Q2 2024 Update 1 Exhibit 99.1

Highlights 03 Financial Summary 04 Operational Summary 06 Vehicle Capacity 07 Core Technology 08 Other Highlights 09 Outlook 10 Photos & Charts 11 Key Metrics 20 Financial Statements 22 Additional Information 28 2

S U M M A R YH I G H L I G H T S (1) Excludes SBC (stock-based compensation), net of tax; (2) Free cash flow = operating cash flow less capex; (3) Includes cash, cash equivalents and investments; (4)Active driver supervision required; does not make the vehicle autonomous. Profitability $1.6B GAAP operating income in Q2 after restructuring and other charges of $0.6B $1.5B GAAP net income in Q2 $1.8B non-GAAP net income1 in Q2 In Q2, we achieved record quarterly revenues despite a difficult operating environment. The Energy Storage business continues to grow rapidly, setting a record in Q2 with 9.4 GWh of deployments, resulting in record revenues and gross profits for the overall segment. We also saw a sequential rebound in vehicle deliveries in Q2 as overall consumer sentiment improved and we launched attractive financing options to offset the impact of sustained high interest rates. We recognized record regulatory credit revenues in Q2 as other OEMs are still behind on meeting emissions requirements. Global EV penetration returned to growth in Q2 and is taking share from ICE vehicles. We believe that a pure EV is the optimal vehicle design and will ultimately win over consumers as the myths on range, charging and service are debunked. Progress continued for our AI initiatives in Q2. We reduced the price of FSD (Supervised)4 in North America and launched free trials to everyone with the necessary hardware. These programs have demonstrated success and are laying the foundation for more meaningful FSD monetization. We expect to see an increase in FSD attach rates for our fleet as the capability improves and we increase awareness of the convenience and safety it offers users. Overall, our focus remains on company-wide cost reduction, including reducing COGS per vehicle, growing our traditional hardware business and accelerating development of our AI- enabled products and services. Though timing of Robotaxi deployment depends on technological advancement and regulatory approval, we are working vigorously on this opportunity given the outsized potential value. Concurrently, we are managing our product portfolio with a long-term orientation and focusing on growing sales, maximizing our installed base and generating sufficient cash flow to invest in future growth. Cash Operating cash flow of $3.6B in Q2 Free cash flow2 of $1.3B in Q2 (AI infrastructure capex was $0.6B in Q2) $3.9B increase in our cash and investments3 in Q2 to $30.7B Operations Record energy storage deployment of 9.4 GWh in Q2 Optimus began performing tasks autonomously in one of our facilities Cybertruck became the best-selling EV pickup in the U.S. in Q2 3

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 YoY Total automotive revenues 21,268 19,625 21,563 17,378 19,878 -7% Energy generation and storage revenue 1,509 1,559 1,438 1,635 3,014 100% Services and other revenue 2,150 2,166 2,166 2,288 2,608 21% Total revenues 24,927 23,350 25,167 21,301 25,500 2% Total gross profit 4,533 4,178 4,438 3,696 4,578 1% Total GAAP gross margin 18.2% 17.9% 17.6% 17.4% 18.0% -23 bp Operating expenses 2,134 2,414 2,374 2,525 2,973 39% Income from operations 2,399 1,764 2,064 1,171 1,605 -33% Operating margin 9.6% 7.6% 8.2% 5.5% 6.3% -333 bp Adjusted EBITDA 4,653 3,758 3,953 3,384 3,674 -21% Adjusted EBITDA margin 18.7% 16.1% 15.7% 15.9% 14.4% -426 bp Net income attributable to common stockholders (GAAP) 2,703 1,853 7,928 1,129 1,478 -45% Net income attributable to common stockholders (non-GAAP) 3,148 2,318 2,485 1,536 1,812 -42% EPS attributable to common stockholders, diluted (GAAP) 0.78 0.53 2.27 0.34 0.42 -46% EPS attributable to common stockholders, diluted (non-GAAP) 0.91 0.66 0.71 0.45 0.52 -43% Net cash provided by operating activities 3,065 3,308 4,370 242 3,612 18% Capital expenditures (2,060) (2,460) (2,306) (2,773) (2,270) 10% Free cash flow 1,005 848 2,064 (2,531) 1,342 34% Cash, cash equivalents and investments 23,075 26,077 29,094 26,863 30,720 33% 4

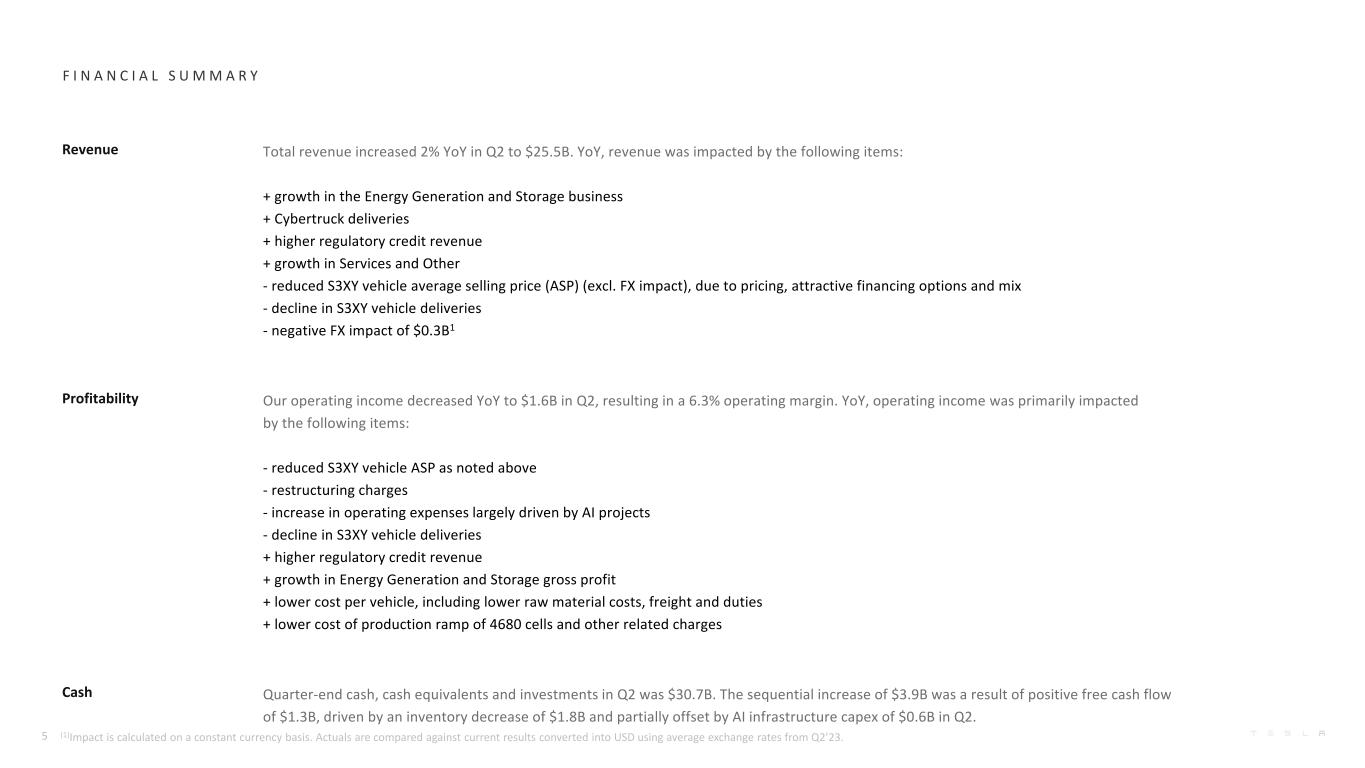

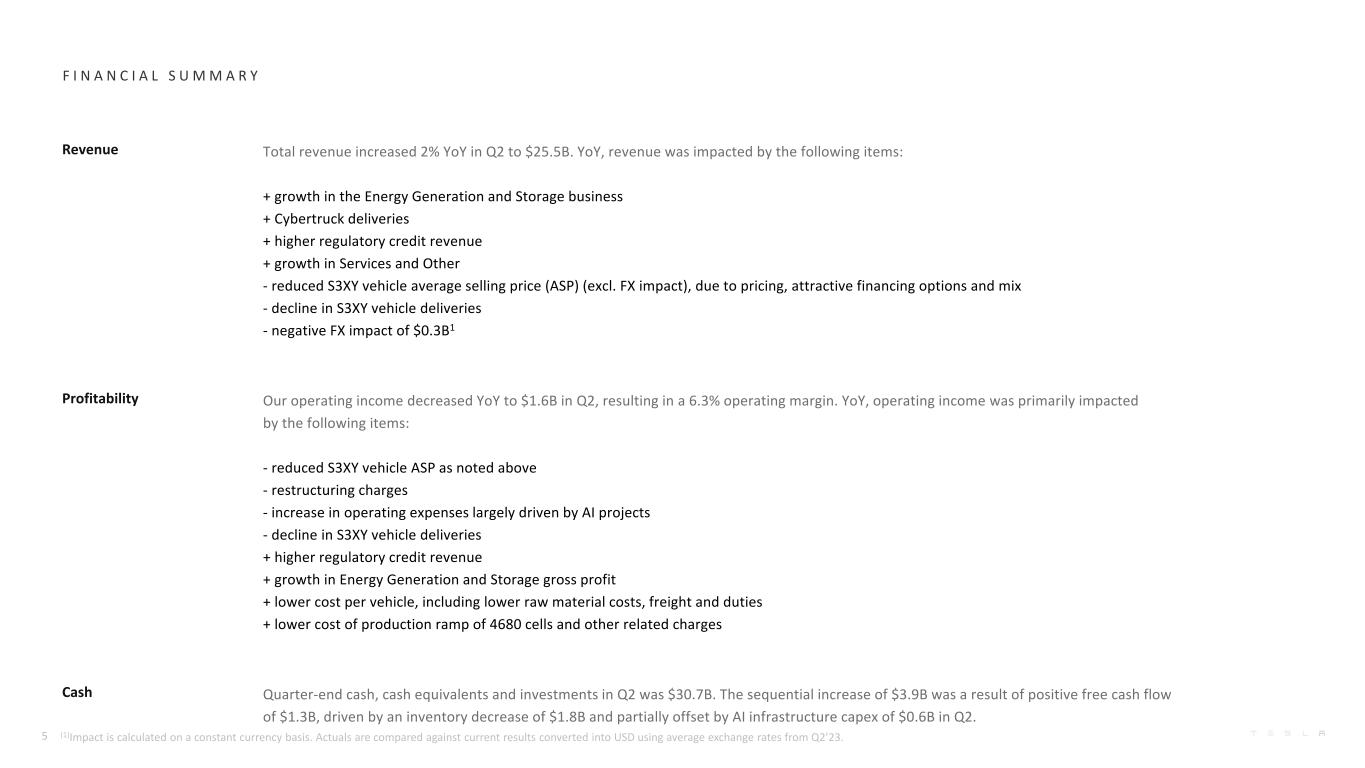

F I N A N C I A L S U M M A R Y Revenue Total revenue increased 2% YoY in Q2 to $25.5B. YoY, revenue was impacted by the following items: + growth in the Energy Generation and Storage business + Cybertruck deliveries + higher regulatory credit revenue + growth in Services and Other - reduced S3XY vehicle average selling price (ASP) (excl. FX impact), due to pricing, attractive financing options and mix - decline in S3XY vehicle deliveries - negative FX impact of $0.3B1 Profitability Our operating income decreased YoY to $1.6B in Q2, resulting in a 6.3% operating margin. YoY, operating income was primarily impacted by the following items: - reduced S3XY vehicle ASP as noted above - restructuring charges - increase in operating expenses largely driven by AI projects - decline in S3XY vehicle deliveries + higher regulatory credit revenue + growth in Energy Generation and Storage gross profit + lower cost per vehicle, including lower raw material costs, freight and duties + lower cost of production ramp of 4680 cells and other related charges Cash Quarter-end cash, cash equivalents and investments in Q2 was $30.7B. The sequential increase of $3.9B was a result of positive free cash flow of $1.3B, driven by an inventory decrease of $1.8B and partially offset by AI infrastructure capex of $0.6B in Q2. 5 (1)Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q2’23.

Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 YoY Model 3/Y production 460,211 416,800 476,777 412,376 386,576 -16% Other models production 19,489 13,688 18,212 20,995 24,255 24% Total production 479,700 430,488 494,989 433,371 410,831 -14% Model 3/Y deliveries 446,915 419,074 461,538 369,783 422,405 -5% Other models deliveries 19,225 15,985 22,969 17,027 21,551 12% Total deliveries 466,140 435,059 484,507 386,810 443,956 -5% of which subject to operating lease accounting 21,883 17,423 10,563 8,365 10,227 -53% Total end of quarter operating lease vehicle count 168,058 176,231 176,564 173,131 171,353 2% Global vehicle inventory (days of supply)(1) 16 16 15 28 18 13% Storage deployed (GWh) 3.7 4.0 3.2 4.1 9.4 158% Tesla locations 1,068 1,129 1,208 1,258 1,286 20% Mobile service fleet 1,769 1,846 1,909 1,897 1,896 7% Supercharger stations 5,265 5,595 5,952 6,249 6,473 23% Supercharger connectors 48,082 51,105 54,892 57,579 59,596 24% (1)Days of supply is calculated by dividing new vehicle ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). O P E R A T I O N A L S U M M A R Y (Unaudited) 6

V E H I C L E C A P A C I T Y Current Installed Annual Vehicle Capacity Region Model Capacity Status California Model S / Model X 100,000 Production Model 3 / Model Y >550,000 Production Shanghai Model 3 / Model Y >950,000 Production Berlin Model Y >375,000 Production Texas Model Y >250,000 Production Cybertruck >125,000 Production Nevada Tesla Semi - Pilot production Various Next Gen Platform - In development TBD Roadster - In development Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on latest available data from ACEA; Autonews.com; CAAM – light-duty vehicles only; TTM = Trailing twelve months 1 IRA = Inflation Reduction Act We continued to add to our vehicle lineup globally, including the introduction of new Model 3 and Model Y trims and additional paint options for the S3XY lineup. After a sequential decline in production in Q2, we expect a sequential increase in production in Q3. US: California, Nevada and Texas Refreshed Model 3 ramp continued successfully, including the introduction of Model 3 Performance in Q2 and Long Range Rear-Wheel Drive in July. We also continue to qualify more Model 3 trims for the IRA1 Tax Credit. Cybertruck production more than tripled sequentially and remains on track to achieve profitability by end of year. Preparation of Semi factory continues and is on track to begin production by end of 2025. China: Shanghai We significantly increased deliveries in several markets supplied by Gigafactory Shanghai in Q2, including South Korea. While the automotive market in China remains among the most competitive globally, we feel that our cost structure and focus on core functionality that drives value for customers – including autonomy – position us well for the long-term. Europe: Berlin-Brandenburg In Q2, Gigafactory Berlin-Brandenburg began producing vehicles for right-hand drive markets and delivered its first units to the U.K. We also began delivering vehicles to Qatar, while increasing deliveries to Israel and Taiwan. Our regional production strategy provides flexibility as needs change across markets. 7 0% 1% 2% 3% 4% US/Canada Europe China

Tesla AI training capacity ramp through end of year (H100 equivalent GPUs) C O R E T E C H N O L O G Y Cumulative miles driven with FSD (Supervised) (billions) Artificial Intelligence Software and Hardware In Q2, we focused on reducing interventions with FSD (Supervised)1, while improving driving comfort. Notably, we rolled out a version of FSD (Supervised) that primarily relies on eye tracking software to monitor driver attentiveness. We also increased the robustness of our next- gen FSD (Supervised) model with substantially more parameters. Looking ahead to future autonomous driving and robotaxi service, we continued progress on software and hardware development. Optimus is performing its first task handling batteries in one of our facilities. The south extension of Gigafactory Texas is nearing completion and will house our largest cluster of H100s yet. Vehicle and Other Software We continue to release software optimizations that enable an increasingly better experience for customers. The Spring Release included an immersive full-screen vehicle controls view when parked, large playback controls and quick access to Recents, Favorites and Up Next in media player, and an expandable Autopilot visualization, with a smaller map in the top right for trip guidance. Audible is now available as a native app, and Spotify queues can be synced across vehicles and devices and playback speed can be adjusted. Battery, Powertrain and Manufacturing In Q2, we produced over 50% more 4680 cells than in Q1 and continued to see cost improvements. In July, we entered validation of vehicle testing for our first prototype Cybertruck produced with in-house dry cathode 4680 cells – a major cost reduction milestone once ramped. Cost reduction across our product lineup remains a top priority.8 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 FSD V12 Miles FSD Miles 0 15,000 30,000 45,000 60,000 75,000 90,000 Existing Capacity Future Planned Capacity (1)Active driver supervision required; does not make the vehicle autonomous.

O T H E R H I G H L I G H T S Energy Storage deployments (GWh) Non-Automotive gross profit ($M) Our non-automotive business is becoming an increasingly profitable part of Tesla. As energy storage products continue to ramp and our vehicle fleet continues to grow, we are expecting continued profit growth of our non-automotive business over time. Energy Generation and Storage Both Megapack and Powerwall achieved record deployment in Q2, resulting in 9.4 GWh of total storage deployments. Overall, the Energy business achieved record revenues and gross profit in Q2. The Lathrop Megafactory continues to ramp successfully, achieving a production record in Q2, and the Shanghai Megafactory remains on track for start of production in Q1 2025. While we expect production to continue to grow sequentially, deployments will continue to fluctuate. Deployment timing depends on many factors, including project milestones and logistics timing as we deliver product globally from a single factory. Powerwall 3 rollout continued successfully, and is now available in Canada, the U.K. and Germany, in addition to the U.S. Services and Other Sequential profit growth for the Services and Other business was driven mostly by service center margin improvement and higher gross profit generation from collision repair. We continue to expand our Supercharging network – and expect to deploy more capacity this year than the rest of the industry combined in North America – with a focus on capital efficiency, congestion and improved coverage. In an effort to increase EV penetration, we remain committed to opening the network to non-Tesla EVs, and plan to onboard more OEMs in North America by the end of the year. Over time, network utilization should continue to increase, driving revenue growth and profit generation. 9 0 1 2 3 4 5 6 7 8 9 10 -1,000 -800 -600 -400 -200 0 200 400 600 800 1,000

O U T L O O K Volume Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and we believe the next one will be initiated by advances in autonomy and introduction of new products, including those built on our next generation vehicle platform. In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next generation vehicle and other products. In 2024, the growth rates of energy storage deployments and revenue in our Energy Generation and Storage business should outpace the Automotive business. Cash We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period. Profit While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware- related profits to be accompanied by an acceleration of AI, software and fleet-based profits. Product Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be able to be produced on the same manufacturing lines as our current vehicle line-up. This approach will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 50% growth over 2023 production before investing in new manufacturing lines. Our purpose-built Robotaxi product will continue to pursue a revolutionary “unboxed” manufacturing strategy. 10

P H O T O S & C H A R T S

E L E C T R I C V E H I C L E A D O P T I O N R A T E - R E T U R N E D T O G R O W T H I N Q 2 Global BEV market share* (12-months trailing) China World ex-China *Source: ev-volumes.com and https://www.renaultgroup.com/en/finance-2/key-figures/monthly-sales/12 0% 2% 4% 6% 8% 10% 12%

G I G A F A C T O R Y T E X A S - S O U T H E X P A N S I O N D A T A C E N T E R 13

C O R P U S C H R I S T I L I T H I U M R E F I N E R Y - S T A R T O F P R O D U C T I O N I N 2 0 2 5 14

C Y B E R T R U C K - C O A T I N G S S H O P 15

M O D E L Y I N Q U I C K S I L V E R - 1 . 9 9 % A P R A V A I L A B L E F O R A L L M O D E L Y T R I M S I N T H E U S T H R O U G H A U G U S T 3 1 S T 16

L U N A R S I L V E R - N O W A V A I L A B L E F O R M O D E L S A N D M O D E L X 17

M E G A P A C K - P L U S P O W E R ’ S 1 G W H S I E R R A E S T R E L L A S I T E 18

O P T I M U S - A U T O N O M O U S L Y H A N D L I N G B A T T E R Y C E L L S 19

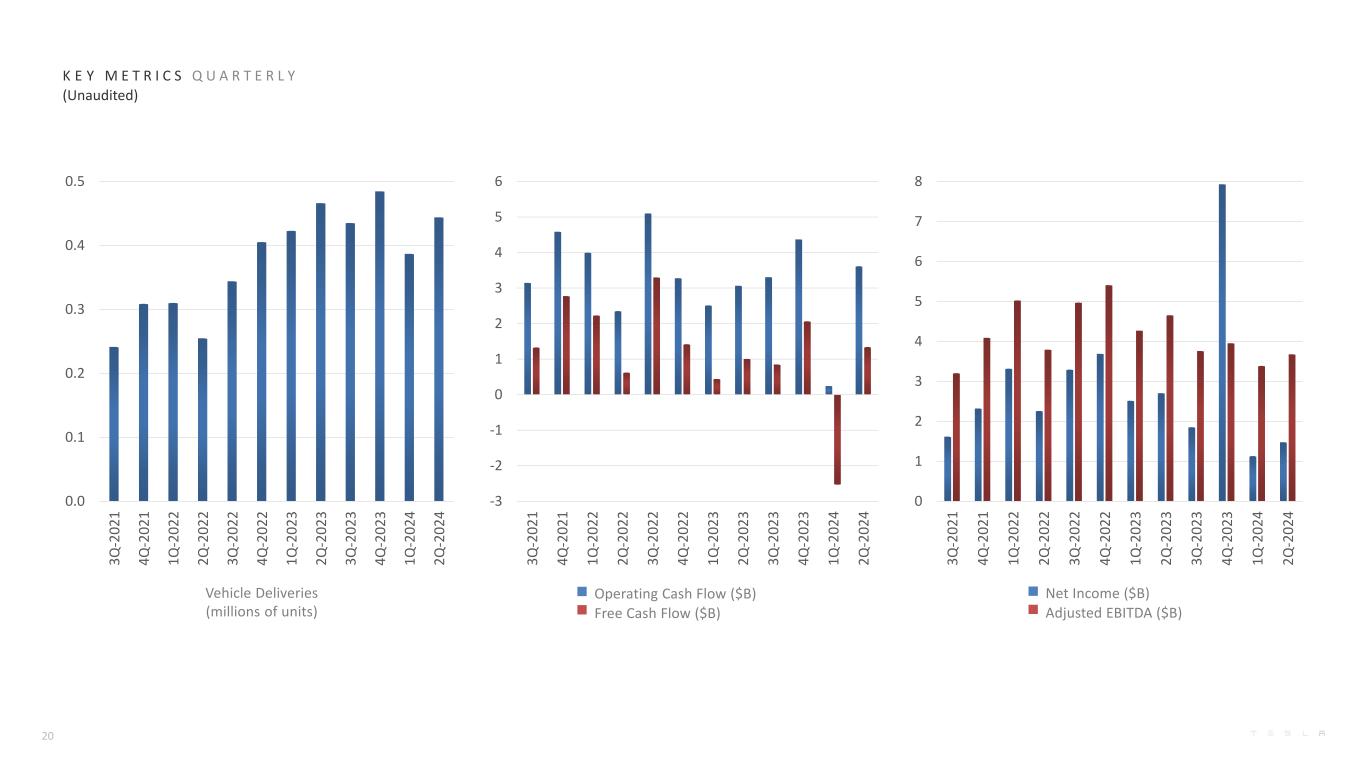

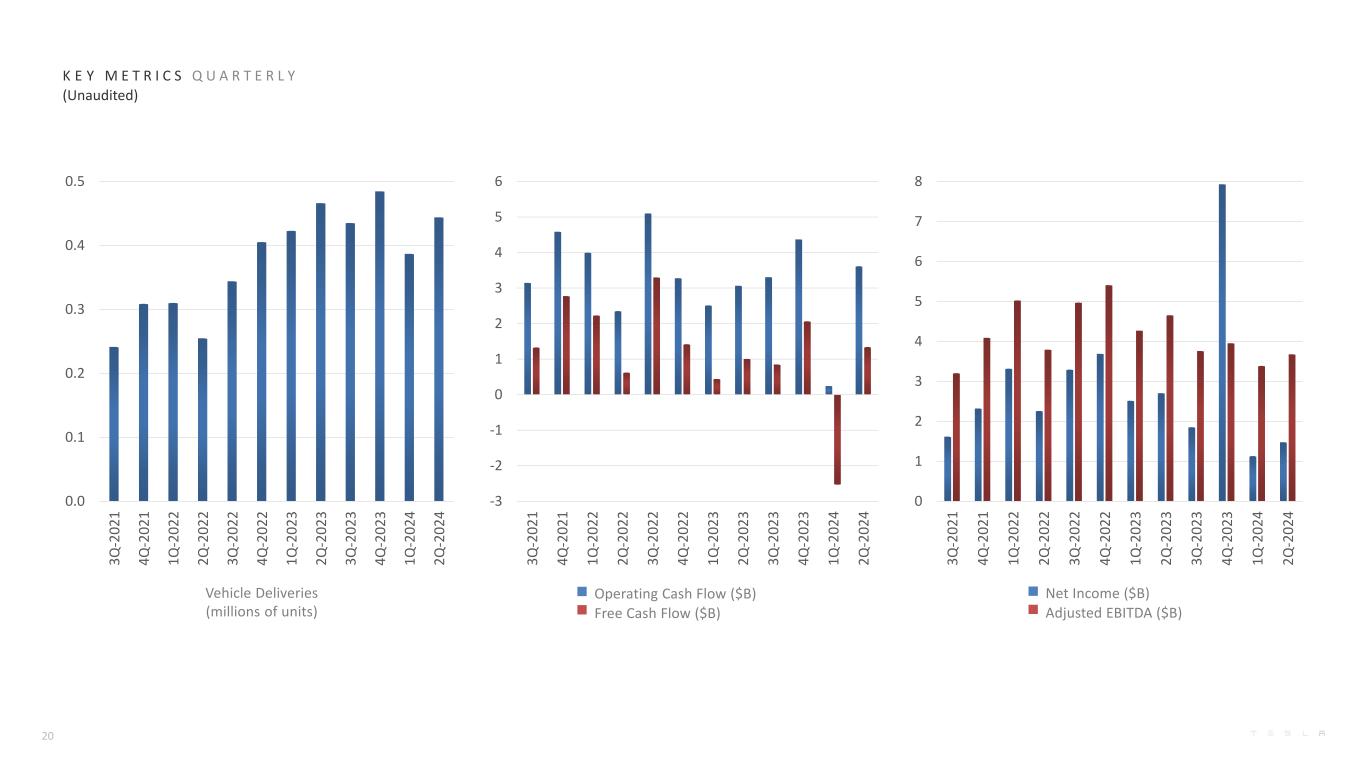

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) Net Income ($B) Adjusted EBITDA ($B) 20 0.0 0.1 0.2 0.3 0.4 0.5 3Q -2 02 1 4Q -2 02 1 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 -3 -2 -1 0 1 2 3 4 5 6 3Q -2 02 1 4Q -2 02 1 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 0 1 2 3 4 5 6 7 8 3Q -2 02 1 4Q -2 02 1 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4

Operating Cash Flow ($B) Free Cash Flow ($B) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) Adjusted EBITDA ($B) Vehicle Deliveries (millions of units) 21 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 3Q -2 02 1 4Q -2 02 1 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 0 2 4 6 8 10 12 14 16 18 20 3Q -2 02 1 4Q -2 02 1 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 0 2 4 6 8 10 12 14 16 18 20 3Q -2 02 1 4Q -2 02 1 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4

F I N A N C I A L S T A T E M E N T S

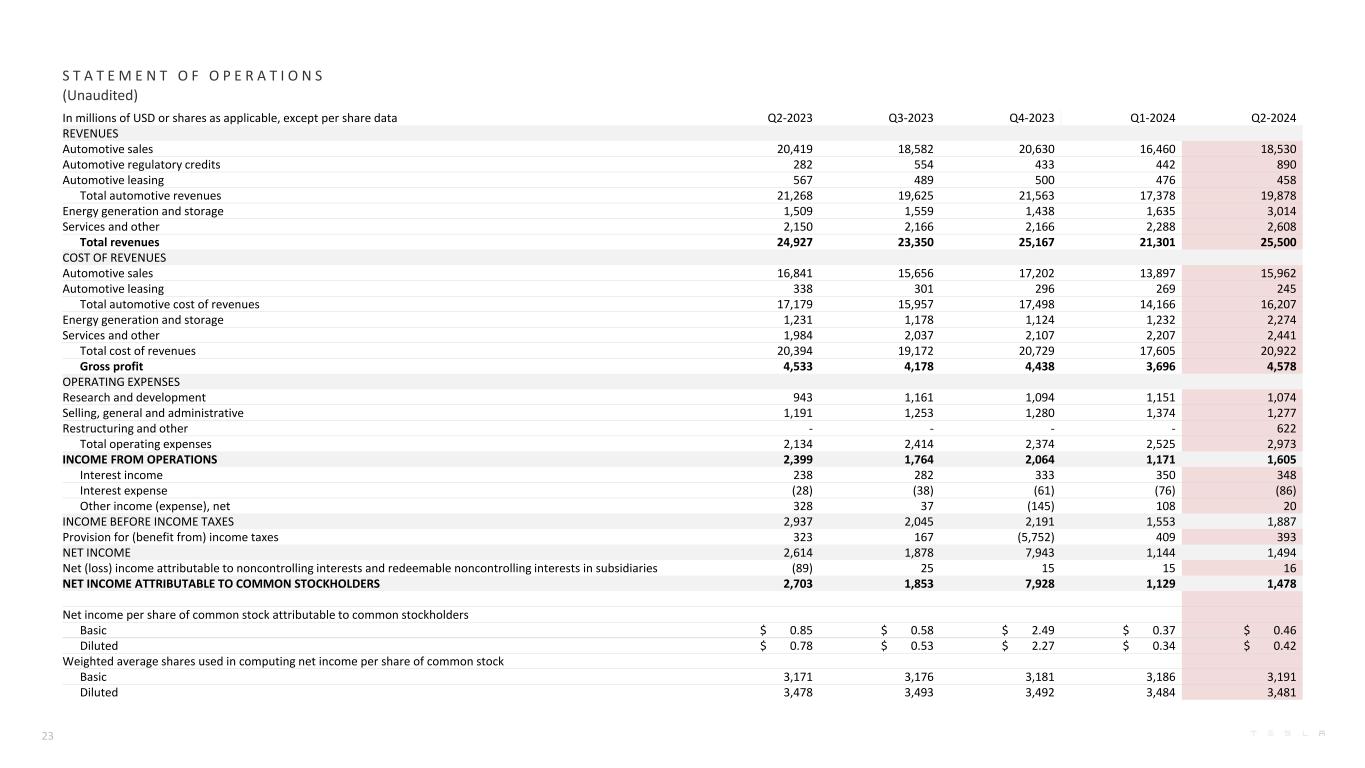

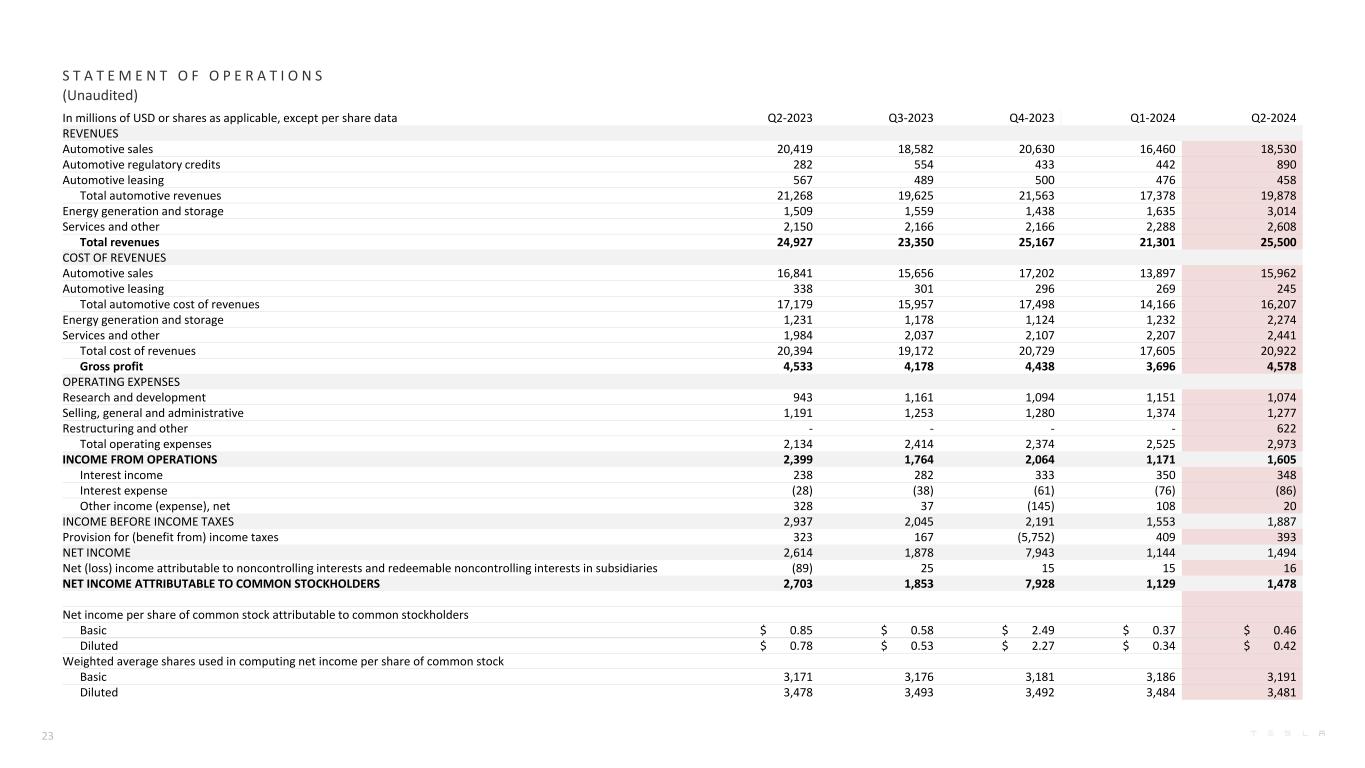

In millions of USD or shares as applicable, except per share data Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 REVENUES Automotive sales 20,419 18,582 20,630 16,460 18,530 Automotive regulatory credits 282 554 433 442 890 Automotive leasing 567 489 500 476 458 Total automotive revenues 21,268 19,625 21,563 17,378 19,878 Energy generation and storage 1,509 1,559 1,438 1,635 3,014 Services and other 2,150 2,166 2,166 2,288 2,608 Total revenues 24,927 23,350 25,167 21,301 25,500 COST OF REVENUES Automotive sales 16,841 15,656 17,202 13,897 15,962 Automotive leasing 338 301 296 269 245 Total automotive cost of revenues 17,179 15,957 17,498 14,166 16,207 Energy generation and storage 1,231 1,178 1,124 1,232 2,274 Services and other 1,984 2,037 2,107 2,207 2,441 Total cost of revenues 20,394 19,172 20,729 17,605 20,922 Gross profit 4,533 4,178 4,438 3,696 4,578 OPERATING EXPENSES Research and development 943 1,161 1,094 1,151 1,074 Selling, general and administrative 1,191 1,253 1,280 1,374 1,277 Restructuring and other - - - - 622 Total operating expenses 2,134 2,414 2,374 2,525 2,973 INCOME FROM OPERATIONS 2,399 1,764 2,064 1,171 1,605 Interest income 238 282 333 350 348 Interest expense (28) (38) (61) (76) (86) Other income (expense), net 328 37 (145) 108 20 INCOME BEFORE INCOME TAXES 2,937 2,045 2,191 1,553 1,887 Provision for (benefit from) income taxes 323 167 (5,752) 409 393 NET INCOME 2,614 1,878 7,943 1,144 1,494 Net (loss) income attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries (89) 25 15 15 16 NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS 2,703 1,853 7,928 1,129 1,478 Net income per share of common stock attributable to common stockholders Basic $ 0.85 $ 0.58 $ 2.49 $ 0.37 $ 0.46 Diluted $ 0.78 $ 0.53 $ 2.27 $ 0.34 $ 0.42 Weighted average shares used in computing net income per share of common stock Basic 3,171 3,176 3,181 3,186 3,191 Diluted 3,478 3,493 3,492 3,484 3,481 S T A T E M E N T O F O P E R A T I O N S (Unaudited) 23

B A L A N C E S H E E T (Unaudited) In millions of USD 30-Jun-23 30-Sep-23 31-Dec-23 31-Mar-24 30-Jun-24 ASSETS Current assets Cash, cash equivalents and investments 23,075 26,077 29,094 26,863 30,720 Accounts receivable, net 3,447 2,520 3,508 3,887 3,737 Inventory 14,356 13,721 13,626 16,033 14,195 Prepaid expenses and other current assets 2,997 2,708 3,388 3,752 4,325 Total current assets 43,875 45,026 49,616 50,535 52,977 Operating lease vehicles, net 5,935 6,119 5,989 5,736 5,541 Solar energy systems, net 5,365 5,293 5,229 5,162 5,102 Property, plant and equipment, net 26,389 27,744 29,725 31,436 32,902 Operating lease right-of-use assets 3,352 3,637 4,180 4,367 4,563 Digital assets, net 184 184 184 184 184 Goodwill and intangible assets, net 465 441 431 421 413 Deferred tax assets 537 648 6,733 6,769 6,692 Other non-current assets 4,489 4,849 4,531 4,616 4,458 Total assets 90,591 93,941 106,618 109,226 112,832 LIABILITIES AND EQUITY Current liabilities Accounts payable 15,273 13,937 14,431 14,725 13,056 Accrued liabilities and other 8,684 8,530 9,080 9,243 9,616 Deferred revenue 2,176 2,206 2,864 3,024 2,793 Current portion of debt and finance leases (1) 1,459 1,967 2,373 2,461 2,264 Total current liabilities 27,592 26,640 28,748 29,453 27,729 Debt and finance leases, net of current portion (1) 872 2,426 2,857 2,899 5,481 Deferred revenue, net of current portion 3,021 3,059 3,251 3,214 3,357 Other long-term liabilities 6,924 7,321 8,153 8,480 9,002 Total liabilities 38,409 39,446 43,009 44,046 45,569 Redeemable noncontrolling interests in subsidiaries 288 277 242 73 72 Total stockholders' equity 51,130 53,466 62,634 64,378 66,468 Noncontrolling interests in subsidiaries 764 752 733 729 723 Total liabilities and equity 90,591 93,941 106,618 109,226 112,832 (1) Breakdown of our debt is as follows: Vehicle and energy product financing (non-recourse) 1,475 3,660 4,613 4,820 7,355 Recourse debt 44 44 44 54 7 Total debt excluding vehicle and energy product financing 44 44 44 54 7 Days sales outstanding 12 12 11 16 14 Days payable outstanding 70 70 63 75 6024

In millions of USD Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 CASH FLOWS FROM OPERATING ACTIVITIES Net income 2,614 1,878 7,943 1,144 1,494 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and impairment 1,154 1,235 1,232 1,246 1,278 Stock-based compensation 445 465 484 524 439 Deferred income taxes (148) (113) (6,033) (11) 144 Other (47) 145 262 — 119 Changes in operating assets and liabilities (953) (302) 482 (2,661) 138 Net cash provided by operating activities 3,065 3,308 4,370 242 3,612 CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures (2,060) (2,460) (2,306) (2,773) (2,270) Purchases of solar energy systems, net of sales (0) 1 (1) (4) (2) Purchases of investments (5,075) (6,131) (5,891) (6,622) (8,143) Proceeds from maturities of investments 3,539 3,816 3,394 4,315 6,990 Proceeds from sales of investments 138 — — — 200 Business combinations, net of cash acquired (76) 12 — — — Net cash used in investing activities (3,534) (4,762) (4,804) (5,084) (3,225) CASH FLOWS FROM FINANCING ACTIVITIES Net cash flows from other debt activities (124) (140) (141) (140) 2,598 Net (repayments) borrowings under vehicle and energy product financing (233) 2,194 952 216 (212) Net cash flows from noncontrolling interests – Solar (34) (45) (76) (131) (43) Other 63 254 152 251 197 Net cash (used in) provided by financing activities (328) 2,263 887 196 2,540 Effect of exchange rate changes on cash and cash equivalents and restricted cash (94) (98) 146 (79) (37) Net (decrease) increase in cash and cash equivalents and restricted cash (891) 711 599 (4,725) 2,890 Cash and cash equivalents and restricted cash at beginning of period 16,770 15,879 16,590 17,189 12,464 Cash and cash equivalents and restricted cash at end of period 15,879 16,590 17,189 12,464 15,354 S T A T E M E N T O F C A S H F L O W S (Unaudited) 25

In millions of USD or shares as applicable, except per share data Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 Net income attributable to common stockholders (GAAP) 2,703 1,853 7,928 1,129 1,478 Stock-based compensation expense, net of tax 445 465 484 407 334 Release of valuation allowance on deferred tax assets — — (5,927) — — Net income attributable to common stockholders (non-GAAP) 3,148 2,318 2,485 1,536 1,812 Less: Buy-outs of noncontrolling interests — 2 1 (42) — Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) 3,148 2,316 2,484 1,578 1,812 EPS attributable to common stockholders, diluted (GAAP) 0.78 0.53 2.27 0.34 0.42 Stock-based compensation expense per share, net of tax 0.13 0.13 0.14 0.11 0.10 Release of valuation allowance on deferred tax assets per share — — (1.70) — — EPS attributable to common stockholders, diluted (non-GAAP) 0.91 0.66 0.71 0.45 0.52 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 3,478 3,493 3,492 3,484 3,481 Net income attributable to common stockholders (GAAP) 2,703 1,853 7,928 1,129 1,478 Interest expense 28 38 61 76 86 Provision for (benefit from) income taxes 323 167 (5,752) 409 393 Depreciation, amortization and impairment 1,154 1,235 1,232 1,246 1,278 Stock-based compensation expense 445 465 484 524 439 Adjusted EBITDA (non-GAAP) 4,653 3,758 3,953 3,384 3,674 Total revenues 24,927 23,350 25,167 21,301 25,500 Adjusted EBITDA margin (non-GAAP) 18.7% 16.1% 15.7% 15.9% 14.4% R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) 26

R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) In millions of USD 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 Net cash provided by operating activities – TTM (GAAP) 9,931 11,497 13,851 14,078 16,031 14,724 13,242 13,956 12,164 13,256 10,985 11,532 Capital expenditures – TTM (5,823) (6,482) (6,901) (7,126) (7,110) (7,158) (7,463) (7,793) (8,450) (8,898) (9,599) (9,809) Free cash flow – TTM (non-GAAP) 4,108 5,015 6,950 6,952 8,921 7,566 5,779 6,163 3,714 4,358 1,386 1,723 In millions of USD 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 Net income attributable to common stockholders – TTM (GAAP) 3,468 5,519 8,399 9,516 11,190 12,556 11,751 12,195 10,756 14,997 13,613 12,388 Interest expense – TTM 546 371 333 302 229 191 159 143 128 156 203 261 Provision for (benefit from) income taxes – TTM 490 699 976 1,066 1,148 1,132 1,047 1,165 1,027 (5,001) (4,853) (4,783) Depreciation, amortization and impairment – TTM 2,681 2,911 3,170 3,411 3,606 3,747 3,913 4,145 4,424 4,667 4,867 4,991 Stock-based compensation expense – TTM 2,196 2,121 1,925 1,812 1,699 1,560 1,560 1,644 1,747 1,812 1,918 1,912 Adjusted EBITDA – TTM (non-GAAP) 9,381 11,621 14,803 16,107 17,872 19,186 18,430 19,292 18,082 16,631 15,748 14,769 TTM = Trailing twelve months In millions of USD 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 Net cash provided by operating activities (GAAP) 3,019 1,641 2,124 3,147 4,585 3,995 2,351 5,100 3,278 2,513 3,065 3,308 4,370 242 3,612 Capital expenditures (1,151) (1,348) (1,505) (1,819) (1,810) (1,767) (1,730) (1,803) (1,858) (2,072) (2,060) (2,460) (2,306) (2,773) (2,270) Free cash flow (non-GAAP) 1,868 293 619 1,328 2,775 2,228 621 3,297 1,420 441 1,005 848 2,064 (2,531) 1,342 In millions of USD 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 Net income attributable to common stockholders (GAAP) 270 438 1,142 1,618 2,321 3,318 2,259 3,292 3,687 2,513 2,703 1,853 7,928 1,129 1,478 Interest expense 246 99 75 126 71 61 44 53 33 29 28 38 61 76 86 Provision for (benefit from) income taxes 83 69 115 223 292 346 205 305 276 261 323 167 (5,752) 409 393 Depreciation, amortization and impairment 618 621 681 761 848 880 922 956 989 1,046 1,154 1,235 1,232 1,246 1,278 Stock-based compensation expense 633 614 474 475 558 418 361 362 419 418 445 465 484 524 439 Adjusted EBITDA (non-GAAP) 1,850 1,841 2,487 3,203 4,090 5,023 3,791 4,968 5,404 4,267 4,653 3,758 3,953 3,384 3,674 27

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its second quarter 2024 financial results conference call beginning at 4:30 p.m. CT on July 23, 2024 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units when installed and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment and (d) stock-based compensation expense. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding operating leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including statements in the “Outlook” section; statements relating to the future development, strategy, ramp, production and capacity, demand and market growth, cost, pricing and profitability, investment, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and services; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in launching and manufacturing our products and features cost-effectively; our ability to grow our sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; consumers’ demand for electric vehicles generally and our vehicles specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive and energy product markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 26, 2024. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise. 28