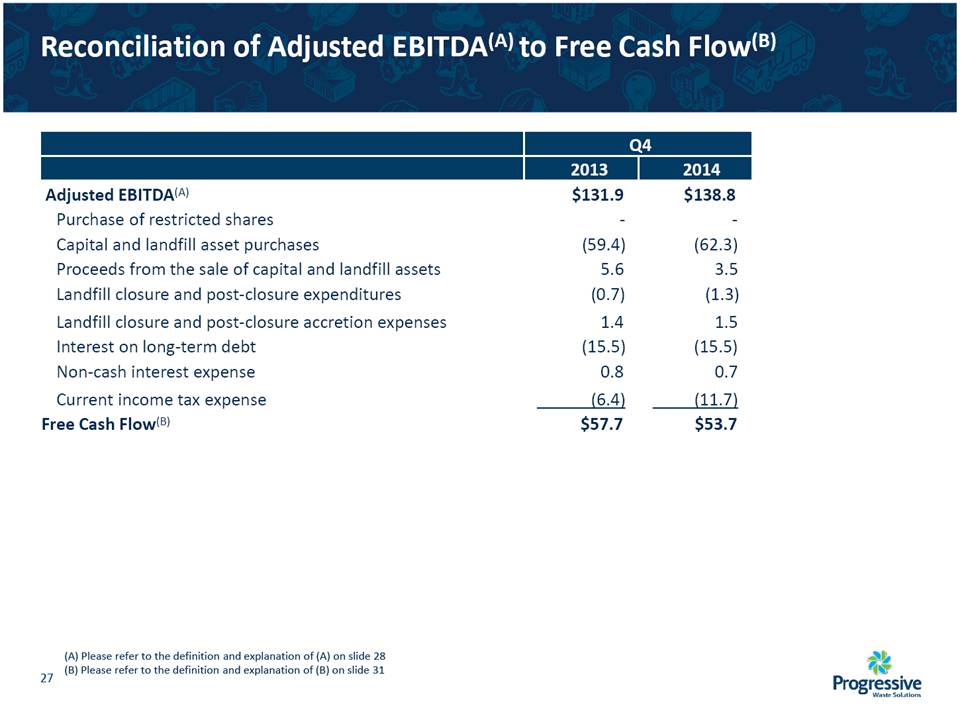

| Non-GAAP Disclosure (A) All references to “Adjusted EBITDA” in this document are to revenues less operating expense and SG&A, excluding certain SG&A expenses, on the consolidated statement of operations and comprehensive income or loss. Adjusted EBITDA excludes some or all of the following: certain SG&A expenses, restructuring expenses, goodwill impairment, amortization, net gain or loss on sale of capital and landfill assets, interest on long-term debt, net foreign exchange gain or loss, net gain or loss on financial instruments, loss on extinguishment of debt, re-measurement gain on previously held equity investment, other expenses, income taxes and income or loss from equity accounted investee. Adjusted EBITDA is a term used by us that does not have a standardized meaning prescribed by U.S. GAAP and is therefore unlikely to be comparable to similar measures used by other companies. Adjusted EBITDA is a measure of our operating profitability, and by definition, excludes certain items as detailed above. These items are viewed by us as either non-cash (in the case of goodwill impairment, amortization, net gain or loss on sale of capital and landfill assets, net foreign exchange gain or loss, net gain or loss on financial instruments, loss on extinguishment of debt, re-measurement gain on previously held equity investment, deferred income taxes and net income or loss from equity accounted investee) or non-operating (in the case of certain SG&A expenses, restructuring expenses, interest on long-term debt, other expenses, and current income taxes). Adjusted EBITDA is a useful financial and operating metric for us, our Board of Directors, and our lenders, as it represents a starting point in the determination of free cash flow(B). The underlying reasons for the exclusion of each item are as follows: Certain SG&A expenses – SG&A expense includes certain non-operating or non-recurring expenses. Non-operating expenses include transaction costs or recoveries related to acquisitions, fair value adjustments attributable to stock options and restricted share expense. Non-recurring expenses include certain equity based compensation amounts, payments made to certain senior management on their departure and other non-recurring expenses from time-to-time. These expenses are not considered an expense indicative of continuing operations. Certain SG&A costs represent a different class of expense than those included in adjusted EBITDA. Restructuring expenses – restructuring expenses includes costs to integrate certain operating locations with our own, exiting certain property and building and office leases, employee severance and employee relocation costs. These expenses are not considered an expense indicative of continuing operations. Accordingly, restructuring expenses represent a different class of expense than those included in adjusted EBITDA. Goodwill impairment – as a non-cash item goodwill impairment has no impact on the determination of free cash flow(B) and is not indicative of our operating profitability. Amortization – as a non-cash item amortization has no impact on the determination of free cash flow(B) and is not indicative of our operating profitability. Net gain or loss on sale of capital and landfill assets – as a non-cash item the net gain or loss on sale of capital and landfill assets has no impact on the determination of free cash flow(B). In addition, the sale of capital and landfill assets does not reflect a primary operating activity and therefore represents a different class of income or expense than those included in adjusted EBITDA. Interest on long-term debt – interest on long-term debt reflects our debt/equity mix, interest rates and borrowing position from time to time. Accordingly, interest on long-term debt reflects our treasury/financing activities and represents a different class of expense than those included in adjusted EBITDA. Net foreign exchange gain or loss – as non-cash items, foreign exchange gains or losses have no impact on the determination of free cash flow(B) and is not indicative of our operating profitability. Net gain or loss on financial instruments – as non-cash items, gains or losses on financial instruments have no impact on the determination of free cash flow(B) and is not indicative of our operating profitability. |