| As filed with the Securities and Exchange Commission on June 28, 2006 |

|

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 1-14398

SHAMIR OPTICAL INDUSTRY LTD

(Exact name of registrant as specified in its charter)

| |

|---|

| |

|---|

| |

|---|

| |

|---|

| |

|---|

| N/A | Israel |

| (Translation of registrant's | (Jurisdiction of incorporation |

| name into English) | or organization) |

KIBBUTZ SHAMIR

UPPER GALILEE

12135 ISRAEL

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| |

|---|

| |

|---|

| |

|---|

| |

|---|

| |

|---|

| Title of each class: | Name of each exchange on which registered: |

| Common Shares, par value NIS 0.01 each | NASDAQ National Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, 0.01 NIS par value each, referred to in this document as 16,256,514 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yeso Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yeso Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yesx Noo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filero Accelerated filer o Non-accelerated filer x

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17o Item 18x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yeso Nox

TABLE OF CONTENTS

ii

CERTAIN DEFINED TERMS

In this annual report, unless otherwise provided, references to “Shamir,” “we,” “us” and “our” refer to Shamir Optical Industry Ltd (or its predecessor or successor entities) and its subsidiaries, and references to our company refer to Shamir Optical Industry Ltd (or its predecessor or successor entities) without its consolidated subsidiaries. The terms “euro,” “EUR” or “€” refer to the common currency of twelve member states of the European Union, “NIS” refers to New Israeli shekel, and “dollar,” “USD” or “$” refers to U.S. dollars.

We own rights directly or through our subsidiary Shamir Insight Inc., in the following trademarks in various jurisdictions world-wide: Shamir™, Shamir logo, Shamir Genesis™, Genesis™, Shamir Piccolo™, Piccolo™, Shamir Office™, Shamir Creation™, Shamir Autograph™, Autograph™, Shamir Attitude™, Attitude™, Prescriptor™ and Eye Point Technology™ Freeform™, Freeform Lenses™, Freeform Technology™, Freeform Software Protocol™ Panorama™, Eye Point™, Direct Lens Technology™, Autograph Golf™, Autograph Short™, Autograph Everyday™, Piccolo Wrap™, The Progressive Lens Experts™, Titan Hardcoat™, Deskvision™, Individual Eyes™, Recreating Perfect Vision™, Multispace™, Nano™, Piccolo Nano™, Autograph Nano™, Studio™ Our main trademarks are registered or are in the process of being registered in the United States, the European Union, Canada and additional countries. All other trademarks or brand names referred to in this annual report are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements. Forward-looking statements may be, but are not necessarily, identified by words like “believe,” “anticipate,” “intend,” “target,” “estimate,” “plan,” “assume,” “may,” “will,” “should,” “could” and similar expressions. Forward-looking statements also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this annual report are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account currently available information. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance of financial condition we express or imply in any forward-looking statements. Some of the important factors that could cause our actual results, performance or financial condition to differ materially from expectations are:

| — | the effects of competition in our industry, and changes in our relationships with optical laboratories, distributors, research and development partners and other third parties; |

| — | the effects of the international expansion of our operations and our ability to manage our growth, including our ability to manage potential future acquisitions; |

| — | our ability to timely develop and market new or enhanced products and the effects of developments in alternative technologies and treatments in our industry; |

| — | our ability to protect our proprietary technology and intellectual property rights; |

| — | our ability to capitalize on our research and development capabilities; |

| — | our ability to retain or recruit key personnel; |

| — | our relationship with Kibbutz Shamir; |

| — | the effects of exchange rate fluctuations; |

| — | the political, military and economic conditions in Israel; |

| — | our success at managing the risks of the foregoing; and |

| — | the other factors referenced in this annual report, including, without limitation, in the sections entitled "Item 3. Key Information - Risk Factors," "Item 5. Operating and Financial Review and Prospect" and "Item 4. Information on the Company.” |

We undertake no obligation to update forward-looking statements or risk factors in this annual report to reflect new information, future events or otherwise, except as may be required under applicable securities laws and regulations.

iii

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation organized under the laws of Israel. Our and most of our subsidiaries’ directors and officers, as well as certain of the experts named in this annual report, are non-U.S. residents, and a substantial portion of our assets and the assets of our directors and officers and of these experts are and will be located outside the United States. As a result, you may not be able to effect service of process within the United States upon these persons or to enforce, in U.S. courts, against these persons judgments of U.S. courts predicated upon any civil liability provisions of the U.S. federal or state securities laws or other laws of the United States. The United States and Israel currently do not have a treaty providing for reciprocal recognition and enforcement of judgments in civil and commercial matters, and there is a doubt as to the enforceability in original actions in Israeli courts of liabilities based on U.S. federal securities laws and as to the enforceability in Israeli courts of judgments of U.S. courts obtained in actions based on the civil liability provisions of U.S. federal securities laws. Therefore, it may not be possible to enforce those actions against us, our non-U.S. directors and officers or the experts named in this annual report. However, subject to certain time limitations, an Israeli court may declare a foreign civil judgment enforceable if it finds that:

| — | the judgment was rendered by a court which was, according to the laws of the jurisdiction of the court, competent to render the judgment; |

| — | the judgment is no longer subject to appeal; |

| — | the obligation imposed by the judgment is enforceable according to the rules relating to the enforceability of judgments in Israel and the substance of the judgment is not contrary to public policy; and |

| — | the judgment can be executed in the country in which it was given. |

A foreign judgment will not be declared enforceable if it was given in a country whose laws do not provide for the enforcement of judgments of Israeli courts (subject to exceptional cases) or if its enforcement is likely to prejudice the sovereignty or security of the State of Israel. An Israeli court also will not declare a foreign judgment enforceable if it is proven to the Israeli court that:

| — | the judgment was obtained by fraud; |

| — | there was no due process; |

| — | the judgment was rendered by a court not competent to render it according to the laws of private international law in Israel; |

| — | the judgment is at variance with another judgment that was given in the same matter between the same parties and which is still valid; or |

| — | at the time the action was brought in the foreign court, a suit in the same matter and between the same parties was pending before a court or tribunal in Israel. |

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS; SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Introduction – Corporate Reorganization

We conducted an initial public offering (“IPO”) and concurrent listing on the NASDAQ National Market of our common shares in March 2005. Prior to the IPO, we were organized as an agricultural co-operative society (A.C.S.), which is a corporate entity organized under Israeli law with shares and limited liability for its members. The principal distinction between an Israeli limited liability company, our current corporate form, and an A.C.S. is that an A.C.S. is a pass-through tax entity and all the profits and losses of the A.C.S. are attributed to its shareholders pro rata to their shareholding. Historically, the articles of association of our A.C.S. reflected the laws and regulations applicable to such an entity.

Our A.C.S. was managed under the supervision of a management board that generally consisted of between four and seven members. Its share capital consisted of 105,506 issued and outstanding shares with a par value of NIS 1.00 each. The A.C.S. had, immediately prior to the reorganization, eight shareholders, or “members.” The following entities were the members of the A.C.S. (along with their percentage holding in the A.C.S.): Kibbutz Shamir (16.11%); Shamir Optical Industry (General Partnership) (16.11%); S.L.A.G. Shamir Plastic Non-Woven Fabrics Industries (Limited Partnership) (16.11%); Shamir Industries (Limited Partnership) (16.11%); Galil Beehive Products Kibbutz Shamir (Limited Partnership) (16.11%); FIBI Investment House Ltd. (14.22%); Kibbutz Eyal (3.95%); and Vision Capital, LLC (1.27%). Kibbutz Shamir directly or indirectly owns Shamir Optical Industry (General Partnership), S.L.A.G. Shamir Plastic Non-Woven Fabrics Industries (Limited Partnership), Shamir Industries (Limited Partnership), and Galil Beehive Products Kibbutz Shamir (Limited Partnership).

On March 6, 2005 we changed the structure of our company from an A.C.S. into an Israeli limited liability company. To do so, we relied on a provision of the Israeli Companies Law that allows such reorganization without having to transfer any assets, rights or liabilities into a new entity and by using the same entity of the A.C.S. in order to change its form into a limited liability company, which is not considered as a taxable event. As part of this reorganization and in preparation for the March 2005 offering, we adopted new articles of association and restructured our share capital by splitting the 105,506 existing shares so that each share with a par value of NIS 1.00 was divided into 100 common shares with a par value of NIS 0.01 each. In addition, we distributed to our shareholders out of our equity 2,160,732 new common shares with a par value of NIS 0.01 each. With this distribution, the old shares of the A.C.S. were in effect split at a ratio of 120.48-to-one, and our total issued and outstanding share capital then amounted to NIS 127,113 consisting of 12,711,332 common shares with a par value of NIS 0.01 each. We also created authorized share capital of 100,000,000 common shares with a par value of NIS 0.01 each. In addition, as part of this reorganization, the shareholdings held by the various entities listed above that are owned by Kibbutz Shamir were combined into one entity. As part of the initial public offering of our common shares, which closed on March 16, 2005, we issued 3,400,000 new common shares with a par value of NIS 0.01 each, and on July 31, 2005, allocated to Severn 145,182, so that our share capital amounts increased to NIS 162,565 as of the date of this annual report consisting of 16,256,514 common shares with a part value of NIS 0.01 each. See also “Item 10. Additional Information–Share Capital.”

As part of the reorganization, we also restructured our board of directors, which consisted of four directors immediately after the reorganization and currently consists of nine directors, five of whom are independent directors for purposes of the listing standards of the NASDAQ National Market. We will appoint two of our nine directors to qualify as external directors in accordance with Israeli law. See “Item 6. Directors, Senior Management and Employees.” We also established committees of our board in accordance with the NASDAQ National Market listing standards at the same time as we appointed the additional members of our board of directors.

3.A SELECTED FINANCIAL DATA

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States (U.S. GAAP). The following data have been derived from our audited consolidated financial statements as of and for the five years ended December 31, 2001, 2002, 2003, 2004 and 2005, which have been audited by Kost, Forer, Gabay & Kasierer, an independent registered public accounting firm and a member firm of Ernst & Young Global. Our audited consolidated balance sheets as of December 31, 2004 and 2005 and the related audited consolidated statements of income and of cash flows for each of the three years in the period ended December 31, 2005, together with the notes thereto, appear elsewhere in this annual report.

1

You should read the following selected consolidated financial data in conjunction with the section of this annual report entitled “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements and the notes thereto included elsewhere in this annual report.

| Year Ended December 31,

|

|---|

| 2001

| 2002

| 2003

| 2004

| 2005

|

|---|

| | | | | | |

|---|

| | | | | |

|---|

| | | | | |

|---|

| (Dollars in thousands) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| STATEMENT OF OPERATIONS DATA: | | |

| Revenues, net | | | $ | 29,386 | | $ | 48,738 | | $ | 60,079 | | $ | 71,269 | | $ | 80,364 | |

| Cost of revenues | | | | 14,724 | | | 24,318 | | | 29,955 | | | 33,414 | | | 36,030 | |

|

| |

| |

| |

| |

| |

| Gross profit | | | | 14,662 | | | 24,420 | | | 30,124 | | | 37,855 | | | 44,334 | |

|

| |

| |

| |

| |

| |

| Operating expenses: | | |

| Research and development | | | | 1,488 | | | 1,594 | | | 1,988 | | | 1,842 | | | 1,688 | |

| Selling and marketing | | | | 4,411 | | | 10,659 | | | 13,756 | | | 18,902 | | | 23,320 | |

| General and administrative | | | | 2,656 | | | 2,756 | | | 3,564 | | | 4,502 | | | 6,622 | |

| Stock-based compensation(1) | | | | 173 | | | -- | | | 1,809 | | | 82 | | | 608 | |

|

| |

| |

| |

| |

| |

| Total operating expenses | | | | 8,728 | | | 15,009 | | | 21,117 | | | 25,328 | | | 32,238 | |

|

| |

| |

| |

| |

| |

| Operating income | | | | 5,934 | | | 9,411 | | | 9,007 | | | 12,527 | | | 12,096 | |

| Financial income (expenses) and other, net | | | | (395 | ) | | (1,600 | ) | | (1,064 | ) | | (864 | ) | | 401 | |

|

| |

| |

| |

| |

| |

| Income before taxes on income | | | | 5,539 | | | 7,811 | | | 7,943 | | | 11,663 | | | 12,497 | |

| Taxes on income | | | | 77 | | | 979 | | | 1,095 | | | 1,549 | | | 4,504 | |

|

| |

| |

| |

| |

| |

| Income after taxes on income | | | | 5,462 | | | 6,832 | | | 6,848 | | | 10,114 | | | 7,993 | |

| Equity in losses of affiliates, net | | | | (377 | ) | | (367 | ) | | (47 | ) | | (48 | ) | | -- | |

| Minority interest in losses (earnings) of | | |

| subsidiaries | | | | 62 | | | (244 | ) | | (1,564 | ) | | (1,254 | ) | | 112 | |

|

| |

| |

| |

| |

| |

| Net income | | | $ | 5,147 | | $ | 6,221 | | $ | 5,237 | | $ | 8,812 | | $ | 8,105 | |

|

| |

| |

| |

| |

| |

| Pro forma data (unaudited)(2): | | |

| Pro forma-additional taxes on income | | | $ | 631 | | $ | 1,075 | | $ | 1,187 | | $ | 1,707 | | | | |

|

| |

| |

| |

| | | |

| Pro forma net income(2) | | | $ | 4,516 | | $ | 5,146 | | $ | 4,050 | | $ | 7,105 | | | | |

|

| |

| |

| |

| | | |

| Net earnings per share: | | |

| Basic | | | $ | 0.44 | | $ | 0.52 | | $ | 0.43 | | $ | 0.70 | | $ | 0.52 | |

|

| |

| |

| |

| |

| |

| Diluted | | | $ | 0.43 | | $ | 0.52 | | $ | 0.43 | | $ | 0.68 | | $ | 0.51 | |

|

| |

| |

| |

| |

| |

| Pro forma earnings per share | | |

| (unaudited)(2): | | |

| Basic | | | $ | 0.39 | | $ | 0.43 | | $ | 0.34 | | $ | 0.56 | | | | |

|

| |

| |

| |

| | | |

| Diluted | | | $ | 0.38 | | $ | 0.43 | | $ | 0.33 | | $ | 0.55 | | | | |

|

| |

| |

| |

| | | |

| Weighted average number of shares | | |

| Basic | | | | 11,602 | | | 12,048 | | | 12,048 | | | 12,625 | | | 15,449 | |

| Diluted | | | | 11,946 | | | 12,048 | | | 12,133 | | | 12,961 | | | 15,869 | |

| Weighted average shares used for pro | | |

| forma(2): | | |

| Basic | | | | 11,602 | | | 12,048 | | | 12,419 | | | 12,625 | | | | |

| Diluted | | | | 11,946 | | | 12,048 | | | 12,505 | | | 12,961 | | | | |

2

| As of December 31,

|

|---|

| 2001

| 2002

| 2003

| 2004

| 2005

|

|---|

| | | | | | |

|---|

| | | | | |

|---|

| | | | | |

|---|

| (Dollars in thousands) | | | | | | | | | | | | | | | | | |

| | | |

| FINANCIAL POSITION DATA: | | |

| Cash and cash equivalents | | | $ | 2,742 | | $ | 2,808 | | $ | 6,033 | | $ | 6,235 | | $ | 27,502 | |

| Working capital | | | | 3,568 | | | 8,622 | | | 10,035 | | | 8,256 | | | 54,671 | |

| Total assets | | | | 33,867 | | | 41,705 | | | 52,922 | | | 65,344 | | | 116,661 | |

| Total liabilities | | | | 25,556 | | | 26,183 | | | 34,560 | | | 43,146 | | | 41,697 | |

| Temporary equity(3) | | | | -- | | | -- | | | -- | | | 3,000 | | | -- | |

| Total debt | | | | 13,901 | | | 12,789 | | | 19,649 | | | 23,020 | | | 21,487 | |

| Total shareholders' equity | | | | 7,315 | | | 11,549 | | | 14,945 | | | 14,630 | | | 71,388 | |

| | (1) | Stock-based compensation includes the following: |

| Year Ended December 31,

|

|---|

| 2001

| 2002

| 2003

| 2004

| 2005

|

|---|

| | | | | | |

|---|

| | | | | |

|---|

| | | | | |

|---|

| (Dollars in thousands) | | | | | | | | | | | | | | | | | |

| | | |

| Research and development | | | | -- | | | -- | | $ | 1,809 | | | -- | | | -- | |

| Selling and marketing | | | | 173 | | | -- | | | -- | | | 13 | | | 343 | |

| General and administrative | | | | -- | | | -- | | | -- | | | 69 | | | 265 | |

|

| |

| |

| |

| |

| |

| Total | | | $ | 173 | | $ | -- | | $ | 1,809 | | $ | 82 | | $ | 608 | |

|

| |

| |

| |

| |

| |

| | (2) | The pro forma adjustments give effect to our reorganization into an Israeli limited liability company (see “–Corporate Reorganization,” above), pursuant to which 105,506 shares in our original corporate entity, an Israeli agricultural co-operative society (A.C.S.) were converted into 12,711,332 common shares of Shamir Optical Industry Ltd. As the A.C.S. was a pass-through tax entity, the tax liability was not charged to our company but to the owners, pro rata to their holding in the A.C.S. For comparison purposes, we have included in our financial statements and in the selected consolidated financial data in this annual report our pro forma net income, which reflects the additional income taxes we would have paid during the historical periods presented, assuming we had been a limited liability company during that time. |

| | (3) | Represents shares of the company owned by Kibbutz Eyal for which Kibbutz Eyal had a right to put the shares to us. This put option expired upon the reorganization of our company from an A.C.S. to a limited liability company. |

Exchange Rate Data

Our reporting currency is the U.S. dollar. We generate revenues and incur expenses principally in dollars, euros and NIS. See also “Item 5. Operating and Financial Review and Prospects–Functional Currency and Exchange Rate Fluctuations.”

The following table sets out the average exchange rates for these currencies per $1.00 for the past five fiscal years, based on the exchange rates published by the Bank of Israel:

Currency

| 2001

| 2002

| 2003

| 2004

| 2005

|

|---|

| | | | | | |

|---|

| | | | | |

|---|

| | | | | |

|---|

| | | | | |

|---|

| EUR | | | | 1.122 | | | 1.025 | | | 0.860 | | | 0.794 | | | 0.804 | |

| NIS | | | | 4.206 | | | 4.738 | | | 4.548 | | | 4.482 | | | 4.488 | |

On June 15, 2006 the exchange rate was NIS4.460 per $1.00 and € 0.792 per $1.00, as reported by the Bank of Israel.

Market Data

This annual report contains information, statistical data and predictions about our industry and the size of our markets. We operate in an industry in which it is difficult to obtain precise industry and market information. We are not aware of any exhaustive industry and market reports from public sources or industry umbrella organizations. The data contained in “Item 4. Information on the Company–Industry Overview” and certain other market data in this annual report is derived from an industry study that we commissioned from Strategy With Vision Ltd. (“SWV”), a U.K. consulting firm to the eyewear and eye care industries, for the year 2005. In compiling the data for this study, SWV relied on published figures and on data it compiled from various participants in the industry. To calculate market size and value, SWV used estimates from companies that are active in the relevant markets, net selling prices of lens manufacturers and its own estimates of optical retail mark-ups. We believe that the industry and market information contained in the annual report provides fair and accurate estimates of the size of our markets.

3.B CAPITALIZATION AND INDEBTEDNESS

Not applicable

3.C REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

3

3.D RISK FACTORS

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking statements contained in this Form 20-F. Any of the following risks could materially adversely affect our business, our operating results, our financial condition and the actual outcome of matters as to which forward-looking statements are made in this report. The risks described below do not purport to be exhaustive and these risks do not constitute the only risks to which we are exposed. The order in which the individual risks are presented does not provide an indication of the likelihood of their occurrence nor of the severity or significance of the individual risks.

Risks Relating to Our Business and the Ophthalmic Industry

The industry in which we operate is highly competitive, and these competitive pressures may harm demand for our products.

Competition in our industry is intense, and we expect competition to increase. New products are introduced frequently, and we compete primarily on the basis of innovation, quality and breadth of product offerings, customer service and price.

Many of our main competitors are significantly larger than we are and have significantly greater financial and human resources than we do. They also have greater technical, product development and marketing resources and are more established and enjoy greater market recognition than we do. As a result, these competitors benefit from greater economies of scale and may be able to develop products or services that are more effective than ours and to respond more quickly to new or emerging technologies or changes in customer requirements. They compete with us in some cases by offering lower prices or devoting greater resources to product marketing than we do. Price competition in our industry is often severe and may result in lower prices or reduced demand for our products and a corresponding reduction in our gross margins, which would, in turn, impair our ability to maintain profitability.

Certain of our competitors also have more developed and substantial direct customer bases than we have and may be able to fund significant direct sale efforts as well as more product development and acquisition efforts. A number of our principal competitors are vertically integrated with optical laboratories to a greater extent than we are. This integration may limit the number of independent optical laboratories to which we can market our products and may limit the amount of purchases of our products by these laboratories. In addition, within a particular market, certain of our competitors may enjoy a “home-country” advantage over foreign competition, and we may also face additional competition if new participants enter the markets in which we operate. The development and successful introduction by a competitor of products or services that are superior in performance to or lower in price than ours could adversely affect our ability to effectively compete in the marketplace for optical lenses.

We rely on optical laboratories in various geographic markets to purchase, market and sell our products worldwide. If we are unable to maintain or expand our relationships with these laboratories, it could have a material adverse effect on the sales and distribution of our products.

We rely on optical laboratories in the different geographic markets in which we operate to purchase our products from us or to distribute our products to the end-user on our behalf. The number, size, business strategy and operations of these laboratories vary widely from market to market. The success of our sales and distribution channels depends heavily on our successful cooperation with these laboratories in each of our various markets.

The U.S. ophthalmic market is characterized by a large number of laboratories, many of which are independent, as well as large national retail chains and buying groups, some of which own their own laboratories. We currently distribute most of our products directly to independent laboratories in the United States. We have not yet established a significant relationship with any national retail chain or buying group. If a large number of the independent laboratories in the United States cease to be independent–either because they are acquired by competitors or national retail chains or for any other reason–we may not be able to sell our products to these laboratories., If we do not develop relationships with national retail chains or buying groups, our sales in the United States could decline .Each of these factors could have a significant adverse impact on our sales and our results of operations.

The European ophthalmic market, relative to the U.S. market, has a small number of optical laboratories, of which only a few are still unaffiliated with lens manufacturers or retail chains. Most of the major optical laboratories in Europe are owned by our competitors. Although we also sell our products in Europe through laboratories owned by our competitors, there is a risk that we may lose some of our existing customers and that our sales to European laboratories will significantly decrease if (i) we are unsuccessful in purchasing any of the remaining independent laboratories, (ii) there is further consolidation among laboratories in Europe, (iii) we are unsuccessful in establishing our own laboratory, or (iv) laboratories owned by our competitors cease to purchase our products.

4

A significant portion of our business is conducted outside of Israel and the United States, and we intend to continue to expand our operations internationally. As a result, we are subject to a number of risks associated with our foreign operations.

We derive substantially all of our revenues from sales outside of Israel and a significant majority from sales outside of Israel and the United States. During 2005 we generated approximately 66.6% of our revenues from sales outside of Israel and the United States, including 57.7% in Europe. We also sell our products in Australia, Canada, South Africa, South America, and China and other countries in East and South-East Asia. An integral part of our expansion strategy is to enter new foreign markets, principally in China and other Asian countries, and to further penetrate those foreign markets in which we are currently active. Our ability to penetrate certain international markets may be limited, and our international sales and operations and our expansion strategy are subject to numerous risks inherent in international business activities, including:

| — | developments in the political and economic environment of some foreign countries, primarily in Asia and South America, that have an adverse effect on our operations in those countries, including the fact that customers in some jurisdictions may not do business with an Israeli company; |

| — | the imposition of tariffs or exchange controls, technology export license requirements or other trade restrictions; |

| — | difficulty in managing a large organization spread through various countries, including staffing and managing foreign operations; |

| — | difficulty enforcing agreements and collecting receivables through certain foreign legal systems, in particular in developing markets in Asia and South America; |

| — | longer payment cycles for foreign customers than for customers in the United States; |

| — | currency exchange risks, in particular between the dollar and the NIS and the dollar and the euro; |

| — | difficulties in complying with a variety of foreign laws and regulations; |

| — | tax rates in certain foreign countries that exceed those in Israel, and withholding requirements on foreign earnings; |

| — | greater difficulty in safeguarding intellectual property in certain jurisdictions, in particular in China and other Asian countries; and |

| — | difficulties in adapting our products to different country-specific requirements. |

These and other factors could have a material adverse effect on our international operations or our business as a whole. As we continue to expand our business globally, our success will increasingly depend on our ability to effectively manage these risks.

If we do not continually enhance our existing products and develop and market new products, our product portfolio may become obsolete and we may not achieve broad market acceptance and brand recognition.

The market for spectacle lenses and lens designs is characterized by:

| — | rapid technological change; |

| — | short product life cycles and frequent product introductions and enhancements; |

| — | evolving industry performance standards; and |

| — | changes in customer and end-user requirements. |

Any one of these factors could reduce the demand for our products or require us to expend substantial resources for research, design and development of new products and technologies to avoid technological or market obsolescence. Our success will depend on our ability to continually enhance our existing products and develop or acquire and market new products in an effort to maintain and increase sales and to improve our gross margins. We cannot assure you that we will have sufficient financial resources or otherwise be able to develop the technological advances necessary for us to remain competitive or that any new products that we develop will be accepted in the marketplace, either at all or on a timely basis or at competitive prices. Any delay or failure by us to respond to these market conditions or to technological advances by our competitors would have a material adverse effect on our business, operating results and financial condition.

5

We compete against alternative technologies and treatments that provide a substitute for spectacle lenses.

Spectacle lenses compete with other methods of vision correction, including laser surgery and contact lenses. Some of these technologies currently offer limited competition to our progressive lens products, our most significant products in terms of sales. See “Item 4. Information on the Company–Industry Overview–Lenses and Alternatives.” As alternative technologies evolve in the future, they may decrease demand for spectacle lenses and progressive lenses, which would have a material adverse effect on our sales and results of operations.

We depend on our manufacturing facilities in Israel. An interruption of manufacturing at these facilities for any reason could have a material adverse effect on our results of operations.

A significant portion of the development and manufacturing of our products is concentrated at our two manufacturing facilities in Israel. Raw materials and finished product inventories are also stored at these facilities. Although these facilities are in two separate locations, a disruption of our operations at or damage to either of these facilities, whether as a result of fire, natural disaster, act of war, terrorist attack or otherwise, could materially affect our ability to deliver products on a timely basis and could materially adversely affect our results of operations. While we have not experienced any such disruption or damage in the past, we cannot assure you that such disruption or damage will not occur in the future. We have insured the portion of our product inventories stored in these two facilities against loss from any such disruption or damage. See also “–Risks Relating to our Operations in Israel.”

Our proprietary technology is difficult to protect. Unauthorized use of our proprietary technology by third parties may impair our ability to compete effectively.

Our success and ability to compete within the ophthalmic industry depend in large part on our ability to protect our proprietary technology. To do so, we currently rely on a combination of patent protection for our technologies and products, trade secret and intellectual property laws, nondisclosure and other contractual agreements, and other technical measures to protect our proprietary rights and maintain the confidentiality of key business and manufacturing processes. We seek to defend and enforce our rights against infringement and to operate without infringing the proprietary rights of others.

The validity and breadth of claims in patent applications for ophthalmic technology or processes involve complex legal and factual questions and may therefore be highly uncertain. We cannot assure you that:

| — | patent authorities will not grant patents based on applications our competitors have filed or may file; |

| — | the scope of any patent protection we receive will exclude competitors or provide us with competitive advantages; |

| — | any of the patents that have been or may be issued to us will be held valid if subsequently challenged; or |

| — | others will not claim rights in or ownership of the patents and other proprietary rights that we hold. |

Furthermore, we cannot assure you that others have not developed or will not develop similar products or technologies, duplicate any of our products or technologies, or design around any patents that have been or may be issued to us. In many countries patent applications remain confidential until the issuance of a patent. We cannot be certain, therefore, that others have not filed earlier applications for inventions covered by our pending patent applications, nor can we be certain that we will not infringe any patents that may be issued to others on such applications.

Certain of our employees and consultants are subject to confidentiality undertakings in favor of the company, and we also seek these undertakings from some suppliers and customers. However, not all of our employees or suppliers and customers are subject to these undertakings, and even where they are, these measures may not be sufficient to protect our technology from third-party infringement or misappropriation. There can be no assurance that our counterparties will not breach these agreements, and we may not have adequate remedies for any breach. In addition, our competitors may learn of our trade secrets through other methods. Intellectual property law protection may be insufficient to safeguard our proprietary information, and our products may be sold in countries that provide less protection to intellectual property than the United States, Europe or Israel, or no protection at all. These countries include, in particular, China, Thailand, Singapore and other Asian countries in which we do or intend to do business. If any third parties infringe our proprietary technology rights, this infringement could have a material adverse effect on our competitive position.

6

Our business may suffer if we are involved in disputes or protracted negotiations regarding our intellectual property rights or the intellectual property rights of third parties.

We are subject to the risk of adverse claims and litigation alleging infringement by us on the intellectual property rights of others. There is an increasing number of patents and patent applications in our industry. Third parties may assert infringement claims in the future, alleging infringement by our current or future products or applications. For example, we have been notified by two companies that they believe that certain of our products infringe patents claimed by those companies. See “Item 8. Financial Information–Legal Proceedings.”

We may institute or otherwise be involved in litigation to protect our registered patents and/or trade secrets or know-how, challenge the validity of proprietary rights of others or defend against alleged infringement by us of proprietary rights of others. This type of litigation is costly and diverts management’s attention from its day-to-day responsibilities of running our business. In addition, an adverse determination in such litigation could:

| — | limit the value of our trade secrets or know how; |

| — | subject us to significant liabilities to third parties; |

| — | require us to seek licenses from third parties; or |

| — | prevent us from manufacturing and selling products, |

any of which could have a material adverse effect on our business, financial condition and results of operations.

We are a company focused on research and development, and we cannot assure you that our research and development efforts will result in new products or product enhancements that will receive the market acceptance and demand that we expect.

We have a strong focus on research and development (R&D), and the success of our business depends substantially on the results of our R&D activities. We conduct R&D both to enhance our existing proprietary technologies and to develop new technologies. We cannot assure you that our R&D efforts will result in product enhancements or new products, or that there will be a market for products related to or based on these new concepts. The success of our R&D efforts depends on the availability of funds as well as on the timely completion of our R&D projects. If we fail to provide the necessary funds to complete our various R&D projects or if we miss our target deadlines, we may lose a competitive advantage of being the first to market. In addition, our competitors that have greater financial resources to commit to R&D efforts may be able to “leap frog” our technological innovations with their own technological innovations and make our innovations obsolete even before we introduce them to market. In addition, some of the agreements pursuant to which we provide design services restrict our ability to offer products with certain qualities that exceed those designed for the customer who is party to the agreement, which may limit our ability to market new product developments outside of those relationships. Our investment of human and financial resources in R&D is therefore highly risky with no guarantees of any development success or investment return.

We also provide design and manufacturing services to producers, distributors and wholesalers of lenses in accordance with specifications defined by such producers, distributors and wholesalers. Though we are usually compensated for this development work, this compensation is primarily in the form of royalties and depends on the ability of these producers, distributors and wholesalers to sell these products. Their failure to do so may adversely affect our results.

We have experienced a period of rapid growth, and if we cannot adequately manage our growth, our results of operations will suffer.

Over the past several years, we have experienced rapid growth in our business. Our anticipated future growth may place a significant strain on our managerial, research and development, technical, administrative, operational, financial and marketing resources. We cannot assure you that we have adequately considered all costs and risks associated with our expansion, or that our systems, procedures and managerial controls will be adequate to support our expanded operations. See “–We have not yet evaluated our internal control over financial reporting in compliance with Section 404 of the Sarbanes-Oxley Act.” If our systems, procedures or controls prove inadequate to support our operations, we may be unable to achieve our goals for growth. Our growth may also require us to hire additional research, engineering, technical support, sales, accounting, administrative and operational personnel and competition for qualified personnel may be intense. We anticipate incurring expenses before realizing a commensurate increase in sales. Failure to manage our future growth effectively could result in higher-than-anticipated costs and lower-than-anticipated sales and could have a material adverse effect on our operating results and financial condition.

7

We intend to continue our policies of acquisitions and of establishing joint ventures with local strategic partners. Pursuing these polices could divert our resources, create unanticipated expenses, disrupt our business and adversely affect our financial condition.

Part of our expansion strategy is to pursue acquisitions of other businesses, in particular laboratories, establish joint ventures and acquire complementary businesses or technologies. Negotiating potential acquisitions or joint ventures as well as integrating newly acquired or jointly developed businesses, products or technologies into our operations could divert our management’s attention from other business matters and could be expensive and time-consuming. We cannot assure you that we will be successful in integrating acquired businesses, laboratories or technologies or in establishing joint ventures or that we will be able to realize the intended sales and cost benefits of the acquisition or joint venture.

In addition, future acquisitions could require substantial cash expenditures and could result in customer or distributor dissatisfaction, including with respect to independent laboratories that may view our ownership of laboratories in their respective jurisdictions as competitive. We may also experience performance problems with an acquired company, suffer a decrease in our profit margins or incur debt and contingent liabilities from the acquired businesses. In addition, we may issue equity securities in the context of an acquisition that could cause dilution to our existing shareholders at the time, and we may incur impairment charges related to goodwill and amortization of intangibles (such as intellectual property). Likewise, we may write off in-process research and development that we no longer wish to continue to fund. Any of these factors could harm our business, financial condition and results of operations.

We depend on third parties and non-wholly-owned subsidiaries for various parts of our business operations, including research and development and sales. If our relationships with these third parties end or deteriorate, it would have a material adverse effect on our business and results of operations.

We rely on third parties for certain aspects of our research and development activities and on non-wholly-owned subsidiaries for certain parts of our foreign operations. We are also currently making efforts to position ourselves with national retail chains, optical retail stores and national retail buying groups who, we believe, will make up a growing part of the distribution of spectacle lenses.

We have minority partners in some of our foreign subsidiaries that contribute significantly to our sales and profitability. These minority partners may object to our management of the subsidiaries, and their consent is required for certain matters regarding their operations, including resolutions that contradict specific existing agreements, issuances of shares, and transactions with related parties (including us) or other transactions outside the ordinary course of business. Dividends and other payments to us from subsidiaries in certain jurisdictions are subject to legal restrictions and may have adverse tax consequences to us. In addition, these payments or loans are contingent on the results of operations of the particular subsidiaries and are subject to various business considerations.

We have an exclusive arrangement with Altra GmbH (“Altra”), a distributor in Europe of which we own 51%, and with Shamir Insight Inc., a distributor in the United States of which we own 90% as of September 30, 2005, of this annual report. Sales in Europe through Altra and in the United States through Shamir Insight accounted for approximately 77.7% of our total sales in 2005. Should these distributors not perform to our expectations or should other distributors provide vendors or end-users with better incentives than Altra or Shamir Insight, our sales will suffer, which will have a direct and adverse impact on our financial condition and results of operations.

We are dependent on a small number of suppliers for raw materials.

Most of the raw materials used in the manufacture of lenses, including our products, are available from a limited number of suppliers. There are currently less than five suitable suppliers of blanks for glass lenses and a similar number of suitable suppliers of monomers for plastic lenses. We purchase our raw materials from some of these suppliers. The loss of any one of these suppliers, or a significant decrease in the supply of glass blanks or monomers, would require us to obtain these raw materials elsewhere. In addition, because the raw materials market is dominated by a small number of suppliers, there is the risk of a price cartel or monopoly. Because these few suppliers offer their supplies for comparable prices, the only way to achieve cost savings in supplies may be to purchase supplies in bulk. Our larger competitors may be able to purchase more supplies at any given time than we are and may therefore achieve lower prices for their supplies than we do. See “–The industry in which we operate is highly competitive, and these competitive pressures may harm demand for our products.” If we are unable to obtain glass blanks or monomers from our suppliers (or alternative suppliers) at acceptable prices, we may realize lower margins and experience difficulty in meeting our customers’ requirements.

We may not be able to continually reduce manufacturing costs for our products.

Prices for certain of our products come under pressure, in particular when such products become available from a comparatively large number of suppliers with little product differentiation. To maintain or strengthen our competitive position for these products within the ophthalmic industry, we must continually reduce our product manufacturing costs. In addition to normal cost reduction activities, we have initiated product migration and standardization activities and reduced the number of people employed to manufacture and market such products world-wide. These reductions are necessary to help offset price decreases, inflationary pressures and changes in product and regional mix. To the extent our cost reduction activities are unsuccessful, in part or in full, our ability to compete may be significantly impacted and our profit margin may be reduced.

8

Our operating results may fluctuate on a periodic basis, which could cause us to fail to meet expectations for a given period and result in a decline in the trading price of our shares.

Our results of operations may fluctuate significantly in the future on a quarterly and an annual basis due to a number of factors, many of which are beyond our control. These factors include:

| — | variations in the timing of orders and shipments of our products and services; |

| — | variations in the demand from and the size of orders by our customers; |

| — | the timing and success of new product or technology introductions by us or our competitors; |

| — | the pricing and profitability of our products or the timing of aggressive low-pricing policies by our competitors; |

| — | changes in the availability or cost of raw materials; |

| — | seasonal variations in customer spending in Europe and the United States; |

| — | the timing of technological innovations for our products or those of our competitors; |

| — | our ability to bring new products into volume production efficiently; |

| — | shifts in market and industry emphasis and end-user demands; and |

| — | market conditions in the ophthalmic industry and in the economy as a whole. |

These factors complicate our planning processes and reduce the predictability of our earnings. This problem is particularly acute for us because of our relatively small size and the dynamics of the industry and markets in which we operate. Fluctuations in our quarterly results could cause us to fail to meet expectations (either our own or those of securities analysts) for the relevant period and could cause the trading price of our shares to decline. Therefore, period-to-period comparisons of our results of operations may not be meaningful, and you should not rely on them as indications of our future performance.

We depend on a limited number of key personnel. If we lose the services of these individuals, our business may be adversely affected.

Our continued growth and success depend to a large extent on the services of, among others, certain of our senior personnel, in particular our Chief Executive Officer, Giora Ben-Zeev, and our Chief Engineer, Dan Katzman. We also depend to some extent on certain of our sales staff, as well as on researchers with whom we have consulting arrangements. If any of these key personnel should leave our employ or if these consultants should terminate their relationship with us, we may be unable to locate and recruit sufficient replacement personnel without undue delay or additional cost or at all. Any such delay or inability could delay or terminate some or all of our development programs or the commercialization of our products. Even if we are able to attract suitable replacement personnel, to the extent that the process of educating new personnel in our technologies, in the needs of the ophthalmic industry and in our company culture requires a certain transition period, we may incur delays with respect to the further developments of our products. The implementation of our business strategy and our future success will also depend in large part on our continued ability to attract and retain other highly qualified scientific, technical and management personnel.

We generate a significant portion of our revenues and expenses in currencies other than the dollar. As a result, our results of operations may be adversely affected by currency fluctuations.

We operate globally, and our financial results are subject to both transaction and translation effects resulting from fluctuations in currency exchange rates. We generate our revenues primarily in euros and dollars, and we incur a significant portion of our expenses, principally salaries and related expenses of our staff in Israel, in NIS. In 2005 we generated approximately 39% of our revenues in dollars and 54% in euros, and we incurred approximately 19% of our expenses in NIS, 27% in dollars and 48% in euros. Exchange rate fluctuations between the dollar and the euro materially impact our revenues, cost of revenues and other operating expenses. See “Item 5. Operating and Financial Review and Prospects–Functional Currency and Exchange Rate Fluctuations.” We currently do not significantly hedge our currency exposure through financial instruments.

9

One currency exchange risk we face is translation risk. In preparing our consolidated financial statements, we convert the results from operations outside the dollar zone into dollars at the average rate for each fiscal quarter. As a result, a strong decline in the value of the euro compared to the dollar will have a negative impact on our sales revenues, while an increase in the value of the NIS or euro to the dollar will have a negative impact on our expenses.

We are also exposed to transaction risk when our sales are denominated in currencies that are different from those in which we purchase raw materials or incur production costs. If the value of the currency in which the purchase price is denominated declines relative to the currency in which we incur our costs, the profit margin for the transaction will be reduced.

We have not yet evaluated our internal control over financial reporting in compliance with Section 404 of the Sarbanes-Oxley Act.

We are required to comply with the internal control evaluation and certification requirements of Section 404 of the Sarbanes-Oxley Act by no later than the end of our 2007 fiscal year, because we expect that our worldwide public float will be less than $75.0 million as of June 30, 2006. We have only recently begun the process of determining whether our existing internal control over our financial reporting systems is compliant with Section 404. This process may take up to twelve months to complete. If it is determined that we are not in compliance with Section 404, we may be required to implement new internal control procedures and reevaluate our financial reporting. We may experience higher than anticipated operating expenses as well as outside auditor fees during the implementation of these changes and thereafter. Further, we may need to hire additional qualified personnel in order for us to be compliant with Section 404. If we are unable to implement these changes effectively or efficiently, it could harm our operations, financial reporting or financial results and could result in our being unable to obtain an unqualified report on internal controls from our independent registered public accounting firm.

Risks Related to Our Relationship with Kibbutz Shamir

Kibbutz Shamir is our controlling shareholder, and its interests may conflict with those of other investors.

Following the initial public offering of our common shares on March 10, 2005, and several share purchases up to June 15, 2006, our majority shareholder, Kibbutz Shamir, holds 58.72% of our outstanding shares. As a result, this single shareholder has sufficient voting power to effectively control all matters concerning our company that require shareholder approval. For example, Kibbutz Shamir may have the power to affect our legal and capital structure; to elect all of our directors; to prevent or effect changes in our control or management; to approve or reject changes to our operations or strategic direction; to amend our Articles of Association and change the rights attached to our shares; and to determine whether we may enter into mergers or other business combination transactions in which shareholders could receive a premium over the prevailing market price for our shares. Kibbutz Shamir has contractually agreed with another shareholder to vote for that shareholder’s nominee for membership on our board. See “Item 7. Major Shareholders and Related Party Transactions.”

In addition, as part of a working services agreement between us and Kibbutz Shamir, we have an obligation to give Kibbutz Shamir the first opportunity to provide us with workers for any vacant position in our company specified in the agreement. Kibbutz Shamir also has a right of first refusal to provide us with certain services as part of a services agreement between us and Kibbutz Shamir. Furthermore, we have entered into a sublease agreement with Kibbutz Shamir that is subject to the terms of the long-term lease agreement between Kibbutz Shamir and the Israel Lands Administration (“ILA”). Pursuant to the sub-lease, we granted Kibbutz Shamir a right of first refusal to carry out any construction work on the property that we lease under the sublease agreement. Pursuant to the underlying long-term lease agreement with the ILA, the ILA may cancel the lease in certain circumstances, including if Kibbutz Shamir commences proceedings to disband or liquidate, or in the event that Kibbutz Shamir ceases to exist in the form of a “kibbutz,” as defined in the lease. In addition, our sub-lease agreement with Kibbutz Shamir depends upon Kibbutz Shamir maintaining control of us. If Kibbutz Shamir were to cease to control us, we could be required to renegotiate our lease agreements and obtain certain approvals from the ILA. For more information with respect to these agreements, see “Item 7. Major Shareholders and Related Party Transactions.”

In these and other circumstances, Kibbutz Shamir’s interests may conflict with those of other investors, and other investors may be unable to prevent Kibbutz Shamir from acting in conflict with their interests.

Our agreements with Kibbutz Shamir may be less favorable to us than if they had been negotiated with unaffiliated third parties.

Our headquarters and certain manufacturing facilities are located on the premises of Kibbutz Shamir, which is our majority shareholder. We have entered into certain agreements with Kibbutz Shamir pursuant to which Kibbutz Shamir provides us with, among other things, office facilities, workers to fill certain positions within our company, administrative services, the operation and administration of our information systems operations, security and facilities maintenance, and other services. While these agreements have been negotiated on an arms’ length basis, they may contain terms that are different from the terms that would have been included had these agreements been negotiated with unaffiliated third parties. See “Item 7. Certain Relationships and Related Party Transactions.”

10

Our directors and executive officers who are members of Kibbutz Shamir may have conflicts of interest with respect to matters involving the company.

Certain of our directors, officers and key employees are members of Kibbutz Shamir, which is our majority shareholder. Some of these individuals are also members of the management board of Kibbutz Shamir. These persons will have fiduciary duties to both us and Kibbutz Shamir. As a result, they may have real or apparent conflicts of interest on matters affecting both us and Kibbutz Shamir and in some circumstances may have interests adverse to ours. Currently, two members of our board of directors, including our chief executive officer, and two other executive officers are members of Kibbutz Shamir and members of Kibbutz Shamir’s management board. One of these board members is also the chairman of the management board of Kibbutz Shamir. In addition, another member of our board of directors, who is not a member of Kibbutz Shamir, also serves on the management board of Kibbutz Shamir. See "Item 6. Directors, Senior Management and Employees."

Risks Related to Our Shares

The trading price of our shares may fluctuate substantially.

The trading price of our shares is likely to be highly volatile and subject to wide fluctuations. Factors that could affect the trading price of our shares include:

| — | the gain or loss of significant orders or customers; |

| — | actual or anticipated variations in our operating results or a variance in our financial performance from the expectations of market analysts; |

| — | announcements of technological innovations, new products or product enhancements, strategic alliances or significant agreements by us or by our competitors; |

| — | conditions and trends in the end markets we serve and changes in the estimates of the sizes and growth rates of these markets; |

| — | recruitment or departure of key personnel; |

| — | changes in our pricing policies or the pricing policies of our competitors; |

| — | changes in the estimates of our operating results or changes in recommendations by any securities analysts that elect to follow our common shares; |

| — | changes in market valuation or earnings of our competitors; |

| — | the trading volume of our shares; and |

| — | market conditions in our industry, the industries of our customers and the economy as a whole. |

If our future quarterly or annual operating results are below the expectations of securities analysts or investors, the price of our shares would likely decline. Share price fluctuations may be exaggerated if the trading volume of our shares is limited.

In addition, the stock market in general, and the NASDAQ National Market in particular, have experienced substantial price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of particular companies affected. These broad market and industry factors may materially harm the market price of our common shares, regardless of our operating performance. In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted against that company. Such litigation, if instituted against us, could result in substantial costs and a diversion of management’s attention and resources, which could materially harm our business, financial condition, future results and cash flow.

11

Future sales of our shares could adversely affect the market price of our shares.

Those of our shareholders who held shares prior to the initial public offering of our common shares on March 10, 2005, hold approximately 73.53% of our outstanding shares as of June 15, 2006. These shareholders are not contractually prohibited from transferring our shares See “Item 7. Major Shareholder and Related Party Transactions.” Any sale by us or our pre-offering shareholders of our shares into the public market, or the perception that sales could occur, could adversely affect the prevailing market price for our shares.

All of our current shareholders who held shares prior to the March 2005 offering have the right, subject to some limited conditions, to demand that we file a registration statement on their behalf to register their shares or that we include their shares in a registration statement that we file on our behalf or on behalf of other shareholders. See “Item 10. Additional Information – Shares Eligible for Future Sale – Registration Rights Agreement.”

Provisions of our Articles of Association and Israeli law could inhibit the acquisition of us by others.

Provisions in our Articles of Association may make it difficult and expensive for a third party to pursue a tender offer or a change in control or takeover attempt that our management and board of directors oppose. Public shareholders that might desire to participate in one of these transactions may not have an opportunity to do so. For example, our Articles of Association contain provisions:

| — | establishing advance notice requirements for director nominations or other proposals at shareholder meetings; |

| — | generally requiring the affirmative vote of holders of at least 75% of the voting power of our outstanding voting shares to amend any provision in our Articles of Association, which could make it more difficult for a third party to remove the provisions we have included to prevent or delay a change of control; and |

| — | providing for staggered terms for the members of our board of directors. |

These anti-takeover provisions could substantially impede the ability of public shareholders to benefit from a change in control or to change our management and board of directors.

Some provisions of Israeli corporate law may also have the effect of delaying, preventing or making more difficult a merger with, or acquisition of, us. In addition, Israeli tax law treats some acquisitions, such as stock-for-stock exchanges between an Israeli company and a foreign company, less favorably than U.S. tax laws. See “Item 10. Additional Information–Share Capital” and “–Israeli Taxation.”

Risks Relating to Our Operations in Israel

Conducting business in Israel entails special risks.

Our headquarters and main research and development and manufacturing facilities are located in the State of Israel, in an area close to its border with Lebanon, and our key employees, our officers and our directors are residents of Israel. Although most of our sales are made to customers outside Israel, we are nonetheless directly influenced by the political, economic and military conditions affecting Israel. Specifically, we could be materially and adversely affected by:

| — | any major hostilities involving Israel; |

| — | a full or partial mobilization of the reserve forces of the Israeli army; |

| — | the interruption or curtailment of trade between Israel and its present trading partners; or |

| — | a significant downturn in the economic or financial condition of Israel. |

Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors, and a state of hostility, varying from time to time in intensity and degree, has led to security and economic problems for Israel. There is no indication as to how long the current hostilities will last or whether there will be any further escalation. Any continuation of or further escalation in these hostilities or any future armed conflict, political instability or violence in the region may have a negative effect on our business condition, harm our results of operations and adversely affect our share price. Furthermore, there are a number of countries, primarily in the Middle East, as well as Malaysia and Indonesia, that restrict business with Israel or Israeli companies, and we are precluded from marketing our products to these countries. Restrictive laws or policies directed toward Israel or Israeli businesses may have an adverse impact on our operations, our financial results or the expansion of our business.

12

Our operations could be disrupted as a result of the obligation of our key personnel in Israel to perform military service.

Many of our officers and employees in Israel, including certain key employees, are obligated to perform annual reserve duty in the Israeli army and are subject to being called up for reserve duty at any time. The obligation to perform compulsory military reserve service on an annual basis extends up to a maximum age of 54 for most male Israeli citizens. The absence of one or more of our officers and key employees for significant periods of time due to military service could be disruptive to our operations.

The Israeli government programs and tax benefits in which we have participated in the past and in which we currently participate or from which we receive benefits require us to meet several conditions. These programs or benefits may be terminated or reduced in the future, which could increase our costs.

We benefit from certain Israeli government programs and tax benefits, particularly from tax exemptions and reductions resulting from the status of our manufacturing facilities in Israel (see “Item 10. Additional Information–Taxation—Israeli Taxation.”). To be eligible for these programs and tax benefits, we must continue to meet certain conditions, including making specified investments in fixed assets and equipment and financing a percentage of those investments with our share capital. If we fail to meet such conditions in the future, these tax benefits could be cancelled or reduced, and we could be required to refund those tax benefits already received, adjusted for inflation and with interest. These programs and tax benefits may not be continued in the future at their current levels or at all, and our requests for future participation in these programs for any future expansion of our manufacturing facilities may not be approved. In recent years, the Israeli government has reduced the benefits available under these programs (among other things, by shortening the tax moratorium in certain geographic areas of the country), and Israeli governmental authorities have indicated that the government may in the future reduce or eliminate the benefits of these programs. Further changes in the policy of the Israeli Government in particular, and the termination or reduction of these programs and tax benefits specifically, could increase our tax rates, thereby reducing our net profits or increasing our net losses, or otherwise materially adversely affect us.

In addition, in March 2005 the law governing these tax benefits was amended to revise the criteria for investments that qualify for tax benefits as an approved enterprise. See “Item 10. Additional Information–Taxation–Israeli Taxation.”

It may be difficult to enforce a U.S. judgment against us, our officers and directors and some of the experts named in this annual report or to assert U.S. securities law claims in Israel.

We are incorporated in Israel. Our executive officers and directors are nonresidents of the United States, and a substantial portion of our assets and the assets of these persons is located outside the United States. Therefore, service of process upon any of our officers and directors may be difficult to effect in the United States. Furthermore, it may be difficult to enforce a judgment obtained in the United States against us or any of these persons, including one based on the civil liability provisions of the U.S. federal securities laws, in both U.S. and non-U.S. courts.

Additionally, it may be difficult for investors to assert U.S. federal securities laws claims or to enforce civil liabilities under U.S. federal securities laws in actions originally instituted in Israel. For more information regarding the enforceability of civil liabilities against us, our directors and our executive officers, please see “Enforceability of Civil Liabilities.”

ITEM 4. INFORMATION ON THE COMPANY

4.A HISTORY AND DEVELOPMENT OF THE COMPANY

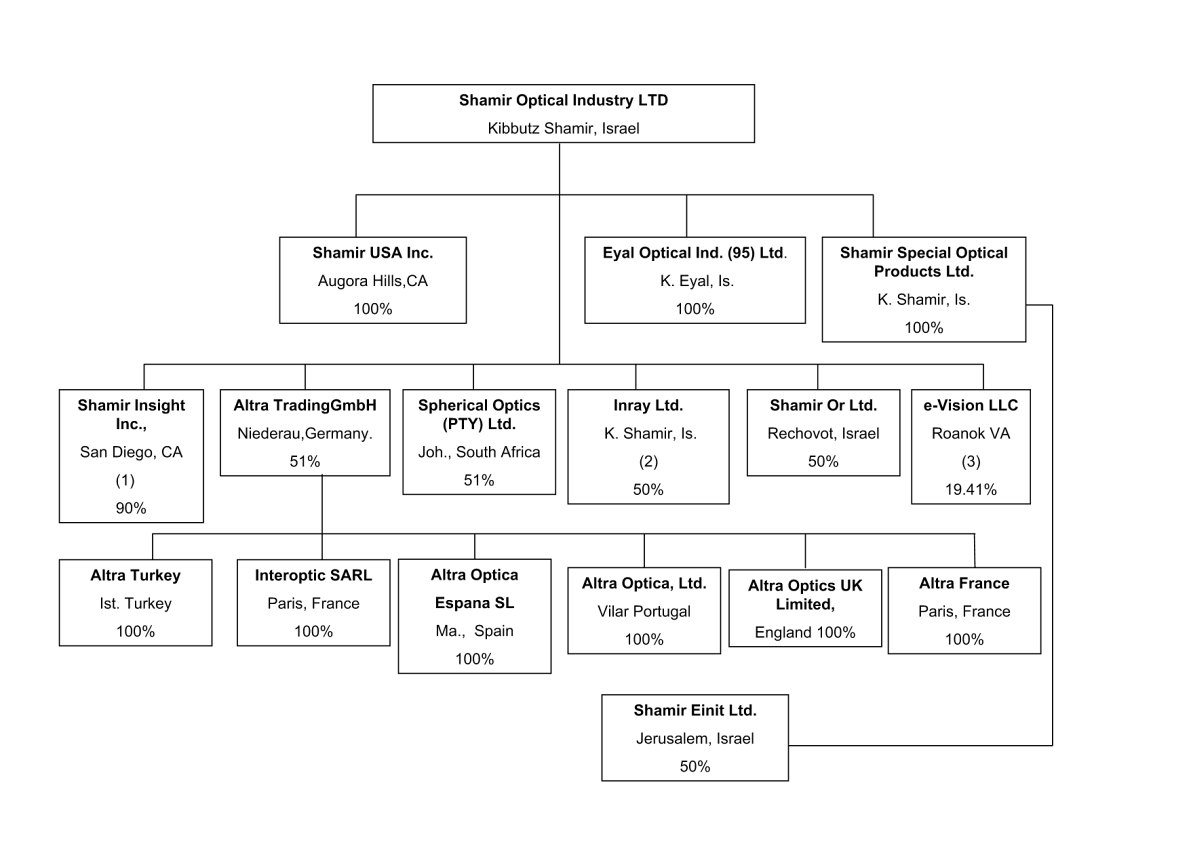

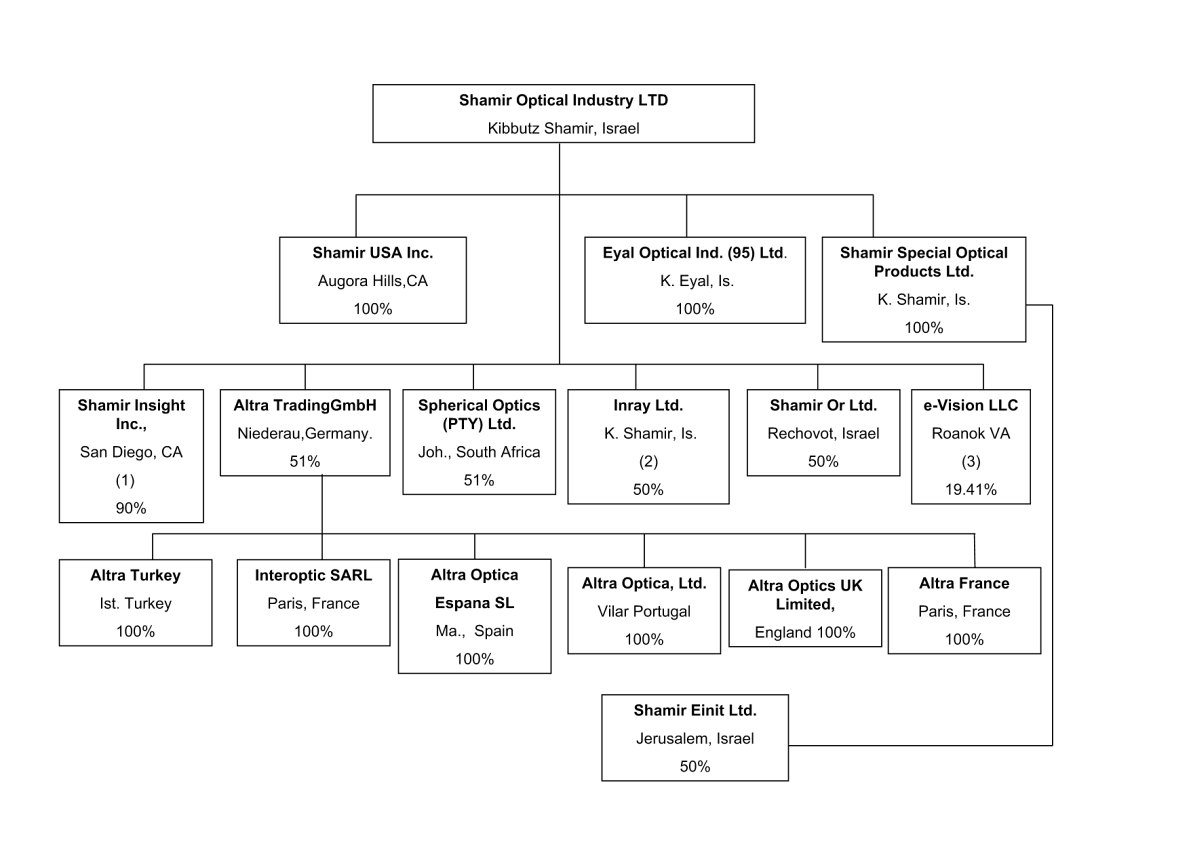

We began our activity as a limited partnership in the early 1970‘s as a manufacturer of bifocal lenses. During the first half of the 1980‘s, we began to develop our own progressive lens. In the mid-1980‘s, we began to produce and market progressive glass lenses and gradually began to produce glass molds for casting progressive plastic lenses for other manufacturers. In 1994 we established Shamir USA in order to establish a marketing presence in the United States. In 1995 we made a decision to focus exclusively on the development and production of progressive lenses. In 1997 we acquired 25% of Eyal, the manufacturer of Shamir brand plastic progressive lenses. In 1998 we developed the Eye-Point Technology, proprietary software that simulates human vision, as well as mathematical tools for the optimal design of progressive and aspherical lenses. Using these technologies, we developed the Shamir Genesis, Shamir Office and Shamir Piccolo lenses. In 1998 we, along with Eyal, also established Shamir Insight, our U.S. distributor of Shamir lens brands, and we purchased an additional 25% of Eyal. In the fourth quarter of 2001 we acquired Altra and an additional 1% of Eyal to give us control of Eyal. In November 2003 we acquired an additional 47% of Eyal, and in May 2004 we acquired the remaining 2% of Eyal’s shares. In September 2004 we purchased, through Altra, Cambridge Optical Group, an optical laboratory in the United Kingdom. In addition, on June 27, 2005, one of our partially-owned subsidiaries established a laboratory facility in Turkey. In establishing this facility, our subsidiary acquired the assets of the laboratory from another laboratory in Turkey for a purchase price of approximately $2.6 million.

13

On September 30, 2005, we completed the purchase of an additional 31.3% stake in Shamir Insight, Shamir’s U.S. distribution center, from Severn Confirmers & Forwarders, Ltd. In addition, in April 2005 we purchased 2% of Shamir Insight from one of its minority shareholders. These transactions increased Shamir’s holdings in Shamir Insight to 90%.

On December 1, 2005, Altra formed a subsidiary, Altra France, in order to establish and operate a laboratory, sales and distribution platform.

In December 2005, we established a subsidiary in Kibbutz Shamir, Israel, called Shamir Special Optical Products Ltd., which will manufacture and develop polycarbonate and finished lenses.

In January 2006, we purchased 51% of Spherical Optics (PTY) Ltd., a local distributor in South Africa, through which we distribute our lens brands in the South African market.

On January 23, 2006, Shamir Special Optical Products Ltd., our wholly owned subsidiary, signed an agreement with a well known local distributor of lens and frames in the Israeli market, Einit Ltd. Pursuant to this agreement, Shamir and Einit established a subsidiary, Shamir Einit Ltd., in which they own equal shares and which will distribute Shamir’s lenses in the Israeli market.

We are in the process of acquiring up to a 51% interest in a laboratory in Thailand. A purchase agreement has been signed. The closing is subject to legal and financial due diligence and to the approval of Shamir’s board of directors.

4.B BUSINESS OVERVIEW

Introduction

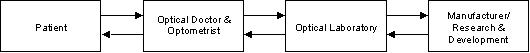

We are a leading provider of innovative products and technology to the progressive spectacle lens market. Utilizing our proprietary technology, we develop, design, manufacture and market progressive lenses that we sell to the ophthalmic market. In addition, we utilize our capabilities to provide design services to optical lens manufacturers under service and royalty agreements. Progressive lenses, also known as progressive addition lenses or PALs, combine several optical strengths in a single lens to provide a gradual and seamless transition from near to intermediate to distant vision.

We differentiate our products from those of our competitors primarily through lens design. We have successfully pursued a strategy of focusing on higher value product categories, and several of our lenses are recognized by industry and research sources for their superior design and quality. Our leading lenses are marketed under a variety of brand names, including Shamir Genesis, Shamir Piccolo, Shamir Office and Shamir Autograph.

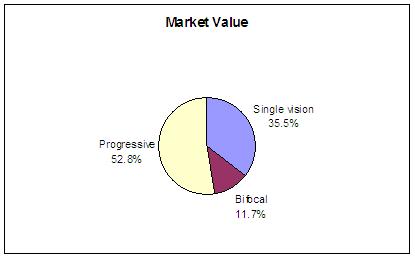

We believe that we have one of the world’s preeminent research and development teams for progressive lenses, molds and complementary technologies and tools. Through our research and development team, we have continually enhanced our capabilities and resources to develop new, innovative products and design tools with superior characteristics.