Howard Weil 37th Energy Conference

March 25, 2009

Disclosure

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain

forward-looking statements so long as such information is identified as forward-looking and is

accompanied by meaningful cautionary statements identifying important factors that could

cause actual results to differ materially from those projected in the information.

The use of words such as “may”, “might”, “will”, “should”, “expect”, “plan”, “outlook”,

“anticipate”, “believe”, “estimate”, “project”, “intend”, “future”, “potential” or “continue”, and

other similar expressions are intended to identify forward-looking statements.

All of these forward-looking statements are based on estimates and assumptions by our

management that, although we believe to be reasonable, are inherently uncertain. Forward-

looking statements involve risks and uncertainties, including, but not limited to, economic,

competitive, governmental and technological factors outside of our control, that may cause our

business, industry, strategy or actual results to differ materially from the forward-looking

statements.

These risks and uncertainties may include those discussed in the Company’s most recent

filings with the Securities and Exchange Commission, and other factors which may not be

known to us. Any forward-looking statement speaks only as of its date. We undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of

new information, future events or otherwise, except as required by law.

2

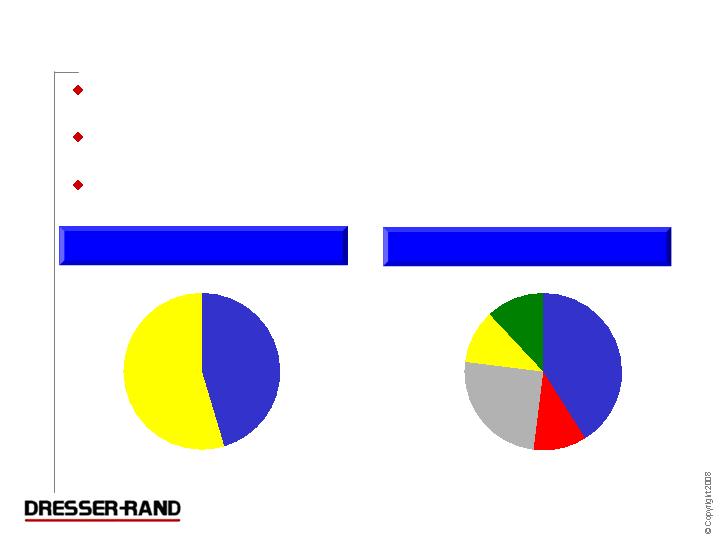

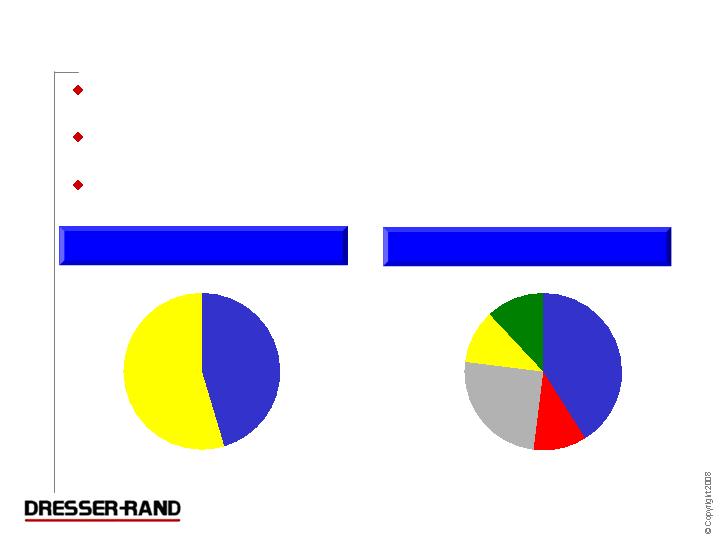

Company Overview

Dresser-Rand - Global Supplier of Energy Solutions

Over 90% of bookings for the twelve months ended 12/31/08 of $2.3

billion from oil and gas infrastructure spending

Compression is needed at every stage of the oil and gas production

cycle – upstream, midstream and downstream

A leading provider of rotating equipment / largest installed base /

industry leading alliances

Aftermarket

Parts and

Services

New Units

55%

45%

2008 Sales By

Business Segment

2008 Revenues By

Destination

North

America

Asia Pacific

11%

41%

Latin

America

Europe

Middle

East /Africa

25%

11%

12%

4

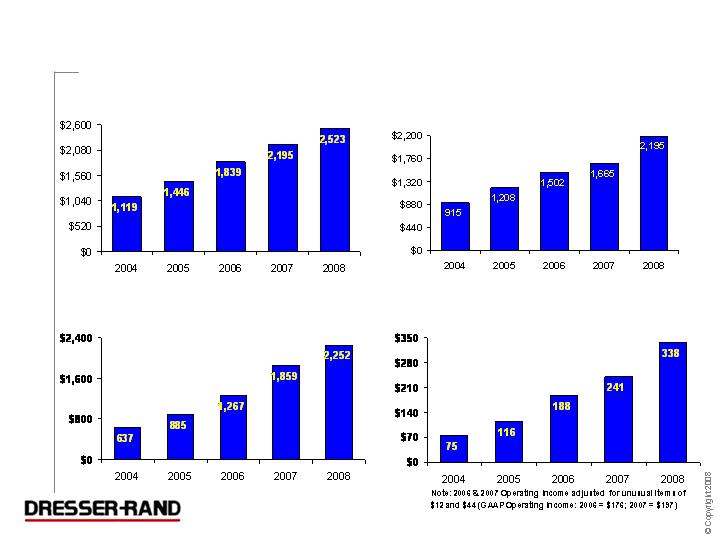

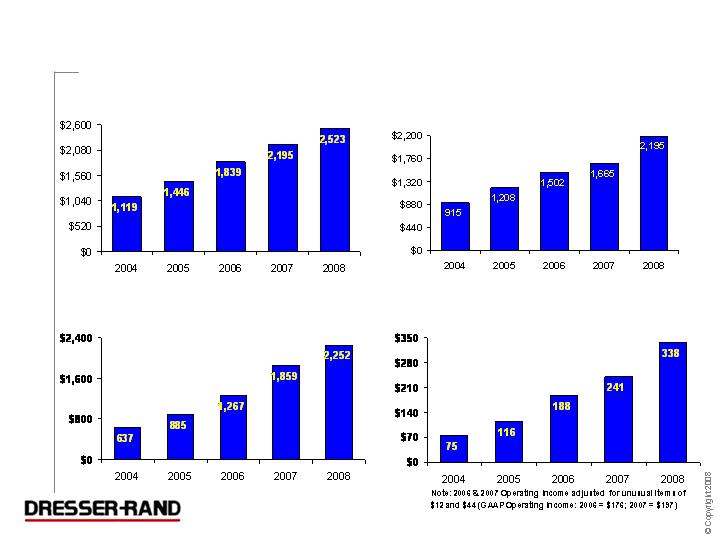

Strong Markets & Operational Excellence Have Led to

Solid Revenue and Income Growth

Backlog End of Period

($ in Millions)

Bookings

($ in Millions)

Sales

($ in Millions)

Operating Income

($ in Millions)

5

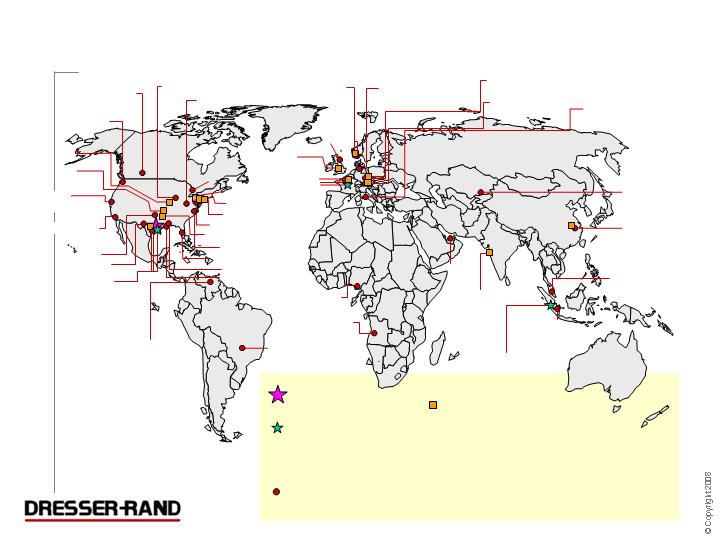

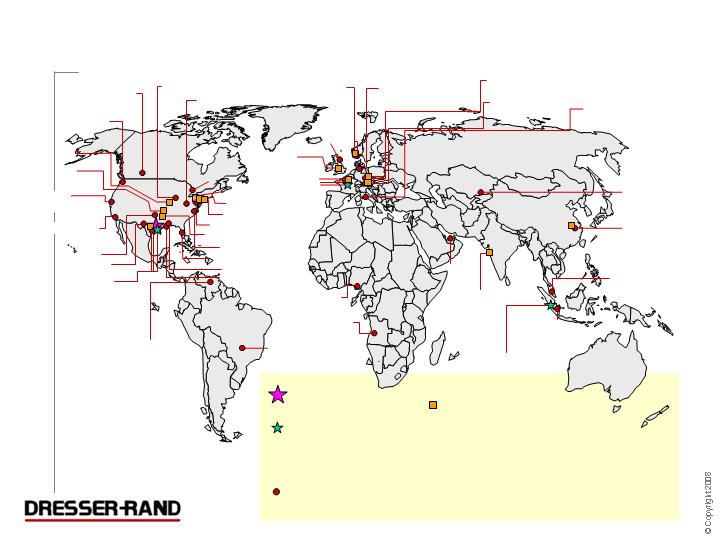

Extensive Global Presence

Shanghai,

PRC

Kemanan,

Terengganu, Malaysia

Cilegon,

Banten, Indonesia

Naroda, India

Kongsberg, Norway

Spijkenisse,

The Netherlands

Oberhausen,

Germany

Peterborough

Cambridgeshire U.K.

Le Havre,

France

Genoa, Italy

Campinas - SP, Brazil

Maracaibo, Edo.

Zulia Venezuela

Edmonton, Alberta

Canada

Seattle, WA

Rancho

Dominguez, CA

Chula Vista, CA

Tulsa, OK

Midland, TX

Houston, TX

Baton Rouge, LA

Chesapeake, VA

Naperville, IL

Hamilton, OH

Horsham, PA

Olean, NY

Wellsville, NY

Painted Post, NY

WW Headquarters

Regional Centers

Kuala Lumpur, Malaysia

Houston, Texas

Le Havre, France

Houston, Texas, USA

Service Centers (33)

Global Operations

Olean, New York

Wellsville, New York

Painted Post, New York

Burlington, Iowa

Houston, Texas

Louisiana, Missouri

Kiefer, Oklahoma

Kuala Lumpur, Malaysia

Burlington, IA

Bielefeld,

Germany

Port Harcourt

Nigeria

Mayport, FL

Chirchik,

Uzbekistan

Angola

Africa

Aberdeen,

Scotland, U.K.

Le Havre, France

Oberhausen, Germany

Bielefeld, Germany

Kongsberg, Norway

Naroda, India

Shanghai, China

Peterborough, UK

Louisiana, MO

Jena, LA

Sarnia, Ontario

Kiefer, OK

Abu Daibi,

UAE

6

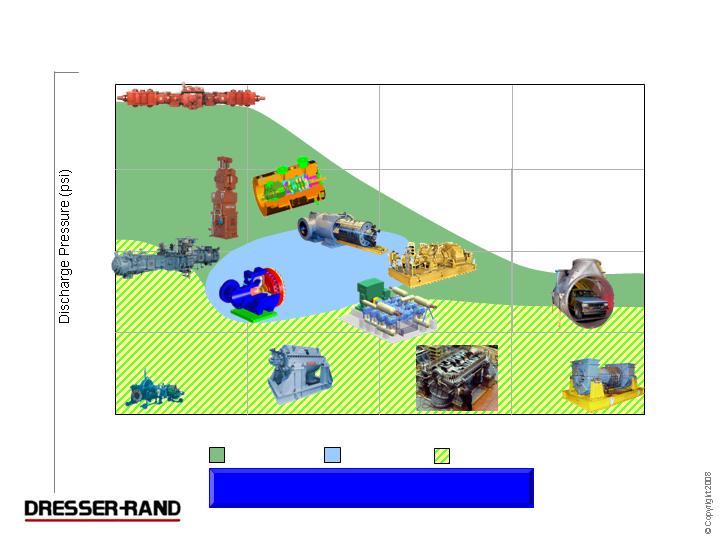

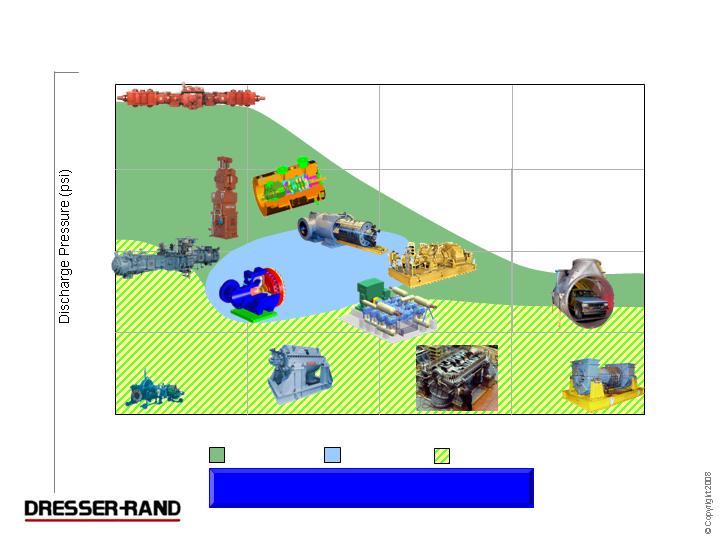

Upstream

Midstream

Downstream

Inlet Volume (cfm)

50

500

5,000

50,000

500,000

1

150

1,500

15,000

75,000

Gas Reinjection

LNG

Refining

Hydrogen

Ethylene

GTL

CNG

Axial

DATUM

Axially

Split

Pipeline

Booster

Process

& Separable

Recip

PDI

Boil-Off

Recip

DATUM (HP)

Clean Fuels

Centrifugal

Gas Transmission

Multi-Stage

Steam

Turbine

SST

Broadest Rotating Equipment Offering

Meets All Applications

7

Most Client Alliances in Industry ~ 50

Validation of Dresser-Rand’s Value Proposition

8

Outlook

Traditional Market Opportunities

Offshore production / LNG / FPSO

Peter Brotherhood acquisition strengthens position in

FPSO market

LNG / Floating LNG (awarded world’s 1st project)

Upstream

Midstream

Downstream

Gas pipelines & storage

Recent acquisitions strengthen position (Arrow;

Enginuity)

Coal bed Methane, Shale

Refining - expansions, process upgrades,

environmental compliance, energy conservation,

difficult crudes

Petro-chemical / Chemical (Asia Pacific, India and

Middle East)

10

Emerging Market Opportunities

ICS - DATUM derivative technology / close

coupled motor / proprietary separation technology

1st commercial order – topside Petrobras P-18

Subsea

CAES

CO2 Sequestration

Experience and Technology - Only operating

installation in North America

Government Incentives - Federal, State and “Green”

incentives

Tracking ~ 15 projects

DRC has the most horsepower worldwide

compressing CO2

Working with Praxair on clean coal pilot plant in

Jamestown New York

Invested in Ramgen supersonic compressor

technology

11

Current Market Conditions

New Unit Bookings

2009 estimate - $0.7 to $1.1 billion (1Q09 run rate below

range)

Delay appears temporary – cost reductions sought

No major new unit order cancellations

Inquiries remain at a high level

Aftermarket bookings continue to be steady

Slowing economy will challenge us but 2009 revenues and

operating income expected to be up from 2008

Planning our manufacturing strategy over the past eight

years to be well positioned for cyclical lows

Not The First Slowdown We Have Faced

12

Well Positioned to Weather a Slowdown

Strong backlog of orders

Historically dependable aftermarket segment

Strong value proposition & selling strategy

Flexible manufacturing model

Unique low capital intensity business model

Strong balance sheet

Leadership in place to ensure continued good execution

Focused on Operational Excellence

And Productivity Improvements

13

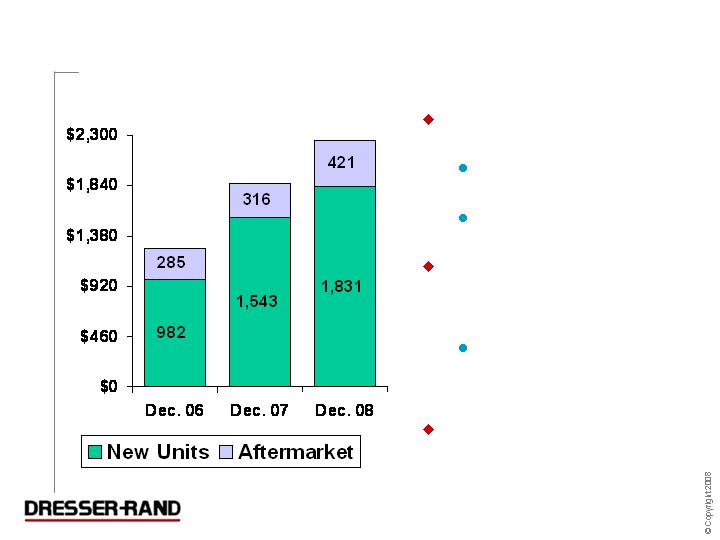

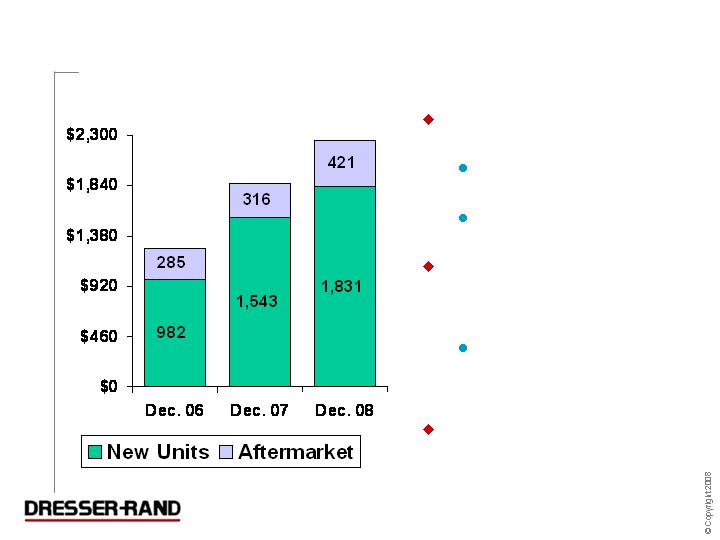

Strong Backlog of Orders

($ in Millions)

Backlog of $2.3 billion

21% higher than 12/07

78% higher than 12/06

New unit backlog up 19%

vs. last year

$1.4 billion scheduled

to ship in 2009

Aftermarket backlog up

33% vs. last year

$1,267

$1,859

$2,252

14

Largest installed base - difficult to duplicate:

Built through organic sales and acquisitions

Typical operating life of ~ 30-years

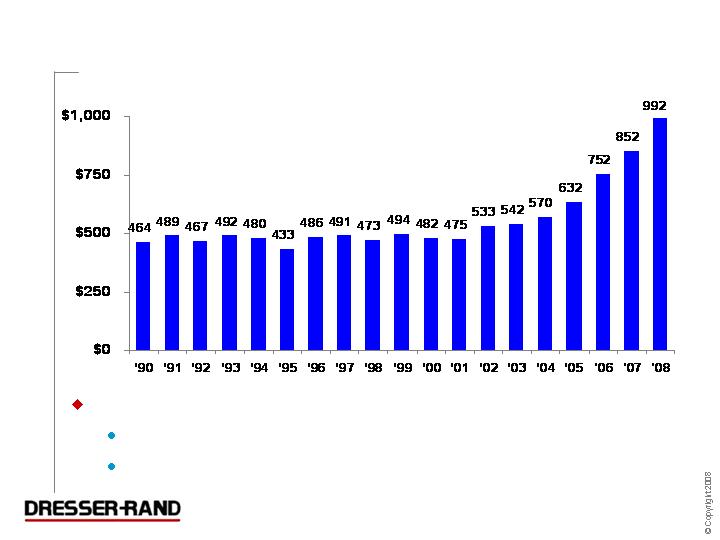

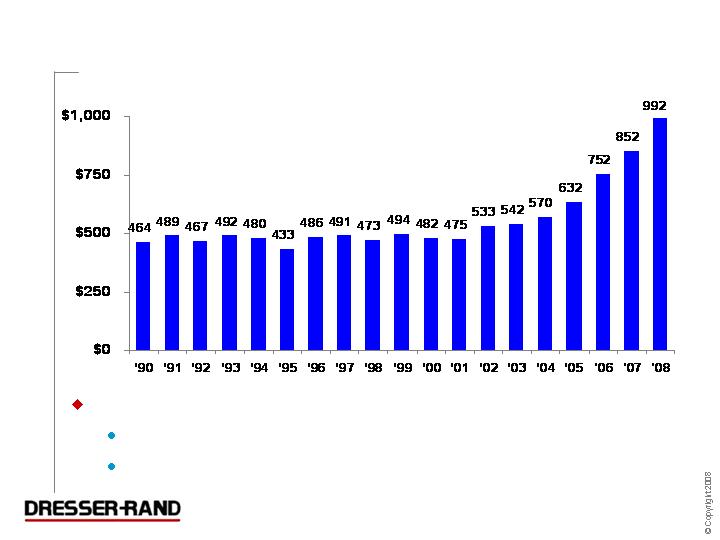

Historically Dependable Aftermarket

(Revenue $ in Millions)

15

Recognized for lowest Total Cost of Ownership

Consistently able to obtain price premiums over competition

D-R’s Technology often offers unique cost saving solutions

others cannot. Example: Flex LNG, world’s 1st floating LNG

Actual quote from the client’s EPC Technical Director:

“D-R was chosen on the basis of their compressor

technology and their gas turbine/compressor packaging

concept, which are drivers for minimizing total project

risk as well as maximizing the production of LNG.”

Strong Value Proposition and Selling Strategy

D-R Technology & Business Processes --

Source of Sustainable Competitive Advantage

16

Flexible Manufacturing Model

Highly absorbed internally at cycle bottoms

Able to flex capacity to meet cycle peaks

Flexibility Through Supply Chain Management

($ in Millions)

2001

2008

08 vs. '01

Sales

$877

$2,195

2 1/2 X

Operating Income

$21

$338

16 X

- % of Sales

2.4%

15.4%

Employees

6,084

6,400

5%

Manufacturing Footprint ( Sq. Ft.)

~ 3.9 M

~ 4.0 M

Small

Change

17

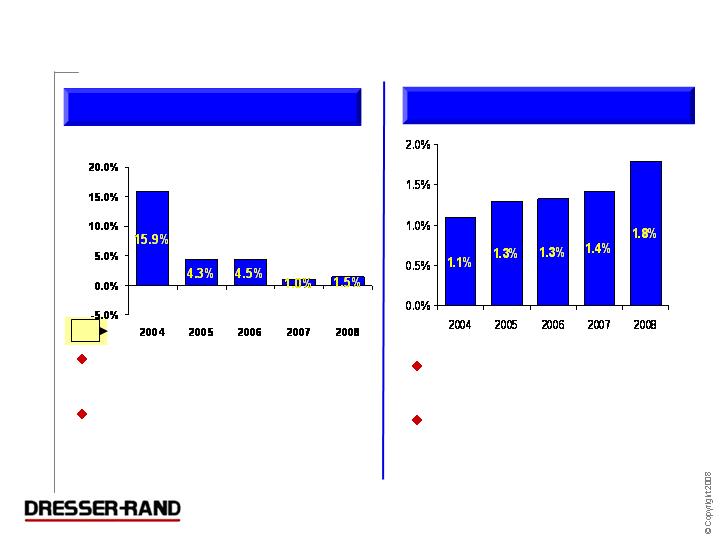

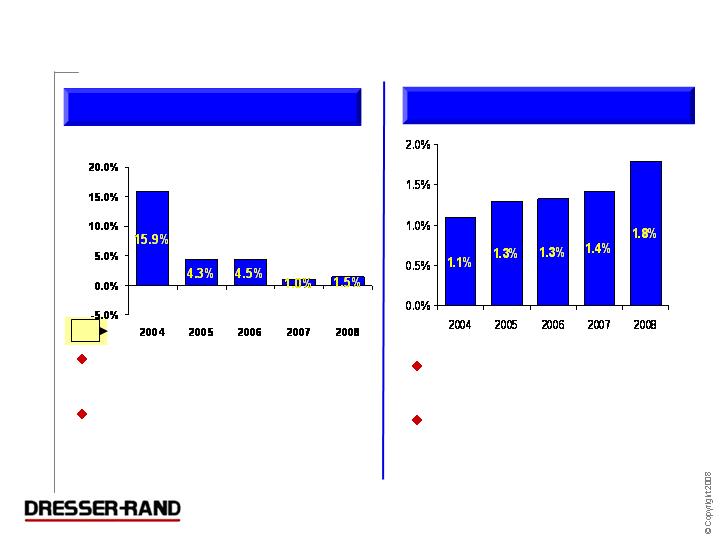

Unique Low Capital Intensity Business Model

NWC as a % of LTM Sales

Modest working capital

requirements

Customer advance payments

and progress payments

finance working capital

Manufacturing strategy allows

for low capital expenditures

Aftermarket segment low

capital intensity

Capex as a % of Sales

*

* Reflects acquisition from Ingersoll-Rand in October 2004.

Period

Ended

*

18

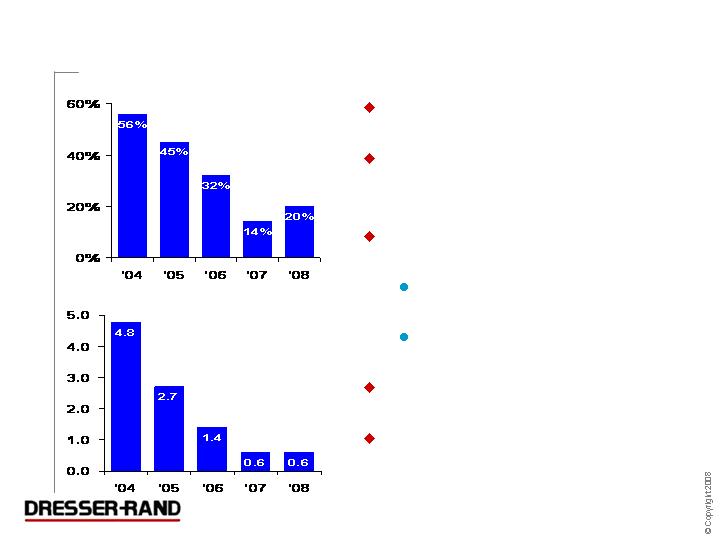

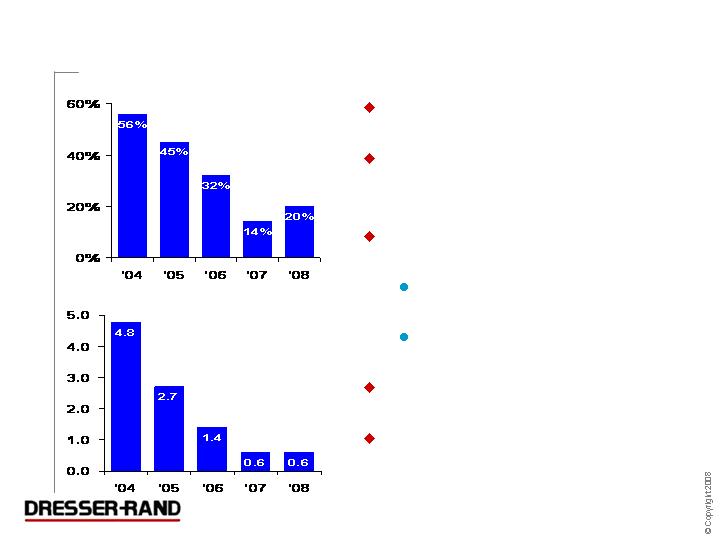

Strong Balance Sheet

7 3/8% Notes Mature 2014

No Revolver Borrowings / $271

Used for Letters of Credit

Net debt to total capital 20%

Total debt $370

Net debt $223

Net debt to adjusted EBITDA 0.6X

Liquidity at 12/31/08 = $376 ($147

Cash + $229 Revolver)

Net Debt to Adjusted EBITDA

Net Debt to Capital

At 12/31:

At 12/31:

19

2009 Operating Income Guidance

($ in Millions)

Basis of 2009 estimate – 1/31/09 exchange rate (EURO to US$ = 1.28)

1Q09 Operating Income guidance unchanged – 11% to 13% of full year

guidance range

2009 Guidance Range

2008

Actual

2008

Pro Forma

(1/31/09 Exch. Rate)

$310 - $315

20

Summary

Believe we have sustainable competitive advantages:

Technology, Alliances, Installed Base, Service Network

Believe we are very well positioned for difficult economy

Unique business model (manufacturing flexibility / low

capital intensity)

Dependable aftermarket revenue stream

Strong financial condition

Experienced leadership

When global economy starts to recover believe energy

infrastructure investment will accelerate quickly and lead to

superior returns for our shareholders

Believe Market Will Reward DRC for its

Flexible Business Model / Consistent Aftermarket

21

Appendix

22

Adjusted EBITDA Reconciliation to GAAP

($ in Millions)

2008

2007

2006

2005

2004

GAAP Net Income

$197.7

$106.7

$78.8

$37.1

$49.4

Interest Expense - net

29.4

36.8

47.9

57.0

6.5

Depreciation & Amortization

48.8

49.3

50.3

61.4

39.0

Income Tax Expense

103.6

60.9

58.6

15.5

19.2

EBITDA

$379.5

$253.7

$235.6

$171.0

$114.1

Adjustments:

Curtailment Amend. / Parial Settlement

(5.4)

0.0

(11.8)

0.0

0.0

Stock-based Compensation

7.4

8.5

23.6

0.0

0.0

Forward Exchange Contracts (gain) loss

(9.2)

1.4

(1.9)

2.2

(1.1)

Other

1.0

(1.5)

3.9

14.5

35.9

Adjusted EBITDA

$373.3

$262.1

$249.4

$187.7

$148.9

23

NWC Reconciliation to GAAP

($ in Millions)

2008

2007

2006

2005

2004

Current Assets

$907.8

$825.7

$669.0

$549.4

$574.6

Less: Current Liabilities

(736.3)

(620.5)

(471.5)

(393.2)

(329.7)

GAAP Net Working Capital (NWC)

$171.5

$205.2

$197.5

$156.2

$244.9

Adjustments:

Cash and Cash Equivalents

(147.1)

(206.2)

(146.8)

(98.0)

(111.5)

Deferred Income Taxes

(22.5)

(19.3)

(13.9)

(10.9)

(7.4)

Accrued Income Taxes Payable

30.2

22.0

30.3

5.0

2.7

Other

0.2

0.2

0.1

0.1

4.0

Net Working Capital

$32.3

$1.9

$67.2

$52.4

$132.7

24

Net Debt Reconciliation to GAAP

($ in Millions)

2008

2007

2006

2005

2004

Total Debt

$370

$370

$506

$598

$823

Less Cash

(147)

(206)

(147)

(98)

(112)

Net Debt

$223

$164

$359

$500

$711

At 12/31

25

www.dresser-rand.com

info@dresser-rand.com

26