Exhibit 99.1

Investor Presentation June 2019

2 SAFE HARBOR STATEMENT This document contains forward - looking statements within the meaning of the safe harbor provisions of the U . S . Private Securities Litigation Reform Act of 1995 (“PSLRA”), including “forward - looking information” within the meaning of applicable Canadian securities laws . These forward - looking statements are neither historical facts nor assurances of future performance and reflect Waste Connections’ current beliefs and expectations regarding future events and operating performance . These forward - looking statements are often identified by the words “may,” “might,” “believes,” “thinks,” “expects,” ”estimate,” “continue,” “intends” or other words of similar meaning . All of the forward - looking statements included in this document are made pursuant to the safe harbor provisions of the PSLRA and applicable securities laws in Canada . Forward - looking statements involve risks and uncertainties . Forward - looking statements in this document include, but are not limited to, statements about expected financial results, outlook and related assumptions, potential acquisition activity and return of capital to shareholders . Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward - looking statements include, but are not limited to, risk factors detailed from time to time in the Company’s filings with the U . S . Securities and Exchange Commission and the securities commissions or similar regulatory authorities in Canada . You should not place undue reliance on forward - looking statements, which speak only as of the date of this document . Waste Connections undertakes no obligation to update the forward - looking statements set forth in this document, whether as a result of new information, future events, or otherwise, unless required by applicable securities laws .

3 WCN: INVESTMENT HIGHLIGHTS Third largest solid waste company in North America ~$28 billion enterprise value; ~$13 billion assets ; over 16,000 employees Differentiated strategy…Differentiated results Only company focused on secondary and exclusive markets Sector - leading EBITDA and free cash flow margins Sector - leading conversion of EBITDA to free cash flow Well positioned for additional strategic growth opportunities Very active current M&A environment Proven management team creating substantial shareholder value Approximately 1.5x the average shareholder return of WM and RSG, over 2x the S&P 500, and over 5x the return of the TSX60 over the past decade 2018 was our 15 th consecutive year of positive shareholder returns Increasing return of capital to shareholders Annual double - digit percentage dividend increases plus opportunistic share repurchases

4 KEYS TO SUCCESS…WHAT WE BELIEVE Solid waste is a commodity business Lowest price provider wins Basic level of service expectation by customers Private companies in competitive markets often dictate collection margins Success is driven by: Market selection => determines sustainability and direction of returns Asset and contractual positioning => facilitates pricing growth/retention Execution at the local level Free cash flow drives value creation The company that wins with Human Capital, delivers over the long term Culture Matters

5 TARGETING ATTRACTIVE MARKETS Integrated Operations Non - Integrated Operations Exclusive Markets: #1 EBITDA margin #1 EBIT margin #1 FCF margin #1 ROA #3 EBITDA margin #2(tie) EBIT margin #2 FCF margin #2 ROA Competitive Markets: #2 EBITDA margin #2(tie) EBIT margin #3 FCF margin #3 ROA #4 EBITDA margin #4 EBIT margin #4 FCF margin #4 ROA Note: Rankings reflect relative attractiveness to WCN Attractive if High Mkt Share & Disposal Neutral

6 OUR DIFFERENTIATED STRATEGY Exclusive solid waste markets Vertically integrated, or Non - integrated Competitive solid waste markets Secondary markets with High collection market share and Vertically integrated or disposal neutral Niche opportunities E&P waste => disposal - oriented business; well - positioned assets in active oil/gas basins Strategic approach to segments of urban markets => drive results in line with secondary markets

7 STRATEGIC IMPLICATIONS Consistent pricing Lower customer churn rates Comparably better core price + volume growth Higher EBITDA and EBIT margins Strong conversion of EBITDA to free cash flow Attractive returns on invested capital Our success: not dependent on behavior or execution of other national players Our strategy: resilient in a weak economy; levered to improving economy

8 REVENUE MIX: ~85% US & ~15% CANADA

9 WCN: FINANCIAL HIGHLIGHTS * A Non-GAAP measure; see appendix for reconciliation tables. 2019e based on February 2019 outlook. $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2016 2017 2018 2019e $ Millions Revenue 44.0% 48.0% 52.0% 56.0% 60.0% $600 $1,000 $1,400 $1,800 2016 2017 2018 2019e $ Millions Adjusted EBITDA and EBITDA - FCF Conversion * EBITDA FCF as % of EBITDA 15.5% 16.0% 16.5% 17.0% 17.5% 18.0% 18.5% 19.0% $200 $400 $600 $800 $1,000 2016 2017 2018 2019e $ Millions Adjusted Free Cash Flow * FCF FCF as % of Revenue

10 WCN: 10 - YEAR OUTPERFORMANCE ____________ A s of 4/30/19. 166% 181% 108% 455% 316% 511% 138% 759% 0 100 200 300 400 500 600 700 800 900 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 WCN WM RSG S&P 500 S&P/TSX Composite Index

11 FINANCIAL DISCUSSION

12 2019 OUTLOOK (as of February 13 th ) Revenue: $5.310 billion Solid w aste organic price + volume growth Price: 4.5%, in line with 2018; Volume: down 0.5%, with underlying flat Recycling: commodity values assumed in the range of current lev els E&P Waste Activity: assumed in line with 2018 Net income attributable to Waste Connections: $636.0 million Adjusted EBITDA: $1.705 billion, or 32.1% of revenue Up 30 bps YoY (up 65 bps net of rollover M&A impact) Net cash provided by operating activities: $1.525 billion Adjusted Free Cash Flow: $950 million ~17.9% of revenue and over 55% of EBITDA Expect double - digit adjusted free cash f low p er s hare growth in 2019 Any increases in volumes, E&P waste activity or acquisitions drive further growth

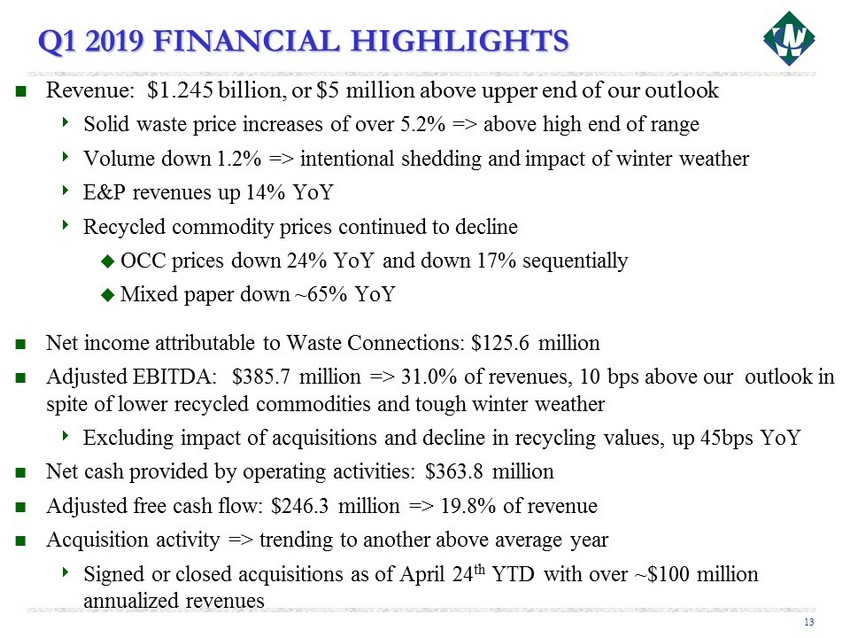

13 Q1 2019 FINANCIAL HIGHLIGHTS Revenue: $1.245 billion, or $5 million above upper end of our outlook Solid waste price increases of over 5.2% => above high end of range Volume down 1.2% => intentional shedding and impact of winter weather E&P revenues up 14% YoY Recycled commodity prices continued to decline OCC prices down 2 4% YoY and down 17% sequentially Mixed paper down ~65% YoY Net income attributable to Waste Connections: $125.6 million Adjusted EBITDA: $385.7 million => 31.0% of revenues, 10 bps above our outlook in spite of lower recycled commodities and tough winter weather Excluding impact of acquisitions and decline in recycling values, up 45bps YoY Net cash provided by operating activities: $363.8 million Adjusted free c ash flow : $246.3 million => 19.8% of revenue Acquisition activity => trending to another above average year Signed or closed acquisitions as of April 24 th YTD with over ~$100 million annualized revenues

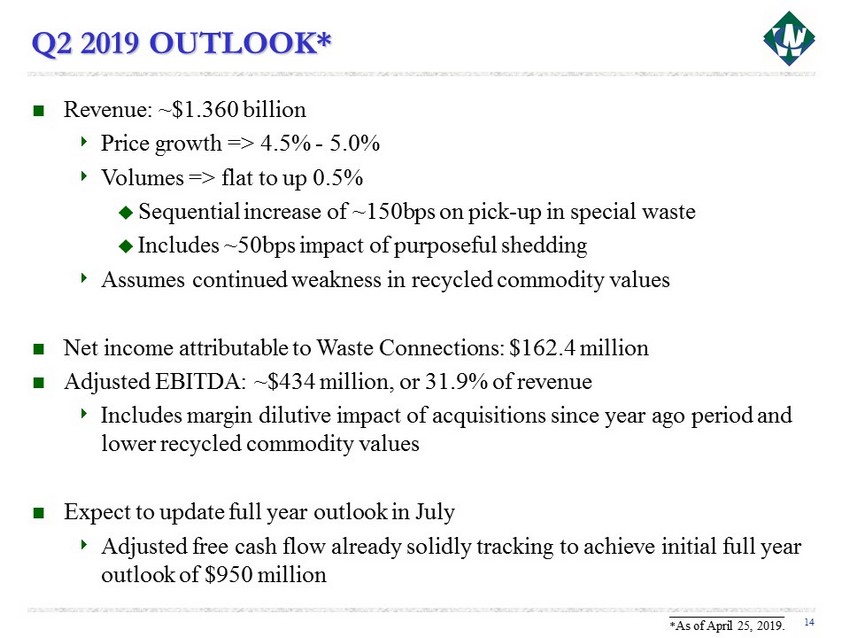

14 Q2 2019 OUTLOOK* Revenue: ~$ 1.360 billion Price growth => 4.5% - 5.0% Volumes => flat to up 0.5% Sequential increase of ~150bps on pick - up in special waste Includes ~50bps impact of purposeful shedding Assumes continued weakness in recycled commodity values Net income attributable to Waste Connections: $162.4 million Adjusted EBITDA: ~$434 million, or 31.9% of revenue Includes margin dilutive impact of acquisitions since year ago period and lower recycled commodity values Expect to update full year outlook in July Adjusted free cash flow already solidly tracking to achieve initial full year outlook of $950 million ___________________ * As of April 25, 2019.

15 CURRENT OBSERVATIONS* Continued strength in solid waste Price growth => at or above upper end of outlook Volumes => sequential improvement driving positive reported volumes Ongoing reductions in high margin commodity - linked revenues expected to impact Q2 - Q4 results Additional 30% erosion in recycled commodity values during Q2 driving YoY declines of 40% - 50% => incremental ~$5mm EBITDA headwind per quarter ~10% reduction in rig count since year end => incremental $3mm - $5mm EBITDA headwind per quarter from slowdown in E&P waste activity Contribution from acquisitions expected to offset headwinds mostly during 2H ‘19 EBITDA offset from comparatively lower margin revenue => impacts EBITDA margins on a reported basis 2H ‘19 EBITDA contributions expected to offset potential Q2 impact __________________ * As of June 3, 2019.

16 NON - GAAP RECONCILIATION SCHEDULES

Adjusted EBITDA* 2016 2017 2018 Q119 Q219e** 2019e** Net income (loss) attributable to Waste Connections 246,540 576,817 546,871 125,622 162,400 636,000 Plus: Net income attributable to noncontrolling interests 781 603 283 (45) 200 1,000 Plus/less: Income tax provision (benefit) 114,044 (68,910) 159,986 27,968 45,900 201,000 Plus: Interest Expense 92,709 125,297 132,104 37,287 36,000 134,000 Less: Interest Income (602) (5,173) (7,170) (3,311) Plus: Depreciation and Amortization 463,912 632,484 680,487 177,389 186,000 720,000 Plus: Closure and post-closure accretion 8,936 11,781 12,997 3,490 3,500 13,000 Plus: Impairments and other operating items 27,678 156,493 20,118 16,112 Less/plus: Other expense (income), net (53) (3,736) (1,263) (2,558) Plus/less: Foreign currency transaction loss (gain) (1,121) 2,200 1,433 (103) Adjustments: Plus: Transaction-related expenses 47,842 5,700 8,607 837 Plus: Fair value changes to equity awards 14,289 16,357 9,205 3,021 Plus: Integration-related and other expenses 44,336 10,612 2,760 Plus: Synergy bonus 11,798 Adjusted EBITDA* 1,071,089 1,460,525 1,566,418 385,709 434,000 1,705,000 Revenues 3,375,863 4,630,488 4,922,941 1,244,637 1,360,000 5,310,000 Adjusted EBITDA* as % of Revenues 31.7% 31.5% 31.8% 31.0% 31.9% 32.1% **2019e based on February 2019 outlook; Q219e based on April outlook. *Adjusted EBITDA, a non-GAAP financial measure, is provided supplementally because it is widely used by investors as a performance and valuation measure in the solid waste industry. Other companies may calculate differently. NON-GAAP RECONCILIATION SCHEDULE (in thousands, except share and per share amounts)

Adjusted Free Cash Flow* 2016 2017 2018 2019e** Net cash provided by operating activities 795,312 1,187,260 1,411,235 1,525,000 Plus/less: Change in book overdraft (1,305) 8,241 (839) Plus: Proceeds from disposal of assets 4,604 28,432 5,385 Plus: Excess tax benefit associated with equity-based compensation 5,196 Less: Capital Expenditures (344,723) (479,287) (546,145) (575,000) Less: Distributions to noncontrolling interests (3) (103) Adjustments: Payment of contingent consideration recorded in earnings 493 10,012 11 Cash received for divestitures (21,100) (2,030) Transaction-related expenses 45,228 5,700 8,607 Integration-related and other expenses 82,526 10,602 2,760 Pre-existing Progressive Waste share-based grants 17,037 5,772 Synergy Bonus 11,798 Tax Effect (36,384) (14,804) (4,752) Adjusted Free Cash Flow* 550,944 763,891 879,901 950,000 Revenues 3,375,863 4,630,488 4,922,941 5,310,000 Adjusted EBITDA * 1,071,089 1,460,525 1,566,418 1,705,000 Adjusted Free Cash Flow* as % of Revenues 16.3% 16.5% 17.9% 17.9% Adjusted Free Cash Flow* as % of Adjusted EBITDA* 51.4% 52.3% 56.2% 55.7% Diluted shares outstanding 231,081,497 264,302,411 264,395,618 264,500,000 **2019e based on February 2019 outlook *Adjusted free cash flow, free cash flow as % of revenue and adjusted EBITDA, non-GAAP financial measures, are provided supplementally because they are widely used by investors as valuation and liquidity measures. Other companies may calculate these metrics differently. NON-GAAP RECONCILIATION SCHEDULE (in thousands, except share and per share amounts)

PRINCIPAL ADMINISTRATIVE OFFICES 3 Waterway Square Place, Suite 110 The Woodlands, TX 77380 (832) 442 - 2200 http://wasteconnections.investorroom.com INVESTOR RELATIONS Mary Anne Whitney, SVP CFO Phone: (832) 442 - 2253 maryannew@wasteconnections.com