Table of Contents

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

IHS INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

IHS INC.

15 Inverness Way East

Englewood, Colorado 80112

www.ihs.com

February 26, 2014

Dear IHS Stockholder:

We are pleased to invite you to attend our 2014 Annual Meeting of Stockholders. The Annual Meeting will be held at 10:00 a.m. Eastern Daylight Time, on Wednesday, April 9, 2014, at the Marriott Marquis, 1535 Broadway, New York, NY 10036.

Whether or not you attend the Annual Meeting, it is important that you participate. We value the vote of every stockholder. Please review the enclosed Proxy Card carefully to understand how you may vote by proxy. If you choose to cast your vote in writing, please sign and return your proxy promptly. For Proxy Cards delivered in hard copy, a return envelope, requiring no postage if mailed in the United States, is enclosed. For your convenience, we have also arranged to allow you to submit your proxy telephonically. If your shares are held in the name of a bank or broker, voting by mail, telephone or Internet will depend on the processes of the bank or broker, and you should follow the instructions you receive from your bank or broker.

If you want to attend the Annual Meeting in person, please let us know in advance. Each stockholder of record has the opportunity to vote in person at the Annual Meeting. If your shares arenot registered in your name (for instance, if you hold shares through a broker, bank, or other institution), please advise the stockholder of record that you wish to attend; that firm will then provide you with evidence of ownership that will be required for admission to the Annual Meeting. Let us know if we can explain any of these matters or otherwise help you with voting or attending our Annual Meeting.

Remember that your shares cannot be voted unless you submit your proxy or attend the Annual Meeting in person. Your participation is important to all of us at IHS, so please review these materials carefully and cast your vote.

We look forward to hearing from you or seeing you at the Annual Meeting.

| Sincerely, |

|

| Executive Vice President, Legal and Corporate Secretary |

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held Wednesday, April 9, 2014

To our Stockholders:

IHS Inc. will hold its Annual Meeting of Stockholders (the “Annual Meeting”) at 10:00 a.m. Eastern Daylight Time, on Wednesday, April 9, 2014, at the Marriott Marquis,1535 Broadway, New York, NY 10036.

We are holding this Annual Meeting to allow our stockholders to vote on several key topics:

| — | to elect three directors to serve until the 2017 Annual Meeting or until their successors are duly elected and qualified; |

| — | to ratify the appointment of Ernst & Young LLP as our independent registered public accountants; |

| — | to approve, on an advisory, non-binding basis, the compensation of our named executive officers; and |

| — | to transact such other business as may properly come before the Annual Meeting and any adjournments or postponements of the Annual Meeting. |

Only stockholders of record at the close of business on February 18, 2014 (the “Record Date”) are entitled to notice of, and to vote, at the Annual Meeting and any adjournments or postponements of the Annual Meeting. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for stockholders to review for purposes relevant to the meeting. To arrange to review that list contact:

IHS Inc., Attn: Corporate Secretary, 15 Inverness Way East, Englewood, Colorado 80112

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL 9, 2014: The Proxy Statement and our Annual Report on Form 10-K (“Annual Report”) for the year ended November 30, 2013 are available athttp://investor.ihs.com

We will deliver a copy of the Proxy Statement and our Annual Report free of charge if a stockholder sends a request to the Corporate Secretary, IHS Inc., 15 Inverness Way East, Englewood, Colorado 80112 or calls 303-790-0600.

It is important that your shares are represented at this Annual Meeting.

Even if you plan to attend the Annual Meeting in person, we hope that you will promptly vote and submit your proxy by dating, signing, and returning the enclosed Proxy Card by mail, or by voting by telephone, or, if you hold your shares in the name of a bank or broker, by following the instructions you receive from your bank or broker.

Casting a vote by proxy will not limit your rights to attend or vote at the Annual Meeting.

| By Order of the Board of Directors, |

|

Stephen Green, Executive Vice President, Legal and Corporate Secretary |

| February 26, 2014 |

Table of Contents

| 1 | ||||

| 5 | ||||

Proposal 2: Ratification of the Appointment of Independent Registered Public Accountants | 6 | |||

| 8 | ||||

| 10 | ||||

Security Ownership of Certain Beneficial Owners and Management | 25 | |||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 41 | ||||

| 50 | ||||

| 59 | ||||

| 64 | ||||

| 66 | ||||

| 69 |

Table of Contents

IHS INC.

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

This Proxy Statement is being furnished to you in connection with the solicitation by the Board of Directors of IHS Inc., a Delaware corporation, of proxies for the 2014 Annual Meeting of Stockholders and any adjournments or postponements thereof. The Annual Meeting will be held at 10:00 a.m. Eastern Daylight Time, on Wednesday, April 9, 2014, at the Marriott Marquis, 1535 Broadway, New York, NY 10036.

This Proxy Statement, the Annual Report on Form 10-K for the year end November 30, 2013 (the “Annual Report”), and the accompanying form of Proxy Card are being first sent to stockholders on or about February 28, 2014. While we are mailing the full set of proxy materials to all of our record holders, with respect to beneficial owners whose shares are held in the name of a bank or broker, we are only providing notice and electronic access to our proxy materials. The notice to such beneficial owners will be mailed on or about February 28, 2014. The notice contains instructions regarding how to access and review our proxy materials over the Internet. The notice also provides instructions regarding how to submit a proxy over the Internet. We believe that this process allows us to provide stockholders with important information in a timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. Beneficial owners who receive such notice may request a printed copy of our proxy materials without charge by contacting our Corporate Secretary no later than April 2, 2014, at IHS Inc., 15 Inverness Way East, Englewood, Colorado 80112 or calling 303-790-0600.

References in this Proxy Statement to “we,” “us,” “our,” “the Company,” and “IHS” refer to IHS Inc. and our consolidated subsidiaries.

Appointment of Proxy Holders

The Board of Directors of IHS (the “Board”) asks you to appoint the following individuals as your proxy holders to vote your shares at the 2014 Annual Meeting of Stockholders:

Scott Key, President and Chief Executive Officer;

Todd Hyatt, Executive Vice President and Chief Financial Officer; and

Stephen Green, Executive Vice President, Legal and Corporate Secretary

You may make this appointment by using one of the methods described below. If appointed by you, the proxy holders will vote your shares as you direct on the matters described in this Proxy Statement. In the absence of your direction, they will vote your shares as recommended by the Board.

Unless you otherwise indicate on the Proxy Card, you also authorize your proxy holders to vote your shares on any matters not known by the Board at the time this Proxy Statement was printed and that, under our Bylaws, may be properly presented for action at the Annual Meeting.

Who Can Vote

Only stockholders who owned shares of our Class A common stock at the close of business on February 18, 2014—the “Record Date” for the Annual Meeting—can vote at the Annual Meeting.

1

Table of Contents

Each holder of our Class A common stock is entitled to one vote for each share held as of the Record Date. As of the close of business on the Record Date, we had 68,053,423 shares of Class A common stock outstanding and entitled to vote.

There is no cumulative voting in the election of directors.

How You Can Vote

You may vote your shares at the Annual Meeting either in person, by mail or telephonically, as described below. If your shares are held in the name of a bank or broker, voting by mail, telephone or Internet will depend on the processes of the bank or broker, and you should follow the voting instructions on the form you receive from your bank or broker.

Voting by Telephone. Stockholders of record entitled to vote at the Annual Meeting can simplify their voting and reduce the Company’s cost by voting their shares via telephone. The telephone voting procedures are designed to authenticate stockholders’ identities, allow stockholders to vote their shares and to confirm that their instructions have been properly recorded. Stockholders who elect to vote over the telephone may incur telecommunication costs for which the stockholder is solely responsible. The telephonic voting facilities for stockholders of record will close at 11:59 p.m. Eastern Daylight Time the day before the Annual Meeting.

Voting by Mail. Stockholders of record may vote by signing, dating, and returning the Proxy Card in the enclosed postage-prepaid return envelope. Carefully review and follow the instructions on the enclosed Proxy Card. The shares represented will be voted in accordance with the directions in the Proxy Card. The Proxy Card must be received by us no later than the close of business on April 8, 2014.

Voting at the Annual Meeting. Voting by proxy will not limit your right to vote at the Annual Meeting if you decide to attend in person. The Board recommends that you vote by proxy, as it is not practical for most stockholders to attend the Annual Meeting. If you hold shares through a bank or broker, you must obtain a proxy, executed in your favor, from the bank or broker to be able to attend and vote in person at the Annual Meeting.

Revocation of Proxies

Stockholders can revoke their proxies at any time before they are exercised in any of three ways:

| — | by voting in person at the Annual Meeting; |

| — | by submitting written notice of revocation to the Corporate Secretary prior to the Annual Meeting; or |

| — | by submitting another proxy—properly executed and delivered—on a later date, but prior to the Annual Meeting. |

Quorum

A quorum, which is a majority of the outstanding shares entitled to vote as of the Record Date, must be present to hold the Annual Meeting. A quorum is calculated based on the number of shares represented by the stockholders attending in person and by their proxy holders. If you indicate an abstention as your voting preference, your shares will be counted toward a quorum but they will not be voted on any given proposal. “Broker non-votes” (see below) will be counted as shares of stock that are present for the purpose of determining the presence of a quorum but will have no effect with respect to any matter for which a broker does not have authority to vote.

2

Table of Contents

Required Vote

With respect toProposal 1, our directors are elected by a majority of the votes cast in favor of their election. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election, with abstentions and “broker non-votes” not counted as a vote cast either for or against that director. However, in the event of a contested election, our directors will be elected by a plurality vote, which means that the three nominees receiving the most affirmative votes will be elected.

Each of the following proposals will be approved if it receives the affirmative vote of the majority of shares present in person or represented by proxy and entitled to vote:

Proposal 2, the ratification of our independent auditors; and

Proposal 3, the advisory vote on executive compensation.

With respect to Proposals 2 and 3, abstentions will not be counted as votes cast on these proposals and will have the effect of a vote against such proposals.

Please note that under current New York Stock Exchange rules, brokers may no longer vote your shares on certain “non-routine” matters without your voting instructions. Accordingly, if you do not provide your broker or other nominee with instructions on how to vote your shares, it will be considered a “broker non-vote” and your broker or nominee will not be permitted to vote those shares on the election of directors (Proposal 1) or the advisory vote on executive compensation (Proposal 3). Your broker or nominee will be entitled to cast broker non-votes on the ratification of independent auditors (Proposal 2).

We encourage you to provide instructions to your broker regarding the voting of your shares.

Solicitation of Proxies

We pay the cost of printing and mailing the Notice of Annual Meeting, the Annual Report, and all proxy and voting materials. Our directors, officers, and other employees may participate in the solicitation of proxies by personal interview, telephone, or e-mail. No additional compensation will be paid to these persons for solicitation. We will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to beneficial owners of our common stock.

Other Matters

Multiple IHS stockholders who share an address may receive only one copy of this Proxy Statement and the Annual Report, unless the stockholder gives instructions to the contrary. We will deliver promptly a separate copy of this Proxy Statement and the Annual Report to any IHS stockholder who resides at a shared address and to which a single copy of the documents was delivered, if the stockholder makes a request by contacting:

Corporate Secretary, IHS Inc., 15 Inverness Way East, Englewood, Colorado 80112

by telephone: 303-790-0600

Multiple stockholders who share a single address and who receive multiple copies of the Proxy Statement and the Annual Report and who wish to receive a single copy of each at that address in the future will need to contact their bank, broker, or other nominee.

3

Table of Contents

Important Reminder

|

Please promptly vote and submit your proxy in writing or by telephone, or if you hold your shares through a bank or broker, as instructed by your bank or broker.

|

To submit a written vote, you may sign, date, and return the enclosed Proxy Card in the postage-prepaid return envelope. To vote telephonically, follow the instructions provided on the Proxy Card.

|

Voting by proxy will not limit your rights to attend or vote at the Annual Meeting.

|

4

Table of Contents

Proposal 1: Election of Directors

Directors and Nominees

Pursuant to the authority granted to the Company’s Board of Directors (the “Board”) by the Company’s Amended and Restated By-Laws, the Board has determined that it be composed of nine directors, divided into three classes. Directors are elected for three-year terms and one class is elected at each Annual Meeting.

Three directors are to be elected at the 2014 Annual Meeting. These directors will hold office until the Annual Meeting in 2017, or until their respective successors have been elected and qualified. Each director nominee set forth below has consented to being named in this Proxy Statement as a nominee for election as director and has agreed to serve as a director if elected. In the event that any of the nominees should become unavailable prior to the Annual Meeting, proxies in the enclosed form will be voted for a substitute nominee or nominees designated by the Board, or the Board may reduce the number of directors to constitute the entire Board, in its discretion.

If an incumbent director nominee fails to receive a majority of the votes cast in an election that is not a contested election, such director is required to immediately tender his or her resignation and such resignation will be effective only if and when accepted by the Board, in the Board’s discretion. If the Board accepts such a resignation, the remaining members of the Board may fill the resulting vacancy or decrease the size of the Board.

2014 NOMINEES FOR DIRECTOR

For more information about each director nominee, our continuing directors, and the operation of our Board, see below under “Business Experience and Qualification of Board Members.”

| ||||||||||

| Name | Age | Director Since | Position with Company | |||||||

| ||||||||||

Brian H. Hall | 66 | 2008 | Director | |||||||

Balakrishnan S. Iyer | 57 | 2003 | Director | |||||||

Jerre L. Stead | 71 | 2000 | Director and Executive Chairman | |||||||

Vote Required and Recommendation

In an uncontested election, directors are elected by a majority of the votes cast in favor of their election. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election, with abstentions and “broker non-votes” not counted as a vote cast either for or against that director. However, in the event of a contested election, our directors would be elected by a plurality vote, which means that the three nominees receiving the most affirmative votes would be elected.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THESE NOMINEES

|

5

Table of Contents

Proposal 2: Ratification of the Appointment of Independent Registered Public Accountants

Proposed Ratification

The Audit Committee of the Board (the “Audit Committee”), which is composed entirely of independent directors, has selected Ernst & Young LLP as the independent registered public accountants to audit our books, records, and accounts and those of our subsidiaries for the fiscal year 2014. The Board has endorsed this appointment. Ratification of the selection of Ernst & Young LLP by stockholders is not required by law. However, as a matter of good corporate practice, such selection is being submitted to the stockholders for ratification at the Annual Meeting. If the stockholders do not ratify the selection, the Board and the Audit Committee will reconsider whether or not to retain Ernst & Young LLP, but may, in their discretion, retain Ernst & Young LLP. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such change would be in the best interests of IHS and its stockholders.

Ernst & Young LLP previously audited our consolidated financial statements during the 13 fiscal years ended November 30, 2013. Representatives of Ernst & Young LLP will be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate stockholder questions.

Audit, Audit-Related, and Tax Fees

In connection with the audit of the 2013 financial statements, IHS entered into an engagement agreement with Ernst & Young LLP that set forth the terms by which Ernst & Young LLP performed audit services for IHS. That agreement subjects IHS to alternative dispute resolution procedures and excludes the award of punitive damages in the event of a dispute between IHS and Ernst & Young LLP.

Aggregate fees for professional services rendered for us by Ernst & Young LLP for the years ended November 30, 2013 and 2012 respectively, were as follows:

| ||||||||

| 2013 | 2012 | |||||||

| ||||||||

| (in thousands) | ||||||||

Audit Fees | $ | 2,251 | $ | 2,225 | ||||

Audit-Related Fees | 403 | 711 | ||||||

Tax Fees | 52 | 456 | ||||||

All Other Fees | — | — | ||||||

| ||||||||

Total | $ | 2,706 | $ | 3,392 | ||||

Audit Fees. Audit fees consist of fees billed for professional services rendered for the audit of our consolidated financial statements, the statutory audit of our subsidiaries, the review of our interim consolidated financial statements, and other services provided in connection with statutory and regulatory filings.

Audit-Related Fees. Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services may include employee benefit

6

Table of Contents

plan audits, auditing work on proposed transactions, attestation services that are not required by regulation or statute, and consultations regarding financial accounting or reporting standards. For 2013, audit-related fees also included approximately $300,000 for professional services rendered related to acquisitions. For 2012, audit-related fees also included approximately $534,000 for professional services rendered related to acquisitions.

Tax Fees. Tax fees consist of tax compliance consultations, preparation of tax reports, and other tax services.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has implemented pre-approval policies and procedures related to the provision of audit and non-audit services by Ernst & Young LLP. Under these procedures, the Audit Committee pre-approves both the type of services to be provided by Ernst & Young LLP and the estimated fees related to these services.

During the approval process, the Audit Committee considers the impact of the types of services and the related fees on the independence of the registered public accountant. The services and fees must be deemed compatible with the maintenance of such accountants’ independence, including compliance with rules and regulations of the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) and the New York Stock Exchange (the “NYSE”). The Audit Committee does not delegate its responsibilities to pre-approve services performed by Ernst & Young LLP to management or to any individual member of the Audit Committee. Throughout the year, the Audit Committee will review any revisions to the estimates of audit and non-audit fees initially approved.

Vote Required and Recommendation

Ratification of the appointment of Ernst & Young LLP requires the affirmative vote of a majority of the shares present and voting at the Annual Meeting in person or by proxy. Unless marked to the contrary, proxies received will be voted “FOR” this Proposal 2 regarding the ratification of Ernst & Young LLP as our independent registered public accountants. In the event ratification is not obtained, the Audit Committee will review its future selection of our independent registered public accountants.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF ERNST & YOUNG LLP AS OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

7

Table of Contents

Proposal 3: Advisory Vote to Approve Executive Compensation

With this proposal, we are providing stockholders an opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our named executive officers (“NEOs”) as disclosed in this Proxy Statement. In accordance with Section 14A of the Exchange Act, as voted upon by our stockholders, and as approved by our Board of Directors, we are holding this advisory vote on an annual basis.

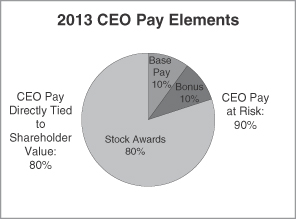

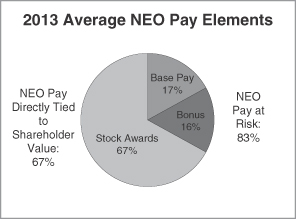

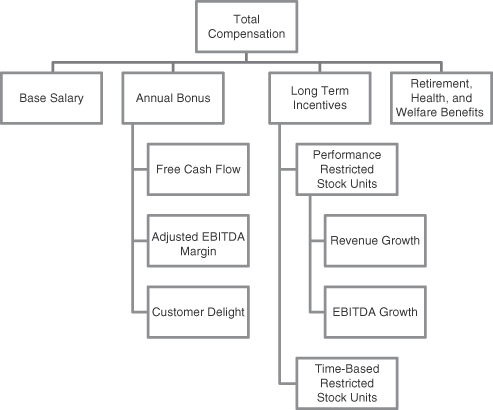

As described in detail under the heading “Compensation Discussion and Analysis,” our executive compensation programs are designed to (i) align executive compensation with key stakeholder interests; (ii) attract, retain, and motivate highly qualified executive talent; and (iii) provide appropriate rewards for the achievement of business objectives and growth in stockholder value. Under these programs, our named executive officers are rewarded for the achievement of specific individual and corporate goals, with an emphasis on creating overall stockholder value.

Please read the “Compensation Discussion and Analysis” section for additional details about our executive compensation programs, including information about the fiscal year 2013 compensation of our NEOs. We would like to specifically point out the following highlights:

| — | Through the awards of performance- and time-based restricted stock units, we have aligned our NEO compensation opportunity directly to the value of our stock. We have emphasized long-term performance with performance-based awards that focus on three-year performance objectives and strong holding requirements. Our NEOs are required to retain IHS stock equal to three to five times the value of their annual salaries. Unvested stock awards do not count toward their respective holding requirements. |

| — | In 2013, we entered into employment agreements with our three new NEOs that specified limited severance protection in certain events, but excluded any protection in the event the officer chose to voluntarily terminate employment. |

| — | Since 2010, we have not entered into any new employment agreements that provide entitlement to tax gross-ups with respect to the excise tax liability under Internal Revenue Code Section 4999 related to any Section 280G excess parachute payment. |

| — | The independent compensation consultant retained by the Human Resources Committee of the Board of Directors is prohibited from doing any unrelated work for the Company. |

The Human Resources Committee continually reviews the compensation programs for our NEOs to ensure they achieve the desired goals of aligning our executive compensation structure with our stockholders’ interests and current market practices. We are asking our stockholders to indicate their support for our named executive officer compensation program and practices as described in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our NEO’s compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies, and practices described in this Proxy Statement. Accordingly, we are asking our stockholders to approve the compensation policies and practices of our NEOs as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the Commission (which includes the “Compensation Discussion and Analysis,” the compensation tables, and related material).

8

Table of Contents

Vote Required and Recommendation

The say-on-pay vote is advisory and therefore not binding on the Company, the Human Resources Committee, or our Board. Our Board and our Human Resources Committee value the opinions of our stockholders and, to the extent there is a significant vote against the named executive officer compensation policies and practices as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and the Human Resources Committee will evaluate whether any actions are necessary to address those concerns.

In 2013, 98 percent of the total shares voted at our Annual Meeting of Stockholders approved the advisory vote on executive compensation. Based on this level of stockholder support, we continued with our compensation philosophy and mix of compensation elements that strongly tie pay to performance.

Unless you instruct us to the contrary, proxies will be voted “FOR” this Proposal 3 regarding named executive officer compensation policies and practices, as described in “Compensation Discussion and Analysis” below, and the other related tables and disclosures in this Proxy Statement.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE

OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT PURSUANT

TO THE COMPENSATION DISCLOSURE RULES OF THE COMMISSION

9

Table of Contents

Corporate Governance and Board of Directors

Board Leadership Structure

The Board of Directors of IHS believes strongly in the value of an independent board of directors to provide effective oversight of management. Of the nine members of our Board of Directors, seven are independent. This includes all members of the key board committees: the Audit Committee, the Human Resources Committee, the Nominating and Corporate Governance Committee, and the Risk Committee. The independent members of the Board of Directors meet regularly without management, which meetings are chaired by the Lead Independent Director, whose role is described further below.

The Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman and Chief Executive Officer (“CEO”) in any way that it deems to be in the best interests of the Company. Jerre Stead served as Chairman of the Board and CEO until May 31, 2013 and became Executive Chairman effective on June 1, 2013 when Scott Key assumed the role of President and CEO. Throughout the time that the offices of Chairman and CEO were combined, Mr. Stead was well positioned to develop agendas that ensured that the Board’s time and attention were focused on the most critical matters. As Executive Chairman, Mr. Stead is charged with presiding over meetings of our Board and providing advice and counsel to the CEO regarding our business and operations. The Board feels that this governance structure is optimal because it enables us to gain the benefits of the continued leadership and other contributions from Mr. Stead, while at the same time executing on our previously announced CEO succession plan.

IHS has established a Lead Independent Director role with broad authority and responsibility. During 2013, C. Michael Armstrong served as Lead Independent Director. Mr. Armstrong has decided to retire at the end of his term effective on April 9, 2013 and will not stand for re-election, but he will continue to serve as Lead Independent Director until his retirement is effective. The Board has elected Brian H. Hall to serve as our new Lead Independent Director beginning immediately after our Annual Meeting of Stockholders. The Lead Independent Director’s responsibilities include:

| — | scheduling meetings of the independent directors; |

| — | chairing the separate meetings of the independent directors; |

| — | serving as principal liaison between the independent directors, the Executive Chairman, and the President and CEO on sensitive issues; |

| — | communicating from time to time with the Executive Chairman and the President and CEO, and disseminating information among the Board of Directors as appropriate; |

| — | providing leadership to the Board of Directors if circumstances arise in which the role of the Executive Chairman may be, or may be perceived to be, in conflict; |

| — | reviewing the agenda and schedule for Board of Directors meetings and executive sessions and adding topics to the agenda as appropriate; |

| — | reviewing the quality, quantity, and timeliness of information to be provided to the Board; |

| — | being available, as appropriate, for communication with stockholders; and |

| — | presiding over the annual self-evaluation of the Board of Directors. |

The Board believes that these responsibilities appropriately and effectively complement the Board leadership structure of IHS.

10

Table of Contents

The Role of the Board of Directors in Risk Oversight

We believe that risk is inherent in innovation and the pursuit of long-term growth opportunities. Management at IHS is responsible for day-to-day risk management activities. The Board of Directors, acting directly and through its committees, is responsible for the oversight of the Company’s risk management. With the oversight of the Board of Directors, IHS has implemented practices and programs designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase stockholder value.

The Board of Directors created a Risk Committee in 2012 to bring additional Board-level focus to the oversight of the Company’s management of key risks, as well as the Company’s policies and processes for monitoring and mitigating such risks. Each of the Board’s four committees, Risk, Audit, Human Resources, and Nominating and Corporate Governance, has a role in assisting the Board of Directors in its oversight of the Company’s risk management, as set forth in the relevant Committee Charters.

The Chair of the Risk Committee gives regular reports of the Risk Committee’s activities to the Audit Committee in order to keep the Audit Committee informed of the Company’s guidelines, policies and practices with respect to risk assessment and risk management; and each committee reports regularly to the full Board of Directors on its activities. In addition, the Board of Directors participates in regular discussions among the Board and with IHS senior management on many core subjects, including strategy, operations, finance, information technology, human resources, and legal and public policy matters, in which risk oversight is an inherent element. The Board of Directors believes that the leadership structure described above under “Board Leadership Structure” facilitates the Board’s oversight of risk management because it allows the Board, with leadership from the Lead Independent Director and working through its independent committees, to participate actively in the oversight of management’s actions.

Business Experience and Qualification of Board Members

The following discussion presents information about the persons who comprise the Board of Directors of IHS, including the three nominees for election at the Annual Meeting.

2014 Nominees for Director

Brian H. Hall, 66, was appointed to our Board in March 2008. From January 2007 through August 2007, Mr. Hall served as Vice Chairman of Thomson Corporation. Previously, from 1995 through 2006, Mr. Hall served as President and CEO of Thomson Legal & Regulatory and West Publishing. Prior to joining Thomson, Mr. Hall was President of Shepard’s and Executive Vice President of McGraw-Hill. Mr. Hall serves as Chairman and a member of the board of trustees of the Rochester Institute of Technology. Mr. Hall currently serves on the board of trustees for the Cheyenne Mountain Zoo and as a director of the Breckenridge Music Festival. He is a former board member of Archipelago Learning, Inc., Bank One of Colorado Springs, and Ryerson of Canada.

Mr. Hall brings to the Board many years of relevant industry experience gained in executive level positions in the information services industry.

Balakrishnan S. Iyer, 57, has served as a member of our Board since December 2003. From October 1998 to June 2003, Mr. Iyer served as Senior Vice President and Chief Financial Officer of

11

Table of Contents

Conexant Systems, Inc. From 1997 to 1998, he was Senior Vice President and Chief Financial Officer of VLSI Technology Inc. and, from 1993 to 1997, he was Vice President, Corporate Controller of VLSI Technology Inc. Mr. Iyer served on the board of directors of Conexant Systems from February 2002 until April 2011 and Life Technologies until it was acquired in February 2014. He currently serves on the board of directors of Skyworks Solutions, Power Integrations, Inc., and QLogic Corporation.

Mr. Iyer provides to the Board his expertise in corporate finance, accounting, and strategy, including experience gained as the Chief Financial Officer of two public companies. Mr. Iyer also brings a background in organizational leadership and experience serving as a public company outside director.

Jerre L. Stead, 71, was named Executive Chairman in June 2013. From September 2006 until June 2013, Mr. Stead was Chief Executive Officer of IHS. He has served as Chairman of the Board since December 1, 2000. From August 1996 until June 2000, Mr. Stead served as Chairman of the board of directors and Chief Executive Officer of Ingram Micro Inc. Prior to that, he served as Chief Executive Officer and Chairman of the board of directors at Legent Corporation, from January 1995 to September 1995. From May 1993 to December 1994, he was Executive Vice President of AT&T and Chairman and Chief Executive Officer of AT&T Corp. Global Information Solutions (NCR Corporation). From September 1991 to April 1993, he was President and Chief Executive Officer of AT&T Corp. Global Business Communication Systems (Avaya Corporation). Mr. Stead was a director of Conexant Systems from May 1998 until May 2011 and a director of Brightpoint, Inc. until its acquisition by Ingram Micro Inc. in 2012. Mr. Stead also served on the board of directors of Mindspeed Technologies, Inc. until January 2014.

Mr. Stead has been involved in the leadership of IHS for more than 13 years and was previously the Chief Executive Officer of six different public companies. As Executive Chairman, Mr. Stead brings to the Board of Directors his thorough knowledge of IHS’ business, strategy, people, operations, competition, and financial position. Mr. Stead provides recognized executive leadership and vision. In addition, he brings with him a global network of customer, industry, and government relationships.

Continuing Directors with Terms Expiring at the Annual Meeting in 2015

Ruann F. Ernst, 67, has served as a member of our Board since December 2006. Dr. Ernst served as Chief Executive Officer of Digital Island, Inc. from 1998 until her retirement in 2002. Dr. Ernst was Chairperson of the board of Digital Island from 1998 until the company was acquired by Cable & Wireless, Plc. in 2001. Prior to Digital Island, Dr. Ernst worked for Hewlett Packard in various management positions, including General Manager, Financial Services Business Unit. Prior to that, she was Vice President for General Electric Information Services Company and a faculty member and Director of Medical Computing at The Ohio State University where she managed a biomedical computing and research facility. Dr. Ernst currently serves on the board of Digital Realty Trust. At The Ohio State University, she serves on the University Foundation Board and the Fisher College of Business Advisory Board in addition to serving as co-chair of The Ohio State University Innovation Foundation. She was a founder and is Board Chair of the non-profit, HealthyLifeStars.

Dr. Ernst brings to the Board a strong technical and computing background as well as skill in the development of information technology businesses. She also has extensive experience as a member of boards where strategic planning and long-term planning are critical to the success of the enterprise.

Christoph v. Grolman, 54, was appointed to our Board in March 2007. Mr. Grolman is CEO of TBG. Prior to his current position he served as Managing Director of TBG Limited (until 2009 TBG Holdings

12

Table of Contents

N.V.) since March 2007. From December 2006 to March 2007, Mr. Grolman served as Executive Director of TBG. From 2002 to 2006 he held the position of Executive Vice President of TBG, responsible for an industrial operating group and venture investments. Prior to joining TBG, he was a consult with Roland Berger & Partner Management Consults in Munich.

Mr. Grolman brings to our Board a wealth of experience in global business operations, strategic acquisitions, and financial strategies for a diverse portfolio of investments.

Richard W. Roedel, 64, has served as a member of our Board since November 2004. Mr. Roedel serves as a director of Lorillard, Inc., Six Flags Entertainment Corporation, and Luna Innovations Incorporated. Mr. Roedel also serves as the non-executive Chairman of Luna. He is also on the board of the Association of Audit Committee Members, Inc., a not-for-profit organization dedicated to strengthening audit committees, and serves on the Standing Advisory Group for the Public Company Accounting Oversight Board (PCAOB). Mr. Roedel served on the board of Sealy Corporation until 2013 when it was acquired. He also served as a director of Broadview Network Holdings, Inc, a private company until 2012 and Dade Behring Holdings, Inc. from October 2002 until November 2005 when Dade was acquired. He was also a director of BrightPoint, Inc. until it was acquired in 2012. Mr. Roedel served in various capacities at Take-Two Interactive Software, Inc. from November 2002 until June 2005, including Chairman and Chief Executive Officer. Until 2000, Mr. Roedel was employed by BDO Seidman LLP, having been Managing Partner of its Chicago and New York Metropolitan area offices and later as Chairman and Chief Executive Officer. Mr. Roedel is a graduate of The Ohio State University and is a certified public accountant.

Mr. Roedel provides to the Board of Directors expertise in corporate finance, accounting, and strategy. He brings experience gained as a Chief Executive Officer and as a director for several companies.

Continuing Directors with Terms Expiring at the Annual Meeting in 2016

Roger Holtback, 69, has served as a member of our Board since December 2003. Since 2001, Mr. Holtback has served as Chairman of Holtback Invest AB. From 1991 to 1993, he served as a member of the Group Executive Committee of SEB and Coordinating Chairman of SEB Sweden. From 1984 to 1990, he served as President and Chief Executive Officer of Volvo Car Corporation and Executive Vice President of AB Volvo. Mr. Holtback is currently Chairman of Rullpack AB, Finnvedan Bulten AB, and the Swedish Exhibition Centre and Congress Centre. He also serves as a director of TROX AB, a member of the Stena Sphere Advisory Board and as Senior Advisor to Nordic Capital.

Mr. Holtback brings to the Board significant operational and strategic experience gained during many years in a Chief Executive Officer position. The Board also benefits from his long experience as an outside public company board member and his vast experience and perspective as a European executive leader.

Scott Key, 55, has served as President and Chief Executive Officer of IHS and as a member of our Board since June 2013. Previously, from January 2011, Mr. Key served as Chief Operating Officer of IHS. From January 2010 through December 2010, he was Senior Vice President of Global Products and Services. Prior to holding these positions, he served as President and Chief Operating Officer of IHS Global Insight from October 2008 until January 2010. Mr. Key joined IHS in 2003 to lead strategy, marketing and product teams for the IHS energy business. He was involved in supporting the IHS initial

13

Table of Contents

public offering, led corporate marketing and strategic planning, and has led acquisition integration efforts, including the largest IHS acquisitions. Mr. Key also served as President and Chief Operating Officer of IHS Jane’s and as Chairman of IHS Fairplay from 2007 to 2008. In addition, he led the EMEA/APAC sales organization and drove the integration of IHS sales teams on a global basis. Based in Denver from 2003 to 2007, he served as Senior Vice President of Corporate Strategy and Marketing and led Energy, Strategy, Products and Marketing. Prior to joining IHS in 2003, Mr. Key served as a senior executive in energy technology and services, based in Houston, Texas. He served as deepwater development manager for Vastar Resources from 1998 to 2000 and was employed by Phillips Petroleum in a range of international and domestic roles of increasing scope from 1987 to 1998. Mr. Key has served as a member of the board of directors of Harte-Hanks Inc. since March 2013. Mr. Key holds bachelor of science degrees in both physics and mathematics from the University of Washington in Seattle as well as a master’s degree in geophysics from the University of Wyoming.

Mr. Key brings to the Board a deep understanding of the business and operations of IHS. He has led transformation and growth across IHS operations during his tenure with the Company and has held leadership positions that span the Company’s operations and assets in information, technology, research and analytics globally.

Jean-Paul Montupet, 66, has served as a member of our Board since October 2012. Mr. Montupet was chair of the Industrial Automation business of Emerson and president of Emerson Europe prior to his retirement in December 2012. Mr. Montupet joined Emerson in 1981, serving in a number of senior executive roles at the global technology provider. Mr. Montupet serves on the boards of Lexmark International, Inc., WABCO Holdings Inc., and Assurant, Inc., and is non-executive chair of the board of PartnerRE Ltd. He is also a trustee of the St. Louis Public Library Foundation and the Winston Churchill National Museum.

Mr. Montupet brings to the Board extensive international business experience, particularly from Europe and Asia Pacific.

Organization of the Board of Directors

The Board held 14 meetings during the fiscal year ended November 30, 2013. At each meeting, the Chairman was the presiding director. Each director attended at least 75 percent of the total regularly scheduled and special meetings of the Board and the committees on which they served. As stated in our Governance Guidelines, our Board expects each director to attend our Annual Meeting of Stockholders, although attendance is not required. At the 2013 Annual Meeting of Stockholders, eight of our nine directors were in attendance.

For 2013, our Board had four standing committees: the Audit Committee, the Human Resources Committee, the Nominating and Corporate Governance Committee, and the Risk Committee. We believe that all members of each of these committees meet the independence standards of the New York Stock Exchange and SEC rules and regulations. The Board has approved a charter for each of the Audit, Human Resources, Nominating and Corporate Governance, and Risk committees, each of which can be found on our website atwww.ihs.com.

Independent and Non-Management Directors

We believe that all of our directors other than Messrs. Stead and Key are “independent directors,” based on the independence standards described above. All of our directors other than Mr. Stead and Mr. Key are non-management directors.

14

Table of Contents

In accordance with the IHS Corporate Governance Guidelines, the independent directors designated Mr. Armstrong as Lead Independent Director in October 2006 and designated Mr. Hall as Lead Independent Director beginning after the Annual Meeting. The Lead Independent Director chairs executive sessions of the independent directors. During our 2013 fiscal year, the independent directors of the Board met four times without the presence of management.

Simultaneous Service on Other Public Company Boards

Although the Board does not have a mandatory policy limiting the number of boards on which a director may serve, our Board has adopted Governance Guidelines (available atwww.ihs.com) indicating that directors should not serve on more than five boards of public companies while serving on the Company’s Board.

The Governance Guidelines also explain that, if a member of the Company’s Audit Committee simultaneously serves on the audit committees of more than three public companies, and the Company does not limit the number of audit committees on which its audit committee members may serve to three or less, then in each case, the Board must determine that such simultaneous service would not impair the ability of such member to serve effectively on the Company’s Audit Committee.

The Board has determined that the service of Mr. Iyer on the audit committees of three public companies in addition to the Company’s Audit Committee does not impair Mr. Iyer’s ability to serve effectively on the Company’s Audit Committee.

Business Code of Conduct

We have adopted a code of ethics that we refer to as our Business Code of Conduct. Our Business Code of Conduct applies to our directors as well as all of our principal executive officers, our financial and accounting officers, and all other employees of IHS.

Our Business Code of Conduct, as well as our Governance Guidelines, are available on our website atwww.ihs.com. If we approve any substantive amendment to our Governance Guidelines or our Business Code of Conduct, or if we grant any waiver of the Business Code of Conduct to the Chief Executive Officer, the Chief Financial Officer, or the Chief Accounting Officer, we intend to post an update on the Investor Relations page of the Company’s website (http://investor.ihs.com) within five business days and keep the update on the site for at least one year.

Communications with the Board

The Board has a process for stockholders or any interested party to send communications to the Board, including any Committee of the Board, any individual director, or our non-management directors. If you wish to communicate with the Board as a whole, with any Committee, with any one or more individual directors, or with our non-management directors, you may send your written communication to:

Stephen Green

Executive Vice President, Legal and Corporate Secretary

IHS Inc.

15 Inverness Way East

Englewood, Colorado 80112

15

Table of Contents

Communications with Non-Management Directors

Interested parties wishing to reach our independent directors or non-management directors may address the communication to our Lead Independent Director on behalf of the non-management directors. Address such communications as follows:

Lead Independent Director

IHS Inc.

15 Inverness Way East

Englewood, Colorado 80112

Depending on how the communication is addressed and the subject matter of the communication, either our Lead Independent Director or Mr. Green will review any communication received and will forward the communication to the appropriate director or directors.

Composition of Board Committees

The Board had four standing committees in fiscal year 2013 with duties, membership, and number of meetings for each as shown below.

| ||||||||

| Name | Audit | Human Resources | Nominating and Corporate | Risk | ||||

| ||||||||

C. Michael Armstrong | ü | Chair | ü | |||||

Ruann F. Ernst | ü | ü | ||||||

Brian H. Hall | Chair | ü | ||||||

Roger Holtback | ü | |||||||

Balakrishnan S. Iyer | Chair | ü | ||||||

Jean-Paul Montupet | ü | |||||||

Richard W. Roedel | ü | ü | Chair | |||||

2013 Meetings | 8 | 6 | 4 | 10 | ||||

Audit Committee

Members:

Balakrishnan S. Iyer,Chairman

Roger Holtback

Richard W. Roedel

Our Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee assists our Board in its oversight of (i) the integrity of our financial statements, (ii) our independent registered public accountant’s qualifications, independence, and performance, (iii) the performance of our internal audit function, and (iv) our compliance with legal and regulatory requirements. The Audit Committee also prepares the report on the Company’s financial statements and its independent auditor that the SEC rules require to be included in the Company’s annual proxy statement. The Audit Committee is governed by a charter, a copy of which may be found at the Company’s websitewww.ihs.com. The Audit Committee has sole responsibility for the engagement or termination of our independent accountants. As required by the Audit Committee Charter, all members of the Audit Committee meet the criteria for “independence” within the meaning of the standards established by the New York Stock Exchange, the Company’s Corporate Governance Guidelines, and

16

Table of Contents

the Audit Committee Charter. Each member of the Audit Committee is financially literate and each member has accounting or related financial management expertise as required by New York Stock Exchange listing standards. In addition, the Board has determined that each member of the Audit Committee meets the definition of “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC.

Human Resources Committee

Members:

Brian H. Hall,Chairman

C. Michael Armstrong

Ruann F. Ernst

The Human Resources Committee has been created by our Board to (i) oversee our compensation and benefits policies generally, (ii) evaluate executive officer performance and review our management succession plan, (iii) oversee and set compensation for our executive officers, (iv) review and discuss the Compensation Discussion and Analysis disclosure with management and provide a recommendation to the Board regarding its inclusion in the Company’s annual proxy statement, and (v) prepare the report on executive officer compensation that the SEC rules require to be included in the Company’s annual proxy statement. The Human Resources Committee is governed by a charter, a copy of which is available at the Company’s websitewww.ihs.com. See “Compensation Discussion and Analysis” below for a more detailed description of the functions of the Human Resources Committee. All members of the Human Resources Committee are “independent” as required by the New York Stock Exchange, our Corporate Governance Guidelines and the Human Resources Committee Charter.

Nominating and Corporate Governance Committee

Members:

C. Michael Armstrong,Chairman

Brian H. Hall

Balakrishnan S. Iyer

Richard W. Roedel

The Nominating and Corporate Governance Committee has been created by our Board to (i) identify individuals qualified to become board members and recommend director nominees to the Board, (ii) recommend directors for appointment to committees established by the Board, (iii) make recommendations to the Board as to determinations of director independence, (iv) oversee the evaluation of the Board, (v) make recommendations to the Board as to compensation for our directors, and (vi) develop and recommend to the Board our corporate governance guidelines and code of business conduct and ethics. The Nominating and Corporate Governance Committee is governed by a charter. A more detailed description of the functions of the Nominating and Corporate Governance Committee can be found under “Director Nominations” in this Proxy Statement, and in the Nominating and Corporate Governance Committee Charter, a copy of which can be found at the Company’s websitewww.ihs.com. All members of the Nominating and Corporate Governance Committee are “independent” as required by our Corporate Governance Guidelines and the Nominating and Corporate Governance Committee Charter.

17

Table of Contents

Risk Committee

Members:

Richard W. Roedel,Chairman

C. Michael Armstrong

Ruann F. Ernst

Jean Paul Montupet

The Risk Committee has been created by our Board to assist our Board in its oversight of the Company’s risk management. In addition to any other responsibilities which may be assigned from time to time by the Board, the Risk Committee is responsible for: (i) reviewing and discussing with management the Company’s risk management and risk assessment processes, including any policies and procedures for the identification, evaluation and mitigation of major risks of the Company; (ii) receiving periodic reports from management as to efforts to monitor, control and mitigate major risks; and (iii) reviewing periodic reports from management on selected risk topics as the Committee deems appropriate from time to time, encompassing major risks other than those delegated by the Board to other Committees of the Board in their respective charters or otherwise. The Risk Committee is governed by a charter, a copy of which is available on the Company’s websitewww.ihs.com. All members of the Risk Committee are “independent” as required by our Corporate Governance Guidelines and the Risk Committee Charter.

Director Nominations

Our Board nominates directors to be elected at each Annual Meeting of Stockholders and elects new directors to fill vacancies when they arise. The Nominating and Corporate Governance Committee has the responsibility to identify, evaluate, recruit, and recommend qualified candidates to the Board for nomination or election.

In addition to considering an appropriate balance of knowledge, experience and capability, the Board has as an objective that its membership be composed of experienced and dedicated individuals with diversity of backgrounds, perspectives, and skills. The Nominating and Corporate Governance Committee will select candidates for director based on the candidate’s character, judgment, diversity of experience, business acumen, and ability to act on behalf of all stockholders (without regard to whether the candidate has been nominated by a stockholder).

The Nominating and Corporate Governance Committee believes that nominees for director should have experience, such as experience in management or accounting and finance, or industry and technology knowledge, that may be useful to IHS and the Board, high personal and professional ethics, and the willingness and ability to devote sufficient time to effectively carry out his or her duties as a director. The Nominating and Corporate Governance Committee believes it appropriate for at least one, and preferably multiple, members of the Board to meet the criteria established by the SEC for an “audit committee financial expert,” and for a majority of the members of the Board to meet the definition of “independent director” under the rules of the New York Stock Exchange. The Nominating and Corporate Governance Committee also believes it appropriate for certain key members of our management to participate as members of the Board.

Prior to each Annual Meeting of Stockholders, the Nominating and Corporate Governance Committee identifies nominees first by evaluating the current directors whose term will expire at the Annual Meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, the candidate’s prior service as a director, and the needs of the Board with

18

Table of Contents

respect to the particular talents and experience of its directors. In the event that a director does not wish to continue his or her service, the Nominating and Corporate Governance Committee determines not to re-nominate the director, or a vacancy is created on the Board as a result of a resignation, an increase in the size of the Board, or other event, the Nominating and Corporate Governance Committee will consider various candidates for membership, including those suggested by the Nominating and Corporate Governance Committee members, by other Board members, by any executive search firm engaged by the Nominating and Corporate Governance Committee, or by any nomination properly submitted by a stockholder pursuant to the procedures for stockholder nominations for directors provided in “Stockholder Proposals for the 2015 Annual Meeting” in this Proxy Statement. As a matter of policy, candidates recommended by stockholders are evaluated on the same basis as candidates recommended by the Board members, executive search firms, or other sources. In 2011, the Nominating and Corporate Governance Committee engaged Spencer Stuart to assist with identifying qualified Board candidates, which resulted in the election of Mr. Montupet to the Board.

Director Stock Ownership Guidelines

We believe that our nonemployee directors should have a significant equity interest in the Company. Our Board has adopted an ownership policy that requires directors to hold shares of our common stock with a market value of at least five times the Board’s annual cash retainer. Vested stock units for which receipt of the stock has been deferred until after termination of service count towards the holding requirements. Unvested awards do not count towards the ownership guidelines. Directors have three years to achieve the holding requirement. Directors are not allowed to sell shares until they reach the guideline. As of the Record Date, all of our current directors held shares in excess of their holding requirement.

Director Compensation

Our nonemployee directors receive compensation for their service on our Board. The compensation is comprised of cash retainers and equity awards. In addition, our nonemployee directors are reimbursed for reasonable expenses.

| ||||

| Director Compensation | 2013 ($) | |||

| ||||

Board Retainer | 90,000 | |||

Committee Chair Retainer | ||||

—Audit Committee | 30,000 | |||

—Human Resources Committee | 30,000 | |||

—Nominating and Corporate Governance Committee | 17,500 | |||

—Risk Committee | 30,000 | |||

Committee Member Retainer | ||||

—Audit Committee | 15,000 | |||

—All Other Committees | 10,000 | |||

Lead Independent Director Retainer | 30,000 | |||

Annual Equity Award | 150,000 | |||

Initial Equity Award | 150,000 | |||

All equity awards for nonemployee directors will be issued pursuant to the IHS Inc. 2004 Directors Stock Plan (the “Directors Stock Plan”). The Board Retainer and certain other retainers may be converted into deferred stock units or deferred under the Directors Stock Plan.

We provide liability insurance for our directors and officers.

19

Table of Contents

Director Compensation During Fiscal Year 2013

The following table sets forth information concerning the compensation of our nonemployee directors during the fiscal year ended November 30, 2013. Directors did not receive any stock option awards during fiscal year 2013.

| ||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | Total ($) | ||||||||||||

| ||||||||||||||||

C. Michael Armstrong(1) | 152,500 | 149,943 | 3,488 | (4) | 305,931 | |||||||||||

Ruann F. Ernst | 110,000 | 149,943 | 259,943 | |||||||||||||

Christoph v. Grolman | 89,910 | (2) | 149,943 | 239,853 | ||||||||||||

Brian H. Hall | 129,963 | (2) | 149,943 | 279,906 | ||||||||||||

Roger Holtback | 105,000 | 149,943 | 254,943 | |||||||||||||

Balakrishnan S. Iyer | 130,000 | 149,943 | 279,943 | |||||||||||||

Michael Klein(5) | 25,000 | 158,032 | (6) | 183,032 | ||||||||||||

Jean-Paul Montupet | 100,000 | 149,943 | 249,943 | |||||||||||||

Richard W. Roedel | 144,960 | (2) | 149,943 | 294,903 | ||||||||||||

| (1) | Mr. Armstrong has decided not to stand for re-election and will retire at the end of his term effective April 9, 2014. |

| (2) | Includes the value of deferred stock units granted to each of Messrs. Grolman, Hall, and Roedel. These directors elected to receive deferred stock units in lieu of their Board and Committee cash retainers. The deferred stock units will be distributed in shares of IHS common stock after the director’s service terminates. |

| (3) | On each December 1, the first day of the Company’s fiscal year, nonemployee directors each receive an annual award of Restricted Stock Units with a market value of $150,000. These units vest one year from the date of grant. The valuation of the stock awards reported in this table is the grant date fair value computed in accordance with FASB ASC Topic 718 for awards granted in fiscal year 2013. Any estimated forfeitures are excluded from values reported in this table. The aggregate number of stock awards held by each director on November 30, 2013, the last day of fiscal year 2013, is as follows: |

| ||||||||||||

| Name | Deferred Stock Units Received in Lieu of Cash Retainers(a) | Deferred and Stock | Total Stock Awards Outstanding at Fiscal Year-End | |||||||||

| ||||||||||||

C. Michael Armstrong | — | 19,859 | 19,859 | |||||||||

Ruann F. Ernst | — | 17,071 | 17,071 | |||||||||

Christoph v. Grolman | 1,991 | 5,382 | 7,373 | |||||||||

Brian H. Hall | 6,450 | 14,844 | 21,294 | |||||||||

Roger Holtback | 8,618 | 18,160 | 26,778 | |||||||||

Balakrishnan S. Iyer | — | 18,160 | 18,160 | |||||||||

Jean-Paul Montupet | — | 3,414 | 3,414 | |||||||||

Richard W. Roedel(c) | 10,371 | 19,859 | 30,230 | |||||||||

| (a) | This column represents deferred stock units that the director has acquired during his or her term in lieu of receiving Board and/or Committee cash retainers. |

| (b) | This column represents the sum of (i) unvested restricted stock units and (ii) vested restricted stock units that have a deferred payment date. These restricted stock units were granted under the terms of the Directors Stock Plan. The grants have a one year vesting schedule, and receipt of shares may be deferred. Directors may choose to receive the shares at vest, or defer delivery of shares until after the director’s service terminates. For each of the directors, all but 1,621 units each are vested. |

| (c) | Mr. Roedel has gifted all of his equity grants to his spouse. |

| (4) | Prior to fiscal year 2013, Mr. Armstrong had elected to defer certain retainers in cash. These deferred cash amounts earn interest at a rate of five percent each year and are to be paid after his termination of service. |

| (5) | Mr. Klein resigned at the end of his term, effective April 10, 2013. |

| (6) | Upon Mr. Klein’s resignation, the Board accelerated his 2013 annual grant of 1,621 Restricted Stock Units that would have otherwise been forfeited. An award modification value of $8,089 is included in the value of the Stock Awards reported in the table above. |

20

Table of Contents

Officers

Set forth below is information concerning our executive officers and other key members of our executive team as of February 18, 2014.

| ||||||

| Name | Age | Position | ||||

| ||||||

Jerre L. Stead | 71 | Executive Chairman | ||||

Scott Key | 55 | President and Chief Executive Officer | ||||

Daniel Yergin | 67 | Vice Chairman | ||||

Todd Hyatt | 53 | Executive Vice President and Chief Financial Officer | ||||

Anurag Gupta | 49 | Executive Vice President, Strategy, Products and Operations | ||||

Sean Menke | 45 | Executive Vice President, Resources | ||||

Stephen Green | 61 | Executive Vice President, Legal and Corporate Secretary | ||||

Stephanie Buscemi | 42 | Senior Vice President, Chief Marketing Officer | ||||

Jaspal Chahal | 48 | Senior Vice President and General Counsel | ||||

Jonathan Gear | 43 | Senior Vice President, Industrials | ||||

Heather Matzke-Hamlin | 46 | Senior Vice President and Chief Accounting Officer | ||||

Jane Okun Bomba | 51 | Senior Vice President and Chief Sustainability, Investor Relations, and Communications Officer | ||||

Jeffrey Sisson | 57 | Senior Vice President and Chief Human Resources Officer | ||||

Brian Sweeney | 53 | Senior Vice President, Global Sales | ||||

Mark Settle | 63 | Senior Vice President and Chief Information Officer | ||||

Executive officers are appointed by our Board. Information about Mr. Stead is provided under “2014 Nominees for Director” and information about Mr. Key is provided under “Continuing Directors with Terms Expiring at the Annual Meeting in 2016” above in this Proxy Statement. A brief biography for each of our other executive officers and key members of our executive team follows.

Daniel Yergin was appointed Vice Chairman of IHS in July 2012. Previously he was Executive Vice President and Strategic Advisor for IHS from September 2006 to June 2012. Dr. Yergin also serves as Chairman of IHS CERA, a position he has held since 1983. Dr. Yergin founded CERA in 1982 and the business was acquired by IHS in 2004. He is a Pulitzer Prize winner, a member of the Board of the United States Energy Association, and a member of the National Petroleum Council and serves on the U.S. Secretary of Energy Advisory Board. He chaired the U.S. Department of Energy’s Task Force on Strategic Energy Research and Development. He is also a Trustee of the Brookings Institution and a Director of the U.S.-Russian Business Council and the New America Foundation.

Dr. Yergin received his bachelor of arts degree from Yale University and his doctor of philosophy degree from the University of Cambridge, where he was a Marshall Scholar.

Todd Hyatt was named Executive Vice President in September 2013 and has served as Chief Financial Officer (“CFO”) since January 2013. Mr. Hyatt also led our worldwide IT operations until February 2014. He served as Senior Vice President and Chief Information Officer since October 2011 and Senior Vice President-Vanguard since 2010, leading the Company’s business transformation efforts. Mr. Hyatt previously served as Senior Vice President-Financial Planning & Analysis from 2007-2010. He also served as CFO leading the finance organization for the Company’s engineering segment from 2005-2007.

21

Table of Contents

Prior to joining IHS, Mr. Hyatt served as Vice President for Lone Tree Capital Management, a private equity firm. During his career, he also has worked for U S WEST / MediaOne where he was an Executive Director in the Multimedia Ventures organization and for AT&T. He started his career in public accounting, working at Arthur Young and Arthur Andersen.

Mr. Hyatt has a bachelor’s degree in accounting from the University of Wyoming and a master’s degree in management from Purdue University.

Anurag Gupta joined IHS as Executive Vice President, Strategy, Products and Operations in April 2013 where he leads the IHS core workflow business lines, global product design and development, and support operations as well as corporate strategy. Mr. Gupta has more than 20 years of experience focusing on business growth while guiding high-performing teams. He served as President of EMEA for BrightPoint, Inc. from January 2010 to October 2012 when BrightPoint was acquired by Ingram Micro Inc. Mr. Gupta continued to serve as Executive Vice President of Ingram Micro and President of EMEA for the larger organization until March 2013. Prior to that time, Mr. Gupta served as Senior Vice President, Global Strategy, Corporate Marketing and Investor Relations for BrightPoint from April 2003 to December 2009. He has also held leadership roles for Motorola and his leadership experience has covered Asia, Europe, Latin America and North America.

He has a bachelor’s and master’s degree in electrical engineering from The University of Toledo and a master of business administration degree from the IIT Stuart School of Business in Chicago.

Sean Menke joined IHS in April 2013 as our Executive Vice President, Resources where he oversees our energy insight, energy technical and chemicals business lines. Mr. Menke joined IHS after holding the roles of President and Chief Executive Officer of Pinnacle Airlines Corp. from June 2011 to June 2012. Prior to that time, Mr. Menke was a private consultant and President of Haggar Clothing Company from May 2010 until June 2011. Mr. Menke has also held leadership roles with Frontier Airlines, including as President and Chief Executive Officer from August 2007 to March 2010. In April 2008, Frontier Airlines filed for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. Mr. Menke has also held management and executive roles at America West Airlines, United Airlines and was the Executive Vice President and Chief Commercial Officer of Air Canada from May 2005 to August 2007. He also served as a member of the board of directors of Pinnacle Airlines from June 2010 until June 2011 and as a member of the Frontier Airlines board from August 2007 until October 2009.

Mr. Menke has a master of business administration degree from the University of Denver, Daniels College of Business and a bachelor of science degree in economics and aviation management from Ohio State University.

Stephen Green was named Executive Vice President, Legal and Corporate Secretary in April 2012. Mr. Green previously served as Senior Vice President and General Counsel of IHS from 2003 through March 2012. He was Vice President and General Counsel of IHS from 1996 to 2003 and was appointed Senior Vice President and General Counsel in December 2003. Mr. Green joined the legal department of TBG Holdings N.V. (“TBG”) in 1981.

Mr. Green holds a bachelor’s degree from Yale University and a juris doctorate from Columbia Law School.

22

Table of Contents

Stephanie Buscemiwas named Senior Vice President and Chief Marketing Officer in September 2012. Prior to joining IHS, Ms. Buscemi served as Senior Vice President of Solutions Marketing at SAP from January 2012 to September 2012, responsible for go-to-market strategy for SAP’s application and technology portfolios. From 2007 to 2012, Ms. Buscemi served in various roles at SAP, including: Group Vice President, Solutions Marketing, managing the go-to-market strategy for SAP’s business intelligence; Vice President, Analytics, Performance Optimization; and Vice President, Performance Management Applications. Prior to joining SAP, Ms. Buscemi spent nearly ten years at Hyperion Solutions, acquired by Oracle, in various marketing leadership positions.

Ms. Buscemi has a bachelor’s degree from the University of California, Los Angeles.

Jaspal Chahalwas appointed Senior Vice President and General Counsel in April 2012. Ms. Chahal previously served as Vice President and Chief Legal Counsel for IHS from 2008 to 2012. Prior to joining IHS, Ms. Chahal was European General Counsel and Chief Privacy Officer of Acxiom Ltd. from 2003 to 2007.

Ms. Chahal holds master and bachelor of law degrees from London University and qualified as a solicitor in the UK.

Jonathan Gearhas served as our Senior Vice President, Industrials since April 2013. In this role, Mr. Gear leads the industrials business lines for IHS, which includes products focused on the electronics and media, automotive, financial services, and aerospace, defense and maritime industries. Prior this role, Mr. Gear served as Senior Vice President, Electronics and Media, Product Design and Supply Chain from 2012 until March 2013. Since joining IHS in March 2005, he has also held a number of leadership roles at IHS, including President and Chief Operating Officer of IHS CERA, Senior Vice President of IHS Insight and Vice President of Global Marketing. Prior to joining IHS, Mr. Gear was Vice President of Marketing and Business Development for Activant Solutions, Vice President for smarterwork.com and held a number of roles at Booz Allen Hamilton.

Mr. Gear received a bachelor of arts degree, magna cum laude, from the University of California, Berkeley and a master of business administration degree from Stanford Graduate School of Business.

Heather Matzke-Hamlin has served as Senior Vice President and Chief Accounting Officer since February 2005. Prior to joining IHS, Ms. Matzke-Hamlin was Director of Internal Audit at Storage Technology Corporation from February 1999 to February 2005. Prior to joining StorageTek, she spent over nine years with PricewaterhouseCoopers (formerly Price Waterhouse) in audit services.

Ms. Matzke-Hamlin holds a bachelor’s degree in accounting from Indiana University and is a Certified Public Accountant in the state of Colorado.

Jane Okun Bomba was named Senior Vice President and Chief Sustainability, Investor Relations, and Communications Officer in March 2011. Ms. Okun Bomba previously served as Senior Vice President, Investor Relations and Chief Customer Process Officer from August 2007 through March 2011 and as Senior Vice President, Investor Relations and Corporate Communications from November 2004 through August 2007. From 2002 to 2004, Ms. Okun Bomba was a partner with Genesis, Inc., a strategic marketing firm also specializing in investor relations. Prior to that, she was Vice President, Investor Relations and Corporate Communications of Velocom, Inc., from 2000 to 2001, and Executive Director, Investor Relations of Media One Group from 1998 to 2000. Prior to joining Media One,

23

Table of Contents