 2014 1 1 1

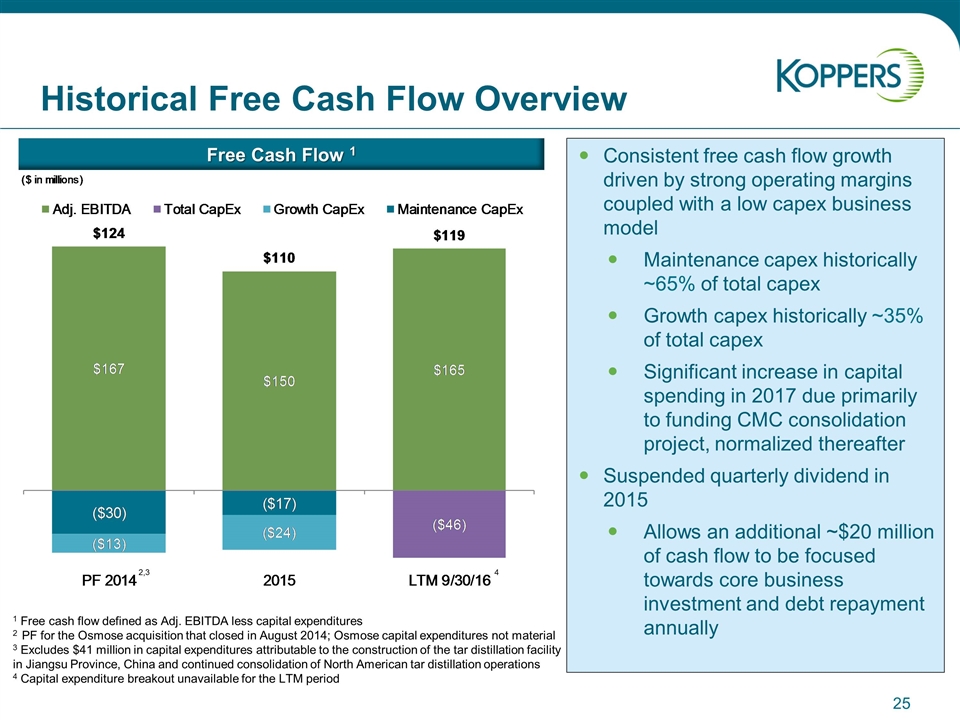

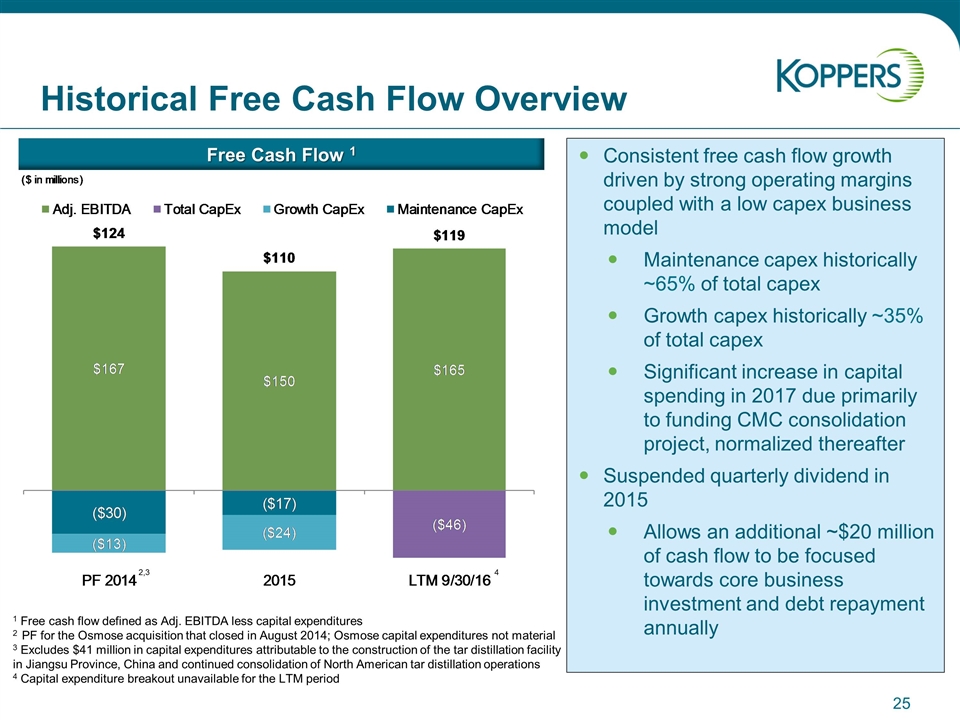

Historical Free Cash Flow Overview Free Cash Flow 1 1 Free cash flow defined as Adj. EBITDA less capital expenditures 2 PF for the Osmose acquisition that closed in August 2014; Osmose capital expenditures not material 3 Excludes $41 million in capital expenditures attributable to the construction of the tar distillation facility in Jiangsu Province, China and continued consolidation of North American tar distillation operations 4 Capital expenditure breakout unavailable for the LTM period Consistent free cash flow growth driven by strong operating margins coupled with a low capex business model Maintenance capex historically ~65% of total capex Growth capex historically ~35% of total capex Significant increase in capital spending in 2017 due primarily to funding CMC consolidation project, normalized thereafter Suspended quarterly dividend in 2015 Allows an additional ~$20 million of cash flow to be focused towards core business investment and debt repayment annually 2,3 4

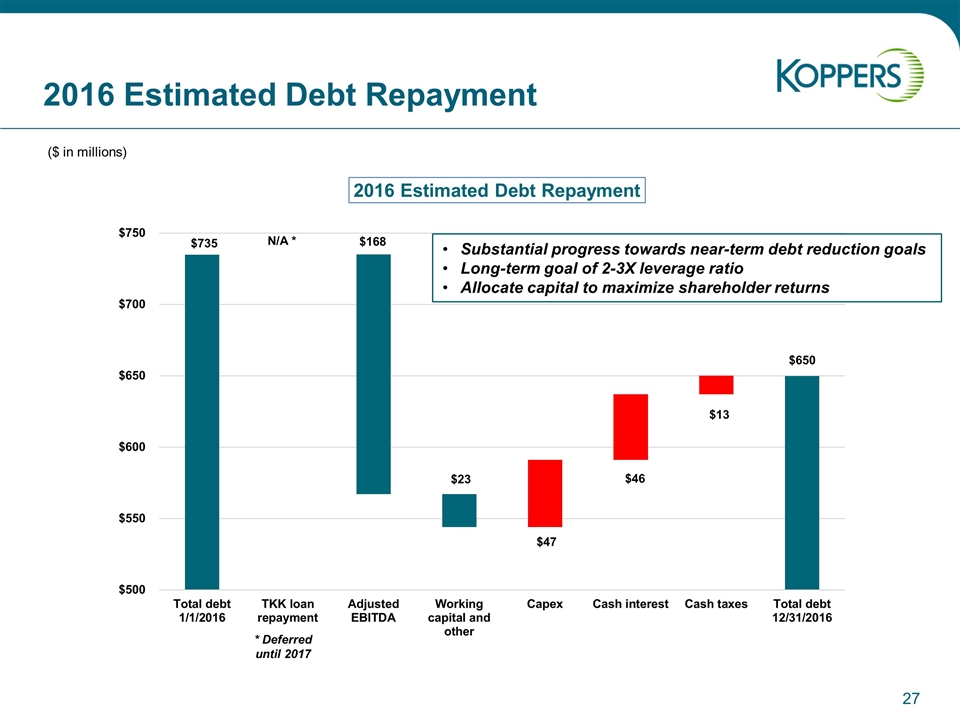

Estimated Debt Repayment

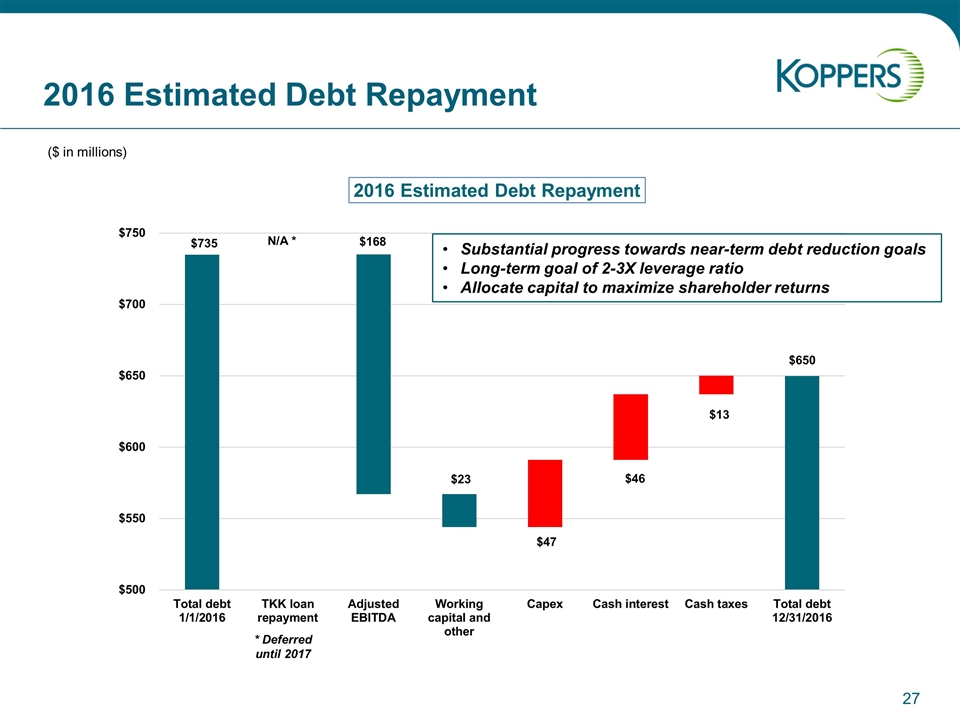

2016 Estimated Debt Repayment ($ in millions) * Deferred until 2017 Substantial progress towards near-term debt reduction goals Long-term goal of 2-3X leverage ratio Allocate capital to maximize shareholder returns

2016 Guidance

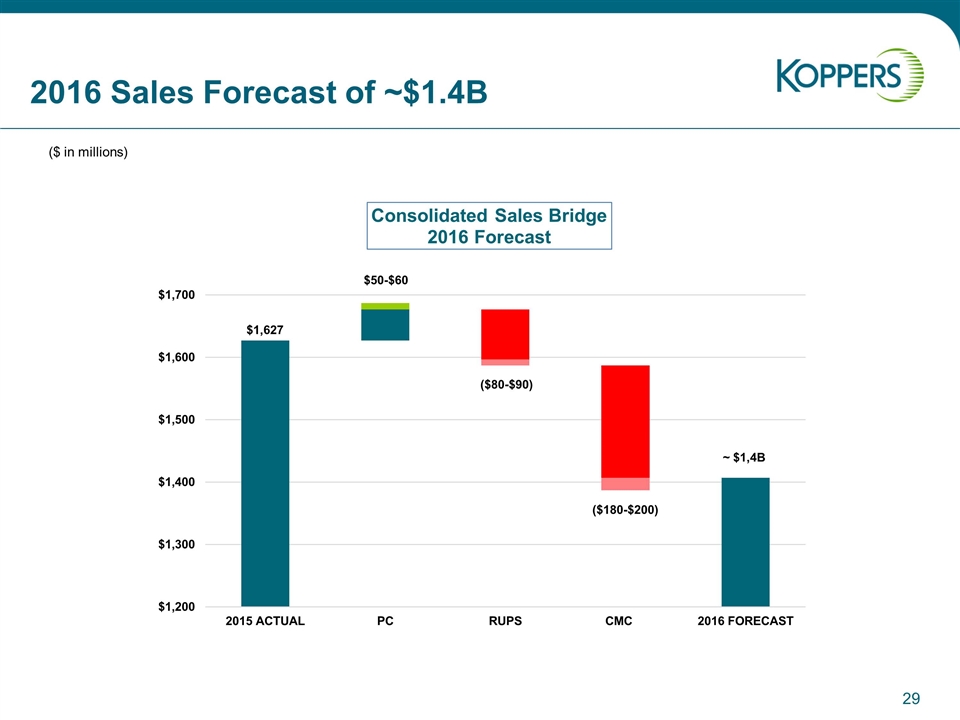

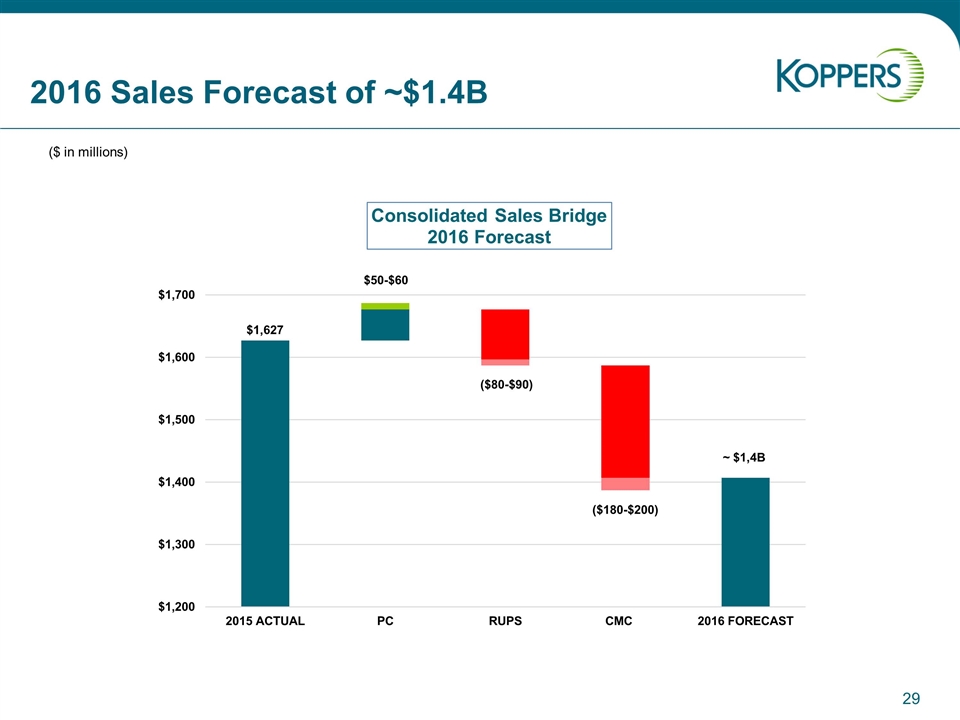

2016 Sales Forecast of ~$1.4B ($ in millions)

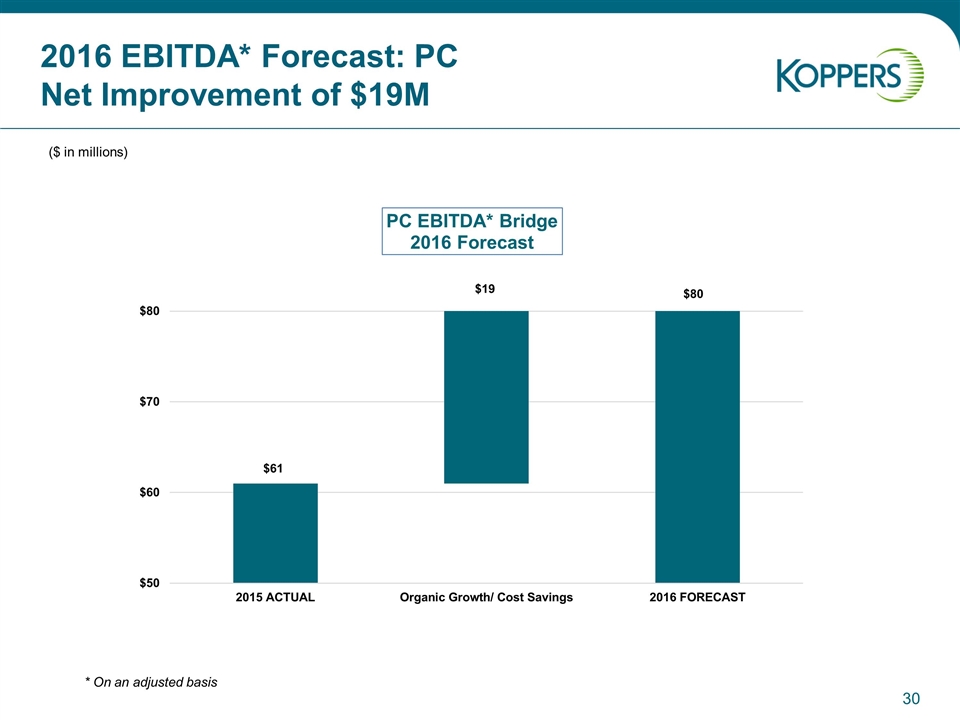

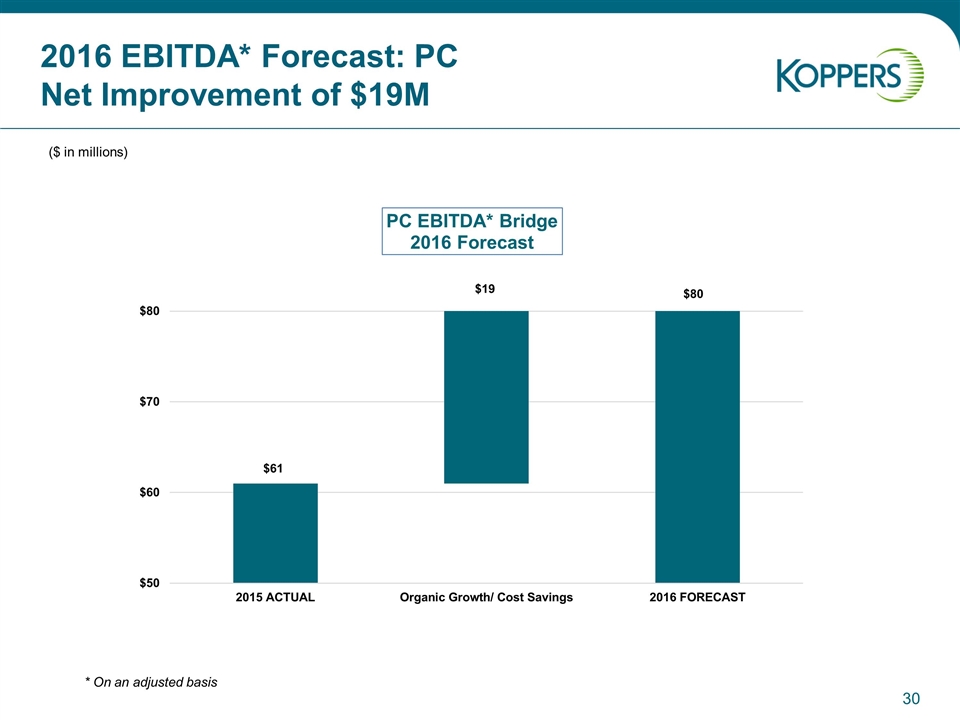

2016 EBITDA* Forecast: PC Net Improvement of $19M ($ in millions) * On an adjusted basis

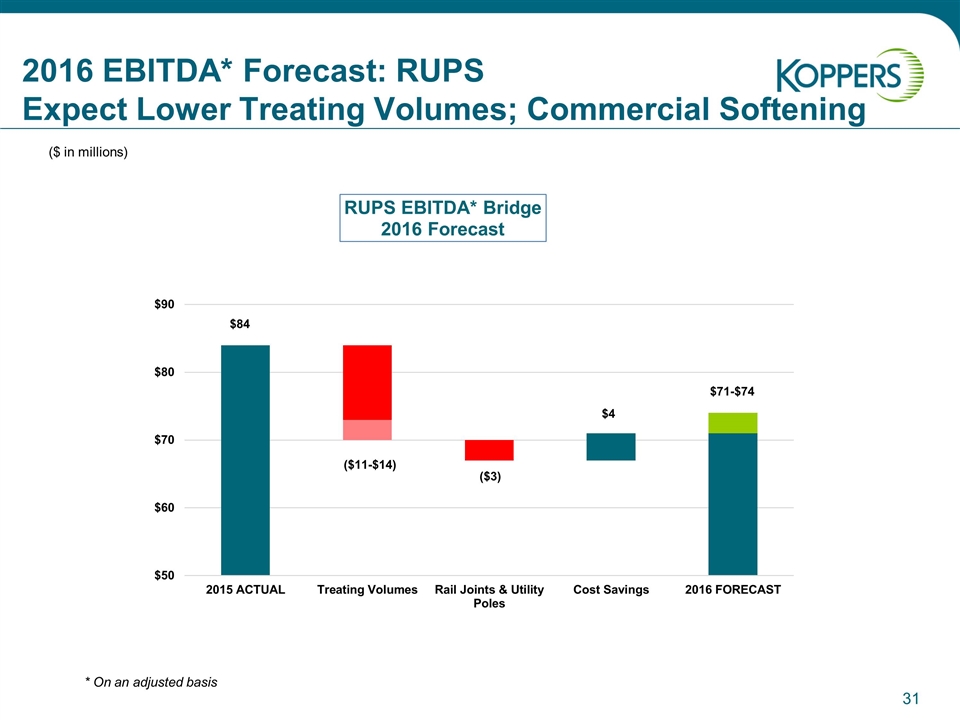

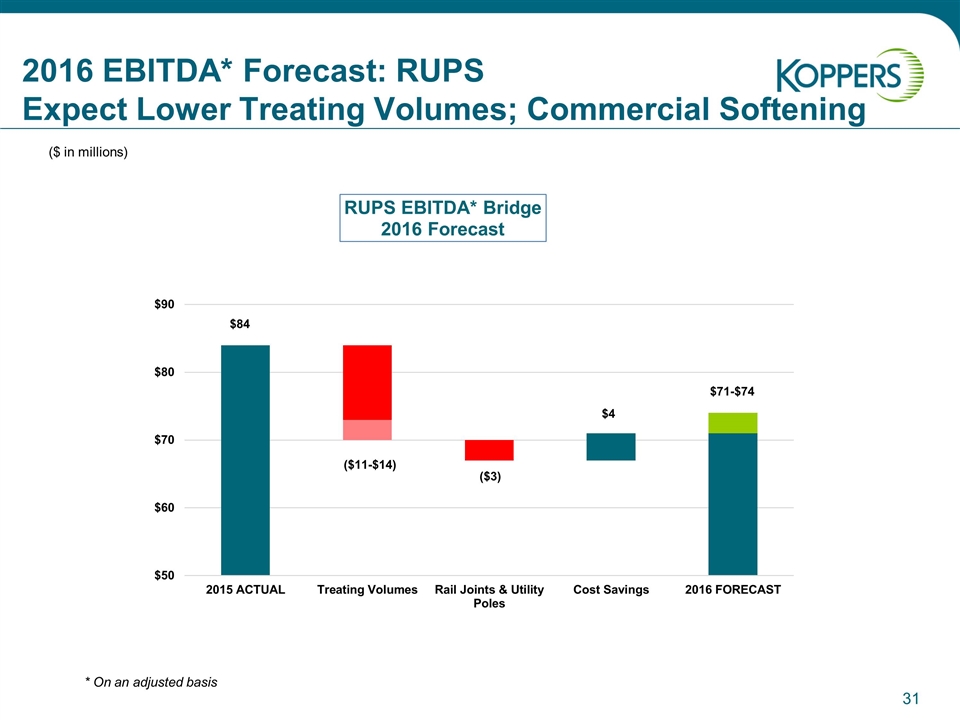

2016 EBITDA* Forecast: RUPS Expect Lower Treating Volumes; Commercial Softening ($ in millions) * On an adjusted basis

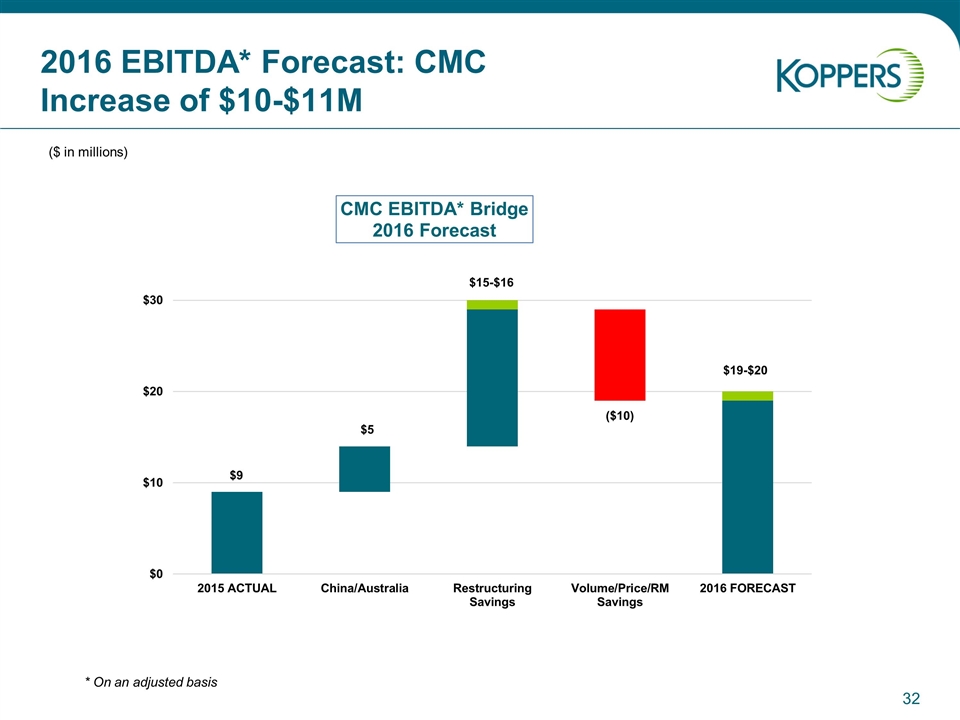

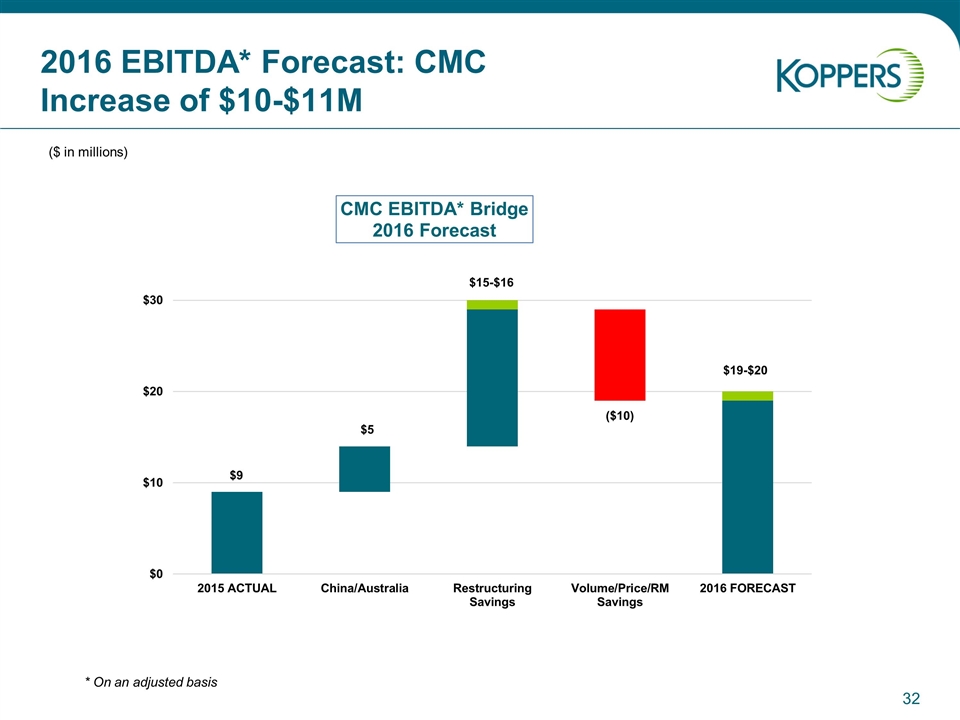

($ in millions) 2016 EBITDA* Forecast: CMC Increase of $10-$11M * On an adjusted basis

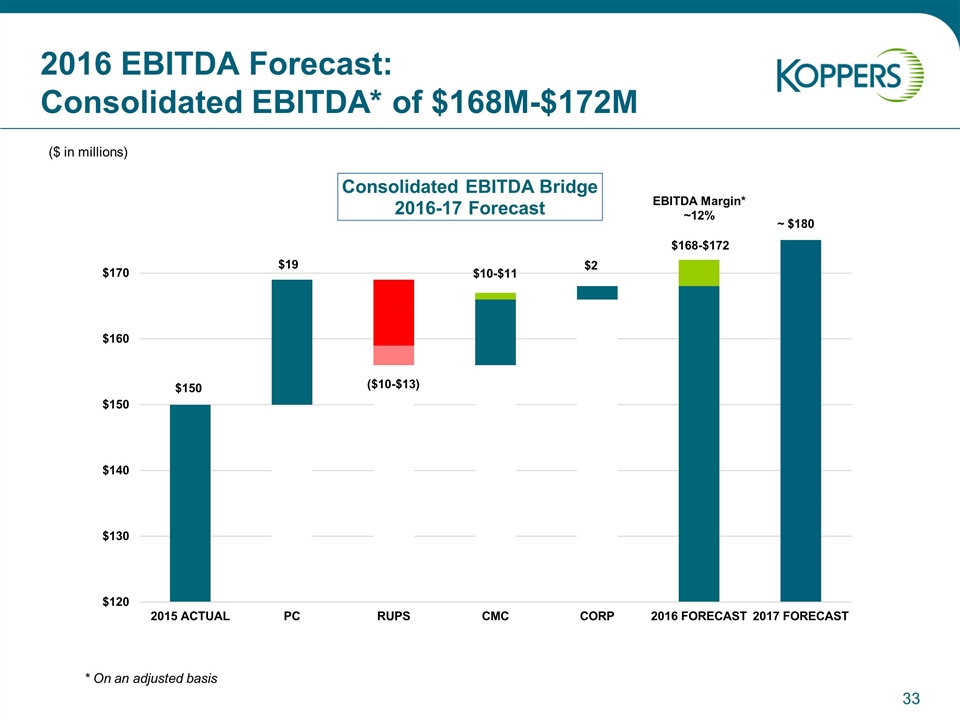

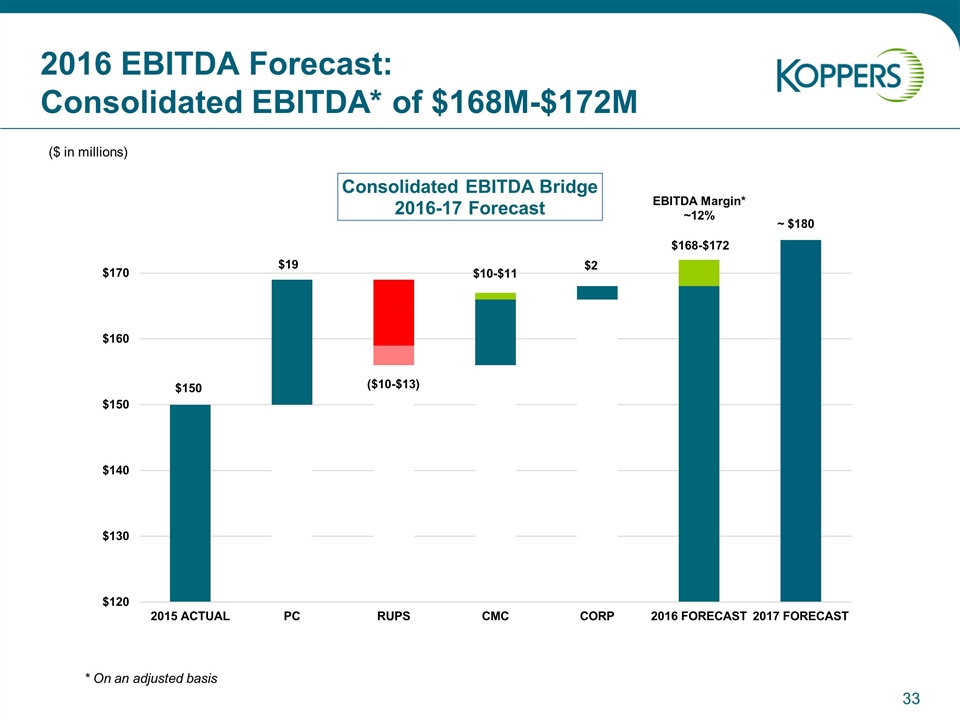

2016 EBITDA Forecast: Consolidated EBITDA* of $168M-$172M ($ in millions) EBITDA Margin* ~12% * On an adjusted basis

Appendix

Non-GAAP Measures and Guidance Koppers believes that EBITDA, adjusted EBITDA, adjusted EBITDA margin, free cash flow, free cash flow conversion ratio and net leverage provide information useful to investors in understanding the underlying operational performance of the company, its business and performance trends and facilitates comparisons between periods and with other corporations in similar industries. The exclusion of certain items permits evaluation and a comparison of results for ongoing business operations, and it is on this basis that Koppers management internally assesses the company's performance. In addition, the Board of Directors and executive management team use adjusted EBITDA and adjusted earnings per share as performance measures under the company’s annual incentive plans. Although Koppers believes that these non-GAAP financial measures enhance investors’ understanding of its business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP basis financial measures and should be read in conjunction with the relevant GAAP financial measure. Other companies in a similar industry may define or calculate these measures differently than the company, limiting their usefulness as comparative measures. Because of these limitations, these non-GAAP financial measures should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP. For the company’s guidance, adjusted EBITDA excludes restructuring, impairment, non-cash LIFO charges, and non-cash mark-to-market commodity hedging. The forecasted amounts for these items are not determinable, but may be significant. For that reason, the company is unable to provide GAAP earnings estimates at this time. Final results could also be affected by various other factors that management is unaware of at this time.

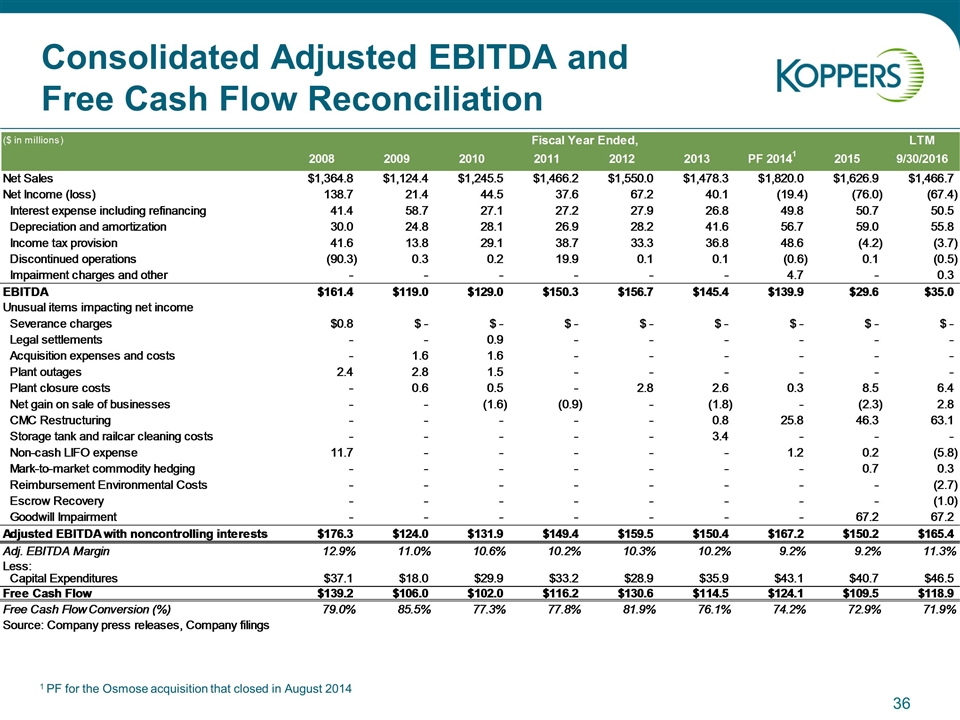

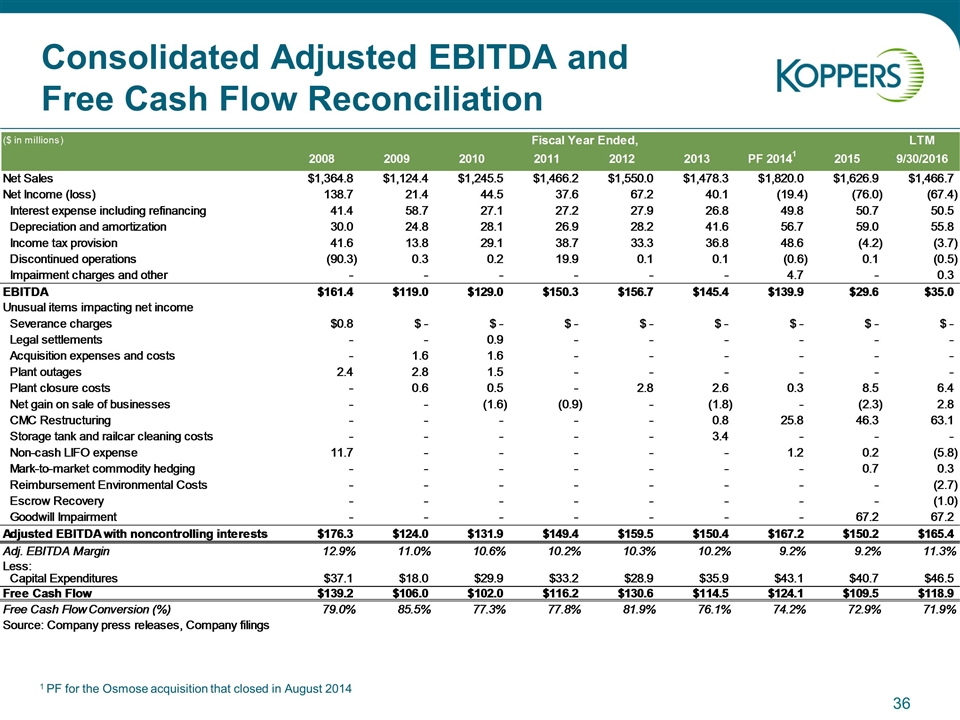

Consolidated Adjusted EBITDA and Free Cash Flow Reconciliation 1 1 PF for the Osmose acquisition that closed in August 2014

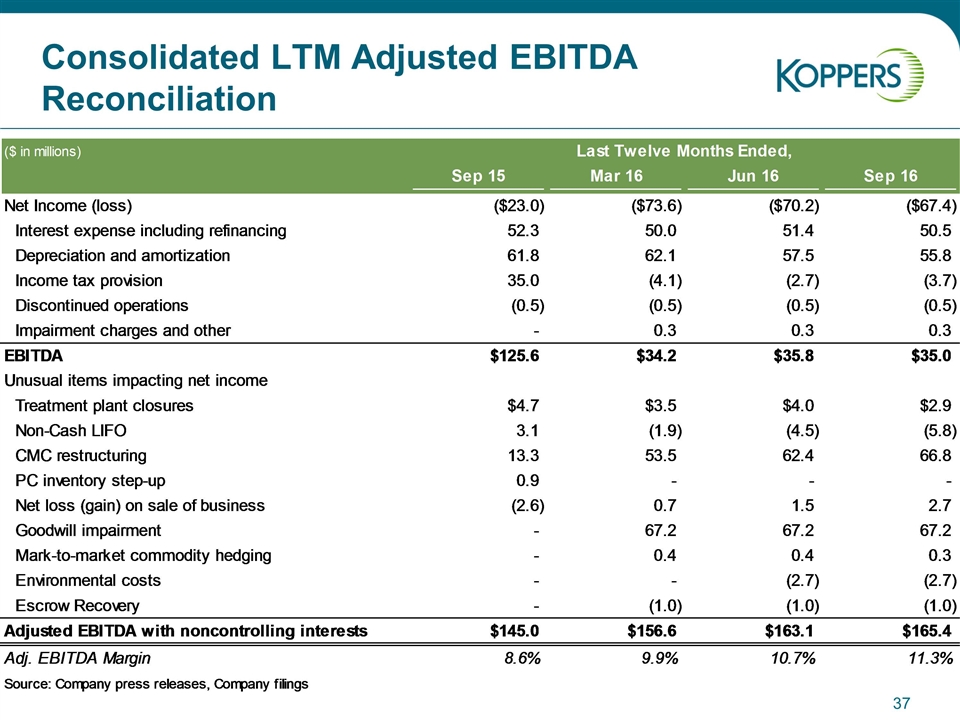

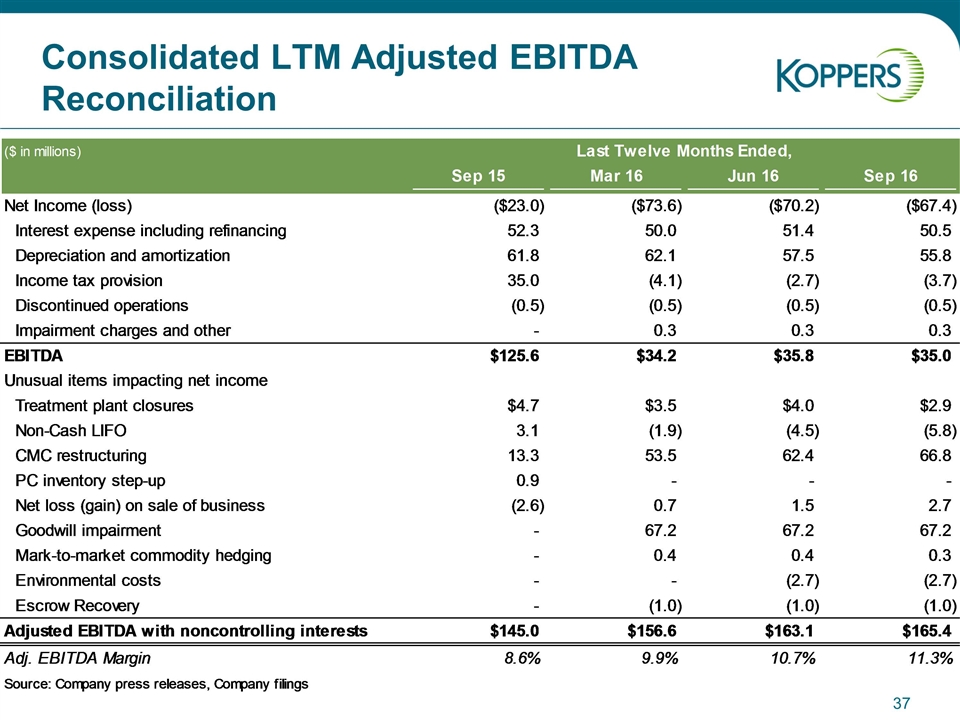

Consolidated LTM Adjusted EBITDA Reconciliation 1

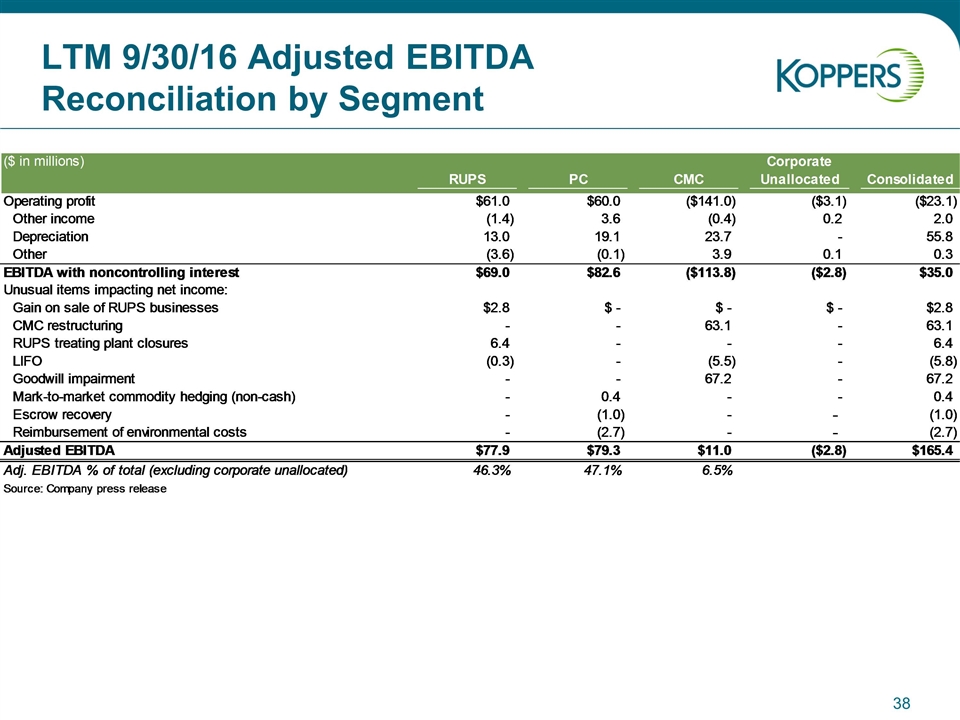

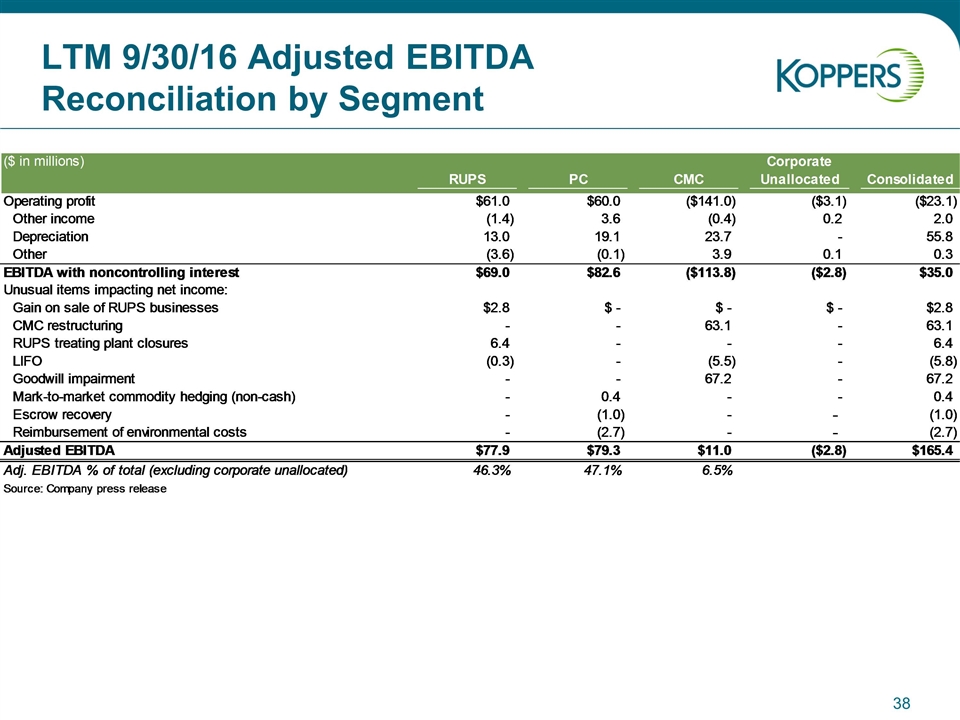

LTM 9/30/16 Adjusted EBITDA Reconciliation by Segment 1

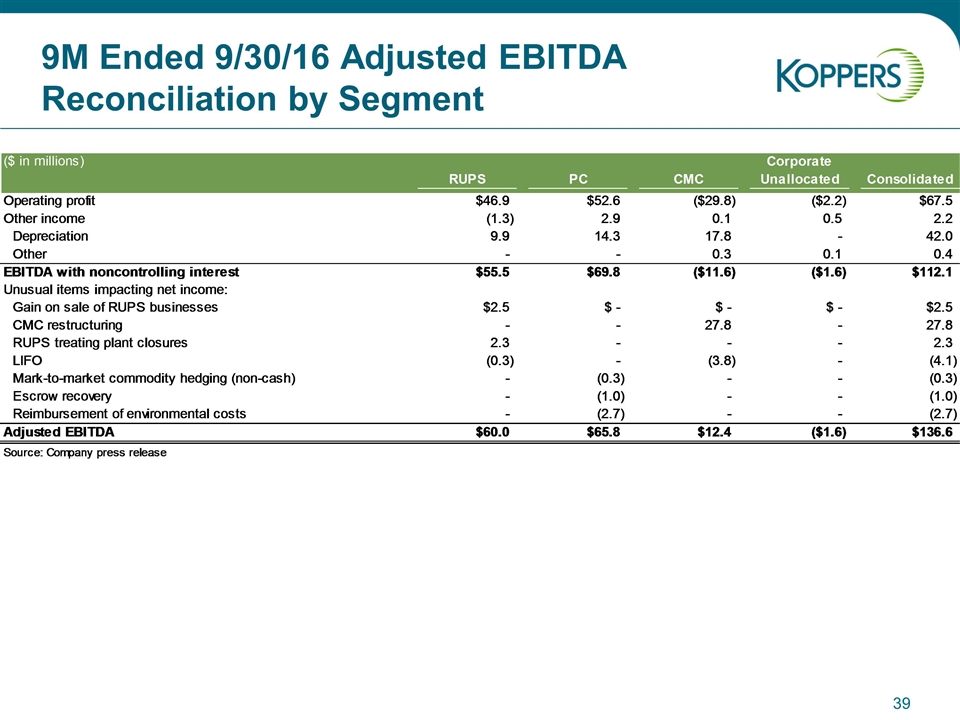

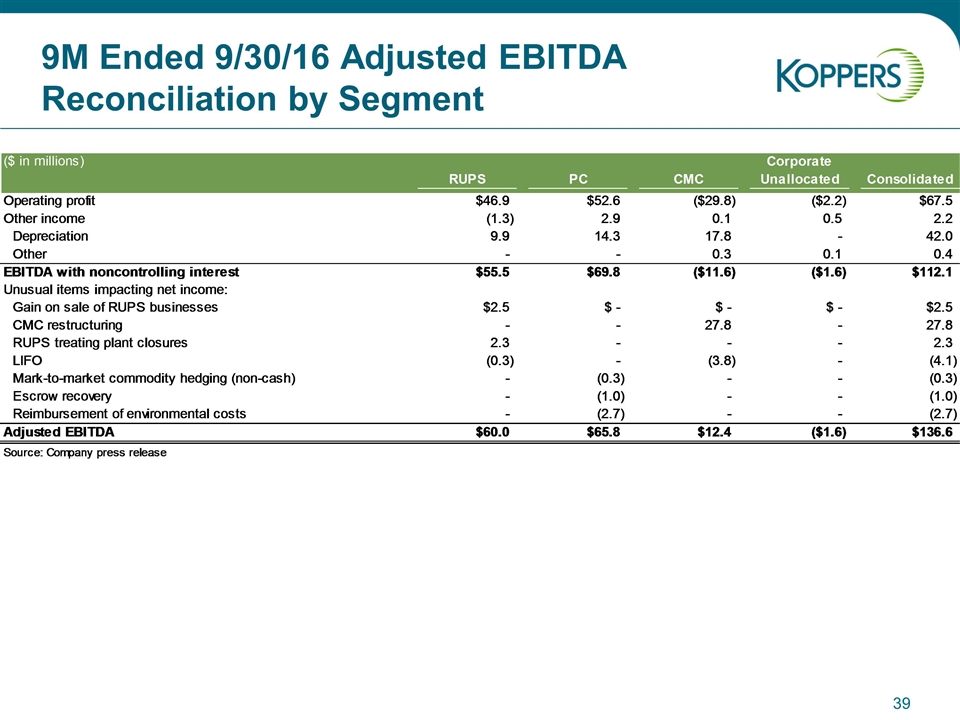

9M Ended 9/30/16 Adjusted EBITDA Reconciliation by Segment 1

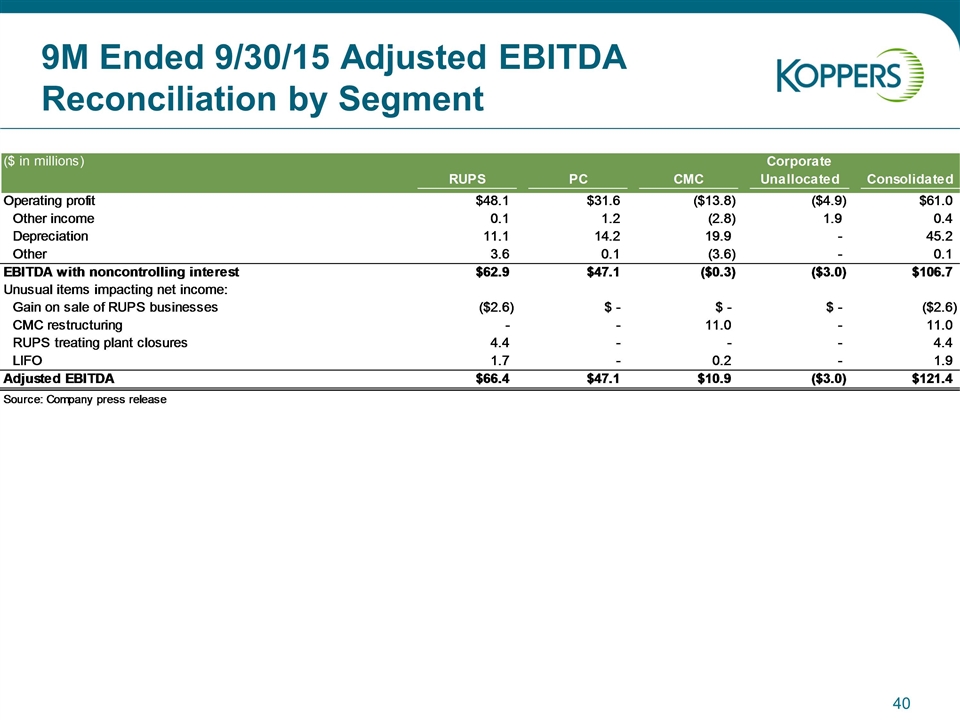

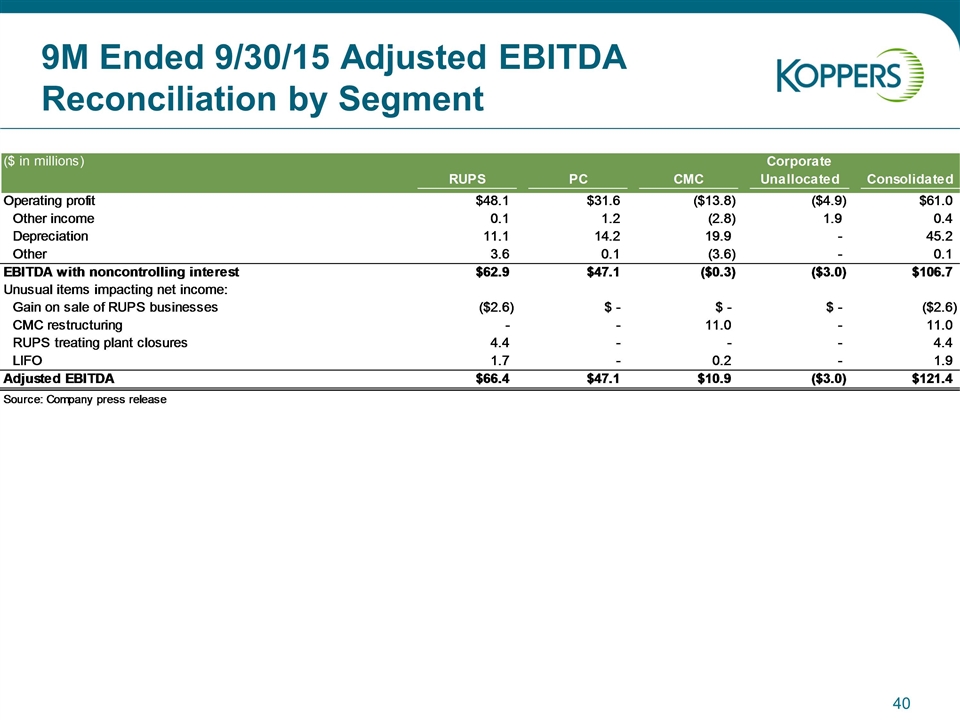

9M Ended 9/30/15 Adjusted EBITDA Reconciliation by Segment 1

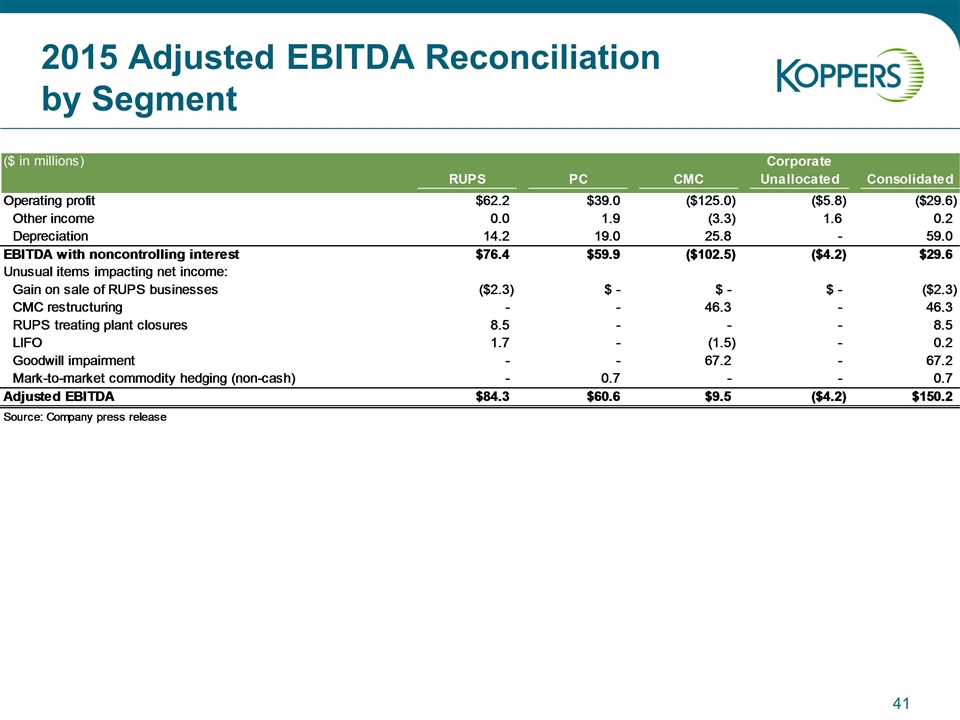

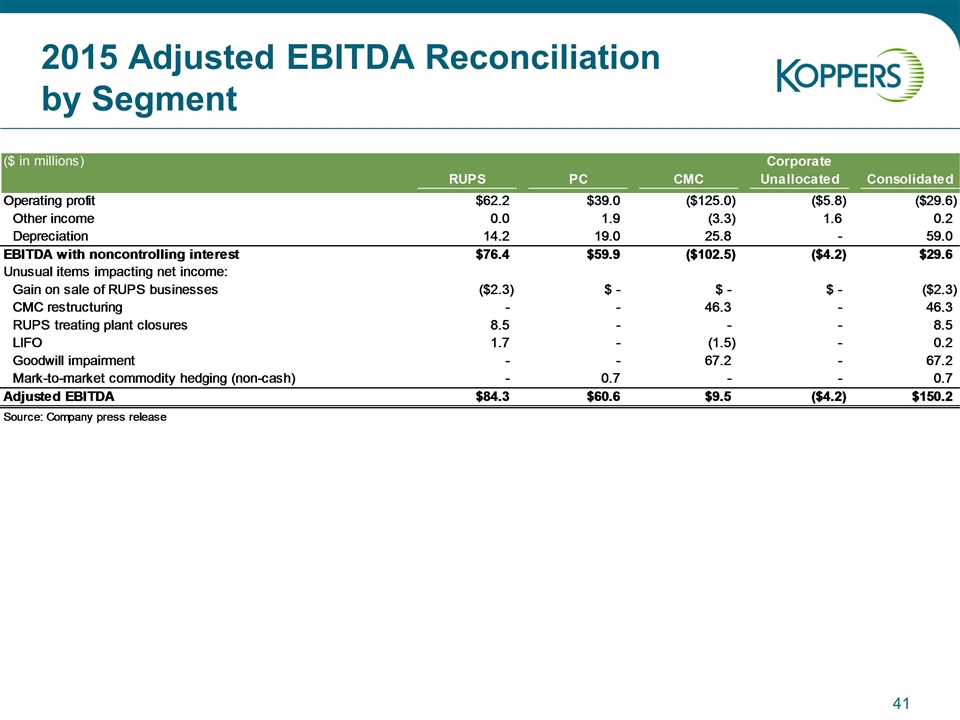

2015 Adjusted EBITDA Reconciliation by Segment 1

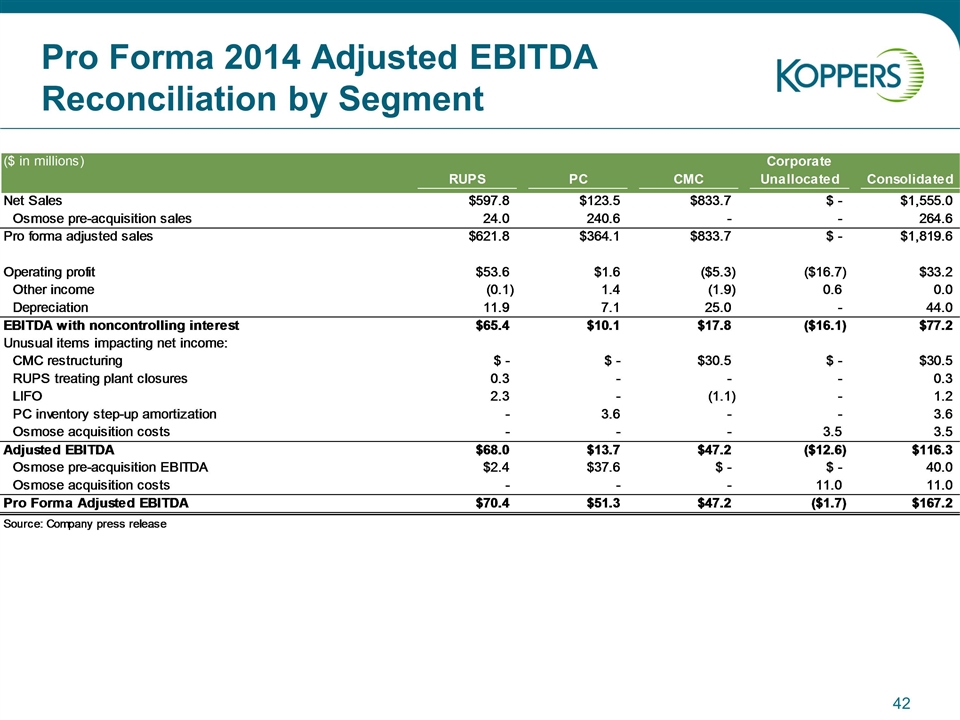

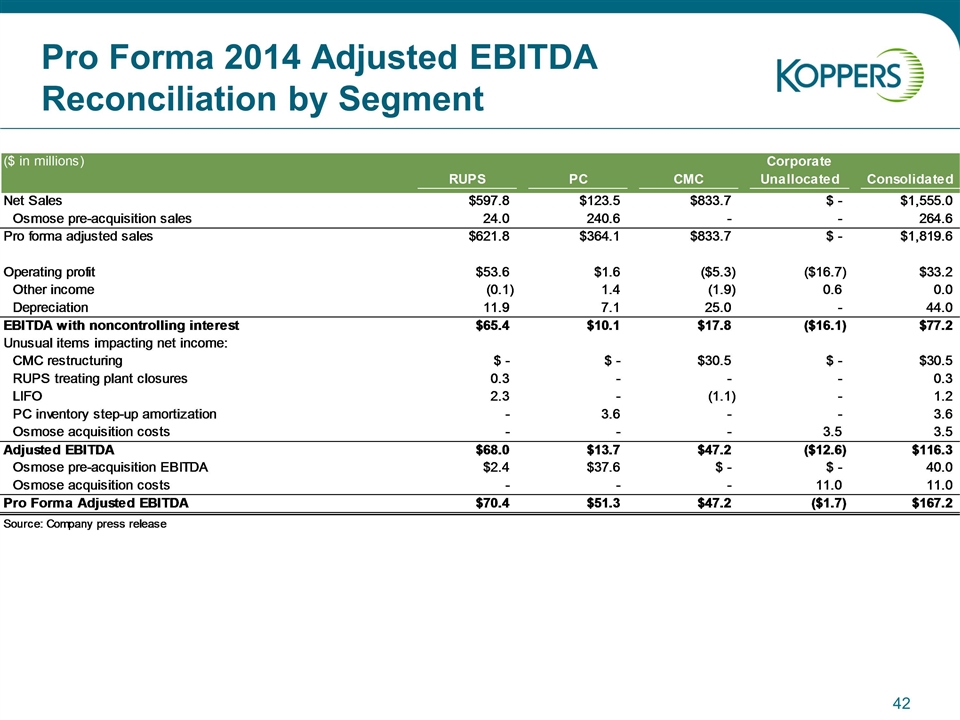

Pro Forma 2014 Adjusted EBITDA Reconciliation by Segment 1

Koppers Holdings Inc. 436 Seventh Avenue Pittsburgh, PA 15219-1800 Koppers, with corporate headquarters in Pittsburgh, Pennsylvania, is an integrated global provider of treated wood products, wood treatment chemicals and carbon compounds. Our products and services are used in a variety of niche applications in a diverse range of end-markets, including the railroad, specialty chemical, utility, residential lumber, agriculture, aluminum, steel, rubber, and construction industries. Stock Exchange Listing NYSE: KOP Contact Information Ms. Quynh McGuire Director, Investor Relations and Corporate Communications 412 227 2049 McGuireQT@koppers.com KOPPERS World Headquarters Pittsburgh, Pennsylvania, USA Koppers is a a member of the American Chemistry Council.