[LETTERHEAD OF SONNENSCHEIN NATH & ROSENTHAL LLP]

February 3, 2009

VIA EDGAR AND FEDERAL EXPRESS

United States Securities and Exchange Commission Division of Corporation Finance 100 F Street, N.E. Mail Stop 3561 Washington, DC 20549-3561 | |

| Mr. Steve Lo

Mr. Ryan Milne |

| Re: | American CareSource Holdings, Inc. Form 10-K for Fiscal Year Ended December 31, 2007 Filed on March 31, 2008 File No. 001-33094 |

Dear Messrs. Lo and Milne:

By letter dated January 14, 2009 (the “SEC Letter”), the staff (the “Staff”) of the Securities and Exchange Commission provided a comment on the annual report on Form 10-K for the fiscal year ended December 31, 2007 of American CareSource Holdings, Inc. (the “Company”). This letter sets forth the Company’s response to the comment contained in the SEC Letter. For your convenience, we have reproduced below in italics the Staff’s comment and have provided the Company’s response immediately below the comment. The headings and numbered paragraph below correspond to the headings and paragraph number in the SEC Letter.

Notes to Consolidated Financial Statements, page F-6

Note 1. Summary of Significant Accounting Policies, page F-6

Revenue recognition, page F-7

| 1. | Please provide us with a more complete understanding of how you view your business model and define the arrangement using the terms found in paragraph 7 of EITF 99-19. Specifically, tell us who the Company views as the customer and the supplier in your transactions in addition to what service are being provided and what role the patient plays in the arrangement. If the ancillary service provided to the patient are excluded from the arrangement, help us understand what the Company’s costs of sales represent as it appears to be the only means in which the service provider is compensated for the ancillary service it has provided to the patient. If the patient is a party to the transaction as the customer, we are unable to understand how you have concluded that the Company is the primary obligor rather than the service provider. |

Terms Used

In the Company’s response, the following terms are used and are defined as set forth below:

“ancillary healthcare service providers” -- include non-hospital, non-physician services associated with surgery centers, free-standing diagnostic imaging centers, home health and infusion, dialysis, supply of durable medical equipment, orthotics and prosthetics, laboratory and other services.

“healthcare payor customers” - -- refers generally to health benefits plan sponsors, including preferred provider organizations, third party administrators, insurance companies and large self-funded employers; these healthcare payors are the Company’s customers.

“patient” -- the individual or group that as an insured/beneficiary has insurance coverage or similar healthcare benefits under insurance contracts or similar arrangements with the healthcare payor.

Summary

The Company views its healthcare payor clients as the customers in its transactions and views the Company as the supplier of services to those customers. These healthcare payor customers are in the business of providing insurance coverage or similar healthcare benefits coverage to individuals and groups for defined healthcare expenses or maintain third party administrator or similar service arrangements with companies that provide insurance coverage or similar health benefits coverage to individuals and groups. They engage the Company to provide them with a particular set of services, focused on the management of a comprehensive array of ancillary healthcare services that the healthcare payors have agreed to make available to their insureds or beneficiaries or for which they have agreed to provide insurance coverage.

The patient does not play any direct role in the Company’s relationship with its healthcare payor customers. The patient has a relationship with the healthcare payor. He or she has insurance coverage or similar healthcare benefits under insurance contracts or similar arrangements with the healthcare payor, and, as an insured/beneficiary, obtains the benefits of his or her own with the healthcare payor by using the ancillary healthcare service providers contracted by the Company and made available to the Company’s healthcare payor customer. The patient and the Company have no relationship; the patient does not pay any insurance premium to the Company, does not look to the Company for insurance coverage or healthcare benefits and does not make any payment to the Company when he or she receives, as an insured/beneficiary, services from an ancillary healthcare service provider.

In accordance with its business plan, the Company has assembled a network of ancillary healthcare service providers through separately negotiated contracts. The Company then has marketed this network to the healthcare payors. The cost of sales includes the amounts paid by the Company to ancillary healthcare service providers pursuant to these separate contractual agreements between the Company and the service providers. The Company believes that accounting for these payments as cost of sales is appropriate because of the Company’s position that (i) its healthcare payor clients are the customers in its transactions, (ii) the Company is the supplier of services to the healthcare payor customers, who view the Company as the provider of all of the services under the Company-healthcare payor customer contracts and (iii) for the reasons discussed herein, the Company is the primary obligor in its transactions. There is no contractual relationship between the payor customer and the provider (in fact, the Company’s agreements include provisions prohibiting such relationships) and the Company has complete latitude in negotiating the price of the delivered services.

These matters are discussed in further detail below.

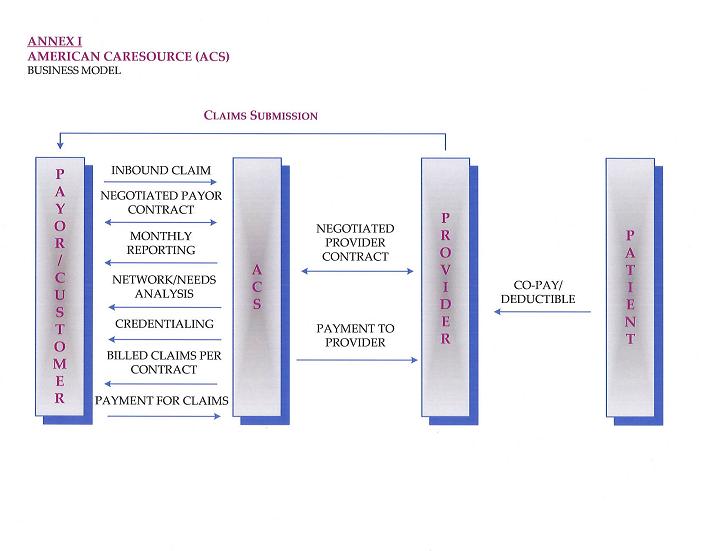

In addition, to provide you with a more complete understanding of how the Company views its business model, an overview of the business model is included below. For your further reference, the Company is providing the diagram attached as Annex I to illustrate its relationships with its healthcare payor customers and its contracted ancillary healthcare service providers.

Discussion

A primary factor in assessing the “gross” vs. “net” issue under EITF 99-19 is whether the company is the “primary obligor.” The Company’s view is that it is the primary obligor in its transactions because it is responsible for providing the services desired by its customers, which paragraph 7 of EITF 99-19 states is a “strong indicator” of a company’s primary obligor or principal role in a transaction.

As noted above, the Company’s customers are its healthcare payor clients. They engage the Company to manage a comprehensive array of ancillary healthcare services that the healthcare payors have agreed to make available to their insureds or beneficiaries or for which they have agreed to provide insurance coverage. The typical services the healthcare payor customers require the Company to provide include:

| | · | providing a network of ancillary healthcare services providers; |

| | · | providing claims management, reporting and processing and payment services; |

| | · | performing network/needs analysis (to assess the benefits to the healthcare payor customer of adding additional/different service providers to a provider network); and |

| | · | credentialing network service providers. |

The nature of the Company’s contractual relationships with its healthcare payor customers and the ancillary healthcare service providers supports the Company’s view that it is the primary obligor. The Company has distinct, separately-negotiated contractual relationships with its healthcare payor customers, on the one hand, and the ancillary healthcare service providers, on the other. The Company does not negotiate agreements with service providers “on behalf of” its payor customers and does not hold itself out as the agent of the payor customers when negotiating the terms of the Company-service provider contract. There are no agreements directly between the Company’s payor customers and the service providers, nor are there any agreements where the Company, the payor customer and a service provider are all co-parties. In fact, the Company’s agreements include provisions prohibiting direct payor-provider agreements or arrangements for ancillary healthcare services so as to maintain the separate and distinct nature of the Company’s agreements with its payor customers, on the one hand, and the service providers, on the other. Further, although the payor customers understand that the Company has contracted with various service providers, they have no control over the terms of the Company’s agreements with the service providers.

In addition, the Company’s assumption of key performance-related risks also evidences its role as the primary obligor in its transactions. In the Company-payor customer relationship, the payor customer looks to the Company as the provider of all of the services under their contracts. The contracts between the Company and its payor customers make it clear that it is the Company’s obligation to deliver services under Company-payor customer agreements and that the payor customer will look only to the Company for performance -- not to the Company-contracted service providers or any other person. In other words, the Company’s responsibilities for providing the services under the Company-payor customer agreement exist and must be met irrespective of any agreement the Company has with the service providers. For example, one of the key services the Company must provide to the payor customer is access to a provider network that is sufficiently comprehensive and professionally qualified to meet each payor customer’s needs. Dissatisfaction with the number and type of available providers, their professional qualifications and the services they provide to patients all affect the Company-payor customer relationship and, if the Company fails to satisfy its payor customers’ needs, they may not do business with the Company.

The pricing/margin risk borne by the Company also illustrates the primary obligor nature of the Company’s role in its transactions. Because the Company negotiates its agreements with its healthcare payor customers and the service providers separately, it has complete discretion in negotiating both the prices it charges its healthcare payor customers and the financial terms of its agreements with ancillary healthcare service providers. Therefore, the Company’s profit is primarily a function of the spread between the prices it has agreed to pay the service providers and the prices the Company’s payor customers have agreed to pay the Company. There is no payor-guaranteed mark-up payable to the Company on the amounts the Company has contracted to pay the service providers, nor is there any agreement with the service providers to be paid a discounted rate by the Company based on the amount the payor is obligated to pay the Company. The Company bears the pricing/margin risk as a principal in its transactions because it is responsible for providing the agreed-upon services to its payor customers whether or not it is able to negotiate fees and other agreement terms with service providers that result in a positive margin for the Company.

A further indication of the Company’s principal role in its transactions can be found in the payment structure of the healthcare payor customer’s payments to the Company. The payments are not made on a commission basis, as is common when there is an agency relationship. The payors do not pay the Company a fixed dollar “processing fee” or similar amount per claim regardless of the amount billed in a claim, nor do they pay the Company a per claim fee based on a stated percentage of the amount billed in a claim.

The patient does not play any direct role in the Company’s relationship with its healthcare payor customers. The Company does not have any agreement or arrangement with any individual insured member or group. The patient is a client of the healthcare payor, and the insured/beneficiary-healthcare payor relationship is separate and distinct from the Company-healthcare payor relationship. The patient does not pay any insurance premium to the Company, does not look to the Company for insurance coverage or healthcare benefits and does not make any payment to the Company when he or she receives, as an insured/beneficiary, services from an ancillary healthcare service provider. Any payments made by patients (e.g., insurance premiums, deductions from wages, contributions to health and welfare plans) are made to the healthcare payor or other person contractually obligated to insure or indemnify the patient’s healthcare expenses or provide healthcare benefits (or, in some cases, a co-payment to a service provider).

The American CareSource Business Model

The Company’s business model centers around two sets of contractual relationships -- one with its healthcare payor customers and the other with ancillary healthcare service providers. The Company does not have any agreement or arrangement with any individual insured member, patient or group (these are the clients of our payor customers).

First, the Company contracts with its healthcare payor customers. These healthcare payors provide insurance or similar healthcare benefits coverage to individuals and groups for defined healthcare expenses or maintain third party administrator or similar service arrangements with companies that provide insurance coverage or similar health benefits coverage to individuals and groups. These payor customers engage the Company to provide them with a particular set of services, focused on the management of a comprehensive array of ancillary healthcare services that the healthcare payors have agreed to make available to their insureds or beneficiaries or for which they have agreed to provide insurance coverage. The services the Company provides allow these payor customers to capture cost savings because the Company assumes responsibility for all aspects of contracting, management and maintenance of provider networks of ancillary healthcare providers. Further, their agreements with the Company allow them to manage their risks with respect to the amounts they pay for services provided by ancillary healthcare service providers. By agreeing to a list of services and rate schedule with the Company and requiring the Company to provide or arrange for the provision of those services at those specific prices (regardless of terms the Company is able to obtain from service providers through its separately-negotiated contracts with service providers), the Company’s payor customers have shifted pricing risk to the Company. In addition to providing access to a comprehensive provider network on a pre-determined fee reimbursement rate schedule, the Company also provides its healthcare payor customers with claims management, processing and payment services, network/needs analysis (to assess the benefits to the payor customer of adding additional/different service providers to a provider network), credentialing of service providers, quality assurance and other value-added services.

Second, the Company contracts with ancillary healthcare service providers. Through these contracts, these service providers contract with the Company to provide defined ancillary healthcare service to patients that have insurance coverage or similar healthcare benefits through one of the Company’s payor customers.

The Company undertakes significant pricing/margin risk under this approach because it is responsible for providing the agreed-upon services to its payor customers whether or not it is able to negotiate fees and other agreement terms with service providers that result in a positive margin for the Company. The Company is not paid a fixed dollar “processing fee” or similar amount per claim regardless of the amount billed in a claim, nor is it paid a per claim fee based on a stated percentage of the amount billed in a claim.

The Company’s agreements with its payor customers, on the one hand, and the service providers, on the other, are negotiated separately. The Company does not negotiate an agreement with service providers based on instructions given or parameters provided by its payor customers. In fact, it acts as the principal in each transaction by negotiating terms which the Company believes will allow it to maximize its profit while allowing the Company to meet its obligations to its payor customers. The Company does not negotiate agreements with service providers “on behalf of” its payor customers and does not hold itself out as the agent of the payor customers when negotiating the terms of the Company-service provider contract. Agreements with payor customers, on the one hand, and service providers, on the other, are not negotiated in tandem and the Company is able and willing to enter new relationships with customers and service providers on different or additional terms. The Company does not have any agreements where the Company, a payor customer of the Company and an ancillary healthcare service provider all are co-parties to the agreement.

With each of its payor customers, the Company negotiates the types of services to be provided to the payor customer and its insureds or beneficiaries by the Company or the service providers contracted by the Company and the prices to be paid by the payor customer to the Company for each service provided by a service provider contracted by the Company. With each of the ancillary healthcare service providers, the Company negotiates the prices to be paid to each of them for a particular service. The Company’s profit is a function of the spread between the prices it has agreed to pay the service providers and the prices the Company’s payor customers have agreed to pay the Company. As noted above, the Company has complete latitude in negotiating the price and undertakes significant pricing/margin risk because it is responsible for providing the agreed-upon services to its payor customers whether or not it is able to negotiate fees and other agreement terms with service providers that result in a positive margin for the Company.

The Company also assumes, as principal, key performance-related risks. The agreements between the Company and its payor customers provide that it is the Company’s obligation to deliver the agreed-upon services and that the payor customer will look only to the Company, not to the service provider or any other person, for performance. The Company is responsible irrespective of the existence or terms of any agreement the Company has with the service providers. The terms of each agreement between the Company and its payor customer make it clear that the Company is obligated to provide or arrange for the provision of all of the service under the Company-payor customer agreement and the Company is responsible for ensuring that the contractual terms are met and such services are provided (whether the service are those performed directly by the Company, such as claims management, processing and payment service, network/needs analysis and credentialing, or those performed by the a service provider contracted by the Company). Payor customers who are not satisfied with the Company’s services may choose not do business with the Company, which would result in the Company losing revenue.

The terms of the agreement between the Company and its payor customers do not contemplate that the payor customers will have any relationship with the service providers and do not permit the payor customers to claim directly against the service providers. Similarly, the terms of each agreement between the Company and ancillary healthcare service providers make it clear that the Company is solely obligated to the service provider under the contract between them and do not contemplate any contractual relationship between the service providers and the Company’s payor customers or permit the service providers to pursue claims directly against the Company’s payor customers. In fact, a payor would not know what to pay a service provider and the service provider would not be able to properly bill a payor since they have no contractual arrangement between them.

Also as noted above, the Company does not have any agreement or arrangement with any individual or group that is insured or has other benefits provided by the Company’s healthcare payor customers or with any patient that seeks treatment or service from ancillary healthcare service providers. The Company does not view the patient as its customer; rather, it views the healthcare payor as the Company’s customer, with the Company’s obligations running solely to the healthcare payor. Any dispute concerning coverage or benefits is the responsibility of the healthcare payor (although a healthcare payor customer may seek information and other assistance from the Company in the payor customer’s actions to resolve any disputes with its insureds or beneficiaries). This does not mean, however, that the ancillary services provided to the patient are entirely excluded from the arrangement. As illustrated in Annex I, any co-payment or deductible must be satisfied by the individual patient to the service provider directly; only those payments are excluded and have no impact on the Company’s financial accounting or statements.

* * *

If you have any questions, or if we may be of any assistance, please do not hesitate to contact the undersigned at (973) 912-7189 or Roland S. Chase at (973) 912-7179.

Sincerely,

/s/ Jeffrey A. Baumel

Jeffrey A. Baumel

Partner

| cc: | Tia Jenkins, Senior Assistant Chief Accountant, Office of Beverages, Apparel and Health Care Services |

David Boone, President and Chief Executive Officer, American CareSource Holdings, Inc.

Doug Roozeboom, RSM McGladrey Inc.