- BLDR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Builders FirstSource (BLDR) DEF 14ADefinitive proxy

Filed: 24 Apr 24, 6:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

Builders FirstSource, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Notice of Annual Meeting

of Stockholders and

2024 Proxy Statement

The Annual Meeting of Stockholders

of Builders FirstSource, Inc. will be held:

Tuesday, June 4, 2024 at 9:00 a.m. local time

6031 Connection Drive

Irving, Texas 75039

|

|

|

|

|

|

A MESSAGE TO OUR STOCKHOLDERS | ||

To Our Fellow Stockholders,

Our scale, distribution footprint, and trusted partnership with customers positions us as one of the premier solutions providers to homebuilders. We are focused on helping to address industry pain points and improve homebuilding efficiency by investing in value-added products and digital solutions. Our strong financial position provides us with the flexibility to invest for profitable growth and deliver long-term shareholder value.

2023 Results Demonstrated Our Strength

Despite a challenging operating environment, including affordability headwinds due to elevated interest rates, we delivered resilient results highlighted by a double-digit EBITDA margin in the high teens and robust free cash flow. We accomplished this through operational rigor, the strength of our broad product portfolio, and by the continued execution of our strategic plan by our nearly 29,000 team members. Our industry-leading distribution footprint, end market diversity, and investments in value-added capacity continue to support our organic growth. Our innovation is a key competitive advantage that creates value for homebuilders, capturing additional wallet share with current and prospective customers. We continue to drive operational improvements across the business as demonstrated by our $175 million in productivity savings in 2023. This year’s results further validate our position as the easiest company to do business with.

We are differentiated as the only provider of an end-to-end digital platform in the industry, which we believe is a game changer as it will bring efficiency to the homebuilding process, saving time and money for our customers and their clients. We launched our platform earlier this year and are confident in our ability to generate value from our digital solutions and meet our target of $200 million of incremental digital revenue by the end of 2024 and $1 billion by 2026 as we grow wallet share and win new customers.

Focused on Shareholder Returns

Our Board of Directors and management team are focused on maximizing shareholder returns through strong free cash flow generation and disciplined capital allocation. We are making high-return organic investments in manufacturing automation and capacity to grow our value-added mix and improve operational efficiency. We also continue to pursue strategic tuck-in M&A, and in 2023, we completed seven tuck-in acquisitions with aggregate 2022 sales of approximately $540 million to expand our footprint into high-growth geographies and enhance our value-added offerings.

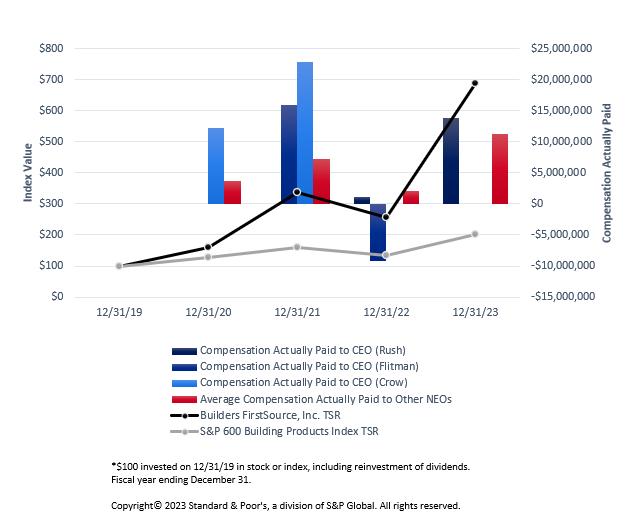

We are also returning capital to shareholders through opportunistic share buybacks. We repurchased $1.8 billion of shares in 2023 and have repurchased more than 42% of our outstanding shares since August 2021. Our efforts to maximize shareholder value resulted in a remarkable 157.3% total shareholder return in 2023.

Committed to Our Team Members and Corporate Social Responsibility

Our people-first culture is a key contributor to our leading position as we attract, train, and retain the best talent in the industry and possess a field leadership team with more than 30 years of average experience. Safety is our number one priority, and in 2023 we implemented a number of new safety processes and features, helping drive a 30% annual improvement in our recordable incident rate and once again beating our 10% annual reduction target.

In 2023, we undertook a team member engagement survey, which showed an 80% favorability rating. We are committed to maintaining engagement with our team members and enhancing their experience at Builders FirstSource.

We are also making meaningful progress on our corporate sustainability journey. Last year, we reported our Scope 1 and 2 greenhouse gas emissions for the first time and continue to drive our sustainability initiatives in a manner that benefits our customers, team members, and stakeholders.

We invite you to attend the annual meeting of stockholders of Builders FirstSource, Inc., which will take place at 6031 Connection Drive, Irving, Texas 75039, on Tuesday, June 4, 2024, at 9:00 a.m. local time. Details of the business to be conducted at the annual meeting follow. Your vote is important to us. Even if you intend to join us in person, we encourage you to vote in advance, so we will know we have a quorum of stockholders for the meeting. When you vote in advance, please also indicate your intention to personally attend the annual meeting. See the Question and Answer section on page three of the Proxy Statement for instructions should you plan to attend in person.

On behalf of the Board of Directors and the executive management team, we would like to express our appreciation for your continued interest in the affairs of Builders FirstSource and ask for your support of management at this year’s annual meeting.

Sincerely, | Sincerely, | |

|

| |

Paul S. Levy Chairman of the Board | David E. Rush Chief Executive Officer and President | |

6031 Connection Drive, Irving, Suite 400, Texas 75039

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

The annual meeting of stockholders of Builders FirstSource, Inc. will take place at 6031 Connection Drive, Irving, Texas 75039, on Tuesday, June 4, 2024, at 9:00 a.m. local time, for the purpose of considering and acting upon the following:

Only stockholders of record at the close of business on April 12, 2024 will be entitled to vote at the meeting.

Directions to be able to attend the meeting and vote in person may be obtained by contacting the Corporation’s legal department at (214) 880-3500.

By Order of the Board of Directors,

Timothy D. Johnson

Corporate Secretary

April 24, 2024

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 4, 2024: The Proxy Statement and the 2023 Annual Report on Form 10-K are available at www.proxydocs.com/BLDR and at www.bldr.com. |

IMPORTANT:

Please see the Question and Answer section on page 3 of this Proxy Statement for instructions on what you need to do to attend the annual meeting in person. Please note that the doors to the annual meeting will open at 8:30 a.m. and will close promptly at 9:00 a.m. Whether or not you expect to personally attend, we urge you to vote your shares at your earliest convenience to ensure the presence of a quorum at the meeting. Promptly voting your shares via the internet, by telephone via toll-free number, or, if you elect to receive your proxy materials by mail, by completing, signing, dating, and returning the enclosed proxy card in the postage-paid envelope provided, will save us the expense and extra work of additional proxy solicitation. Because your proxy is revocable at your option, submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so. Please refer to the voting instructions included on the Notice Regarding the Availability of Proxy Materials, proxy card, or voting instructions forwarded by your bank, broker, or other stockholder of record, as applicable.

Table of Contents

TABLE OF CONTENTS

1 |

| 26 | ||||

|

|

|

|

|

|

|

2 |

| 28 | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

| 28 | ||||

| 2 |

|

| 41 | ||

| 2 |

|

| 42 | ||

|

|

|

|

| 43 | |

3 |

|

| 44 | |||

|

|

|

| 45 | ||

|

|

| 47 | |||

|

|

|

|

| 47 | |

Proposal 1 — Election of Directors

| 7 |

| ||||

8 |

| 48 | ||||

|

|

| 49 | |||

10 |

|

| 50 | |||

|

|

| ||||

|

|

|

|

| 54 | |

10 |

| |||||

11 |

| |||||

|

|

|

|

|

| |

13 |

| 55 | ||||

|

|

|

| |||

| 13 |

|

| |||

14 |

|

|

|

| ||

|

|

|

| 56 | ||

| 15 |

|

| |||

|

|

|

|

|

|

|

15 | Securities Owned by Directors, Executive

|

| 57 | |||

15 |

| |||||

| 16 |

|

| |||

16 |

|

|

| |||

17 |

| 59 | ||||

|

|

|

|

|

|

|

18 | Proposal 3 — Ratification of Selection of |

| 60 | |||

| 18 |

|

| |||

19 |

| |||||

|

|

|

|

| ||

|

|

|

|

|

|

|

20 |

| 60 | ||||

|

|

|

|

|

|

|

22 |

| 62 | ||||

|

|

|

|

|

|

|

22 |

| 64 | ||||

By-law Provisions on Stockholder Nominations of | 22 |

|

|

|

| |

|

|

|

|

| ||

|

|

| ||||

Policy on Stockholder Recommendations for Director | 23 |

| 65 | |||

|

|

|

|

| ||

|

|

|

|

| ||

23 |

|

|

| |||

23 |

|

|

| |||

24 | ||||||

| 24 |

|

|

|

| |

24 |

|

|

| |||

|

|

|

|

|

|

|

25 |

|

|

| |||

|

|

|

|

|

|

|

Builders FirstSource, Inc. | 2024 Proxy Statement i

6031 Connection Drive, Suite 400, Irving, Texas 75039

PROXY STATEMENT

Annual Meeting of Stockholders

June 4, 2024

This Proxy Statement is being furnished by Builders FirstSource, Inc. (the “Corporation,” the “Company,” or “Builders FirstSource”) in connection with a solicitation of proxies by its Board of Directors (the “Board of Directors” or the “Board”) to be voted at the annual meeting of the Corporation’s stockholders to be held on June 4, 2024 (the “annual meeting” or “meeting”). Whether or not you personally attend, it is important that your shares be represented and voted at the annual meeting. Most stockholders have a choice of voting over the internet, by using a toll-free telephone number, or, for stockholders who elect to receive their proxy materials by mail, by completing a proxy card and mailing it in the postage-paid envelope provided. Check the Notice Regarding the Availability of Proxy Materials, your proxy card, or the information forwarded by your bank, broker, or other stockholder of record, as applicable, to determine which voting options are available to you. The internet voting and telephone voting facilities for stockholders of record will be available until 8:00 a.m. Central Time on June 4, 2024. The Notice Regarding the Availability of Proxy Materials will first be mailed on or about April 24, 2024.

SOLICITATION AND RATIFICATION OF PROXIES

If a proxy card is signed and returned, it will be voted as specified on the proxy card, or, if no vote is specified, it will be voted “FOR” all nominees presented in Proposal 1, and “FOR” Proposals 2 and 3. At any time before it is exercised, you may revoke your proxy by timely delivery of written notice to the Corporate Secretary, by timely delivery of a properly executed, later-dated proxy (including by internet or telephone vote), or by voting via ballot at the annual meeting. Voting in advance of the annual meeting will not limit your right to vote at the annual meeting if you decide to attend in person. If you are a beneficial owner, and your shares are registered in the name of a bank, broker, or other stockholder of record, to be able to vote in person at the annual meeting you must obtain, from the stockholder of record, a legal proxy and submit it together with your ballot at the meeting. See “Questions and Answers about the Meeting and Voting” in this Proxy Statement for an explanation of the term “beneficial owner.”

The proxy accompanying this Proxy Statement is being solicited by the Board of Directors. The Corporation will bear the entire cost of this solicitation, including the preparation and delivery of this Proxy Statement, the proxy, and any additional information furnished to stockholders. In addition to using the mail and the internet, proxies may be solicited by directors, executive officers, and other employees of Builders FirstSource or its subsidiaries, in person or by telephone. No additional compensation will be paid to directors, executive officers, or other employees for their services in this regard. Builders FirstSource will also request banks, brokers, and other stockholders of record to forward proxy materials, at the Corporation’s expense, to the beneficial owners of the Corporation’s shares.

Builders FirstSource, Inc. | 2024 Proxy Statement 1

GENERAL INFORMATION ABOUT PROXIES AND VOTING

Outstanding Stock

The stockholders of record of Builders FirstSource, Inc. Common Stock (“Common Stock”) at the close of business on April 12, 2024 will be entitled to vote in person or by proxy at the annual meeting. At that time, the Corporation had 121,978,476 outstanding shares of its Common Stock. Each stockholder will be entitled to one vote in person or by proxy for each share of Common Stock held. A quorum for the transaction of business shall be constituted by the presence at the annual meeting, in person or by proxy, of a majority of the outstanding shares of Common Stock entitled to vote thereat. All shares for which proxies or voting instructions are returned are counted as present for purposes of determining the existence of a quorum at the annual meeting.

Internet Availability of Proxy Materials

As permitted by federal securities laws, Builders FirstSource is making this Proxy Statement and 2023 Annual Report on Form 10-K (the “2023 Annual Report”) available to its stockholders primarily via the internet instead of mailing printed copies of these materials to each stockholder. On or about April 24, 2024, we will mail to our stockholders (other than those who previously requested electronic or paper delivery) a Notice Regarding Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the Proxy Statement and accompanying 2023 Annual Report. These proxy materials will be made available to our stockholders on or about April 24, 2024. The Notice provides instructions regarding how to vote through the internet. The Proxy Statement and 2023 Annual Report are also available on our website at www.bldr.com.

If you received a Notice by mail, you will not receive a printed copy of the proxy materials by mail unless you request printed materials. If you wish to receive printed proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

If you receive more than one Notice, it means your shares are registered differently and are held in more than one account. To ensure all shares are voted, please either vote each account over the internet or by telephone or sign and return by mail all proxy cards.

Voting Matters and Board Recommendations

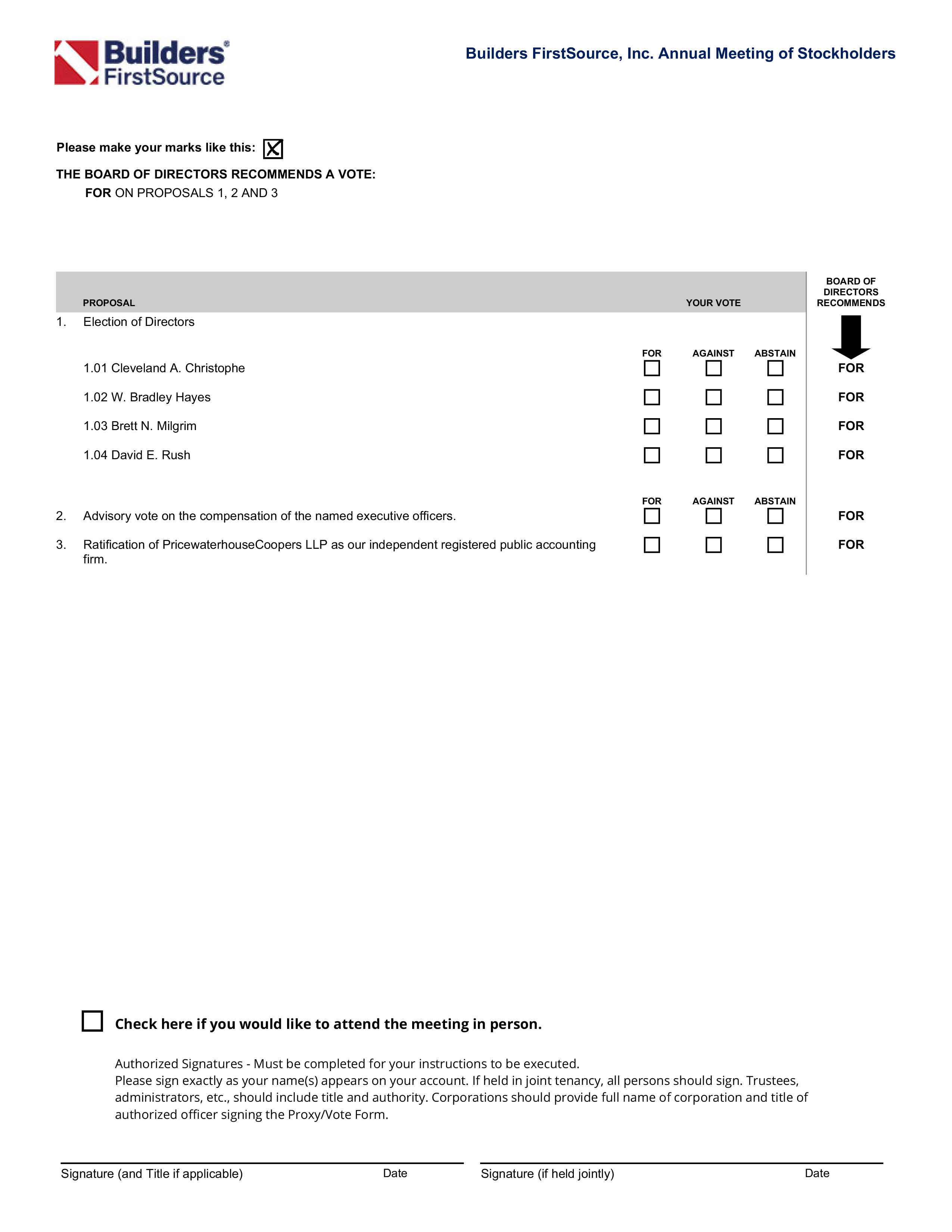

At this year’s annual meeting, we are asking our stockholders to vote on the following matters:

| Proposal | Board Recommendation | Page Number | |||

1. | Election of Directors | FOR each nominee | 7 | |||

2. | Advisory vote on the compensation of the named executive officers | FOR | 54 | |||

3. | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm | FOR | 60 |

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT. IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE CORPORATION SINCE THE DATE OF THIS PROXY STATEMENT. |

2 Builders FirstSource, Inc. | 2024 Proxy Statement

Questions and Answers about the Meeting and Voting

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

What is a proxy?

A proxy is your legal designation of another person, called a proxy holder, to vote the shares that you own. We designated Timothy D. Johnson, our Executive Vice President, General Counsel and Corporate Secretary, and Peter M. Jackson, our Executive Vice President and Chief Financial Officer, to act as proxy holders at the annual meeting as to all shares for which proxy cards are returned or voting instructions are provided by internet or telephone.

What is a proxy statement?

A proxy statement is a document that the Securities and Exchange Commission (the “SEC”) regulations require us to give you when we ask you to provide a proxy (by voting by phone or internet or, if applicable, by returning a proxy card by mail) designating the proxy holders described above to vote on your behalf.

What is the difference between a stockholder of record and a stockholder who holds stock in street name, also called a “beneficial owner?”

If your shares are registered in your name at our transfer agent, Computershare Investor Services, you are a stockholder of record.

If your shares are held through a broker, bank, trustee, nominee, or other similar stockholder of record on your behalf, your shares are held in street name and you are the beneficial owner of the shares.

How do you obtain admission to the annual meeting?

Stockholders of Record. Stockholders of record must bring a current government-issued photo identification card to gain admission to the annual meeting.

Street Name Holders. To obtain admission to the annual meeting, a street name holder must (i) bring a current government-issued photo identification card and (ii) ask his or her broker or bank for a legal proxy and must bring that legal proxy with him or her to the meeting. If you do not receive the legal proxy in time, bring your most recent brokerage statement with you to the meeting. We can use that to verify your ownership of Common Stock and admit you to the meeting. However, you will not be able to vote your shares at the meeting without a legal proxy. Please note that if you own shares in street name, and you are issued a legal proxy, any previously executed proxy will be revoked, and your vote will not be counted unless you appear at the meeting and vote in person.

What different methods can you use to vote?

By Written Proxy. Stockholders who elect to receive their proxy materials by mail may vote by mailing the written proxy card.

By Telephone and Internet Proxy. All stockholders of record may also vote by telephone from the U.S., using the toll-free telephone number provided on the proxy card or on the website listed on the Notice, or by the internet, using the procedures and instructions described in the Notice or proxy card. Street name holders may vote by telephone or the internet if their bank, broker, or other stockholder of record makes those methods available. If that is the case, the bank, broker, or other stockholder of record will enclose the instructions with the Proxy Statement or other notice of the meeting. The telephone and internet voting procedures, including the use of control numbers, are designed to authenticate stockholders’ identities, allow stockholders to vote their shares, and confirm that their instructions have been properly recorded.

Builders FirstSource, Inc. | 2024 Proxy Statement 3

In Person. All stockholders may vote in person at the meeting (unless they are street name holders without a legal proxy, as described in the foregoing question).

What is the record date and what does it mean?

The record date for the annual meeting is April 12, 2024. The record date is established by the Board of Directors as required by Delaware law. Stockholders of record at the close of business on the record date are entitled to receive notice of the annual meeting and to vote their shares at the meeting.

What are your voting choices for director nominees, and what vote is needed to elect directors?

For the vote on the election of the Class I director nominees to serve until the 2027 annual meeting, stockholders may:

At the annual meeting in 2024, directors will be elected by a majority of the votes cast in person or by proxy at the annual meeting. Each director nominee in 2024 has submitted an irrevocable resignation that will be effective upon the occurrence of (i) the failure of such director nominee to receive a majority of the votes cast and (ii) the acceptance of that resignation by the Board. Abstentions from voting have no effect on the outcome of such vote because the election of directors is determined on the basis of votes cast and abstentions are not counted as votes cast.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES. |

What are your voting choices on the advisory vote to approve the 2023 compensation of the Corporation’s named executive officers, including the Corporation’s compensation practices and principles and their implementation?

In the non-binding vote to approve the 2023 compensation of the Corporation’s named executive officers, including the Corporation’s compensation practices and principles and their implementation, as discussed and disclosed in this Proxy Statement, stockholders may:

This proposal requires the affirmative vote of a majority of the votes represented and entitled to vote at the annual meeting. Accordingly, abstentions have the effect of a vote “against” Proposal 2. This is an advisory vote, and, as such, is not binding on the Board or the Compensation Committee. However, the Board and the Compensation Committee will consider the results of the vote when setting the compensation of the Corporation’s executive officers in the future.

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL 2. |

4 Builders FirstSource, Inc. | 2024 Proxy Statement

Questions and Answers about the Meeting and Voting

What are your voting choices on the ratification of the appointment of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm, and what vote is needed to ratify their appointment?

On the vote on the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year 2024, stockholders may:

The proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm will require the affirmative vote of a majority of the shares represented and entitled to vote at the annual meeting. Accordingly, abstentions will have the effect of a vote “against” Proposal 3. This vote is not binding on the Board or the Audit Committee.

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL 3. |

What if a stockholder does not specify a choice for a matter when returning a proxy card?

Stockholders should specify their choice for each proposal described on the proxy card, if they receive one. However, proxy cards that are signed and returned, but for which no specific instruction is given, will be voted “FOR” all the director candidates listed in Proposal 1, and “FOR” Proposals 2 and 3.

If any matters not specifically set forth in this Proxy Statement properly come to a vote at the meeting, either of the members of the Proxy Committee, comprised of Timothy D. Johnson and Peter M. Jackson, will vote regarding those matters in accordance with their best judgments.

What are broker non-votes and how are they counted?

Although your broker is the record holder of any shares that you hold in street name, it must vote those shares pursuant to your instructions. If you do not provide instructions, your broker may exercise discretionary voting power over your shares for “routine” items but not for “non-routine” items. All matters described in this Proxy Statement, except for the ratification of the appointment of our independent auditor, are considered to be non-routine matters. “Broker non-votes” occur with respect to a non-routine matter when shares held of record by a broker are not voted on such matter because the beneficial owner has not provided voting instructions and the broker either lacks or declines to exercise the authority to vote the shares in its discretion.

Broker non-votes will be counted as present for purposes of establishing a quorum. Broker non-votes will not have any effect on Proposal 1, since broker non-votes are not votes cast. Broker non-votes will have the effect of a vote “AGAINST” Proposal 2, since broker non-votes are entitled to vote at the annual meeting but are not entitled to vote on “non-routine” items. Brokers have discretionary authority to vote on Proposal 3.

Can I change my mind and revoke or change my proxy?

Yes. A stockholder of record may revoke a proxy or change its vote prior to its exercise at the annual meeting by:

Builders FirstSource, Inc. | 2024 Proxy Statement 5

Note that attendance at the annual meeting, by itself, will not revoke your proxy.

A street name holder may revoke a proxy given pursuant to this solicitation by following the instructions of the bank, broker, trustee, or other nominee who holds his or her shares.

6 Builders FirstSource, Inc. | 2024 Proxy Statement

Proposal 1 — Election of Directors

PROPOSAL 1 — ELECTION OF DIRECTORS

Pursuant to the Corporation’s By-laws, the Board is “classified,” which means it is divided into three classes of directors based on the expiration of their terms. Under the classified Board arrangement, directors are elected to terms that expire on the annual meeting date three years following the annual meeting at which they were elected and the terms are “staggered” so that the terms of approximately one-third of the directors expire each year.

The terms of four Class I directors, Cleveland A. Christophe, W. Bradley Hayes, Brett N. Milgrim, and David E. Rush, will expire at the annual meeting in 2024. Accordingly, Proposal 1 seeks the election of four directors to fill the continuing directorships whose terms expire in 2027.

The Board of Directors has nominated Messrs. Christophe, Hayes, Milgrim, and Rush, for election to a term that will expire at the annual meeting in 2027.

Nominee | Age | Position | Independent | Audit | Compensation | Nominating and Corporate | ||||||

Cleveland A. Christophe | 78 | Director | X |

| Chair |

| X | |||||

W. Bradley Hayes | 58 | Director | X | Chair |

|

|

| |||||

| ||||||||||||

Brett N. Milgrim | 55 | Director | X |

| X |

|

| |||||

David E. Rush | 61 | Director |

|

|

| |||||||

Unless otherwise indicated, all proxies that authorize the proxy holders to vote for the election of directors will be voted “FOR” the election of the nominees listed below. If a nominee becomes unavailable for election as a result of unforeseen circumstances, it is the intention of the proxy holders to vote for the election of such substitute nominee, if any, as the Board of Directors may propose. As of the date of this Proxy Statement, each of the nominees has consented to serve and the Board is not aware of any circumstances that would cause a nominee to be unable to serve as a director.

Builders FirstSource, Inc. | 2024 Proxy Statement 7

The background and business affiliations of the director nominees, as well as the qualifications that led the Board to conclude that each nominee should serve as a director of the Corporation, are set forth below:

Class I — Directors with Terms Expiring in 2024

Cleveland A. Christophe |

| |

Director since 2005 Independent 78 years old Compensation Committee (Chair) Nominating and Corporate Governance Committee (Member) | Career Highlights: • President, US&S, Inc., a supplier of services and materials primarily to various agencies of the U.S. Government (2009 – 2013) • Managing Partner, TSG Capital Group, a private equity investment firm, which he founded (1992 – 2008) • Senior Vice President, TLC Group, L.P. (1987 – 1988) • Numerous senior positions, Citibank, N.A. (1971 – 1987) • Chartered Financial Analyst since 1975

Skills and Qualifications: CEO/President Leadership Experience, Operational Responsibility, Finance, Marketing, Business Development and M&A

Mr. Christophe has substantial financial and management expertise from his long tenure in the investment and banking industries. He also has significant senior management experience in the commercial and industrial service industry. Additionally, Mr. Christophe’s prior service on other public company boards and audit committees positions him to make valuable contributions to the governance and operation of the Board and its committees. |

W. Bradley Hayes |

| |

Director since 2019 Independent 58 years old Audit Committee (Chair) | Career Highlights: • Executive Vice President, Chief Financial Officer, Treasurer and other various senior positions, Laboratory Corporation of America Holdings (“LabCorp"), a NYSE listed life sciences company (2005 – 2014) • KPMG Auditor for nine years

Other Public Company Boards: • Indaptus Therapeutics, Inc. (2021 – Present) • Patheon, N.V. (2016 – 2018)

Skills and Qualifications: Operational Responsibility, Finance, Marketing

Mr. Hayes has significant public company financial experience. He has over 15 years of experience in senior and executive management and practiced as a C.P.A. for three decades. Through his previous experience as chief financial officer and chairman of the audit committee of publicly-traded companies, Mr. Hayes brings valuable knowledge to the Board and the Audit Committee of the Corporation. |

8 Builders FirstSource, Inc. | 2024 Proxy Statement

Proposal 1 — Election of Directors

Brett N. Milgrim |

| |

Director since 1999 Independent 55 years old Compensation Committee (Member) | Career Highlights: • Co-Chairman of the Board, Loar Group, Inc., a business specializing in the design and manufacture of aerospace components (2017 – Present) • Managing Director, JLL Partners, Inc., a leading private equity firm (1997 – 2011)

Other Public Company Boards: • PGT Innovations, Inc. (2003 – Present) • Horizon Global Corp. (2019 – 2023)

Skills and Qualifications: CEO/President Leadership Experience, Building Materials Industry Experience, Business Development and M&A

Mr. Milgrim is very knowledgeable regarding all aspects of corporate finance and capital markets. His long tenure on the board of directors of the Corporation, as well as his service on the boards of two other building products companies, gives him in-depth knowledge of the building products industry and the issues faced by the Corporation. |

David E. Rush |

| |

Director since 2022 61 years old | Career Highlights: • President and CEO, and other senior executive roles including Chief Operating Officer - East, Executive Vice President of the Strategic Management Office, Integration lead for the BMC and ProBuild acquisitions, and Senior Vice President of Strategy and Business Development, Builders FirstSource, Inc. (1999 – Present)

Skills and Qualifications: CEO/President Leadership Experience, Building Materials Industry Experience, Operational Responsibility, Finance, Business Development and M&A

Mr. Rush is the Corporation’s Chief Executive Officer. That role, along with his extensive knowledge of the Corporation and its operations and finances from his over twenty years with the Corporation, make him an essential Board member. |

Builders FirstSource, Inc. | 2024 Proxy Statement 9

CONTINUING DIRECTORS

The background and business affiliations of the Corporation’s other directors, whose terms of service continue beyond 2024, as well as the qualifications that led the Board to conclude that such directors should serve as a director of the Corporation, are set forth below:

Class II — Directors with Terms Expiring in 2025

Mark A. Alexander |

| |

Director since 2021 Independent 65 years old Audit Committee (Member) | Career Highlights: • Founder, Chairman and Chief Executive Officer, Landmark Property Group, a property management and real estate redevelopment company (2009 – Present) • Chief Executive Officer, President, and Director, Suburban Propane Partners, a multibillion-dollar publicly-traded energy services company (1996 – 2009) • Senior Vice President, Business Development, Hanson Industries, the U.S. arm of Hanson plc (1984 – 1996)

Other Public Company Boards: • W.P. Carey Inc. (2016 – Present)

Skills and Qualifications: CEO/President Leadership Experience, Operational Responsibility, Logistics, Manufacturing, Finance, Business Development and M&A

Mr. Alexander possesses significant executive and financial expertise and experience gained from previous management positions. Additionally, his current service on another public company board and its audit committee enables him to provide invaluable guidance and knowledge to our Board and its committees. |

Dirkson R. Charles |

|

|

Director since 2022 Independent 60 years old Audit Committee (Member) |

| Career Highlights: • Founder and Chief Executive Officer, Loar Group, Inc., a business specializing in the design and manufacture of aerospace components (2012 – Present) • Chairman, Doncasters Group Limited, a privately-held leading international manufacturer of high-precision alloy components (2020 – Present) • Executive Vice President, McKechnie Aerospace (2007 – 2012) • Executive Vice President and Chief Financial Officer, K&F Industries, a leading manufacturer of aviation wheels, brakes, fuel tanks and brake control systems (Prior to 2012)

Skills and Qualifications: CEO/President Leadership Experience, Operational Responsibility, Finance, Business Development and M&A

Mr. Charles has significant corporate executive experience through his current roles as a CEO and chairman and in prior high-level leadership positions. Additionally, he possesses critical accounting skills as a licensed C.P.A. and from his prior experience in public accounting. Mr. Charles’s qualifications and accomplishments will provide a crucial perspective for the Board. |

10 Builders FirstSource, Inc. | 2024 Proxy Statement

Continuing Directors

Class III — Directors with Terms Expiring in 2026

Paul S. Levy |

| |

Director since 1998 Independent 76 years old Chairman of the Board | Career Highlights: • Founder and Managing Director, JLL Partners, Inc., a leading private equity firm (1988 – Present) • Director, Loar Group, Inc., a business specializing in the design and manufacture of aerospace components (2017 – Present)

Other Public Company Boards: • Patheon, Inc. (2011 – 2017) • PGT Innovations, Inc. (2006 – 2013) Skills and Qualifications: Building Materials Industry Experience, Finance, Legal, Business Development and M&A

Mr. Levy has vast experience investing in and managing a wide variety of businesses, including other building products companies. He has served on the boards of directors of several public companies. Mr. Levy has also been the CEO of a large company, general counsel of another company, and a practicing lawyer, bringing further breadth to his contributions to the Board. |

Cory J. Boydston |

| |

Director since 2021 Independent 65 years old Nominating and Corporate Governance Committee (Member) | Career Highlights: • Director, Audit Committee Member and ESG Committee Member, The New Home Company, a privately held homebuilding company (2023 – Present) • Director and Compensation Committee Member, Roseburg Forest Products, a privately held provider of wood products and owner of timberlands (2023 – Present) • Chief Financial Officer, Ashton Woods USA L.L.C., the largest private homebuilder in the United States (2009 – 2022) • Senior Vice President, Chief Financial Officer and Partner, Starwood Land Ventures, LLC, a real estate investment firm that engages in residential land acquisition, development and financing (2008 – 2009) • Senior Vice President, Finance and Treasury, Beazer Homes USA, Inc. (1998 – 2008) • Chief Financial Officer and other senior executive roles, Lennar Corporation (1987 – 1997) Skills and Qualifications: Building Materials Industry Experience, Finance, Business Development and M&A

Ms. Boydston possesses substantial public company accounting and finance experience through her more than 30 years of service in senior and executive management and as a C.P.A. Most of her experience is in the homebuilding industry, our primary end-market, which qualifies Ms. Boydston to make critical contributions to the Corporation and our Board. |

Builders FirstSource, Inc. | 2024 Proxy Statement 11

James O’Leary |

| |

Director since 2021 Independent 61 years old Compensation Committee (Member) | Career Highlights: • Chairman, Kinematics Manufacturing Company (2015 – Present) • Director, Sentient Science, a software company that provides digital twin technology to predict the life of mechanical systems (2014 – Present) • Director, ProSource Plumbing Supply, a plumbing supply company in North Carolina and South Carolina (2022 – Present) • Chairman and Chief Executive Officer, WireCo Worldgroup, Inc., a leading global manufacturer of engineered wire, steel rope, and synthetic rope (2017 – 2019) • Chairman and Chief Executive Officer, Kaydon Corporation, Inc., a diversified global manufacturer of precision industrial goods (2007 – 2013)

Other Public Company Boards: • DMC Global, Inc. (2023 – Present) Skills and Qualifications: CEO/President Leadership Experience, Building Materials Industry Experience, Operational Responsibility, Manufacturing, Finance, Business Development and M&A

Mr. O’Leary has a depth of business, operations, and financial experience gained from serving as a chief executive officer for multiple manufacturing companies, including a publicly-traded company. He also brings valuable accounting experience to our Board as a licensed C.P.A. (currently inactive in New York). |

Craig A. Steinke |

| |

Director since 2006 Independent 67 years old Audit Committee (Member) Nominating and Corporate Governance Committee (Chair) | Career Highlights: • Chief Executive Officer and Director, Service Logic LLC, a private equity owned company that specializes in energy management and HVAC services for office buildings, hospitals, data centers, and other commercial buildings on a national scale (2013 – Present) • Operating Partner, Sterling Investment Partners, a leading private equity firm (2008 – 2017) • Director and Operating Adviser, Lazer Spot Inc., which specialized in providing logistics support to Fortune 500 companies (2010 – 2015) • President and Chief Executive Officer, GPX International Tire Corporation, an international manufacturer and distributor of branded industrial and off road equipment tires (2007 – 2013) • President and Chief Executive Officer, Eagle Family Foods, Inc., a private equity owned consumer products company in the food industry. (2001 – 2007) Skills and Qualifications: CEO/President Leadership Experience, Building Materials Industry Experience, Operational Responsibility, Manufacturing, Finance, Marketing, Business Development and M&A

Mr. Steinke’s extensive experience at the senior executive management level, including as a Chief Executive Officer, allows him to make significant contributions to the development of the Corporation’s business strategy. He also brings a broad knowledge of accounting and experience as a C.P.A. to the Board’s discussions. Mr. Steinke has also served as a director on numerous boards. |

12 Builders FirstSource, Inc. | 2024 Proxy Statement

Director Compensation

DIRECTOR COMPENSATION

Compensation of Directors

The following table sets forth the cash and other compensation paid by the Corporation to the members of the Board of Directors of the Corporation for all services in all capacities during 2023.

|

|

|

|

|

|

| |||||||||

Name |

| Fees Earned or |

| Stock |

| Total ($) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Mark A. Alexander |

|

| 119,843 |

| (2) |

|

| 174,966 |

|

|

|

| 294,809 |

|

|

Cory J. Boydston |

|

| 119,843 |

| (2) |

|

| 174,966 |

|

|

|

| 294,809 |

|

|

Dirkson R. Charles |

|

| 119,843 |

| (2) |

|

| 174,966 |

|

|

|

| 294,809 |

|

|

Cleveland A. Christophe |

|

| 140,000 |

|

|

|

| 174,966 |

|

|

|

| 314,966 |

|

|

W. Bradley Hayes |

|

| 144,789 |

| (2) |

|

| 174,966 |

|

|

|

| 319,755 |

|

|

Paul S. Levy |

|

| 252,219 |

| (2) |

|

| 174,966 |

|

|

|

| 427,185 |

|

|

Brett N. Milgrim |

|

| 119,843 |

| (2) |

|

| 174,966 |

|

|

|

| 294,809 |

|

|

James O’ Leary |

|

| 119,843 |

| (2) |

|

| 174,966 |

|

|

|

| 294,809 |

|

|

David R. Rush(3) |

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

Craig A. Steinke |

|

| 137,235 |

| (2) |

|

| 174,966 |

|

|

|

| 312,201 |

|

|

The following table shows the total number of shares of Common Stock underlying restricted stock units held by the members of the Board of Directors of the Corporation (excluding executive officers) as of December 31, 2023:

|

|

| ||||

Name |

| Number of | ||||

|

|

|

|

|

| |

Mark A. Alexander |

|

|

| 1,446 |

|

|

Cory J. Boydston |

|

|

| 1,446 |

|

|

Dirkson R. Charles |

|

|

| 1,446 |

|

|

Cleveland A. Christophe |

|

|

| 1,446 |

|

|

W. Bradley Hayes |

|

|

| 1,446 |

|

|

Paul S. Levy |

|

|

| 1,446 |

|

|

Brett N. Milgrim |

|

|

| 1,446 |

|

|

James O’Leary |

|

|

| 1,446 |

|

|

Craig A. Steinke |

|

|

| 1,446 |

|

|

Builders FirstSource, Inc. | 2024 Proxy Statement 13

Director Compensation Program

Under the Amended and Restated Director Compensation Policy, directors are entitled to compensation for their service on the Board if they are not concurrently employed in any capacity by the Corporation or any of its subsidiaries ("Eligible Directors"). Following a review of director compensation by Meridian Compensation Partners, LLC, the Corporation's compensation consultant, the Board approved, upon recommendation from the Nominating and Corporate Governance Committee, amendments to the Amended and Restated Director Compensation Policy effective June 1, 2023. The amendments increased (i) the annual cash retainer from $100,000 to $120,000, (ii) the grant date fair market value of the annual grant of restricted stock units from $150,000 to $175,000, (iii) the annual cash retainer for the Chair of the Nominating and Corporate Governance Committee from $10,000 to $20,000, and (iv) the annual cash retainer for the Chair of the Board from $100,000 to $150,000. All annual cash retainers are payable quarterly in advance.

Directors receive annual fees for serving on the Board’s committees, but do not receive separate per meeting fees for attending Board or committee meetings. The annual fees for serving on the Board’s committees are as follows:

|

|

|

|

|

|

|

| ||||

Committee |

| Chair Fee | Member Fee | ||||||||

|

|

|

|

|

|

|

| ||||

Audit Committee |

|

| $ | 30,000 |

|

|

| $ | 5,000 |

|

|

Compensation Committee |

|

| $ | 20,000 |

|

|

| $ | 5,000 |

|

|

Nominating and Corporate Governance Committee |

|

| $ | 20,000 |

|

|

| $ | 5,000 |

|

|

Eligible Directors also receive annual grants of restricted stock units. In 2023, the number of shares underlying these awards is determined by dividing a dollar value ($175,000 per year) by the fair market value of our Common Stock on the date of grant. These awards vest in full on the earlier of the first anniversary of the grant date or upon such director’s cessation of service due to death, disability, or retirement. If a new Eligible Director joins the Board, or if an existing director’s status changes to allow him or her to qualify as an Eligible Director, that director will receive a grant of restricted stock units on a pro-rated basis for the remainder of the current director compensation year, which is the year from the date of the prior annual meeting of stockholders to the date of the next annual meeting of stockholders.

In lieu of receiving cash retainers, an Eligible Director may elect to receive fully vested shares of Common Stock having a value on the first day of the service quarter for which they are issued approximately equal to the amount of the cash retainer payment he or she would otherwise receive. Such stock grants in lieu of cash retainer payments will be awarded on a quarterly basis at the same time cash retainer payments would be made. Eligible Directors may only elect to receive fully vested shares of Common Stock in lieu of cash retainers during an open trading window and such election does not take effect until the following year.

We do not compensate directors for any period of service in which they are not Eligible Directors.

14 Builders FirstSource, Inc. | 2024 Proxy Statement

Information Regarding the Board and its Committees

INFORMATION REGARDING THE BOARD AND ITS COMMITTEES

Name |

| Board of |

| Audit |

| Compensation Committee |

| Nominating and |

Paul S. Levy |

| Chair |

|

|

| |||

Mark A. Alexander |

| X |

| X |

|

| ||

Cory J. Boydston |

| X |

|

|

| X | ||

Dirkson R. Charles |

| X |

| X |

|

| ||

Cleveland A. Christophe |

| X |

|

| Chair |

| X | |

W. Bradley Hayes |

| X |

| Chair |

|

| ||

Brett N. Milgrim |

| X |

|

| X |

| ||

James O’Leary |

| X |

|

| X |

| ||

David E. Rush |

| X |

|

|

| |||

Craig A. Steinke |

| X |

| X |

|

| Chair |

Board Purpose and Structure

The mission of the Board is to provide strategic guidance to the Corporation’s management, to monitor the performance and ethical behavior of the Corporation’s management, and to maximize the long-term financial return to the Corporation’s stockholders, while considering and appropriately balancing the interests of other stakeholders and constituencies. The Board currently consists of 10 directors.

Board Diversity and Skills Composition

The following chart below highlights the key competencies and the range of diversity characteristics of our directors:

Builders FirstSource, Inc. | 2024 Proxy Statement 15

Director Independence

The Board of Directors is comprised of one management director, Mr. Rush (who is the Corporation’s current President and CEO), and nine non-management directors. As part of its annual evaluation of director independence, the Board examined, among other things, whether any transactions or relationships exist currently, or existed during the past three years, between each independent director and the Corporation or its subsidiaries or independent registered public accounting firm (the “auditors”). If such transactions or relationships exist, the Board reviews the nature of those transactions or relationships, including under the relevant New York Stock Exchange Listing Standards (the “NYSE Standards”) and SEC standards, to determine whether those transactions or relationships would impair such director’s independence. The Board also examined whether there are, or have been within the past year, any transactions or relationships between each independent director and members of the senior management of Builders FirstSource or its affiliates. As a result of this evaluation, the Board affirmatively determined that each of Messrs. Levy, Alexander, Charles, Christophe, Hayes, Milgrim, O’Leary, and Steinke, and Ms. Boydston, is independent under those criteria.

In addition, our Board of Directors affirmatively determined that all the members of the Compensation Committee and all the members of the Audit Committee meet the additional independence requirements of the SEC and NYSE Standards to audit and compensation committee members. As a result, the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee are each comprised solely of independent directors.

Each year, the independent directors meet in regularly scheduled executive sessions outside the presence of management representatives. Interested parties, including stockholders, may communicate with the Chairman or the independent directors as a group through the process described in this Proxy Statement under the heading “Policy on Stockholder-Director Communications.”

Board Meetings and Attendance

In 2023, our Board of Directors met seven times, our Audit Committee met four times, our Compensation Committee met six times, and our Nominating and Corporate Governance Committee met four times, including regularly scheduled and special meetings. During 2023, each of the Corporation’s incumbent directors attended approximately 75% of the combined meetings of the Board and any committee on which such director served during his or her term as a director. Pursuant to the Builders FirstSource, Inc. Corporate Governance Guidelines (available on the Governance section of our website at www.bldr.com), all directors are strongly encouraged to attend the annual meeting. Any director who is unable to attend an annual meeting of stockholders is expected to notify the Chairman of the Board in advance of such meeting. In 2023, six members of the Board were available at our annual meeting by conference call.

16 Builders FirstSource, Inc. | 2024 Proxy Statement

Information Regarding the Board and its Committees

Board Leadership Structure and Role in Risk Oversight

The Board is led by the Chairman of the Board, Paul Levy. Dave Rush, the only employee director, has no formal leadership role with the Board. Mr. Levy takes a leading role in establishing the timing, agenda, and procedure of Board meetings. However, each of the directors actively participates in guiding the actions of the Board. The Board has determined that this leadership structure is appropriate and effective due to the Board’s size, the working relationship that has developed between the directors as a result of their length of service on the Board, and the significant experience that the members of the Board have as directors and members of senior management with other companies. The Board reviews and guides the Corporation in the following areas, among others:

| Team Member Safety |

| Regulatory and legislative developments | |||

| ||||||

| Environmental, social and governance matters |

| Cybersecurity and data privacy | |||

| ||||||

| Business strategy and policy, including industry and economic developments |

| Human capital management and diversity and inclusion | |||

| ||||||

| Operations and system integrity |

| Annual budget, including capital investment plan | |||

| ||||||

| Litigation and other legal matters |

| Acquisitions and Integration | |||

The Corporation’s Board of Directors recognizes that, although day-to-day risk management is primarily the responsibility of the Corporation’s management team, the Board plays a critical role in the oversight of risk management. In that light, the Board is active, as a whole and also at the committee level, in reviewing management’s assessment of the major risks facing the Corporation and management’s processes for monitoring and controlling these risks. The Board regularly receives information from senior management regarding the Corporation’s financial results, credit, liquidity, operations, and other matters, as well as reports from the Corporation’s Audit Committee and Compensation Committee. During its review of such information, the Board discusses and analyzes risks associated with each area, as well as risks associated with new business ventures and those relating to the Corporation’s executive compensation plans and arrangements. The Board assumes ultimate responsibility for ensuring that the Corporation’s management adequately assesses the risks facing the Corporation and appropriately manages those risks.

The Audit Committee is specifically responsible for overseeing and monitoring the quality and integrity of the Corporation’s financial reports and other financial information provided to its stockholders. This includes reviewing the results of management’s risk assessment and compliance with management policies as they relate to financial reporting. The Audit Committee also monitors the Corporation’s compliance with legal and regulatory requirements and the risks associated therewith. On a regular basis, the Audit Committee reviews with senior management significant areas of risk exposure, including financial reporting controls, operational risks, pending litigation, employee issues, cybersecurity, disaster recovery planning, and issues arising from complaints to the Corporation’s hotline and other risk detection mechanisms.

The Board and the Audit Committee take an active role in reviewing the Corporation’s cybersecurity risk and actions to reduce or mitigate it. The Corporation’s Chief Information Security Officer (the “CISO”) and Chief Information Officer (the “CIO”), and the Chief Financial Officer, continuously monitor internal and external cybersecurity threats and review and revise the Corporation’s cybersecurity defenses on an ongoing basis. The CISO and CIO prepare reports on cybersecurity metrics for the Audit Committee on a regular basis. The Chief Financial Officer and CIO present those reports to the Audit Committee and address any questions and concerns raised by the Audit Committee. At least annually, the Audit Committee meets with the CIO and CISO in person to discuss cybersecurity in greater detail. The Audit Committee reports to the Board regarding cybersecurity matters, and the Board addresses cybersecurity issues either directly with management or through the Audit Committee.

The Compensation Committee reviewed with management the design and operation of our compensation programs for all employees, including executive officers, for the purpose of determining whether such programs might encourage inappropriate risk-taking that could have a material adverse effect on the Corporation. After conducting its evaluation, the Compensation Committee concluded that the Corporation’s compensation programs do not encourage employees to take risks that are reasonably likely to have a material adverse effect on the Corporation.

Builders FirstSource, Inc. | 2024 Proxy Statement 17

Audit Committee

The Audit Committee is composed of four independent directors, Messrs. Hayes, Alexander, Charles and Steinke, all of whom are independent (as that term is defined by the NYSE Standards and SEC regulations). Mr. Hayes serves as the Chair of the Audit Committee. The Board of Directors affirmatively determined that all Audit Committee members are financially literate as defined by the NYSE Standards. All members of the Audit Committee were also designated by the Board as audit committee “financial experts” under the SEC’s guidelines. The Board further determined that all members of the Audit Committee meet the independence standards of both the SEC regulations and the NYSE Standards for audit committee members. A copy of the Audit Committee charter is available on the Governance section of our website at www.bldr.com. The Audit Committee is a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The primary function of the Audit Committee is to assist the Board of Directors of the Corporation in fulfilling its oversight responsibilities relating to (i) the quality and integrity of the Corporation’s financial reports and other financial information provided by the Corporation to its stockholders, the public, and others, (ii) the Corporation’s compliance with legal and regulatory requirements, (iii) the auditors’ qualifications, independence, performance, and compensation, and (iv) the performance of the Corporation’s internal audit function, including its internal control systems. The Audit Committee’s functions include preparation of the audit committee report included in this Proxy Statement and the review of material related party transactions. The Audit Committee is also annually required to evaluate its performance and review and assess the adequacy of its charter.

Compensation Committee

The Compensation Committee is composed of three independent directors, Messrs. Christophe, Milgrim and O’Leary. Mr. Christophe serves as the Chair of the Compensation Committee. A copy of the Compensation Committee charter is available on the Governance section of our website at www.bldr.com.

The Compensation Committee is charged with (i) annually reviewing and recommending to the Board, for the Board’s approval, all Corporation goals and objectives relevant to the Chief Executive Officer’s compensation, (ii) annually evaluating the Chief Executive Officer’s performance in light of the Corporation’s goals and objectives, (iii) annually reviewing and recommending to the Board for its approval the Chief Executive Officer’s base salary, incentive compensation levels, and perquisites and other personal benefits based on the Compensation Committee’s evaluation of the Chief Executive Officer’s performance relative to the Corporation’s goals and objectives, (iv) annually reviewing, evaluating, and recommending to the Board for its approval the base salary level, incentive compensation levels, and perquisites and other personal benefits of the other executive officers of the Corporation, (v) reviewing and making recommendations to the Board regarding any employment, severance, or termination arrangements to be made with any executive officer of the Corporation, (vi) making recommendations to the Board with respect to awards under the Corporation’s incentive compensation plans and equity-based compensation plans, (vii) making regular reports to the Board concerning the activities of the Compensation Committee, (viii) performing an annual performance evaluation of the Compensation Committee, (ix) approving the implementation or revision of the Corporation’s clawback policy to recoup compensation paid to senior executive officers and other employees, (x) establishing and monitoring stock ownership guidelines for the executive officers and directors, (xi) reviewing and recommending to the Board management development and succession plans, (xii) assessing the results of the Corporation’s most recent advisory vote on executive compensation, (xiii) overseeing significant matters pertaining to the Corporation’s human capital management strategy, including building a respective and inclusive culture and recruitment, retention, and engagement of employees, and (xiv) performing other activities as the Compensation Committee or Board may deem appropriate. The Compensation Committee may delegate authority to subcommittees when appropriate. Information regarding the role of the Compensation Committee and its processes and procedures for considering and determining executive compensation is set forth in the “Compensation Discussion and Analysis” section later in this Proxy Statement.

18 Builders FirstSource, Inc. | 2024 Proxy Statement

Information Regarding the Board and its Committees

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is composed of three independent directors, Messrs. Steinke and Christophe and Ms. Boydston. Mr. Steinke serves as the Chair of the Committee. A copy of the Nominating and Corporate Governance Committee charter is available on the Governance section of our website at www.bldr.com.

The purpose of the Nominating and Corporate Governance Committee is to (i) identify and evaluate individuals qualified to become Board members, consistent with criteria approved by the Board, (ii) recommend to the Board the persons to be nominated for election as directors at any meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board, (iii) recommend to the Board the directors to be appointed to each committee of the Board, (iv) evaluate and make recommendations to the Board regarding (a) the eligibility criteria for receipt of compensation as a director and (b) the appropriate compensation to be paid to eligible members of the Board and to members of Board committees, (v) assist the Board with general corporate governance issues, (vi) assist the Board and its committees with their internal governance issues, and (vii) provide oversight of management’s efforts on issues related to corporate social responsibility and sustainability, including environmental sustainability.

The Nominating and Corporate Governance Committee is charged with identifying potential nominees for director and considers a wide range of criteria, including skills, expertise, integrity, character, judgment, age, independence, corporate experience, length of service, diversity of background and experience, including with respect to race, gender and ethnicity, conflicts of interest and commitments, and other qualities which the Nominating and Corporate Governance Committee believes enhances the Board’s ability to manage and direct, in an effective manner, the affairs and business of the Corporation. The Nominating and Corporate Governance Committee may, from time to time, engage firms that specialize in identifying director candidates. In addition, the Nominating and Corporate Governance Committee will also consider candidates recommended by stockholders. The Nominating and Corporate Governance Committee evaluates all candidates, regardless of who recommends a candidate, based on the same criteria listed above.

Builders FirstSource, Inc. | 2024 Proxy Statement 19

REPORT OF THE AUDIT COMMITTEE

The primary responsibility of the Audit Committee is to assist the Board of Directors of the Corporation (the “Board”) in fulfilling its oversight responsibilities relating to (i) the quality and integrity of the financial reporting process, (ii) compliance with legal and regulatory requirements, (iii) the performance of the Corporation’s internal audit function, (iv) the appointment of the independent registered public accounting firm, and (v) the Corporation’s assessment and management of risks related to cybersecurity. Management is responsible for the financial statements and the financial reporting process, including the implementation and maintenance of effective internal controls. The independent registered public accounting firm, PricewaterhouseCoopers LLP (“PwC”), is responsible for expressing an opinion on the Corporation’s financial statements and its internal control over financial reporting. The Board has concluded that (i) Messrs. Hayes, Alexander, Charles, and Steinke satisfy the applicable independence requirements set forth in the NYSE’s rules, and (ii) each of the Audit Committee members satisfies the applicable independence requirements set forth under SEC Rule 10A-3, and meets the financial literacy requirements for audit committee membership under the NYSE’s rules and the rules and regulations of the SEC. The Board has also designated the chair of the Audit Committee, W. Bradley Hayes, and committee members Mark A. Alexander, Dirkson R. Charles, and Craig A. Steinke as Audit Committee “financial experts” under the SEC’s guidelines. The Audit Committee has reviewed and discussed with management and PwC the Corporation’s audited financial statements as of and for the year ended December 31, 2023.

During 2023, the Audit Committee conducted four meetings. The Audit Committee chair and other members of the Audit Committee reviewed and commented on the Corporation’s earnings news release and interim financial statements contained in the Corporation’s quarterly report on SEC Form 10-Q during each quarter, and met and discussed the Corporation’s draft Annual Report on SEC Form 10-K with the chief financial officer, general counsel, and PwC prior to the report’s filing and public release. The Audit Committee considers various relevant factors including qualifications, performance, and independence when appointing the audit firm and evaluating the audit firm annually. The Audit Committee is also involved in the selection process of the lead engagement partner when rotation is required after five years under the SEC’s audit partner rotation rules or for other reasons. In addition, the Audit Committee reviewed and ratified its Charter which is available within the Governance section of the Corporation’s website.

The Audit Committee discussed with PwC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. Both the vice president of internal audit and PwC have complete and direct access to the Audit Committee, and the Audit Committee has the same access to the vice president of internal audit and PwC. The Audit Committee met with the vice president of internal audit and PwC, with and without management present, to discuss the results of their examinations, their evaluations of the Corporation’s internal controls, and the overall quality of the Corporation’s financial reporting process. The Audit Committee met separately with the Corporation’s chief financial officer and general counsel. The Audit Committee discussed with management the status of pending litigation, taxation, and other areas of oversight relating to financial reporting and audit processes as the Committee determined to be appropriate. The Audit Committee also reviewed the Company’s Enterprise Risk Management (ERM) program, including, among other topics, specific information technology and cyber security risks. The Audit Committee has discussed the overall scope of the Corporation’s internal audits and approved the annual internal audit plan. The Audit Committee reports the results of these discussions to the Board on a quarterly basis.

The Audit Committee received and reviewed the written communications from PwC as required by applicable requirements of the Public Company Accounting Oversight Board for independent auditor communications with audit committees concerning independence, and has discussed with PwC its independence. The Audit Committee has adopted procedures for pre-approving all audit, audit-related, and non-audit services provided by PwC, which included reviewing and approving estimated fees for audit, audit-related, and permitted non-audit services. The Audit Committee considers the compatibility of all services provided by PwC with its independence and has concluded the provision of the non-audit services is compatible with maintaining PwC’s independence. During the fiscal year ended December 31, 2023, PwC was employed principally to perform the annual audit and to render tax services. The Audit Committee reviewed the audit engagement letter and approved all fees paid to PwC for audit, audit-related, and non-audit services.

20 Builders FirstSource, Inc. | 2024 Proxy Statement

Report of the Audit Committee

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Corporation’s Annual Report on SEC Form 10-K for the year ended December 31, 2023, as filed with the SEC. The Audit Committee appointed PwC as the Corporation’s independent registered public accounting firm for fiscal 2024, subject to stockholder ratification.

Submitted by the Audit Committee: |

|

W. Bradley Hayes (Chair) |

Mark A. Alexander |

Dirkson R. Charles |

Craig A. Steinke |

Builders FirstSource, Inc. | 2024 Proxy Statement 21

CORPORATE GOVERNANCE

Builders FirstSource is committed to conducting its business in a way that reflects best practices, as well as the highest standards of legal and ethical conduct. To that end, the Board of Directors has approved a comprehensive system of corporate governance documents and policies. These documents and policies are reviewed periodically and updated as necessary to reflect changes in regulatory requirements and evolving governing practices. These policies embody the principles, policies, processes, and practices followed by the Board, executive officers, and employees in governing the Corporation and serve as a flexible framework for sound corporate governance.

Code of Business Conduct and Ethics

Builders FirstSource and its subsidiaries endeavor to do business according to the highest ethical and legal standards, complying with both the letter and spirit of the law. Our Board of Directors approved a Code of Business Conduct and Ethics that applies to the Corporation’s directors, officers (including our principal executive officer, principal financial officer, principal accounting officer, and controller), and employees. Our Code of Business Conduct and Ethics is administered by the Compliance Committee, which is made up of representatives from our Finance, Legal, Human Resources, and Internal Audit Departments. Our employees are encouraged to report any suspected violations of laws, regulations, or the Code of Business Conduct and Ethics and all unethical business practices. We provide a continuously monitored hotline for anonymous reporting by employees. Our Board of Directors also approved a Supplemental Code of Ethics for the Chief Executive Officer, President, and Senior Financial Officers of Builders FirstSource, Inc., which is administered by our General Counsel. Both policies can be found on the Governance section of our corporate website at www.bldr.com. Stockholders may request a free copy of these policies by contacting the Corporate Secretary, Builders FirstSource, Inc., 6031 Connection Drive, Suite 400, Irving, Texas 75039.

In addition, within four business days of:

that relates to one or more of the items set forth in Item 406(b) of Regulation S-K, we will provide information regarding any such amendment or waiver (including the nature of any waiver, the name of the person to whom the waiver was granted, and the date of the waiver) on our website at the internet address above. Such information will be available on our website for at least a 12-month period. In addition, we will promptly disclose any waivers to our Code of Business Conduct and Ethics and our Supplemental Code of Ethics as required by the NYSE Standards.

Additionally, the Corporation has adopted a Related Party Transaction Policy that works in conjunction with the Code of Business Conduct and Ethics and sets forth the process by which the Audit Committee will review certain related party transactions between the Corporation and its executive officers, directors, and greater than five percent beneficial owners, and their immediate family members, and the Corporation.

By-law Provisions on Stockholder Nominations of Director Candidates

Builders FirstSource’s By-laws provide that, other than pursuant to the Corporation’s proxy access provision (which is described below), no director candidate may be nominated by a stockholder for election at a meeting unless the stockholder (i) has delivered to the Corporate Secretary, within the time limits described in the By-laws, a written notice containing the information specified in the By-laws and (ii) was a stockholder of record (a) at the time such notice was delivered to the Corporate Secretary and (b) on the record date for the determination of stockholders entitled to notice and to vote at the meeting at which such director is standing for election. Accordingly, in order for a stockholder’s nomination of a person for election to the Board of Directors to be considered by the stockholders at the 2024 annual meeting in accordance with the Corporation’s By-laws, the required written notice must be received by our Corporate Secretary on or after February 15, 2024, but no later than March 16, 2024. Only individuals nominated in accordance with the procedures set forth in the

22 Builders FirstSource, Inc. | 2024 Proxy Statement

Corporate Governance

By-laws are eligible to stand for election as directors at a meeting of stockholders and to serve as directors. A copy of the By-laws may be obtained on the Governance section of our website at www.bldr.com, by written request to the Corporate Secretary, Builders FirstSource, Inc., 6031 Connection Drive, Suite 400, Irving, Texas 75039, or by e-mail at inforequest@bldr.com. The foregoing is subject to the Corporation’s obligations under SEC Rule 14a-8 regarding the inclusion of stockholder proposals in the Corporation’s proxy statements, which is further described below in “Stockholder Proposals.”

Policy on Stockholder Recommendations for Director Candidates

The Nominating and Corporate Governance Committee adopted a Policy on Stockholder Recommendations for Director Candidates to describe the process by which the Nominating and Corporate Governance Committee (in preparing their recommendation of director nominees to the Board) will consider candidates for director recommended by stockholders in accordance with the Corporation’s By-laws. A current copy of the Policy on Stockholder Recommendations for Director Candidates is available on the Governance section of our website at www.bldr.com. To have a candidate considered by the Nominating and Corporate Governance Committee, a stockholder must submit the recommendation in writing and must include the information set forth in the Policy on Stockholder Recommendations for Director Candidates.

Proxy Access for Director Nominations

In addition to the above, Builders FirstSource’s By-laws also include a proxy access provision, which permits a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Corporation’s outstanding Common Stock continuously for at least three years to nominate and include in the Corporation’s proxy materials director nominees constituting up to two individuals or 20% of the Board (whichever is greater); provided, however, that for so long as the Corporation has a classified Board of Directors, in no case shall the number of nominees appearing in the Corporation’s proxy materials exceed one-half of the number of directors to be elected at such annual meeting (rounded down to the nearest whole number).

Pursuant to the Corporation’s By-laws, to be timely for inclusion in the proxy materials for our 2024 annual meeting, a stockholder’s written notice to nominate a director using the Corporation’s proxy materials must be received by our Corporate Secretary on or after February 15, 2024, but no later than March 16, 2024. Such notice should be addressed to the Corporate Secretary, Builders FirstSource, Inc., 6031 Connection Drive, Suite 400, Irving, Texas 75039. The notice must contain the information required by our By-laws, and the stockholder(s) and nominee(s) must comply with the information and other requirements in our By-Laws relating to the inclusion of stockholder nominees in our proxy materials. A copy of the By-laws may be obtained on the Governance section of our website at www.bldr.com, by written request to the Corporate Secretary, Builders FirstSource, Inc., 6031 Connection Drive, Suite 400, Irving, Texas 75039, or by e-mail at inforequest@bldr.com.

Corporate Governance Guidelines