Barclays Capital 2009 CEO Energy/Power Conference

September 2009

Disclosure

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain

forward-looking statements so long as such information is identified as forward-looking and is

accompanied by meaningful cautionary statements identifying important factors that could

cause actual results to differ materially from those projected in the information.

The use of words such as “may”, “might”, “will”, “should”, “expect”, “plan”, “outlook”,

“anticipate”, “believe”, “estimate”, “project”, “intend”, “future”, “potential” or “continue”, and

other similar expressions are intended to identify forward-looking statements.

All of these forward-looking statements are based on estimates and assumptions by our

management that, although we believe to be reasonable, are inherently uncertain. Forward-

looking statements involve risks and uncertainties, including, but not limited to, economic,

competitive, governmental and technological factors outside of our control, that may cause our

business, industry, strategy or actual results to differ materially from the forward-looking

statements.

These risks and uncertainties may include those discussed in the Company’s most recent

filings with the Securities and Exchange Commission, and other factors which may not be

known to us. Any forward-looking statement speaks only as of its date. We undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of

new information, future events or otherwise, except as required by law.

2

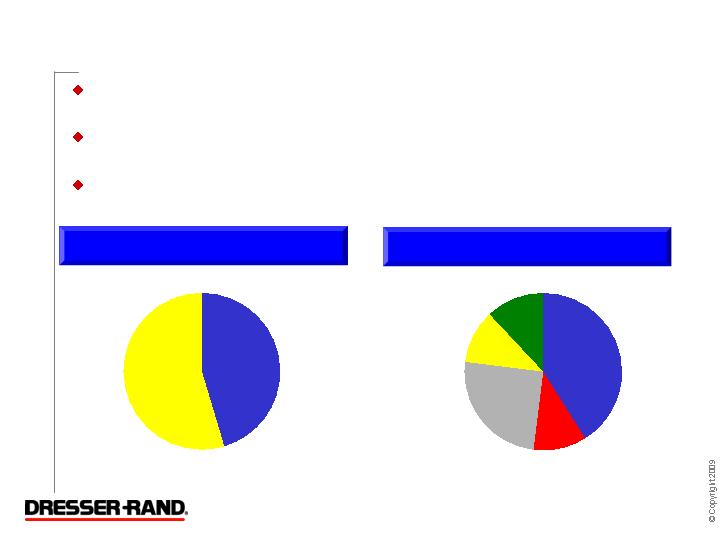

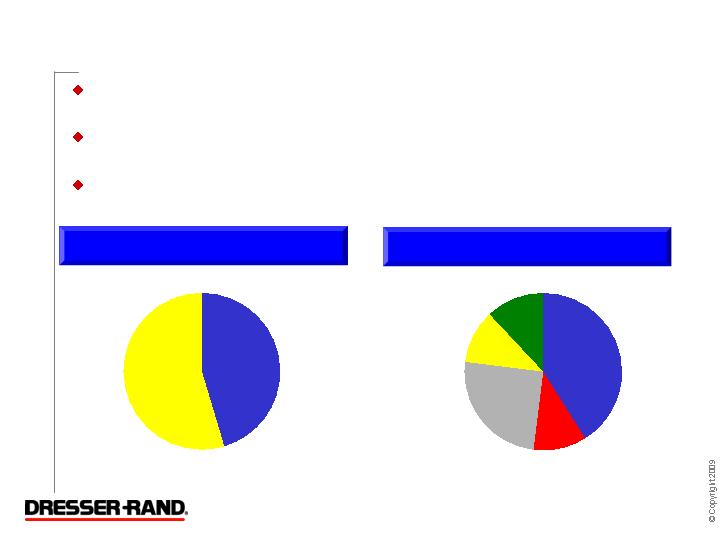

Company Overview

Dresser-Rand - Global Supplier of Energy Solutions

Over 90% of bookings for the twelve months ended 6/30/09 of $2.2

billion from oil and gas infrastructure spending

Compression is needed at every stage of the oil and gas production

cycle – upstream, midstream and downstream

A leading provider of rotating equipment / largest installed base /

industry leading alliances

Aftermarket

Parts and

Services

New Units

55%

45%

2008 Sales By

Business Segment

2008 Revenues By

Destination

North

America

Asia Pacific

11%

41%

Latin

America

Europe

Middle

East /Africa

25%

11%

12%

4

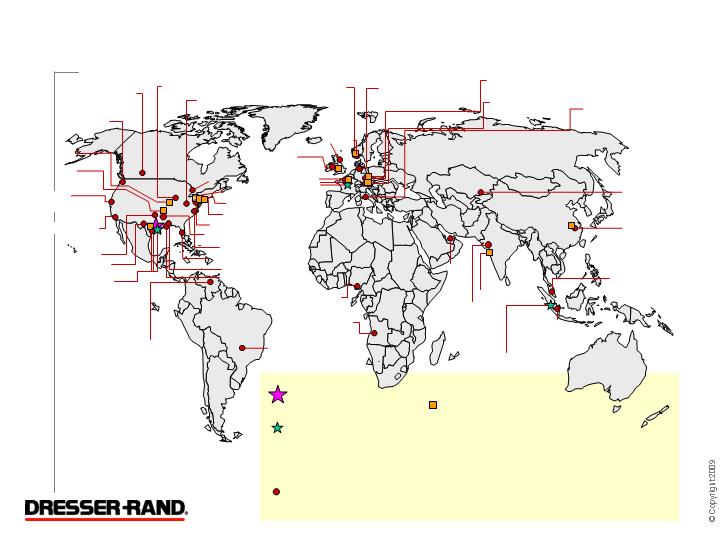

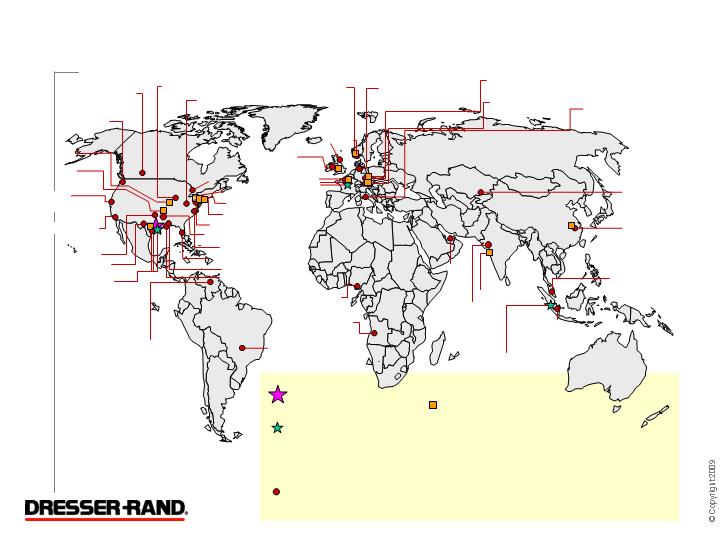

Extensive Global Presence

Shanghai,

PRC

Kemanan,

Terengganu, Malaysia

Cilegon,

Banten, Indonesia

Naroda, India

Kongsberg, Norway

Spijkenisse,

The Netherlands

Oberhausen,

Germany

Peterborough

Cambridgeshire U.K.

Le Havre,

France

Genoa, Italy

Campinas - SP, Brazil

Maracaibo, Edo.

Zulia Venezuela

Edmonton, Alberta

Canada

Seattle, WA

Rancho

Dominguez, CA

Chula Vista, CA

Tulsa, OK

Midland, TX

Houston, TX

Baton Rouge, LA

Chesapeake, VA

Naperville, IL

Hamilton, OH

Horsham, PA

Olean, NY

Wellsville, NY

Painted Post, NY

WW Headquarters

Regional Centers

Kuala Lumpur, Malaysia

Houston, Texas

Le Havre, France

Houston, Texas, USA

Service Centers (35)

Global Operations (12)

Olean, New York

Wellsville, New York

Painted Post, New York

Burlington, Iowa

Houston, Texas

Kuala Lumpur, Malaysia

Burlington, IA

Bielefeld,

Germany

Port Harcourt

Nigeria

Mayport, FL

Chirchik,

Uzbekistan

Angola

Africa

Aberdeen,

Scotland, U.K.

Le Havre, France

Oberhausen, Germany

Bielefeld, Germany

Kongsberg, Norway

Naroda, India

Shanghai, China

Peterborough, UK

Louisiana, MO

Jena, LA

Sarnia, Ontario

Kiefer, OK

Abu Dhabi

UAE

Baroda, India

5

Recognized for lowest Total Cost of Ownership

Able to obtain price premiums over competition

D-R’s Technology often offers unique cost saving solutions

others cannot. Example: Gazprom’s Portovaya Station

Head station for the Nord Stream pipeline

Installed compression capacity of 354 MW - - unparalled

in Russia

DRC technology provides the best solution in terms of

total number of installed units, operational flexibility and

operating cost

Strong Value Proposition and Selling Strategy

D-R Technology & Business Processes --

Source of Sustainable Competitive Advantage

6

Most Client Alliances in Industry ~ 50

Validation of Dresser-Rand’s Value Proposition

7

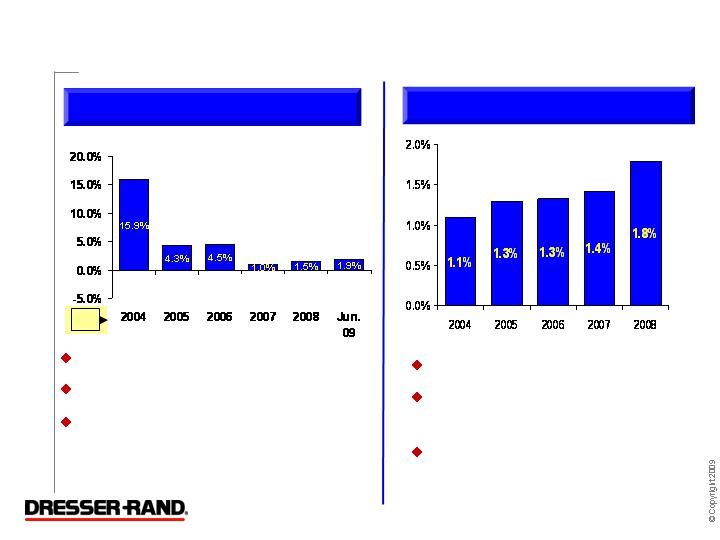

Solid Revenue and Income Growth

Backlog End of Period

($ in Millions)

Bookings

($ in Millions)

Sales

($ in Millions)

Operating Income

($ in Millions)

8

Outstanding First Half 2009 Performance

($ in Millions)

9

1H 09

1H 08

Change

Sales

$1,115.0

$905.0

23%

Operating Income

$160.3

$122.4

31%

- Settlement / (Curtail. Amend.)

1.3

(5.4)

Adjusted Operating Income

$161.6

$117.0

38%

- Adjusted Margin %

14.5%

12.9%

Interest Expense - net

(15.4)

(14.0)

Other (Expense) Income, net

0.9

3.0

Net Income

$94.8

$73.9

- Settlement / (Curtail. Amend.)

0.8

(3.6)

Adjusted Net Income

$95.6

$70.3

36%

Diluted EPS

$1.16

$0.86

- Adjusted EPS

$1.17

$0.82

43%

Business Model Characteristics

~ ½ revenues tied to new build-out – cyclical

Flexible manufacturing model to effectively meet rapid

demand swings

~ ½ revenues tied to installed base – cycle independent

~ 75% operating income from aftermarket (installed

base)

Strong value proposition

Low capital intensity

Strong Relative Performance in Both Up and Down

Cycles

10

New Units - Flexible Manufacturing Model

Highly absorbed internally at cycle bottoms

Able to flex capacity to meet cycle peaks

Flexibility Through Supply Chain Management

11

($ in Millions)

2001

2008

08 vs. '01

Sales

$877

$2,195

2 1/2 X

Operating Income

$21

$338

16 X

- % of Sales

2.4%

15.4%

Employees

6,084

6,400

5%

Manufacturing Footprint ( Sq. Ft.)

~ 3.9 M

~ 4.0 M

Small

Change

Dependable Aftermarket

(Revenue $ in Millions)

DRC Captures ~ 10% of Market Opportunity

~10% CAGR past 8 years

Key Initiatives:

Sales Entitlement Model

Leverage Alliances

Expand Service Centers

Added 11 since ’05 IPO

Technology Leadership

Applied Technology

’09 bookings $107

Acquisitions

Tuthill, Gimpel, Peter

Brotherhood, Arrow,

Enginuity, Compressor

Renewal Services

New leadership team

Implemented growth strategy

12

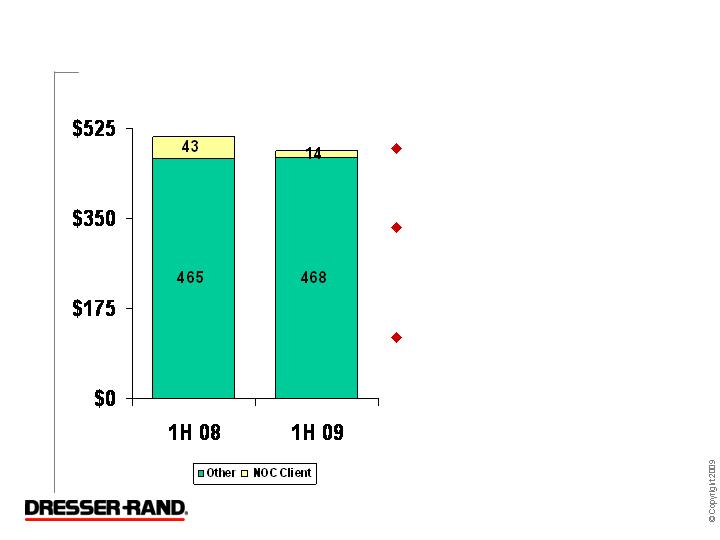

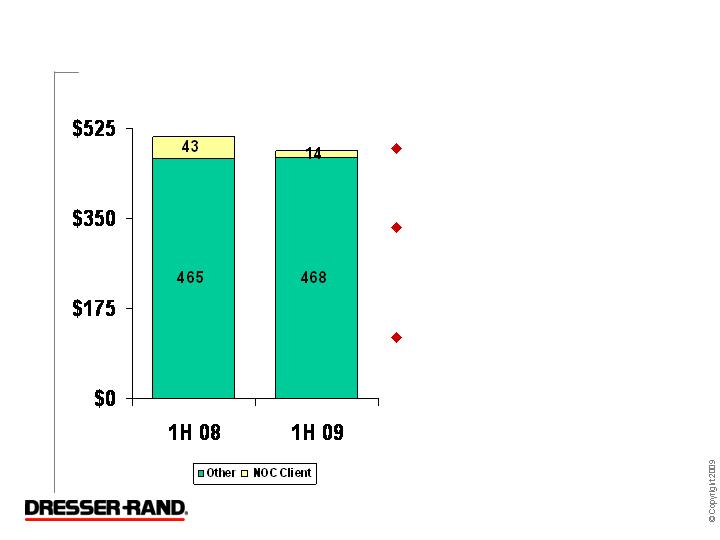

Aftermarket Bookings – 1st Six Months

($ in Millions)

Significant reduction in order

flow from one NOC

Adjusting for NOC shortfall,

1H 09 bookings slightly

higher than 1H 08

Stronger U.S. dollar ~ $(34)

$508

$482

13

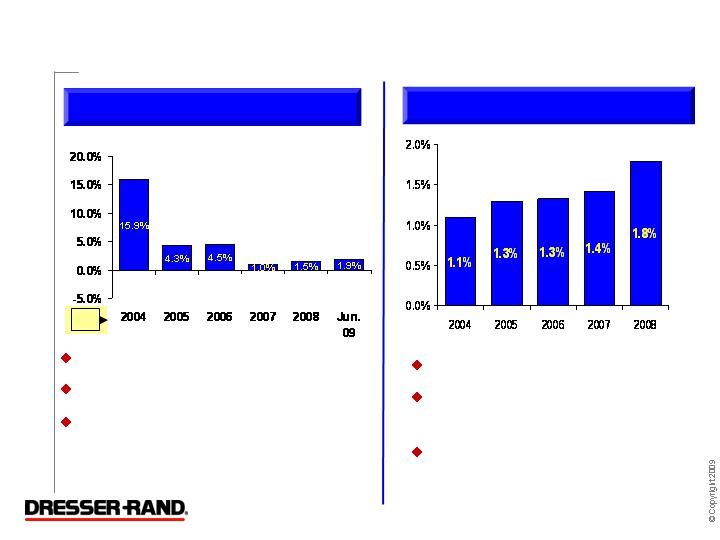

Unique Low Capital Intensity Business Model

NWC as a % of LTM Sales

Custom-engineered equipment

~12 to 15 month cycle time

Customer advance payments and

progress payments finance

working capital

2009 ~ 1 ½ to 2% of sales

Manufacturing strategy allows

for low capital expenditures

Aftermarket segment low

capital intensity

Capex as a % of Sales

* Reflects acquisition from Ingersoll Rand in 2004

Period

Ended

*

14

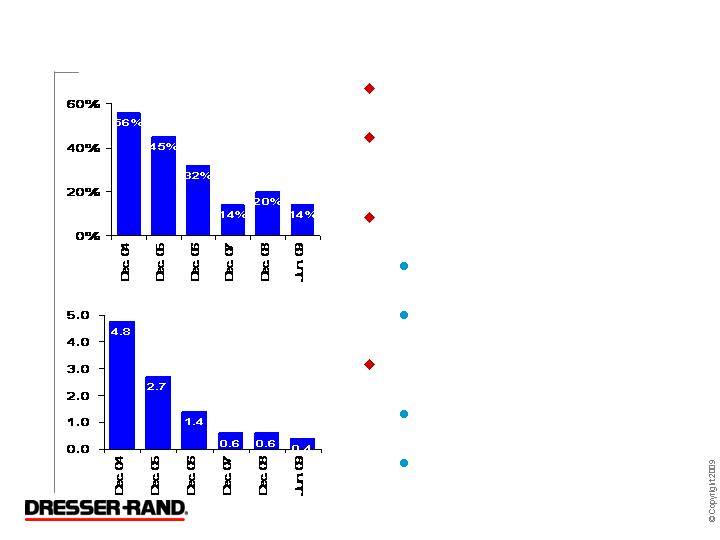

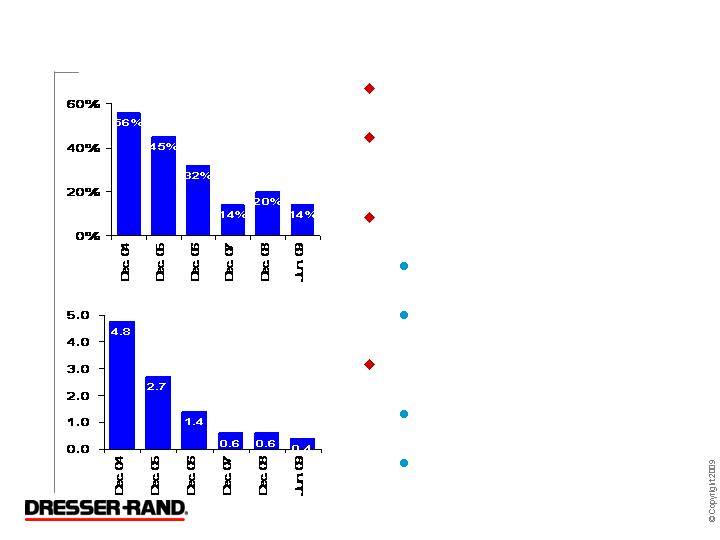

Strong Balance Sheet

7 3/8% Notes Mature 2014

No Revolver Borrowings / $271

Used for Letters of Credit

Net debt to total capital 14%

Total debt $370

Net debt $169

Liquidity at 6/30/09 = $460

Cash $201

Revolver Availability $259

Net Debt to Adjusted EBITDA

Net Debt to Capital

15

Outlook

Current Market Conditions

New unit bookings remain sluggish

Believe client delays in placing orders are temporary

Steady flow of inquiries

Continue to expect new unit bookings for the full year to

be in the range of $700 million to $1.1 billion

Visibility to many projects

Aftermarket bookings expected to be consistent with 2008

One NOC client significantly reduced order flow 1H09

Recovery expected in traditional markets,

augmented by emerging market opportunities

17

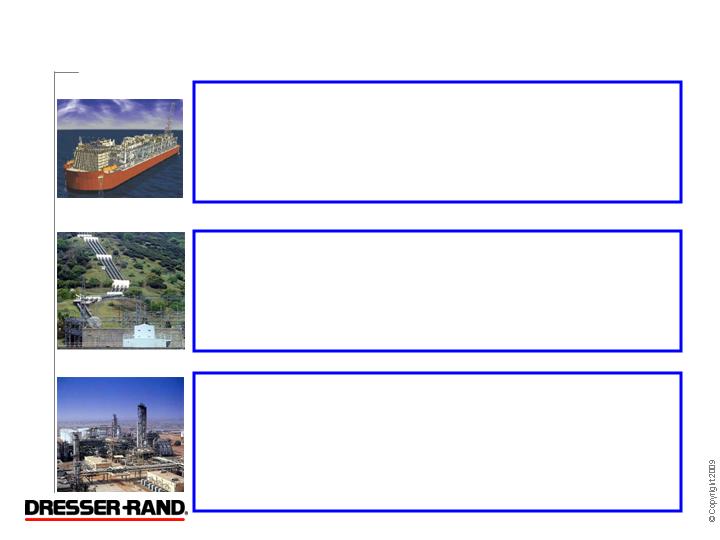

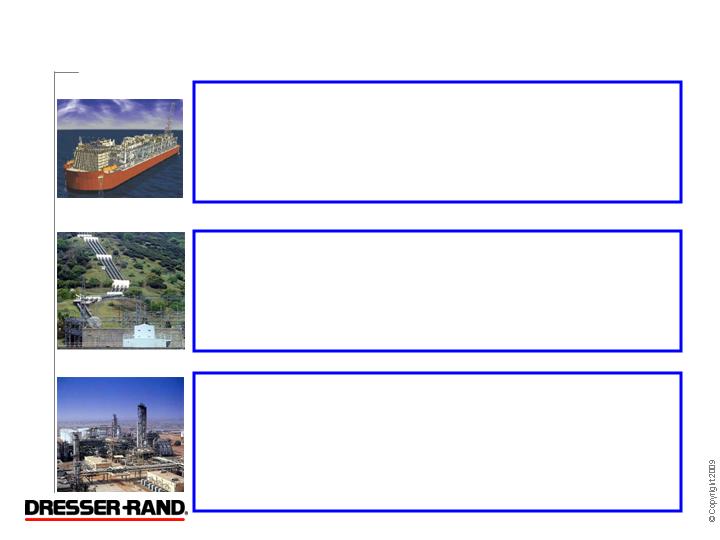

Traditional Market Opportunities

Offshore production / FPSO (100+ next 5 yrs.)

Tracking ~ 60 LNG projects (more than 20 FLNG)

Awarded world’s 1st FLNG project

Peter Brotherhood acquisition / Samsung Techwin

Upstream

Midstream

Downstream

Pipelines & storage (growth in Asia, China, India, US)

Coal bed methane & shale opportunities

Acquisitions strengthen position (Arrow; Enginuity;

Compressor Renewal Services)

Refining – 200,000 bpd ~ $50MM opportunity

Expansions e.g., Saudi Aramco Jubail & Yanbu

Process upgrades, environmental compliance,

energy conservation, difficult crudes

Chemical (Asia, India & Middle East)

18

Emerging Market Opportunities

ICS - “Only-In-Class” - DATUM derivative

technology / close coupled motor / proprietary

separation technology

1st commercial order – topside Petrobras P-18

Subsea

CAES

CO2 Sequestration

Experience & Technology - Only operating installation

in North America

Potential to combine with wind and solar

Government incentives and “Green” incentives

Tracking ~ 20 projects (100 MW ~ $50MM opportunity)

DRC has a significant amount of installed horsepower

worldwide compressing CO2

Opportunity involving coal-fired power plants

Potential for carbon tax or Cap & Trade incentives

Ramgen supersonic compressor technology

19

Summary

Believe we have sustainable competitive advantages: Technology,

Alliances, Installed Base, Service Network

Believe we are very well positioned for difficult economy

DRC Business Model Characteristics:

Steady high margin aftermarket

Flexible manufacturing model

Results:

Ability to meet significant New Unit demand swings with

minimal disruption

Good performance even in down markets

Low capital intensity

2009 Operating Income expected to be $320 to $360 million

20

www.dresser-rand.com

info@dresser-rand.com