June 16, 2016

Dear Shareholder:

In each of the last few years I have begun this letter with a word or a phrase that attempted to sum up the current state of AeroGrow. Three years ago I used the term “transformational” to describe the deal we had just completed with the Scotts Miracle-Gro Company. Two years ago I began this letter by saying “it’s an exciting time here at AeroGrow” as we grew our sales by over 90% and posted our first meaningful EBITDA profit in the company’s history. Last year I focused on “Growth, Innovation and Sustainability” as we looked to refine our distribution, improve margins and further develop our product line.

As we begin our fiscal 2017, I’m not sure a single word or phrase does justice to everything I believe the company is poised to achieve. Over the past few years we’ve positioned the company to accomplish great things…and I’m optimistic that our payoff will accelerate in the coming year. We’ve worked hard to design innovative products with broad market appeal, develop and optimize our channels of distribution, build the brand through effective consumer advertising and significantly improve our gross margin. I think as we wrapped up FY 2016 it became apparent that we had “checked the box” on each of these key initiatives and we’re now ready for what I hope will be a period of significant growth on both the top and bottom lines. Given all of this, an appropriate phrase to describe our circumstance as FY 2017 begins might be “Inflection Point.”

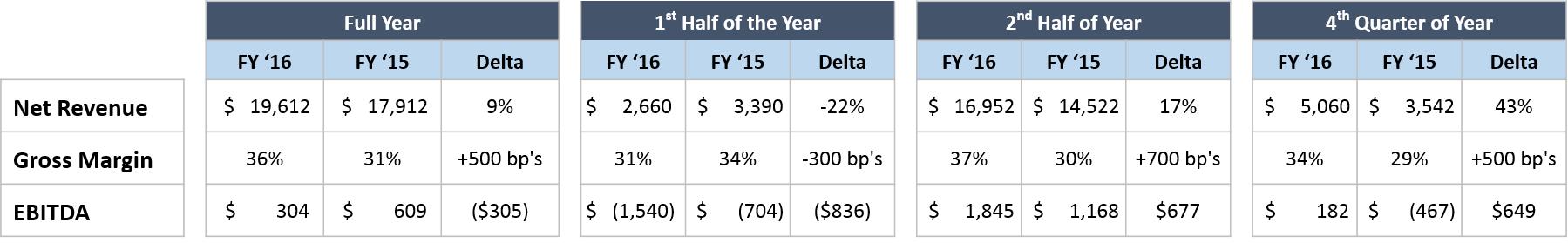

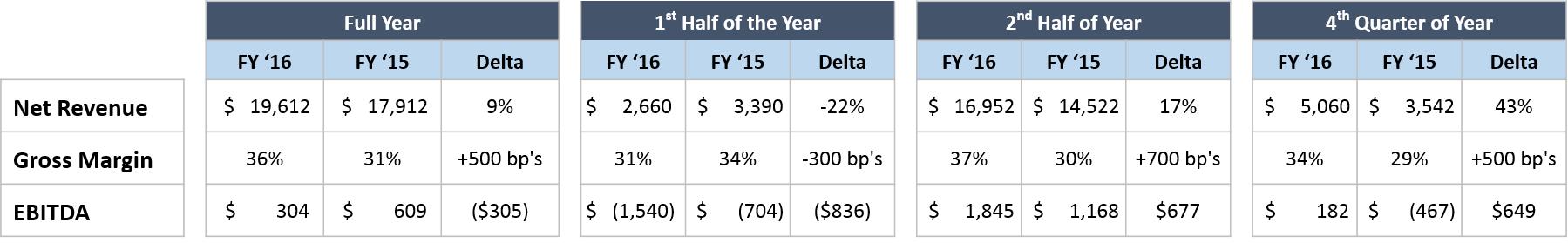

Our core strategy for Fiscal Year 2016, which ended on March 31, 2016, was to slow our growth a bit to ensure laser focus on making improvements to our margins and refining our distribution strategy. We grew by 10% last year (with accelerated growth in the second half of the year highlighted by 43% growth in our Q4) and improved our gross margin by nearly 500 basis points to 36%.

We also launched several new products that were very well received in the market and successfully tested a series of broad television and digital advertising campaigns that helped drive sell-thru. Most important, we continued to build several proven distribution channels – while unlocking several new ones – that give us multiple, proven platforms through which to sell our products. All of this resulted in our second consecutive year of positive EBITDA earnings – the first time in the company’s history this has been achieved.

So we begin our FY 2017 with a lot of momentum. Instead of having to redesign our product line, we get to refine it; instead of having to unlock advertising and distribution, we get to extend what we know is working; and instead of having to improve our gross margins, we get to leverage the big improvements we’ve already made (with more planned). So given all of this momentum, I’m excited to tell you about the details of our plans for the year ahead, but let’s first take a look back on Fiscal Year 2016, which ended on March 31, 2016.

RECAPPING FISCAL YEAR 2016:

Fiscal 2016 was marked by distinct differences in the first half of the year vs. the second half. For those of you who have kept up with the company over the past few years, you’ll recall that when we first applied the Miracle-Gro brand to our product name, we were hopeful that this would unlock our ability to sell at mass retail given the vast consumer recognition of the Miracle-Gro brand. While this brand has helped us in a lot of ways, it turned out that brand alone was not enough to carry us at mass retailers such as Walmart, Sam’s Club, The Home Depot, Costco and others we tested in during the holiday season of 2015.

Coming off of our holiday and spring selling season one year ago, we were having great success in selling on line at Amazon and other top tier .com retailers, but it became clear that we had to pivot in our distribution strategy related to selling in-store. It also had become clear to us that in order to make in-store retail distribution work we had to develop an effective marketing program to drive awareness of the indoor gardening category generally and of our brand specifically so that more consumers would place the AeroGarden in their consideration set for purchase.

While refining our distribution strategy and working to expand our marketing efforts, we also undertook a massive product overhaul that would allow us to introduce numerous new products last fall while taking significant costs out of our supply chain (gross margin improvement was another of our key objectives for last year).

The effect of all of these factors led to the distinct differences between the first and second halves of the year that I noted earlier. I’ll speak to all of these developments in a bit more detail below, but the following chart clearly depicts the difference in the first vs. the second half of our year. In the first half our sales actually fell by 22% as we pivoted toward different distribution channels and our gross margin actually fell as we sold out our older product models. But our second half marked very significant progress as we grew by over 17% and saw a 700 basis point improvement in our margins. This momentum was even more amplified in our 4th quarter as we grew by 43%, improved our EBITDA profit by $649,000 and posted just the second Q4 EBITDA profit in the Company’s history.

I think you can see why I’m so excited about our progress in FY 2016 and feel as though we are poised to capitalize on the momentum that we achieved over the course of last year and leverage our collective improvements into significant gains in FY 2017.

Let’s now take a closer look at the factors that drove this improvement. When last year began, I outlined 7 key initiatives that we identified as being critical to our success in Fiscal 2016. I think it’s important for us to briefly look back and evaluate how we did in accomplishing our key goals from last year, so following are a few remarks about each of these key initiatives:

| 1. | Expansion of our retail distribution. To best understand our retail distribution, it’s helpful to divide them into .com and in-store. |

| · | .com: A year ago we saw significant promise in our .com channel, and that view was only underscored in FY 2016. Amazon is the big story for us…with YOY growth of nearly 80% -- off of what was already becoming a significant base. When you add growth at Amazon in Canada of over 300%, you can see that we have clearly unlocked a significant distribution channel. Net sales at Amazon were actually larger in FY 2016 than our own Direct Response business, and – for the first time in the Company’s history – gives us a proven, profitable “second leg of the stool” in addition to our DR channel through which can distribute our products. I can’t stress how important this is in building a long-term strategy…one that we can count on to grow and provide meaningful distribution. |

In addition to Amazon, we continued to see good progress in our .com channel with other on-line retailers such as Walmart.com, Costco.com/ca and others. While not a .com channel per se, we also had good success in selling on QVC. Our margins are not what we’d like when we sell on QVC, but the exposure and “demonstration” nature of the presentation is invaluable to us as we try to build awareness of the AeroGarden.

| · | In-store: A critically important achievement in FY 2016 was beginning to unlock in-store retail. As I noted earlier, last year we tested in-store at places like Walmart, Sam’s, Costco, Home Depot and others…and we sold a lot of AeroGardens. But we had a lot of challenges too with product placement (often in the garden center during the holiday season – when nobody goes there), timing of store sets, retailer returns, etc. But amidst these challenges we also saw opportunities: When we were placed in housewares departments at the right time and had appropriate point of purchase presentations, we actually sold quite well. |

So over the course of last year we pivoted on our distribution strategy and began testing at more traditional housewares retailers, and the results were extremely encouraging. We had a successful 400 store test at Bed, Bath & Beyond during the holiday season and a successful 135 store test at Sur La Table this spring. Both of these retailers (and others) will be rolling out with us this fall. It’s also worth noting that we did very well on BedBathandBeyond.com and SurLaTable.com, and had a very strong test on Williams-Sonoma.com as well.

I want to conclude my remarks on our distribution by stressing that I believe that at some point we will successfully sell at Walmart, Costco, Home Depot and other mass retailers. I just think it’s going to take driving more consumer awareness of our product so that when people encounter the AeroGarden at one of these stores, they already know what it is and we don’t have to try and do the entire selling job at the retail store. This is where we had hoped that the Miracle-Gro brand would carry the day, but we’re going to have to supplement it with more traditional brand building as well.

| 2. | Extending our selling season. Our business model has always placed an emphasis on our selling during the holiday season with a modest second season being the calendar first quarter. We placed a particular emphasis this past year on ramping up the January – April period this year, with encouraging results. In our 4th Quarter (ended March 31st) net sales were up 43% and we posted a solid EBITDA profit in this period. We’ll look to continue expanding our selling efforts in what might be called the “indoor gardening season.” I don’t know that we can ever expect this season to be as big as November – December, but I do think it can be much more sizable than it has been in the past and a major contributor to our annual sales and profitability. |

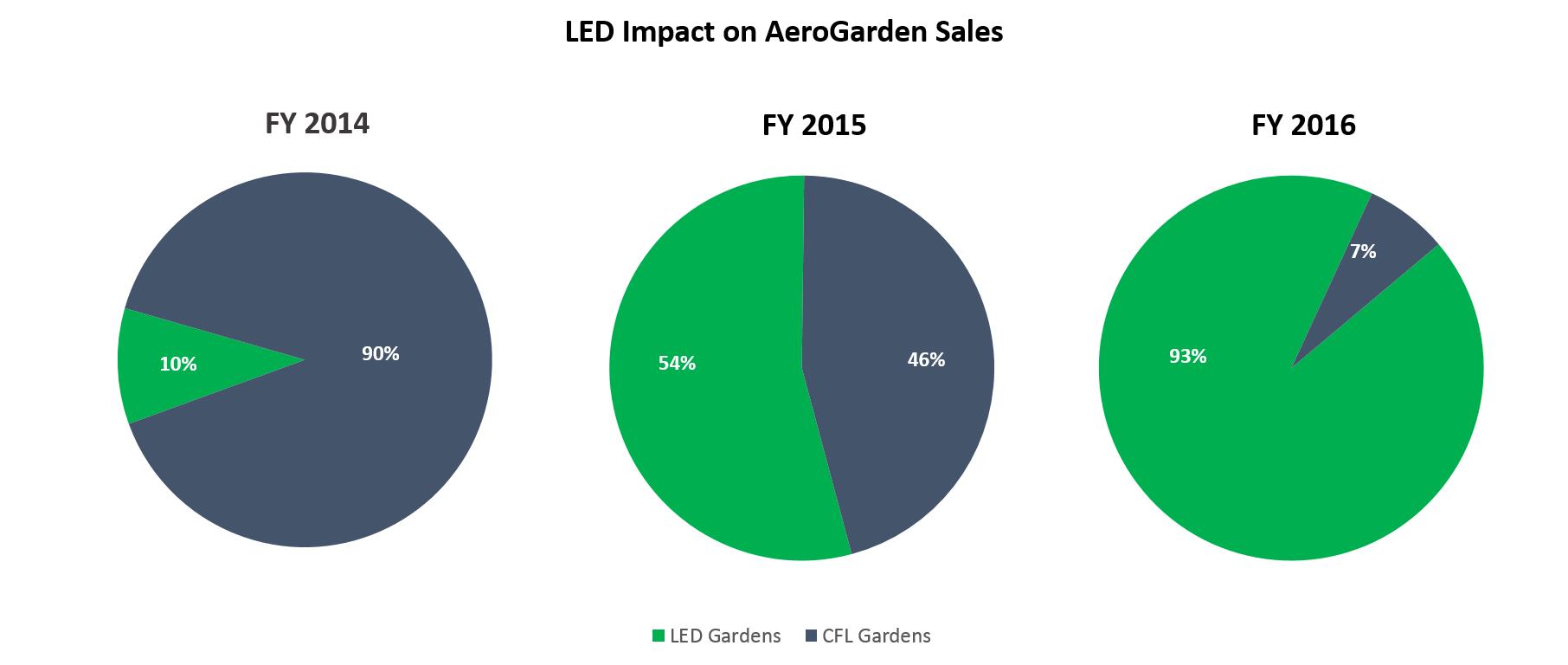

| 3. | Innovation: I think we hit a home run with our new product launches in FY 2016. Our efforts were based on the fact that consumers have so thoroughly embraced LED lighting systems on their AeroGardens. The following chart indicates just how rapidly consumers have migrated to AeroGardens with LED lights over the past three years, from 10% in 2014 to over 93% last year. |

In addition to greater plant growing efficacy, a better long term consumer experience and lower operating costs, LED grow lights allow us to create much thinner, sleeker designs that are more appealing to our core target market.

| Beyond migrating virtually our entire line of AeroGardens to LED lights, we also worked on introducing two new products last year: the Harvest and the Bounty, which are shown at the right and on the next page. The Harvest line has allowed us to capture the right footprint for use on the kitchen countertop and was the product that we used in our successful tests at Bed, Bath & Beyond and Sur La Table. The Bounty, our biggest garden ever with 9 pods and a 45 watt LED lighting system, was an immediate hit on Amazon and AeroGarden.com and a stainless version of the product has been working well with Williams-Sonoma. | AeroGarden Harvest |

| We also introduced touch screens and other features that have proven popular with consumers. FY 2016 was a great year in our product development efforts…and I’m confident that we’ll continue on this path in FY 2017 and beyond. | AeroGarden Bounty |

| 4. | Improved Gross Margins: While beginning to unlock in-store retail distribution and bringing several great new products to market were critical high profile achievements, perhaps our most important success in FY 2016 was improving our gross margin. This was a critical goal last year – we just had to generate more contribution per dollar of sales in order to fund the increased advertising and to generate more profitability over the long term – and I’m very pleased to report that we improved our year-over-year margins by nearly 500 basis points (and by over 700 basis points in the second half of the year after our new products were introduced). |

Three factors are responsible for these improved margins: (1) a focus on cost outs in our Asian and domestic supply chains; (2) related, our new products were designed with significant efficiencies in mind – we’re now making products that work better than ever at lower costs than we’ve ever achieved; and (3) improved pricing strategies in the market. Our new products allowed us to establish higher prices and we did a better job of holding price in the market than we ever have before.

Another important factor is that these margin improvements are now “baked in” to our costs and pricing model. I think we can hold these margins while looking for additional improvements in FY 2017 and beyond.

| 5. | International Distribution: Another key goal of ours in FY 2016 was to begin testing international distribution. We began testing on Amazon.uk (in the UK) in January of this year. While small, the sales results are very encouraging (for perspective, January – April sales in the United Kingdom were 65% higher in our initial testing than they were on Amazon in Canada in the same period, a market that grew to nearly $1MM in sales for us last year and is set to grow quite a bit more). These early results give us a great deal of confidence that we can roll out on Amazon not just in the UK but throughout the European Union. We’re planning to expand our testing using the Amazon platform to France and Germany later this year. |

| 6. | Brand Awareness through Media: As FY 2016 began, we were convinced that we needed to make some big changes in how we made target consumers aware of our product. In last year’s letter I stated the following: |

“I think the biggest issue that we’ll face in the coming year is doing everything we can to ensure retail sell-thru as we drive to expand our footprint. As leaders in a nascent category, it falls to us to both drive awareness of the indoor gardening category generally and of our brand specifically. I’m not at all sure that when consumers encounter our product on retail shelves that they know what it is or what its benefits are – or understand why they might need it.”

So we set about addressing these challenges and I’m pleased to report that we launched a television and digital media campaign with 15, 30, 60 and 120 second spots last November that proved to be quite effective. While it’s difficult to measure exactly the impact of media on sales, through our own web site we were able to detect meaningful signals of sales activity that correlated with the times that the ads were on air. In addition, we believe that some of the success we had with both on-line and in-store retailers can be attributed to this campaign as well, and we will look to expand this program in FY 2017.

Media isn’t inexpensive…and we have made a commitment to building our brand over the next few years. There is little doubt that we could have had improved bottom line results last year had we not spent what we did on media (we spent over $3MM on advertising in FY 2016), but we thought it was important to execute this program as we build the company for the long-term.

In case you missed it, you can see the two minute version of the spot at http://www.aerogarden.com/agtv.

| 7. | Capital: Scotts Miracle-Gro provided us $6MM in short term working capital and it was fully re-paid in April of this year. We’ll need additional short term funding to continue fueling our growth in FY 2017, and I am confident that we will again have access to the capital that we’ll need and will be able to fully re-pay any debt quickly as our receivables come due. |

So…that’s the recap of FY 2016. All in all, I think it was a very successful year as we accomplished all of the operational goals that we set forth while adding only 2 people to our team, bringing our Full Time head count to 23 (excluding seasonal and Customer Service personnel) at the end of FY 2106. Another reason I think we’re poised to leverage our business in the coming year is that we believe we can grow substantially while only adding a few additional FTE’s.

Now the key for us is to build on this success and leverage everything we’ve accomplished into a strong FY 2017. It’s definitely an “Inflection Point” for our growing business.

A LOOK AHEAD…OUR PLANS FOR FISCAL YEAR 2017:

I hope you’ll agree that AeroGrow has come a very long distance over the past few years. I am extremely proud of the progress that we’ve made on a number of fronts, notably distribution, profitability, product design and efficacy, gross margins and brand building. With the help of a committed partner in Scotts along with a highly dedicated team here at the company, I think we are on the precipice of accomplishing some great things.

Now we have to do it.

As I outlined in the opening section of this letter, we begin FY 2017 with a lot of momentum having made big improvements to our product line and developing a media program that effectively drives brand awareness and sell-thru. We improved our gross margin by nearly 500 basis points last year and believe we can improve this even further in the coming year. And perhaps most important, we have begun to unlock multiple channels of distribution, which is ultimately the key to our growing a significant business.

Given the promising developments over the last year, it is my intent that in FY 2017 we can now bring everything together and begin delivering consistent growth to both the top and bottom lines, while making the investments in product development and brand building that will ensure that we are able to deliver good growth and earnings for a long time.

Over the past few years I have outlined a very vigorous set of initiatives that we would be undertaking in the coming year. From a complete change in our supply chain to a full make-over in our product line to launching our products in foreign countries, we’ve successfully taken on some big challenges. The theme of this coming year will be to build on the foundation we’ve built over the past several years…with an eye toward consistently delivering strong top and bottom line performance in the short and long terms. Here’s what we’ll be focused on:

| 1. | Expansion of our Distribution: As I touched on earlier in this letter, we made great progress on distribution over the past year. Now our plan is to further leverage the channels that are proven, expand those that have successfully been tested and continue testing new channels for future expansion. Here’s a brief comment on each: |

| · | Proven Channels: The AeroGarden has become a proven seller on many on-line platforms such as Amazon.com/ca, Costco.com/ca, Walmart.com and others. We’ve had excellent line reviews with each of these buyers this spring and we have plans for aggressive expansion with each of these on-line retailers this fall. |

| · | Expand Channels that have been successfully tested: We made a concerted effort to establish new channels of distribution last year – particularly in the housewares channel. Look for us to significantly expand our presence in this channel this year, with full store roll-outs at Bed, Bath & Beyond and Sur La Table. Williams-Sonoma is also off to a good start for us and we’ve had great results on QVC’s kitchen shows. |

| · | New Channels: We want to continue testing new venues for the AeroGarden. We have small tests planned for this year in the Home Center and hardware channels, and will look to unlock areas for continued growth in future years. |

In addition to these retail channels, our Direct Response business continues to produce strong results for us. We’ll also be looking to expand our international efforts with a ramp up in the UK and planned tests in other EU markets.

| 2. | Product Development: We have tried to make innovation a cornerstone of our company’s culture…so we will always be looking to bring new products, features and functions to market. FY 2017 will be no different, but rather than changing the fundamental look and feel of several of our products, this year we’ll be doing a bit more fine tuning. We have three big product development goals for this year: |

| · | Wi-Fi capabilities. This is a significant undertaking, but we’re hopeful that by later this year AeroGardeners will be able to communicate with their garden and track its progress on their smart devices. From receiving reminders on when to water and fertilize the garden to making it super-easy to re-order seed kits and supplies, we think this is a big idea that will drive further engagement with our customers. |

| · | Beautiful finishes. A central part of our strategy to effectively unlock our selling in the Housewares channel was to design AeroGardens to look more like main-stream countertop products that accent any kitchen. We’ve tried to take on much more of a Kitchen-Aid or Keurig look than we ever have in the past. I think a lot of the success we were able to achieve at Bed, Bath and Beyond, Sur La Table, QVC and Williams-Sonoma can be attributed to this strategy. In the coming year, look for us to escalate our efforts on this front. We’ll be introducing more stainless steel models, many in colors and high-end finishes that are in step with modern kitchens. We’ll also be upgrading the control panels on several of our models to make them better looking and easier to use than ever. |

| · | BIG Gardens. We think the AeroGarden has become the undisputed leader in the countertop gardening category. And now we’re thinking even bigger. We’re working on a product – tentatively named the AeroGarden Farm – that will allow AeroGardeners to grow even bigger crops and generate even bigger harvests. Our goal is to help a family perpetually grow all of the fresh herbs, salads, tomatoes, etc. they’ll ever need – without having to purchase these items at a store – and to do it year-round. It’s a potentially transformational concept, and we’re hoping to have this product ready for market by the spring of 2017. |

In addition to these major development efforts, we’re always working on ways to make AeroGardens work better. More powerful LED lights, new pump designs, innovative seed kits, and many other efforts are all part of our everyday development efforts. If you’re ever in or around Boulder, Colorado and want to stop by and see our labs, just let me know.

| 3. | Continued efforts to build brand and category. I want to share a quick story regarding brand awareness. Two weeks ago I was checking in for a Buyer meeting at the Amazon offices in Seattle. I handed the receptionist my business card and she said “AeroGarden…I love the AeroGarden! I can’t wait to own one.” Two years ago it was rare that anyone had ever heard of the AeroGarden, today it seems as though more and more people are familiar with our product. So I think our efforts to build brand and category awareness are working…but it’s a big job. |

We spent aggressively last year in marketing support and we’ll look to accelerate these efforts in the coming year. In addition to supporting our retail partners with funds designed to optimize AeroGarden sales, we plan to extend our general media buys on television and digital platforms – hopefully by as much as double last year. We are committed to making the investments in advertising, promotion and media in order to drive general awareness of the AeroGarden brand for the long term. We believe this is an essential component of our strategy to drive broader distribution.

| 4. | Further improvements to our Supply Chain and to our Gross Margins: We’ll continue to aggressively pursue cost-outs of our products – both in Asia and domestically – and to refine our supply chain so that we are able to be more nimble in ordering and receiving goods. We’ve come a long way on this front…but I do think there is still room for improvement in our supply chain and it is a constant focus of our management team. |

These will be the key areas of emphasis that we will be focusing on in FY 2017 – which began on April 1, 2016 and really gets going as we head into our busy selling season, which starts around November 1. It is refreshing that this year’s key challenges are to refine what is working rather than embarking on altogether new projects. I think this speaks to the emerging strength of the Company and underscores my belief that we have a lot of momentum as we enter FY 2017.

I’m sometimes asked why don’t we just grow rapidly and worry about earnings down the road? Or why don’t we invest even more in product development to build AeroGardens that generate even bigger crops? Others wonder why we don’t focus more on the bottom line and generate bigger profits in the short term? The answer is that I’ve been seeking the right balance of all of these factors so that we can build a significant, sustainable business for the long term. And I believe that in FY 2017 we will begin to see this Company emerge…with good top and bottom line performance and a product line and brand of which we can all be proud.

SUMMARY:

How big can AeroGrow become? The truth is that I don’t know, but I believe it can become a much bigger company than it is today…one that consistently generates good bottom line results while bringing innovative new products to market. The AeroGarden is a product that is “right for the times,” with consumers wanting fresh, safe, convenient food more than ever. And I feel like we’ve really just begun to unlock our North American distribution with Europe and other markets showing considerable promise. Now with improved margins and our branding efforts starting to bear fruit, I’m optimistic that we’re entering a period of strong, sustainable sales and earnings growth.

We are committed to building THE leading company in the indoor gardening market – a market that we believe more than ever is set for significant growth. Given the continued emergence of this market and all of the progress we’ve made within our Company, I think we’re poised for FY 2017 to be our “Inflection Point”.

In closing, I want to acknowledge all of our key stakeholders and thank you for your outstanding support of AeroGrow. I also want to acknowledge the entire team here at AeroGrow and our partners at Scotts Miracle-Gro. I truly appreciate everyone’s extraordinary dedication to making this Company a special one.

Thank you.

/s/ J. MICHAEL WOLFE

J. Michael Wolfe

President & Chief Executive Officer