1

Introducing the

New SGI

Investor Day

September 22, 2011

NASDAQ:SGI

2 ©2011 SGI

Legal Notice

Safe Harbor Cautionary Statement

This presentation contains forward-looking statements, including statements regarding management‟s expectations about the markets, business,

products, operating plans and financial performance of Silicon Graphics International Corp. (“SGI”) as of September 22, 2011. Statements

containing words such as "will," "expect," "believe," and "intend," and other statements in the future tense, are forward-looking statements. Any

statements contained in this presentation that are not statements of historical fact may be deemed forward-looking statements. Actual outcomes

and results may differ materially from the expectations expressed or implied in these statements due to a number of risks and uncertainties,

including, but not limited to: SGI operates in a very competitive market which may cause pricing pressure and impair our market penetration; SGI

has extensive international business activities which create risks from complex international operations, foreign currency exposure and changing

legal, regulatory, political or economic conditions, including SGI‟s operations in Japan, which may be negatively affected by earthquakes and other

natural disasters, as well as ongoing power supply disruptions following the March 2011 earthquake and tsunami; uncertainty arising from SGI‟s

increased dependence on business with U.S. Government entities; failure of our customers to accept new products; and economic conditions

impacting the purchasing decisions of SGI‟s customers. Detailed information about these and other risks and uncertainties that could affect SGI‟s

business, financial condition and results of operations is set forth in SGI‟s Annual Report on Form 10-K under the caption “Risks Factors,” which

was filed with the Securities and Exchange Commission on August 29, 2011, as updated by the subsequent filings with the SEC made by SGI, all

of which are available at www.sec.gov. Accordingly, you are cautioned not to place undue reliance on forward-looking statements. This

presentation is as of September 22, 2011, and the continued posting or availability of this presentation does not imply that forward-looking

statements continue to be true as of any later date. We expressly disclaim any obligation to update or alter our forward-looking statements,

whether, as a result of new information, future events or otherwise, except where required by law.

The SGI logos and SGI product names used or referenced herein are either registered trademarks or trademarks of Silicon Graphics International

Corp. or one of its subsidiaries. All other trademarks, trade names, service marks and logos referenced herein belong to their respective holders.

Any and all copyright or other proprietary notices that appear herein, together with this Legal Notice, must be retained on this presentation.

Non-GAAP Reconciliation

All non-GAAP financial measures contained in this presentation are reconciled to GAAP on slide 106 of this presentation.

3

SGI

Strategic Overview

Mark J. Barrenechea

President & CEO

4 ©2011 SGI

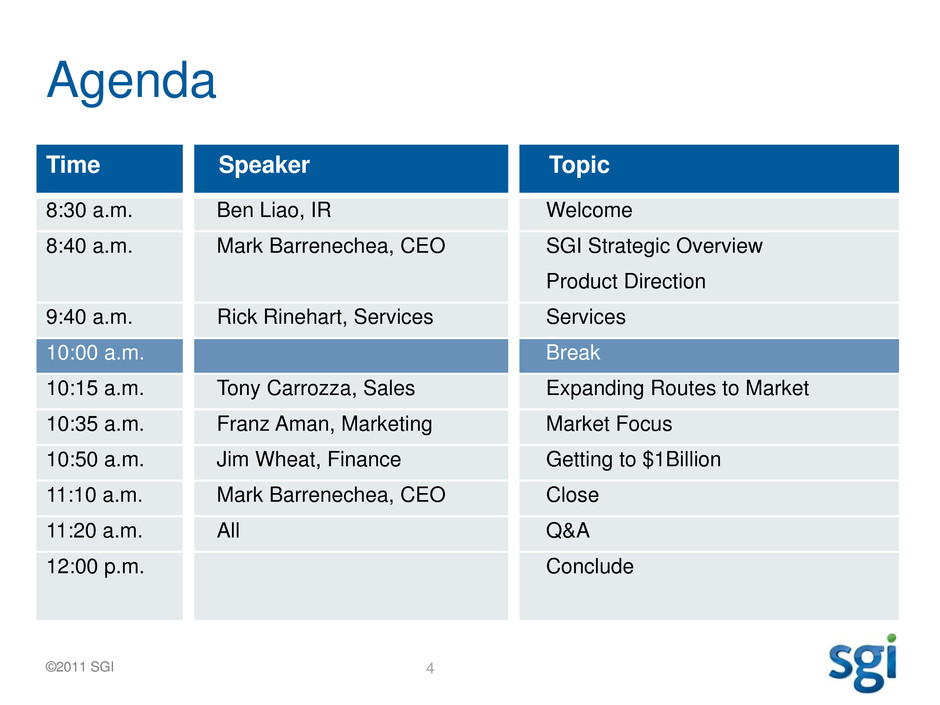

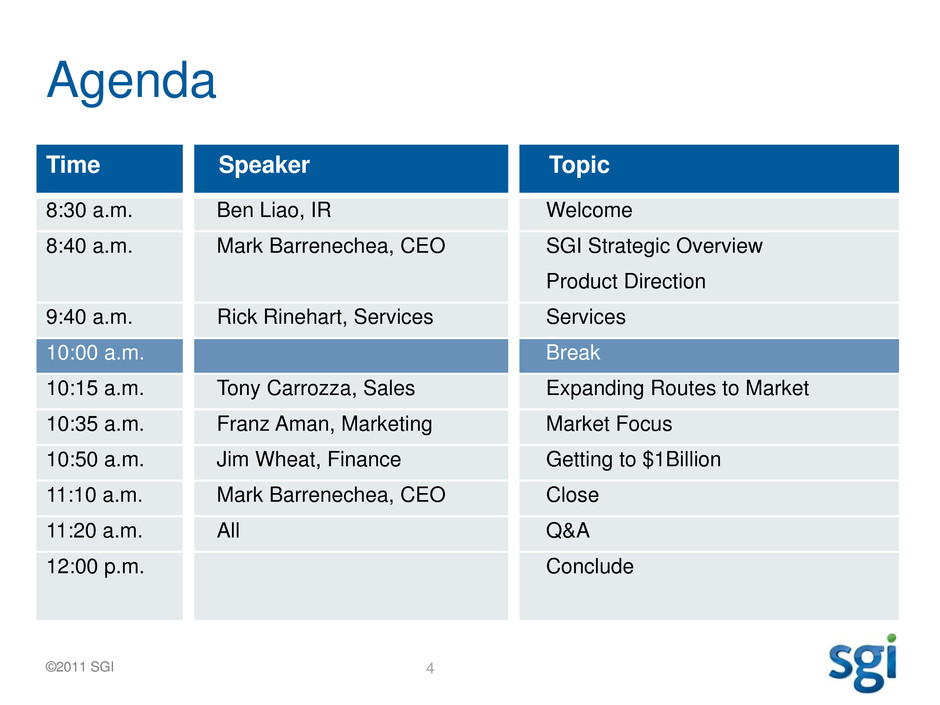

Agenda

Time

8:30 a.m. Ben Liao, IR Welcome

8:40 a.m. Mark Barrenechea, CEO SGI Strategic Overview

Product Direction

9:40 a.m. Rick Rinehart, Services Services

10:00 a.m. Break

10:15 a.m. Tony Carrozza, Sales Expanding Routes to Market

10:35 a.m. Franz Aman, Marketing Market Focus

10:50 a.m. Jim Wheat, Finance Getting to $1Billion

11:10 a.m. Mark Barrenechea, CEO Close

11:20 a.m. All Q&A

12:00 p.m. Conclude

Speaker Topic

5 ©2011 SGI

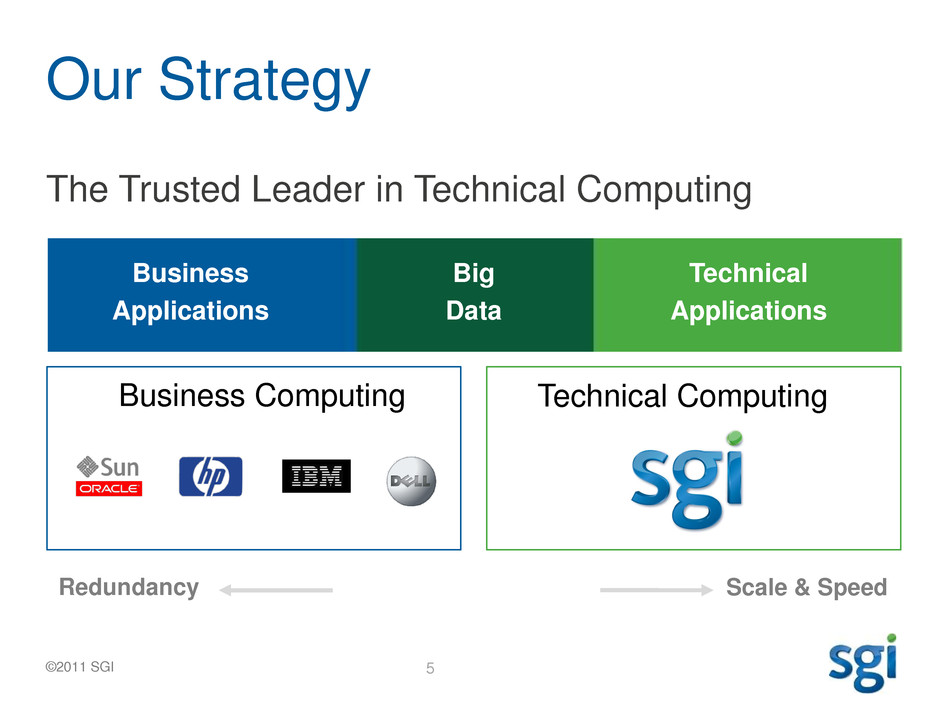

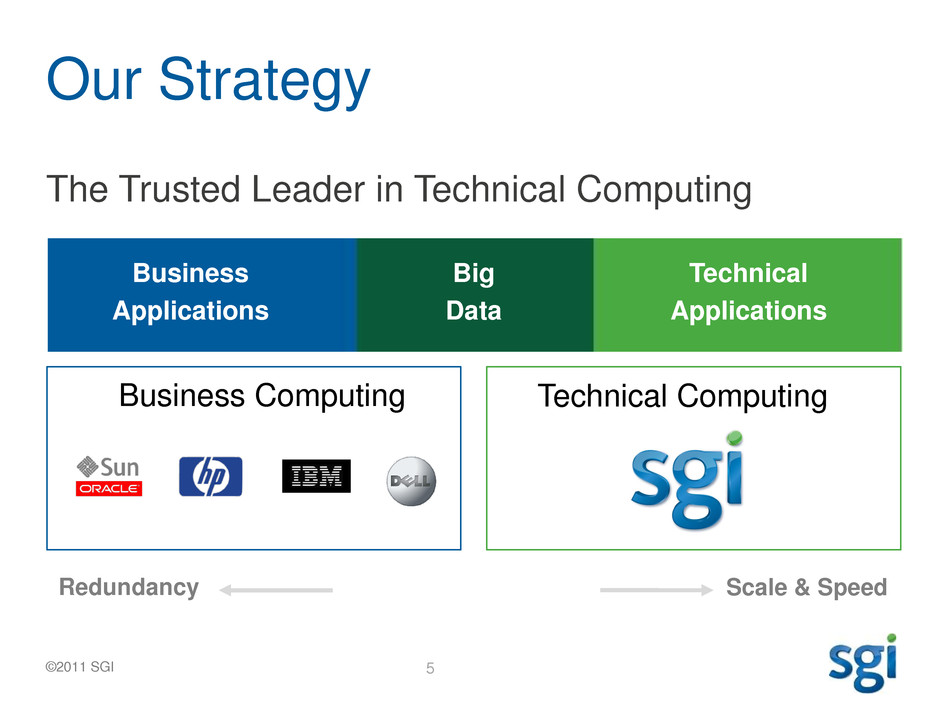

Our Strategy

The Trusted Leader in Technical Computing

Business Computing

Business

Applications

Technical Computing

Workload Optimized

Big

Data

Technical

Applications

Redundancy Scale & Speed

6 ©2011 SGI

The Opportunity

HPC

Commercial

Scientific

Modeling & Simulation

Cloud

Public

Private

Government

Big Data

Hadoop

In-memory

Analytics

Archive

Providing Customers with Trusted Technical Computing Solutions

7 ©2011 SGI

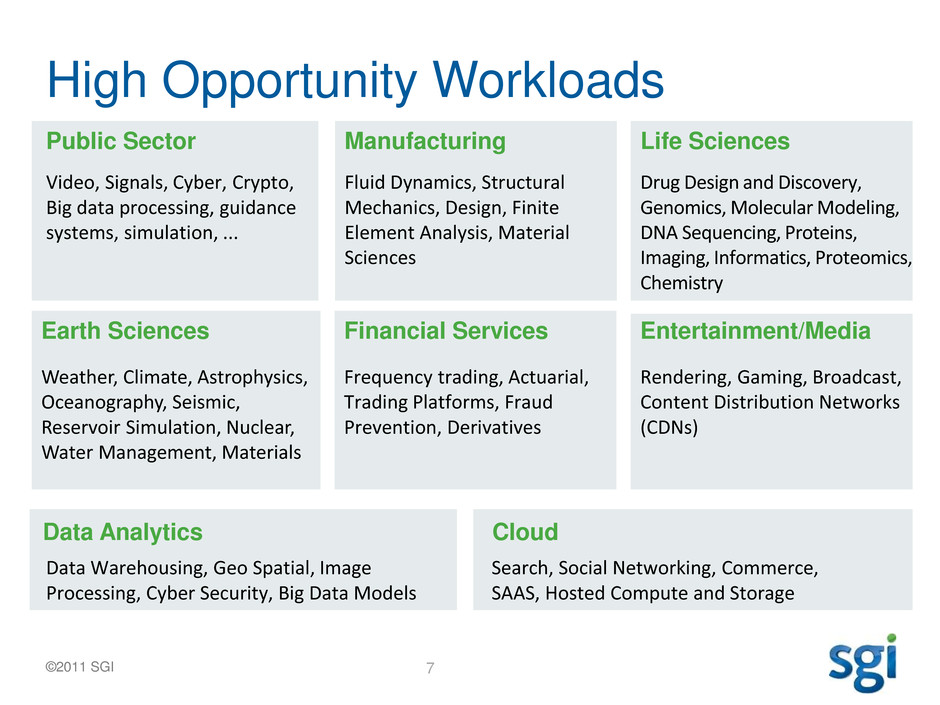

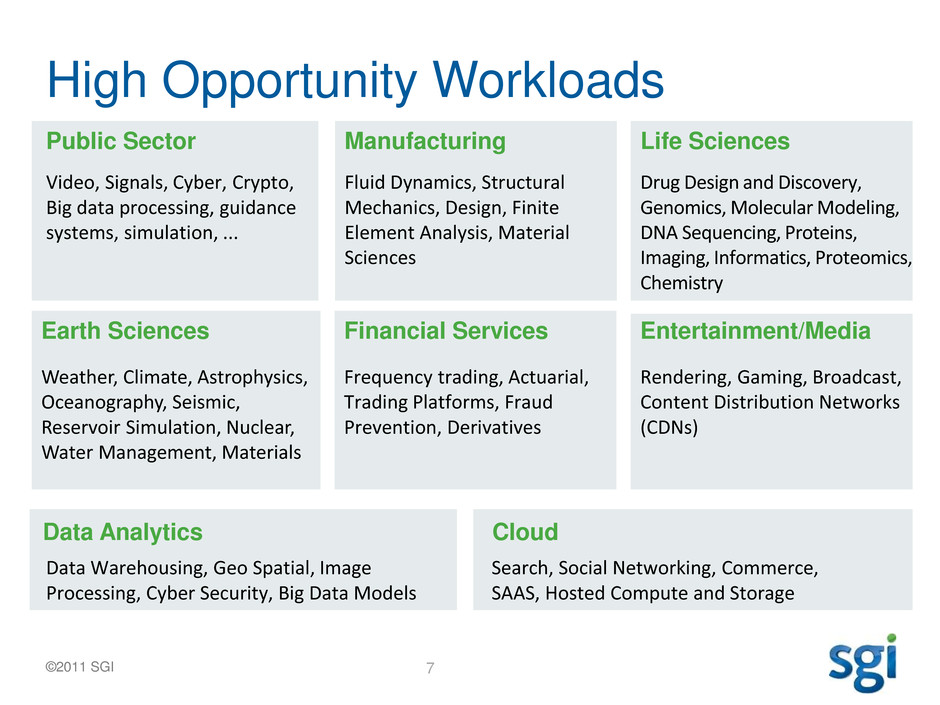

High Opportunity Workloads

Public Sector

Video, Signals, Cyber, Crypto,

Big data processing, guidance

systems, simulation, ...

Manufacturing

Fluid Dynamics, Structural

Mechanics, Design, Finite

Element Analysis, Material

Sciences

Financial Services

Frequency trading, Actuarial,

Trading Platforms, Fraud

Prevention, Derivatives

Life Sciences

Drug Design and Discovery,

Genomics, Molecular Modeling,

DNA Sequencing, Proteins,

Imaging, Informatics, Proteomics,

Chemistry

Earth Sciences

Weather, Climate, Astrophysics,

Oceanography, Seismic,

Reservoir Simulation, Nuclear,

Water Management, Materials

Entertainment/Media

Rendering, Gaming, Broadcast,

Content Distribution Networks

(CDNs)

Data Warehousing, Geo Spatial, Image

Processing, Cyber Security, Big Data Models

Data Analytics

Search, Social Networking, Commerce,

SAAS, Hosted Compute and Storage

Cloud

8 ©2011 SGI

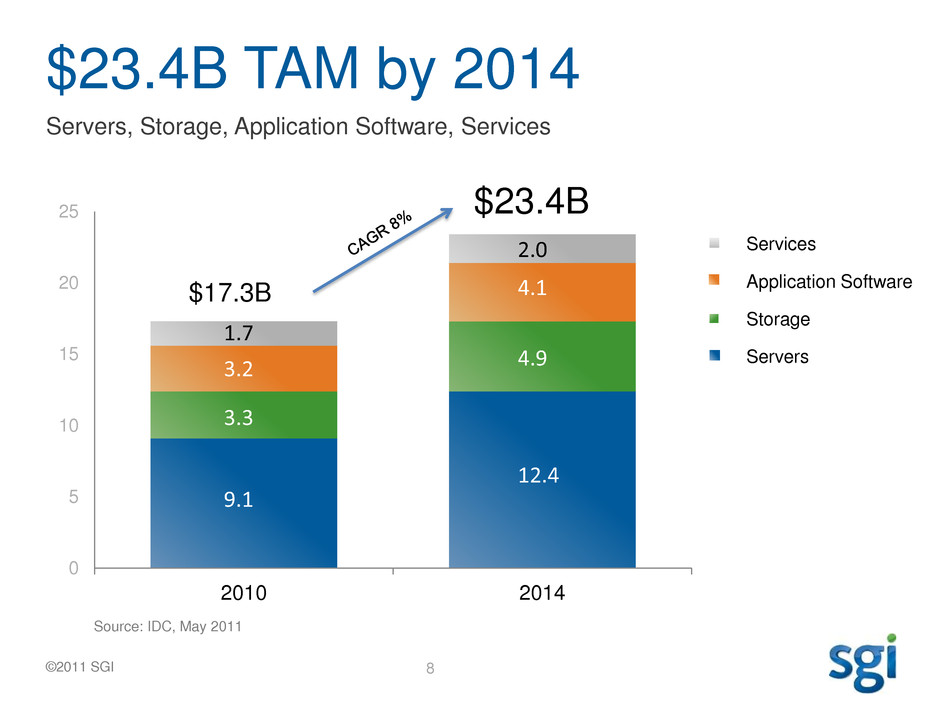

0

5

10

15

20

25

2010 2014

Services

Application Software

Storage

Servers

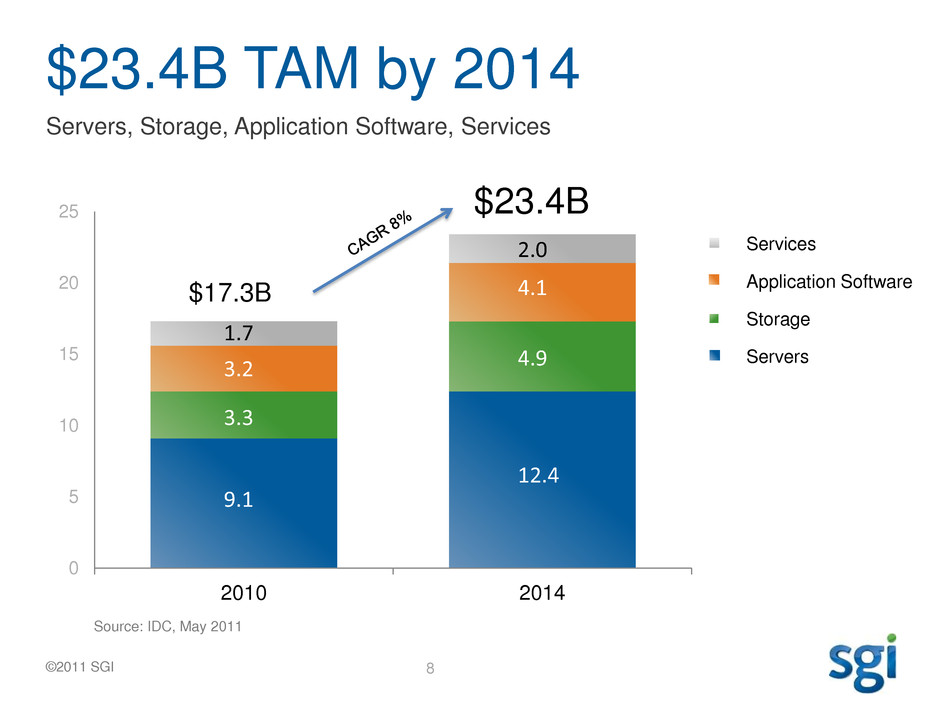

$23.4B TAM by 2014

Servers, Storage, Application Software, Services

Source: IDC, May 2011

$17.3B

$23.4B

1.7

3.2

3.3

9.1

2.0

4.1

4.9

12.4

Services

Application Software

Storage

Servers

9 ©2011 SGI

0

5

10

15

20

25

2010 2014

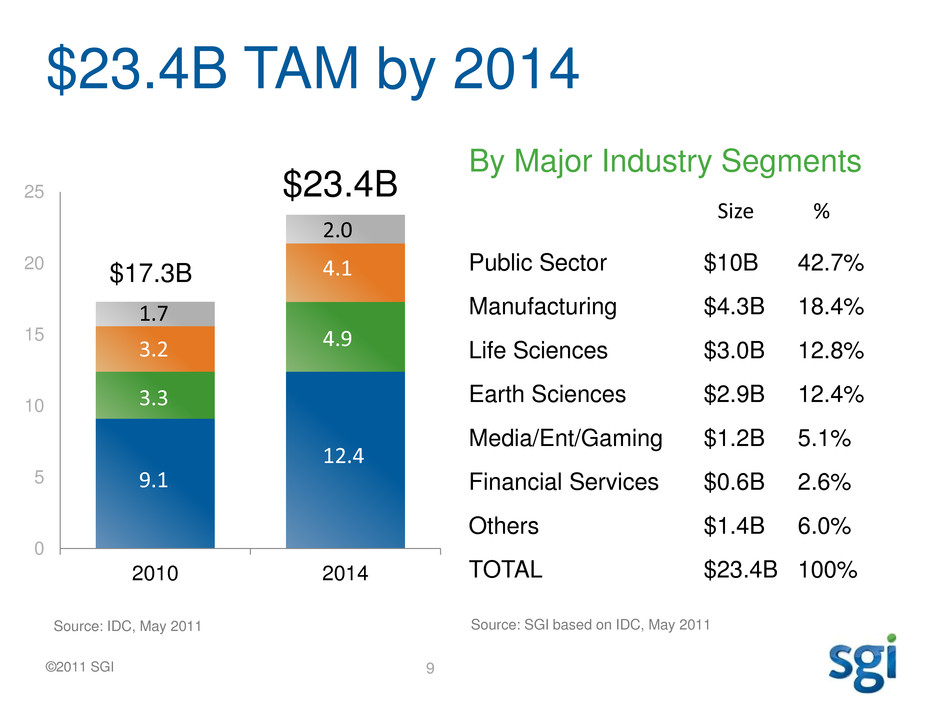

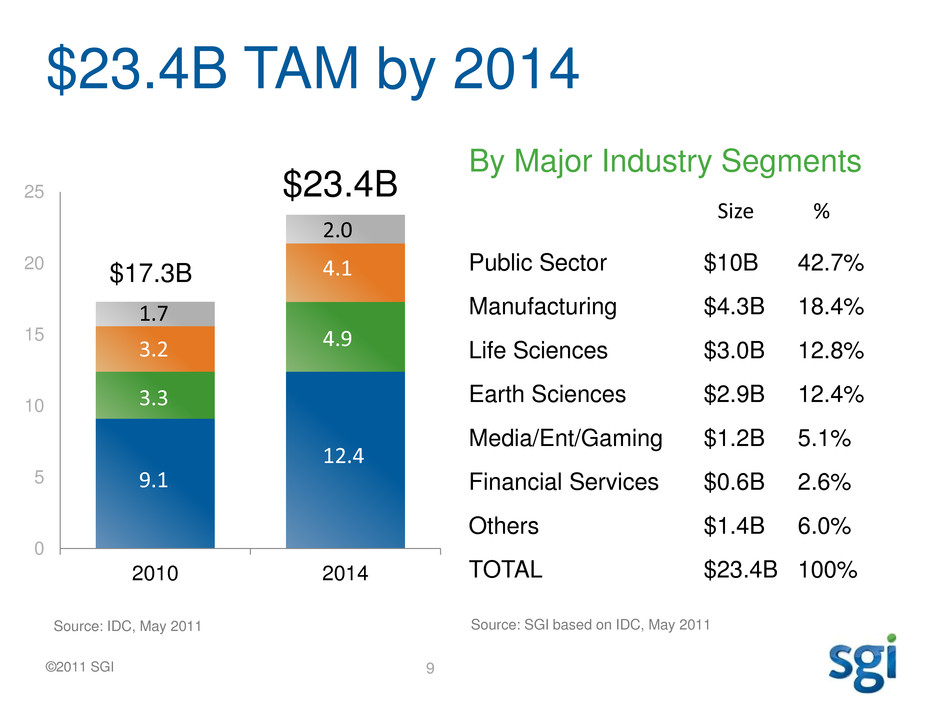

$23.4B TAM by 2014

Source: IDC, May 2011

$17.3B

$23.4B

1.7

3.2

3.3

9.1

2.0

4.1

4.9

12.4

By Major Industry Segments

Public Sector $10B 42.7%

Manufacturing $4.3B 18.4%

Life Sciences $3.0B 12.8%

Earth Sciences $2.9B 12.4%

Media/Ent/Gaming $1.2B 5.1%

Financial Services $0.6B 2.6%

Others $1.4B 6.0%

TOTAL $23.4B 100%

Source: SGI based on IDC, May 2011

Size %

10

Building Business Momentum

• Largest Independent Provider of

Technical Computing

• Product cycles getting stronger

• Distribution in 50 countries

• 1,500+ employees

• Net Assets: $538M3

• Cash & Investments: $143M3

• Debt Free3

$780M

$630M

$404M

$247M

FY 08

2

FY 10 FY 11 FY 12

1

1 Revenue Guidance Range of $740m to $780m

2 Rackable acquired substantially all the assets of Silicon Graphics, Inc., changed name to SGI in May 2009, filed a

6-month stub year-end on 6-26-09

3 As of June 24, 2011

$740M

11 ©2011 SGI

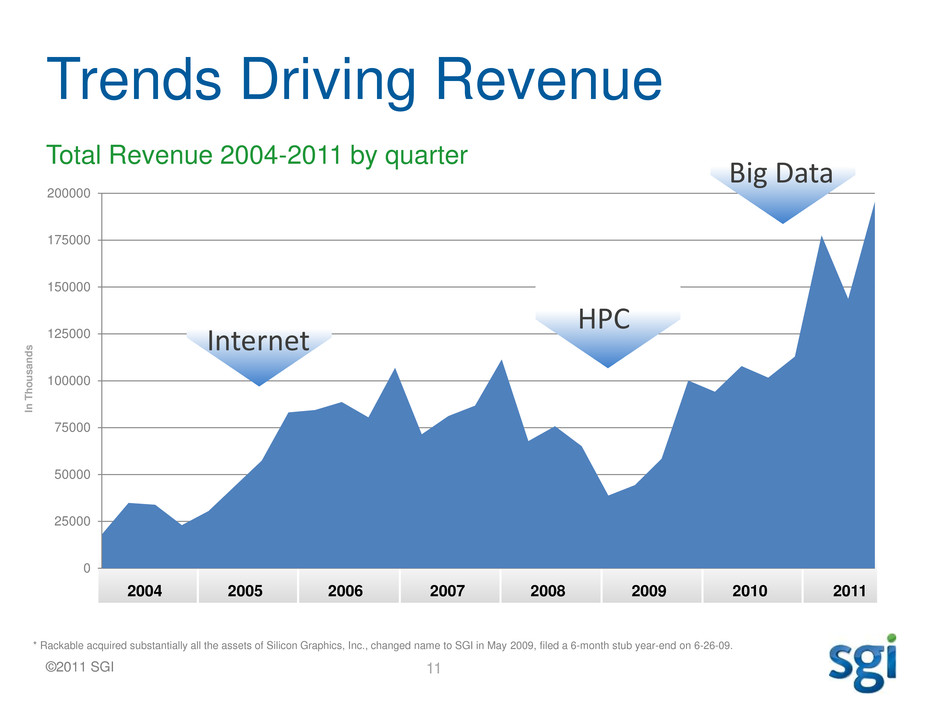

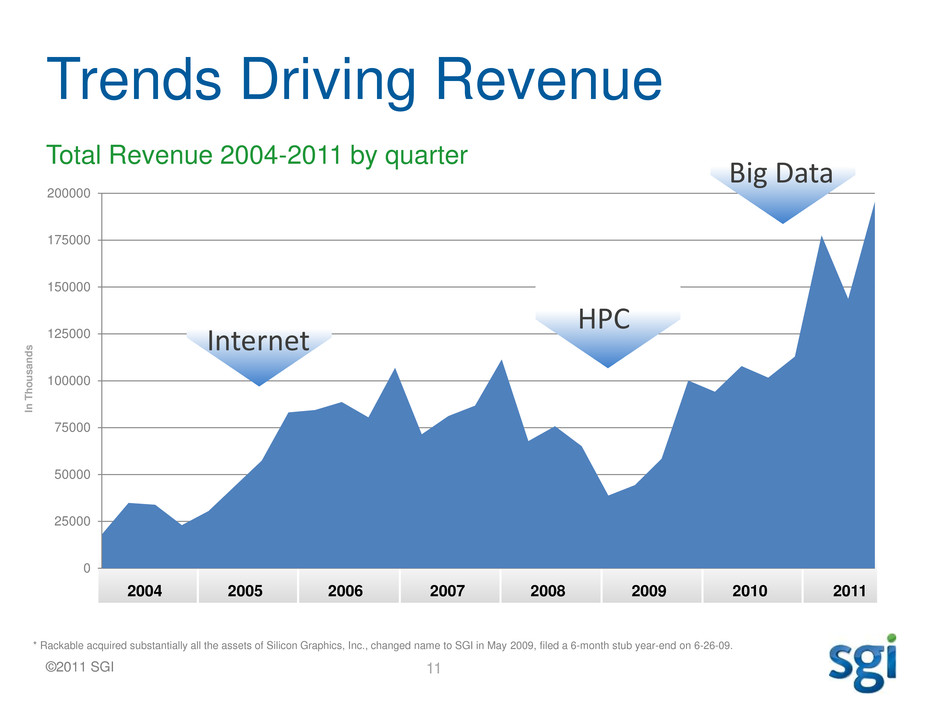

Total Revenue 2004-2011 by quarter

0

25000

50000

75000

100000

125000

150000

175000

200000

In

T

hous

a

nd

s

HPC

Internet

* Rackable acquired substantially all the assets of Silicon Graphics, Inc., changed name to SGI in May 2009, filed a 6-month stub year-end on 6-26-09.

Trends Driving Revenue

Big Data

2004 2005 2006 2007 2008 2009 2010 2011

12 ©2011 SGI

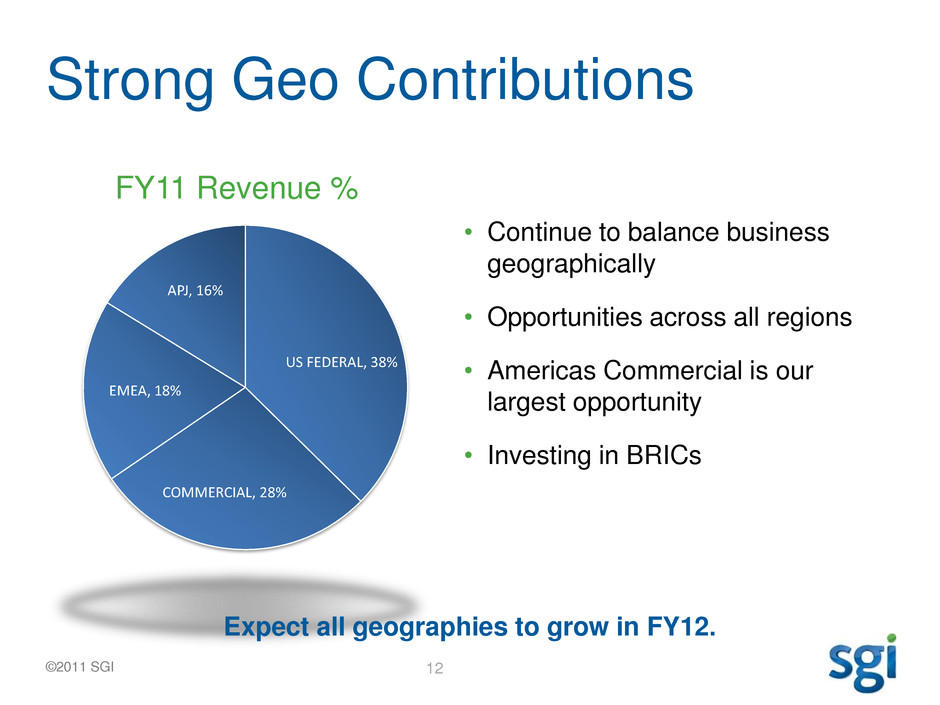

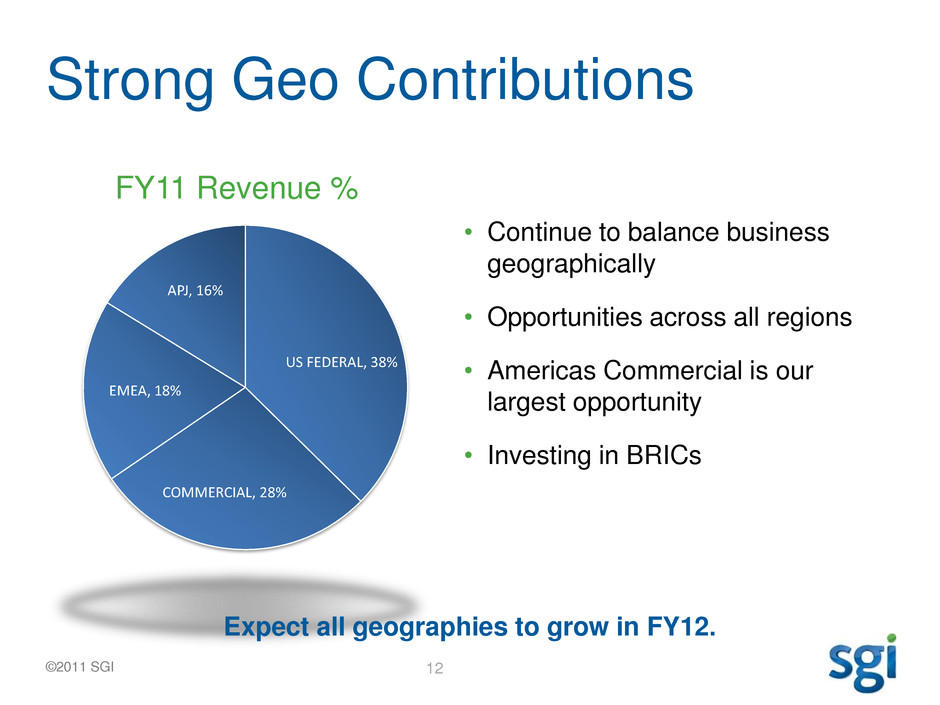

Strong Geo Contributions

FY11 Revenue %

US FEDERAL, 38%

COMMERCIAL, 28%

EMEA, 18%

APJ, 16%

• Continue to balance business

geographically

• Opportunities across all regions

• Americas Commercial is our

largest opportunity

• Investing in BRICs

Expect all geographies to grow in FY12.

13 ©2011 SGI

How we think about acquisitions

• Balancing organic and acquisitive

growth

• We look for value

• Accretive

• Affinity: Storage, Services

and Software

The SGI Approach

14 ©2011 SGI

Multiple Growth Opportunities

• Large growing market

• No dominant player

• Emerging high-growth workloads

• Abundant partner opportunities

• Many under-penetrated geographies

• Many under-penetrated industries

We can double revenue in our current market.

15 ©2011 SGI

Selling How Customers Want to Buy

Cloud

Embedded Systems

SIs

Channels

Technology Partners

Direct

16 ©2011 SGI

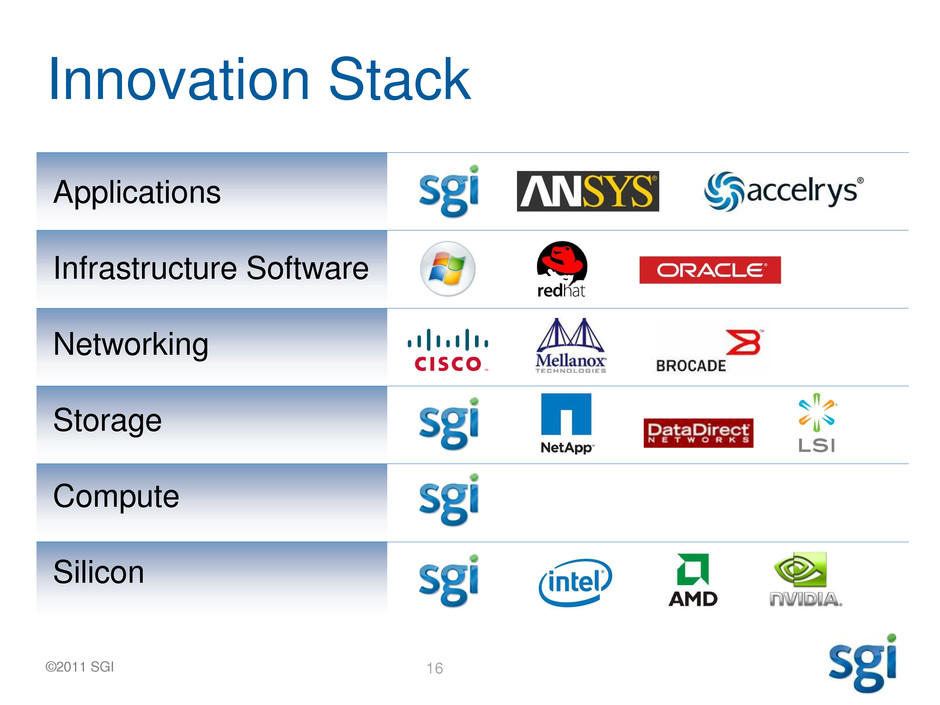

Innovation Stack

Applications

Infrastructure Software

Networking

Storage

Compute

Silicon

17 ©2011 SGI

SGI Partner Ecosystem

Global Service Credentials

Design/Plan

• Solution design across

hardware, software, and

datacenter

• Site Readiness

• Assessments

• Integration of 3rd party

solutions

• Architecture design

and development

• Packaged offerings

Sales/Consulting Services

Deploy/Run Support/Maintain

Managed Services Customer Support Services

• In-factory integration

and testing

• Installation and

production services

• Performance Turning

• System Administration

• Onsite personnel

• Education

• Managed services

• Call Centers

• eServices and online

support

• Extended warranty and

response times

• Onsite and remote

technical support

• Materials management

18 ©2011 SGI

Customers Trust SGI

Mission, operations

and exploration

KEGG: World’s largest

DNA Database

Power allocation to

1 Billion People

Maintaining

nuclear warheads

Protecting the

warfighter

Powering the cloud Discovering the

next 100 years

of energy

Forecasting

19 ©2011 SGI

In a Word: Trust.

We need to be the most trusted people in the lives

of our customers.

• Mission and focus

• Our people

• Solutions

• Service

• Supply Chain

• Company

Trust in every Customer Interaction

20 ©2011 SGI

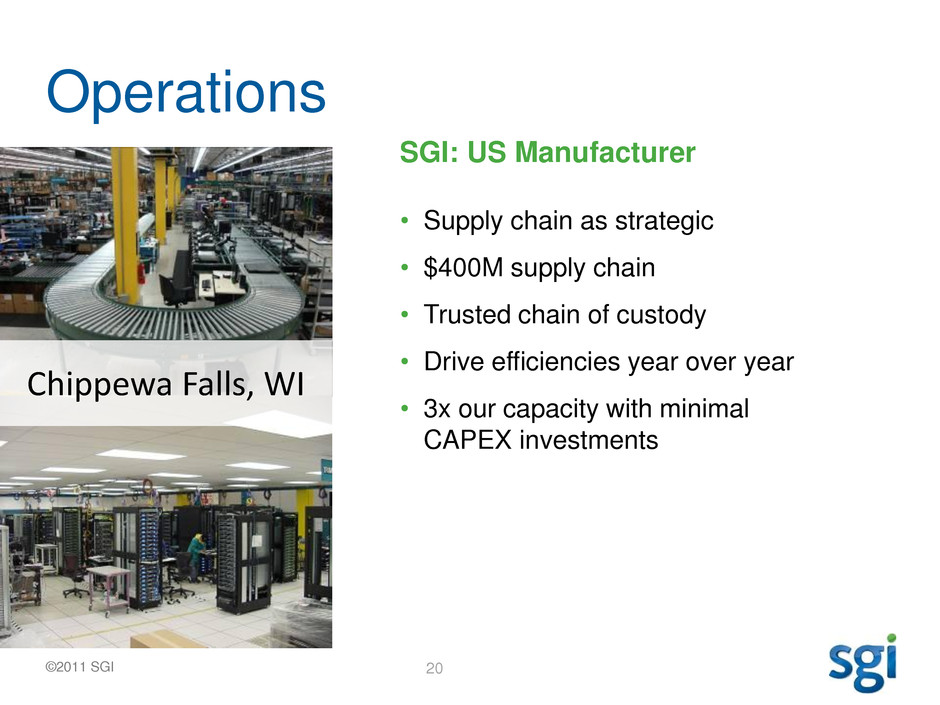

Operations

• Supply chain as strategic

• $400M supply chain

• Trusted chain of custody

• Drive efficiencies year over year

• 3x our capacity with minimal

CAPEX investments

SGI: US Manufacturer

Chippewa Falls, WI

21 ©2011 SGI

FY12 Priorities

• Deliver against our plan

• Expand our market share

• Drive business velocity with

innovation

• Strengthen our culture and

framework for scale

• Integrated solutions, including

software

22

Product Direction

23 ©2011 SGI

What Our Customers Are Saying

• Power, Density, Space

• I need more cores / performance

• Workloads are getting more specialized

• Data sets are growing. Data is being lost

because we cannot ingest it. We can‟t get to

facts because we cannot process it fast

enough

• More integrated solutions

• I want to see my results

• Need a trusted supply chain

24 ©2011 SGI

Two Converging Trends

Combining Core explosion + data volume growth will

transform how customers design and deliver

products and solutions

x86 Core Explosion Data Volume Growth

1 core

4 core

8 core

64 core

1971 2000 2010 2013

130

Exa bytes

2005 2010 2015

1.2

Zetta bytes

0.8

Yotta bytes

25 ©2011 SGI

Four Solution Pillars

Compute Storage Software Services

Designed to work together. Designed to scale.

• Altix® ICE

• Altix® UV

• Rackable™

• Big Data Solutions

• Project xRay

• InfiniteStorage

• ArcFiniti™

• OpenFOAM®

• Management

Center

• Performance

Center

• DMF / XFS

• Consulting

Services

• Managed Services

• Customer Support

Services

26 ©2011 SGI

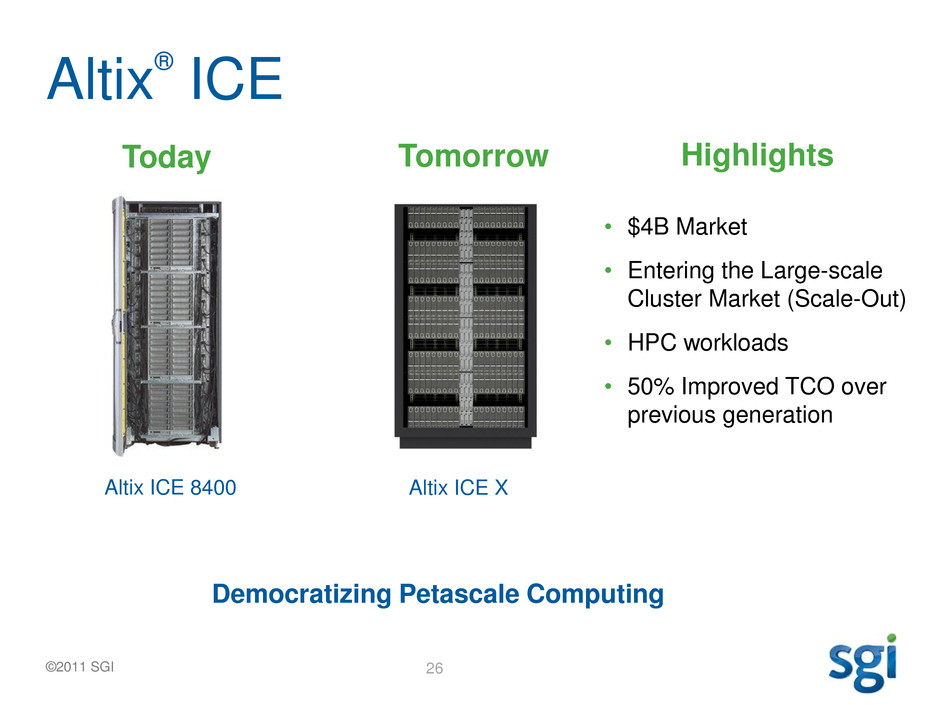

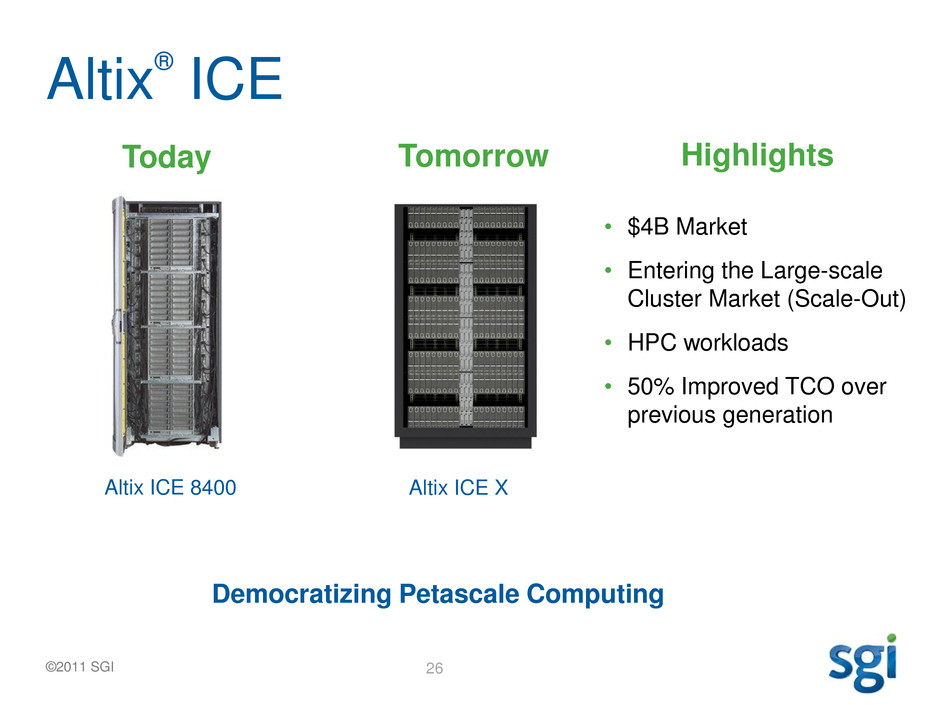

Altix

®

ICE

Altix ICE 8400 Altix ICE X

• $4B Market

• Entering the Large-scale

Cluster Market (Scale-Out)

• HPC workloads

• 50% Improved TCO over

previous generation

Democratizing Petascale Computing

Today Highlights Tomorrow

27 ©2011 SGI

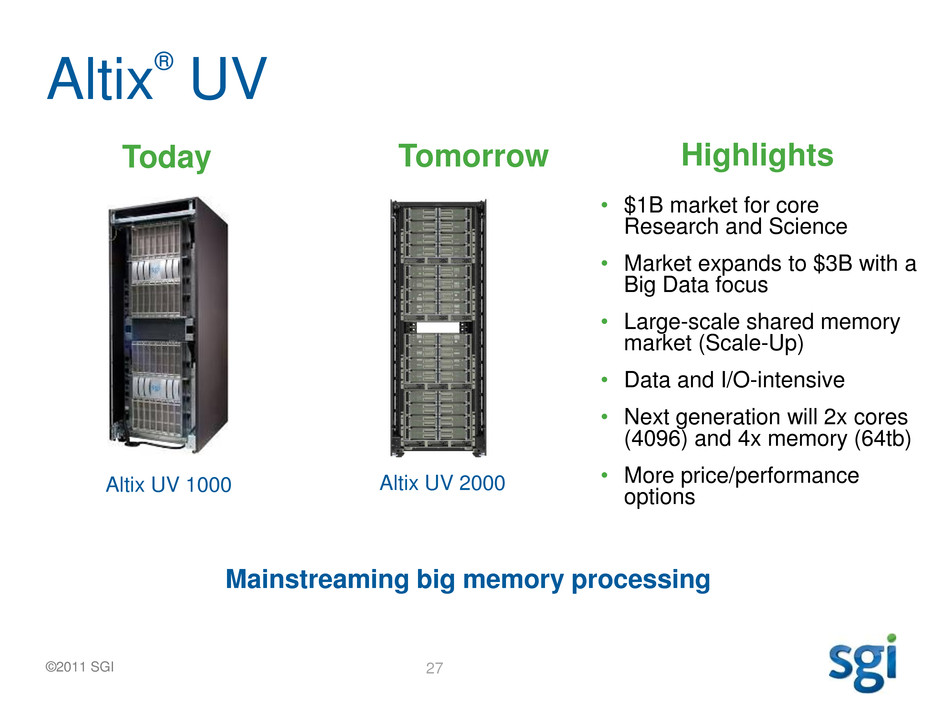

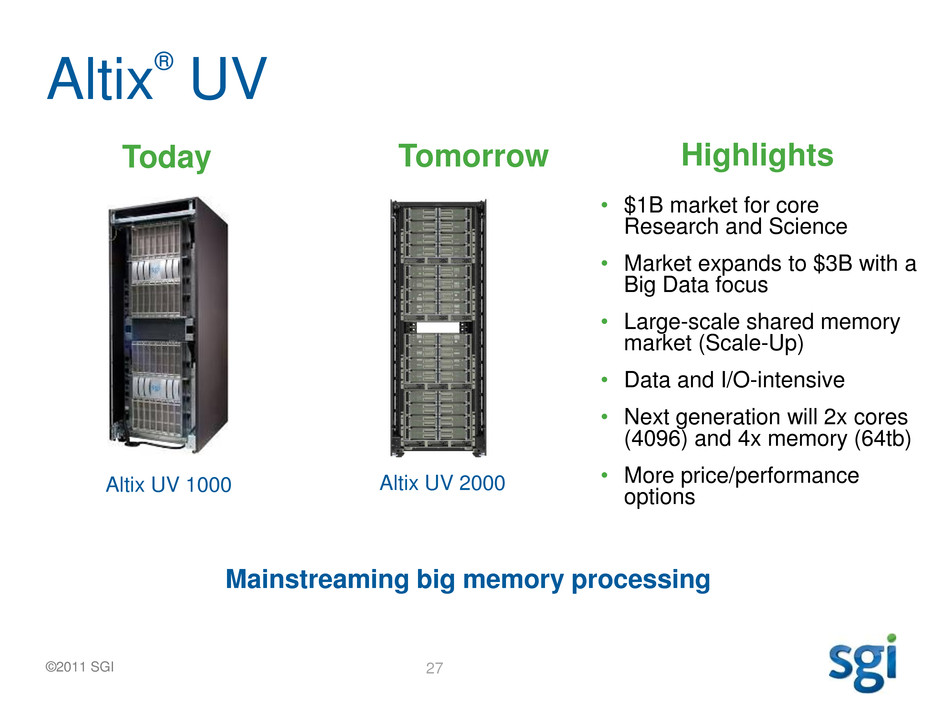

Altix

®

UV

Altix UV 1000 Altix UV 2000

• $1B market for core

Research and Science

• Market expands to $3B with a

Big Data focus

• Large-scale shared memory

market (Scale-Up)

• Data and I/O-intensive

• Next generation will 2x cores

(4096) and 4x memory (64tb)

• More price/performance

options

Mainstreaming big memory processing

Today Highlights Tomorrow

28 ©2011 SGI

Rackable

Industry leading platform for Storage Clouds,

Hadoop, and Design-to-Order

CloudRack

®

V2 CloudRack

®

V3

• $3B Dollar Market

• Flexibility

• Custom Engineering

• Power Efficiency

• Massive Scale

• Intel Romley Refresh

Today Highlights Tomorrow

29 ©2011 SGI

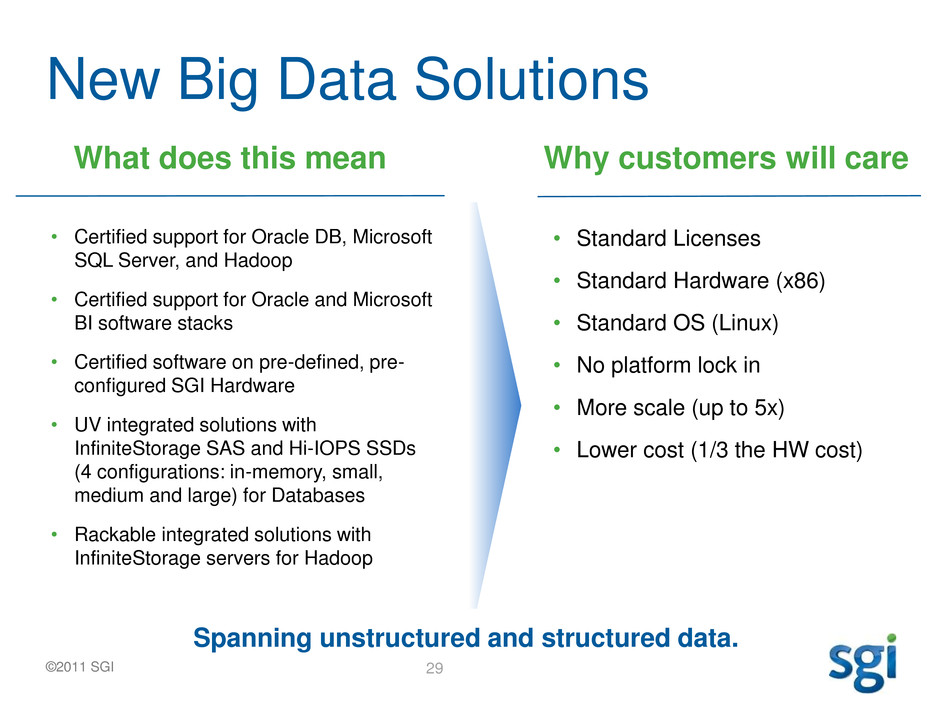

New Big Data Solutions

Why customers will care What does this mean

Spanning unstructured and structured data.

• Certified support for Oracle DB, Microsoft

SQL Server, and Hadoop

• Certified support for Oracle and Microsoft

BI software stacks

• Certified software on pre-defined, pre-

configured SGI Hardware

• UV integrated solutions with

InfiniteStorage SAS and Hi-IOPS SSDs

(4 configurations: in-memory, small,

medium and large) for Databases

• Rackable integrated solutions with

InfiniteStorage servers for Hadoop

• Standard Licenses

• Standard Hardware (x86)

• Standard OS (Linux)

• No platform lock in

• More scale (up to 5x)

• Lower cost (1/3 the HW cost)

30 ©2011 SGI

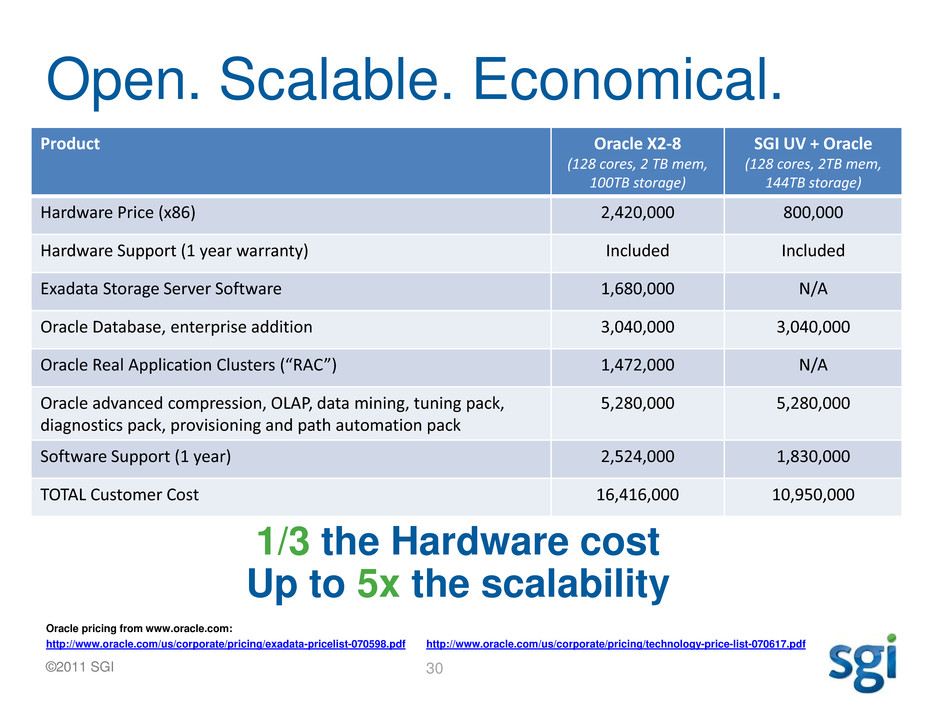

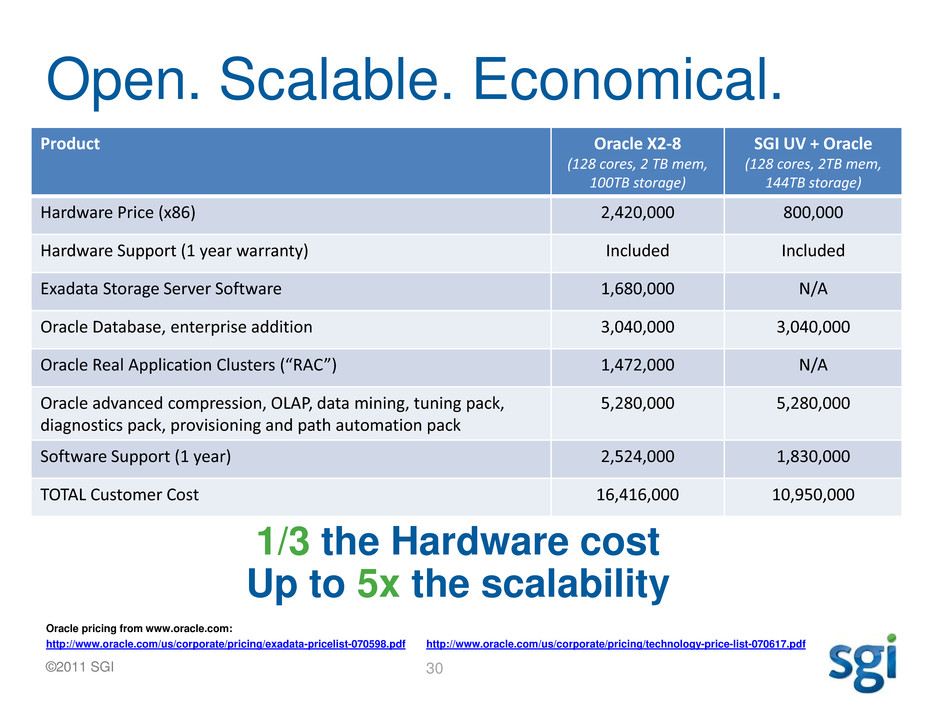

Open. Scalable. Economical.

Oracle pricing from www.oracle.com:

http://www.oracle.com/us/corporate/pricing/exadata-pricelist-070598.pdf http://www.oracle.com/us/corporate/pricing/technology-price-list-070617.pdf

1/3 the Hardware cost

Up to 5x the scalability

Product Oracle X2-8

(128 cores, 2 TB mem,

100TB storage)

SGI UV + Oracle

(128 cores, 2TB mem,

144TB storage)

Hardware Price (x86) 2,420,000 800,000

Hardware Support (1 year warranty) Included Included

Exadata Storage Server Software 1,680,000 N/A

Oracle Database, enterprise addition 3,040,000 3,040,000

Oracle Real Application Clusters (“RAC”) 1,472,000 N/A

Oracle advanced compression, OLAP, data mining, tuning pack,

diagnostics pack, provisioning and path automation pack

5,280,000 5,280,000

Software Support (1 year) 2,524,000 1,830,000

TOTAL Customer Cost 16,416,000 10,950,000

31 ©2011 SGI

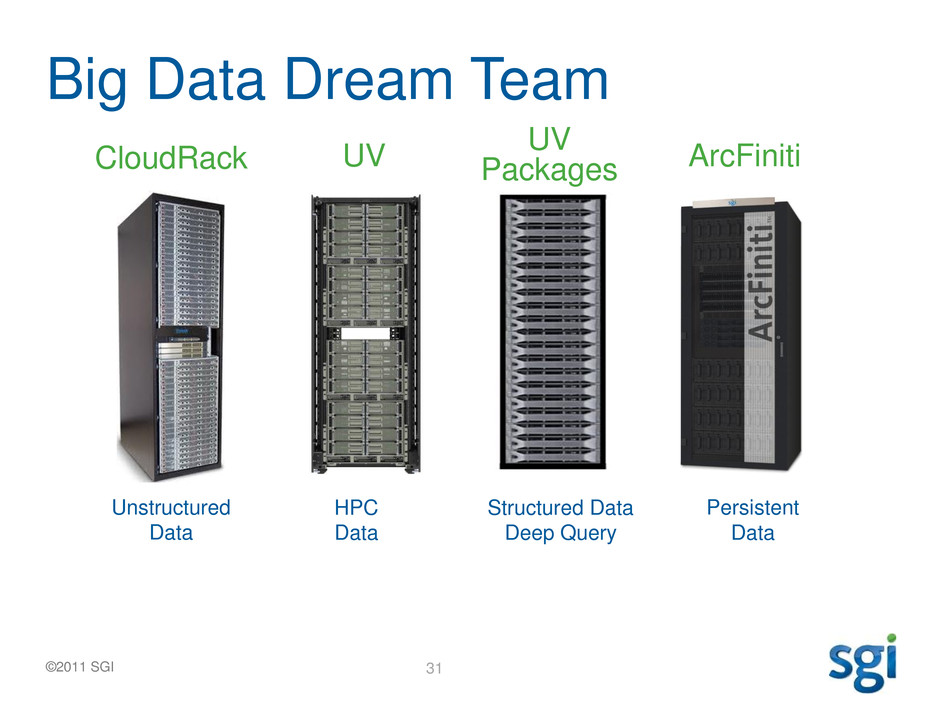

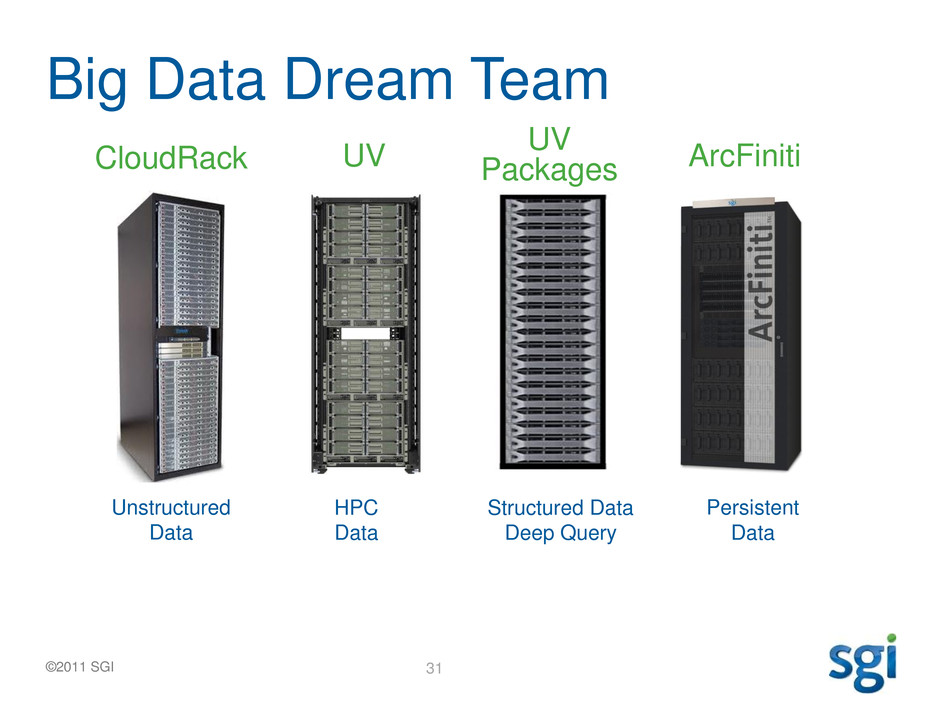

Big Data Dream Team

CloudRack UV

UV

Packages ArcFiniti

Unstructured

Data

HPC

Data

Structured Data

Deep Query

Persistent

Data

End-to-End Big Data Platforms Deep Query. Big Data. Fast Analytics.

32 ©2011 SGI

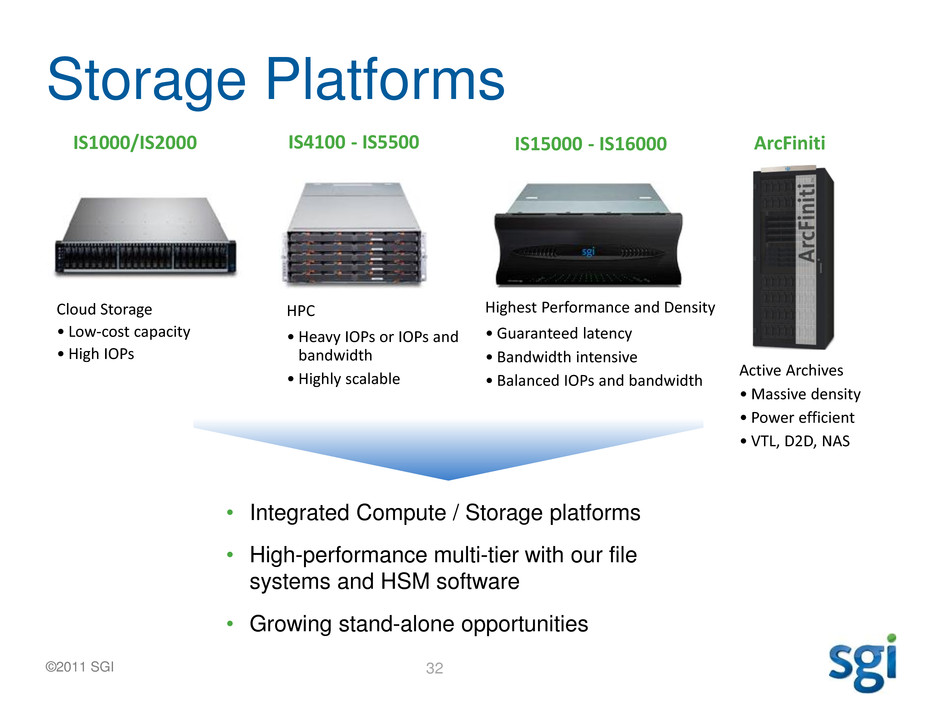

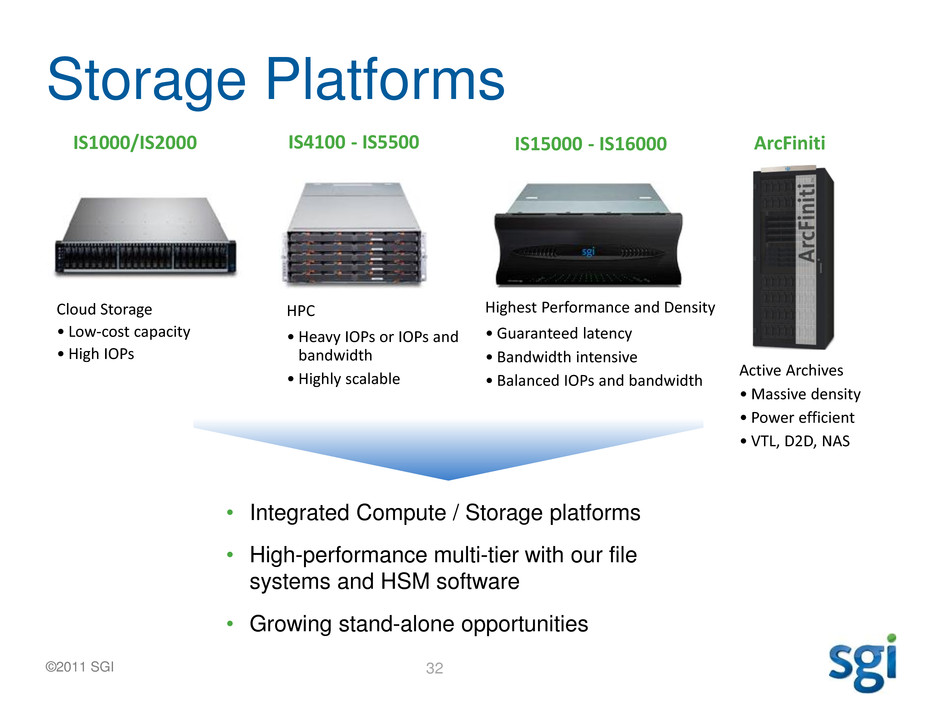

Storage Platforms

IS4100 - IS5500 IS15000 - IS16000 IS1000/IS2000 ArcFiniti

Cloud Storage

• Low-cost capacity

• High IOPs

HPC

• Heavy IOPs or IOPs and

bandwidth

• Highly scalable

Highest Performance and Density

• Guaranteed latency

• Bandwidth intensive

• Balanced IOPs and bandwidth

Active Archives

•Massive density

• Power efficient

• VTL, D2D, NAS

• Integrated Compute / Storage platforms

• High-performance multi-tier with our file

systems and HSM software

• Growing stand-alone opportunities

33 ©2011 SGI

Software is a Priority

• Today our Software business is < $10m.

Clear opportunity to grow the business.

• Ability to differentiate SGI Hardware

• Ability to provide integrated solutions

• Three Focus Areas:

Applications

Management

Performance

SGI OpenFoam

SGI Performance Center

SGI Management Center

34 ©2011 SGI

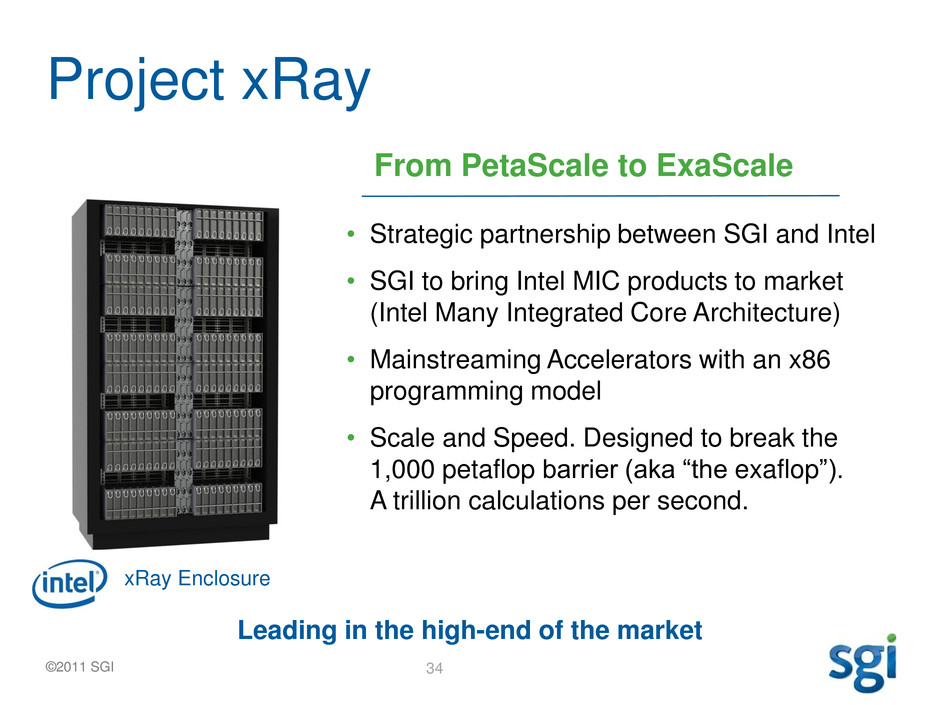

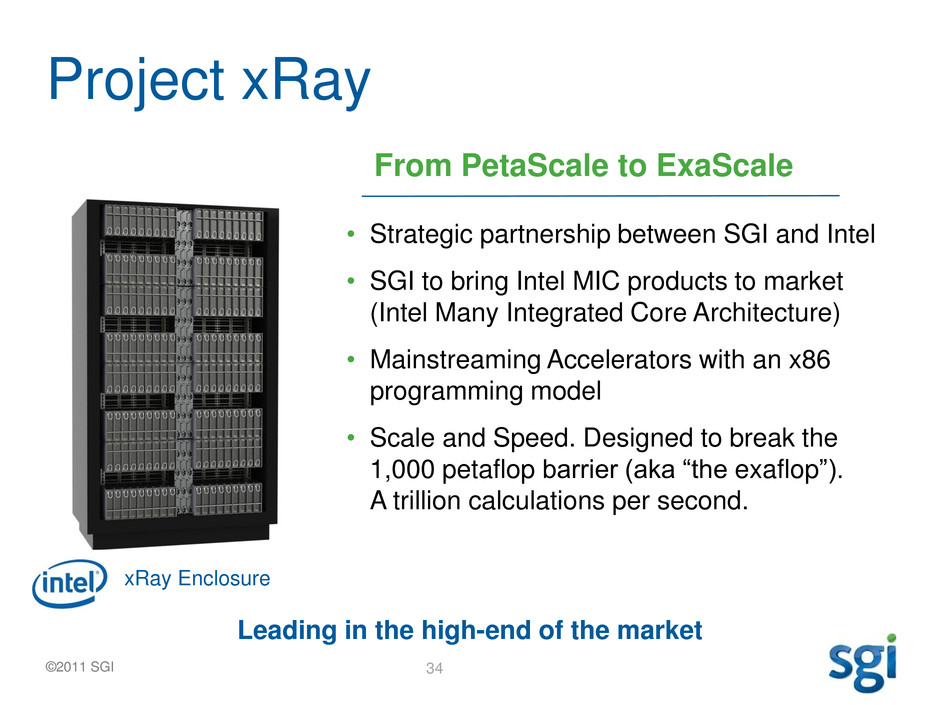

Project xRay

From PetaScale to ExaScale

• Strategic partnership between SGI and Intel

• SGI to bring Intel MIC products to market

(Intel Many Integrated Core Architecture)

• Mainstreaming Accelerators with an x86

programming model

• Scale and Speed. Designed to break the

1,000 petaflop barrier (aka “the exaflop”).

A trillion calculations per second.

xRay Enclosure

Leading in the high-end of the market

35 ©2011 SGI

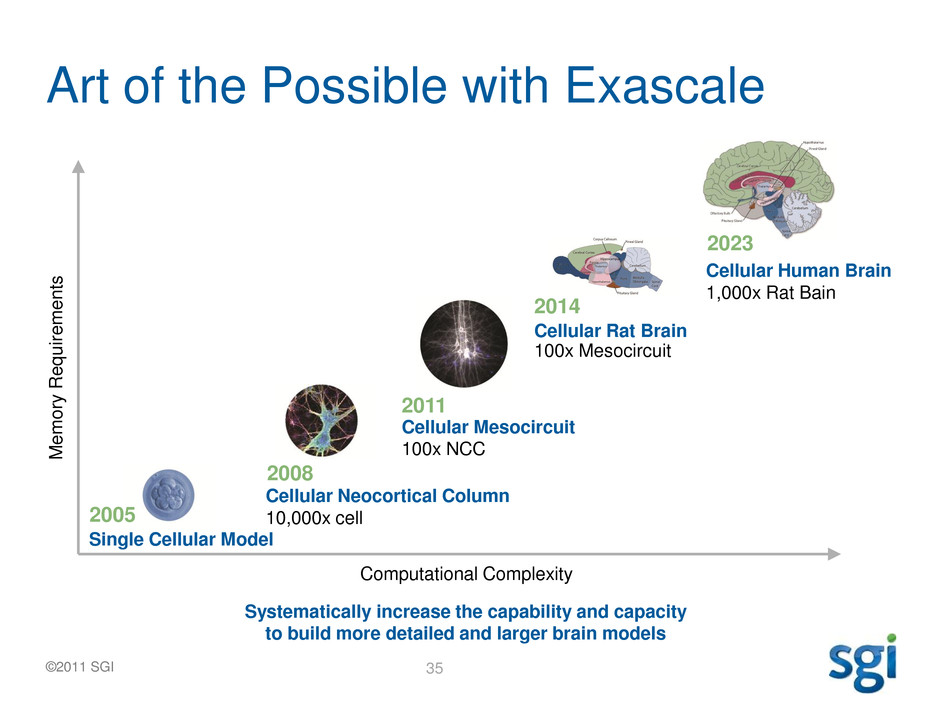

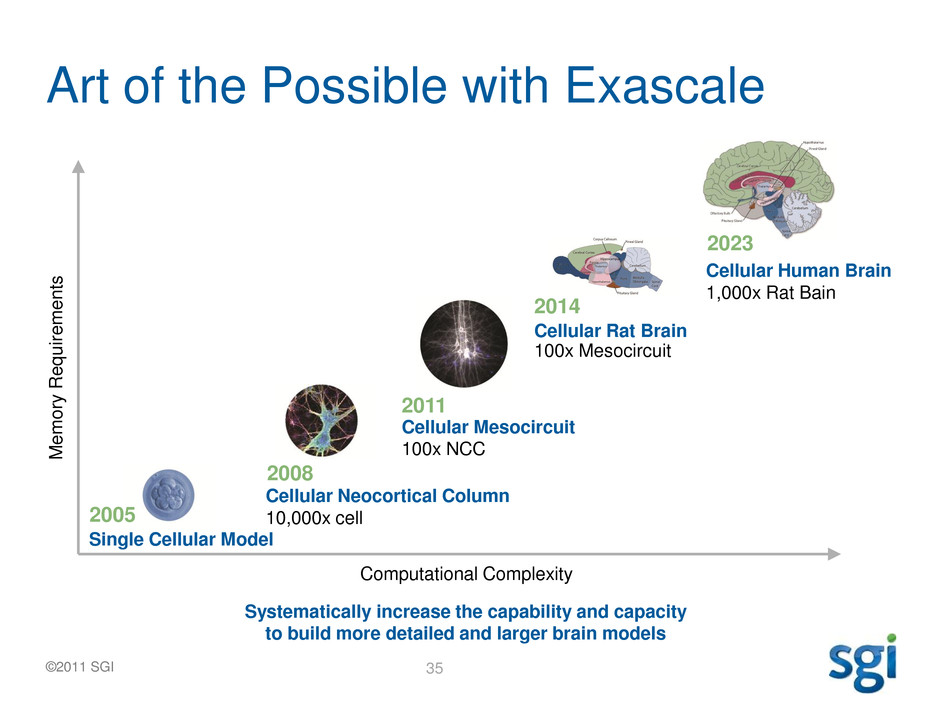

Art of the Possible with Exascale

M

e

m

or

y

R

equire

m

en

ts

Computational Complexity

Systematically increase the capability and capacity

to build more detailed and larger brain models

2005

Single Cellular Model

Cellular Neocortical Column

10,000x cell

Cellular Mesocircuit

100x NCC

Cellular Rat Brain

100x Mesocircuit

Cellular Human Brain

1,000x Rat Bain

2008

2011

2014

2023

36 ©2011 SGI

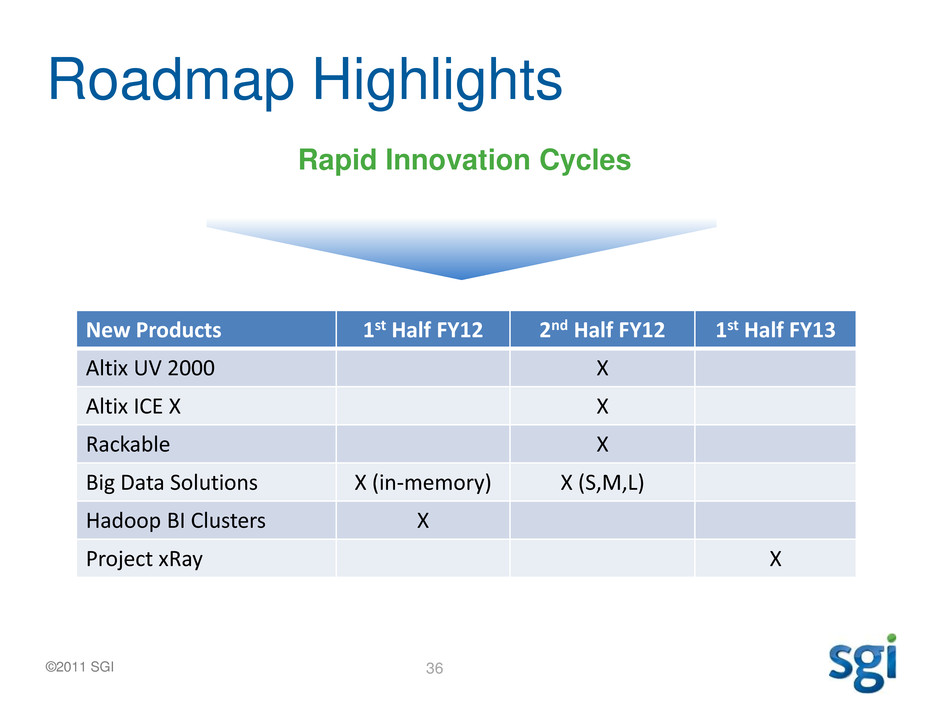

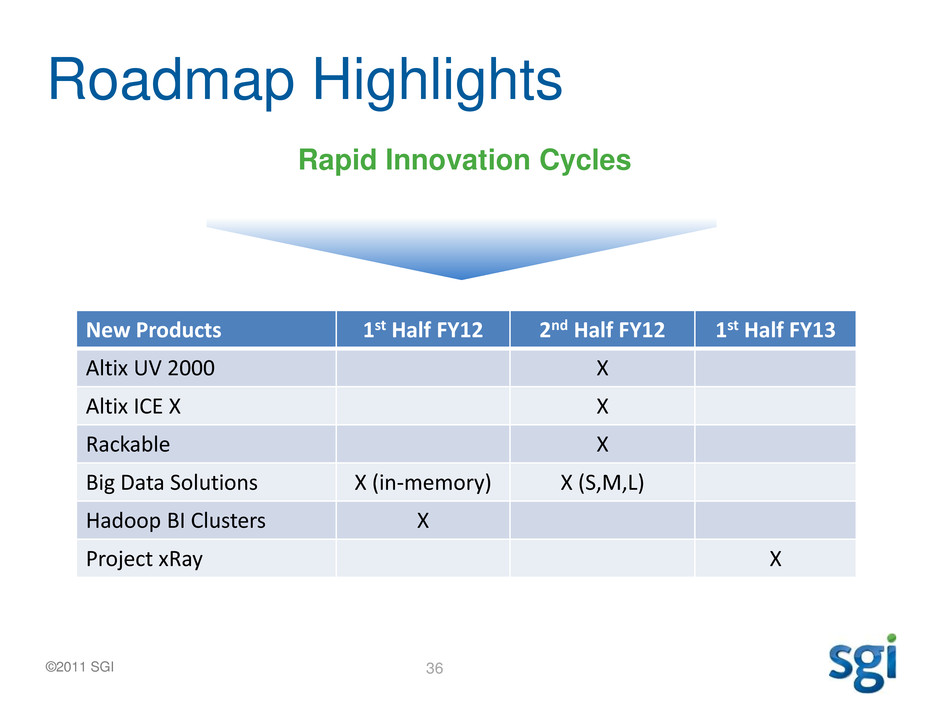

Roadmap Highlights

New Products 1st Half FY12 2nd Half FY12 1st Half FY13

Altix UV 2000 X

Altix ICE X X

Rackable X

Big Data Solutions X (in-memory) X (S,M,L)

Hadoop BI Clusters X

Project xRay X

Rapid Innovation Cycles

37 ©2011 SGI

Dawn of a New Era

From Cells to Cures

From Thought to Production

From Simulation to Answers

SGI is uniquely positioned to transform how customers

design and deliver products and solutions

From Data to Action

38

Services

Rick Rinehart

Global Services

39

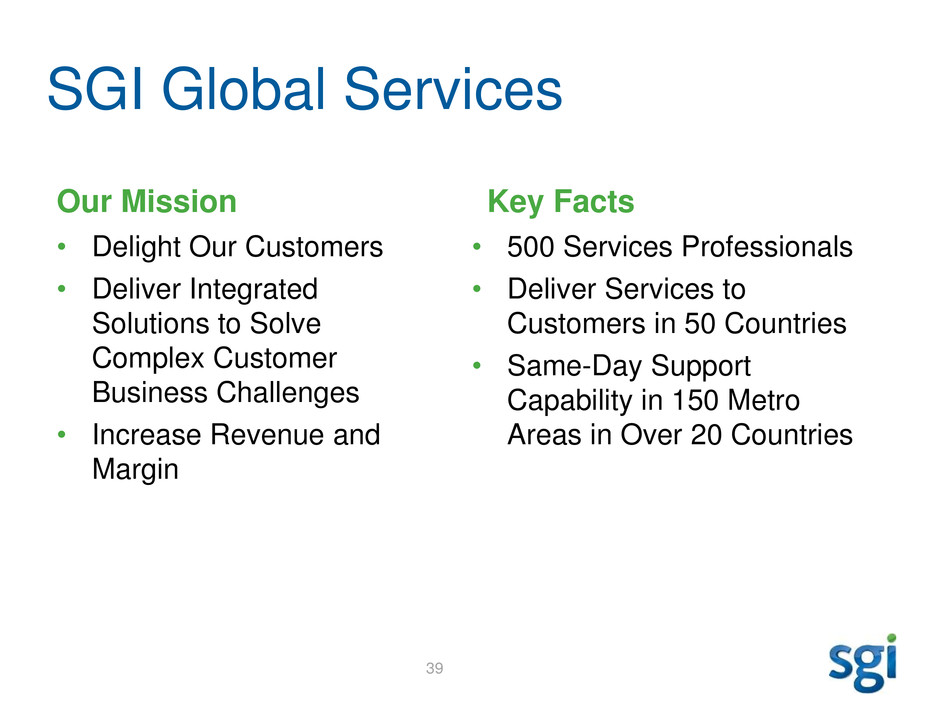

Our Mission

• Delight Our Customers

• Deliver Integrated

Solutions to Solve

Complex Customer

Business Challenges

• Increase Revenue and

Margin

Key Facts

• 500 Services Professionals

• Deliver Services to

Customers in 50 Countries

• Same-Day Support

Capability in 150 Metro

Areas in Over 20 Countries

SGI Global Services

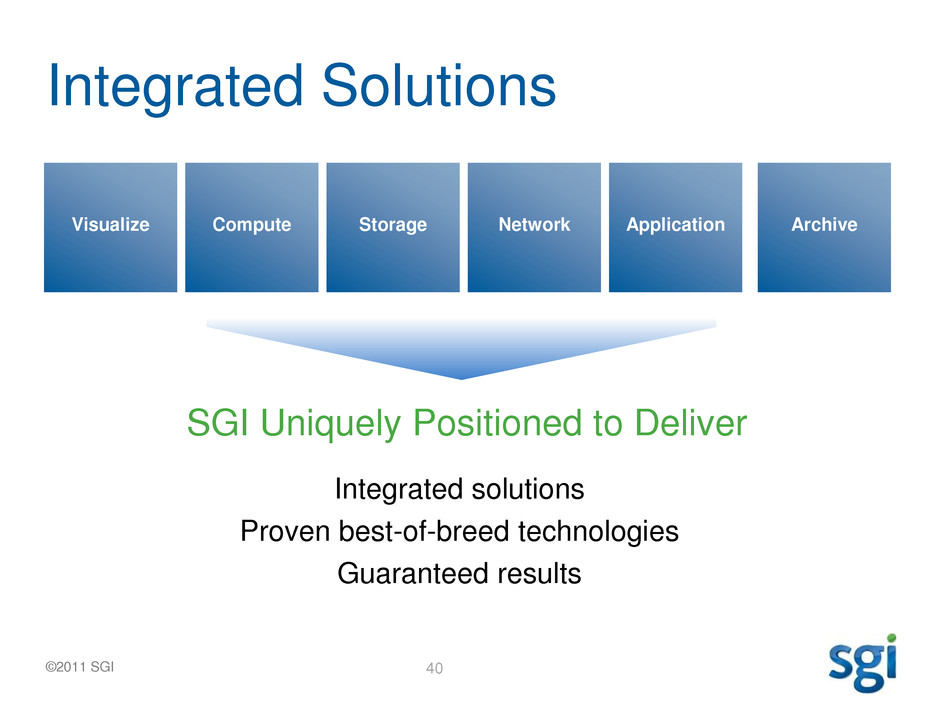

40 ©2011 SGI

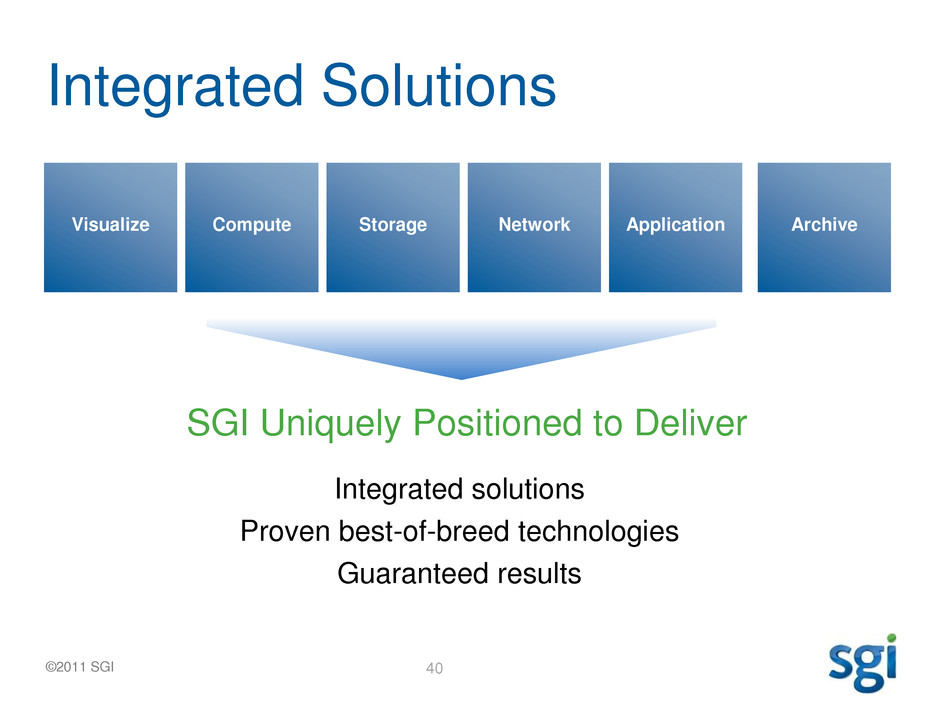

Integrated Solutions

Visualize Compute Storage Network Application Contracting Archive

Integrated solutions

Proven best-of-breed technologies

Guaranteed results

SGI Uniquely Positioned to Deliver

41 ©2011 SGI

• Assessment Services

• Architecture Design & Development

• Integrated Solutions

- Visualization

- Compute

- Storage

- Networking

- Applications

- Archive Solutions

Planning & Design

Sales/Consulting Services

SGI Global Services – What We Do

42 ©2011 SGI

• System Integration

• System Implementation

• Customization

• Performance Tuning

• Data Migration

• In-factory Integration and Test

Deployment

Implementation

Managed Services

• Application Consulting

• System Administration

• Education Services

SGI Global Services – What We Do

43 ©2011 SGI

• SGI Service Plans

- FullExpress 7x24

- FullExpress

- FullCare

- HWCare/SWCare

• Onsite and Remote Support

• Flexible Coverage Options

• Multi-Vendor Support

• Global Logistics

Support/Maintenance

Customer Support Services

SGI Global Services – What We Do

44 ©2011 SGI

SGI Global Services – How We Do It

The Business Challenge

– A research platform for use by the NIH Community to perform cutting edge, memory intensive

research in the fields of chemical dynamics and computational biology

SGI’s Solution

– “Koronis” - MSI‟s largest shared-memory and most powerful high performance computer

system

– A powerful shared-memory system with 1,152 processor cores that can access

3.1 terabytes of system memory directly, ultrafast disk storage/access, and high-end

visualization capabilities

Solution Components

– Compute, Storage, File Systems, Visualization, Archiving and 3rd Party Software

Services Value

– Assessment, Factory Integration & Test, 3rd Party Hardware & Software Integration,

Installation, Configuration, Performance Tuning and Project Management

Minnesota Supercomputing Institute (MSI)

45 ©2011 SGI

The Business Challenge

– To sequence and characterize pancreatic and ovarian cancer to an unprecedented level of

detail to gain a better understanding of what leads to genetic instability and ultimately cancer

SGI’s Solution

– A robust high performance solution to ingest, archive, manage, and analyze vast amounts of

sequencing data with end to end data accountability

Solution Components

– Compute, Archiving, Storage and 3rd Party Software

Services Value

– Integrated Solution Architecture, Hardware & Software Design Specification, Installation,

Integration, Workflow Consultation, and Project Management

SGI Global Services – How We Do It

Queensland Centre for Medical Genomics

46 ©2011 SGI

SGI Global Services – How We Do It

The Business Challenge

– To identify new strategies for cancer research by processing massive amounts of cancer-

relevant data from multiple sources

SGI’s Solution

– A fully integrated server and multi-tiered storage solution which can quickly process and

correlate large diverse sets of medical and biological data

Solution Components

– Compute, Storage, Archiving, Networking, File Systems and 3rd Party Software

Services Value

– Solution Architecture & Design, Installation, Integration, Configuration,

Performance Tuning, Workflow Consultation, Training, and Project Management

Institute of Cancer Research (ICR)

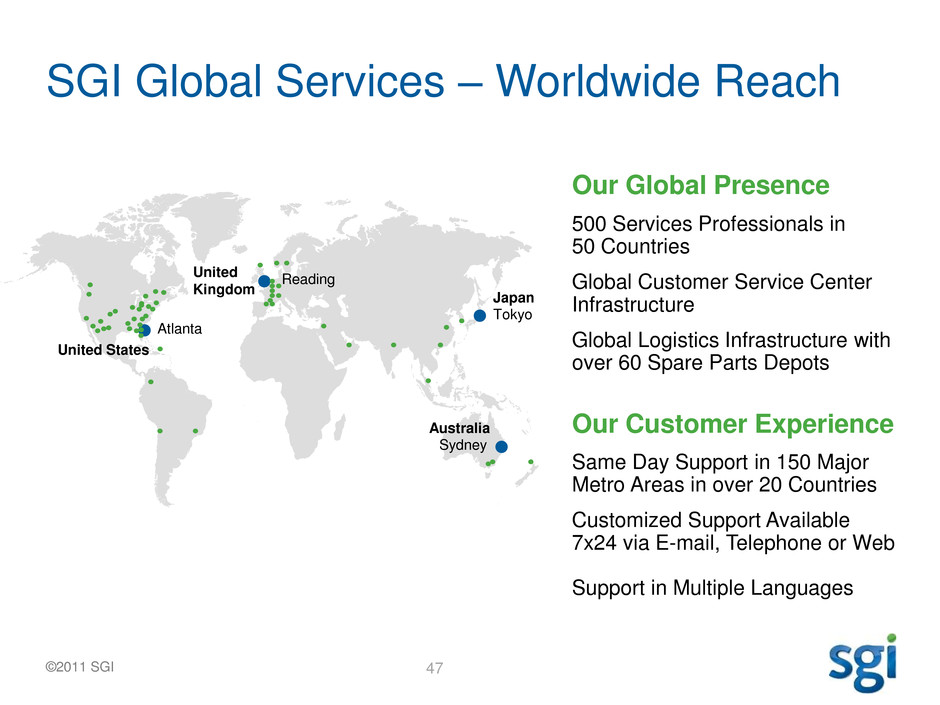

47 ©2011 SGI

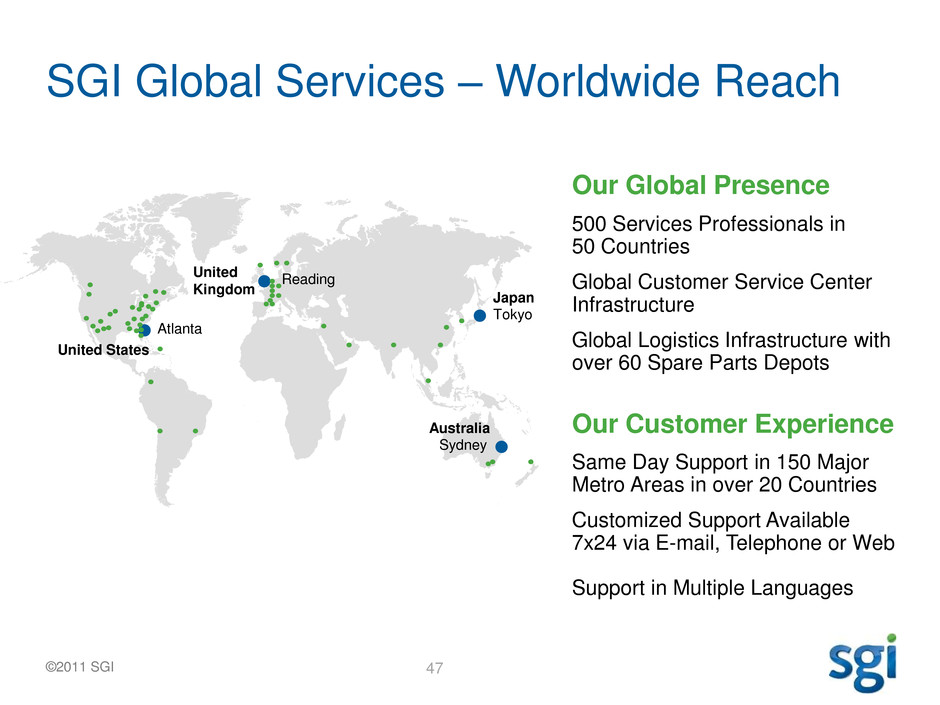

SGI Global Services – Worldwide Reach

Our Global Presence

United States

Atlanta

Australia

Sydney

Japan

Tokyo

Our Customer Experience

500 Services Professionals in

50 Countries

Global Customer Service Center

Infrastructure

Global Logistics Infrastructure with

over 60 Spare Parts Depots

Same Day Support in 150 Major

Metro Areas in over 20 Countries

Customized Support Available

7x24 via E-mail, Telephone or Web

Support in Multiple Languages

United

Kingdom

Reading

48 ©2011 SGI

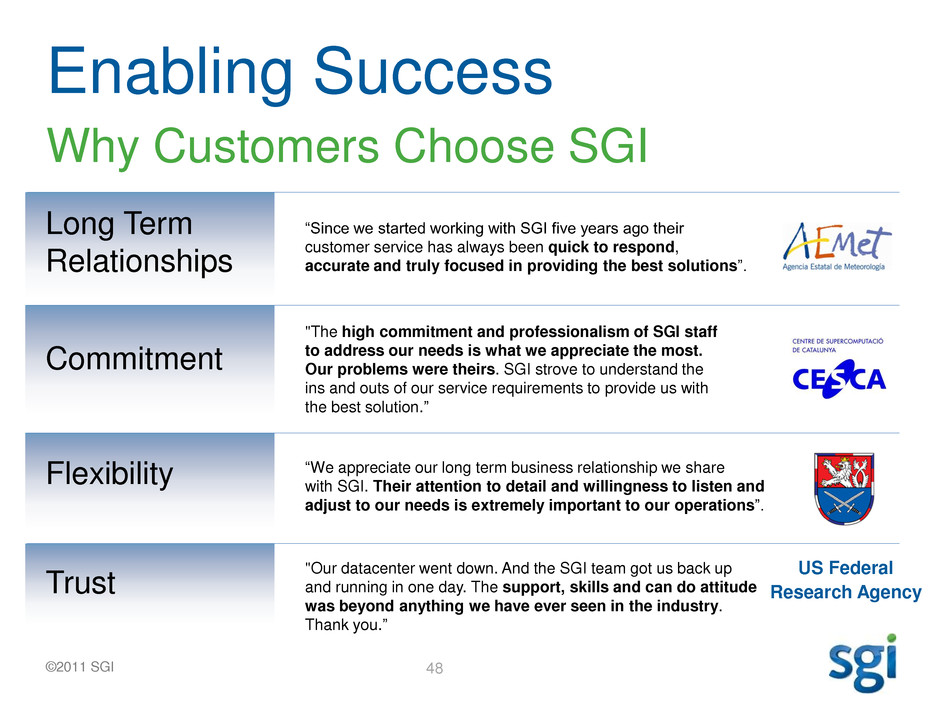

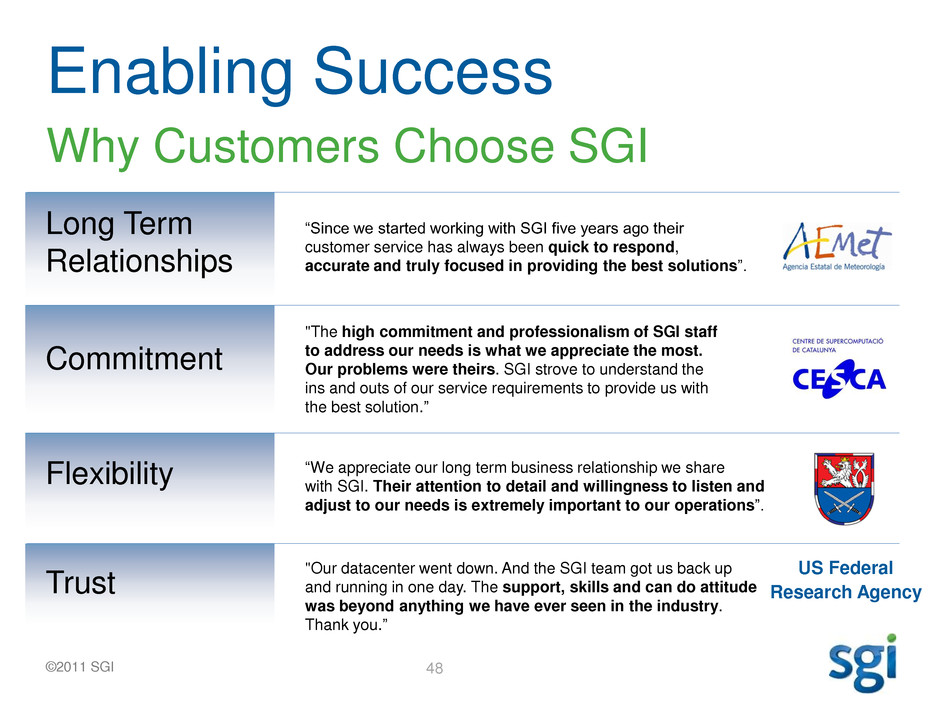

US Federal

Research Agency

Enabling Success

Why Customers Choose SGI

Long Term

Relationships

“Since we started working with SGI five years ago their

customer service has always been quick to respond,

accurate and truly focused in providing the best solutions”.

"The high commitment and professionalism of SGI staff

to address our needs is what we appreciate the most.

Our problems were theirs. SGI strove to understand the

ins and outs of our service requirements to provide us with

the best solution.”

“We appreciate our long term business relationship we share

with SGI. Their attention to detail and willingness to listen and

adjust to our needs is extremely important to our operations”.

"Our datacenter went down. And the SGI team got us back up

and running in one day. The support, skills and can do attitude

was beyond anything we have ever seen in the industry.

Thank you.”

Commitment

Flexibility

Trust

49 ©2011 SGI

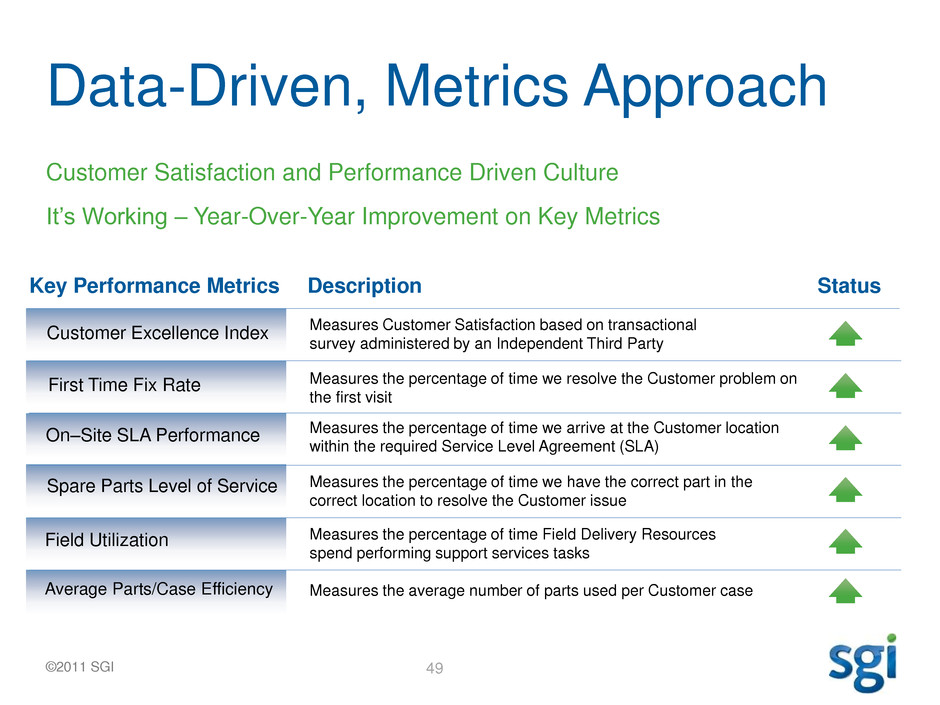

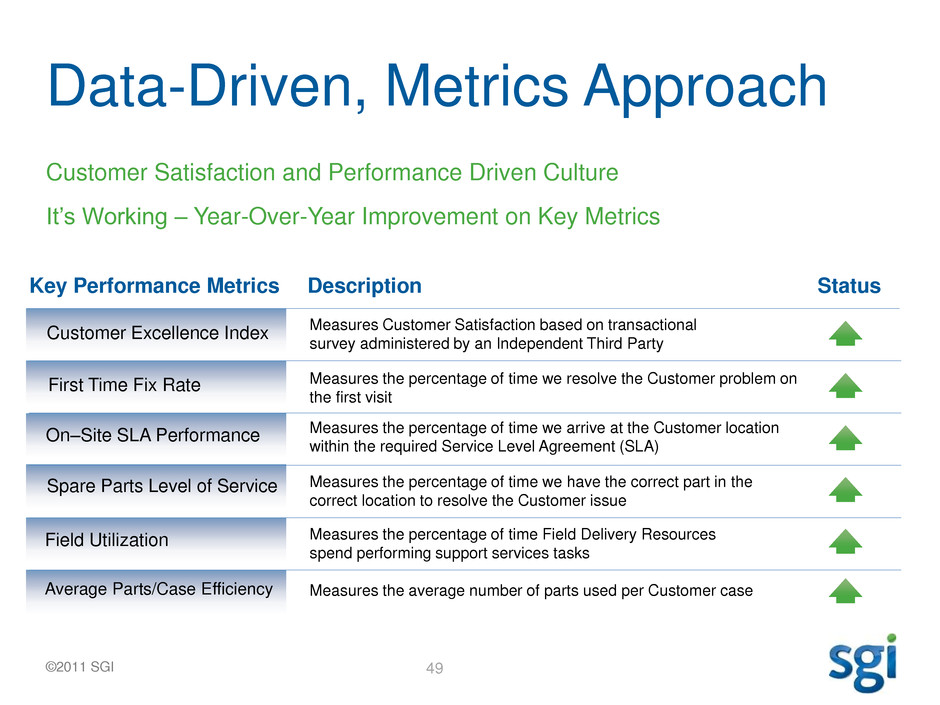

Data-Driven, Metrics Approach

Customer Satisfaction and Performance Driven Culture

It‟s Working – Year-Over-Year Improvement on Key Metrics

Customer Excellence Index

First Time Fix Rate

On–Site SLA Performance

Spare Parts Level of Service

Field Utilization

Average Parts/Case Efficiency

Key Performance Metrics

Measures Customer Satisfaction based on transactional

survey administered by an Independent Third Party

Measures the percentage of time we resolve the Customer problem on

the first visit

Measures the percentage of time we arrive at the Customer location

within the required Service Level Agreement (SLA)

Measures the percentage of time we have the correct part in the

correct location to resolve the Customer issue

Measures the percentage of time Field Delivery Resources

spend performing support services tasks

Measures the average number of parts used per Customer case

Description

Status

50 ©2011 SGI

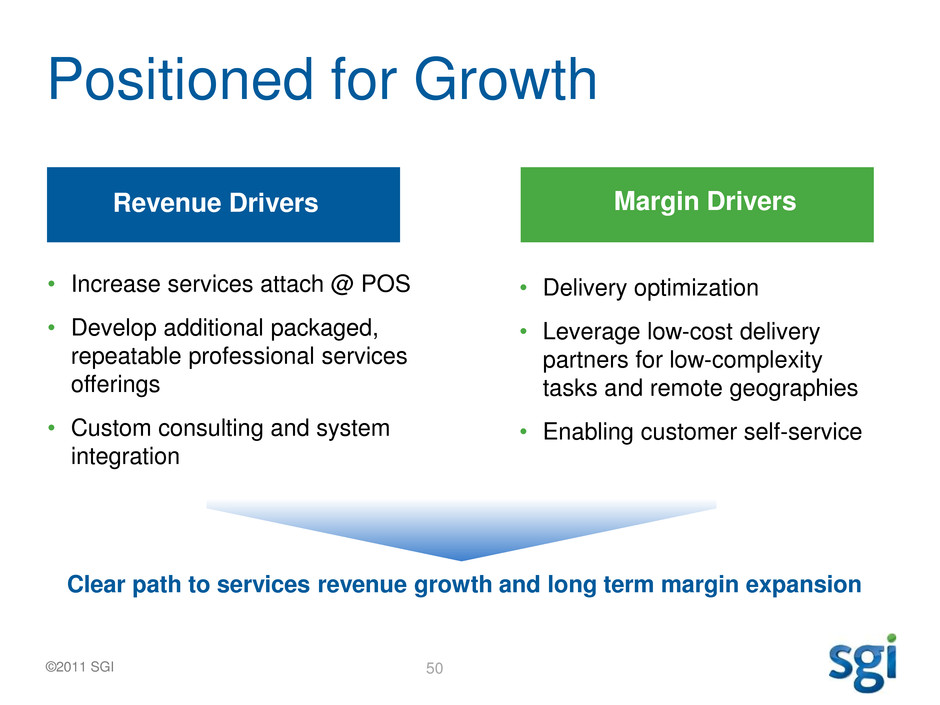

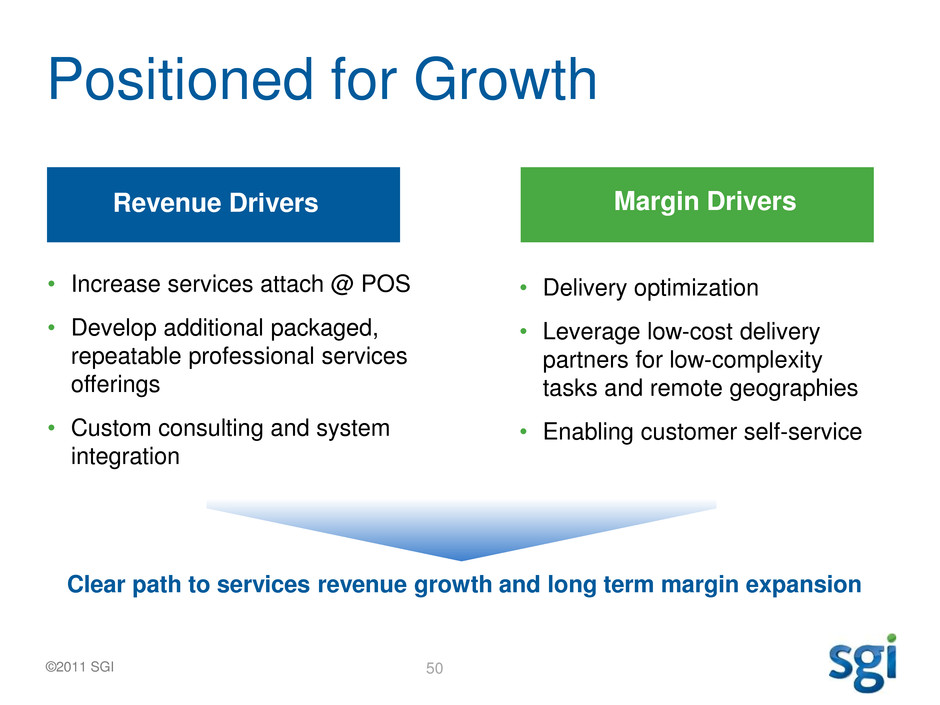

Positioned for Growth

Revenue Drivers

Clear path to services revenue growth and long term margin expansion

• Increase services attach @ POS

• Develop additional packaged,

repeatable professional services

offerings

• Custom consulting and system

integration

• Delivery optimization

• Leverage low-cost delivery

partners for low-complexity

tasks and remote geographies

• Enabling customer self-service

Margin Drivers

51

Expanding

Routes to Market

Tony Carrozza

Global Sales

52 ©2011 SGI

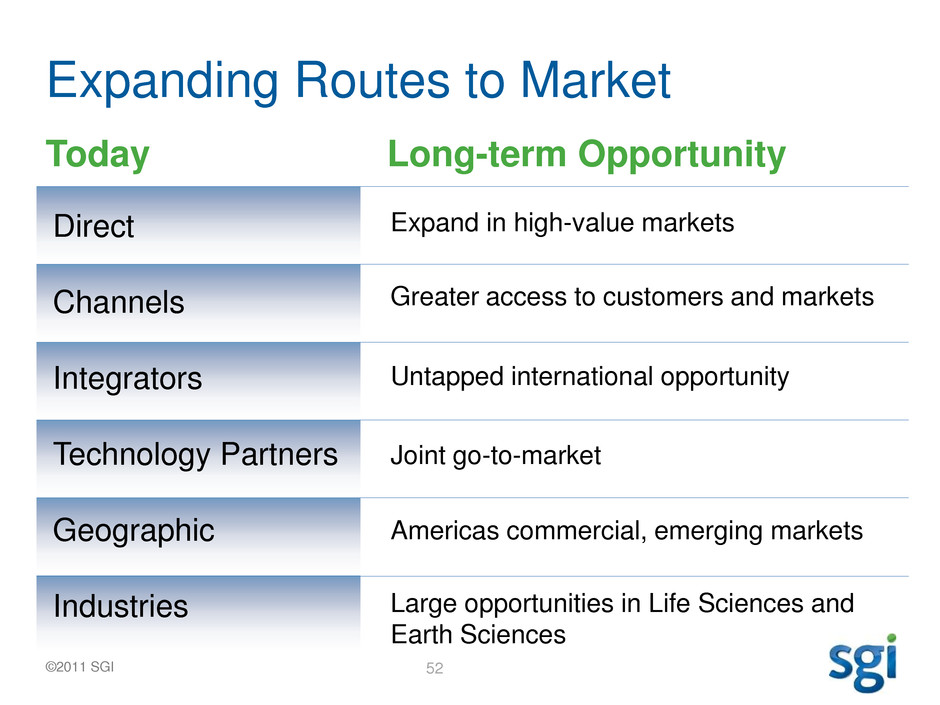

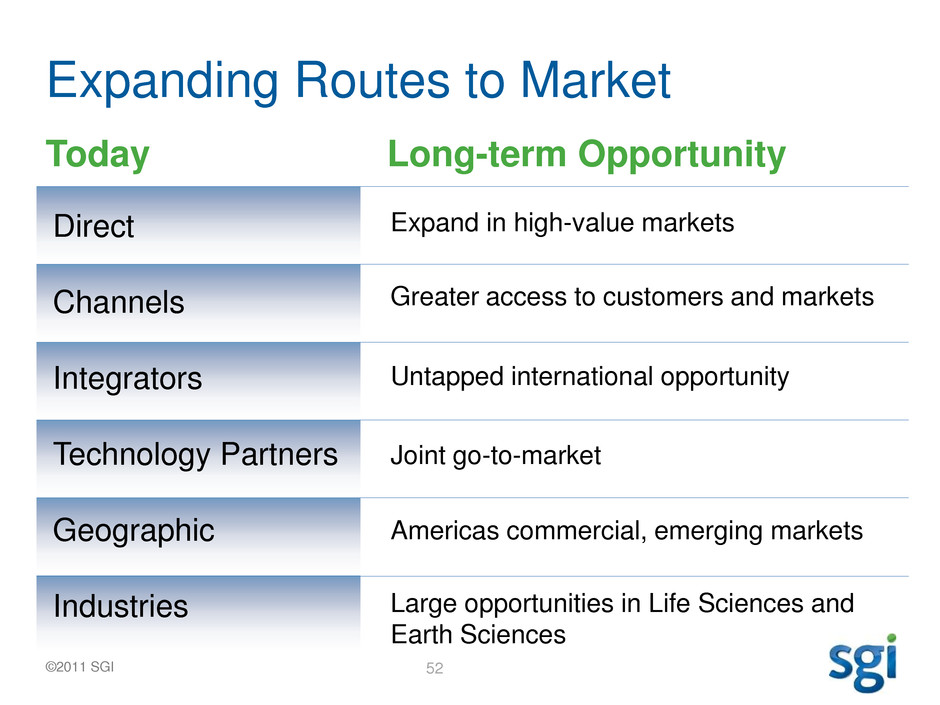

Expanding Routes to Market

Today Long-term Opportunity

Direct

Channels

Integrators

Technology Partners

Geographic

Industries

Expand in high-value markets

Greater access to customers and markets

Untapped international opportunity

Joint go-to-market

Large opportunities in Life Sciences and

Earth Sciences

Americas commercial, emerging markets

53 ©2011 SGI

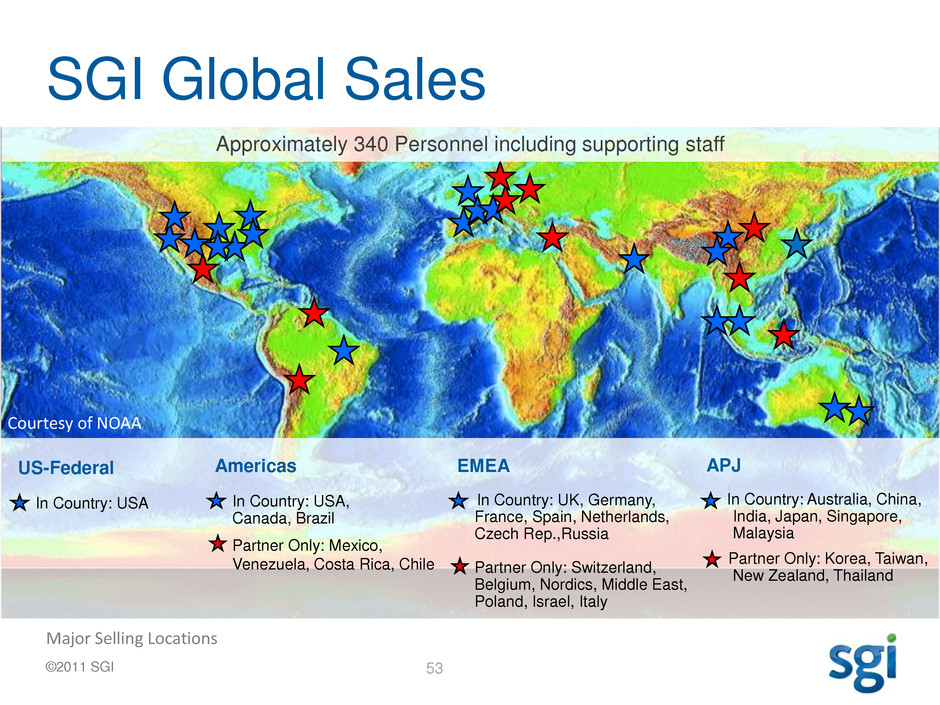

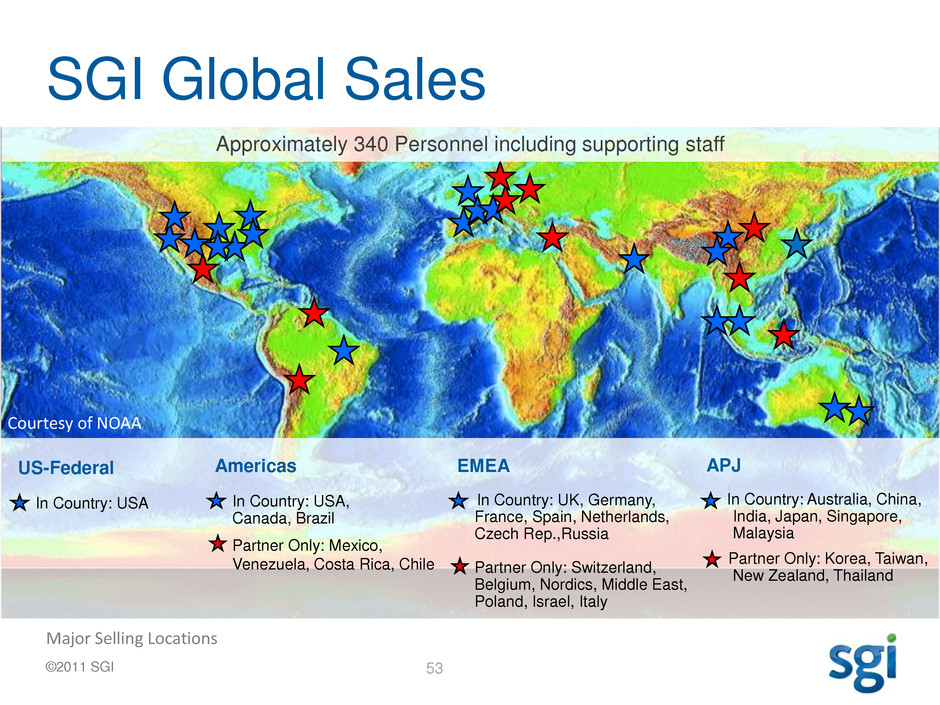

SGI Global Sales

Americas

In Country: USA,

Canada, Brazil

Partner Only: Mexico,

Venezuela, Costa Rica, Chile

EMEA

In Country: UK, Germany,

France, Spain, Netherlands,

Czech Rep.,Russia

Partner Only: Switzerland,

Belgium, Nordics, Middle East,

Poland, Israel, Italy

APJ

In Country: Australia, China,

India, Japan, Singapore,

Malaysia

Partner Only: Korea, Taiwan,

New Zealand, Thailand

US-Federal

In Country: USA

Approximately 340 Personnel including supporting staff

Courtesy of NOAA

Major Selling Locations

54 ©2011 SGI

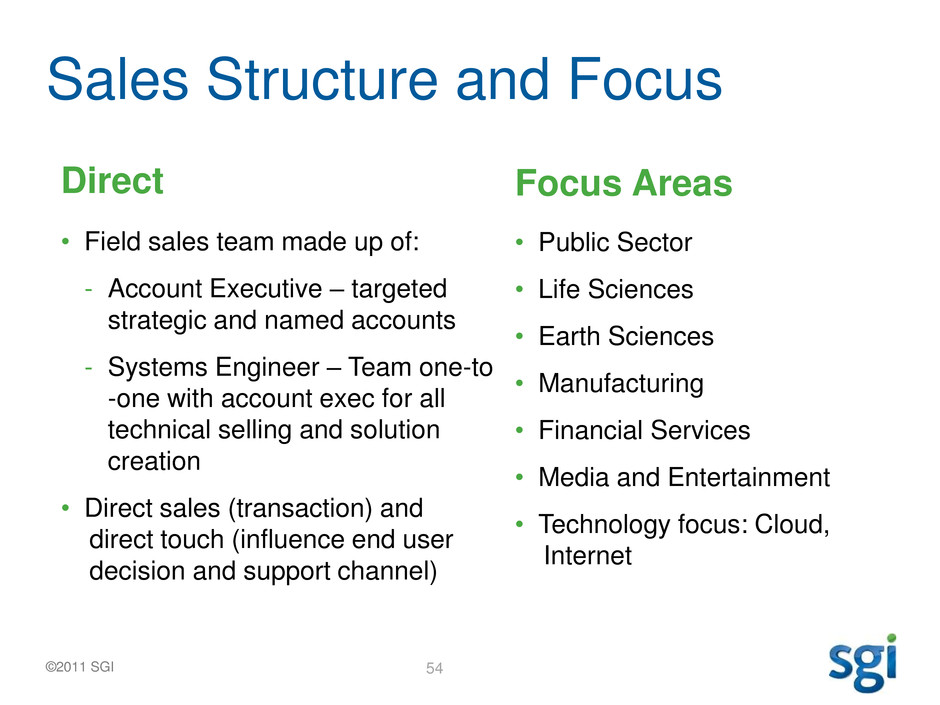

• Field sales team made up of:

- Account Executive – targeted

strategic and named accounts

- Systems Engineer – Team one-to

-one with account exec for all

technical selling and solution

creation

• Direct sales (transaction) and

direct touch (influence end user

decision and support channel)

Direct

• Public Sector

• Life Sciences

• Earth Sciences

• Manufacturing

• Financial Services

• Media and Entertainment

• Technology focus: Cloud,

Internet

Focus Areas

Sales Structure and Focus

55 ©2011 SGI

Global Channels

• Global single tier channel model

- Limited second tier distribution in select countries

• Dedicated channel teams to drive partner recruitment,

training and field engagement

- Includes inside sales team in the U.S.

• Channel partners provide:

- Reach and Access (Geographic, Market Segments)

- Expertise (application, vertical integration, solution)

- Customer Relationships (trusted advisor, procurement preferences)

• Why SGI? Long term commitment to:

Focused channel strategy, channel culture, programs and processes

56 ©2011 SGI

Growing the Channel

• Channel is about 25% of

our book of business

• Doubled the channel business

over the last two years

• Underpenetrated in EMEA and

APJ

• Opportunity in Americas

Commercial

Highlights

57 ©2011 SGI

Federal Systems Integrators

Strategic Relationships with Marquee Integrators

58 ©2011 SGI

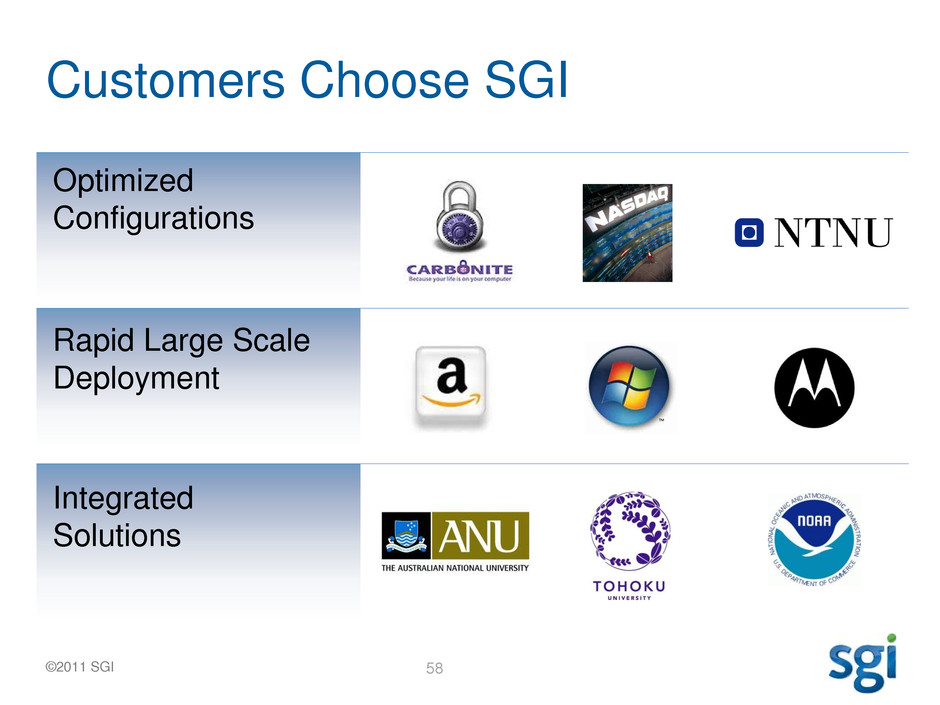

Customers Choose SGI

Optimized

Configurations

Rapid Large Scale

Deployment

Integrated

Solutions

59 ©2011 SGI

Solutions That Are Our Customers‟ Business

Content distribution and fraud reduction NASDAQ and Frequency Firms

trading billions of shares a day

Audi, Tata, Skoda, and Ford

building safer and more efficient cars

F16, F22, F35, Global Hawk

simulation and data ingest systems

60 ©2011 SGI

Solutions That Are Our Customers‟ Business

NBA keeps score with their content National Geographic Content

Distribution Network

Motorola delivering a new generation

of content to the palm of your hand

ONERA designing the next

generation aircraft

61 ©2011 SGI

Technology Partnerships

CPUs, GPUs,

system boards,

10GbE

Storage

Software

62

Country expansion (China, India, Japan, South

Korea), Manufacturing, Life Sciences, channel

expansion

Underpenetrated Geographies and Industries

Focused Opportunities

Additional sales coverage, channel expansion,

Commercial SIs

DoD, Civilian Agencies, broader SI

relationships

Country expansion, Public Sector, channel

expansion

63 ©2011 SGI

A Winning Combination

Great Results

Great Solutions Great People Great Partners

64

Market Focus

Franz Aman

Marketing

65 ©2011 SGI

Marketing Mission

• Attach (compute + storage + software + …)

• Adjacencies (within accounts, industries, geographies)

• Select Channels, worldwide

Focused Strategy

• Drive visibility and demand

• When we compete, we win

Connecting Customers with our Solutions

66 ©2011 SGI

Visibility

Global PR agency, global and consistent message

67 ©2011 SGI

Global Integrated Programs

Programmatically scaling best practices across the world

68 ©2011 SGI

Industry Orientation

• Public Sector

• Cloud

• Manufacturing

• Life Sciences

• Earth Sciences

Top 5

• Public Sector

• Cloud

• Manufacturing

Top 3

Build on our strength. Enter new industries with differentiated product.

69 ©2011 SGI

Public Sector Defined

Intelligence

Defense

Civilian Agencies

National Labs

Universities/Research

State/Local

Strong Sector

Growing Sector with NATO opportunities

Emerging Sector

Strong Sector

Not a focus area

Lightly penetrated, with global opportunity

$ 10B Market in 2014

70 ©2011 SGI

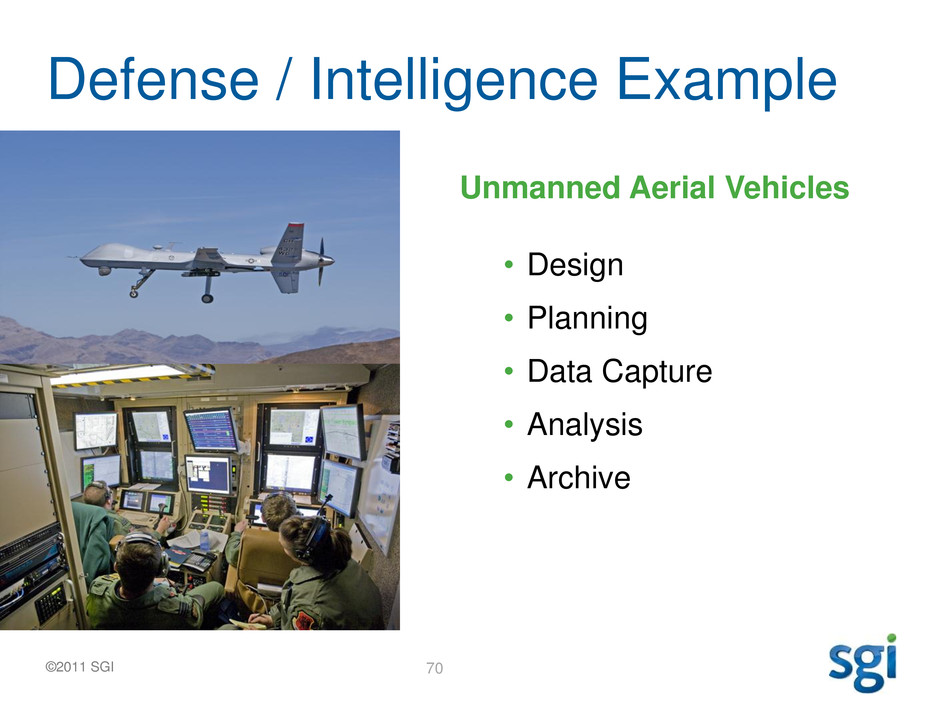

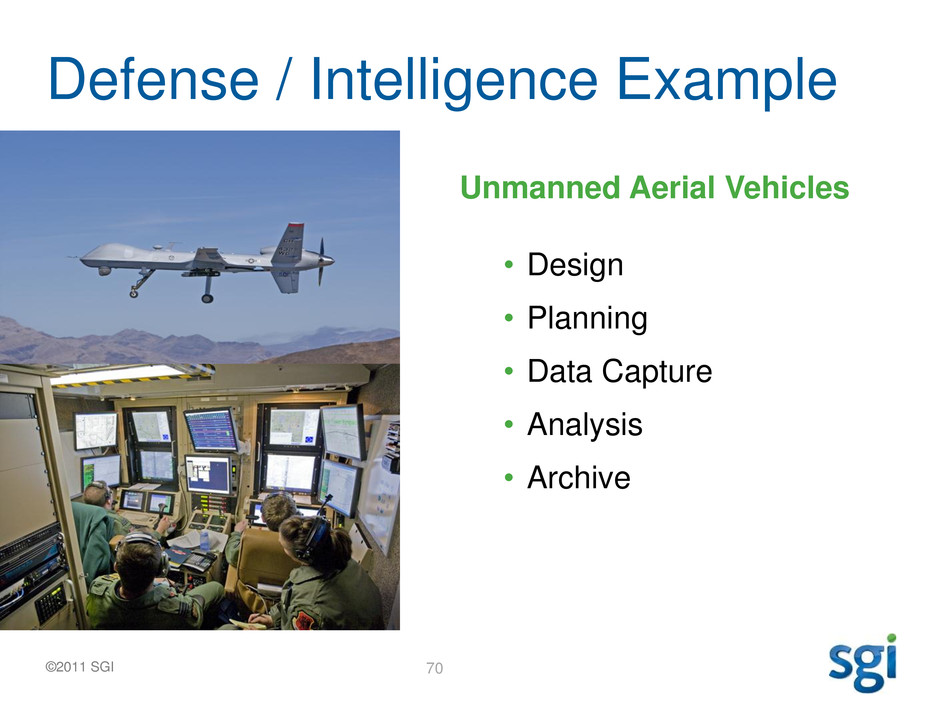

Defense / Intelligence Example

• Design

• Planning

• Data Capture

• Analysis

• Archive

Unmanned Aerial Vehicles

71 ©2011 SGI

Cloud Defined

Public Cloud

Private Cloud

Government Cloud

72 ©2011 SGI

Cloud

• Optimization for

Cost

Power

Compute, Storage, Memory

• Leading Flexibility

• Designed-to-order

• New workloads: Hadoop

Focus on high value

73 ©2011 SGI

Manufacturing Defined

Mechanical, physical, or chemical transformation

of materials, substances, or components into new

products.

Aerospace

Automotive

Chemical and Petroleum

Distribution

Electrical and Electronics

Food and Beverage

Heavy Machinery

Medical

Metalworking

Pharmaceutical

Plastic and Rubber

74 ©2011 SGI

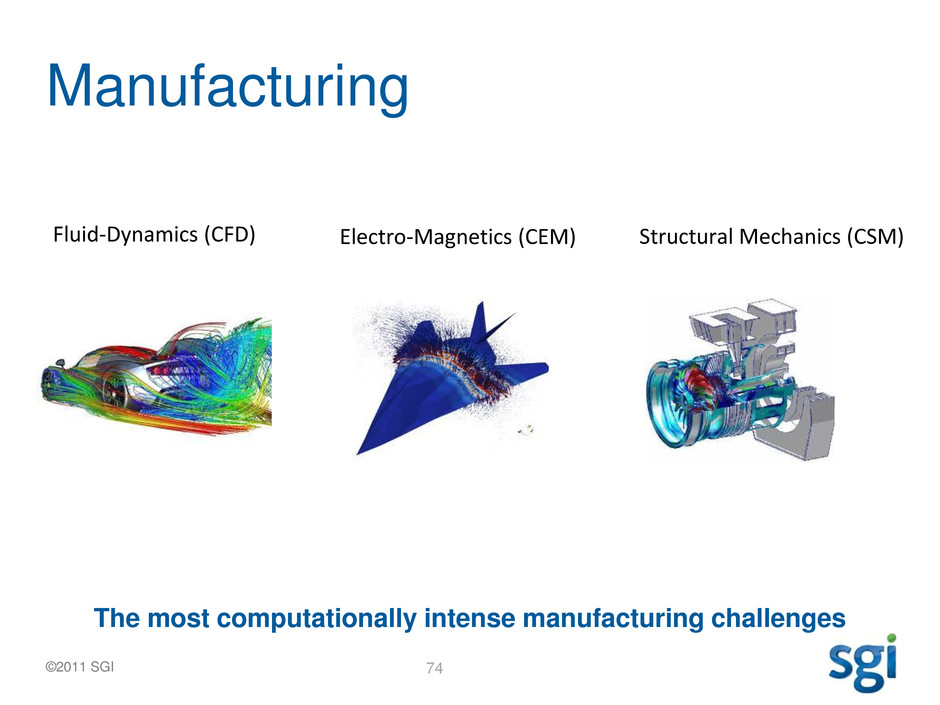

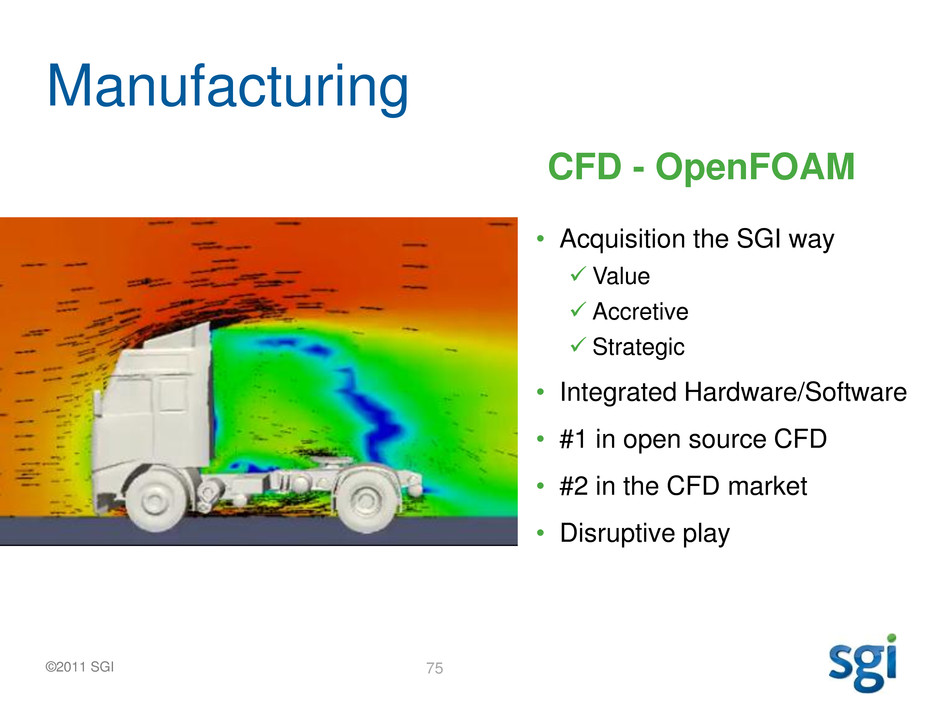

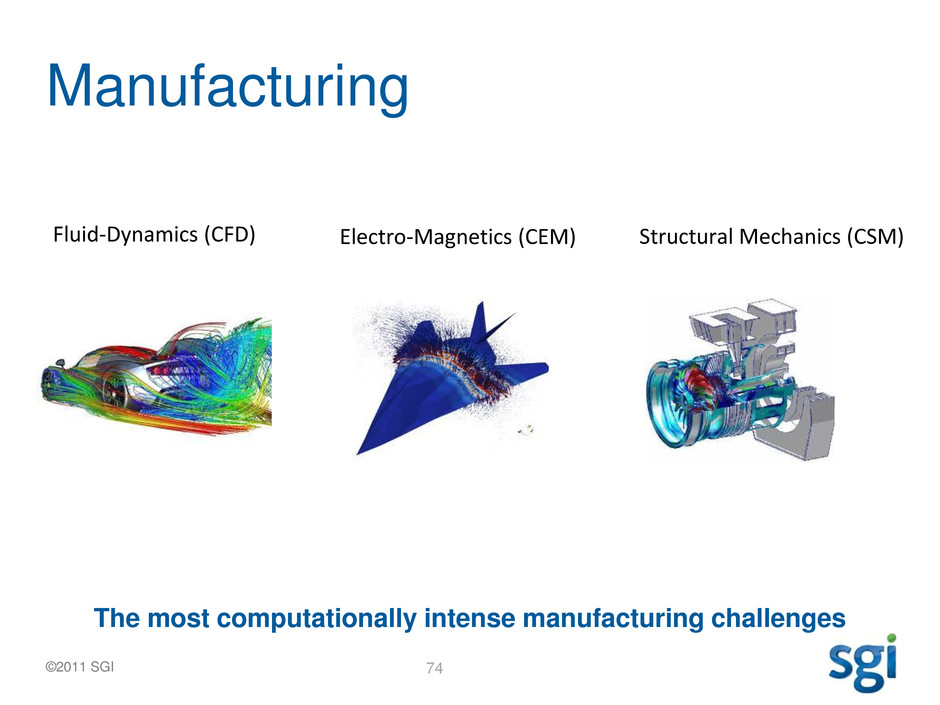

Manufacturing

Fluid-Dynamics (CFD) Electro-Magnetics (CEM) Structural Mechanics (CSM)

The most computationally intense manufacturing challenges

75 ©2011 SGI

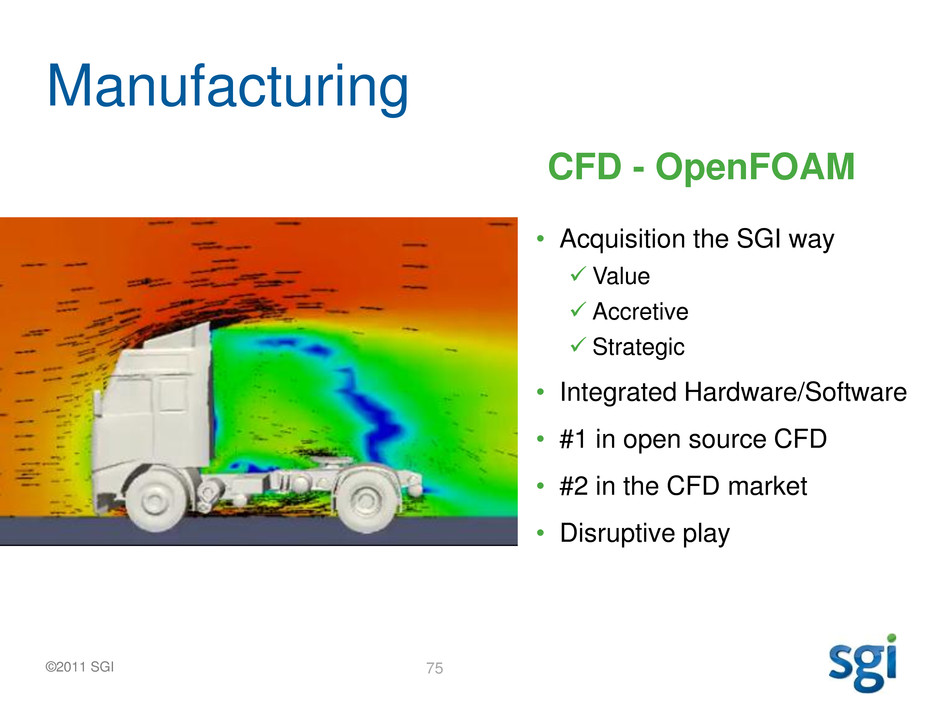

Manufacturing

• Acquisition the SGI way

Value

Accretive

Strategic

• Integrated Hardware/Software

• #1 in open source CFD

• #2 in the CFD market

• Disruptive play

CFD - OpenFOAM

76 ©2011 SGI

Manufacturing

$ 4.3B Market in 2014

11.0% CAGR

77 ©2011 SGI

Life Sciences

Key fields with a common pattern: Genomics, Pharma, Imaging

78 ©2011 SGI

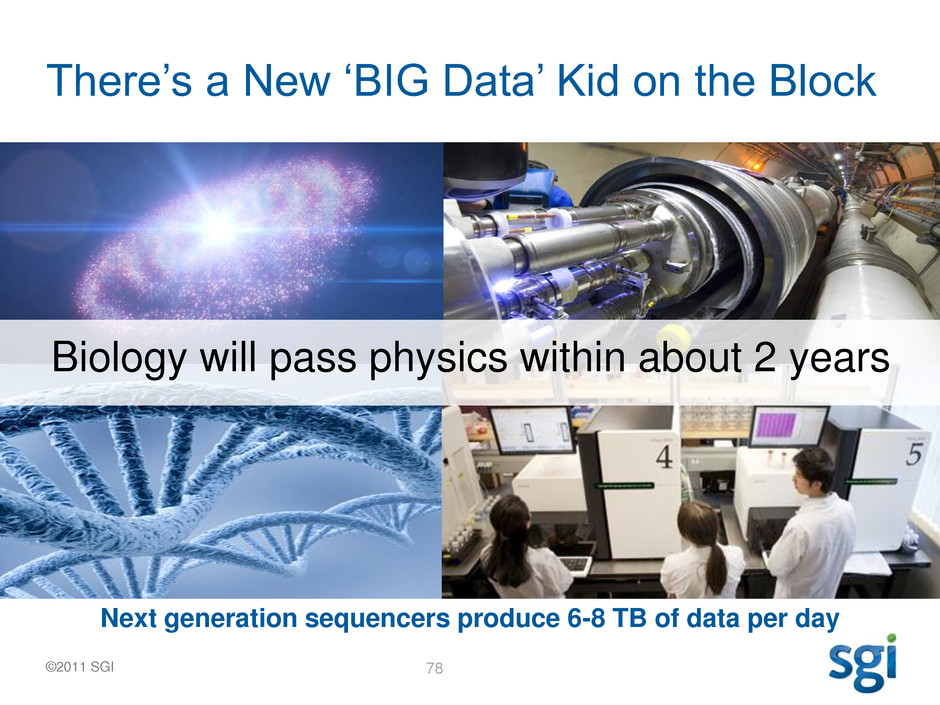

There‟s a New „BIG Data‟ Kid on the Block

Biology will pass physics within about 2 years

Next generation sequencers produce 6-8 TB of data per day

79 ©2011 SGI

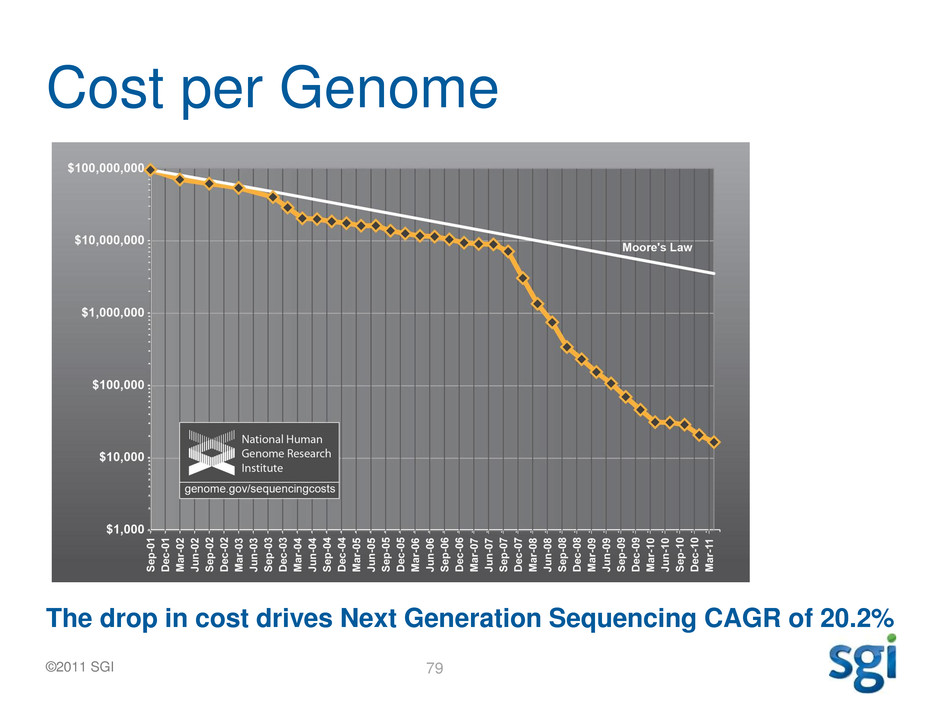

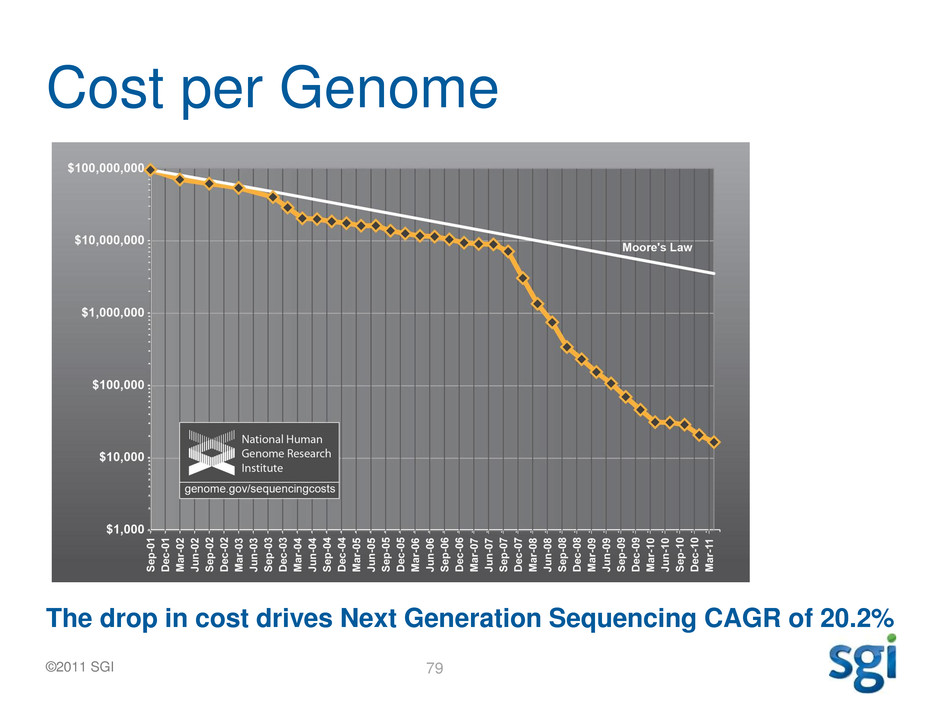

Cost per Genome

The drop in cost drives Next Generation Sequencing CAGR of 20.2%

80 ©2011 SGI

Life Sciences

$ 3B Market in 2014

81 ©2011 SGI

Earth Sciences

Image courtesy NASA

Atmospheric

Geology

Geography

Geophysics

Oceanography

Seismic

Reservoir

82 ©2011 SGI

Climate

More research is needed to keep people out of harm’s way,

understand climate change and root cause

83 ©2011 SGI

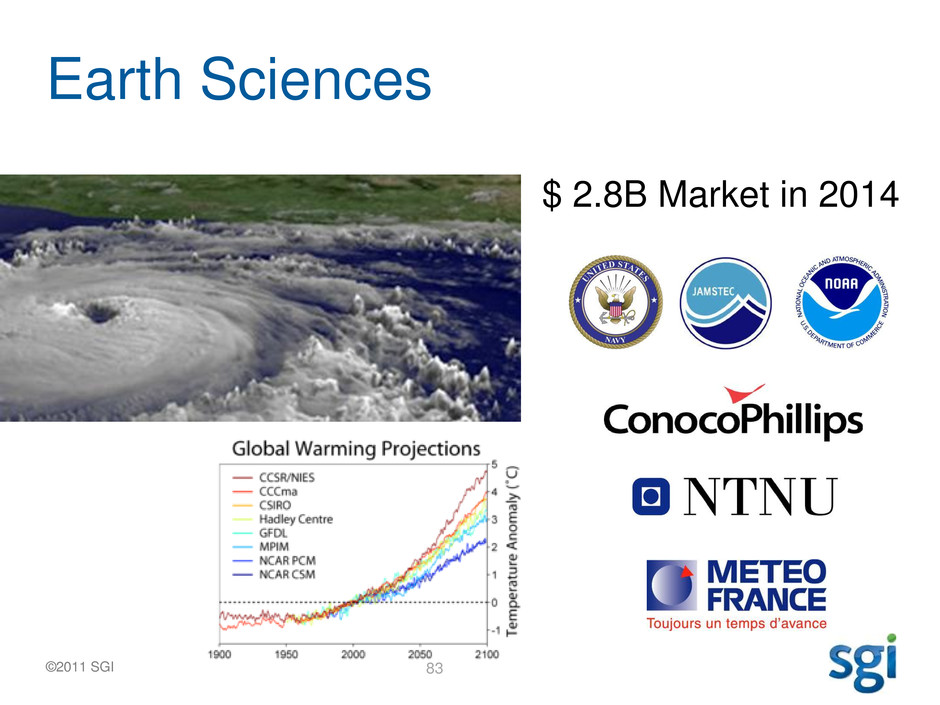

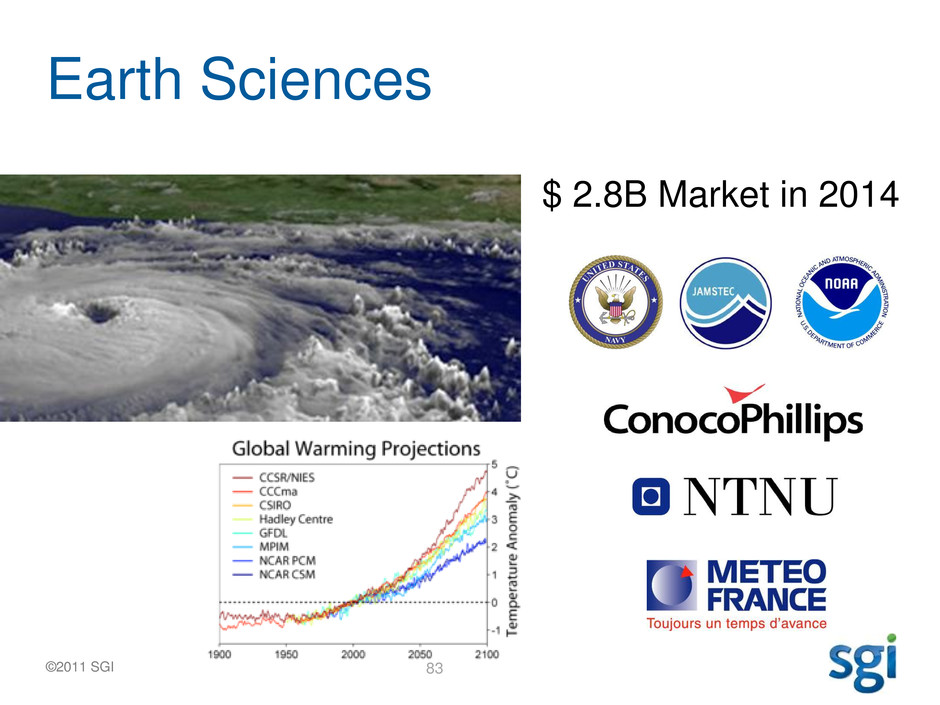

Earth Sciences

$ 2.8B Market in 2014

84

Getting to $1 Billion

Jim Wheat

CFO

85 ©2011 SGI

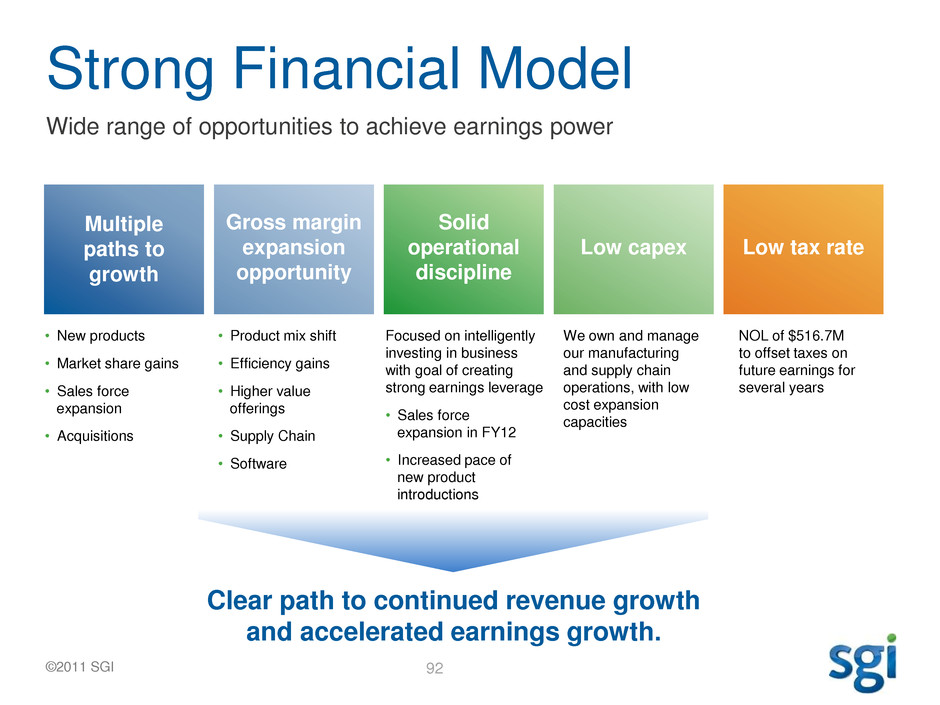

Strong Financial Model

Wide range of opportunities to achieve earnings power

Multiple

paths to

growth

Gross margin

expansion

opportunity

Solid

operational

discipline

Low capex Low tax rate

Clear path to continued revenue growth

and accelerated earnings growth.

86 ©2011 SGI

Strong Financial Model

Wide range of opportunities to achieve earnings power

• New products

• Market share gains

• Sales force expansion

• Acquisitions

Gross margin

expansion

opportunity

Solid

operational

discipline

Low capex Low tax rate

Multiple

paths to

growth

87 ©2011 SGI

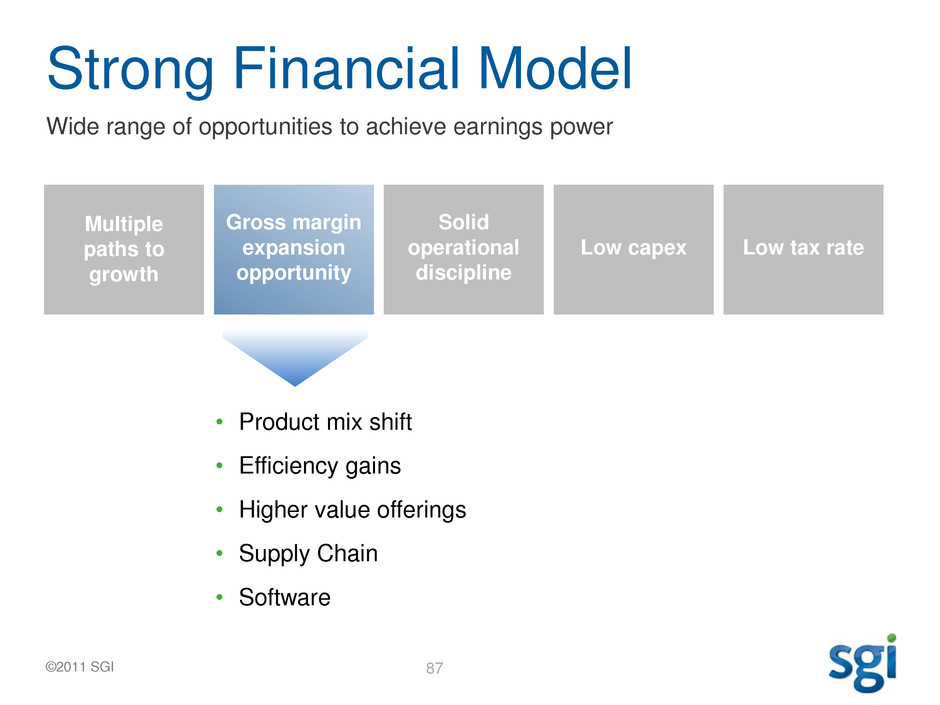

Gross margin

expansion

opportunity

Strong Financial Model

Wide range of opportunities to achieve earnings power

• Product mix shift

• Efficiency gains

• Higher value offerings

• Supply Chain

• Software

Solid

operational

discipline

Low capex Low tax rate

Multiple

paths to

growth

88 ©2011 SGI

Gross Margin History

* Rackable acquired substantially all the assets of Silicon Graphics, Inc., changed

name to SGI in May 2009 and filed a 6-month stub year-end on June 26, 2009

** Includes our guidance range of 28-30% gross margin

0

5

10

15

20

25

30

35

FY 08* FY 10 FY 11 FY 12

**

12%

22%

27%

28-30%

89 ©2011 SGI

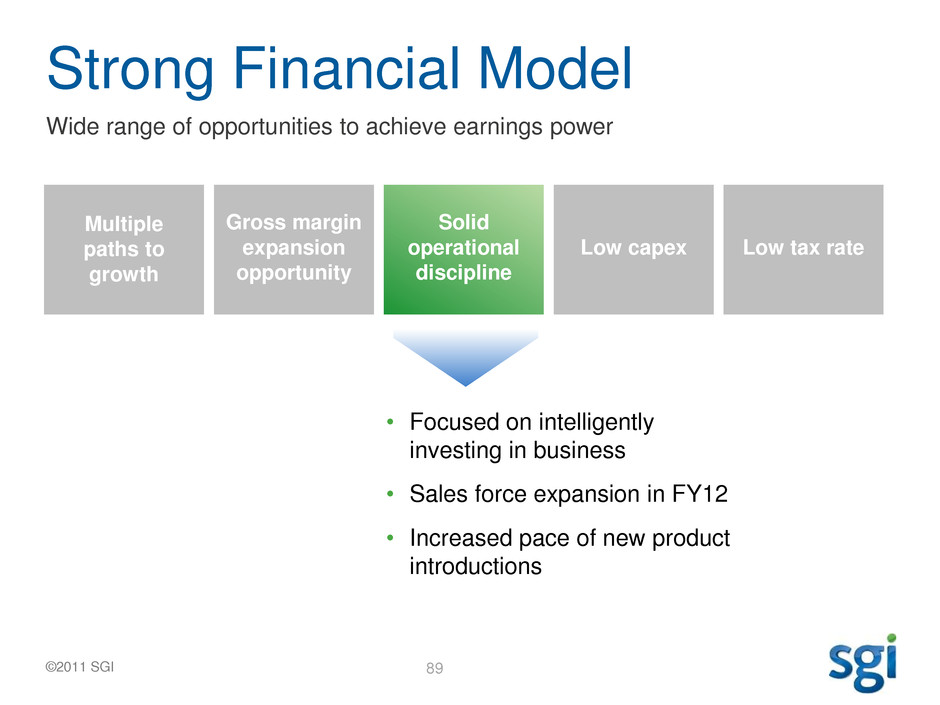

Solid

operational

discipline

Strong Financial Model

Wide range of opportunities to achieve earnings power

• Focused on intelligently

investing in business

• Sales force expansion in FY12

• Increased pace of new product

introductions

Gross margin

expansion

opportunity

Low capex Low tax rate

Multiple

paths to

growth

90 ©2011 SGI

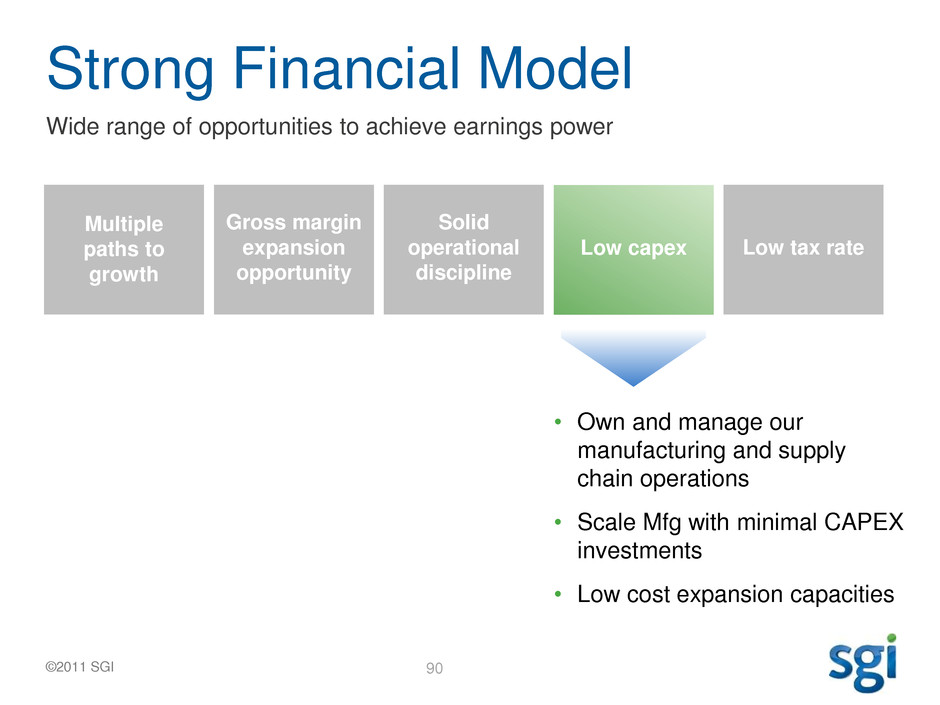

Low capex

Strong Financial Model

Wide range of opportunities to achieve earnings power

• Own and manage our

manufacturing and supply

chain operations

• Scale Mfg with minimal CAPEX

investments

• Low cost expansion capacities

Gross margin

expansion

opportunity

Solid

operational

discipline

Low tax rate

Multiple

paths to

growth

91 ©2011 SGI

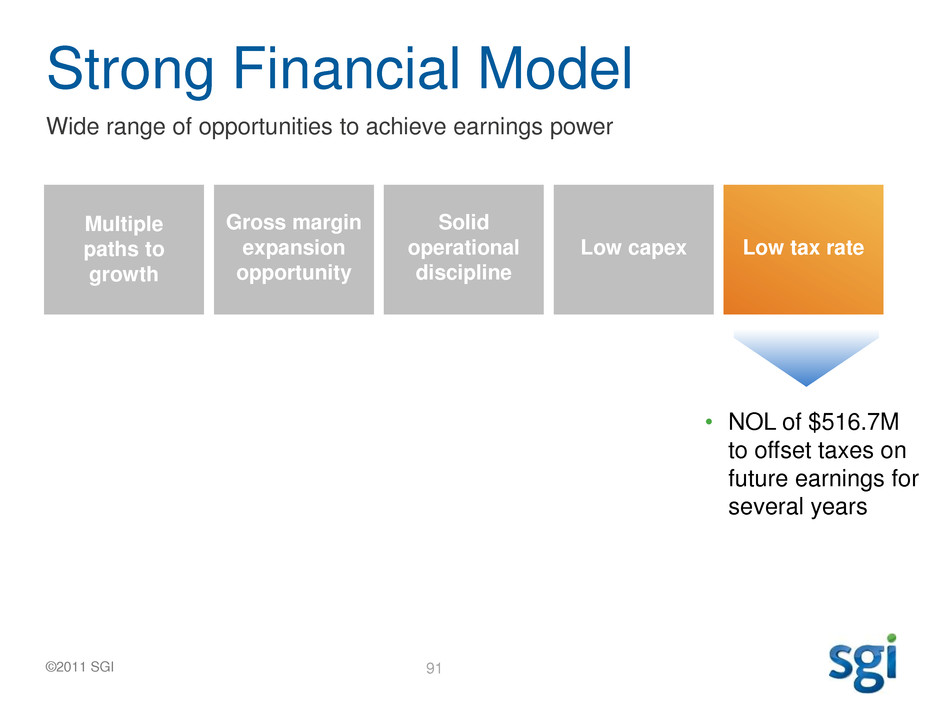

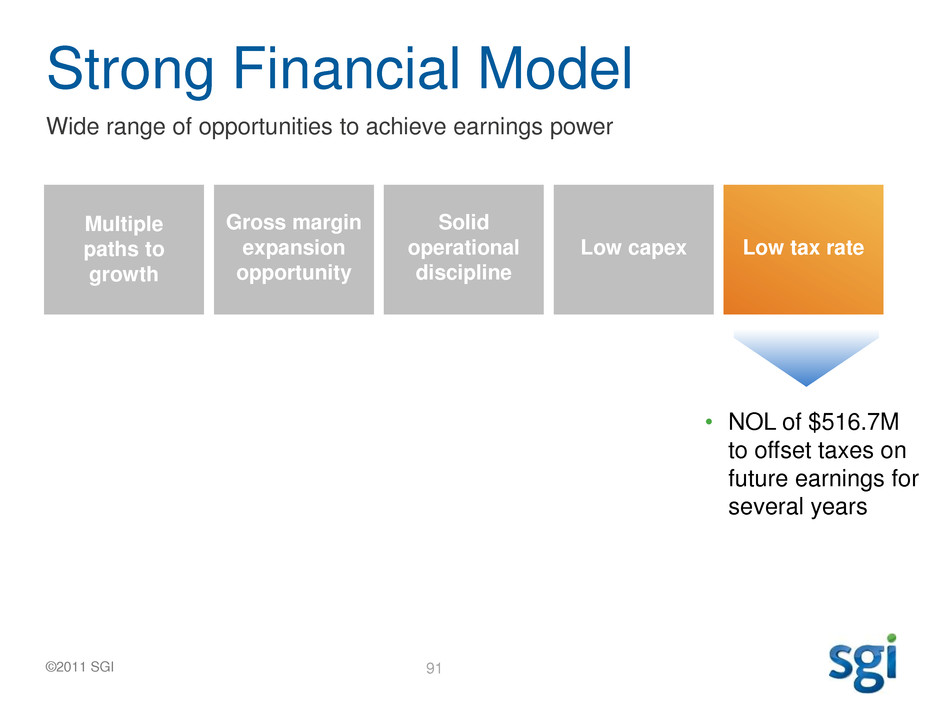

Low tax rate

Strong Financial Model

Wide range of opportunities to achieve earnings power

• NOL of $516.7M

to offset taxes on

future earnings for

several years

Gross margin

expansion

opportunity

Solid

operational

discipline

Low capex

Multiple

paths to

growth

92 ©2011 SGI

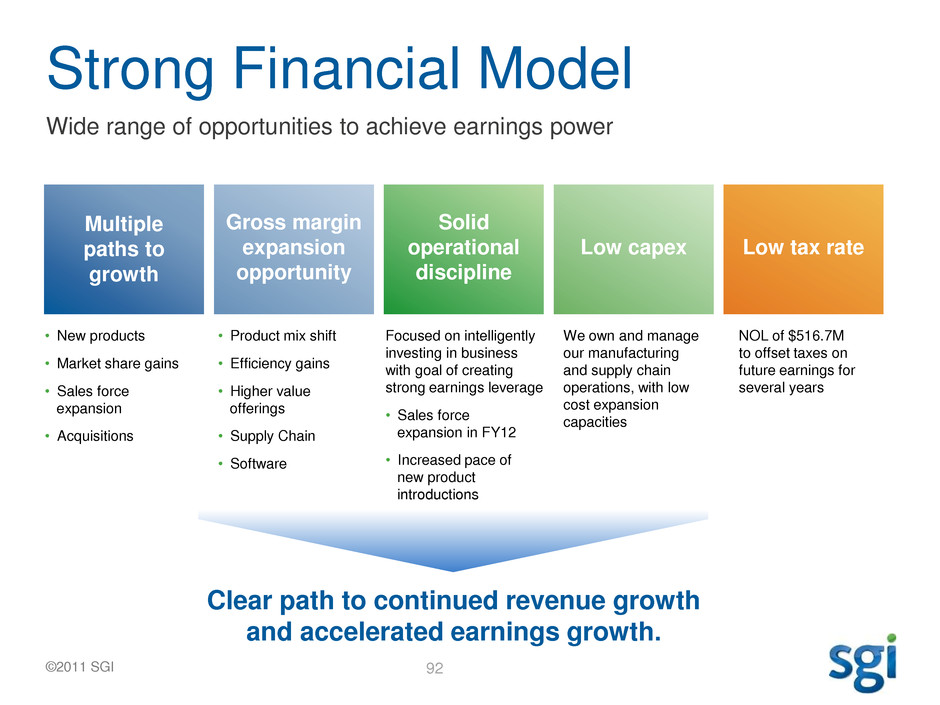

Gross margin

expansion

opportunity

Solid

operational

discipline

Low capex Low tax rate

Strong Financial Model

Wide range of opportunities to achieve earnings power

Clear path to continued revenue growth

and accelerated earnings growth.

• New products

• Market share gains

• Sales force

expansion

• Acquisitions

• Product mix shift

• Efficiency gains

• Higher value

offerings

• Supply Chain

• Software

Focused on intelligently

investing in business

with goal of creating

strong earnings leverage

• Sales force

expansion in FY12

• Increased pace of

new product

introductions

We own and manage

our manufacturing

and supply chain

operations, with low

cost expansion

capacities

NOL of $516.7M

to offset taxes on

future earnings for

several years

Multiple

paths to

growth

93 ©2011 SGI

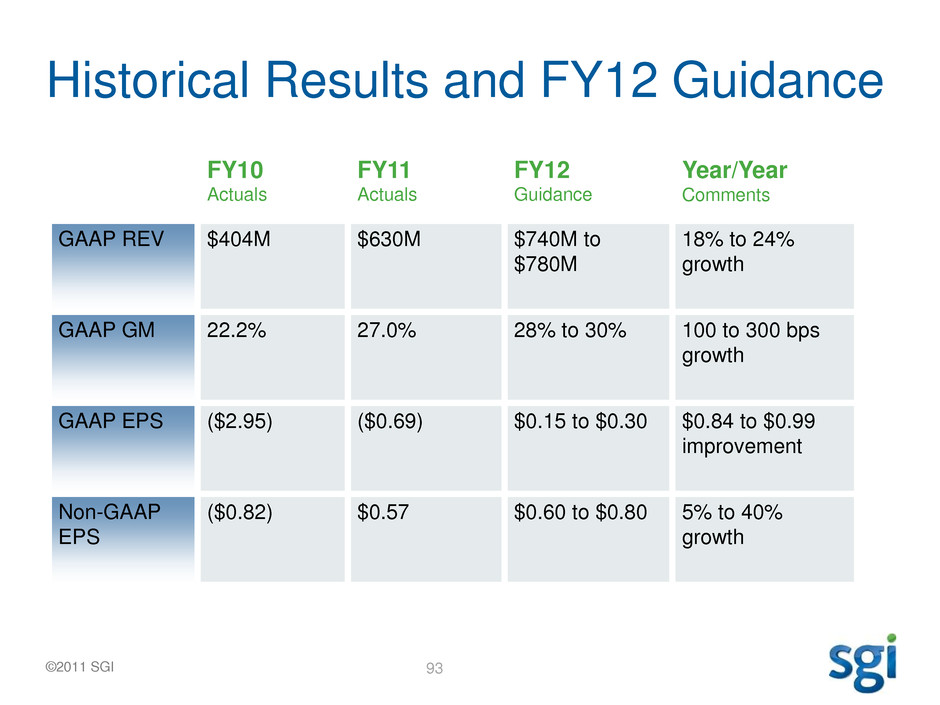

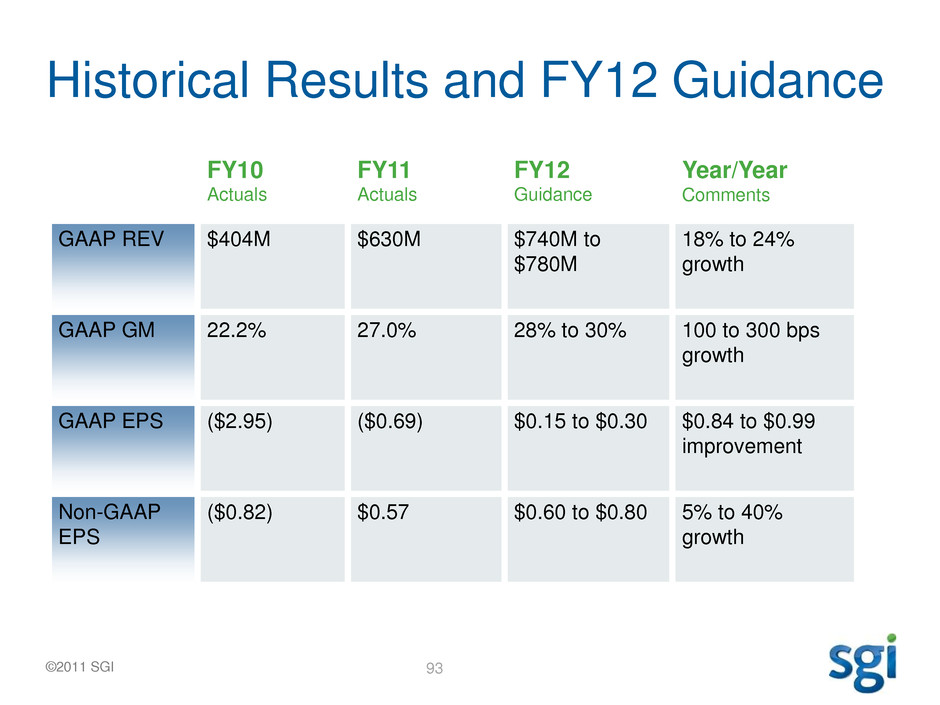

FY10

Actuals

FY11

Actuals

FY12

Guidance

Year/Year

Comments

GAAP REV $404M

$630M $740M to

$780M

18% to 24%

growth

GAAP GM

22.2%

27.0% 28% to 30% 100 to 300 bps

growth

GAAP EPS

($2.95)

($0.69)

$0.15 to $0.30

$0.84 to $0.99

improvement

Non-GAAP

EPS

($0.82) $0.57

$0.60 to $0.80

5% to 40%

growth

Historical Results and FY12 Guidance

94 ©2011 SGI

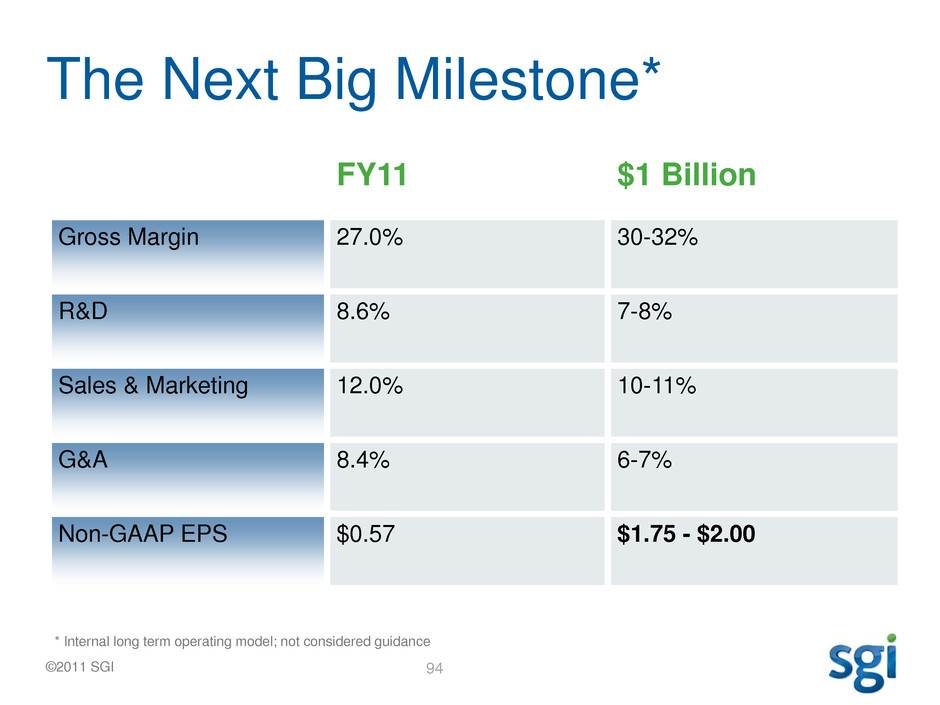

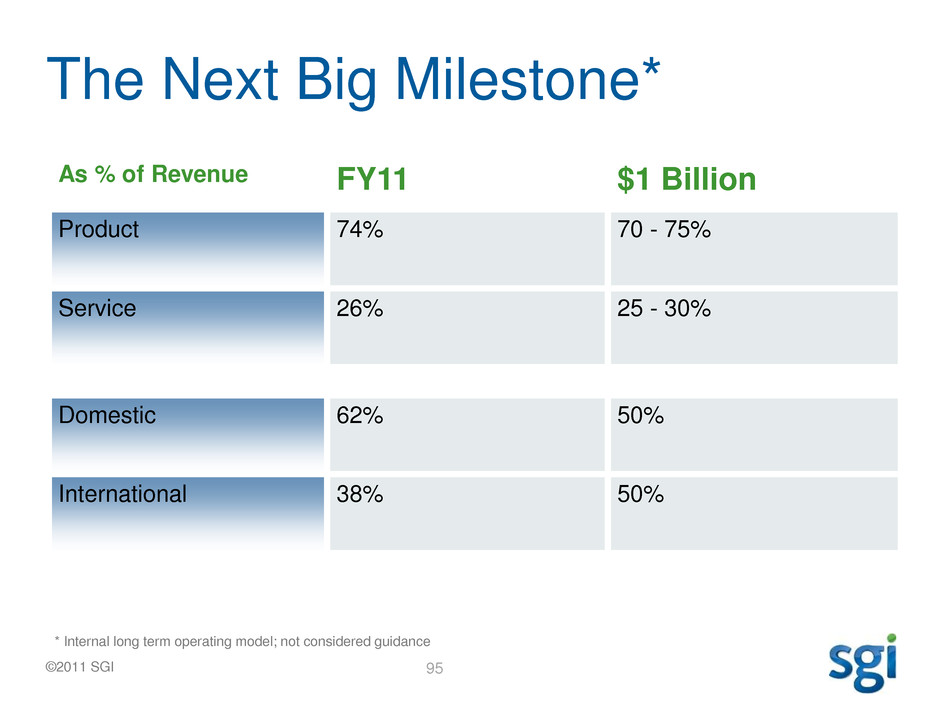

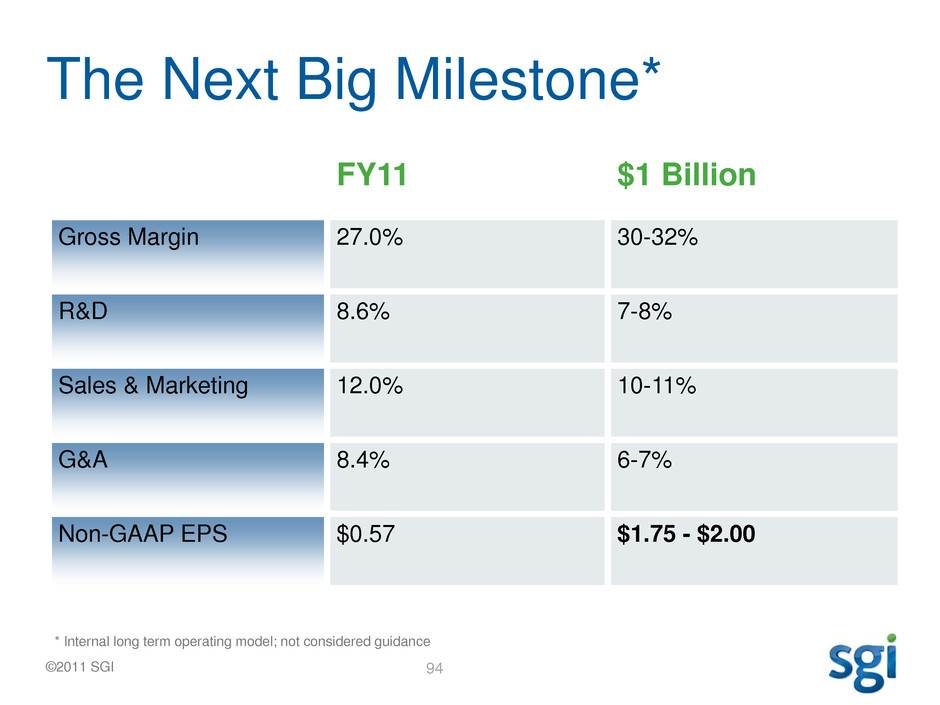

FY11 $1 Billion

Gross Margin 27.0%

30-32%

R&D

8.6%

7-8%

Sales & Marketing

12.0%

10-11%

G&A

8.4% 6-7%

Non-GAAP EPS $0.57 $1.75 - $2.00

The Next Big Milestone*

* Internal long term operating model; not considered guidance

95 ©2011 SGI

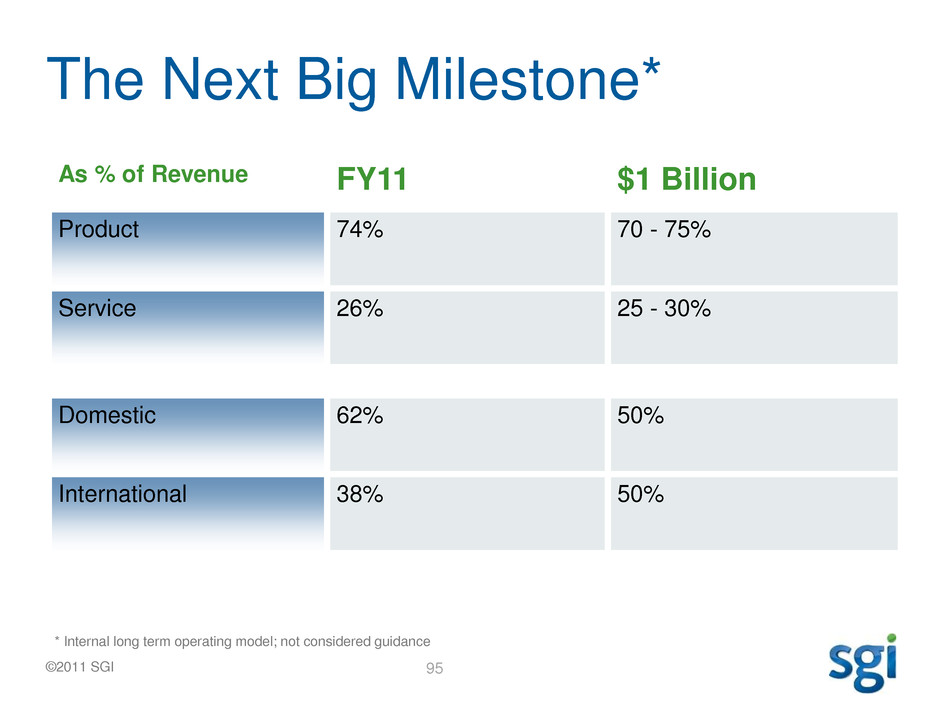

As % of Revenue FY11 $1 Billion

Product 74%

70 - 75%

Service

26%

25 - 30%

Domestic

62% 50%

International 38% 50%

The Next Big Milestone*

* Internal long term operating model; not considered guidance

96 ©2011 SGI

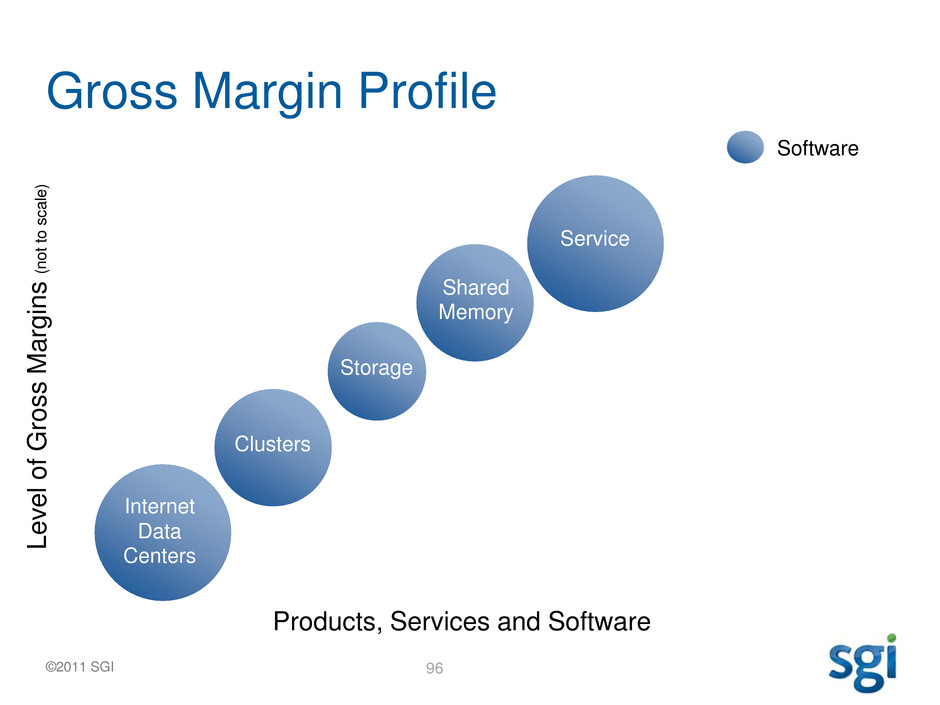

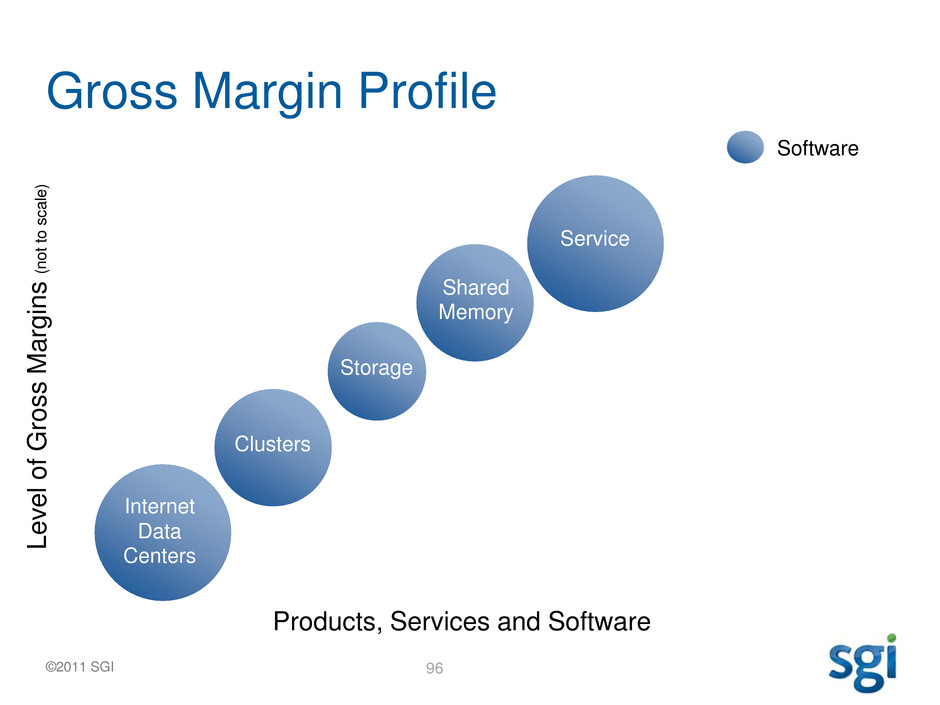

Gross Margin Profile

Internet

Data

Centers

Clusters

Storage

Shared

Memory

Service

Software

Products, Services and Software

Le

v

el

of

Gro

s

s

Margins

(n

o

t

to

scale

)

97

SGI Summary

Mark J. Barrenechea

President & CEO

98 ©2011 SGI

Top 10 Investor Questions

• Paths to growth

• Long-term operating model

• How we will compete and win

• Our view of the public sector

• Corporate priorities

• Approach to acquisitions

• Big Data opportunity

• Sales & Service Model

• GAAP Financials

• Earnings potential

99 ©2011 SGI

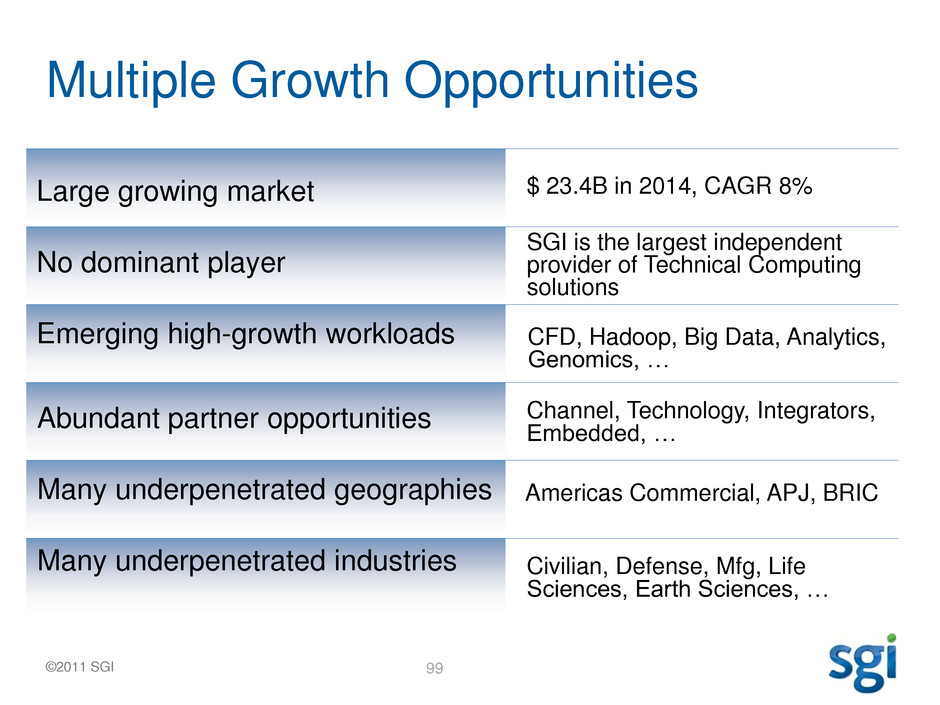

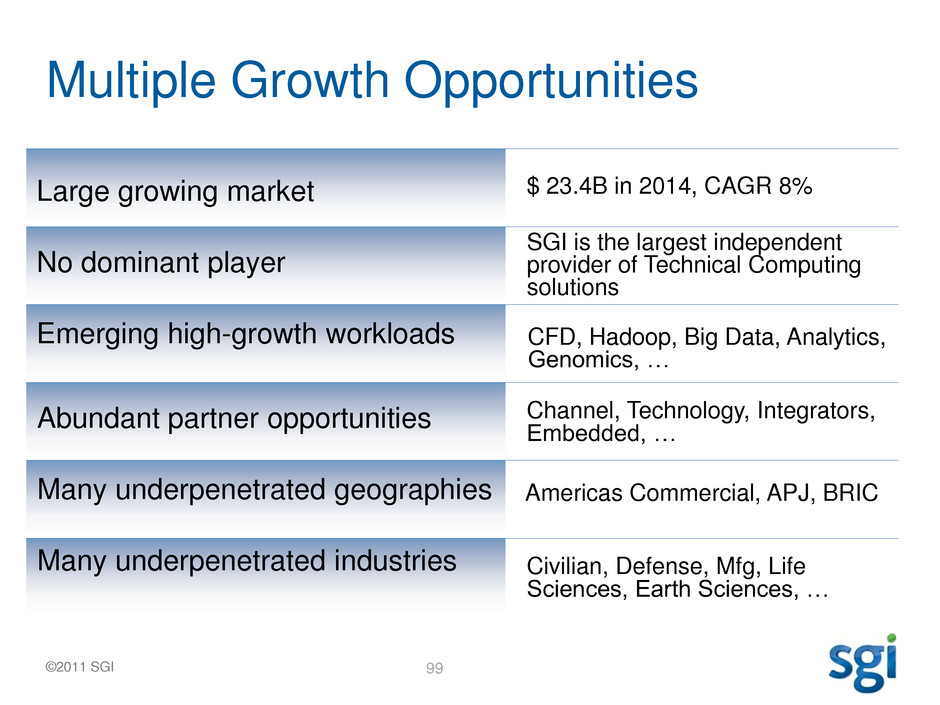

Multiple Growth Opportunities

Large growing market

No dominant player

Emerging high-growth workloads

Abundant partner opportunities

Many underpenetrated geographies

Many underpenetrated industries

$ 23.4B in 2014, CAGR 8%

SGI is the largest independent

provider of Technical Computing

solutions

CFD, Hadoop, Big Data, Analytics,

Genomics, …

Channel, Technology, Integrators,

Embedded, …

Civilian, Defense, Mfg, Life

Sciences, Earth Sciences, …

Americas Commercial, APJ, BRIC

100 ©2011 SGI

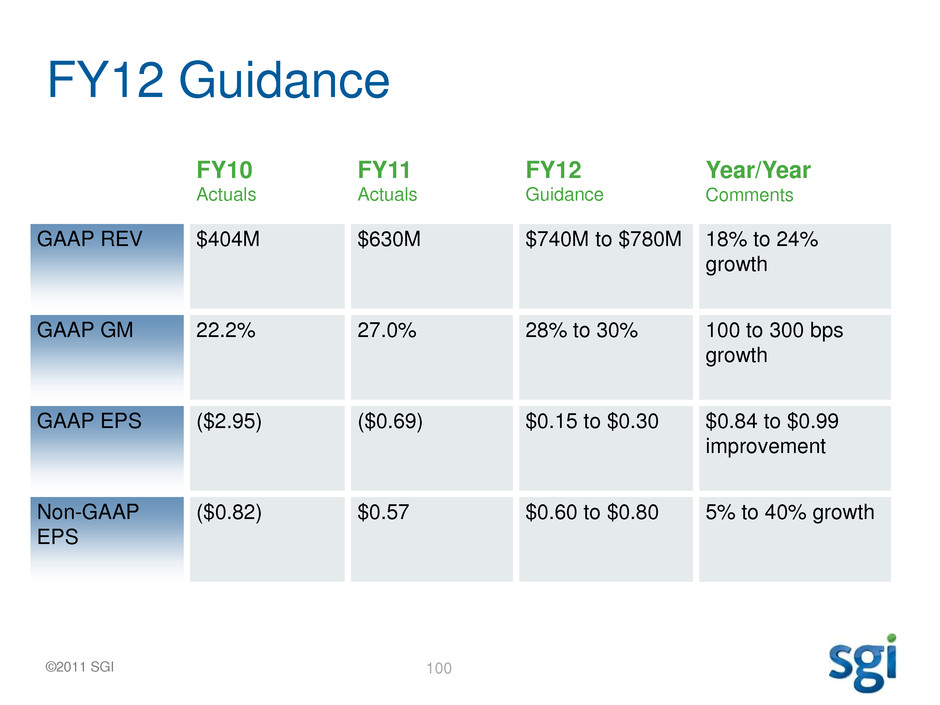

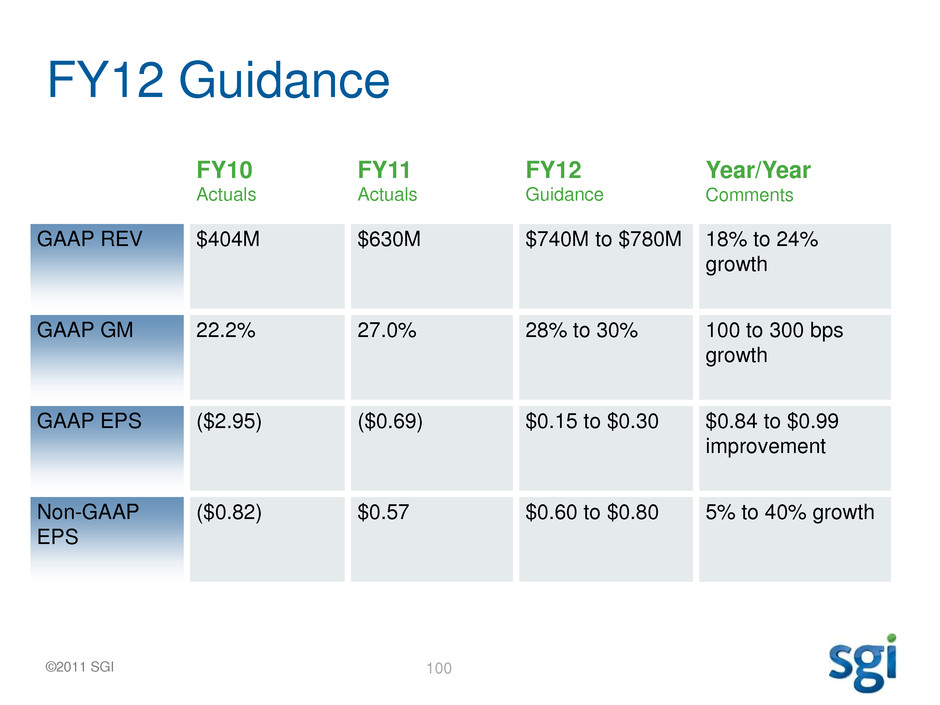

FY10

Actuals

FY11

Actuals

FY12

Guidance

Year/Year

Comments

GAAP REV $404M

$630M $740M to $780M

18% to 24%

growth

GAAP GM

22.2%

27.0% 28% to 30% 100 to 300 bps

growth

GAAP EPS

($2.95)

($0.69)

$0.15 to $0.30

$0.84 to $0.99

improvement

Non-GAAP

EPS

($0.82) $0.57

$0.60 to $0.80

5% to 40% growth

FY12 Guidance

101 ©2011 SGI

FY12 Priorities

• Deliver against our plan

• Expand our market share

• Drive business velocity with

innovation

• Strengthen our culture and

framework for scale

• Integrated solutions, including

software

102 ©2011 SGI

Great Customers. Great Results.

Customer-centric Culture

Great

Company

Great

Solutions

Great

People

103 ©2011 SGI

Q&A

104 ©2011 SGI

105 ©2011 SGI

Appendix

106 ©2011 SGI

FY10

FY11

GAAP EPS ($2.95) ($0.69)

Share-Based Comp 0.16 0.19

Amort. Of

Intangibles

0.21

0.27

Restructuring

0.17 0.17

ASC 985-605 and

ASC 605-25

1.41 0.29

Acquisition Related

and Other

0.18 0.34

Non-GAAP EPS ($0.82) $0.57

GAAP to Non-GAAP EPS Reconciliation