- BLDR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Builders FirstSource (BLDR) 425Business combination disclosure

Filed: 30 Oct 20, 5:16pm

FILED BY BUILDERS FIRSTSOURCE, INC.

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14a-12

UNDER THE SECURITIES EXCHANGE ACT OF 1934

SUBJECT COMPANY: BMC STOCK HOLDINGS, INC.

COMMISSION FILE NO. 333-249376

The following are excerpts from Builders FirstSource, Inc.’s earning presentation to investors issued on October 30, 2020, and from the transcript from its earnings call held on October 30, 2020. The excerpts contain only those portions of the release relating to the proposed acquisition by Builders FirstSource, Inc. of BMC Stock Holdings, Inc.:

Excerpts from Earnings Presentation

Excerpts from Earnings Call

Chad Crow

Chief Executive Officer

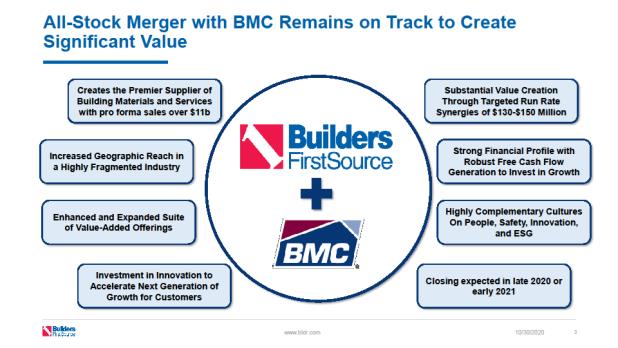

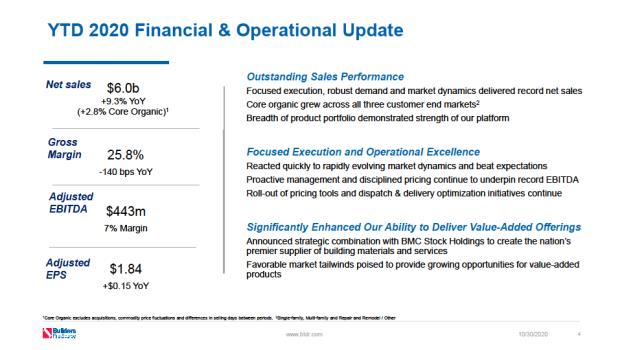

Before diving into our results. I will start on Slide 3, and spend a moment discussing our recently announced merger with BMC Stock Holdings. This merger is on track to [create the] nation’s premier supplier of building materials and services with combined adjusted EBITDA of approximately $950 million including run rate synergies. Together we will have an expansive geographic footprint and enhanced local relationships in attractive high growth markets.

The combined company will benefit from greater geographic reach and diversity within what is still a very fragmented industry. We will have a strong footprint in many of the nation’s largest and fastest growing regions, and we’ll be exceptionally well positioned for long-term growth, supported by a resilient housing environment. We expect to continue to deliver above-market growth through our shared commitment of value added product offerings, which allow us to closely partner with customers to streamline the construction process.

In addition, a larger platform will strengthen our ability to invest in best-in-class innovative solutions that deliver significant benefits to our customers. In the past month and a half Dave Flitman and I have traveled to many regions of the country including Texas, the Mid-Atlantic, the Southeast and Mountain states and the West Coast, among others. In many of these cities, we have held town hall meetings to hear directly from our team members about their local market strength.

2

It was extremely beneficial to observe both of our company’s capabilities in real time and envision all the ways we will be able to complement each other to do some truly exceptional things for our customers. They brought both of us great pride to see our hard working team members across the country. Those efforts are directly responsible for putting us in the successful position we are in today. Both Dave and I enjoyed getting to interact with so many team members and seeing their excitement for future opportunities as we take our combined business to new heights.

In terms of timing, thus far the deal is progressing as expected the merger planning work that’s happening in the background right now continues to be very positive. In October, we filed a 30-day extension under the HSR review process with the DOJ. Also, in October, we filed our Form S-4 with the SEC. We are working diligently with both agencies. Once we have completed these two regulatory milestones, there will be a required 20 working day notice before Builders FirstSource and BMC request their respective shareholder approvals. This keeps us on track to close the merger in late 2020 or early 2021. At this point. I could not be more pleased with our significant strides towards the winning together is one which is our merger tagline, while continuing to stay focused on customers and delivering exceptional operational performance.

* * *

And finally, amongst the many — merger with BMC to our team members and customers and shareholders. We will continue to expand our network of value-added offsite component manufacturing facilities, which are core to our collective strategy. Post combination that will continue to be a focus of our combined growth with a portion of the cash we intend to generate we will continue investing in value-added growth through both organic and inorganic opportunities.

As an example, in October we commissioned the state-of-the-art Greenfield truss plant in Riverside, California, extending our industry-leading position to 66 manufacturing facilities, whether through new facilities, new truss lines in existing plants, door facility expansions or other system enhancements. These differentiated offerings offer industry leading value add capacity And will remain key to enhancing our geographic footprint, technological capabilities and integrated partnerships with customers. The favorable market conditions, we see today should provide growing opportunities for the bigger and better Builders FirstSource we know customers value our commitment to high quality service, and in particular, our ability to continually invest in our service capabilities throughout the housing cycles. This is a differentiator for Builders FirstSource within our industry. It has been an element of our success in 2020 and will continue to be a core focus after we complete our transformational merger with BMC.

* * *

Looking ahead, we are all very pleased to welcome the BMC team to the Builders FirstSource family our accomplishments to this point. I have only strengthened my conviction in the merits of this merger this merger will allow us to deliver solutions that make our customers more productive and efficient through deeper and more integrated relationships than ever before.

3

Value-added offerings will continue to represent the largest portion of our business in the focus of our investments with our expanded capital resources. We believe we will be uniquely positioned to accelerate our profitable growth through underlying market expansion supplemented by targeted acquisitions and operational excellence initiatives. This merger aligns with our share growth strategies and occurs at an optimal time for both companies to create significant value through a much larger and more efficient platform. We look forward to completing this merger and working closely together with a unified leadership team that has a proven record of successful integrations I’m confident that with the two outstanding organizations coming together, we will be better positioned than ever to be the supplier of choice for building materials and value-added products and services in the years to come.

* * *

Matthew Bouley

Barclays

And secondly, I wanted to ask, just on the, on the merger. It sounds like the timelines on track, but you’ve continue to obviously progress with the merger planning. So I guess I’m just curious if there’s any sort of operational updates around how you’re thinking about that some of the things we talked about like overlapping locations in a few markets may be any final points on the synergy potential, just as you continue to dig deeper just curious what kind of the latest is on the operations. Thank you.

Peter Jackson

Chief Financial Officer

Yeah, I would kind of sum it up, as expected, clearly we’re still two separate companies. And so we are doing as much of the planning as we can in the interim as I mentioned in the prepared comments, Dave and I visited a lot of locations there’s a lot of excitement out there, amongst our team members on the opportunities that we’re going to have as a go-forward company, but no real surprises, good or bad. So far, it’s just as expected, which is good. Still feel good about the synergy ranges we’ve given one thing that is clear, we’re all very busy so there’s not a whole lot of excess capacity sitting around at the moment, which is a high-class problem to have. So, yes, it’s going as expected. Which is a good thing.

* * *

Steven Ramsey

Thompson Research Group

Do you plan in the next six to 12 months to greenfield or open more or expand value add capacity in those areas or does at the acquisition of BMC gets you into those areas to maybe a degree that you would like.

4

Peter Jackson

Chief Financial Officer

Yeah, it’s a mix. Some markets it absolutely helps us and we’re excited about where we’re going to be able to do together and we’ll be able to add capacity. I mean the reality is if the capacity in the market is constrained because all of us are already constraints. So that’ll be a different challenge those markets where we don’t play as much there may be opportunities to do some of that it there’s a lot to say grace over right now

* * *

Seldon Clarke

Deutsche Bank

And you mentioned just briefly that you were excited about some of the capabilities and complementary aspects of the merger. So could you just give us a little bit more color on, maybe what you learned throughout this process and whether you’re thinking about the potential top line synergies and any differently now that you’re kind of a couple of more months into the process and you have had these experiences meeting with some of the local teams and things like that?

Chad Crow

Chief Executive Officer

Sure. Yeah. What was really good to see is as you go into some of these, and we were visiting primarily in the markets where we overlap and mainly major, major markets, but really good to see the geographic footprint. So top of mind there you can see the potential and logistics savings where our footprint, might be more focused on the south into town and their footprint, might be more focused on the north in. It certainly is going to give us some ways to optimize our delivery from a product selection standpoint, we would see a facility where are very big. They have a very big ready frame operation for example, and we were very big in components and they may also have a large millwork facility and so when you look at these in these major markets where we overlap, just the completeness of the, the product and service offering. We can offer our customers and then how much better we will be positioned from a geographic standpoint to deliver it, that’s what you’re after right, you want to be able to serve your customers with a full breadth of offerings, but also in the most efficient way you can.

And so we saw a lot of examples of that. And then, not to mention just the enthusiasm and in many cases there was almost a little mini family reunion to going on when we saw some people that we’ve traded employees over the years and they’ve got a lot of talented people we’ve got talented people, and it’s just, it’s really great to think about really will be the when we put these two companies together.

5

* * *

Kurt Yinger

DA Davidson

Thanks and good morning everyone. Appreciate you squeezed me in. I just wanted to start off, I mean with two pretty remarkable periods of volatility in commodities over the last three years. Is there anything internally or that your customers are pushing to do to maybe change some of the backward looking price locks and I realize it’s not completely standardized, but is there anything creative or something people are trying to do to may be smooth out a bit.

Chad Crow

Chief Executive Officer

Well, there’s certainly been a lot of conversation about it your question. I think there are some ebbs and flows in some customers who have gone away from the price or tried to, I think some, some of us of the industry and distribution space have looked for ways to create a bit more stability in terms of the way we buy whether it be directly from the mills or contractual relationships, unfortunately I’m not sure the auctions markets are really all about helpful just based on the way that they work right now so that even the discussions about how that might change in the future, I’m optimistic that our new in our new structure is the combined entity with BMC that might be something we could even continue to follow down that path.

Our ability to be a positive influence and a stabilizing influence in this industry, I think is enhanced with our scale and with our ability to act in the coordinated way. So we will absolutely continue to look at that and certainly some interesting models based on what. Some folks have done out there.

Kurt Yinger

DA Davidson

Okay, that’s interesting. And just my second one, an earlier question touched on the $750 million EBITDA target. Could you just remind us within your own control As far as the operational excellent targets kind of where you stand as far as putting those in place and the biggest buckets of opportunity that remain?

Peter Jackson

Chief Financial Officer

Sure. Yeah, I mean, we had talked about a roughly $65 million target out there for ourselves. I think we’re probably about halfway based on what we talked through up to the prior year, continuing to make progress in that space. We certainly see the best opportunities, the biggest opportunities for ourselves in a couple of key areas. We think that that pricing management and pricing discipline sort of taken the inconsistencies in inefficiencies out of our process is still being a real potential forward-looking benefit for our business.

Excited to see what we can do partner together with BMC in that way as well. And then I think, our ability to continue to enhance our internal operations using digital tools, processes, whether that be as we interact with our customers, but even back office. We certainly still see tremendous value going forward. Leveraging best practices leveraging technology in a combination of those two things, we think will be really impactful. So certainly feel very good about our ability to

6

deliver and go beyond those targets we issued back in, back in ‘18 so certainly expecting that to be an important part of the way the business is going to run post-merger as well.

* * *

Chad Crow

Chief Executive Officer

Thank you once again for joining us today and we look forward to updating you on our future results and the progress on our merger with BMC, if you have any follow-up questions, don’t hesitate to reach out to Binit or Peter. Have a good day. Thank you.

* * *

Cautionary Notice Regarding Forward-Looking Statements

This communication, in addition to historical information, contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of Builders FirstSource, Inc. (“Builders FirstSource”) and BMC Stock Holdings, Inc. (“BMC”). Words such as “may,” “will,” “should,” “plans,” “estimates,” “predicts,” “potential,” “anticipate,” “expect,” “project,” “intend,” “believe,” or the negative of these terms, and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Any forward-looking statements involve risks and uncertainties that are difficult to predict or quantify, and such risks and uncertainties could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks, or uncertainties related to the novel coronavirus disease 2019 (also known as “COVID-19”) pandemic and its impact on the business operations of Builders FirstSource and BMC and on local, national and global economies, the growth strategies of Builders FirstSource and BMC, fluctuations of commodity prices and prices of the products of Builders FirstSource and BMC as a result of national and international economic and other conditions, or the significant dependence of both companies’ revenues and operating results on, among other things, the state of the homebuilding industry and repair and remodeling activity, lumber prices and the economy. Neither Builders FirstSource nor BMC may succeed in addressing these and other risks or uncertainties.

Forward-looking statements relating to the proposed business combination between Builders FirstSource and BMC include, but are not limited to: statements about the benefits of the proposed business combination between Builders FirstSource and BMC, including future financial and operating results; the plans, objectives, expectations and intentions of Builders FirstSource and BMC; the expected timing of completion of the proposed business combination; and other statements relating to the proposed merger that are not historical facts. Forward-looking statements are based on information currently available to Builders FirstSource and BMC and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed business combination between Builders FirstSource and BMC, these factors could include, but are not limited to: the risk that Builders FirstSource and BMC may be

7

unable to obtain governmental and regulatory approvals required for the business combination, or that required governmental and regulatory approvals may delay the business combination or result in the imposition of conditions that could reduce the anticipated benefits from the proposed business combination or cause the parties to abandon the proposed business combination; the risk that a condition to closing of the business combination may not be satisfied, including as a result of the failure to obtain approval of stockholders of Builders FirstSource and BMC on the expected terms and schedule or at all; the length of time necessary to consummate the proposed business combination, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed business combination may not be fully realized or may take longer to realize than expected; the assumptions on which the parties’ estimates of future results of the combined business have been based may prove to be incorrect in a number of material ways, which could result in an inability to realize the expected benefits of the proposed business combination or exposure to material liabilities; the diversion of management time on issues related to the business combination; the effect of future regulatory or legislative actions on the companies or the industries in which they operate; the risk that the credit ratings of the combined company may be different from what the parties expect; economic and foreign exchange rate volatility; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential effect of the announcement or consummation of the proposed business combination on relationships with customers, suppliers, competitors, lenders, landlords, management and other employees; the ability to attract new customers and retain existing customers in the manner anticipated or at all; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; certain restrictions during the pendency of the business combination that may affect the ability of Builders FirstSource and BMC to pursue certain business opportunities or strategic transactions; and the potential of international unrest, economic downturn or effects of anticipated tax rates, raw material costs or availability, benefit or retirement plan costs, or other regulatory compliance costs.

Additional information concerning other risk factors pertaining to Builders FirstSource and BMC is also contained in the parties’ respective most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other information filed with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are beyond Builders FirstSource’s or BMC’s ability to control or predict. Because of these risks and uncertainties, you should not place undue reliance on these forward-looking statements. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete. Furthermore, neither Builders FirstSource nor BMC undertakes any obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this communication. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that the earnings per share of the common stock of Builders FirstSource or of the common stock of BMC for the current or any future financial years, or the earnings per share of the common stock of the combined company, will necessarily match or exceed the historical published earnings per share of the common stock of Builders FirstSource or BMC, as applicable. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. All subsequent written

8

and oral forward-looking statements concerning Builders FirstSource, BMC, the proposed business combination, the combined company or other matters and attributable to Builders FirstSource, BMC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Additional Information and Where to Find It

In connection with the proposed business combination, Builders FirstSource filed with the SEC on October 8, 2020 a registration statement on Form S-4 (the “Registration Statement”) that includes a prospectus with respect to the shares of common stock to be issued by Builders FirstSource in the business combination and a joint proxy statement for Builders FirstSource’s and BMC’s respective stockholders (the “Joint Proxy Statement”). This Registration Statement has not yet been declared effective and the Joint Proxy Statement included therein is in preliminary form. Each of Builders FirstSource and BMC will send the definitive Joint Proxy Statement to its stockholders and may file other documents regarding the business combination with the SEC. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement, or any other document that Builders FirstSource or BMC may send to its stockholders in connection with the proposed business combination. This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. INVESTORS AND SECURITY HOLDERS OF BUILDERS FIRSTSOURCE AND BMC ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT, AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT BUILDERS FIRSTSOURCE, BMC, THE PROPOSED BUSINESS COMBINATION AND RELATED MATTERS. Investors and security holders of Builders FirstSource and BMC may obtain free copies of the Registration Statement, the Joint Proxy Statement, and other documents (including any amendments or supplements thereto) containing important information about Builders FirstSource and BMC filed with the SEC, through the website maintained by the SEC at www.sec.gov. Builders FirstSource and BMC make available free of charge at investors.bldr.com and ir.buildwithbmc.com, respectively, copies of materials they file with, or furnish to, the SEC.

Participants in the Solicitation

Builders FirstSource, BMC, and their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Builders FirstSource and BMC in connection with the proposed business combination.

9

The identity of Builders FirstSource’s directors and executive officers and their ownership of the common stock of Builders FirstSource is set forth in Builders FirstSource’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 21, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2020.

The identity of BMC’s directors and executive officers and their ownership of BMC’s common stock is set forth in BMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 27, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on March 27, 2020.

Investors may obtain additional information regarding the interest of such participants and a description of their direct and indirect interests, by security holdings or otherwise, by reading the Registration Statement, the Joint Proxy Statement, and other materials filed with the SEC in connection with the proposed business combination when they become available. You may obtain these documents free of charge through the website maintained by the SEC at www.sec.gov and from the websites of Builders FirstSource or BMC as described above.

10