Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | | Annual Report Pursuant to Section 13 or 15(d) of | | |

| | the Securities Exchange Act of 1934 | | |

| | | | |

| | For the fiscal year ended February 1, 2014 | | |

| | | | |

| | Or | | |

| | | | |

o | | Transition Report Pursuant to Section 13 or 15(d) of | | |

| | the Securities Exchange Act of 1934 | | |

For the transition period from to

Commission File Number: 000-51315

CITI TRENDS, INC.

(Exact name of registrant as specified in its charter)

Delaware | | 52-2150697 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

| | |

104 Coleman Boulevard, Savannah, Georgia | | 31408 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (912) 236-1561

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Name of each exchange

on which registered |

Common Stock, $.01 Par Value | | NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | | Accelerated filer x |

| | |

Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $211,981,707 as of August 2, 2013.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: Common Stock, par value $.01 per share, 15,580,948 shares outstanding as of March 25, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information from the registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year covered by this Annual Report on Form 10-K, with respect to the Annual Meeting of Stockholders to be held on June 4, 2014.

Table of Contents

PART I

Some statements in, or incorporated by reference into, this Annual Report on Form 10-K (this “Report”) of Citi Trends, Inc. (“we”, “us”, or the “Company”) may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than historical facts contained in this Report, including statements regarding our future financial position, business policy and plans and objectives and expectations of management for future operations, are forward-looking statements. The words “believe,” “may,” “could,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan,” “project” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events, including, among other things: our ability to anticipate and respond to fashion trends, competition in our markets, consumer spending patterns, actions of our competitors or anchor tenants in the strip shopping centers where our stores are located, and anticipated fluctuations in our operating results.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Item 1A. Risk Factors and elsewhere in this Report and the other documents we file with the Securities and Exchange Commission (“SEC”), including our reports on Form 8-K and Form 10-Q, and any amendments thereto. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. These forward-looking statements speak only as of the date of such statements. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained in this Report, whether as a result of any new information, future events or otherwise.

Information is provided herein with respect to our operations related to our fiscal years ended on February 1, 2014 (“fiscal 2013”), February 2, 2013 (“fiscal 2012”) and January 28, 2012 (“fiscal 2011”).

ITEM 1. BUSINESS

Overview and History

We are a value-priced retailer of urban fashion apparel and accessories for the entire family. Our merchandise offerings are designed to appeal to the fashion preferences of value-conscious consumers, particularly African-Americans. We believe that we provide merchandise at compelling values. Our goal is to provide nationally recognized branded merchandise and non-branded merchandise at discounts to department and specialty stores’ regular prices of 20% to 70%. Our stores average approximately 10,800 square feet of selling space and are typically located in neighborhood shopping centers that are convenient to low and moderate income customers. As of February 1, 2014, we operated 505 stores in both urban and rural markets in 29 states.

Our predecessor, Allied Department Stores, was founded in 1946 and grew into a chain of family apparel stores operating in the Southeast. In 1999, the Company, then consisting of 85 stores, was acquired by a private equity firm. Following this acquisition, management implemented several strategies to focus on the growing urban market and improve our operating and financial performance. After the successful implementation of these strategies and the successful growth of our chain from 85 stores to 212 stores, we completed an initial public offering of our common stock on May 18, 2005.

Our executive offices are located at 104 Coleman Boulevard, Savannah, Georgia 31408 and our telephone number is (912) 236-1561. Our Internet address is http://www.cititrends.com. The reference to our web site address in this Report does not constitute the incorporation by reference of the information contained at the web site in this Report. We make available, free of charge through publication on our web site, copies of our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we have filed such materials with, or furnished such materials to, the SEC. In addition, you may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or on the SEC’s web site at http://www.sec.gov, and you may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Company Strengths and Strategies

Our goal is to be the leading value-priced retailer of urban fashion apparel and accessories. We believe the following business strengths differentiate us from our competitors and are important to our success:

Focus on Urban Fashion Mix. We focus our merchandise on urban fashions, which we believe appeal to our core customers. We do not attempt to dictate trends, but rather devote considerable effort to identifying emerging trends and ensuring that our apparel assortment is considered timely and fashionable in the urban market. Our merchandising staff tests new emerging merchandise trends

3

Table of Contents

before reordering and actively manages the mix of fashion and branded products in the stores to keep our offering fresh and minimize markdowns.

Superior Value Proposition. As a value-priced retailer, we seek to offer top quality, fashionable merchandise at compelling prices in relation to department and specialty stores. We also offer products under our proprietary brands such as “Citi Steps,” “Red Ape,” “Vintage Harlem,” and “Lil Ms Hollywood.” These private brands enable us to expand our product selection, offer fashion merchandise at lower prices and enhance our product offerings.

Merchandise Mix that Appeals to the Entire Family. We merchandise our stores to create a destination environment capable of meeting the fashion needs of the entire value-conscious family. Each store offers a wide variety of products for men and women, as well as children. Our stores feature sportswear, dresses, outerwear, footwear, intimate apparel, accessories, scrubs and home décor. We believe that the breadth of our merchandise distinguishes our stores from many competitors that offer urban apparel primarily for women, and reduces our exposure to fashion trends and demand cycles in any single category.

Strong and Flexible Sourcing Relationships. We maintain strong sourcing relationships with a large group of suppliers. We have purchased merchandise from over 1,600 vendors in the past 12 months. Purchasing is controlled by a 40-plus member buying team located in one of our three buying offices - New York, New York; Los Angeles, California; and our Savannah, Georgia headquarters. We purchase merchandise through planned programs with vendors at reduced prices and opportunistically through close-outs, with the majority of our merchandise purchased for the current season and a lesser quantity held for sale in future seasons. To foster vendor relationships, we pay vendors promptly and do not ask for typical retail concessions, such as promotional and markdown allowances.

Attractive Fashion Presentation and Store Environment. We seek to provide a fashion-focused shopping environment that is similar to a specialty apparel retailer, rather than a typical off-price store. Products from nationally recognized brands are prominently displayed by brand, rather than by size, on dedicated, four-way fixtures featuring multiple sizes and styles. The remaining merchandise is arranged on hanging racks. The stores are carpeted and well-lit, with most featuring a sound system that plays urban adult and urban contemporary music throughout the store. Nearly all of our stores have either been opened or remodeled in the past ten years.

Cost-Effective Store Locations. We locate stores in high traffic strip shopping centers that are convenient to low and moderate income neighborhoods. We generally utilize previously occupied store sites which enables us to obtain attractive rents. Similarly, advertising expenses are low as we do not rely on promotion-driven sales but rather seek to build our reputation for value through everyday low prices. At the same time, from an investment perspective, we seek to design stores that are inviting and easy to shop, while limiting startup and fixturing costs.

Product Merchandising and Pricing

Products. Our merchandising strategy is to offer high quality urban apparel and accessories at attractive prices for the entire value-conscious family. We seek to maintain a diverse assortment of first quality, in-season merchandise that appeals to the distinctive tastes and preferences of our core customers. Approximately 33% of our net sales in fiscal 2013 were represented by nationally recognized brands. We also offer a wide variety of products from less recognized brands and a lesser amount representing private label products under our proprietary brands. Our private brand products enable us to expand product selection, offer merchandise at lower prices and enhance our product offerings.

Our merchandise includes apparel, accessories and home décor. Within apparel, we offer fashion sportswear for men, women and children, including offerings for newborns, infants, toddlers, boys and girls. Accessories include handbags, jewelry, footwear, belts, intimate apparel, scrubs and sleepwear.

The following table sets forth the merchandise assortment by classification as a percentage of net sales for fiscal 2013, 2012, and 2011.

| | Percentage of Net Sales | |

| | 2013 | | 2012 | | 2011 | |

Children’s | | 27% | | 27% | | 28% | |

Ladies’ | | 26% | | 29% | | 32% | |

Accessories | | 26% | | 23% | | 18% | |

Men’s | | 18% | | 18% | | 19% | |

Home décor | | 3% | | 3% | | 3% | |

Pricing. We purchase our merchandise at attractive prices and mark prices up less than department or specialty stores. We seek to provide nationally recognized brands at prices that are 20% to 70% below regular retail prices available in department stores and

4

Table of Contents

specialty stores. Further, we also consider the price-to-value relationships of our non-branded products to be exceptionally strong. Both branded and non-branded offerings validate our value and fashion positioning to our customers. The discount from the suggested retail price is reflected on the price tag. We review each department in our stores at least monthly for possible markdowns based on sales rates and fashion seasons to promote faster turnover of inventory and to accelerate the flow of current merchandise.

Sourcing and Allocation

The merchandising department oversees the sourcing, planning and allocation of merchandise to our stores, which allows us to utilize volume purchase discounts and maintain control over our inventory. We source our merchandise from over 1,600 vendors, consisting of domestic manufacturers and importers. Our Chief Merchandising Officer supervises a planning and allocation team consisting of 20 associates, as well as a buying team, which is comprised of over 40 merchants.

The members of our buying team have on average more than 14 years of experience in the retail business and have developed long-standing relationships with many of our vendors, including those controlling the distribution of branded apparel. Our buyers, who are based in New York, Los Angeles and Savannah, travel regularly to the major United States apparel markets, visiting major manufacturers and attending national and regional apparel trade shows, including urban-focused trade shows.

Our buyers purchase merchandise in styles, sizes and quantities to meet inventory levels developed by the planning staff. The buying staff utilizes several purchasing techniques that enable us to offer to customers branded and non-branded fashion merchandise at everyday low prices. The majority of the nationally recognized branded products we sell are purchased in-season, and we generally purchase later in the merchandising buying cycle than department and specialty stores. This allows us to take advantage of imbalances between retailers’ demands for specific merchandise and manufacturers’ supply of that merchandise. We also purchase merchandise from some vendors in advance of the selling season at reduced prices and purchase merchandise on an opportunistic basis near the end of the selling season, which we then store in our distribution centers for sale three to nine months later. Where possible, we seek to purchase items based on style or color in limited quantities on a test basis with the right to reorder as needed. Finally, we purchase private brand merchandise that we source to our specifications.

We allocate merchandise across our store base according to store-level demand. The merchandising staff utilizes a centralized management system to monitor merchandise purchasing, planning and allocation in order to maximize inventory turnover, identify and respond to changing product demands and determine the timing of markdowns to our merchandise. The buyers also regularly review the age and condition of the merchandise and manage both the reordering and clearance processes. In addition, the merchandising team communicates with regional, district and store managers to ascertain regional and store-level conditions and to better ensure that our product mix meets our consumers’ demands in terms of quality, fashion, price and availability.

We accept payment from our customers for merchandise at time of sale. Payments are made to us by cash, check, Visa™, Mastercard™ or Discover™. We do not extend credit terms to our customers; however, we do offer a layaway service.

Seasonality

The nature of our business is seasonal. Historically, sales in the first and fourth quarters have been higher than sales achieved in the second and third quarters of the fiscal year. Expenses and, to a greater extent, operating income, vary by quarter. Results of a period shorter than a full year may not be indicative of results expected for the entire year. Furthermore, the seasonal nature of our business may affect comparisons between periods.

Store Operations

Store Format. The average selling space of our existing 505 stores is approximately 10,800 square feet, which allows us the space and flexibility to departmentalize our stores and provide directed traffic patterns. We arrange most of our stores in a racetrack format with women’s sportswear in the center of each store and complementary categories adjacent to those items. Men’s and boy’s apparel is displayed on one side of the store, while dresses, footwear and accessories are displayed on the other side. Merchandise for infants, toddlers and girls, as well as home goods, are displayed along the back of the store. Impulse items, such as jewelry and sunglasses, are featured near the checkout area. Products from nationally recognized brands are prominently displayed on four-way racks at the front of each department. The remaining merchandise is displayed on hanging racks and occasionally on table displays. Large hanging signs identify each category location. The unobstructed floor plan allows the customer to see virtually all of the different product areas from the store entrance and provides us the flexibility to easily expand and contract departments in response to customer demand, seasonality and merchandise availability. Virtually all of our inventory is displayed on the selling floor. Prices are clearly marked and often have the comparative retail-selling price noted on the price tag.

In 2010, with the assistance of a retail design consulting firm, we began to test a new store format which we refer to as “Citi Lights”. We opened our first new prototype store in Savannah in July 2010 and have now opened a total of 66 new stores with the prototype design. Also, we have converted 25 of our existing stores to the new format and implemented the new format in connection with the relocation or expansion of 22 other stores, resulting in a total of 113 stores in the new format as of the end of fiscal 2013. The stores

5

Table of Contents

feature a new color palette and logo, a new layout, new fixturing, dressing room, graphics and lighting, a redesigned checkout area stocked with impulse items and an expanded footwear department. They typically have a main center drive aisle rather than the racetrack design utilized in our traditional stores. We plan to continue evaluating the performance of the Citi Lights stores before converting more of our stores to this format.

Store Management. Store operations are managed by our Senior Vice President of Store Operations, three regional vice presidents and 48 district managers, each of whom manages five to seventeen stores. The typical store is staffed with a store manager, two or three assistant managers and seven to eight part-time sales associates, all of whom rotate work days on a shift basis. Store managers and assistant store managers participate in a bonus program based on achieving predetermined levels of sales and inventory shrinkage. District managers participate in bonus programs based on achieving targeted levels of sales, profits, inventory shrinkage and payroll costs. Regional Vice Presidents participate in a bonus program based partly on a roll-up of the district managers’ bonuses and partly on the Company’s profit performance in relation to budget. Sales associates are compensated on an hourly basis with incentives. Moreover, we recognize individual performance through internal promotions and provide opportunities for advancement.

We place significant emphasis on loss prevention in order to control inventory shrinkage. Initiatives include electronic tags on most of our products, training and education of store personnel on loss prevention issues, digital video camera systems, alarm systems and motion detectors in the stores. In certain stores, we use an outside service to visually monitor the stores throughout the day using sophisticated camera systems. We also capture extensive point-of-sale data and maintain systems that monitor returns, voids and employee sales, and produce trend and exception reports to assist in identifying shrinkage issues. We have a centralized loss prevention team that focuses exclusively on implementation of these initiatives and specifically on stores that have experienced above average levels of shrinkage. We also maintain an independent, third party administered, toll-free line for reporting shrinkage concerns and any other employee concerns.

Employee Training. Our employees are critical to achieving our goals, and we strive to hire employees with high energy levels and motivation. We have well-established store operating policies and procedures and an extensive 90-day in-store training program for new store managers and assistant managers. Sales associates also participate in a 30-day customer service and store procedures training program, which is designed to enable them to assist customers in a friendly, helpful manner.

Layaway Program. We offer a layaway program that allows customers to purchase merchandise by initially paying a 20% deposit and a $2 service charge, although at various times, we have reduced the deposit requirement to 10% and waived the service charge in connection with promotional events. The customer then makes additional payments every two weeks and has 60 days within which to complete the purchase. If the purchase is not completed, the customer receives a merchandise credit for amounts paid less a re-stocking and layaway service fee.

Site Selection. Cost-effective store locations are an important part of our store profitability model. Accordingly, we look for second and third use store locations that offer attractive rents, but also meet our demographic and economic criteria. We have a dedicated real estate management team responsible for new store site selection. In selecting a location, we target both urban and rural markets. Demographic criteria used in site selection include concentrations of our core consumers. In addition, we require convenient site accessibility, as well as strong co-tenants, such as food stores, dollar stores and rent-to-own stores.

Shortly after we sign a new store lease and complete the necessary leasehold improvements to the building, we prepare the store over a three to four week period by installing fixtures, signs, dressing rooms, checkout counters and cash register systems and merchandising the initial inventory.

Advertising and Marketing

Our marketing goals are to build the “Citi Trends” brand, promote customers’ association of the “Citi Trends” brand with value, quality, fashion and everyday low prices, and drive traffic into our stores. We generally focus our advertising efforts during the first quarter (Spring/Easter), back-to-school and Christmas through the use of hip-hop radio stations, both local and syndicated. We also utilize social media as a way to engage our customers. In 2011, we started a Facebook page which has grown to over 370,000 fans. In addition, we promote new seasons and events in our window signage and through in-store announcements on our Muzak system. For store grand openings and significant remodels, we typically seek to create community awareness and consumer excitement through local radio remotes with local radio personalities broadcasting from the new location. We also distribute promotional items such as gift cards in connection with our grand openings and significant remodels.

Distribution

All merchandise sold in our stores is shipped directly from our distribution centers in Darlington, South Carolina and Roland, Oklahoma, utilizing various express package distributors. Our stores receive multiple shipments of merchandise from our distribution centers each week. The Darlington distribution center has 550,000 square feet of space, while the Roland distribution center has 460,000 square feet.

6

Table of Contents

Information Technology and Systems

We have information systems in place to support our core business functions, using an IBM iSeries as the computer platform, with enterprise software from Island Pacific, a software provider to the retail industry. This software supports purchase order management, price and markdown management, merchandise allocation, general ledger, accounts payable and sales audit functions. Our distribution centers are supported by software from Manhattan Associates.

Our stores use point-of-sale software from DataVantage, a division of MICROS Systems, Inc., to run the stores’ cash registers. The system uses bar code scanners at checkout to capture item sales and is supplemented by external pinpad/signature capture devices for the processing of charge card transactions. It also supports end-of-day processing and automatically transmits sales and transaction data to the corporate office soon after the close of business. Additionally, the software supports store time clock functions. To facilitate the marking down and re-ticketing of merchandise, employees in the stores use hand-held scanners that read UPC barcodes and prepare new price tickets for merchandise. The DataVantage software also enables us to sort, review and analyze store transaction data to assist with loss prevention activities. Software services from Workday are utilized to process our payroll and to facilitate various human capital management processes.

We believe that our information systems, with upgrades and updates over time, are adequate to support our operations for the foreseeable future.

Growth Strategy

Due to a challenging sales environment, we are taking a conservative approach to opening new stores. After opening four new stores in fiscal 2012, we opened one in fiscal 2013 and plan to open five to ten in fiscal 2014. We will continue to evaluate our growth strategy as we monitor operating results in fiscal 2014.

Competition

The markets we serve are highly competitive. The principal methods of competition in the retail business are fashion, assortment, pricing and presentation. We believe we have a competitive advantage in our offering of fashionable brands at everyday low prices. We compete against a diverse group of retailers, including national off-price retailers, mass merchants, smaller specialty retailers and dollar stores. The off-price retail companies with which we compete include TJX Companies, Inc. (“TJX Companies”), Ross Stores, Inc. (“Ross Stores”), The Cato Corporation (“Cato”), and Burlington Stores, Inc. (“Burlington”). In particular, Ross Stores’ “dd’s DISCOUNTS” stores, and Cato’s “It’s Fashion Metro” stores target lower and moderate income consumers. We believe our strategy of appealing to African-American consumers and offering urban apparel products allows us to compete successfully with these retailers. We also believe we offer a more inviting store format than the off-price retailers, including our use of carpeted floors and more prominently displayed brands. In addition, we compete with a group of smaller specialty retailers that sell only women’s products, such as Rainbow, It’s Fashion! and Simply Fashions. Our mass merchant competitors include Wal-Mart, Target and Kmart. These chains do not focus on fashion apparel and, within their apparel offering, lack the urban focus that we believe differentiates our offering and appeals to our core customers. Similarly, while some of the dollar store chains offer apparel, they typically offer a more limited selection focused on basic apparel needs. As a result, we believe there is significant demand for a value retailer that addresses the market of low and moderate income consumers generally and, particularly, African-American and other minority consumers who seek value-priced, urban fashion apparel and accessories. See Item 1A. Risk Factors in this Report for additional information.

Intellectual Property

We regard our trademarks and service marks as having significant value and as being important to our marketing efforts. We have registered “Citi Trends” as a trademark with the U.S. Patent and Trademark Office on the Principal Register for retail department store services. We have also registered the following trademarks with the U.S. Patent and Trademark Office on the Principal Register for various apparel: “Citi Steps,” “Citi Trends Fashion for Less,” “Diva Blue,” “Lil Citi Man,” “Lil Ms Hollywood,” “Red Ape,” “Satin in The Hood,” and “Vintage Harlem.” Our policy is to pursue registration of our marks and to oppose vigorously infringement of our marks.

Employees

As of February 1, 2014, we had approximately 2,400 full-time and approximately 2,600 part-time employees. Of these employees, approximately 4,300 are employed in our stores and the remainder are employed in our distribution centers and corporate office. We are not a party to any collective bargaining agreements, and none of our employees are represented by a labor union.

7

Table of Contents

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors, together with the other information contained or incorporated by reference into this Report. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we deem to be currently immaterial also may impair our business operations. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition and results of operations.

Our success depends on our ability to anticipate, identify and respond rapidly to changes in consumers’ fashion tastes, and our failure to adequately evaluate fashion trends could have an adverse effect on our business, financial condition and results of operations.

The apparel industry in general and our core customer market in particular are subject to rapidly evolving fashion trends and shifting consumer demands. Accordingly, our success is heavily dependent on our ability to anticipate, identify and capitalize on emerging fashion trends, including products, styles and materials that will appeal to our target consumers. A failure on our part to anticipate, identify or react appropriately and timely to changes in styles, trends, brand preferences or desired image preferences is likely to lead to lower demand for our merchandise, which could cause, among other things, sales declines, excess inventories and higher markdowns.

If we are unsuccessful in competing with our retail apparel competitors, our market share could decline or our growth could be impaired and, as a result, our financial results could suffer.

The retail apparel market is highly competitive with few barriers to entry. We compete against a diverse group of retailers, including national off-price apparel chains such as TJX Companies, Ross Stores, Cato, and Burlington; mass merchants such as Wal-Mart, Target and Kmart; smaller discount retail chains that sell only women’s products, such as Rainbow, It’s Fashion!, and Simply Fashions; and general merchandise discount stores and dollar stores, which offer a variety of products, including apparel, for the value-conscious consumer. We also compete against local off-price and specialty retail stores, regional retail chains, traditional department stores, web-based retail stores and other direct retailers.

The level of competition we face from these retailers varies depending on the product segment, as many of our competitors do not offer apparel for the entire family. Our greatest competition is generally in women’s apparel. Many of our competitors are larger than we are and have substantially greater resources than we do and, as a result, may be able to adapt better to changing market conditions, exploit new opportunities and exert greater pricing pressures on suppliers than we can. Many of these retailers have better name recognition among consumers than we do and purchase significantly more merchandise from vendors. These retailers may be able to purchase merchandise that we cannot purchase because of their name recognition and relationships with suppliers, or they may be able to purchase merchandise with better pricing concessions than we can. Our local and regional competitors have extensive knowledge of the consumer base and may be able to garner more loyalty from customers than we can. If the consumer base we serve is satisfied with the selection, quality and price of our competitors’ products, consumers may decide not to shop in our stores. Additionally, if our existing competitors or other retailers decide to focus more on our core customers, particularly African-American consumers, we may have greater difficulty in competing effectively, our business and results of operations could be adversely affected, and the market price of our common stock could suffer.

Our ability to attract consumers to our stores depends on the success of the strip shopping centers where our stores are located.

We locate our stores primarily in strip shopping centers where we believe our consumers and potential consumers shop. The success of an individual store can depend on favorable placement within a given strip shopping center. We cannot control the development of alternative shopping destinations near our existing stores or the availability or cost of real estate within existing or new shopping destinations. If our store locations fail to attract sufficient consumer traffic or we are unable to locate replacement locations on terms acceptable to us, our business could suffer. If one or more of the anchor tenants located in the strip shopping centers where our stores are located close or leave, or if there is significant deterioration of the surrounding areas in which our stores are located, our business may be adversely affected.

We could experience a reduction in sales if we are unable to fulfill our current and future merchandising needs.

We depend on our suppliers for the continued availability and satisfactory quality of our merchandise. Most of our suppliers could discontinue selling to us at any time. Additionally, if the manufacturers or other owners of brands or trademarks terminate the license agreements under which some of our suppliers sell our products, we may be unable to obtain replacement merchandise of comparable fashion appeal or quality, in the same quantities or at the same prices. In addition, a number of our suppliers are smaller, less capitalized companies and are more likely to be impacted by unfavorable general economic and market conditions than larger and better capitalized companies. These smaller suppliers may not have sufficient liquidity during economic downturns to properly fund their businesses, and their ability to supply their products to us could be negatively impacted. If we lose the services of one or more of

8

Table of Contents

our significant suppliers or one or more of them fail to meet our merchandising needs, we may be unable to obtain replacement merchandise in a timely manner, which could negatively impact our sales and results of operations.

Our sales could decline as a result of general economic and other factors outside of our control, such as changes in consumer spending patterns and declines in employment levels.

Downturns, or the expectation of a downturn, in general economic conditions, including the effects of unemployment levels, interest rates, levels of consumer debt, inflation in food and energy prices, taxation, government stimulus, consumer confidence, and other macroeconomic factors, could adversely affect consumer spending patterns, our sales and our results of operations. Consumer confidence may also be affected by domestic and international political unrest, acts of war or terrorism, natural disasters or other significant events outside of our control, any of which could lead to a decrease in spending by consumers. Because apparel generally is a discretionary purchase, declines in consumer spending patterns may have a more negative effect on apparel retailers than some other retailers. In addition, since many of our stores are located in the southeastern United States, our operations are more susceptible to regional factors than the operations of our more geographically diversified competitors. Therefore, any adverse economic conditions that have a disproportionate effect on the southeastern United States could have a greater negative effect on our sales and results of operations than on retailers with a more geographically diversified store base.

Adverse trade restrictions may disrupt our supply of merchandise. We also face various risks because much of our merchandise is imported from abroad.

We purchase the products we sell directly from approximately 1,600 vendors, and a substantial portion of this merchandise is manufactured outside of the United States and imported by our vendors from countries such as China and other areas of the Far East. The countries in which our merchandise currently is manufactured or may be manufactured in the future could become subject to new trade restrictions imposed by the United States or other foreign governments. Trade restrictions, including increased customs restrictions and tariffs or quotas against apparel items, as well as United States or foreign labor strikes, work stoppages or boycotts, could increase the cost or reduce the supply of apparel available to us and have an adverse effect on our business. In addition, our merchandise supply could be impacted if our vendors’ imports become subject to existing or future duties and quotas, or if our vendors face increased competition from other companies for production facilities, import quota capacity and shipping capacity.

We also face a variety of other risks generally associated with relying on vendors that do business in foreign markets and import merchandise from abroad, such as:

· political instability, natural disasters, or the threat of terrorism, in particular in countries where our vendors source merchandise;

· increases in merchandise costs due to raw material price inflation or changes in purchasing power caused by fluctuations in currency exchange rates;

· enhanced security measures at United States and foreign ports, which could delay delivery of imports;

· imposition of new or supplemental duties, taxes, and other charges on imports;

· delayed receipt or non-delivery of goods due to the failure of foreign-source suppliers to comply with import regulations, organized labor strikes or congestion at United States ports; and

· local business practice and political issues, including issues relating to compliance with domestic or international labor standards.

9

Table of Contents

As an apparel retailer, we rely on numerous third parties in the supply chain to produce and deliver the products that we sell, and our business may be negatively impacted by their failure to comply with applicable law.

We rely on numerous third parties to supply the products that we sell. Violations of law by our importers, manufacturers or distributors could result in delays in shipments and receipt of goods or damage our reputation, thus causing our sales to decline. In addition, merchandise we sell in our stores is subject to regulatory standards set by various governmental authorities with respect to quality and safety. Regulations in this area may change from time to time. Issues with the quality and safety of merchandise we sell in our stores, regardless of our fault, or customer concerns about such issues, could result in damage to our reputation, lost sales, uninsured product liability claims or losses, merchandise recalls and increased costs. Further, we are susceptible to the receipt of counterfeit brands or unlicensed goods. We could incur liability with manufacturers or other owners of the brands or trademarked products if we inadvertently receive and sell counterfeit brands or unlicensed goods and, therefore, it is important that we establish relationships with reputable vendors to prevent the possibility that we inadvertently receive counterfeit brands or unlicensed goods. Although we have a quality assurance team to check merchandise in an effort to assure that we purchase only authentic brands and licensed goods and are careful in selecting our vendors, we may receive products that we are prohibited from selling or incur liability for selling counterfeit brands or unlicensed goods, which could adversely impact our results of operations.

A significant disruption to our distribution process or southeastern retail locations could have an adverse effect on our business, financial condition and results of operations.

Our ability to distribute our merchandise to our store locations in a timely manner is essential to the efficient and profitable operation of our business. We have distribution centers located in Darlington, South Carolina and Roland, Oklahoma. Any natural disaster or other disruption to the operation of either of these facilities due to fire, accidents, weather conditions or any other cause could damage a significant portion of our inventory and impair our ability to stock our stores adequately.

In addition, the southeastern United States, where the Darlington distribution center and many of our stores are located, is vulnerable to significant damage or destruction from hurricanes and tropical storms. Although we maintain insurance on our stores and other facilities, the economic effects of a natural disaster that affects our distribution centers and/or a significant number of our stores could increase our operating expenses, impair our cash flows and reduce our sales.

If we fail to protect our trademarks, there could be a negative effect on our brand image and limitations on our ability to penetrate new markets.

We believe that our “Citi Trends” trademark is integral to our store design and our success in building consumer loyalty to our brand. We have registered this trademark with the U.S. Patent and Trademark Office. We have also registered, or applied for registration of, additional trademarks with the U.S. Patent and Trademark Office that we believe are important to our business. We cannot assure you that these registrations will prevent imitation of our name, merchandising concept, store design or private label merchandise or the infringement of our other intellectual property rights by others. Imitation of our name, concept, store design or merchandise in a manner that projects lesser quality or carries a negative connotation of our brand image could have an adverse effect on our business, financial condition and results of operations.

In addition, we cannot assure you that others will not try to block the manufacture or sale of our private label merchandise by claiming that our merchandise violates their trademarks or other proprietary rights since other entities may have rights to trademarks that contain the word “Citi” or may have rights in similar or competing marks for apparel and/or accessories. Although we cannot currently estimate the likelihood of success of any such lawsuit or ultimate resolution of such a conflict, such a controversy could have an adverse effect on our business, financial condition and results of operations.

If we fail to implement and maintain effective internal controls in our business, there could be an adverse effect on our business, financial condition, results of operations and stock price.

Section 404 of the Sarbanes Oxley Act of 2002 requires annual management assessments of the effectiveness of our internal controls over financial reporting and an audit of such controls by our independent registered public accounting firm. If we fail to maintain the adequacy of our internal controls, we may be unable to conclude on an ongoing basis that we have effective internal controls over financial reporting. Moreover, effective internal controls, particularly those related to revenue recognition and accounting for inventory/cost of sales, are necessary for us to produce reliable financial reports and are important in our effort to prevent financial fraud. If we cannot produce reliable financial reports or prevent fraud, our business, financial condition and results of operations could be harmed, investors could lose confidence in our reported financial information, the market price of our stock could decline significantly and we may be unable to obtain additional financing to operate and expand our business.

Failure to attract, train, assimilate and retain skilled personnel could have an adverse effect on our financial condition.

Like most retailers, we experience significant employee turnover rates, particularly among store sales associates and managers. We therefore must continually attract, hire and train new personnel to meet our staffing needs. We constantly compete for qualified

10

Table of Contents

personnel with companies in our industry and in other industries. A significant increase in the turnover rate among our store sales associates and managers would increase our recruiting and training costs and could cause us to be unable to service our customers effectively, thus reducing our ability to operate our stores as profitably as we have in the past.

In addition, we rely heavily on the experience and expertise of our senior management team and other key management associates, and accordingly, the loss of their services could have a material adverse effect on our business strategy and results of operations.

Failure to comply with legal requirements could result in increased costs.

Compliance risks in our business include areas such as employment law, taxation, customer relations and personal injury claims, among others. Failure to comply with laws, rules and regulations could result in unexpected costs and have an adverse effect on our business and reputation.

Changes in government regulations could have an adverse effect on our financial condition and results of operations.

New legal requirements, including health care legislation, could result in higher compliance costs. For instance, health care reform legislation, among other things, includes guaranteed coverage requirements, eliminates exclusions for pre-existing conditions and maximum benefits, restricts the extent to which policies can be rescinded, and imposes new taxes on health insurers and health care benefits. Such significant changes in government regulations could have a material adverse effect on our business and results of operations.

Increases in the minimum wage could have an adverse effect on our financial condition and results of operations.

Wage rates for many of our employees are at or slightly above the minimum wage. As federal and/or state minimum wage rates increase, we may need to increase not only our employees’ wage rates that are under the new minimum, but also the wages paid to our other hourly employees. Any increase in the cost of our labor could have a material adverse effect on our operating costs, financial condition and results of operations.

Any failure of our management information systems or the inability of third parties to continue to upgrade and maintain our systems could have an adverse effect on our business, financial condition and results of operations.

We depend on the accuracy, reliability and proper functioning of our management information systems, including the systems used to track our sales and facilitate inventory management. We also rely on our management information systems for merchandise planning, replenishment and markdowns, as well as other key business functions. These functions enhance our ability to optimize sales while limiting markdowns and reducing inventory risk through properly marking down slow-selling styles, reordering existing styles and effectively distributing new inventory to our stores. We do not currently have redundant systems for all functions performed by our management information systems. Any interruption in these systems could impair our ability to manage our inventory effectively, which could have an adverse effect on our business.

We depend on third-party suppliers to maintain and periodically upgrade our management information systems, including the software programs supporting our inventory management functions. If any of these suppliers is unable to continue to maintain and upgrade these software programs and/or if we are unable to convert to alternate systems in an efficient and timely manner, it could result in an adverse effect on our business.

Failure to secure our customers’ charge card information, or the private data relating to our associates or the Company, could subject us to negative publicity, government enforcement actions, or private litigation.

We have procedures and technology in place to safeguard our customers’ debit and credit card information, our associates’ private data, and the Company’s records and intellectual property. However, if we experience a data security breach, we could be exposed to costly negative publicity, governmental enforcement actions, and private litigation. In addition, our sales could be negatively impacted if our customers have security concerns and are not willing to purchase our merchandise using charge cards.

Our sales, inventory levels and earnings fluctuate on a seasonal basis, which makes our business more susceptible to adverse events that occur during the first and fourth quarters.

Our sales and earnings are significantly higher during the first and fourth quarters each year due to the importance of the spring selling season, which includes Easter, and the fall selling season, which includes Christmas. Factors negatively affecting us during the first and fourth quarters, including adverse weather, unfavorable economic conditions, reduced governmental assistance, and tax refund patterns for our customers, will have a greater adverse effect on our financial condition than if our business was less seasonal.

In order to prepare for the spring and fall selling seasons, we must order and keep in stock significantly more merchandise than during other parts of the year. This seasonality makes our business more susceptible to the risk that our inventory will not satisfy actual

11

Table of Contents

consumer demand. In addition, any unanticipated demand imbalances during these peak shopping seasons could require us to sell excess inventory at a substantial markdown or fail to satisfy our consumers. In either event, our sales may be lower and our cost of sales may be higher than historical levels, which could have a material adverse effect on our business, financial condition and results of operations.

We experience fluctuations and variability in our comparable store sales and quarterly results of operations and, as a result, the market price of our common stock may fluctuate substantially.

Our comparable store sales and quarterly results have fluctuated significantly in the past based on a number of economic, seasonal and competitive factors, and we expect them to continue to fluctuate in the future. Since the beginning of fiscal 2010, our quarter-to-quarter comparable store sales have ranged from a decrease of 11.9% to an increase of 9.6%. This variability could cause our comparable store sales and quarterly results to fall below the expectations of securities analysts or investors, which could result in a decline in the market price of our common stock.

Our stock price is subject to volatility.

Our stock price has been volatile in the past and may be influenced in the future by a number of factors, including:

· actual or anticipated fluctuations in our operating results;

· changes in securities analysts’ recommendations or estimates of our financial performance;

· changes in market valuations or operating performance of our competitors or companies similar to ours;

· announcements by us, our competitors or other retailers;

· additions and departures of key personnel;

· changes in accounting principles;

· the passage of legislation or other developments affecting us;

· the trading volume of our common stock in the public market;

· changes in economic or financial market conditions;

· natural disasters, terrorist acts, acts of war or periods of civil unrest; and

· the realization of some or all of the risks described in this section entitled “Risk Factors.”

In addition, the stock markets have experienced significant price and trading volume fluctuations from time to time, and the market prices of the equity securities of retailers have been extremely volatile and have recently experienced sharp price and trading volume changes. These broad market fluctuations may adversely affect the market price of our common stock.

We do not currently intend to pay dividends on our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future.

Provisions in our certificate of incorporation and by-laws and Delaware law may delay or prevent our acquisition by a third party.

Our second amended and restated certificate of incorporation and our amended and restated by-laws contain several provisions that may make it more difficult for a third party to acquire control of us without the approval of our board of directors. These provisions include, among other things, a classified board of directors, advance notice for raising business or making nominations at stockholder meetings and “blank check” preferred stock. Blank check preferred stock enables our board of directors, without stockholder approval, to designate and issue additional series of preferred stock with such dividend, liquidation, conversion, voting or other rights, including convertible securities with no limitations on conversion, as our board of directors may determine, including rights to dividends and proceeds in a liquidation that are senior to the common stock.

12

Table of Contents

We are also subject to several provisions of the Delaware General Corporation Law that could delay, prevent or deter a merger, acquisition, tender offer, proxy contest or other transaction that might otherwise result in our stockholders receiving a premium over the market price for their common stock or may otherwise be in the best interests of our stockholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Store Locations

As of February 1, 2014, we operated 505 stores located in 29 states. Our stores average approximately 10,800 square feet of selling space and are typically located in neighborhood strip shopping centers that are convenient to low and moderate income customers.

We have no franchising relationships, and all of the stores are company operated. All existing 505 stores, totaling 6.7 million total square feet and 5.5 million selling square feet, are leased under operating leases. The typical store lease is for five years with options to extend the lease term for three additional five-year periods. Nearly all store leases provide us the right to cancel following an initial three-year period in the event the store does not meet pre-determined sales levels. The table below sets forth the number of stores in each of the 29 states in which we operated as of February 1, 2014:

Alabama—29

Arkansas—8

California—9

Delaware—1

Florida—47

Georgia—61

Illinois—18

Indiana—12

Iowa—2

Kansas—1

Kentucky—6

Louisiana—33

Maryland—3

Michigan—21

Minnesota—1

Mississippi—25

Missouri—6

Nebraska—1

Nevada—3

New York—4

North Carolina—43

Ohio—26

Oklahoma—5

Pennsylvania—5

South Carolina—42

Tennessee—18

Texas—49

Virginia—20

Wisconsin—6

Support Center Facilities

We own a facility in Savannah, Georgia totaling approximately 70,000 square feet, which serves as our headquarters and, to a lesser extent, as a storage facility. We also own an approximately 550,000 square-foot distribution center in Darlington, South Carolina and a 460,000 square-foot distribution center in Roland, Oklahoma. In addition, we currently lease a 9,200 square-foot office in New York City and a 1,200 square-foot office in Los Angeles which are used for buyer operations and meetings with vendors.

13

Table of Contents

ITEM 3. LEGAL PROCEEDINGS

On August 12, 2011, we received a letter of determination from the U.S. Equal Employment Opportunity Commission (the “EEOC”) commencing a conciliation process regarding alleged discrimination against males by us in our hiring and promotion practices during the years 2004 through 2006. In its letter of determination, the EEOC sought recovery in the amount of $0.2 million on behalf of a former male employee and in the additional amount of $3.8 million in a settlement fund for a class of unidentified males who sought or considered seeking manager or assistant manager positions in our stores. The EEOC also seeks certain undertakings by us with regard to our employment policies and procedures and a reporting obligation to the EEOC with respect to our compliance with these undertakings.

We have not received full documentation or information from the EEOC in support of its letter of determination, but have undertaken our own internal analysis of the EEOC’s claims and defenses to such claims and have had discussions with the EEOC in that regard. Following discussions with the EEOC regarding possible settlement, the EEOC proposed a settlement amount to be paid by us of $2.5 million, with any unclaimed funds following efforts to identify and compensate claimants to be directed to one or more charities. In the interest of reaching a satisfactory conciliation agreement with the EEOC, we proposed a total economic settlement offer of $1.0 million to cover all claims and the expenses of administering and complying with the settlement (excluding professional fees), with no reversion of unclaimed funds back to us. We continue to await the EEOC’s response to our most recent proposal regarding settlement. We are also evaluating other aspects of the conciliation process established by the EEOC.

On February 24, 2012, a suit was filed in the United States District Court for the Northern District of Alabama, Middle Division, by certain individuals as a purported collective action on behalf of current and former employees of the Company holding store managerial positions. The plaintiffs allege that store managers have been improperly classified as exempt from the obligation to pay overtime in violation of the Fair Labor Standards Act. We are vigorously defending the claims that have been asserted in this lawsuit. The trial court has conditionally certified a class of store managers and ruled that store managers who signed arbitration agreements are not subject to arbitration. The trial court’s ruling regarding arbitration was affirmed on appeal by a panel of the United States Court of Appeals for the Eleventh Circuit. Also, notwithstanding the initial actions by the trial court, the conditional class may be subject to decertification at the close of discovery. Because no discovery has been conducted to date, we are unable to determine the probability of any particular outcome and it is not reasonably possible to estimate a range of loss with respect to this matter. Accordingly, no accrual for costs has been recorded, and the potential impact of this matter on our financial position, results of operations and cash flows cannot be determined at this time.

We are from time to time also involved in various other legal proceedings incidental to the conduct of our business, including claims by customers, employees or former employees. Once it becomes probable that we will incur costs in connection with a legal proceeding and such costs can be reasonably estimated, we establish appropriate reserves. While legal proceedings are subject to uncertainties and the outcome of any such matter is not predictable, we are not aware of any legal proceedings pending or threatened against us that we expect to have a material adverse effect on our financial condition, results of operations or liquidity.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

14

Table of Contents

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS ANDISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on The NASDAQ Stock Market under the symbol “CTRN”. The following table shows the high and low per share prices of our common stock for the periods indicated.

| | High | | Low | |

2012 | | | | | |

First Quarter | | 12.50 | | 8.80 | |

Second Quarter | | 16.42 | | 10.19 | |

Third Quarter | | 15.51 | | 10.53 | |

Fourth Quarter | | 14.61 | | 10.10 | |

| | | | | |

2013 | | | | | |

First Quarter | | 13.49 | | 9.73 | |

Second Quarter | | 15.65 | | 11.58 | |

Third Quarter | | 18.21 | | 13.87 | |

Fourth Quarter | | 18.45 | | 14.40 | |

On March 25, 2014, the last reported sale price of our common stock on The NASDAQ Stock Market was $16.42 per share. On March 25, 2014, there were 107 holders of record and approximately 2,500 beneficial holders of our common stock.

We have never declared or paid any cash dividends on our common stock and do not intend to pay any cash dividends on our common stock in the foreseeable future.

Recent Sales of Unregistered Securities.

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers.

None.

Equity Compensation Plan Information.

See Item 12 of this Report.

15

Table of Contents

Stock Performance Graph

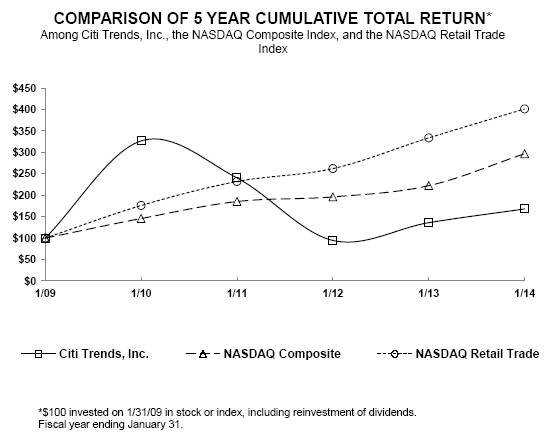

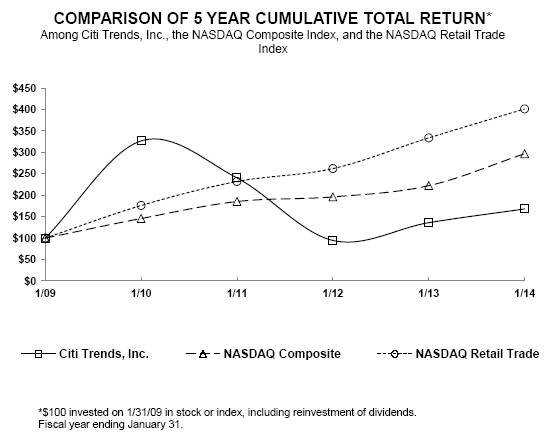

Set forth below is a line graph comparing the last five years’ percentage change in the cumulative total stockholder return on shares of our common stock against (i) the cumulative total return of companies listed on The NASDAQ Stock Market and (ii) the cumulative total return of the NASDAQ Retail Trade Index. This graph assumes that $100 was invested on January 31, 2009 in our common stock and in each of the market index and the industry index, and that all cash distributions were reinvested. Our common stock price performance shown on the graph is not indicative of future price performance.

Total Return Analysis | | 1/09 | | 1/10 | | 1/11 | | 1/12 | | 1/13 | | 1/14 | |

| | | | | | | | | | | | | |

Citi Trends, Inc. | | 100.00 | | 326.65 | | 240.29 | | 94.44 | | 135.78 | | 167.89 | |

NASDAQ Composite | | 100.00 | | 145.73 | | 185.35 | | 196.13 | | 222.33 | | 296.73 | |

NASDAQ Retail Trade | | 100.00 | | 176.03 | | 231.96 | | 262.10 | | 333.70 | | 401.19 | |

16

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

Selected Financial and Operating Data

The following table provides selected consolidated financial and operating data for each of the fiscal years in the five-year period ended February 1, 2014, including: (a) consolidated statement of operations data for each such period, (b) additional operating data for each such period and (c) consolidated balance sheet data as of the end of each such period. The consolidated statement of operations data for the fiscal years ended February 1, 2014, February 2, 2013 and January 28, 2012 and the consolidated balance sheet data as of February 1, 2014 and February 2, 2013 are derived from our audited consolidated financial statements included in Item 8 of this Report that have been audited by KPMG LLP, an independent registered public accounting firm. The statement of operations data for the fiscal years ended January 29, 2011 and January 30, 2010 and the balance sheet data as of January 28, 2012, January 29, 2011 and January 30, 2010 are derived from our audited financial statements that are not included in this Report. The selected consolidated financial and operating data set forth below should be read in conjunction with, and are qualified in their entirety by reference to, the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this Report and our consolidated financial statements and related notes set forth in the financial pages of this Report. Historical results are not necessarily indicative of results to be expected for any future period.

| | Fiscal Year Ended (1) | |

| | February 1,

2014 | | February 2,

2013 | | January 28,

2012 | | January 29,

2011 | | January 30,

2010 | |

| | (dollars in thousands, except per share amounts) | |

Statement of Operations Data: | | | | | | | | | | | |

Net sales | | $ | 622,204 | | $ | 654,653 | | $ | 640,824 | | $ | 622,528 | | $ | 551,869 | |

| | | | | | | | | | | |

Cost of sales (exclusive of depreciation shown separately below) | | (394,445 | ) | (426,904 | ) | (420,321 | ) | (383,318 | ) | (338,898 | ) |

Selling, general and administrative expenses | | (206,146 | ) | (207,411 | ) | (207,025 | ) | (187,231 | ) | (165,166 | ) |

Depreciation | | (21,974 | ) | (23,950 | ) | (24,958 | ) | (20,324 | ) | (18,319 | ) |

Asset impairment | | (1,542 | ) | (1,177 | ) | (6,514 | ) | (211 | ) | (112 | ) |

Gain on sale of former distribution center | | 1,526 | | — | | — | | — | | — | |

(Loss) income from operations | | (377 | ) | (4,789 | ) | (17,994 | ) | 31,444 | | 29,374 | |

Interest, net | | 87 | | 48 | | 164 | | 150 | | 312 | |

(Loss) income before income taxes | | (290 | ) | (4,741 | ) | (17,830 | ) | 31,594 | | 29,686 | |

Income tax (benefit) expense | | (754 | ) | (2,516 | ) | (7,816 | ) | 10,742 | | 9,969 | |

Net income (loss) | | $ | 464 | | $ | (2,225 | ) | $ | (10,014 | ) | $ | 20,852 | | $ | 19,717 | |

Net income (loss) per common share: | | | | | | | | | | | |

Basic | | $ | 0.03 | | $ | (0.15 | ) | $ | (0.69 | ) | $ | 1.44 | | $ | 1.36 | |

Diluted | | $ | 0.03 | | $ | (0.15 | ) | $ | (0.69 | ) | $ | 1.44 | | $ | 1.36 | |

Weighted average shares used to compute net income (loss) per share: | | | | | | | | | | | |

Basic | | 14,798,154 | | 14,671,638 | | 14,589,247 | | 14,503,418 | | 14,363,894 | |

Diluted | | 14,813,444 | | 14,671,638 | | 14,589,247 | | 14,522,662 | | 14,395,605 | |

Additional Operating Data: | | | | | | | | | | | |

Number of stores: | | | | | | | | | | | |

Opened during period | | 1 | | 4 | | 55 | | 60 | | 49 | |

Closed during period | | 9 | | 2 | | 5 | | 2 | | 3 | |

Open at end of period | | 505 | | 513 | | 511 | | 461 | | 403 | |

Selling square footage at end of period | | 5,467,021 | | 5,500,698 | | 5,473,846 | | 4,891,637 | | 4,205,046 | |

Comparable store sales (decrease) increase (2) | | (1.6 | )%(3) | (5.6 | )%(3) | (8.3 | )% | (1.8 | )% | 0.6 | % |

Average sales per store (4) | | $ | 1,222 | | $ | 1,279 | | $ | 1,319 | | $ | 1,441 | | $ | 1,452 | |

Balance Sheet Data: | | | | | | | | | | | |

Cash and cash equivalents | | $ | 58,928 | | $ | 37,263 | | $ | 41,986 | | $ | 69,231 | | $ | 62,993 | |

Short-term investments | | 6,004 | | 12,771 | | 902 | | 586 | | 33,025 | |

Long-term investments | | 19,777 | | 5,754 | | 18,840 | | 9,205 | | — | |

Total assets | | 291,308 | | 292,145 | | 314,777 | | 306,402 | | 279,986 | |

Total liabilities | | 92,437 | | 96,174 | | 118,374 | | 101,598 | | 98,643 | |

Total stockholders’ equity | | 198,871 | | 195,971 | | 196,403 | | 204,804 | | 181,343 | |

17

Table of Contents

(1) Our fiscal year ends on the Saturday closest to January 31 of each year. The years ended February 1, 2014, February 2, 2013, January 28, 2012, January 29, 2011, and January 30, 2010 are referred to as fiscal 2013, 2012, 2011, 2010 and 2009, respectively. Fiscal 2012 is comprised of 53 weeks, while fiscal years 2013, 2011, 2010 and 2009 are each comprised of 52 weeks.

(2) Stores included in the comparable store sales calculation for any period are those stores that were opened prior to the beginning of the preceding fiscal year and were still open at the end of such period. Relocated stores and expanded stores are included in the comparable store sales results.

(3) The Company is reporting comparable store sales on a comparable store and comparable weeks basis; for fiscal 2013, the 52 weeks ended February 1, 2014 were compared to the 52 weeks ended February 2, 2013; for fiscal 2012, the 53 weeks ended February 2, 2013 were compared to the 53 weeks ended February 4, 2012.

(4) Average sales per store is defined as net sales divided by the average number of stores open at the end of the prior fiscal year and stores open at the end of the current fiscal year.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OFOPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the section entitled “Selected Financial and Operating Data” and our audited consolidated financial statements and the respective related notes included elsewhere in this Annual Report on Form 10-K. This discussion may contain forward-looking statements that involve risks and uncertainties. As a result of many factors, such as those set forth under the section entitled “Risk Factors” and elsewhere in this Report, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

We are a value-priced retailer of urban fashion apparel and accessories for the entire family. Our merchandise offerings are designed to appeal to the preferences of fashion conscious consumers, particularly African-Americans. We operate 505 stores in both urban and rural markets in 29 states.

Due to a challenging sales environment, we are taking a conservative approach to opening new stores. After opening four new stores in fiscal 2012, we opened one in fiscal 2013 and plan to open five to ten in fiscal 2014. We will continue to evaluate our growth strategy as we monitor operating results in fiscal 2014.

We measure performance using key operating statistics. One of the main performance measures we use is comparable store sales growth. We define a comparable store as a store that has been open for an entire fiscal year. Therefore, a store will not be considered a comparable store until its 13th month of operation at the earliest or until its 24th month at the latest. As an example, stores opened in fiscal 2012 and fiscal 2013 were not considered comparable stores in fiscal 2013. Relocated and expanded stores are included in the comparable store sales results. We also use other operating statistics, most notably average sales per store, to measure our performance. As we typically occupy existing space in established shopping centers rather than sites built specifically for our stores, store square footage (and therefore sales per square foot) varies by store. We focus on overall store sales volume as the critical driver of profitability. In addition to sales, we measure cost of sales as a percentage of sales and store operating expenses, with a particular focus on labor, as a percentage of sales. These results translate into store level contribution, which we use to evaluate overall performance of each individual store. Finally, we monitor corporate expenses against budgeted amounts. All of the statistics discussed above are critical components of earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA (comprised of EBITDA, excluding non-cash asset impairment expense and the 2013 gain on sale of our former distribution center), which are considered our most important operating statistics. Although EBITDA and Adjusted EBITDA provide useful information on an operating cash flow basis, they are limited measures in that they exclude the impact of cash requirements for capital expenditures, income taxes and interest expense. Therefore, EBITDA and Adjusted EBITDA should be used as supplements to results of operations and cash flows as reported under GAAP and should not be used as a singular measure of operating performance or as a substitute for GAAP results. Provided below is a reconciliation of net income (loss) to EBITDA and to Adjusted EBITDA for fiscal years ended February 1, 2014, February 2, 2013 and January 28, 2012:

18

Table of Contents

| | Fiscal Year Ended | |

| | February 1, 2014 | | February 2, 2013 | | January 28, 2012 | |

| | | | | | | |

Net income (loss) | | $ | 464 | | $ | (2,225 | ) | $ | (10,014 | ) |

| | | | | | | |

Plus: | | | | | | | |

Interest expense | | 194 | | 212 | | 79 | |

Depreciation | | 21,974 | | 23,950 | | 24,958 | |

| | | | | | | |

Less: | | | | | | | |

Interest income | | (281 | ) | (260 | ) | (243 | ) |

Income tax benefit | | (754 | ) | (2,516 | ) | (7,816 | ) |

EBITDA | | 21,597 | | 19,161 | | 6,964 | |

| | | | | | | |

Asset impairment | | 1,542 | | 1,177 | | 6,514 | |

Gain on sale of former distribution center | | (1,526 | ) | — | | — | |

| | | | | | | |

Adjusted EBITDA | | $ | 21,613 | | $ | 20,338 | | $ | 13,478 | |

Basis of the Presentation

Net sales consist of store sales and layaway fees, net of returns by customers. Cost of sales consists of the cost of products we sell and associated freight costs. Depreciation is not considered a component of cost of sales and is included as a separate line item in the consolidated statements of operations. Selling, general and administrative expenses are comprised of store costs, including payroll and occupancy costs, corporate and distribution center costs and advertising costs. We operate on a 52- or 53-week fiscal year, which ends on the Saturday closest to January 31. Each of our fiscal quarters consists of four 13-week periods, with an extra week added to the fourth quarter every five to six years. The years ended February 1, 2014, February 2, 2013, January 28, 2012, January 29, 2011, and January 30, 2010 are referred to as fiscal 2013, 2012, 2011, 2010, and 2009, respectively. Fiscal 2012 is comprised of 53 weeks, while fiscal years 2013, 2011, 2010 and 2009 are each comprised of 52 weeks.

Results of Operations

The following discussion of our financial performance is based on the consolidated financial statements set forth in the financial pages of this Report. The nature of our business is seasonal. Historically, sales in the first and fourth quarters have been higher than sales achieved in the second and third quarters of the fiscal year. Expenses and, to a greater extent, operating income, vary by quarter. Results of a period shorter than a full year may not be indicative of results expected for the entire year. Furthermore, the seasonal nature of our business may affect comparisons between periods.

19

Table of Contents

Net Sales and Additional Operating Data

The following table sets forth, for the periods indicated, selected consolidated statement of operations data expressed both in dollars and as a percentage of net sales:

| | Fiscal Year Ended | |

| | February 1, | | February 2, | | January 28, | |

| | 2014 | | 2013 | | 2012 | |

| | (dollars in thousands) | |

Statement of Operations Data | | | | | | | | | | | | | |

Net sales | | $ | 622,204 | | 100.0% | | $ | 654,653 | | 100.0% | | $ | 640,824 | | 100.0% | |

| | | | | | | | | | | | | |

Cost of sales (exclusive of depreciation shown separately below) | | (394,445 | ) | (63.4)% | | (426,904 | ) | (65.2)% | | (420,321 | ) | (65.6)% | |

Selling, general and administrative expenses | | (206,146 | ) | (33.1)% | | (207,411 | ) | (31.7)% | | (207,025 | ) | (32.3)% | |

Depreciation | | (21,974 | ) | (3.5)% | | (23,950 | ) | (3.6)% | | (24,958 | ) | (3.9)% | |

Asset impairment | | (1,542 | ) | (0.2)% | | (1,177 | ) | (0.2)% | | (6,514 | ) | (1.0)% | |