| CITIGROUP FUNDING INC. | November 28, 2012 Medium-Term Notes, Series D Pricing Supplement No. 2012-MTNDG0317 (to Underlying Supplement No. 1 dated May 23, 2012, Prospectus Supplement dated May 12, 2011 and Prospectus dated May 12, 2011) Registration Statement Nos. 333-172554 and 333-172554-01 Filed pursuant to Rule 424(b)(2) |

STRUCTURED INVESTMENTS

Autocallable Contingent Coupon Equity Linked Securities

Based on the S&P 500® Index due December 1, 2017

$1,000 per Security

Any Payments Due from Citigroup Funding Inc. Fully and Unconditionally Guaranteed by Citigroup Inc.

| · | The securities will mature on December 1, 2017, subject to automatic early redemption. |

| · | The stated principal amount and issue price will be $1,000 per security. |

| · | Unlike conventional debt securities, the securities do not provide for repayment of the stated principal amount at maturity in all circumstances, do not provide for fixed payments of interest and are subject to automatic early redemption on a quarterly basis beginning November 28, 2014. The payments on the securities, including your payment at maturity (if the securities are not earlier redeemed) and any coupon payments on the securities, and whether the securities are automatically redeemed, all depend on the performance of the S&P 500® Index, which we refer to as the “underlying index.” |

| · | Contingent coupon. On each quarterly contingent coupon payment date, unless previously redeemed, the securities will pay a contingent coupon equal to 1.25% of the stated principal amount of the securities (equal to an annualized rate of 5.00%) if and only if the closing level of the underlying index on the related valuation date is greater than or equal to the downside threshold level. If the closing level of the underlying index on any quarterly valuation date is less than the downside threshold level, you will not receive any contingent coupon payment on the related contingent coupon payment date, and if the closing level of the underlying index is less than the downside threshold level on all twenty quarterly valuation dates, you will not receive any contingent coupon payments over the term of the securities. |

| · | Automatic early redemption. If the closing level of the underlying index is greater than or equal to the initial index level on any valuation date occurring on or after November 28, 2014, the securities will be automatically redeemed on the related contingent coupon payment date for an amount in cash per security equal to $1,000 plus the related contingent coupon payment. In that case, you will not receive any additional contingent coupon payments following the redemption. The securities are not subject to automatic early redemption prior to the contingent coupon payment date related to the valuation date occurring on November 28, 2014. |

| · | Payment at maturity. If the securities are not automatically redeemed prior to maturity, your payment at maturity, for each security you then hold, will be an amount in cash equal to: |

| | o | If the final index level is greater than or equal to the downside threshold level: $1,000 plus the contingent coupon payment due at maturity. |

| | o | If the final index level is less than the downside threshold level: the product of (i) $1,000 and (ii) the final index level divided by the initial index level. |

If the final index level is less than the downside threshold level, your payment at maturity will be less, and possibly significantly less, than $800 per security and you will not receive any contingent coupon payment at maturity.

| · | The “final index level” will equal the closing level of the underlying index on the final valuation date. |

| · | The “downside threshold level” equals 1,127.944, 80% of the initial index level. |

| · | The “initial index level” equals 1,409.93, the closing level of the underlying index on the pricing date. |

| · | The “pricing date” is November 28, 2012, the date on which the securities priced for initial sale to the public. |

| · | The “valuation dates” are the 28th of each February, May, August and November, beginning on February 28, 2013 and ending on November 28, 2017 (the “final valuation date”), subject to postponement for non-scheduled trading days and certain market disruption events. |

| · | The “contingent coupon payment date” for any valuation date will be the third business day after such valuation date, except that the contingent coupon payment date for the final valuation date will be the maturity date. |

| · | Any return on the securities will be limited to the sum of your contingent coupon payments, if any. Investors in the securities will not receive any dividend yield on the stocks included in the underlying index or share in any appreciation of the underlying index over the term of the securities, but investors will bear the full downside risk of the underlying index if the final index level is less than the downside threshold level. If the securities are automatically redeemed, the term of the securities may be limited to as short as two years and you will not receive any contingent coupon for any subsequent valuation date. |

| · | All payments on the securities are subject to the credit risk of Citigroup Inc. |

| · | The securities will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not invest in the securities unless you are willing to hold them to maturity. |

| · | The CUSIP for the securities is 1730T0ZK8. The ISIN for the securities is US1730T0ZK86. |

Investing in the securities involves risks not associated with an investment in conventional debt securities. See “Risk Factors” beginning on page PS-3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this pricing supplement or the accompanying underlying supplement, prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The securities are not deposits or savings accounts but are unsecured debt obligations of Citigroup Funding Inc. The securities are not insured or guaranteed by the Federal Deposit Insurance Corporation or by any other governmental agency or instrumentality.

| | | | | | | |

| Public Offering Price | | $ | 1,000.00 | | | $ | 1,567,000 | |

Underwriting Fee(1) | | $ | 25.00 | | | $ | 39,175 | |

Proceeds to Citigroup Funding Inc. (2) | | $ | 975.00 | | | $ | 1,527,825 | |

(1) Citigroup Global Markets Inc., an affiliate of Citigroup Funding Inc. and the underwriter of the sale of the securities, is acting as principal and will receive an underwriting fee of up to $25.00 for each $1,000 security sold in this offering. The actual underwriting fee per security will be equal to $25.00 for each security sold by Citigroup Global Markets Inc. directly to the public and will otherwise be equal to the selling concession provided to selected dealers, as described in this paragraph. Selected dealers not affiliated with Citigroup Global Markets Inc. will receive a selling concession of up to $25.00 for each security they sell. Certain broker-dealers affiliated with Citigroup Global Markets Inc., including Citi International Financial Services, Citigroup Global Markets Singapore Pte. Ltd. and Citigroup Global Markets Asia Limited, will receive a fixed selling concession, and financial advisors employed by such affiliated broker-dealers will receive a fixed sales commission, of $25.00 for each $1,000 security they sell. Citigroup Global Markets Inc. will pay the registered representatives of Citigroup Global Markets Inc. a sales commission of $25.00 for each $1,000 security they sell. Additionally, it is possible that Citigroup Global Markets Inc. and its affiliates may profit from expected hedging activity related to this offering, even if the value of the securities declines. You should refer to “Risk Factors” and “Plan of Distribution; Conflicts of Interest” in this pricing supplement for more information.

(2) The per security proceeds to Citigroup Funding Inc. indicated above represent the minimum per security proceeds to Citigroup Funding Inc. for any security, assuming the maximum per security underwriting fee of $25.00. As noted in footnote (1), the underwriting fee is variable. The total proceeds to Citigroup Funding Inc. shown above gives effect to the actual amount of this variable underwriting fee. You should refer to “Risk Factors” and “Plan of Distribution; Conflicts of Interest” in this pricing supplement for more information.

Citigroup Global Markets Inc. expects to deliver the securities to purchasers on or about December 3, 2012.

| Investment Products | Not FDIC Insured | May Lose Value | No Bank Guarantee |

| Final Terms |

| Issuer: | Citigroup Funding Inc. (“Citigroup Funding”) |

| Guarantee: | Any payments due on the securities are fully and unconditionally guaranteed by Citigroup Inc., Citigroup Funding’s parent company; however, because the securities are not principal protected, you may lose the entire stated principal amount of your securities. |

| Securities: | Autocallable Contingent Coupon Equity Linked Securities Based on the S&P 500® Index due December 1, 2017 |

| Underlying index: | S&P 500® Index |

| Issue price: | $1,000 per security |

| Stated principal amount: | $1,000 per security |

| Aggregate stated principal amount: | $1,567,000 |

| Pricing date: | November 28, 2012 |

| Issue date: | December 3, 2012 |

| Valuation dates: | The 28th of each February, May, August and November, beginning on February 28, 2013 and ending on November 28, 2017 (the “final valuation date”), subject to postponement for non-scheduled trading days and certain market disruption events. |

| Maturity date: | December 1, 2017 |

| Contingent coupon: | On each quarterly contingent coupon payment date, unless previously redeemed, the securities will pay a contingent coupon equal to 1.25% of the stated principal amount of the securities (equal to an annualized rate of 5.00%) if and only if the closing level of the underlying index on the related valuation date is greater than or equal to the downside threshold level. If the closing level of the underlying index on any quarterly valuation date is less than the downside threshold level, you will not receive any contingent coupon payment on the related contingent coupon payment date, and if the closing level of the underlying index is less than the downside threshold level on all twenty quarterly valuation dates, you will not receive any contingent coupon payments over the term of the securities. |

| Contingent coupon payment dates: | The contingent coupon payment date for any valuation date will be the third business day after such valuation date, except that the contingent coupon payment date for the final valuation date will be the maturity date. |

| Automatic early redemption: | If the closing level of the underlying index is greater than or equal to the initial index level on any valuation date occurring on or after November 28, 2014, the securities will be automatically redeemed on the related contingent coupon payment date for an amount in cash per security equal to $1,000 plus the related contingent coupon payment. In that case, you will not receive any additional contingent coupon payments following the redemption. The securities are not subject to automatic early redemption prior to the contingent coupon payment date related to the valuation date occurring on November 28, 2014. |

| Payment at maturity: | If the securities are not automatically redeemed prior to maturity, your payment at maturity, for each security you then hold, will be an amount in cash equal to: · If the final index level is greater than or equal to the downside threshold level: $1,000 + the contingent coupon payment due at maturity · If the final index level is less than the downside threshold level: $1,000 × (the final index level / the initial index level) If the final index level is less than the downside threshold level, your payment at maturity will be less, and possibly significantly less, than $800 per security and you will not receive any contingent coupon payment at maturity. |

| Initial index level: | 1,409.93, the closing level of the underlying index on the pricing date |

| Final index level: | The closing level of the underlying index on the final valuation date |

| Downside threshold level: | 1,127.944, 80% of the initial index level |

| Risk factors: | Please see “Risk Factors” beginning on page PS-3. |

| Clearing and settlement: | DTC |

| Listing: | The securities will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not invest in the securities unless you are willing to hold them to maturity. |

| Underlying index publisher: | S&P Dow Jones Indices LLC |

| Calculation agent: | Citigroup Global Markets Inc. (“Citigroup Global Markets”) |

| Trustee: | The Bank of New York Mellon (as successor trustee under an indenture dated June 1, 2005) |

| CUSIP / ISIN: | 1730T0ZK8 / US1730T0ZK86 |

RISK FACTORS

Because the terms of the securities differ from those of conventional debt securities, an investment in the securities entails significant risks not associated with an investment in conventional debt securities, including, among other things, fluctuations in the value of the underlying index and other events that are difficult to predict and beyond our control. You should read the risk factors below together with the risk factors contained in the section “Risk Factors” in the accompanying prospectus supplement and the description of risks relating to the underlying index contained in the section “Risk Factors” beginning on page 1 in the accompanying underlying supplement. You should also carefully read the risk factors included in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup Inc. more generally.

The securities do not guarantee return of any principal.

Unlike conventional debt securities, the securities do not provide for the full repayment of the stated principal amount in all circumstances. If the securities have not been automatically redeemed prior to maturity and if the final index level is less than the downside threshold level, you will lose 1% of the stated principal amount of your securities for every 1% by which the final index level is less than the initial index level. See “Hypothetical Examples of Amounts Payable on the Securities” below.

You will not receive any contingent coupon payment for any quarter in which the closing level of the underlying index is less than the downside threshold level on the related valuation date.

A contingent coupon payment will be made on a quarterly contingent coupon payment date if and only if the closing level of the underlying index on the related valuation date is greater than or equal to the downside threshold level. If the closing level of the underlying index is less than the downside threshold level on any valuation date, you will not receive any contingent coupon payment on the related contingent coupon payment date, and if the closing level of the underlying index remains below the downside threshold level on each valuation date over the term of the securities, you will not receive any contingent coupon payments over the term of the securities.

Your opportunity to receive any contingent coupon payments may be limited by the automatic early redemption feature or by a depreciation in the closing level of the underlying index below the downside threshold level.

The securities will generate their maximum potential total return if the closing level of the underlying index is less than the initial index level on each of the first nineteen quarterly valuation dates, but is not less than the initial index level by more than 20% on any of the twenty valuation dates. In this scenario, the securities will pay a contingent coupon on each of the twenty quarterly contingent coupon payment dates and you will be repaid your stated principal amount at maturity. In all other scenarios, you will not receive a contingent coupon on each of the contingent coupon payment dates, because either the underlying index has appreciated causing an automatic early redemption or has depreciated below the downside threshold level. Additionally, if at maturity the closing level of the underlying index has depreciated below the downside threshold level, you will lose 1% of the stated principal amount of your securities for every 1% by which the final index level is less than the initial index level.

For example, if the closing level of the underlying index is greater than or equal to the initial index level on any of the valuation dates occurring on or after November 28, 2014, the securities will be automatically redeemed on the related contingent coupon payment date. If the securities are redeemed early, you will not receive any additional contingent coupon payments after the redemption and may not be able to reinvest your funds in another investment that offers comparable terms or returns. The term of your investment in the securities may be limited to as short as two years by the automatic early redemption feature of the securities and your return on your securities will be limited to the sum of your contingent coupon payments paid on the first eight contingent coupon payment dates. If the underlying index depreciates by more than 20% from the pricing date to any of the quarterly valuation dates, you will not receive any contingent coupon payment on the related contingent coupon payment date.

The securities may be adversely affected by volatility in the closing level of the underlying index.

If the closing level of the underlying index is volatile, or if the volatility of the underlying index increases over the term of the securities, it is more likely that you will not receive one or more contingent coupon payments or will not receive the full stated principal amount of the securities at maturity. This is because greater volatility in the closing level of the underlying index is associated with a greater likelihood that the closing level of the

underlying index will be less than the downside threshold level on one or more valuation dates. You should understand that, in general, the higher the contingent coupon rate determined on the pricing date, the greater the expected likelihood as of the pricing date that the closing level of the underlying index will be less than the downside threshold level on one or more valuation dates, such that you would not receive one or more contingent coupon payments or the full stated principal amount of the securities at maturity.

Volatility refers to the magnitude and frequency of changes in the level of the underlying index over any given period. Although the underlying index may theoretically experience volatility in either a positive or a negative direction, the level of the underlying index is much more likely to decline as a result of volatility than to increase.

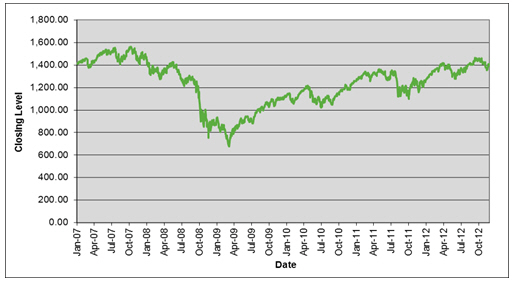

Historically, the level of the underlying index has been volatile. From January 3, 2007 to November 28, 2012, the closing level of the underlying index has been as low as 676.53 and as high as 1,565.15.

The performance of the securities will depend on the closing level of the underlying index solely on the relevant valuation dates, which makes the securities particularly sensitive to volatility of the underlying index.

The performance of the securities—including the payments on the securities and whether the securities are automatically called prior to maturity—will depend on the closing level of the underlying index on only twenty dates (or fewer, if the securities are automatically redeemed prior to maturity). Whether the contingent coupon will be paid for any given quarter will depend solely on the closing level of the underlying index on the related valuation date, and if the securities are not earlier redeemed, your payment at maturity will depend solely on the closing level of the underlying index on the final valuation date. You will not receive the contingent coupon payment for a given quarter and you will not receive the full stated principal amount of your securities at maturity if the closing level of the underlying index on the related valuation date is less than the downside threshold level, even if the closing level of the underlying index is greater than the downside threshold level on other days during the term of the securities. Moreover, your securities will be automatically redeemed prior to maturity if the closing level of the underlying index is greater than or equal to the initial index level on any of the valuation dates occurring on or after November 28, 2014, even if the closing level of the underlying index is less than the initial index level on other days during the term of the securities.

Because the performance of the securities depends on the closing level of the underlying index on twenty or fewer dates, the securities will be particularly sensitive to volatility in the closing level of the underlying index. Even if the closing level of the underlying index does, in general, decline moderately over the term of the securities, the securities may nevertheless not perform as well as expected, and your investment may result in a loss, if volatility in the underlying index results in a closing level on a valuation date that deviates from the general trend. You should understand that the underlying index has historically been highly volatile.

You may be exposed to the full negative performance, but will not participate in any positive performance, of the underlying index.

Even though you will be subject to the risk of a decline in the level of the underlying index, you will not participate in any appreciation in the level of the underlying index over the term of the securities. Your maximum possible return on the securities will be limited to the sum of the contingent coupon payments you receive, if any. Consequently, your return on the securities may be significantly less than the return you could achieve on an alternative investment that provides for participation in the appreciation of the underlying index. You should not invest in the securities if you seek to participate in any appreciation of the underlying index.

The securities are subject to the credit risk of Citigroup Inc., and any actual or anticipated changes to its credit ratings or credit spreads may adversely affect the value of the securities.

You are subject to the credit risk of Citigroup Inc., Citigroup Funding’s parent company and the guarantor of any payments due on the securities. The securities are not guaranteed by any entity other than Citigroup Inc. If we default on our obligations and Citigroup Inc. defaults on its guarantee obligations under the securities, your investment would be at risk and you could lose some or all of your investment. As a result, the value of the securities prior to maturity will be affected by changes in the market’s view of Citigroup Inc.’s creditworthiness. Any decline, or anticipated decline, in Citigroup Inc.’s credit ratings or increase, or anticipated increase, in the credit spreads charged by the market for taking Citigroup Inc. credit risk is likely to adversely affect the value of the securities.

The securities will not be listed on any securities exchange and you may not be able to sell your securities prior to maturity.

The securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities.

Citigroup Global Markets intends to make a secondary market in relation to the securities and to provide an indicative bid price on a daily basis. Any indicative bid prices provided by Citigroup Global Markets shall be determined in Citigroup Global Markets’ sole discretion, taking into account prevailing market conditions, and shall not be a representation by Citigroup Global Markets that any instrument can be purchased or sold at such prices (or at all).

Notwithstanding the above, Citigroup Global Markets may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. Consequently, there may be no market for the securities and investors should not assume that such a market will exist. Accordingly, an investor must be prepared to hold the securities until the maturity date. Where a market does exist, to the extent that an investor wants to sell the securities, the price may, or may not, be at a discount from the stated principal amount.

The inclusion of underwriting fees and projected profit from hedging in the issue price is likely to adversely affect secondary market prices.

Assuming no change in market conditions or any other relevant factors, the price, if any, at which Citigroup Global Markets may be willing to purchase the securities in secondary market transactions will likely be lower than the public offering price because the public offering price of the securities includes, and secondary market prices are likely to exclude, underwriting fees paid with respect to the securities, as well as the cost of hedging our obligations under the securities. The cost of hedging includes the projected profit that our affiliates may realize in consideration for assuming the risks inherent in managing the hedging transactions. Any secondary market price for the securities is also likely to be reduced by the costs of unwinding the related hedging transactions at the time of the secondary market transaction. Our affiliates may realize a profit from the expected hedging activity even if investors do not receive a favorable investment return under the terms of the securities or in any secondary market transaction. Any secondary market prices may differ from values determined by pricing models used by Citigroup Global Markets, as a result of dealer discounts, mark-ups or other transaction costs.

The value of the securities prior to maturity will fluctuate based on many unpredictable factors.

The value of the securities prior to maturity will fluctuate based on the closing level of the underlying index and a number of other factors, including those described below. Some of these factors are interrelated in complex ways. As a result, the effect of any one factor may be offset or magnified by the effect of another factor. The paragraphs below describe what we expect to be the impact on the value of the securities of a change in a specific factor, assuming all other conditions remain constant. You should understand that the value of your securities at any time prior to maturity may be significantly less than the stated principal amount.

Closing Level of the Underlying Index. We expect that the value of the securities at any time will depend substantially on the closing level of the underlying index at that time. If the closing level of the underlying index declines following the pricing date, the value of your securities, if any, will also likely decline, perhaps significantly. The closing level of the underlying index will be influenced by the value and volatility of the stocks that constitute the underlying index, as well as by complex and interrelated political, economic, financial and other factors that can affect the capital markets generally. Our, or our counterparties’, hedging activity, the issuance of other securities similar to the securities and trading and other activities by us, our affiliates or other market participants can also affect the closing level of the underlying index.

Volatility of the Underlying Index. If the expected volatility of the underlying index increases during the term of the securities, the value of the securities is likely to decrease because of a perceived increase in the likelihood that the closing level of the underlying index on any valuation date will be less than the downside threshold level.

Dividend Yield. If the dividend yield on the stocks included in the underlying index increases, we expect that the value of the securities may decrease. You will not be entitled to receive any dividends paid on the stocks included in the underlying index and any amounts you receive on the securities will generally not reflect the value of such dividend payments.

Interest Rates. We expect that the value of the securities will be affected by changes in U.S. interest rates. In general, if U.S. interest rates increase, the value of the securities may decrease.

Time Remaining to Maturity. At any given time, a portion of the value of the securities will be attributable to time value, which is based on the amount of time then remaining to maturity. If you sell the securities at any time prior to maturity, you will be giving up any increase in the time value of the securities that may result as the time remaining to maturity shortens.

Credit Ratings, Financial Condition and Results of Operations of Citigroup Funding and Citigroup Inc. Actual or anticipated changes in the financial condition or results of operations of Citigroup Inc. or the credit ratings, financial condition or results of operations of Citigroup Inc. or Citigroup Funding may affect the value of the securities. The securities are subject to the credit risk of Citigroup Inc., the guarantor of the payments due on the securities.

Investing in the securities is not equivalent to investing in the underlying index or the stocks included in the underlying index.

You will not have voting rights, rights to receive dividends or other distributions or any other rights with respect to the stocks included in the underlying index. As of November 28, 2012, the stocks included in the underlying index average a dividend yield of 2.19% per year, which, if this dividend yield remained constant for the term of the securities (and the securities were not redeemed prior to maturity), would be equivalent to 10.95% (calculated on a simple interest basis) over the term of the securities. However, it is impossible to predict whether the dividend yield over the term of the securities will be higher, lower or the same as this dividend yield or the average dividend yield during any other period. Moreover, because the return on the securities is limited to the sum of your contingent coupon payments, if any, even if the final index level greatly exceeds the initial index level, you will not share in any appreciation of the underlying index over the term of the securities. Accordingly, the securities are not a suitable investment for investors who are looking to receive returns that reflect the performance of the underlying index.

Our offering of the securities does not constitute a recommendation of the underlying index.

You should not take our offering of the securities as an expression of our views about how the underlying index will perform in the future or as a recommendation to invest in the underlying index, including through an investment in the securities. As we are part of a global financial institution, our affiliates may, and often do, have positions (including short positions) in the stocks included in the underlying index and/or other financial instruments related to the underlying index and/or stocks included in the underlying index that conflict with an investment in the securities. You should undertake an independent determination of whether an investment in the securities is suitable for you in light of your specific investment objectives, risk tolerance and financial resources.

Our affiliates may have published research, expressed opinions or provided recommendations that are inconsistent with investing in the securities and may do so in the future, and any such research, opinions or recommendations could adversely affect the closing level of the underlying index.

Citigroup Global Markets and other of our affiliates may publish research from time to time relating to the financial markets or the underlying index that may influence the closing level of the underlying index and the value of the securities. Citigroup Global Markets and other of our affiliates may have published or may publish research or other opinions that call into question the investment view implicit in an investment in the securities. Any research, opinions or recommendations expressed by such affiliates of ours may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the underlying index and the merits of investing in the securities.

The level of the underlying index and, therefore, the value of the securities may be affected by our or our affiliates’ hedging and other trading activities.

In anticipation of the sale of any issuance of the securities, we have hedged our obligations under the securities through certain affiliated or unaffiliated counterparties, who may take positions in stocks included in the underlying index and/or in instruments, such as options, swaps or futures, related to the underlying index and/or stocks included in the underlying index. We or our counterparties may also adjust this hedge during the term of the securities and close out or unwind this hedge on or before a valuation date, which may involve our counterparties purchasing or selling such stocks or instruments. This hedging activity on or prior to the pricing date could have potentially affected the level of the underlying index on the pricing date. Additionally, this hedging activity during the term of the securities, including on or near a

valuation date, could affect the level of the underlying index on such valuation date and, therefore, affect the likelihood of your receiving a contingent coupon payment or of the securities being automatically redeemed. This hedging activity may present a conflict of interest between your interest as a holder of the securities and the interests we and/or our counterparties, which may be our affiliates, have in executing, maintaining and adjusting hedging transactions. These hedging activities could also affect the price, if any, at which Citigroup Global Markets may be willing to purchase your securities in the secondary market.

Citigroup Global Markets and other of our affiliates may also trade in the stocks included in the underlying index and other financial instruments related to the underlying index and/or stocks included in the underlying index on a regular basis (taking long or short positions or both), for their accounts, for other accounts under their management or to facilitate transactions, including block transactions, on behalf of customers. As with our or our affiliates’ hedging activity, this trading activity could affect the level of the underlying index and, therefore, the performance of the securities.

It is possible that these hedging or trading activities could result in substantial returns for our affiliates while the value of the securities declines.

We and our affiliates may have economic interests that are adverse to those of the holders of the securities as a result of our affiliates’ business activities.

Our affiliates may currently or from time to time engage in business with the issuers of the stocks included in the underlying index. These activities may include extending loans to, making equity investments in or providing advisory services to such issuers, including merger and acquisition advisory services. In the course of this business, our affiliates may acquire non-public information about the issuers of the stocks included in the underlying index, and we will not disclose any such information to you. Any prospective purchaser of the securities should undertake an independent investigation of the underlying index as in its judgment is appropriate to make an informed decision with respect to an investment in the securities. We do not make any representation or warranty to any purchaser of the securities with respect to any matters whatsoever relating to our affiliates’ business with the issuers of the stocks included in the underlying index.

If any of our affiliates is or becomes a creditor of an issuer of the stocks included in the underlying index or otherwise enter into any transaction with such issuer in the course of our business, such affiliate may exercise remedies against that issuer without regard to the impact on your interests as a holder of the securities.

Additionally, we or one of our affiliates may serve as issuer, agent or underwriter for issuances of other securities or financial instruments with returns linked or related to changes in the level of the underlying index. To the extent that we or one of our affiliates does so, our or their interests with respect to these products may be adverse to those of the holders of the securities. By introducing competing products into the marketplace in this manner, we or one or more of our affiliates could adversely affect the value of the securities.

The historical performance of the underlying index is not an indication of the future performance of the underlying index.

The historical performance of the underlying index, which is included in this pricing supplement, should not be taken as an indication of the future performance of the underlying index during the term of the securities. Changes in the level of the underlying index will affect the value of the securities and the payments you will receive on the securities, but it is impossible to predict whether the level of the underlying index will fall or rise.

Adjustments to the underlying index could adversely affect the value of the securities.

The underlying index publisher may add, delete or substitute the stocks constituting the underlying index or make other methodological changes that could change the level of the underlying index. The underlying index publisher may also discontinue or suspend calculation or publication of the underlying index at any time. In this circumstance, the calculation agent will have the sole discretion to substitute a successor index that is comparable to the discontinued underlying index and is not precluded from considering indices that are calculated and published by the calculation agent or any of its affiliates.

You will have no rights against the underlying index publisher.

You will have no rights against the underlying index publisher, even though any contingent coupon payable to you and any amount you receive at maturity will depend on the closing level of the underlying index. The underlying index

publisher is not in any way involved in this offering and has no obligations relating to the securities or the holders of the securities.

The calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities.

As calculation agent, Citigroup Global Markets, our affiliate, will determine whether the closing level of the underlying index is less than the downside threshold level or greater than or equal to the initial index level on any valuation date, any contingent coupon payable to you, whether the securities are automatically redeemed and, if not, your payment at maturity. Determinations made by Citigroup Global Markets in its capacity as calculation agent, including with respect to the occurrence or non-occurrence of market disruption events, the selection of a successor index or calculation of the closing level of the underlying index in the event of the unavailability or discontinuance of the underlying index or the occurrence of a market disruption event, may adversely affect any amounts payable to you on the securities.

The U.S. federal tax consequences of an investment in the securities are unclear.

There is no direct legal authority regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities described herein. If the IRS were successful in asserting an alternative treatment for the securities, the tax consequences of ownership and disposition of the securities might be materially and adversely affected. As described below under “United States Federal Tax Considerations,” in 2007 the U.S. Treasury Department and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. While it is not clear whether the securities would be viewed as similar to the typical prepaid forward contract described in the notice, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, including the character and timing of income or loss and the degree, if any, to which income realized by non-U.S. persons should be subject to withholding tax, possibly with retroactive effect.

As described in this pricing supplement under “United States Federal Tax Considerations,” in connection with any information reporting requirements we may have in respect of the securities under applicable law, we intend (in the absence of an administrative determination or judicial ruling to the contrary) to treat a portion of each coupon payment as attributable to interest and the remainder to option premium. However, in light of the uncertain treatment of the securities, it is possible that other persons having withholding or information reporting responsibility in respect of the securities may treat a security differently, for instance, by treating the entire coupon payment as ordinary income at the time received or accrued by a holder and/or treating some or all of each coupon payment on a security as subject to withholding tax at a rate of 30%. If withholding tax applies to the securities, we will not be required to pay any additional amounts with respect to amounts so withheld. Both U.S. and non-U.S. persons considering an investment in the securities should review carefully the section of this pricing supplement entitled “United States Federal Tax Considerations” and consult their tax advisers regarding the U.S. federal tax consequences of an investment in the securities (including possible alternative treatments and the issues presented by the 2007 notice), as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

DESCRIPTION OF THE SECURITIES

You should read this pricing supplement together with the accompanying underling supplement, prospectus supplement and prospectus in connection with your investment in the Securities. The description in this pricing supplement of the particular terms of the Securities supplements, and, to the extent inconsistent with, replaces, the descriptions of the general terms and provisions of the debt securities set forth in the accompanying prospectus supplement and prospectus.

You may access the underlying supplement, prospectus supplement and prospectus on the SEC Web site at www.sec.gov as follows (or if such address has changed, by reviewing our filings for May 23, 2012 and May 12, 2011 on the SEC Web site):

| | § | Underlying Supplement No. 1 filed on May 23, 2012: |

| | § | Prospectus and Prospectus Supplement filed on May 12, 2011: |

General

The Autocallable Contingent Coupon Equity Linked Securities Based on the S&P 500® Index due December 1, 2017 (the “Securities”) are senior unsecured debt securities issued by Citigroup Funding under the senior debt indenture described in the accompanying prospectus supplement and prospectus. All payments due on the Securities are fully and unconditionally guaranteed by Citigroup Inc. The Securities will constitute part of the senior debt of Citigroup Funding and will rank equally with all other unsecured and unsubordinated debt of Citigroup Funding. As a result of the guarantee by Citigroup Inc., any payments due on the Securities will rank equally with all other unsecured and unsubordinated debt of Citigroup Inc. All payments on the Securities are subject to the credit risk of Citigroup Inc.

Unlike conventional debt securities, the Securities do not provide for repayment of the stated principal amount at maturity in all circumstances, do not provide for fixed payments of interest and are subject to automatic early redemption on a quarterly basis beginning November 28, 2014. The payments on the Securities, including your payment at maturity (if the Securities are not earlier redeemed) and any coupon payments on the Securities, and whether the Securities are automatically redeemed, all depend on the performance of the S&P 500® Index. We refer to such index as the “Underlying Index” and to the publisher of such index as the “Underlying Index Publisher.”

Each Security represents a stated principal amount of $1,000. You may transfer the Securities only in units of $1,000 and integral multiples of $1,000. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the Securities in the form of a global certificate, which will be held by The Depository Trust Company (“DTC”) or its nominee. Direct and indirect participants in DTC will record beneficial ownership of the Securities by individual investors. Accountholders in the Euroclear or Clearstream Banking clearance systems may hold beneficial interests in the Securities through the accounts those systems maintain with DTC. You should refer to the section “Description of the Securities—Book-Entry System” in the accompanying prospectus supplement and the section “Description of Debt Securities—Book-Entry Procedures and Settlement” in the accompanying prospectus.

Reference is made to the accompanying prospectus supplement and prospectus for a detailed summary of additional provisions of the Securities and of the senior debt indenture under which the Securities will be issued.

Please note that certain terms used in the following sections are defined below under “—Certain Important Definitions.”

Contingent Coupon Payments

On each quarterly Contingent Coupon Payment Date, unless previously redeemed, the Securities will pay a contingent coupon (the “Contingent Coupon”) equal to 1.25% of the stated principal amount of the Securities (equal to an annualized rate of 5.00%) if and only if the Closing Level of the Underlying Index on the related Valuation Date is greater than or equal to the Downside Threshold Level. If the Closing Level of the Underlying Index on any quarterly Valuation Date is less than the Downside Threshold Level, you will not receive any Contingent Coupon payment on the related Contingent Coupon Payment Date, and if the Closing Level of the Underlying Index is less than the

Downside Threshold Level on all twenty quarterly Valuation Dates, you will not receive any Contingent Coupon payments over the term of the Securities.

The Contingent Coupon payment, if any, will be payable to the persons in whose names the Securities are registered at the close of business on the Business Day immediately preceding the applicable Contingent Coupon Payment Date (each such day, a “Regular Record Date”), except that the Contingent Coupon payment due upon early redemption or at maturity, if any, will be payable to the persons who receive cash upon such early redemption or at maturity, as applicable.

Automatic Early Redemption

If, on any of the Valuation Dates beginning on November 28, 2014, the Closing Level of the Underlying Index is greater than or equal to the Initial Index Level, the Securities will be automatically redeemed on the related Contingent Coupon Payment Date for an amount in cash per Security equal to $1,000 plus the related Contingent Coupon payment. In that case, you will not receive any additional Contingent Coupon payments following the redemption.

Your Payment at Maturity

The Securities will mature on December 1, 2017 (the “Maturity Date”), subject to automatic early redemption. If the Securities are not automatically redeemed prior to maturity, you will be entitled to receive at maturity, for each Security you then hold, an amount in cash equal to:

| | o | If the Final Index Level is greater than or equal to the Downside Threshold Level: $1,000 plus the Contingent Coupon payment due at maturity. |

| | o | If the Final Index Level is less than the Downside Threshold Level: the product of (i) $1,000 and (ii) the Final Index Level divided by the Initial Index Level. |

If the Final Index Level is less than the Downside Threshold Level, your payment at maturity will be less, and possibly significantly less, than $800 per Security and you will not receive any Contingent Coupon payment at maturity.

Any return on the Securities will be limited to the sum of your Contingent Coupon payments, if any. Investors in the Securities will not receive any dividend yield on the stocks included in the Underlying Index or share in any appreciation of the Underlying Index over the term of the Securities, but investors will bear the full downside risk of the Underlying Index if the Final Index Level is less than the Downside Threshold Level. If the Securities are automatically redeemed, the term of the Securities may be limited to as short as two years and you will not receive any Contingent Coupon for any subsequent Valuation Date.

Certain Important Definitions

“Business Day” means any day that is not a Saturday, a Sunday or a day on which the securities exchanges or banking institutions or trust companies in the City of New York are authorized or obligated by law or executive order to close.

The “Calculation Agent” means Citigroup Global Markets, an affiliate of Citigroup Funding, or any successor appointed by Citigroup Funding.

The “Closing Level” of the Underlying Index on any date of determination will be the closing level of the Underlying Index as published by the Underlying Index Publisher on any day, subject to the terms described under “—Discontinuance or Material Modification of the Underlying Index” below. If the Closing Level of the Underlying Index is not published by the Underlying Index Publisher on any date of determination, the Closing Level on that date will be the closing level of the Underlying Index as calculated by the Calculation Agent in accordance with the formula for and method of calculating the Underlying Index last in effect prior to the failure to publish, but using only those securities included in the Underlying Index immediately prior to such failure to publish. If a Market Disruption Event occurs with respect to the Underlying Index on any date of determination, the Calculation Agent may, in its sole discretion, determine the Closing Level of the Underlying Index on such date either (x) pursuant to the immediately preceding sentence (using its good faith estimate of the value of any security included in the Underlying Index as to which an event giving rise to the Market

Disruption Event has occurred) or (y) if available, using the closing level of the Underlying Index on such day as published by the Underlying Index Publisher.

The “Contingent Coupon Payment Date” for a Valuation Date will be the third Business Day after such Valuation Date (as it may be postponed pursuant to “—Consequences of a Market Disruption Event; Postponement of a Valuation Date,” if applicable), except that the Contingent Coupon Payment Date for the Final Valuation Date will be the Maturity Date.

The “Downside Threshold Level” equals 1,127.944, 80% of the Initial Index Level.

The “Final Index Level” will equal the Closing Level of the Underlying Index on the Final Valuation Date.

The “Initial Index Level” equals 1,409.93, the Closing Level of the Underlying Index on the Pricing Date.

The “Pricing Date” means November 28, 2012, the date on which the Securities priced for initial sale to the public.

The “Underlying Index Publisher” means S&P Dow Jones Indices LLC.

The “Valuation Dates” are the 28th of each February, May, August and November, ending November 28, 2017 (the “Final Valuation Date”). Each scheduled Valuation Date will be subject to postponement for non-Scheduled Trading Days and Market Disruption Events as provided under “—Consequences of a Market Disruption Event; Postponement of a Valuation Date” below.

Consequences of a Market Disruption Event; Postponement of a Valuation Date

If a Market Disruption Event occurs on any scheduled Valuation Date, the Calculation Agent may, but is not required to, postpone the Valuation Date to the next succeeding Scheduled Trading Day on which a Market Disruption Event does not occur; provided that the Valuation Date may not be postponed for more than five consecutive Scheduled Trading Days or, in any event, past the Scheduled Trading Day immediately preceding the Maturity Date. In addition, if any scheduled Valuation Date is not a Scheduled Trading Day, the Valuation Date will be postponed to the next succeeding day that is a Scheduled Trading Day, but in no event past the Business Day immediately preceding the Maturity Date.

If a Market Disruption Event occurs on any Valuation Date and the Calculation Agent does not postpone the Valuation Date, or if any Valuation Date is postponed for any reason to the last date to which it may be postponed, in each case as described above, then the Closing Level to be determined on such date will be determined as set forth in the definition of “Closing Level” above.

Certain Definitions

The “Closing Time” on any day for any Exchange or Related Exchange is the Scheduled Closing Time for such Exchange or Related Exchange on such day or, if earlier, the actual closing time of such Exchange or Related Exchange on such day.

An “Exchange” means, with respect to any security included in the Underlying Index, the principal exchange or market on which trading in such security occurs.

An “Exchange Business Day” means, with respect to the Underlying Index, any Scheduled Trading Day for the Underlying Index on which the Exchange(s) for each security included in the Underlying Index and each Related Exchange for the Underlying Index are open for trading during their respective regular trading sessions, notwithstanding any such Exchange or Related Exchange closing prior to its Scheduled Closing Time.

A “Market Disruption Event” means, with respect to the Underlying Index, as determined by the Calculation Agent,

(1) the occurrence or existence of any suspension of or limitation imposed on trading by the relevant Exchange or otherwise (whether by reason of movements in price exceeding limits permitted by the relevant Exchange or otherwise) relating to securities that comprise 20 percent or more of the level of the Underlying Index, which the Calculation Agent determines is material, at any time during the one-hour period that ends at the Closing Time of the relevant Exchange;

(2) the occurrence or existence of any suspension of or limitation imposed on trading by any Related Exchange or otherwise (whether by reason of movements in price exceeding limits permitted by the Related Exchange or otherwise) in futures or options contracts relating to the Underlying Index, which the Calculation Agent determines is material, at any time during the one-hour period that ends at the Closing Time of the relevant Related Exchange;

(3) the occurrence or existence of any event (other than an Early Closure (as defined below)) that disrupts or impairs (as determined by the Calculation Agent) the ability of market participants in general to effect transactions in, or obtain market values for, securities that comprise 20 percent or more of the level of the Underlying Index on their relevant Exchanges, which the Calculation Agent determines is material, at any time during the one-hour period that ends at the Closing Time of the relevant Exchange;

(4) the occurrence or existence of any event (other than an Early Closure) that disrupts or impairs (as determined by the Calculation Agent) the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to the Underlying Index on any Related Exchange for the Underlying Index, which the Calculation Agent determines is material, at any time during the one-hour period that ends at the Closing Time of the relevant Related Exchange;

(5) the closure on any Exchange Business Day of the Exchange(s) for securities comprising 20 percent or more of the level of the Underlying Index or any Related Exchange for the Underlying Index prior to its Scheduled Closing Time unless such earlier closing time is announced by such Exchange or Related Exchange at least one hour prior to the earlier of (i) the actual closing time for the regular trading session on such Exchange or Related Exchange on such Exchange Business Day and (ii) the submission deadline for orders to be entered into the Exchange or Related Exchange system for execution at the Scheduled Closing Time of such Exchange or Related Exchange on such Exchange Business Day (an “Early Closure”); or

(6) the failure of the Exchange for any security included in the Underlying Index or any Related Exchange for the Underlying Index to open for trading during its regular trading session.

For purposes of this definition, the relevant percentage contribution of a security included in the Underlying Index to the level of the Underlying Index will be based on a comparison of the portion of the level of the Underlying Index attributable to that security to the level of the Underlying Index, in each case immediately before the applicable event that, if the 20 percent threshold is met, would be a Market Disruption Event.

A “Related Exchange” for the Underlying Index means each exchange where trading has a material effect (as determined by the Calculation Agent) on the overall market for futures or options contracts relating to the Underlying Index.

The “Scheduled Closing Time” on any day for any Exchange or Related Exchange is the scheduled weekday closing time of such Exchange or Related Exchange on such day, without regard to after hours or any other trading outside of the regular trading session hours.

A “Scheduled Trading Day” with respect to the Underlying Index means, as determined by the Calculation Agent, a day on which the Exchange(s) for securities comprising more than 80 percent of the level of the Underlying Index (determined based on a comparison of the portion of the level of the Underlying Index attributable to that security to the level of the Underlying Index, in each case as of the close of the immediately preceding Scheduled Trading Day) and each Related Exchange, if any, for the Underlying Index are scheduled to be open for trading for their respective regular trading sessions. If such Exchanges do not include at least one U.S. national securities exchange, such day must also be a Business Day. Notwithstanding the foregoing, the Calculation Agent may, in its sole discretion, deem any day on which a Related Exchange for the applicable Index is not scheduled to be open for trading for its regular trading session, but on which the Exchange(s) for securities comprising more than 80 percent of the level of the Underlying Index are scheduled to be open for their regular trading sessions, to be a Scheduled Trading Day.

Discontinuance or Material Modification of the Underlying Index

If the Underlying Index is (i) not calculated and announced by the Underlying Index Publisher but is calculated and announced by a successor publisher acceptable to the Calculation Agent or (ii) replaced by a successor index that the Calculation Agent determines, in its sole discretion, uses the same or a substantially similar formula for and method of calculation as used in the calculation of the Underlying Index, in each case the Calculation Agent may deem that index (the “Successor Index”) to be the Underlying Index. Upon the selection of any Successor Index by the Calculation Agent pursuant to this paragraph, references in this pricing supplement to the original Underlying Index will no longer be deemed

to refer to the original Underlying Index and will be deemed instead to refer to that Successor Index for all purposes, and references in this pricing supplement to the Underlying Index Publisher will be deemed to be to the publisher of the Successor Index. In such event, the Calculation Agent will make such adjustments, if any, to any level of the Underlying Index that is used for purposes of the Securities as it determines are appropriate in the circumstances. Upon any selection by the Calculation Agent of a Successor Index, the Calculation Agent will cause notice to be furnished to us and the trustee.

If a relevant Underlying Index Publisher (i) announces that it will make a material change in the formula for or the method of calculating the Underlying Index or in any other way materially modifies the Underlying Index (other than a modification prescribed in that formula or method to maintain the Underlying Index in the event of changes in constituent stock and capitalization and other routine events) or (ii) permanently cancels the Underlying Index and no Successor Index is chosen as described above, then the Calculation Agent will calculate the closing level of the Underlying Index on each subsequent date of determination in accordance with the formula for and method of calculating the Underlying Index last in effect prior to the change or cancellation, but using only those securities included in the Underlying Index immediately prior to such change or cancellation. Such closing level, as calculated by the Calculation Agent, will be the relevant Closing Level for all purposes.

Notwithstanding these alternative arrangements, the discontinuance or material modification of the Underlying Index may adversely affect the value of your Securities.

No Redemption at the Option of the Holder; Defeasance

The Securities will not be subject to redemption at the option of any holder prior to maturity and will not be subject to the defeasance provisions described in the accompanying prospectus under “Description of Debt Securities—Defeasance.”

Events of Default and Acceleration

In case an event of default (as described in the accompanying prospectus) with respect to the Securities shall have occurred and be continuing, the amount declared due and payable upon any acceleration of the Securities will be determined by the Calculation Agent and will equal, for each Security, the amount to be received at maturity, calculated as though the date of acceleration were the Final Valuation Date. For purposes of the immediately preceding sentence, the portion of such payment attributable to the final Contingent Coupon payment, if any, will be prorated from and including the immediately preceding Contingent Coupon Payment Date to but excluding the date of acceleration.

In case of default under the Securities, whether in the payment of Contingent Coupon or any other payment or delivery due under the Securities, no interest will accrue on such overdue payment or delivery either before or after the Maturity Date.

Paying Agent and Trustee

Citibank, N.A. will serve as paying agent and registrar for the Securities and will also hold the global securities representing the Securities as custodian for DTC. The Bank of New York Mellon, as successor trustee to JPMorgan Chase Bank, N.A. under an indenture dated as of June 1, 2005, will serve as trustee for the Securities.

The CUSIP for the Securities is 1730T0ZK8. The ISIN for the Securities is US1730T0ZK86.

Calculation Agent

The Calculation Agent for the Securities will be Citigroup Global Markets, an affiliate of Citigroup Funding. All determinations made by the Calculation Agent will be at the sole discretion of the Calculation Agent and will, in the absence of manifest error, be conclusive for all purposes and binding on Citigroup Funding, Citigroup Inc. and the holders of the Securities. The Calculation Agent is obligated to carry out its duties and functions in good faith and using its reasonable judgment.

Potential Future Events

It is possible that Citigroup Funding will merge into Citigroup Inc. in the near future. If a merger occurs, Citigroup Inc. will assume all the obligations of Citigroup Funding under the Securities, as required by the indenture under which the Securities are issued.

HYPOTHETICAL EXAMPLES OF AMOUNTS PAYABLE ON THE SECURITIES

The examples below illustrate the total amount you may receive on the Securities in a number of different hypothetical scenarios. These examples are only hypothetical and do not indicate the actual payments you will receive on the Securities. For purposes of the examples, the total return at early redemption or maturity is calculated by dividing (i) the difference between the stated principal amount and the hypothetical total amount you receive per Security over the term of the Securities by (ii) the stated principal amount. Annualized returns are calculated on a simple interest basis, assuming no reinvestment of coupon payments. The examples are based on the following terms:

| Stated Principal Amount: | $1,000 per Security |

| Valuation Dates: | A total of twenty quarterly Valuation Dates if the Securities are not automatically redeemed prior to maturity |

| Initial Index Level: | 1,409.93 |

| Downside Threshold Level: | 1,127.944, which is 80% of the Initial Index Level |

| Contingent Coupon Payment: | $12.50 (1.25% of the stated principal amount) |

Hypothetical Examples of Amounts Payable on the Securities if the Securities Are Automatically Redeemed Prior to Maturity

The following examples illustrate the hypothetical payments on the Securities in scenarios in which the Securities are automatically redeemed prior to maturity.

Example 1: The Closing Level of the Underlying Index moderately decreases initially, but later increases relative to the Initial Index Level.

| | Hypothetical Closing Level of Underlying Index | Contingent Coupon Payment per Security | Payment upon Redemption (Stated Principal Amount Plus Contingent Coupon Payment) per Security |

| Valuation Date 1 | 1,390.00 | $12.50 | N/A |

| Valuation Date 2 | 1,380.00 | $12.50 | N/A |

| Valuation Date 3 | 1,365.00 | $12.50 | N/A |

| Valuation Date 4 | 1,380.00 | $12.50 | N/A |

| Valuation Date 5 | 1,375.00 | $12.50 | N/A |

| Valuation Date 6 | 1,390.00 | $12.50 | N/A |

| Valuation Date 7 | 1,380.00 | $12.50 | N/A |

| Valuation Date 8 | 1,360.00 | $12.50 | N/A |

| Valuation Date 9 | 1,350.00 | $12.50 | N/A |

| Valuation Date 10 | 1,420.00 | $12.50 | $1,012.50 |

Total value received per Security:

$1,000 stated principal amount upon redemption + $125 in aggregate Contingent Coupon payments = $1,125

Total return at early redemption: 12.50%, equivalent to an annualized return of 5.00%

In this example, the hypothetical Closing Level of the Underlying Index is less than the Initial Index Level but greater than the Downside Threshold Level on each of the first nine Valuation Dates and greater than the Initial Index Level on the tenth Valuation Date. The Securities would pay the Contingent Coupon on the first nine Contingent Coupon Payment Dates, because the Closing Level of the Underlying Index on each of the related Valuation Dates is greater than the Downside Threshold Level. On the tenth Contingent Coupon Payment Date, because the Closing Level of the Underlying Index on the related Valuation Date is greater than the Initial Index Level, the Securities would be automatically redeemed for the stated principal amount plus the Contingent Coupon payment. In this scenario, investors in the Securities would receive a total return of 12.50% over the 30-month term to early redemption, equivalent to an annualized return of 5.00%.

Example 2: The Closing Level of the Underlying Index increases after issuance of the Securities relative to the Initial Index Level.

| | Hypothetical Closing Level of Underlying Index | Contingent Coupon Payment per Security | Payment upon Redemption (Stated Principal Amount Plus Contingent Coupon Payment) per Security |

| Valuation Date 1 | 1,410.00 | $12.50 | N/A |

| Valuation Date 2 | 1,420.00 | $12.50 | N/A |

| Valuation Date 3 | 1,430.00 | $12.50 | N/A |

| Valuation Date 4 | 1,440.00 | $12.50 | N/A |

| Valuation Date 5 | 1,450.00 | $12.50 | N/A |

| Valuation Date 6 | 1,460.00 | $12.50 | N/A |

| Valuation Date 7 | 1,470.00 | $12.50 | N/A |

| Valuation Date 8 | 1,465.00 | $12.50 | $1,012.50 |

Total value received per Security:

$1,000 stated principal amount upon redemption + $100 in aggregate Contingent Coupon payments = $1,100

Total return at early redemption: 10.00%, equivalent to an annualized return of 5.00%

In this example, the hypothetical Closing Level of the Underlying Index is greater than the Initial Index Level on each of the first eight Valuation Dates. Because the Closing Level of the Underlying Index is greater than the Initial Index Level on the Valuation Date occurring on November 28, 2014, the Securities would be automatically redeemed on the related Contingent Coupon Payment Date for the stated principal amount plus the Contingent Coupon payment. In this scenario, investors in the Securities would receive a total return of 10.00% over the two-year term to early redemption, equivalent to an annualized return of 5.00%.

Example 3: The Closing Level of the Underlying Index significantly decreases initially, but later increases relative to the Initial Index Level.

| | Hypothetical Closing Level of Underlying Index | Contingent Coupon Payment per Security | Payment upon Redemption (Stated Principal Amount Plus Contingent Coupon Payment) per Security |

| Valuation Date 1 | 1,110.00 | $0.00 | N/A |

| Valuation Date 2 | 1,100.00 | $0.00 | N/A |

| Valuation Date 3 | 1,000.00 | $0.00 | N/A |

| Valuation Date 4 | 900.00 | $0.00 | N/A |

| Valuation Date 5 | 990.00 | $0.00 | N/A |

| Valuation Date 6 | 1,100.00 | $0.00 | N/A |

| Valuation Date 7 | 1,000.00 | $0.00 | N/A |

| Valuation Date 8 | 1,110.00 | $0.00 | N/A |

| Valuation Date 9 | 1,100.00 | $0.00 | N/A |

| Valuation Date 10 | 990.00 | $0.00 | N/A |

| Valuation Date 11 | 1,100.00 | $0.00 | N/A |

| Valuation Date 12 | 1,420.00 | $12.50 | $1,012.50 |

Total value received per Security:

$1,000 stated principal amount upon redemption + $12.50 in aggregate Contingent Coupon payments = $1,012.50

Total return at early redemption: 1.25%, equivalent to an annualized return of approximately 0.42%

In this example, the hypothetical Closing Level of the Underlying Index is less than the Downside Threshold Level on each of the first eleven Valuation Dates but greater than the Initial Index Level on the twelfth Valuation Date. The Securities would not pay any Contingent Coupon on the first eleven Contingent Coupon Payment Dates, because the Closing Level of the Underlying Index on each of the related Valuation Dates is less than the Downside Threshold Level. On the twelfth Contingent Coupon Payment Date, because the Closing Level of the Underlying Index on the related

Valuation Date is greater than the Initial Index Level, the Securities would be automatically redeemed for the stated principal amount plus the Contingent Coupon payment. In this scenario, investors in the Securities would receive a total return of 1.25% over the three-year term to early redemption, equivalent to an annualized return of approximately 0.42%.

In each of the first three examples, the automatic early redemption feature of the Securities would limit the term of the Securities to less than the full five-year term to maturity, and possibly to as short as two years. If the Securities are redeemed early, you will not receive any additional Contingent Coupon payments after the redemption, and you may not be able to reinvest in other investments that offer comparable terms or returns. Although, in each of these examples, the Closing Level of the Underlying Index on the Valuation Date immediately before redemption is greater than the Initial Index Level, investors in the Securities will not share in any appreciation of the Underlying Index.

Hypothetical Examples of Amounts Payable on the Securities if the Securities Are Not Redeemed Prior to Maturity

The following examples illustrate hypothetical payments on the Securities in scenarios in which the Securities are not automatically redeemed prior to maturity.

Example 4: The Closing Level of the Underlying Index moderately decreases over the term of the Securities.

| | Hypothetical Closing Level of Underlying Index | Contingent Coupon Payment per Security | Payment upon Redemption (Stated Principal Amount Plus Contingent Coupon Payment) per Security |

| Valuation Date 1 | 1,390.00 | $12.50 | N/A |

| Valuation Date 2 | 1,380.00 | $12.50 | N/A |

| Valuation Date 3 | 1,370.00 | $12.50 | N/A |

| Valuation Date 4 | 1,360.00 | $12.50 | N/A |

| Valuation Date 5 | 1,350.00 | $12.50 | N/A |

| Valuation Date 6 | 1,340.00 | $12.50 | N/A |

| Valuation Date 7 | 1,350.00 | $12.50 | N/A |

| Valuation Date 8 | 1,360.00 | $12.50 | N/A |

| Valuation Date 9 | 1,320.00 | $12.50 | N/A |

| Valuation Date 10 | 1,310.00 | $12.50 | N/A |

| Valuation Date 11 | 1,280.00 | $12.50 | N/A |

| Valuation Date 12 | 1,290.00 | $12.50 | N/A |

| Valuation Date 13 | 1,275.00 | $12.50 | N/A |

| Valuation Date 14 | 1,270.00 | $12.50 | N/A |

| Valuation Date 15 | 1,260.00 | $12.50 | N/A |

| Valuation Date 16 | 1,250.00 | $12.50 | N/A |

| Valuation Date 17 | 1,200.00 | $12.50 | N/A |

| Valuation Date 18 | 1,150.00 | $12.50 | N/A |

| Valuation Date 19 | 1,170.00 | $12.50 | N/A |

| Valuation Date 20 | 1,200.00 | $12.50 | $1,012.50 |

Total value received per Security:

$1,000 stated principal amount at maturity + $250 in aggregate Contingent Coupon payments = $1,250

Total return at maturity: 25.00%, equivalent to an annualized return of 5.00%

In this example, the hypothetical Closing Level of the Underlying Index is less than the Initial Index Level but greater than the Downside Threshold Level on each of the twenty Valuation Dates. The Securities would pay the Contingent Coupon on the first nineteen Contingent Coupon Payment Dates, because the Closing Level of the Underlying Index on each of the related Valuation Dates is greater than the Downside Threshold Level. At maturity, because the Closing Level of the Underlying Index on the Final Valuation Date is greater than the Downside Threshold Level, investors would receive the stated principal amount of the Securities plus the Contingent Coupon payment. In this scenario, investors in the Securities would receive a total return of 25.00% over the term of the Securities (equivalent to an annualized return of 5.00%), consisting of twenty Contingent Coupon payments of 1.25% each. This example illustrates the maximum possible return on the Securities.

Example 5: The Closing Level of the Underlying Index moderately decreases initially, but later increases to a level greater than the Initial Index Level on the Final Valuation Date.

| | Hypothetical Closing Level of Underlying Index | Contingent Coupon Payment per Security | Payment at Maturity (including the Contingent Coupon Payment, if applicable) per Security |

| Valuation Date 1 | 1,390.00 | $12.50 | N/A |

| Valuation Date 2 | 1,380.00 | $12.50 | N/A |

| Valuation Date 3 | 1,370.00 | $12.50 | N/A |

| Valuation Date 4 | 1,360.00 | $12.50 | N/A |

| Valuation Date 5 | 1,350.00 | $12.50 | N/A |

| Valuation Date 6 | 1,340.00 | $12.50 | N/A |

| Valuation Date 7 | 1,350.00 | $12.50 | N/A |

| Valuation Date 8 | 1,360.00 | $12.50 | N/A |

| Valuation Date 9 | 1,320.00 | $12.50 | N/A |

| Valuation Date 10 | 1,310.00 | $12.50 | N/A |

| Valuation Date 11 | 1,280.00 | $12.50 | N/A |

| Valuation Date 12 | 1,290.00 | $12.50 | N/A |

| Valuation Date 13 | 1,275.00 | $12.50 | N/A |

| Valuation Date 14 | 1,270.00 | $12.50 | N/A |

| Valuation Date 15 | 1,260.00 | $12.50 | N/A |

| Valuation Date 16 | 1,250.00 | $12.50 | N/A |

| Valuation Date 17 | 1,200.00 | $12.50 | N/A |

| Valuation Date 18 | 1,150.00 | $12.50 | N/A |

| Valuation Date 19 | 1,390.00 | $12.50 | N/A |

| Valuation Date 20 | 1,550.92 | $12.50 | $1,012.50 |

Total value received per Security:

$1,000 stated principal amount at maturity + $250 in aggregate Contingent Coupon payments = $1,250

Total return at maturity: 25.00%, equivalent to an annualized return of 5.00%

In this example, the hypothetical Closing Level of the Underlying Index is less than the Initial Index Level but greater than the Downside Threshold Level on each of the first nineteen Valuation Dates and greater than the Initial Index Level on the Final Valuation Date. The Securities would pay the Contingent Coupon on the first nineteen Contingent Coupon Payment Dates, because the Closing Level of the Underlying Index on each of the related Valuation Dates is greater than the Downside Threshold Level. At maturity, because the Closing Level of the Underlying Index on the Final Valuation Date is greater than the Downside Threshold Level, investors would receive the stated principal amount of the Securities plus the Contingent Coupon payment. In this scenario, investors in the Securities would receive a total return of 25.00% over the term of the Securities (equivalent to an annualized return of 5.00%), consisting of twenty Contingent Coupon payments of 1.25% each. This example illustrates the maximum possible return on the Securities. Although the Closing Level of the Underlying Index on the Final Valuation Date is greater than the Initial Index Level by 10%, investors in the Securities will not share in any appreciation of the Underlying Index.