Q4 and FY 2024 Update 1 Exhibit 99.1

Highlights 03 Financial Summary 04 Operational Summary 07 Vehicle Capacity 09 Core Technology 10 Other Highlights 11 Outlook 12 Photos & Charts 13 Key Metrics 26 Financial Statements 28 Additional Information 35 2

S U M M A R YH I G H L I G H T S (1) Excludes SBC (stock-based compensation), net of tax; (2) Free cash flow = operating cash flow less capex; (3) Includes cash, cash equivalents and investments; (4) Active driver supervision required; does not make the vehicle autonomous; (5) Calculated by dividing Cost of Automotive Sales Revenue by respective quarter’s new deliveries (ex-operating leases) Profitability $7.1B GAAP operating income in 2024; $1.6B in Q4 $7.1B GAAP net income in 2024; $2.3B in Q4 incl. $0.6B mark-to-market gain on digital assets $8.4B non-GAAP net income1 in 2024; $2.6B in Q4 Q4 was a record quarter for both vehicle deliveries and energy storage deployments. We expect Model Y to once again be the best-selling vehicle, of any kind, globally for the full year 2024, and we have made it even better, with the New Model Y now launched in all markets. In 2024, we made significant investments in infrastructure that will spur the next wave of growth for the company, including vehicle manufacturing capabilities for new models, AI training compute and energy storage manufacturing capacity. Affordability remains top of mind for customers, and we continue to review every aspect of our cost of goods sold (COGS) per vehicle5 to help alleviate this concern. In Q4, COGS per vehicle reached its lowest level ever at <$35,000, driven largely by raw material cost improvement, helping us to partially offset our investment in compelling financing and lease options. The Energy business achieved another record in Q4 with its highest-ever gross profit generation. Construction of Megafactory Shanghai was completed in December and will begin ramping this quarter. Powerwall deployments achieved another record quarter as we continue to ramp Powerwall 3 production and launch in additional markets. 2025 will be a seminal year in Tesla’s history as FSD (Supervised) continues to rapidly improve with the aim of ultimately exceeding human levels of safety. This will eventually unlock an unsupervised FSD option for our customers and the Robotaxi business, which we expect to begin launching later this year in parts of the U.S. We also continue to work on launching FSD (Supervised) in Europe and China in 2025. Cash Operating cash flow of $14.9B in 2024; $4.8B in Q4 Free cash flow2 of $3.6B in 2024; $2.0B in Q4 $7.5B increase in our cash and investments3 in 2024 to $36.6B Operations Increased AI training compute by over 400% in 2024 Over three billion miles driven cumulatively on FSD (Supervised)4 as of January Completed construction of Megafactory Shanghai 3

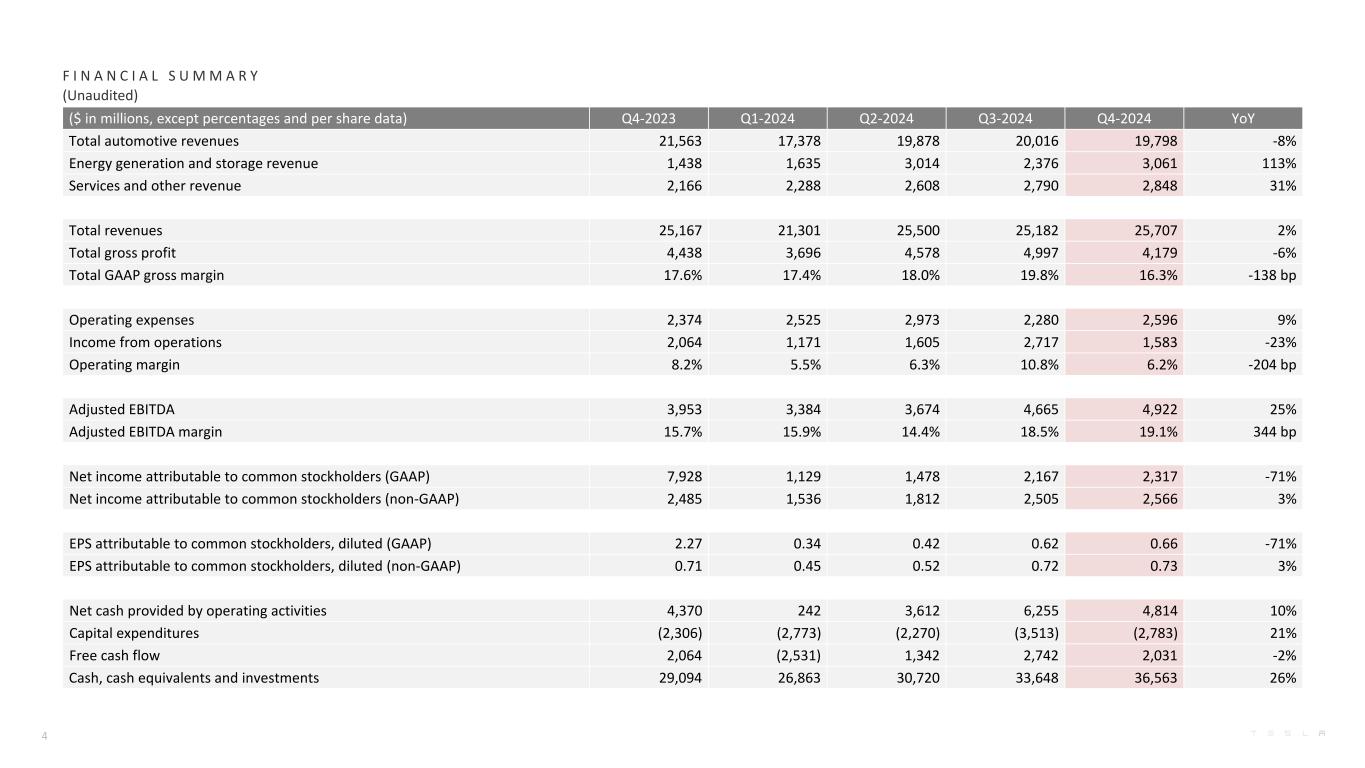

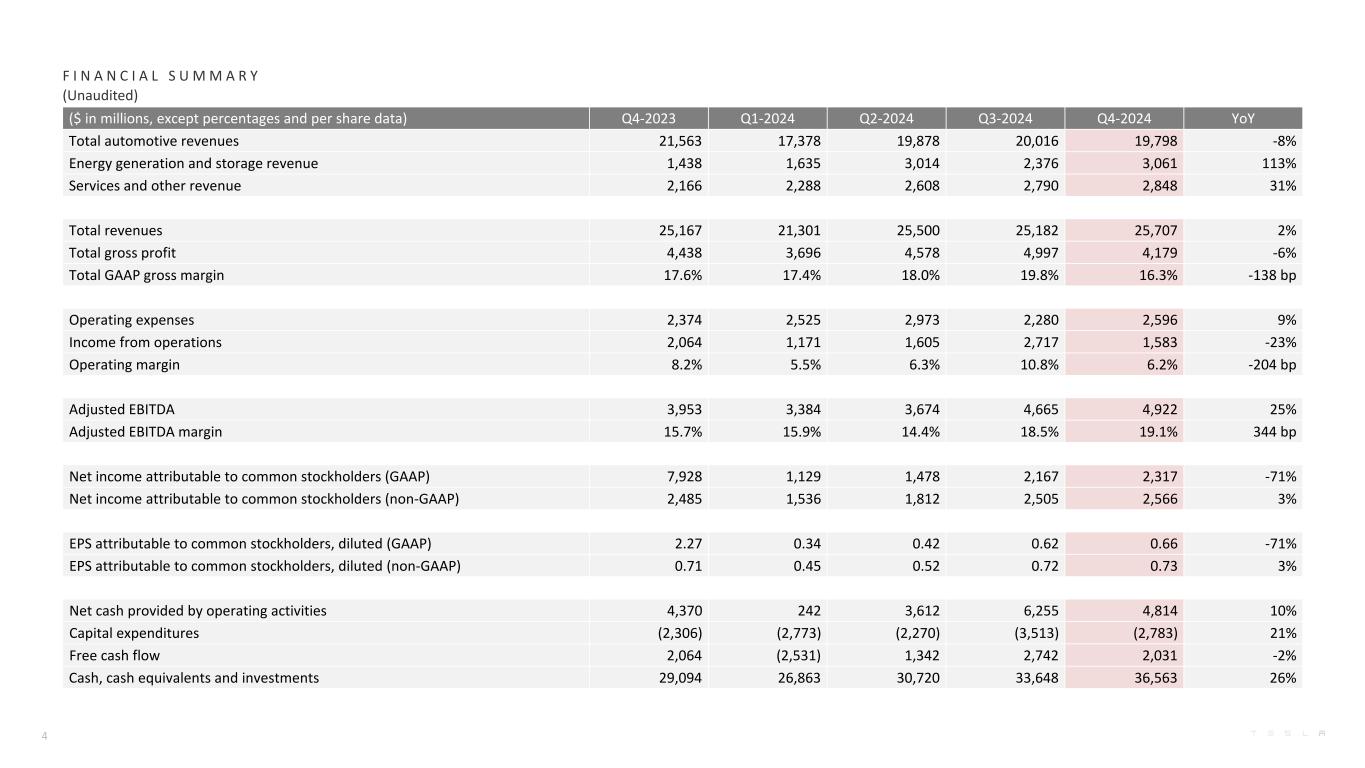

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 YoY Total automotive revenues 21,563 17,378 19,878 20,016 19,798 -8% Energy generation and storage revenue 1,438 1,635 3,014 2,376 3,061 113% Services and other revenue 2,166 2,288 2,608 2,790 2,848 31% Total revenues 25,167 21,301 25,500 25,182 25,707 2% Total gross profit 4,438 3,696 4,578 4,997 4,179 -6% Total GAAP gross margin 17.6% 17.4% 18.0% 19.8% 16.3% -138 bp Operating expenses 2,374 2,525 2,973 2,280 2,596 9% Income from operations 2,064 1,171 1,605 2,717 1,583 -23% Operating margin 8.2% 5.5% 6.3% 10.8% 6.2% -204 bp Adjusted EBITDA 3,953 3,384 3,674 4,665 4,922 25% Adjusted EBITDA margin 15.7% 15.9% 14.4% 18.5% 19.1% 344 bp Net income attributable to common stockholders (GAAP) 7,928 1,129 1,478 2,167 2,317 -71% Net income attributable to common stockholders (non-GAAP) 2,485 1,536 1,812 2,505 2,566 3% EPS attributable to common stockholders, diluted (GAAP) 2.27 0.34 0.42 0.62 0.66 -71% EPS attributable to common stockholders, diluted (non-GAAP) 0.71 0.45 0.52 0.72 0.73 3% Net cash provided by operating activities 4,370 242 3,612 6,255 4,814 10% Capital expenditures (2,306) (2,773) (2,270) (3,513) (2,783) 21% Free cash flow 2,064 (2,531) 1,342 2,742 2,031 -2% Cash, cash equivalents and investments 29,094 26,863 30,720 33,648 36,563 26% 4

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) 2020 2021 2022 2023 2024 YoY Total automotive revenues 27,236 47,232 71,462 82,419 77,070 -6% Energy generation and storage revenue 1,994 2,789 3,909 6,035 10,086 67% Services and other revenue 2,306 3,802 6,091 8,319 10,534 27% Total revenues 31,536 53,823 81,462 96,773 97,690 1% Total gross profit 6,630 13,606 20,853 17,660 17,450 -1% Total GAAP gross margin 21.0% 25.3% 25.6% 18.2% 17.9% -39 bp Operating expenses 4,636 7,083 7,197 8,769 10,374 18% Income from operations 1,994 6,523 13,656 8,891 7,076 -20% Operating margin 6.3% 12.1% 16.8% 9.2% 7.2% -194 bp Adjusted EBITDA 5,817 11,621 19,186 16,631 16,645 0% Adjusted EBITDA margin 18.4% 21.6% 23.6% 17.2% 17.0% -15 bp Net income attributable to common stockholders (GAAP) 721 5,519 12,556 14,997 7,091 -53% Net income attributable to common stockholders (non-GAAP) 2,455 7,640 14,116 10,882 8,419 -23% EPS attributable to common stockholders, diluted (GAAP) 0.21 1.63 3.62 4.30 2.04 -53% EPS attributable to common stockholders, diluted (non-GAAP) 0.75 2.26 4.07 3.12 2.42 -22% Net cash provided by operating activities 5,943 11,497 14,724 13,256 14,923 13% Capital expenditures (3,157) (6,482) (7,158) (8,898) (11,339) 27% Free cash flow 2,786 5,015 7,566 4,358 3,584 -18% Cash, cash equivalents and investments 19,384 17,707 22,185 29,094 36,563 26% 5

F I N A N C I A L S U M M A R Y Revenue Total revenue increased 2% YoY in Q4 to $25.7B. YoY, revenue was impacted by the following items: + growth in Energy Generation and Storage and Services and Other + growth in vehicle deliveries + higher regulatory credit revenue - reduced S3XY vehicle average selling price (ASP) (excl. FX impact1), due to pricing, attractive financing options and mix Profitability Our operating income decreased 23% YoY to $1.6B in Q4, resulting in a 6.2% operating margin. YoY, operating income was primarily impacted by the following items: - reduced S3XY vehicle ASP - increase in operating expenses driven by AI and other R&D projects + growth in Energy Generation and Storage and Services and Other gross profit + lower cost per vehicle, including lower raw material costs partially offset by lower fixed cost absorption from production decrease YoY + higher regulatory credit revenue Cash Quarter-end cash, cash equivalents and investments in Q4 was $36.6B. The sequential increase of $2.9B was primarily the result of positive free cash flow of $2.0B. 6 (1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q4’23.

Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 YoY Model 3/Y production 476,777 412,376 386,576 443,668 436,718 -8% Other models production 18,212 20,995 24,255 26,128 22,727 25% Total production 494,989 433,371 410,831 469,796 459,445 -7% Model 3/Y deliveries 461,538 369,783 422,405 439,975 471,930 2% Other models deliveries 22,969 17,027 21,551 22,915 23,640 3% Total deliveries 484,507 386,810 443,956 462,890 495,570 2% of which subject to operating lease accounting 10,563 8,365 10,227 14,449 26,962 155% Total end of quarter operating lease vehicle count 176,564 173,131 171,353 168,867 180,523 2% Global vehicle inventory (days of supply)(1) 15 28 18 19 12 -20% Storage deployed (GWh) 3.2 4.1 9.4 6.9 11.0 244% Tesla locations 1,208 1,258 1,286 1,306 1,359 13% Mobile service fleet 1,909 1,897 1,896 1,933 1,895 -1% Supercharger stations 5,952 6,249 6,473 6,706 6,975 17% Supercharger connectors 54,892 57,579 59,596 62,421 65,495 19% (1) Days of supply is calculated by dividing new vehicle ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). O P E R A T I O N A L S U M M A R Y (Unaudited) 7

2020 2021 2022 2023 2024 YoY Model 3/Y production 454,932 906,032 1,298,434 1,775,159 1,679,338 -5% Other models production 54,805 24,390 71,177 70,826 94,105 33% Total production 509,737 930,422 1,369,611 1,845,985 1,773,443 -4% Model 3/Y deliveries 442,562 911,242 1,247,146 1,739,707 1,704,093 -2% Other models deliveries 57,085 24,980 66,705 68,874 85,133 24% Total deliveries 499,647 936,222 1,313,851 1,808,581 1,789,226 -1% of which subject to operating lease accounting 34,470 60,912 47,582 72,226 60,003 -17% Total end of quarter operating lease vehicle count 72,089 120,342 140,667 176,564 180,523 2% Global vehicle inventory (days of supply)(1) 15 6 16 16 13 -19% Storage deployed (GWh) 3.0 4.0 6.5 14.7 31.4 114% Tesla locations 523 644 963 1,208 1,359 13% Mobile service fleet 894 1,281 1,584 1,909 1,895 -1% Supercharger stations 2,564 3,476 4,678 5,952 6,975 17% Supercharger connectors 23,277 31,498 42,419 54,892 65,495 19% (1) Days of supply is calculated by dividing new vehicle ending inventory by the relevant year’s deliveries and using 300 trading days (aligned with Automotive News definition). O P E R A T I O N A L S U M M A R Y (Unaudited) 8

V E H I C L E C A P A C I T Y Current Installed Annual Vehicle Capacity Region Model Capacity Status California Model S / Model X 100,000 Production Model 3 / Model Y >550,000 Production Shanghai Model 3 / Model Y >950,000 Production Berlin Model Y >375,000 Production Texas Model Y >250,000 Production Cybertruck >125,000 Production Cybercab - In development Nevada Tesla Semi - Pilot production TBD Roadster - In development Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on latest available data from ACEA; Autonews.com; CAAM – light-duty vehicles only; TTM = Trailing twelve months Preparations are underway across our existing factories for the launch of new products in 2025, including more affordable models. New Model Y has launched on the configurator globally with production ramp and deliveries beginning later in Q1. US: California, Nevada and Texas Semi Factory construction continued in Q4 and recently completed roof and wall enclosure of the main building area. First truck builds are scheduled to start by end of 2025 with ramp beginning in early 2026. Preparation is underway for Cybercab lines at Gigafactory Texas with volume production planned for 2026. Given its unique functionality – including Powershare, stainless steel exterior, enhanced durability and bioweapon defense mode – we deployed a fleet of Cybertrucks equipped with Starlink in the Los Angeles area to help first responders and those impacted by the fires get access to electricity and Wi-Fi. We expect Cybertruck to be eligible for the IRA consumer tax credit, helping to improve affordability and access for even more customers. APAC: Shanghai In Q4, we achieved record deliveries in China as Model Y became the best-selling vehicle for the full year. Tesla also became the fastest growing brand in South Korea, and we launched vehicle sales in the Philippines. Europe: Berlin-Brandenburg In 2024, Model Y was the best-selling vehicle of any type in Denmark, Norway, Sweden, Switzerland and the Netherlands and we expect Model Y to have been the second best-selling vehicle of any type in Europe. Tesla was the most sold brand in Norway for the fourth year in a row with Model Y and Model 3 the best- and second-best selling cars of any type in 2024.9 0% 1% 2% 3% 4% US/Canada Europe China

Million miles driven before an accident occurs C O R E T E C H N O L O G Y Cumulative miles driven with FSD (Supervised) (billions) Artificial Intelligence Software and Hardware In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements. FSD (Supervised) can now start from park and perform unpark, reverse and park capabilities. In Q4, Tesla vehicles using Autopilot technology drove 5.94 million miles between accidents2 – the best Q4 ever – compared to the U.S. average of .70 million miles. Progress on Optimus hardware and software continued in Q4, including the latest generation hand, robust locomotion and training on additional tasks, ahead of planned pilot production in 2025. Vehicle and Other Software The holiday release included Apple Watch support - customers can pair their watch as a key to unlock and lock their vehicle without ever pressing a button just like the phone key. With a Premium Connectivity subscription, Dashcam and Sentry Mode clips can be viewed and downloaded directly from the Tesla mobile app. An animated three-hour precipitation forecast can be viewed on the map, and SiriusXM is now available to our full lineup with launch as a native app for Model 3, Model Y and Cybertruck. Battery, Powertrain and Manufacturing We processed our first spodumene (lithium-containing concentrate) through the front-end of the lithium refinery only 18 months after ground-breaking: much faster than any plant we know of outside of Asia. The intermediate material was on-spec, and we are on track to commission the plant in 2025. Our in-house 4680 cell hit a production rate exceeding 2.5k Cybertrucks/week. 10 (1) Active driver supervision required; does not make the vehicle autonomous (2) For more information, see our Vehicle Safety Report 0.0 0.5 1.0 1.5 2.0 2.5 3.0 FSD Miles on V12 and Beyond FSD Miles on V11 and Before 0 1 2 3 4 5 6 Q4 2019 Q4 2020 Q4 2021 Q4 2022 Q4 2023 Q4 2024 Tesla vehicles using Autopilot technology Tesla vehicles not using Autopilot technology U.S. avg

O T H E R H I G H L I G H T S Energy Storage deployments (GWh) Energy and Services and Other gross profit ($M) Our Energy business continued to grow rapidly in 2024 as we expand capacity for both Megapack and Powerwall to meet demand. Services and Other – a collection of businesses that support new vehicle sales – achieved its third year in a row of profitability in 2024. Energy Generation and Storage The Energy business achieved record deployments for both Powerwall and Megapack at a combined 11.0 GWh, resulting in a record gross profit in Q4. Material and other costs continued to come down in Q4 at the Lathrop Megafactory. Both Powerwall and Megapack continue to be supply constrained as we open new markets and demand for energy storage products continues to grow. With construction completed, Shanghai Megafactory will begin ramping in Q1. Services and Other In Q4, we added over 3k Supercharger stalls to the network and delivered 1.4 TWh of energy. We unveiled our V4 cabinet, which supports 400V-1,000V vehicle architectures, charges up to 500kW for passenger vehicles and 1.2MW for Tesla Semi and has cutting-edge power electronics with 3x the power density. We launched Battery Heating at Superchargers, a feature that gets vehicles with LFP battery packs back on the road up to 4x faster. We also continued to welcome more OEMs to the North American Supercharger network, including the first NACS native vehicles. Overall, in 2024, we launched Superchargers in three new countries, added over 10k new Supercharger stalls, and grew the network by 19% year-over-year, for a total of 65k+ Superchargers worldwide. We delivered 5.2+ TWh, offsetting over 5.5 billion kg of direct CO2 emissions and 2.4 billion liters of gasoline. 11 0 1 2 3 4 5 6 7 8 9 10 11 12 -1,000 -800 -600 -400 -200 0 200 400 600 800 1,000

O U T L O O K Volume With the advancements in vehicle autonomy and the introduction of new products, we expect the vehicle business to return to growth in 2025. The rate of growth will depend on a variety of factors, including the rate of acceleration of our autonomy efforts, production ramp at our factories and the broader macroeconomic environment. We expect energy storage deployments to grow at least 50% year-over-year in 2025. Cash We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period. Profit While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware- related profits to be accompanied by an acceleration of AI, software and fleet-based profits. Product Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be produced on the same manufacturing lines as our current vehicle line-up. This approach will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 60% growth over 2024 production before investing in new manufacturing lines. Our purpose-built Robotaxi product – Cybercab – will continue to pursue a revolutionary “unboxed” manufacturing strategy and is scheduled for volume production starting in 2026. 12

P H O T O S & C H A R T S

A V E R A G E C O G S P E R V E H I C L E * A C H I E V E D A N A L L – T I M E L O W I N Q 4 2 0 2 4 14 $32,000 $33,000 $34,000 $35,000 $36,000 $37,000 $38,000 $39,000 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 * Calculated by dividing Cost of Automotive Sales Revenue by respective quarter’s new deliveries (ex-operating leases)

C Y B E R T R U C K - A D V A N C E M E N T S I N V E H I C L E T E C H N O L O G Y A N D A R C H I T E C T U R E 15 Technology Description Use in Future Vehicles Manufacturing and Design Stainless Steel Exoskeleton • Cold-rolled full hard stainless steel exoskeleton carries crash loads and increases torsional stiffness of the body • Iconic visual design; high dent- and corrosion- resistance reduce concerns over daily wear and tear Air Bending Manufacturing Process • First-of-its-kind automated tooling developed by Tesla that can bend full hard stainless steel without touching it • Enables the use of full hard stainless steel as an A-surface without getting scratched by tooling Giga-castings • Our largest castings ever - custom alloy and a 9,000-ton press combine to make front and rear vehicle structures • Reduces number of parts and manufacturing complexity, and, as a bonus, scrap is fully recyclable ✓ Integrated Audio with Body Structure • Utilizes the body structure as the reactive volume for dual subwoofers • Giant sound in extremely dense packaging ✓ Powertrain and Electrical Architecture 48-Volt Electrical Architecture • 48-volt electrical system reduces current by 4x and heat generated by 16x compared to typical automotive voltage • Reduction in vehicle harness reduces vehicle weight, increases energy efficiency and simplifies electrical systems ✓ 800-Volt Battery System • Higher voltage powertrain is more energy efficient for high power vehicles such as Cybertruck and Tesla Semi • Enables smaller cables which reduces cost and mass while also enabling higher power (500kW) charging ✓ Etherloop Communication Architecture • Gigabit ethernet communication is 1,000x faster than traditional automotive communication standards • Enables distributed controller architecture which improves redundancy and eliminates 70% of cross-vehicle wires ✓ Bidirectional Charging (Powershare) • The Cybertruck can provide power to your jobsite, home or other devices (Vehicle-to-Grid or Vehicle-to-Home) • Turns vehicles into mobile energy storage units with up to 11.5kW of onboard power, enabling hours of work ✓ Ride and Comfort Custom Laminated Glass • Novel glass and laminate developed by Tesla for increased comfort and strength • Improves sound isolation and blocks harmful UV, keeping the cabin cool while maintaining a panoramic view ✓ Adaptive Air Suspension • Adjusts ride height and damping for different terrains with 12” of adjustment getting up to 16” of ground clearance • Improves on-road comfort and stability without sacrificing off-road capability ✓ Steer-by-Wire • Replaces traditional steer shaft with redundant controllers and motors, enabling an adjustable steering ratio for different speeds and driving styles • Reduces the amount you need to turn the wheel, enabling more agility at low speeds and more stability at high speeds ✓ Rear Wheel Steering • Leveraging steer-by-wire, enables approximately ten degrees of steering on the rear wheels • Improves turning radius at low speeds and increases stability at high speeds ✓

N E W M O D E L Y - T H E W O R L D ’ S B E S T S E L L I N G V E H I C L E I S N O W E V E N B E T T E R 16

N E W M O D E L Y - T H E W O R L D ’ S B E S T S E L L I N G V E H I C L E I S N O W E V E N B E T T E R 17

N E W M O D E L Y - T H E W O R L D ’ S B E S T S E L L I N G V E H I C L E I S N O W E V E N B E T T E R 18 * Before estimated savings, Model Y Rear-Wheel Drive starts at $46,630 (U.S) and New Model Y Launch Series Long Range All-Wheel Drive starts at $61,630 (U.S.). Prices include Destination and Order Fees, but exclude taxes and other fees. Subject to change. New Model Y Launch Series has upgrades that will increase the price. Estimated savings includes $6,000 in gas savings estimated over five years and the $7,500 Federal Tax Credit, available to eligible buyers and subject to MSRP caps. Not all vehicles, customers or finance options will be eligible. Terms apply. ** Actual range dependent on trim and wheel size.

S E M I F A C T O R Y - F I R S T T R U C K B U I L D S S C H E D U L E D L A T E R T H I S Y E A R 19

M E G A F A C T O R Y S H A N G H A I - W I T H G I G A F A C T O R Y S H A N G H A I I N T H E B A C K G R O U N D 20

M E G A F A C T O R Y S H A N G H A I - G E N E R A L A S S E M B L Y 21

T E S L A L I T H I U M R E F I N E R Y - S T A R T O F P R O D U C T I O N I N 2 0 2 5 22

T E S L A L I T H I U M T E A M O N S P O D U M E N E D A Y 23

C O R T E X ~ 5 0 K G P U T R A I N I N G C L U S T E R 24

C O R T E X ~ 5 0 K G P U T R A I N I N G C L U S T E R 25

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) Net Income ($B) Adjusted EBITDA ($B) 26 0.0 0.1 0.2 0.3 0.4 0.5 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 -3 -2 -1 0 1 2 3 4 5 6 7 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 0 1 2 3 4 5 6 7 8 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4

Operating Cash Flow ($B) Free Cash Flow ($B) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) Adjusted EBITDA ($B) Vehicle Deliveries (millions of units) 27 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 0 2 4 6 8 10 12 14 16 18 20 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 0 2 4 6 8 10 12 14 16 18 20 1Q -2 02 2 2Q -2 02 2 3Q -2 02 2 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4

F I N A N C I A L S T A T E M E N T S

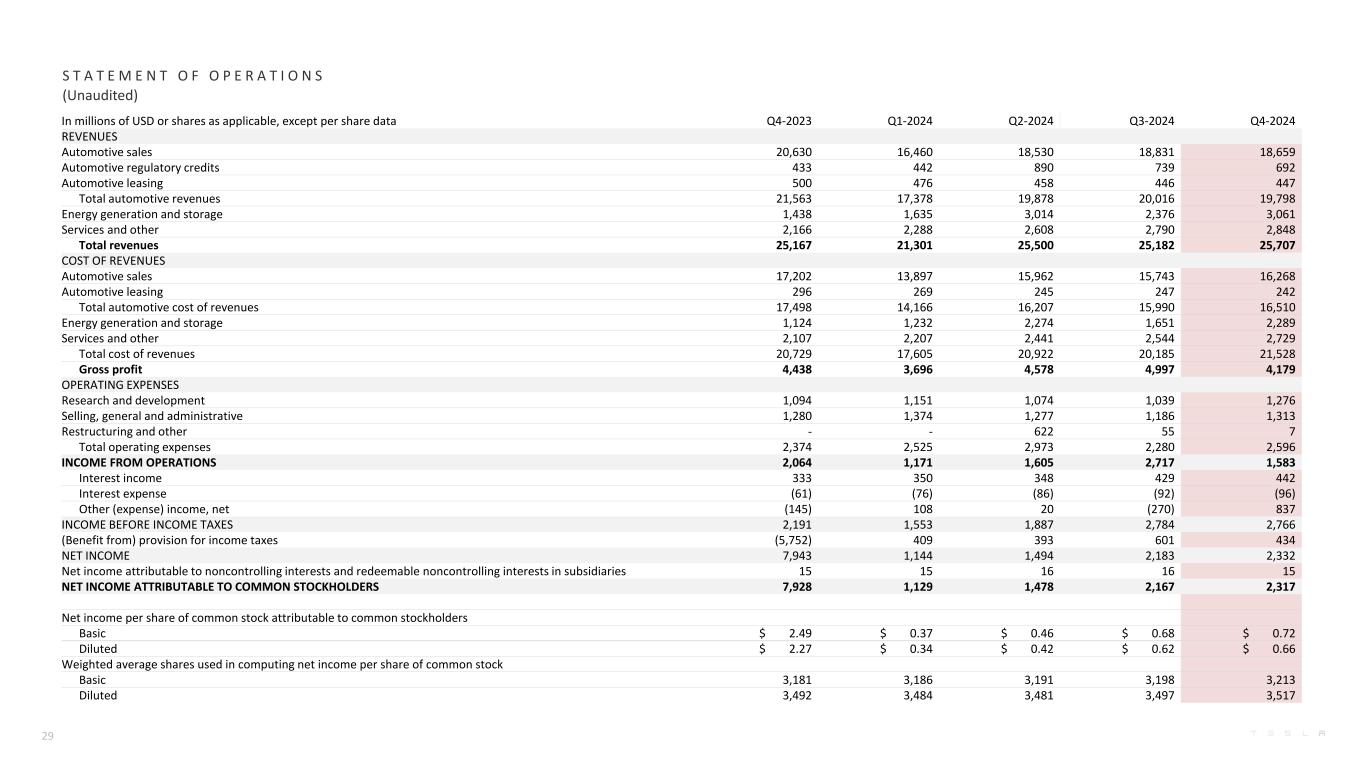

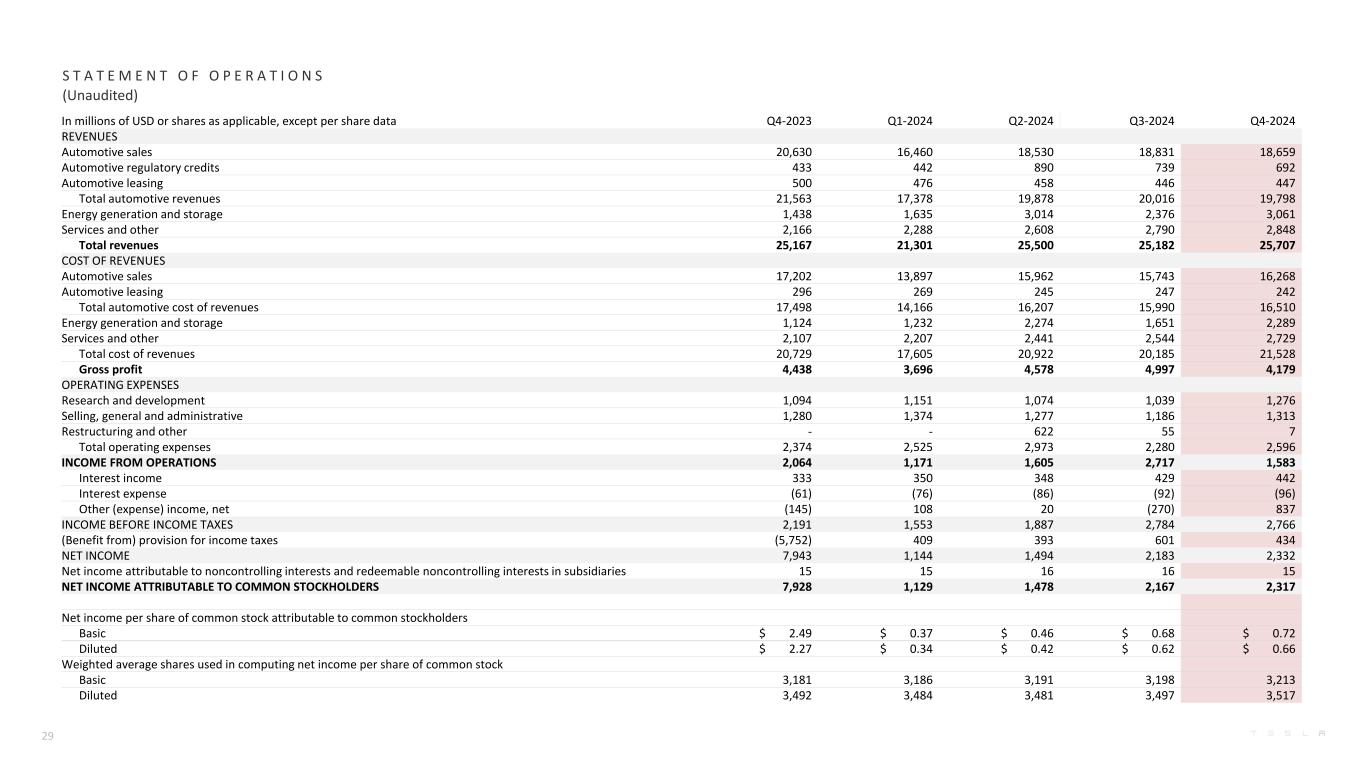

In millions of USD or shares as applicable, except per share data Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 REVENUES Automotive sales 20,630 16,460 18,530 18,831 18,659 Automotive regulatory credits 433 442 890 739 692 Automotive leasing 500 476 458 446 447 Total automotive revenues 21,563 17,378 19,878 20,016 19,798 Energy generation and storage 1,438 1,635 3,014 2,376 3,061 Services and other 2,166 2,288 2,608 2,790 2,848 Total revenues 25,167 21,301 25,500 25,182 25,707 COST OF REVENUES Automotive sales 17,202 13,897 15,962 15,743 16,268 Automotive leasing 296 269 245 247 242 Total automotive cost of revenues 17,498 14,166 16,207 15,990 16,510 Energy generation and storage 1,124 1,232 2,274 1,651 2,289 Services and other 2,107 2,207 2,441 2,544 2,729 Total cost of revenues 20,729 17,605 20,922 20,185 21,528 Gross profit 4,438 3,696 4,578 4,997 4,179 OPERATING EXPENSES Research and development 1,094 1,151 1,074 1,039 1,276 Selling, general and administrative 1,280 1,374 1,277 1,186 1,313 Restructuring and other - - 622 55 7 Total operating expenses 2,374 2,525 2,973 2,280 2,596 INCOME FROM OPERATIONS 2,064 1,171 1,605 2,717 1,583 Interest income 333 350 348 429 442 Interest expense (61) (76) (86) (92) (96) Other (expense) income, net (145) 108 20 (270) 837 INCOME BEFORE INCOME TAXES 2,191 1,553 1,887 2,784 2,766 (Benefit from) provision for income taxes (5,752) 409 393 601 434 NET INCOME 7,943 1,144 1,494 2,183 2,332 Net income attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries 15 15 16 16 15 NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS 7,928 1,129 1,478 2,167 2,317 Net income per share of common stock attributable to common stockholders Basic $ 2.49 $ 0.37 $ 0.46 $ 0.68 $ 0.72 Diluted $ 2.27 $ 0.34 $ 0.42 $ 0.62 $ 0.66 Weighted average shares used in computing net income per share of common stock Basic 3,181 3,186 3,191 3,198 3,213 Diluted 3,492 3,484 3,481 3,497 3,517 S T A T E M E N T O F O P E R A T I O N S (Unaudited) 29

B A L A N C E S H E E T (Unaudited) In millions of USD 31-Dec-23 31-Mar-24 30-Jun-24 30-Sep-24 31-Dec-24 ASSETS Current assets Cash, cash equivalents and investments 29,094 26,863 30,720 33,648 36,563 Accounts receivable, net 3,508 3,887 3,737 3,313 4,418 Inventory 13,626 16,033 14,195 14,530 12,017 Prepaid expenses and other current assets 3,388 3,752 4,325 4,888 5,362 Total current assets 49,616 50,535 52,977 56,379 58,360 Operating lease vehicles, net 5,989 5,736 5,541 5,380 5,581 Solar energy systems, net 5,229 5,162 5,102 5,040 4,924 Property, plant and equipment, net 29,725 31,436 32,902 36,116 35,836 Operating lease right-of-use assets 4,180 4,367 4,563 4,867 5,160 Digital assets, net 184 184 184 184 1,076 Goodwill and intangible assets, net 431 421 413 411 394 Deferred tax assets 6,733 6,769 6,692 6,486 6,524 Other non-current assets 4,531 4,616 4,458 4,989 4,215 Total assets 106,618 109,226 112,832 119,852 122,070 LIABILITIES AND EQUITY Current liabilities Accounts payable 14,431 14,725 13,056 14,654 12,474 Accrued liabilities and other 9,080 9,243 9,616 10,601 10,723 Deferred revenue 2,864 3,024 2,793 3,031 3,168 Current portion of debt and finance leases (1) 2,373 2,461 2,264 2,291 2,456 Total current liabilities 28,748 29,453 27,729 30,577 28,821 Debt and finance leases, net of current portion (1) 2,857 2,899 5,481 5,405 5,757 Deferred revenue, net of current portion 3,251 3,214 3,357 3,350 3,317 Other long-term liabilities 8,153 8,480 9,002 9,810 10,495 Total liabilities 43,009 44,046 45,569 49,142 48,390 Redeemable noncontrolling interests in subsidiaries 242 73 72 70 63 Total stockholders' equity 62,634 64,378 66,468 69,931 72,913 Noncontrolling interests in subsidiaries 733 729 723 709 704 Total liabilities and equity 106,618 109,226 112,832 119,852 122,070 (1) Breakdown of our debt is as follows: Non-recourse debt 4,613 4,820 7,355 7,379 7,871 Recourse debt 44 54 7 11 7 Days sales outstanding 11 16 14 13 14 Days payable outstanding 63 75 60 63 58 30

In millions of USD Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 CASH FLOWS FROM OPERATING ACTIVITIES Net income 7,943 1,144 1,494 2,183 2,332 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and impairment 1,232 1,246 1,278 1,348 1,496 Stock-based compensation 484 524 439 457 579 Deferred income taxes (6,033) (11) 144 285 59 Digital assets gain, net — — — — (589) Other 262 — 119 408 (93) Changes in operating assets and liabilities 482 (2,661) 138 1,574 1030 Net cash provided by operating activities 4,370 242 3,612 6,255 4,814 CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures (2,306) (2,773) (2,270) (3,513) (2,783) Purchases of solar energy systems, net of sales (1) (4) (2) — 3 Purchases of investments (5,891) (6,622) (8,143) (6,032) (15,158) Proceeds from maturities of investments 3,394 4,315 6,990 6,670 10,335 Proceeds from sales of investments — — 200 — — Net cash used in investing activities (4,804) (5,084) (3,225) (2,875) (7,603) CASH FLOWS FROM FINANCING ACTIVITIES Net cash flows from other debt activities (141) (140) 2,598 (75) (108) Net borrowings (repayments) under vehicle and energy product financing 952 216 (212) (107) 677 Net cash flows from noncontrolling interests – Solar (76) (131) (43) (26) (37) Other 152 251 197 340 453 Net cash provided by financing activities 887 196 2,540 132 985 Effect of exchange rate changes on cash and cash equivalents and restricted cash 146 (79) (37) 108 (133) Net increase (decrease) in cash and cash equivalents and restricted cash 599 (4,725) 2,890 3,620 (1,937) Cash and cash equivalents and restricted cash at beginning of period 16,590 17,189 12,464 15,354 18,974 Cash and cash equivalents and restricted cash at end of period 17,189 12,464 15,354 18,974 17,037 S T A T E M E N T O F C A S H F L O W S (Unaudited) 31

In millions of USD or shares as applicable, except per share data Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 Net income attributable to common stockholders (GAAP) 7,928 1,129 1,478 2,167 2,317 Stock-based compensation expense, net of tax 484 407 334 338 249 Release of valuation allowance on deferred tax assets (5,927) — — — — Net income attributable to common stockholders (non-GAAP) 2,485 1,536 1,812 2,505 2,566 Less: Buy-outs of noncontrolling interests 1 (42) — — 3 Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) 2,484 1,578 1,812 2,505 2,563 EPS attributable to common stockholders, diluted (GAAP) 2.27 0.34 0.42 0.62 0.66 Stock-based compensation expense per share, net of tax 0.14 0.11 0.10 0.10 0.07 Release of valuation allowance on deferred tax assets per share (1.70) — — — — EPS attributable to common stockholders, diluted (non-GAAP) 0.71 0.45 0.52 0.72 0.73 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 3,492 3,484 3,481 3,497 3,517 Net income attributable to common stockholders (GAAP) 7,928 1,129 1,478 2,167 2,317 Interest expense 61 76 86 92 96 (Benefit from) provision for income taxes (5,752) 409 393 601 434 Depreciation, amortization and impairment 1,232 1,246 1,278 1,348 1,496 Stock-based compensation expense 484 524 439 457 579 Adjusted EBITDA (non-GAAP) 3,953 3,384 3,674 4,665 4,922 Total revenues 25,167 21,301 25,500 25,182 25,707 Adjusted EBITDA margin (non-GAAP) 15.7% 15.9% 14.4% 18.5% 19.1% R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) 32

In millions of USD or shares as applicable, except per share data 2020 2021 2022 2023 2024 Net income attributable to common stockholders (GAAP) 721 5,519 12,556 14,997 7,091 Stock-based compensation expense, net of tax 1,734 2,121 1,560 1,812 1,328 Release of valuation allowance on deferred tax assets — — — (5,927) — Net income attributable to common stockholders (non-GAAP) 2,455 7,640 14,116 10,882 8,419 Less: Buy-outs of noncontrolling interests 31 (5) (27) (2) (39) Less: Dilutive convertible debt — (9) (1) — — Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) 2,424 7,654 14,143 10,884 8,458 EPS attributable to common stockholders, diluted (GAAP) 0.21 1.63 3.62 4.30 2.04 Stock-based compensation expense per share, net of tax 0.54 0.63 0.45 0.52 0.38 Release of valuation allowance on deferred tax assets per share — — — (1.70) — EPS attributable to common stockholders, diluted (non-GAAP) 0.75 2.26 4.07 3.12 2.42 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 3,249 3,386 3,475 3,485 3,498 Net income attributable to common stockholders (GAAP) 721 5,519 12,556 14,997 7,091 Interest expense 748 371 191 156 350 Provision for (benefit from) income taxes 292 699 1,132 (5,001) 1,837 Depreciation, amortization and impairment 2,322 2,911 3,747 4,667 5,368 Stock-based compensation expense 1,734 2,121 1,560 1,812 1,999 Adjusted EBITDA (non-GAAP) 5,817 11,621 19,186 16,331 16,645 Total revenues 31,536 53,823 81,462 96,773 97,690 Adjusted EBITDA margin (non-GAAP) 18.4% 21.6% 23.6% 17.2% 17.0% R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) 33

R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) In millions of USD 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 4Q-2024 Net cash provided by operating activities – TTM (GAAP) 13,851 14,078 16,031 14,724 13,242 13,956 12,164 13,256 10,985 11,532 14,479 14,923 Capital expenditures – TTM (6,901) (7,126) (7,110) (7,158) (7,463) (7,793) (8,450) (8,898) (9,599) (9,809) (10,862) (11,339) Free cash flow – TTM (non-GAAP) 6,950 6,952 8,921 7,566 5,779 6,163 3,714 4,358 1,386 1,723 3,617 3,584 In millions of USD 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 3Q-2024 Net income attributable to common stockholders – TTM (GAAP) 8,399 9,516 11,190 12,556 11,751 12,195 10,756 14,997 13,613 12,388 12,702 7,091 Interest expense – TTM 333 302 229 191 159 143 128 156 203 261 315 350 Provision for (benefit from) income taxes – TTM 976 1,066 1,148 1,132 1,047 1,165 1,027 (5,001) (4,853) (4,783) (4,349) 1,837 Depreciation, amortization and impairment – TTM 3,170 3,411 3,606 3,747 3,913 4,145 4,424 4,667 4,867 4,991 5,104 5,368 Stock-based compensation expense – TTM 1,925 1,812 1,699 1,560 1,560 1,644 1,747 1,812 1,918 1,912 1,904 1,999 Adjusted EBITDA – TTM (non-GAAP) 14,803 16,107 17,872 19,186 18,430 19,292 18,082 16,631 15,748 14,769 15,676 16,645 TTM = Trailing twelve months In millions of USD 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 4Q-2024 Net cash provided by operating activities (GAAP) 2,124 3,147 4,585 3,995 2,351 5,100 3,278 2,513 3,065 3,308 4,370 242 3,612 6,255 4,814 Capital expenditures (1,505) (1,819) (1,810) (1,767) (1,730) (1,803) (1,858) (2,072) (2,060) (2,460) (2,306) (2,773) (2,270) (3,513) (2,783) Free cash flow (non-GAAP) 619 1,328 2,775 2,228 621 3,297 1,420 441 1,005 848 2,064 (2,531) 1,342 2,742 2,031 In millions of USD 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 3Q-2024 Net income attributable to common stockholders (GAAP) 1,142 1,618 2,321 3,318 2,259 3,292 3,687 2,513 2,703 1,853 7,928 1,129 1,478 2,167 2,317 Interest expense 75 126 71 61 44 53 33 29 28 38 61 76 86 92 96 Provision for (benefit from) income taxes 115 223 292 346 205 305 276 261 323 167 (5,752) 409 393 601 434 Depreciation, amortization and impairment 681 761 848 880 922 956 989 1,046 1,154 1,235 1,232 1,246 1,278 1,348 1,496 Stock-based compensation expense 474 475 558 418 361 362 419 418 445 465 484 524 439 457 579 Adjusted EBITDA (non-GAAP) 2,487 3,203 4,090 5,023 3,791 4,968 5,404 4,267 4,653 3,758 3,953 3,384 3,674 4,665 4,922 34

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its fourth quarter 2024 financial results conference call beginning at 4:30 p.m. CT on January 29, 2025 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units when installed and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment and (d) stock-based compensation expense. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding operating leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant period's deliveries and using trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including, but not limited to, statements in the “Outlook” section; statements relating to the development, strategy, ramp, production and capacity, demand and market growth, cost, pricing and profitability, investment, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and services; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories and refinery are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on assumptions and management’s current expectations, involve certain risks and uncertainties, and are not guarantees. Future results may differ materially from those expressed in any forward-looking statement. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in launching and/or manufacturing our products, services and features cost-effectively; our ability to build and/or grow our products and services, sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; our ability to successfully and timely develop, introduce and scale, as well as our consumers’ demand for, products and services based on artificial intelligence, robotics and automation, electric vehicles, Autopilot and FSD (Supervised) features, and ride-hailing services generally and our vehicles and services specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive, transportation and energy product and services markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 29, 2024 and subsequent quarterly reports on Form 10-Q. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise. 35