UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

INVESTMENT MANAGERS SERIES TRUST

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Act”), is as follows:

EP Emerging Markets Fund

Class A/EPASX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EP Emerging Markets Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/emerging-markets-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EP Emerging Markets Fund

(Class A/EPASX) | $190 | 1.75% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

From a country perspective, the primary factors driving the fund’s performance were its overweight position in China and underweight positions in India and Taiwan. From a sector perspective, the primary factors driving the fund’s performance were its underweight position in Technology and overweight in Consumer Staples. The fund's underweight in Taiwan Semiconductor (10% benchmark vs 2.5% fund) and other AI-driven semiconductor stocks was a negative drag on performance. The gap between high-growth tech stocks and traditional value stocks is expected to narrow over time. Our positions in Mexico and South Korea also contributed negatively to performance with both markets underperforming substantially during the year. The funds positions in Mr Price Group, CFMoto and Castrol India were positive contributors to fund performance.

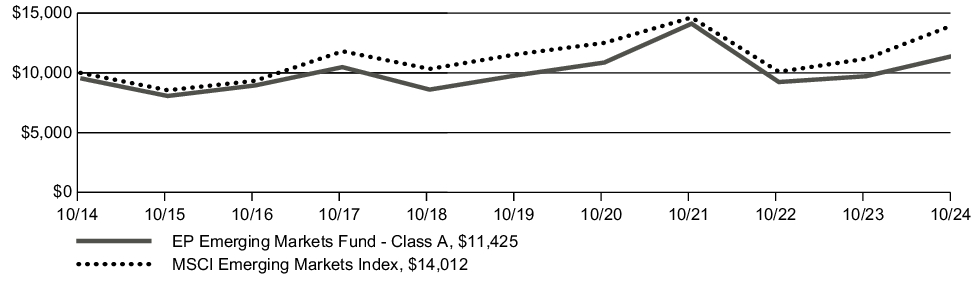

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EP Emerging Markets Fund (Class A/EPASX) | 12.21% | 2.17% | 1.34% |

| EP Emerging Markets Fund (Class A/EPASX) — excluding sales load | 17.55% | 3.12% | 1.81% |

| MSCI Emerging Markets Index | 25.31% | 3.93% | 3.43% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $89,840,120 |

| Total number of portfolio holdings | 60 |

| Total advisory fees paid (net) | $837,687 |

| Portfolio turnover rate as of the end of the reporting period | 37% |

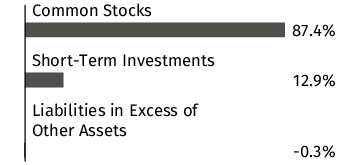

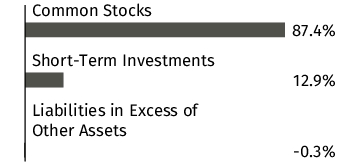

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Common Stocks of the Fund.

| Luzhou Laojiao Co., Ltd. - Class A | 3.2% |

| Zhejiang Cfmoto Power Co., Ltd. - Class A | 3.0% |

| British American Tobacco PLC | 2.9% |

| China Overseas Property Holdings Ltd. | 2.8% |

| Alibaba Group Holding Ltd. | 2.7% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 2.6% |

| Wuliangye Yibin Co., Ltd. - Class A | 2.5% |

| BGF Retail Co., Ltd. | 2.3% |

| Tencent Holdings Ltd. | 2.3% |

| Aspirasi Hidup Indonesia Tbk P.T. | 2.2% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/emerging-markets-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/emerging-markets-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EP Emerging Markets Fund

Class I/EPEIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EP Emerging Markets Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/emerging-markets-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EP Emerging Markets Fund

(Class I/EPEIX) | $163 | 1.50% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

From a country perspective, the primary factors driving the fund’s performance were its overweight position in China and underweight positions in India and Taiwan. From a sector perspective, the primary factors driving the fund’s performance were its underweight position in Technology and overweight in Consumer Staples. The funds underweight in Taiwan Semiconductor (10% benchmark vs 2.5% fund) and other AI-driven semiconductor stocks was a negative drag on performance. The gap between high-growth tech stocks and traditional value stocks is expected to narrow over time. Our positions in Mexico and South Korea also contributed negatively to performance with both markets underperforming substantially during the year. The funds positions in Mr Price Group, CFMoto and Castrol India were positive contributors to fund performance.

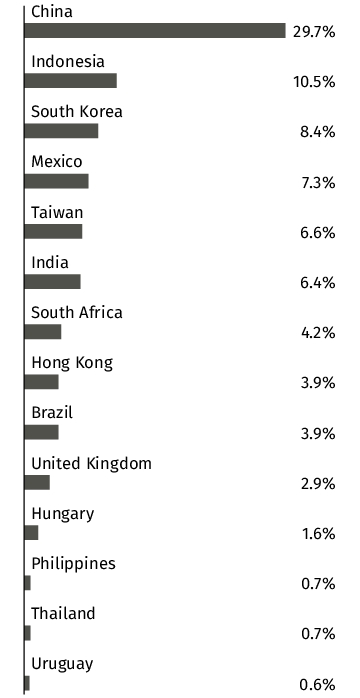

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EP Emerging Markets Fund (Class I/EPEIX) | 17.86% | 3.37% | 2.07% |

| MSCI Emerging Markets Index | 25.31% | 3.93% | 3.43% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $89,840,120 |

| Total number of portfolio holdings | 60 |

| Total advisory fees paid (net) | $837,687 |

| Portfolio turnover rate as of the end of the reporting period | 37% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Common Stocks of the Fund.

| Luzhou Laojiao Co., Ltd. - Class A | 3.2% |

| Zhejiang Cfmoto Power Co., Ltd. - Class A | 3.0% |

| British American Tobacco PLC | 2.9% |

| China Overseas Property Holdings Ltd. | 2.8% |

| Alibaba Group Holding Ltd. | 2.7% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 2.6% |

| Wuliangye Yibin Co., Ltd. - Class A | 2.5% |

| BGF Retail Co., Ltd. | 2.3% |

| Tencent Holdings Ltd. | 2.3% |

| Aspirasi Hidup Indonesia Tbk P.T. | 2.2% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/emerging-markets-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/emerging-markets-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac Gold Fund

Class A/EPGFX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac Gold Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/gold-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac Gold Fund

(Class A/EPGFX) | $166 | 1.37% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The fund had a return of 42.43% excluding sales load, and 36.05% with sales load included, in the 12 months ending October 31st, 2024, just a tad below the GDX Index. We experienced a series of major issues at many of our largest holdings, which negatively affected performance, starting with Franco-Nevada (whose largest asset was ordered closed by the Panamanian government last year) through to B2Gold (whose largest mine is in Mali, another country with political upheaval). Overall, the largest royalty companies, however, performed well. We also largely avoided some of the major stock declines of the period, such as Newmont.

Our overweight to silver stocks also helped, since that group in aggregate outperformed the GDX index. One, Silvercrest, benefit from a takeover offer near the end of the period.

The large weighting to junior stocks was a drag on performance, although a handful of our larger juniors, such as Orogen Royalties, well outperformed the index, supporting our selection within this group. Among the larger miners, Barrick, a major holding, also hurt performance, though given its very low valuation multiples relative to peers, we believe a period of outperformance could lie ahead.

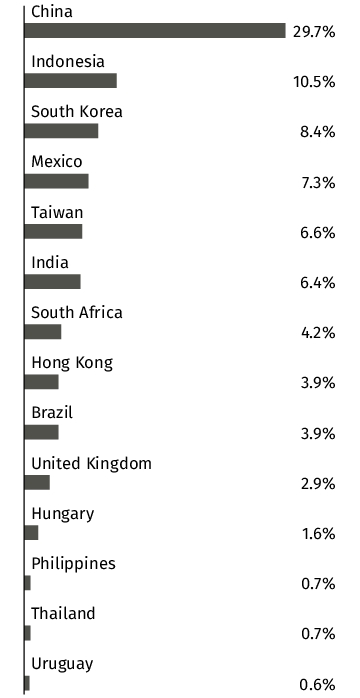

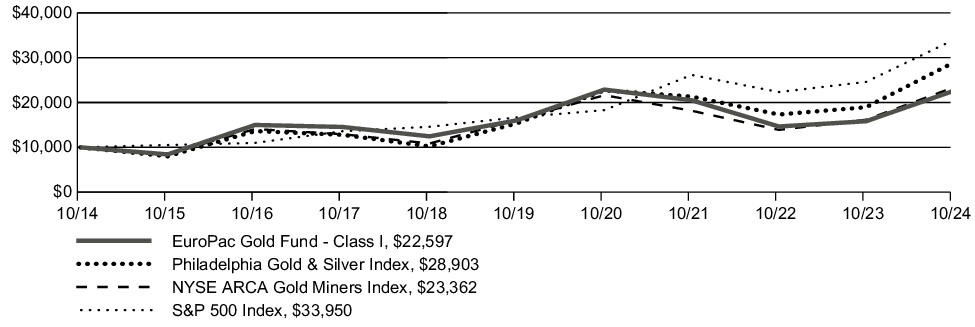

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac Gold Fund (Class A/EPGFX) | 36.05% | 5.85% | 7.83% |

| EuroPac Gold Fund (Class A/EPGFX)-- excluding sales load | 42.43% | 6.83% | 8.33% |

| Philadelphia Gold & Silver Index | 52.47% | 13.48% | 11.20% |

| NYSE ARCA Gold Miners Index | 44.56% | 7.68% | 8.86% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $268,395,202 |

| Total number of portfolio holdings | 82 |

| Total advisory fees paid (net) | $1,810,323 |

| Portfolio turnover rate as of the end of the reporting period | 26% |

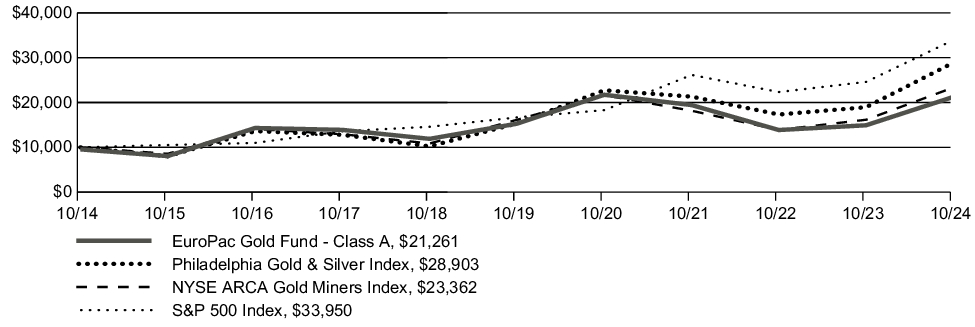

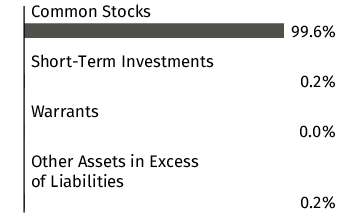

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Sector Allocation chart represents Common Stocks of the Fund.

| Agnico Eagle Mines Ltd. | 7.3% |

| Fortuna Silver Mines, Inc. | 6.7% |

| Pan American Silver Corp. | 6.6% |

| Wheaton Precious Metals Corp. | 5.4% |

| Barrick Gold Corp. | 5.2% |

| Royal Gold, Inc. | 5.2% |

| Franco-Nevada Corp. | 5.0% |

| Osisko Gold Royalties Ltd. | 4.8% |

| B2Gold Corp. | 4.5% |

| Metalla Royalty & Streaming Ltd. | 4.2% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/gold-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/gold-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac Gold Fund

Class I/EPGIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac Gold Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/gold-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac Gold Fund

(Class I/EPGIX) | $136 | 1.12% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The fund had a return of 42.79% in the 12 months ending October 31st, 2024, just a tad below the GDX Index. We experienced a series of major issues at many of our largest holdings, which negatively affected performance, starting with Franco-Nevada (whose largest asset was ordered closed by the Panamanian government last year) through to B2Gold (whose largest mine is in Mali, another country with political upheaval). Overall, the largest royalty companies, however, performed well. We also largely avoided some of the major stock declines of the period, such as Newmont.

Our overweight to silver stocks also helped, since that group in aggregate outperformed the GDX index. One, Silvercrest, benefit from a takeover offer near the end of the period.

The large weighting to junior stocks was a drag on performance, although a handful of our larger juniors, such as Orogen Royalties, well outperformed the index, supporting our selection within this group. Among the larger miners, Barrick, a major holding, also hurt performance, though given its very low valuation multiples relative to peers, we believe a period of outperformance could lie ahead.

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac Gold Fund (Class I/EPGIX)1 | 42.79% | 7.11% | 8.49% |

| Philadelphia Gold & Silver Index | 52.47% | 13.48% | 11.20% |

| NYSE ARCA Gold Miners Index | 44.56% | 7.68% | 8.86% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1 | The performance figures for Class I shares include the performance of the Class A shares for the periods prior to the inception date of Class I shares. Class A shares impose higher expenses than that of Class I shares. Class I shares do not have any initial or deferred sales charge. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $268,395,202 |

| Total number of portfolio holdings | 82 |

| Total advisory fees paid (net) | $1,810,323 |

| Portfolio turnover rate as of the end of the reporting period | 26% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Sector Allocation chart represents Common Stocks of the Fund.

| Agnico Eagle Mines Ltd. | 7.3% |

| Fortuna Silver Mines, Inc. | 6.7% |

| Pan American Silver Corp. | 6.6% |

| Wheaton Precious Metals Corp. | 5.4% |

| Barrick Gold Corp. | 5.2% |

| Royal Gold, Inc. | 5.2% |

| Franco-Nevada Corp. | 5.0% |

| Osisko Gold Royalties Ltd. | 4.8% |

| B2Gold Corp. | 4.5% |

| Metalla Royalty & Streaming Ltd. | 4.2% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/gold-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/gold-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac International Bond Fund

Class A/EPIBX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac International Bond Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/international-bond-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac International Bond Fund

(Class A/EPIBX) | $119 | 1.15% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The fund (EPBIX) performed in line with expectations over the year, slightly below its benchmark, with a total return of 6.25% excluding sales load, and 1.47% with sales load included. This return is just a bit below the gross yield of the fund before expenses, so the slightly weaker dollar over the year helped to offset those expenses.

The fund has a large percentage of its assets allocated to Emerging Markets, which have suffered over most of the year as China’s weak economy has been a drag on many markets, and inflation continues to be an issue for certain economies such as Brazil.

From an allocation perspective, Asian bonds have been a key focus, particularly India and Indonesia – the two combined represent over 25% of the assets of the fund. These currencies are relatively stable, +/- 1%, are not overly indebted economies, and the fund holds bonds that yield 6% - 8%. About 65% of the fund is allocated to Emerging Markets due to the significantly higher yields offered because of their economies growing at a faster clip, which is often supportive of the currencies, hence the positive carry of holding the bonds.

The fund also holds some high yielding Corporate bonds in Scandinavian currencies, namely Hawk Infinity Software, Gaming Innovation Group, and Lime Petroleum Group, that performed well, and still have double-digit yields.

The Fund’s positions in high-duration Thailand and Philippines bonds were the most positive contributors to the fund’s performance. Some of the LatAm bonds denominated in Brazilian Real, Mexican Peso, and Chilean Peso were a small drag on performance.

The Fund’s holdings in Euros and Norwegian Krone were strong contributors to positive performance – these are primarily unrated bonds or below investment grade with significantly higher yields than the “safest” German bunds, for example. Conclusively, AsiaPac and Western Europe were the regions that contributed most to the positive performance.

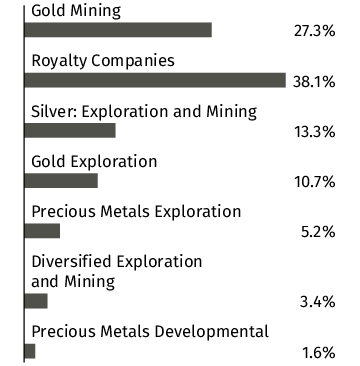

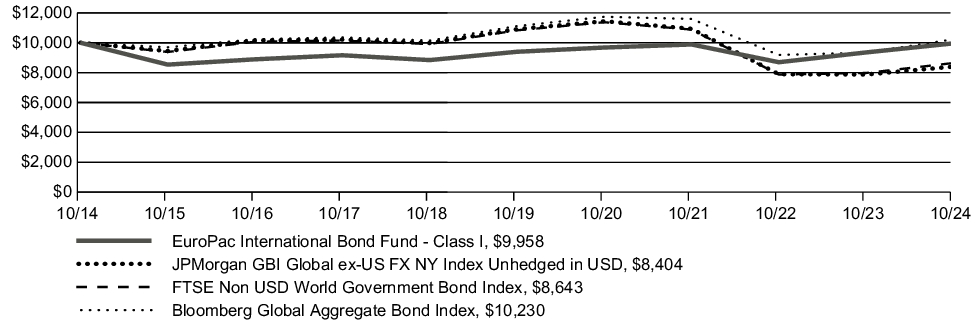

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac International Bond Fund (Class A/EPIBX) | 1.47% | 0.01% | -0.75% |

| EuroPac International Bond Fund (Class A/EPIBX)—excluding sales load | 6.25% | 0.93% | -0.29% |

| JPMorgan GBI Global ex-US FX NY Index Unhedged in USD | 6.77% | -5.08% | -1.72% |

| FTSE Non USD World Government Bond Index | 8.36% | -4.41% | -1.45% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $55,163,724 |

| Total number of portfolio holdings | 41 |

| Total advisory fees paid (net) | $178,825 |

| Portfolio turnover rate as of the end of the reporting period | 28% |

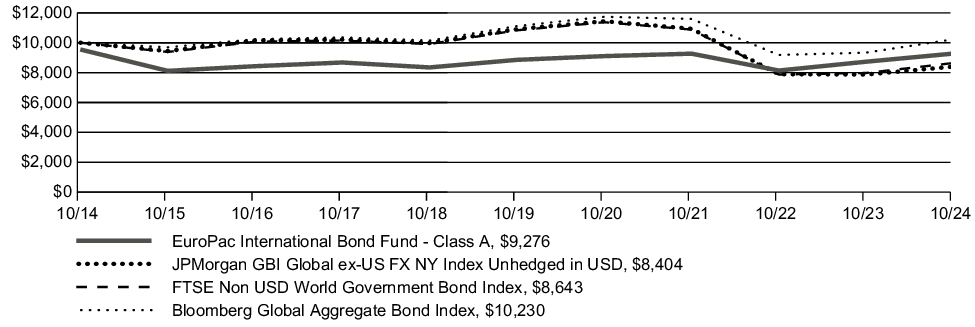

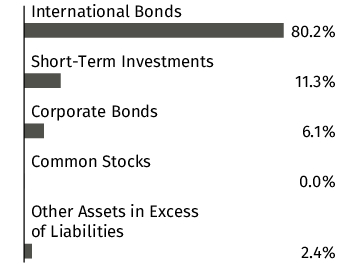

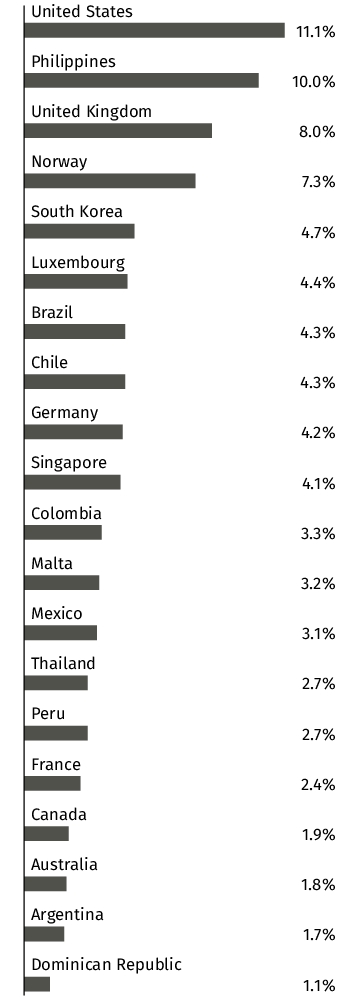

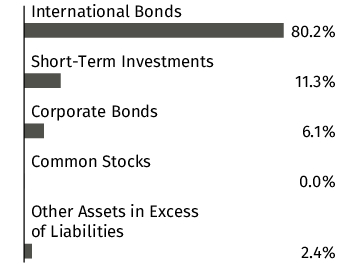

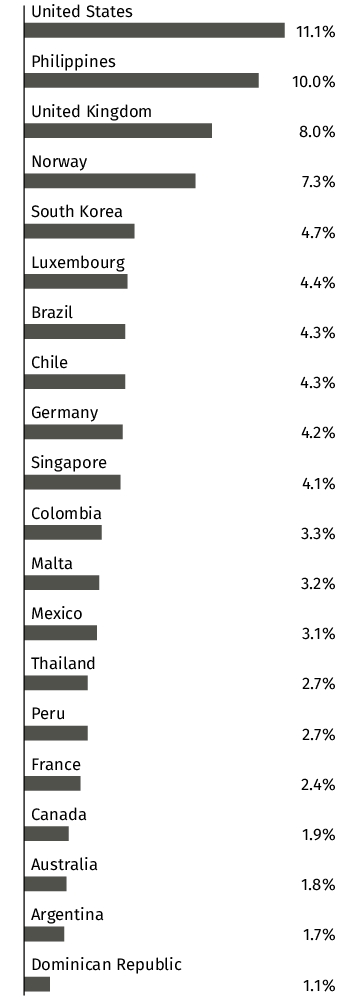

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Fixed Income Securities of the Fund.

| Philippine Government International Bond, 6.250%, 1/14/2036 | 5.1% |

| Inter-American Development Bank, 5.100%, 11/17/2026 | 4.7% |

| Brazilian Government International Bond, 10.250%, 1/10/2028 | 4.3% |

| Bonos de la Tesoreria de la Republica en pesos, 6.000%, 4/1/2033 | 4.3% |

| Kreditanstalt fuer Wiederaufbau, 4.400%, 7/25/2025 | 4.2% |

| Export-Import Bank of Korea, 7.250%, 12/7/2024 | 4.1% |

| European Bank for Reconstruction & Development, 6.300%, 10/26/2027 | 4.0% |

| Colombia Government International Bond, 9.850%, 6/28/2027 | 3.3% |

| Asian Development Bank, 6.200%, 10/6/2026 | 2.8% |

| European Investment Bank, 5.750%, 1/24/2025 | 2.8% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/international-bond-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/international-bond-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac International Bond Fund

Class I/EPBIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac International Bond Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/international-bond-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac International Bond Fund

(Class I/EPBIX) | $93 | 0.90% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The fund (EPBIX) performed in line with expectations over the year, slightly below its benchmark, with a total return of 6.5%. This return is just a bit below the gross yield of the fund before expenses, so the slightly weaker dollar over the year helped to offset those expenses.

The fund has a large percentage of its assets allocated to Emerging Markets, which have suffered over most of the year as China’s weak economy has been a drag on many markets, and inflation continues to be an issue for certain economies such as Brazil.

From an allocation perspective, Asian bonds have been a key focus, particularly India and Indonesia – the two combined represent over 25% of the assets of the fund. These currencies are relatively stable, +/- 1%, are not overly indebted economies, and the fund holds bonds that yield 6% - 8%. About 65% of the fund is allocated to Emerging Markets due to the significantly higher yields offered because of their economies growing at a faster clip, which is often supportive of the currencies, hence the positive carry of holding the bonds.

The fund also holds some high yielding Corporate bonds in Scandinavian currencies, namely Hawk Infinity Software, Gaming Innovation Group, and Lime Petroleum Group, that performed well, and still have double-digit yields.

The Fund’s positions in high-duration Thailand and Philippines bonds were the most positive contributors to the fund’s performance. Some of the LatAm bonds denominated in Brazilian Real, Mexican Peso, and Chilean Peso were a small drag on performance.

The Fund’s holdings in Euros and Norwegian Krone were strong contributors to positive performance – these are primarily unrated bonds or below investment grade with significantly higher yields than the “safest” German bunds, for example. Conclusively, AsiaPac and Western Europe were the regions that contributed most to the positive performance.

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac International Bond Fund (Class I/EPBIX) | 6.50% | 1.17% | -0.04% |

| JPMorgan GBI Global ex-US FX NY Index Unhedged in USD | 6.77% | -5.08% | -1.72% |

| FTSE Non USD World Government Bond Index | 8.36% | -4.41% | -1.45% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $55,163,724 |

| Total number of portfolio holdings | 41 |

| Total advisory fees paid (net) | $178,825 |

| Portfolio turnover rate as of the end of the reporting period | 28% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Fixed Income Securities of the Fund.

| Philippine Government International Bond, 6.250%, 1/14/2036 | 5.1% |

| Inter-American Development Bank, 5.100%, 11/17/2026 | 4.7% |

| Brazilian Government International Bond, 10.250%, 1/10/2028 | 4.3% |

| Bonos de la Tesoreria de la Republica en pesos, 6.000%, 4/1/2033 | 4.3% |

| Kreditanstalt fuer Wiederaufbau, 4.400%, 7/25/2025 | 4.2% |

| Export-Import Bank of Korea, 7.250%, 12/7/2024 | 4.1% |

| European Bank for Reconstruction & Development, 6.300%, 10/26/2027 | 4.0% |

| Colombia Government International Bond, 9.850%, 6/28/2027 | 3.3% |

| Asian Development Bank, 6.200%, 10/6/2026 | 2.8% |

| European Investment Bank, 5.750%, 1/24/2025 | 2.8% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/international-bond-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/international-bond-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac International Dividend Income Fund

Class A/EPDPX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac International Dividend Income Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/international-dividend-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac International Dividend Income Fund

(Class A/EPDPX) | $165 | 1.51% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

For the 12-month period ending October 31, 2024, the EuroPac International Dividend Income Fund returned 19.03% excluding sales load, and 13.63% with sales load included, which compared favorably to the 18.65% return of the S&P International Dividend Opportunities Index.

With regard to industry allocation, the Fund’s overweight allocation to the Materials sectors was a positive contributor with notable outperformance from IAMGold and Agnico Eagle Mines. Conversely, an overweight allocation to the Energy sector was a negative contributor with notable underperformance from BP PLC and Equinor ASA.

With regard to country allocation, the Fund’s overweight allocation to Canada was a positive relative contributor while an underweight allocation to Japan was a negative relative contributor.

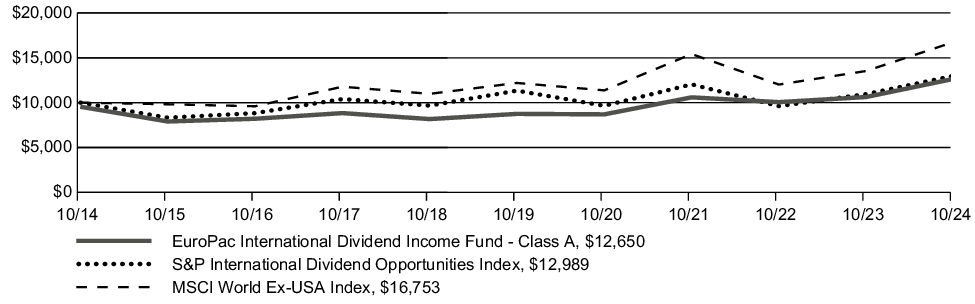

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac International Dividend Income Fund (Class A/EPDPX) | 13.63% | 6.66% | 2.38% |

| EuroPac International Dividend Income Fund (Class A/EPDPX) — excluding sales load | 19.03% | 7.66% | 2.85% |

| S&P International Dividend Opportunities Index | 18.65% | 2.76% | 2.65% |

| MSCI World Ex-USA Index | 23.84% | 6.55% | 5.30% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $120,606,730 |

| Total number of portfolio holdings | 62 |

| Total advisory fees paid (net) | $1,002,986 |

| Portfolio turnover rate as of the end of the reporting period | 4% |

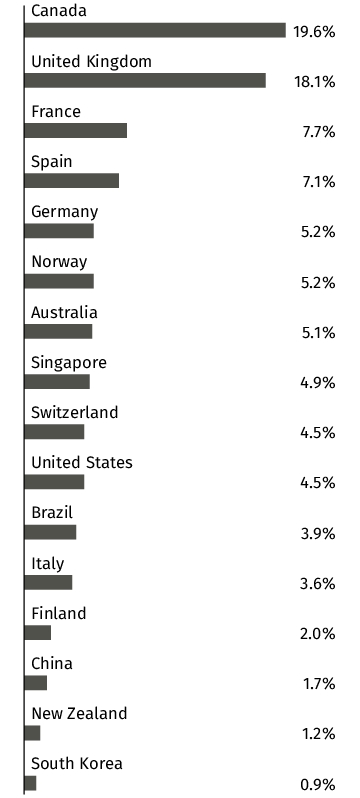

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Common Stocks of the Fund.

| Vodafone Group PLC | 4.6% |

| British American Tobacco PLC - ADR | 4.4% |

| Agnico Eagle Mines Ltd. | 3.2% |

| Barrick Gold Corp. | 3.1% |

| Pan American Silver Corp. | 2.9% |

| Engie S.A. | 2.9% |

| Roche Holding A.G. | 2.6% |

| Enel S.p.A. | 2.5% |

| Singapore Telecommunications Ltd. | 2.3% |

| IAMGOLD Corp. | 2.3% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/international-dividend-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/international-dividend-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac International Dividend Income Fund

Class I/EPDIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac International Dividend Income Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/international-dividend-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac International Dividend Income Fund

(Class I/EPDIX) | $138 | 1.26% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

For the 12-month period ending October 31, 2024, the EuroPac International Dividend Income Fund returned 19.28%, which compared favorably to the 18.65% return of the S&P International Dividend Opportunities Index.

With regard to industry allocation, the Fund’s overweight allocation to the Materials sectors was a positive contributor with notable outperformance from IAMGold and Agnico Eagle Mines. Conversely, an overweight allocation to the Energy sector was a negative contributor with notable underperformance from BP PLC and Equinor ASA.

With regard to country allocation, the Fund’s overweight allocation to Canada was a positive relative contributor while an underweight allocation to Japan was a negative relative contributor.

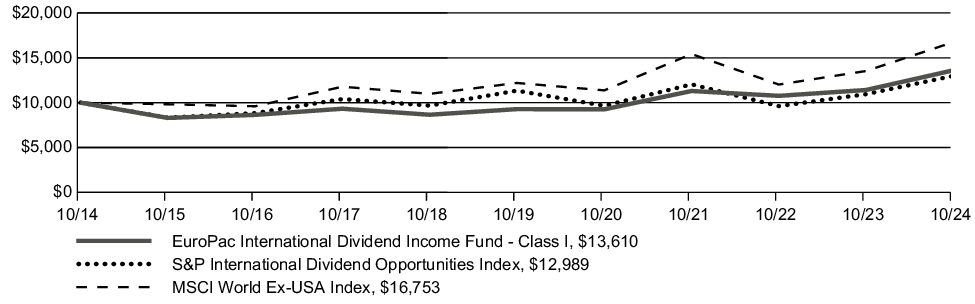

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac International Dividend Income Fund (Class I/EPDIX) | 19.28% | 7.97% | 3.13% |

| S&P International Dividend Opportunities Index | 18.65% | 2.76% | 2.65% |

| MSCI World Ex-USA Index | 23.84% | 6.55% | 5.30% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $120,606,730 |

| Total number of portfolio holdings | 62 |

| Total advisory fees paid (net) | $1,002,986 |

| Portfolio turnover rate as of the end of the reporting period | 4% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Common Stocks of the Fund.

| Vodafone Group PLC | 4.6% |

| British American Tobacco PLC - ADR | 4.4% |

| Agnico Eagle Mines Ltd. | 3.2% |

| Barrick Gold Corp. | 3.1% |

| Pan American Silver Corp. | 2.9% |

| Engie S.A. | 2.9% |

| Roche Holding A.G. | 2.6% |

| Enel S.p.A. | 2.5% |

| Singapore Telecommunications Ltd. | 2.3% |

| IAMGOLD Corp. | 2.3% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/international-dividend-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/international-dividend-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac International Value Fund

Class A/EPIVX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac International Value Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/international-value-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac International Value Fund

(Class A/EPIVX) | $190 | 1.71% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

From an allocation perspective, the primary factors driving the fund’s performance were its overweight position in gold mining shares and underweight position in Information Technology. Gold mining shares (20% allocation) had a strong performance for the year and contributed positively to the fund performance. Conversely, 0% exposure to the Information Technology sector contributed negatively to performance. The fund benefited from strong stock selection in Japan, with positions in Monotaro, Chugai Pharmaceutical and Baycurrent Consulting positively contributing to performance. The fund’s positions in Bayer and Vodaphone were a negative contributor. The Funds holding in Adidas was a positive contributor.

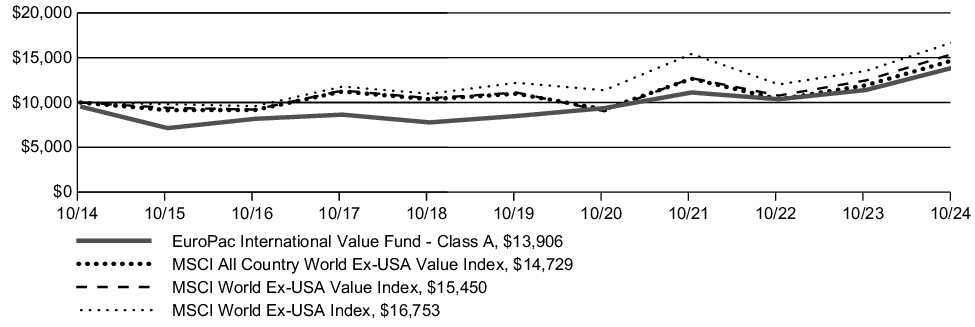

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac International Value Fund (Class A/EPIVX) | 16.56% | 9.35% | 3.35% |

| EuroPac International Value Fund (Class A/EPIVX)—excluding sales load | 22.02% | 10.35% | 3.83% |

| MSCI All Country World Ex-USA Value Index | 23.56% | 6.05% | 3.95% |

| MSCI World Ex-USA Value Index | 23.93% | 6.83% | 4.45% |

| MSCI World Ex-USA Index | 23.84% | 6.55% | 5.30% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $143,261,383 |

| Total number of portfolio holdings | 46 |

| Total advisory fees paid (net) | $1,507,720 |

| Portfolio turnover rate as of the end of the reporting period | 20% |

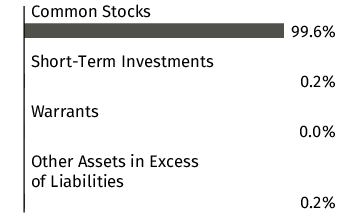

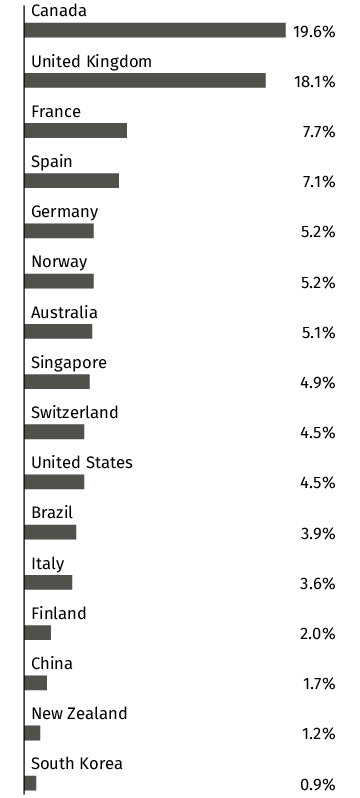

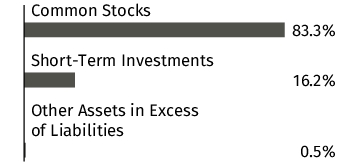

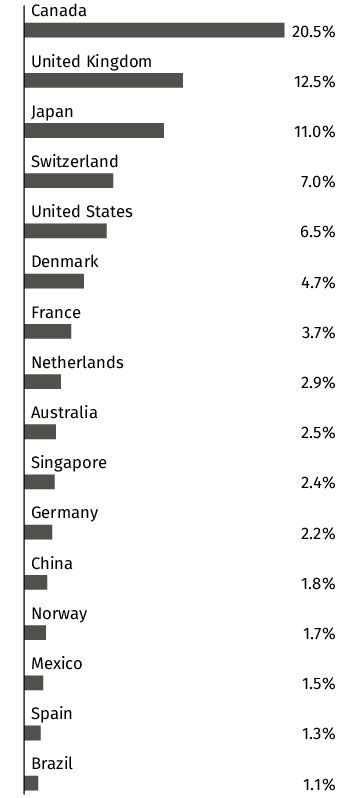

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Common Stocks of the Fund.

| British American Tobacco PLC - ADR | 4.9% |

| Barrick Gold Corp. | 4.5% |

| Agnico Eagle Mines Ltd. | 3.3% |

| Bank of Nova Scotia | 3.1% |

| Franco-Nevada Corp. | 2.8% |

| Newmont Corp. | 2.7% |

| Sonic Healthcare Ltd. | 2.5% |

| Newmont Corp. - CDI | 2.4% |

| Shell PLC | 2.3% |

| IAMGOLD Corp. | 2.3% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/international-value-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/international-value-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

EuroPac International Value Fund

Class I/EPVIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the EuroPac International Value Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://europacificfunds.com/our-funds/international-value-fund/. You can also request this information by contacting us at (888) 558-5851.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

EuroPac International Value Fund

(Class I/EPVIX) | $162 | 1.46% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

From an allocation perspective, the primary factors driving the fund’s performance were its overweight position in gold mining shares and underweight position in Information Technology. Gold mining shares (20% allocation) had a strong performance for the year and contributed positively to the fund performance. Conversely, 0% exposure to the Information Technology sector contributed negatively to performance. The fund benefited from strong stock selection in Japan, with positions in Monotaro, Chugai Pharmaceutical and Baycurrent Consulting positively contributing to performance. The fund’s positions in Bayer and Vodaphone were a negative contributor. The Funds holding in Adidas was a positive contributor.

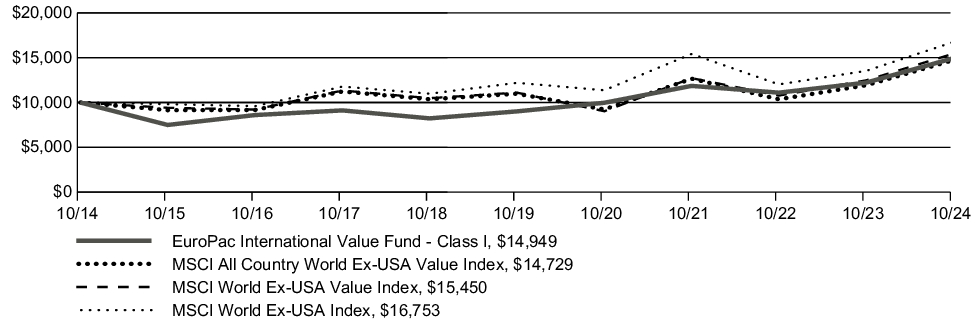

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| EuroPac International Value Fund (Class I/EPVIX) | 22.38% | 10.65% | 4.10% |

| MSCI All Country World Ex-USA Value Index | 23.56% | 6.05% | 3.95% |

| MSCI World Ex-USA Value Index | 23.93% | 6.83% | 4.45% |

| MSCI World Ex-USA Index | 23.84% | 6.55% | 5.30% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $143,261,383 |

| Total number of portfolio holdings | 46 |

| Total advisory fees paid (net) | $1,507,720 |

| Portfolio turnover rate as of the end of the reporting period | 20% |

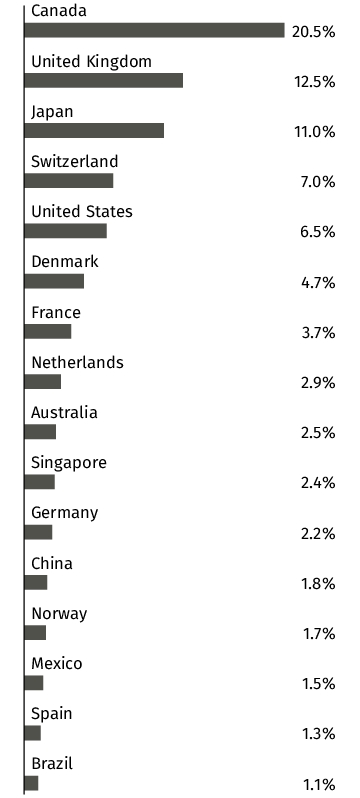

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Country Allocation exclude short-term holdings, if any. The Country Allocation chart represents Common Stocks of the Fund.

| British American Tobacco PLC - ADR | 4.9% |

| Barrick Gold Corp. | 4.5% |

| Agnico Eagle Mines Ltd. | 3.3% |

| Bank of Nova Scotia | 3.1% |

| Franco-Nevada Corp. | 2.8% |

| Newmont Corp. | 2.7% |

| Sonic Healthcare Ltd. | 2.5% |

| Newmont Corp. - CDI | 2.4% |

| Shell PLC | 2.3% |

| IAMGOLD Corp. | 2.3% |

Material Fund Changes

Distribution Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC, serves as the Fund's distributor (the “Distributor”). Prior to December 6, 2024, UMB Distribution Services, LLC (“UMB Distribution Services”), a wholly owned subsidiary of UMBFS, served as the Fund's distributor. The Distributor does not receive compensation from the Fund for its distribution services; The Adviser pays the Distributor a fee for its distribution-related services.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's prospectus, which is dated February 29, 2024 at https://europacificfunds.com/our-funds/international-value-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://europacificfunds.com/our-funds/international-value-fund/. You can also request this information by contacting us at (888) 558-5851.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (888) 558-5851 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

(b) Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant's principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

The registrant undertakes to provide to any person without charge, upon request, a copy of its code of ethics by mail when they call the registrant at (888) 558-5851.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. William H. Young is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. "Audit services" refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. "Audit-related services" refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. "Tax services" refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no "other services" provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | Euro Pacific Funds | FYE 10/31/2024 | FYE 10/31/2023 |

| (a) | Audit Fees | $86,000 | $77,625 |

| (b) | Audit-Related Fees | N/A | N/A |

| (c) | Tax Fees | $14,000 | $14,000 |

| (d) | All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Tait, Weller, & Weller LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| Euro Pacific Funds | FYE 10/31/2024 | FYE 10/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

| (f) | All of the principal accountant's hours spent on auditing the registrant's financial statements were attributed to work performed by full-time permanent employees of the principal accountant. |

The following table indicates the non-audit fees billed or expected to be billed by the registrant's accountant for services to the registrant and to the registrant's investment advisor (and any other controlling entity, etc.—not sub-advisor) for the last two years. The audit committee of the Board of Trustees has considered whether the provision of non-audit services that were rendered to the registrant's investment advisor is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant's independence.

| | Euro Pacific Funds | FYE 10/31/2024

| FYE 10/31/2023 |

| (g) | Registrant Non-Audit Related Fees | N/A | N/A |

| (h) | Registrant’s Investment Advisor | N/A | N/A |

Item 5. Audit Committee of Listed Registrants.

| (a) | Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934). |

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7 of this Form. |

EuroPac International Value Fund

Class A (EPIVX)

Class I (EPVIX)

EuroPac International Bond Fund

Class A (EPIBX)

Class I (EPBIX)

EuroPac International Dividend Income Fund

Class A (EPDPX)

Class I (EPDIX)

EP Emerging Markets Fund

Class A (EPASX)

Class I (EPEIX)

EuroPac Gold Fund

Class A (EPGFX)

Class I (EPGIX)

Annual Financials and Other Information

October 31, 2024

Euro Pacific Funds

Each a series of Investment Managers Series Trust

Table of Contents

| Item 7. Financial Statements and Financial Highlights | |

| Schedule of Investments | |

| EuroPac International Value Fund | 1 |

| EuroPac International Bond Fund | 4 |

| EuroPac International Dividend Income Fund | 8 |

| EP Emerging Markets Fund | 11 |

| EuroPac Gold Fund | 14 |

| Statements of Assets and Liabilities | 18 |

| Statements of Operations | 22 |

| Statements of Changes in Net Assets | 25 |

| Financial Highlights | 30 |

| Notes to Financial Statements | 40 |

| Report of Independent Registered Public Accounting Firm | 58 |

| Supplemental Information | 59 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Euro Pacific Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective shareholder report and prospectus.

https://europac.com

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

EuroPac International Value Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2024

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 83.3% | | | | |

| | | | | AUSTRALIA — 2.5% | | | | |

| | 200,000 | | | Sonic Healthcare Ltd. | | $ | 3,524,120 | |

| | | | | | | | | |

| | | | | BRAZIL — 1.1% | | | | |

| | 750,656 | | | Ambev S.A. - ADR | | | 1,636,430 | |

| | | | | | | | | |

| | | | | CANADA — 20.5% | | | | |

| | 55,000 | | | Agnico Eagle Mines Ltd. | | | 4,745,950 | |

| | 85,000 | | | Bank of Nova Scotia | | | 4,376,365 | |

| | 335,000 | | | Barrick Gold Corp. | | | 6,472,200 | |

| | 30,000 | | | Franco-Nevada Corp. | | | 3,979,800 | |

| | 600,000 | | | IAMGOLD Corp. * | | | 3,324,000 | |

| | 300,000 | | | Kinross Gold Corp. | | | 3,024,000 | |

| | 30,000 | | | Nutrien Ltd. | | | 1,430,400 | |

| | 84,694 | | | Pan American Silver Corp. | | | 1,982,686 | |

| | | | | | | | 29,335,401 | |

| | | | | CHINA — 1.8% | | | | |

| | 50,000 | | | Tencent Holdings Ltd. | | | 2,607,106 | |

| | | | | | | | | |

| | | | | DENMARK — 4.7% | | | | |

| | 20,000 | | | Novo Nordisk A/S - ADR | | | 2,239,000 | |

| | 30,000 | | | Novonesis (Novozymes) B | | | 1,885,239 | |

| | 35,000 | | | Royal Unibrew A/S | | | 2,633,098 | |

| | | | | | | | 6,757,337 | |

| | | | | FRANCE — 3.7% | | | | |

| | 25,000 | | | Pluxee N.V. * | | | 526,199 | |

| | 35,000 | | | Societe BIC S.A. | | | 2,554,661 | |

| | 25,000 | | | Sodexo S.A. | | | 2,170,130 | |

| | | | | | | | 5,250,990 | |

| | | | | GERMANY — 2.2% | | | | |

| | 20,000 | | | BASF S.E. | | | 972,283 | |

| | 35,000 | | | Carl Zeiss Meditec A.G. | | | 2,203,390 | |

| | | | | | | | 3,175,673 | |

| | | | | JAPAN — 11.0% | | | | |

| | 85,000 | | | BayCurrent Consulting, Inc. | | | 2,762,421 | |

| | 50,000 | | | Chugai Pharmaceutical Co., Ltd. | | | 2,379,074 | |

| | 200,000 | | | MonotaRO Co., Ltd. | | | 3,017,270 | |

| | 200,000 | | | Ono Pharmaceutical Co., Ltd. | | | 2,498,039 | |

| | 150,000 | | | Shoei Co., Ltd. | | | 2,301,883 | |

EuroPac International Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2024

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | JAPAN (Continued) | | | | |

| | 130,000 | | | Yakult Honsha Co., Ltd. | | $ | 2,825,043 | |

| | | | | | | | 15,783,730 | |

| | | | | MEXICO — 1.5% | | | | |

| | 1,500,000 | | | Kimberly-Clark de Mexico S.A.B. de C.V. - Class A | | | 2,153,727 | |

| | | | | | | | | |

| | | | | NETHERLANDS — 2.9% | | | | |

| | 22,000 | | | Aalberts N.V. | | | 793,903 | |

| | 100,000 | | | Shell PLC | | | 3,365,789 | |

| | | | | | | | 4,159,692 | |

| | | | | NORWAY — 1.7% | | | | |

| | 105,000 | | | Equinor A.S.A. | | | 2,495,031 | |

| | | | | | | | | |

| | | | | SINGAPORE — 2.4% | | | | |

| | 165,000 | | | Singapore Exchange Ltd. | | | 1,413,889 | |

| | 842,700 | | | Singapore Telecommunications Ltd. | | | 1,988,147 | |

| | | | | | | | 3,402,036 | |

| | | | | SPAIN — 1.3% | | | | |

| | 382,689 | | | Telefonica S.A. | | | 1,795,887 | |

| | | | | | | | | |

| | | | | SWITZERLAND — 7.0% | | | | |

| | 1,500 | | | Barry Callebaut A.G. | | | 2,626,216 | |

| | 20,000 | | | Novartis A.G. - ADR | | | 2,168,000 | |

| | 10,000 | | | Roche Holding A.G. | | | 3,098,856 | |

| | 6,000 | | | Sonova Holding A.G. | | | 2,195,498 | |

| | | | | | | | 10,088,570 | |

| | | | | UNITED KINGDOM — 12.5% | | | | |

| | 85,000 | | | BP PLC - ADR | | | 2,495,600 | |

| | 200,000 | | | British American Tobacco PLC - ADR | | | 6,996,000 | |

| | 125,000 | | | Burberry Group PLC | | | 1,270,648 | |

| | 55,760 | | | GSK PLC | | | 2,049,737 | |

| | 40,000 | | | Reckitt Benckiser Group PLC | | | 2,426,636 | |

| | 45,000 | | | Unilever PLC - ADR | | | 2,740,950 | |

| | | | | | | | 17,979,571 | |

| | | | | UNITED STATES — 6.5% | | | | |

| | 85,000 | | | Newmont Corp. | | | 3,862,400 | |

| | 73,200 | | | Newmont Corp. - CDI | | | 3,392,000 | |

EuroPac International Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2024

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | UNITED STATES (Continued) | | | | |

| | 15,000 | | | Philip Morris International, Inc. | | $ | 1,990,500 | |

| | | | | | | | 9,244,900 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $99,183,677) | | | 119,390,201 | |

| | | | | SHORT-TERM INVESTMENTS — 16.2% | | | | |

| | 23,223,031 | | | Federated Hermes Treasury Obligations Fund - Institutional Class, 4.635% 1 | | | 23,223,031 | |

| | | | | Total Short-Term Investments | | | | |

| | | | | (Cost $23,223,031) | | | 23,223,031 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.5% | | | | |

| | | | | (Cost $122,406,708) | | | 142,613,232 | |

| | | | | Other Assets in Excess of Liabilities — 0.5% | | | 648,151 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 143,261,383 | |

ADR – American Depository Receipt

CDI – CHESS Depositary Interest

PLC – Public Limited Company

| * | Non-income producing security. |

| 1 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

EuroPac International Bond Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2024

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 0.0% | | | | |

| | | | | UNITED STATES — 0.0% | | | | |

| | 118 | | | Hycroft Mining Holding Corp. * | | $ | 282 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $1,559,793) | | | 282 | |

| | | | | | | | | |

Principal

Amount1 | | | | | | | |

| | | | | FIXED INCOME SECURITIES — 86.3% | | | | |

| | | | | ARGENTINA — 1.7% | | | | |

| | | | | Argentina Treasury Bond BONCER | | | | |

| | 48,000,000 | | | 2.000%, 11/9/2026 | | | 955,637 | |

| | | | | | | | | |

| | | | | AUSTRALIA — 1.8% | | | | |

| | | | | Newcrest Finance Pty Ltd. | | | | |

| | 1,000,000 | | | 5.750%, 11/15/20412 | | | 1,023,444 | |

| | | | | | | | | |

| | | | | BRAZIL — 4.3% | | | | |

| | | | | Brazilian Government International Bond | | | | |

| | 13,500,000 | | | 10.250%, 1/10/2028 | | | 2,372,758 | |

| | | | | | | | | |

| | | | | CANADA — 1.9% | | | | |

| | | | | Pembina Pipeline Corp. | | | | |

| | 1,500,000 | | | 3.310%, 2/1/20303 | | | 1,034,243 | |

| | | | | | | | | |

| | | | | CHILE — 4.3% | | | | |

| | | | | Bonos de la Tesoreria de la Republica en pesos | | | | |

| | 2,200,000,000 | | | 6.000%, 4/1/20332 | | | 2,355,466 | |

| | | | | | | | | |

| | | | | COLOMBIA — 3.3% | | | | |

| | | | | Colombia Government International Bond | | | | |

| | 8,150,000,000 | | | 9.850%, 6/28/2027 | | | 1,805,164 | |

| | | | | | | | | |

| | | | | DOMINICAN REPUBLIC — 1.1% | | | | |

| | | | | Dominican Republic International Bond | | | | |

| | 37,000,000 | | | 9.750%, 6/5/2026 | | | 622,437 | |

| | | | | | | | | |

| | | | | FRANCE — 2.4% | | | | |

| | | | | TotalEnergies S.E. | | | | |

| | 1,200,000 | | | 3.369% 3,4,5 | | | 1,300,968 | |

| | | | | | | | | |

| | | | | GERMANY — 4.2% | | | | |

| | | | | Kreditanstalt fuer Wiederaufbau | | | | |

| | 48,700,000 | | | 4.400%, 7/25/2025 | | | 2,329,286 | |

EuroPac International Bond Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2024

Principal

Amount1 | | | | | Value | |

| | | | | FIXED INCOME SECURITIES (Continued) | | | | |

| | | | | LUXEMBOURG — 4.4% | | | | |

| | | | | European Investment Bank | | | | |

| | 24,500,000,000 | | | 5.750%, 1/24/2025 | | $ | 1,556,057 | |

| | 75,000,000 | | | 6.950%, 3/1/20292 | | | 888,783 | |

| | | | | | | | 2,444,840 | |

| | | | | MALTA — 3.2% | | | | |

| | | | | Gaming Innovation Group PLC | | | | |

| | 9,000,000 | | | 10.517% (Stockholm Interbank Offered Rates 3 Month + 725 basis points), 12/18/20263,6 | | | 874,270 | |

| | | | | Samara Asset Group PLC | | | | |

| | 800,000 | | | 12.200% (Oslo Bors Norway Interbank Offered Rate Fixing 3 Month + 750 basis points), 11/5/20292,3,6 | | | 870,228 | |

| | | | | | | | 1,744,498 | |

| | | | | MEXICO — 3.1% | | | | |

| | | | | America Movil S.A.B. de C.V. | | | | |

| | 17,850,000 | | | 9.500%, 1/27/20313 | | | 849,368 | |

| | | | | Mexican Bonos | | | | |

| | 20,000,000 | | | 7.750%, 11/23/2034 | | | 856,368 | |

| | | | | | | | 1,705,736 | |

| | | | | NORWAY — 7.3% | | | | |

| | | | | Aker A.S.A. | | | | |

| | 4,000,000 | | | 6.650% (Oslo Bors Norway Interbank Offered Rate Fixing 3 Month + 190 basis points), 11/22/20243,6 | | | 363,901 | |

| | 5,000,000 | | | 6.275%, 9/27/2027 | | | 465,194 | |

| | | | | City of Oslo Norway | | | | |

| | 5,000,000 | | | 1.320%, 2/16/2028 | | | 411,492 | |

| | | | | DNB Bank A.S.A. | | | | |

| | 10,000,000 | | | 7.040% (Oslo Bors Norway Interbank Offered Rate Fixing 3 Month + 230 basis points), 5/28/20303,6 | | | 915,352 | |

| | | | | Hawk Infinity Software A.S. | | | | |

| | 10,300,000 | | | 11.230% (Oslo Bors Norway Interbank Offered Rate Fixing 3 Month + 650 basis points), 10/3/20283,6 | | | 973,801 | |

| | | | | NFH 240448 A.S. | | | | |

| | 10,000,000 | | | 13.940% (Oslo Bors Norway Interbank Offered Rate Fixing 3 Month + 925 basis points), 7/19/20272,3,6 | | | 912,272 | |

| | | | | | | | 4,042,012 | |

| | | | | PERU — 2.7% | | | | |

| | | | | Peruvian Government International Bond | | | | |

| | 5,400,000 | | | 5.940%, 2/12/2029 | | | 1,467,677 | |

EuroPac International Bond Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2024

Principal

Amount1 | | | | | Value | |

| | | | | FIXED INCOME SECURITIES (Continued) | | | | |

| | | | | PHILIPPINES — 10.0% | | | | |

| | | | | Asian Development Bank | | | | |

| | 132,000,000 | | | 6.200%, 10/6/2026 | | $ | 1,556,598 | |

| | 100,000,000 | | | 6.150%, 2/25/2030 | | | 1,150,959 | |

| | | | | Philippine Government International Bond | | | | |

| | 165,000,000 | | | 6.250%, 1/14/2036 | | | 2,795,195 | |

| | | | | | | | 5,502,752 | |

| | | | | SINGAPORE — 4.1% | | | | |

| | | | | Housing & Development Board | | | | |

| | 1,000,000 | | | 2.320%, 1/24/2028 | | | 745,824 | |

| | | | | Singapore Government Bond | | | | |

| | 2,000,000 | | | 2.125%, 6/1/2026 | | | 1,501,842 | |

| | | | | | | | 2,247,666 | |

| | | | | SOUTH KOREA — 4.7% | | | | |

| | | | | Export-Import Bank of Korea | | | | |

| | 35,500,000,000 | | | 7.250%, 12/7/2024 | | | 2,261,026 | |

| | 20,000,000 | | | 3.700%, 3/23/2026 | | | 337,749 | |

| | | | | | | | 2,598,775 | |

| | | | | THAILAND — 2.7% | | | | |

| | | | | Thailand Government Bond | | | | |

| | 47,000,000 | | | 3.390%, 6/17/2037 | | | 1,511,158 | |

| | | | | | | | | |

| | | | | UNITED KINGDOM — 8.0% | | | | |

| | | | | BP Capital Markets PLC | | | | |

| | 1,000,000 | | | 3.250% 3,4,5 | | | 1,080,066 | |

| | | | | European Bank for Reconstruction & Development | | | | |

| | 190,000,000 | | | 6.300%, 10/26/2027 | | | 2,223,186 | |

| | | | | Vodafone Group PLC | | | | |

| | 1,000,000 | | | 4.200%, 10/3/20783,5 | | | 1,102,312 | |

| | | | | | | | 4,405,564 | |

| | | | | UNITED STATES — 11.1% | | | | |

| | | | | Inter-American Development Bank | | | | |

| | 41,500,000,000 | | | 5.100%, 11/17/2026 | | | 2,576,831 | |