SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | |

¨ Definitive Additional Materials | |

¨ Soliciting Material Pursuant to § 240.14a-12 | |

Rackable Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 6. | Amount Previously Paid: |

| | 7. | Form, Schedule or Registration Statement No.: |

RACKABLE SYSTEMS, INC.

1933 MILMONT DRIVE

MILPITAS, CA 95035

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 31, 2006

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Rackable Systems, Inc., a Delaware corporation. The meeting will be held on Wednesday, May 31, 2006 at 9:00 a.m. local time at 1933 Milmont Drive, Milpitas, CA, 95035, for the following purposes:

| 1. | To elect directors to serve for the ensuing year and until their successors are elected. |

| 2. | To ratify the selection of Deloitte & Touche LLP as independent auditors of Rackable Systems for its fiscal year ending December 31, 2006. |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is April 10, 2006. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors

William P. Garvey

Secretary

Milpitas, California

April 14, 2006

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

RACKABLE SYSTEMS, INC.

1933 MILMONT DRIVE

MILPITAS, CA 95035

PROXY STATEMENT

FOR THE 2006 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

MAY 31, 2006

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors (the “Board”) of Rackable Systems, Inc. is soliciting your proxy to vote at the 2006 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We intend to mail this proxy statement and accompanying proxy card on or about April 19, 2006 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 10, 2006 will be entitled to vote at the annual meeting. On this record date, there were 27,643,386 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 10, 2006 your shares were registered directly in your name with Rackable Systems’ transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 10, 2006 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

| | • | | Election of five directors; |

| | • | | Ratification of Deloitte & Touche LLP as independent auditors of Rackable Systems for its fiscal year ending December 31, 2006. |

1

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | • | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Rackable Systems. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet if and as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 10, 2006.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all five nominees for director and “For” the ratification of Deloitte & Touche LLP as independent auditors of Rackable Systems for its fiscal year ending December 31, 2006. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

2

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| | • | | You may submit another properly completed proxy card with a later date. |

| | • | | You may send a written notice that you are revoking your proxy to Rackable Systems’ Secretary at 1933 Milmont Drive, Milpitas, CA 95035. |

| | • | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 15, 2006 to our Corporate Secretary at 1933 Milmont Drive, Milpitas, CA 95035. If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director pursuant to our Bylaws, you must provide specified information to us between January 31, 2007 and March 2, 2007; provided, however, that if our 2007 annual meeting is held before May 1, 2007 or after June 30, 2007, you must provide that specified information to us between the 120th day prior to the 2007 annual meeting and not later than the 90th day prior to the 2007 annual meeting or the 10th day following the day on which we first publicly announce of the date of the 2007 annual meeting. If you wish to do so, please review our Bylaws, which contain a description of the information required to be submitted as well as additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

| | • | | For the election of directors, the five nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| | • | | To be approved, Proposal No. 2 ratifying Deloitte & Touche LLP as the independent registered public accounting firm of Rackable Systems for fiscal year ending December 31, 2006 must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

3

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 27,643,386 shares outstanding and entitled to vote. Thus 13,821,694 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of 2006.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Rackable Systems’ Board of Directors consists of five directors. There are five nominees for director this year. Each director to be elected will hold office until the next annual meeting of stockholders and until his successor is elected, or until the director’s death, resignation or removal. Each of the nominees listed below is currently a director of Rackable Systems who was previously elected by the stockholders. Although we do not have a formal policy regarding director attendance at our annual meetings, we intend to invite all of our directors to attend our annual meetings of stockholders. This is our first annual meeting of stockholders.

Directors are elected by a plurality of the votes properly cast in person or by proxy. The five nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five nominees named below.If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by Rackable Systems’ management. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

NOMINEES

The following is a brief biography of each nominee for director.

Thomas K. Barton, age 42, joined Rackable Systems in December 2002 as our President, Chief Executive Officer and a member of our Board of Directors. From June 2002 to December 2002, Mr. Barton provided consulting services to us as a consultant at Callero Partners. From September 2000 to May 2002, Mr. Barton was a Venture Partner and Entrepreneur in Residence at Lightspeed Venture Partners. From November 1999 to May 2000, Mr. Barton was Senior Vice President of Client Services at Red Hat, Inc., a software and services company. Mr. Barton joined Red Hat via its acquisition of Cygnus Solutions, a software development tools company. From August 1996 to its acquisition by Red Hat in November 1999, Mr. Barton held many positions at Cygnus Solutions, including interim CEO. Mr. Barton holds an A.B. in History, a B.S. in Industrial Engineering and an M.B.A. from Stanford University.

Gary A. Griffiths, age 55, has been a member of our Board of Directors since November 2004. Since February 2006, Mr. Griffiths has been Vice President, Products for WebEx Communications, Inc., a provider of web-based conferencing solutions. From June 1999 to July 2005, Mr. Griffiths was Chairman, President and Chief Executive Officer at Everdream Corporation, a technology services company. Mr. Griffiths holds a B.S. in Aerospace Engineering from the United States Naval Academy and an M.B.A. from George Washington University.

Michael J. Maulick, age 50, has been a member of our Board of Directors since November 2004. Since June 2003, Mr. Maulick has been President and Chief Executive Officer at Platform Solutions, Inc., a plug compatible mainframe company. From June 2001 to June 2003, Mr. Maulick was Chairman, President and Chief Executive Officer of Resilience Corp., a technology security company. From April 1998 to June 2001, Mr. Maulick was Chief Executive Officer at Release Now, Inc., a digital rights management company. Prior to 1998 Mr. Maulick was an executive of the IBM Corp., where he held various positions since 1977. Mr. Maulick holds a B.S. in Electrical Engineering from Marquette University.

Hagi Schwartz, age 44, has been a member of our Board of Directors since August 2004. Since February 2005, Mr. Schwartz has been President of Magnolia Capital, an investment advisory firm. From February 2003 to August 2005, Mr. Schwartz was Chief Financial Officer of HyperRoll, Inc., a provider of high-performance database aggregation and summarization software. From September 2000 to July 2002, Mr. Schwartz was Chief Financial Officer of ATRICA, Inc., a telecommunications company. From October 1999 to May 2000, Mr. Schwartz was Chief Financial Officer at Noosh, Inc., a print management software company. From January

5

1996 to September 1999, Mr. Schwartz served as Vice President of Finance and Chief Financial Officer of Check Point Software, Inc., a software company. Mr. Schwartz has a B.A. in Economics and Accounting from Bar Ilan University. Mr. Schwartz is a partner in Magnolia Capital Partners LTD, which provides corporate advisory services to its clients in Israel and the United States, and which has entered into a solicitation and referral agreement with one of the underwriters in our public offerings.

Ronald D. Verdoorn, age 55, joined Rackable Systems as a director in March 2005 and was elected Chairman of the Board of Directors in January 2006. From January 1999 to 2002, Mr. Verdoorn served as Executive Vice President of Global Operations for Affymetrix, Inc., a company specializing in the development of technology for acquiring and managing complex genetic information for use in biomedical research, genomics and clinical diagnostics, following which he continued as a consultant until December 2003. From 1997 to 1999, Mr. Verdoorn served as an independent consultant to the hard disk drive industry. From 1983 to 1997, Mr. Verdoorn held a number of positions with Seagate Technology, Inc., most recently as Executive Vice President and Chief Operating Officer of Storage Products. Mr. Verdoorn has a B.A. in Sociology from Linfield College.

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

INDEPENDENCEOF THE BOARDOF DIRECTORS

As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with our counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and Rackable Systems, its senior management and its independent auditors, the Board affirmatively has determined that the following directors are independent directors within the meaning of the applicable Nasdaq listing standards: Mr. Griffiths, Mr. Maulick, Mr. Schwatrz and Mr. Verdoorn. In making this determination, the Board found that none of these directors or nominees for director have a material or other disqualifying relationship with Rackable Systems. Mr. Barton, our President and Chief Executive Officer, is not an independent director.

INFORMATION REGARDINGTHE BOARDOF DIRECTORSANDITS COMMITTEES

In fiscal 2005 our independent directors met two times in regularly scheduled executive sessions during quarterly Board meetings at which only independent directors were present.

Our Board has three committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal 2005 for each of the Board committees:

| | | | | | | | | |

Name | | Audit | | | Compensation | | | Nominating

and

Corporate

Governance | |

Gary A. Griffiths | | X | | | X | | | X | * |

Michael J. Maulick | | X | | | X | * | | X | |

Hagi Schwartz | | X | * | | X | | | X | |

Total meetings in fiscal year 2005 | | 8 | | | 6 | | | 0 | |

6

Below is a description of each committee of the Board. The Board has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to Rackable Systems.

AUDIT COMMITTEE

The Audit Committee of the Board of Directors oversees our corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on Rackable Systems’ audit engagement team as required by law; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review our annual audited financial statements and quarterly financial statements with management and the independent auditor. Three directors comprise the Audit Committee: Messrs. Griffiths, Maulick and Schwartz. The Audit Committee met eight times during the fiscal year. The Board has adopted a written Audit Committee Charter that is attached as Appendix A to these proxy materials.

The Board annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of our Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards.The Board has determined that Mr. Schwartz qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Schwartz’s level of knowledge and experience based on a number of factors, including Mr. Schwartz’s past professional experience as the chief financial officer of various companies.

COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors reviews and approves the overall compensation strategy and policies for Rackable Systems. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management; recommends to the Board for approval the compensation plans and programs for our company; determines and approves the compensation and other terms of employment of our Chief Executive Officer; determines and approves the compensation and other terms of employment of the other executive officers; determines and approves the compensation for our non-employee directors, and administers our stock option and stock purchase plans. Three directors comprise the Compensation Committee: Messrs. Griffiths, Maulick and Schwartz. All members of our Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards. The Compensation Committee met six times during the fiscal year. The Board has adopted a written Compensation Committee Charter.

NOMINATINGAND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of Rackable Systems, reviewing and evaluating incumbent directors, selecting candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board and developing a set of corporate governance principles for Rackable Systems. Our Nominating and Corporate

7

Governance Committee charter can be found on our corporate website at www.rackablesystems.com. Three directors comprise the Nominating and Corporate Governance Committee: Messrs. Griffiths, Maulick and Schwartz. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Nominating and Corporate Governance Committee did not meet during 2005. The Board has adopted a written Nominating and Corporate Governance Committee Charter.

The Nominating and Corporate Governance Committee believes that nominees for director of Rackable Systems should possess the following minimum criteria: be able to read and understand basic financial statements; be over 21 years of age; and have the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider the following additional criteria for nominees for director of Rackable Systems: the candidate’s relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of Rackable Systems, demonstrated excellence in his or her field, having the ability to exercise sound business judgment, and having the commitment to rigorously represent the long-term interests of our stockholders. The Nominating and Corporate Governance Committee evaluates candidates for director nominees in the context of the current composition of the Board, the operating requirements of Rackable Systems, and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers the criteria for director qualifications set by the Board of Directors, as well as diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and Rackable Systems to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to Rackable Systems during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates. To date, the Nominating and Corporate Governance Committee has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of our voting stock.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder or not. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: Rackable Systems at 1933 Milmont Drive, Milpitas, CA 95035 not less than six months prior to any meeting at which directors are to be elected. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of our stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

8

MEETINGSOFTHEBOARDOFDIRECTORS

The Board of Directors met 15 times during the last fiscal year. Each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member, respectively.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Our Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Persons wishing to communicate with the Board or an individual director may send a written communication addressed as follows: Rackable Systems Board Communication, 1933 Milmont Drive, Milpitas, CA 95035.Any communication sent must state the number of shares owned by the security holder making the communication. Our corporate secretary will review each communication and forward such communication to the Board or to any individual director to whom the communication is addressed unless the communication is unduly frivolous, hostile, threatening or similarly inappropriate, in which case, our corporate secretary shall discard the communication.

CODE OF CONDUCTAND ETHICS

We have adopted the Rackable Systems, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees, including the principal executive officer, principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics is available on our website at www.rackable.com., and may be found as follows:

1. From our main Web page, first click on “Investor Relations.”

2. Next, click on “Corporate Governance.”

3. Then, click on “Code of Conduct.”

Stockholders may request a free copy of the code by submitting a written request to Rackable Systems, Inc., Attention: Secretary, 1933 Milmont Drive, Milpitas, CA 95035. If we make any substantive amendments to our Code of Business Conduct and Ethics or grant any waiver from a provision of the code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

9

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS1

The primary purpose of the Audit Committee is to assist the Board in its general oversight of Rackable Systems’ financial reporting process. The Audit Committee’s function is more fully described in its charter, which the Board has adopted and is included as Appendix A to this Proxy Statement. The Audit Committee reviews the charter on an annual basis. The Board annually reviews the Nasdaq listing standards’ definition of independence for audit committee members and has determined that each member of the Audit Committee meets that standard.

Our management has primary responsibility for preparing our financial statements, ensuring the integrity of such data and establishing the financial reporting process, including our systems of internal controls. Deloitte & Touche LLP, our independent registered public accounting firm, are responsible for performing an audit of our consolidated financial statements, and expressing an opinion as to the conformity of such financial statements with generally accepted accounting principles in the Unites States. The Audit Committee’s responsibility is to oversee and review this process.

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in our Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Audit Committee reviewed with our independent registered public accounting firm its judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards, including those matters set forth in Statement of Auditing Standards No. 61, as amended, “Communication with Audit Committees” (Codification of Statements on Auditing Standards, AU Section 380). In addition, the Audit Committee has discussed with our independent registered public accounting firm its independence from management and Rackable Systems, including the matters in the written disclosures required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has considered the compatibility of non-audit services with the independent registered public accounting firm’s independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended, subject to stockholder ratification, the retention of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2006.

Respectfully submitted,

The Audit Committee of the Board of Directors

Hagi Schwartz (Chairman)

Michael J. Maulick

Gary A. Griffiths

| 1 | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the 1933 or 1934 Act. |

10

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected Deloitte & Touche LLP as Rackable Systems’ independent auditors for the fiscal year ending December 31, 2006 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. Deloitte & Touche LLP has audited our financial statements since our inception as a Delaware corporation in December 2002, and before that it audited our predecessor entities]. Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Bylaws nor other governing documents or law require stockholder ratification of the selection of Deloitte & Touche LLP as our independent auditors. However, the Audit Committee of the Board is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of Rackable Systems and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Deloitte & Touche LLP.Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

PRINCIPALACCOUNTANTFEESANDSERVICES

The following table presents fees for professional audit services rendered by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, the “Deloitte Entities”) for the audit of our annual financial statements for 2005 and 2004, and fees billed for all other services rendered by the Deloitte Entities.

| | | | | | |

| | | Fiscal Year

Ended (in thousands) |

| | | 2005 | | 2004 |

Audit Fees (a) | | $ | 1,740 | | $ | 528 |

Audit-related Fees | | | — | | | — |

Tax Fees (b) | | | 85 | | | — |

All Other Fees (specifically describe all other fees incurred) | | | — | | | — |

| | | | | | |

Total Fees | | $ | 1,825 | | $ | 528 |

| | | | | | |

| (a) | Fees for audit services billed in 2004 and 2005 consisted of: |

| | • | | Audit of our annual financial statements. |

| | • | | Reviews of our quarterly financial statements. |

| | • | | Fees for services rendered in connection with our Form S-1 and Form S-8 filings. |

| | • | | Comfort letters, consents and other services related to Securities and Exchange Commission matters. |

| (b) | Fees for tax services billed in 2005 consisted of tax compliance, Federal and state income tax return assistance and tax advice. |

11

PRE-APPROVAL POLICIESAND PROCEDURES.

As required by Section 10A(i)(1) of the Exchange Act, all non-audit services to be performed by Rackable Systems’ principal accountants must be approved in advance by the Audit Committee of the Board of Directors, subject to certain exceptions relating to non-audit services accounting for less than five percent of the total fees paid to its principal accountants which are subsequently ratified by the Audit Committee (the De Minimus Exception). The Audit Committee has established procedures by which the Chairperson of the Audit Committee may pre-approve such services provided the Chairperson report the details of the services to the full Audit Committee at its next regularly scheduled meeting and the fees for such services prior to such report to not exceed $50,000 in the aggregate. None of the non-audit services described above were performed pursuant to the De Minimus Exception during 2005.

The Audit Committee has determined that the rendering of the services other than audit services by Deloitte & Touche LLP is compatible with maintaining the principal accountant’s independence.

FORMER INDEPENDENT PUBLIC ACCOUNTING FIRM.

On January 23, 2003, upon the recommendation of our board of directors, Rackable Systems, as a newly-formed Delaware corporation engaged Ernst & Young LLP (“E&Y”) as our independent public accounting firm. The engagement with E&Y was formalized on September 3, 2003. On July 26, 2004, upon the recommendation of our board of directors, we dismissed E&Y as our independent registered public accounting firm. At the same time, upon the recommendation of our board of directors, we engaged Deloitte & Touche LLP as our independent registered public accounting firm, which engagement was formalized on August 23, 2004. At the time of their dismissal, E&Y had not completed an audit of our or our predecessor’s financial statements and, accordingly, has not issued any report on our or our predecessor’s financial statements as of any date or for any period. During the period from January 23, 2003 through July 26, 2004, there were no disagreements on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of E&Y, would have caused E&Y to make a reference to the subject matter of the disagreements in connection with their report. We did not consult with Deloitte & Touche LLP on any financial or accounting reporting matters in the period between December 10, 2002, the date of incorporation of our company in its current form, and the time of our engagement of Deloitte & Touche LLP on August 23, 2004.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

12

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of March 16, 2006 by: (i) each nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all our executive officers and directors as a group; and (iv) all those known by us to be beneficial owners of more than five percent of our common stock, if any.

| | | | | |

| | | Beneficial Ownership (1) | |

Name and Address of Beneficial Owner | | Number of Shares | | Percent of Total | |

Thomas K. Barton (2) | | 491,508 | | 1.7 | % |

Giovanni Coglitore (3) | | 213,072 | | * | |

Todd R. Ford (4) | | 321,043 | | 1.1 | |

Nikolai Gallo | | 213,073 | | * | |

William P. Garvey (2) | | 7,614 | | * | |

Thomas Gallivan (5) | | 15,458 | | * | |

Nancy Dirgo (6) | | 0 | | * | |

Gary A. Griffiths (2) | | 17,832 | | * | |

Michael J. Maulick (2) | | 17,832 | | * | |

Hagi Schwartz (2) | | 23,666 | | * | |

Ronald D. Verdoorn (2) | | 14,916 | | * | |

All current directors and executive officers as a group (10 persons) (7) | | 907,437 | | 3.2 | |

| * | Represents beneficial ownership of less than one percent of the outstanding shares of common stock. |

| (1) | This table is based upon information supplied by officers and directors and upon information gathered by Rackable Systems about principal stockholders known to us based on a Schedule 13G filed with the Securities and Exchange Commission (the “SEC”). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 27,642,386 shares outstanding on March 16, 2006, adjusted as required by rules promulgated by the SEC. All shares of common stock subject to options currently exercisable or exercisable within 60 days after March 16, 2006 are deemed to be outstanding for the purpose of computing the percentage of ownership of the person holding such options, but are not deemed to be outstanding for computing the percentage of ownership of any other person. |

| (2) | Consists solely of shares issuable upon the exercise of options exercisable within 60 days after March 16, 2006. |

| (3) | Includes 3,666 shares held by Giovanni Coglitore, as custodian for Enzo Coglitore, under the California Uniform Transfers to Minors Act and 3,666 shares held by Giovanni Coglitore, as custodian for Katrina Coglitore, under the California Uniform Transfers to Minors Act. |

| (4) | Includes of 319,944 shares issuable upon the exercise of options exercisable within 60 days after March 16, 2006. |

| (5) | Includes 14,125 shares issuable upon the exercise of options exercisable within 60 days after March 16, 2006. |

| (6) | Ms. Dirgo ceased to be an executive officer on October 24, 2005. |

| (7) | Represents shares issuable upon the exercise of stock options within 60 days after March 16, 2006. See footnotes 2, 4 and 5 above. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the “1934 Act”) requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of Rackable Systems. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

13

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2005, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with; except that Mr. Garvey filed one report late covering the initial reporting of his beneficial ownership and Madhu Ranganathan filed one report late covering one transaction.

COMPENSATIONOF DIRECTORS

We currently provide cash compensation at a rate of $35,000 per year, payable quarterly, to each non-employee director for his services as a director. In addition, our non-employee chairman of the Board, currently Mr. Verdoorn, is paid an additional fee of $10,000 per year. We also pay the chairperson of the audit committee a fee of $10,000 per year, and each of the chairmen of the compensation and the nominating and corporate governance committees a fee of $5,000 per year, in each case payable quarterly. We also pay each non-chair committee member a fee of $2,500 per year. In addition, we also reimburse our non-employee directors for all reasonable expenses incurred in attending meetings of the Board and its committees.

In January 2005, we adopted our 2005 Non-Employee Directors’ Stock Option Plan to provide for the automatic grant of options to purchase shares of common stock to our non-employee directors who are not our employees or consultants or who can exercise voting power over 10% or more of our common stock. Under our 2005 Non-Employee Directors’ Stock Option Plan:

| | • | | any new non-employee director will receive an initial option to purchase 11,333 shares of common stock; |

| | • | | any non-employee director who becomes our audit committee chairman will receive an initial option to purchase 10,000 shares of common stock; and |

| | • | | any non-employee director who becomes our compensation or nominating and corporate governance committee chairman will receive an initial option to purchase 3,333 shares of common stock. |

Each of Messrs. Griffiths, Maulick, Schwartz and Verdoorn received options to purchase 14,666, 14,666, 21,333 and 11,333 shares of our common stock, respectively, under our 2002 Stock Option Plan, and did not receive initial grants under our 2005 Non-Employee Directors’ Stock Option Plan. The grants under our 2002 Stock Option Plan were made in connection with their services as non-employee directors and as the respective committee chairmen, and reflect the same number of shares to which they would have been entitled had they become directors after our initial public offering. In November 2005, each of Messrs. Griffiths, Maulick, Schwartz and Verdoorn received an additional option to purchase 25,334, 25,334, 18,667 and 28,667 shares of our common stock, respectively, under our 2005 Equity Incentive Plan.

In addition, under our 2005 Non-Employee Directors’ Stock Option Plan, each non-employee director, commencing with our annual meeting of stockholders in 2006, will receive an annual option grant to purchase 2,833 shares of our common stock, our audit committee chairman will receive an annual grant to purchase 2,500 shares of our common stock, and each compensation committee chairman and nominating and corporate governance committee chairman will receive an annual grant to purchase 833 shares of our common stock. Annual grants will be reduced proportionally if the person did not serve in that capacity for the full year prior to the annual grant. Please refer to the section entitled “Equity Compensation and Defined Contribution Plans” for a more detailed explanation of the terms of these stock options.

14

COMPENSATIONOF EXECUTIVE OFFICERS

The following table shows the compensation awarded or paid to, or earned by, our Chief Executive Officer, our four other most highly compensated executive officers serving in such capacity at December 31, 2005, whose total annual salary and bonus exceeded $100,000 for the year ended December 31, 2005. In addition, the table also includes two additional employees, Nikolai Gallo and Nancy Dirgo, each of whom served as an executive officer during the year ended December 31, 2005 but ceased to be an executive officer prior to December 31, 2005. We refer to these employees collectively as our “named executive officers.”

Summary Compensation Table

| | | | | | | | | | | | | | | |

| | | Year | | Annual

Compensation | | Bonus ($) | | | Long-Term Compensation Awards | | All Other Compensation

($) | |

Name and Position | | | Salary ($) | | | Securities Underlying Options (#) | |

Thomas K. Barton President and Chief Executive Officer | | 2005

2004 | | $

| 229,233

176,542 | | $

| 262,500

100,000 | (1)

| | —

— | | $

| 4,439

548,959 | (2)

(3) |

| | | | | |

Todd R. Ford Executive Vice President of Operations and Chief Financial Officer | | 2005

2004 | |

| 204,771

176,542 | |

| 150,000

100,000 | (1)

| | —

— | |

| 4,360

301,041 | (2)

(3) |

| | | | | |

Giovanni Coglitore Co-Founder and Chief Technology Officer | | 2005

2004 | |

| 150,010

147,125 | |

| —

50,000 |

| | —

— | |

| —

— |

|

| | | | | |

Nikolai Gallo (4) Co-Founder and Manager, Commodity Procurement | | 2005

2004 | |

| 150,010

147,125 | |

| —

25,000 |

| | —

— | |

| —

— |

|

| | | | | |

William P. Garvey General Counsel and Vice President of Corporate Development | | 2005

2004 | |

| 182,693

— | |

| 47,500

— | (1)

| | 91,666

— | |

| —

— |

|

| | | | | |

Thomas Gallivan Vice President of Worldwide Sales | | 2005

2004 | |

| 159,994

43,075 | |

| 294,866

25,000 | (1)

| | 51,666

100,000 | | | — | |

| | | | | |

Nancy Dirgo (5) Former Vice President of Engineering | | 2005

2004 | |

| 136,291

37,502 | |

| 41,177

— | (6)

| | —

26,666 | | | — | |

| (1) | Includes bonus payments paid in 2006, which for Mr. Gallivan consisted entirely of sales commissions. |

| (2) | Represents reimbursement of legal expenses. |

| (3) | Represents deferred compensation payments. |

| (4) | Mr. Gallo’s position with our company changed from Chief Procurement Officer to Manager, Commodity Procurement on November 16, 2005. |

| (5) | Ms. Dirgo resigned as Vice President of Engineering on October 24, 2005. |

| (6) | Includes a severance payment of $26,667. |

15

Stock Option Grants in Last Fiscal Year

We have granted and will continue to grant options to our executive officers and employees under our equity compensation plans. The percentage of total options granted to employees in 2005 is based on options granted to our employees to purchase a total of 1,424,694 shares of our common stock at exercise prices ranging from $6.00 per share to $22.86 per share, for a weighted average exercise price of $14.11 per share.

Generally, 25% of the shares subject to options initially granted to our employees vests one year from the date of hire and 1/48 of the shares subject to the option vests on each monthly anniversary thereafter, such that the option can be fully vested four years from the date of hire. Prior to April 2005, 20% of the shares subject to options initially granted to our employees generally vested one year from the date of hire and one-sixtieth of the shares subject to the option vests on each monthly anniversary thereafter, such that the option can be fully vested five years from the date of hire. Options generally expire ten years from the date of grant.

The exercise price per share of each option granted was equal to, or greater than, the fair market value of the underlying common stock as determined by our Board on the date of the grant.

The following tables show information regarding options granted to our named executive officers for the fiscal year ended December 31, 2005:

| | | | | | | | | | | | | | | | | |

| | | Option Grants in 2005 | | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation for

Option Terms (1) |

| | | Number of

Securities

Underlying

Options

Granted (#) | | | Percent of

Total Options

Granted to

Employees (%) | | | Exercise

Price Per

Share ($) | | Expiration Date | |

Name | | | | | | 5% | | 10% |

Thomas K. Barton | | — | | | — | | | | — | | — | | | — | | | — |

Todd R. Ford | | — | | | — | | | | — | | — | | | — | | | — |

Giovanni Coglitore | | — | | | — | | | | — | | — | | | — | | | — |

Nikolai Gallo | | — | | | — | | | | — | | — | | | — | | | — |

William P. Garvey | | 35,000

10,000

46,666 | (2)

| | 2.5

0.7

3.3 | %

| | $

| 12.82

10.88

6.00 | | August 25, 2015

March 15, 2015

January 2, 2015 | | $

| 235,900

86,800

632,790 | | $

| 639,100

202,000

1,170,383 |

Thomas Gallivan | | 35,000

16,666 | (2)

| | 2.5

1.2 |

| |

| 12.82

10.88 | | August 25, 2015

March 15, 2015 | |

| 235,900

144,661 | |

| 639,100

336,653 |

Nancy Dirgo | | — | | | — | | | | — | | — | | | — | | | — |

| (1) | Potential realizable values set forth in this column have been calculated based on the term of the option at the time of grant, which is 10 years. The values are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date of grant until their expiration date, minus the applicable exercise price, assuming with respect to option grants made prior to our initial public offering of our common stock a value per share equal to $12.00 per share, the price per share in our initial public offering. These numbers are calculated based on the requirements of the Securities and Exchange Commission and do not reflect our estimate of future stock price growth. Actual gains, if any, on stock option exercises will depend on the future performance of the common stock and the date on which the options are exercised. |

| (2) | The option vests as to 1/48th of the shares each month commencing August 25, 2005. |

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth the number of shares of our common stock exercised by our named executive officers in 2005 and the number of shares of our common stock subject to exercisable and unexercisable stock options held by each of our named executive officers as of December 31, 2005. Mr. Barton’s and Mr. Ford’s unexercised options listed in the table are exercisable at any time but, if exercised, the options are subject to a

16

lapsing right of repurchase by us until the options are fully vested. Amounts presented under the caption “Value of Unexercised In-the-Money Options at December 31, 2005” are based on the closing price per share of our common stock on the Nasdaq National Market as of December 31, 2005 of $28.48 per share, less the exercise price payable for such shares, multiplied by the number of shares subject to the stock option, without taking into account any taxes that might be payable in connection with the transaction.

| | | | | | | | | | | | | | | |

Name | | Shares

Acquired

on

Exercise | | Value

Realized | | Number of Securities

Underlying Unexercised Options

at December 31, 2005 (#) | | Value of Unexercised

In-the-Money Options at

December 31, 2005 ($) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Thomas K. Barton (1) | | 141,825 | | $ | 2,459,246 | | 691,508 | | — | | $ | 18,723,912 | | | — |

Todd R. Ford (1) | | 238,389 | | | 4,133,665 | | 594,944 | | — | | | 16,042,716 | | | — |

Giovanni Coglitore | | — | | | — | | — | | — | | | — | | | — |

Nikolai Gallo | | — | | | — | | — | | — | | | — | | | — |

William P. Garvey | | — | | | — | | 2,916 | | 88,750 | | | 45,665 | | $ | 1,727,487 |

Thomas Gallivan | | 9,000 | | | 108,450 | | 18,916 | | 123,750 | | | 405,345 | | | 2,481,757 |

Nancy Dirgo | | 3,611 | | | 60,881 | | — | | — | | | — | | | — |

| (1) | Stock option grants named in the table above may be exercised pursuant to an early exercise agreement. |

Employment, Severance and Change of Control Agreements

Thomas K. Barton

We entered into an employment agreement with Mr. Barton on December 23, 2002 having an initial term of five years and entered into an amendment of this agreement on September 1, 2005. The term may be extended by the mutual agreement of both parties. The agreement, as amended, provides for an annual base salary of $340,000, which is subject to increase at least once every 12 months upon review by our Board, as well as other customary benefits and terms. In addition, Mr. Barton is entitled to receive an annual bonus of up to $175,000, if he meets targets established by our Board. Pursuant to the terms of the agreement, Mr. Barton received a stock option to purchase 500,000 shares of our common stock at an exercise price of $0.714 per share and a stock option to purchase 333,333 shares of our common stock at an exercise price of $2.144 per share. Both options vested as to 20% of the shares underlying the option on December 23, 2003 and then vest in equal monthly installments over the next four years thereafter.

In the event that we terminate Mr. Barton’s employment without cause or if he terminates his employment for good reason, Mr. Barton is entitled to receive severance equal to twelve months of salary and twelve months of continued medical benefits, in addition to twelve months of accelerated vesting of any outstanding options and a twelve-month period following termination to exercise those options. If Mr. Barton’s employment is terminated for any other reason, payment of his base salary will cease on his termination date.

Todd R. Ford

We entered into an employment agreement with Mr. Ford on December 23, 2002 having an initial term of five years and entered into an amendment of this agreement on September 1, 2005. The term may be extended by the mutual agreement of both parties. The agreement provides for an initial annual base salary of $260,500, which is subject to increase at least once every 12 months upon review by our Board, as well as other customary benefits and terms. In addition, Mr. Ford is entitled to receive an annual bonus of up to $100,000, if he meets targets established by our Board. Pursuant to the terms of the agreement, Mr. Ford received a stock option to purchase 500,000 shares of our common stock at an exercise price of $0.714 per share and a stock option to purchase 333,333 shares of our common stock at an exercise price of $2.144 per share. Both options vested as to 20% of the shares underlying the option on December 23, 2003 and then vest in equal monthly installments over the next four years thereafter.

17

In the event that we terminate Mr. Ford’s employment without cause or if he terminates his employment for good reason, Mr. Ford is entitled to receive severance equal to twelve months of salary and twelve months of continued medical benefits, in addition to twelve months of accelerated vesting of any outstanding options and a twelve-month period following termination to exercise those options. If Mr. Ford’s employment is terminated for any other reason, payment of his base salary will cease on his termination date.

Giovanni Coglitore

We entered into an employment agreement with Mr. Coglitore on December 23, 2002 having an initial term of five years, and entered into an amendment of this agreement on November 16, 2005. The term may be extended by the mutual agreement of both parties. The agreement, as amended, provides for an initial annual base salary of $150,000, which increased to $200,000 as of January 1, 2006, and is subject to increase at least once every 12 months upon review by our Board, as well as other customary benefits and terms. Mr. Coglitore is also entitled to receive an annual bonus of up to $100,000 if he meets targets established by our Board. In addition, we are required to keep our medical insurance policy in place unless we are able to obtain other medical insurance that provides substantially similar coverage.

In the event that we terminate Mr. Coglitore’s employment without cause or if he terminates his employment for good reason, Mr. Coglitore is entitled to receive severance equal to 12 months of salary and continued medical benefits for 12 months if the termination occurs on or after May 15, 2006, and three months of salary and continued medical benefits for six months if the termination occurs prior to May 15, 2006.

Nikolai Gallo

We entered into an employment agreement with Mr. Gallo on December 23, 2002 having an initial term of five years, and entered into an amendment of this agreement on November 16, 2005. The term may be extended by the mutual agreement of both parties. The agreement, as amended, provides for an initial annual base salary of $150,000, which increased to $175,000 as of January 1, 2006 and is subject to increase at least once every 12 months upon review by our Board, as well as other customary benefits and terms. In addition, Mr. Gallo is entitled to receive an annual bonus of up to $75,000 if he meets targets established by our Board.

In the event that we terminate Mr. Gallo’s employment without cause or if he terminates his employment for good reason, Mr. Gallo is entitled to receive severance equal to six months of salary if the termination occurs on or after May 15, 2006, and three months of salary if the termination occurs prior to May 15, 2006, and continued medical benefits for six months. Mr. Gallo was our Chief Procurement Officer from December 2002 to November 2005 and is currently our Manager of Commodity Procurement.

William P. Garvey

We entered into an offer letter agreement with Mr. Garvey dated November 29, 2004. The offer letter provides for salary, bonus and stock option compensation terms, as well as other customary benefits and terms.

In the event that we terminate Mr. Garvey’s employment without cause, Mr. Garvey is entitled to receive severance payments of his base salary and COBRA premiums through the earlier of six months from the termination date or until Mr. Garvey commences full-time employment for another entity. In addition, within 12 months following a change of control, or an exchange of more than 50% of our equity securities in a transaction, if Mr. Garvey is terminated without cause, given a position with substantially less responsibility or required to relocate, Mr. Garvey is entitled to immediate vesting of all unvested shares.

Thomas Gallivan

We entered into an offer letter agreement with Mr. Gallivan dated September 8, 2004. The offer letter provides for salary, bonus and stock option compensation terms, as well as other customary benefits and terms.

18

Within 12 months following a change of control, or an exchange of more than 50% of our equity securities in a transaction, if Mr. Gallivan is terminated without cause, given a position with substantially less responsibility or required to relocate, Mr. Gallivan is entitled to immediate vesting of all unvested shares.

Change in Control Arrangements

A change of control is defined as a sale of all or substantially all of the assets of Rackable Systems or the transfer of outstanding equity securities of Rackable Systems such that after giving effect to such transfer, such acquiring party would own the right to elect a majority of the members of our Board. Mr. Barton’s and Mr. Ford’s outstanding unvested options shall immediately vest and become exercisable in full upon a change of control of Rackable Systems.

Our 2005 Equity Incentive Plan, our 2005 Non-Employee Directors Plan and our 2006 New Recruit Equity Incentive Plan provide that in the event of specified change of control transactions, including our merger with or into another corporation or the sale of substantially all of our assets, all outstanding options under the plan may be either assumed or substituted for by any surviving entity. If the surviving or acquiring entity elects not to assume or substitute for such options, the vesting and exercisability of such options will be accelerated in full and such options will be terminated if not exercised prior to the effective date of such change of control transaction.

19

REPORTOFTHE COMPENSATION COMMITTEEOFTHE BOARDOF DIRECTORS

ON EXECUTIVE COMPENSATION(1)

The Compensation Committee (the “Committee”) administers Rackable Systems’ executive compensation program. In this regard, the role of the Committee is to oversee our compensation plans and policies, review and approve all executive officers’ compensation, and administer our equity incentive plans (including reviewing and approving stock option grants to executive officers). The Committee’s charter reflects these various responsibilities. The Committee’s membership is determined by the Board and is composed entirely of independent directors. The Committee meets regularly during the year, and it also considers and takes action by written consent. The Committee Chairman reports on Committee actions and recommendations at Board meetings. In addition, the Committee has the authority to engage the services of outside advisers, experts and others to assist the Committee.

General Compensation Philosophy

The Committee’s philosophy is to provide a compensation package that attracts and retains executive talent by providing a mix of cash and equity-based compensation that the Committee believes appropriate to align the short- and long-term interests of Rackable Systems’ executives with that of its stockholders. It is the Committee’s practice to provide incentives to its executives that promote both the short- and long-term financial objectives of Rackable Systems. Achievement of short-term objectives is rewarded through base salary and performance-based, cash incentives, while equity-based incentive grants encourage executives to focus on Rackable Systems’ long-term goals as well. These performance-based, cash incentives are based on financial objectives of importance to Rackable Systems, including revenue and earnings growth. Rackable Systems’ compensation practices reflect a pay-for-performance philosophy, whereby a significant portion of executive compensation is at risk and tied to both individual and Company performance.

The Committee periodically reviews the effectiveness and competitiveness of Rackable Systems’ executive compensation structure and during 2005, engaged an outside compensation consulting firm to assist the Committee in this review. This consulting firm provided the Committee with salary, bonus and equity-based data for executives at similarly situated companies.

Elements of Executive Compensation

Base Salary

The Committee reviews and determines the base salaries of the Chief Executive Officer and other members of senior management. In each case, the Committee takes into account the results achieved by the executive, scope of responsibilities and experience, and competitive compensation practices.

Performance-Based, Cash Incentives

Annual performance-based, cash incentives are tied to Rackable Systems’ overall performance, as well as the performance of each executive and of his or her area of responsibility or business unit. For fiscal 2005, Messrs Barton and Ford’s performance-based, cash incentives were based on Rackable Systems’ results of operations, overall operational and strategic achievements and each individual’s roles and contributions to Rackable Systems. Mr. Gallivan’s performance-based, cash incentives were based on Rackable Systems achieving certain sales goals. Mr. Garvey and Ms. Dirgo’s performance-based, cash incentives were determined based on completing certain management bonus objectives that were established on a quarterly basis.

Equity-Based Incentive Grants

Equity-based incentive grants encourage executives to focus on Rackable Systems’ long-term goals. As noted in the “Options Granted” column of the Summary Compensation Table, in 2005, Rackable Systems

| (1) | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Rackable Systems under the 1933 Act or 1934 Act, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.” A compensation committee report on option repricing must be excepted from this footnote. |

20

provided stock option grants to certain executives under Rackable Systems’ equity incentive plans. The value of stock options granted to executives is tied to the future performance of Rackable Systems’ common stock and provides value to the recipient only when the price of Rackable Systems’ common stock increases above the option per share exercise price.

Compensation of the Chief Executive Officer

In September 2005, the Committee increased Mr. Barton’s annual base salary to $340,000 and increased Mr. Barton’s potential annual bonus to $175,000. In addition, the Committee approved an amendment to Mr. Barton’s employment agreement, such that if Mr. Barton’s employment is terminated without cause or if he terminates his employment for good reason, Mr. Barton is entitled to receive severance equal to twelve months of salary and twelve months of continued medical benefits, in addition to twelve months of accelerated vesting of any outstanding options and a twelve-month period following termination to exercise those options.

The Committee’s decision to amend Mr. Barton’s cash-based compensation and the terms of Mr. Barton’s severance if he were to be terminated without cause or if he terminates his employment for good reason, were based on a number of factors including: (i), the completion of Rackable Systems’ initial public offering in June 2005, (ii) Rackable Systems’ operational performance, including its revenue and earnings growth and (iii) the results of the compensation report prepared by an outside compensation consultant.

The Committee also approved other compensation paid to Mr. Barton during fiscal 2005, related to reimbursement of certain legal expenses and found these amounts to be reasonable.

In January 2006, the Committee approved a 2005 bonus payment for Mr. Barton in the amount of $175,000 bringing Mr. Barton’s total annual 2005 bonus to $262,500. Mr. Barton’s bonus was determined based on the evaluation of his performance, the overall performance of Rackable Systems’ business, including the results of operations for the fourth quarter and full year of 2005 and Rackable Systems’ overall operational and strategic achievements during these periods including Mr. Barton’s contribution to thereto.

Internal Revenue Code Section 162(m)

The Compensation Committee has considered the anticipated tax treatment to the company regarding the compensation and benefits paid to the executive officers of the company in light of the enactment of Section 162(m) of the United States Internal Revenue Code. The basic philosophy of the Compensation Committee is to strive to provide the executive officers of the company with a compensation package which will preserve the deductibility of such payments for the company to the greatest extent possible. However, certain types of compensation payments and their deductibility (e.g., the spread on exercise of non-qualified options) depend upon the timing of an executive officer’s vesting or exercise of previously granted rights. Moreover, interpretations of and changes in the tax laws and other factors beyond the Compensation Committee’s control may affect the deductibility of certain compensation payments. In addition, in order to attract and retain qualified management personnel, the Committee will not necessarily seek to limit executive compensation to that deductible under Section 162(m) of the Code.

Respectfully submitted,

The Compensation Committee of the Board of Directors

Michael J. Maulick (Chairman)

Gary A. Griffiths

Hagi Schwartz

COMPENSATION COMMITTEE INTERLOCKSAND INSIDER PARTICIPATION

Prior to establishing the Compensation Committee, our Board as a whole made decisions relating to compensation of our executive officers. As noted above, our Compensation Committee consists of Mr. Maulick, Mr. Schwartz and Mr. Griffiths. None of the members of our Compensation Committee has at any time been an officer or employee of Rackable Systems. No member of our Board or our Compensation Committee serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

21

PERFORMANCE MEASUREMENT COMPARISON (1)

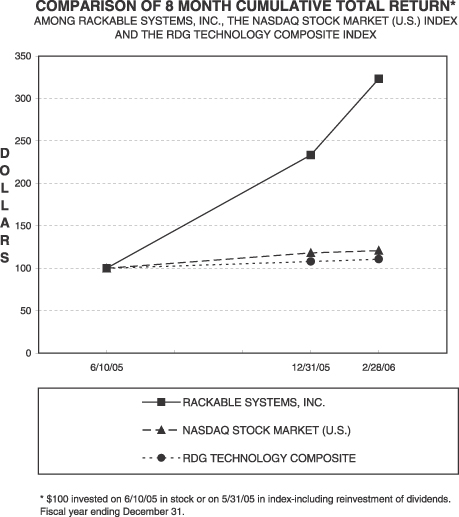

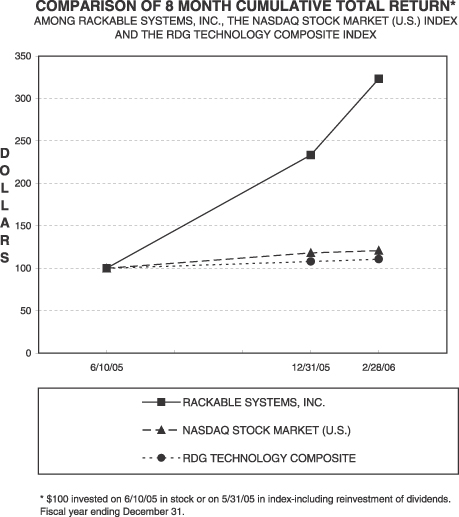

The following graph shows the total stockholder return of an investment of $100 in cash on June 10, 2005, the date our common stock first started trading on the Nasdaq National Market, for (i) our common stock, (ii) the Nasdaq Stock Market (U.S.) Index and (iii) the RDG Technology Composite Index as of December 31, 2005 and February 28, 2006. Pursuant to applicable SEC rules, all values assume reinvestment of the full amount of all dividends, however no dividends have been declared on our common stock to date. The stockholder return shown on the graph below is not necessarily indicative of future performance, and we do not make or endorse any predictions as to future stockholder returns.

Comparison of Cumulative Total Return on Investment

| (1) | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of Rackable Systems under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing |

22

CERTAIN RELATIONSHIPSAND RELATED PARTY TRANSACTIONS

The following is a description of transactions in 2005 to which we have been a party, in which the amount involved in the transaction exceeds $60,000, and in which any of our directors, former or current executive officers or, to our knowledge, holders of more than 5% of our capital stock had or will have a direct or indirect material interest.

Preferred Stock Conversions

Immediately prior to our initial public offering in June 2005, Rackable Investments LLC, then our largest stockholder, converted all of the shares of our then outstanding Series A preferred stock and distributed the resulting shares to its members. Each share of Series A preferred stock converted into one share of Series B preferred stock, which at the closing of our initial public offering was redeemed for approximately $1.25 in cash, and approximately 0.467 shares of common stock. Mr. Barton, our chief executive officer, was a member of Rackable Investment LLC, and owned units representing 616,667 shares of our Series A preferred stock, and Mr. Ford, our chief financial officer, also was a member of Rackable Investment LLC and owned units in Rackable Investment LLC representing 283,333 shares of our Series A preferred stock.

Warrant Agreement