Exhibit 99.2

ITC Holdings Corp.

2011 Year? End Investor Call February 22, 2012

Safe Harbor Language & Legal Disclosure

This presentation contain certain statements that describe ITC Holdings Corp. (“ITC”) management’s beliefs concerning future business conditions and prospects, growth opportunities and the outlook for ITC’s business, including ITC’s business and the electric transmission industry based upon information currently available. Such statements are “forward? looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Wherever possible, ITC has identified these forward? looking statements by words such as “anticipates”, “believes”, “intends”, “estimates”, “expects”, “projects” and similar phrases. These forward? looking statements are based upon assumptions ITC management believes are reasonable. Such forward? looking statements are subject to risks and uncertainties which could cause ITC’s actual results, performance and achievements to differ materially from those expressed in, or implied by, these statements, including, among other things, (a) the risks and uncertainties disclosed in ITC’s annual report on Form 10? K and ITC’s quarterly reports on Form 10? Q filed with the Securities and Exchange Commission (the “SEC”) from time to time and (b) the following transactional factors (in addition to others described elsewhere in this document and in subsequent filings with the SEC): (i) risks inherent in the contemplated transaction, including: (A) failure to obtain approval by the Company’s shareholders; (B) failure to obtain regulatory approvals necessary to consummate the transaction or to obtain regulatory approvals on favorable terms; (C) the ability to obtain the required financings; (D) delays in consummating the transaction or the failure to consummate the transactions; and (E) exceeding the expected costs of the transactions; (ii) legislative and regulatory actions, and (iii) conditions of the capital markets during the periods covered by the forward? looking statements.

Because ITC’s forward? looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond ITC’s control or are subject to change, actual results could be materially different and any or all of ITC’s forward? looking statements may turn out to be wrong. They speak only as of the date made and can be affected by assumptions ITC might make or by known or unknown risks and uncertainties. Many factors mentioned in this document and the exhibits hereto and in ITC’s annual and quarterly reports will be important in determining future results. Consequently, ITC cannot assure you that ITC’s expectations or forecasts expressed in such forward? looking statements will be achieved. Actual future results may vary materially. Except as required by law, ITC undertakes no obligation to publicly update any of ITC’s forward? looking or other statements, whether as a result of new information, future events, or otherwise.

The transaction is subject to certain conditions precedent, including regulatory approvals, approval of ITC’s shareholders and the availability of financing. ITC cannot provide any assurance that the proposed transactions related thereto will be completed, nor can it give assurances as to the terms on which such transactions will be consummated.

2 |

|

Safe Harbor Language & Legal Disclosure

ITC and Mid South TransCo LLC (“TransCo”) will file registration statements with the SEC registering shares of ITC common stock and TransCo common units to be issued to Entergy Corporation (“Entergy”) shareholders in connection with the proposed transactions. ITC will also file a proxy statement with the SEC that will be sent to the shareholders of ITC. Entergy shareholders are urged to read the prospectus and/or information statement that will be included in the registration statements and any other relevant documents, because they contain important information about ITC, TransCo and the proposed transactions. ITC’s shareholders are urged to read the proxy statement and any other relevant documents because they contain important information about ITC, TransCo and the proposed transactions. The proxy statement, prospectus and/or information statement, and other documents relating to the proposed transactions (when they are available) can be obtained free of charge from the SEC’s website at www.sec.gov. The documents, when available, can also be obtained free of charge from Entergy upon written request to Entergy Corporation, Investor Relations, P.O. Box 61000 New Orleans, LA 70161 or by calling Entergy’s Investor Relations information line at 1? 888? ENTERGY (368? 3749), or from ITC upon written request to ITC Holdings Corp., Investor Relations, 27175 Energy Way, Novi, MI 48377 or by calling 248? 946? 3000

This presentation is not a solicitation of a proxy from any security holder of ITC. However, Entergy, ITC and certain of their respective directors and executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders of ITC in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Entergy may be found in its Annual Report on Form 10? K filed with the SEC, and its definitive proxy statement relating to its Annual Meeting of Shareholders filed with the SEC. Information about the directors and executive officers of ITC may be found in its Annual Report on Form 10? K filed with the SEC, and its definitive proxy statement relating to its Annual Meeting of Shareholders filed with the SEC.

2011 Year? In? Review

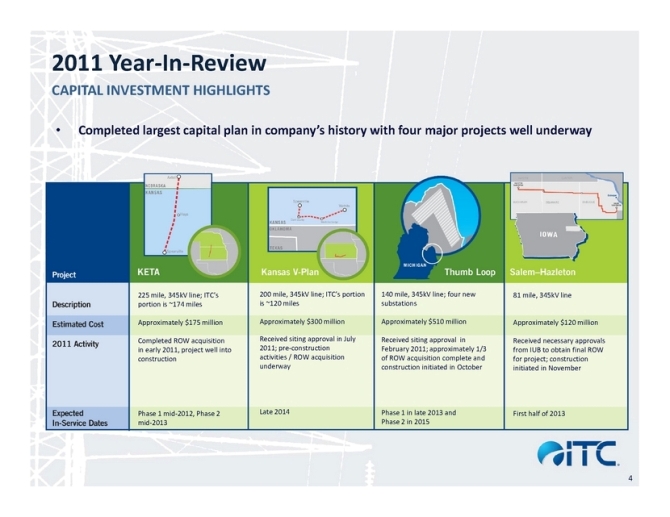

CAPITAL INVESTMENT HIGHLIGHTS

• Completed largest capital plan in company’s history with four major projects well underway

225 mile, 345kV line; ITC’s 200 mile, 345kV line; ITC’s portion 140 mile, 345kV line; four new 81 mile, 345kV line portion is ~174 miles is ~120 miles substations

Approximately $175 million Approximately $300 million Approximately $510 million Approximately $120 million

Completed ROW acquisition Received siting approval in July Received siting approval in Received necessary approvals in early 2011, project well into 2011; pre? construction February 2011; approximately 1/3 from IUB to obtain final ROW construction activities / ROW acquisition of ROW acquisition complete and for project; construction underway construction initiated in October initiated in November

Phase 1 mid? 2012, Phase 2 Late 2014 Phase 1 in late 2013 and First half of 2013 mid? 2013 Phase 2 in 2015

4 |

|

2011 Year? In? Review

BEST? IN? CLASS OPERATIONS

• Completed most active maintenance plan in company history

• Top decile safety performance based on survey of EEI employees

• Excellent system performance for ITCTransmission and METC even under stressed conditions

Performance at ITCTransmission and METC expected to be top decile for 2011

• Significant improvements in system performance and restoration at ITC Midwest

Performance improvement plans remain on track, although much remains to be completed

Reductions in generator curtailments on ITC Midwest system continue to benefit customers/market

5 |

|

2011 Year? In? Review

REGULATORY POLICY REFORM

• Pivotal year with regulatory policies largely focused on promoting investment in transmission through Order 1000

Order 1000 should serve to remove two historical impediments to regional transmission infrastructure: planning and cost allocation

Implementation of the order is underway and should result in advancements across all regions in facilitating regional transmission

• SPP & MISO advancements have demonstrated the effectiveness of planning and cost allocation principles consistent with Order 1000

• Notice of Inquiry on transmission incentives issued in May 2011 provided strong platform to highlight and advocate benefits of independent model

No defined next steps to NOI; continue to believe there will be no material implications to

ITC’s business model

6 |

|

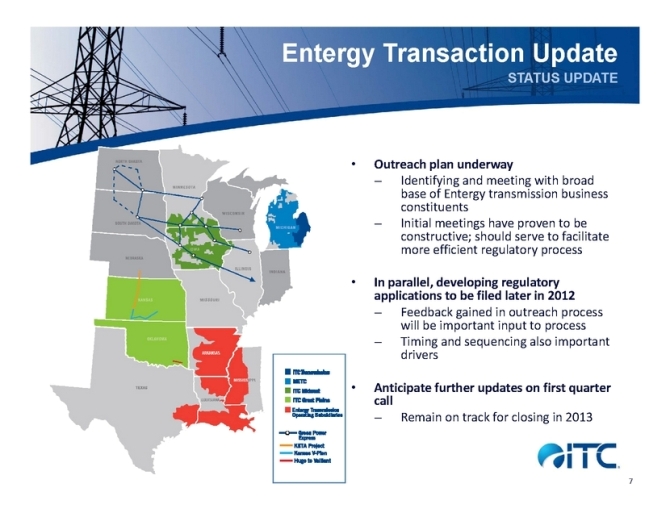

Entergy Transaction Update

STATUS UPDATE

• Outreach plan underway

Identifying and meeting with broad base of Entergy transmission business constituents

Initial meetings have proven to be constructive; should serve to facilitate more efficient regulatory process

• In parallel, developing regulatory applications to be filed later in 2012

Feedback gained in outreach process will be important input to process

Timing and sequencing also important drivers

• Anticipate further updates on first quarter call

Remain on track for closing in 2013

7 |

|

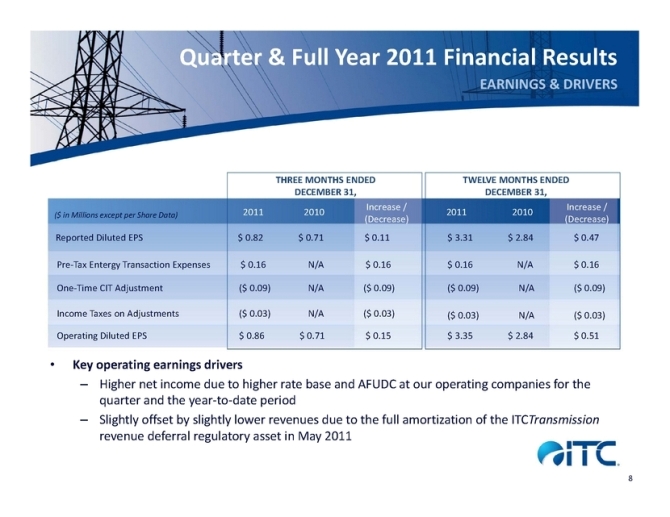

Quarter & Full Year 2011 Financial Results

EARNINGS & DRIVERS

THREE MONTHS ENDED TWELVE MONTHS ENDED DECEMBER 31, DECEMBER 31,

Increase / Increase /

($ in Millions except per Share Data) 2011 2010 2011 2010

(Decrease) (Decrease)

Reported Diluted EPS $ 0.82 $ 0.71 $ 0.11 $ 3.31 $ 2.84 $ 0.47

Pre? Tax Entergy Transaction Expenses $ 0.16 N/A $ 0.16 $ 0.16 N/A $ 0.16

One? Time CIT Adjustment ($ 0.09) N/A ($ 0.09) ($ 0.09) N/A ($ 0.09)

Income Taxes on Adjustments ($ 0.03) N/A ($ 0.03) ($ 0.03) N/A ($ 0.03)

Operating Diluted EPS $ 0.86 $ 0.71 $ 0.15 $ 3.35 $ 2.84 $ 0.51

• Key operating earnings drivers

– Higher net income due to higher rate base and AFUDC at our operating companies for the quarter and the year? to? date period

– Slightly offset by slightly lower revenues due to the full amortization of the ITCTransmission revenue deferral regulatory asset in May 2011

8 |

|

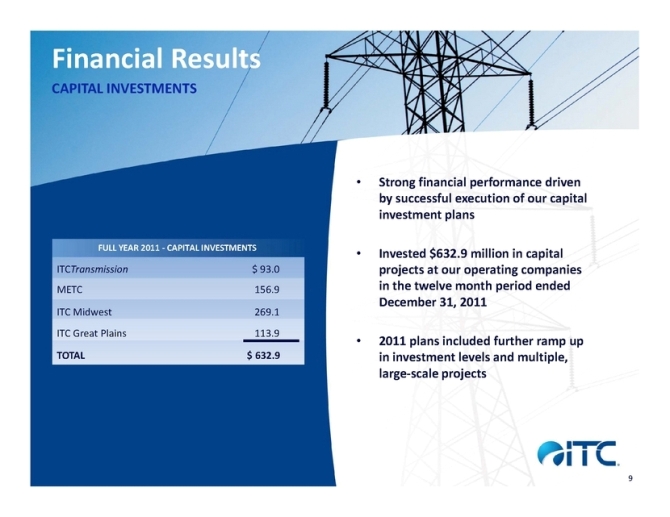

Financial Results

CAPITAL INVESTMENTS

• Strong financial performance driven by successful execution of our capital investment plans

FULL YEAR 2011 CAPITAL ? INVESTMENTS

• Invested $632.9 million in capital ITCTransmission $ 93.0 projects at our operating companies METC 156.9 in the twelve month period ended December 31, 2011

ITC Midwest 269.1

ITC Great Plains 113.9

• 2011 plans included further ramp up TOTAL $ 632.9 in investment levels and multiple, large? scale projects

9

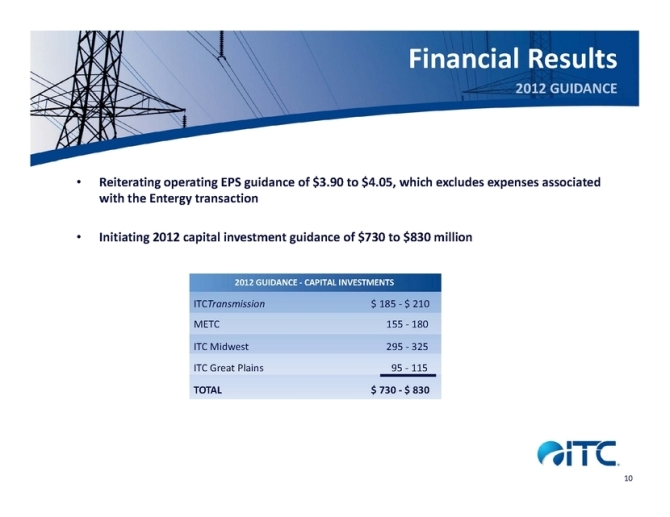

Financial Results

2012 GUIDANCE

• Reiterating operating EPS guidance of $3.90 to $4.05, which excludes expenses associated with the Entergy transaction

• Initiating 2012 capital investment guidance of $730 to $830 million

2012 GUIDANCE CAPITAL ? INVESTMENTS

ITCTransmission $ 185 $ ?210 METC 155 180 ?ITC Midwest 295 325 ?ITC Great Plains 95 115 ?

TOTAL $ 730 $ ?830

10

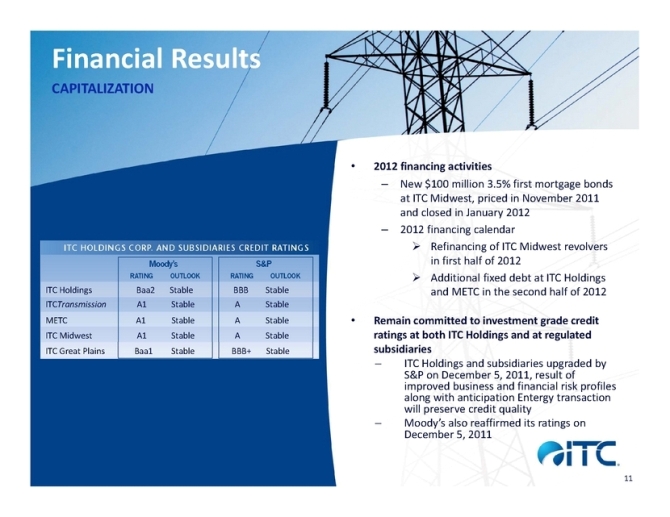

Financial Results

CAPITALIZATION

• 2012 financing activities

– New $100 million 3.5% first mortgage bonds at ITC Midwest, priced in November 2011 and closed in January 2012

– 2012 financing calendar

??Refinancing of ITC Midwest revolvers in first half of 2012

??Additional fixed debt at ITC Holdings ITC Holdings Baa2 Stable BBB Stable and METC in the second half of 2012

ITCTransmission A1 Stable A Stable

METC A1 Stable A Stable • Remain committed to investment grade credit ITC Midwest A1 Stable A Stable ratings at both ITC Holdings and at regulated

ITC Great Plains Baa1 Stable BBB+ Stable subsidiaries

ITC Holdings and subsidiaries upgraded by S&P on December 5, 2011, result of improved business and financial risk profiles along with anticipation Entergy transaction will preserve credit quality

Moody’s also reaffirmed its ratings on December 5, 2011

11

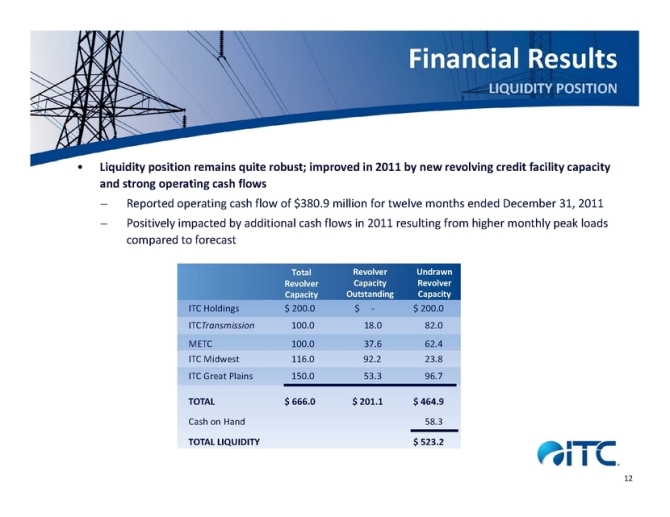

Financial Results

LIQUIDITY POSITION

• Liquidity position remains quite robust; improved in 2011 by new revolving credit facility capacity and strong operating cash flows $ in Millions Reported operating cash flow of $380.9 million for twelve months ended December 31, 2011

Positively impacted by additional cash flows in 2011 resulting from higher monthly peak loads compared to forecast

Total Revolver Undrawn Revolver Capacity Revolver Capacity Outstanding Capacity

ITC Holdings Amounts $ 200.0 in $MM $ ? $ 200.0 ITCTransmission 100.0 18.0 82.0

METC 100.0 37.6 62.4 ITC Midwest 116.0 92.2 23.8

ITC Great Plains 150.0 53.3 96.7

TOTAL $ 666.0 $ 201.1 $ 464.9

Cash on Hand 58.3

TOTAL LIQUIDITY $ 523.2

12

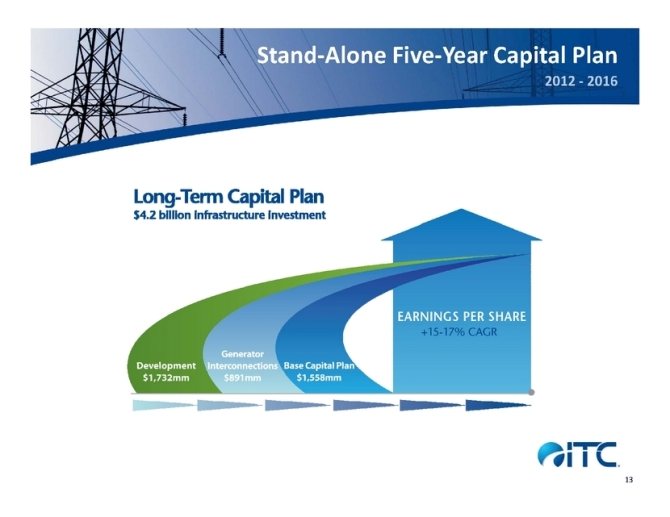

Stand? Alone Five? Year Capital Plan

2012 2016 ?

13

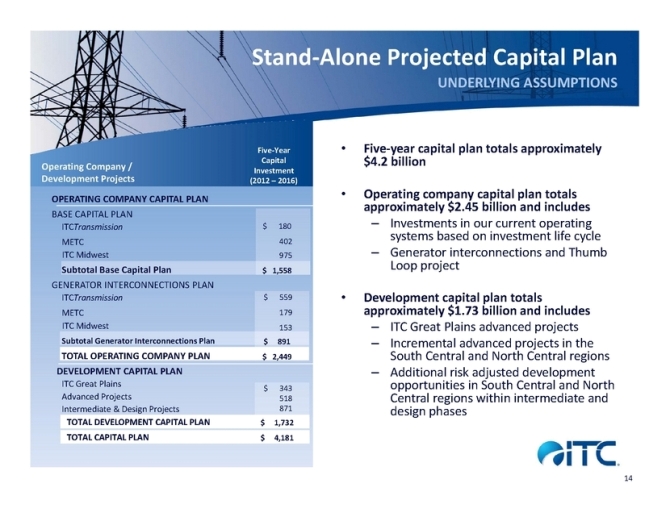

Stand? Alone Projected Capital Plan

UNDERLYING ASSUMPTIONS

Five? Year • Five? year capital plan totals approximately Capital $4.2 billion

Operating Company /

Investment Development Projects (2012 – 2016)

• Operating company capital plan totals

OPERATING COMPANY CAPITAL PLAN

approximately $2.45 billion and includes

BASE CAPITAL PLAN Investments in our current operating

ITCTransmission $ 180 –

systems based on investment life cycle

METC 402

ITC Midwest 975 – Generator interconnections and Thumb

Subtotal Base Capital Plan Loop project $ 1,558

GENERATOR INTERCONNECTIONS PLAN

ITCTransmission $ 559 • Development capital plan totals METC 179 approximately $1.73 billion and includes

ITC Midwest 153 – ITC Great Plains advanced projects

Subtotal Generator Interconnections Plan $ 891 – Incremental advanced projects in the TOTAL OPERATING COMPANY PLAN $ 2,449 South Central and North Central regions

DEVELOPMENT CAPITAL PLAN – Additional risk adjusted development ITC Great Plains opportunities in South Central and North

$ 343

Advanced Projects 518 Central regions within intermediate and

Intermediate & Design Projects 871 design phases

TOTAL DEVELOPMENT CAPITAL PLAN $ 1,732 TOTAL CAPITAL PLAN $ 4,181

14

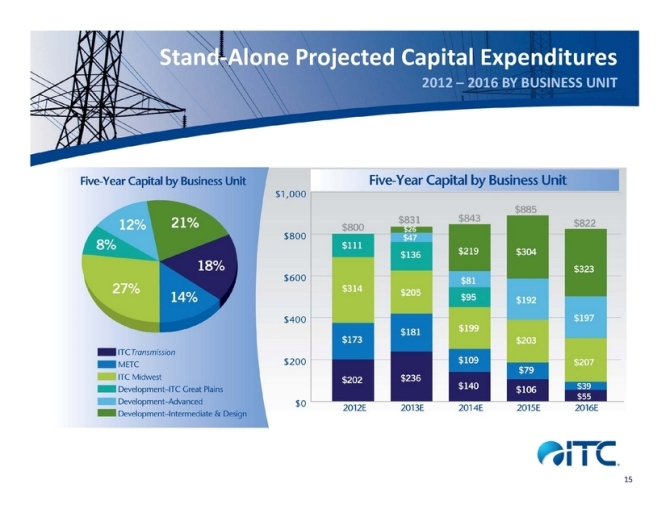

Stand? Alone Projected Capital Expenditures

2012 – 2016 BY BUSINESS UNIT

15

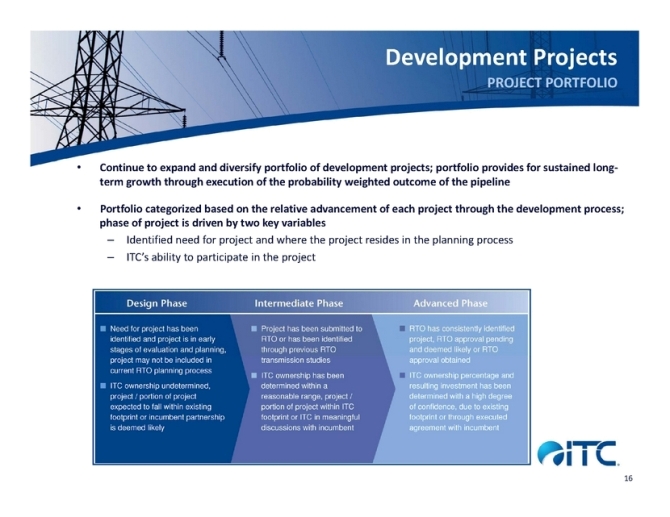

Development Projects

PROJECT PORTFOLIO

• Continue to expand and diversify portfolio of development projects; portfolio provides for sustained long?term growth through execution of the probability weighted outcome of the pipeline

• Portfolio categorized based on the relative advancement of each project through the development process; phase of project is driven by two key variables

– Identified need for project and where the project resides in the planning process

– ITC’s ability to participate in the project

16

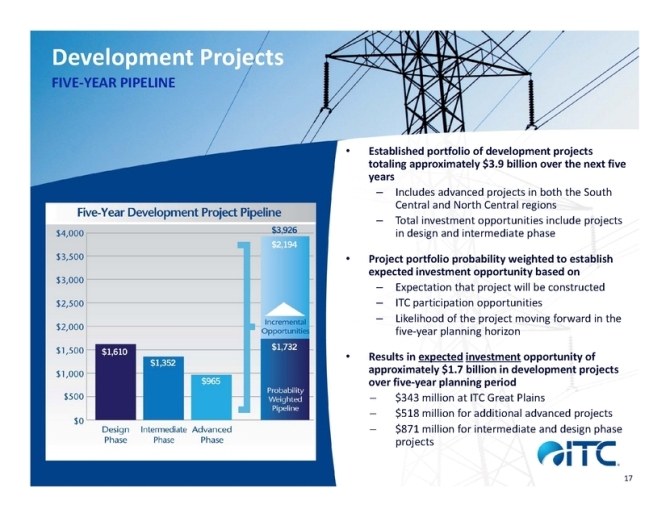

Development Projects

FIVE? YEAR PIPELINE

• Established portfolio of development projects totaling approximately $3.9 billion over the next five years

– Includes advanced projects in both the South Central and North Central regions

– Total investment opportunities include projects in design and intermediate phase

• Project portfolio probability weighted to establish expected investment opportunity based on

– Expectation that project will be constructed

– ITC participation opportunities

– Likelihood of the project moving forward in the five? year planning horizon

• Results in expected investment opportunity of approximately $1.7 billion in development projects over five? year planning period

$343 million at ITC Great Plains

$518 million for additional advanced projects

$871 million for intermediate and design phase projects

17

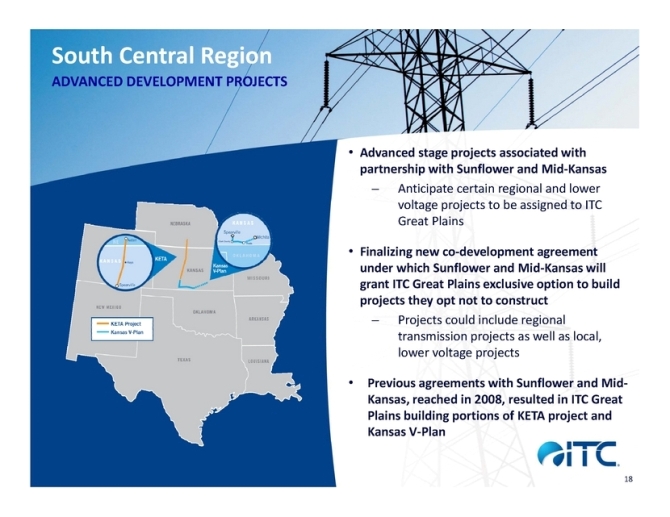

South Central Region

ADVANCED DEVELOPMENT PROJECTS

• Advanced stage projects associated with partnership with Sunflower and Mid? Kansas

Anticipate certain regional and lower voltage projects to be assigned to ITC Great Plains

• Finalizing new co? development agreement under which Sunflower and Mid? Kansas will grant ITC Great Plains exclusive option to build projects they opt not to construct

Projects could include regional transmission projects as well as local, lower voltage projects

• Previous agreements with Sunflower and Mid?Kansas, reached in 2008, resulted in ITC Great Plains building portions of KETA project and Kansas V? Plan

18

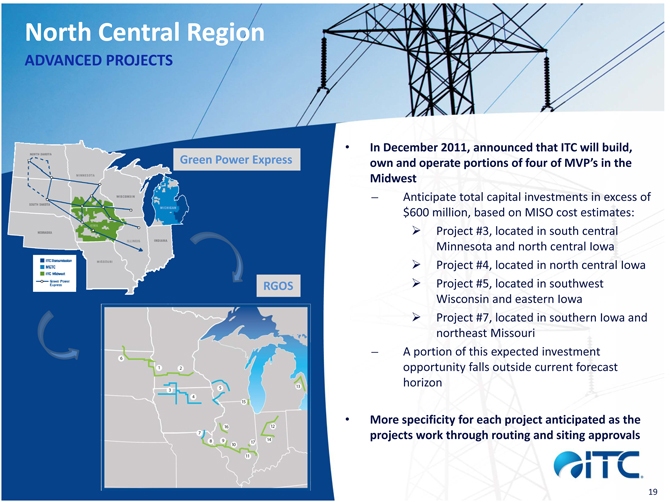

North Central Region

ADVANCED PROJECTS

• In December 2011, announced that ITC will build, Green Power Express own and operate portions of four of MVP’s in the Midwest

Anticipate total capital investments in excess of $600 million, based on MISO cost estimates:

??Project #3, located in south central Minnesota and north central Iowa

??Project #4, located in north central Iowa

RGOS ??Project #5, located in southwest

Wisconsin and eastern Iowa

??Project #7, located in southern Iowa and northeast Missouri

A portion of this expected investment opportunity falls outside current forecast horizon

• More specificity for each project anticipated as the projects work through routing and siting approvals

19

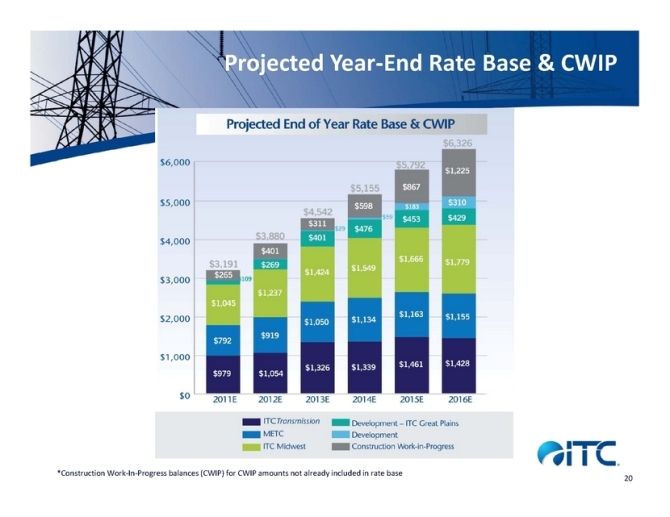

Projected Year? End Rate Base & CWIP

*Construction Work? In? Progress balances (CWIP) for CWIP amounts not already included in rate base

20

Dividend Policy

• Recognize dividend as important factor in overall shareholder return

– Remain committed to continuing to grow annually while recognizing investment needs

Quarterly Dividend of the business

– Historically resulted in annual increases of approximately 5%

• Dividend policy going forward

– 2012 and beyond believe we have additional flexibility around annual dividend increases, compared to historical levels

– Expect this flexibility to allow us to preserve payout ratio in the high 30% range, even as we continue to grow earnings at a robust pace

– Expect to be measured in dividend increases given attractive development pipeline opportunities and Entergy transaction

21

Funding of Capital Requirements

• Total cash requirements to execute five? year plan total approximately $5.5 billion

– Cash inflows support funding of capital Amounts in $MM expenditures, dividends and retirements of existing debt Operating Cash Flow $ 2,493 – Internally generated operating cash flow Debt Issuances 2,225 expected to fund approximately 45% of the Equity Issuances – overall cash requirement

Change in Revolver/Other 813

• New equity issuances are not anticipated to

Total Sources of Cash $ 5,531

fund current five? year capital plan

• Remain committed to investment grade credit ratings

Investing Cash Flow $ 3,976

Common Dividends 507 – Recent S&P upgrade evidence of this Generator Interconnections 66 – Five? year capital plan positions company Refinanced Debt 982 well to maintain investment grade ratings

Total Cash Requirement $ 5,531

22

Looking Ahead

• Five? year plan positions the company well to provide shareholder value while continuing to make needed investment in transmission for benefit of customers

• $4.2 billion five? year capital plan expected to generate EPS CAGR of 15 to 17%

Coupled with ongoing dividend policy provides attractive value creation opportunity for shareholders

Reflects ITC stand? alone plan and does not reflect expectations of proposed Entergy transaction

• 2011 performance reinforces our track record of delivering on commitments

• Focus in 2012 remains on executing against our existing strategy and plans while also advancing Entergy transaction towards close

23

Appendix

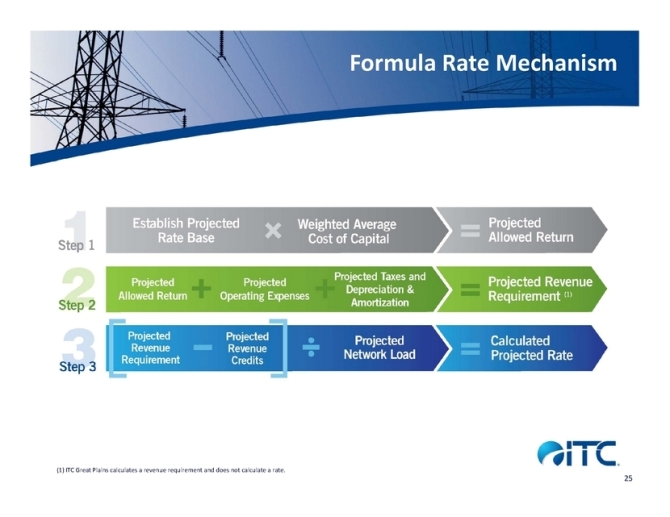

Formula Rate Mechanism

(1) |

| ITC Great Plains calculates a revenue requirement and does not calculate a rate. |

25

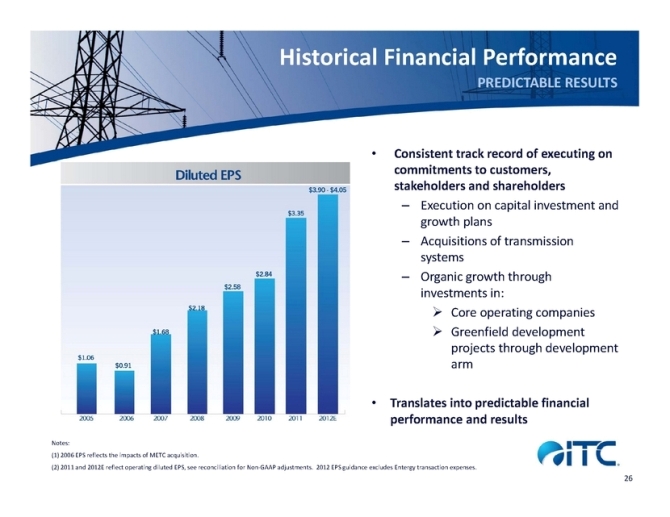

Historical Financial Performance

PREDICTABLE RESULTS

• Consistent track record of executing on commitments to customers, stakeholders and shareholders

– Execution on capital investment and growth plans

– Acquisitions of transmission systems

– Organic growth through investments in:

??Core operating companies

??Greenfield development projects through development arm

• Translates into predictable financial performance and results

Notes:

(1) |

| 2006 EPS reflects the impacts of METC acquisition. |

(2) 2011 and 2012E reflect operating diluted EPS, see reconciliation for Non? GAAP adjustments. 2012 EPS guidance excludes Entergy transaction expenses.

26

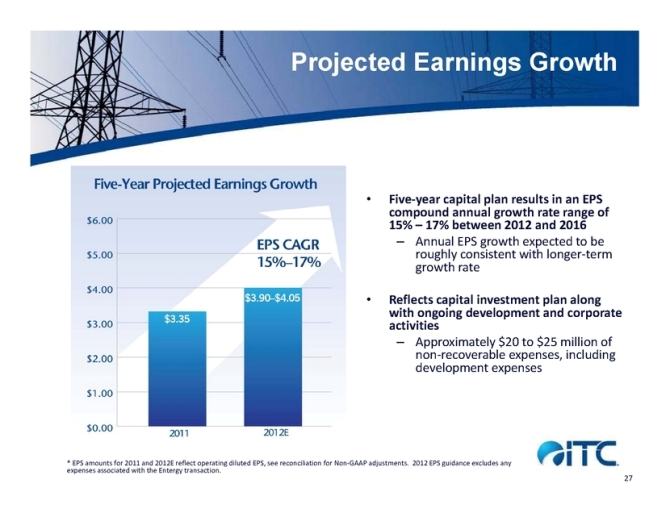

Projected Earnings Growth

• Five? year capital plan results in an EPS compound annual growth rate range of 15% – 17% between 2012 and 2016

– Annual EPS growth expected to be roughly consistent with longer? term growth rate

• Reflects capital investment plan along with ongoing development and corporate activities

– Approximately $20 to $25 million of non? recoverable expenses, including development expenses

* EPS amounts for 2011 and 2012E reflect operating diluted 27 EPS, see reconciliation for Non? GAAP adjustments. 2012 EPS guidance excludes any expenses associated with the Entergy transaction.

27

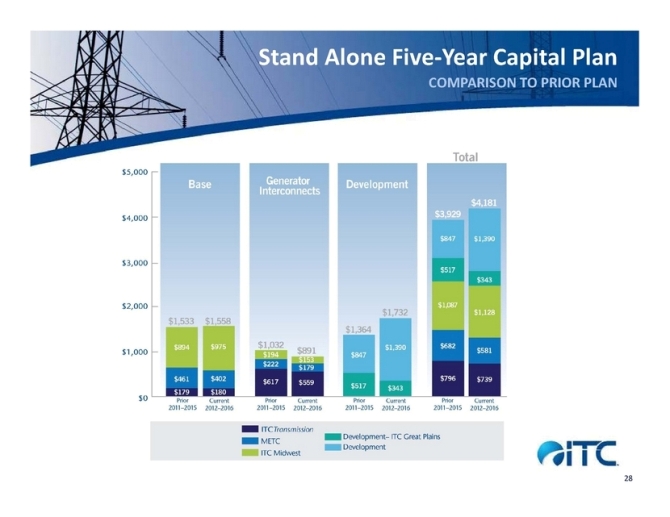

Stand Alone Five? Year Capital Plan

COMPARISON TO PRIOR PLAN

28

28

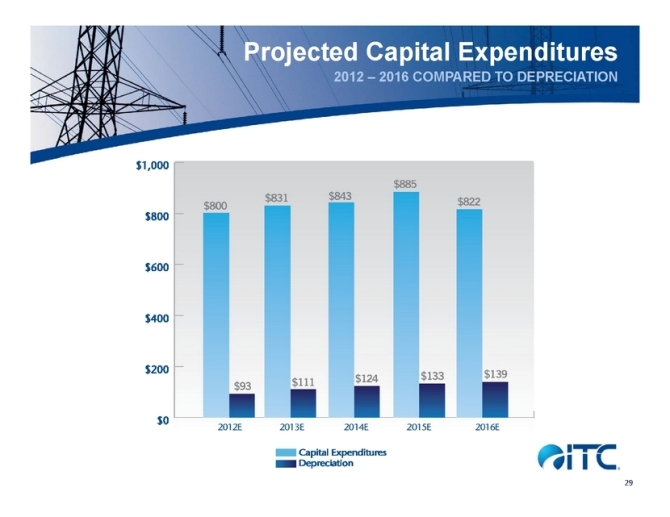

Projected Capital Expenditures

2012 – 2016 COMPARED TO DEPRECIATION

29

Long-Term Value Proposition

• Pure Play Transmission • Historical Underinvestment Model

• Long? Term Reliability Needs

• Best? In? Class Operations & Grid Stability

• Unparalleled Regulatory • Evolving Generation Construct Portfolio

– Integration of Renewables

• Strategic Footprint – Aging Coal Fleet

– Stricter Environmental

Standards Base

• Proven Development Development Generator Capital

Capabilities Interconnections Plan

• Increasingly Supportive Federal & Regulatory Framework

30

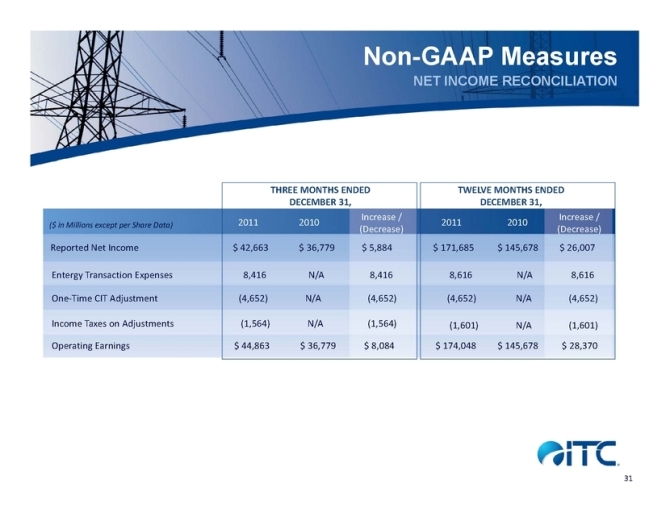

Non-GAAP Measures

NET INCOME RECONCILIATION

THREE MONTHS ENDED TWELVE MONTHS ENDED DECEMBER 31, DECEMBER 31,

Increase / Increase /

($ in Millions except per Share Data) 2011 2010 2011 2010

(Decrease) (Decrease)

Reported Net Income $ 42,663 $ 36,779 $ 5,884 $ 171,685 $ 145,678 $ 26,007

Entergy Transaction Expenses 8,416 N/A 8,416 8,616 N/A 8,616

One? Time CIT Adjustment (4,652) N/A (4,652) (4,652) N/A (4,652)

Income Taxes on Adjustments (1,564) N/A (1,564) (1,601) N/A (1,601)

Operating Earnings $ 44,863 $ 36,779 $ 8,084 $ 174,048 $ 145,678 $ 28,370

31