Searchable text section of graphics shown above

First Quarter Results

[LOGO]

May 15th, 2006

Forward Looking Statements

• This conference call may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 concerning the business, operations and financial condition of Rockwood Holdings, Inc. and its subsidiaries (“Rockwood”). Although Rockwood believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. “Forward-looking statements” consist of all non-historical information, including the statements referring to the prospects and future performance of Rockwood or the four businesses of Dynamit Nobel that Rockwood has acquired. Actual results could differ materially from those projected in Rockwood’s forward-looking statements due to numerous known and unknown risks and uncertainties, including, among other things, the “Risk Factors” described in its Form 10-K on file with the Securities and Exchange Commission. Rockwood does not undertake any obligation to publicly update any forward-looking statement to reflect events or circumstances after the date on which any such statement is made or to reflect the occurrence of unanticipated events.

2

Where to Find Materials/Archives

• A replay of the conference call will be available through May 22, 2006 at (800) 475-6701 in the U.S., access code: 827497, and internationally at (320) 365-3844, access code: 827497. The webcastand the materials will also be archived on our website at www.rocksp.com or www.rockwoodspecialties.com and are accessible by clicking on “Company News.”

3

Agenda

• Yr 2006 First Quarter Highlights

• Yr 2006 First Quarter Results

• Financial Summary

Appendices

4

Yr 2006 First Quarter Highlights

5

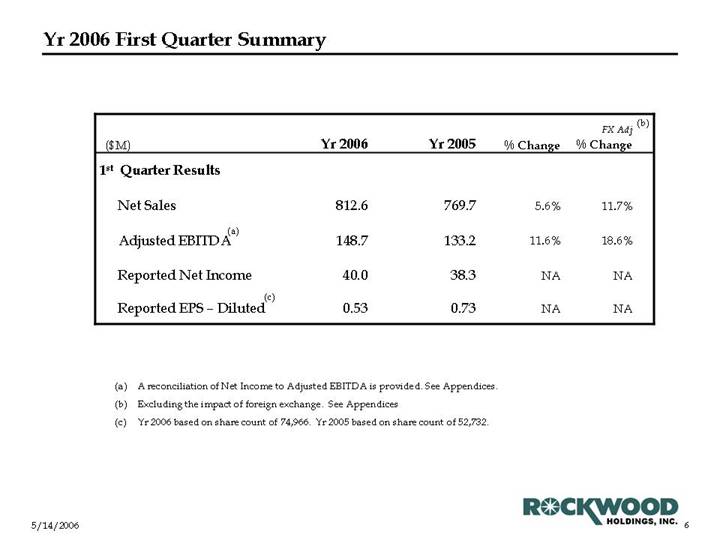

Yr 2006 First Quarter Summary

| | | | | | | | FX Adj (b) | |

($M) | | Yr 2006 | | Yr 2005 | | % Change | | % Change | |

| | | | | | | | | |

1st Quarter Results | | | | | | | | | |

| | | | | | | | | |

Net Sales | | 812.6 | | 769.7 | | 5.6 | % | 11.7 | % |

| | | | | | | | | |

Adjusted EBITDA(a) | | 148.7 | | 133.2 | | 11.6 | % | 18.6 | % |

| | | | | | | | | |

Reported Net Income | | 40.0 | | 38.3 | | NA | | NA | |

| | | | | | | | | |

Reported EPS – Diluted(c) | | 0.53 | | 0.73 | | NA | | NA | |

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices

(c) Yr 2006 based on share count of 74,966. Yr 2005 based on share count of 52,732.

6

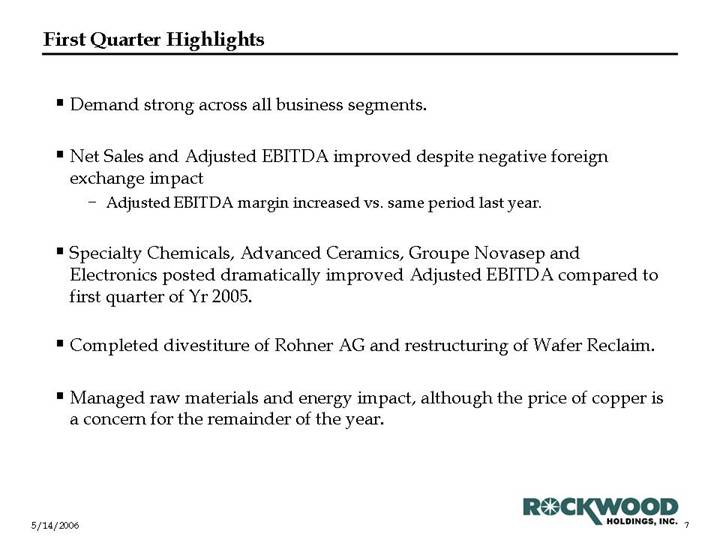

First Quarter Highlights

• Demand strong across all business segments.

• Net Sales and Adjusted EBITDA improved despite negative foreign exchange impact

• Adjusted EBITDA margin increased vs. same period last year.

• Specialty Chemicals, Advanced Ceramics, Groupe Novasep and Electronics posted dramatically improved Adjusted EBITDA compared to first quarter of Yr 2005.

• Completed divestiture of Rohner AG and restructuring of Wafer Reclaim.

• Managed raw materials and energy impact, although the price of copper is a concern for the remainder of the year.

7

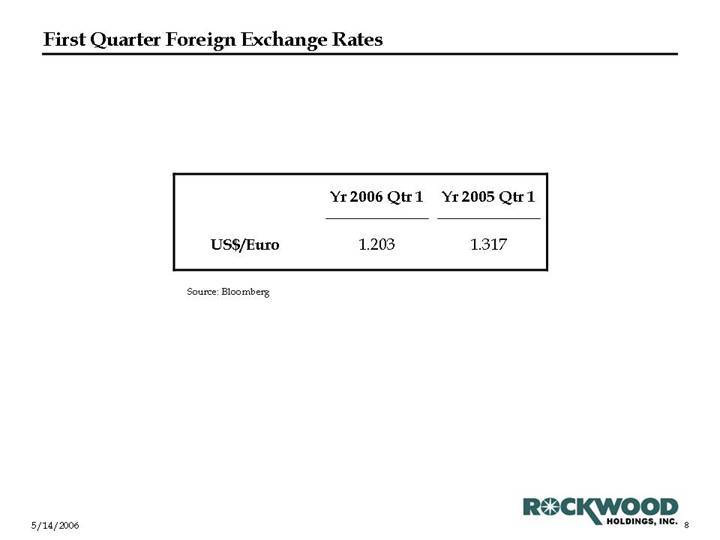

First Quarter Foreign Exchange Rates

| | Yr 2006 Qtr 1 | | Yr 2005 Qtr 1 | |

| | | | | |

US$/Euro | | 1.203 | | 1.317 | |

Source: Bloomberg

8

Rockwood Yr 2006 First Quarter Results

9

Consolidated Results

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 812.6 | | $ | 769.7 | | 5.6 | % | 11.7 | % | $ | 148.7 | | $ | 133.2 | | 11.6 | % | 18.6 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 18.3 | % | 17.3 | % | 1 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

10

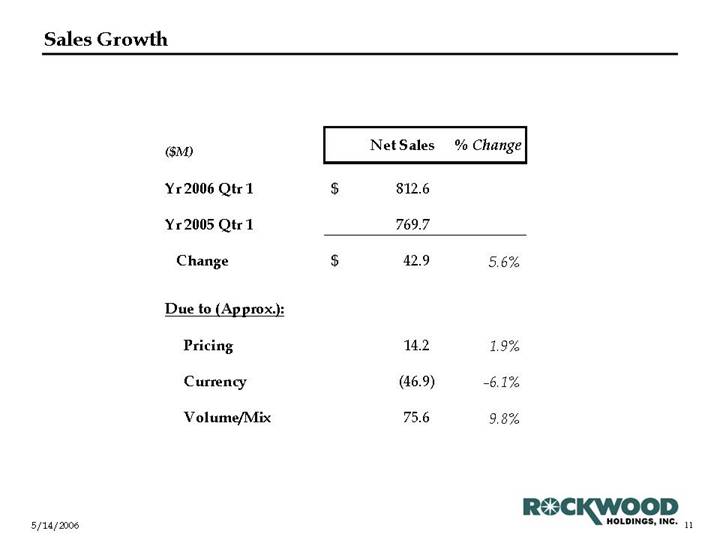

Sales Growth

($M) | | Net Sales | | % Change | |

| | | | | |

Yr 2006 Qtr 1 | | $ | 812.6 | | | |

| | | | | |

Yr 2005 Qtr 1 | | 769.7 | | | |

| | | | | |

Change | | $ | 42.9 | | 5.6 | % |

| | | | | |

Due to (Approx.): | | | | | |

| | | | | |

Pricing | | 14.2 | | 1.9 | % |

| | | | | |

Currency | | (46.9 | ) | -6.1 | % |

| | | | | |

Volume/Mix | | 75.6 | | 9.8 | % |

11

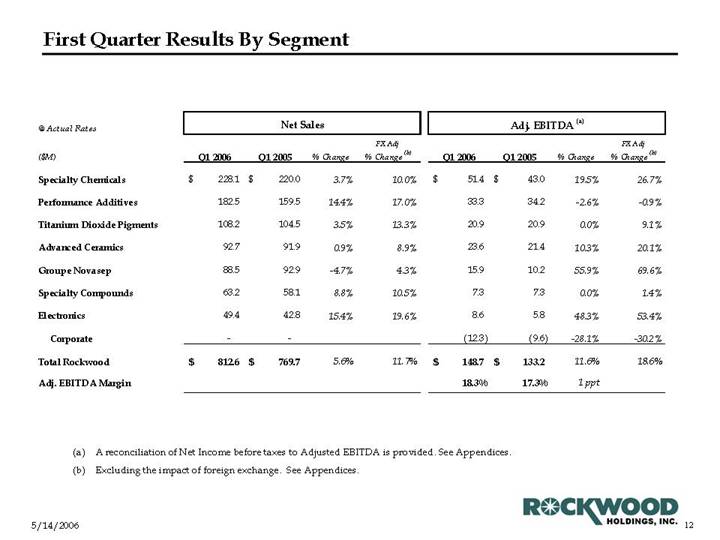

First Quarter Results By Segment

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($M) | | Q1 2006 | | Q1 2005 | | % Change | | % Change (b) | | Q1 2006 | | Q1 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

Specialty Chemicals | | $ | 228.1 | | $ | 220.0 | | 3.7 | % | 10.0 | % | $ | 51.4 | | $ | 43.0 | | 19.5 | % | 26.7 | % |

| | | | | | | | | | | | | | | | | |

Performance Additives | | 182.5 | | 159.5 | | 14.4 | % | 17.0 | % | 33.3 | | 34.2 | | -2.6 | % | -0.9 | % |

| | | | | | | | | | | | | | | | | |

Titanium Dioxide Pigments | | 108.2 | | 104.5 | | 3.5 | % | 13.3 | % | 20.9 | | 20.9 | | 0.0 | % | 9.1 | % |

| | | | | | | | | | | | | | | | | |

Advanced Ceramics | | 92.7 | | 91.9 | | 0.9 | % | 8.9 | % | 23.6 | | 21.4 | | 10.3 | % | 20.1 | % |

| | | | | | | | | | | | | | | | | |

Groupe Novasep | | 88.5 | | 92.9 | | -4.7 | % | 4.3 | % | 15.9 | | 10.2 | | 55.9 | % | 69.6 | % |

| | | | | | | | | | | | | | | | | |

Specialty Compounds | | 63.2 | | 58.1 | | 8.8 | % | 10.5 | % | 7.3 | | 7.3 | | 0.0 | % | 1.4 | % |

| | | | | | | | | | | | | | | | | |

Electronics | | 49.4 | | 42.8 | | 15.4 | % | 19.6 | % | 8.6 | | 5.8 | | 48.3 | % | 53.4 | % |

| | | | | | | | | | | | | | | | | |

Corporate | | — | | — | | | | | | (12.3 | ) | (9.6 | ) | -28.1 | % | -30.2 | % |

| | | | | | | | | | | | | | | | | |

Total Rockwood | | $ | 812.6 | | $ | 769.7 | | 5.6 | % | 11.7 | % | $ | 148.7 | | $ | 133.2 | | 11.6 | % | 18.6 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 18.3 | % | 17.3 | % | 1 | ppt | | |

(a) A reconciliation of Net Income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

12

Yr 2006 Qtr 1 Raw Materials and Energy Summary

• Rockwood has not been significantly impacted by increases in raw material and energy costs in the first quarter of Yr 2006

Raw Materials -

• Although higher raw material costs have negatively impacted all businesses except for Fine Chemicals and Electronics, much of the negative impact have been recovered through higher selling prices.

• The exception is Timber where higher copper and MEA prices have not yet been passed on to customers.

Energy -

• Higher energy has impacted all businesses. However, since it represents only 3.3% of our net sales (FY 2005), it has not dramatically impacted our bottom line.

13

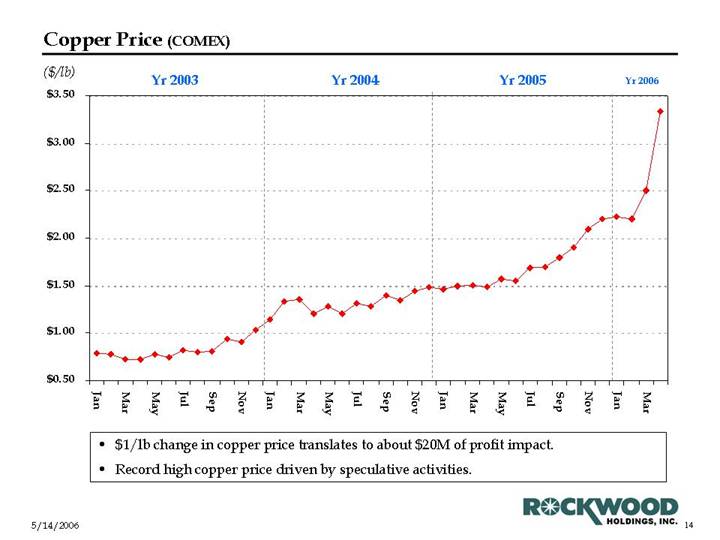

Copper Price (COMEX)

[CHART]

• $1/lb change in copper price translates to about $20M of profit impact.

• Record high copper price driven by speculative activities.

14

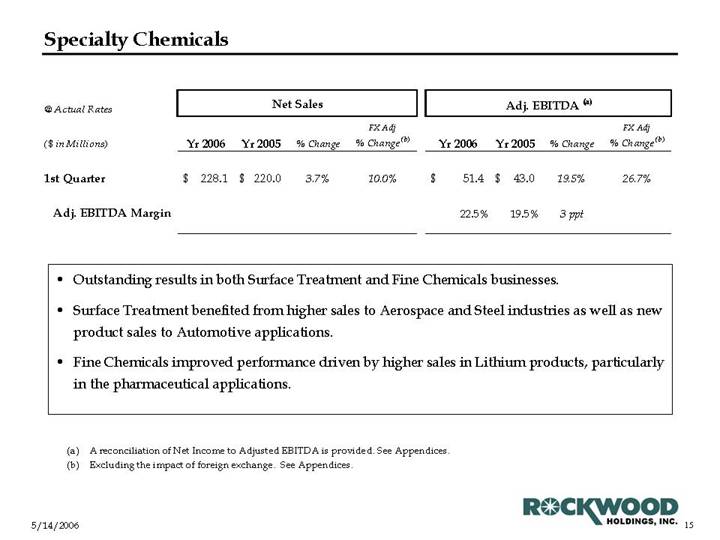

Specialty Chemicals

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 228.1 | | $ | 220.0 | | 3.7 | % | 10.0 | % | $ | 51.4 | | $ | 43.0 | | 19.5 | % | 26.7 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 22.5 | % | 19.5 | % | 3 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Outstanding results in both Surface Treatment and Fine Chemicals businesses.

• Surface Treatment benefited from higher sales to Aerospace and Steel industries as well as new product sales to Automotive applications.

• Fine Chemicals improved performance driven by higher sales in Lithium products, particularly in the pharmaceutical applications.

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

15

Performance Additives

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 182.5 | | $ | 159.5 | | 14.4 | % | 17.0 | % | $ | 33.3 | | $ | 34.2 | | -2.6 | % | -0.9 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 18.2 | % | 21.4 | % | -3.2 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Positive results in Clay-based Additives, Water and Color Pigments driven by strong volume and higher selling prices to help offset higher raw materials and energy costs.

• Clay-based Additives benefited from higher sales to Oilfields and Sud-Chemie acquisition.

• Color Pigments has experienced increased demand from construction industry in both US and Europe.

• Timber has been adversely impacted by higher copper and MEA prices which contributed to the segment’s lowered Adjusted EBITDA and margin.

(a) A reconciliation of net income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

16

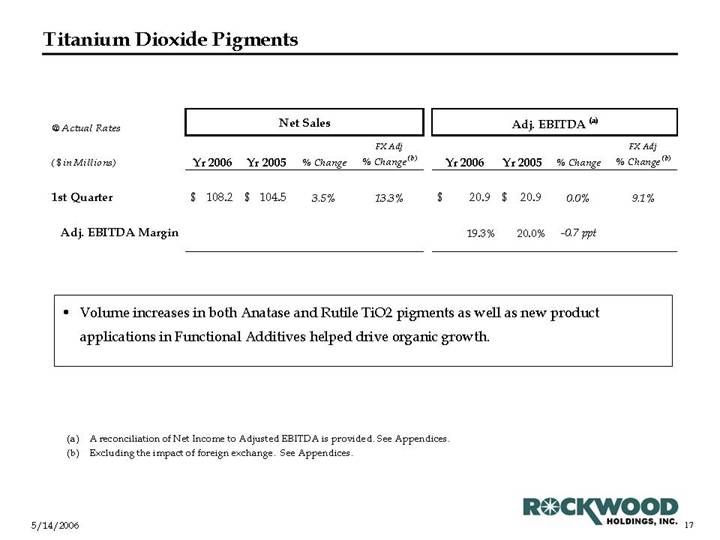

Titanium Dioxide Pigments

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 108.2 | | $ | 104.5 | | 3.5 | % | 13.3 | % | $ | 20.9 | | $ | 20.9 | | 0.0 | % | 9.1 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 19.3 | % | 20.0 | % | -0.7 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Volume increases in both Anatase and Rutile TiO2 pigments as well as new product applications in Functional Additives helped drive organic growth.

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

17

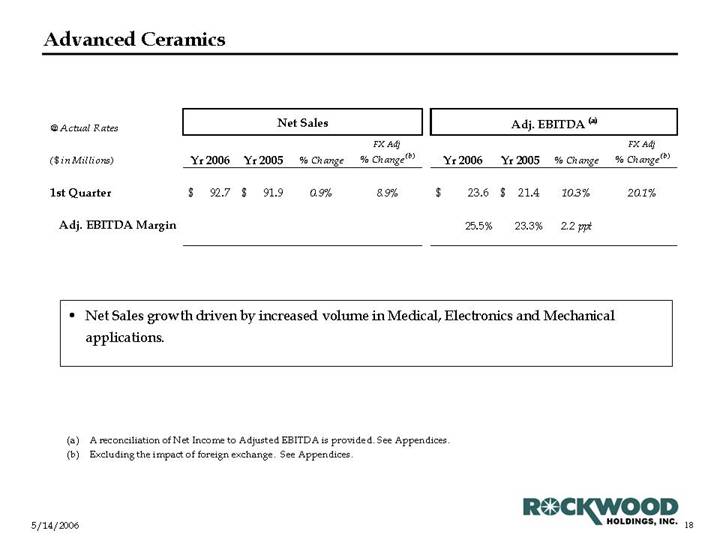

Advanced Ceramics

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 92.7 | | $ | 91.9 | | 0.9 | % | 8.9 | % | $ | 23.6 | | $ | 21.4 | | 10.3 | % | 20.1 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 25.5 | % | 23.3 | % | 2.2 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Net Sales growth driven by increased volume in Medical, Electronics and Mechanical applications.

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

18

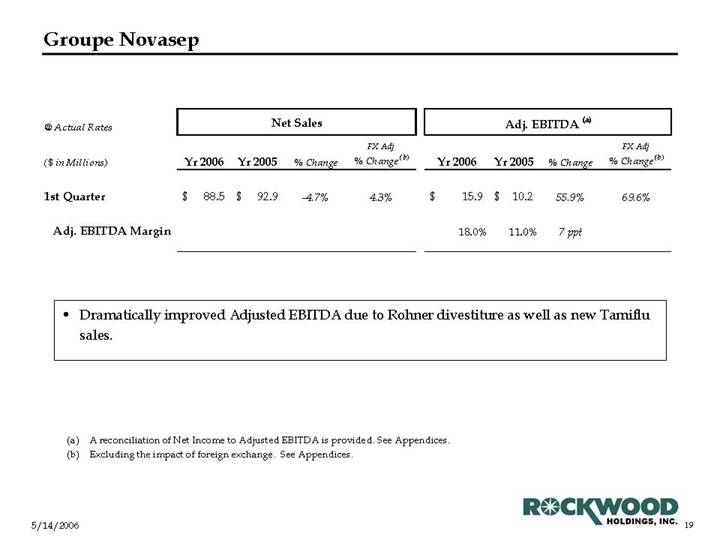

Groupe Novasep

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 88.5 | | $ | 92.9 | | -4.7 | % | 4.3 | % | $ | 15.9 | | $ | 10.2 | | 55.9 | % | 69.6 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 18.0 | % | 11.0 | % | 7 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Dramatically improved Adjusted EBITDA due to Rohner divestiture as well as new Tamiflu sales.

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

19

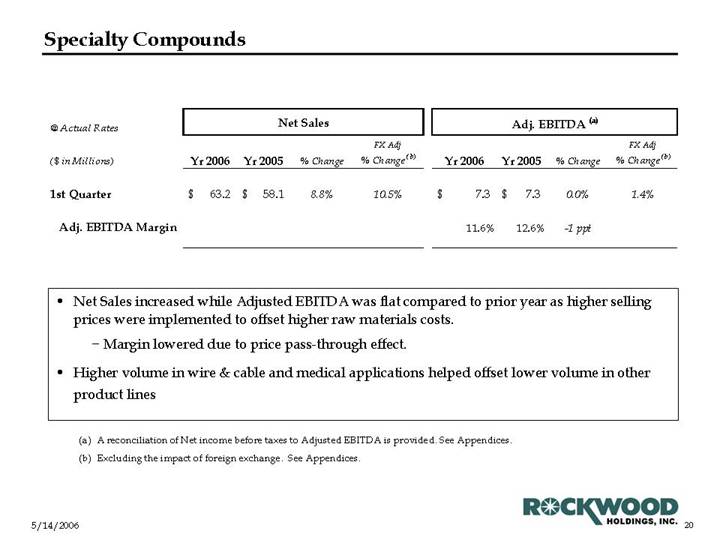

Specialty Compounds

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 63.2 | | $ | 58.1 | | 8.8 | % | 10.5 | % | $ | 7.3 | | $ | 7.3 | | 0.0 | % | 1.4 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 11.6 | % | 12.6 | % | -1 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Net Sales increased while Adjusted EBITDA was flat compared to prior year as higher selling prices were implemented to offset higher raw materials costs.

• Margin lowered due to price pass-through effect.

• Higher volume in wire & cable and medical applications helped offset lower volume in other product lines

(a) A reconciliation of Net income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

20

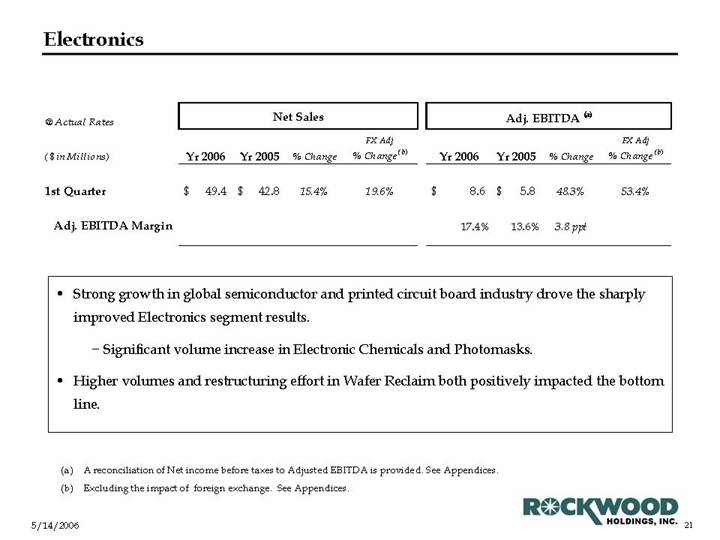

Electronics

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($ in Millions) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | | Yr 2006 | | Yr 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

1st Quarter | | $ | 49.4 | | $ | 42.8 | | 15.4 | % | 19.6 | % | $ | 8.6 | | $ | 5.8 | | 48.3 | % | 53.4 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 17.4 | % | 13.6 | % | 3.8 | ppt | | |

| | | | | | | | | | | | | | | | | | | | | |

• Strong growth in global semiconductor and printed circuit board industry drove the sharply improved Electronics segment results.

• Significant volume increase in Electronic Chemicals and Photomasks.

• Higher volumes and restructuring effort in Wafer Reclaim both positively impacted the bottom line.

(a) A reconciliation of Net income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

21

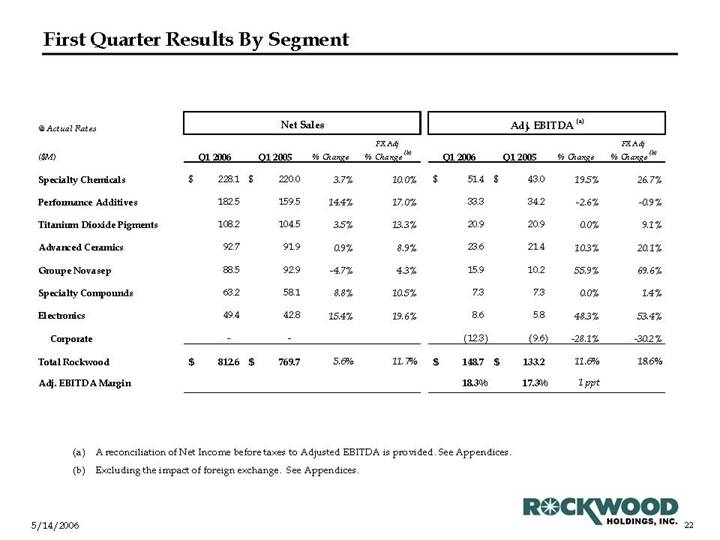

First Quarter Results By Segment

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($M) | | Q1 2006 | | Q1 2005 | | % Change | | % Change (b) | | Q1 2006 | | Q1 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

Specialty Chemicals | | $ | 228.1 | | $ | 220.0 | | 3.7 | % | 10.0 | % | $ | 51.4 | | $ | 43.0 | | 19.5 | % | 26.7 | % |

| | | | | | | | | | | | | | | | | |

Performance Additives | | 182.5 | | 159.5 | | 14.4 | % | 17.0 | % | 33.3 | | 34.2 | | -2.6 | % | -0.9 | % |

| | | | | | | | | | | | | | | | | |

Titanium Dioxide Pigments | | 108.2 | | 104.5 | | 3.5 | % | 13.3 | % | 20.9 | | 20.9 | | 0.0 | % | 9.1 | % |

| | | | | | | | | | | | | | | | | |

Advanced Ceramics | | 92.7 | | 91.9 | | 0.9 | % | 8.9 | % | 23.6 | | 21.4 | | 10.3 | % | 20.1 | % |

| | | | | | | | | | | | | | | | | |

Groupe Novasep | | 88.5 | | 92.9 | | -4.7 | % | 4.3 | % | 15.9 | | 10.2 | | 55.9 | % | 69.6 | % |

| | | | | | | | | | | | | | | | | |

Specialty Compounds | | 63.2 | | 58.1 | | 8.8 | % | 10.5 | % | 7.3 | | 7.3 | | 0.0 | % | 1.4 | % |

| | | | | | | | | | | | | | | | | |

Electronics | | 49.4 | | 42.8 | | 15.4 | % | 19.6 | % | 8.6 | | 5.8 | | 48.3 | % | 53.4 | % |

| | | | | | | | | | | | | | | | | |

Corporate | | — | | — | | | | | | (12.3 | ) | (9.6 | ) | -28.1 | % | -30.2 | % |

| | | | | | | | | | | | | | | | | |

Total Rockwood | | $ | 812.6 | | $ | 769.7 | | 5.6 | % | 11.7 | % | $ | 148.7 | | $ | 133.2 | | 11.6 | % | 18.6 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 18.3 | % | 17.3 | % | 1 | ppt | | |

(a) A reconciliation of Net Income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

22

Financial Summary

| | | | | | | | FX Adj (b) | |

($M) | | Yr 2006 | | Yr 2005 | | % Change | | % Change | |

| | | | | | | | | |

1st Quarter Results | | | | | | | | | |

| | | | | | | | | |

Net Sales | | 812.6 | | 769.7 | | 5.6 | % | 11.7 | % |

| | | | | | | | | |

Adjusted EBITDA(a) | | 148.7 | | 133.2 | | 11.6 | % | 18.6 | % |

| | | | | | | | | |

Reported Net Income | | 40.0 | | 38.3 | | NA | | NA | |

| | | | | | | | | |

Reported EPS – Diluted(c) | | 0.53 | | 0.73 | | NA | | NA | |

(a) A reconciliation of Net Income to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices

(c) Yr 2006 based on share count of 74,966. Yr 2005 based on share count of 52,732.

24

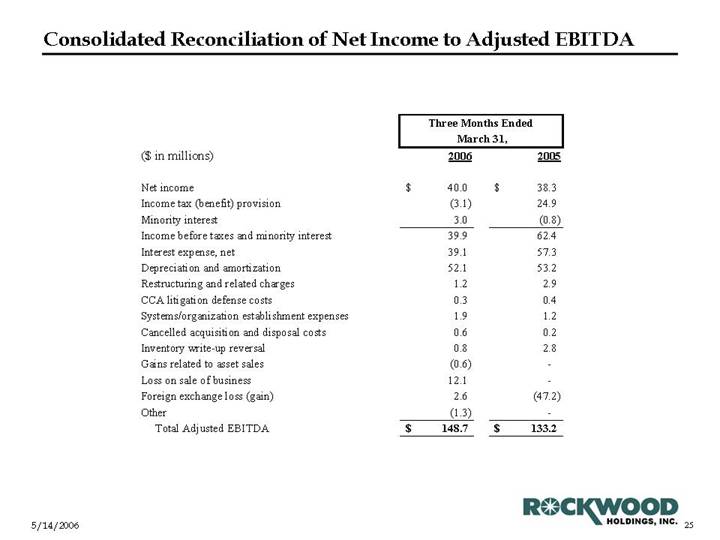

Consolidated Reconciliation of Net Income to Adjusted EBITDA

| | Three Months Ended | |

| | March 31, | |

($ in millions) | | 2006 | | 2005 | |

| | | | | |

Net income | | $ | 40.0 | | $ | 38.3 | |

Income tax (benefit) provision | | (3.1 | ) | 24.9 | |

Minority interest | | 3.0 | | (0.8 | ) |

Income before taxes and minority interest | | 39.9 | | 62.4 | |

Interest expense, net | | 39.1 | | 57.3 | |

Depreciation and amortization | | 52.1 | | 53.2 | |

Restructuring and related charges | | 1.2 | | 2.9 | |

CCA litigation defense costs | | 0.3 | | 0.4 | |

Systems/organization establishment expenses | | 1.9 | | 1.2 | |

Cancelled acquisition and disposal costs | | 0.6 | | 0.2 | |

Inventory write-up reversal | | 0.8 | | 2.8 | |

Gains related to asset sales | | (0.6 | ) | — | |

Loss on sale of business | | 12.1 | | — | |

Foreign exchange loss (gain) | | 2.6 | | (47.2 | ) |

Other | | (1.3 | ) | — | |

Total Adjusted EBITDA | | $ | 148.7 | | $ | 133.2 | |

25

First Quarter Results By Segment

@ Actual Rates | | Net Sales | | Adj. EBITDA (a) | |

| | | | | | | | FX Adj | | | | | | | | FX Adj | |

($M) | | Q1 2006 | | Q1 2005 | | % Change | | % Change (b) | | Q1 2006 | | Q1 2005 | | % Change | | % Change (b) | |

| | | | | | | | | | | | | | | | | |

Specialty Chemicals | | $ | 228.1 | | $ | 220.0 | | 3.7 | % | 10.0 | % | $ | 51.4 | | $ | 43.0 | | 19.5 | % | 26.7 | % |

| | | | | | | | | | | | | | | | | |

Performance Additives | | 182.5 | | 159.5 | | 14.4 | % | 17.0 | % | 33.3 | | 34.2 | | -2.6 | % | -0.9 | % |

| | | | | | | | | | | | | | | | | |

Titanium Dioxide Pigments | | 108.2 | | 104.5 | | 3.5 | % | 13.3 | % | 20.9 | | 20.9 | | 0.0 | % | 9.1 | % |

| | | | | | | | | | | | | | | | | |

Advanced Ceramics | | 92.7 | | 91.9 | | 0.9 | % | 8.9 | % | 23.6 | | 21.4 | | 10.3 | % | 20.1 | % |

| | | | | | | | | | | | | | | | | |

Groupe Novasep | | 88.5 | | 92.9 | | -4.7 | % | 4.3 | % | 15.9 | | 10.2 | | 55.9 | % | 69.6 | % |

| | | | | | | | | | | | | | | | | |

Specialty Compounds | | 63.2 | | 58.1 | | 8.8 | % | 10.5 | % | 7.3 | | 7.3 | | 0.0 | % | 1.4 | % |

| | | | | | | | | | | | | | | | | |

Electronics | | 49.4 | | 42.8 | | 15.4 | % | 19.6 | % | 8.6 | | 5.8 | | 48.3 | % | 53.4 | % |

| | | | | | | | | | | | | | | | | |

Corporate | | — | | — | | | | | | (12.3 | ) | (9.6 | ) | -28.1 | % | -30.2 | % |

| | | | | | | | | | | | | | | | | |

Total Rockwood | | $ | 812.6 | | $ | 769.7 | | 5.6 | % | 11.7 | % | $ | 148.7 | | $ | 133.2 | | 11.6 | % | 18.6 | % |

| | | | | | | | | | | | | | | | | |

Adj. EBITDA Margin | | | | | | | | | | 18.3 | % | 17.3 | % | 1 | ppt | | |

(a) A reconciliation of Net Income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Excluding the impact of foreign exchange. See Appendices.

26

Net Sales and Adjusted EBITDA by Segment

| | | | | | | | | | Titanium | | | | | | | | | |

| | Performance | | Specialty | | | | Specialty | | Dioxide | | Advanced | | Groupe | | | | | |

($ in millions) | | Additives | | Compounds | | Electronics | | Chemicals | | Pigments | | Ceramics | | Novasep | | Corporate | | Consolidated | |

Three months ended March 31, 2006 | | | | | | | | | | | | | | | | | | | |

Net Sales | | $ | 182.5 | | $ | 63.2 | | $ | 49.4 | | $ | 228.1 | | $ | 108.2 | | $ | 92.7 | | $ | 88.5 | | $ | — | | $ | 812.6 | |

Adjusted EBITDA(a) | | 33.3 | | 7.3 | | 8.6 | | 51.4 | | 20.9 | | 23.6 | | 15.9 | | (12.3 | ) | 148.7 | |

| | | | | | | | | | | | | | | | | | | |

Three months ended March 31, 2005 | | | | | | | | | | | | | | | | | | | |

Net Sales | | $ | 159.5 | | $ | 58.1 | | $ | 42.8 | | $ | 220.0 | | $ | 104.5 | | $ | 91.9 | | $ | 92.9 | | $ | — | | $ | 769.7 | |

Adjusted EBITDA(a) | | 34.2 | | 7.3 | | 5.8 | | 43.0 | | 20.9 | | 21.4 | | 10.2 | | (9.6 | ) | 133.2 | |

(a) A reconciliation of Net Income before taxes to Adjusted EBITDA is provided. See Appendices.

27

Earnings Per Share

| | Yr 2006 Qtr 1 | |

($M) | | Net Income | | EPS (6) | |

| | | | | |

Reported Net Income | | 40.0 | | 0.53 | |

| | | | | |

Non-Recurring Items | | | | | |

| | | | | |

(Gain)/Loss on Rohner Divestiture(1) | | (7.6 | ) | (0.10 | ) |

| | | | | |

(Gain)/Loss on MTM of Interest Swaps(2) | | (6.7 | ) | (0.09 | ) |

| | | | | |

FX (Gain)/Loss on Euro Debt(3) | | 1.9 | | 0.02 | |

| | | | | |

Restructuring Costs(4) | | 0.8 | | 0.01 | |

| | | | | |

Other Miscellaneous One- Time Charges(5) | | 1.1 | | 0.01 | |

(1) P&L Impact due to the Sale of Rohner.

(2) P&L impact due to the market-to-market valuation of the interest swaps

(3) Results from the impact of the euro/GBP change on our euro-denominated debt.

(4) Costs associated primarily with Wafer Reclaim restructuring

(5) Includes systems and organization establishment cost, acquisition & divestiture cost, CCA litigation cost, and gain on disposal of assets.

(6) Based on 74,966 diluted shares based on the Treasury Stock Method.

28

Interest Expense

($M) | | Qtr 1 2006 | |

| | | |

MTM of Swaps (non-cash) | | (10.9 | ) |

| | | |

Deferred Financing Cost (non-cash) | | 2.3 | |

| | | |

Cash Interest on Existing Debt | | 47.7 | |

| | | |

Total Rockwood Reported Interest | | 39.1 | |

29

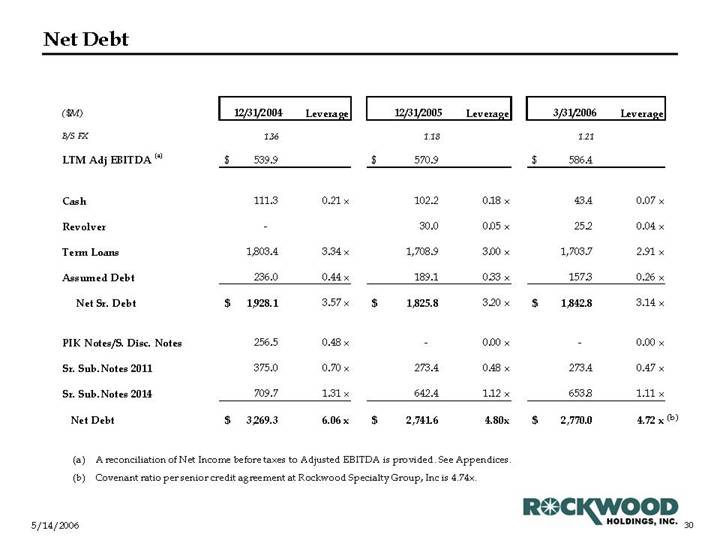

Net Debt

($M) | | 12/31/2004 | | Leverage | | 12/31/2005 | | Leverage | | 3/31/2006 | | Leverage | |

| | | | | | | | | | | | | |

B/S FX | | 1.36 | | | | 1.18 | | | | 1.21 | | | |

| | | | | | | | | | | | | |

LTM Adj EBITDA (a) | | $ | 539.9 | | | | $ | 570.9 | | | | $ | 586.4 | | | |

| | | | | | | | | | | | | |

Cash | | 111.3 | | 0.21 | x | 102.2 | | 0.18 | x | 43.4 | | 0.07 | x |

| | | | | | | | | | | | | |

Revolver | | — | | | | 30.0 | | 0.05 | x | 25.2 | | 0.04 | x |

| | | | | | | | | | | | | |

Term Loans | | 1,803.4 | | 3.34 | x | 1,708.9 | | 3.00 | x | 1,703.7 | | 2.91 | x |

| | | | | | | | | | | | | |

Assumed Debt | | 236.0 | | 0.44 | x | 189.1 | | 0.33 | x | 157.3 | | 0.26 | x |

| | | | | | | | | | | | | |

Net Sr. Debt | | $ | 1,928.1 | | 3.57 | x | $ | 1,825.8 | | 3.20 | x | $ | 1,842.8 | | 3.14 | x |

| | | | | | | | | | | | | |

PIK Notes/S. Disc. Notes | | 256.5 | | 0.48 | x | — | | 0.00 | x | — | | 0.00 | x |

| | | | | | | | | | | | | |

Sr. Sub.Notes 2011 | | 375.0 | | 0.70 | x | 273.4 | | 0.48 | x | 273.4 | | 0.47 | x |

| | | | | | | | | | | | | |

Sr. Sub.Notes 2014 | | 709.7 | | 1.31 | x | 642.4 | | 1.12 | x | 653.8 | | 1.11 | x |

| | | | | | | | | | | | | |

Net Debt | | $ | 3,269.3 | | 6.06 | x | $ | 2,741.6 | | 4.80 | x | $ | 2,770.0 | | 4.72 | x(b) |

(a) A reconciliation of Net Income before taxes to Adjusted EBITDA is provided. See Appendices.

(b) Covenant ratio per senior credit agreement at Rockwood Specialty Group, Inc is 4.74x.

30

Total Net Debt / LTM Adjusted EBITDA

[CHART]

31

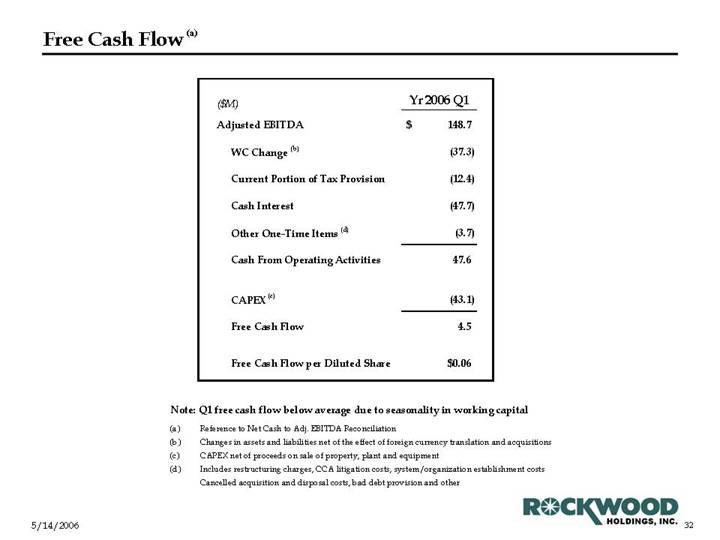

Free Cash Flow (a)

($M) | | Yr 2006 Q1 | |

| | | |

Adjusted EBITDA | | $ | 148.7 | |

| | | |

WC Change (b) | | (37.3 | ) |

| | | |

Current Portion of Tax Provision | | (12.4 | ) |

| | | |

Cash Interest | | (47.7 | ) |

| | | |

Other One-Time Items (d) | | (3.7 | ) |

| | | |

Cash From Operating Activities | | 47.6 | |

| | | |

CAPEX (c) | | (43.1 | ) |

| | | |

Free Cash Flow | | 4.5 | |

| | | |

Free Cash Flow per Diluted Share | | $ | 0.06 | |

Note: Q1 free cash flow below average due to seasonality in working capital

(a) Reference to Net Cash to Adj. EBITDA Reconciliation

(b) Changes in assets and liabilities net of the effect of foreign currency translation and acquisitions

(c) CAPEX net of proceeds on sale of property, plant and equipment

(d) Includes restructuring charges, CCA litigation costs, system/organization establishment costs Cancelled acquisition and disposal costs, bad debt provision and other

32

Consolidated Reconciliation of Net Income to Adjusted EBITDA

| | Three Months Ended | |

| | March 31, | |

($ in millions) | | 2006 | | 2005 | |

| | | | | |

Net income | | $ | 40.0 | | $ | 38.3 | |

Income tax (benefit) provision | | (3.1 | ) | 24.9 | |

Minority interest | | 3.0 | | (0.8 | ) |

Income before taxes and minority interest | | 39.9 | | 62.4 | |

Interest expense, net | | 39.1 | | 57.3 | |

Depreciation and amortization | | 52.1 | | 53.2 | |

Restructuring and related charges | | 1.2 | | 2.9 | |

CCA litigation defense costs | | 0.3 | | 0.4 | |

Systems/organization establishment expenses | | 1.9 | | 1.2 | |

Cancelled acquisition and disposal costs | | 0.6 | | 0.2 | |

Inventory write-up reversal | | 0.8 | | 2.8 | |

Gains related to asset sales | | (0.6 | ) | — | |

Loss on sale of business | | 12.1 | | — | |

Foreign exchange loss (gain) | | 2.6 | | (47.2 | ) |

Other | | (1.3 | ) | — | |

Total Adjusted EBITDA | | $ | 148.7 | | $ | 133.2 | |

34

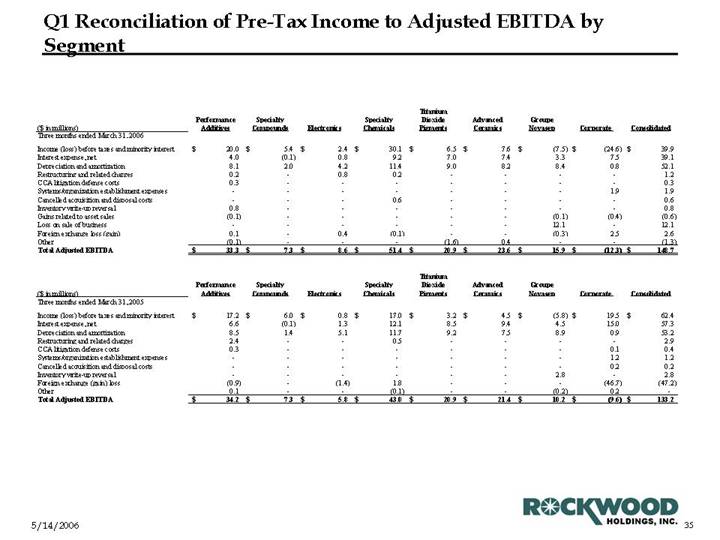

Q1 Reconciliation of Pre-Tax Income to Adjusted EBITDA by Segment

| | | | | | | | | | Titanium | | | | | | | | | |

| | Performance | | Specialty | | | | Specialty | | Dioxide | | Advanced | | Groupe | | | | | |

($ in millions) | | Additives | | Compounds | | Electronics | | Chemicals | | Pigments | | Ceramics | | Novasep | | Corporate | | Consolidated | |

Three months ended March 31, 2006 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) before taxes and minority interest | | $ | 20.0 | | $ | 5.4 | | $ | 2.4 | | $ | 30.1 | | $ | 6.5 | | $ | 7.6 | | $ | (7.5 | ) | $ | (24.6 | ) | $ | 39.9 | |

Interest expense, net | | 4.0 | | (0.1 | ) | 0.8 | | 9.2 | | 7.0 | | 7.4 | | 3.3 | | 7.5 | | 39.1 | |

Depreciation and amortization | | 8.1 | | 2.0 | | 4.2 | | 11.4 | | 9.0 | | 8.2 | | 8.4 | | 0.8 | | 52.1 | |

Restructuring and related charges | | 0.2 | | — | | 0.8 | | 0.2 | | — | | — | | — | | — | | 1.2 | |

CCA litigation defense costs | | 0.3 | | — | | — | | — | | — | | — | | — | | — | | 0.3 | |

Systems/organization establishment expenses | | — | | — | | — | | — | | — | | — | | — | | 1.9 | | 1.9 | |

Cancelled acquisition and disposal costs | | — | | — | | — | | 0.6 | | — | | — | | — | | — | | 0.6 | |

Inventory write-up reversal | | 0.8 | | — | | — | | — | | — | | — | | — | | — | | 0.8 | |

Gains related to asset sales | | (0.1 | ) | — | | — | | — | | — | | — | | (0.1 | ) | (0.4 | ) | (0.6 | ) |

Loss on sale of business | | — | | — | | — | | — | | — | | — | | 12.1 | | — | | 12.1 | |

Foreign exchange loss (gain) | | 0.1 | | — | | 0.4 | | (0.1 | ) | — | | — | | (0.3 | ) | 2.5 | | 2.6 | |

Other | | (0.1 | ) | — | | — | | — | | (1.6 | ) | 0.4 | | — | | — | | (1.3 | ) |

Total Adjusted EBITDA | | $ | 33.3 | | $ | 7.3 | | $ | 8.6 | | $ | 51.4 | | $ | 20.9 | | $ | 23.6 | | $ | 15.9 | | $ | (12.3 | ) | $ | 148.7 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Titanium | | | | | | | | | |

| | Performance | | Specialty | | | | Specialty | | Dioxide | | Advanced | | Groupe | | | | | |

($in millions) | | Additives | | Compounds | | Electronics | | Chemicals | | Pigments | | Ceramics | | Novasep | | Corporate | | Consolidated | |

Three months ended March 31, 2005 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) before taxes and minority interest | | $ | 17.2 | | $ | 6.0 | | $ | 0.8 | | $ | 17.0 | | $ | 3.2 | | $ | 4.5 | | $ | (5.8 | ) | $ | 19.5 | | $ | 62.4 | |

Interest expense, net | | 6.6 | | (0.1 | ) | 1.3 | | 12.1 | | 8.5 | | 9.4 | | 4.5 | | 15.0 | | 57.3 | |

Depreciation and amortization | | 8.5 | | 1.4 | | 5.1 | | 11.7 | | 9.2 | | 7.5 | | 8.9 | | 0.9 | | 53.2 | |

Restructuring and related charges | | 2.4 | | — | | — | | 0.5 | | — | | — | | — | | — | | 2.9 | |

CCA litigation defense costs | | 0.3 | | — | | — | | — | | — | | — | | — | | 0.1 | | 0.4 | |

Systems/organization establishment expenses | | — | | — | | — | | — | | — | | — | | — | | 1.2 | | 1.2 | |

Cancelled acquisition and disposal costs | | — | | — | | — | | — | | — | | — | | — | | 0.2 | | 0.2 | |

Inventory write-up reversal | | — | | — | | — | | — | | — | | — | | 2.8 | | — | | 2.8 | |

Foreign exchange (gain) loss | | (0.9 | ) | — | | (1.4 | ) | 1.8 | | — | | — | | — | | (46.7 | ) | (47.2 | ) |

Other | | 0.1 | | — | | — | | (0.1 | ) | — | | — | | (0.2 | ) | 0.2 | | — | |

Total Adjusted EBITDA | | $ | 34.2 | | $ | 7.3 | | $ | 5.8 | | $ | 43.0 | | $ | 20.9 | | $ | 21.4 | | $ | 10.2 | | $ | (9.6 | ) | $ | 133.2 | |

35

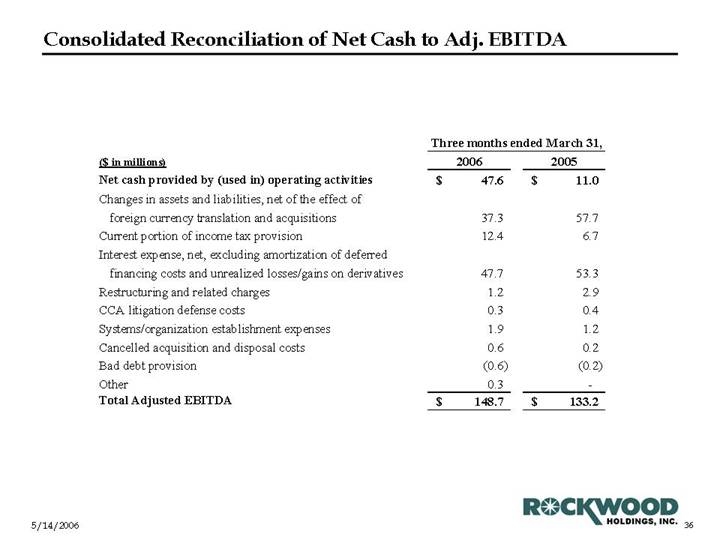

Consolidated Reconciliation of Net Cash to Adj. EBITDA

| | Three months ended March 31, | |

($ in millions) | | 2006 | | 2005 | |

Net cash provided by (used in) operating activities | | $ | 47.6 | | $ | 11.0 | |

Changes in assets and liabilities, net of the effect of foreign currency translation and acquisitions | | 37.3 | | 57.7 | |

Current portion of income tax provision | | 12.4 | | 6.7 | |

Interest expense, net, excluding amortization of deferred financing costs and unrealized losses/gains on derivatives | | 47.7 | | 53.3 | |

Restructuring and related charges | | 1.2 | | 2.9 | |

CCA litigation defense costs | | 0.3 | | 0.4 | |

Systems/organization establishment expenses | | 1.9 | | 1.2 | |

Cancelled acquisition and disposal costs | | 0.6 | | 0.2 | |

Bad debt provision | | (0.6 | ) | (0.2 | ) |

Other | | 0.3 | | — | |

Total Adjusted EBITDA | | $148.7 | | $ | 133.2 | |

| | | | | | | |

36

FX impact on Q1 Results

| | Three Months Ended | | | | | | Foreign | | | | | |

| | March 31, | | Total | | Total | | Exchange | | Organic | | Organic | |

($ in millions) | | 2006 | | 2005 | | Change in $ | | Change in % | | Effect in $ | | Change in $ | | Change in % | |

Net Sales: | | | | | | | | | | | | | | | |

Performance Additives | | $ | 182.5 | | $ | 159.5 | | $ | 23.0 | | 14.4 | % | $ | (4.1 | ) | $ | 27.1 | | 17.0 | % |

Specialty Compounds | | 63.2 | | 58.1 | | 5.1 | | 8.8 | | (1.0 | ) | 6.1 | | 10.5 | |

Electronics | | 49.4 | | 42.8 | | 6.6 | | 15.4 | | (1.8 | ) | 8.4 | | 19.6 | |

Specialty Chemicals | | 228.1 | | 220.0 | | 8.1 | | 3.7 | | (14.0 | ) | 22.1 | | 10.0 | |

Titanium Dioxide Pigments | | 108.2 | | 104.5 | | 3.7 | | 3.5 | | (10.2 | ) | 13.9 | | 13.3 | |

Advanced Ceramics | | 92.7 | | 91.9 | | 0.8 | | 0.9 | | (7.4 | ) | 8.2 | | 8.9 | |

Groupe Novasep | | 88.5 | | 92.9 | | (4.4 | ) | (4.7 | ) | (8.4 | ) | 4.0 | | 4.3 | |

Total | | $ | 812.6 | | $ | 769.7 | | $ | 42.9 | | 5.6 | % | $ | (46.9 | ) | $ | 89.8 | | 11.7 | % |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | Foreign | | | | | |

| | March 31, | | Total | | Total | | Exchange | | Organic | | Organic | |

($ in millions) | | 2006 | | 2005 | | Change in $ | | Change in % | | Effect in $ | | Change in $ | | Change in % | |

Adjusted EBITDA: | | | | | | | | | | | | | | | |

Performance Additives | | $ | 33.3 | | $ | 34.2 | | $ | (0.9 | ) | (2.6 | )% | $ | (0.6 | ) | $ | (0.3 | ) | (0.9 | )% |

Specialty Compounds | | 7.3 | | 7.3 | | — | | — | | (0.1 | ) | 0.1 | | 1.4 | |

Electronics | | 8.6 | | 5.8 | | 2.8 | | 48.3 | | (0.3 | ) | 3.1 | | 53.4 | |

Specialty Chemicals | | 51.4 | | 43.0 | | 8.4 | | 19.5 | | (3.1 | ) | 11.5 | | 26.7 | |

Titanium Dioxide Pigments | | 20.9 | | 20.9 | | — | | — | | (1.9 | ) | 1.9 | | 9.1 | |

Advanced Ceramics | | 23.6 | | 21.4 | | 2.2 | | 10.3 | | (2.1 | ) | 4.3 | | 20.1 | |

Groupe Novasep | | 15.9 | | 10.2 | | 5.7 | | 55.9 | | (1.4 | ) | 7.1 | | 69.6 | |

Corporate | | (12.3 | ) | (9.6 | ) | (2.7 | ) | 28.1 | | 0.2 | | (2.9 | ) | 30.2 | |

Total | | $ | 148.7 | | $ | 133.2 | | $ | 15.5 | | 11.6 | % | $ | (9.3 | ) | $ | 24.8 | | 18.6 | % |

37

Consolidated Reconciliation of Net Income to Adjusted EBITDA

| | Full Year | |

($ in millions) | | 2005 | | 2004 | |

| | | | | |

Net (loss) income | | $ | 95.8 | | $ | (190.1 | ) |

Income tax provision | | 71.8 | | 67.1 | |

Minority interest | | (3.0 | ) | — | |

Income (loss) before taxes and minority interest | | 164.6 | | (123.0 | ) |

Interest expense, net | | 215.6 | | 244.3 | |

Depreciation and amortization | | 206.4 | | 179.8 | |

Impairment charges | | 45.1 | | 11.0 | |

Restructuring and related charges | | 14.4 | | 1.1 | |

CCA litigation defense costs | | 1.2 | | — | |

Systems/organization establishment expenses | | 4.1 | | 4.8 | |

Cancelled acquisition and disposal costs | | 1.2 | | 0.5 | |

Costs incurred related to debt modifications | | 1.0 | | 2.0 | |

Stamp duty tax | | — | | 4.0 | |

Inventory write-up reversal | | 3.1 | | 61.1 | |

Management services agreement termination fee | | 10.0 | | — | |

Loss on early extinguishment of debt | | 26.6 | | — | |

Write-off of deferred debt issuance costs | | — | | 25.1 | |

Gains related to asset sales | | (4.4 | ) | — | |

Loss from disposed businesses | | — | | 0.8 | |

Foreign exchange loss (gain) | | (114.6 | ) | 125.7 | |

Other | | (3.4 | ) | 2.7 | |

| | | | | |

Total Adjusted EBITDA | | $ | 570.9 | | $ | 539.9 | |

38