Use these links to rapidly review the document

TABLE OF CONTENTS

Exhibit 99.2

Proxy 2016 Circular Vote your proxy in support of creating one of North America’s largest and most profitable waste services providers. Progressing Toward the Future May 26, 2016

A LETTER FROM OUR CHAIRMAN Fellow Shareholders: It was an exciting and busy 2015 for all of us at Progressive. During the year, we stayed true to our core values and delivered on many of our objectives. Of Note in 2015 (All dollar amounts herein are U.S. dollars) 5 Acquisitions added high-quality and well-maintained assets in attractive markets Opened Canada’s largest renewable natural gas facility near Montreal which converts naturally occurring landfill gas into a renewable energy source that is an alternative to fossil fuels $1.926B consolidated revenues, up 1.1% year-over-year on a constant currency basis $150M free cash flow(B) generated $150M returned to shareholders through share repurchases under our normal course issuer bid and dividends

We are now embarking on the next stage of our journey. On January 18, 2016, we entered into an Agreement and Plan of Merger with Waste Connections, Inc. We are confident that this transaction will create significant long-term value for shareholders. Since our Merger announcement, our share price has already appreciated approximately 30%.

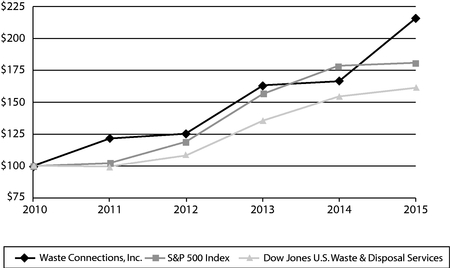

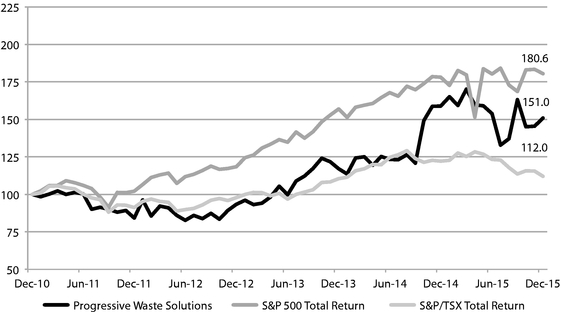

A LETTER FROM OUR CHAIRMAN We believe that the Merger is the right next step for Progressive and will allow us to strengthen our commitment to safety and operational excellence. About Waste Connections Waste Connections, Inc. (“Waste Connections”) is the premier provider of municipal solid waste services in mostly secondary and exclusive markets across the U.S. and is a leading provider of exploration and production (E&P) waste treatment, recovery and disposal services in the U.S. The Waste Connections executive management team, which will lead the combined company following completion of the Merger, has an outstanding record of creating substantial stockholder value over the past 18 years. In 2015, Waste Connections delivered its 12th consecutive year of positive stockholder return and, over the past ten years (as illustrated below), has outperformed key indices and its industry peer group. Waste Connections has demonstrated a commitment to increasing the return of capital to its stockholders through cash dividends and repurchases of shares of its common stock. 10-Year TSR (NYSE: WCN) Waste Connections Waste Management Republic Services S&P 500 S&P/TSX Composite Index As of 12/31/15 $400 289% 300 148% 129% 103% 200 53% 100 0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Waste Connections’ Financial Highlights: 2011–2015 ($ in thousands, except for dividends)20112012201320142015 Revenue 1,505,3661,661,618 1,928,795 2,079,1662,117,287 Adjusted EBITDA(A) 489,613528,419 657,002 717,078710,607 Adjusted Free Cash Flow(B) 254,792275,759 301,579 321,431342,987 Annual Dividend Payment0.3150.37 0.415 0.4750.535

Combination Creates an Industry Leader Together with Waste Connections, we will effectively double in size, creating an industry leader with more than $4 billion of combined revenue. Combined, we will have enhanced scale and a stronger financial profile. Below are some of the key strategic and financial benefits of the transaction: Expanded Operational Footprint The combined company will have pro forma annual revenue of approximately $4.1 billion and operate an integrated network of solid waste operations across North America. With combined operational footprints, we expect to leverage the resources, geographic reach and operational capacity of both companies to serve many more communities across the United States and Canada. Corporate HQ Regional HQ/Office Collection, Transfer and Recycling Operations Disposal/Landfill E&P Assets Meaningful Synergy Opportunities Diversified Revenue Streams Strong Financial Profile The Merger is expected to generate approximately $50 million in annualized SG&A cost savings within the first 12 months after closing, with the potential for additional upside over the long-term from operational and safety-related improvements and market rationalization. The combination of Waste Connections’ differentiated position in mostly secondary and exclusive U.S. markets with Progressive’s strong position in Canada and complementary U.S. markets is expected to result in high quality revenue, margin and free cash flow(B). The attractive credit profile of the combined company, along with sector-leading conversion of adjusted EBITDA(A) to adjusted free cash flow(B) will provide a solid foundation not only for our employees and communities, but also for the combined company to further enhance shareholder returns through additional growth opportunities and share repurchases. Additionally, the compelling free cash flow(B) characteristics of the combined company will support the continued payment of a quarterly dividend. It is anticipated that, following the completion of the Merger, the combined company will pay a quarterly dividend on the common shares of the combined company in the amount of $0.145 per common share.

Stronger Together Financial Highlights Estimated Combined Year 1 Fiscal 2015 Fiscal 2015 Revenue $1.9B $2.1B $4.1B Adjusted EBITDA(A) $480M $711M $1.25-1.3B Adjusted Free Cash Flow(B) $150M $343M $610M Operational Highlights Employees 7,900 7,200 15,000+ Customers ~3 Million ~3 Million 6 Million+ Collection Vehicles ~4,000 ~3,000 7,000+ Collection Operations 118 155 273 Transfer Stations 63 69 132 Landfills 31 62(1) 93 Recycling Facilities 34 37 71 24 24 Injection Wells 20 20 and Oil Recovery Facilities (A) Adjusted EBITDA, a non-U.S. GAAP financial measure, is provided supplementally because it is widely used by investors as a performance and valuation measure in the solid waste industry. For a reconciliation of this non-GAAP measure, please refer to filings made by Waste Connections and Progressive Waste with the U.S. Securities and Exchange Commission, including Waste Connections’ quarterly reports on Form 10-Q and its annual report on Form 10-K for the year ended December 31, 2015, as well as in Progressive Waste’s filings with the Canadian securities regulators. (B) Adjusted free cash flow is a term which does not have a standardized meaning prescribed by U.S. GAAP. For a reconciliation of this non-GAAP measure, please refer to filings made by Waste Connections and Progressive Waste with the U.S. Securities and Exchange Commission, including Waste Connections’ quarterly reports on Form 10-Q and its annual report on Form 10-K for the year ended December 31, 2015, as well as in Progressive Waste’s filings with the Canadian securities regulators. (1) Includes active Municipal Solid Waste (MSW), E&P and/or non-MSW landfills. E&P Liquid Waste E&P Waste Treatment Waste Connections and the E&P Industry Waste Connections is a leading provider of non-hazardous exploration and production (E&P) waste treatment, recovery and disposal services in several of the most active natural resource-producing areas of the U.S. Volume growth within E&P waste services has attractive incremental margin and free cash flow(B) characteristics. The positioning of these assets gives Waste Connections significant leverage to a recovery in crude oil prices and drilling activity.

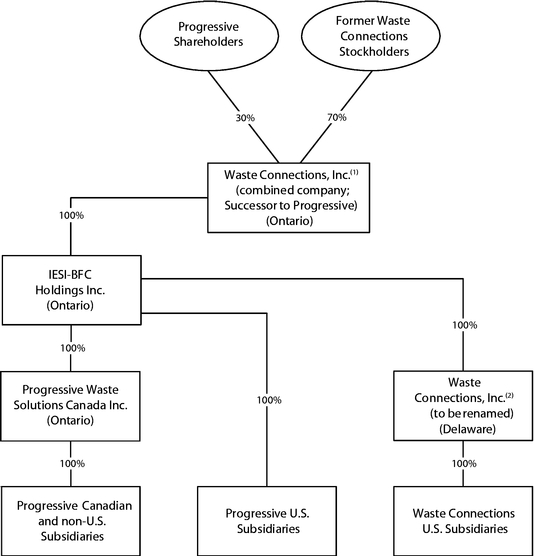

We are confident that this is a winning combination that will secure a strong future for all of Progressive’s stakeholders. We’re encouraged that the transaction has been greeted by both companies’ shareholders with a favorable reception, which we believe has been reflected in the stock performance since the announcement. shares for each share of Waste Connections common stock as a result of the Merger and the number of Progressive common shares held by Progressive shareholders will remain unchanged. Finally, immediately following the Consolidation (or, where the Consolidation is not approved by our shareholders, immediately following the Merger), Progressive will amalgamate with a new, wholly owned subsidiary of Progressive, with the resulting amalgamated corporation electing to use the “Waste Connections, Inc.” name. Given the all-stock nature of the Merger, our shareholders will have a unique opportunity to participate in the significant near-and long-term upside potential as part of a more powerful combined company. Holders of shares of Waste Connections common stock (“Waste Connections stockholders”) will receive newly issued common shares in the capital of Progressive (“Progressive common shares”) as consideration under the Merger Agreement at an exchange ratio of 2.076843 Progressive common shares for every one (1) share of Waste Connections common stock (the “Exchange Ratio”). It is anticipated that shareholders of Progressive (“Progressive shareholders”) and Waste Connections stockholders, in each case as of immediately prior to the Merger, will hold approximately 30% and 70%, respectively, of the Progressive common shares immediately after completion Your Board of Directors has unanimously approved the Merger. It has determined, after consulting with its legal and financial advisors, and based in part on the unanimous recommendation of a Special Committee composed of three independent directors of Progressive, and the fairness opinions received from J.P. Morgan Securities LLC and BMO Nesbitt Burns Inc., that the Merger and the other transactions contemplated by the Merger Agreement are in the best interest of Progressive. The Board unanimously recommends that our Progressive shareholders vote in favor of the Merger and the other transactions contemplated by the Merger Agreement. of the Merger. I would like to thank everyone on the Progressive team — our loyal and hard-working employees and our committed and dedicated management and Board of Directors — who together have created value for our most important constituents, our customers and shareholders. Subject to the approval of Progressive shareholders at the Meeting, immediately after the Merger, Progressive also intends to implement a share consolidation whereby 2.076843 Progressive common shares outstanding will be converted to one (1) Progressive common share (the “Consolidation”). If the Consolidation is approved, after taking into account the effects of the Merger and the Consolidation, Waste Connections stockholders will effectively receive one (1) post-Consolidation Progressive common share for each share of Waste Connections common stock. The Merger is not conditional on Progressive shareholders approving the Consolidation of shares outstanding. In the event that the Merger is consummated but the Progressive shareholder approval of the Consolidation is not obtained, Waste Connections stockholders will receive 2.076843 Progressive common We look forward to completing the Merger with Waste Connections and are confident that the future of the combined company will be bright. Sincerely, James J. Forese Chairman of the Board

We are now embarking on the next stage of our journey. On January 18, 2016, we entered into an Agreement and Plan of Merger with Waste Connections, Inc. We are confident that this transaction will create significant long-term value for shareholders. Since our Merger announcement, our share price has already appreciated approximately 30%.

Your vote is very important regardless of the number of Progressive common shares you own. Our Annual and Special Meeting of Toronto, Ontario The Progressive board of directors unanimously Questions? If you have any questions about the Merger or the other transactions contemplated by the Merger Agreement, including the Consolidation, any of the other matters to be considered and voted on at the Meeting, the Meeting itself or the proxy materials, or if you need assistance submitting your form of proxy or voting your Progressive common shares or need additional copies of this document or the enclosed form of proxy, please contact: Kingsdale Shareholder Services 1.888.518.1556 (North American Toll Free) 416.867.2272 (Collect Outside North America) contactus@kingsdaleshareholder.com The accompanying Notice of Meeting and Circular provide a description of the transactions contemplated by the Merger Agreement, and include certain additional information to assist you in considering how to vote on, among other things, the resolutions approving the Merger and the other transactions contemplated by the Merger Agreement. You are urged to read this information carefully and, if you require assistance, to consult your tax, financial, legal or other professional advisors. Your vote is very important regardless of the number of Progressive common shares you own. If you are a registered Progressive shareholder (i.e., if your name appears on the register of Progressive shareholders maintained by or on behalf of Progressive) and you are unable to attend the Meeting in person, please complete, sign, date and return the accompanying form of proxy, as applicable, so that your Progressive common shares can be voted at the Meeting (or at any adjournments or postponements thereof ) in accordance with your instructions. To be effective, the enclosed form of proxy must be received by our transfer agent, Computershare Investor Services Inc. (according to the instructions on the proxy), not later than 10:00 a.m. (Eastern Time) on May 24, 2016, or, if the Meeting is adjourned or postponed, at least 48 hours (excluding weekends and statutory holidays in the Province of Ontario) before the new time of the adjourned or postponed Meeting. The deadline for the deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, Join Us Shareholders will be held: May 26, 2016 10 a.m. (Eastern Time) St. Andrew’s Club and Conference Centre 27th Floor, 150 King Street West Vote recommends that Progressive shareholders vote: FOR the Transaction Resolution FOR the Consolidation Resolution FOR the Incentive Plan Resolution FOR each of the Annual Resolutions without notice.

PROGRESSIVE WASTE SOLUTIONS LTD.

NOTICE OF ANNUAL AND SPECIAL MEETING

TO BE HELD MAY 26, 2016

NOTICE IS HEREBY GIVEN that an annual and special meeting (the "Meeting") of shareholders ("Progressive shareholders") of Progressive Waste Solutions Ltd. ("Progressive" or the "Corporation") will be held at 10:00 a.m. (Eastern Time) on May 26, 2016 at the St. Andrew's Club and Conference Centre, 150 King Street West, 27th Floor, Toronto, Ontario, for the following purposes:

- (a)

- to consider and, if thought advisable, pass, with or without variation, an ordinary resolution authorizing and approving the Agreement and Plan of Merger dated as of January 18, 2016 (the "Merger Agreement", a copy of which is included as Schedule B to the management information circular (the "Circular") accompanying this Notice of Meeting) by and among Progressive, Water Merger Sub LLC ("Merger Sub") and Waste Connections, Inc. ("Waste Connections"), and the transactions contemplated by the Merger Agreement, including:

- (i)

- the proposed business combination involving the Corporation, Waste Connections and Merger Sub (the "Merger");

- (ii)

- the issuance by Progressive of such number of common shares in the capital of Progressive ("Progressive common shares") as is necessary to complete the Merger; and

- (iii)

- the assumption by the Corporation of certain outstanding stock-based awards of Waste Connections;

- (b)

- conditional upon the approval of the Transaction Resolution, to consider and, if thought advisable, pass, with or without variation, a special resolution approving a consolidation (the "Consolidation") of the issued and outstanding Progressive common shares on the basis of one (1) Progressive common share on a post-Consolidation basis for every 2.076843 Progressive common shares outstanding on a pre-Consolidation basis, subject to, and immediately following, the completion of the Merger (the "Consolidation Resolution");

- (c)

- conditional upon the approval of the Transaction Resolution, to consider and, if thought advisable, pass, with or without variation, an ordinary resolution authorizing and approving the adoption by the Corporation of a new equity incentive plan (the "New Incentive Plan"), a copy of which is included as Schedule J to the Circular, and the reservation for issuance under the New Incentive Plan of 10,384,215 Progressive common shares (5,000,000 Progressive common shares if the Consolidation is effected), in each case subject to, and immediately following, the completion of the Merger (the "Incentive Plan Resolution");

- (d)

- to receive the consolidated financial statements of the Corporation for the year ended December 31, 2015 and the report of the auditors thereon;

- (e)

- to appoint auditors of the Corporation and to authorize the directors of the Corporation to fix the remuneration of the auditors;

- (f)

- to elect the board of directors of the Corporation; and

- (g)

- to transact such other business as may properly come before the Meeting and any and all postponements or adjournments thereof.

all as more particularly detailed in the accompanying Circular (the "Transaction Resolution");

Resolutions (e) and (f) are referred to collectively as the "Annual Resolutions".

Specific details of the matters proposed to be put before the Meeting are set forth in the Circular that accompanies this Notice of Meeting. The full text of the Transaction Resolution, the Consolidation Resolution and the Incentive Plan Resolution are attached as Schedule A to the Circular.

Neither the completion of the Merger nor the approval of the Transaction Resolution is conditional on the approval of the Consolidation Resolution, the Incentive Plan Resolution or the Annual Resolutions that Progressive shareholders are being asked to consider. If the Transaction Resolution is not approved by Progressive shareholders at the Meeting, the Consolidation Resolution and the Incentive Plan Resolution will not be proceeded with or voted on at the Meeting.

The items of business listed above, the Merger and the Merger Agreement are described in detail in the accompanying Circular of which this Notice of Meeting forms a part. Progressive will transact no other business at the Meeting except such business as may properly be brought before the Meeting or any adjournment or postponement thereof.

This Notice of Meeting and the accompanying Circular are available on the Corporation's website (www.progressivewaste.com) and on SEDAR at www.sedar.com or EDGAR at www.sec.gov.

The board of directors of Progressive has unanimously determined that the business combination with Waste Connections and the other transactions contemplated by the Merger Agreement, including the Consolidation and the adoption of the New Incentive Plan, and the other matters to be considered and voted on at the Meeting, are in the best interests of Progressive. Accordingly, the Progressive board of directors unanimously recommends that Progressive shareholders voteFOR the Transaction Resolution,FOR the Consolidation Resolution,FOR the Incentive Plan Resolution andFOR each of the Annual Resolutions.

Registered holders of Progressive common shares at the close of business on April 15, 2016 are entitled to attend and vote in person or by proxy at the Meeting and any adjournment or postponement thereof. Registered holders of Progressive common shares who are unable to attend the Meeting should complete, sign and return the enclosed form of proxy. To be valid, proxies must be received by the Corporation's transfer agent, Computershare Investor Services Inc., not later than 10:00 a.m. (Eastern Time) on May 24, 2016 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding weekends and statutory holidays in the Province of Ontario) before the new time of the adjourned or postponed Meeting. The deadline for the deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice. Proxies may be returned by facsimile to 1-866-249-7775 (416-263-9524 from outside North America) or by mail (a) in the enclosed envelope, or (b) in an envelope addressed to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1.

Beneficial (non-registered) holders of Progressive common shares who receive these materials through their broker, bank, trust company or other intermediary or nominee should follow the instructions provided by their broker, bank, trust company or other intermediary or nominee.

Your vote is important. Whether or not you expect to attend in person, you should authorize a proxy to vote your shares as promptly as possible so that your Progressive common shares may be represented and voted at the Meeting.

If you have any questions about the information contained in this Notice of Meeting and the accompanying Circular or require assistance in completing your proxy, please contact Progressive's proxy solicitation and information agent, Kingsdale Shareholder Services, by telephone at 1-888-518-1556 (North American Toll Free) or 416-867-2272 (Collect Outside North America), or by email at contactus@kingsdaleshareholder.com.

DATED at Vaughan, Ontario this 12th day of April, 2016

| BY ORDER OF THE BOARD OF DIRECTORS | ||

(Signed) Loreto Grimaldi | ||

LORETO GRIMALDI |

| | Page | |

|---|---|---|

QUESTIONS AND ANSWERS | Q&A-1 | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 1 | |

NOTICE TO U.S. SECURITYHOLDERS | 2 | |

GENERAL MATTERS | 3 | |

Reporting Currencies and Accounting Principles | 3 | |

Exchange Rate Data | 3 | |

Information Contained in this Circular | 3 | |

Information Contained in this Circular Regarding Waste Connections | 4 | |

SUMMARY | 5 | |

The Meeting | 5 | |

Date, Time and Place of Meeting | 5 | |

Purpose of the Meeting | 5 | |

The Companies | 6 | |

The Merger and Related Transactions | 8 | |

Recommendation of the Special Committee and Board of Directors and Progressive's Reasons for the Merger | 9 | |

Fairness Opinions | 13 | |

Interest of Informed Persons in the Merger | 14 | |

Board of Directors of the Combined Company | 14 | |

Management of the Combined Company | 14 | |

Regulatory Approvals Required for the Merger | 15 | |

No Solicitation; Third Party Acquisition Proposals | 15 | |

Change of Recommendation | 16 | |

Conditions to the Completion of the Merger | 17 | |

Termination of the Merger Agreement; Termination Fees | 19 | |

Listing of Progressive Common Shares; Delisting of Shares of Waste Connections Common Stock | 21 | |

The Consolidation | 21 | |

The Name Change | 22 | |

Dissent Rights | 22 | |

Risk Factors | 22 | |

Selected Historical Financial Data of Waste Connections | 22 | |

Selected Unaudited Pro Forma Financial Data | 26 | |

Comparative Historical and Unaudited Pro Forma Per Share Financial Data | 27 | |

Proxy Solicitation Agent | 28 | |

GENERAL INFORMATION CONCERNING THE MEETING AND VOTING | 29 | |

Date, Time and Place of Meeting | 29 | |

Purpose of the Meeting | 29 | |

The Record Date and Progressive Shareholders Entitled to Vote | 31 | |

Solicitation of Proxies | 31 | |

Registered Holders — Voting and Appointment of Proxies | 31 | |

Non-Registered Holders — Voting of Progressive Common Shares | 32 | |

Revocation of Proxies | 32 | |

Voting of Proxies | 33 | |

Quorum | 33 | |

Progressive Common Shares and Principal Holders Thereof | 33 | |

Recommendations of the Progressive Board of Directors | 33 |

i

| | Page | |

|---|---|---|

THE COMPANIES | 34 | |

Progressive | 34 | |

Merger Sub | 34 | |

Waste Connections | 34 | |

Information Concerning the Combined Company | 35 | |

THE MERGER | 36 | |

Transaction Structure | 36 | |

Merger Consideration | 36 | |

Background to the Merger | 37 | |

Special Committee | 43 | |

Recommendation of the Progressive Board of Directors | 43 | |

Reasons for the Recommendation | 44 | |

Fairness Opinions | 47 | |

Board of Directors and Management after the Merger | 49 | |

Treatment of Waste Connections Stock-Based Awards in the Merger | 49 | |

Regulatory Approvals Required for the Merger | 49 | |

Shareholder Approvals | 50 | |

Listing of Progressive Common Shares; Delisting of Shares of Waste Connections Common Stock | 51 | |

Dissent Rights | 51 | |

THE MERGER AGREEMENT | 52 | |

Explanatory Note Regarding the Merger Agreement | 52 | |

The Merger | 52 | |

Closing and Effective Time of the Merger | 52 | |

Merger Consideration | 53 | |

Exchange Agent and Transmittal Materials and Procedures | 53 | |

Withholding | 54 | |

No Fractional Progressive Common Share Consideration | 54 | |

Representations and Warranties | 54 | |

No Survival of Representations and Warranties | 57 | |

Covenants and Agreements | 57 | |

Conditions to the Completion of the Merger | 65 | |

Termination of the Merger Agreement; Termination Fees | 67 | |

Limitation on Remedies | 69 | |

Fees and Expenses | 70 | |

Indemnification; Directors' and Officers' Insurance | 70 | |

Amendment and Waiver | 70 | |

Governing Law | 71 | |

Assignment | 71 | |

Specific Performance | 71 | |

EQUITY INCENTIVE PLAN MATTERS | 71 | |

New Incentive Plan | 72 | |

Assumed Waste Connections Equity Plans | 79 | |

THE CONSOLIDATION | 81 | |

Principal Effects of the Consolidation | 81 | |

Effect on Progressive Common Share Certificates | 81 | |

Procedure for Implementing the Consolidation | 82 | |

Effect on Fractional Progressive Common Shares | 82 | |

Effect on Non-Registered Holders | 83 | |

Timing of the Consolidation | 83 | |

Dissent Rights | 83 | |

THE NAME CHANGE | 83 |

ii

| | Page | |

|---|---|---|

SECURITIES LAW MATTERS | 84 | |

Multilateral Instrument 61-101 | 84 | |

Canadian Continuous Disclosure Obligations | 84 | |

MATERIAL TAX CONSEQUENCES | 84 | |

Material U.S. Federal Income Tax Considerations | 84 | |

Canadian Federal Income Tax Consequences of the Consolidation | 87 | |

INTEREST OF INFORMED PERSONS IN THE MERGER | 89 | |

Agreements with Executive Officers | 90 | |

Treatment of Outstanding Equity-Based Awards | 91 | |

Short Term Incentive Plan | 92 | |

Retention Bonus Agreements | 92 | |

Interests of Directors | 92 | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 93 | |

RISK FACTORS | 93 | |

Risks Related to the Merger | 94 | |

Risks Related to the Business of Progressive | 96 | |

Risks Related to the Business of the Combined Company | 97 | |

SELECTED HISTORICAL FINANCIAL DATA OF WASTE CONNECTIONS | 101 | |

Adjusted EBITDA | 102 | |

Adjusted Net Income and Adjusted Net Income per Diluted Share | 103 | |

SELECTED UNAUDITED PRO FORMA FINANCIAL DATA | 104 | |

COMPARATIVE HISTORICAL AND UNAUDITED PRO FORMA PER SHARE FINANCIAL DATA | 105 | |

MANAGEMENT CONTRACTS | 106 | |

AUDITORS, TRANSFER AGENT AND REGISTRAR | 106 | |

LEGAL MATTERS | 106 | |

EXPERTS | 106 | |

ADDITIONAL INFORMATION | 106 | |

OTHER MATTERS | 107 | |

DIRECTORS' APPROVAL | 107 | |

GLOSSARY OF TERMS | 108 | |

CONSENT OF J.P. MORGAN SECURITIES LLC | 113 | |

CONSENT OF BMO NESBITT BURNS INC. | 114 |

iii

The following are answers to certain questions that you may have regarding the matters to be considered at the annual and special meeting of the shareholders of Progressive Waste Solutions Ltd. scheduled to be held on May 26, 2016 (the "Meeting"). The questions and answers below are not meant to be a substitute for the more detailed description and information contained in the management information circular provided herewith (the "Circular"). We urge you to read carefully the Circular, including the Schedules thereto and the other information incorporated into the Circular by reference, because the information in this section may not provide all of the information that might be important to you in determining how to vote.

WHAT IS THE PROPOSED TRANSACTION THAT I AM BEING ASKED TO VOTE ON?

Pursuant to the Agreement and Plan of Merger (the "Merger Agreement") dated January 18, 2016 by and among Progressive Waste Solutions Ltd. ("Progressive" or the "Corporation"), Water Merger Sub LLC, a Delaware limited liability company and a wholly-owned subsidiary of Progressive ("Merger Sub"), and Waste Connections, Inc. ("Waste Connections"), Progressive will combine with Waste Connections in an all-stock merger. Merger Sub will merge with and into Waste Connections (referred to as the "Merger"), with Waste Connections continuing as the surviving corporation. Following the Merger, Waste Connections will be a subsidiary of Progressive and the shares of Waste Connections common stock will be delisted from the New York Stock Exchange ("NYSE") and deregistered under the United States Securities Exchange Act of 1934. Pursuant to the Merger, holders of shares of Waste Connections common stock ("Waste Connections Stockholders") will receive common shares in the capital of Progressive ("Progressive common shares") in exchange for their shares of Waste Connections common stock and will become shareholders of Progressive ("Progressive shareholders").

Waste Connections stockholders will receive newly issued Progressive common shares as consideration under the Merger at an exchange ratio of 2.076843 Progressive common shares for every one (1) share of Waste Connections common stock. It is anticipated that Progressive shareholders and Waste Connections stockholders, in each case as of immediately prior to the Merger, will hold approximately 30% and 70%, respectively, of the Progressive common shares immediately following the completion of the Merger. The Merger is expected to close in the second quarter of 2016.

Subject to the approval by (i) Progressive shareholders of the Consolidation Resolution (as defined below) and (ii) the Toronto Stock Exchange (the "TSX"), Progressive also intends to implement a consolidation whereby, subject to and immediately following the completion of the Merger, every 2.076843 Progressive common shares held by a Progressive shareholder will be consolidated into one (1) Progressive common share (the "Consolidation"). If Progressive shareholders approve the Consolidation Resolution, and the Consolidation is effected, then every 2.076843 pre-Consolidation Progressive common shares will be consolidated into one (1) post-Consolidation Progressive common share. If the Consolidation is approved, after taking into account the effects of the Merger and the Consolidation, Waste Connections stockholders will effectively receive one (1) post-Consolidation Progressive common share for each share of Waste Connections common stock. The Merger is not conditioned on Progressive shareholder approval of the Consolidation. In the event that the Merger is consummated but the Progressive shareholder approval of the Consolidation is not obtained, Waste Connections stockholders will receive 2.076843 Progressive common shares for each share of Waste Connections common stock as a result of the Merger and the number of Progressive common shares held by Progressive shareholders will remain unchanged.

Finally, immediately following the Consolidation (or, if the Consolidation is not approved by Progressive shareholders, immediately following the completion of the Merger), subject to the approval of the TSX, Progressive will amalgamate with a direct wholly-owned subsidiary with the resulting amalgamated corporation using the "Waste Connections, Inc." name (the "Name Change") and its common shares are expected to trade on the NYSE and TSX under the symbol "WCN".

Progressive has applied to list the Progressive common shares to be issued in connection with the Merger, including Progressive common shares issuable under certain outstanding stock-based awards of Waste Connections that Progressive will assume pursuant to the Merger Agreement and the Progressive common shares to be reserved for issuance under the New Incentive Plan (as defined below), on the NYSE and the TSX. Progressive has also filed an application with the TSX requesting approval of, among other things, the Consolidation, the Name Change and the change of the Corporation's trading symbol to "WCN". The Merger is conditioned on the approval of the TSX of the

Q&A-1

listing of the Progressive common shares to be issued pursuant to the Merger on the TSX. The Merger is not conditioned on the approval of the TSX of the Consolidation, the Name Change or the change of the Corporation's trading symbol to "WCN".

The TSX has granted conditional approval of the Merger and transactions contemplated by the Merger Agreement, including the listing of the Progressive common shares to be issued in connection with the Merger and the Progressive common shares to be reserved for issuance pursuant to the terms of the outstanding Waste Connections stock-based awards that Progressive will assume pursuant to the Merger, the Consolidation, the New Incentive Plan and the listing of the Progressive common shares to be reserved for issuance pursuant to the New Incentive Plan, and the Name Change and the change of the Corporation's trading symbol to "WCN".

WHY AM I RECEIVING THIS DOCUMENT?

Progressive is sending these materials to you, as a Progressive shareholder, to help you decide how to vote your Progressive common shares with respect to the matters to be considered at the Meeting.

Completion of the Merger requires an affirmative vote of at least a majority of the votes cast thereon either in person or by proxy at the Meeting. Progressive will ask its shareholders to consider and, if thought advisable, pass, with or without variation, an ordinary resolution authorizing and approving the transactions contemplated by the Merger Agreement, including (i) the proposed business combination involving Progressive, Waste Connections and Merger Sub, (ii) the issuance by Progressive of such number of Progressive common shares as is necessary to complete the Merger, and (iii) the assumption by Progressive of certain outstanding stock-based awards of Waste Connections.

At the Meeting, Progressive will, subject to approval of the Transaction Resolution (as defined below), ask that its shareholders consider and, if thought advisable, pass, with or without variation a special resolution authorizing and approving the Consolidation to be effected immediately following the completion of the Merger and an ordinary resolution authorizing and approving a new equity incentive plan (the "New Incentive Plan") to be adopted immediately following the completion of the Merger and the reservation for issuance of Progressive common shares under the New Incentive Plan; provided, however, that neither the approval of the Consolidation Resolution (as defined below) nor the approval of the Incentive Plan Resolution (as defined below) is a condition to the consummation of the Merger.

At the Meeting, Progressive shareholders will also be asked to receive the consolidated financial statements of the Corporation for the year ended December 31, 2015 and the report of the auditors thereon and to consider and, if thought advisable, pass resolutions appointing the auditors of the Corporation and to authorize the directors of the Corporation to fix the remuneration of the auditors and to elect the members of the board of directors of Progressive (the "Progressive board of directors") (such resolutions are referred to as the "Annual Resolutions"), and to transact such other business as may properly come before the Meeting and any and all postponements or adjournments thereof. The approval of the Annual Resolutions is not conditioned on the approval of the Transaction Resolution nor is it a condition to the Merger.

Further information about the Meeting, the Merger, and the conditions to the Merger, including the approvals sought from Progressive shareholders, is contained in this Circular.

The Merger will constitute a "reverse takeover" for the purposes of National Instrument 51-102 — Continuous Disclosure Obligations and a "backdoor listing" under the rules of the TSX. Accordingly, the Circular contains detailed information and financial data and statements regarding Progressive, Waste Connections and the combined company following the completion of the Merger. Progressive shareholders are urged to read such information, data and statements carefully prior to voting their Progressive common shares at the Meeting.

WHO IS ENTITLED TO VOTE AT THE MEETING?

Only Progressive shareholders of record at 5:00 p.m. (Eastern Time) on April 15, 2016 (referred to as the "Record Date") will be entitled to receive notice of and vote at the Meeting or any adjournment or postponement thereof.

Q&A-2

IF I AM A PROGRESSIVE SHAREHOLDER, WILL I RECEIVE ANY SECURITIES AS PART OF THE MERGER?

No. If the Merger is completed, Progressive shareholders will continue to hold their Progressive common shares, subject to the implementation of the Consolidation and the Name Change.

WHAT WILL WASTE CONNECTIONS STOCKHOLDERS RECEIVE IN THE MERGER?

As a result of the Merger, each issued and outstanding share of Waste Connections common stock will be cancelled and in consideration therefor each holder of such shares of Waste Connections common stock will have the right to receive 2.076843 validly issued, fully paid and nonassessable Progressive common shares. If the Consolidation is approved at the Meeting, and the Consolidation is effected, all Progressive common shares will be consolidated on the basis of one (1) post-Consolidation Progressive common share for every 2.076843 Progressive common shares on a pre-Consolidation basis. If the Consolidation is approved and effected, then, after taking into account the effects of the Merger and the Consolidation, Waste Connections stockholders will receive one (1) post-Consolidation Progressive common share for each share of Waste Connections common stock. It is anticipated that Progressive shareholders and Waste Connections stockholders, in each case as of immediately prior to the Merger, will hold approximately 30% and 70%, respectively, of the combined company immediately following the completion of the Merger. The combined company will use the Waste Connections name and its shares are expected to trade on the NYSE and on the TSX under the symbol "WCN".

No holder of Waste Connections common stock will be issued fractional Progressive common shares in the Merger. All fractional Progressive common shares will be aggregated and sold in the open market for holders of shares of Waste Connections common stock by the exchange agent and each holder of Waste Connections common stock who would otherwise have been entitled to receive a fraction of a Progressive common share will receive, in lieu thereof, cash, without interest, in an amount equal to the proceeds from such sale by the exchange agent, if any, less any brokerage commissions or other fees, from the sale of such fractional Progressive common share in accordance with such holders' fractional interest in the aggregate number of Progressive common shares sold.

WHAT WILL HOLDERS OF WASTE CONNECTIONS STOCK-BASED AWARDS RECEIVE UPON COMPLETION OF THE MERGER?

As further detailed in the section entitled "The Merger — Treatment of Waste Connections Stock-Based Awards in the Merger," in connection with the Merger, each Waste Connections stock-based award that is outstanding immediately prior to the effective time of the Merger will be converted into a corresponding equity award of Progressive based upon the Exchange Ratio (and, if applicable, the Consolidation).

WHEN WILL THE MERGER BE COMPLETED?

Progressive and Waste Connections currently expect that the Merger will be completed in the second quarter of 2016. Neither Progressive nor Waste Connections can predict, however, the actual date on which the Merger will be completed, or whether it will be completed, because it is subject to factors beyond each company's control.

WHAT ARE PROGRESSIVE SHAREHOLDERS BEING ASKED TO VOTE ON AND WHY IS THIS APPROVAL NECESSARY?

Progressive shareholders are being asked to consider and, if thought advisable, pass, with or without variation, the following resolutions:

Transaction Resolution: An ordinary resolution authorizing and approving the transactions contemplated by the Merger Agreement, including (i) the proposed business combination involving Progressive, Waste Connections and Merger Sub, (ii) the issuance by Progressive of such number of Progressive common shares as is necessary to complete the Merger, and (iii) the assumption by Progressive of certain outstanding stock-based awards of Waste Connections (the "Transaction Resolution");

Consolidation Resolution: Conditional upon the approval of the Transaction Resolution, a special resolution approving a consolidation of the issued and outstanding Progressive common shares on the basis of one (1) Progressive common share on a post-Consolidation basis for every 2.076843 Progressive common shares

Q&A-3

outstanding on a pre-Consolidation basis, subject to, and immediately following, the completion of the Merger (the "Consolidation Resolution"); and

Incentive Plan Resolution: Conditional upon the approval of the Transaction Resolution, an ordinary resolution authorizing and approving the adoption by the Corporation of the New Incentive Plan and the reservation for issuance of Progressive common shares under the New Incentive Plan, in each case subject to, and immediately following, the completion of the Merger (the "Incentive Plan Resolution").

Progressive shareholder approval of the Transaction Resolution is required for completion of the Merger. Neither Progressive shareholder approval of the Consolidation Resolution nor Progressive shareholder approval of the Incentive Plan Resolution is required for completion of the Merger.

In addition to the foregoing resolutions, Progressive shareholders will be asked at the Meeting to consider and vote on each of the Annual Resolutions. For further information concerning the Annual Resolutions, refer to Schedule I to the Circular.

WHAT ARE THE BENEFITS OF THE MERGER?

- •

- Combining Progressive and Waste Connections, each well-known and respected waste management companies, would create a North American industry leader in waste management with pro forma revenue of approximately $4.1 billion.

- •

- The completion of the Merger would bring together two vertically integrated companies with strong and complementary positions in primary, secondary and exclusive markets, and with a shared commitment to operational safety, environmental excellence and employee engagement, under a best-in-class, safety-focused operating model to enhance the conversion of EBITDA to adjusted free cash flow.

- •

- The value of the Merger represents a 16% premium to the Corporation's 20-day volume weighted average trading price on the NYSE prior to January 4, 2016, the day the Corporation announced that it was engaged in a review of strategic alternatives.

- •

- As a result of its increased scale and operating synergies, the combined company is expected to generate significant annualized SG&A cost savings within the first 12 months after closing, with operational and safety-related improvements and market rationalization contributing additional upside over the long term.

- •

- The all-stock nature of the Merger provides Progressive shareholders with the opportunity to participate in the expected significant near- and long-term upside potential of a combined company with a greater geographic diversity and asset base, serving more than six million commercial, industrial and residential customers in 38 U.S. states, the District of Columbia and in six Canadian provinces.

WHAT VOTE IS REQUIRED TO APPROVE THE RESOLUTIONS RELATED TO THE MERGER?

The Transaction Resolution is an ordinary resolution, and accordingly, the affirmative vote of at least a majority of the votes cast thereon either in person or by proxy at the Meeting is required to approve the Transaction Resolution.

The Consolidation Resolution is a special resolution, and accordingly, the affirmative vote of at least two-thirds of the votes cast thereon either in person or by proxy at the Meeting is required to approve the Consolidation Resolution.

The Incentive Plan Resolution is an ordinary resolution, and accordingly, the affirmative vote of at least a majority of the votes cast thereon either in person or by proxy at the Meeting is required to approve the Incentive Plan Resolution.

HOW DOES THE PROGRESSIVE BOARD OF DIRECTORS RECOMMEND I VOTE?

The Progressive board of directors has unanimously approved the Merger Agreement and determined that the Merger Agreement and the transactions contemplated by the Merger Agreement, including the Merger and the Consolidation, and each of the other matters to be considered and voted on at the Meeting, are advisable and in the

Q&A-4

best interests of Progressive. The Progressive board of directors unanimously recommends that you vote your Progressive common shares:

- 1.

- "FOR" the Transaction Resolution;

- 2.

- "FOR" the Consolidation Resolution;

- 3.

- "FOR" the Incentive Plan Resolution; and

- 4.

- "FOR" each of the Annual Resolutions.

After carefully reading and considering the information contained in, and incorporated by reference into, the Circular, including the Schedules thereto, please vote your Progressive common shares as soon as possible so that your Progressive common shares will be represented at the Meeting. Please follow the instructions set forth on the form of proxy accompanying the Circular if you are a registered holder of Progressive common shares or on the voting instruction form provided to you by your intermediary (which include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans (each an "Intermediary")) if you are a non-registered holder of Progressive common shares.

If you are a registered holder of Progressive common shares as of the Record Date, you may submit your proxy before the Meeting in one of the following ways:

- 1.

- visit the website shown on your form of proxy to vote via the Internet, if available;

- 2.

- call the toll-free number for telephone voting, as shown on your form of proxy, if available; or

- 3.

- sign, date, mark and return the form of proxy accompanying the Circular.

You may also cast your vote in person at the Meeting.

If your Progressive common shares are held through an Intermediary, that institution will send you separate instructions describing the procedure for voting your Progressive common shares. Non-registered holders of Progressive common shares who wish to vote in person at the Meeting will need to obtain a form of proxy from their Intermediary.

As a Progressive shareholder, you are entitled to one vote for each Progressive common share that you owned as of the close of business on the Record Date.

BY WHEN DO I HAVE TO VOTE MY PROGRESSIVE COMMON SHARES?

To be valid, proxies must be received by the Corporation's transfer agent, Computershare Investor Services Inc., not later than 10:00 a.m. (Eastern Time) on May 24, 2016 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding weekends and statutory holidays in the Province of Ontario) before the new time of the adjourned or postponed Meeting. The deadline for the deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice. Proxies may be returned by facsimile to 1-866-249-7775 (416-263-9524 from outside North America) or by mail (a) in the enclosed envelope, or (b) in an envelope addressed to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1.

WHEN AND WHERE IS THE MEETING?

The Meeting will be held at 10:00 a.m. (Eastern Time) on May 26, 2016 at the St. Andrew's Club and Conference Centre, 150 King Street West, 27th Floor, Toronto, Ontario.

The quorum for the transaction of business at the Meeting, including approving any of the resolutions to be voted on by Progressive shareholders, is two persons present and each entitled to vote at the Meeting and holding

Q&A-5

personally or representing as proxies, in the aggregate, at least twenty-five percent (25%) of the Progressive common shares eligible to be voted at the Meeting.

IF MY SHARES ARE HELD BY AN INTERMEDIARY, WILL MY INTERMEDIARY VOTE MY SHARES FOR ME?

If you are a non-registered holder of Progressive common shares, you must provide your Intermediary with instructions on how to vote your Progressive common shares. Intermediaries will send to non-registered holders of Progressive common shares, in substitution for the form of proxy sent to registered holders, a voting instruction form ("Voting Instruction Form") which, when properly completed and signed by the non-registered holder and returned to the Intermediary, will constitute voting instructions which the Intermediary must follow.

If you are a non-registered holder who receives a Voting Instruction Form and you wish to vote at the Meeting in person or have another person attend and vote on your behalf, you must indicate in the place provided for that purpose in the Voting Instruction Form and a form of proxy will be sent to you. In any event, if you are a non-registered holder, you should carefully follow the instructions of your Intermediary set out in your Voting Instruction Form.

WHAT WILL HAPPEN IF I RETURN MY FORM OF PROXY WITHOUT INDICATING HOW TO VOTE?

If you sign and return your form of proxy without indicating how to vote on any particular resolution, the Progressive common shares represented by your form of proxy will be voted "FOR" each resolution in accordance with the recommendation of the Progressive board of directors.

MAY I CHANGE MY VOTE AFTER I HAVE DELIVERED MY PROXY OR VOTING INSTRUCTION FORM?

Yes. If you are a registered holder of Progressive common shares, you may revoke your proxy: (a) by completing and signing a proxy bearing a later date and returning it to Progressive's transfer agent, Computershare Investor Services Inc., in advance of 10:00 a.m. (Eastern Time) on May 24, 2016, or if the Meeting is adjourned or postponed, no later than 48 hours (excluding weekends and statutory holidays in the Province of Ontario) before the new time of the adjourned or postponed Meeting, (b) by depositing an instrument in writing executed by you or by your attorney authorized in writing (i) at the head office of the Corporation at any time up to and including the last business day preceding the date of the Meeting, or any reconvened meeting, at which the proxy is to be used, or (ii) with the Chair of the Meeting prior to the commencement of the Meeting on the date thereof or of any reconvened meeting, or (c) in any other manner permitted by law, including under subsection 110(4) of theBusiness Corporations Act (Ontario).

If you are a non-registered holder of Progressive common shares and wish to revoke your form of proxy or voting instruction form, you must contact your Intermediary in writing to change your vote. In order to ensure that your Intermediary acts upon your instructions to revoke your form of proxy or voting information form, the written notice should be received by your Intermediary well in advance of the Meeting.

ARE PROGRESSIVE SHAREHOLDERS ENTITLED TO DISSENT RIGHTS?

No. There are no dissent rights available to Progressive shareholders in connection with any of the transactions contemplated by the Merger Agreement, including the Merger or the Consolidation.

WHAT HAPPENS IF THE MERGER IS NOT COMPLETED?

If the Merger is not completed, no Progressive common shares will be issued to Waste Connections stockholders, Progressive will not combine with Waste Connections and will remain an independent public company and its common shares will continue to be listed and traded on the TSX and on the NYSE under the symbol "BIN". Under specified circumstances, Progressive or Waste Connections may be required to pay to, or be entitled to receive from, the other party a fee with respect to the termination of the Merger Agreement. See "The Merger Agreement — Termination of the Merger Agreement; Termination Fees" in the Circular.

WHOM SHOULD I CONTACT IF I HAVE ANY QUESTIONS ABOUT THE PROXY MATERIALS OR VOTING?

If you have any questions about the Merger or the other transactions contemplated by the Merger Agreement, including the Consolidation, any of the other matters to be considered and voted on at the Meeting, the Meeting itself or the proxy materials or if you need assistance submitting your form of proxy or voting your Progressive common shares or need additional copies of this document or the enclosed form of proxy, please contact Kingsdale Shareholder Services, our proxy solicitation and information agent, by telephone at 1-888-518-1556 (North American Toll Free) or 416-867-2272 (Collect Outside North America), or by email at contactus@kingsdaleshareholder.com.

Q&A-6

PROGRESSIVE WASTE SOLUTIONS LTD.

400 Applewood Crescent, 2nd Floor

Vaughan, Ontario L4K 0C3

MANAGEMENT INFORMATION CIRCULAR

DATED APRIL 12, 2016

The board of directors (the "Progressive board of directors") and management of Progressive Waste Solutions Ltd. ("Progressive" or the "Corporation") are furnishing this management information circular (the "Circular") to solicit proxies from the holders ("Progressive shareholders") of common shares in the capital of Progressive ("Progressive common shares") for use at the annual and special meeting of Progressive shareholders to be held at 10:00 a.m. (Eastern Time) on May 26, 2016 at the St. Andrew's Club and Conference Centre, 150 King Street West, 27th Floor, Toronto, Ontario (such meeting and any adjournment(s) or postponement(s) thereof, the "Meeting") for the purposes set forth in the accompanying notice of annual and special meeting of Progressive shareholders (the "Notice of Meeting"), including to consider the proposed business combination involving the Corporation, Water Merger Sub LLC ("Merger Sub") and Waste Connections, Inc. ("Waste Connections").

If you have any questions about the information contained in this Circular or require assistance in voting your Progressive common shares, please contact Kingsdale Shareholder Services (our "Proxy Solicitation and Information Agent"), by telephone at: 1-888-518-1556 (North American Toll Free) or 416-867-2272 (Collect Outside North America), or by email at contactus@kingsdaleshareholder.com.

For further information concerning the Meeting and voting at the Meeting, see "General Proxy Information" in this Circular.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Circular, and the documentation incorporated by reference herein, includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 (which includes "forward-looking information" within the meaning of applicable Canadian securities laws) and other U.S. securities laws and is subject to the safe-harbor created by such Act. These forward-looking statements are not based on historical facts but instead reflect Progressive's management's expectations, estimates or projections concerning future results or events. Forward-looking statements may often but not always be identified by the words "may", "might", "believes", "thinks", "anticipates", "plans", "expects", "intends", "budgeted" or similar expressions or variations including negative variations of such words and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved, and include statements regarding (1) expectations regarding whether the transactions contemplated by the Merger Agreement, including the Merger, the issuance of Progressive common shares in connection with the Merger, the adoption by Progressive of certain outstanding stock-based awards of Waste Connections, and the proposed Consolidation, will be consummated, including whether conditions to the consummation of such transactions will be satisfied, or the timing for completing the transactions, (2) expectations for the effects of the transactions or the ability of the combined company to successfully achieve business objectives, including integrating the respective businesses of Progressive and Waste Connections, or the effects of unexpected costs, liabilities or delays, (3) the potential benefits and synergies of such transactions, including expected cost savings and tax benefits and operating efficiencies, (4) expectations for other economic, business, and/or competitive factors, including future financial and operating results and revenue enhancements, and (5) any other statements regarding events or developments that Progressive believes or anticipates will or may occur in the future, including any pro forma financial statements. Although Progressive believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements, as unknown or unpredictable factors

1

could have material adverse effects on future results, performance or achievements of the combined company. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements include the following: the ability to consummate the proposed transactions; the ability to obtain requisite regulatory and shareholder approvals and the satisfaction of other conditions to the consummation of the proposed transactions on the proposed terms and schedule; the ability of Progressive and Waste Connections to successfully integrate their respective operations and employees and realize synergies and cost savings at the times, and to the extent, anticipated; Progressive's, Waste Connections' and, following completion of the Merger, the combined company's ability to make divestitures or acquisitions and their ability to integrate or manage such acquired businesses; the potential impact of the announcement or consummation of the proposed transactions on relationships, including with employees, suppliers, customers and competitors; changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws; significant competition that Waste Connections and Progressive face; compliance with extensive government regulation; Progressive's, Waste Connections', as well as, following completion of the Merger, the combined company's capital structure, including the indebtedness amounts of each, the limitations imposed by the covenants in the documents governing the indebtedness of each and the maintenance of the financial and disclosure controls and procedures of each; alternative acquisition proposals that could delay completion of such transactions or divert management's time and attention from such transactions; the diversion of time and attention of Progressive's and Waste Connections' respective management teams while such transactions are pending; and other risks detailed under the heading "Risk Factors" of this Circular, in the "Statement Regarding Forward-Looking Information," "Risk Factors" and other sections of Progressive's annual information form dated March 2, 2016 for the year ended December 31, 2015 and its annual Management's Discussion and Analysis for the year ended December 31, 2015, which are available on SEDAR at www.sedar.com. Progressive wishes to caution readers that certain important factors may have affected and could in the future affect their actual results and could cause their actual results for subsequent periods to differ materially from those expressed in any forward-looking statement made by or on behalf of Progressive. Progressive does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date hereof, except as may be specifically required by applicable securities laws.

NOTICE TO U.S. SECURITYHOLDERS

Progressive is currently a "foreign private issuer" within the meaning of Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"). The solicitation of proxies from Progressive shareholders is not subject to the proxy requirements of Section 14(a) of the Exchange Act. Accordingly, the solicitation contemplated herein is being made to Progressive shareholders resident in the U.S. only in accordance with applicable Canadian corporate and securities laws, and this Circular has been prepared in accordance with the disclosure requirements of applicable Canadian securities laws. Progressive shareholders resident in the U.S. should be aware that, in general, such Canadian disclosure requirements are different from those applicable to proxy statements, prospectuses or registration statements prepared in accordance with U.S. laws. The financial statements of Progressive and Waste Connections incorporated by reference herein have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

In connection with the Merger, Waste Connections and Progressive will file relevant materials with the United States Securities and Exchange Commission (the "SEC"), including a Progressive registration statement on Form F-4 that will include a proxy statement of Waste Connections and constitute a prospectus of the Corporation, which will be the sole means pursuant to which the Corporation will offer any securities to U.S. holders of shares of Waste Connections common stock in connection with the Merger.

The enforcement by investors of civil liabilities under U.S. securities laws may be affected adversely by the fact that Progressive is organized under the laws of a jurisdiction other than the U.S., that some or all of the officers and directors of Progressive are residents of countries other than the U.S., that some or all of the experts named in this Circular and the documents incorporated by reference herein may be residents of countries other than the U.S., and that a substantial portion of the assets of Progressive and such persons are located outside the U.S. As a result, it may be difficult or impossible for Progressive shareholders resident in the U.S. to effect service of process within the U.S. upon Progressive, its officers and directors or certain of the experts named in this Circular and any documents incorporated by reference herein, or to realize, against them, upon judgments of courts in the U.S. predicated upon civil liabilities under the securities laws of the U.S. In addition, Progressive shareholders resident in the U.S. should

2

not assume that Canadian courts: (i) would enforce judgments of U.S. courts obtained in actions against such persons predicated upon civil liabilities under the securities laws of the U.S. or "blue sky" laws of any state within the U.S.; or (ii) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the securities laws of the U.S. or "blue sky" laws of any state within the U.S.

Reporting Currencies and Accounting Principles

Unless otherwise indicated, all dollar amounts in this Circular are expressed in U.S. dollars. References to "Cdn.$" are to Canadian dollars. Progressive's financial statements that are included or incorporated by reference herein are reported in U.S. dollars and are prepared in accordance with U.S. GAAP. Waste Connections' financial statements that are included or incorporated by reference herein are reported in U.S. dollars and are prepared in accordance with U.S. GAAP.

The following tables show the high and low exchange rates for one U.S. dollar expressed in Canadian dollars and one Canadian dollar expressed in U.S. dollars for each period indicated, the average of the exchange rates for each period indicated and the exchange rate at the end of each such period, based upon the noon buying rates provided by the Bank of Canada:

| | Cdn.$ per U.S.$1.00 | U.S.$ per Cdn.$1.00 | |||||

|---|---|---|---|---|---|---|---|

Date Prior to Announcement of Merger (January 18, 2016) | $ | 1.4507 | $ | 0.6893 | |||

April 12, 2016 | $ | 1.2799 | $ | 0.7813 | |||

| | Average rate (Bank of Canada noon) | ||||||

|---|---|---|---|---|---|---|---|

Year ended December 31, | Cdn.$ per U.S.$1.00 | U.S.$ per Cdn.$1.00 | |||||

2011 | $ | 0.9892 | $ | 1.0109 | |||

2012 | $ | 0.9994 | $ | 1.0006 | |||

2013 | $ | 1.0302 | $ | 0.9707 | |||

2014 | $ | 1.1047 | $ | 0.9052 | |||

2015 | $ | 1.2788 | $ | 0.7820 | |||

High low Canadian to U.S. exchange rate for the last six months | High | Low | |||||

|---|---|---|---|---|---|---|---|

| | U.S.$ per Cdn.$1.00 | ||||||

October 2015 | $ | 0.7750 | $ | 0.7552 | |||

November 2015 | $ | 0.7637 | $ | 0.7485 | |||

December 2015 | $ | 0.7485 | $ | 0.7148 | |||

January 2016 | $ | 0.7159 | $ | 0.6854 | |||

February 2016 | $ | 0.7366 | $ | 0.7123 | |||

March 2016 | $ | 0.7715 | $ | 0.7425 | |||

On April 12, 2016, the noon exchange rate for one U.S. dollar expressed in Canadian dollars as reported by the Bank of Canada, was Cdn.$0.7813.

Information Contained in this Circular

The information contained in this Circular is given as at April 12, 2016, except where otherwise noted and except that information in documents incorporated by reference is given as of the dates noted therein. No person has been authorized to give any information or to make any representation in connection with the Merger and other matters described herein other than those contained in this Circular and, if given or made, any such

3

information or representation should be considered not to have been authorized by Progressive or Waste Connections.

This Circular does not constitute the solicitation of an offer to purchase, or the making of an offer to sell, any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation or offer is not authorized or in which the person making such solicitation or offer is not qualified to do so or to any person to whom it is unlawful to make such solicitation or offer.

Information contained in this Circular should not be construed as legal, tax or financial advice and Progressive shareholders are urged to consult their own professional advisors in connection therewith.

Descriptions in this Circular of the terms of the Merger Agreement are summaries of the terms of such document and are qualified in their entirety by the full text of the Merger Agreement. Progressive shareholders should refer to the full text of the Merger Agreement for complete details thereof. The full text of the Merger Agreement may be viewed under Progressive's profile on SEDAR at www.sedar.com, Progressive's profile on EDGAR at www.sec.gov and is attached to this Circular as Schedule B.

Information Contained in this Circular Regarding Waste Connections

Certain information in this Circular pertaining to Waste Connections, including, but not limited to, information pertaining to Waste Connections under the heading "Information Concerning Waste Connections" and in Schedule F to this Circular, including the documents which have been filed with the SEC by Waste Connections, and, for purposes of the Circular, by Progressive under its SEDAR profile as "Other Documents", which are expressly incorporated by reference into the Circular, has been furnished by Waste Connections. With respect to this information, the Progressive board of directors has relied exclusively upon Waste Connections, without independent verification by Progressive. Although Progressive does not have any knowledge that would indicate that such information is untrue or incomplete, neither Progressive nor any of its directors or officers assumes any responsibility for the accuracy or completeness of such information including any of Waste Connections' financial statements, or for the failure by Waste Connections to disclose events or information that may affect the completeness or accuracy of such information. For further information regarding Waste Connections, please refer to Waste Connections' filings with the SEC which may be obtained under Waste Connections' profile on EDGAR at www.sec.gov.

4

This Summary should be read together with and is qualified in its entirety by the more detailed information and financial data and statements contained elsewhere in this Circular, including the Schedules hereto and documents incorporated into this Circular by reference. Capitalized terms in this Summary have the meanings set out in the Glossary of Terms or as set out in this Summary.

Date, Time and Place of Meeting

The Meeting will be held at 10:00 a.m. (Eastern Time) on May 26, 2016 at the St. Andrew's Club and Conference Centre, 150 King Street West, 27th Floor, Toronto, Ontario.

At the Meeting, Progressive shareholders will be asked:

- (a)

- to consider and, if thought advisable, pass, with or without variation, an ordinary resolution authorizing and approving the Agreement and Plan of Merger (the "Merger Agreement") dated as of January 18, 2016 between Progressive, Merger Sub and Waste Connections, a copy of which is included as Schedule B to this Circular, and the transactions contemplated by the Merger Agreement, including:

- (i)

- the proposed business combination involving the Corporation, Waste Connections and Merger Sub (the "Merger");

- (ii)

- the issuance by Progressive of such number of common shares in the capital of Progressive ("Progressive common shares") as is necessary to complete the Merger; and

- (iii)

- the assumption by the Corporation of certain outstanding stock-based awards of Waste Connections,

- (b)

- conditional upon the approval of the Transaction Resolution, to consider and, if thought advisable, pass, with or without variation, a special resolution approving a consolidation (the "Consolidation") of the issued and outstanding Progressive common shares on the basis of one (1) Progressive common share on a post-Consolidation basis for every 2.076843 Progressive common shares outstanding on a pre-Consolidation basis, subject to, and immediately following, the completion of the Merger (the "Consolidation Resolution");

- (c)

- conditional upon the approval of the Transaction Resolution, to consider and, if thought advisable, pass, with or without variation, an ordinary resolution authorizing and approving a new equity incentive plan (the "New Incentive Plan") of the Corporation, a copy of which is included as Schedule J to this Circular; and the reservation for issuance under the New Incentive Plan of 10,384,215 Progressive common shares (5,000,000 Progressive common shares if the Consolidation is effected), in each case subject to, and immediately following, the completion of the Merger (the "Incentive Plan Resolution");

- (d)

- to receive the consolidated financial statements of the Corporation for the year ended December 31, 2015 and the report of the auditors thereon;

- (e)

- to appoint auditors of the Corporation and to authorize the directors of the Corporation to fix the remuneration of the auditors;

- (f)

- to elect the board of directors of the Corporation; and

- (g)

- to transact such other business as may properly come before the Meeting and any and all postponements or adjournments thereof.

all as more particularly detailed herein (the "Transaction Resolution");

Resolutions (e) and (f) are referred to collectively as the "Annual Resolutions".

Neither the completion of the Merger nor the approval of the Transaction Resolution is conditional on the approval of the Consolidation Resolution, the Incentive Plan Resolution or the Annual Resolutions that Progressive shareholders are being asked to consider. If the Transaction Resolution is not approved by

5

Progressive shareholders at the Meeting, neither the Consolidation Resolution nor the Incentive Plan Resolution will be proceeded with or voted on at the Meeting.

The current auditors of Progressive are Deloitte LLP and the Annual Resolutions contemplate reappointing Deloitte LLP as the auditors of the Corporation. Following completion of the Merger, it is anticipated that PricewaterhouseCoopers LLP, the current auditors of Waste Connections, will be appointed as the auditors of the combined company.

The Merger and other transactions contemplated by the Merger constitute a "backdoor listing" because Progressive is the legal acquiror of Waste Connections (which is not listed on the TSX). Progressive shareholders will own approximately 30% of the combined company upon the completion of the Merger, the current management of Waste Connections will assume the management of the combined company, and all five of the current directors of Waste Connections will become directors of the combined company comprising a majority of its board of directors. As a "backdoor listing" under the rules of the TSX, the combined company must meet the TSX original listing requirements in order to issue Progressive common shares in exchange for the cancellation of shares of Waste Connections common stock pursuant to the Merger. The TSX has determined that the combined company will meet the original listing requirements upon completion of the Merger. Further, as a "backdoor listing", Section 626 of the TSX Company Manual requires that the Transaction Resolution be approved by the affirmative vote of at least a majority of the votes cast thereon by Progressive shareholders either in person or by proxy at the Meeting.

As of the close of business on April 12, 2016, there were 109,316,773 Progressive common shares outstanding. In connection with the completion of the Merger, Progressive currently estimates that it will issue or reserve for issuance approximately 257,700,124 Progressive common shares (124,082,622 Progressive common shares if the Consolidation is effected) (equal to approximately 233% of the number of Progressive common shares currently outstanding on a fully-diluted basis), including approximately: (a) 255,025,907 Progressive common shares (122,794,986 Progressive common shares if the Consolidation is effected) issuable in exchange for the cancellation of 122,794,986 shares of Waste Connections common stock (equal to approximately 231% of the number of Progressive common shares currently outstanding on a fully-diluted basis) pursuant to the Merger; and (b) 2,674,217 Progressive common shares (1,287,636 Progressive common shares if the Consolidation is effected) reserved for issuance in respect of certain outstanding stock-based awards of Waste Connections that Progressive has agreed to assume pursuant to the Merger Agreement (equal to approximately 2% of the number of Progressive common shares currently outstanding on a fully-diluted basis). In addition, in connection with the adoption of the New Incentive Plan, Progressive will reserve for issuance 10,384,215 Progressive common shares (5,000,000 Progressive common shares if the Consolidation is effected) on the exercise or settlement of equity incentive awards that may be issued from time to time under the New Incentive Plan.

The Record Date and Progressive Common Shares Entitled to Vote

The record date for determining Progressive shareholders entitled to receive notice of and to vote at the Meeting is April 15, 2016 (the "Record Date"). Only Progressive shareholders of record as of the close of business (5:00 p.m. (Eastern Time)) on the Record Date are entitled to receive notice of and to vote at the Meeting.

As of the close of business on April 12, 2016, a total of approximately 109,316,773 Progressive common shares were outstanding. Each outstanding Progressive common share on the Record Date is entitled to one vote on each resolution and any other matter properly coming before the Meeting.

See "General Information Concerning the Meeting and Voting".

Progressive Waste Solutions Ltd.

400 Applewood Crescent, 2nd Floor

Vaughan, Ontario L4K 0C3

Telephone: (905) 532-7510

Progressive is one of North America's largest full-service waste management companies, providing waste collection, recycling and disposal services to commercial, industrial, municipal and residential customers in 14 U.S. states, the District of Columbia and in six Canadian provinces. Progressive serves its customers using a

6

vertically integrated suite of collection and disposal assets. Progressive benefits from its longstanding relationships with many of its commercial, industrial and residential customers, which provide a high degree of stability for its business.

Progressive was formed by the mergers of several long-established waste services companies. In 2010, the company acquired Waste Services Inc., with operations throughout Canada and the U.S. Southeast, to become one of the largest non-hazardous solid waste services companies in North America. The overall parent corporation changed its name to Progressive Waste Solutions Ltd. in May 2011. Progressive common shares are listed on the NYSE and the TSX under the symbol "BIN".

c/o Progressive Waste Solutions Ltd.

400 Applewood Crescent, 2nd Floor

Vaughan, Ontario L4K 0C3

Telephone: (905) 532-7510

Merger Sub is a Delaware limited liability company and currently a wholly-owned subsidiary of Progressive. Merger Sub was incorporated on January 14, 2016 for the purposes of effecting the Merger. To date, Merger Sub has not conducted any activities other than those incidental to its formation, the execution of the Merger Agreement, and the preparation of applicable filings under U.S. securities laws and regulatory filings made in connection with the proposed transaction.

3 Waterway Square Place, Suite 110

The Woodlands, Texas 77380

Telephone: (832) 442-2200