Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

Commission file number 333-128780

NCL Corporation Ltd.

(Exact name of registrant as specified in its charter)

| Bermuda |

| (Jurisdiction of incorporation or organization) |

7665 Corporate Center Drive

Miami, Florida 33126

(305) 436-4000

(Address of principal executive offices)

Daniel S. Farkas, 305-436-4000, dfarkas@ncl.com, 7665 Corporate Center Drive, Miami, Florida, 33126

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Title of Class

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 20,000,000 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. x Yes ¨ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| x | U.S. GAAP | ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board | |||||||

| ¨ | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ¨ Yes x No

Table of Contents

References herein to “Company,” “we,” “our” and “us” refer to NCL Corporation Ltd. and its subsidiaries for periods subsequent to the “Reorganization” and Arrasas Limited and its subsidiaries for periods prior to the “Reorganization,” unless stated otherwise or the context requires otherwise (in April 2004, Star Cruises completed a reorganization transaction which included the formation of NCL Corporation Ltd. in December 2003). “NCL” refers to NCL Corporation Ltd. individually and “Norwegian Cruise Line,” “NCL America” and “Orient Lines” refer to the Norwegian Cruise Line, NCL America and Orient Lines brands, respectively. “Star Cruises” refers to Star Cruises’ company and its affiliates. “Apollo” refers to Apollo Management L.P. and its affiliates, NCL Investment Ltd. and NCL Investment II Ltd. “Affiliate(s)” refers to Star Cruises and/or Apollo. “TPG” refers to the entities TPG Viking I, L.P., TPG Viking II, L.P. and TPG Viking AIV III, L.P. References to the “U.S.” are to the United States of America and “dollars” or “$” are to U.S. dollars.

Table of Contents

Industry and market data

This annual report includes market share and industry data and forecasts that we obtained from industry publications, third-party surveys and internal company surveys. Industry publications, including those from the Cruise Lines International Association, or CLIA, and surveys and forecasts generally state that the information contained therein has been obtained from sources that we believe are reliable, but there can be no assurance as to the accuracy or completeness of included information. All CLIA information relates to CLIA member lines, which represent 23 of the major North American cruise lines including NCL, which together represented 97% of the North American cruise capacity as of December 31, 2008. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. We use the most currently available industry and market data to support statements as to our market position. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Item 3—Key Information—Risk factors” and “Item 5—Operating and Financial Review and Prospects”—“forward-looking statements” in this annual report.

1

Table of Contents

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Selected Financial Data

The selected consolidated financial and operating data presented below are for the years 2004 through 2008 and as of the end of each such year. Our consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the U.S. We refer you to “Item 18— Financial Statements.”

| Years ended December 31, | ||||||||||||||||||||

(in thousands) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Statement of operations data | ||||||||||||||||||||

Revenues: | ||||||||||||||||||||

Passenger ticket revenues | $ | 1,501,646 | $ | 1,575,851 | $ | 1,442,628 | $ | 1,196,948 | $ | 992,124 | ||||||||||

Onboard and other revenues | 604,755 | 601,043 | 537,313 | 435,262 | 353,238 | |||||||||||||||

Total revenues | 2,106,401 | 2,176,894 | 1,979,941 | 1,632,210 | 1,345,362 | |||||||||||||||

Cruise operating expenses: | ||||||||||||||||||||

Commissions, transportation and other | 341,936 | 434,749 | 429,280 | 331,386 | 259,313 | |||||||||||||||

Onboard and other | 182,817 | 204,768 | 186,240 | 141,957 | 120,250 | |||||||||||||||

Payroll and related | 377,208 | 436,843 | 412,943 | 323,621 | 243,355 | |||||||||||||||

Fuel | 258,262 | 193,173 | 164,530 | 119,412 | 78,013 | |||||||||||||||

Food | 126,736 | 120,633 | 102,324 | 94,105 | 81,448 | |||||||||||||||

Other operating | 291,522 | 306,853 | 275,697 | 240,532 | 226,076 | |||||||||||||||

Total cruise operating expenses | 1,578,481 | 1,697,019 | 1,571,014 | 1,251,013 | 1,008,455 | |||||||||||||||

Marketing, general and administrative expenses | 299,827 | 287,093 | 249,250 | 225,240 | 204,560 | |||||||||||||||

Depreciation and amortization expenses | 162,565 | 148,003 | 119,097 | 85,615 | 76,937 | |||||||||||||||

Impairment loss (1) | 128,775 | 2,565 | 8,000 | — | 14,500 | |||||||||||||||

Total operating expenses | 2,169,648 | 2,134,680 | 1,947,361 | 1,561,868 | 1,304,452 | |||||||||||||||

Operating (loss) income | (63,247 | ) | 42,214 | 32,580 | 70,342 | 40,910 | ||||||||||||||

Non-operating income (expenses): | ||||||||||||||||||||

Interest income | 2,796 | 1,384 | 3,392 | 4,803 | 1,434 | |||||||||||||||

Interest expense, net of capitalized interest | (152,364 | ) | (175,409 | ) | (136,478 | ) | (87,006 | ) | (48,886 | ) | ||||||||||

Other income (expenses), net (2) | 1,012 | (95,151 | ) | (30,393 | ) | 28,096 | (11,548 | ) | ||||||||||||

Total non-operating expenses | (148,556 | ) | (269,176 | ) | (163,479 | ) | (54,107 | ) | (59,000 | ) | ||||||||||

Net (loss) income | $ | (211,803 | ) | $ | (226,962 | ) | $ | (130,899 | ) | $ | 16,235 | $ | (18,090 | ) | ||||||

2

Table of Contents

| As of or for the years ended December 31, | ||||||||||||||||||||

(in thousands, except operating data) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Balance sheet data | ||||||||||||||||||||

Assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | 185,717 | $ | 40,291 | $ | 63,530 | $ | 60,416 | $ | 172,424 | ||||||||||

Property and equipment, net | 4,119,222 | 4,243,872 | 3,816,292 | 3,113,229 | 2,529,739 | |||||||||||||||

Total assets | 5,047,141 | 5,033,698 | 4,629,624 | 3,984,227 | 3,464,546 | |||||||||||||||

Liabilities and shareholders’ equity: | ||||||||||||||||||||

Due to Affiliate, net (3) | 210,058 | — | — | 3,141 | 1,273 | |||||||||||||||

Advance ticket sales | 250,638 | 332,802 | 314,050 | 276,644 | 226,081 | |||||||||||||||

Other current liabilities | 348,625 | 291,509 | 298,768 | 217,430 | 189,952 | |||||||||||||||

Current portion of long-term debt | 182,487 | 191,172 | 154,638 | 140,694 | 86,198 | |||||||||||||||

Long-term debt | 2,474,014 | 2,977,888 | 2,405,357 | 1,965,983 | 1,604,331 | |||||||||||||||

Other long-term liabilities | 31,520 | 4,801 | 1,744 | 2,631 | 5,734 | |||||||||||||||

Ordinary shares (4) | 24 | 12 | 12 | 12 | 12 | |||||||||||||||

Total shareholders’ equity | 1,549,799 | 1,235,526 | 1,455,067 | 1,377,704 | 1,350,977 | |||||||||||||||

Operating data: | ||||||||||||||||||||

Passengers carried | 1,270,281 | 1,304,385 | 1,153,844 | 981,665 | 874,926 | |||||||||||||||

Passenger cruise days (5) | 9,503,839 | 9,857,946 | 8,807,632 | 7,613,100 | 6,744,609 | |||||||||||||||

Capacity days (6) | 8,900,816 | 9,246,715 | 8,381,445 | 7,172,040 | 6,370,096 | |||||||||||||||

Occupancy percentage (7) | 106.8 | % | 106.6 | % | 105.1 | % | 106.1 | % | 105.9 | % | ||||||||||

Total number of cruise ships | 11 | 13 | 14 | 12 | 11 | |||||||||||||||

Other financial data: | ||||||||||||||||||||

Net cash (used in) provided by operating activities | (23,297 | ) | 36,331 | 147,504 | 136,828 | 153,758 | ||||||||||||||

Net cash used in investing activities | (166,236 | ) | (581,578 | ) | (756,245 | ) | (678,309 | ) | (750,710 | ) | ||||||||||

Net cash provided by financing activities | 334,959 | 522,008 | 611,855 | 429,473 | 570,235 | |||||||||||||||

Additions property and equipment, net | (163,607 | ) | (582,837 | ) | (809,403 | ) | (658,795 | ) | (748,267 | ) | ||||||||||

| (1) | In 2008, an impairment loss of $128.8 million was recorded as a result of the cancellation of a contract to build a ship (we refer you to our consolidated financial statements Note 4 “Property and Equipment”); in 2007, an impairment loss was recorded as a result of a write-down of $2.6 million relating to the sale ofOceanic, formerly known asIndependence; in 2006, an impairment loss was recorded as a result of a write-down of $8.0 million relating to the Orient Lines tradename; and in 2004, an impairment loss was recorded as a result of a write-down of $14.5 million relating to the carrying value of one of our cruise ships. |

| (2) | In 2008, foreign currency translation gains of $101.8 million were primarily offset by $99.9 million of losses due to the change in fair value of our fuel derivative contracts. For the years ended December 31, 2007, 2006, 2005 and 2004, such amount includes foreign currency translation gains (losses) of ($94.5) million, ($38.9) million, $28.7 million, and ($11.5) million, respectively, primarily due to fluctuations in the Euro/U.S. dollar exchange rate. |

| (3) | Amounts due to Star Cruises were subsequently settled. The amount due as of December 31, 2008 was in connection with the Reimbursement and Distribution Agreement, (we refer you to “Item 7—Major Shareholders and Related Party Transactions”). |

3

Table of Contents

| (4) | Star Cruises and our Board of Directors approved a share split on November 12, 2007. As of December 31, 2008, we had 25,000,000 shares authorized and 20,000,000 ordinary shares issued and outstanding with par value $.0012 per share. |

| (5) | Represents the number of passengers carried for the period multiplied by the number of days in their respective cruises. |

| (6) | Represents double occupancy per cabin multiplied by the number of cruise days for the period. |

| (7) | Represents the ratio of Passenger Cruise Days to Capacity Days. A percentage in excess of 100% indicates that three or more passengers occupied some cabins. |

Risk factors

The specific risk factors set forth below, as well as the other information contained in this annual report on Form 20-F, are important factors, among others, that could cause our actual results to differ from our expected or historical results. It is not possible to predict or identify all such factors. Consequently, this list should not be considered a complete statement of all potential risks or uncertainties. We refer you to “Item 5—Operating and Financial Review and Prospects” for a note regarding “forward-looking” statements.

Risks relating to our business

The impact of changes in the global credit markets may adversely affect our ability to borrow and could increase our counterparty credit risks, including those under our credit facilities, derivative instruments, contingent obligations, insurance contracts and new ship progress payment guarantees.

During 2007, a crisis began in the subprime mortgage sector of the U.S. economy as a result of credit quality deterioration and rising delinquencies, and that crisis has continued and strengthened throughout 2008 and into 2009 which has led to a deterioration of the global credit markets, a closing of the debt markets and widening credit spreads. This crisis has adversely impacted our access to capital, and there can be no assurance that this crisis will not worsen or impact the availability or cost of debt financing in the future. There can be no assurance that we will be able to borrow additional money on terms as favorable as our current debt, on commercially acceptable terms, or at all.

As a result of the global credit crisis, certain financial institutions have filed for bankruptcy, have sold some or all of their assets, or may be looking to enter into a merger or other transaction with another financial institution. Consequently, some of the counterparties under our credit facilities, derivative instruments, contingent obligations, insurance contracts and new ship progress payment guarantees may be unable to perform their obligations or may breach their obligations to us under our contracts with them, which could include failures of financial institutions to fund required borrowings under our loan agreements and to pay us amounts that may become due under our derivative contracts and other agreements. Also, we may be limited in obtaining funds to pay amounts due to our counterparties under our derivative contracts and to pay amounts that may become due under other agreements. If we were to elect to replace any counterparty for their failure to perform their obligations under such instruments, we would likely incur significant costs to replace the counterparty. Any failure to replace any counterparties under these circumstances may result in additional costs to us or an ineffective instrument.

4

Table of Contents

We are highly leveraged with a high level of floating rate debt, and our level of indebtedness could limit cash flow available for our operations and could adversely affect our financial condition, operations, prospects and flexibility.

As of December 31, 2008, we had $2.7 billion of total debt, of which $182.5 million is the current portion of long-term borrowings. As of the same date, we had $1.5 billion in shareholders’ equity. Most of our debt has been incurred to finance ship construction. Our high level of indebtedness may adversely affect our future strategy and operations in a number of ways, including:

| • | a substantial portion of our cash flow from operations will be required to service debt, thereby reducing the funds available to us for other purposes; |

| • | our ability to obtain additional financing for working capital, capital expenditures and general corporate purposes, including upgrades of our current ships or the construction of new ships, may be limited; and |

| • | our high level of leverage may hinder our ability to withstand competitive pressures or adjust rapidly to changing market conditions. |

With respect to our projections for 2009, a one percentage point increase in annual LIBOR and EURIBOR interest rates would increase our annual interest expense in 2009 by approximately $15.4 million. In addition, future financings we may undertake may also provide for rates that fluctuate with prevailing interest rates.

Subject to compliance with various financial and other covenants imposed by our credit facilities and the agreements governing our indebtedness, we and our subsidiaries may incur additional indebtedness from time to time, including, but not limited to, debt to finance the purchase or completion of new ships. Our incurrence of additional debt could further exacerbate the risks described in this annual report and could result in a material adverse effect on our business, financial condition and results of operations. Our ships and substantially all our other property are pledged as collateral for our debt. We refer you to “Item 5—Operating and Financial Review and Prospects—Liquidity and capital resources”.

Our future operating cash flow may not be sufficient to fund future obligations, and we may not be able to obtain additional financing, if necessary, at a cost that is favorable or that meets our expectations.

To fund our capital expenditures and scheduled debt payments, we have relied primarily on cash generated from operations, bank and other borrowings and equity infusions from our Affiliates. Our forecasted cash flow from future operations may be adversely affected by various factors, including, among others, declines in customer demand, increased competition, overcapacity, a further deterioration in general economic and business conditions, terrorist attacks, ship accidents and other incidents, adverse publicity and increases in fuel prices, as well as other factors noted under these “Risk factors” that are beyond our control. To the extent that we are required, or choose, to fund future cash requirements, including future shipbuilding commitments, from sources other than cash flow from operations, cash on hand, committed financings and equity infusions or loans from our Affiliates, we will have to secure such financing from banks or through the offering of debt and/or equity securities in the public or private markets. Our access to, and the cost of, financing will depend on, among other things, the maintenance of adequate credit ratings. Any lowering of our credit ratings may have adverse consequences on our ability to access the financial markets and/or on our cost of financings. In addition, interest rates and our ability to obtain financing are dependent on many economic and political factors beyond our control. There is no assurance that such cash flows from operations and additional financings will be available in the future to fund our future obligations.

5

Table of Contents

An increase in the supply of cruise ships without a corresponding increase in passenger demand could materially and adversely affect our financial condition and results of operations.

Historically, cruise capacity has grown to meet the growth in demand. According to CLIA, North American cruise capacity, in terms of berths, has increased from 1981 through 2008 at a compound annual growth rate of 7.4%. CLIA estimates that, between the end of 2008 and 2012, the CLIA member line fleet will increase by approximately 33 additional ships, an approximate 24% increase in capacity from 2008, which have either been contracted for or planned and which includes ships projected to leave the market. In order to profitably utilize this new capacity, the cruise industry will likely need to improve its percentage share of the U.S. population who has cruised at least once, which is approximately 20%, according to CLIA. If there is such an industry-wide increase in capacity without a corresponding increase in public demand, we, as well as the entire cruise industry, could experience reduced occupancy rates and/or be forced to discount our prices, which could adversely affect our financial condition and results of operations.

We face intense competition.

We face intense competition from other cruise companies in North America where the cruise market is mature and developed. The North American cruise industry is highly concentrated and dominated by three players. As of December 31, 2008, Carnival Corporation and Royal Caribbean Cruises Ltd., each of which may possess greater financial resources than we do, together accounted for 85% of North American cruise passenger capacity in terms of berths while we, as of the same date, operating under both of our brands accounted for 9% of North American cruise passenger capacity in terms of berths.We also face competition for many itineraries from other cruise operators, such as MSC Cruises and Disney Cruise Line.

We also face competition from non-cruise vacation alternatives, including beach resorts, golf and tennis resorts, theme parks, land-based gaming operations, and other hotels and tourist destinations. In the event we do not compete effectively, our financial condition and results of operations could be adversely affected.

Adverse economic conditions in the North American region and throughout the world and related factors such as a higher unemployment rate, fuel price increases, declines in the securities and real estate markets, and perceptions of these conditions that decrease the level of disposable income of consumers or consumer confidence could adversely affect our financial condition and results of operations.

For each of the years ended December 31, 2008, 2007 and 2006, approximately 83%, 86% and 87% respectively, of our revenues were derived from passengers residing in North America. Adverse changes in the perceived or actual economic climate, such as higher fuel prices, higher interest rates, stock and real estate market declines and/or volatility, more restrictive credit markets, higher taxes, and changes in governmental policies could reduce the level of discretionary income or consumer confidence in the countries from which we source our guests. Consequently, this may negatively affect demand for cruise vacations, which are a discretionary purchase. Decreases in demand could lead to price discounting and lower onboard purchases which, in turn, could reduce the profitability of our business. In addition, these conditions can also impact our suppliers, which can result in disruptions in service and financial losses. For example, the current worldwide economic downturn has had an adverse effect on discretionary income and consumer confidence which could result in cruise booking slowdowns, decreased cruise prices and lower onboard revenues for us and for our competitors. We cannot predict the extent or duration of this downturn or the timing or strength of a subsequent economic recovery. However, if the downturn continues for an extended period of time or worsens, we could experience a prolonged period of

6

Table of Contents

booking slowdowns, depressed cruise prices and reduced onboard revenues. There can be no certainty that North America, the U.S. in particular and the world economies will experience growth in the future, nor can there be any assurance that external events similar to those experienced in the past will not recur. Due to our reliance on passengers from the U.S. and globally, any such events would likely have an adverse effect on our financial condition and results of operations.

Terrorist acts, acts of piracy, armed conflict and threats thereof, and other international events impacting the security of travel could adversely affect the demand for cruises and as a result adversely affect our financial condition and results of operations.

Past acts of terrorism, such as the terrorist attacks in the U.S. on September 11, 2001, have had an adverse effect on tourism, travel and the availability of air service and other forms of transportation. The threat or possibility of future terrorist acts, an outbreak of hostilities or armed conflict abroad or the possibility thereof, the issuance of travel advisories by national governments, and other geo-political uncertainties have had in the past and may again in the future have an adverse impact on the demand for cruises and consequently the pricing for cruises. Decreases in demand and reduced pricing in response to such decreased demand would adversely affect our financial condition and results of operations by reducing our profitability.

We rely on external distribution channels for passenger bookings; major changes in the availability of external distribution channels could undermine our customer base.

In 2008, the vast majority of our passengers on our fleet booked their cruises through independent travel agents and wholesalers. These independent travel agents generally sell and market our cruises on a nonexclusive basis. Although we offer incentives to travel agents for booking our cruises that are comparable to those offered by others in the industry, there can be no guarantee that our competitors will not offer other incentives in the future. Travel agents may face increasing pressure from our competitors, particularly in North America and Europe, to sell and market these competitors’ cruises exclusively. If such exclusive arrangements were introduced, there can be no assurance that we will be able to find alternative distribution channels to ensure that our customer base would not be affected.

We rely on scheduled commercial airline services for passenger connections; increases in the price of, or major changes or reduction in, commercial airline services could undermine our customer base.

A number of our passengers depend on scheduled commercial airline services to transport them to ports of embarkation for our cruises. Increases in the price of airfare, due to increases in fuel prices or otherwise, would increase the overall vacation cost to our customers and may adversely affect demand for our cruises. Changes in commercial airline services as a result of strikes, weather or other events, or the lack of availability due to schedule changes or a high level of airline bookings could adversely affect our ability to deliver passengers to our cruises and increase our cruise operating expenses which would, in turn, have an adverse effect on our financial condition and results of operations.

Increases in fuel prices or other cruise operating costs could have an adverse impact on our financial condition and results of operations.

Fuel costs accounted for 16.4% of our total cruise operating expenses in 2008, 11.4% in 2007 and 10.5% in 2006. Economic and political conditions in certain parts of the world make it difficult to predict the price of fuel in the future. Future increases in the cost of fuel globally would increase the cost of our cruise ship operations. In addition, we could experience increases in other cruise operating costs, such as crew, insurance and security costs, due to market forces and economic or political instability beyond our

7

Table of Contents

control. Accordingly, increases in fuel prices or other cruise operating costs could have a material adverse effect on our financial condition and results of operations (we refer you to “Item 8– Financial Information – Legal proceedings, material litigation, (iv)”).

Our revenues are seasonal owing to variations in passenger fare rates and occupancy levels at different times of the year; we may not be able to generate revenues that are sufficient to cover our expenses during certain periods of the year.

The cruise industry in North America, our principal market, is seasonal, with greatest demand generally occurring during the months of June through August. This seasonality in demand has resulted in fluctuations in our revenues and results of operations. The seasonality of our results is increased due to ships being taken out of service for dry-docking, which we typically schedule during non-peak demand periods for such ships. Accordingly, seasonality in demand and dry-docking could adversely affect our ability to generate sufficient revenues to cover expenses and particularly so during certain periods of the year.

Any delays in the construction and delivery of new cruise ships or any repairs and refurbishments of our cruise ships may have a material adverse effect on our business, financial condition and results of operations.

Building a ship and undertaking repairs and refurbishments of ships are subject to risks similar to those encountered in other sophisticated and lengthy projects. Delivery delays can occur as a result of problems or events involving our shipbuilders such as insolvency, financial problems, work stoppages and other labor actions or “force majeure” events that are beyond our control and the control of the shipbuilders. In September 2008, one of our subsidiaries, F3 One, Ltd. cancelled the contract to build an F3 ship (we refer you to “Item 8– Financial Information – Legal proceedings, material litigation, (vi)”). A separate contract to buildNorwegian Epic remains in force with additional capacity of approximately 4,200 berths and anticipated delivery in the second quarter of 2010. We have developed our current business strategy on the assumption that this ship will be delivered on time and that it will perform in the manner indicated by its design specifications. A significant delay in the delivery of this new ship, or a significant performance deficiency or significant mechanical failure on or of a ship, particularly in light of decreasing availability of dry-docking facilities, could have a material adverse effect on our business, financial condition and results of operations.

Conducting business internationally and development of information technology areas may result in increased costs and risks.

We operate our business internationally and plan to continue to develop our international presence. Operating internationally exposes us to a number of risks. Examples include political risks and risks of increase in duties and taxes as well as changes in laws and policies affecting cruising, vacation or maritime businesses, or governing the operations of foreign-based companies. Because some of our expenses are incurred in foreign currencies, we are exposed to exchange rate risks. We have a ship construction contract that is denominated in Euro and a portion of our debt is denominated in Euro. Additional risks include interest rate movements, imposition of trade barriers and restrictions on repatriation of earnings. In addition, we are exposed to increased costs and risks associated with complying with increasing and new regulation of corporate governance and disclosure standards, including certain provisions under the Sarbanes-Oxley Act of 2002 including its requirements under Section 404 relating to internal controls over financial reporting. Furthermore, our operations utilize information technology resources in performing a number of functions, some of which resources may be costly, as a result of which we must update and acquire new information resources over time. The failure to successfully implement or acquire such information resources could expose us to additional risks. If we are unable to address these risks adequately, our financial condition and results of operations could be adversely affected.

8

Table of Contents

Future epidemics and viral outbreaks may have an adverse effect on our financial condition and results of operations.

Public perception about the safety of travel and adverse publicity related to passenger illness may impact demand for cruises and adversely affect our future sales, financial condition and results of operations. If any wide-ranging health scare should occur, our financial condition and results of operations would likely be adversely affected.

The political environment in certain countries where we operate is uncertain and our ability to operate our business as we have in the past may be restricted.

We operate in waters and call at ports throughout the world, including geographic regions that, from time to time, have experienced political and civil unrest and insurrection and armed hostilities. Historically, adverse international events have affected demand for cruise products generally and have had an adverse effect on us.

Adverse incidents involving cruise ships may have an adverse impact on our financial condition and results of operations.

The operation of cruise ships involves the risk of accidents, mechanical failures and other incidents at sea or while in port, including missing passengers, inappropriate crew or passenger behavior and onboard crimes, that may bring into question passenger safety, may adversely affect future industry performance and may lead to litigation against us. Although we place passenger safety as the highest priority in the design and operation of our fleet, we have experienced accidents and other incidents involving our cruise ships. In addition, we offer itineraries in certain parts of the world that may present challenges specific to that country and/or region or may be impacted by adverse weather patterns or natural disasters, such as hurricanes and earthquakes. There can be no assurance that similar events will not occur in the future. It is possible that we could be forced to cancel a cruise or a series of cruises due to these factors or incur increased port related and other costs resulting from such adverse events, which could have an adverse effect on our sales, financial condition and results of operations. Any such event involving our cruise ships or other passenger cruise ships may adversely affect passengers’ perceptions of safety or result in increased governmental or other regulatory oversight and may therefore affect our results of operations. An adverse judgment or settlement in respect of any of the ongoing claims against us may also lead to negative publicity about us. Anything that damages our reputation (whether or not justified), including adverse publicity about passenger safety, could have an adverse impact on demand, which could lead to price discounting, a reduction in our sales and an overall adverse impact on our financial condition and results of operations. We refer you to “Item 4—Information on the Company—Company operations and cruise infrastructure—Crew and passenger safety” and “Item 8—Financial Information—Legal proceedings” for additional information about our safety provisions and litigation in which we are involved.

Amendments to the collective bargaining agreements for crew members of our fleet have had and could have an adverse impact on our financial condition and results of operations.

Currently, we are a party to six collective bargaining agreements. Three of these agreements with the Norwegian Seafarer’s Union shall be reviewed annually by us and the Union. If at any time we and the Union mutually agree on amendments and/or additions to the Protocol, such amendments and additions shall be agreed in writing and signed by the parties and considered incorporated in the International Transport Workers’ Federation Special Agreement.

9

Table of Contents

The three remaining collective bargaining agreements are scheduled to expire in 2009. Agreement by and between NCL America, Inc. and District No. 1-PCD MEBA, AFL-CIO; Seafarers International Union of North America, Atlantic, Gulf, Lakes and Inland Waters District/NMU, AFL-CIO and NCL America, Inc. and Seafarers Entertainment and Allied Trades Union and NCL America, Inc. Amendments to such collective bargaining agreements in favor of the union members may increase labor costs and could have an additional adverse impact on our financial condition and results of operations.

As of May 2008, we had only one ship remaining in Hawaii,Pride of America. However, previously, our U.S.-flagged ships sailed in the Hawaii islands under the NCL America brand.Pride of Alohacommenced sailing in the summer of 2004,Pride of Americacommenced sailing in the summer of 2005 andPride of Hawai’i commenced sailing in the spring of 2006. Under U.S. law, we have been obligated to employ a certain percentage of U.S. crew members onboard these U.S.-flagged ships and have complied with U.S. Federal labor laws and regulations and Hawaii state laws and regulations for all our crewmembers. The collective bargaining agreements with the U.S. unions resulted in U.S. labor as well as international labor permitted to serve on the U.S.-flagged ships to be more expensive than on internationally-flagged ships. We also incurred higher expenses for benefits for the crews on our U.S.-flagged ships. Also, the higher costs of hiring, training and retaining U.S. crews have had an adverse effect on our financial condition and results of operations. In February 2008,Pride of Hawai’i was re-flagged into our international fleet and renamedNorwegian Jade and was deployed in Europe year-round. In May 2008,Pride of Aloha was withdrawn from the Hawaii market and re-flagged into our international fleet and renamed and launched asNorwegian Sky in July 2008.

Unavailability of ports of call may adversely affect our financial condition and results of operations.

We believe that attractive port destinations are a major reason why passengers choose to go on a particular cruise or on a cruise vacation. The availability of ports is affected by a number of factors, including, but not limited to, existing capacity constraints, security concerns, adverse weather conditions and natural disasters, financial limitations on port development, local governmental regulations and local community concerns about port development and other adverse impacts on their communities from additional tourists. Any limitations on the availability of our ports of call could adversely affect our financial condition and results of operations.

We may suffer an uninsured loss, as we are not protected against all risks or lawsuits that we may face.

The operation of ocean-going ships carries an inherent risk of loss caused by adverse weather conditions, marine disaster, including, but not limited to, oil spills and other environmental mishaps, fire, mechanical failure, collisions, human error, war, terrorism, piracy, political action, civil unrest and insurrection in various countries and other circumstances or events. Any such event may result in loss of life or property, loss of revenues or increased costs and could result in significant litigation against us.

We seek to maintain comprehensive insurance coverage at commercially reasonable rates. We believe that our current coverage is adequate to protect against most of the accident-related risks involved in the conduct of our business. We are not protected against all lawsuits brought against us, although certain individual claims may be covered by insurance, depending on their subject matter.

There can be no assurance that all risks are fully insured against, that any particular claim will be fully paid or that we will be able to procure adequate insurance coverage at commercially reasonable rates in the future. We have been and may continue to be subject to

10

Table of Contents

calls, or premiums, in amounts based not only on our own claim records, but also the claim records of all other members of the protection and indemnity associations through which we receive indemnity coverage for tort liability. Our payment of these calls could result in significant expenses to us which could reduce our cash flows. If we were to sustain significant losses in the future, our ability to obtain insurance coverage or coverage at commercially reasonable rates could be materially adversely affected.

Risks relating to the regulatory environment in which we operate

Future changes in applicable tax laws, or our inability to take advantage of favorable tax regimes, may have an adverse impact on our financial condition and results of operations.

As we generally derive revenue from shipboard activity in international waters and not in a particular jurisdiction, our exposure to tax is limited in some instances. For example, Bermuda, the jurisdiction of formation of NCL and certain of our operating subsidiaries, and the Isle of Man, the jurisdiction of incorporation of certain of our operating subsidiaries, impose no tax on our income. We do, however, submit to the tax regimes of the jurisdictions in which we operate and pay taxes as required by those regimes.

The income that we derive from the international operation of ships, as well as certain income that is considered to be incidental to such income (“Shipping Income”), is exempt from U.S. Federal income taxes under Section 883 of the Internal Revenue Code of 1986, as amended, or the Code, based upon certain assumptions as to shareholdings and other information as of December 31, 2008, 2007 and 2006, as more fully described in “Item 4—Information on the Company—Taxation—U.S. Federal income taxation.” We believe that substantially all of our income derived from the international operation of ships is properly categorized as Shipping Income. The U.S.-source portion of our income from the international operation of ships that is not Shipping Income is subject to U.S. taxation. We believe that, if our Shipping Income were not exempt from Federal income taxation under Section 883 of the Code, that income, as well as any other income from cruise operations of NCL that is not Shipping Income, to the extent derived from U.S. sources, generally would be taxed on a net basis to our shareholders as discussed below, at U.S. Federal corporate income tax rates (generally 35%). We would make a distribution to our shareholders to pay such tax and any state income taxes which would be payable. They also would be subject to a 30% Federal branch profits tax under section 884 of the Code, generally on the after tax portion of such income that was from U.S. sources each year to the extent that such income was not properly viewed as reinvested and maintained in our U.S. business. Interest paid or accrued by us to some extent could be treated as U.S.-source interest and also could be subject to a 30% withholding tax and/or branch interest taxes under section 884 of the Code. If Section 883 of the Code had not applied to us in 2006 and 2007, we would have been subject to U.S. corporate income tax only on the portion of our income derived from U.S. sources. If Section 883 of the Code had not applied to our shareholders in 2008, they would have been subject to U.S. corporate income tax on their allocable share of our income derived from U.S. sources and under Section 1446 of the Code, we would have been required to withhold and remit taxes on income allocable to our foreign partners. Amounts withheld may have been treated as a distribution. Further, a change in our operations could result in a change in the amount of U.S. source income that would be allocable to our shareholders and subject to U.S. Federal and state income tax. Moreover, the income that we derive from our U.S.-flagged operations under the NCL America brand is subject to tax on a net basis at the graduated U.S. Federal corporate and state income tax rates generally applicable to corporations organized in the U.S. U.S.-source dividends and interest paid by NCL America generally would be subject to a 30% withholding tax unless exempt under one of various exemptions. As of December 31, 2008, 2007 and 2006, our U.S.-flagged operations were not in a U.S. income tax paying position because they had substantial net operating loss carry-forwards.

11

Table of Contents

In January 2008, NCL, formerly a corporation, became a partnership for U.S. Federal income tax purposes. An entity that is treated as a partnership for U.S. Federal income tax purposes is not a taxable entity and incurs no U.S. Federal or state income tax liability. Instead, each partner is required to take into account its allocable share of items of income, gain, loss and deduction of the partnership in computing its U.S. Federal income tax liability, regardless of whether or not cash distributions are made. Under Section 1446 of the Code, NCL would be required to withhold and remit taxes on income allocable to foreign partners. Amounts withheld may be treated as a distribution to such partners. The applicability of the exemption under Section 883 of the Code, for NCL’s international shipping income for the 2008 tax year and onwards, applies to our shareholders rather than to us. Each shareholder needs to meet the requirements of Section 883 discussed above in order for the exemption to apply to the income allocated to such shareholder.

Certain State, Local and Non-U.S. Tax Matters. NCL may be subject to state, local and non-U.S. income or non-income taxes in various jurisdictions, including those in which we transact business, own property or reside. We may be required to file tax returns in some or all of those jurisdictions. The state, local or non-U.S. tax treatment of NCL may not conform to the U.S. Federal income tax treatment discussed above. We may be required to pay non-U.S. taxes on dispositions of foreign property or operations involving foreign property may give rise to non-U.S. income or other tax liabilities in amounts that could be substantial.

The various tax regimes to which we are currently subject result in a relatively low effective tax rate on our world-wide income. These tax regimes, however, are subject to change. Moreover, we may become subject to new tax regimes and may be unable to take advantage of favorable tax provisions afforded by current or future law.

We are subject to complex laws and regulations, including environmental laws and regulations, which could adversely affect our operations; any changes in the current laws and regulations could lead to increased costs or decreased revenues and adversely affect our business prospects, financial condition and results of operations.

Some environmental groups have lobbied for more extensive oversight of cruise ships and have generated negative publicity about the cruise industry and its environmental impact. Increasingly stringent Federal, state, local and international laws and regulations on environmental protection and health and safety of workers could affect our operations. The U.S. Environmental Protection Agency, the International Maritime Organization, commonly referred to as the IMO, the Council of the European Union and individual states are considering, as well as implementing, new laws and rules to manage cruise ship waste. In addition, many aspects of the cruise industry are subject to governmental regulation by the U.S. Coast Guard as well as international treaties such as the International Convention for the Safety of Life at Sea, commonly referred to as SOLAS, the International Convention for the Prevention of Pollution from Ships, commonly referred to as MARPOL, the Standard of Training Certification and Watchkeeping for Seafarers, commonly referred to as STCW and the recently adopted Manning Convention. International regulations regarding ballast water and security levels are currently pending. Additionally, the U.S. and various state and foreign government or regulatory agencies have enacted or are considering new environmental regulations or policies, such as requiring the use of low sulfur fuels, increasing fuel efficiency requirements or further restricting emissions. Compliance with such laws and regulations may entail significant expenses for ship modification and changes in operating procedures which could adversely impact our operations as well as our competitors’ operations. In addition, the state of Alaska has recently passed stringent regulations concerning waste water discharge and the limits set are not attainable at present. A two-year extension has been granted for the industry. Currently, we and our competitors cannot comply with these regulations due to technology constraints. The Maritime Labor Convention 2006 (“MLC”) will become international law in 2010 or 2011, when the prerequisite number of countries ratify. It will regulate many aspects of maritime crew labor and will impact the worldwide sourcing of new crewmembers.

12

Table of Contents

These issues are, and we believe will continue to be, an area of focus by the relevant authorities throughout the world. This could result in the enactment of more stringent regulation of cruise ships that would subject us to increasing compliance costs in the future.

By virtue of our operations in the U.S., the U.S. Federal Maritime Commission, commonly known as the FMC, requires us to maintain a $15.0 million third party performance guarantee on our behalf in respect of liabilities for non-performance of transportation and other obligations to passengers. The FMC has proposed rules that would significantly increase the amount of our required guarantees and accordingly our cost of compliance. There can be no assurance that such an increase in the amount of our guarantees, if required, would be available to us. For additional discussion of the FMC’s proposed requirements, we refer you to “Item 4—Information on the Company—Regulatory issues.”

In 2007, the state of Alaska implemented new taxes which have impacted the cruise industry operating in Alaska. It is possible that other states, countries or ports of call that our ships regularly visit may also decide to assess new taxes or fees or change existing taxes or fees specifically applicable to the cruise industry and its employees and/or guests, which could increase our operating costs and/or could decrease the demand for cruises and ultimately could adversely affect our financial condition and results of operations.

The Passenger Shipping Association (“PSA”) has issued a legal requirement for us to maintain a security guarantee based on cruise business originated from the United Kingdom currently valued at British Pound Sterling 5.8 million.

New health, safety, security and other regulatory issues could adversely affect our business prospects, financial condition and results of operations.

We are subject to various international, national, state and local health, safety and security laws and regulations. For additional discussion of these requirements, we refer you to “Item 4—Information on the Company—Regulatory issues.” Changes in existing legislation or regulations and the imposition of new requirements could adversely affect our business prospects, financial condition and results of operations.

Implementation of U.S. Federal regulations, requiring U.S. citizens to obtain passports for seaborne travel to all foreign destinations, could adversely affect our financial condition and results of operations. Many cruise customers may not currently have passports or may not obtain a passport card (previously known as the People Access Security Service Card, or PASS Card) as an alternative to a passport. This card was created to meet the documentary requirements of the Western Hemisphere Travel Initiative. Applications for the card have been accepted since February 1, 2008 and the cards were made available to the public beginning in July 2008.

| Item 4. | Information on the Company |

History and development of the Company

The Norwegian Cruise Line brand commenced operations in 1966. In February 2000, Star Cruises, a Bermuda company with limited liability, acquired control of and subsequently became the sole owner of the Norwegian Cruise Line operations through its subsidiary Arrasas Limited, an Isle of Man company.

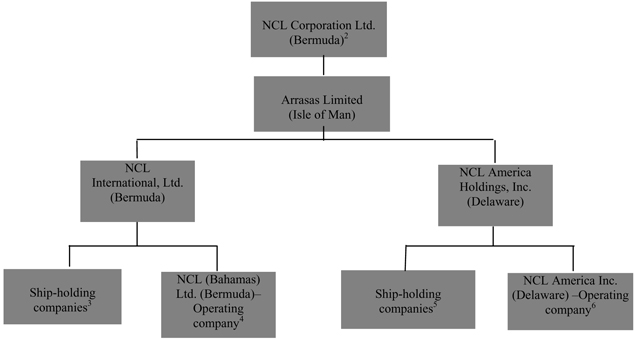

In December 2003, the Company was incorporated in Bermuda as a wholly-owned subsidiary of Star Cruises. In connection with our formation, Star Cruises contributed its 100% ownership interest in Arrasas Limited to us. Various subsidiaries were reorganized so

13

Table of Contents

that the entities owning or operating Bahamas-flagged ships became subsidiaries of NCL International, Ltd., also a Bermuda company, and the entities owning or operating U.S.-flagged ships became subsidiaries of NCL America Holdings, Inc., a Delaware corporation. NCL International, Ltd. and NCL America Holdings, Inc. are wholly-owned by Arrasas Limited. We refer you to “Item 4—Information on the Company—Organizational structure” for a diagram of our organization.

As of December 31, 2008, 47.4% of the shareholding interests in Star Cruises were held by Golden Hope Limited (“GHL”), as trustee of the Golden Hope Unit Trust, a private unit trust held directly and indirectly by GZ Trust Corporation as trustee of a discretionary trust established for the benefit of certain members of the family of one of our board members, Tan Sri KT Lim (the “Lim Family”). In addition, Resorts World Bhd (“RWB”), a Malaysian company listed on Bursa Malaysia Securities Berhad, in which the Lim Family has a substantial indirect beneficial interest, held 19.3% of the shareholding interests in Star Cruises. Star Cruises’ shares are listed on the Stock Exchange of Hong Kong Limited and traded on the Quotation and Execution System for Trading of the Singapore Exchange Securities Trading Limited. We refer you to “Item 4—Information on the Company—Business overview” for further information.

On January 7, 2008, Apollo became the owner of 50% of our outstanding ordinary share capital through an equity investment of $1.0 billion made pursuant to a subscription agreement dated August 17, 2007 among us, Star Cruises and NCL Investment Ltd. (the “Subscription Agreement”) and an assignment agreement dated January 7, 2008 by and among us, Apollo and Star Cruises. The net proceeds of the equity investment were $948.1 million. On January 8, 2008, TPG acquired, in the aggregate, 12.5% of our outstanding share capital from Apollo. We refer you to “Item 7—Major Shareholders and Related Party Transactions” for more information on our shareholders and the equity investment by Apollo and TPG.

The Company’s registered offices are located at Milner House, 18 Parliament Street, Hamilton HM 12, Bermuda. Our principal executive offices are located at 7665 Corporate Center Drive, Miami, Florida 33126, U.S. and the main telephone number at that address is (305) 436-4000. The website for Norwegian Cruise Line and NCL America (“NCLA”) are located at www.ncl.com. Information contained on our websites is not incorporated by reference into this or any other report filed with or furnished to the U.S. Securities and Exchange Commission (“SEC”). Daniel S. Farkas, the Company’s Senior Vice President and General Counsel, is our agent for service of process at our principal executive offices.

Business overview

We are one of the leading cruise ship operators in the world and are increasing the capacity and modernity of our fleet. Our fleet is the youngest in the industry among the major operators. We currently operate 11 ships with a total of 23,550 berths, which represents 9% of the overall cruise capacity in North America in terms of berths. In November 2009,Norwegian Majesty, which we currently charter from Star Cruises, will leave our fleet. In the second quarter of 2010, we expect to add one new ship to our fleet with approximately 4,200 berths. We offer a wide variety of itineraries focused on North America, including year-round cruises from New York, the only seven-day inter-island itineraries in Hawaii and a variety of itineraries in Alaska. We also offer numerous mainstream itineraries in the Caribbean, Europe, South America and North Africa. We currently operate under two brands: Norwegian Cruise Line and NCL America.

14

Table of Contents

Segment Reporting

The two brands, Norwegian Cruise Line and NCL America, have been aggregated as a single reportable segment based on the similarity of their economic characteristics, as well as products and services provided.

Although we sell cruises on an international basis, our passenger ticket revenue is primarily attributed to passengers who make reservations in North America. For the years ended December 31, 2008, 2007 and 2006, revenues attributable to North American passengers were 83%, 86% and 87%, respectively. Substantially all of our long–lived assets are located outside of the U.S. and consist primarily of our ships and ship under construction.

Our business strategies

We seek to attract vacationers by pioneering new products and services, exploring new markets and adding modern ships to our fleet. Our objective is to offer vacation products, unique in the cruise industry and which offer better value and more attractive characteristics than the broader, land-based leisure alternatives with which we compete. We have a long tradition of product innovation within the cruise industry: Norwegian Cruise Line is the oldest established consumer brand in Caribbean cruising; we became the first cruise operator to buy a private island in the Bahamas to offer a private beach experience to our passengers; and we were the first to introduce a 2,000-berth megaship into the Caribbean market in 1980. This tradition of innovation has continued in recent years with the launch of “Freestyle Cruising” and the development of “Homeland Cruising,” including the initiation of year-round cruises from New York.

“Freestyle Cruising”One of our most significant initiatives has been the introduction of a new style of cruising, called “Freestyle Cruising,” onboard our fleet. Our primary aim has been to eliminate the traditional cruise ship practice of fixed dining schedules, assigned dinner seating, formal dress codes, and cash tipping of service staff. Additionally, we have increased the number of activities and dining facilities available onboard, allowing passengers to organize their onboard experience according to their own schedules and tastes. The key elements of “Freestyle Cruising” include:

| • | flexible dining policy in our dining rooms; no fixed dining times or pre-assigned seating; |

| • | up to 11 dining locations ranging from casual fast-food outlets to à la carte gourmet and specialty ethnic restaurants; |

| • | resort-casual dress code acceptable throughout the ship, at all times; |

| • | increased service staff for a more personalized vacation experience; |

| • | replacement of cash tipping with an automated service charge system; |

| • | diverse “lifestyle” activities, including cultural and educational onboard programs along with an increased adventure emphasis for shore excursions; and |

| • | passenger-friendly disembarkation policies. |

15

Table of Contents

Our new ships have been designed and built for “Freestyle Cruising,” which we believe differentiates us significantly from our major competitors. We further believe that “Freestyle Cruising” attracts a passenger base that prefers the less structured, resort-style experience of our cruises.

With the success of “Freestyle Cruising” we have implemented across our fleet “Freestyle 2.0” featuring significant enhancements in our onboard product experience. The enhancements include a major investment in the total dining experience; upgrading the stateroom experience across the ship; new wide-ranging onboard activities for all ages; additional recognition, service and amenities for balcony, suite and villa passengers.

HawaiiWe have offered cruises in Hawaii since 1998. Initially, our cruises were on non-U.S.-flagged ships and were required to call on a foreign port during each cruise to comply with the provisions of the U.S. Jones Act. As a result, our Hawaii cruises called on Fanning Island in the Republic of Kiribati, which is the closest foreign port that complies with the Jones Act provisions and is located approximately 900 nautical miles south of the Big Island of Hawaii. In February 2003, we sought and received U.S. Congressional permission to operate in the Hawaii inter-island trade. Pursuant to Federal law, we were permitted to re-flag an existing non-U.S.-flagged ship in our fleet as a U.S.-flagged ship and complete the construction of two additional U.S.-flagged ships outside the U.S. As a result, three of our ships had the ability to cruise between and among ports in Hawaii without the need to call at a foreign port.

With the additional capacity introduced to the Hawaii market, our results in 2007 indicated that we had experienced a very competitive pricing environment in Hawaii, and in response to the unsatisfactory result, we withdrewPride of Hawai’i from the market in February 2008. The ship was re-flagged into the international fleet and renamedNorwegian Jade and was deployed in Europe year-round. In May 2008, we re-flaggedPride of Aloha into our international fleet and renamed and launched the ship asNorwegian Sky.The remaining year-round ship in Hawaii isPride of America (we refer you to “Item 7—Major Shareholders and Related Party Transactions” for additional information regarding these operations).

Fleet renewalWe have the youngest fleet in the industry among the major operators. An important element of our strategy since our acquisition by Star Cruises in 2000 has been to make significant investments in the renewal of our fleet. In the second quarter of 2010, we expect to add one additional ship to our fleet. The total cost of the new ship is currently estimated to be $1.2 billion based on the Euro/U.S. dollar exchange rate on December 31, 2008, of which we had paid $147.4 million as of December 31, 2008. We also have refurbished three ships in 2008,Norwegian Jade,Norwegian Sky andNorwegian Spirit. Renewal of our fleet is expected to enhance our results because new and refurbished ships:

| • | are more attractive to passengers; |

| • | are larger and have a more profitable mix of cabins, including a higher percentage of cabins with private balconies for which passengers are willing to pay a premium; |

| • | are faster than many of our competitors’ ships, giving us more flexibility in designing new and attractive itineraries; |

| • | tend to provide greater operating economies of scale; and |

| • | have been designed and built to deliver “Freestyle Cruising”. |

16

Table of Contents

“Homeland Cruising”We are one of the industry leaders in offering cruises from a wide variety of North American homeports close to major population centers, thus eliminating the need for vacationers to fly to distant ports to board a ship and reducing the overall cost and duration of a vacation. We branded this initiative as “Homeland Cruising” in response to changing consumer travel patterns in recent years. We are, for example, the only brand operating year-round from Honolulu and New York, the largest population center in the U.S., and we offer Bermuda cruises from Baltimore, Boston, Charleston, New York and Philadelphia.

The fleet

As of December 31, 2008, we operated a fleet of 11 cruise ships with a total of 23,550 berths. We are one of the industry leaders in offering cruises from a wide variety of North American homeports close to major population centers on ships specifically designed or re-configured to offer our unique “Freestyle Cruising” product.

Most of our ships are characterized by state-of-the-art passenger amenities including multiple dining choices in up to 11 restaurants on each ship, together with hundreds of standard private balcony cabins on each ship. Private balcony cabins are very popular with passengers and offer the opportunity for potential increased revenues by allowing us to charge a premium. Additionally,Norwegian Jade,Norwegian Gem,Norwegian Pearl,Norwegian Jewel,Norwegian Star andNorwegian Dawn each have a “ship within a ship” of luxury garden villas with up to approximately 5,750 square feet. These garden villas contain three separate bedroom areas, spacious living and dining room areas, as well as butler and concierge service. In addition,Norwegian Jade, Norwegian Gem,Norwegian Pearl, andNorwegian Jewel each have 10 courtyard villas, with up to approximately 570 square feet, which provide access to an exclusive private courtyard area with a private pool.

Norwegian Cruise Line ships

The table below provides a brief description of the Norwegian Cruise Line ships and areas of operations based on 2008 itineraries:

Ship | Year Built/ Rebuilt | Berths | Crew Capacity | Gross Tons | Primary Areas of Operation | |||||

| Norwegian Gem | 2007 | 2,400 | 1,200 | 93,500 | Europe, Bahamas | |||||

| Norwegian Jade(1) | 2006 | 2,400 | 1,100 | 93,600 | Europe | |||||

| Norwegian Pearl | 2006 | 2,400 | 1,200 | 93,500 | Alaska, Caribbean, Pacific Coastal and Panama Canal | |||||

| Norwegian Jewel | 2005 | 2,380 | 1,100 | 93,500 | Caribbean and Europe | |||||

| Norwegian Dawn | 2002 | 2,220 | 1,100 | 92,300 | Bahamas, Bermuda, Caribbean, Canada and New England | |||||

| Norwegian Star | 2001 | 2,240 | 1,100 | 91,700 | Alaska, Mexico and Pacific Coastal | |||||

| Norwegian Sun | 2001 | 1,940 | 900 | 78,300 | Alaska, Caribbean, Pacific Coastal and Panama Canal | |||||

| Norwegian Majesty(2) | 1992/1999 | 1,440 | 700 | 40,900 | Bahamas, Bermuda and Caribbean | |||||

| Norwegian Dream(2) | 1992/1998 | 1,740 | 700 | 50,800 | Caribbean, Europe, Panama Canal and South America | |||||

| Norwegian Spirit | 1998 | 2,000 | 1,000 | 75,300 | Caribbean, Bahamas, Canada and New England | |||||

| Norwegian Sky(3) | 1999 | 1,990 | 900 | 77,100 | Bahamas | |||||

| Pride of America | 2005 | 2,140 | 950 | 80,400 | Hawaii |

| (1) | In February 2008,Pride of Hawai’i, was re-flagged into our international fleet and renamed and launched asNorwegian Jade. |

17

Table of Contents

| (2) | Norwegian Majesty is scheduled to leave the fleet in November 2009 andNorwegian Dream left the fleet in November 2008. |

| (3) | In May 2008,Pride of Aloha was re-flagged into our international fleet and renamed and launched asNorwegian Sky. The remaining year-round ship in Hawaii isPride of America (we refer you to “Item 7—Major Shareholders and Related Party Transactions” for additional information regardingNorwegian Sky). |

Orient Line ship

In March 2008, the charter agreement forMarco Polo expired and we no longer operate the Orient brand name.

Current new ship on order

We have a contract to buildNorwegian Epic with additional capacity of approximately 4,200 berths and anticipated delivery in the second quarter of 2010.

Ship deployment

We offer cruise itineraries ranging from one day to several weeks calling on approximately 150 destinations worldwide, including destinations in the Caribbean, Bermuda, the Bahamas, Mexico, Alaska, Europe, Hawaii, New England, Central and South America, North Africa and Scandinavia. We have developed, and are continuing to develop, innovative itineraries to position our ships in new and niche markets as well as in the mainstream markets throughout the Americas and Europe. We believe this strategy allows us to maintain our status as one of the three major North American cruise operators while diversifying our deployment rather than relying as heavily on the traditional mass market trades in the Caribbean and the Bahamas out of South Florida.

Ports and facilities

We have an agreement with the Government of Bermuda whereby two of our ships, including, but not limited to,Norwegian Majesty, Norwegian Spiritand Norwegian Dawn are permitted weekly calls in Bermuda through 2018 from Boston, Baltimore, Charleston, New York and Philadelphia. In addition, we own a private island in the Bahamas, Great Stirrup Cay, which we utilize as a port-of-call on some of our itineraries.

In June 2004, we entered into a contract with the City of New York pursuant to which we receive preferential berths on specific piers at the city’s passenger ship terminal. Furthermore, in September 2006, we entered into a contract with the city of Los Angeles pursuant to which we receive preferential use of a berth at the city’s cruise ship terminal. In addition, effective October 2008, we entered into a contract with the Port of Miami for which we receive preferential berths at the Miami cruise terminal.

We have a concession permit with the U.S. National Park Service (“Park Service”) whereby our ships are permitted to call on Glacier Bay 13 times through December 2009. In 2010 through 2019, we shall be permitted to call on Glacier Bay 22 times during each season.

18

Table of Contents

At present, we do not intend to acquire any port facilities. We believe that our facilities are adequate for our current needs, and that we are capable of obtaining additional facilities as necessary.

Company revenue management

Cruise pricing and revenue management

Our cruise prices generally include cruise fare and a wide variety of onboard activities and amenities, including meals and entertainment. In some instances, cruise prices include round-trip airfare to and from the port of embarkation. Prices vary depending on the particular cruise itinerary, cabin category selected and the time of year that the voyage takes place. Additional charges are levied for dining in specialty restaurants, certain beverages, gift shop purchases, spa services, shore excursions and other similar purchases.

We base our pricing and revenue management on a strategy that encourages travelers to book early and secure attractive savings. This is accomplished through a revenue management system designed to maximize net revenue per Capacity Day by matching projected availability to anticipated future passenger demand. We perform extensive analyses of our databases in order to determine booking history and trends by market segment and distribution channel. In addition, we establish a set of cabin categories throughout each cruise ship and price our cruise fares on the basis of these cabin categories—the better the cabin category, the higher the cruise fare. Typically, the published fares are established months in advance of the departure of a cruise at a level which, under normal circumstances, would provide a high level of occupancy. If the rate at which cabin inventory is sold differs from expectations, we gradually and systematically adjust the number of cabins assigned for different fares for sale as the departure date approaches. Our yield management system is designed to encourage earlier booking of higher category cabins and a more orderly booking of lower category cabins, thereby reducing the need for last minute price cuts to fill ships.

We are further developing a sophisticated revenue management system, typical of other systems used by competitors within the North American cruise market. This system tracks and forecasts demand and provides optimal pricing and selling limit recommendations. The system will also shorten the time to implement pricing decisions.

Onboard and other revenues

Cruise prices typically include cruise accommodation, meals in certain dining facilities and many onboard activities. We earn additional revenues principally from shore excursions, food and beverage sales, gaming, retail sales, and spa services. Onboard and other revenue is an important component of our revenue base. To maximize onboard revenues, we use various cross-marketing and promotional tools and are supported by point-of-sale systems permitting “cashless” transactions for the sale of these onboard products and services. Food and beverage, gaming and shore excursions are managed directly by the company while retail shops, spa services, photography, art auctions and internet services are managed through contracts with third party concessionaires. These contracts generally entitle us to a fixed percentage of the gross or net sales derived from these concessions.

Seasonality

The seasonality of the North American cruise industry generally results in the greatest demand for cruises during the months of June through August. This predictable seasonality in demand has resulted in fluctuations in our revenues and results of operations. The seasonality of our results is increased due to ships being taken out of service for dry-docking, which we typically schedule during non-peak demand periods for such ships.

19

Table of Contents

Sales and marketing

Travel agent relationships

In 2008, a vast majority of our passengers booked their cruises through independent travel agents who sell our itineraries on a non-exclusive basis. Since almost all of our sales are made through independent travel agents, a major focus of our marketing strategy is motivating and supporting the retail travel agent community. Our marketing is supported by an extensive network of approximately 20,000 independent travel agencies including brick and mortar, internet-based and home-based operators located in North America, South America, Europe, Asia and Australia.

A new initiative in 2008 named “Partnership 2.0” included an overhaul of reservations and customer service processes which has enhanced our travel agent relationships. We introduced a completely interactive educational tool for travel agents offering classes for CLIA credit, “blogs,” informative videos, and forums for agent-to-agent communication.

Our call centers are located in Florida, Arizona, the United Kingdom and Germany with over 650 personnel oriented towards servicing travel agents and direct customer calls. Additionally, we have outsourced relationships with firms that manage two additional locations for us in Louisiana and Guatemala. We believe that our diverse locations should minimize risks associated with natural disasters, labor markets and other factors which could impact the operation of our call centers.

Marketing, brand communications and advertising

Our marketing department has been staffed and organized into core areas to support a continued awareness of our brand identity and increase consumer marketing, while continuing trade and travel partner marketing. The core areas are: marketing communications, direct marketing and loyalty and website/interactive.

All marketing supports our comprehensive brand identity created expressly to capture and articulate our “Freestyle Cruising” concept. Our brand identity campaign started in late 2006 and has been very successful in differentiating us from our competitors. Media mix to promote our identity includes television, print, radio, digital, newspaper as well as a new component of our travel partner marketing, NCL University online. This is a travel partner education program which provides valuable information to our travel partners.

Sustainable customer loyalty of our past passengers is an important element of our marketing strategy. We believe that attending to our past passengers’ needs and motivations creates a cost-effective means of attracting business, particularly to our new itineraries, because past passengers are familiar with our brands, products and services. The Norwegian Cruise Line program, which includes NCLA, is known as the Latitudes Club. Members of this program receive periodic mailings with informative destination information and cruise promotions that include special pricing, shipboard credits, cabin upgrades and onboard recognition. Avid cruisers can use our co-branded credit card to earn upgrades and discounts. Also, we have established a variety of interactive dialogue opportunities through periodic market research, polling e-mails and annual contests.

We have made significant progress in expanding our marketing reach with our online products and services. Our website, www.ncl.com, serving both our passengers and travel agency partners, has been a major focus of this momentum. We continue to

20

Table of Contents

enhance our redesigned website that aligns with our new brand look and further promotes our “Freestyle Cruising” program. Our consumer and travel agency partner booking engine provides passengers and travel agency partners the ability to shop and purchase any of our worldwide cruise itineraries with a more intuitive and informative online experience. We continue to develop additional functionality and tools to serve our passengers and travel agency partners.

Company operations and cruise infrastructure

Ship maintenance

In addition to routine maintenance and repairs performed on an ongoing basis and in accordance with applicable requirements, each of our ships is generally taken out of service, approximately every 24 to 60 months, for a period of one or more weeks for maintenance work, repairs and improvements performed in dry-dock. Dry-dock duration is a statutory requirement controlled under the chapters of SOLAS and to some extent the International Load Lines Convention. Under these regulations, it is required that a passenger ship dry-dock twice in 5 years and the maximum duration between each dry-dock cannot exceed 3 years. However, a certain number of ships within our fleet qualify under a special exemption provided by the Bahamas (Flag State) after meeting certain criteria set forth by the Bahamas to dry-dock once in every 5 years. To the extent practical, each ship’s crew, catering and hotel staff remain with the ship during the dry-docking period and assist in performing maintenance and repair work. We lose revenue earning opportunities while ships are dry-docked. Accordingly, dry-docking work is typically performed during non-peak demand periods to minimize the adverse effect on revenues that results from ships being out of service. Dry-dockings are typically scheduled in spring or autumn and depend on shipyard availability which may impact the itinerary of the ship.

Information technology