SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement | | |

| ¨ | | Definitive Additional Materials | | |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 | | |

Rackable Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 6. | Amount Previously Paid: |

| | 7. | Form, Schedule or Registration Statement No.: |

Rackable Systems, Inc.

46600 Landing Parkway

Fremont, CA 94538

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 29, 2009

Dear Stockholder:

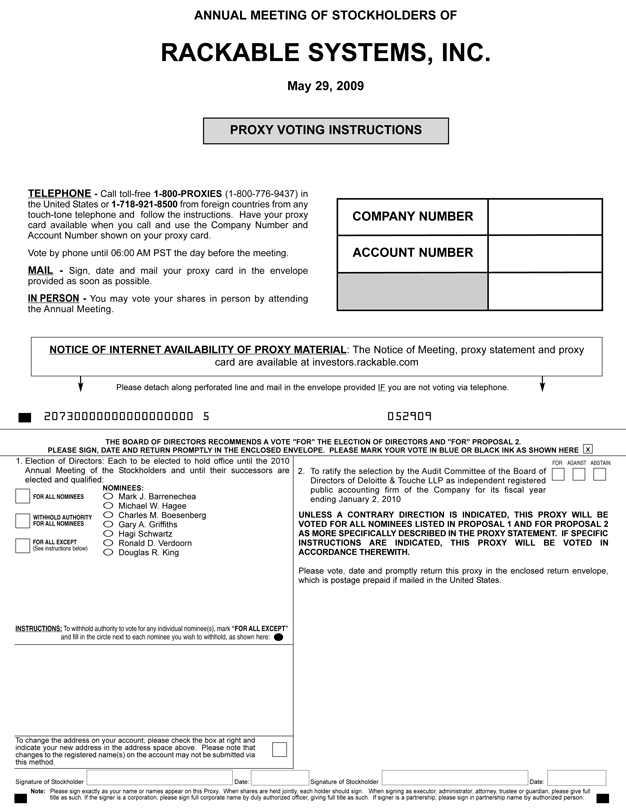

You are cordially invited to attend the Annual Meeting of Stockholders ofRACKABLE SYSTEMS, INC.,a Delaware corporation (the “Company”). The meeting will be held on Friday, May 29, 2009 at 9:00 a.m. local time at our executive offices located at 46600 Landing Parkway, Fremont, CA 94538 for the following purposes:

| 1. | To elect the seven nominees for director named herein to serve until the next annual meeting and their successors are duly elected and qualified. |

| 2. | To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of the Company for its fiscal year ending January 2, 2010. |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is April 10, 2009. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on May 29, 2009 at 9:00 a.m. local time at our executive offices located at 46600 Landing Parkway, Fremont, CA 94538. The proxy statement and annual report to stockholders are available at http://investors.rackable.com. |

|

By Order of the Board of Directors |

|

|

| Maurice Leibenstern |

| Secretary |

May 1, 2009

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy card, or vote over the telephone as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

Rackable Systems, Inc.

46600 Landing Parkway

Fremont, CA 94538

PROXY STATEMENT

FOR THE 2009 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

MAY 29, 2009

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors (the “Board”) ofRACKABLE SYSTEMS, INC. (sometimes referred to as the “Company” or “Rackable Systems”) is soliciting your proxy to vote at the 2009 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone. In addition, we are sending our stockholders an annual report that will accompany this proxy statement in accordance with SEC rules.

We intend to mail these proxy materials on or about May 1, 2009 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 10, 2009 will be entitled to vote at the annual meeting. On this record date, there were 30,116,494 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 10, 2009 your shares were registered directly in your name with Rackable Systems’ transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 10, 2009 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

| | • | | Election of our seven nominees for director; |

| | • | | Ratification of selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of the Company for its fiscal year ending January 2, 2010. |

1

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting,vote by proxy using the enclosed proxy card, or vote by proxy over the telephone. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | • | | To vote over the telephone, dial toll-free 1-800-776-9437 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 6:00 a.m. Pacific Time on May 28, 2009 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Rackable Systems. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 10, 2009.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking any voting selections, your shares will be voted, as applicable, “For” the election of all seven nominees for director and “For” the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending January 2, 2010. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If your shares are held instreet name and you do not instruct your broker or other nominee how to vote your shares, you broker or nominee may either use its discretion to vote your shares on “routine matters” or leave your

2

shares unvoted. If your shares are held instreet name, your broker, bank or nominee has enclosed a voting instruction card with this Proxy Statement. We strongly encourage you to vote your shares by following the instructions provided on the voting instruction card.

Please return your proxy card to your nominee and contact the person responsible for your account to ensure that a proxy card is voted on your behalf.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees and MacKenzie Partners, Inc. (“MacKenzie Partners”) may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies but MacKenzie Partners will be paid its customary fee not to exceed $12,500 plus out-of-pocket expenses if it solicits proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials and complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | • | | You may submit another properly completed proxy card with a later date. |

| | • | | You may grant a subsequent proxy by telephone. |

| | • | | You may send a timely written notice that you are revoking your proxy to Rackable Systems’ Secretary at 46600 Landing Parkway, Fremont, CA 94538. |

| | • | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone proxy is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by January 1, 2010 to our Corporate Secretary at 46600 Landing Parkway, Fremont, CA 94538; provided, however, that if our 2010 annual meeting is held before April 29, 2010 or after June 28, 2010, you must provide that specified information to us a reasonable time before we begin to print and send our proxy statement for our 2010 annual meeting. If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director pursuant to our Bylaws, you must provide specified information to us between January 29, 2010 and February 28, 2010; provided, however, that if our 2010 annual meeting is held before April 29, 2010 or after June 28, 2010, you must provide that specified information to us between the 120th day prior to the 2010 annual meeting and not later than the 90th day prior to the 2010 annual meeting or the 10th day following the day on which we first publicly announce of the date of the 2010 annual meeting. If you wish to do so, please review

3

our Bylaws, which contain a description of the information required to be submitted as well as additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For” and “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. With respect to proposals other than the election of directors, abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, “non-routine” matters are generally those involving a contest or a matter that may substantially affect the rights or privileges of stockholders, such as mergers or stockholder proposals.

How many votes are needed to approve each proposal?

| | • | | Since the number of nominees timely nominated for the Annual Meeting does not exceed the number of directors to be elected at the 2009 Annual Meeting, the 2009 election is uncontested election under the Bylaws. As a result, the nominees receiving more “For” votes than “Withheld” votes (from the holders of votes of shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors) will be elected. Broker non-votes and abstentions will have no effect. Pursuant to our Bylaws, each of the nominees listed below has tendered an irrevocable conditional resignation as a director (subject to certain conditions; see the section entitled “Proposal 1—Election of Directors” on Page 7 below). |

| | • | | To be approved, Proposal No. 2 ratifying Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 2, 2010 must receive “For” votes from the holders of a majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 30,116,494 shares outstanding and entitled to vote. Thus, the holders of 15,058,248 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting or the holders of a majority of the shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

4

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of 2009.

What proxy materials are available on the internet?

The letter to stockholders, proxy statement, Form 10-K and annual report to stockholders are available at investors.rackable.com.

5

PROPOSAL 1

ELECTION OF DIRECTORS

RACKABLE SYSTEMS’ Board of Directors consists of seven directors. There are seven nominees for director this year. Each director to be elected and qualified will hold office until the next annual meeting of stockholders and until his successor is elected, or, if sooner, until the director’s death, resignation or removal. Each of the nominees listed below is currently a director of the Company who was previously elected by the stockholders. The process by which our Nominating and Corporate Governance Committee identifies, evaluates and selects potential director nominees involves a variety of factors and criteria, all of which are described underNominating and Corporate Governance Committee on page 13.

Although we do not have a formal policy regarding director attendance at our annual meetings, we intend to invite all of our directors to attend our annual meetings of stockholders. Four of the seven members of our Board serving at the time of our 2008 annual meeting of stockholders attended the 2008 annual meeting of stockholders.

Because the number of nominees timely nominated for the 2009 Annual Meeting does not exceed the number of directors to be elected at the 2009 Annual Meeting, the 2009 election is an “uncontested election” under the Bylaws. As a result, directors will be elected if they receive more “For” votes than “Withheld” votes of the shares present in person or represented by proxy at the meeting and entitled to vote generally on the election of directors. Pursuant to our Bylaws, each of the nominees listed below has tendered an irrevocable resignation as a director, which resignation is conditioned upon both: (a) such director failing to have received more “For” votes than “Withheld” votes in an election; and (B) acceptance by the Board of Directors’ of such resignation.

NOMINEES

The following is a brief biography of each nominee for director.

| | | | |

NAME | | AGE | | PRINCIPAL OCCUPATION |

Mr. Mark J. Barrenechea | | 44 | | President and Chief Executive Officer of Rackable Systems |

General Michael W. Hagee | | 64 | | Retired |

Mr. Charles M. Boesenberg | | 60 | | Retired |

Mr. Gary A. Griffiths | | 59 | | President and Chief Operating Officer, LiteScape Technologies, Inc. |

Mr. Hagi Schwartz | | 47 | | President, Magnolia Capital |

Mr. Ronald D. Verdoorn | | 58 | | Retired |

Mr. Douglas R. King | | 66 | | Retired |

Mark J. Barrenechea joined Rackable Systems in November 2006 as a member of our board of directors, and in April 2007 became our President and Chief Executive Officer. Previously, Mr. Barrenechea served as Executive Vice President and CTO for CA, Inc. (“CA”), (formerly Computer Associates International, Inc.), a software company, from 2003 to 2006 and was a member of the executive management team. Prior to CA, Mr. Barrenechea served as Senior Vice President of Applications Development at Oracle Corporation, an enterprise software company, from 1997 to 2003, managing a multi-thousand person global team while serving as a member of the executive management team. From 1994 to 1997, Mr. Barrenechea served as Vice President of Development at Scopus, an applications company. Prior to Scopus Mr. Barrenechea was with Tesseract, an applications company, where he was responsible for reshaping the company’s line of human capital management software as Vice President of Development. Mr. Barrenechea holds a Bachelor of Science degree in computer science from Saint Michael’s College.

General Michael W. Hagee has been a member of our Board of Directors since February 2008. General Hagee is the head of MH Dimension Consulting, specializing in advising, counseling and training in topics such as ethical leadership, team building, mentoring and organizational efficiency. General Hagee retired from the

6

Marine Corps in January 2007. From 2003 to 2006 General Hagee was a member of the Joint Chiefs of Staff as the 33rd Commandant of the United States Marine Corps. Prior to that, he was the Commanding General of the 1st Marine Expeditionary Force. In total, General Hagee served in the U.S. military for more than 43 years. General Hagee holds numerous military, civilian, and foreign decorations, including the Bronze Star with Valor, National Intelligence Distinguished Service Medal, and Defense Distinguished Service Medal. General Hagee graduated with distinction from the U.S. Naval Academy in 1968 with a Bachelor of Science in Engineering. General Hagee also holds a Master of Science in Electrical Engineering from the U.S. Naval Postgraduate School and a Master of Arts in National Security and Strategic Studies from the Naval War College. General Hagee currently serves as a member of the Board of Directors of Cobham, plc, a publicly traded British manufacturing company.

Charles M. Boesenberg has been a member of our Board of Directors since August 2006. Mr. Boesenberg has served as Executive Chairman of the Board of Callidus Software from November 2007 until November 2008 and as Non-Executive Chairman of the Board since November 2008. From January 2002 to June 2006, Mr. Boesenberg served as Chief Executive Officer and, beginning in August 2002, Chairman of the Board at NetIQ Corp, a provider of integrated systems and security management solutions. Prior to joining NetIQ, Mr. Boesenberg held senior executive positions at IBM and Apple and served as president and chief executive officer of Central Point Software, Magellan and Integrated Systems. Mr. Boesenberg currently serves as a member of the Board of Directors of Callidus Software, a publicly traded provider of sales performance management and incentive compensation software, as a director at Interwoven, a publicly traded provider of content management solutions, and as a director at Keynote Systems, a publicly traded provider of on-demand test and measurement products for mobile communications, VoIP, streaming, and Internet performance. He has also previously served on the Board of Directors of Symantec, Macromedia and Maxtor. Mr. Boesenberg holds a B.S. in mechanical engineering from the Rose Hulman Institute of Technology and a M.S. in business administration from Boston University.

Gary A. Griffiths has been a member of our Board of Directors since November 2004. In July 2008, Mr. Griffiths joined LiteScape Technologies, Inc., a company focused on unifying various communication technologies over VoIP, as President and Chief Operating Officer. Upon the acquisition in May 2007 by Cisco Systems, Inc. of WebEx Communications, Inc., a provider of web-based conferencing solutions, Mr. Griffiths became a Vice President at Cisco, where he remained until April 2008. Mr. Griffiths joined WebEx in December 2005 as Vice President of Products, and became President of WebEx, where he remained until May 2007. From June 1999 to July 2005, Mr. Griffiths was Chairman, President and Chief Executive Officer at Everdream Corporation, a technology services company. Mr. Griffiths holds a B.S. in Aerospace Engineering from the United States Naval Academy and an M.S. from George Washington University.

Hagi Schwartz has been a member of our Board of Directors since August 2004. Since February 2005, Mr. Schwartz has been President of Magnolia Capital, an investment advisory firm. From February 2003 to August 2005, Mr. Schwartz was Chief Financial Officer of HyperRoll, Inc., a provider of high-performance database aggregation and summarization software. From September 2000 to July 2002, Mr. Schwartz was Chief Financial Officer of ATRICA, Inc., a telecommunications company. From October 1999 to May 2000, Mr. Schwartz was Chief Financial Officer at Noosh, Inc., a print management software company. From January 1996 to September 1999, Mr. Schwartz served as Vice President of Finance and Chief Financial Officer of Check Point Software, Inc., a software company. Currently, Mr. Schwartz serves on the Board of Directors of BigFix, Inc. Mr. Schwartz has a B.A. in Economics and Accounting from Bar Ilan University. Mr. Schwartz is a partner in Magnolia Capital Partners LTD, which provides corporate advisory services to its clients in Israel and the United States, and which has entered into a solicitation and referral agreement with one of the underwriters in our public offerings.

Ronald D. Verdoorn joined Rackable Systems as a director in March 2005 and was elected Chairman of the Board of Directors in January 2006. From January 1999 to 2002, Mr. Verdoorn served as Executive Vice President of Global Operations for Affymetrix, Inc., a company specializing in the development of technology for acquiring and managing complex genetic information for use in biomedical research, genomics and clinical

7

diagnostics, following which he continued as a consultant until December 2003. From 1997 to 1999, Mr. Verdoorn served as an independent consultant to the hard disk drive industry. From 1983 to 1997, Mr. Verdoorn held a number of positions with Seagate Technology, Inc., most recently as Executive Vice President and Chief Operating Officer of Storage Products. Mr. Verdoorn has a B.A. in Sociology from Linfield College.

Douglas R. King has been a member of our Board of Directors since February 2008. Mr. King is a Certified Public Accountant with more than 30 years of experience in the accounting industry. Mr. King most recently served as the Managing Partner of the San Francisco office of Ernst & Young LLP, from which he retired in 2002. Currently, Mr. King serves on the Board of Directors of: SJW Corp as Chairman of the Audit Committee and member of the Executive Compensation Committee; Fuel Systems Solutions, Inc. as Chairman of the Audit Committee and a member of its Governance Committee; and of the private company Adaptive Spectrum and Signal Alignment, Inc. Mr. King has a Bachelor of Science from the University of Wisconsin (Madison) and an MBA from the University of Arkansas.

8

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

INDEPENDENCEOFTHE BOARDOF DIRECTORS

As required under the NASDAQ Stock Market (“NASDAQ”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the NASDAQ, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and Rackable Systems, its senior management and its independent auditors, the Board affirmatively has determined that the following directors are independent directors within the meaning of the applicable NASDAQ listing standards: General Hagee, Mr. Boesenberg, Mr. Griffiths, Mr. King, Mr. Schwartz and Mr. Verdoorn. In making its determination, the Board found that none of these directors or nominees for director have a material or other disqualifying relationship with Rackable Systems. The relationships considered by the Board in determining that these directors are independent consisted of: (a) Mr. Griffith’s former position as an executive officer of WebEx Communications, Inc. which is a customer of Rackable Systems. In 2008, WebEx purchased approximately $900,000 of products and services from Rackable Systems; and (b) Mr. Schwartz’s position as President of Magnolia Capital Partners LTD (“Magnolia”), which provides corporate advisory services to its clients in Israel and the United States and is party to an agreement (the “Referral Agreement”) under which Magnolia is entitled to compensation with respect to certain U.S. and Israeli clients for which Thomas Weisel Partners LLC, the investment banker in our public offerings in 2005 and 2006, provides investment banking services. We have been advised that Magnolia did not receive any compensation under the Referral Agreement in connection with our public offerings and will not receive any compensation in respect of any other services that may in the future be provided by Thomas Weisel Partners LLC to Rackable Systems. Mr. Barrenechea, our Chief Executive Officer, is not an independent director.

MEETINGSOFTHE BOARDOF DIRECTORS

The Board of Directors met 15 times during the last fiscal year. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he served, held during the portion of the last fiscal year for which he was a director or committee member.

As required under applicable NASDAQ listing standards, in fiscal year 2008, the Company’s independent directors met5 times in regularly scheduled executive sessions at which only independent directors were present.

INFORMATION REGARDING COMMITTEESOFTHE BOARDOF DIRECTORS

The Board has three committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal 2008 for each of the Board committees:

| | |

Type of Meeting Held | | Number of Meetings |

Board | | 15 |

Audit Committee (“AUD”) | | 12 |

Compensation Committee (“COM”) | | 13 |

Nominating and Corporate Governance Committee (“NOM”) | | 5 |

9

| | | | |

Director | | Board Meetings Attended | | Committee Meetings

Attended |

Mark J. Barrenechea (1) | | 15 of 15 | | n/a |

| | |

Michael W. Hagee (2) | | 12 of 13 | | 1 of 1 NOM |

| | |

Charles M. Boesenberg (3) | | 13 of 15 | | 12 of 12 AUD

13 of 13 COM |

| | |

Gary A. Griffiths (4) | | 15 of 15 | | 2 of 2 AUD

5 of 5 NOM 11 of 11 COM |

| | |

Hagi Schwartz (5) | | 14 of 15 | | 9 of 12 AUD

4 of 4 NOM |

| | |

Ronald D. Verdoorn | | 15 of 15 | | 13 of 13 COM |

| | |

Douglas R. King (6) | | 12 of 13 | | 10 of 10 AUD

1 of 1 NOM |

| (1) | Mr. Barrenechea did not serve on any committees. |

| (2) | General Hagee was elected to the Board on January 29, 2008 and was appointed to serve on the Nominating and Corporate Governance Committee and Strategic Committee on March 28, 2008. |

| (3) | Mr. Boesenberg has served on the Audit Committee and Compensation Committee since January 26, 2007. |

| (4) | Mr. Griffiths ceased serving on the Audit Committee on March 28, 2008, and joined the Compensation Committee on March 28, 2008. |

| (5) | Mr. Schwartz ceased serving on the Nominating and Corporate Governance Committee on March 28, 2008. |

| (6) | Mr. King was elected to the Board on January 29, 2008 and was appointed to serve on the Nominating and Corporate Governance Committee and Audit Committee, including as Chairman of the Audit Committee, on March 28, 2008. |

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage legal counsel or other advisors or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable NASDAQ rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors oversees our corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on Rackable Systems’ audit engagement team as required by law; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review our annual audited financial statements and quarterly financial statements with management and the independent auditor. Three directors currently comprise the Audit Committee: Messrs. King (Chairman), Boesenberg, and Schwartz. The Board has adopted a written Audit Committee Charter, which can be found on the Investor Relations section of our corporate website at www.rackable.com under Corporate Governance.

10

The Board annually reviews the NASDAQ listing standards definition of independence for Audit Committee members and has determined that all members of our Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the NASDAQ listing standards. The Board has determined that Messrs. King, Schwartz and Boesenberg all qualify as “audit committee financial experts,” as defined in applicable SEC rules. The Board made a qualitative assessment of Messrs. King’s, Boesenberg’s and Schwartz’s level of knowledge and experience based on a number of factors, including: Mr. King’s past experience as a managing partner at Ernst & Young, LLP, and his experience as an audit committee member and chairman for numerous public companies; Mr. Boesenberg’s past experience as president, chief executive officer and audit committee member of numerous public companies; and Mr. Schwartz’s past professional experience as the chief financial officer of various companies.

Compensation Committee

The Compensation Committee of the Board of Directors reviews and approves the overall compensation strategy and policies for Rackable Systems. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management; recommends to the Board for approval the compensation plans and programs for our company; determines and approves the compensation and other terms of employment of our Chief Executive Officer; determines and approves the compensation and other terms of employment of the other executive officers; determines and approves the compensation for our non-employee directors, and administers our stock option and stock purchase plans. Three directors currently comprise the Compensation Committee: Messrs. Boesenberg (Chairman), Verdoorn, and Griffiths. Mr. Griffiths joined the Compensation Committee in March 2008. All members of our Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Board has adopted a written Compensation Committee Charter, which can be found on the Investor Relations section of our corporate website at www.rackable.com under Corporate Governance which can be found on our corporate website at www.rackable.com.

The processes used by the Compensation Committee for the consideration and determination of executive officer and director compensation consist of the following:

| | • | | regular meetings of the Compensation Committee to review and evaluate compensation matters |

| | • | | evaluating the chief executive officer’s recommendation regarding the amount and form of compensation to be paid to executive officers, including himself |

| | • | | analyzing third party survey data and specific recommendations provided by independent compensation consultants in connection with evaluation of compensation matters |

The Compensation Committee has full access to all books, records, facilities and personnel of Rackable Systems as deemed necessary or appropriate by any member of the Compensation Committee to discharge his or her responsibilities under its charter. The Compensation Committee has the authority to obtain, at the expense of Rackable Systems, advice and assistance from internal or external legal, accounting or other advisors and consultants. In addition, the Compensation Committee has sole authority to retain and terminate any compensation consultant to assist in the evaluation of director, chief executive officer or senior executive compensation, including sole authority to approve such consultant’s reasonable fees and other retention terms, all at Rackable Systems’ expense. The Compensation Committee has the authority in incur other reasonable expenditures for external resources that the Compensation Committee deems necessary or appropriate in the performance of its duties. The Compensation Committee may form and delegate authority to subcommittees as appropriate, including, but not limited to, a subcommittee composed of one or more members of the Board to grant stock awards under Rackable Systems’ equity incentive plans to persons who are not (a) “Covered Employees” under Section 162(m) of the Internal Revenue Code; (b) individuals with respect to whom Rackable Systems wishes to comply with Section 162(m) of the Internal Revenue Code or (c) then subject to Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”).

11

The Compensation Committee has delegated the authority to the Chief Executive Officer to approve non-officer new hire options grants. The Chief Executive Officer does recommend the amount and form of compensation for other executive officers, but does not determine such compensation.

During 2008, the Compensation Committee hired the independent firms of Radford Consulting, to conduct the director compensation survey, and Towers Perrin, to conduct the executive compensation survey. Radford Consulting and Towers Perrin were instructed to review the compensation and equity components at comparable companies, as determined by the consulting companies and compare market data against Rackable Systems’ current director and executive compensation package. Radford Consulting and Towers Perrin were also instructed to make recommendations to the Compensation Committee as to possible changes to Rackable Systems compensation practices based upon the results of the survey. The Towers Perrin report for executive compensation was presented to the Compensation Committee in December 2008, and the Radford report for directors’ compensation was presented to the Compensation Committee in January 2009. In addition, prior to making any annual compensation decisions, the Compensation Committee met with representatives of the Company’s largest shareholders to discuss the Company’s executive compensation practices. The Compensation Committee considered the input from these shareholders, as well as both the Towers Perrin and Radford reports, the Company’s performance and other financial data in establishing the executive management compensation plans for 2009. After doing so, the Compensation Committee concluded that there would be no increases made to compensation.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of Rackable Systems, reviewing and evaluating incumbent directors, selecting candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board and developing a set of corporate governance principles for Rackable Systems. The Board has adopted a written Nominating and Corporate Governance Committee Charter, which can be found on the Investor Relations section of our corporate website at www.rackable.com under Corporate Governance. Three directors comprise the Nominating and Corporate Governance Committee: Mr. Griffiths (Chairman), Mr. King, and General Hagee. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the NASDAQ listing standards).

The Nominating and Corporate Governance Committee believes that nominees for director of Rackable Systems should possess the following minimum criteria: be able to read and understand basic financial statements; be over 21 years of age; and have the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider the following additional criteria for nominees for director of Rackable Systems: the candidate’s relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of Rackable Systems, demonstrated excellence in his or her field, having the ability to exercise sound business judgment, and having the commitment to rigorously represent the long-term interests of our stockholders. The Nominating and Corporate Governance Committee evaluates candidates for director nominees in the context of the current composition of the Board, the operating requirements of Rackable Systems, and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers the criteria for director qualifications set by the Board of Directors, as well as diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and Rackable Systems to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to Rackable Systems during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing

12

standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates, other than with respect to the search conducted to identify Mr. King and General Hagee, described above. To date, the Nominating and Corporate Governance Committee has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of our voting stock. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder or not. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: Rackable Systems at 46600 Landing Parkway, Fremont, CA, 94538 not less than six months prior to any meeting at which directors are to be elected. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of our stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

STOCKHOLDER COMMUNICATIONS WITHTHE BOARDOF DIRECTORS

Our Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Persons wishing to communicate with the Board or an individual director may send a written communication addressed as follows: Rackable Systems Board Communication, 46600 Landing Parkway, Fremont, CA, 94538. Any communication sent must state the number of shares owned by the security holder making the communication. Our corporate secretary will review each communication and forward such communication to the Board or to any individual director to whom the communication is addressed unless the communication is unduly frivolous, hostile, threatening or similarly inappropriate, in which case, our corporate secretary shall discard the communication.

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE GUIDELINES

The Board of Directors serves as our ultimate decision-making body, except with respect to matters reserved for the decision of our stockholders. The Board of Directors has adopted Corporate Governance Guidelines to assist in the performance of its responsibilities. These guidelines can be found on the Investor Relations section of our corporate website at www.rackable.com under Corporate Governance.

The Corporate Governance Guidelines provide, among other things, and in addition to the corporate governance matters described above, as follows:

1. The Board of Directors, which is elected annually (we do not have a staggered board), will periodically review the appropriate size of the Board.

2. It is the policy of the Board of Directors that our Chairman of the Board and Chief Executive Officer shall be different individuals, and if our Chairman of the Board is not an independent director, that we will have an independent director serve as our Lead Independent Director.

13

3. Board members may serve as a board member on no more than four additional public companies, and our Chief Executive Officer can serve as a board member on no more than two additional public companies. In addition, no member of our Audit Committee can serve on the audit committee of more than two additional public companies without the prior approval of our Chairman of the Board.

4. In uncontested elections, if a Board member receives more “withheld” votes than “for” votes, then our Corporate Governance and Nominating Committee will recommend to the Board of Directors whether to accept the resignation of such director, and the Board will accept the resignation absent compelling circumstances to the contrary. Further, the director subject to that determination will not participate in the decision as to whether to accept the resignation.

5. Directors who retire from their employment or materially change their position should offer to resign from the Board of Directors.

6. Directors are expected to participate in continuing education programs endorsed by Institutional Shareholder Services or the National Association of Corporate Directors as necessary in order to maintain the necessary level of expertise to perform their responsibilities as directors.

7. Directors are expected to hold, after one year of service, stock ownership in Rackable Systems with a market value at least equal to the annual retainer payable to directors.

8. Assessments of the performance of the Board of Directors and its committees will be conducted annually, as well as assessments of each director’s performance.

Stockholders may request a free copy of the code by submitting a written request to Rackable Systems, Inc., Attention: Secretary, 46600 Landing Parkway, Fremont, CA, 94538.

CODEOF CONDUCTAND ETHICS

We have adopted the Rackable Systems, Inc. Code of Conduct and Ethics that applies to all officers, directors and employees, including the principal executive officer, principal financial officer and principal accounting officer. The Code of Conduct and Ethics can be found on the Investor Relations section of our corporate website at www.rackable.com under Corporate Governance.

Stockholders may request a free copy of the code by submitting a written request to Rackable Systems, Inc., Attention: Secretary, 46600 Landing Parkway, Fremont, CA, 94538. If we make any substantive amendments to our Code of Conduct and Ethics or grant any waiver from a provision of the code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

DIRECTOR STOCK OWNERSHIP GUIDELINES

Our Corporate Governance Guidelines provide that each director who has served on the Board for at least one year is expected to own shares of Rackable Systems’ common stock with a market value at least the amount of his or her annual cash base retainer.

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS(1)

The primary purpose of the Audit Committee is to assist the Board in its general oversight of Rackable Systems’ financial reporting process. The Audit Committee’s function is more fully described in its charter, which can be found on the Investor Relations section of our corporate website at www.rackable.com under Corporate Governance. The Audit Committee reviews the charter on an annual basis. The Board annually

| (1) | The material in this report is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of Rackable Systems under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

14

reviews the NASDAQ listing standards’ definition of independence for audit committee members and has determined that each member of the Audit Committee meets that standard.

Our management has primary responsibility for preparing our financial statements, ensuring the integrity of such data and establishing the financial reporting process, including our systems of internal controls. Deloitte & Touche LLP, our independent registered public accounting firm, are responsible for performing an audit of our consolidated financial statements, and expressing an opinion as to the conformity of such financial statements with generally accepted accounting principles in the Unites States. The Audit Committee’s responsibility is to oversee and review this process.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended January 3, 2009 with management of the Company, including a discussion of the quality, not just the acceptability, of the accounting principals, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Audit Committee has discussed with the independent auditors its judgments as to the quality, not just the acceptability, of our accounting principles and such other matters required to be discussed by Statement on Auditing Standards No. 114, The Auditor’s Communication with Those Charged with Governance, as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from the independent accountants required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence, and has discussed with the independent accountants the independent accountants’ independence.

Based on the foregoing, and in reliance on the reviews and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 3, 2009.

Respectfully submitted,

The Audit Committee of the Board of Directors

Douglas R. King (Chairman)

Charles M. Boesenberg

Hagi Schwartz

15

PROPOSAL 2

RATIFICATIONOF SELECTIONOF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected Deloitte & Touche LLP as the Company’s independent auditors for the fiscal year ending January 2, 2010 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the annual meeting. Deloitte & Touche LLP has audited the Company’s financial statements since our inception as a Delaware corporation in December 2002, and before that it audited our predecessor entities. Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Bylaws nor other governing documents or law require stockholder ratification of the selection of Deloitte & Touche LLP as our independent auditors. However, the Audit Committee of the Board is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of Rackable Systems and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Deloitte & Touche LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The Board Of Directors Recommends

A Vote In Favor Of Proposal 2

PRINCIPAL ACCOUNTANT FEESAND SERVICES

The following table presents fees for professional audit services rendered by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, the “Deloitte Entities”) for the audit of our annual financial statements for 2008 and 2007, and fees billed for all other services rendered by the Deloitte Entities.

| | | | | | |

| | | Fiscal Year Ended |

| | | 2008 | | 2007 |

| | | (in thousands) |

Audit Fees (a) | | $ | 1,897 | | $ | 1,827 |

Audit-related Fees (b) | | | 263 | | | 23 |

Tax Fees (c) | | | 100 | | | 132 |

Total Fees | | $ | 2,236 | | $ | 1,982 |

| (a) | Audit Fees.Consists of the audit of our annual financial statements, the audit of our internal control over financial reporting, review of financial statements included in our Form 10-Q quarterly reports, and services that are normally provided by the independent registered public accounting firm in connection with statutory audit and regulatory filings, for those fiscal years. This category also includes advice on accounting matters that arose during, or as a result of, the audit or the review of interim financial statements. |

| (b) | Consists of fees for services rendered in connection with actual and proposed business acquisitions and Distributed Parity Engine and our Option Exchange Program in 2007. |

16

| (c) | Consists of fees for tax services billed in 2007 and 2008 consisted of services for transfer pricing study. |

All fees described above were approved by the Audit Committee

PRE-APPROVAL POLICIESAND PROCEDURES.

As required by Section 10A(i)(1) of the Exchange Act, all non-audit services to be performed by Rackable Systems’ principal accountants must be approved in advance by the Audit Committee of the Board of Directors, subject to certain exceptions relating to non-audit services accounting for less than five percent of the total fees paid to its principal accountants which are subsequently ratified by the Audit Committee (the De Minimus Exception). The Audit Committee has established procedures by which the Chairperson of the Audit Committee may pre-approve such services provided the Chairperson report the details of the services to the full Audit Committee at its next regularly scheduled meeting and the fees for such services prior to such report to not exceed $50,000 in the aggregate. None of the non-audit services described above were performed pursuant to the De Minimus Exception during 2008.

The Audit Committee has determined that the rendering of the services other than audit services by Deloitte & Touche LLP is compatible with maintaining the principal accountant’s independence.

17

SECURITY OWNERSHIPOF

CERTAIN BENEFICIAL OWNERSAND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of February 9, 2009 by: (1) each director and nominee for director; (2) each of the executive officers named in the Summary Compensation Table; (3) all our executive officers and directors as a group; and (4) all those known by us to be beneficial owners of more than five percent of our common stock, if any. We do not have any class of equity securities outstanding other than our common stock.

| | | | |

| | | Beneficial Ownership(1) |

Name and Address of Beneficial Owner | | Number of Shares | | Percent of Total |

Artis Capital Management, L.P., Artis Capital Management, Inc. and Stuart L. Peterson (2) | | 2,682,971 | | 8.96 |

Galleon Management, L.P. and Raj Rajaratnam (6)(3) | | 2,618,556 | | 8.74 |

Renaissance Technologies, LLC and James H. Simons (4) | | 2,363,300 | | 7.89 |

Sun Life Financial, Inc. (5) | | 2,192,981 | | 7.32 |

FMR, LLC (3)(6) | | 1,538,360 | | 5.13 |

Mark J. Barrenechea (7) | | 511,805 | | * |

Jim Wheat | | — | | * |

Madhu Ranganathan (8) | | 25,967 | | * |

Giovanni Coglitore (9) | | 66,630 | | * |

David Yoffie (10) | | 47,890 | | * |

Maurice Leibenstern (11) | | 46,700 | | * |

Anthony Gaughan (12) | | 8,965 | | * |

Michael W. Hagee (13) | | 8,749 | | * |

Charles M. Boesenberg (14) | | 30,831 | | * |

Gary A. Griffiths (15) | | 44,354 | | * |

Douglas R. King (16) | | 14,249 | | * |

Hagi Schwartz (17) | | 43,892 | | * |

Ronald D. Verdoorn (18) | | 52,851 | | * |

All current directors and executive officers as a group (13 persons) (19) | | 902,883 | | 3.01 |

| * | Represents beneficial ownership of less than one percent of the outstanding shares of common stock. |

| (1) | This table is based upon information supplied by officers and directors and upon information gathered by Rackable Systems about principal stockholders known to us based on Schedules 13G filed with the Securities and Exchange Commission (the “SEC”). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 29,958,733 shares outstanding on February 9, 2009, adjusted as required by rules promulgated by the SEC. All shares of common stock subject to options currently exercisable or exercisable within 60 days after February 9, 2009 are deemed to be outstanding for the purpose of computing the percentage of ownership of the person holding such options, but are not deemed to be outstanding for computing the percentage of ownership of any other person. |

| (2) | Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 17, 2009 by Artis Capital Management, L.P., Artis Capital Management, Inc. and Stuart L. Peterson, reporting beneficial ownership as of December 31, 2008. Artis Capital Management, L.P., Artis Capital Management, Inc. and Stuart L. Peterson have shared voting and dispositive power with respect to the shares. The address of Artis Capital Management, L.P., Artis Capital Management, Inc. and Stuart L. Peterson is One Market Plaza, Steuart Street Tower, Suite 2700, San Francisco, CA 94105. |

18

| (3) | Based on information set forth in a Schedule 13G/A filed with the Securities and Exchange Commission on February 14, 2008 by Galleon Management, L.P. and Raj Rajaratnam, reporting beneficial ownership as of December 31, 2007. Galleon Management, L.P. and Raj Rajaratnam have shared voting and dispositive power with respect to the shares. The address of Galleon Management, L.P. and Raj Rajaratnam is 590 Madison Avenue, 34th Floor, New York, NY 10022. |

| (4) | Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 13, 2009 by Renaissance Technologies LLC and James H. Simons, reporting beneficial ownership as of May 23, 2008. Renaissance Technologies LLC and James H. Simons have sole voting power with respect to 2,239,345 shares, sole dispositive power with respect to 2,357,300 shares and shared dispositive power with respect to 6,000 shares. |

| (5) | Based on information set forth in a Schedule 13F filed with the Securities and Exchange Commission on February 12, 2009 by Sun Life Financial Inc., Sun Capital Advisers LLC and Sun Life Assurance Company of Canada, reporting beneficial ownership as of December 31, 2007. Sun Life Financial Inc. and Sun Capital Advisers LLC have shared voting and dispositive power with respect to 1,811,623 of the shares. Sun Life Financial Inc. and Sun Life Assurance Company of Canada have shared voting and dispositive power with respect to 337,932 of the shares. The address of Sun Life Financial Inc. is 150 King Street West, Toronto, Ontario, Canada, M5H 1J9. |

| (6) | Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 17, 2009 by FMR, LLC, reporting beneficial ownership as of December 31, 2008. FMR, LLC has sole voting power with respect to 1,401,060 shares and sole dispositive power with respect to 1,538,360 shares. The address of FMR, LLC is 82 Devonshire Street, Boston, Massachusetts 02109. |

| (7) | Includes 352,915 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 9,375 shares issuable upon the vesting of restricted stock unit awards within 60 days of February 9, 2009. |

| (8) | Ms Ranganathan ceased to be an executive officer of Rackable Systems on May 16, 2008. |

| (9) | Includes 7,397 shares issuable upon the vesting of restricted stock unit awards within 60 days of February 9, 2009. |

| (10) | Includes 31,250 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 5,001 issuable upon the vesting of restricted stock unit awards within 60 days of February 9, 2009. |

| (11) | Includes 28,125 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 6,250 shares issuable upon the vesting of restricted stock unit awards within 60 days of February 9, 2009. |

| (12) | Mr. Gaughan ceased to be an executive officer of Rackable Systems on November 12, 2008 |

| (13) | Includes 8,749 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009. |

| (14) | Includes 20,971 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 977 shares issuable upon the vesting of restricted stock unit awards within 60 days of February 9, 2009. |

| (15) | Includes 36,166 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 782 shares issuable upon vesting of restricted stock unit awards with 60 days of February 9, 2009. |

| (16) | Includes 11,249 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009. |

| (17) | Includes 36,860 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 1,173 shares issuable upon the vesting of restricted stock unit awards with 60 days of February 9, 2009. |

| (18) | Includes 35,819 shares issuable upon the exercise of options exercisable within 60 days of February 9, 2009 and 1,173 shares issuable upon the vesting of restricted stock unit awards with 60 days of February 9, 2009. |

| (19) | Includes 594,232 shares issuable upon the vesting of restricted stock unit awards, and upon the exercise of options exercisable, in each case within 60 days of February 9, 2009. |

19

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended January 3, 2009, all Section 16(a) filing requirements applicable to its officers and directors were complied with. We did not receive any representations or reports from greater than ten percent beneficial owners.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of January 3, 2009 with respect to shares of our Common Stock that may be issued under our existing equity compensation plans.

| | | | | | | | | |

Plan category | | Number of securities

to be issued upon

exercise of options | | | Weighted average

exercise price of

outstanding options | | Number of available

securities remaining

for future issuance | |

Equity compensation plans approved by stockholders (1) | | 2,681,956 | (3) | | $ | 13.17 | | 3,584,439 | (4) |

Equity compensation plans not approved by stockholders (2) | | 1,567,202 | | | $ | 11.18 | | 404,068 | |

| | | | | | | | | |

Total | | 4,249,158 | | | $ | 12.24 | | 3,988,507 | |

| | | | | | | | | |

| (1) | Consists of four plans: our 2002 Stock Option Plan, 2005 Equity Incentive Plan (the “2005 Plan”), 2005 Non-Employee Directors’ Stock Option Plan (the “Directors’ Plan”) and the 2005 Employee Stock Purchase Plan (the “Purchase Plan”). |

| (2) | Consists of one plan: our 2006 New Recruit Equity Incentive Plan (the “2006 Plan”). See Note 6 of the Notes to Consolidated Financial Statements in our 2008 Annual Report on Form 10-K for a description of this plan. |

(3) | Excludes purchase rights accruing under the Purchase Plan. Under the Purchase Plan, each eligible employee may purchase up to $25,000 worth of Rackable Systems’ Common Stock (determined on the basis of the fair market value per share on the date or dates such rights are granted and subject to a maximum number of shares, as determined by the Board from time to time, which is currently 1,333 shares per purchase date) at each semi-annual purchase date (the February 14th and August 14th each year) at a purchase price per share equal to eighty-five percent (85%) of the lower of (a) the closing selling price per share of Common Stock on the date immediately preceding the start date of offering period in which that semi-annual purchase date occurs and (b) the closing selling price per share of Common Stock on the semi-annual purchase date. |

| (4) | Includes shares available for future issuance under the 2005 Plan, the Directors’ Plan and the Purchase Plan. As of January 3, 2009, an aggregate of 2,615,446, 70,333 and 898,660 shares of common stock were available for issuance under the 2005 Plan, the Directors’ Plan and the Purchase Plan, respectively. |

The number of shares of common stock available for issuance under the 2005 Plan automatically increases on January 1st each year, by the lesser of:

| | • | | 4% of the total number of shares of common stock outstanding on the date immediately preceding the date of increase; |

20

| | • | | the greatest number of shares of common stock that could be added to the 2005 Plan as of that date without causing the number of shares not already subject to outstanding stock awards under the 2005 Plan as of that date to exceed 7% of the fully diluted number of shares of common stock on the day prior to the determination, which fully diluted number includes all shares available for issuance under all of our equity compensation plans, whether or not subject to stock awards; and |

| | • | | such smaller number as may be determined by our board of directors prior to that date. |

The number of shares of common stock available for issuance under the Directors’ Plan automatically increases on January 1st each year by the number of shares of common stock subject to options granted during the preceding calendar year.

The number of shares of common stock available for issuance under the Purchase Plan automatically increases on January 1st each year by the by the lesser of:

| | • | | 1% of the total number of shares of common stock outstanding on the date immediately preceding the date of increase; |

| | • | | the greatest number of shares of common stock that could be added to the purchase plan as of such date without causing the number of shares that may be sold under the purchase plan as of that date to exceed 3% of the number of shares of common stock outstanding on December 31st of the preceding calendar year; and |

| | • | | such smaller number as may be determined by our board of directors prior to that date. |

EXECUTIVE COMPENSATIONAND RELATED INFORMATION

COMPENSATIONOF DIRECTORS

The following table shows for the fiscal year ended January 3, 2009 certain information with respect to the compensation of all non-employee directors of Rackable Systems:

DIRECTOR COMPENSATIONFOR FISCAL 2008

| | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($)(1) | | Stock

Awards

($)(2)(3) | | | Option

Awards

($)(2)(3) | | | All Other

Compensation

($) | | | Total ($) |

General Michael W. Hagee | | 43,990 | | | | | 67,350 | (9) | | | | | 111,340 |

Mr. Charles M. Boesenberg | | 65,500 | | 50,257 | (5) | | 119,732 | (10) | | | | | 235,489 |

Mr. Gary A. Griffiths | | 57,250 | | 40,206 | (6) | | 85,339 | (11) | | 7,524 | (4) | | 190,319 |

Mr. Hagi Schwartz | | 61,250 | | 60,309 | (7) | | 94,139 | (12) | | 11,256 | (4) | | 226,954 |

Mr. Ronald D. Verdoorn | | 72,000 | | 60,309 | (8) | | 81,833 | (13) | | 11,256 | (4) | | 225,398 |

Mr. Douglas R. King | | 57,490 | | | | | 89,837 | (14) | | | | | 147,327 |

| (1) | This column represents annual director fees, non-employee chairman fees, committee chairman fees and other committee member fees earned in 2008. Excludes fees paid in 2008 but earned in 2007. |

| (2) | The dollar amount in these columns represents the compensation cost for the year ended January 3, 2009 of awards granted in and prior to the fiscal year ended January 3, 2009. These amounts have been calculated in accordance with SFAS No. 123R, ignoring the estimates of forfeiture and using the Black Scholes option-pricing model. Assumptions used in the calculation of these amounts are included in footnote 5 to our audited financial statements for the fiscal year ended January 3, 2009 included in our Annual Report on Form 10-K. |

21

| (3) | The following options were outstanding as of January 3, 2009: Mr. Boesenberg, 38,415; Mr. Griffiths, 50,998; Mr. Schwartz, 55,374; Mr. Verdoorn, 48,499; Mr. King, 40,000; and Mr. Hagee, 30,000. The following restricted stock units were outstanding as of January 3, 2009: Mr. Boesenberg, 10,742; Mr. Griffiths, 8,594; Mr. Schwartz, 12,981; and Mr. Verdoorn, 12,891. |

| (4) | Consists of amounts paid for our contribution to the payment of the director’s medical insurance premiums. |

| (5) | Consists of $10,051 and $40,206 representing the compensation expense incurred by us in fiscal year 2008 in connection with the restricted stock unit awards to Mr. Boesenberg to purchase up to 3,125 shares of common stock on June 11, 2007 and 12,500 shares of common stock on June 11, 2007. |

| (6) | Consists of $40,206 representing the compensation expense incurred by us in fiscal year 2008 in connection with the restricted stock unit award to Mr. Griffiths to purchase up to 12,500 shares of common stock on June 11, 2007. |

| (7) | Consists of $20,103 and $40,206 representing the compensation expense incurred by us in fiscal year 2008 in connection with the restricted stock unit awards to Mr. Schwartz to purchase up to 6,250 shares of common stock on June 11, 2007 and 12,500 shares of common stock on June 11, 2007. |

| (8) | Consists of $20,103 and $40,206 representing the compensation expense incurred by us in fiscal year 2008 in connection with the restricted stock unit awards to Mr. Verdoorn to purchase up to 6,250 shares of common stock on June 11, 2007 and 12,500 shares of common stock on June 11, 2007. |

| (9) | Consists of $41,908 and $25,442, representing the compensation expense incurred by us in fiscal year 2008 in connection with the option grants to Mr. Hagee to purchase up to 18,667 shares of common stock on February 6, 2008, and 11,333 shares of common stock on February 6, 2008. |

| (10) | Consists of $64,091, $38,913, $7,708, $3,194, $1,324 and $4,502, representing the compensation expense incurred by us in fiscal year 2008 in connection with the option grants to Mr. Boesenberg to purchase up to 18,667 shares of common stock on August 29, 2006, 11,333 shares of common stock on August 29, 2006, 3,333 shares of common stock on April 26, 2007 and 1,416 of common stock on May 23, 2007, 833 shares of common stock on May 29, 2008 and 2,833 shares of common stock on May 29, 2008. |

| (11) | Consists of $5,383, $2,590, $37,494, $19,921, $5,857, $6,389, $1,878, $4,503 and $1,324, representing the compensation expense incurred by us in fiscal year 2008 in connection with the option grants to Mr. Griffiths to purchase up to 11,333 shares of common stock on November 4, 2004, 3,333 shares of common stock on November 4, 2004, 25,334 shares of common stock on November 2, 2005, 2,833 of common stock on May 31, 2006, 833 shares of common stock on May 31, 2006, 2,833 shares of common stock on May 23, 2007, 833 shares of common stock on May 23, 2007, 2,833 shares of common stock on May 29, 2008 and 833 shares of common stock on May 29, 2008. |