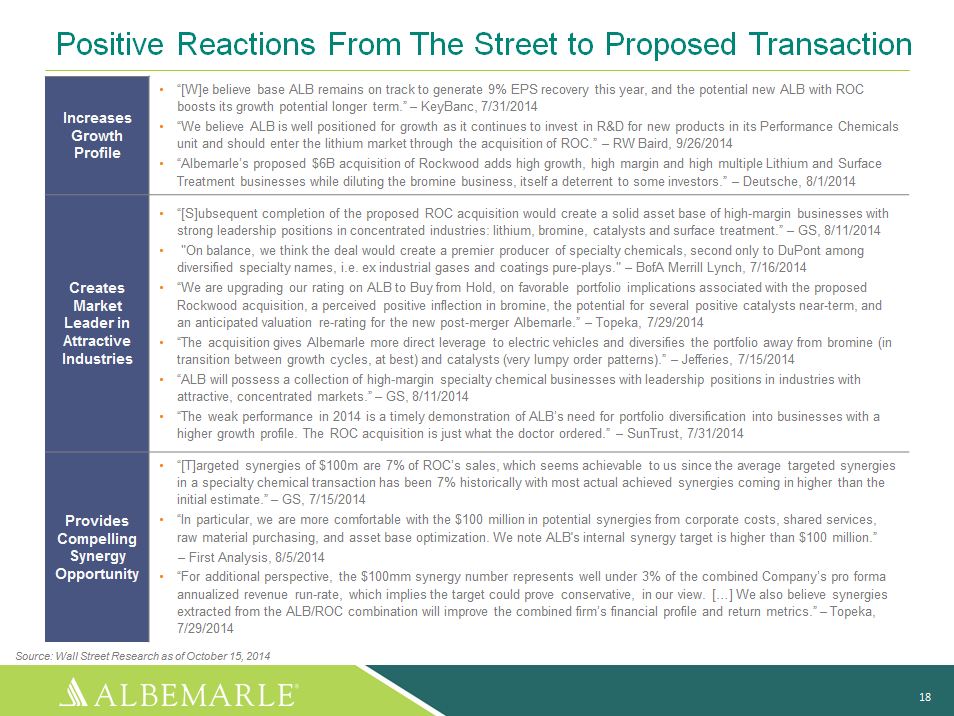

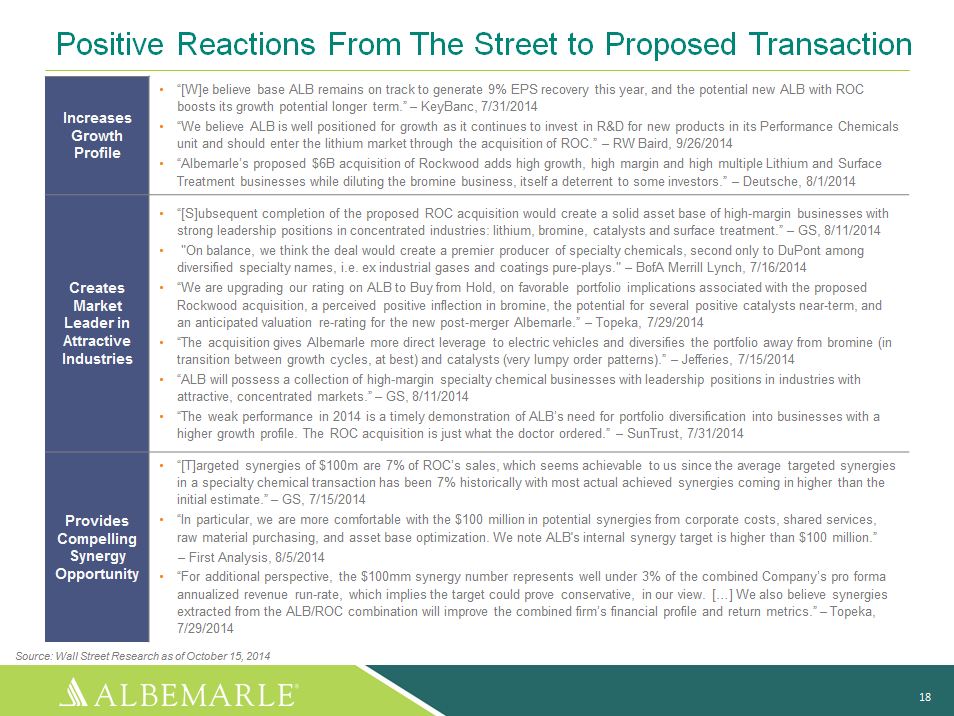

Positive Reactions From The Street to Proposed Transaction

Increases Growth Profile

"[W]e believe base ALB remains on track to generate 9% EPS

recovery this year, and the potential new ALB with ROC

boosts its growth potential longer term." - KeyBanc,

7/31/2014

"We believe ALB is well positioned for growth as it

continues to invest in R and D for new products in its

Performance Chemicals unit and should enter the lithium

market through the acquisition of ROC." - RW Baird,

9/26/2014

"Albemarle's proposed $6B acquisition of Rockwood adds high

growth, high margin and high multiple Lithium and Surface

Treatment businesses while diluting the bromine business,

itself a deterrent to some investors." - Deutsche, 8/1/2014

Creates Market Leader in Attractive Industries

"[S]ubsequent completion of the proposed ROC acquisition

would create a solid asset base of high-margin businesses

with strong leadership positions in concentrated industries:

lithium, bromine, catalysts and surface treatment." - GS,

8/11/2014

"On balance, we think the deal would create a premier

producer of specialty chemicals, second only to DuPont among

diversified specialty names, i.e. ex industrial gases and

coatings pure-plays." - BofA Merrill Lynch, 7/16/2014

"We are upgrading our rating on ALB to Buy from Hold, on

favorable portfolio implications associated with the

proposed Rockwood acquisition, a perceived positive

inflection in bromine, the potential for several positive

catalysts near-term, and an anticipated valuation re-rating

for the new post-merger Albemarle." - Topeka, 7/29/2014

"The acquisition gives Albemarle more direct leverage to

electric vehicles and diversifies the portfolio away from

bromine (in transition between growth cycles, at best) and

catalysts (very lumpy order patterns)." - Jefferies,

7/15/2014

"ALB will possess a collection of high-margin specialty

chemical businesses with leadership positions in industries

with attractive, concentrated markets." - GS, 8/11/2014

"The weak performance in 2014 is a timely demonstration of

ALB's need for portfolio diversification into businesses

with a higher growth profile. The ROC acquisition is just

what the doctor ordered." - SunTrust, 7/31/2014

Provides Compelling Synergy Opportunity

"[T]argeted synergies of $100m are 7% of ROC's sales, which

seems achievable to us since the average targeted synergies

in a specialty chemical transaction has been 7% historically

with most actual achieved synergies coming in higher than

the initial estimate." - GS, 7/15/2014

"In particular, we are more comfortable with the $100

million in potential synergies from corporate costs, shared

services, raw material purchasing, and asset base

optimization. We note ALB's internal synergy target is

higher than $100 million." - First Analysis, 8/5/2014

"For additional perspective, the $100mm synergy number

represents well under 3% of the combined Company's pro forma

annualized revenue run-rate, which implies the target could

prove conservative, in our view. [ ... ] We also believe

synergies extracted from the ALB/ROC combination will

improve the combined firm's financial profile and return

metrics." - Topeka, 7/29/2014

Source: Wall Street Research as of October 15, 2014

Albemarle 18

|  |