Exhibit 99.1

SUMMARY

This summary highlights selected information about our company, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus, in the documents we incorporate by reference and in any free writing prospectus that we have authorized for use in connection with this offering. This summary is not complete and does not contain all the information that you should consider before investing in our common stock and the accompanying warrants. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the “Risk Factors” contained in this prospectus supplement, the accompanying prospectus and the financial documents and notes incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering, before making an investment decision. This prospectus supplement may add to, update or change information in the accompanying prospectus.

The Company

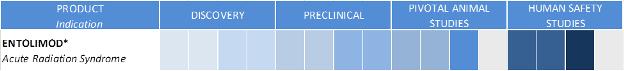

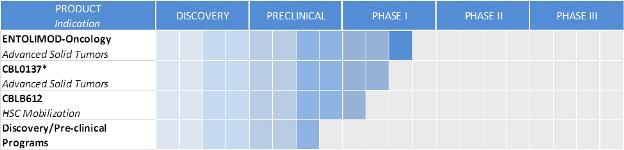

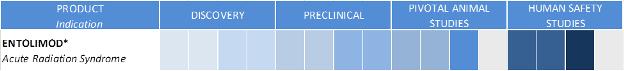

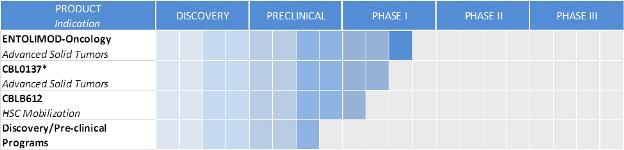

We are an innovative biopharmaceutical company seeking to develop first-in-class pharmaceuticals designed to address diseases with significant unmet medical need. We combine our proven scientific expertise and our depth of knowledge about our products’ mechanisms of action into a passion for developing drugs to save lives. Our programs are focused on the implementation of novel pharmacological approaches to control cell death. Our proprietary drug candidates act via unique mechanisms that are designed to kill cancer and protect healthy cells. We conduct business in the United States and the Russian Federation and have worldwide development and commercialization rights to all of our product candidates, subject to certain financial obligations to our current licensors. Our lead product candidates are entolimod, which we are developing as a radiation countermeasure and an oncology drug, and CBL0137, our lead oncology product candidate. We also have an additional clinical stage program and multiple innovative projects in different stages of preclinical drug development. Our primary product development programs and their respective development stages are illustrated below:

| * | Lead product development program |

| ** | HSC means hematopoietic stem cell |

Entolimod, our most advanced product candidate, is a Toll-like receptor 5, or TLR5, agonist, which we are developing as a radiation countermeasure for prevention of death from Acute Radiation Syndrome, or ARS, and as an oncology drug. We believe that entolimod is the most efficacious radiation countermeasure currently in development. Following is a summary of the clinical development of entolimod to date and regulatory status:

1

Entolimod is being developed under the U.S. Food & Drug Administration’s, or FDA’s, Animal Efficacy Rule, or the Animal Rule, for the indication of reducing the risk of death following exposure to potentially lethal irradiation occurring as a result of a radiation disaster. We anticipated that entolimod will be administered within 25 hours following radiation exposure. We have completed two dose escalation clinical studies designed to evaluate the safety, pharmacokinetics and pharmacodynamics in a total of 150 healthy volunteers. Administration of entolimod was not associated with irreversible harm at any of the doses evaluated in these two studies. We have completed a Good Laboratory Practices, or GLP, randomized, blinded, placebo-controlled, pivotal study designed to evaluate the dose-dependent effect of entolimod on survival and biomarker induction in 179 non-human primates exposed to 7.2 Gy total body irradiation when entolimod or placebo were administered at 25 hours after radiation exposure. We have completed a GLP, randomized, open-label, placebo-controlled, pivotal study designed to evaluate the dose-dependent effect of Entolimod on biomarker induction in 160 non-irradiated non-human primates. We met with the FDA in July 2014 to present our human dose-conversion and to discuss our intent to submit a pre-Emergency Use Application, or pre-EUA. The FDA confirmed that our existing efficacy and safety data and animal-to-human dose conversion are sufficient to proceed with a pre-EUA submission and agreed to accept a pre-EUA application for review. We are currently preparing the pre-EUA submission, which we anticipate filing in the first half of 2015. If the FDA authorizes the application, then Federal agencies will be free to procure entolimod to stockpile and distribute in the event of an emergency, i.e. prior to the drug being formally approved by FDA under a Biologic License Application, or BLA.

We received contracts and grants with the U.S. government totaling $44.6 million for the development of our lead compound, entolimod, for biodefense application as a radiation countermeasure through December 31, 2014. In January 2015, we announced that we received notice that the proposal application to support further development of entolimod as a medical radiation countermeasure was recommended for funding subject to negotiations by the Department of Defense, or DoD, office of Congressionally Directed Medical Research Programs, or CDMRP. The subject proposal includes aims to conduct several pivotal animal studies required by the FDA for submission of a BLA. There is no guarantee that DoD will award us a contract based on this proposal, or if an award is made, that it will support the studies originally proposed. The award of a contract by DoD based on the referenced proposal is subject to completion of successful negotiations and availability of funds.

Additionally, we have completed enrollment in a Phase 1 open-label, dose-escalation trial of entolimod in patients with advanced cancer in the United States and have begun dosing in a small expansion study in the Russian Federation enrolling additional patients at the highest doses achieved in the U.S. study. Both studies include evaluation of immune cell response to administrations of entolimod.

CBL0137, our lead oncology product candidate, acts through a novel mechanism enabling this compound to simultaneously target several molecular pathways within cancer cells. We believe that CBL0137 has the potential to be a broadly-marketed cancer treatment that will address the unmet needs of treating multiple types of cancer that are resistant to current treatments. CBL0137 inhibits Nuclear Factor kappa-B, or NF-kB, Heat Shock Factor Protein-1, or HSF-1, and Hypoxia-inducible factor 1-alpha, or HIF1 alpha, transcription factors that are essential for viability of many types of tumors and activates tumor suppressor protein p53 by modulating intracellular localization and activity of chromatin remodeling complex Facilitates Chromatin Transcription, or FACT. CBL0137 has demonstrated reproducible anti-tumor effects in animal models of colon, breast, renal, pancreatic, head and neck and prostate cancers, melanoma, non-small cell lung cancer, glioblastoma, lymphoma, leukemia and neuroblastoma. We are currently enrolling two Phase 1 trials of CBL0137: (i) a multi-center, single agent, dose-escalation study in the Russian Federation evaluating oral administration of CBL0137 in subjects with advanced solid tumors that are resistant or refractory to standard of care treatment; and (ii) a multi-center, single agent dose-escalation study in the United States, evaluating intravenous administration of CBL0137 in patients with metastatic or unresectable advanced solid cancers and lymphomas. We are conducting parallel evaluation of oral and intravenous routes of administration and continuous low-dose versus interrupted high-dose schedules to reduce our developmental risk by fully characterizing the clinical pharmacology of CBL0137.

In January 2015, we announced clinical progress with CBL0137. A formal interim analysis of the 19 patients enrolled in the first six cohorts of the ongoing oral administration study indicated that the study medication was well tolerated at all investigated dose levels. The observation of drug exposure in plasma documented high oral bioavailability (typically estimated to be> 50%). To date, no dose-limiting toxicities have been observed with either oral or intravenous administration through the highest CBL0137 dose levels tested. Heavily pretreated patients with advanced cancers of the esophagus, colon, breast, cervix, and prostate have had stable disease for periods ranging from 4 to 6 months. Peripheral blood mononuclear cells (PBMC) from evaluable blood samples have shown pharmacodynamic effects consistent with the expected mechanism of action of CBL0137.

2

Our Partners

In December 2009, we entered into a Participation Agreement with BioProcess Capital Partners, LLC, a Russian Federation venture capital fund, to create a joint venture, Incuron, LLC (“Incuron”), to develop our Curaxin line of anti-cancer product candidates including CBL0137, a new, proprietary molecule optimized to better target similar mechanisms of action in combating cancer. Incuron is our partially-owned subsidiary, with approximately 46.97% of its equity interests held by us as at December 31, 2015.

In September 2011, we entered into an Investment Agreement with Open Joint Stock Company “Rusnano”, or Rusnano, a multi-billion Russian Federation venture fund, governing the creation of Panacela, a joint venture company formed to develop five separate product candidates. Panacela is a partially-owned subsidiary, with 54.6% of its shares held by us as at September 30, 2014. Panacela is currently performing under a three-year contract, received in October 2013, valued at approximately 149 million rubles with the Ministry of Industry and Trade of the Russian Federation to support pre-clinical and clinical studies of its product candidate, Mobilan, a cancer vaccine that is expected to enter the clinic in the first half of 2015.

Additionally, we leverage close development relationships with Roswell Park Cancer Institute, Cleveland Clinic Foundation and Children’s Cancer Institute Australia. Together, our team of legal entities, financial partners and other collaborators engage in the collective development efforts necessary to advance all of our product candidates towards marketing approval and commercialization.

3

RISK FACTORS

Before purchasing our common stock and the accompanying warrants, you should carefully consider the risk factors set forth below and under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, each of which are on file with the SEC and are incorporated herein by reference, as well as all other information contained in this prospectus supplement and the accompanying prospectus and incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering. The risks and uncertainties described below and in our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of the risks described below or in our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, actually occur, our business, financial condition and results of operations could suffer. As a result, the trading price of our stock could decline, perhaps significantly, and you could lose all or part of your investment. The risks discussed below and in most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See the section entitled “Forward-Looking Information.”

Risks Related To Our Financial Condition And Need For Additional Capital

We will require substantial additional financing in order to meet our business objectives.

Since our inception, most of our resources have been dedicated to the pre-clinical and clinical development of our product candidates. In particular, we are currently conducting multiple clinical trials of our product candidates, each of which will require substantial funds to complete. We believe that we will continue to expend substantial resources for the foreseeable future developing our pre-clinical and clinical product candidates. These expenditures will include costs associated with research and development, conducting pre-clinical and clinical studies, obtaining regulatory approvals and products from third-party manufacturers, as well as marketing and selling any products approved for sale. In addition, other unanticipated costs may arise. For example, if one of our subsidiaries faces insolvency, we may elect to make additional capital contributions to fund its operations and any such cash contributions will reduce cash available for our business. Because the outcome of our planned and anticipated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts of capital necessary to successfully complete the development and commercialization of our product candidates.

As of September 30, 2014, our cash, cash equivalents and short-term investments available to CBLI amounted to $9.2 million. We believe that our existing cash, cash equivalents and marketable securities will allow us to fund our operating plan into the first quarter of 2015.

Because of the numerous risks and uncertainties associated with research, development and commercialization of pharmaceutical products, we are unable to estimate the exact amounts of our total capital requirements. Our future capital requirements depend on many factors, including:

| | • | | the number and characteristics of the product candidates we pursue; |

| | • | | the scope, progress, results and costs of researching and developing our product candidates, and conducting pre-clinical and clinical studies; |

| | • | | the timing of, and the costs involved in, obtaining regulatory approvals for our product candidates; |

| | • | | the cost of commercialization activities for any of our product candidates that are approved for sale, including marketing, sales and distribution costs; |

| | • | | the cost of manufacturing our product candidates and any products we successfully commercialize; |

| | • | | our ability to establish and maintain strategic partnerships, licensing or other arrangements and the financial terms of such agreements; |

| | • | | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation costs and the outcome of such litigation; |

4

| | • | | whether we realize the full amount of any projected cost savings associated with our strategic restructuring; |

| | • | | the occurrence of a breach or event of default under our loan agreement with Hercules Technology II, L.P., or Hercules, or under any other agreements with third parties; |

| | • | | the success of any pre-EUA submission we make with the FDA; and |

| | • | | the timing, receipt and amount of sales of, or royalties on, our future products, if any. |

If our available cash and cash equivalents are insufficient to satisfy our liquidity requirements, or if we identify additional opportunities to do so, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity or convertible debt securities may result in additional dilution to our stockholders. If we raise additional funds through the issuance of debt securities or preferred stock or through additional credit facilities, these securities and/or the loans under credit facilities could provide for rights senior to those of our common stock and could contain covenants that would restrict our operations. Furthermore, any funds raised through collaboration and licensing arrangements with third parties may require us to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. In any such event, our business prospects, financial condition and results of operations could be materially adversely affected.

Even after taking into account the proceeds expected to be received from the sale of shares of our common stock offered pursuant to this prospectus supplement and the concurrent private placement of warrants, we may require additional capital beyond our currently forecasted amounts and additional funds may not be available when we need them, on terms that are acceptable to us, or at all. In particular, the decline in the market price of our common stock could make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem appropriate. In addition, the variable rate clauses in the stock purchase agreement for the purchase of the common stock offered hereunder and the warrants to be offered in a concurrent private placement prohibit certain types of capital raising activities for certain periods of time and the pledge of assets in our loan and security agreement with Hercules, which may inhibit our ability to attract future investors and/or lenders. Additionally, our corporate structure, including the ownership of several of our product candidates in our non-wholly owned subsidiaries, may deter third parties from entering into collaboration and licensing arrangements with us. If we fail to raise sufficient additional financing, on terms and dates acceptable to us, we may not be able to continue our operations and the development of our product candidates, and may be required to reduce staff, reduce or eliminate research and development, slow the development of our product candidates, outsource or eliminate several business functions or shut down operations.

We have a history of operating losses. We expect to continue to incur losses and may not continue as a going concern.

We have incurred net losses of $9.6 million and $145.2 million for the nine months ended September 30, 2014 and since inception, respectively. We expect significant losses to continue for the next few years as we spend substantial sums on the continued research and development of our proprietary product candidates. There is no certainty that we will ever become profitable as a result of these expenditures. As a result of losses that will continue throughout our development stage, we may exhaust our financial resources and be unable to complete the development of our product candidates.

Our ability to become profitable depends primarily on the following factors:

| | • | | our ability to obtain adequate sources of continued financing; |

| | • | | our ability to obtain approval for, and if approved, to successfully commercialize our product candidates; |

| | • | | our ability to successfully enter into license, development or other partnership agreements with third-parties for the development and/or commercialization of one or more of our product candidates; |

| | • | | our R&D efforts, including the timing and cost of clinical trials; and |

| | • | | our ability to enter into favorable alliances with third-parties who can provide substantial capabilities in clinical development, manufacturing, regulatory affairs, sales, marketing and distribution. |

5

Even if we successfully develop and market our product candidates, we may not generate sufficient or sustainable revenue to achieve or sustain profitability.

We may be unable to service our existing debt due to lack of cash flow, which could lead to default.

In September 2013, we entered into a loan and security agreement with Hercules under which we borrowed $6.0 million. The current interest rate is 10.45%, with the initial 12 months of the facility requiring interest only payments and the following 30 months requiring interest and principal payments. The loan matures on January 1, 2017. Since entering into the agreement with Hercules and prior to a $4.0 million principal payment in June 2014, we had been making monthly interest-only payments to Hercules of approximately $54,000 per month. Commencing in November 2014, our payments increased to approximately $76,000 per month to include amortization of principal, with a principal and interest payment of approximately $205,000 due in January 2017. Additionally, upon termination of the loan, we will also owe Hercules an end-of-term fee of $550,000. As of December 31, 2014, the remaining principal and end-of-term fee owed to Hercules amounted to $2.4 million. We granted Hercules a first priority security interest in substantially all of our assets, with the exception of (i) our intellectual property, where the security interest is limited to proceeds of intellectual property, and (ii) following the June 2014 loan paydown of $4.0 million, our equity interest in Incuron.

If we do not make the required payments when due, either at maturity, or at applicable installment payment dates, or if we breach the agreement, default under the agreement as a result of an occurrence of a “material adverse event,” as defined in the loan agreement, or become insolvent, Hercules could elect to declare all amounts outstanding together with all accrued and unpaid interest and penalties, to be immediately due and payable. In order to continue our planned operations and satisfy our debt obligations with Hercules, we will need to raise additional capital in the future. Additional capital may not be available on terms acceptable to us, or at all. Even if we were able to repay the full amount in cash, any such repayment could leave us with little or no working capital for our business. If we are unable to repay these amounts, Hercules will have a first claim on our assets pledged under the loan agreement. If Hercules should attempt to foreclose on the collateral, there may not be any assets remaining for distribution to shareholders after repayment in full of such secured indebtedness. Any default under the loan agreement and resulting foreclosure would have a material adverse effect on our financial condition and our ability to continue our operations.

Additionally, in September 2013, our partially owned subsidiary Panacela entered into a $1.5 million Convertible Loan Agreement with Rusnano, or the Rusnano Loan, and is required to pay all unpaid principal and interest under the loan in September 2015. The loan may be converted into shares of Panacela stock at any time at Rusnano’s option or will automatically convert upon certain financing events. In the event Panacela defaults on the loan and such default is not cured, Rusnano shall have the right to exercise a warrant to purchase shares of Cleveland BioLabs common stock equal to 69.2% of the outstanding amount remaining unpaid under the Rusnano Loan at the time of exercise, divided by the exercise price of $33.88 per share.

Our ability to use our net operating loss carryforwards may be limited.

As of December 31, 2013, we had federal net operating loss carryforwards, or NOLs, of $109.9 million to offset future taxable income, which begin to expire if not utilized by 2023. Under the provisions of the Internal Revenue Code, substantial changes in our ownership, in certain circumstances, will limit the amount of NOLs that can be utilized annually in the future to offset taxable income. In particular, section 382 of the Internal Revenue Code imposed limitations on a company’s ability to use NOLs if a company experiences a more than 50% ownership change over a three-year period. If we are limited in our ability to use our NOLs in future years in which we have taxable income, we will pay more taxes than if we were able to utilize our NOLs fully. A full valuation allowance has been recorded against our deferred tax assets, including the net operating loss carryforwards, as we believe it is more likely than not we will be unable to realize the benefit of these assets.

Risks Relating to our Securities and this Offering

There is uncertainty regarding the application of the federal and state securities laws to our offering of common stock and warrants, and there is a corresponding risk that we could be required to refund the purchase price of securities offered to purchasers who so elect.

6

We are conducting an offering under a registration statement filed with the Securities and Exchange Commission and a concurrent private placement intended to comply with the requirements of Section 4(a)(2) under the Securities Act of 1933, as amended, and Rule 506(b) promulgated thereunder. See “Private Placement Transaction and Warrants.” Shares of common stock and warrants are being offering and sold in combination. The shares of common stock and pre-funded warrants are intended to be offered and sold in a transaction registered under the Securities Act, while the other warrants and shares of common stock issuable thereunder are intended to be offered and sold in a private placement exempt from the registration requirements of the Securities Act.

While we are aware of other transactions using a concurrent public/private offering approach, the Commission has not addressed whether concurrent public and private offerings and sales to the same prospective investors would adversely impact the public offering or preclude the private offering from satisfying the requirements of Rule 506(b). If the securities offered in our concurrent private placement do not satisfy the conditions of Rule 506(b), the offering would be a violation of Section 5 of the Securities Act and each purchaser would have the right to rescind its purchase of the securities, meaning that we would be required to refund the purchase price of the securities to each purchaser electing rescission. If that were to occur, we would face severe financial demands and reputational harm that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the Commission. It is also possible that additional remedies may be available to purchasers under applicable state law.

If we are unable to obtain shareholder approval for the issuance of the all of the shares of common stock upon conversion of the Preferred Stock, exercise of the Series B Pre-funded Warrants or exercise of the Series A Warrants, we will owe dividend, redemption and other obligations on the Preferred Stock.

We agreed to seek approval from our stockholders as may be required by the applicable rules and regulations of the Nasdaq Stock Market, including the issuance of all of the shares of common stock upon conversion of the Preferred Stock and exercise of the Series B Pre-funded Warrants in excess of 19.99% of our issued and outstanding common stock on the closing date of the agreement, including certain adjustments to the conversion price of the Preferred Stock and exercise of the Series B Pre-funded Warrants. We refer to this approval as the “Shareholder Approval.” Each share of Preferred Stock will be convertible into Common Stock at any time at the election of the investor, subject to obtaining the Shareholder Approval for any amounts exceeding these thresholds. If we are unable to obtain the Shareholder Approval, we will be required to call a meeting every 65 days to continue seeking the Shareholder Approval until obtained or the Preferred Stock is no longer outstanding.

In addition, among other conditions, until we obtain Stockholder Approval, we will be required to continue complying with negative covenants that limit our ability to incur debt, incur liens, amend our charter documents, repurchase securities, pay dividends or enter into related party transactions, which could adversely impact our operations.

The price of our common stock has been and could remain volatile, which may in turn expose us to securities litigation.

The market price of our common stock has historically experienced and may continue to experience significant volatility. In 2014, the market price of our common stock, which is listed on the NASDAQ Capital Market, fluctuated from a high of $24.80 per share in the first quarter of 2014 to a low of $5.40 in the fourth quarter of 2014. As of January 30, 2015 the closing price of our common stock was $3.93. The listing of our common stock on the NASDAQ Capital Market does not assure that a meaningful, consistent and liquid trading market will exist, and in recent years, the market has experienced extreme price and volume fluctuations that have particularly affected the market prices of many smaller companies like us. Our common stock is thus subject to this volatility in addition to volatility caused by the occurrence of industry and company specific events. Factors that could cause fluctuations include, but are not limited to, the following:

| | • | | Our progress in developing and commercializing our products; |

| | • | | Price and volume fluctuations in the overall stock market from time to time; |

| | • | | Fluctuations in stock market prices and trading volumes of similar companies; |

| | • | | Actual or anticipated changes in our earnings or fluctuations in our operating results or in the expectations of securities analysts; |

| | • | | General economic conditions and trends; |

| | • | | Major catastrophic events; |

| | • | | Sales of large blocks of our stock; |

| | • | | Departures of key personnel; |

| | • | | Changes in the regulatory status of our product candidates, including results of our pre-clinical studies and clinical trials; |

| | • | | Status of contract and funding negotiations relating to our product candidates; |

| | • | | Events affecting our collaborators; |

| | • | | Announcements of new products or technologies, commercial relationships or other events by us or our competitors; |

| | • | | Regulatory developments in the U.S. and other countries; |

| | • | | Failure of our common stock to be listed or quoted on the NASDAQ Capital Market, other national market system or any national stock exchange; |

7

| | • | | Changes in accounting principles; and |

| | • | | Discussion of us or our stock price by the financial and scientific press and in online investor communities. |

As a result of the volatility of our stock price, we could be subject to securities litigation, which could result in substantial costs and divert management’s attention and company resources from our business.

We have received a delisting notice from The NASDAQ Stock Market. Our common stock may be involuntarily delisted from trading on The NASDAQ Capital Market if we fail to regain compliance with the minimum closing bid price requirement of $1.00 per share. A delisting of our common stock is likely to reduce the liquidity of our common stock and may inhibit or preclude our ability to raise additional financing.

The quantitative listing standards of the NASDAQ Stock Market, or NASDAQ, require, among other things, that listed companies maintain a minimum closing bid price of $1.00 per share. We failed to satisfy this threshold for 30 consecutive trading days and on March 10, 2014, we received a letter from NASDAQ indicating that we have been provided an initial period of 180 calendar days, or until September 8, 2014, in which to regain compliance. On September 9, 2014 we received an additional 180-day compliance period that will end on March 9, 2015. If we do not regain compliance by March 9, 2015, the NASDAQ staff will provide written notice that our common stock is subject to delisting. To regain compliance with this listing requirement, we conducted a reverse split of our common stock. We received approval from our shareholders on January 27, 2015 to conduct a reverse stock split and we effected such split on January 28, 2015.

In addition to the minimum closing bid price requirement, we are required to comply with certain NASDAQ continued listing requirements, including a series of financial tests relating to shareholder equity, public float, and number of market makers and shareholders. If we fail to maintain compliance with any of those requirements, our common stock could be delisted from NASDAQ’s Capital Market. If, for any reason, NASDAQ should delist our common stock from trading on its exchange and we are unable to obtain listing on another national securities exchange or take action to restore our compliance with the NASDAQ continued listing requirements, a reduction in some or all of the following may occur, each of which could have a material adverse effect on our shareholders:

| | • | | the liquidity of our common stock; |

| | • | | the market price of our common stock; |

| | • | | our ability to obtain financing for the continuation of our operations; |

| | • | | the number of institutional and general investors that will consider investing in our common stock; |

| | • | | the number of investors in general that will consider investing in our common stock; |

| | • | | the number of market makers in our common stock; |

| | • | | the availability of information concerning the trading prices and volume of our common stock; and |

| | • | | the number of broker-dealers willing to execute trades in shares of our common stock. |

If securities or industry analysts do not publish research or reports about our business, or publish negative reports about our business, our stock price and trading volume could decline.

The trading market for our common stock depends in part on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over these reports and we currently do not have any industry analysts covering us. In the event we do regain analyst coverage, there can be no assurance that analysts will provide favorable coverage. Our stock price may be adversely impacted by our current lack of analyst coverage as we may have less visibility in the financial markets than other companies in our industry, which may cause declined trading volume and stock price.

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

8

The public offering price of the shares offered by this prospectus will be substantially higher than the as adjusted net tangible book value per share of our common stock based on the total value of our tangible assets less our total liabilities immediately following this offering. Therefore, if you purchase shares of our common stock in this offering, you will experience immediate and substantial dilution of approximately $0.347 per share in the price you pay for shares of our common stock as compared to the as adjusted net tangible book value per share, based on the assumed public offering price of $3.00 per share. In addition, we have a significant number of options and warrants outstanding. To the extent outstanding options or warrants to purchase shares of common stock are exercised, there will be further dilution. For further information on this calculation, see “Dilution” elsewhere in this prospectus.

We have broad discretion in the use of net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their intended use. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

9