December 6, 2012

Mr. Rufus Decker

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

RE: | Rockwood Holdings, Inc. |

| Form 10-K for the Year Ended December 31, 2011 |

| Filed February 23, 2012 |

| Form 8-K |

| Filed September 18, 2012 |

| File No. 1-32609 |

Dear Mr. Decker:

Rockwood Holdings, Inc. (the “Company,” “we” or “our”) is providing the following responses to the comments contained in the comment letter of the Staff of the Commission dated November 21, 2012. For convenience of reference, the text of the comments in the Staff’s letter has been reproduced in bold herein.

Form 10-K for the Year Ended December 31, 2011

General

1. Where a comment below requests additional disclosures or other revisions to be made, please show us in your supplemental response what the revisions will look like. These revisions should be included in your future filings, including your interim filings, if applicable.

Where a comment requests additional disclosures or other revisions to be made, we will include the revisions in future filings. As appropriate below, we have provided proposed revised text in italics as we expect such to appear in future filings.

Management’s Discussion and Analysis of Financial Condition and Results…., page 36

Results of Operations, page 41

Provision for Income Taxes, page 46

100 Overlook Center, Princeton, New Jersey 08540 Tel: (609) 514-0300 Fax: (609) 514-8722

2. Expand your discussion of income taxes to better discuss your effective tax rate for each period and with reference to your reconciliation of the U.S. statutory income tax rate to the effective tax rate in Note 11 to your financial statements, address the underlying material reasons for the change in your effective tax rate from period to period.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure of our effective tax rate as follows (revised and newly added disclosure in bold):

We recorded an income tax provision of $124.4 million on income from continuing operations before taxes of $456.1 million in the year ended December 31, 2011 resulting in an effective tax rate of 27.3%. The 2011 effective tax rate is lower than the U. S. statutory rate of 35% primarily due to a beneficial foreign earnings mix of (5.5)% primarily in Germany, Chile and the U.K , a tax benefit related to a capital loss of (19.3)% resulting from a tax election made related to a non-U.S. subsidiary, partially offset by an increase to the U.S. valuation allowance on deferred tax assets of 22.2%, primarily related to the above capital loss.

We recorded an income tax benefit of $24.6 million for the year ended December 31, 2010 on income from continuing operations before taxes of $204.5 million resulting in an effective tax rate of (12.0)%. The 2010 effective tax rate is lower than the U. S. statutory rate of 35% primarily due to the reversal of a U.S. valuation allowance on deferred tax assets of (26.4)%, which is mainly attributable to net operating losses that were expected to be utilized as a result of the gain on the sale of the Company’s plastic compounding business in January 2011. Additionally, the effective tax rate was positively impacted by a beneficial foreign earnings mix of (14.8)% primarily in Germany, Chile and the U.K. and an allocation of tax benefits to continuing operations of (3.8)%.

We recorded an income tax provision of $9.7 million for the year ended December 31, 2009 on income from continuing operations of $10.2 million resulting in a 95.1% effective tax rate. The 2009 effective tax rate is higher than the U. S. statutory rate of 35% primarily due to recording a U.S. valuation allowance on deferred tax assets of 383.9% attributable to our domestic business and was positively impacted by a non-recurring tax benefit related to foreign currency changes of (145.1)%, a beneficial foreign earnings mix of (114.5)% primarily in Germany, Chile and the U.K. and an allocation of tax benefits to continuing operations of (77.6)%.

See Note 11, “Income Taxes,” for the reconciliation of the U.S. statutory income tax rate to the effective tax rate.

Liquidity and Capital Resources, page 51

Cash Flows, page 51

3. You indicate that net cash provided by operating activities was $449.0 million for 2011 compared with $482.4 million for 2010. You indicate that the decrease in net cash provided by operating activities in 2011 was primarily due to working capital

2

changes, partially offset by higher net income. Please expand your disclosure to discuss the underlying reasons for changes in working capital components, with specific discussions for account receivable, inventories and accrued expenses and other liabilities, as applicable. Given the impact of the changes in your accounts receivables and inventories, please also consider whether a discussion of financial measures such as days sales outstanding and days sales in inventory would be relevant to a reader of your financial statements. Please revise your disclosure for all periods presented. See Section IV.B of the SEC Interpretive Release No. 33-8350.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure as follows (revised and newly added disclosure in bold):

Operating Activities. Net cash provided by operating activities was $449.0 million and $482.4 million in 2011 and 2010, respectively. Net cash from operating activities decreased in 2011 primarily due to working capital changes, partially offset by higher net income. Specifically, inventories increased primarily due to a build in the finished goods inventory of the Titanium Dioxide Pigments segment in anticipation of higher sales, as well as an increase in the Color Pigments and Services inventory due to raw material purchases in anticipation of raw material cost increases. In addition, accrued expenses and other liabilities decreased primarily due to lower annual cash incentive bonus accruals across most businesses based upon the cash incentive plans in place.

In response to the Staff’s comment regarding the disclosure of financial measures such as days sales outstanding and days sales in inventory, we respectfully inform the Staff that we do not believe such information is material to investors either on an individual segment basis or in the aggregate due to the diverse end use markets that we serve, the geographic disparity of our customers and suppliers and the production lead time on various products.

4. You indicate that management uses Adjusted EBITDA as a liquidity measure. On page 54, you have provided a reconciliation of net cash provided by operating activities from continuing operations to Adjusted EBITDA. We note that you have included restructuring and other severance costs, system/organization establishment expenses and acquisition and disposal costs in your reconciliation. Please tell us what consideration you gave to Item 10(e)(1)(ii)(A) in determining whether it was appropriate to exclude charges or liabilities that required, or will require, cash settlement, or would have required cash settlement absent an ability to settle in another manner, from your non-GAAP liquidity measure. Please also address the appropriateness of your non-GAAP liquidity measures used in your earnings releases and presentation materials filed in your various Forms 8-K throughout fiscal 2012.

In response to the Staff’s comment, we respectfully inform the Staff that we use Adjusted EBITDA as a liquidity measure. We believe this financial measure is important in analyzing our liquidity because our senior secured credit agreement and indenture governing the 2020 Notes contain financial covenants that are determined based on Adjusted EBITDA. We reviewed Item 10(e)(1)(ii)(A) and Question 102.09 of the Compliance and Disclosure Interpretations: Non-GAAP Financial Measures. We believe that our disclosure is consistent with Item 10(e)(1)(ii)(A) and Question 102.09 because these debt agreements are material to Rockwood, the

3

financial covenants therein are material terms of these agreements, and the financial covenants, and the definition of Adjusted EBITDA, provide information that is material to an investor’s understanding of our financial condition and liquidity. We believe that all of the reconciling items, including charges or liabilities requiring cash settlement, from net cash provided by operating activities from continuing operations to Adjusted EBITDA are appropriate as they are consistent with management’s interpretation of the definition in our senior secured credit agreement. We include a discussion of our definition of our non-GAAP financial measures in “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Note Regarding Non-GAAP Financial Measures — Definition of Adjusted EBITDA - Management’s Uses, and - Limitations” on pages 39 — 41 of our Form 10-K for the year ended December 31, 2011.

In response to the Staff’s comment about the appropriateness of our non-GAAP liquidity measures used in our earnings releases and presentation materials filed in our Forms 8-K throughout fiscal 2012, we respectfully inform the Staff that the Company believes these non-GAAP measures provide meaningful information to investors and our disclosure of this information is in accordance with Regulation G. Where the Company discloses non-GAAP measures, it has provided presentations of equal prominence of the most directly comparable GAAP financial measures and the applicable reconciliations between such non-GAAP financial measures. For example, in our quarterly earnings releases and our presentation materials, we provide a reconciliation of free cash flow to net cash provided by operating activities of continuing operations. In addition, in the section titled “Non-GAAP Financial Measures” in our earnings releases, we include an explanation of the limitations of using the non-GAAP measures we disclose.

Critical Accounting Policies and Estimates, page 56

Impairment, page 56

Goodwill, page 56

5. We note your disclosures regarding your policy for goodwill impairment. In the interest of providing readers with a better insight into management’s judgments in accounting for goodwill, please disclose the following:

· Identify the reporting unit(s) to which goodwill applies.

· Explain how the assumptions and methodologies in the current year have changed since the prior year, if applicable, highlighting the impact of any changes. For example, you indicate that you have identified three reporting units within your reportable segments that qualified for a review. In your Form 10-K for the year ended December 31, 2010, you identified seven reporting units within your reportable segments. Please advise;

In any event, if any of your reporting units have estimated fair values that are not substantially in excess of the carrying value and to the extent that goodwill for these reporting units, in the aggregate or individually, could materially impact your

4

operating results; please provide the following disclosures for each of these reporting units:

· Identify the reporting unit;

· The percentage by which fair value exceeds the carrying value as of the most-recent step-one test;

· The amount of goodwill;

· A description of the assumptions that drive the estimated fair value;

· A discussion of the uncertainty associated with the key assumptions. For example, assuming you use a discounted cash flow model, to the extent that you have included assumptions in your discounted cash flow model that materially deviates from your historical results, please include a discussion of these assumptions; and

· A discussion of any potential events and/or circumstances that could have a negative effect on the estimated fair value.

If you have determined that the estimated fair value substantially exceeds the carrying value for all of your reporting units, please disclose this determination. Please refer to Item 303 of Regulation S-K and Sections 216 and 501.14 of the Financial Reporting Codification for guidance.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure as follows (revised and newly added disclosure in bold):

The recoverability of goodwill is reviewed on an annual basis during the fourth quarter. Additionally, the recoverability of goodwill would be reviewed when events or changes in circumstances occur indicating that the carrying value of the assets may not be recoverable. We have determined that our reporting units for our goodwill impairment review are our operating segments or components of an operating segment that constitute a business for which discrete financial information is available and for which segment management regularly reviews the operating results. Based on this analysis, we have identified three of seven reporting units within our reportable segments that qualify for such review, Fine Chemicals, Surface Treatment and Advanced Ceramics, as each of these units had a goodwill balance as of December 31, 2011. The other four reporting units had no goodwill balance as of December 31, 2011. Based upon our review, the estimated fair values for the Company’s three reporting units having goodwill were substantially in excess of their carrying values. See “Impairment Accounting” section of Note 1, “Basis of Presentation and Significant Accounting Policies,” for the process used to test goodwill for impairment.

Goodwill impairment analyses are based on inherent assumptions and estimates about future cash flows and appropriate benchmark peer companies or groups. Subsequent changes in these assumptions could result in future impairment. There have not been significant changes in the assumptions and methodologies used in the goodwill impairment analyses from the prior year. Although we consistently use the same methods in developing the assumptions and estimates underlying the fair value calculations, such estimates are uncertain by nature and can vary from actual results.

5

The Company further advises the Staff that as of December 31, 2011, the estimated fair values of our three reporting units that had a goodwill balance and qualified for such review substantially exceeded their respective carrying values (as noted above in our revised disclosure). In future filings, if the Company determines that any of its reporting units have estimated fair values that are not substantially in excess of their respective carrying values, the Company will consider further expanding its disclosure in future filings to include the following:

· The percentage by which fair value of its reporting unit exceeds the carrying value as of the most recent step-one test.

· The amount of goodwill.

· A description of the assumptions that drive the estimated fair value.

· A discussion of the uncertainty associated with the key assumptions; and

· A discussion of any potential events and/or circumstances that could have a negative effect on the estimated fair value.

Long-lived Tangibles and Other Intangible Assets, page 57

6. We note your disclosures regarding impairment of long-lived assets. In the interest of providing readers with a better insight into management’s judgments in accounting for long-lived assets, including property, plant and equipment, please disclose the following:

· How you group long-lived assets for impairment and your basis for that determination;

· How you determine when long-lived assets should be tested for impairment;

· How frequently you evaluate for the types of events and circumstances that may indicate impairment; and

· Sufficient information to enable a reader to understand what method you apply in estimating the fair value of your long-lived assets.

If any material long-lived assets or asset groups have a carrying value less than their corresponding undiscounted cash flows and their carrying value is not substantially in excess of fair value, please disclose the nature of the assets and their carrying value and convey how close their carrying value is to fair value. Please also disclose key assumptions you made and describe any potential events and/or changes in circumstances that could reasonably be expected to negatively affect those key assumptions.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure as follows (revised and newly added disclosure in bold):

Long-lived tangible and other intangible assets are reviewed each reporting period to determine if events or changes in circumstances have occurred indicating that the carrying value of the assets may not be recoverable. Such circumstances may include a significant adverse change in the manner in which a long-lived asset is used, a current-period operating or cash flow loss combined with projected and/or a history of operating or cash flow losses associated with the use of a long-lived asset, or changes in the expected useful life of the long-lived asset.

6

For impairment testing, assets are grouped at the lowest level for which there are identifiable cash flows that are independent from the cash flows of other assets, which could be at the individual asset level, the product line level, the plant level or the subsidiary level depending on the nature of the identifiable cash flows at our various subsidiaries. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of the assets or asset group to the future undiscounted net cash flows expected to be generated by the asset or asset group.

The assumptions underlying future undiscounted cash flow projections represent management’s best estimates at the time of the impairment review. Significant factors that management estimate include industry and market conditions, including future sales volumes and prices, raw material and labor costs, and inflation rates. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. To determine fair value, we would use our internal cash flow estimates discounted at an applicable interest rate, third party appraisals, as appropriate, and/or market prices of similar assets, when available.

For the years ended December 31, 2011 and 2010, there were no material long-lived assets or asset groups that had a carrying value greater than their corresponding undiscounted cash flows and therefore, we did not perform any applicable fair value calculations.

Financial Statements

1. Basis Of Presentation and Significant Accounting Policies, page 69

Impairment Accounting, page 71

7. You indicate that if the initial review does not result in clear evidence that no impairment indicators exist, a review based on expected future cash flows is performed; this is the discounted cash flow approach. Expand your disclosures herein or within your critical accounting policies to explain and/or quantify how you define clear evidence and indicate (i) whether the results of your initial review resulted in the need to perform a review based on expected future cash flows for any of your reporting units and (ii) the results of your expected cash flow analysis.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure within our critical accounting policy disclosures and in Note 1, “Basis of Presentation and Significant Accounting Policies,” as follows (revised and newly added disclosure in bold):

The recoverability of goodwill is reviewed on an annual basis during the fourth quarter. Additionally, the recoverability of goodwill would be reviewed when events or changes in circumstances occur indicating that the carrying value of the assets may not be recoverable. We have determined that our reporting units for our goodwill impairment review are our operating segments or components of an operating segment that constitute a business for which discrete financial information is available and for which segment management regularly reviews the operating results. Based on this analysis, we have identified three of seven reporting units within our reportable segments that qualify for such review, Fine Chemicals, Surface Treatment and Advanced Ceramics, as each of these units had a goodwill balance as of December 31, 2011. The other four reporting units had no goodwill balance as of December 31, 2011. Based upon

7

such review as described below, the estimated fair values for the Company’s three reporting units having goodwill were substantially in excess of their carrying values.

In accordance with the accounting guidance for determining goodwill impairment, the Company applies a two-step methodology.

First Step

In the first step, the Company determines the estimated fair value of each reporting unit and compares that fair value to the carrying value of such reporting unit. In determining the estimated fair value of each reporting unit, the Company uses the following approaches.

Peer Multiple Approach: This approach begins with estimating the fair value of each reporting unit, which is derived from peer multiples. Specifically, the estimated fair value of each reporting unit is based on an industry metric that is the ratio of enterprise value (“EV” which is commonly defined as market capitalization, plus long-term debt, less cash) to Adjusted EBITDA of the relevant benchmark peer companies and groups. The Company uses EV multiples for the last twelve months Adjusted EBITDA and for the next fiscal year’s Adjusted EBITDA. The peer companies are typically based upon the competitors disclosed in Item 1, “Business” for each of the reporting units. The Company then multiplies this ratio by the Adjusted EBITDA for the recently completed year and the budgeted Adjusted EBITDA for the upcoming year of such reporting unit and compares it to the carrying value of such reporting unit. If the product of such peer multiple and reporting unit’s Adjusted EBITDA is less than such carrying value, it may be an indication of an impairment.

Discounted Cash Flow Approach: Under this approach, the Company makes certain assumptions, among other things, estimates of future cash flows, including growth rates, price increases, capital expenditures, the benefits of recent acquisitions and expected synergies, and an appropriate discount rate in determining the estimated fair value of each applicable reporting unit.

If the fair value resulting from the peer multiple approach substantially exceeds carrying value of a reporting unit, there is clear evidence that no impairment exists. If the estimated fair value determined under the peer multiple approach does not substantially exceed the carrying value of a reporting unit, then the Company estimates the fair value of each applicable reporting unit using the discounted cash flow approach to corroborate the estimated fair value determined from the peer multiple approach. If the fair values estimated under the peer multiple approach and the discounted cash flow approach are substantially different, the relevant facts and circumstances are reviewed and a qualitative assessment is made to determine the proper weighting for estimating fair value. Once the estimated fair value is determined, it is compared to the carrying value of a reporting unit. If the estimated fair value exceeds the carrying value of a reporting unit, there is no impairment. If the results of the first step indicate the carrying value of a reporting unit exceeds its estimated fair value, the second step is performed.

8

Second Step

In the second step, the Company would determine the implied fair value of goodwill in the same manner as if it had acquired those reporting units. The potential impairment is computed by comparing the implied fair value of the reporting unit’s goodwill with the carrying amount of goodwill. If the carrying amount of the reporting unit’s goodwill is greater than the implied fair value of its goodwill, an impairment loss must be recognized for the excess. If necessary, the Company may consult with valuation specialists to assist with its goodwill impairment review.

For the years ended December 31, 2011 and 2010, there was clear evidence that no impairment existed based on the peer multiple approach for our Fine Chemicals, Surface Treatment and Advanced Ceramics reporting units, as the estimated fair value substantially exceeded the carrying value of each reporting unit. Accordingly, the second step for determining the existence of a goodwill impairment was not required for any of our reporting units. As such, we concluded there was no goodwill impairment for any of our reporting units.

8. On page 72, you disclose that in the fourth quarter of 2010 and 2011, you performed a recoverability test of certain intangible assets in your Viance timber treatment chemical venture and concluded that there was no impairment of those assets. Please expand your disclosures to indicate why you performed a recoverability test of these assets and disclose the amount of the intangible asset related to the Viance timber treatment chemicals so that readers have a sense of the amount of assets at risk. To the extent an impairment of these assets may be material, please expand your critical accounting policy disclosures to provide the key estimates and judgments used to assess the recoverability of these assets.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure within our critical accounting policy disclosures and in Note 1, “Basis of Presentation and Significant Accounting Policies,” as follows (revised and newly added disclosure in bold):

Long-lived tangible and other intangible assets are reviewed each reporting period to determine if events or changes in circumstances have occurred indicating that the carrying value of the assets may not be recoverable. The recoverability of other intangible assets is reviewed when events or changes in circumstances occur indicating that the carrying value of the assets may not be recoverable. Such circumstances may include a significant adverse change in the manner in which a long-lived asset is being used, a current-period operating or cash flow loss combined with projected and/or a history of operating or cash flow losses associated with the use of a long-lived asset, or changes in the expected useful life of the long-lived asset.

In the fourth quarter of 2010, the Company performed a recoverability test of intangible assets related to a specific product line in our Viance timber treatment chemicals venture. During 2011, the Company performed recoverability tests of certain intangible assets related to multiple product lines in our Viance timber treatment chemicals venture. These recoverability

9

tests were performed because actual and historical sales volumes related to these specific products were significantly lower than projected sales volumes primarily due to changes in market conditions.

For the intangible assets tested in the fourth quarter of 2010, the primary reason for lower sales was the decision to delay the introduction of one product to the marketplace. For the recoverability tests performed in the fourth quarter of 2010, we estimated cash flows for the estimated remaining life of the assets. The primary assumptions used in these analyses were the timing of the penetration of such product in the marketplace and the expected demand. Our recoverability test resulted in undiscounted cash flows that substantially exceeded the carrying value of the assets for this product line.

For the intangible assets tested during 2011, the primary reasons for lower sales were the delay in the introduction of one product to the marketplace and the loss of another product’s largest customer in the first quarter of 2011. For the recoverability tests performed in 2011, we estimated cash flows for the estimated remaining life of the assets. The primary assumptions used in these analyses were the timing of the penetration of such product in the marketplace and the expected demand. Our recoverability tests resulted in undiscounted cash flows that substantially exceeded the carrying value of the assets for each product line.

Based on these tests, the Company concluded that there was no impairment of these assets. The carrying value of the applicable intangible assets was $64.7 million and $42.5 million as of December 31, 2011 and 2010, respectively. The Company will continue to monitor the recoverability of these assets if events or circumstances indicate that the carrying value of such assets may not be recoverable.

As noted in our response above for comment #6 on “Long-lived Tangibles and Other Intangible Assets,” we have expanded our critical accounting policy disclosures to provide key estimates and judgments used to assess the recoverability of these assets.

2. Discontinued Operations, page 74

9. On page 75, you indicate that the valuation allowance related to net operating losses was reversed in the fourth quarter of 2010 as a benefit to income taxes in continuing operations. Please tell us how you determined that it was appropriate reverse the valuation allowance as a benefit to income taxes in continuing operations.

In response to the Staff’s comment, the Company respectfully informs the Staff that in December 2010, the plastic compounding business owned by the Company met the criteria for being reported as a discontinued operation. The sale was completed on January 7, 2011 resulting in a net gain of $119.3 million (net of taxes of $78.2 million) which was recorded in discontinued operations in 2011. In the fourth quarter of 2010, the Company reversed $76.5 million of its valuation allowance on deferred tax assets through continuing operations.

Paragraph ASC 740-10-45-20 states that changes in the beginning of year balance of a valuation allowance caused by changes in judgment about the realization of deferred tax assets in future years are ordinarily allocated to continuing operations. The only exceptions are

10

changes to valuation allowances of certain tax benefits that are adjusted within the measurement period as required by paragraphs ASC 805-740-45-2 related to business combinations and the initial recognition of tax benefits related to the items specified in paragraph ASC 740-20-45-11 (c) through (f).

The Company believes the reversal of the valuation allowance on deferred tax assets recorded in the fourth quarter of 2010 was a change in the beginning of the year balance and did not meet any of the exceptions under paragraph ASC 740-10-45-20. This reversal was made on the basis that there was a change in judgment about the realization of the related deferred tax assets in future years (i.e., because the gain on the sale was not recognized until 2011). Accordingly, the impact of the reversal of this valuation allowance was included in income from continuing operations.

Please also tell what consideration you gave to your intra-period tax allocation in determining the reversal of your valuation allowance in 2010. Refer to ASC 740-20-45.

In response to the Staff’s comment, the Company had, for the year ended December 31, 2010, a pre-tax domestic loss in continuing operations, income in domestic discontinued operations and income in domestic other comprehensive income. The income in domestic discontinued operations and domestic other comprehensive income would ordinarily give rise to the utilization of a net operating loss and a corresponding reversal of valuation allowance resulting in a tax benefit in those categories.

However, ASC 740-20-45-7 states, in part, “The tax effect of pretax income or loss from continuing operations generally should be determined by a computation that does not consider the tax effects of items that are not included in continuing operations. The exception to that incremental approach is that all items (for example, extraordinary items, discontinued operations, and so forth) be considered in determining the amount of tax benefit that results from a loss from continuing operations and that shall be allocated to continuing operations.”

In accordance with ASC 740-20-45-7, the Company prepared a tax provision applying the above exception to the intra-period tax allocation rules. Specifically, while the application of the general rules regarding intra-period tax allocation would have resulted in no tax expense or benefit being allocated to continuing operations, discontinued operations or other comprehensive income, the application of the exception provided by ASC 740-20-45-7 resulted in the Company allocating a tax benefit to continuing operations and an equal amount of tax expense was allocated between discontinued operations and other comprehensive income. In determining income sources to absorb the loss from continuing operations, the Company considered book income adjusted for significant book/tax permanent differences. The amount allocated to the domestic loss from continuing operations was limited to the Company’s recorded loss from continuing operations, adjusted for significant book/tax permanent differences.

As a result of applying the intra-period tax allocation, an income tax benefit was reflected in continuing operations of $8.0 million, an income tax charge was reflected as part of discontinued operations of $7.6 million and an income tax charge was reflected in other comprehensive income of $0.4 million. This was illustrated in the income tax provision (benefit) table in “Item 8. Financial Statements—Note 11 “Income Taxes” in the Form 10-K for the year ended December 31, 2011.

11

13. Stock-Based Compensation, page 91

10. On page 92, you indicate that you did not recognize any compensation costs for the awards issued in December 2011 because the performance targets that will form the basis for vesting of these restricted stock units were not available as of December 31, 2011. Please revise your disclosures to indicate whether you recognized compensation expense for the 2010 awards. Your disclosures should be similar to your disclosures regarding your 2011 awards.

In response to the Staff’s comment, in future filings we will revise and expand our disclosure as follows (revised and newly added disclosure in bold):

The Company did not recognize any compensation expense for the restricted stock units issued in December 2011 because the performance targets that formed the basis for vesting of these awards were not available as of December 31, 2011. In January 2012, the performance targets related to the 2011 restricted stock awards were determined and granted, and the Company began recording compensation expense at that time for those awards.

The Company did not recognize any compensation expense for the restricted stock units issued in December 2010 because the performance targets that formed the basis for vesting of these awards were not available as of December 31, 2010. In January 2011, the performance targets related to the 2010 restricted stock awards were determined and granted, and the Company began recording compensation expense at that time for those awards.

Form 8-K filed on September 18, 2012

Exhibit 99.1

Note 21. Guarantor Financial Statements, page 89

11. You disclose that you and certain of your wholly-owned domestic subsidiaries (“Guarantor Subsidiaries”) will jointly, fully, severally and unconditionally guarantee each debt securities. Please confirm, and revise your disclosure if true, that all the subsidiary guarantors are “100% owned” as defined by Rule 3-10(h)(1) of Regulation S-X. Note that “wholly-owned,” as defined in Rule 1-02(aa) of Regulation S-X, is not the same as “100% owned.”

In response to the Staff’s comment, we confirm that all subsidiary guarantors are “100% owned” as defined by Rule 3-10 (h)(1) of Regulation S-X. In future filings, we will revise our disclosure as follows (revised and newly added disclosure in bold):

In connection with the issuance of the 2020 Notes in the aggregate principal amount of $1.25 billion in September 2012 by Rockwood Specialties Group, Inc. (RSGI), an indirect 100% owned subsidiary of the Company, the Company (“Parent Company”) and certain of its 100% owned domestic subsidiaries (“Guarantor Subsidiaries”) jointly and severally, and fully and unconditionally guarantee such debt securities.

12

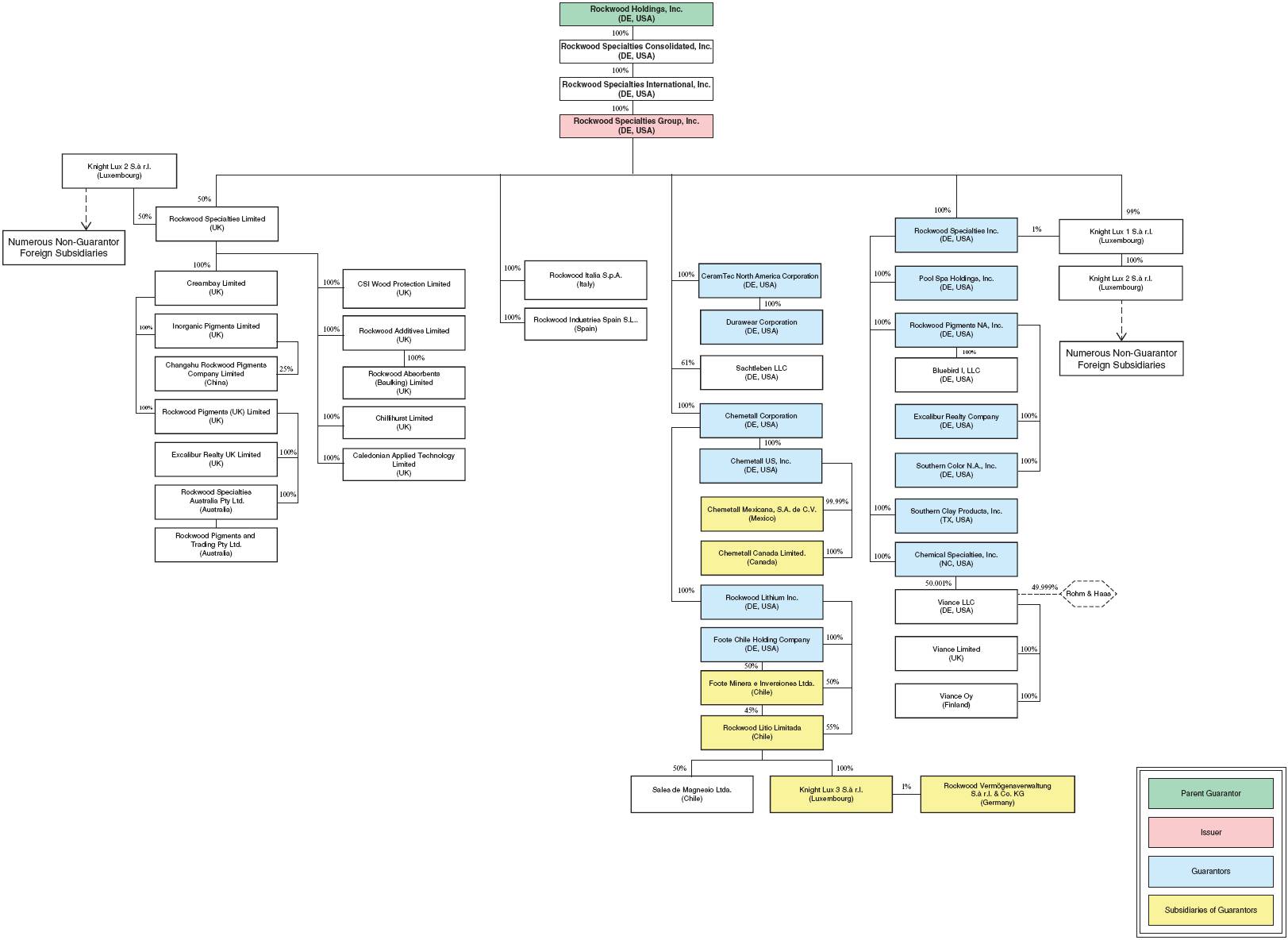

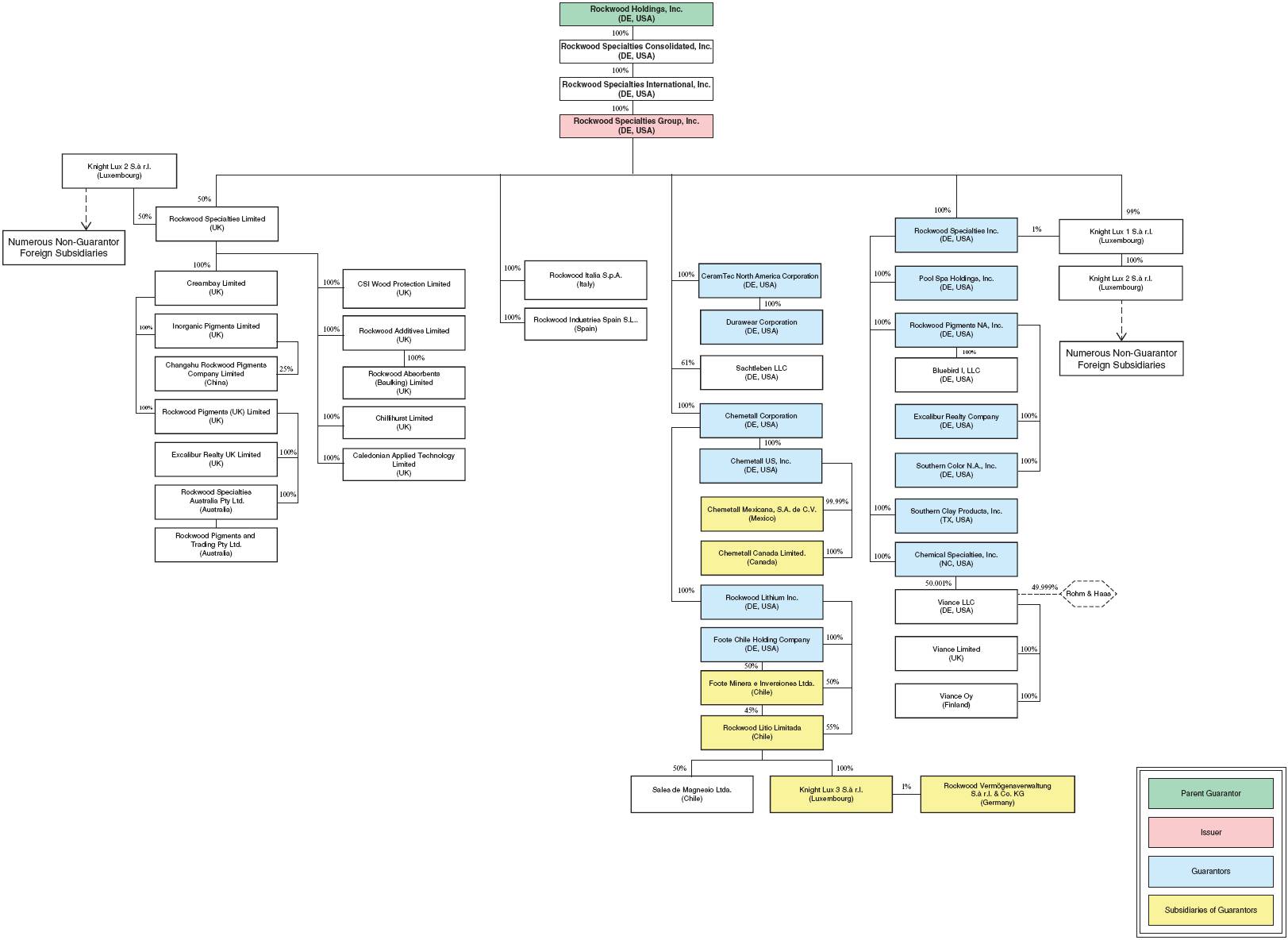

12. Please provide us with a sufficiently detailed organizational chart. With reference to your organizational chart as well as the specific guidance and instructions set forth in Rule 3-10 of Regulation S-X, please address the following as it relates to your consolidating financial information:

· the appropriateness of presenting the Non-Guarantor RSCI and RSII columns; and

· for each column presented, identify the entities reflected in your statement of operations line item, “Equity in undistributed earnings of subsidiaries” as well as your balance sheet line item, “Investment in subsidiary.”

Please also address this comment as it relates to your condensed consolidating financial information provided in Note 15 to your interim financial statements presented in your Form 10-Q for the period ended September 30, 2012.

In response to the Staff’s comment, we have provided you with an organizational chart (see Appendix A) and for each column presented, a listing of entities reflected in our statement of operations line item, “Equity in undistributed earnings of subsidiaries” and our balance sheet line item, “Investment in subsidiary” (see Appendix B for the Form 8-K and Appendix C for the 10-Q).

In response to the Staff’s comment on the appropriateness of presenting the Non-Guarantor RSCI and RSII columns, these entities are subsidiaries of the Parent Company Guarantor that directly or indirectly own 100% of the interest of the issuer, Rockwood Specialties Group, Inc. (RSGI). In the Form 8-K, we concluded that it would be beneficial to provide additional disclosure to separately present financial information for these two entities which portrays the Company’s actual organizational structure. However, upon further review and analysis, we determined that it would be appropriate to include these entities in the “Non-Guarantor Subsidiaries” column since these entities are non-guarantors and since the only activity in these entities is “Equity in undistributed earnings of subsidiaries” and “Investment in subsidiary”. This format was reflected in our Form 10-Q for the quarterly period ended September 30, 2012.

**********

Rockwood Holdings, Inc. acknowledges that:

· Such company is responsible for the adequacy and accuracy of the disclosure in the filing;

· Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and

· Such company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

We welcome the opportunity to discuss these matters further if you so desire. Please feel free to contact me at 609-734-6403.

| Sincerely, |

| |

| /s/ Robert J. Zatta |

| Robert J. Zatta |

| Senior Vice President and Chief Financial Officer |

13

Appendix A

Appendix B

Rockwood Holdings, Inc. and Subsidiaries

Equity in Undistributed Earnings of Subsidiaries / Investment in subsidiary

Form 8-K filed September 18, 2012

Parent Company Guarantor (Rockwood Holdings. Inc.)

Rockwood Specialties Consolidated, Inc (RSCI)

Non-Guarantor RSCI

Rockwood Specialties International, Inc (RSII)

Non-Guarantor RSII

Rockwood Specialties Group, Inc (RSGI)

Issuer – RSGI

Guarantor subsidiaries

Rockwood Pigments NA, Inc.

Southern Color N.A., Inc.

Excalibur Realty Company

Southern Clay Products, Inc.

Chemical Specialties, Inc.

CeramTec North America Corporation

Durawear Corporation

Rockwood Lithium Inc.

Foote Chile Holding Company

Chemetall US, Inc.

Chemetall Corporation

Rockwood Specialties Inc.

Non-Guarantor subsidiaries

Aechener Chemische Werke Gesellschaft für glastechnische Produkte und Verfahren GmbH

Alberti & Co. GmbH

AM Craig Limited

Ardrox Ltd.

BCI Pensions Trustees Ltd.

Bedec S.A.S.

Bluebird I, LLC

Brent Europe Ltd.

Brent International B.V.

Brockhues GmbH & Co. KG

Caledonian Applied Technology Limited

CeramTec GmbH

CeramTec Czech Republic s.r.o.

CeramTec-ETEC GmbH

CeramTec Ibérica – Innovative Ceramic Engineering S.L.

CeramTec Innovative Ceramic Engineering (M) Sdn. Bhd.

CeramTec Italia S.r.l. (in liquidation)

CeramTec Korea Ltd.

CeramTec Suzhou Ltd.

CeramTec UK Ltd.

Cerasiv GmbH Innovatives Keramik-Engineering

Changchun Chemetall Chemicals Co., Ltd.

Changshu Rockwood Pigments Company Limited

Chemetall (Australasia) Pty. Ltd.

Chemetall New Zealand Ltd.

Chemetall (Proprietary) Ltd.

Chemetall AB

Chemetall Asia Pte. Ltd.

Chemetall B.V.

Chemetall do Brasil Ltda.

Chemetall Finland Oy

Chemetall GmbH

Chemetall Hong Kong Ltd.

Chemetall Hungaria Vegyianyagokat Gyártó es Forgalmazó Kft

Chemetall India Company Ltd.

Chemetall Italia S.r.l.

Chemetall ooo

Chemetall Philippines Co. Ltd., Inc.

Chemetall Ltd.

Chemetall Polska Sp. z o.o.

Chemetall PVC (Proprietary) Ltd.

Chemetall-Rai India Ltd.

Chemetall S.r.l.

Chemetall Sanayi Kimyasallari Ticaret ve Sanayi A.S.

Chemetall S.A.S.

Chemetall S.A.

Chemetall Specialty Chemicals Shanghai Co., Ltd.

Chemetall South Africa (Propriety) Ltd.

Chemetall Surface Treatment Holding Co., Ltd.

Chemetall Taiwan Co., Ltd.

Chemetall (Thailand) Co., Ltd.

Chemserve Ltd.

ChemStore GmbH

Chillihurst Limited

Chongqing Chemetall Chemicals Co., Ltd.

CM-Hilfe GmbH Unterstützungskasse

Creambay Limited

CSI Kemwood AB

CSI Wood Protection Limited

Deutsche Baryt-Industrie Dr. Rudolf Albert GmbH & Co. KG

DICON Explosives Company Ltd.

DNVJ Vermögensverwaltung GmbH

Dynamit Nobel GmbH

Dynamit Nobel Unterstützungsfonds GmbH

Emil Müller GmbH

Excalibur Realty UK Limited

Hebro Chemie GmbH

Holliday Chemical Espana S.A.S.

Holliday France S.A.S.

Holliday Pigments International S.A.S.

Holliday Pigments S.A.S.

Industrieservice Ges.mbH

Inorganic Pigments Limited

Kendell S.r.l.

Knight Chimiques de Spécialité S.A.S.

Knight Lux 1 S.à r.l.

Knight Lux 2 S.à r.l.

Knight Lux 4 S.à r.l.

Metalon Stolberg Gesellschaft mit beschränkter Haftung

Metalon Environmental Management & Solutions oHG

Nanjing Chemetall Surface Technologies Co., Ltd.

Nigerian Development and Construction Company Ltd.

Nuodex Mexicana, S.A. de C.V.

Nuodex Italiana S.r.l.

Pigment-Chemie GmbH

Pool Spa Holdings, Inc.

Press + Sintertechnik Sp.z o.o.

Press and Sinter Technics de Mexico, S.A. de C.V.

PST Press Sintertécnica Brasil Ltda.

Process Ink Holdings Ltd.

Process Inks And Coatings Ltd.

RA Rohsoffallianz GmbH

Rockwood Absorbents (Baulking) Limited

Rockwood Additives Limited

Rockwood Clay Additives GmbH

Rockwood Far East Limited

Rockwood Hong Kong Limited

Rockwood Industries Spain S.L.

Rockwood Italia S.p.A

Rockwood Lithium Australia Pty. Ltd

Rockwood Lithium Australia Holding Pty. Ltd

Rockwood Lithium GmbH

Rockwood Lithium India Pvt. Ltd.

Rockwood Lithium (UK) Ltd.

Rockwood Lithium Japan K.K.

Rockwood Pigmente Holding GmbH

Rockwood Pigments (UK) Limited

Rockwood Pigments and Trading Pty Ltd.

Rockwood Shenzhen Pigments Company Ltd.

Rockwood Specialties Australia Pty Ltd.

Rockwood Specialties GmbH

Rockwood Specialties Group GmbH

Rockwood Specialties Limited

Rockwood Tiacang Pigments Company Ltd.

Rockwood Vermögensverwaltung GmbH

Rockwood Wafer Reclaim S.A.S.

Sachtleben Chemie GmbH

Sachtleben LLC

Sachtleben GmbH

Sachtleben Pigments Oy

Sachtleben Pigment GmbH

Sachtleben Trading (Shanghai) Company Limited

Sachtleben Wasserchemie (Holding) GmbH

Sachtleben Wasserchemie GmbH

Sales de Magnesio Ltda.

Shanghai Chemetall Chemicals Co., Ltd.

Silo Pigmente GmbH

Stadeln Genehmigungshaltergesellschaft mbH

The Brent Manufacturing Company Ltd.

Tribotecc GmbH

Troisdorf Genehmigungshaltergesellschaft mbH

Viance Limited

Viance LLC

Viance Oy

Würgendorf Genehmigungshaltergesellschaft mbH

Guarantor Subsidiaries*

Rockwood Litio Limitada

Foote Minera e Inversiones Ltda.

Chemetall Mexicana, S.A. de C.V

Chemetall Canada Limited.

Knight Lux 3 S.à r.l

Rockwood Vermögensverwaltung S.à r.l. & Co. KG

* These subsidiaries are included in the Non-Guarantor subsidiary column and are 100% owned by Guarantor subsidiaries of the Issuer (RSGI).

Appendix C

Rockwood Holdings, Inc. and Subsidiaries

Equity in Undistributed Earnings of Subsidiaries / Investment in subsidiary

Form 10-Q for the quarterly period ended September 30, 2012

Parent Company Guarantor (Rockwood Holdings, Inc.)

Rockwood Specialties Consolidated, Inc (RSCI)

Issuer – Rockwood Specialties Group, Inc. (RSGI)

Guarantor subsidiaries

Rockwood Pigments NA, Inc.

Southern Color N.A., Inc.

Excalibur Realty Company

Southern Clay Products, Inc.

Chemical Specialties, Inc.

CeramTec North America Corporation

Durawear Corporation

Rockwood Lithium Inc.

Foote Chile Holding Company

Chemetall US, Inc.

Chemetall Corporation

Rockwood Specialties Inc.

Non-Guarantor subsidiaries

Aechener Chemische Werke Gesellschaft für glastechnische Produkte und Verfahren GmbH

Alberti & Co. GmbH

AM Craig Limited

Ardrox Ltd.

BCI Pensions Trustees Ltd.

Bedec S.A.S.

Bluebird I, LLC

Brent Europe Ltd.

Brent International B.V.

Brockhues GmbH & Co. KG

Caledonian Applied Technology Limited

CeramTec GmbH

CeramTec Czech Republic s.r.o.

CeramTec-ETEC GmbH

CeramTec Ibérica – Innovative Ceramic Engineering S.L.

CeramTec Innovative Ceramic Engineering (M) Sdn. Bhd.

CeramTec Italia S.r.l. (in liquidation)

CeramTec Korea Ltd.

CeramTec Suzhou Ltd.

CeramTec UK Ltd.

Cerasiv GmbH Innovatives Keramik-Engineering

Changchun Chemetall Chemicals Co., Ltd.

Changshu Rockwood Pigments Company Limited

Chemetall (Australasia) Pty. Ltd.

Chemetall New Zealand Ltd.

Chemetall (Proprietary) Ltd.

Chemetall AB

Chemetall Asia Pte. Ltd.

Chemetall B.V.

Chemetall do Brasil Ltda.

Chemetall Finland Oy

Chemetall GmbH

Chemetall Hong Kong Ltd.

Chemetall Hungaria Vegyianyagokat Gyártó es Forgalmazó Kft

Chemetall India Company Ltd.

Chemetall Italia S.r.l.

Chemetall ooo

Chemetall Philippines Co. Ltd., Inc.

Chemetall Ltd.

Chemetall Polska Sp. z o.o.

Chemetall PVC (Proprietary) Ltd.

Chemetall-Rai India Ltd.

Chemetall S.r.l.

Chemetall Sanayi Kimyasallari Ticaret ve Sanayi A.S.

Chemetall S.A.S.

Chemetall S.A.

Chemetall Specialty Chemicals Shanghai Co., Ltd.

Chemetall South Africa (Propriety) Ltd.

Chemetall Surface Treatment Holding Co., Ltd.

Chemetall Taiwan Co., Ltd.

Chemetall (Thailand) Co., Ltd.

Chemserve Ltd.

ChemStore GmbH

Chillihurst Limited

Chongqing Chemetall Chemicals Co., Ltd.

CM-Hilfe GmbH Unterstützungskasse

Creambay Limited

CSI Kemwood AB

CSI Wood Protection Limited

Deutsche Baryt-Industrie Dr. Rudolf Albert GmbH & Co. KG

DICON Explosives Company Ltd.

DNVJ Vermögensverwaltung GmbH

Dynamit Nobel GmbH

Dynamit Nobel Unterstützungsfonds GmbH

Emil Müller GmbH

Excalibur Realty UK Limited

Hebro Chemie GmbH

Holliday Chemical Espana S.A.S.

Holliday France S.A.S.

Holliday Pigments International S.A.S.

Holliday Pigments S.A.S.

Industrieservice Ges.mbH

Inorganic Pigments Limited

Kendell S.r.l.

Knight Chimiques de Spécialité S.A.S.

Knight Lux 1 S.à r.l.

Knight Lux 2 S.à r.l.

Knight Lux 4 S.à r.l.

Metalon Stolberg Gesellschaft mit beschränkter Haftung

Metalon Environmental Management & Solutions oHG

Nanjing Chemetall Surface Technologies Co., Ltd.

Nigerian Development and Construction Company Ltd.

Nuodex Mexicana, S.A. de C.V.

Nuodex Italiana S.r.l.

Pigment-Chemie GmbH

Pool Spa Holdings, Inc.

Press + Sintertechnik Sp.z o.o.

Press and Sinter Technics de Mexico, S.A. de C.V.

PST Press Sintertécnica Brasil Ltda.

Process Ink Holdings Ltd.

Process Inks And Coatings Ltd.

RA Rohsoffallianz GmbH

Rockwood Absorbents (Baulking) Limited

Rockwood Additives Limited

Rockwood Clay Additives GmbH

Rockwood Far East Limited

Rockwood Hong Kong Limited

Rockwood Industries Spain S.L.

Rockwood Italia S.p.A

Rockwood Lithium Australia Pty. Ltd

Rockwood Lithium Australia Holding Pty. Ltd

Rockwood Lithium GmbH

Rockwood Lithium India Pvt. Ltd.

Rockwood Lithium (UK) Ltd.

Rockwood Lithium Japan K.K.

Rockwood Pigmente Holding GmbH

Rockwood Pigments (UK) Limited

Rockwood Pigments and Trading Pty Ltd.

Rockwood Shenzhen Pigments Company Ltd.

Rockwood Specialties Australia Pty Ltd.

Rockwood Specialties GmbH

Rockwood Specialties Group GmbH

Rockwood Specialties International, Inc (RSII)

Rockwood Specialties Limited

Rockwood Tiacang Pigments Company Ltd.

Rockwood Vermögensverwaltung GmbH

Rockwood Wafer Reclaim S.A.S.

Sachtleben Chemie GmbH

Sachtleben LLC

Sachtleben GmbH

Sachtleben Pigments Oy

Sachtleben Pigment GmbH

Sachtleben Trading (Shanghai) Company Limited

Sachtleben Wasserchemie (Holding) GmbH

Sachtleben Wasserchemie GmbH

Sales de Magnesio Ltda.

Shanghai Chemetall Chemicals Co., Ltd.

Silo Pigmente GmbH

Stadeln Genehmigungshaltergesellschaft mbH

The Brent Manufacturing Company Ltd.

Tribotecc GmbH

Troisdorf Genehmigungshaltergesellschaft mbH

Viance Limited

Viance LLC

Viance Oy

Würgendorf Genehmigungshaltergesellschaft mbH

Guarantor Subsidiaries*

Rockwood Litio Limitada

Foote Minera e Inversiones Ltda.

Chemetall Mexicana, S.A. de C.V

Chemetall Canada Limited.

Knight Lux 3 S.à r.l

Rockwood Vermögensverwaltung S.à r.l. & Co. KG

* These subsidiaries are included in the Non-Guarantor subsidiary column and are 100% owned by Guarantor subsidiaries of the Issuer (RSGI).