UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant T

Filed by a Party other than the Registrant £

Check the appropriate box:

| £ | Preliminary Proxy Statement |

| £ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| £ | Definitive Proxy Statement |

| £ | Definitive Additional Materials |

| T | Soliciting Material under Rule 14a-12 |

Dresser-Rand Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| £ | Fee paid previously with preliminary materials. |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

© Copyright 2010 © Copyright 2014 Transaction Overview PLANNED ACQUISITION OF DRESSER - RAND BY SIEMENS

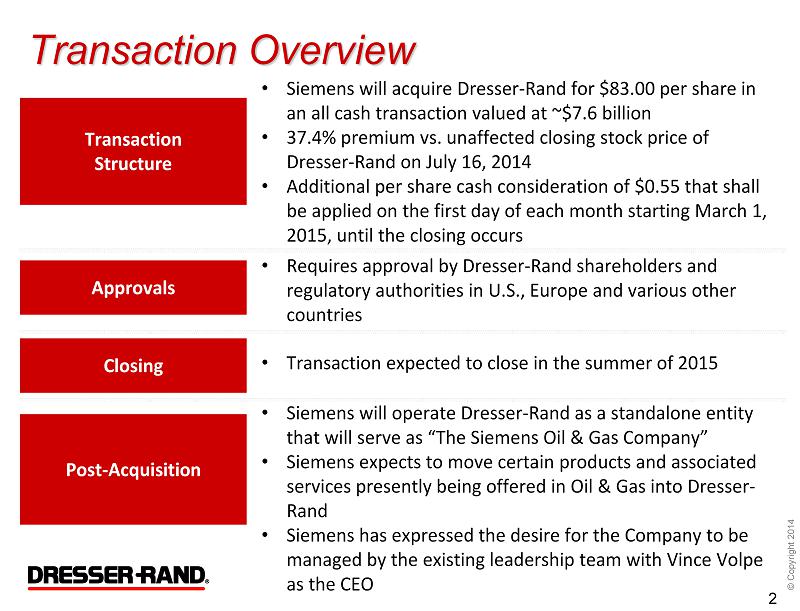

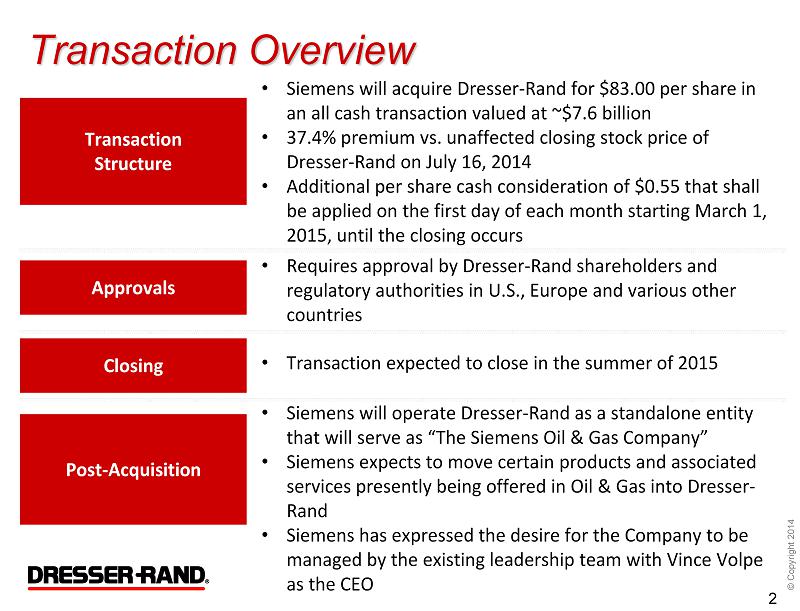

© Copyright 2014 Transaction Overview 2 • Siemens will acquire Dresser - Rand for $83.00 per share in an all cash transaction valued at ~$7.6 billion • 37.4 % premium vs. unaffected closing stock price of Dresser - Rand on July 16, 2014 • Additional per share cash consideration of $0.55 that shall be applied on the first day of each month starting March 1, 2015, until the closing occurs Approvals Closing • Requires approval by Dresser - Rand shareholders and regulatory authorities in U.S., Europe and various other countries • Transaction expected to close in the summer of 2015 Transaction Structure Post - Acquisition • Siemens will operate Dresser - Rand as a standalone entity that will serve as “The Siemens Oil & Gas Company” • Siemens expects to move certain products and associated services presently being offered in Oil & Gas into Dresser - Rand • Siemens has expressed the desire for the Company to be managed by the existing leadership team with Vince Volpe as the CEO

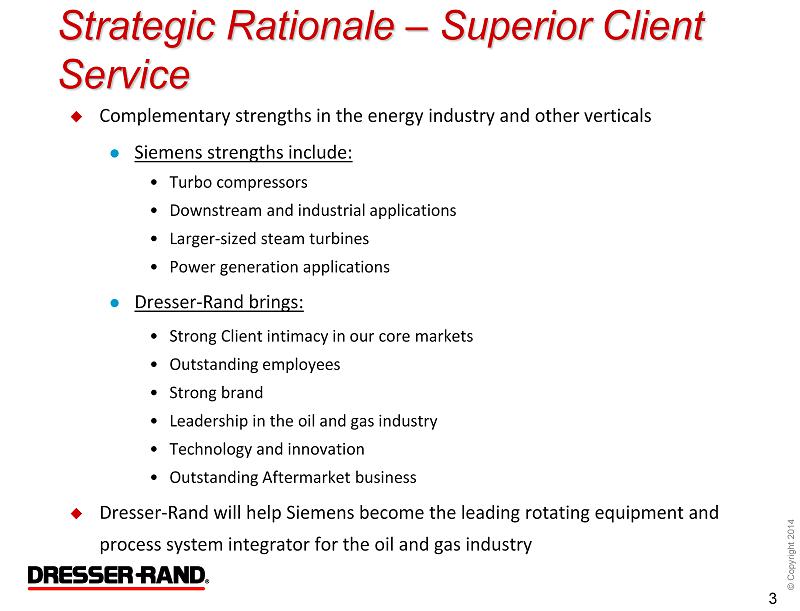

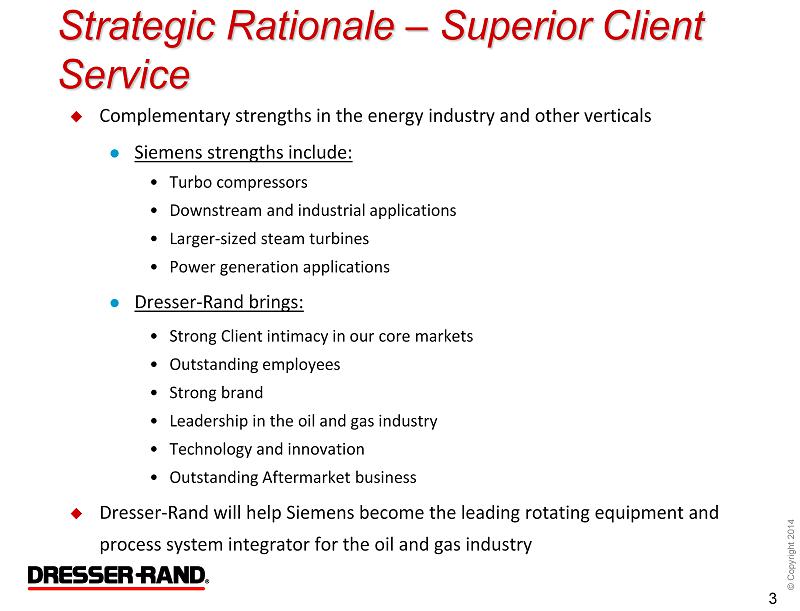

© Copyright 2014 Strategic Rationale – Superior Client Service Complementary strengths in the energy industry and other verticals Siemens strengths include: • Turbo compressors • Downstream and industrial applications • Larger - sized steam turbines • Power generation applications Dresser - Rand brings: • Strong Client intimacy in our core markets • Outstanding employees • Strong brand • Leadership in the oil and gas industry • Technology and innovation • Outstanding Aftermarket business Dresser - Rand will help Siemens become the leading rotating equipment and process system integrator for the oil and gas industry 3

© Copyright 2014 What does this mean for clients? Siemens is a global engineering company based in Munich, Germany, which operates in the Energy, Healthcare, Industry and Infrastructure and City business segments Siemens shares our strong commitment to innovation and to providing clients with environmentally responsible, high - quality products and service solutions We believe the merger, upon consummation, will be a winning combination for our clients as Dresser - Rand and Siemens have complementary strengths in the energy industry and other verticals, and Dresser - Rand will be maintained as the Company that serves you As part of the merger, Dresser - Rand’s product and services offerings will be enhanced by the inclusion of centrifugal compressors and other products presently being offered separately by Siemens We believe that this expanded range of mission critical rotating equipment solutions and aftermarket services will enhance the value proposition for our valued clients 4 Until transaction closes, Dresser - Rand and Siemens remain separate companies and it is business as usual

© Copyright 2014 Additional Information and Where to Find It In connection with the proposed transaction with Siemens, Dresser - Rand Group Inc. (the “Company”) will file with the U.S. Securities and Exchange Commission (the “SEC”) and mail or otherwise provide to its stockholders a proxy statement regarding the proposed transaction. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the proxy statement and other documents that the Company files with the SEC (when available) from the SEC’s website at www.sec.gov and the Company’s website at www.dresser - rand.com. In addition, the proxy statement and other documents filed by the Company with the SEC (when available) may be obtained from the Company free of charge by directing a request to Dresser - Rand Group Inc., Investor Relations, West8 Tower, Suite 1000, 10205 Westheimer Road, Houston, Texas 77042, 713 - 973 - 5497 . Participants in Solicitation The Company and its directors, executive officers and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from the Company’s stockholders with respect to the proposed acquisition of the Company by Siemens. Security holders may obtain information regarding the names, affiliations and interests of such individuals in the Company’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2013, and its definitive proxy statement for the 2014 annual meeting of stockholders. Additional information regarding the interests of such individuals in the proposed acquisition of the Company by Siemens will be included in the proxy statement relating to such acquisition when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and the Company’s website at www.dresser - rand.com . 5

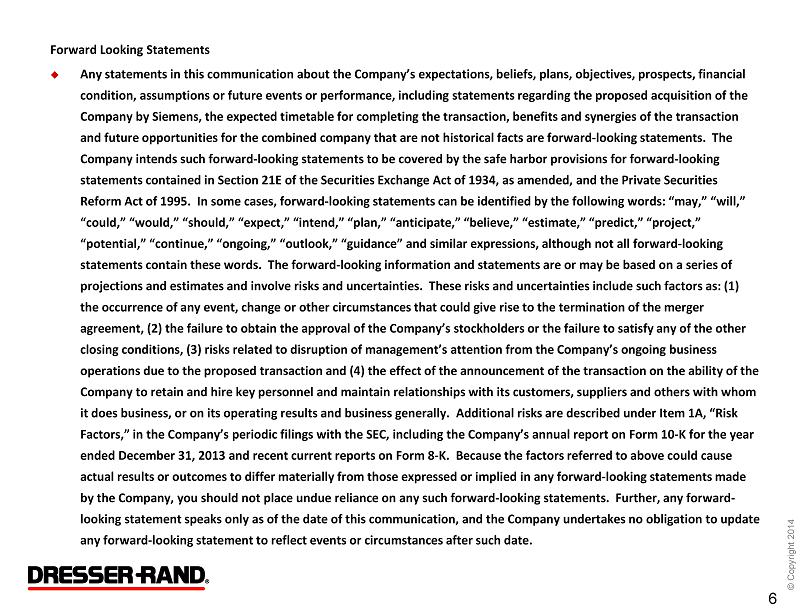

© Copyright 2014 Forward Looking Statements Any statements in this communication about the Company’s expectations, beliefs, plans, objectives, prospects, financial condition, assumptions or future events or performance, including statements regarding the proposed acquisition of the Company by Siemens, the expected timetable for completing the transaction, benefits and synergies of the transaction and future opportunities for the combined company that are not historical facts are forward - looking statements. The Company intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Reform Act of 1995. In some cases, forward - looking statements can be identified by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “outlook,” “guidance” and similar expressions, although not all forward - looking statements contain these words. The forward - looking information and statements are or may be based on a series of projections and estimates and involve risks and uncertainties. These risks and uncertainties include such factors as: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (2) the failure to obtain the approval of the Company’s stockholders or the failure to satisfy any of the other closing conditions, (3) risks related to disruption of management’s attention from the Company’s ongoing business operations due to the proposed transaction and (4) the effect of the announcement of the transaction on the ability of the Company to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business, or on its operating results and business generally. Additional risks are described under Item 1A, “Risk Factors,” in the Company’s periodic filings with the SEC, including the Company’s annual report on Form 10 - K for the year ended December 31, 2013 and recent current reports on Form 8 - K. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or implied in any forward - looking statements made by the Company, you should not place undue reliance on any such forward - looking statements. Further, any forward - looking statement speaks only as of the date of this communication, and the Company undertakes no obligation to update any forward - looking statement to reflect events or circumstances after such date . 6