UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

DRESSER-RAND GROUP INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| þ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

| | |

| | Dresser-Rand Group Inc. |

| | West8 Tower, Suite 1000 |

| | 10205 Westheimer Road |

| | Houston, Texas 77042 |

| | Tel: 713-973-5356 |

| | Fax: 713-973-5323 |

| | www.dresser-rand.com |

| | March 25, 2013 |

TO THE STOCKHOLDERS OF DRESSER-RAND GROUP INC.:

This year’s Annual Meeting of Stockholders of Dresser-Rand Group Inc. (“DRC”) will be held at 8:30 a.m. (Central), Tuesday, May 7, 2013, at the offices of DRC located at West8 Tower, Suite 1000, 10205 Westheimer Road, Houston, Texas 77042.

In addition to acting on the matters outlined in the enclosed Proxy Statement, there will be a brief presentation on DRC’s business.

We hope that you attend the Annual Meeting personally and we look forward to seeing you. Whether or not you expect to attend in person, your voting as soon as possible would be greatly appreciated and will ensure that your shares will be represented at the Annual Meeting. If you do attend the Annual Meeting, you may revoke your proxy should you wish to vote in person.

On behalf of the directors and management of Dresser-Rand Group Inc., we would like to thank you for your continued support and confidence in DRC.

| | |

| Sincerely yours, |

|

|

|

| William E. Macaulay |

| Chairman of the Board |

DRESSER-RAND GROUP INC.

West8 Tower, Suite 1000

10205 Westheimer Road

Houston, Texas 77042

NOTICE OF 2013 ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

To Be Held

May 7, 2013

To the Stockholders of Dresser-Rand Group Inc.:

NOTICE IS HEREBY GIVEN that the 2013 Annual Meeting of Stockholders of Dresser-Rand Group Inc. (“DRC,” the “Company,” “Dresser-Rand,” “we” or “our”) will be held at 8:30 a.m. (Central) on Tuesday, May 7, 2013, at the offices of the Company located at West8 Tower, Suite 1000, 10205 Westheimer Road, Houston, Texas 77042 (the “Annual Meeting”).

At the Annual Meeting, we will ask stockholders to:

1. Elect the eight directors named in this proxy statement to serve until the next annual meeting of stockholders and until their successors have been duly elected and qualified;

2. Ratify the appointment of PricewaterhouseCoopers LLP as DRC’s independent registered public accountants;

3. Hold an advisory vote on executive compensation

4. Approve the Company’s performance goals under the 2008 Stock Incentive Plan; and

5. Consider any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof.

We plan to hold a brief business meeting focused on these items and we will attend to any other proper business that may arise.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” PROPOSALS 1, 2, 3 AND 4.The proposals are further described in the proxy statement.

Only DRC Stockholders of record at the close of business on March 13, 2013, are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting. For ten days prior to the Annual Meeting, a list of stockholders entitled to vote will be available for inspection at DRC’s corporate offices located at West8 Tower, Suite 1000, 10205 Westheimer Road, Houston, Texas 77042.

|

| By order of the Board of Directors, |

|

|

| Mark F. Mai |

| Vice President, General Counsel and Secretary |

YOUR VOTE IS IMPORTANT

WE URGE YOU TO VOTE PROMPTLY EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING. YOUR PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE TIME IT IS VOTED AT THE ANNUAL MEETING.

TABLE OF CONTENTS

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS OF

DRESSER-RAND GROUP INC. TO BE HELD ON

MAY 7, 2013

GENERAL INFORMATION ABOUT DRC’S ANNUAL MEETING

Dresser-Rand Group Inc. (“DRC,” “Dresser-Rand,” the “Company,” “we” or “our”) is providing this proxy statement to stockholders entitled to vote at the 2013 Annual Meeting of Stockholders (the “Annual Meeting”) of DRC as part of a solicitation by the Board of Directors for use at the Annual Meeting and at any adjournment or postponement that may take place. The Annual Meeting will be held on Tuesday, May 7, 2013, at 8:30 a.m. (Central) at the offices of the Company located at West8 Tower, Suite 1000, 10205 Westheimer Road, Houston, Texas 77042.

We are taking advantage of Securities and Exchange Commission (“SEC”) rules that allow us to deliver proxy materials to our stockholders on the Internet. Under these rules, we are sending our stockholders a one-page notice regarding the Internet availability of proxy materials instead of a full printed set of proxy materials. Our stockholders will not receive printed copies of the proxy materials unless specifically requested. Instead, the one-page notice that our stockholders receive will tell them how to access and review on the Internet all of the important information contained in the proxy materials. This notice also tells our stockholders how to submit their proxy card on the Internet and how to request to receive a printed copy of our proxy materials. We expect to provide notice and electronic delivery of this proxy statement to such stockholders beginning on or about March 25, 2013.

Who is entitled to vote at the Annual Meeting?

Anyone who owns of record DRC common stock as of the close of business on March 13, 2013, is entitled to one vote per share owned. We refer to that date as the Record Date. There were 76,066,307 shares outstanding on the Record Date.

Who is soliciting my proxy to vote my shares?

DRC’s Board of Directors (the “Board”) is soliciting your “proxy,” or your authorization for our representatives to vote your shares. Your proxy will be effective for the Annual Meeting on May 7, 2013, and at any adjournment or postponement of that meeting.

Who is paying for and what is the cost of soliciting proxies?

DRC is bearing the entire cost of soliciting proxies. We have not hired a solicitation firm to assist us in the solicitation of proxies, but we reserve the right to do so. Proxies will be solicited both through the mail and Internet, but also may be solicited personally or by telephone, facsimile, email or special letter by DRC’s directors, officers, and employees for no additional compensation. DRC will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending our proxy materials to their customers or principals who are the beneficial owners of shares of DRC common stock.

What constitutes a quorum?

For business to be conducted at the Annual Meeting, a quorum constituting a majority of the shares of DRC common stock issued and outstanding and entitled to vote must be in attendance or represented by proxy.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Delaware law and DRC’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws govern the vote on each proposal. The Board’s recommendation is set forth together with the description of each item in this proxy statement. In summary, the Board’s recommendations and the approval requirements are:

PROPOSAL 1. ELECTION OF DIRECTORS.

The first proposal to be voted on is the election of the eight directors named in this proxy statement to hold office until the 2014 Annual Meeting and until their successors have been elected and qualified. The Board has nominated eight people as directors, each of whom currently is serving as a director of DRC.

You may find information about these nominees beginning on Page 6.

You may vote in favor of or against each nominee, or abstain from voting on such nominee. Assuming a quorum, each director is elected by a majority of the votes cast. This means that each nominee must receive more “FOR” votes than “AGAINST” votes in order to be elected as a director. Abstentions and broker non-votes (as described below) will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that you vote “FOR” each director nominee.

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS.

The second proposal to be voted on is to ratify the appointment of PricewaterhouseCoopers LLP as DRC’s Independent Registered Public Accountants for 2013.

You may find information about this proposal beginning on Page 10.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will pass if approved by a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as votes against the proposal and, if a broker elects not to exercise its discretionary authority, any resulting broker non-votes will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that you vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accountants for 2013.

PROPOSAL 3. ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION.

The third proposal to be voted on is an advisory resolution to approve executive compensation.

You may find information about this proposal beginning on Page 10.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposed advisory resolution will be approved if a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the matter are voted in favor of the proposal. Abstentions will have the same effect as votes against the proposal and broker non-votes will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that you vote “FOR” this advisory resolution to approve executive compensation.

2

PROPOSAL 4. APPROVAL OF THE COMPANY’S PERFORMANCE GOALS UNDER THE 2008 STOCK INCENTIVE PLAN.

The fourth proposal to be voted on is to approve the Company’s performance goals under the 2008 Stock Incentive Plan.

You may find information about this proposal beginning on Page 12.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will be approved if a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the matter are voted in favor of the proposal. Abstentions will have the same effect as votes against the proposal and broker non-votes will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that you vote “FOR” this proposal to approve the Company’s performance goals under the 2008 Stock Incentive Plan.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The Board is not aware of any other business to be presented for a vote of the stockholders at the Annual Meeting. If any other matters are properly presented for a vote, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment.

The chairman of the Annual Meeting may refuse to allow presentation of a proposal or nominee for the Board if the proposal or nominee was not properly submitted. The requirements for submitting proposals and nominations for next year’s meeting are described below under the heading “Stockholder Proposals for the 2014 Annual Meeting.”

VOTING AND PROXY PROCEDURE

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full printed set of proxy materials?

We are taking advantage of SEC rules that allow us to deliver our proxy materials on the Internet to our stockholders. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials to our stockholders. This notice includes instructions on how to access the proxy materials on the Internet and how to request to receive a printed set of our proxy materials. In addition, our stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

How do I obtain electronic access to the proxy materials?

The Notice Regarding the Availability of Proxy Materials you received includes instructions on how to:

| | • | | View the proxy materials for the Annual Meeting on the Internet; |

| | • | | Vote on the Internet or in person; and |

| | • | | Request a copy of proxy materials by the Internet, telephone or email. |

In addition to the website referenced in the one-page Notice Regarding the Availability of Proxy Materials, our 2013 proxy materials are also available on the Internet atwww.dresser-rand.com using the Investors link.

What are the voting rights of holders of DRC common stock?

Each outstanding share of DRC common stock on the Record Date will be entitled to one vote on each matter considered at the meeting.

3

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. There are some important distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered in your name with our transfer agent, Computershare, you are the stockholder of record for those shares. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the meeting.

Beneficial Owner

If your shares are held in a brokerage account, by a bank or other nominee (commonly referred to as being held in “street name”), you are the beneficial owner of those shares. Your broker, bank or other nominee is the stockholder of record and, therefore, has forwarded proxy-related materials to you as the beneficial owner. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares and also are invited to attend the meeting. However, since beneficial owners are not the stockholder of record, you may not vote your shares in person at the meeting unless you obtain a signed proxy from your broker, bank or other nominee giving you the right to vote the shares. If your shares were issued pursuant to the Company’s 2005 Stock Incentive Plan, 2005 Directors Stock Incentive Plan, or 2008 Stock Incentive Plan and remain subject to a risk of forfeiture, you may grant your voting proxy directly to us.

What does it mean if I receive more than one Notice Regarding the Availability of Proxy Materials?

It means that you have multiple accounts at the transfer agent or with brokers or other nominees. Follow the instructions on each notice to ensure that all of your shares are voted.

How do I vote?

You may vote by Internet, mail, telephone or in person.

1. BY INTERNET. You can vote on the Internet by following the instructions provided in the one-page Notice Regarding the Availability of Proxy Materials. Your vote by Internet must be properly transmitted not later than 11:59 p.m. (Eastern) on May 6, 2013, to be effective.

2. BY MAIL. If you request to receive a printed set of our proxy materials by mail, you can vote by mail. The Board recommends that you vote by proxy even if you plan on attending the meeting. Mark your voting instructions on, and sign and date, the proxy card delivered to you by mail and then return it in the postage-paid envelope provided with your printed set of materials. If you mail your proxy card, we must receive it in accordance with the instructions that will be included in the proxy materials delivered to you by mail.

3. BY TELEPHONE. You can vote by telephone using the phone number obtained by accessing the website set forth in the instructions provided in the one-page Notice Regarding the Availability of Proxy Materials. Your telephonic vote must be completed not later than 11:59 p.m. (Eastern) on May 6, 2013, to be effective.

4. IN PERSON. If you are a stockholder of record, you may vote in person at the meeting. “Street name” or nominee account stockholders who wish to vote at the meeting will need to obtain a signed proxy form from the institution that holds their shares of record giving such owners the right to vote the shares at the meeting. Any stockholder wishing to attend the meeting will need to present valid photo identification to the building receptionist and to the Company receptionist on the 10th floor.

4

How do I revoke my proxy or change my voting instructions?

You can change your vote or revoke your proxy before the final vote at the meeting. You can do this by casting a later proxy through any of the available methods described in the question and answer immediately above. If you are a stockholder of record, you also can revoke your proxy by delivering a written notice of your revocation to our Corporate Secretary, Mark F. Mai, at our executive office at West8 Tower, Suite 1000, 10205 Westheimer Road, Houston, Texas 77042. If you are a beneficial owner, you can revoke your proxy by following the instructions sent to you by your broker, bank or other nominee.

How will proxies be voted if I give my authorization?

The Board has selected Vincent R. Volpe Jr. and Mark F. Mai, and each of them, to act as proxies with full power of substitution. All properly submitted proxies will be voted in accordance with the directions given. If you properly submit a proxy with no further instructions, your shares will be voted in accordance with the recommendations of the Board (FORall director nominees named in this proxy statement,FORthe ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2013,FORthe adoption of the advisory resolution to approve executive compensation andFOR the approval of the Company’s performance goals under the 2008 Stock Incentive Plan). Management knows of no other matters that may come before the Annual Meeting for consideration by the stockholders. However, if any other matter properly comes before the Annual Meeting, the persons named as proxy holders, or their nominees or substitutes, will vote upon such matters in accordance with the recommendation of the Board, or in the absence of such a recommendation, in accordance with the judgment of the proxy holders, in either case to the extent permitted by law.

What is the voting requirement to approve each of the matters?

For Proposal 1, the election of directors, each nominee must receive more “FOR” votes than “AGAINST” votes in order to be elected as a director.

For Proposal 2 (to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants for 2013), Proposal 3 (the adoption of the advisory resolution to approve executive compensation) and Proposal 4 (the approval of the Company’s performance goals under the 2008 Stock Incentive Plan), approval requires the affirmative vote of stockholders holding a majority of those shares present (in person or by proxy) and entitled to vote on the matter.

If you are a beneficial owner and do not provide the stockholder of record with voting instructions, your shares may constitute broker non-votes for certain matters (as described in the question and answer immediately below). In tabulating the voting result for a proposal, shares that constitute broker non-votes are not considered as being entitled to vote on that proposal.

How will votes be counted?

The inspector of elections for the Annual Meeting will calculate affirmative votes, negative votes, abstentions, and broker non-votes, as applicable. Under Delaware law, abstentions will be included in determining the number of shares present at the meeting for the purpose of determining the presence of a quorum, as will shares voted by brokers or other “street” nominees pursuant to their discretionary authority.

You, as a beneficial owner, own your shares in “street name” if your broker or other “street” nominee is actually the record owner. Brokers or other “street” nominees have discretionary authority to vote on routine matters, regardless of whether they have received voting instructions from their clients who are the beneficial owners. Director elections, the advisory resolution to approve executive compensation and the approval of the performance goals under the 2008 Stock Incentive Plan are not considered “routine matters” and brokers or other “street” nominees may not vote on these matters in the absence of receiving voting instructions from their clients. Ratifying the appointment of the independent registered public accountants is considered a routine matter and, therefore, brokers and “street” nominees have discretionary authority to vote on this matter. A “broker non-vote”

5

results on a matter when a broker or other “street” nominee record holder returns a duly executed proxy but does not vote on a non-routine matter because it does not have discretionary authority to vote on non-routine matters and has not received voting instructions from its client (the beneficial holder). Accordingly, no broker non-votes occur when brokers exercise their discretionary authority to vote on routine matters. The approval of each non-routine matter, other than the election of directors, is determined based on the vote of all shares present in person or represented and entitled to vote on the matter. An abstention on that proposal has the same effect as a vote “against” that proposal. Broker non-votes have no effect on the vote on that proposal. Because of the majority vote standard for the election of directors, abstentions and broker non-votes have no effect on the outcome of the vote on the election of directors.

Where do I find voting results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published by DRC in a current report on Form 8-K within four business days after the Annual Meeting. The report will be filed with the SEC and you may receive a copy by contacting our Vice President, Investor Relations, Blaise E. Derrico, at 713-973-5497. You also may access a copy on the Internet atwww.dresser-rand.comor through the SEC’s Internet site atwww.sec.gov.

PROPOSAL 1

ELECTION OF DIRECTORS

The first agenda item to be voted on is the election of eight directors to hold office until the 2014 Annual Meeting and until their successors have been elected and qualified. The Board has nominated eight directors, each of whom is currently serving as a director of DRC. The Board unanimously recommends that you vote “FOR” such nominees.

The Board of Directors currently consists of eight directors. Each director’s term expires at the Annual Meeting and when his or her successor has been elected and qualified. All nominees have indicated their willingness to serve, if elected, but if any of the nominees should be unable or unwilling to serve, the Board may either reduce its size, or designate or not designate a substitute nominee. If the Board designates a substitute nominee, proxies that would have been cast for the original nominee will be cast for the substitute nominee unless instructions are given to the contrary.

The table below sets forth the name, age as of March 13, 2013, and existing positions with DRC of each director nominee:

| | | | | | |

Name | | Age | | | Office or Position Held |

William E. Macaulay | | | 67 | | | Chairman of the Board of Directors |

Vincent R. Volpe Jr. | | | 55 | | | Director, President, and Chief Executive Officer |

Rita V. Foley | | | 59 | | | Director and Member of the Audit and Compensation Committees |

Louis A. Raspino | | | 60 | | | Director and Member of the Audit and Compensation Committees |

Philip R. Roth | | | 61 | | | Director and Member of the Audit and Nominating and Governance Committees |

Stephen A. Snider | | | 65 | | | Director and Member of the Compensation and Nominating and Governance Committees |

Michael L. Underwood | | | 69 | | | Director and Member of the Audit and Nominating and Governance Committees |

Joseph C. Winkler III | | | 61 | | | Director and Member of the Compensation and Nominating and Governance Committees |

6

In evaluating director candidates, and considering incumbent directors for re-nomination to the Board, the Board and the Nominating and Governance Committee have considered a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments, and experience in light of the needs of the Company. For incumbent directors, the factors include past performance on the Board. Each director provides a broad range of complementary skills, expertise, knowledge and a diversity of perspective to build a capable, responsive and effective Board. This section presents biographical and other information about our director nominees, each of whom is currently serving as a director. It also presents for each director the specific experiences, qualifications, attributes and skills considered by the Board in re-nominating each director to serve on the Board.

William E. Macaulayhas been the Chairman of our Board of Directors since October 2004. Mr. Macaulay is the Chairman, Chief Executive Officer, and a Managing Director of First Reserve Corporation (“FRC”), a private equity firm focusing on the energy industry, which he joined in 1983. FRC was an affiliate of our former indirect parent, Dresser-Rand Holdings LLC. Prior to joining First Reserve, Mr. Macaulay was a co-founder of Meridien Capital Company, a private equity buyout firm. From 1972 to 1982, Mr. Macaulay was with Oppenheimer & Co., Inc., where he served as Director of Corporate Finance, with responsibility for investing Oppenheimer’s capital in private equity transactions, as a General Partner and member of the Management Committee of Oppenheimer & Co., as well as President of Oppenheimer Energy Corporation. Mr. Macaulay serves as a director of Glencore International Plc, an integrated commodities producer and marketer, and Weatherford International Ltd., an oilfield service company, and formerly served as a director of Alpha Natural Resources, Inc., Dresser, Inc., Foundation Coal Holdings, Inc., National Oilwell Varco and Pride International, Inc. Mr. Macaulay holds a B.B.A. degree, Magna Cum Laude, in Economics from City College of New York and an M.B.A. from the Wharton School of the University of Pennsylvania.

Mr. Macaulay brings to the Company leadership, industry, economics and finance experience resulting from his career spanning more than 35 years in private equity and finance, including over 25 years focusing on the energy industry.

Vincent R. Volpe Jr.is our President and Chief Executive Officer and has served as a member of our Board of Directors since October 2004. Mr. Volpe has been with Dresser-Rand Group Inc., its affiliates and predecessor companies to the business since 1981. He has held positions in Engineering, Marketing and Operations residing and working in various countries, including: Applications Engineer in Caracas, Venezuela; Vice President Dresser-Rand Japan in Tokyo, Japan; Vice President Marketing and Engineering Steam and Turbo Products in Olean, New York; Executive Vice President European Operations in Le Havre, France; and President Dresser-Rand Europe in London, U.K. In January 1997, Mr. Volpe became President of Dresser-Rand Company’s Turbo Product Division, a position he held until September 2000. In April 1999, he assumed the additional role of Chief Operating Officer for Dresser-Rand Company, responsible for worldwide manufacturing, technology and supply chain management, serving in that position until September 2000. Mr. Volpe became President and Chief Executive Officer of Dresser-Rand Company in September 2000. He has served as an independent director of FMC Corporation since 2007. Mr. Volpe earned a B.S. in Mechanical Engineering and a B.A. in German literature, both from Lehigh University.

Mr. Volpe has substantial historical knowledge of the Company and its operations with 32 years of employment in various capacities with the Company, its affiliates and predecessor companies to the business, across the organization’s international operations. He brings leadership experience and extensive operations and industry experience to the Company.

Rita V. Foleyhas been a member of our Board of Directors since May 2007. Ms. Foley retired in June 2006 as Senior Vice President of MeadWestvaco Corporation, a leading global provider of packaging to the entertainment, healthcare, cosmetics, and consumer products industries, and President of its Consumer Packaging Group. Prior to that, from 2001 to 2002, she was the Chief Operating Officer of MeadWestvaco’s Consumer Packaging Group. Ms. Foley held various senior positions from 1999 to 2001 within Westvaco, the predecessor to MeadWestvaco, including Senior Vice President and Chief Information Officer. Ms. Foley has also held various executive global sales, marketing, and general management positions at Harris Lanier, Digital Equipment

7

Corporation, and QAD Inc. Ms. Foley serves on the board of PetSmart Inc. and she is a former director of the Council of the Americas. Ms. Foley earned a B.S. degree from Smith College and she is a graduate of Stanford University’s Executive Program.

Ms. Foley brings leadership, operational, marketing, merger and acquisition and financial experience to the Company. She served as the President of a global packaging business utilizing an engineered to order manufacturing process similar to that of the Company and has director experience from serving on other public company boards, including membership on compensation, audit and executive committees.

Louis A. Raspinohas been a member of our Board of Directors since December 2005. He has over 30 years of experience in the oil and gas exploration, production and service industry. Mr. Raspino was the President and Chief Executive Officer and a member of the Board of Directors of Pride International Inc., an international provider of contract drilling and related services to oil and natural gas companies (“Pride”), from July 2005 to June 2011, when Pride merged into Ensco plc. He served as Executive Vice President and Chief Financial Officer of Pride from December 2003 until June 2005. Before joining Pride in December 2003, he was Senior Vice President and Chief Financial Officer of Grant Prideco, Inc., a manufacturer of drilling and completion products supplying the energy industry, from July 2001 until December 2003. Previously, he was Vice President of Finance for Halliburton Company, Senior Vice President and Chief Financial Officer of The Louisiana Land & Exploration Company and began his career with Ernst & Young. Mr. Raspino has served as a member of the board of directors of Forum Energy Technologies, Inc., a global provider of manufactured technologies and applied products to the energy industry, since April 2012. In March 2013, he also joined the board of directors of Chesapeake Energy Corporation, a company engaged in the development, acquisition, production, exploration, and marketing of onshore oil and natural gas properties in the U.S., and was appointed chair of that company’s audit committee. Mr. Raspino is a CPA and earned a B.S. from Louisiana State University and an M.B.A. from Loyola University.

Mr. Raspino has over 35 years of experience in the oil and gas exploration, production and service industry, as well as international and capital markets experience, and brings to the Company leadership and finance experience. He has senior executive experience, having recently served as the President and Chief Executive Officer of a public company. He is also a CPA and has served in various executive finance positions throughout his career, including as the Chief Financial Officer of two public companies.

Philip R. Rothhas been a member of our Board of Directors since December 2005. He has over 30 years of accounting and finance experience. Mr. Roth formerly was Vice President, Finance and Chief Financial Officer of Gardner Denver, Inc., which designs, manufactures and markets compressor and vacuum products and fluid transfer products, from May 1996 until August 2004. Prior to joining Gardner Denver, Mr. Roth was with Emerson Electric Co. from 1980 until 1996, where he held positions in accounting, treasury and investor relations at the corporate office. He also held positions in strategic planning and acquisitions, and as a Chief Financial Officer at the division level. Mr. Roth is a CPA and began his career with Price Waterhouse. He earned a B.S. in Accounting and Business Administration from the University of Missouri and an M.B.A. from the Olin School of Business at Washington University.

Mr. Roth has spent most of his career in leadership positions with manufacturing companies, including more than eight years as Chief Financial Officer of a publicly-traded company with significant international operations. He also has extensive compressor industry and acquisition-related experience, as well as a wide-ranging background in accounting, treasury and investor relations.

Stephen A. Sniderhas been a member of our Board of Directors since November 2009. Mr. Snider was the Chief Executive Officer and director of Exterran Holdings, Inc., a global natural gas compression services company from August 2007 to June 2009, and was Chief Executive Officer and Chairman of the general partner of Exterran Partners, L.P., a domestic natural gas contract compression services business, from August 2007 to June 2009. Prior to that, Mr. Snider was President, Chief Executive Officer and Director of Universal Compression Holdings Inc. (“Universal”), a supplier of equipment used to ship natural gas through pipelines,

8

from 1998 until Universal merged with Hanover Compressor Company in 2007 to form Exterran Corporation. Mr. Snider has over 30 years of experience in senior management of operating companies, and also serves as a current director of Energen Corporation and Thermon Group Holdings, Inc. Mr. Snider also served as a director of T-3 Energy Services, Inc. from 2003 to July 2007 and Seahawk Drilling Incorporated from August 2009 to February 2011. On February 11, 2011, Seahawk announced that substantially all of its assets would be sold to Hercules Offshore, Inc., such sale being implemented through a Chapter 11 bankruptcy filing, citing heavy losses due to the slow issuance of shallow water drilling permits in the U.S. Gulf of Mexico following the Macondo well blowout and other factors.

Mr. Snider brings to the Company leadership experience, including as a public company Chief Executive Officer, and nearly 40 years of involvement in rotating equipment, with approximately 25 years dedicated to natural gas compression and processing.

Michael L. Underwoodhas been a member of our Board of Directors since August 2005. Mr. Underwood worked the majority of his 35-year career in public accounting at Arthur Andersen LLP, where he was a partner. He moved to Deloitte & Touche LLP as a director in 2002, retiring in 2003. Mr. Underwood currently serves on the board of directors of Chicago Bridge & Iron Company N.V. He holds a B.A. in Philosophy and Economics and a Masters Degree in Accounting from the University of Illinois.

Mr. Underwood brings to the Company leadership experience and over 35 years of public accounting experience, a significant portion of which was with publicly traded companies in the manufacturing industry.

Joseph C. Winkler IIIhas been a member of our Board of Directors since May 2007. Mr. Winkler served as the Chairman and Chief Executive Officer of Complete Production Services, Inc., a provider of specialized oil and gas services and equipment in North America (“Complete”), from March 2007 until February 2012, at which time Complete was acquired by Superior Energy Services, Inc. Between June 2005 and March 2007, Mr. Winkler served as Complete’s President and Chief Executive Officer. Prior to that, from March 2005 until June 2005, Mr. Winkler served as the Executive Vice President and Chief Operating Officer of National Oilwell Varco, Inc., an oilfield capital equipment and services company (“Varco”), and from May 2003 until March 2005 as the President and Chief Operating Officer of the company’s predecessor, Varco International, Inc. From April 1996 until May 2003, Mr. Winkler served in various other capacities with Varco and its predecessor, including Executive Vice President and Chief Financial Officer. From 1993 to April 1996, Mr. Winkler served as the Chief Financial Officer of D.O.S., Ltd., a privately held provider of solids control equipment and services and coil tubing equipment to the oil and gas industry, which was acquired by Varco in April 1996. Prior to joining D.O.S., Ltd., he was Chief Financial Officer of Baker Hughes INTEQ, and served in a similar role for various companies owned by Baker Hughes Incorporated including Eastman/Telco and Milpark Drilling Fluids. Mr. Winkler has served as a member of the board of directors of Commercial Metals Company, a vertically integrated, Fortune 500 steel company that recycles, manufactures, fabricates and trades steel globally, since June 2012, and Hi-Crush Partners LP, a domestic producer of a specialized mineral used to enhance the recovery rates of hydrocarbons from oil and natural gas wells, since August 2012. Mr. Winkler received a B.S. degree in Accounting from Louisiana State University.

Mr. Winkler has many years of operational, financial, international and capital markets experience, a significant portion of which was with publicly traded companies in the oil and gas services, manufacturing and exploration and production industries. He recently served as the Chairman and Chief Executive Officer of a public company that provided specialized oil and gas services and equipment.

The Board of Directors unanimously recommends that you vote “FOR” each of the director nominees named above.

9

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The second agenda item to be voted on is the ratification of the appointment of PricewaterhouseCoopers LLP as DRC’s independent registered public accountants for the fiscal year ending December 31, 2013. The Board of Directors unanimously recommends that you vote “FOR” this proposal.

The Audit Committee has appointed PricewaterhouseCoopers LLP to act as DRC’s independent registered public accountants, which we also refer to as our “independent accountants,” for the fiscal year ending December 31, 2013. The Board of Directors has directed that such appointment be submitted to DRC’s stockholders for ratification at the Annual Meeting. PricewaterhouseCoopers LLP was DRC’s independent registered public accounting firm for the fiscal year ended December 31, 2012.

Stockholder ratification of the appointment of PricewaterhouseCoopers LLP as DRC’s independent registered public accountants is not required. The Board, however, is submitting the appointment to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the appointment, the Board will request that the Audit Committee reconsider its appointment of PricewaterhouseCoopers LLP for the fiscal year ending December 31, 2013, and consider such vote in its review and future appointment of the Company’s independent registered public accounting firm. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different accounting firm at any time during the 2013 fiscal year if the Audit Committee determines that such a change would be in the best interests of DRC and its stockholders.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they so desire. They will be available to respond to appropriate questions.

The Board of Directors unanimously recommends that you vote “FOR” this proposal.

PROPOSAL 3

ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION

The third agenda item to be voted on is the adoption of an advisory resolution on executive compensation. The Board of Directors unanimously recommends that you vote “FOR” this proposal.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, requires us to offer our stockholders an opportunity to vote on whether to approve an advisory resolution on executive compensation. This vote, commonly known as “say on pay,” provides you as a stockholder the opportunity to endorse or not endorse the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules.

The Board of Directors believes that the Company’s success as one of the largest global suppliers of custom-engineered rotating equipment solutions to the oil, gas, petrochemical, process, power, military and other industries is led by the collective talent, experience and performance of its executive leadership team. With that in mind, our overall executive compensation program has been designed to attract, retain, engage and motivate leaders who will develop and execute strategies that generate short- and long-term success and growth. The key principles underlying the Company’s executive compensation program are described in detail in the Compensation Discussion & Analysis (“CD&A”) beginning on page 33 of this proxy statement and are set forth below:

| | • | | align the financial interest of the Company’s leadership’s with that of its stockholders; |

| | • | | promote consistent and long-term growth and stability; |

10

| | • | | attract, retain and engage talented executive officers; |

| | • | | reward individuals for overall Company, functional and business unit results; and |

| | • | | recognize individual responsibility, leadership, performance, potential, skills, team work, knowledge, experience and impact. |

We believe that our executive compensation policies and practices are effective in supporting these guiding principles, including policies and practices such as:

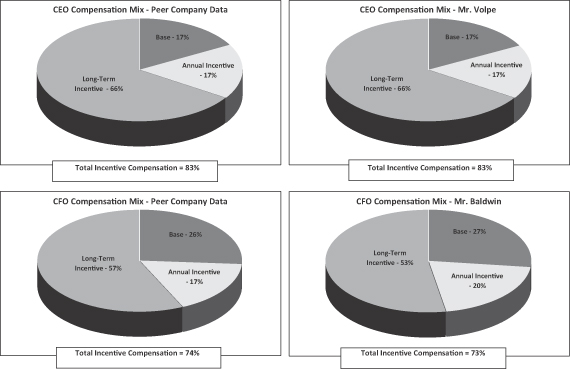

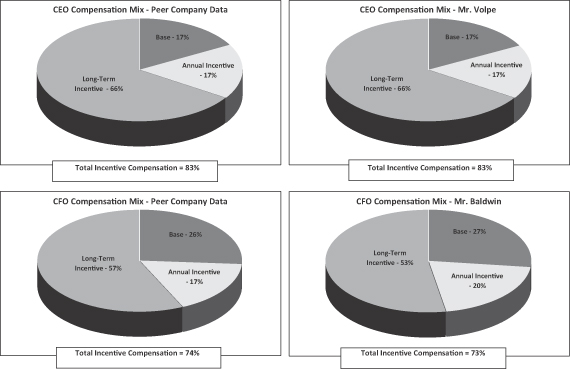

| | • | | Basing a significant portion of the compensation of executives on performance of the Company and the executive’s functional or business unit; for the CEO and CFO, at least 70% of their total direct compensation is variable and over half is tied to performance. Total direct compensation is defined as base salary, target annual incentive opportunity and target long-term incentive opportunity. For the remaining named executive officers (“NEOs”), at least 60% of their total direct compensation is variable; |

| | • | | Promoting and rewarding actions that balance short-term strategies with long-term growth and stability using a variety of financial and non-financial metrics (e.g., operating income, net working capital as a percentage of sales, total shareholder return, safety); |

| | • | | Including recoupment features, which serve to support good corporate governance, in the Company’s incentive programs; and |

| | • | | Requiring NEOs to own a substantial amount of Company stock. |

We urge stockholders to read the CD&A beginning on page 33 of this proxy statement, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the Summary Compensation Table and other related compensation tables, notes and narrative, appearing on pages 53 through 67, which provide detailed information on the compensation of our named executive officers.

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as a matter of good corporate governance, we are asking you to approve the following advisory resolution at the Annual Meeting:

“Resolved, that the Company’s stockholders approve, on an advisory basis, the compensation paid to the named executive officers, as disclosed in this proxy statement, including the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative discussion.”

Because this vote is advisory, it will not be binding upon the Board of Directors or the Company. Although non-binding, the Compensation Committee and the Board values the opinions expressed by stockholders in their vote on this proposal and will review and consider the voting results when making future decisions regarding our executive compensation program.

The Board of Directors unanimously recommends that you vote “FOR” approval of this proposal.

11

PROPOSAL 4

APPROVAL OF THE COMPANY’S PERFORMANCE GOALS UNDER THE 2008 STOCK INCENTIVE PLAN

Overview

The Company’s 2008 Stock Incentive Plan (the “plan”) enables the Compensation Committee to award incentive and nonqualified stock options, stock appreciation rights, shares of our common stock, restricted stock, restricted stock units and incentive bonuses (which may be paid in cash or stock or a combination thereof), any of which may be performance-based, with vesting and other award provisions that provide effective incentives to Company employees (including officers), non-employee directors and other service providers. The plan became effective on May 13, 2008, following its adoption on March 10, 2008 by the Board (through its delegation to the Compensation Committee) and upon its approval by the Company’s stockholders. In order to allow for awards under the plan to continue to qualify as tax-deductible performance-based compensation under Section 162(m) (“Section 162(m)”) of the Internal Revenue Code (the “Code”), the Company is asking stockholders to approve the material terms of the performance goals under the plan, which approval is required at least every five years as described below. Stockholders are not being asked to approve any amendment to the plan or to approve the plan itself.

Why Stockholders Should Vote to Approve the Performance Goals under the Plan

Our Board believes that it is in the best interests of the Company and its stockholders to continue to provide for an equity incentive plan under which equity-based compensation awards made to the Company’s named executive officers (other than the chief financial officer) can qualify for deductibility by the Company for federal income tax purposes. Accordingly, the plan has been structured in a manner such that awards under it can satisfy the requirements for “performance-based” compensation within the meaning of Section 162(m). In general, under Section 162(m), in order for us to be able to deduct compensation in excess of $1 million paid in any one year to our named executive officers listed on page 34 (other than the chief financial officer), such compensation must qualify as “performance-based.” One of the requirements of “performance-based” compensation for purposes of Section 162(m) is that the material terms of the performance goals under which compensation may be paid be disclosed to and approved by the Company’s stockholders at least once every five years. The initial stockholder approval for the performance goals was obtained when the plan was approved by stockholders at the 2008 stockholders’ meeting.

For purposes of Section 162(m) the material terms include:

| | • | | the employees eligible to receive compensation; |

| | • | | a description of the business criteria on which the performance goals may be based; and |

| | • | | the maximum amount of compensation that can be paid to an employee under the performance goal. |

With respect to the various types of awards available under the plan, each of these aspects is discussed below, and, as noted above, stockholders are being asked under this proposal to approve each of these aspects of the plan for purposes of the approval requirements of Section 162(m).

Plan Summary

The following description of the plan is not intended to be complete and is qualified in its entirety by the complete text of the plan, which is attached to this proxy statement asAppendix A. Stockholders are urged to read the plan in its entirety. Any capitalized terms that are used in this summary description but are not defined here or elsewhere in this proxy statement have the meanings assigned to them in the plan.

12

Background and Purpose of the Plan. Our Board, through authority delegated to the Compensation Committee, adopted the plan on March 10, 2008, subject to stockholder approval. The Company’s stockholders approved the plan on May 13, 2008, at which time it became effective. The plan was further amended by the Compensation Committee on February 12, 2010 and March 15, 2010. Any capitalized terms that are used in this summary description but are not defined here or elsewhere in this proxy statement have the meanings assigned to them in the plan.

The purpose of the plan is to provide employees (including officers), non-employee directors and other service providers with incentives for the future performance of services that are linked to the profitability of the Company’s businesses and to the interests of its stockholders. Aspects of the plan also are intended to encourage employees (including officers), non-employee directors and other service providers to own Company stock, so that they may establish or increase their proprietary interest in the Company and align their interests with the interests of the stockholders.

Types of Awards Under the Plan. The plan allows the following types of awards:

| | • | | Stock options (both incentive stock options (ISOs) and “non-qualified” stock options); |

| | • | | Stock appreciation rights (SARs), alone or in conjunction with stock options or other awards; |

| | • | | Grants of our common shares; |

| | • | | Shares of restricted stock and restricted stock units (RSUs); and |

| | • | | Incentive bonuses that may be paid in cash, stock, or a combination thereof. |

Administration. The plan is administered by the Compensation Committee of the Board, except that our Nominating and Governance Committee makes grants to our non-employee directors. Members of the Compensation Committee may be replaced by the Board. The Compensation Committee has broad authority, subject to the provisions of the plan, to administer and interpret the plan, including, without limitation, the authority to:

| | • | | prescribe, amend and rescind rules and regulations relating to the plan and to define terms not otherwise defined in the plan; |

| | • | | determine which persons are plan participants, to which of such participants awards will be granted and the timing of any such awards; |

| | • | | grant awards and determine the terms and conditions of those grants, including the number of shares subject to awards and the exercise or purchase price of such shares and the circumstances under which awards become exercisable or vested or are forfeited or expire; |

| | • | | establish and verify the extent of satisfaction of any performance goals or other conditions applicable to the grant, issuance, exercisability, vesting and/or ability to retain any award; |

| | • | | prescribe and amend the terms of the agreements or other documents evidencing awards and the terms of or form of any document or notice required to be delivered to the Company by participants under the plan; |

| | • | | determine the extent to which adjustments are required in relation to changes in the Company’s capitalization, such as stock-splits, reverse stock-splits or dividends; |

| | • | | interpret and construe the plan, any rules and regulations under the plan and the terms and conditions of any award, and to make exceptions to any such provisions in good faith in extraordinary circumstances; and |

| | • | | make all other determinations deemed necessary or advisable for the administration of the plan. |

13

All decisions and actions of the Compensation Committee are final and binding on all participants. Subject to certain limitations, the Compensation Committee may by resolution authorize one or more officers of the Company to perform any or all things the Committee is authorized and empowered to do or perform under the plan. The plan permits the Board to exercise the Compensation Committee’s powers, other than with respect to matters required by law to be determined by the Compensation Committee. Other than in connection with a change in the Company’s capitalization: (i) the exercise price of an option or strike price of an SAR may not be reduced without stockholder approval (including canceling previously awarded options or SARs and regranting them with a lower exercise price), and (ii) without stockholder approval, an option or SAR may not be cancelled, exchanged, substituted for, bought out by the Company or surrendered in exchange for cash, other awards or a combination thereof. The Committee may delegate any or all aspects of the day-to-day administration of the plan to one or more officers or employees of the Company or any subsidiary, and/or to one or more agents.

Stock Subject to Plan. The maximum number of shares that may be issued under the plan is equal to six million shares. As of March 13, 2013, a total of 2,272,360 shares remained available for awards under the plan, and a total of 2,632,128 shares were subject to outstanding awards under the plan. Of the 1,581,726 shares subject to outstanding option awards, the weighted average remaining contractual term was 6.3 years with a weighted average exercise price of $34.90.

Shares of Common Stock issued under the plan may be either authorized and unissued shares or previously issued shares acquired by the Company. On termination or expiration of an unexercised option, SAR or other stock-based award under the plan, in whole or in part, the number of shares of Common Stock subject to such award again becomes available for grant under the plan. Any shares of restricted stock forfeited as described below will become available for grant. However, the following shares willnot again become eligible for issuance under the plan: shares subject to awards that have been retained by the Company in payment or satisfaction of the exercise price, purchase price or tax withholding obligation of an award; shares subject to awards that otherwise do not result in the issuance of shares in connection with payment or settlement of an award; and shares that have been delivered (either actually or by attestation) to the Company in payment or satisfaction of the exercise price, purchase price or tax withholding obligation of an award. Under the plan, no single participant may be granted awards covering more than eight hundred thousand (800,000) shares of Common Stock in any fiscal year. The maximum number of shares of Common Stock that may be issued pursuant to stock options intended to be incentive stock options is six million (6,000,000) shares.

The number and kind of shares available for issuance under the plan (including under any awards then outstanding), and the number and kind of shares subject to the limits set forth in the plan, will be equitably adjusted by the Compensation Committee to reflect any reorganization, reclassification, combination of shares, stock split, reverse stock split, spin-off, dividend or distribution of securities, property or cash (other than regular, quarterly cash dividends), or any other event or transaction that affects the number or kind of shares of the Company outstanding. The terms of any outstanding award will also be equitably adjusted by the Compensation Committee as to price, number or kind of shares subject to such award, vesting, and other terms to reflect the foregoing events, which adjustments need not be uniform as between different awards or different types of awards.

Eligibility. Employees (including officers), non-employee directors and service providers of the Company and its subsidiaries and affiliates are eligible for grants under the plan. The Board has identified these classes of individuals as those whose services are linked most directly to the profitability of our businesses and to the interests of our stockholders. In determining the persons to whom grants will be awarded and the number of shares to be covered by each grant, the Compensation Committee may take into account, among other things, the duties of the respective persons, their present and potential contributions to the success of the Company and such other factors as the Compensation Committee deems relevant in connection with accomplishing the purpose of the plan. Because awards are established at the discretion of the Compensation Committee subject to the limits described above, the number of shares that may be granted to any participant under the plan cannot be determined. The Compensation Committee has historically granted awards under the plan to fewer than 1,000 employees and other participants each year based on the factors referenced above. In 2012, the Compensation

14

Committee granted awards to approximately 615 participants under the plan. For more information on grants made to our NEOs in 2012, refer to the section of this Proxy Statement titled “Executive Compensation - Grants of Plan-Based Awards for 2012” on page 56.

Terms and Conditions of Stock Options. Stock options granted to participants may be granted alone or in addition to other awards granted under the plan and may be of two types: (i) incentive stock options within the meaning of Section 422 of the Internal Revenue Code; or (ii) non-qualified stock options, which are not intended to be incentive stock options. All stock options granted under the plan will be evidenced by a written agreement between the Company and the participant. Each agreement will provide, among other things, whether it is intended to be an agreement for an incentive stock option or a non-qualified stock option, the number of shares subject to the option, the exercise price, exercisability (or vesting), the term of the option, which may not exceed 10 years, and other terms and conditions.

Subject to the express provisions of the plan, options generally may be exercised over such period, in installments or otherwise, as the Compensation Committee may determine, except that options granted to officers subject to Section 16 of the Exchange Act (“Section 16 officers”) that become exercisable based solely on continued employment or the passage of time may not become exercisable in full prior to the thirty-sixth (36) month following the grant date but may be subject to pro-rata vesting over such period (except that the Compensation Committee may provide for the acceleration of vesting of such options in the event of the participant’s death, Disability, retirement or in connection with a Change in Control); provided, however, that up to 2.5% of the total awards authorized under the plan may be granted with shorter vesting periods. Subject to the foregoing, if the Compensation Committee provides that any stock option is exercisable only in installments, the Compensation Committee may at any time waive such installment exercise provisions, in whole or in part, based on such factors as it, in its sole discretion, deems appropriate, and the Compensation Committee may at any time accelerate the exercisability of any stock option. Dividend equivalents may not be granted with respect to shares underlying stock options.

The exercise price for any stock option granted may not be less than the fair market value of the Common Stock subject to that option on the grant date. There is one exception to this requirement. This exception allows the exercise price per share with respect to an option that is granted in connection with a merger or other acquisition as a substitute or replacement award for options held by optionees of the acquired entity to be less than 100% of the fair market value on the grant date if such exercise price is based on a formula set forth in the terms of the options held by such optionees or in the terms of the agreement providing for such merger or other acquisition. The exercise price may be paid in shares, cash or a combination thereof, as determined by the Compensation Committee, including an irrevocable commitment by a broker to pay over such amount from a sale of the shares issuable under an option, the delivery of previously owned shares and withholding of shares deliverable upon exercise.

Options granted under the plan may not be transferred except by will or by the laws of descent and distribution, and each option or Stock Appreciation Right shall be exercisable only by the participant during his or her lifetime.

Following termination of employment, the participant’s right to exercise an option then held shall be determined by the Compensation Committee and set forth in an award agreement. In all cases, individual option agreements may provide for different terms, and in no case may an option be exercised after the expiration of its term.

Terms and Conditions of Stock Appreciation Rights. Stock Appreciation Rights may be granted alone (“freestanding SARs”) or in conjunction with all or part of a stock option (“tandem SARs”). Upon exercising a SAR, the participant is entitled to receive the amount by which the fair market value of the Common Stock at the time of exercise exceeds the strike price of the SAR. The strike price of a freestanding SAR will be specified in the award agreement and is subject to the same limitations as the exercise price of an option. The strike price of a tandem SAR is the same as the exercise price of the related option. This amount is payable in Common Stock, cash, or a combination of Common Stock and cash, at the Compensation Committee’s discretion. The other terms and conditions that apply to stock options, including the provisions that apply in the event of a participant’s termination of employment, also generally apply to freestanding SARs.

15

A participant may exercise a freestanding SAR in the manner determined by the Compensation Committee and specified in the award agreement, but may only exercise a tandem SAR if the related stock option is also exercisable. A participant’s tandem SAR will not be exercisable if the participant has already exercised the related stock option, or if that option has terminated. See Terms and Conditions of Stock Options for details. Similarly, once a participant exercises a tandem SAR, the related stock options will no longer be exercisable. Dividend equivalents may not be granted with respect to shares underlying stock appreciation rights.

Terms and Conditions of Grants of Common Shares, Restricted Stock and RSUs. Common shares may be granted to participants, subject to such conditions as determined by the Compensation Committee. A restricted stock award is an award of Common Shares (as defined in the plan) with restrictions that lapse in one or more installments over a vesting period following the grant date; provided, however, that the grant, issuance, retention, vesting and/or settlement of shares under any such award granted to a Section 16 officer that is based solely upon continued employment and/or the passage of time may not vest or be settled in full prior to the thirty-sixth month following its date of grant, but may be subject to pro-rata vesting over such period (except that the Compensation Committee may provide for the satisfaction and/or lapse of all conditions under any such award in the event of the participant’s retirement, death or Disability or in connection with a Change in Control); provided, further, that up to 2.5% of the total awards authorized under the plan may be granted with shorter vesting periods to Section 16 officers. The plan also allows for restricted stock treated as a performance award, under which the grant, issuance or vesting of an award would be based on satisfaction of pre-established objective performance criteria over a performance period of at least one year. A restricted stock unit, or RSU, provides for the issuance of shares of stock following the vesting date or dates associated with the award. Shares of restricted stock and RSUs may be awarded either alone or in addition to other awards granted under the plan. The Compensation Committee will determine the eligible individuals to whom grants will be awarded, and the terms and conditions of the grants subject to the limitations contained in the plan.

Unless otherwise determined by the Compensation Committee, the recipient of a restricted stock award will have, with respect to the shares of restricted stock, all of the rights of a stockholder of the Company holding the type of shares that are the subject of the restricted stock, including, if applicable, the right to vote the shares and receive any cash dividends (which may be deferred by the Compensation Committee and reinvested in additional restricted stock). Holders of RSUs are not entitled to voting rights in the shares of Common Stock underlying their units until the underlying shares are actually reflected as issued and outstanding shares on the Company’s stock ledger. Common Shares (as defined in the plan) underlying the RSUs shall not have rights to receive dividends or dividend equivalents, unless otherwise provided by the Compensation Committee.

Terms and Conditions of Incentive Bonuses. An incentive bonus is an opportunity for a participant to earn a future payment tied to the level of achievement with respect to one or more performance criteria established for a performance period of not less than one year. The maximum cash amount payable pursuant to that portion of an incentive bonus granted in any calendar year to any participant that is intended to satisfy the requirements for “performance-based compensation” under Section 162(m) shall not exceed $10,000,000. The terms of any incentive bonus will be set forth in an award agreement that will include provisions regarding (i) the target and maximum amount payable to the participant, (ii) the performance criteria and level of achievement versus these criteria that shall determine the amount of such payment, (iii) the term of the performance period as to which performance shall be measured for determining the amount of any payment, (iv) the timing of any payment earned by virtue of performance, (v) restrictions on the alienation or transfer of the incentive bonus prior to actual payment, (vi) forfeiture provisions and (vii) such further terms and conditions as determined by the Committee.

The Committee shall establish the performance criteria and level of achievement versus these criteria that shall determine the target and maximum amount payable under an incentive bonus, which criteria may be based on financial performance and/or personal performance evaluations. The Committee may specify the percentage of the target incentive bonus that is intended to satisfy the requirements for “performance-based compensation” under Section 162(m), in which case the performance criteria will be determined as specified below under “Performance Goals May Apply to Stock Options, Stock Appreciation Rights, Restricted Stock, RSUs and

16

Incentive Bonuses.” The Committee shall certify the extent to which any performance criteria have been satisfied, and the amount payable as a result thereof, prior to payment of any incentive bonus that is intended to satisfy the requirements for “performance-based compensation” under Section 162(m).

The Committee shall determine the timing of payment of any incentive bonus. Payment of the amount due under an incentive bonus may be made in cash or in shares, as determined by the Committee.

Performance Goals May Apply to Stock Options, Stock Appreciation Rights, Restricted Stock, RSUs and Incentive Bonuses. The Compensation Committee may specify certain performance criteria, which must be satisfied before stock options, stock appreciation rights, restricted stock and RSUs will be granted or will vest or incentive bonuses will become payable.

“Performance goals” means the specific objectives that may be established by the Compensation Committee, from time to time, with respect to a grant. These objectives may be based on the attainment of specified levels of one or more of the following measures, applied to either the Company as a whole or to a business unit or a subsidiary or division, either individually, alternatively or in any combination, and measured either quarterly, annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, as applicable: (i) revenue growth; (ii) earnings before interest, taxes, depreciation and amortization; (iii) earnings before interest, taxes and amortization; (iv) operating income; (v) pre- or after-tax income; (vi) cash flow; (vii) cash flow per share; (viii) net income; (ix) earnings per share; (x) return on equity; (xi) return on invested capital; (xii) return on assets; (xiii) economic value added (or an equivalent metric); (xiv) share price performance; (xv) total stockholder return; (xvi) improvement in or attainment of expense levels; (xvii) improvement in or attainment of working capital levels; or (xviii) debt reduction.

Under the plan and to the extent consistent with Section 162(m), the Compensation Committee (i) shall adjust any evaluation of performance under a performance goal to eliminate the effects of charges for restructurings, discontinued operations, extraordinary items and all items of gain, loss or expense determined to be extraordinary or unusual in nature or related to the disposal of a segment of a business or related to a change in accounting principle all determined in accordance with Accounting Standards Codification 225-20 or other applicable or successor accounting provisions, and/or described as extraordinary or unusual in management’s discussion and analysis of financial condition and results of operations appearing in the Company’s annual report to stockholders for the applicable year, and (ii) may appropriately adjust any evaluation of performance under a Quality Performance Criteria to exclude any of the following events that occurs during a performance period: (a) asset write-down; (b) litigation, claims, judgments or settlements; (c) the effect of change in tax law or other such law or provisions affecting reported results; (d) the adverse effect of work stoppages and slowdowns; (e) accruals for reorganization and restructuring programs and (f) accruals of any amounts for payment under the plan or any other compensation arrangement maintained by the Company. Performance goals established by the Compensation Committee may be different with respect to different grantees. The Compensation Committee has the authority to make equitable adjustments to any performance goal.

With respect to grants made to our named executive officers (other than the chief financial officer), the vesting or payment of which are to be made subject to performance goals, the Compensation Committee may design such grants or a portion of them to comply with the applicable provisions of Section 162(m), including, without limitation, those provisions relating to the pre-establishment and certification of those performance goals. With respect to grants not intended to comply with Section 162(m) officers, performance goals may also include such individual or subjective performance criteria as the Compensation Committee may, from time to time, establish. Performance goals applicable to any grant may include a threshold level of performance below which no portion of the grant will become vested or payable, and levels of performance at which specified percentages of such grant will become vested or payable.

Automatic Annual Grants to Non-employee Directors. In addition to any discretionary grants, immediately following the first regular meeting of the Board in any full calendar year the plan is in effect, or at such other

17

time during such calendar year as determined by the Committee, each non-employee director then in office shall receive an annual grant of Common Shares or the right to receive Common Shares. The form of award shall be determined by the Committee and the value of the award shall be determined by the Board. Each annual grant will vest as determined by the Nominating and Governance Committee, subject to the director remaining in office on each vesting date. Each Annual Grant shall also become vested upon the director’s death or disability or upon a change in control (as defined in the plan).

Change in Control. The Committee may provide in any award agreement provisions relating to the treatment of Awards in the event of a change in control. The Committee may provide for the acceleration of vesting of, or the lapse of transfer or other similar restrictions on, awards, for a cash payment based on the change in control price (as defined in the plan) in settlement of awards, or for the assumption or substitution of awards by a participant’s employer (or the parent or an affiliate of such employer) immediately following the change in control.

Amendment and Termination. The Board may amend, alter or discontinue the plan and the Committee may amend, or alter any agreement or other document evidencing an award made under the plan, but no such amendment shall, without the approval of the Company’s stockholders, reduce the exercise price of outstanding options or SARs, reduce the price at which options may be granted or otherwise amend the plan in any manner requiring stockholder approval by law or under the New York Stock Exchange listing requirements. No amendment or alteration to the plan or an award shall be made which would impair the rights of a participant, without the participant’s consent, provided that no such consent shall be required if the Committee determines in its sole discretion and prior to the date of any change in control that such amendment or alteration either is required or advisable in order for the Company, the plan or the award to satisfy any law or regulation or to meet the requirements of or avoid adverse financial accounting consequences under any accounting standard. Unless earlier terminated by the Board, the plan will continue in effect until March 10, 2018.

Repricings. Other than in connection with a change in the Company’s capitalization: (i) the exercise price of an option or strike price of an SAR may not be reduced without stockholder approval (including canceling previously awarded options or SARs and regranting them with a lower exercise price), and (ii) without stockholder approval, an option or SAR may not be cancelled, exchanged, substituted for, bought out by the Company or surrendered in exchange for cash, other awards or a combination thereof.

U.S. Federal Income Tax Consequences. The following tax discussion is a brief summary of current U.S. federal income tax law applicable to stock options as of March 13, 2013. The discussion is intended solely for general information and does not make specific representations to any option award recipient. The discussion does not address state, local or foreign income tax rules or other U.S. tax provisions, such as estate or gift taxes. A recipient’s particular situation may be such that some variation of the basic rules is applicable to him or her. In addition, the federal income tax laws and regulations frequently have been revised and may be changed again at any time. Therefore, each recipient is urged to consult a tax advisor before exercising any award or before disposing of any shares acquired under the plan both with respect to federal income tax consequences as well as any foreign, state or local tax consequences.