OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2007

Estimated average burden hours per response...19.4

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21713

Madison Strategic Sector Premium Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: June 30, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1

Semi-Annual Report

(unaudited)

June 30, 2005

Madison Strategic Sector

Premium Fund (MSP)

Active Equity Management combined with a

Covered Call Option Strategy

Madison Investment Advisors, Inc.

www.madisonfunds.com

Table of Contents

| Portfolio Manager Review | |

| Portfolio Structure and Selection Process | 1 |

| Dividend Policy | 2 |

| Market Conditions and the Fund's Outlook | 2 |

| Manager Comments | 2 |

| Portfolio of Investments | 3 |

| Statement of Assets and Liabilities | 6 |

| Statement of Operations | 7 |

| Statement of Changes in Net Assets | 8 |

| Financial Highlights | 9 |

| Notes to Financial Statements | 10 |

| Dividend Reinvestment Plan | 14 |

Portfolio Manager Review

Madison Asset Management LLC* is pleased to report on the progress of the Madison Strategic Sector Premium Fund (MSP) (the "Fund") for the semi-annual period ending June 30, 2005. The Fund has enjoyed an excellent startup from its inception on April 27, 2005, with its NAV (net asset value per share) growing nicely from $19.10 at inception, before deduction of offering costs charged to capital, to $19.94 on June 30, 2005. The 4.40% increase compares favorably to the 3.41% increase for the Standard & Poor's 500 and the 1.45% increase of the BXM (CBOE's Buy/Write Index) over the same period. Thus, we believe the Fund has achieved excellent results over its early months of operation, providing us with confidence in meeting our longer term goals.

Portfolio Structure and Selection Process

Since its inception, the Fund has transitioned from its initial start-up period to its current operational structure in an efficient manner. As of June 30, 2005, the Fund held 46 common stocks, comprising 93% of total net assets. Covered call options were written against 82% of the stock holdings. We have received net option premiums of $6,218,110 which have an average duration to their option expiration dates of 4.3 months. On June 30, over 50% of the covered stocks have risen in price beyond their respective option strike prices (so-called "in-the-money"). This provides the Fund with a measure of downside protection, following the recent stock market rally, because those stocks may now drift slightly lower in price, down to the option expiration price, without sacrificing our maximum potential total return for those stocks.**

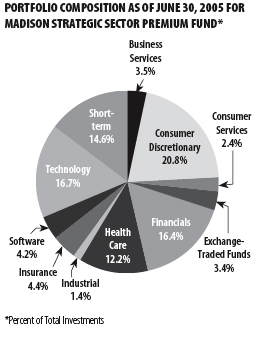

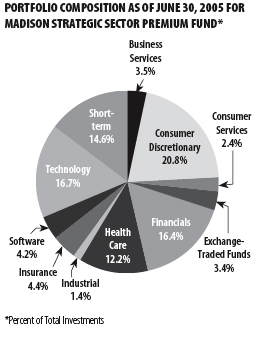

MSP's stock selection strategy starts with investing in stocks that we believe are selling at a reasonable price with respect to their long-term earnings growth rates. Management continues to invest in stocks within economic sectors that, in our opinion, are the most attractive for our "Growth-at-a-Reasonable-Price" style of investing. The Fund has concentrated its investments in four primary sectors: Consumer Discretionary and Retail, Technology, Medical, Health and Pharmaceutical and Financial Institutions. It is our view that the common stocks in these sectors provide better opportunities for higher option premiums than those available in most other sectors. In addition, we believe the option premiums on stocks in the aforementioned sectors are higher than those available from options on stock indices such as the S&P 500.

After we have chosen what we believe are attractive stocks, we employ our option writing strategy which entails selling calls that are primarily out-of the-money, meaning that the strike price is higher than the common stock price. This allows the Fund to participate in some stock appreciation before the stock is subject to being called away on or before its expiration date. With high current income and gains being a primary goal of the Fund, this strategy allows MSP to receive a high level of investment income while adding an element of downside protection. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

*Madison Asset Management, LLC, (MAM) a wholly-owned subsidiary of Madison Investment Advisors, Inc., manages, with its affiliates, over $11 billion in individual, corporate, pension, insurance, endowment and mutual fund assets as of June 30, 2005.

** Assuming they are not called away beforehand.

Dividend Policy

The Fund declared its first monthly dividend of $.15 per share, with an ex-dividend date of July 14, 2005, payable on July 27, 2005. Based on Fund's traded market price of $19.99 per share on June 30, the annualized dividend yield was 9.00%. It is management's objective that all distributed dividends during 2005 will represent ordinary income, dividend income, and short-term capital gains from option premiums, and that the 2005 distributions will not include any return of capital. In addition, we do not anticipate currently having to declare any special or year-end dividends or capital gains distributions in 2005. (See Note 4 to this report for a discussion of return of capital applicable to the fund's initial dividend distributions.)

Market Conditions and the Fund's Outlook

After a meaningful pause in the post-recession market rally, stocks have moved solidly ahead since the August 2004 lows, and have gained just over 5% since the more recent April 2005 lows through June 30. With the expectation of a strong economy in the second half of 2005, the market advance has enjoyed solid underpinnings and gives us confidence that the rally may continue through the remainder of the year. However, many stocks in our research universe, including a number of the Fund's larger stock holdings, appear rather fully priced after the recent rally. Finding new, attractive stocks has proven more difficult in recent weeks, also suggesting that an intermediate market correction is possible. Such a short-term setback could actually be a welcome event, as it would restore better value to allow us decent opportunities to replace appreciated stocks that may be called away at their various option expiration dates over the next few months.

Manager Comments

The Fund's management is pleased with MSP's early success. Based on NAV for the brief period since inception on April 27, 2005 through June 30, 2005, the Fund outperformed the S&P 500 and BXM indices and, in our assessments, most of the other publicly traded option writing closed-end funds, including many of those that have entered the market over the past year. We continue to believe that our strategy is designed to provide superior long-term results, owing to (1) selecting high quality, consistent growth stocks at reasonable valuations, (2) writing call options on individual stocks which offer larger option premiums than call options on major market indexes and (3) allowing for some upside appreciation participation in our individual stocks. We at Madison Asset Management would like to thank you for your investment in MSP. We are pleased with the results the Fund has provided thus far, and we believe we are on our way to achieving the objectives we set forth to accomplish. For the most up-to-date information on your investment, please visit the Fund's website at www.madisonfunds.com.

Portfolio of Investments | June 30, 2005 | unaudited

| Number of Shares | | Value |

| | Common Stocks – 93% | |

| | Business Services – 3.8% | |

27,000 | Cintas Corp. | $ 1,042,200 |

79,000 | First Data Corp. | 3,171,060 |

| | | 4,213,260 |

| | Consumer Discretionary – 22.7% | |

40,000 | American Eagle Outfitters, Inc. | 1,226,000 |

83,000 | Bed Bath & Beyond Inc.* | 3,467,740 |

55,000 | Best Buy Co, Inc. | 3,770,250 |

11,015 | Harley-Davidson Inc. | 546,344 |

87,000 | Home Depot Inc. | 3,384,300 |

55,000 | Kohl's Corp.* | 3,075,050 |

70,000 | Lowe's Cos, Inc. | 4,075,400 |

60,000 | Ross Stores, Inc. | 1,734,600 |

20,000 | Target Corp. | 1,088,200 |

51,000 | Tiffany & Co. | 1,670,760 |

23,000 | Williams-Sonoma Inc. | 910,110 |

| | | 24,948,754 |

| | Consumer Services – 2.6% | |

63,000 | Intuit, Inc.* | 2,841,930 |

| | Exchange-Traded Funds – 3.7% | |

110,000 | Nasdaq-100 Index Tracking Stock | 4,046,900 |

| | Financials – 17.9% | |

32,000 | Affiliated Managers Group, Inc.* | 2,186,560 |

45,000 | Capital One Financial Corp. | 3,600,450 |

40,000 | Citigroup Inc. | 1,849,200 |

90,000 | Countrywide Financial Corp. | 3,474,900 |

90,000 | MBNA Corp. | 2,354,400 |

60,000 | Merrill Lynch & Co., Inc. | 3,300,600 |

55,000 | Morgan Stanley | 2,885,850 |

| | | 19,651,960 |

| | Health Care – 13.3% | |

55,000 | Amgen, Inc.* | 3,325,300 |

90,000 | Biogen Idec Inc.* | 3,100,500 |

65,000 | Biomet Inc. | 2,251,600 |

80,000 | Boston Scientific Co.* | 2,160,000 |

70,000 | Health Management Associates, Inc. | 1,832,600 |

10,000 | Laboratory Corp. of America Holdings* | 499,000 |

75,000 | Mylan Laboratories | 1,443,000 |

| | | 14,612,000 |

| | Industrial – 1.5% | |

45,000 | Dover Corporation | 1,637,100 |

| | | |

| | Insurance – 4.8% | |

30,000 | American International Group, Inc. | $ 1,743,000 |

55,000 | MGIC Investment Corp. | 3,587,100 |

| | | 5,330,100 |

| | Software – 4.6% | |

110,000 | Check Point Software Technologies Ltd.* | 2,178,000 |

130,000 | Symantec Corp.* | 2,826,200 |

| | | 5,004,200 |

| | Technology – 18.1% | |

35,000 | Apple Computer Inc.* | 1,288,350 |

140,000 | Applied Materials, Inc. | 2,265,200 |

120,000 | Cisco Systems, Inc.* | 2,293,200 |

60,000 | EBAY Inc.* | 1,980,600 |

170,000 | Flextronics International Ltd.* | 2,245,700 |

120,000 | Hewlett-Packard Co. | 2,821,200 |

40,000 | Intel Corp. | 1,042,400 |

22,000 | Linear Technology Co. | 807,180 |

38,000 | Mercury Interactive Corp.* | 1,457,680 |

100,000 | Oracle Corp.* | 1,320,000 |

30,000 | Qlogic Corp.* | 926,100 |

54,000 | Texas Instruments, Inc. | 1,515,780 |

| | | 19,963,390 |

| | Total Long-Term Investments | |

| | (Cost $95,450,796) | 102,249,594 |

| | Short-Term Investments – 15.9% | |

| | Repurchase Agreement – | |

| | Morgan Stanley (issued 6/30/05 at 2.73% due 7/1/05 collateralized by $17,860,737 par of U.S.Treasury Notes due 2/15/27). Proceeds at maturity are $17,508,328 (Cost $17,507,000) | 17,507,000 |

| | Total Investments – 108.9% (Cost $112,957,796) | 119,756,594 |

| | Liabilities less other assets - (1.4%) | (1,482,043) |

| | Total Options Written - (7.5%) | (8,225,210) |

| | Net Assets – 100.0% | $ 110,049,341 |

*Non-income producing.

Contracts (100 shares per contract) | Call Options Written* | Expiration Date | Exercise Price | Market Value |

220 | Affiliated Managers Group, Inc. | September 2005 | $ 65.00 | $ 111,100 |

100 | Affiliated Managers Group, Inc. | December 2005 | 65.00 | 68,000 |

200 | American International Group, Inc. | August 2005 | 55.00 | 77,000 |

100 | American International Group, Inc. | November 2005 | 55.00 | 53,000 |

200 | Amgen, Inc. | October 2005 | 65.00 | 19,500 |

350 | Amgen, Inc. | January 2006 | 60.00 | 154,000 |

235 | American Eagle Outfitters, Inc. | August 2005 | 27.50 | 90,475 |

165 | American Eagle Outfitters, Inc. | November 2005 | 30.00 | 53,625 |

700 | Applied Materials, Inc. | July 2005 | 15.00 | 85,750 |

700 | Applied Materials, Inc. | October 2005 | 16.00 | 73,500 |

290 | Apple Computers | October 2005 | 37.50 | 92,800 |

60 | Apple Computers | January 2006 | 37.50 | 26,100 |

200 | Bed Bath & Beyond, Inc. | August 2005 | 37.50 | 96,000 |

400 | Bed Bath & Beyond, Inc. | November 2005 | 40.00 | 160,000 |

230 | Bed Bath & Beyond, Inc. | November 2005 | 42.50 | 59,800 |

200 | Best Buy Co, Inc. | September 2005 | 55.00 | 287,000 |

350 | Best Buy Co, Inc. | December 2005 | 50.00 | 694,750 |

50 | Biogen Idec Inc. | January 2006 | 35.00 | 18,000 |

850 | Biogen Idec Inc. | January 2006 | 40.00 | 155,125 |

200 | Boston Scientific Corp. | November 2005 | 32.50 | 8,000 |

600 | Boston Scientific Corp. | January 2006 | 30.00 | 84,000 |

450 | Capital One Financial Corp. | December 2005 | 75.00 | 389,250 |

900 | Check Point Software Technologies Ltd. | October 2005 | 22.50 | 47,250 |

200 | Check Point Software Technologies Ltd. | January 2006 | 25.00 | 7,500 |

94 | Cintas Corp. | November 2005 | 40.00 | 14,570 |

300 | Cisco Systems, Inc. | July 2005 | 17.50 | 49,500 |

600 | Cisco Systems, Inc. | October 2005 | 20.00 | 37,500 |

300 | Cisco Systems, Inc. | January 2006 | 17.50 | 75,750 |

400 | Countrywide Financial Corp. | October 2005 | 35.00 | 194,000 |

500 | Countrywide Financial Corp. | January 2006 | 37.50 | 205,000 |

200 | EBAY Inc. | January 2006 | 32.50 | 85,000 |

400 | EBAY Inc. | January 2006 | 35.00 | 122,000 |

200 | First Data Corp. | November 2005 | 40.00 | 46,000 |

850 | Flextronics International Ltd. | October 2005 | 12.50 | 112,625 |

850 | Flextronics International Ltd. | January 2006 | 12.50 | 144,500 |

110 | Harley-Davidson Inc. | January 2006 | 50.00 | 42,350 |

230 | Hewlett-Packard Co. | August 2005 | 22.50 | 34,500 |

970 | Hewlett-Packard Co. | November 2005 | 22.50 | 201,275 |

700 | Health Management Associates, Inc. | November 2005 | 25.00 | 150,500 |

870 | Home Depot Inc. | November 2005 | 40.00 | 152,250 |

400 | Intel Corp. | October 2005 | 25.00 | 81,000 |

630 | Intuit, Inc. | October 2005 | 42.50 | 270,900 |

250 | Kohl's Corp. | October 2005 | 50.00 | 188,750 |

300 | Kohl's Corp. | January 2006 | 50.00 | 264,000 |

100 | Laboratory Corp. of America Holdings | November 2005 | 50.00 | 25,750 |

220 | Linear Technology Co. | November 2005 | 37.50 | 41,250 |

200 | Lowe's Cos, Inc. | October 2005 | 55.00 | 98,000 |

300 | Lowe's Cos, Inc. | October 2005 | 60.00 | 57,750 |

200 | Lowe's Cos, Inc. | January 2006 | 60.00 | 60,000 |

300 | MBNA Corp. | September 2005 | 20.00 | 186,000 |

450 | MBNA Corp. | December 2005 | 22.50 | 175,500 |

380 | Mercury Interactive Corp. | January 2006 | 45.00 | 61,750 |

560 | Merrill Lynch & Co., Inc. | October 2005 | 55.00 | 138,600 |

40 | Merrill Lynch & Co., Inc. | January 2006 | 55.00 | 14,000 |

200 | MGIC Investment Corp. | December 2005 | 60.00 | 146,000 |

350 | MGIC Investment Corp. | December 2005 | 65.00 | 143,500 |

200 | Morgan Stanley | January 2006 | 55.00 | 52,000 |

489 | Mylan Laboratories, Inc. | October 2005 | 17.50 | 114,915 |

300 | Oracle Corp | December 2005 | 12.00 | 51,000 |

700 | Oracle Corp | December 2005 | 13.00 | 70,000 |

200 | QLogic Corp. | October 2005 | 32.50 | 36,500 |

900 | Nasdaq-100 Index Tracking Stock | July 2005 | 36.00 | 83,250 |

200 | Nasdaq-100 Index Tracking Stock | December 2005 | 37.00 | 36,500 |

600 | Ross Stores, Inc. | November 2005 | 27.50 | 180,000 |

500 | Symantec Corp. | July 2005 | 20.00 | 93,750 |

600 | Symantec Corp. | January 2006 | 20.00 | 201,000 |

200 | Symantec Corp. | January 2006 | 22.50 | 40,000 |

200 | Target Co. | October 2005 | 47.50 | 156,000 |

340 | Texas Instruments, Inc. | October 2005 | 25.00 | 129,200 |

200 | Texas Instruments, Inc. | January 2006 | 25.00 | 88,000 |

510 | Tiffany & Co. | January 2006 | 30.00 | 226,950 |

230 | Williams-Sonoma Inc. | November 2005 | 35.00 | 134,550 |

| | Total Call Options Written (Premiums received $6,218,110) | | | $ 8,225,210 |

*Non-income producing.

See notes to financial statements.

Statement of Assets and Liabilities | June 30, 2005 | unaudited

| ASSETS | |

| Investments, at value (Note 2) | |

| Investment securites | $102,249,594 |

| Repurchase agreements | 17,507,000 |

| Total investments (cost $112,957,796) | 119,756,594 |

| Cash | 610 |

| Receivables | |

| Investment securities sold | 169,082 |

| Dividends and interest | 52,026 |

| Total assets | 119,978,312 |

| | |

| LIABILITIES | |

| Options written, at value (premiums received of $6,218,110) | 8,225,210 |

| Payables | |

| Investment securities purchased | 1,702,316 |

| Independent trustee and auditor fees | 3,613 |

| Other expenses | (2,168) |

| Total liabilities | 9,928,971 |

| | |

| NET ASSETS | $110,049,341 |

| Net assets consists of: | |

| Paid in capital | 105,180,103 |

| Undistributed net investment income | 77,540 |

| Accumulated net realized gain on investments and options transactions | -- |

| Net unrealized appreciation on investments and options transactions | 4,791,698 |

| Net Assets | $110,049,341 |

| | |

| CAPITAL SHARES ISSUED AND OUTSTANDING | |

| An unlimited number of capital shares authorized, $.01 par value per share | 5,518,330 |

| | |

| NET ASSET VALUE PER SHARE | $19.94 |

Statement of Operations | For the period April 27, 2005* through June 30, 2005 | unaudited

| INVESTMENT INCOME (Note 2) | |

| Interest income | $149,186 |

| Dividend income | 111,448 |

| Total investment income | 260,634 |

| | |

| EXPENSES (Note 3) | |

| Investment advisory | 149,717 |

| Administration | 4,679 |

| Fund accounting | 5,146 |

| Independent trustee and auditor | 8,113 |

| Other | 15,439 |

| Total expenses | 183,094 |

| | |

| NET INVESTMENT INCOME | 77,540 |

| | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| Net realized gain (loss) on: | |

| Investments | -- |

| Options | -- |

| Net unrealized appreciation (depreciation) on: | |

| Investments | 6,798,798 |

| Options | (2,007,100) |

| | |

| NET GAIN ON INVESTMENTS AND OPTIONS TRANSACTIONS | 4,791,698 |

| | |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $4,869,238 |

* Commencement of operations.

Statement of Changes in Net Assets | unaudited

For the period April 27, 2005* through June 30, 2005

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

| Net investment income | $77,540 |

| Net realized gain (loss) on investments and options transactions | -- |

| Net unrealized appreciation on investments and options transactions | 4,791,698 |

| Total increase in net assets resulting from operations | 4,869,238 |

| | |

| CAPITAL SHARE TRANSACTIONS | |

| Proceeds from issuance of common shares | 105,050,000 |

| Reinvestment of dividends | -- |

| Common share offering costs charged to paid-in-capital | (220,000) |

| Total increase in net assets resulting from capital share transactions | 104,830,000 |

| | |

| TOTAL INCREASE IN NET ASSETS | 109,699,238 |

| | |

| NET ASSETS | |

| Beginning of period | $350,103 |

| End of period | $110,049,341 |

* Commencement of operations.

Financial Highlights | For the period April 27, 2005* through June 30, 2005

Per Share Operating Performance for One Share Outstanding Throughout the Period (unaudited)

| Net Asset Value, Beginning of Period1 | $19.10 |

| Investment Operations | |

| Net Investment Income | 0.01 |

| Net realized and unrealized gain on investments and options transactions | 0.87 |

| Total from investment operations | 0.88 |

| Offering Costs Charged to Paid-in-Capital | (0.04) |

| Net Asset Value, End of Period | $19.94 |

| Market Value, End of Period | $19.99 |

| Total Investment Return | |

| Net asset value (%) | 4.40 |

| Market value (%) | (0.05) |

| Ratios and Supplemental Data | |

| Net assets, end of period (thousands) | $110,049 |

| Ratio of expenses to average net assets (%)2 | 0.95 |

| Ratio of net investment Income to average net assets (%)2 | 0.40 |

| Portfolio turnover (%) | 0 |

* Commencement of operations.

1 Before deduction of offering costs charged to capital.

2 Annualized.

Notes to Financial Statements | June 30, 2005

Note 1 – Organization:

Madison Strategic Sector Premium Fund (the "Fund") was organized as a Delaware statutory trust on February 4, 2005. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended. The Fund's primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation.

The Fund will pursue its investment objectives by investing in a portfolio consisting primarily of common stocks of large and mid-capitalization issuers that are, in the view of the Fund's Investment Advisor, selling at a reasonable price in relation to their long-term earnings growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment objectives. The Fund's investment objectives are considered fundamental and may not be changed without shareholder approval.

Note 2 – Significant Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Fund.

(a) Valuation of Investments

Readily marketable portfolio securities listed on an exchange or traded in the over-the counter market are generally valued at their last reported sale price. If no sales are reported, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day, then the security is valued by such method as the Fund's Board of Trustees shall determine in good faith to reflect its fair value. Portfolio securities traded on more than one securities exchange are valued at the last sale price at the close of the exchange representing the principal market for such securities. Debt securities are valued at the last available bid price for such securities or, if such prices are not available, at the mean between the last bid and asked price. Exchange-traded options are valued at the mean of the best bid and best asked prices across all option exchanges.

Short-term debt securities having a remaining maturity of sixty days or less are valued at amortized cost, which approximates market value.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis.

The Fund may invest in repurchase agreements, which are short-term investments in which the Fund acquires ownership of a debt security and the seller agrees to repurchase the security at a future time and specified price. Repurchase agreements are fully collateralized by the underlying debt security. The Fund will make payment for such securities only upon physical delivery or evidence of book entry transfer to the account of the custodian bank. The seller is required to maintain the value of the underlying security at not less than the repurchase proceeds due the Fund.

Note 3 – Investment Advisory Agreement and Other Transactions with Affiliates:

Pursuant to an Investment Advisory Agreement between the Fund and Madison Asset Management, LLC, a wholly-owned subsidiary of Madison Investment Advisors, Inc. (collectively "the Advisor"), the Advisor, under the supervision of the Fund's Board of Trustees, will provide a continuous investment program for the Fund's portfolio; provide investment research and make and execute recommendations for the purchase and sale of securities; and provide certain facilities and personnel, including officers required for the Fund's administrative management and compensation of all officers and trustees of the Fund who are its affiliate. For these services, the Fund will pay the Investment Advisor a fee, payable monthly, in an amount equal to 0.80% of the Fund's average daily net assets.

Under a separate Services Agreement, effective April 26, 2005, the Advisor provides fund administration services, fund accounting services, and arranges to have all other necessary operational and support services, for a fee, to the Fund. These fees are accrued daily and shall not exceed 0.18% of the Fund's average daily net assets. The Advisor assumes responsibility for payment of all expenses greater than 0.18% of average net assets.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

Information on the tax components of capital, excluding option contracts, as of June 30, 2005 is as follows:

| Aggregate Cost | $112,957,796 |

| Gross unrealized appreciation | 7,849,125 |

| Gross unrealized depreciation | (1,050,327) |

| Net unrealized appreciation (depreciation) | $6,798,798 |

Net realized gains or losses may differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions.

Return of Capital

On June 13, 2005, the Fund declared a dividend of 15 cents per share to be paid on July 27, 2005 to shareholders of record on July 18, 2005. As disclosed in the Fund's prospectus, a percentage of monthly dividends during the early months of the Fund's operation may be characterized as a return of capital. However, for the entire calendar year of 2005, it is anticipated that the actual composition of the Fund's distributions, based on the Fund's investment activity, will be fully taxable, primarily as short term capital gains taxable as ordinary income and secondarily as qualified dividend income. The Fund expects varied timing of recognition of gains primarily related to initial monthly distributions, during the period in which the Fund is initially implementing its covered call option strategy. The ultimate tax characterization of the Fund's distributions made in a calendar year will not be determined until after the end of that calendar year.

For example, as of the June 13, 2005 declaration date, approximately 1 cent of the 15 cent dividend would have been attributable to short-term capital gains and other ordinary income and 14 cents would have been attributable to return of capital if June 13, 2005 had been the year end. As this report approached its printing date on August 22, 2005, and considering the August dividend declared on August 1, 2005, this amount changed as a result of ongoing Fund operations to 6 cents attributable to short-term capital gains and other ordinary income and 9 cents attributable to return of capital if August 22, 2005 had been the year end. By the actual year end on December 31, 2005, the Fund anticipates that all 15 cents for the declared dividend in June and all subsequent declared dividends will be attributable to short-term capital gains and other ordinary interest income.

Note 5 – Investment Transactions:

During the period, the cost of purchases and proceeds from sales of investments, excluding short-term investments were $95,450,796 and $0, respectively. No U.S. Government securities were purchased or sold during the period.

Note 6 – Covered Call Options:

The Fund will pursue its primary objective by employing an option strategy of writing (selling) covered call options on common stocks. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or "strike" price. The writer of an option on a security has the obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or to pay the exercise price upon delivery of the underlying security (in the case of a put).

There are several risks associated with transactions in options on securities. As the writer of a covered call option, the Fund forgoes, during the option's life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call but has retained the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

Transactions in option contracts during the period ended June 30, 2005 were as follows:

| | Number of Contracts | Premiums Received |

| Options written during the period | 26,973 | $6,289,857 |

| Options expired during the period | -- | -- |

| Options closed during the period | (200) | (71,747) |

| Options assigned during the period | -- | -- |

| Options outstanding, end of period | 26,773 | $6,218,110 |

Note 7 – Capital:

Common Shares

In connection with its organizational process, the Fund sold 5,240 and 13,090 common shares of beneficial interest to the Advisor and Frank Burgess, founder of the Advisor and Trustee of the Fund, for consideration of $100,094 and $250,019, respectively. The Fund has an unlimited amount of common shares, $0.01 par value, authorized and issued 5,500,000 shares of common stock in its initial public offering. These shares were all issued at $19.10 per share for total consideration of $105,050,000 after deducting the sales load but before a reimbursement of expenses to the underwriters of $0.005 per share.

Offering costs of $220,000 or $0.04 per share, in connection with the issuance of the common shares have been borne by the Fund and were charged to paid-in-capital. The Advisor has agreed to pay the Fund's organizational expenses and all offering costs in excess of $220,000.

The Fund did not issue any additional shares during the period in connection with its dividend reinvestment plan.

Note 8 – Indemnifications

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and, therefore cannot be estimated; however, the risk of material loss from such claims is considered remote.

Forward-Looking Statement Disclosure.

One of our most important responsibilities as investment company managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information.

The Fund adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Fund's portfolios. Additionally, information regarding how the Fund voted proxies related to portfolio securities, if applicable, during the period ended June 30, 2005 is available to you upon request and free of charge, by writing to Madison Strategic Sector Premium Fund, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. The Fund's proxy voting policies and voting information may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Fund will respond to shareholder requests for copies of our policies and voting information within two business days of request by first-class mail or other means designed to ensure prompt delivery.

N-Q Disclosure.

The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the "Commission") for the first and third quarters of each fiscal year on Form N-Q. The Fund's Forms N-Q are available on the Commission's website. The Fund's Forms N-Q may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-942-8090. Form N-Q and other information about the Fund are available on the EDGAR Database on the Commission's Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the Commission's Public Reference Section, Washington, DC 20549-0102. Finally, you may call the Fund at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Statement Regarding Basis for Approval of Investment Advisory Contract.

In approving the Advisory Agreement on March 3, 2005, the Fund's Board of Trustees, including the non-interested Trustees, considered in general the nature, quality and scope of the services to be provided by the Adviser. The Board of Trustees, including the non-interested Trustees, met with representatives of the Adviser, who described the Fund's investment objective and policies and discussed the Fund's model portfolio. The Board of Trustees discussed with representatives of the Adviser the operations of the Adviser and the background, experience and expertise of key personnel of the Adviser.

Nature, Extent and Quality of Services. The Board of Trustees reviewed the experience of the Adviser and its affiliates as sub-adviser to another closed-end investment company with a similar investment strategy, as adviser to open-end investment companies and as adviser to other accounts with similar investment strategies. The Board of Trustees reviewed the Adviser's Form ADV and latest financial information. The Board of Trustees considered the biographies and tenure of personnel of the Adviser who will be responsible for managing the Fund's portfolio and providing other services to the Fund. The Board discussed with portfolio management personally the investment philosophies and the strategies of the Fund. In light of the services to be provided and the experience and expertise of the personnel performing such services, the Board of Trustees concluded that the Adviser's personnel are well qualified to provide portfolio management and other services to the Fund.

Performance Comparisons. While the Fund is newly organized and does not have performance information as of March 3, 2005, the Board of Trustees considered performance projections based on a model portfolio, performance of accounts of the Adviser which employ similar investment strategies and the performance of other comparable closed-end investment companies. The Board of Trustees also considered the appropriate performance benchmarks against which to judge the performance of the Fund.

Fee Comparisons. Prior to approving the Advisory Agreement, the Board of Trustees considered materials prepared by the Adviser regarding the comparability of the proposed advisory fee with the fees of similar investment companies. The Board of Trustees considered the advisory fees of four other closed-end funds with investment objectives and strategies similar to the Fund. The Board of Trustees also considered information regarding the other expenses, total expense ratios, assets and inception dates for these comparable funds. The Board of Trustees considered this information in comparison with the proposed advisory fee and estimated total expense ratio of the Fund. The Board of Trustees, after reviewing the totality of the information presented concluded that the proposed advisory fee is fair and reasonable.

Other Cost and Profit Considerations. The Board of Trustees also considered the costs to the Adviser of providing services to the Fund, the profits to be realized by the Adviser from the Fund and potential economies of scale to be realized to the Adviser, and the extent to which the Fund may benefit from such economies of scale. In light of the costs to the Adviser and profits to be realized by the Adviser in connection with providing services to the Fund, the Board concluded that the proposed advisory fee is fair and reasonable.

Conclusions. The Board of Trustees, after reviewing the totality of the information presented, including the information set forth above and other information considered by the Board of Trustees, concluded that the proposed advisory fee is fair and reasonable for the Fund and that the Advisory Agreement is in the best interests of the Fund and its shareholders.

The Trustees who are not interested persons of the Adviser met separately with their independent counsel to discuss their responsibilities as Trustees of the Fund in general and specifically with respect to approval of the investment advisory agreement. The non-interested Trustees discussed the proposed advisory fee, total expenses to the Fund, the personnel, experience and expertise of portfolio management and other personnel of the Adviser and the services to be provided to the Fund. Based on this review, the non-interested Trustees concluded that the proposed advisory fee is fair and reasonable for the Fund and that the Advisory Agreement is in the best interests of the Fund and its shareholders.

Dividend Reinvestment Plan | June 30, 2005

Unless the registered owner of common shares elects to receive cash by contacting the Plan Administrator, all dividends declared on common shares of the Fund will be automatically reinvested by Computershare Trust Company, Inc. (the "Plan Administrator"), Administrator for shareholders in the Fund's Dividend Reinvestment Plan (the "Plan"), in additional common shares of the Fund. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional common shares of the Fund for you. If you wish for all dividends declared on your common shares of the Fund to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each common shareholder under the Plan in the same name in which such common shareholder's common shares are registered. Whenever the Fund declares a dividend or other distribution (together, a "Dividend") payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in common shares. The common shares will be acquired by the Plan Administrator for the participants' accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized common shares from the Fund ("Newly Issued Common Shares") or (ii) by purchase of outstanding common shares on the open market ("Open-Market Purchases") on the New York Stock Exchange or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commission per common share is equal to or greater than the net asset value per common share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant's account will be determined by dividing the dollar amount of the Dividend by the net asset value per common share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Dividend will be divided by 95% of the closing market price per common share on the payment date. If, on the payment date for any Dividend, the net asset value per common share is greater than the closing market value plus estimated brokerage commission, the Plan Administrator will invest the Dividend amount in common shares acquired on behalf of the participants in Open-Market Purchases.

If, before the Plan Administrator has completed its Open-Market Purchases, the market price per common share exceeds the net asset value per common share, the average per common share purchase price paid by the Plan Administrator may exceed the net asset value of the common shares, resulting in the acquisition of fewer common shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly Issued Common Shares at net asset value per common share at the close of business on the Last Purchase Date provided that, if the net asset value is less than or equal to 95% of the then current market price per common share; the dollar amount of the Dividend will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders' accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instruction of the participants.

There will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commission incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any Federal, state or local income tax that may be payable (or required to be withheld) on such Dividends.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, Computershare Trust Company, Inc., 2 North LaSalle Street, Chicago, IL, 60602, Phone Number: (800) 727-0196 or (312) 360-5486.

This page was left blank intentionally.

Board of Trustees

Philip E. Blake

Frank Burgess

James Imhoff, Jr.

Lorence Wheeler

Officers

Katherine L. Frank

President

Frank Burgess

Senior Vice President

Ray DiBernardo

Vice President

Jay Sekelsky

Vice President

Deborah Pines

Vice President

Greg Hoppe

Chief Financial Officer

& Treasurer

W. Richard Mason

Secretary, General Counsel &

Chief Compliance Officer

Investment Advisor

Madison Asset Management, LLC

550 Science Drive

Madison, WI 53711

Administrator

Madison Investment Advisors, Inc.

550 Science Drive

Madison, WI 53711

Custodian

US Bank NA

Cincinnati, Ohio

Transfer Agent

Computershare Investor Services, LLC

Chicago, Illinois

Legal Counsel

Skadden, Arps, Slate, Meagher &

Flom, LLP

Chicago, Illinois

Independent Registered

Public Accounting Firm

Grant Thornton LLP

Chicago, Illinois

Privacy Principles of Madison Strategic Sector Premium Fund for Shareholders

The Fund is committeed to maintaining the privacy of shareholders and to safeguarding its non-public information. The following information is provided to help you understand what personal information the Fund collects, how we protect that information and why, in certain cases, we may share information with select other parties.

Generally, the Fund does not receive any nonpublic personal information relating to its shareholders, alther certainnonpublic personal information of its shareholders may become available to the Fund. The Fund does not disclose any nonpublic personal informatin about its shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third party administrator).

The Fund restricts access to nonpublic personal information about the shareholders to Madison Asset Management, LLC and Madison Investment Advisors, Inc. employees with a legitimate business need for the information. The Fund maintains physical, electronic and procedural safeguards designed to protect the nonbpublic personal information of its shareholders.

Question concerning your shares of Madison Strategic Sector Premium Fund?

If your shares are held in a Brokerage Account, contact your broker

If you have physical possession of your shares in certificate form, contact the Fund's Transfer Agent:

Computershare Investor Services, LLC, 2 North LaSalle Street, Chicago, Illinois 60602 1-800-727-0196

This report is sent to shareholders of Madison Strategic Sector Premium Fund for their information. It is not a Prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

Madison Investment Advisors, Inc.

550 SCIENCE DRIVE

MADISON, WISCONSIN 53711

1-800-767-0300

www.madisonfunds.com

Item 2. Code of Ethics.

Not applicable in semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable in semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable in semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable in semi-annual report.

Item 6. Schedule of Investments

Included in report to shareholders (Item 1) above.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable in semi-annual report.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable in semi-annual report.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

(a) No purchases were made during the period covered by this report by on or behalf of the registrant or any "affiliated purchaser," as defined in Rule 10b-18(a)(3) under the Exchange Act of shares or other units of any class of the registrant's equity securities this is registered by the registrant pursuant to Section 12 of the Exchange Act.

(b)

REGISTRANT PURCHASES OF EQUITY SECURITIES

| Period | (a) Total Number of Shares (or Units) Purchased | (b)Average Price Paid per Share (or Unit) | (c)Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d)Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

| Month #1 (Inception to May 31 2005) | 0 | 0 | 0 | 0 |

| Month #2 (June 1 to June 30 2005) | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 |

Note to Item 9: As announced and disclosed in the registrant's prospectus, the registrant maintains a Dividend Reinvestment Plan. The plan has no expiration date and no limits on the dollar amount of securities that may be purchased by the registrant to satisfy the plan's dividend reinvestment requirements.

Item 10. Submission of Matters to a Vote of Security Holders.

At the registrant's organizational meeting on March 2, 2005, the registrant adopted written procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees.

Item 11. Controls and Procedures.

(a) The Trust’s principal executive officer and principal financial officer determined that the registrant’s disclosure controls and procedures are effective, based on their evaluation of these controls and procedures within 90 days of the date of this report. There were no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

(b) There have been no changes in the registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. (Note that the registrant's initial public offering was April 27, 2005.)

Item 12. Exhibits.

(a)(1) Not applicable to semi-annual report.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) None.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Madison Strategic Sector Premium Fund

By: (signature)

W. Richard Mason, Secretary

Date: August 8, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: (signature)

Katherine L. Frank, Chief Executive Officer

Date: August 8, 2005

By: (signature)

Greg Hoppe, Chief Financial Officer

Date: August 8, 2005