Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

CALCULATION OF REGISTRATION FEE

| | | | |

| | | | |

| |

Class of securities registered

| | Maximum Aggregate

Offering Price

| | Amount of

Registration Fee

|

|---|

| |

4.875% Senior Notes due 2025 | | $1,200,000,000 | | $139,440 |

|

- (1)

- The filing fee, calculated in accordance with Rule 457(r), has been transmitted to the SEC in connection with the securities offered from Registration Statement File No. 333-184605 by means of this prospectus supplement.

Table of Contents

Filed Pursuant to rule 424(b)(5)

Registration File No. 333-184605

PROSPECTUS SUPPLEMENT

(To Prospectus dated October 26, 2012)

$1,200,000,000

MarkWest Energy Partners, L.P.

MarkWest Energy Finance Corporation

4.875% Senior Notes due 2025

MarkWest Energy Partners, L.P. and MarkWest Energy Finance Corporation are offering $1,200,000,000 aggregate principal amount of 4.875% Senior Notes due 2025 (the "notes").

The notes will mature on June 1, 2025. Interest on the notes will accrue from June 2, 2015, and we will pay interest on the notes twice a year, beginning on December 1, 2015.

We may redeem, at our option, some or all of the notes at any time at the redemption prices described in this prospectus supplement under "Description of Notes — Optional Redemption." If we sell certain of our assets or experience specific kinds of changes of control, we must offer to repurchase the notes.

The notes will be the senior unsecured obligations of MarkWest Energy Partners, L.P. and MarkWest Energy Finance Corporation, a wholly-owned subsidiary of ours that has no material assets and was formed for the sole purpose of being a co-issuer of some of our indebtedness, including the notes. The notes will rank equally with all of our existing and future senior debt, senior to all of our future subordinated debt and effectively junior in right of payment to all of our secured debt to the extent of the value of the collateral securing such indebtedness. Further, the notes will be guaranteed on a senior unsecured basis by each of our existing subsidiaries that guarantees both our revolving credit facility and our outstanding senior notes and by certain of our future subsidiaries. The notes will be structurally subordinated to the liabilities of any of our subsidiaries that do not guarantee the notes.

Investing in the notes involves risks. Please read "Risk Factors" beginning on page S-8.

| | | | | | | |

| | Per Note | | Total | |

|---|

Initial price to public(1) | | | 99.02600 | % | $ | 1,188,312,000 | |

Underwriting discounts and commissions | | | 0.95833 | % | $ | 11,500,000 | |

Proceeds, before expenses, to us(1) | | | 98.06767 | % | $ | 1,176,812,000 | |

- (1)

- Plus accrued interest, if any, from June 2, 2015.

None of the Securities and Exchange Commission, any state securities commission or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect that the delivery of the notes will be made to investors in book-entry form through the facilities of The Depository Trust Company on or about June 2, 2015.

| | | | |

| Joint Book-Running Managers |

Wells Fargo Securities |

|

Barclays |

|

BofA Merrill Lynch |

| Citigroup | | Goldman, Sachs & Co. | | J.P. Morgan |

| Morgan Stanley | | RBC Capital Markets | | SunTrust Robinson Humphrey |

| UBS Investment Bank | | | | US Bancorp |

|

Senior Co-Managers |

BBVA |

|

BNP PARIBAS |

|

Capital One Securities |

| Comerica Securities | | Natixis | | PNC Capital Markets LLC |

| | | SMBC Nikko | | |

Prospectus Supplement dated May 28, 2015.

Table of Contents

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of the notes. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering. Generally, when we refer only to the "prospectus," we are referring to both parts combined. If the information about this offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Where You Can Find More Information" on page S-67 of this prospectus supplement.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus relating to this offering of the notes. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are offering to sell the notes, and seeking offers to buy the notes, only in jurisdictions where such offers and sales are permitted. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in these documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of any document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

FORWARD-LOOKING STATEMENTS

Statements included or incorporated by reference in this prospectus supplement that are not historical facts are forward-looking statements. We use words such as "could," "may," "predict," "should," "expect," "hope," "continue," "potential," "plan," "intend," "anticipate," "project," "believe," "estimate," and similar expressions to identify forward-looking statements.

These statements are based on current expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties. Forward-looking statements are not guarantees and actual results could differ materially from those expressed or implied in the forward-looking statements as a result of a number of factors. We do not update publicly any forward-looking statement with new information or future events. Undue reliance should not be placed on forward-looking statements as many of these factors are beyond our ability to control or predict. Please read "Risk Factors."

S-i

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

| | |

ABOUT THIS PROSPECTUS SUPPLEMENT | | S-i |

FORWARD-LOOKING STATEMENTS | | S-i |

SUMMARY | | S-1 |

OUR STRUCTURE AND MANAGEMENT | | S-3 |

RISK FACTORS | | S-8 |

USE OF PROCEEDS | | S-11 |

CAPITALIZATION | | S-12 |

RATIO OF EARNINGS TO FIXED CHARGES | | S-14 |

DESCRIPTION OF NOTES | | S-15 |

BOOK-ENTRY, DELIVERY AND FORM | | S-57 |

DESCRIPTION OF OTHER INDEBTEDNESS | | S-60 |

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES | | S-61 |

CERTAIN ERISA CONSIDERATIONS | | S-66 |

UNDERWRITING | | S-68 |

VALIDITY OF THE NOTES | | S-72 |

EXPERTS | | S-72 |

WHERE YOU CAN FIND MORE INFORMATION | | S-72 |

Prospectus

| | |

ABOUT THIS PROSPECTUS | | 1 |

WHERE YOU CAN FIND MORE INFORMATION | | 2 |

FORWARD-LOOKING STATEMENTS | | 4 |

ABOUT MARKWEST ENERGY PARTNERS | | 5 |

RISK FACTORS | | 6 |

USE OF PROCEEDS | | 7 |

RATIOS OF EARNINGS TO FIXED CHARGES | | 8 |

DESCRIPTION OF COMMON UNITS | | 9 |

DESCRIPTION OF OUR DEBT SECURITIES | | 11 |

CASH DISTRIBUTION POLICY | | 20 |

PARTNERSHIP AGREEMENT | | 21 |

MATERIAL TAX CONSEQUENCES | | 31 |

INVESTMENT IN MARKWEST ENERGY PARTNERS BY EMPLOYEE BENEFIT PLANS | | 45 |

PLAN OF DISTRIBUTION | | 48 |

VALIDITY OF THE SECURITIES | | 50 |

EXPERTS | | 50 |

S-ii

Table of Contents

SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information that you should consider before making an investment decision. For a more complete understanding of this offering, you should read this entire prospectus supplement, the accompanying base prospectus and the documents incorporated herein and therein by reference, including our historical financial statements and the notes thereto, which are incorporated herein by reference to our annual report on Form 10-K for the year ended December 31, 2014 and any subsequent reports on Form 10-Q. Please read "Where You Can Find More Information" on page S-67 of this prospectus supplement. Please read "Risk Factors" beginning on page S-8 of this prospectus supplement and Part I — Item 1A in our annual report on Form 10-K for the year ended December 31, 2014 and any subsequent quarterly reports on Form 10-Q which are incorporated herein by reference for information regarding risks you should consider before buying the notes in this offering.

For purposes of this prospectus supplement and the accompanying base prospectus, unless the context clearly indicates otherwise, "we," "us," "our" and the "Partnership" refer to MarkWest Energy Partners, L.P. and, when applicable, its consolidated subsidiaries; and "MarkWest Hydrocarbon" refers to MarkWest Hydrocarbon, Inc. and its direct and indirect consolidated subsidiaries.

MarkWest Energy Partners, L.P.

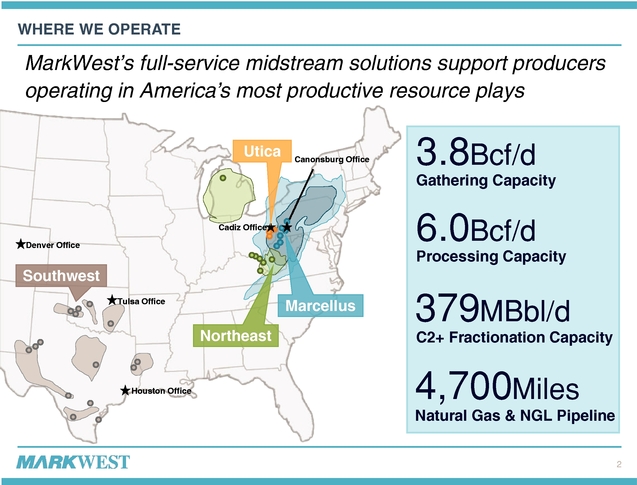

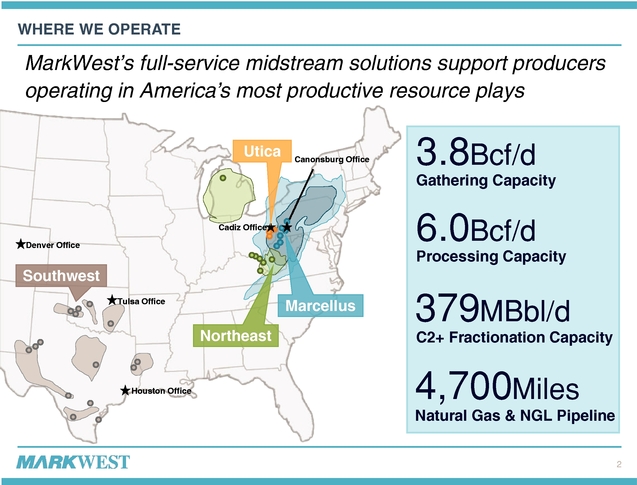

We are a publicly traded master limited partnership that owns and operates midstream services related businesses. We have a leading presence in many natural gas resource plays including the Marcellus Shale, Utica Shale, Huron/Berea Shale, Haynesville Shale, Woodford Shale and Granite Wash formation where we provide midstream services to our producer customers.

Our integrated midstream energy asset network links producers of natural gas, natural gas liquids ("NGLs") and crude oil from some of the largest supply basins in the United States to domestic and international markets. Our midstream energy operations include: natural gas gathering, processing and transportation; NGL gathering, transportation, fractionation, storage, and marketing; and crude oil gathering and transportation. Our assets include approximately 5,800 MMcf/d of natural gas processing capacity, 379,000 Bbl/d of NGL fractionation capacity and over 4,000 miles of pipelines.

We conduct our operations in the following operating segments: Marcellus, Utica, Northeast and Southwest. Further description of these segments is included in the periodic reports we file with the Securities and Exchange Commission ("SEC"), which are incorporated herein by reference. Our primary business strategy is to provide best-in-class midstream services by developing and operating high-quality, strategically-located assets in liquids-rich resource plays in the United States.

Execution of our business strategy has allowed us to grow substantially since our inception. As a result, we are now a leading provider of gathering, processing and fractionation services in the United States.

Ongoing Acquisition Activities

Consistent with our business strategy, we are continuously engaged in discussions with potential sellers regarding the possible purchase of assets and operations that are strategic and complementary to our existing operations. In addition, we have in the past evaluated and pursued, and intend in the future to evaluate and pursue, other energy-related assets that have characteristics and opportunities similar to our existing business lines and enable us to leverage our asset base, knowledge base and skill sets. Such acquisition efforts may involve participation by us in processes that have been made public and involve a number of potential buyers, commonly referred to as "auction" processes, as well as situations in which we believe we are the only party or one of a limited number of potential buyers in negotiations with the potential seller. These acquisition efforts often involve assets which, if acquired, could have a material effect on our financial condition and results of operations.

S-1

Table of Contents

We typically announce a transaction after we have executed a definitive acquisition agreement. However, in certain cases in order to protect our business interests or for other reasons, we may defer public announcement of an acquisition until closing or a later date. Past experience has demonstrated that discussions and negotiations regarding a potential acquisition can advance or terminate in a short period of time. Moreover, the closing of any transaction for which we have entered into a definitive acquisition agreement will be subject to customary and other closing conditions, which may not ultimately be satisfied or waived. Accordingly, we can give no assurance that our current or future acquisition efforts will be successful. Although we expect any acquisitions we make to be accretive in the long term, we can provide no assurance that our expectations will ultimately be realized.

For the three months ended March 31, 2015, our share of total capital spent to fund identified organic growth, expansion projects, acquisitions, and maintenance expenditures on our businesses was approximately $468.9 million.

Tender Offers

On May 28, 2015, we commenced tender offers (the "Tender Offers") to purchase for cash, subject to certain conditions, any and all of the $500 million outstanding principal amount of our 6.75% senior notes due 2020 (the "2020 Notes"), $325 million outstanding principal amount of our 6.5% senior notes due 2021 (the "2021 Notes") and $455 million outstanding principal amount of our 6.25% senior notes due 2022 (the "2022 Notes").

Pursuant to the Tender Offers, we are offering to purchase any and all of the 2020 Notes, 2021 Notes and 2022 Notes tendered prior to the expiration of the Tender Offers for consideration of $1,058.14 per $1,000 principal amount of the 2020 Notes, $1,072.38 per $1,000 principal amount of the 2021 Notes and $1,111.63 per $1,000 principal amount of the 2022 Notes. Each Tender Offer is scheduled to expire at 5:00 p.m., New York City time, on June 3, 2015 and is subject to the satisfaction or waiver of certain conditions, including our receiving net proceeds from this offering in an amount sufficient to fund all of our obligations under the Tender Offers. Provided that the conditions to the Tender Offers have been satisfied or waived, we will pay for the 2020 Notes, 2021 Notes and 2022 Notes accepted for purchase in the Tender Offers, together with any accrued and unpaid interest thereon, promptly after the expiration of the Tender Offers, which is expected to be June 4, 2015 (or June 8, 2015 in the case of notes tendered pursuant to a Notice of Guaranteed Delivery).

This offering is not conditioned upon our completion of any of the Tender Offers. If any condition of any of the Tender Offers is not satisfied or waived, we will not be obligated to accept for purchase, or to pay for, any of the notes subject to such Tender Offer and may delay acceptance for payment of any tendered notes, in each case subject to applicable laws. We may also terminate, extend or amend the terms of any of the Tender Offers and may postpone the acceptance for purchase of, and payment for, the notes tendered. This prospectus supplement is not an offer to purchase the 2020 Notes, 2021 Notes or 2022 Notes. The Tender Offers are made only by and pursuant to the terms of an Offer to Purchase and the related Letter of Transmittal and Notice of Guaranteed Delivery, each dated May 28, 2015, as the same may be amended or supplemented.

If fully subscribed by June 4, 2015, we expect that the Tender Offers will result in an after-tax loss from repurchase of the 2020 Notes, 2021 Notes and 2022 Notes of approximately $111.3 million, of which, approximately $103.5 million relates to the payment of tender premiums and third party expenses (but excluding accrued and unpaid interest), which would be funded with a portion of the net proceeds from this offering as described in "Use of Proceeds."

There is no assurance that the Tender Offers will be subscribed for in any amount. Depending upon the results of a Tender Offer, we may or may not elect to redeem any of the notes that were subject to that Tender Offer but remain outstanding afterwards; and, if we do elect to redeem any such notes, we may redeem them promptly after consummating the Tender Offer or at one or more later times, including on or after the first call date for the applicable series of notes. If we elect to redeem any notes of one series in such circumstances, we may or may not elect to redeem any notes of the other series.

S-2

Table of Contents

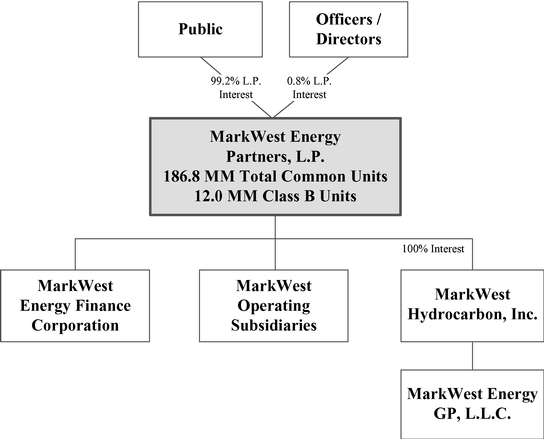

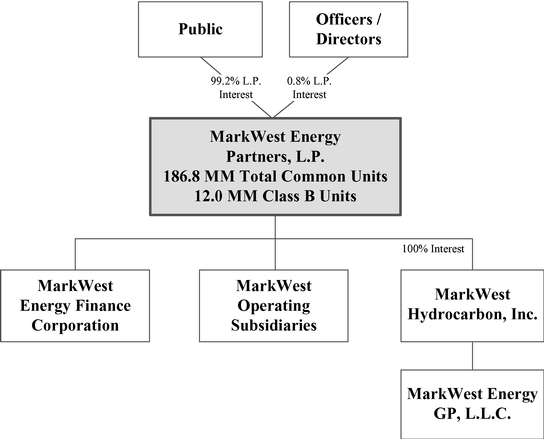

Our Structure and Management

The diagram below depicts our organization and ownership structure as of May 26, 2015, without giving effect to our Class A units issued in connection with our acquisition of MarkWest Hydrocarbon, Inc. in 2008. All of our Class B Units are owned by an affiliate of The Energy & Minerals Group ("EMG") and are included in the public ownership percentage in the diagram below. The Class B Units were issued in December 2011 in connection with our acquisition of EMG's interest in MarkWest Liberty Midstream & Resources, L.L.C. ("Liberty").

MarkWest Energy Finance Corporation, the co-issuer of the notes, is a direct wholly owned subsidiary of MarkWest Energy Partners and carries on no independent business other than acting as a co-issuer of the notes and our other senior notes.

For more details about our ownership structure, please read "Organizational Structure" included in Item 1 in our annual report on Form 10-K for the year ended December 31, 2014, which is incorporated herein by reference.

Our Management

Our general partner, which we indirectly own and control, has sole responsibility for conducting our business and for managing our operations. Our common unitholders have the right to elect the members of the board of directors of our general partner at our annual meeting of unitholders.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 1515 Arapahoe Street, Tower 1, Suite 1600, Denver, Colorado 80202. We maintain a website at http://www.markwest.com. The information on our website is not part of this prospectus supplement, and you should rely only on information contained in or

S-3

Table of Contents

incorporated by reference herein and any free writing prospectus filed in connection with this offering when making an investment decision.

Additional Information

For additional information about us, including our partnership structure and management, please refer to the documents set forth under "Where You Can Find More Information," including our annual report on Form 10-K for the fiscal year ended December 31, 2014 and any subsequent quarterly reports on Form 10-Q which are incorporated by reference herein.

S-4

Table of Contents

THE OFFERING

| | |

| The issuers | | MarkWest Energy Partners, L.P. and MarkWest Energy Finance Corporation. |

Securities offered |

|

$1,200,000,000 aggregate principal amount of 4.875% Senior Notes due 2025 (the "notes"). |

Maturity date |

|

June 1, 2025. |

Interest payment dates |

|

June 1 and December 1 of each year, commencing December 1, 2015. Interest on the notes will accrue from June 2, 2015. |

Optional redemption |

|

We may redeem, at our option, all or part of the notes at any time, prior to March 1, 2025 (three months prior to their maturity date) at the applicable redemption prices described under "Description of Notes — Optional Redemption" plus accrued interest to the date of redemption. We may also redeem, at our option, all or part of the notes at any time on or after March 1, 2025 (three months prior to their maturity date), at a price of 100% of the principal amount thereof plus accrued interest to the date of redemption. |

Mandatory offer to repurchase |

|

If we sell certain assets and do not reinvest the proceeds or repay senior indebtedness, or if we experience specific kinds of change of control events, we must offer to repurchase the notes at the prices, in the amounts and subject to the conditions described in the section "Description of Notes — Repurchase at the Option of Holders." |

Subsidiary guarantees |

|

Each of our existing subsidiaries that guarantees our debt under both our revolving credit facility (the "Credit Facility") and our outstanding series of senior notes will guarantee the notes initially. If we cannot make payments on the notes when they are due, the guarantor subsidiaries, if any, must make them instead. Certain of our existing subsidiaries are not guarantors, and not all of our future subsidiaries will have to become guarantors. Please read "Description of Notes — The Guarantees." |

Ranking |

|

The notes will be: |

| | • our senior unsecured obligations; |

| | • equal in right of payment with all of our existing and future senior debt; |

| | • senior in right of payment to all of our future subordinated debt; |

| | • effectively junior in right of payment to our secured debt to the extent of the value of the assets securing the debt, including our obligations in respect of the Credit Facility; and |

| | • structurally subordinated to all liabilities of our subsidiaries that do not guarantee the notes. |

S-5

Table of Contents

| | |

| | | Upon the closing of this offering and the application of the net proceeds therefrom in the manner described under "Use of Proceeds," we anticipate that we and the subsidiary guarantors will have approximately $4.2 billion of consolidated indebtedness (including the notes offered hereby) ranking equally in right of payment with the notes and the guarantees. As of May 26, 2015, we and the subsidiary guarantors had approximately $120.2 million of secured indebtedness outstanding (excluding obligations under letters of credit and hedges outstanding under the Credit Facility). |

Covenants |

|

We will issue the notes under an indenture with Wells Fargo Bank, National Association, as trustee. The indenture, among other things, will limit our ability and the ability of our restricted subsidiaries to: |

| | • borrow money; |

| | • pay distributions or dividends on equity or purchase, redeem or otherwise acquire equity; |

| | • make investments; |

| | • use assets as collateral in other transactions; |

| | • sell certain assets or merge with or into other companies; and |

| | • engage in transactions with affiliates. |

|

|

For more details, please read "Description of Notes — Covenants." |

Covenant termination |

|

If at any time the notes are rated investment grade by either Standard & Poor's Ratings Services ("Standard & Poor's") or Moody's Investors Service, Inc. ("Moody's") and no default has occurred and is continuing under the indenture, certain of the foregoing covenants will terminate and will no longer apply to us or our subsidiaries. Please read "Description of Notes — Covenants — Covenant Termination." |

Listing for trading |

|

We do not intend to list the notes for trading on any securities exchange. We can provide no assurance as to the liquidity of, or development of any trading market for, the notes. |

Use of proceeds |

|

We intend to use the net proceeds from this offering to fund the payments we will make upon the settlement of our pending Tender Offers for any and all of our outstanding 2020 Notes, 2021 Notes and 2022 Notes. Please read "Summary — Tender Offers." Any amounts required to make the payments necessary at settlement of the Tender Offers that are not funded by the net proceeds from this offering will be funded partly by cash on hand, with the remainder to be funded through borrowings under the Credit Facility. Please read "Use of Proceeds." |

S-6

Table of Contents

| | |

| | | Certain of the underwriters or their affiliates may be holders of notes subject to the Tender Offers and may therefore also receive a portion of the proceeds from this offering in respect of such notes. Please read "Underwriting." |

Risk factors |

|

Investing in the notes involves risks. Please read "Risk Factors" beginning on page S-8 of this prospectus supplement and in the documents incorporated by reference, as well as the other cautionary statements throughout this prospectus, for a discussion of factors you should carefully consider before deciding to invest in the notes. |

S-7

Table of Contents

RISK FACTORS

An investment in the notes is subject to a number of risks. You should carefully consider the risk factors included below and those in Item 1A. "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2014 and any subsequent quarterly reports on Form 10-Q which are incorporated herein by reference, together with all of the other information included or incorporated by reference in this prospectus supplement. You should consider the following risk factors in evaluating this investment. If any of these risks materialize into actual events, our business, financial condition, results of operations or cash flow could be adversely affected.

Risks Related to the Notes

We have a holding company structure in which our subsidiaries conduct our operations and own our operating assets.

We are a holding company, and our subsidiaries conduct all of our operations and own all of our operating assets. We have no significant assets other than the partnership interests, stock and the other equity interests in our subsidiaries. As a result, our ability to make required payments on the notes depends on the performance of our subsidiaries and their ability to distribute funds to us. The ability of our subsidiaries to make distributions to us may be restricted by, among other things, the Credit Facility and applicable state business organization laws and other laws and regulations. If we are unable to obtain the funds necessary to pay the principal amount at maturity of the notes, or to repurchase the notes upon the occurrence of a change of control, we may be required to adopt one or more alternatives, such as a refinancing of the notes. We cannot assure you that we would be able to refinance the notes or obtain the funds to pay principal or interest on the notes.

Payment of principal and interest on the notes will be effectively subordinated to our senior secured debt to the extent of the value of the assets securing that debt and structurally subordinated to the liabilities of any of our subsidiaries that do not guarantee the notes.

The notes will be effectively subordinated to claims of our secured creditors, and the subsidiary guarantees will be effectively subordinated to the claims of our secured creditors as well as the secured creditors of the subsidiary guarantors. As of May 26, 2015, we and the subsidiary guarantors had approximately $120.2 million of secured indebtedness outstanding (excluding obligations under letters of credit and hedges outstanding under the Credit Facility). Holders of our secured obligations, including obligations under the Credit Facility, will have claims that are prior to claims of the holders of the notes with respect to the assets securing those obligations. In the event of a liquidation, dissolution, reorganization, bankruptcy or any similar proceeding, our assets and those of our subsidiaries will be available to pay obligations on the notes and the guarantees only after holders of our senior secured debt have been paid the value of the assets securing such debt. Although almost all of our wholly owned subsidiaries will guarantee the notes, in the future, under certain circumstances, these guarantees are subject to release, and we have various partially owned subsidiaries that will not guarantee the notes. Consequently, the notes will be structurally subordinated to the claims of all creditors, including trade creditors and tort claimants, of our subsidiaries that are not guarantors. In the event of the liquidation, dissolution, reorganization, bankruptcy or similar proceeding of the business of a subsidiary that is not a guarantor, creditors of that subsidiary would generally have the right to be paid in full before any distribution is made to us or the holders of the notes. Accordingly, there may not be sufficient funds remaining to pay amounts due on all or any of the notes.

We require a significant amount of cash to service our indebtedness. Our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on and to refinance our indebtedness, including the notes, and to fund planned capital expenditures depends on our ability to generate cash in the future. This, to a

S-8

Table of Contents

certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot assure you that we will generate sufficient cash flow from operations or that future borrowings will be available to us under the Credit Facility or otherwise in an amount sufficient to enable us to pay our indebtedness, including the notes, or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, including the notes, on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, including indebtedness outstanding under the Credit Facility and the notes, on commercially reasonable terms or at all.

We distribute all of our available cash to our unitholders and we are not required to accumulate cash for the purpose of meeting our future obligations to our noteholders, which may limit the cash available to service the notes.

Subject to the limitations on restricted payments contained in the indenture governing the notes, the credit agreement governing the Credit Facility and other indebtedness, we distribute all of our "available cash" each quarter to our limited partners and our general partner. "Available cash" is defined in our partnership agreement, and it generally means, for each fiscal quarter:

- •

- all cash and cash equivalents on hand at the end of the quarter (excluding cash at MarkWest Hydrocarbon);

- •

- less the amount of cash that our general partner determines in its reasonable discretion is necessary or appropriate to:

- •

- provide for the proper conduct of our business;

- •

- comply with applicable law, any of our debt instruments, or other agreements; or

- •

- provide funds for distributions to unitholders for any one or more of the next four quarters;

- •

- plus all cash and cash equivalents on hand on the date of determination of available cash for the quarter resulting from working capital borrowings made after the end of the quarter. Working capital borrowings are generally borrowings that are made under the Credit Facility and in all cases are used solely for working capital purposes or to pay distributions to partners.

As a result, we do not expect to accumulate significant amounts of cash. Depending on the timing and amount of our cash distributions, these distributions could significantly reduce the cash available to us in subsequent periods to make payments on the notes.

We may not be able to fund a change of control offer.

Upon the occurrence of certain change of control events, we will be required, subject to certain conditions, to offer to purchase all outstanding notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest thereon to the date of purchase. The holders of our other outstanding series of senior notes have similar put rights. If a change of control event were to occur today, we would not have sufficient funds available to purchase all of the outstanding notes were they to be tendered in response to an offer made as a result of a change of control event. We cannot assure you that we will have sufficient funds available or that we will be permitted by our other debt instruments to fulfill these obligations upon a change of control event in the future. Furthermore, certain change of control events would constitute an event of default under the Credit Facility. Please read "Description of Notes — Repurchase at the Option of Holders — Change of Control."

Many of the covenants contained in the indenture will terminate if the notes are rated investment grade by either Standard & Poor's or Moody's and no default has occurred and is continuing.

Many of the covenants in the indenture governing the notes will terminate if the notes are rated investment grade by either Standard & Poor's or Moody's provided at such time no default or event of

S-9

Table of Contents

default has occurred and is continuing. The covenants will restrict, among other things, our ability to pay dividends, incur debt, and to enter into certain other transactions. There can be no assurance that the notes will ever be rated investment grade. However, termination of these covenants would allow us to engage in certain transactions that would not be permitted while these covenants were in force, and the effects of any such transactions will be permitted to remain in place even if the notes are subsequently downgraded below investment grade. Please read "Description of Notes — Covenants — Covenant Termination."

The subsidiary guarantees could be deemed fraudulent conveyances under certain circumstances, and a court may try to subordinate or void the subsidiary guarantees.

Under the federal bankruptcy laws and comparable provisions of state fraudulent transfer laws, a subsidiary guarantee could be voided, or claims in respect of a subsidiary guarantee could be subordinated to all other debts of that subsidiary guarantor if, among other things, the subsidiary guarantor, at the time it incurred the indebtedness evidenced by its subsidiary guarantee:

- •

- received less than reasonably equivalent value or fair consideration for the incurrence of such subsidiary guarantee; and

- •

- was insolvent or rendered insolvent by reason of such incurrence;

- •

- was engaged in a business or transaction for which the subsidiary guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature.

In addition, any payment by that subsidiary guarantor pursuant to its subsidiary guarantee could be voided and required to be returned to the subsidiary guarantor, or to a fund for the benefit of the creditors of the subsidiary guarantor. The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a subsidiary guarantor would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets;

- •

- the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability, including contingent liabilities, on its existing debts, as they become absolute and mature; or

- •

- it could not pay its debts as they become due.

Your ability to sell the notes may be limited by the absence of a trading market.

The notes will not be listed on any securities exchange or included in any automated quotation system. The underwriters have advised us that, following completion of this offering, they intend to make a market in the notes as permitted by applicable law. The underwriters are not obligated, however, to make a market in the notes, and may discontinue any market making activities at any time without notice, in their sole discretion. If the underwriters fail to act as a market maker for the notes for any reason, there can be no assurance that another firm or person will make a market in the notes. Accordingly, we cannot assure you as to the development or liquidity of any market for the notes. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. We cannot assure you that the market, if any, for the notes will be free from similar disruptions. Any such disruption may adversely affect your ability to sell the notes.

S-10

Table of Contents

USE OF PROCEEDS

We estimate the net proceeds to us from this offering to be approximately $1,175.1 million, after deducting estimated fees and expenses payable by us (including underwriting discounts and commissions).

We intend to use the net proceeds from this offering to fund the payments we will make upon the settlement of our pending Tender Offers for any and all of our outstanding 2020 Notes, 2021 Notes and 2022 Notes. Please read "Summary — Tender Offers." Any amounts required to make the payments necessary at settlement of the Tender Offers that are not funded by the net proceeds from this offering will be funded partly by cash on hand, with the remainder to be funded through borrowings under the Credit Facility.

As of May 26, 2015, the outstanding balance under the Credit Facility, which matures in March 2019, was approximately $120.2 million (excluding approximately $11.3 million of outstanding letters of credit), and the weighted average interest rate of the Credit Facility was 3.6%. Existing borrowings under the Credit Facility were incurred to fund our ongoing capital expenditure program and for working capital purposes. Certain of the underwriters or their affiliates may be holders of notes subject to the Tender Offers and may therefore also receive a portion of the proceeds from this offering in respect of such notes. See "Underwriting."

S-11

Table of Contents

CAPITALIZATION

The following table sets forth our consolidated cash and cash equivalents and our consolidated capitalization as of March 31, 2015:

- •

- on an actual basis; and

- •

- on an as adjusted basis to give effect to the issuance of the notes in this offering and the application of the net proceeds therefrom in the manner described under "Use of Proceeds."

This table is derived from, should be read together with, and is qualified in its entirety by reference to the information contained in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical consolidated financial statements, including the related notes, contained in our quarterly report on Form 10-Q for the quarter ended March 31, 2015, which is incorporated by reference in this prospectus supplement.

| | | | | | | |

| | As of March 31, 2015 | |

|---|

| | Actual | | As Adjusted | |

|---|

| | (unaudited, in thousands)

| |

|---|

Cash and cash equivalents(1) | | $ | 236,284 | | $ | 175,284 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Debt: | | | | | | | |

Credit Facility(2) | | $ | — | | $ | 147,392 | |

6.75% senior notes due 2020 | | $ | 500,000 | | $ | — | (4) |

6.5% senior notes due 2021 | | $ | 324,603 | (3) | $ | — | (4) |

6.25% senior notes due 2022 | | $ | 455,000 | | $ | — | (4) |

5.5% senior notes due 2023 | | $ | 744,385 | (3) | $ | 744,385 | (3) |

4.5% senior notes due 2023 | | $ | 1,000,000 | | $ | 1,000,000 | |

4.875% senior notes due 2024 | | $ | 1,160,475 | (3) | $ | 1,160,475 | (3) |

4.875% senior notes due 2025 | | $ | — | | $ | 1,188,312 | (3) |

| | | | | | | | |

Total debt | | $ | 4,184,463 | | $ | 4,240,564 | |

Equity: | | |

| | |

| |

Common units | | $ | 4,584,275 | | $ | 4,472,990 | (5) |

Class B units | | $ | 451,519 | | $ | 451,519 | |

Non-controlling interest in consolidated subsidiaries | | $ | 1,015,034 | | $ | 1,015,034 | |

| | | | | | | | |

Total equity | | $ | 6,050,828 | | $ | 5,939,543 | |

| | | | | | | | |

Total capitalization | | $ | 10,235,291 | | $ | 10,180,107 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- (1)

- Includes approximately $161.9 million of cash held by our non-guarantor subsidiaries, but does not give effect to the payment of approximately $23.0 million of accrued but unpaid interest on the 2020 Notes, 2021 Notes and 2022 Notes payable in connection with the Tender Offers based on the assumption in note (4) below.

- (2)

- As of May 26, 2015, we had approximately $120.2 million of borrowings outstanding and $11.3 million of letters of credit outstanding under the Credit Facility.

- (3)

- Net of unamortized discount and premium.

- (4)

- As adjusted amount assumes all outstanding 2020 Notes, 2021 Notes and 2022 Notes are tendered prior to the expiration of the Tender Offers and purchased by us for cash at settlement on June 4, 2015 in accordance with the terms of the Tender Offers. However, this offering is not conditioned upon the consummation of any Tender Offer at any level of acceptance. Please read "Summary — Tender Offers."

S-12

Table of Contents

- (5)

- Reflects decreases of approximately $118.5 million of loss on extinguishment of debt related to the Tender Offers, of which $14.6 million is related to the write-off of deferred financing costs and $0.4 million to the write-off of the unamortized bond discount on the 2021 Notes, based on the assumptions in note (4) above. These decreases are offset by a tax benefit of $7.2 million.

S-13

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES

The table below sets forth our ratios of earnings to fixed charges for each of the periods indicated. The ratio of earnings to fixed charges is calculated as earnings divided by fixed charges. Earnings consist of pre-tax income from continuing operations before fixed charges. Fixed charges consist of interest expense and capitalized interest, including the gain or loss on interest rate swaps and amortization of premiums, discounts and capitalized expenses related to indebtedness. Fixed charges also include an estimate of the interest within rental expense.

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Three Months

Ended

March 31,

2015 | |

|---|

| | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | |

|---|

Ratio of earnings to fixed charges | | | 1.35x | | | 2.00x | | | 2.54x | | | 1.15x | | | 1.91x | | | 1.30x | |

S-14

Table of Contents

DESCRIPTION OF NOTES

We will issue the notes under an indenture dated as of November 2, 2010, as supplemented by a supplemental indenture to be dated as of the Issue Date (collectively the "Indenture"), among us, the Subsidiary Guarantors and Wells Fargo Bank, National Association, as trustee (the "Trustee"). The terms of the notes include those expressly set forth in the Indenture and those made part of the Indenture by reference to the Trust Indenture Act of 1939, as amended (the "Trust Indenture Act"). The Indenture is unlimited in aggregate principal amount, although the issuance of notes in this offering will be limited to $1.2 billion.

You can find the definitions of certain terms in this description under the caption "— Definitions." In this description, the word "Issuers" refers only to MarkWest Energy Partners and MarkWest Finance and not to any of their subsidiaries and any reference to "MarkWest Energy Partners" or "MarkWest Finance" does not include any of their respective subsidiaries. As used in this section, "MarkWest Finance" means our subsidiary, MarkWest Energy Finance Corporation, which is a co-issuer of the notes.

This "Description of Notes," together with the "Description of Our Debt Securities" included in the accompanying base prospectus, is intended to be a useful overview of the material provisions of the notes and the Indenture. Since this "Description of Notes" and such "Description of Our Debt Securities" are only summaries, you should refer to the Indenture for a complete description of the obligations of the Issuers and your rights. This "Description of Notes" supersedes the "Description of Our Debt Securities" in the accompanying base prospectus to the extent it is inconsistent with such "Description of Our Debt Securities."

The registered holder of a note will be treated as the owner of it for all purposes. Only registered holders will have rights under the indenture.

Brief Description of the Notes and the Guarantees

The Notes

The notes will:

- •

- be general unsecured, senior obligations of the Issuers;

- •

- rank equally in right of payment to any existing and future senior Indebtedness of either of the Issuers, without giving effect to collateral arrangements, but are effectively subordinated to all present and future secured Indebtedness of either of the Issuers to the extent of the value of the collateral securing such Indebtedness; and

- •

- be unconditionally guaranteed on a senior, unsecured basis by the Subsidiary Guarantors.

The Guarantees

Initially, the notes will be guaranteed by MarkWest Energy Partners' principal operating company, MarkWest Energy Operating Company, L.L.C., which we refer to as the "Operating Company" in this description, and by all of MarkWest Energy Partners' other existing subsidiaries that guarantee both the Credit Facility and its outstanding series of senior notes.

Each Guarantee of a Subsidiary Guarantor of the notes will:

- •

- be a general unsecured, senior obligation of that Subsidiary Guarantor; and

- •

- rank equally in right of payment to any future senior Indebtedness of the Subsidiary Guarantor, without giving effect to collateral arrangements, but is effectively subordinated to all present and future secured Indebtedness of the Subsidiary Guarantor to the extent of the value of the collateral securing such Indebtedness.

S-15

Table of Contents

As a result of the effective subordination described above, in the event of a bankruptcy, liquidation or reorganization of MarkWest Energy Partners or MarkWest Finance, holders of these notes may recover less ratably than secured creditors of the Issuers who are holders of senior Indebtedness to the extent of the value of the collateral securing such Indebtedness.

As of March 31, 2015, on an as adjusted basis as described under "Capitalization," MarkWest Energy Partners (excluding its subsidiaries) would have had approximately $4.2 billion of total senior Indebtedness outstanding (excluding obligations under letters of credit and hedges), approximately $147.4 million of which would have been secured, and no Indebtedness contractually subordinated to the notes. On the same basis, the Subsidiary Guarantors would have had approximately $4.2 billion of senior Indebtedness outstanding (excluding intercompany debt and obligations under letters of credit and hedges), approximately $147.4 million of which would have been secured, and no Indebtedness contractually subordinated to their guarantees of the notes.

Currently, all of our Subsidiaries other than Liberty, MarkWest Utica EMG L.L.C., MarkWest Panola Pipeline L.L.C. and West Relay Gathering Company, L.L.C. and their respective Subsidiaries are "Restricted Subsidiaries." However, under the circumstances described below under the caption "— Covenants — Designation of Restricted and Unrestricted Subsidiaries," we may designate certain additional Restricted Subsidiaries as "Unrestricted Subsidiaries." Unrestricted Subsidiaries will not be subject to many of the restrictive covenants in the Indenture. Unrestricted Subsidiaries will not guarantee the notes.

MarkWest Energy Partners owns a 50% equity interest in MarkWest Pioneer, L.L.C. ("Pioneer"), the owner and operator of the Arkoma Connector Pipeline. In addition, MarkWest Energy Partners owns a 40% equity interest in Centrahoma Processing L.L.C. ("Centrahoma") that is accounted for using the equity method. Neither Pioneer, Centrahoma, nor any other unconsolidated subsidiary or equity investee will qualify as a "Subsidiary" under the Indenture, and, therefore, they will not be subject to any of the restrictive covenants in the Indenture nor will they guarantee the notes.

In the event of a bankruptcy, liquidation or reorganization of any of these non-guarantor consolidated subsidiaries or equity investees, they will pay the holders of their debt and their trade creditors before they will be able to distribute any of their assets to us.

For consolidated financial information as to our non-guarantor consolidated subsidiaries, please read footnote 15 in the notes to the condensed consolidated financial statements contained in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 that is incorporated by reference herein.

Principal, Maturity and Interest

The Issuers will issue the notes in an aggregate principal amount of $1.2 billion. Subject to compliance with the covenant described below under the caption "— Covenants — Incurrence of Indebtedness and Issuance of Disqualified Equity," the Issuers may issue additional notes from time to time under the Indenture. The notes offered hereby and any additional notes subsequently issued under the Indenture will be treated as a single class for all purposes under the Indenture, including, without limitation, waivers, amendments, redemptions and offers to purchase. The Issuers may issue notes only in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. The notes will mature on June 1, 2025.

Interest on the notes will accrue at the rate of 4.875% per annum and is payable semi-annually in arrears on June 1 and December 1, commencing on December 1, 2015. The Issuers will make each interest payment to the holders of record of the notes on the immediately preceding May 15 and November 15.

Interest on the notes will accrue from June 2, 2015. Interest will be computed on the basis of a 360-day year comprised of twelve 30-day months.

S-16

Table of Contents

Methods of Receiving Payments on the Notes

If a holder of more than $1.0 million has given wire transfer instructions to an account within the United States to the Issuers, the Issuers will make all payments of principal of, premium, if any, and interest on the notes in accordance with those instructions. All other payments on these notes will be made at the office or agency of the Paying Agent in Dallas, Texas, unless the Issuers elect to make interest payments by check mailed to the holders at their address set forth in the register of holders.

Paying Agent and Registrar for the Notes

The Trustee will act as Paying Agent and Registrar at its corporate trust office in Dallas, Texas. The Issuers may change the Paying Agent or Registrar without prior notice to the holders of the notes, and the Issuers or any of their Subsidiaries may act as Paying Agent or Registrar.

Transfer and Exchange

A holder may transfer or exchange notes in accordance with the Indenture. The Registrar and the Trustee may require a holder, among other things, to furnish appropriate endorsements and transfer documents and the Issuers may require a holder to pay any taxes and fees required by law or permitted by the Indenture. The Issuers are not required to transfer or exchange any note selected for redemption or repurchase (except in the case of a note to be redeemed or repurchased in part, the portion not to be redeemed or repurchased). Also, the Issuers are not required to transfer or exchange any note for a period of 15 days before a selection of notes to be redeemed or between a record date and the next succeeding interest payment date.

The registered holder of a note will be treated as the owner of it for all purposes, and all references in this description to "holders" are to holders of record.

The Guarantees

Initially, all of our wholly-owned Restricted Subsidiaries, excluding MarkWest Finance and MarkWest Energy West Texas Gas Company, L.L.C., will guarantee our Obligations under the notes and the Indenture. In the future, our Restricted Subsidiaries will be required to guarantee our Obligations under the notes and the Indenture in the circumstances described below under the caption "— Covenants — Additional Subsidiary Guarantees." We anticipate that MarkWest Energy West Texas Gas Company, L.L.C. will guarantee the notes shortly after their issuance.

The Subsidiary Guarantors will jointly and severally guarantee on a senior basis the Issuers' Obligations under the existing notes. The obligations of each Subsidiary Guarantor under its Guarantee rank equally in right of payment with other Indebtedness of such Subsidiary Guarantor, except to the extent such other Indebtedness is expressly subordinate to the obligations arising under the Guarantee. However, the notes will be structurally subordinated to the secured Indebtedness of the Subsidiary Guarantors to the extent of the value of the collateral securing such Indebtedness. The obligations of each Subsidiary Guarantor under its Guarantee will be limited as necessary to prevent that Guarantee from constituting a fraudulent conveyance under applicable law. See "Risk Factors."

As of March 31, 2015, on an as adjusted basis as described under "Capitalization," the Issuers and the Subsidiary Guarantors would have had approximately $4.2 billion of Indebtedness outstanding (excluding obligations under letters of credit and hedges and intercompany debt).

A Subsidiary Guarantor may not sell or otherwise dispose of all or substantially all of its properties or assets to, or consolidate with or merge with or into (whether or not such Subsidiary Guarantor is the surviving Person), another Person, except MarkWest Energy Partners or another Subsidiary Guarantor, unless:

(1) immediately after giving effect to that transaction, no Default or Event of Default exists; and

S-17

Table of Contents

(2) the Person acquiring the properties or assets in any such sale or other disposition or the Person formed by or surviving any such consolidation or merger (if other than the Subsidiary Guarantor) assumes all the Obligations of that Subsidiary Guarantor under its Guarantee and the Indenture pursuant to a supplemental indenture satisfactory to the Trustee, unless the Guarantee of such Subsidiary Guarantor is released as provided in clauses (1) and (2) of the next paragraph.

The Guarantee of a Subsidiary Guarantor will be released:

(1) in connection with any sale or other disposition of all or substantially all of the assets of that Subsidiary Guarantor (including by way of merger or consolidation) to a Person that is not (either before or after giving effect to such transaction) a Restricted Subsidiary, if the sale or other disposition does not violate the provisions of the Indenture applicable to Asset Sales;

(2) in connection with any sale or other disposition of the Equity Interests of a Subsidiary Guarantor to a Person that is not (either before or after giving effect to such transaction) an Issuer or a Restricted Subsidiary, if the sale or other disposition does not violate the provisions of the Indenture applicable to Asset Sales and the Subsidiary Guarantor ceases to be a Restricted Subsidiary of MarkWest Energy Partners as a result of the sale or other disposition;

(3) if MarkWest Energy Partners designates any Restricted Subsidiary that is a Subsidiary Guarantor as an Unrestricted Subsidiary;

(4) upon Legal Defeasance or Covenant Defeasance as described below under the caption "— Legal Defeasance and Covenant Defeasance" or upon satisfaction and discharge of the Indenture as described below under the caption "— Satisfaction and Discharge;"

(5) in the case of any Subsidiary Guarantor other than the Operating Company, at such time as such Subsidiary Guarantor ceases to guarantee any other Indebtedness of either of the Issuers and any Indebtedness of the Operating Company; or

(6) in the case of the Operating Company, at such time as the Operating Company ceases to guarantee any other Indebtedness of either of the Issuers, provided that it is then no longer an obligor with respect to any Indebtedness under any Credit Facility.

See "— Repurchase at the Option of Holders — Asset Sales."

Optional Redemption

The notes will be redeemable as a whole at any time or in part from time to time, at the option of the Issuers, at a redemption price equal to:

(x) if the redemption date is prior to March 1, 2025 (the date three months prior to the stated maturity of the notes), the greater of (i) 100% of the principal amount of the notes or (ii) the sum of the present values of the remaining scheduled payments of principal and interest thereon from the redemption date to March 1, 2025 (exclusive of any accrued interest) discounted to the redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 50 basis points; or

(y) if the redemption date is on or after March 1, 2025 (the date three months prior to the stated maturity of the notes), 100% of the principal amount of notes,

plus, in each case, any interest accrued but not paid to the date of redemption (subject to the right of holders of record on the relevant record date to receive interest due on an interest payment date that is on or prior to the redemption date).

"Treasury Rate" means, with respect to any redemption date, the rate per annum equal to the semiannual equivalent yield to maturity (computed by MarkWest Energy Partners as of the second business day immediately preceding such redemption date) of the Comparable Treasury Issue, assuming

S-18

Table of Contents

a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such redemption date.

"Comparable Treasury Issue" means the United States Treasury security or securities selected by the Independent Investment Banker as having an actual or interpolated maturity comparable to the remaining term of the notes, calculated as if the maturity date of the notes were March 1, 2025 (the date three months prior to the stated maturity of the notes), that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of a comparable maturity to the remaining term of the notes, calculated as if the maturity date of the notes were March 1, 2025 (the date three months prior to the stated maturity of the notes).

"Comparable Treasury Price" means, with respect to any redemption date, the average of the Reference Treasury Dealer Quotations for such redemption date.

"Independent Investment Banker" means one of the Reference Treasury Dealers appointed by MarkWest Energy Partners.

"Reference Treasury Dealer" means each of Wells Fargo Securities, LLC and a primary U.S. government securities dealer in the United States (a "Primary Treasury Dealer") selected by MarkWest Energy Partners, and their respective successors; provided, however, that if either of the foregoing shall not be a Primary Treasury Dealer at the appropriate time, MarkWest Energy Partners shall substitute therefor another Primary Treasury Dealer.

"Reference Treasury Dealer Quotations" means, with respect to each Reference Treasury Dealer and any redemption date, the average, as determined by the Independent Investment Banker, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount) quoted in writing to the Independent Investment Banker by such Reference Treasury Dealer at 3:30 p.m. New York time on the third business day preceding such redemption date.

Selection and Notice

If less than all of the notes are to be redeemed at any time, the Trustee will select notes for redemption as follows:

(1) if the notes are listed, in compliance with the requirements of the principal national securities exchange on which the notes are listed; or

(2) if the notes are not so listed or there are no such requirements, on a pro rata basis (or, in the case of notes in global form, the Trustee will select notes for redemption based on DTC's method that most nearly approximates a pro rata selection), by lot or by such method as the Trustee shall deem fair and appropriate.

No notes of $2,000 or less shall be redeemed in part. Notices of redemption shall be mailed by first class mail at least 30 but not more than 60 days before the redemption date to each holder of notes to be redeemed at its registered address, except that optional redemption notices may be mailed more than 60 days prior to a redemption date if the notice is issued in connection with a defeasance of the notes or a satisfaction and discharge of the Indenture.

Any such redemption may, at the discretion of MarkWest Energy Partners, be subject to one or more conditions precedent. If such redemption is subject to the satisfaction of one or more conditions precedent, the related notice shall describe each such condition, and if applicable, shall state that, in the discretion of MarkWest Energy Partners, the date of redemption may be delayed until such time as any or all such conditions shall be satisfied or waived (provided that in no event shall such date of redemption be delayed to a date later than 60 days after the date on which such notice was sent), or such redemption may not occur and such notice may be rescinded in the event that any or all such conditions shall not have been satisfied or waived by the date of redemption, or by the date of redemption as so delayed.

S-19

Table of Contents

If any note is to be redeemed in part only, the notice of redemption that relates to that note shall state the portion of the principal amount thereof to be redeemed. A new note in principal amount equal to the unredeemed portion of the original note will be issued in the name of the holder thereof upon cancellation of the original note. Notes called for redemption without condition become due on the date fixed for redemption. On and after the redemption date, interest ceases to accrue on notes or portions of them called for redemption unless the Issuers default in making such redemption payment.

Mandatory Redemption

Except as set forth below under "— Repurchase at the Option of Holders," neither of the Issuers is required to make mandatory redemption or sinking fund payments with respect to the notes or to repurchase the notes at the option of the Holders.

Repurchase at the Option of Holders

Change of Control

If a Change of Control occurs, each holder of notes will have the right to require MarkWest Energy Partners to repurchase all or any part (equal to $2,000 or an integral multiple of $1,000 in excess thereof) of that holder's notes pursuant to the Change of Control Offer. In the Change of Control Offer, MarkWest Energy Partners will offer a Change of Control Payment in cash equal to 101% of the aggregate principal amount of notes repurchased plus accrued and unpaid interest thereon, if any, to the date of purchase (the "Change of Control Payment Date"), subject to the rights of any holder in whose name a note is registered on a record date occurring prior to the Change of Control Payment Date to receive interest due on an interest payment date that is on or prior to such Change of Control Payment Date. Within 30 days following any Change of Control, MarkWest Energy Partners will mail a notice to each holder describing the transaction or transactions that constitute the Change of Control and offering to repurchase notes on the Change of Control Payment Date specified in such notice, pursuant to the procedures required by the Indenture and described in such notice. MarkWest Energy Partners will comply with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws and regulations thereunder to the extent such laws and regulations are applicable in connection with the repurchase of the notes as a result of a Change of Control. To the extent that the provisions of any securities laws or regulations conflict with the Change of Control provisions of the Indenture, MarkWest Energy Partners will comply with the applicable securities laws and regulations and will not be deemed to have breached their obligations under the Change of Control provisions of the Indenture by virtue of such compliance.

On or before the Change of Control Payment Date, MarkWest Energy Partners will, to the extent lawful, accept for payment all notes or portions thereof properly tendered pursuant to the Change of Control Offer. Promptly after such acceptance, on the Change of Control Payment Date, MarkWest Energy Partners will:

(1) deposit with the Paying Agent an amount equal to the Change of Control Payment in respect of all notes or portions thereof so tendered; and

(2) deliver or cause to be delivered to the Trustee the notes so accepted together with an officers' certificate stating the aggregate principal amount of notes or portions thereof being purchased by MarkWest Energy Partners.

On the Change of Control Payment Date, the Paying Agent will mail to each holder of notes accepted for payment the Change of Control Payment for such notes (or, if all the notes are then in global form, make such payment through the facilities of DTC), and the Trustee will promptly authenticate and mail (or cause to be transferred by book entry) to each holder a new note equal in principal amount to any unpurchased portion of the notes surrendered, if any; provided that each such new note will be in a principal amount of $2,000 or an integral multiple of $1,000 in excess thereof. MarkWest

S-20

Table of Contents

Energy Partners will publicly announce the results of the Change of Control Offer on or as soon as practicable after the Change of Control Payment Date.

The provisions described above that require MarkWest Energy Partners to make a Change of Control Offer following a Change of Control will be applicable regardless of whether or not any other provisions of the Indenture are applicable. Except as described above with respect to a Change of Control, the Indenture will not contain provisions that permit the holder of the notes to require that the Issuers repurchase or redeem the notes in the event of a takeover, recapitalization or similar transaction.

MarkWest Energy Partners will not be required to make a Change of Control Offer upon a Change of Control if (1) a third party makes the Change of Control Offer in the manner, at the times and otherwise in compliance with the requirements set forth in the Indenture applicable to a Change of Control Offer made by MarkWest Energy Partners and purchases all notes properly tendered and not withdrawn under the Change of Control Offer, (2) notice of redemption of all outstanding notes has been given pursuant to the Indenture as described above under the caption "— Optional Redemption," unless and until there is a default in payment of the applicable redemption price or (3) in connection with or in contemplation of any Change of Control, MarkWest Energy Partners has made an offer to purchase (an "Alternate Offer") any and all notes validly tendered at a cash price equal to or higher than the Change of Control Payment and has purchased all notes properly tendered in accordance with the terms of such Alternate Offer.

A Change of Control Offer may be made in advance of a Change of Control, and conditioned upon the occurrence of the Change of Control, if a definitive agreement is in place for the Change of Control at the time of making the Change of Control Offer.

The Credit Agreement provides that certain change of control events with respect to MarkWest Energy Partners would constitute a default under the agreements governing such Indebtedness. Any future credit agreements or other agreements relating to Indebtedness to which MarkWest Energy Partners becomes a party may contain similar restrictions and provisions. Moreover, the exercise by the holders of their right to require MarkWest Energy Partners to repurchase the notes could cause a default under such Indebtedness, even if the Change of Control does not, due to the financial effect of such a repurchase on MarkWest Energy Partners. If a Change of Control occurs at a time when MarkWest Energy Partners is prohibited from purchasing notes, MarkWest Energy Partners could seek the consent of the lenders of the borrowings containing such prohibition to the purchase of notes or could attempt to refinance such borrowings. If MarkWest Energy Partners does not obtain such a consent or repay such borrowings, MarkWest Energy Partners will remain prohibited from purchasing notes. In such case, MarkWest Energy Partners' failure to purchase tendered notes would constitute an Event of Default under the Indenture, which would, in turn, in all likelihood constitute a default under such borrowings. Finally, MarkWest Energy Partners' ability to pay cash to the holders upon a repurchase may be limited by MarkWest Energy Partners' then existing financial resources. We cannot assure you that sufficient funds will be available when necessary to make any required repurchases.

The definition of Change of Control includes a phrase relating to the sale, lease, transfer, conveyance or other disposition of "all or substantially all" of the properties or assets of MarkWest Energy Partners and its Restricted Subsidiaries taken as a whole. Although there is a limited body of case law interpreting the phrase "substantially all," there is no precise established definition of the phrase under applicable law. Accordingly, the ability of a holder of notes to require MarkWest Energy Partners to repurchase such notes as a result of a sale, lease, transfer, conveyance or other disposition of less than all of the properties or assets of MarkWest Energy Partners and its Restricted Subsidiaries taken as a whole to another Person or group may be uncertain.

In the event that holders of not less than 90% of the aggregate principal amount of the outstanding notes accept a Change of Control Offer or an Alternate Offer and MarkWest Energy Partners (or a third party making the Change of Control Offer as provided above) purchases all of the notes held by such holders, the Issuers will have the right, upon not less than 30 nor more than 60 days' notice, given

S-21

Table of Contents

not more than 30 days following the purchase pursuant to the Change of Control Offer or Alternate Offer described above, as the case may be, to redeem all of the notes that remain outstanding following such purchase at a redemption price equal to the Change of Control Payment plus, to the extent not included in the Change of Control Payment, accrued and unpaid interest on the notes that remain outstanding, to the date of redemption (subject to the right of holders of record on the relevant record date to receive interest due on an interest payment date that is on or prior to the redemption date).

Asset Sales

MarkWest Energy Partners will not, and will not permit any of its Restricted Subsidiaries to, consummate an Asset Sale unless:

(1) MarkWest Energy Partners (or the Restricted Subsidiary, as the case may be) receives consideration at the time of such Asset Sale at least equal to the fair market value of the assets or Equity Interests issued or sold or otherwise disposed of;

(2) such fair market value is determined by (a) an executive officer of the General Partner if the value is less than $50.0 million, as evidenced by an officers' certificate delivered to the Trustee or (b) the Board of Directors of the General Partner if the value is $50.0 million or more, as evidenced by a resolution of such Board of Directors of the General Partner; and

(3) at least 75% of the aggregate consideration received by MarkWest Energy Partners and its Restricted Subsidiaries in the Asset Sale and all other Asset Sales since the Issue Date is in the form of cash or Cash Equivalents. For purposes of this provision, each of the following shall be deemed to be cash:

(a) any liabilities (as shown on MarkWest Energy Partners' most recent consolidated balance sheet) of MarkWest Energy Partners or any Restricted Subsidiary (other than contingent liabilities and liabilities that are by their terms subordinated to the notes or any Guarantee) that are assumed by the transferee of any such assets pursuant to a novation or indemnity agreement that releases MarkWest Energy Partners or such Restricted Subsidiary from, or indemnifies it against, further liability; and

(b) any securities, notes or other Obligations received by MarkWest Energy Partners or any such Restricted Subsidiary from such transferee that are within 120 days after the Asset Sale (subject to ordinary settlement periods) converted by such Issuer or such Restricted Subsidiary into cash (to the extent of the cash received in that conversion).

Within 360 days after the receipt of any Net Proceeds from an Asset Sale, MarkWest Energy Partners or a Restricted Subsidiary may apply (or enter into a definitive agreement for such application within such 360-day period, provided that such application occurs within 90 days after the end of such 360-day period) such Net Proceeds at its option:

(1) to repay senior Indebtedness of MarkWest Energy Partners and/or its Restricted Subsidiaries (or to make an offer to repurchase or redeem such Indebtedness, provided that such repurchase or redemption closes within 45 days after the end of such 360-day period);

(2) to make a capital expenditure in a Permitted Business;

(3) to acquire other long-term tangible assets that are used or useful in a Permitted Business; or

(4) to invest in any other Permitted Investments other than Investments in Cash Equivalents, Interest Swaps or Currency Agreements.

Pending the final application of any such Net Proceeds, MarkWest Energy Partners or a Restricted Subsidiary may temporarily reduce revolving credit borrowings or otherwise invest such Net Proceeds in any manner that is not prohibited by the Indenture.

S-22

Table of Contents

Any Net Proceeds from Asset Sales that are not applied or invested as provided in the second paragraph of this covenant will constitute Excess Proceeds. When the aggregate amount of Excess Proceeds exceeds $50.0 million, within ten days thereof MarkWest Energy Partners will make a pro rata offer (an "Asset Sale Offer") to all holders of notes and all holders of other Indebtedness that is pari passu with the notes containing provisions similar to those set forth in the Indenture with respect to offers to purchase or redeem with the proceeds of sales of assets to purchase or redeem the maximum principal amount of notes and such other pari passu Indebtedness that may be purchased or redeemed out of the Excess Proceeds. The offer price in any Asset Sale Offer will be equal to 100% of principal amount plus accrued and unpaid interest, if any, to the date of purchase, subject to the rights of any holder in whose name a note is registered on a record date occurring prior to the payment date to receive interest due on an interest payment date that is on or prior to such payment date, and will be payable in cash. If any Excess Proceeds remain after consummation of an Asset Sale Offer, MarkWest Energy Partners and its Restricted Subsidiaries may use such Excess Proceeds for any purpose not otherwise prohibited by the Indenture, including, without limitation, the repurchase or redemption of Indebtedness of the Issuers or any Subsidiary Guarantor that is subordinated to the notes or, in the case of any Subsidiary Guarantor, the Guarantee of such Subsidiary Guarantor. If the aggregate principal amount of notes tendered into such Asset Sale Offer exceeds the amount of Excess Proceeds allocated for repurchases of notes pursuant to the Asset Sale Offer for notes, the Trustee shall select the notes to be purchased on a pro rata basis (or, in the case of notes in global form, the Trustee will select notes for redemption based on DTC's method that most nearly approximates a pro rata selection). Upon completion of each Asset Sale Offer, the amount of Excess Proceeds shall be reset at zero.

MarkWest Energy Partners will comply with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws and regulations thereunder to the extent those laws and regulations are applicable in connection with each repurchase of notes pursuant to an Asset Sale Offer. To the extent that the provisions of any securities laws or regulations conflict with the Asset Sale provisions of the Indenture, MarkWest Energy Partners will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations under the Asset Sale provisions of the Indenture by virtue of such compliance.

Covenants

Restricted Payments

MarkWest Energy Partners will not, and will not permit any of its Restricted Subsidiaries to, directly or indirectly: