Filed pursuant to Rule 433

Registration Nos. 333-172554 and 333-172554-01

Citi First

Performance

Buffer NotesA Guide for Investors

| | | | |

| 2 | | CitiFirst Buffer Notes |September 2012 | | |

Citigroup Funding Inc., the issuer, and Citigroup Inc., the guarantor, have filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the offerings to which this communication relates. Before you invest, you should read the prospectus in the applicable registration statement and the other documents the issuer and the guarantor have filed with the SEC for more complete information about the issuers, the guarantor, and offerings. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you can request the prospectus by calling toll-free 1-877-858-5407.

| | | | | | | | | | |

| | Investment Products | | Not FDIC Insured | | May Lose Value | | No Bank Guarantee | | |

| | | | |

| | CitiFirst Buffer Notes |September 2012 | | 3 |

About Us

Citi, the leading global financial services company, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Citi’s Private Investor Products Group services Family Offices, Private Banks, Financial Advisors, Consumer Banks, Broker-Dealers and other institutional and corporate investors throughout the world. We provide a wide variety of innovative investment strategies and trading products for affluent, high-net-worth and ultra-high-net-worth investors. CitiFirst investments are multi-asset and complementary to a traditional investment portfolio.

What is CitiFirst?

CitiFirst is the family name for Citi’s offering of investments including notes, deposits, certificates and OTC strategies. Tailored to meet the needs of a broad range of investors, CitiFirst investments are divided into three categories based on the amount of principal due at maturity.

CitiFirst Investment Categories

CitiFirst Protection

Full principal amount due

at maturity

Investments provide for the full principal amount to be due at maturity, subject to the credit risk of the issuer or guarantor, and are for investors who place a priority on the preservation of principal while looking for a way to potentially outperform cash or traditional fixed income investments

CitiFirst Performance

Payment due at maturity may be less

than the principal amount

Investments provide for a payment due at maturity that may be less than the principal amount and in some cases may be zero, and are for investors who are seeking the potential for current income and/or growth, in addition to partial or contingent downside protection

CitiFirst Opportunity

Payment due at maturity

may be zero

Investments provide for a payment at maturity that may be zero and are for investors who are willing to take full market risk in return for either leveraged principal appreciation at a predetermined rate or access to a unique underlying strategy

| n | When depicting a product, the relevant underlying asset will be shown as a symbol on the applicable cube |

| n | Buffer Notes are CitiFirst Performance investments that can be tied to many different asset classes |

| n | If a Buffer Note we retied to an equity underlying, its cube would be shown as follows: |

| | | | |

| 4 | | CitiFirst Buffer Notes |September 2012 | | |

Buffer Notes

What are Buffer Notes?

| n | Buffer Notes offer leveraged participation in the appreciation of an underlying up to a cap while providing limited protection from a decline in the underlying. |

| n | Buffer Notes have a typical maturity of between 12 months and 2 years. |

Who might be interested in Buffer Notes?

| n | Current or prospective holders of the underlying equity. |

| n | Investors with a moderately bullish view on the underlying looking to outperform a benchmark. |

| n | Investors looking for a potential recovery strategy for underperforming assets. |

| n | Investors looking for limited protection from a decline in the underlying. |

What benefits specific to Buffer Notes should you be aware of?

| n | Buffer Notes typically have a lower volatility than the underlying and thus can help you reduce the risk of your portfolio by substituting the note for the underlying. |

| n | Although the return on Buffer Notes is capped, the leveraged participation helps you realize that capped return even when there is a smaller return in the underlying. |

| n | Buffer Notes lessen the amount of potential loss with respect to the underlying, subject to the credit risk of the issuer. |

| n | For tax purposes, U.S. holders will generally receive a capital gain or loss on the Buffer Notes with the potential for long-term capital gain or loss if held for more than one year. |

| n | Buffer Notes can offer you exposure to a variety of underlyings such as domestic and foreign indices, exchange-traded funds, commodities and equities |

What risks specific to Buffer Notes should you be aware of?

| n | Buffer Notes are not principal protected and thus you could receive significantly less than the initial amount you invest in the Buffer Notes. |

| n | Because the return on Buffer Notes is capped, Buffer Notes will underperform a direct investment in the underlying if the underlying appreciates beyond the cap. |

| n | You will not receive any periodic payments of interest or any other periodic payments, such as dividends paid on the underlying, while holding the Buffer Notes. |

| n | For a full description of the risks involved with this type of investment, please review the “Risk Factors Relating to the Notes” in any Buffer Note pricing supplement. |

| | | | |

| | CitiFirst Buffer Notes |September 2012 | | 5 |

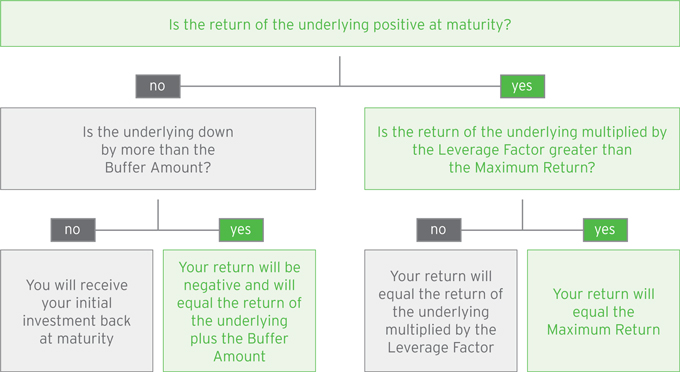

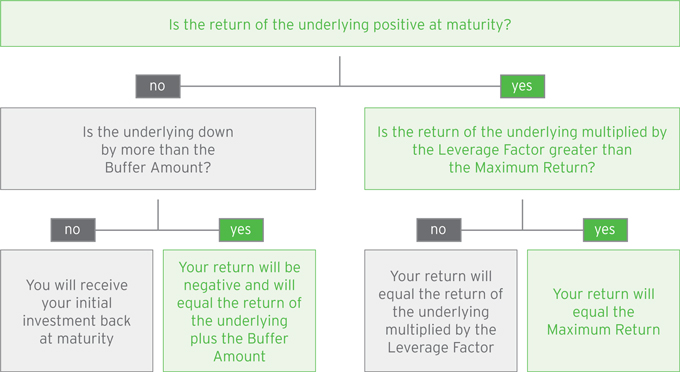

How do Buffer Notes work?

Each Buffer Note will specify the following terms:

n Buffer Amount:

An amount, such as 10%, which indicates your level of principal protection in the Buffer Notes.

n Maximum Return:

An amount, such as 30%, which signifies your overall return limit on the Buffer Notes.

n Leverage Factor:

An amount, such as 300%, which enhances your return on the Buffer Notes, if any, up to the Maximum Return

| n | Payment at maturity depends only on where the underlying is at maturity. |

The amount you receive at maturity for a Buffer Note can be determined by answering the following questions:

| | | | |

| 6 | | CitiFirst Buffer Notes |September 2012 | | |

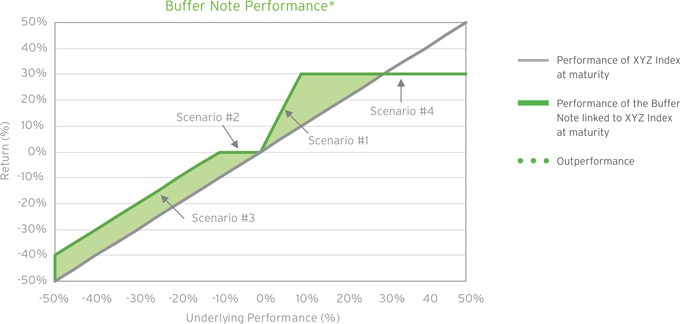

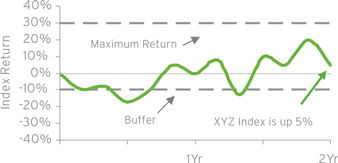

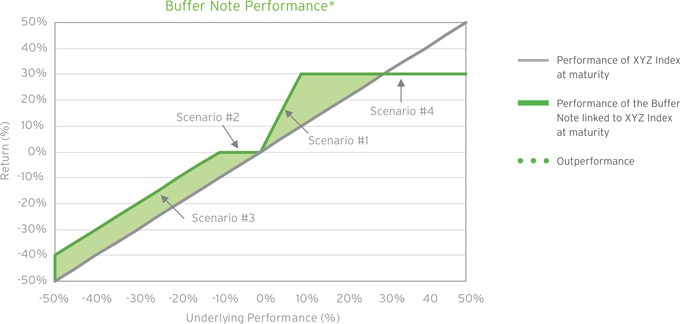

What are some hypothetical examples of Buffer Note returns?

Assuming you purchase one $10 Buffer Note linked to “XYZ Index” with a 2-year maturity, a Buffer Amount of 10%, a Maximum Return of 30%, and a Leverage Factor of 300%, the following represent four potential returns at maturity:

Below are select hypothetical return scenarios:

| | |

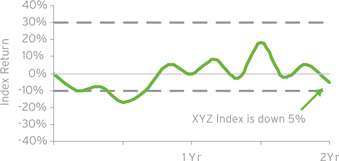

| | Scenario 1: |

| | 1. Is XYZ Index up at maturity?YES |

| | 2. Is the return of XYZ Index multiplied by the Leverage Factor more than the Maximum Return?NO |

| | The return of the Buffer Notes equals the return of the underlying multiplied by the Leverage Factor (5% x 300%) so you would receive $11.50 at maturity |

| | |

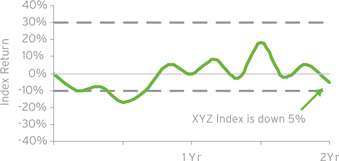

| | Scenario 2: |

| | 1. Is XYZ Index up at maturity?NO |

| | 2. Is XYZ Index down by more than the Buffer Amount?NO |

| | You would receive $10, your initial investment, at maturity |

| | |

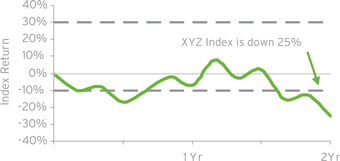

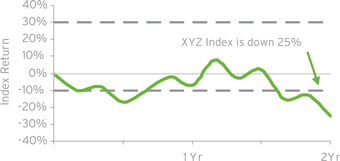

| | Scenario 3: |

| | 1. Is XYZ Index up at maturity?NO |

| | 2. Is XYZ Index down by more than the Buffer Amount?YES |

| | The return of the Buffer Notes equals the return of the underlying plus the Buffer Amount (-25% + 10%) so you would receive $8.50 at maturity |

| | |

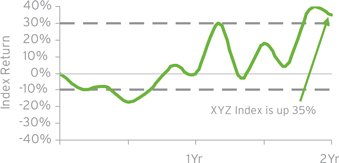

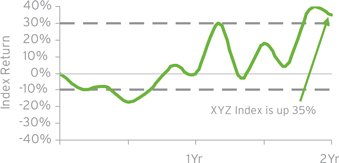

| | Scenario 4: |

| | 1. Is XYZ Index up at maturity?YES |

| | 2. Is the return of XYZ Index multiplied by the Leverage Factor more than the Maximum Return?YES |

| | The return of the Buffer Notes equals the Maximum Return (30%) so you would receive $13 at maturity |

| | | | |

| | CitiFirst Buffer Notes |September 2012 | | 7 |

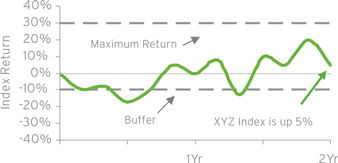

How do Buffer Notes compare to a direct investment in the underlying?

At maturity, Buffer Notes will outperform the underlying in all scenarios except when the underlying appreciates by an amount equal to or more than the Maximum Return.

Buffer Notes will have the largest outperformance in a moderately bullish environment.

| * | This analysis does not include the effect of dividends on the return of the underlying equity nor is it meant to be a complete analysis of comparable investments |

Additional Information

Buffer Notes are available through periodic CitiFirst investment offerings as well as through the customized solutions platform for ultra high net worth clients.

For current Buffer Note offerings, as well as other CitiFirst offerings, please contact your Investment Professional or Financial Advisor.

| | | | |

| 8 | | CitiFirst Buffer Notes |September 2012 | | |

| | |

CitiFirst Performance | |  |

Any figures or terms provided in this product brochure are sample product terms, illustrative and are no indication of what final terms or actual returns will be. This brochure does not consider the effect taxes and fees will have on your returns. The terms of each product vary from offering to offering. For terms relating to particular offerings, including direct and indirect risks and other material considerations, you should refer to that product’s disclosure documents.

All product categories within the CitiFirst family may be offered in various forms, including as medium-term notes, market-linked deposits and premium deposits. Products within the CitiFirst Protection category provide full principal protection if held to maturity, subject to the credit risk of the issuer, but there is no guarantee that investors will receive a return greater than the initial principal invested. Products within the CitiFirst Performance category provide various forms of limited downside protection but do not provide principal protection. Products within the CitiFirst Opportunity category offer no principal protection and no downside protection.

Citigroup Global Markets Inc. and its affiliates (“Citi”) do not guarantee that a secondary market will develop in any CitiFirst products you purchase. If a secondary market does develop it may not be liquid and may not continue for the term of the product. If the secondary market is limited there may be few buyers should you choose to sell the product prior to maturity and this may reduce the price you receive. There is no guarantee that investors wishing to liquidate an investment in such products prior to the stated maturity will receive a price equal to or in excess of the initial principal amount invested.

The value of CitiFirst products may rise as well as fall during the term of the product and the return on any product may be lower than what could be earned on a conventional investment of similar duration and credit risk. For each product, investors assume the full credit risk of the issuer and any guarantor of issuer’s obligations. As a product may be linked to the credit of one or more entities, the deterioration of the credit of any of these entities may result in the loss of your principal invested. Products may provide for adjustments to be made to their final terms during their term due to certain events including corporate actions, mergers and acquisitions, divestitures, price source disruption, trading suspension, material change in index formula and/or index content and change in taxation laws.

Citi may at any time hold long or short positions. Accordingly, Citi may actively trade these and related securities for its own account and those of its customers and, at any time, may have long or short positions in and buy and sell, the securities, commodities, futures, options, derivatives or other instruments and investments identical with or related to those mentioned in this brochure.

Before making an investment in a specific product, you should obtain and carefully read the legal documents relating to that product offering, which will contain additional information needed to evaluate the investment and provide important disclosures regarding risks, fees and expenses. Additionally, such legal documents will contain the only complete description, and final terms, of the terms and conditions of that product. Before making any commitment to invest, you should take whatever business, legal, tax, accounting or other advice you consider necessary given your particular circumstances. If you invest in a CitiFirst product it is your responsibility to arrange to account for any tax lawfully due from you on the income or gains arising from such investment. Citi does not provide business, legal, tax or accounting advice and makes no representation in respect of any of them. Investments in the form of mediumterm notes are not deposits and are neither obligations of nor guaranteed by Citibank, or any governmental entity or agency unless the terms of that product specifically state otherwise. Investments taking the form of market-linked deposits and premium deposits are obligations of Citibank, N.A. or an affiliate, subject to the depositary insurance provisions of the Federal Depositary Insurance Corporation (FDIC) but are not otherwise insured by Citi or any of its affiliates. Neither the medium-term notes nor the market-linked deposits are guaranteed by the FDIC under the Temporary Liquidity Guarantee Program. If you have any doubt about the suitability of these investments, you should contact your own advisers for advice.

| | | | |

| | CitiFirst Buffer Notes |September 2012 | | 9 |

Notes

Learn More

Current offerings are available onwww.citifirst.com.

Please contact your Investment Professional if you are looking to potentially buy Buffer Notes.

Financial Advisors and Distribution partners may contact our sales professionals at:

+1 (212) 723-7005 and +1 (212) 723-7288

©2012 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its subsidiaries and are used and registered throughout the world.