UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-32586

DRESSER-RAND GROUP INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-1780492 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

West8 Tower, Suite 1000

10205 Westheimer Rd.

Houston, Texas 77042

112 Avenue Kleber

75784 Cedex 16, Paris France

(Address Of Principal Executive Offices)

(713) 354-6100 (Houston)

33 156 267171 (Paris)

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price of $44.54 per share at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter was $3,299,803,980.

There were 75,890,132 shares of common stock outstanding on February 21, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement for its 2013 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III.

TABLE OF CONTENTS

-2-

ITEM 1. BUSINESS ($ in millions)

Overview

Dresser-Rand Group Inc. is a Delaware corporation formed in October 2004. The common stock trades on the New York Stock Exchange under the symbol “DRC.” Unless the context otherwise indicates, as used in this Form 10-K, (i) the terms “we,” “our,” “us,” the “Company” and similar terms refer to Dresser-Rand Group Inc. and its consolidated subsidiaries and (ii) the term “Ingersoll Rand” refers to Ingersoll-Rand plc (NYSE: IR) and its predecessors.

We are among the largest global suppliers of custom-engineered rotating equipment solutions for long-life, critical applications in the oil, gas, chemical, petrochemical, process, power generation, military and other industries worldwide. Our high-speed rotating equipment is also supplied to the environmental solutions market space within energy infrastructure.

Our products and services are widely used in oil and gas applications that include hydrogen recycle, make-up, wet gas and other applications for the refining industry; cracked gas, propylene and ethylene compression for petrochemical facilities; ammonia syngas, refrigeration, and carbon dioxide compression for fertilizer production; a number of compression duties for chemical plants; gas gathering, export, lift and re-injection of natural gas or carbon dioxide (“CO2”) to meet regulatory requirements or for oil field enhanced recovery in the upstream market; gas processing, main refrigeration compression and a variety of other duties required in the production of liquefied natural gas (“LNG”); gas processing duties, storage and pipeline transmission compression for the midstream market; synthetic fuels; and steam turbine power generation for floating production, storage and offloading (“FPSO”) vessels as well as power generation or mechanical drive duties for a variety of compression and pumping applications in the oil and gas market. We are also a supplier of diesel and gas engines that provides customized energy solutions across worldwide energy infrastructure markets based upon reciprocating engine power systems technologies.

Our custom-engineered products are also used in other advanced applications in the environmental markets we serve. These applications use renewable energy sources, reduce carbon footprint, recover energy and/or increase energy efficiency. These products include, among others, compression technologies for carbon capture and sequestration (“CCS”); hot gas turbo-expanders for energy recovery in refineries and certain chemical facilities; co- and tri-generation combined heat and power (“CHP”) packages for institutional and other clients; and a large number of steam turbine applications to generate power using steam produced by recovering exhaust heat from the main engines in ships, recovering heat from mining and metals production facilities and exhaust heat recovery from gas turbines in on-shore and off-shore sites. We also have experience in the design, construction and development of power generation and cogeneration plants and mini-hydroelectric plants, and the development and exploitation of wind farms and biomass, used oil and landfill gas, photovoltaic solar energy and farming waste processing. Other biomass and biogas applications for our steam turbine product line include gasification of municipal solid waste or incineration of wood, palm oil, sugar or pulp and paper residues to generate power. Our equipment is used for compressed air energy storage (“CAES”) for utility sized power generation. These applications are environmentally-friendly and provide unique grid management features. A CAES plant makes use of our classes of axial compressors, centrifugal compressors, gas expanders, controls and rotating equipment system integration capabilities. Other general industrial markets served include steel and distributed power generation. We operate globally with manufacturing facilities in the United States (“U.S.”), France, United Kingdom (“UK”), Germany, Spain, Norway and India.

We provide a wide array of products and services to our worldwide client base in over 150 countries from our global locations in 18 U.S. states and 32 countries (over 76 sales offices, 49 service and support centers, including six engineering and research and development centers, and 13 manufacturing locations). Our clients include, among others, BP, Chevron, ConocoPhillips, Dow Chemical Company, ExxonMobil, Gazprom, LUKOIL, Marathon Petroleum Company, PDVSA, Pemex, Petrobras, PetroChina, Petronas, Repsol, Royal Dutch Shell, SBM, Saudi Aramco, Statoil, Total and Turkmengaz.

Our solutions-based service offering combines our industry-leading technology, extensive worldwide service center network, deep product expertise and a culture of safety (which we believe to be industry-leading safety performance) and continuous improvement. This approach drives our growth as we offer integrated service solutions that help our clients lower the life cycle costs of their rotating equipment, minimize adverse environmental impact and maximize returns on their production and processing equipment. We believe our business model and alliance-based approach built on alliance and frame agreements align us with our clients who increasingly choose service providers that can help optimize performance over the entire life cycle of their equipment. Our alliance/frame agreement program encompasses both the provision of new units and/or parts and services. We offer our clients a dedicated team, advanced business tools, a streamlined engineering and procurement process, and a life cycle approach to manufacturing, operating and maintaining their equipment, whether originally manufactured by us or by a third party. In many of our alliances, we are the preferred supplier of equipment and aftermarket parts and services to a client. Our alliances and frame agreements enable us to:

| | • | lower clients’ total cost of ownership and improve equipment performance; |

| | • | lower both our clients’ and our transaction costs; |

| | • | better forecast our future revenues; |

-3-

| | • | develop a broad, continuing business-to-business relationship with our clients that often results in a substantial increase in the level of activity with those clients; and |

| | • | provide access to the entire organization, which enhances communications. |

The markets in which we operate are large and fragmented. We estimate that in 2012, the worldwide aggregate annual value of new unit sales of the classes of equipment we manufacture was approximately $8 billion for critical applications in the oil, gas, chemical, petrochemical, process, power, military and other industries worldwide, as well as the environmental market space within energy infrastructure. The aftermarket parts and services needs of the installed base of turbo products, reciprocating compressors and steam turbines (both in-house and outsourced) was estimated at approximately $11 billion. In addition, we have aftermarket repair capability for gas turbines, an estimated market size of approximately $4 billion.

We believe that, in the long-term, we are well positioned to benefit from a variety of trends that should continue to drive demand for our products and services, including:

| | • | the increased worldwide demand for energy resulting from population growth, economic growth and a rising middle class; |

| | • | the maturation of production fields worldwide, which requires increased use of compression equipment to offset depletion rates and extend the life of the fields as well as to bring new fields into production; |

| | • | the increase in demand for natural gas, which is driving growth in gas production, processing, storage and transmission infrastructure; |

| | • | regulatory and environmental initiatives, including clean fuel legislation and stricter emissions controls worldwide; |

| | • | the interest in and government support for renewable energy sources such as wind, solar and wave, as well as environmentally focused solutions such as CHP, biomass, CAES and CCS; |

| | • | the aging installed base of equipment, which is increasing demand for aftermarket parts and services, revamps and upgrades; and |

| | • | the increased outsourcing of equipment maintenance and operations. |

Business Strategy

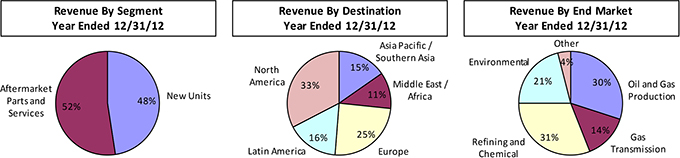

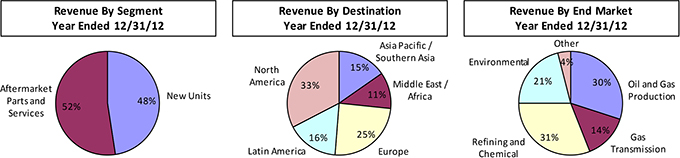

In 2012, approximately 96% of our revenues were generated from energy infrastructure (oil, gas and environmental solutions). Additionally, 48% of our total combined revenues were generated by our new units segment and 52% by our aftermarket parts and services segment. We intend to continue to focus on the upstream, midstream, and downstream oil and gas markets. In addition, we have entered the emerging alternative energy and environmental services markets with our rotating equipment products and services. Thus, we expect to capitalize on the expected long-term growth in equipment and services investment in these energy infrastructure markets.

Our new units segment, which is tied to energy infrastructure investments, is cyclical by nature. Our flexible manufacturing model, which fundamentally is our ability to flex our manufacturing capacity using our supply chain, minimizes the impact of cycles on our profitability. Our flexible manufacturing model allows us to accomplish the same amount of manufacturing in less space, by using our suppliers to flex our capacity up or down to address our manufacturing requirements. In periods of slowing demand, we reduce the amount of work outsourced and/or subcontracted to third-party suppliers allowing us to keep our factories relatively full and fixed costs more fully absorbed, which enables us to better maintain operating margins.

Another important aspect of our business model is that our aftermarket parts and services segment is much less sensitive to business cycles than our new units segment. Our equipment is typically mission critical to the operating assets of our end user clients. Those assets run continuously and, therefore, generally require parts and servicing regardless of changes in economic activity or commodity prices. In 2012, this segment of our business represented approximately 73% of the Company’s income from operations, excluding unallocated net expenses. Revenues of the aftermarket segment have grown at about a 10% compounded annual rate over the last ten years.

Two other important characteristics of our business model are our strong value proposition and our low capital intensity. Our value proposition is based on our clients’ estimated total cost of ownership, which comprises selecting, purchasing, installing, bringing on-line, operating and maintaining our supplied long-lived equipment. For example, we recently developed the highest pressure, highest density centrifugal compressor technology available, which made it possible for a client in the Pre-Salt fields offshore Brazil to eliminate multiple, high pressure CO2 pumping systems and separate injection manifolds. Thus, we reduced capital costs in equipment, weight and footprint. Our technology also increases the reliability of the complete system and reduces operating costs as there are fewer machines to operate and maintain because our equipment is often the highest efficiency solution for client applications. This class of equipment may run for 30 years or more. Over the life cycle of that equipment, the more efficient the equipment, the less energy it consumes to operate and the less CO2 and other emissions emanate from the equipment driving our machines. Our equipment has design features that allow for ease of maintenance, which increases production over the equipment’s service life. Accordingly, there is a quantifiable value proposition associated with what we build.

-4-

We have historically demonstrated the ability to run our business on an ongoing basis with low levels of internally measured net working capital (defined as accounts receivable, inventories net of progress payments, and prepaid expenses less accounts payable and accruals and customer advances) and capital expenditures. For example, the average net working capital and capital expenditures were approximately 5.1% and 2.2%, respectively, of total revenues in the three year period ended December 31, 2012. For 2013, we expect our capital expenditures to be approximately 3.0% of total revenues as a result of operational and infrastructure growth initiatives in Saudi Arabia and Brazil and our expansion of the global capabilities of our gas turbine repair business. As a result of a change in client mix to a higher percentage of national oil companies, we expect our net working capital as a percentage of sales to increase to as high as 10%.

Key Strategic Objectives

With respect to our long-term business strategy, certain of our key strategic objectives are described below.

Increase Sales of Aftermarket Parts and Services to the Existing Installed Base. The substantial portion of the aftermarket parts and services needs of the existing installed base of equipment that we currently do not or only partially service represents a significant opportunity for growth. We believe the market has a general preference for original equipment manufacturers’ (“OEMs”) parts and services. We are continuing to implement globally a proactive approach to aftermarket parts and services sales that capitalizes on our knowledge of the installed base of our own and our competitors’ equipment. We have assembled a significant amount of data on both Dresser-Rand’s and our competitors’ installed base of equipment. We have developed predictive models that help us identify and be proactive in securing aftermarket parts and services opportunities. We are expanding our service center network, which we believe is the largest in the industry for our class of equipment. Through our lean operating system, we have instilled a culture of operational and visual excellence. We believe our premium service level will result in continued growth of sales of aftermarket parts and services. We also expect positive contributions from recently added service centers and newly acquired businesses.

Expand Aftermarket Parts and Services Business to Non-Dresser-Rand Equipment in our Class. We believe the aftermarket parts and services market for non-Dresser-Rand equipment in our class represents a significant growth opportunity that we continue to pursue on a systematic basis. As a result of the knowledge and expertise derived from our long history and experience servicing the largest installed base in the industry, combined with our extensive and on-going investment in technology, we have a proven process of applying our technology and processes to improve the operating efficiency and performance of our competitors’ products. Through our acquisition of Leading Edge Turbine Technologies in 2010, we added a new dimension to the Company’s service portfolio with extension into the large and growing industrial gas turbine repair and field services segment. Additionally, with the largest global network of full-capability service centers and field service support for our class of equipment, we are often in a position to provide quick response to clients and to offer local service. We believe these, along with our world class field service safety performance, are important service differentiators for our clients. By using intelligence gathered on the installed base of our competitors’ equipment, we intend to capitalize on our knowledge, our broad network of service centers, our leading technology and our existing relationships with most major industry participants to grow our aftermarket parts and services solutions for such non-Dresser-Rand equipment. We are able to identify technology upgrades that improve the performance of our clients’ assets and to proactively suggest upgrade and revamp projects that clients may not have considered.

Grow Alliances. As a result of the need to improve efficiency in a competitive global economy, oil and gas companies are frequently consolidating their supplier relationships and seeking alliances with suppliers, shifting from purchasing units and services on an individual transactional basis to choosing long-term service and technology providers that can help them optimize performance over the entire service life of their equipment. We continue to see a high level of interest among our clients in seeking alliances and/or frame agreements with us, and we have entered into agreements with more than 50 of our clients. We plan to leverage our market and technology leadership, global presence, and comprehensive range of products and services to continue to take advantage of this trend by pursuing new client alliances as well as strengthening our existing ones. We currently are the only alliance partner for compressors with Marathon Petroleum Company. In addition to our alliance agreements, we are a preferred supplier to other clients, including BP, Chevron, ConocoPhillips, ExxonMobil, Fluor, LyondellBasell, TransCanada PDVSA, Pemex, Petrobras, Praxair, Repsol, Statoil and Valero.

Expand Our Performance-Based Long-Term Service Contracts. We are growing our participation in the outsourced services market with our energy asset management and our long-term service contracts, which are designed to offer clients significant value through improved equipment performance, decreased life cycle cost and higher availability levels versus the traditional services and products approach. These contracts generally represent multiyear, recurring revenue opportunities for us that typically include a performance-based element to the service provided. We offer these contracts for most of the markets that we serve.

-5-

Introduce New and Innovative Products and Technologies. We believe we are an industry leader in introducing new, value-added technology. Product innovation has historically provided, and we believe will continue to provide, significant opportunities to increase revenues from both new units sales and upgrades to the installed base of equipment manufactured by us and other OEMs. Many of our products utilize innovative technology that lowers operating costs and increases reliability and performance. Examples of such technology offerings include the DATUM® compressor platform, dry-gas seals, hydrodynamic and magnetic bearings and the ‘only-in-class’ integrated compression system (“ICS”) which incorporates a new generation of liquid / gas separation technology (a rotary separator) inside the compressor casing located directly before the first stage of compression. We have introduced a complete line of remote-monitoring and control instrumentation that offers significant performance benefits to clients and enhances our operations and maintenance services offering. Further discussion about innovative products and technologies can be found underNew Product Development.We plan to continue developing innovative products, including new compressor platforms, which could further open up new markets to us. Under our Guascor® engine product line, we have developed, and continue to develop, gas engines that operate on a wide range of fuels from natural gas (industrial and domestic quality natural gas) to different types of methane based gases, such as flare gas (associated gas), a variety of bio-gas types (landfill, sewage and biomethanization) and propane, syngas and dual fuel engines (running on diesel and natural gas).

Continue to Improve Profitability. We continually seek to improve our financial and operating performance through operational excellence initiatives, cost reductions and productivity improvements. Process efficiencies, cycle time reductions and cost improvements are being driven by greater worldwide collaboration across Dresser-Rand locations. We have Process Innovation teams removing waste using advanced lean manufacturing methodologies such as value stream mapping. A large portion of our finished products comes from purchased materials and we are extending our process innovation and lean methodologies to remove waste from our supply chain. We are focused on continuing to improve our cost position across our business, and we continue to believe there is substantial opportunity to further increase our productivity and reduce costs.

Selectively Pursue Acquisitions. We intend to continue our disciplined pursuit of acquisition opportunities that fit our business strategy. We will focus on acquisitions within the energy infrastructure sector that add new products or technologies to our portfolio, provide us with access to new markets or enhance our current product offering or service capabilities. Given our size and the large number of small companies in our industry and related industries, we believe many opportunities for strategic acquisitions remain.

Products and Services

We design, manufacture and market highly engineered rotating equipment and provide services to the worldwide oil, gas, petrochemical, power generation, environmental solutions and industrial process industries. We have two reportable segments based on the demand for energy infrastructure and the associated products and services required, as follows:

| | 1) | New units are predominately highly engineered solutions to new requests from clients. New units also include standardized equipment such as engines and single stage steam turbines. The segment includes engineering, manufacturing, packaging, testing, sales and administrative support. |

| | 2) | Aftermarket parts and services consist of support solutions for the existing population of installed equipment and the operation and maintenance of several types of energy plants. The segment includes engineering, manufacturing, installation, commissioning, start-up and other field services, repairs, overhauls, refurbishment, sales and administrative support. |

The following charts show the proportion of our revenue generated by segment, destination and end market for the periods indicated:

Revenues in the United States were approximately 30% of total revenues for the year ended December 31, 2012. Segment and destination revenues and related financial information for 2012, 2011, and 2010 can be found in Note 20 to the consolidated financial statements in Item 15Exhibits, Financial Statements and Schedules of this Form 10-K.

-6-

New Units

We are a leading manufacturer of highly-engineered turbo and reciprocating compression equipment and steam turbines. We also manufacture power turbines; special-purpose gas turbines; hot gas expanders; gas and diesel engines; trip, trip throttle and non-return valves; magnetic bearings and control systems. Our new unit products are built to client specifications for long-life, critical applications. The following is a description of principal new unit products that we currently offer.

Dresser-Rand Major Product Categories

| | | | | | | | | | | | | | | | | | |

| | | | | End Markets |

| | | Maximum | | Up | | Mid | | Down | | Petro | | | | | | | | |

Product | | Performance | | Stream | | Stream | | Stream | | Chemical | | Chemical | | Industrial | | Power | | Environmental |

Turbo Products | | | | | | | | | | | | | | | | | | |

Centrifugal Compressors | | up to 700k CFM | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

Gas Turbines & Power Turbines | | up to 50+ MW | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

Power Recovery Expanders | | up to 1600 °F | | | | | | ü | | ü | | | | | | ü | | ü |

Reciprocating Compressors | | | | | | | | | | | | | | | | | | |

Process | | up to 45k HP | | ü | | ü | | ü | | ü | | ü | | ü | | | | ü |

Separable | | up to 11k HP, | | ü | | ü | | ü | | | | | | | | | | ü |

| | 7500 psig | | | | | | | | | | | | | | | | |

Steam Turbines | | up to 75 MW | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

Engines | | up to 1.5 MW | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

Turbo Products. We are a leading supplier of turbo machinery for the energy infrastructure markets worldwide. Turbo products sales represented 58.1%, 47.0%, and 54.4% of our total new unit revenues for the fiscal years ended 2012, 2011, and 2010, respectively. Centrifugal compressors utilize turbo machinery technology that employs a series of graduated impellers to increase pressure dynamically. Generally, these centrifugal compressors are used to move a variety of gases through gas processing, refining, and petrochemical facilities; gather gas in oil and gas fields; export gas from main gathering or processing facilities; move gas in pipelines from production to processing, distribution and/or consumption centers; re-inject natural gases into petroleum fields to aid production or increase petroleum recovery; or re-inject CO2 to meet regulatory requirements or enhance recovery. Applications for our turbo products include gas gathering, lift, export and injection; CO2 compression for enhanced oil recovery; storage and transmission; synthetic fuels; ethylene and fertilizer production; refineries and chemical production; CCS and CAES.

Our proprietary DATUM® product line incorporates enhanced engineering features that provide significant operating and maintenance benefits for our clients. The DATUM® product line is a comprehensive line of radial and axial split centrifugal compressors, with modular and scalable construction, for flows up to 700,000 cubic feet per minute (“cfm”) (330 m3/s), and discharge pressures that can range from near atmospheric to well over 15,000 pounds per square inch gauge (1,000 barg). In some applications, a single DATUM® compressor can develop greater pressure ratios per frame size than a comparable existing competitor product offering, resulting in the capability to handle the same pressure ratio with fewer compressor casings. The DATUM® product line also offers improved rotor stability characteristics. DATUM® compressors are available in 15 frame sizes. In addition to the DATUM® centrifugal compressor line, other turbo products we manufacture include a line of axial flow compressors, legacy centrifugal compressors, warm-gas expanders and hot-gas expanders.

In addition, we offer a variety of gas and power turbines covering a power range from approximately 1.5 megawatts (“MW”) to more than 50 MW, which support driver needs for various centrifugal compressor product lines, as well as for power generation applications. We also offer control systems for our centrifugal compressors.

Reciprocating Compressors. We are a leading supplier of reciprocating compressors, offering products ranging from medium to high-speed separable units driven by engines or electric motors, to large, slow speed motor driven process reciprocating compressors. Reciprocating compressor product sales represented 18.0%, 22.8%, and 22.7% of our total new unit revenues for the fiscal years ended 2012, 2011, and 2010, respectively. Reciprocating compressors use a traditional piston and cylinder engine design to increase pressure within a chamber. Typically, reciprocating compressors are used in lower volume/higher pressure ratio applications, and are better able to handle changes in pressure and flow compared to centrifugal compressors. We offer 11 models of process reciprocating compressors, with power capability up to 45,000 horsepower (33.6 MW), and pressures ranging from vacuum to 60,000 psig (4,140 barg). We offer seven models of medium- to high-speed reciprocating compressors, with power ratings over 11,000 horsepower (8.2 MW). Applications for our reciprocating compressors include upstream production (gas lift, boil-off/residue gas, export, gathering, processing, LNG and natural gas liquids (“NGL”); midstream services (gas transport, storage, fuel gas and CO2 injection) and downstream processing (gas-to-liquids (GTL), hydrogen (H2) production, various other refining applications, cool gas, methanol and ethylene, ammonia (NH3), nitric acid and urea). We also offer control systems for our reciprocating compressors.

-7-

Steam Turbines. We are a leading supplier of standard and engineered mechanical drive steam turbines and turbine generator sets. Steam turbine product sales represented 17.7%, 19.0%, and 22.8% of our total new unit revenues for the fiscal years ended 2012, 2011, and 2010, respectively. Steam turbines use steam from power plant or process facilities or renewable or waste energy sources, and expand it through nozzles and fixed and rotating vanes, converting the steam energy into mechanical energy of rotation. We are one of the few remaining North American manufacturers of standard and engineered-to-order multi-stage steam turbines. Our steam turbine models cover a power range from a few kilowatts up to 75MW, are available for high inlet steam pressure and temperature conditions, with or without induction and/or extraction sections and in condensing or back-pressure designs. These units are used primarily to drive pumps, fans, blowers, generators and compressors. Our steam turbines are used in a variety of industries, including oil and gas (upstream mechanical drives in auxiliary systems; power generation in FPSO vessels; mechanical drive and power generation in refining and petrochemical applications); chemicals; biomass; CHP, pulp and paper; metals; industrial power production and utilities; sugar and palm oil. We are the sole supplier to the United States Navy of steam turbines for aircraft carrier propulsion and other ship services. We also offer steam turbine protection valves that are part of the overall rotating equipment protection system and include trip, trip throttle and non-return valves.

Engines. We are a leading supplier of diesel, gas and dual fuel internal combustion reciprocating engines. Engine sales represented approximately 4.8% and 9.8% of our total new unit revenues for the fiscal years ended 2012 and 2011, respectively. Our Guascor® engines cover a power range of up to 1.5 megawatts. Guascor® engines are used in 1) industrial applications and power generation, 2) marine propulsion and auxiliary generation, and 3) environmental solutions, CHP and bioenergy (waste water treatment plant, landfill and biogas generation).

New Product Development

We believe clients are increasingly choosing their suppliers based upon capability to custom engineer, manufacture and deliver reliable, high-performance products, with the lowest total cost of ownership, in the shortest cycle time, and to provide timely, locally based service and support. New product and technology development is a fundamental part of our value proposition and we believe that we are an industry leader in introducing new, value-added products and technologies. Our investment in research and development also includes a continued commitment to attract and retain a globally based staff of innovative technical experts who are recognized within the industry while building a partner network that includes several leading universities around the world.

We have delivered numerous products and technologies that contribute to aftermarket parts and services growth, as well as design and process improvements that increase profitability. We continue to invest in the advancement of core technologies that include improving our DATUM® compressor and steam turbine product line efficiency; reciprocating compressor power and rod load ratings as well as new technologies that will ensure our long-term industry leadership and maintain our reputation for high quality, reliable solutions. Our continuing investment in Ramgen Power Systems, LLC (“Ramgen”) provides an opportunity to commercialize a breakthrough compression technology that applies proven supersonic aircraft technology to ground-based air and gas compressors.

We are also making incremental research and development investments that support our growth strategies for environmental solutions that include solutions such as waste-to-energy, combined heat and power and ocean wave energy, as well as our proven energy storage solutions for alternative energy power generation via Compressed Air Energy Storage (“SMARTCAES™”). We also continue to invest in Echogen Power Systems, LLC (“Echogen”), a company that is developing and commercializing power generation systems that harness waste heat for power and cooling applications.

In 2010, we shipped our first ICS for installation on an existing offshore platform. The DATUM® ICS uses high-efficiency DATUM® centrifugal compressor technology driven by a high-speed, close-coupled oil-free electric motor, including an integrated gas-liquid separation technology, packaged with process coolers in a single module. This solution provides a complete compression system that can be applied to upstream, midstream and downstream markets and is part of our technology roadmap to subsea compression. This ‘only-in-class’ gas-liquid separation and compression technology can also be applied to and used in compressors driven by steam or gas turbines, or conventional electric motors. In June 2011, we and Statoil (NYSE: STO) launched a joint research and development project based on the ICS. We believe this joint industry development program will lead to an improved value proposition for the ‘only-in-class’ ICS, and will help accelerate the broad market acceptance of the technology for both topside and subsea applications.

In 2012, we received an order in connection with an offshore production platform, which is of particular strategic interest because it is reflective of the growing interest in the technology underpinning our “only-in-class” ICS technology platform. A major national oil company ordered two single lift gas compression modules for an offshore platform. Each module will have our VECTRA® gas turbine, driving a two casing compressor train in addition to all the process equipment required to deliver the gas flows at the required export pressure. These trains will include DATUM® I compressors rated at approximately 18 megawatts, but are capable of transmitting the full power of the gas turbine of approximately 27 megawatts on-site. The advantage of DATUM® I’s proprietary design is accomplishing gas-liquid separation and compression in the same device, making the machine more compact and reliable than competitor offerings.

-8-

In 2012, we launched our new MOSTMreciprocating compressor product line. This new separable compressor currently has the greatest-in-class rated rod load, highest-in-class horsepower per throw, widest-in-class speed range, and most-in-class stroke capability. This new product line targets the upstream oil and gas markets and will be developed in our small-scale LNG production technology.

Our VECTRA® product line of power turbines, combined with the General Electric LM2500® family of gas generators, provides a high speed gas turbine solution that is available for new equipment and as a retrofit for legacy turbine packages. The advantage of our VECTRA® product line is a light, compact and fully modular design with high efficiency and quick change-out that increases operating availability and lowers operating costs.

In January 2012, we acquired Synchrony Inc. (“Synchrony”), a technology development company with a portfolio of world-class technologies and products including active magnetic bearings, high speed motors and generators, and power electronics for clean, efficient and reliable rotating machinery. Several years ago we identified the strategic importance of being able to offer oil-free solutions in high speed rotating equipment applications. This is accomplished through the application of magnetic bearing technology. The overall value proposition for eliminating auxiliary oil systems centers around three principles: a) reduced footprint and weight in platform and FPSO applications generate overall capital expenditure savings in the construction phase, b) oil-lubricated bearings in subsea applications are neither practical nor reliable, and c) lubrication oil in compressor and steam turbine applications in general needs to be reconditioned and ultimately discarded as it is mixed with process gas or steam, thus making it environmentally unfriendly. We believe that the seamless integration of this capability into our product development process will provide us with the ability to continuously improve our overall equipment designs.

In 2012, we acquired certain intellectual property assets from Energy Storage and Power LLC (“ES&P”) which complements Dresser-Rand’s currentSMARTCAES™ compressed air energy storage technology and expands the range of its offerings. We are now able to provide the smallest to the largest CAES projects to meet specific grid scale requirements.

In 2012, we also entered into an agreement with Expansion Energy LLC, granting us a worldwide exclusive license to their proprietary VX™ Cycle technology for the small-scale production of LNG. The agreement is important because it gives us exclusive rights to serve a new and large market opportunity with our legacy products as well as our newly introduced MOSTM reciprocating compressor and our recently acquired Guascor® engine line. We will now be able to provide liquefaction machines for the smallest to the largest LNG projects from large land-based and floating LNG projects to small scale LNG plants (quantities from 1,500 gallons per day to 100,000 gallons per day).

Revamp/Upgrade Opportunities

In addition to supplying new units, there are significant opportunities for us to supply engineered revamp and upgrade services to the installed base of rotating equipment.

Revamp services involve significant improvement to the aerodynamic performance of rotating machinery by incorporating newer technology to enhance equipment efficiency, durability or capacity. For example, steam turbine revamps involve modifying the original steam flow path components to match new operating specifications, such as requirements for power, speed and steam condition.

Upgrade services are offered on all our lines of rotating equipment, either in conjunction with revamps or on a stand-alone basis. Upgrades are offered to provide the latest applicable technology components for the equipment to improve durability, reliability, and/or availability. Typical upgrades include replacement of components such as governors, bearings, seals, pistons and electronic control devices and retrofitting of existing lubrication, sealing and control systems with newer technology.

Our proactive efforts to educate our clients on improved revamp technologies to our DATUM® line provide significant growth potential with attractive margins. We have the support systems in place, including our technology platform and service facilities and our cost effective Corporate Product Configurator (“CPC”) platform, to prepare accurate proposals that will allow us to take advantage of the growth potential in this market. In addition, we believe our alliance relationships will allow us to secure revamp opportunities.

Aftermarket Parts and Services

We continue to believe that the aftermarket parts and services segment provides us with long-term growth opportunities. Aftermarket parts and services are generally less sensitive to business cycles than the new units segment, although revenues and bookings tend to be higher in the second half of the year. With a typical operating life of 30 years or more, rotating equipment requires substantial aftermarket parts and services over its operating life. Parts and services activities realize higher margins than new unit sales. Additionally, the cumulative revenues from these aftermarket activities often exceed the initial purchase price of the unit. Our aftermarket parts and services business offers a range of services designed to enable clients to maximize their return on assets by optimizing the performance of their mission-critical rotating equipment. We offer a broad range of aftermarket parts and services, including: replacement parts, field service turnaround, service and repair, operation and maintenance contracts, rotor / spare parts storage, condition monitoring, controls retrofit, site / reliability audits, remote area energy solutions, equipment repair and rerates, equipment installation, applied technology, long-term service agreements, special coatings / weldings, product training, turnkey installation / project management and energy asset management.

-9-

We believe we have the largest installed base of the classes of equipment we manufacture and the largest associated aftermarket parts and services business in the industry. Many of the units we manufacture are unique and highly engineered, and servicing these units requires knowledge of their design and performance characteristics. We estimate that we currently provide approximately 57% of the supplier-provided aftermarket parts and services needs of our own manufactured turbo products, reciprocating compressors and steam turbines and less than 5% of the supplier provided aftermarket parts and services needs of these same classes of equipment of other manufacturers. We focus on a global offering of technologically advanced aftermarket products and services, and as a result, our aftermarket activities tend to be concentrated on the provision of higher value-added parts and upgrades and the delivery of sophisticated operating, repair and overhaul services. Small independent companies tend to focus on local markets and have a more basic aftermarket offering.

A significant portion of our installed base is serviced in-house by our clients. However, we believe there is an increasing trend for clients to outsource this activity, driven by declining in-house expertise, cost efficiency and the superior service levels and operating performance offered by OEM service providers. We believe the steady demand for aftermarket parts and services from our installed base represents a stable source of recurring revenues and cash flow. Moreover, with our value-based solutions strategy, we have a demonstrated track record of growth in this segment as a result of our focus on expanding our service offerings into new areas, including servicing other OEMs’ installed base of equipment, developing new technology upgrades, increasing our penetration of higher value-added services to our own installed base and extending our served markets through acquisitions in contiguous markets such as gas and diesel engine repair, gas turbine repair, steam turbine trip and throttle valves, foundation repair and emission control technologies for integral gas engines.

Because equipment in our industry typically has a multi-decade operating life, we believe aftermarket parts and services capability is a key element in both new unit purchasing decisions and sales of service contracts. Given the critical role played by the equipment we sell, clients place a great deal of importance on a supplier’s ability to provide rapid, comprehensive service, and we believe that the aftermarket parts and services business represents a significant long-term growth opportunity. We believe important factors for our clients include a broad product range, servicing capability, the ability to provide technology upgrades, local presence and rapid response time. We provide our solutions to our clients through a proprietary network of 49 service and support centers, including six engineering and research and development centers in 32 countries that employ over 1,500 service center and field service personnel, which service our own and other OEMs’ turbo and reciprocating compressors and steam and gas turbines. We believe our coverage area of service centers servicing both turbo and reciprocating compressors and steam turbines is approximately 50% larger than that of our next closest competitor.

Sales and Marketing

We market our services and products worldwide through our established sales presence in 32 countries. In addition, in certain countries in which we do business, we sell our products and services through sales representatives. Our sales force is comprised of more than 700 direct sales/service personnel and a global network of approximately 180 independent representatives and distributors, all of whom sell our products and provide service and aftermarket support to our installed base locally in over 150 countries. We are able to deliver significant value to our clients through the use of our CPC platform, which permits us to interactively configure certain engineered solutions in real time at their location or ours in days rather than months. We believe this capability to be unique in the industry.

Manufacturing and Engineering Design

Our products and services are used primarily in supplying and servicing mission critical rotating equipment for the energy infrastructure market worldwide, where increased environmental regulations test our innovative technologies and design capabilities. Our technologies support our clients’ competitiveness by improving process efficiencies and reducing emissions. We have taken aggressive steps to address the challenge of increasing environmental regulation, including creating a strategic business unit to focus on our growth in environmental markets. Our lean manufacturing and quality efforts are critical to reducing waste in production, transportation, inventory and material use. We also use a “flexible manufacturing” strategy, which allows us to accomplish the same amount of manufacturing in less space, by using our suppliers to flex our capacity up or down as needed to meet our manufacturing requirements.

We are committed to providing our clients with the highest quality products and services, and are continuously striving for improved quality and efficiency of both our products and our processes. Our worldwide process innovation team works to improve quality, on-time delivery, cycle time and profitability. The team uses a number of continuous improvement tools such as Six Sigma, lean methodologies, value analysis/value engineering and total quality management. The team teaches employees how to apply value-creation and change management methodologies to their areas of responsibility, and to take ownership of process improvement. The lean philosophy and quality improvement principles are continually being encouraged and expanded throughout our Company in a structured fashion using a variety of tools. Since mid-2008, approximately 18,850 courses and workshops have been completed, and over 3,500 employees have completed at least one on-line lean course. From management to machine tool operators, our employees have an understanding of these quality and lean practices. Employees apply this knowledge in their daily activities to continuously improve the efficiency of our operations and service centers, thus providing our clients with faster and improved configured solutions, shorter response times, and improved cycle times.

-10-

We also seek to provide a competitive advantage to our clients through our current localization strategy with strategic arrangements in the Kingdom of Saudi Arabia, Brazil, Angola, China, India and South Korea.

Clients

Our global client base consists of most major independent oil and gas producers and distributors worldwide, national oil and gas companies, major energy companies, independent refiners, multinational engineering, procurement and construction companies (“EPC”), petrochemical companies, the United States government and other businesses operating in certain process industries. Our clients include, among others, BP, Chevron, ConocoPhillips, Dow Chemical Company, ExxonMobil, Gazprom, LUKOIL, Marathon Petroleum Company, PDVSA, Pemex, Petrobras, PetroChina, Petronas, Repsol, Royal Dutch Shell, SBM, Saudi Aramco, Statoil, Total and Turkmengaz. In 2012, no one customer comprised more than 5% of total net revenues. In 2011, Chevron totaled 5.9% of total net revenues; and in 2010, Petrobras totaled 7.3% of total net revenues.

We believe our business model aligns us with our clients who are shifting from purchasing isolated units and services on an individual transactional basis to choosing service providers that can help optimize performance over the entire life cycle of their equipment. We are responding to this demand through an alliance-based approach. An alliance can encompass the provision of new units and/or parts and services, whereby we offer our clients a dedicated, experienced team, streamlined engineering and procurement processes, and a life cycle approach to selecting, procuring, installing, bringing on-line, operating and maintaining their equipment. Pursuant to the terms of an alliance agreement, we may become the client’s exclusive or preferred supplier of rotating equipment and aftermarket parts and services, which gives us an advantage in obtaining new business from that client. Our client alliance agreements include frame agreements, preferred supplier agreements and blanket purchasing agreements. These alliance agreements are broad form agreements for supply of products and/or services and are generally terminable upon 30 days’ notice without penalty by either party.

Competition

We encounter competition in all areas of our business. We compete against products manufactured by competitors globally. The principal methods of competition in these markets relate to product performance, client service, product lead times, global reach, brand reputation, breadth of product line, quality of aftermarket service and support, and price. We believe the significant capital required to construct new manufacturing facilities, the production volumes required to maintain low unit costs, the need to secure a broad range of reliable raw material and intermediate material supplies, the significant technical knowledge required to develop high-performance products, applications and processes and the need to develop close, integrated relationships with clients are barriers to entry for potential new market entrants. Some of our existing competitors have greater financial and other resources than we do.

Over the last 25 years, the number of major competitors has declined by at least half in each of our principle product lines. Our larger competitors in the new unit segment of the turbo compressor industry include GE Oil & Gas, Solar Turbines, Inc., MAN Diesel & Turbo, Siemens, Rolls-Royce Energy, Elliott Company and Mitsubishi Heavy Industries; in the reciprocating compressor industry include GE Oil & Gas, Burckhardt Compression, Neuman & Esser Group, Ariel Corp., Howden Thomassen Compressors BV and Mitsui & Co., Ltd.; in the steam turbine industry include Siemens, Elliott Company, GE Oil & Gas, Mitsubishi Heavy Industries and Shin Nippon Machinery Co. Ltd.; and in the engine industry include GE/Jenbacher, Caterpillar and Cummins.

In our aftermarket parts and services segment, we compete with our major competitors as discussed above, small independent local providers and our clients’ in-house service providers. However, we believe there is an increasing trend for clients to outsource services, driven by declining in-house expertise, cost efficiency and the superior service levels and operating performance offered by OEMs.

Research and Development

Our research and development expenses were $30.4 million, $27.6 million, and $23.9 million for the years ended December 31, 2012, 2011, and 2010, respectively. Certain development expenses are associated with specific orders and are not shown as research and development expenses in our Consolidated Statement of Income, but instead are included in cost of sales. We have also acquired technologies through strategic acquisitions such as Synchrony, or through our investments in Ramgen and Echogen and through our agreements with ES&P and Expansion Energy LLC. We make a substantial investment in research and development each year in order to maintain our product and services leadership positions. We have developed many of the technology and product breakthroughs in our markets, and manufacture some of the most advanced products available in each of our product lines. We believe we have significant opportunities for growth by developing new services and products that offer our clients greater performance, significant cost savings and lower environmental impacts. We are also actively involved in research and development programs designed to improve existing products and manufacturing methods.

-11-

Employees

As of December 31, 2012, we had approximately 7,976 employees worldwide, with approximately 53% located in the United States. Approximately 33% of our employees in the United States are covered by collective bargaining agreements. Additionally, approximately 50% of our employees outside of the United States belong to industry or national labor unions.

Painted Post, New York (“N.Y.”)

In November of 2007, Local 313 of IUE-CWA, the union that represents certain employees at the Company’s Painted Post facility (the “IUE”), made an offer to have its striking members return to work under the terms of the previously expired union agreement. The Company rejected that offer and locked out these represented employees. Approximately one week later, after reaching an impasse in negotiations, the Company exercised its right to implement the terms of its last contract offer, ended the lockout, and the employees represented by the IUE agreed to return to work under the implemented terms. Subsequently, the IUE filed several unfair labor practice (“ULP”) charges against the Company with Region 3 of the National Labor Relations Board (“NLRB”), asserting multiple allegations arising from the protracted labor dispute, its termination, contract negotiations and related matters.

Region 3 of the NLRB decided to proceed to complaint on only one-third of the ULP allegations asserted by the IUE, while the remaining claims were dismissed. Notably, the NLRB found that many of the critical aspects of the Company’s negotiations with the IUE were handled appropriately, including the NLRB’s findings that the union’s strike was not an unfair labor practice strike and the Company’s declaration of impasse and its unilateral implementation of its last offer were lawful. The Company, therefore, continued to operate under a more contemporary and competitive implemented contract offer while contract negotiations with the IUE continued in 2008 and 2009. In November 2009, a collective bargaining agreement between the IUE and the Company was ratified, which agreement expires in March 2013. As a result, the Company was not required to make available the retiree medical benefits which the Company eliminated in its implemented last contract offer.

The claims that proceeded to complaint before the NLRB included the Company’s handling of the one week lockout, the negotiation of the recall process used to return employees to the facility after reaching impasse and lifting the lockout, and the termination of two employees who engaged in misconduct on the picket line during the strike. The trial of this matter took place before a NLRB Administrative Law Judge (the “ALJ”) in Elmira and Painted Post, New York, during the summer of 2009. On January 29, 2010, the ALJ issued his decision in which he found in favor of the union on some issues and upheld the Company’s position on others. The Company timely appealed the ALJ’s rulings against the Company to the NLRB in Washington, D.C. On August 6, 2012, the NLRB affirmed the ALJ’s rulings. The Company timely appealed the matter to the U.S. Fifth Circuit Court of Appeals, and continues to believe it complied with the law and that it will ultimately prevail with respect to these ULP allegations. The litigation process, including further appeals, could reasonably take one to two years to resolve with finality.

Other Labor Relations Matters

Our operations in the following locations have individuals under collective bargaining agreements and/or are unionized: Olean, Painted Post and Wellsville, N.Y.; Burlington, Iowa; Le Havre, France; Peterborough, UK; Naroda, India; Oberhausen and Bielefeld, Germany; Zumaia and Minano, Spain; and Kongsberg, Norway. Further, certain of our employees in Brazil are subject to regional collective agreements. A new collective bargaining agreement was entered with our employees at our Wellsville, N.Y. facility in August 2012, and collective bargaining agreements will expire at our Painted Post, N.Y., and Burlington, Iowa facilities in March and June of 2013, respectively. In addition, we have an agreement with the United Brotherhood of Carpenters and Joiners of America whereby we hire skilled trade workers on a contract-by-contract basis in many parts of the United States. Our contract with the United Brotherhood of Carpenters and Joiners of America can be terminated by either party with 90 days prior written notice. Although we believe that our relations with our represented employees are good, we cannot assure that we will be successful in negotiating new collective bargaining agreements, that such negotiations will not result in significant increases in cost of labor or that a breakdown in such negotiations will not result in the disruption of our operations.

-12-

Environmental and Government Regulation

Manufacturers, such as our Company, are subject to extensive environmental laws and regulations concerning, among other things, emissions to the air, discharges to land, surface water and subsurface water, the generation, handling, storage, transportation, treatment and disposal of waste and other materials and the remediation of environmental pollution relating to such companies’ properties and operations (past and present). Costs and expenses under such environmental laws incidental to ongoing operations are generally included within operating budgets. Potential costs and expenses may also be incurred in connection with the repair or upgrade of facilities to meet existing or new requirements under environmental laws. In many instances, the ultimate costs under environmental laws and the time period during which such costs are likely to be incurred are difficult to predict. We do not believe that our liabilities in connection with compliance issues will have a material adverse effect on us.

Various federal, state and local laws and regulations impose liability on current or previous real property owners, lessees or operators for the cost of investigating, cleaning up or removing contamination caused by hazardous or toxic substances at the property. In addition, such laws impose liability for such costs on persons who disposed of, or arranged for the disposal of, hazardous substances at third-party sites. Such liability may be imposed without regard to the legality of the original actions and without regard to whether we knew of, or were responsible for, the presence of such hazardous or toxic substances, and such liability may be joint and several with other parties. If the liability is joint and several, we could be responsible for payment of the full amount of the liability, whether or not any other responsible party is also liable.

We have sent wastes from our operations to various third-party waste disposal sites. From time to time we receive notices from representatives of governmental agencies and private parties contending that we are potentially liable for a portion of the investigation and remediation costs and damages at such third-party sites. We do not believe that our liabilities in connection with such third-party sites, either individually or in the aggregate, will have a material adverse effect on us.

The equity purchase agreement entered into in connection with the October 2004 acquisition of the Company from Ingersoll Rand by First Reserve Corporation provides that, with the exception of non-Superfund off-site liabilities and non-asbestos environmental tort cases, which had a three-year time limit for a claim to be filed, Ingersoll Rand will remain responsible without time limit for certain specified known environmental liabilities that existed as of the October 29, 2004, closing date. Each of these liabilities has been placed on the Environmental Remediation and Compliance Schedule to the equity purchase agreement (the “Final Schedule”). We are responsible for all environmental liabilities that were not identified prior to the closing date and placed on the Final Schedule, although we may have claims against others.

Pursuant to the equity purchase agreement, Ingersoll Rand is responsible for all response actions associated with the contamination matters placed on the Final Schedule and must perform such response actions diligently. However, to the extent contamination at leased properties was caused by a third party and to the extent contamination at owned properties resulted from the migration of releases caused by a third party, Ingersoll Rand is only required to conduct response actions after being ordered to do so by a governmental authority.

As part of its due diligence procedures leading up to the acquisition of Guascor, the Company identified a potential environmental liability associated with subsurface contamination at a facility in Spain. The Company is undertaking environmental site investigation work to characterize the subsurface contamination and develop the plans for the appropriate remedial actions to be taken. The Company does not expect that the environmental costs associated with the site investigation work and any future remediation actions will have a material adverse effect on the Company, and such costs are subject to indemnification by the sellers of Guascor under the share purchase agreement entered into between the Company, Guascor and the stockholders of Guascor, which provides that the sellers of Guascor will remain responsible for Guascor’s environmental liabilities that existed as of the May 4, 2011, closing date.

There is significant regulatory activity underway at both the federal and state levels related to climate change. It is expected that international agreements, climate legislation and promulgation of greenhouse gas regulation will continue. Ultimately, caps on carbon emissions in the United States may be established and the cost of regulation is not likely to be distributed uniformly as the energy sector is expected to incur disproportionate cost. Greenhouse gas regulation and reduction for companies in the power and energy sector will have a pronounced impact on key issues of business strategy, such as production economics, cost competitiveness, investment decisions and value of assets.

The timing and magnitude of these changes are uncertain. We have positioned and continue to position ourselves to provide solutions for our clients. Today we produce equipment for oil production, refining, petrochemical, LNG, pipelines and an array of other applications that, if this legislation were to be enacted or regulations promulgated, could slow investment by the clients that use our equipment. However, our products have applications regardless of the energy source; for instance, our high-speed rotating equipment can be used for the sequestration of CO2 as coal-fired power plants seek to reduce greenhouse gas emissions, in connection with the use of steam from plants now burning biomass to create electricity, as a means to create the bulk energy storage needed to more economically utilize wind and solar energy, in solar-thermal applications or, conceivably, to harness power from waves. While climate change presents business risk, it also presents business opportunities for us.

-13-

Intellectual Property

We rely on a combination of patent, trademark, copyright and trade secret laws, employee and third-party nondisclosure / confidentiality agreements and license agreements to protect our intellectual property. We sell most of our products and provide services under a number of registered trade names, service names, brand names and registered trademarks, which we believe are widely recognized in the industry.

In addition, many of our products and technologies are protected by patents. Except for our Company’s name and principal mark “Dresser-Rand,” no single patent, trademark or trade name is currently material to our business as a whole. We anticipate that we will apply for additional patents in the future as we develop new products and processes. Any issued patents that cover our proprietary technology may not provide us with substantial protection or be commercially beneficial to us. The issuance of a patent is not conclusive as to its validity or its enforceability. If we are unable to protect our patented technologies or confidential information, our competitors could commercialize our technologies. Competitors may also be able to design around our patents. In addition, we may also face claims that our products, services, or operations infringe patents or misappropriate other intellectual property rights of others.

With respect to proprietary know-how, we rely on trade secret protection and confidentiality agreements. Monitoring the unauthorized use of our proprietary technology is difficult and the steps we have taken may not prevent unauthorized disclosure or use of such technology. The disclosure or misappropriation of our trade secrets and other proprietary information could harm our ability to protect our rights and our competitive position.

Our Company’s name and principal trademark is a combination of the names of our founder companies, Dresser Industries, Inc. and Ingersoll Rand. We have acquired rights to use the “Rand” portion of our principal mark from Ingersoll Rand, and the rights to use the “Dresser” portion of our name from Dresser, Inc., the successor of Dresser Industries, Inc. and now a wholly-owned subsidiary of General Electric Company. If we lose the right to use either the “Dresser” or “Rand” portion of our name, our ability to build our brand identity could be negatively affected.

Additional Information

We file annual, quarterly and current reports, amendments to these reports, proxy statements and other information with the United States Securities and Exchange Commission (“SEC”). Our SEC filings may be accessed and read free of charge through our website at www.dresser-rand.com or through the SEC’s website at www.sec.gov. These SEC filings are available on our website as soon as reasonably practicable after we file them electronically with the SEC. The information contained on, or that may be accessed through, our website is not part of this Form 10-K. All documents we file are also available at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We have adopted a Code of Conduct that applies to all employees, executive officers and directors and a Code of Ethics for the Chief Executive Officer (“CEO”) and Senior Financial Officers. The Code of Conduct, which serves as our “Code of Business Conduct and Ethics” as required by Section 303A.10 of the New York Stock Exchange Listed Company Manual, and the Code of Ethics for the CEO and Senior Financial Officers, which serves as our “Code of Ethics” under Item 406 of Regulation S-K, are posted on our website, www.dresser-rand.com, and are available in print upon written request by any stockholder at no cost. The request should be submitted to Dresser-Rand Group Inc., c/o General Counsel, 112 Avenue Kleber, 75784 Cedex 16 Paris, France, or West8 Tower, Suite 1000, 10205 Westheimer Rd. Houston, Texas, 77042.

Any amendment to the Code of Ethics for the CEO and Senior Financial Officers, any waiver of any provision of the Code of Conduct granted to one of our executive officers or members of the board of directors or any waiver of any provisions of the Code of Ethics for the CEO and Senior Financial Officers granted to our principal executive officer, principal financial officer, principal accounting officer or controller or person performing similar functions, will be disclosed on our website at www.dresser-rand.com or in a report on Form 8-K within four business days of such event. Any amendment to the Code of Conduct will also be disclosed on our website at www.dresser-rand.com. Any waiver of any provision of the Code of Conduct granted to an executive officer or director may only be made by the Company’s Board of Directors or a Committee of the Board authorized to do so.

-14-

ITEM 1A. RISK FACTORS ($ and€in millions)

Economic recessions could adversely affect our business.

Prolonged periods of adverse global economic conditions could decrease demand for oil and gas, which in turn could result in lower prices for oil and gas. Such decreased demand and lower prices can result in lower demand for our new equipment and, to a lesser extent, aftermarket parts and services and, therefore, could adversely affect our results of operations and cash flows. For example, the decline in global economic activity in late 2008 and into 2009 significantly reduced demand for our new units and, to a lesser extent, our aftermarket parts and services. New units and aftermarket bookings in 2009 declined 49.1% and 14.6%, respectively, from 2008 levels. A significant portion of the decline in aftermarket bookings in 2009 compared to 2008 was due to currency translation resulting from the impact of a stronger U.S. dollar.

Volatility and disruption of the credit markets may negatively impact us.

We intend to finance our operations and initiatives with existing cash, cash from operations, and borrowings under our senior secured credit facility (“Senior Secured Credit Facility”) and other financing alternatives, if necessary. Adverse national and international economic conditions may affect our ability to fully draw upon our Senior Secured Credit Facility and we may not be able to obtain financing at competitive pricing and terms. Further, while we believe our present liquidity is adequate for our current plans, deterioration in the credit markets or prolonged tightening of credit availability could adversely affect the ability of our clients to pay us or the ability of our suppliers to meet our needs or do so competitively, which could affect our results of operations, liquidity and cash flows.

Our operating results and cash flows could be harmed because of industry downturns.

Conditions in the oil and gas industry, which affect the majority of our revenue, are subject to factors beyond our control. The businesses of most of our clients, particularly oil, gas and petrochemical companies, are, to varying degrees, cyclical and historically have experienced periodic downturns. Profitability in those industries is highly sensitive to supply and demand cycles and volatile commodity prices, and our clients in those industries historically have tended to delay large capital projects, including expensive maintenance and upgrades, during industry downturns. These industry downturns have been characterized by diminished product demand, excess manufacturing capacity and subsequent accelerated erosion of average selling prices. Demand for our new units and, to a lesser extent, aftermarket parts and services is driven by a combination of long-term and cyclical trends, including increased outsourcing of services, maturing oil and gas fields, the aging of the worldwide installed base of equipment, gas market growth and the construction of new energy infrastructure, and regulatory factors. In addition, the growth of new unit sales is generally linked to the growth of oil and gas consumption in markets in which we operate. Moreover, new unit bookings can be highly variable due to volatile market conditions, subjectivity clients exercise in placing orders and timing of large orders.

Prices of oil and gas have been very volatile over recent years. For example, prices increased to historic highs in July 2008 followed by a significant decline through February 2009. These price declines reduced demand for our new units and, to a lesser extent, for our aftermarket parts and services, from the levels experienced during 2008; and our new unit bookings in 2009 declined 49.1% compared with 2008.

Prolonged periods of reduced client investment in new units could have a material adverse impact on our financial condition, results of operations and cash flows. Any significant downturn in our clients’ markets or in general economic conditions could result in a reduction in demand for our products and services and could harm our business. Such downturns, including the perception that they might continue, could have a significant negative impact on the market price of our common stock and our 6 1/2% Senior Subordinated Notes (“Senior Subordinated Notes”).

We may not be successful in implementing our business strategy.

We estimate that we currently provide approximately 57% of the supplier-provided aftermarket parts and services needs of our own manufactured turbo products, reciprocating compressors and steam turbines, and less than 5% of the aftermarket parts and services needs of these same classes of equipment of other manufacturers. The successful implementation of our strategy depends on our ability to provide aftermarket parts and services to both our own and our competitors’ installed base of equipment, to develop and maintain our alliance relationships and to maintain competitive costs. Our ability to successfully implement our aftermarket business strategy also depends to a large extent on the success of our competitors in servicing the aftermarket parts and services needs of our clients, the willingness of clients to outsource their service needs to us and general economic conditions. In addition, our ability to implement and execute our localization initiatives, globalize our gas turbine repair business, make strategic acquisitions, reduce cycle times, execute large, complicated extended scope projects and enter into service contracts and new alliance agreements with national oil companies in developing countries will impact the success of our business strategy. We cannot assure you that we will succeed in implementing our strategy.

Our reliance on certain suppliers may cause delays in shipments and result in significant revenue and profit deferrals.

In our new units segment we rely on third-party suppliers for certain major pieces of equipment that are integrated into our compression packages. These finished goods are commonly referred to as “major buyouts,” such as large gas turbines or motors that drive our compressors. Our reliance on third-party suppliers for this equipment exposes us to delays resulting from a supplier’s failure to deliver the equipment in a sufficiently timely manner to enable us to meet our commitments to our clients. Any such delays in the delivery of major buyouts may delay our deliveries of compression packages to our clients until subsequent quarterly or annual periods, resulting in deferral of revenue and profit recognition to those future periods.

-15-