INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to Section 240.14a-12

FIRST VALLEY BANCORP, INC.

(Name of Registrant as Specified In Its Charter)

_______________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

____________________________________________

(2) Aggregate number of securities to which transaction applies:

____________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined):

____________________________________________

(4) Proposed maximum aggregate value of transaction:

____________________________________________

(5) Total fee paid:

____________________________________________

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously paid:

____________________________________________

(2) Form, Schedule or Registration Statement No.:

____________________________________________

(3) Filing Party:

____________________________________________

(4) Date Filed:

____________________________________________

Dear Shareholder:

You are cordially invited to attend the 2006 Annual Meeting (the “Meeting”) of the Shareholders of First Valley Bancorp, Inc. (the “Company”) to be held on Monday, May 22, 2006 at 5:00 p.m. at Nuchie’s Restaurant, 164 Central Street, Forestville, Connecticut. Matters scheduled for consideration at the Meeting are the election of Directors, the ratification of the appointment of the Company’s independent registered public accounting firm for 2006 and to transact such other business as may properly come before the Meeting or any adjournment thereof.

Please give the enclosed Proxy Statement your prompt and careful attention. A copy of the Bank’s 2005 Annual Report to Shareholders is also enclosed. If you need an additional copy of the Company’s Annual Report, please call Wanita A. Parent at (860) 582-8868. That Report also satisfies the requirements of Part 350 of the Federal Deposit Insurance Corporation’s regulations.

It is important that your shares be represented at the Meeting. To ensure that your shares will be represented, please sign and promptly return the enclosed Proxy in the pre-paid envelope provided, regardless of whether you plan to attend the Meeting. If you attend the Meeting, you may vote in person even if you previously mailed in your Proxy.

| Sincerely, | Sincerely, |

| | |

| | |

| / s / James J. Pryor | / s / Robert L. Messier, Jr. |

| JAMES J. PRYOR | ROBERT L. MESSIER, JR. |

| Chairman | President and Chief Executive Officer |

FIRST VALLEY BANCORP, INC.

Four Riverside Avenue, Bristol, Connecticut 06010

Phone (860) 582-8868 Fax (860) 314-6098

Website: www.valleybankct.com

FIRST VALLEY BANCORP, INC.

Four Riverside Avenue

Bristol, Connecticut 06010

__________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND PROXY STATEMENT

To Be Held on May 22, 2006

__________

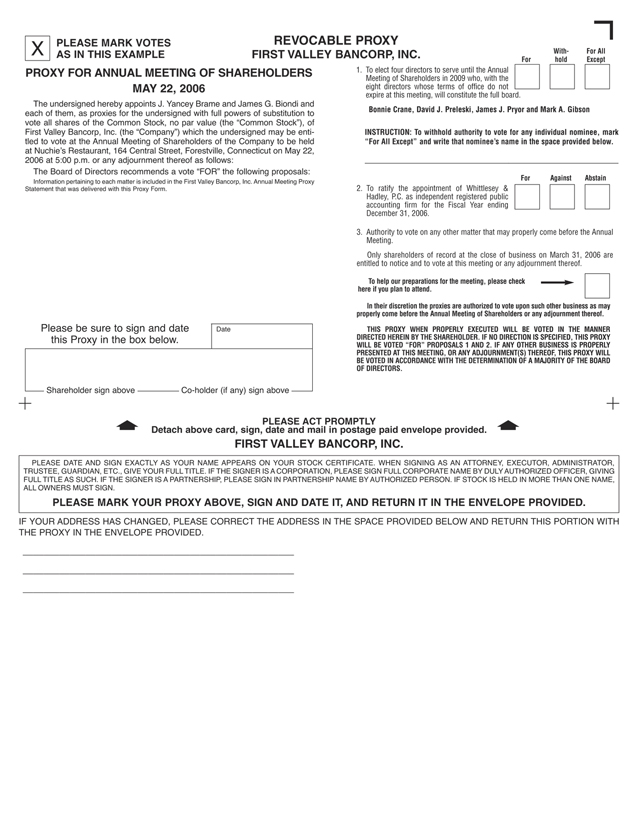

Notice is hereby given that the Annual Meeting of Shareholders of First Valley Bancorp, Inc. ("Bancorp") will be held at Nuchie's Restaurant, 164 Central Street, Forestville, Connecticut at 5:00 p.m. on Monday, May 22, 2006 for the following purposes:

(1) To elect four (4) directors to serve three year terms expiring in 2009 or until their successors are elected;

(2) To consider and act upon a proposal to ratify the appointment of Whittlesey & Hadley, P.C. as independent registered public accounting firm for the year ending December 31, 2006; and

(3) To transact such other business as may properly be brought before the Annual Meeting.

The close of business on March 31, 2006 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof.

Whether or not you expect to be present at the meeting, please mark, date, sign and return the enclosed form of proxy in the stamped and addressed envelope provided. No postage is required.

By Order of the Board of Directors

/ s / Robert L. Messier, Jr.

Robert L. Messier, Jr.

President & Chief Executive Officer

Bristol, Connecticut

April 21, 2006

PROXY STATEMENT, DATED APRIL 21, 2006

FIRST VALLEY BANCORP, INC.

Four Riverside Avenue

Bristol, Connecticut 06010

__________

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 22, 2006

__________

INTRODUCTION

This Proxy Statement (this "Proxy Statement") is being furnished in connection with the solicitation by the Board of Directors of First Valley Bancorp, Inc. ("Bancorp"), whose subsidiary is Valley Bank (the "Bank"), of proxies from holders of Bancorp's common stock, no par value per share ("Common Stock"), to be voted at the Annual Meeting of Shareholders to be held on May 22, 2006 and at any adjournments thereof. This year, 2006, marks the first year in which Bancorp is holding an Annual Meeting of Shareholders. At the Annual Meeting of Shareholders of the Bank held on May 23, 2005, the Bank's shareholders approved the reorganization of the Bank into a bank holding company structure. On July 1, 2005, the Bank completed its reorganization into a bank holding company structure and the Bank became the wholly-owned subsidiary of Bancorp. Your shares of Bank common stock were exchanged for an identical number of shares of Bancorp common stock as you have now become a shareholder of Bancorp. To the extent you continue to possess share certificates of the Bank, these are deemed for all purposes, including voting, to be shares of Bancorp.

The time and place of the Annual Meeting, as well as the purposes therefor, are set forth in the accompanying Notice of Annual Meeting. The approximate date on which this Proxy Statement and the enclosed proxy are first being sent or given to shareholders is April 21, 2006. In addition to solicitation by mail, directors, officers and certain management employees of Bancorp or the Bank, may solicit by telephone or in person the return of signed proxies from shareholders without additional remuneration therefor.

Any proxy given by a shareholder may be revoked at any time before its exercise, and any shareholder who executes and returns a proxy and who attends the Annual Meeting may withdraw the proxy at any time before it is voted and vote his or her shares in person. A proxy may also be revoked by submitting a duly executed proxy bearing a later date or by giving notice to the Secretary of Bancorp in writing (at our address indicated above) or in open meeting prior to the taking of a vote.

Unless so revoked, the proxy will be voted at the Annual Meeting, and unless authorization to vote for the election of directors or for any particular nominee is withheld, the shares represented by such proxy will be voted FOR the nominees set forth in this Proxy Statement. If authorization to vote for any nominee or nominees is withheld in a proxy, the votes of the shares represented thereby will be distributed among the remaining nominees in the manner determined by the persons named in the proxy, unless contrary instructions are given. Proxies containing instructions on Proposal 2 (the ratification of the appointment of Whittlesey & Hadley, P.C. as independent registered public accounting firm for 2006) will be voted in accordance with such instructions. If no instructions are contained on Proposal 2, proxies will be voted FOR the proposal. The four director candidates with the most votes will be elected. Approval of Proposal 2 requires the affirmative vote of a majority of the votes cast at the Annual Meeting. An abstention or a broker non-vote will be counted for purposes of determining whether a quorum is present but will not be counted as votes cast.

VOTING SECURITIES AND PRINCIPAL HOLDERS

The record date for determining shareholders entitled to notice of and to vote at the Annual Meeting and any adjournments thereof has been set as March 31, 2006 (the "Record Date"). As of the Record Date, there were 1,187,619 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter submitted to the Annual Meeting.

There is no person who, to the knowledge of our Board of Directors, owns beneficially more than 5% of the outstanding Common Stock other than (1) Leo G. Charette, who owns 62,147 shares or 5.2%, (2) David W. Florian, who owns 73,505 shares or 6.1% and (3) Edward T. McPhee, Jr., who owns 76,158 shares or 6.4%. Information as to the number of shares of Common Stock owned by each of our directors and by each nominee for election as a director of Bancorp and each principal shareholder is set forth below under "Election of Directors--Security Ownership of Certain Beneficial Owners and Management."

To our knowledge, no arrangement exists the operation of which might result in a change in control of Bancorp.

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees and Directors

In connection with the formation of Bancorp as a holding company for the Bank, all members of the Bank's Board of Directors were appointed as the initial members of Bancorp's Board in accordance with Bancorp's Certificate of Incorporation (the "Certificate"). Mark A. Gibson was added as a director by the Board of Directors by action on May 23, 2005, effective June 27, 2005. Mr. Gibson was added as a director to the Bank's Board of Directors on August 22, 2005. The Certificate provides that Bancorp's Board of Directors shall consist of not less than seven (7) persons and not more than fifteen (15) persons as fixed from time to time by the Board. The number of persons who will serve as members of Bancorp's Board of Directors following the Annual Meeting is twelve (12). The Certificate divides the Board into three classes of Directors, as nearly equal in number as possible, with overlapping terms of three years. One class is elected annually. Bancorp's Board of Directors has nominated Bonnie Crane, David J. Preleski, James J. Pryor and Mark A. Gibson for election at the Annual Meeting on May 22, 2006. For each nominee, a plurality of votes cast for such nominee is required. Each director holds office until the next Annual Meeting of Shareholders and until his or her successor is elected and qualifies (or until his or her earlier resignation, death or removal). Each of the nominees has consented to being named in this Proxy Statement and to serve as a director if elected. Each of the directors also serves as a director of the Bank.

The persons named in the form of proxy to represent shareholders at the Annual Meeting are J. Yancey Brame and James G. Biondi. It is the intention of the persons named in the proxy to vote FOR the election of the nominees unless authority to vote is withheld with respect to one or more nominees. In the event that any nominee for director should become unavailable for election for any reason, the persons named in the proxy will consult with our Board of Directors and use their discretion in deciding whether and how to vote the shares represented by such proxies.

The names of the nominees for election as directors and our current directors whose terms of office will continue after the 2006 Annual Meeting are set forth below, together with their principal occupations and employment, ages, directorships in publicly held companies and any company registered as an investment company under the Investment Company Act of 1940, directorships in other companies and lengths of service as directors. There is no arrangement or understanding between any director and any other person or persons pursuant to which such director was or is to be selected as a director or nominee. There is no family relationship between any director and any of our executive officers.

Each of the nominees and of the current directors has held the principal occupation listed for the past five years, except as set forth below.

Name | Age | Position and Offices with Bancorp and Bank and Principal Occupation and Employment |

Director nominees for a three-year term expiring in 2009: |

| Bonnie Crane | 61 | Director of the Bank since 1998 and of Bancorp since 2005. Mrs. Crane is retired. She was the Director of Human Resources at Kaba High Security Lock, Southington, Connecticut. Mrs. Crane is one of the former owners of Lori Lock Corporation of Southington, Connecticut. |

| | | |

| Mark A. Gibson | 44 | Director of Bancorp and the Bank since 2005. Mr. Gibson is the President and 1/3 owner of Quality Coils, Incorporated. He is also President and 1/3 owner of DynaLock Corporation. Both companies are located in Bristol, Connecticut. Mr. Gibson graduated from Rider College with a degree in accounting. Mr. Gibson has served as a Director of the Bristol Chamber of Commerce, and as both a Director of, and Vice President of, Chippanee Golf Club, as well as having served on the Advisory Board of Bank of Boston. |

| | | |

| David J. Preleski | 49 | Director of the Bank since 1998 and of Bancorp since 2005. Mr. Preleski is a principal in the law firm of Vitrano, Preleski & Wynne, LLC where he has been employed since 1996. Attorney Preleski's previous experience includes a twenty year career in banking with Bristol Savings Bank, First Federal Bank and Webster Financial Corporation. He is a former President and Corporate Secretary of Bristol Savings Bank and has experience in retail and commercial banking and as legal liaison with bank regulatory agencies. He is a Director of the New England Carousel Museum and is Past President of the Board of Directors of the Family Center. |

| | | |

| James J. Pryor | 69 | Chairman and Director of the Bank since 1998 and of Bancorp since 2005. Mr. Pryor is a Director of Allied Insurance Center. Mr. Pryor is a past Director of St. Francis Hospital and past Chairman of Bristol Hospital. Mr. Pryor was formerly an organizer and a Director of Bank of Southington in Southington, Connecticut. |

| | | |

Directors continuing in office: Directors whose terms expire in 2008 |

| James G. Biondi | 68 | Director of the Bank since 1998 and of Bancorp since 2005. Mr. Biondi is retired. He was the President and CEO of Apex Machine Tool Co. Inc. from 1961 until 1997. He is a current member and past President of the Connecticut Tooling and Machine Association. Mr. Biondi was a member of the advisory Board of Directors of Bank of Southington. |

| | | |

| J. Yancey Brame | 61 | Director of the Bank since 1998 and of Bancorp since 2005. Mr. Brame has been the President of Whitman Controls Corporation since 1981. In 1967, he received a BS degree from Cornell University and in 1973, an MBA degree from Columbia University. While an undergraduate, Mr. Brame worked in the Municipal Bond Department at Chemical Bank. Between 1973 and 1980, Mr. Brame was an Assistant Vice President at Chemical Bank, working in their International Edge Act subsidiary and Corporate Finance Group in New York. |

| | | |

| Edmund D. Donovan | 61 | Director of the Bank since 1998 and of Bancorp since 2005. Mr. Donovan serves as the Executive Vice President of Nickson Industries, Inc., a Plainville, Connecticut manufacturer of automotive exhaust hardware and has been in its employ since 1977. He is also involved in a real estate development in Southington, Connecticut. |

| | | |

| Edward T. McPhee, Jr. | 70 | Director of the Bank since 1998 and of Bancorp since 2005. Mr. McPhee is a graduate Engineer from Lowell Technological Institute and Founder of McPhee, Ltd. and McPhee & Sons, Ltd., firms engaged in electrical contracting. He is a member of the Academy of Electrical Contractors. He is an officer and Director of Kozy Kollar, Inc., a manufacturing concern. Mr. McPhee is a U.S. Army veteran. |

Directors whose terms expire in 2007 |

| Thomas O. Barnes | 57 | Director of the Bank since 1998 and of Bancorp since 2005. He is the Chairman of the Board of Barnes Group, Inc. where he has been employed since 1993. Barnes Group, Inc. is a public company involved in various manufacturing and distribution enterprises. Mr. Barnes is currently Chairman of the Board of the Main St. Community Foundation and has served on many other boards of charitable organizations. |

| | | |

| David W. Florian | 71 | Director of the Bank since 1998 and of Bancorp since 2005. Mr. Florian was the founder and CEO of Lori Lock of Southington from 1960 until 1990. He is a real estate developer and a Director and President of Bison Realty, Inc. Mr. Florian was formerly a Director of State Savings Bank located in Southington, Connecticut. |

| | | |

| Robert L. Messier, Jr. | 63 | President, Chief Executive Officer and Director of the Bank since 1998 and of Bancorp since 2005. Mr. Messier served as Vice President and regional commercial banking officer with Eagle Bank from 1996 until its merger with Webster Bank in 1998. From 1992 to 1996, Mr. Messier was a Vice President, with corporate/small business lending regional manager responsibilities of BankBoston Connecticut. He is Director Emeritus and Past Chairman of Greater Bristol Health Care, Inc., a Director of St. Francis Hospital and Medical Center and Director of Central Connecticut Medical Management. He served as the President of the Greater Bristol Chamber of Commerce from 1995 to 1997. He has been the President of the Business Education Foundation since 1990 and Chairman of the Central Connecticut Revolving Loan Fund since 1995. |

| | | |

| Thomas P. O'Brien | 60 | Director of the Bank since 1999 and of Bancorp since 2005. Mr. O'Brien is the Manager of O'Brien Funeral Home, located in Forestville, Connecticut. Mr. O'Brien is currently serving as Chairman of the Bristol/Burlington Health District and is a member of the Bristol Board of Education. |

Executive Officers

The following table provides information concerning the executive officers of Bancorp and the Bank other than Robert L. Messier, Jr., information about whom is listed in the table above.

Name | Age | Position and Offices With Bancorp Presently Held and Principal Occupation and Employment |

| | | |

| Mark J. Blum | 53 | Mr. Blum has been the Executive Vice President and Chief Financial Officer of the Bank since December 2000 and Bancorp since 2005. In December 2004, he was appointed Treasurer of the Bank. He has thirty years of banking experience. Prior to joining the Bank, he served as Executive Vice President and Chief Financial Officer of Eagle Financial Corporation and its subsidiary, Eagle Bank. |

| | | |

| Anthony M. Mattioli | 47 | Mr. Mattioli is the Executive Vice President and Senior Lending Officer and has been employed by the Bank since April 2000. He has been in banking and finance since 1984. Prior to joining the Bank, he was a Commercial Lender at Webster Bank and Bristol Savings Bank. |

Meetings and Committees of the Board

During 2005, our Board of Directors met 13 times. All directors attended at least 75% of the total number of meetings of our Board of Directors and of those Board committees on which he or she served which were held during 2005.

The members of the Board of Directors devote time and talent to certain standing and ad hoc committees of Bancorp and the Bank. Among these committees are the Executive Committee, the Operations/Technology Committee, the Governance Committee, the Strategic Planning Committee, the Asset/Liability Committee, the Audit/Compliance Committee, the Loan Committee, and the Salary/Personnel Committee, whose members and principal functions are described below.

The principal function of the Executive Committee is to serve as an advisory committee to management. The members of the Executive Committee are Mr. Pryor, Chairman, Messrs. Barnes, Florian, McPhee, Messier, and Preleski. During 2005, the Executive Committee of Bancorp met 4 times.

The principal function of the Governance Committee is to consider and recommend to the full Board of Directors nominees for directorship positions at Bancorp and the Bank. The Committee is also responsible for reporting and recommending from time to time to the Board matters relative to corporate governance. The members of the Governance Committee are Mr. Preleski, Chairman, Messrs. Barnes, Florian, McPhee and Pryor. Messrs. Blum and Messier are Management Liaisons to the Governance Committee. During 2005, the Governance Committee met 3 times.

The functions of the Asset/Liability Committee include managing Bancorp's and the Bank's liquidity and interest rate risk positions, ensuring adherence to the investment policies of Bancorp and the Bank, recommending amendments thereto, and exercising authority regarding investments. The members of the Asset/Liability Committee are Mr. Brame, Chairman, Messrs. Biondi, Blum, Donovan, Messier, O'Brien and Preleski. During 2005, the Asset/Liability Committee met 5 times.

The functions of the Audit/Compliance Committee include reviewing and recommending policies regarding internal audit, establishing and implementing policies to comply with applicable regulations, causing suitable audits to be made by auditors engaged by the Audit/Compliance Committee on behalf of Bancorp, pre-approving all audit services and permitted non-audit services provided by the auditors, and reviewing the independence of the auditors and qualifications of "audit committee financial experts" on the Audit/Compliance Committee. The Audit/Compliance Committee or its Chairman also discusses with the independent auditor the auditor's review of our unaudited quarterly financial statements. The Audit/Compliance Committee operates under a written charter adopted by the Board of Directors attached hereto as Exhibit A. The members of the Audit/Compliance Committee are Mr. Florian, Chairman, Messrs. Biondi, Brame, Gibson and McPhee. Messrs. Donovan and Pryor serve as alternates on the Committee. Messrs. Blum and Messier serve as Management Liaisons to the Committee. Each member of the Committee is independent under the rules and regulations of the Securities Exchange Act of 1934 (the "Exchange Act") and The NASDAQ Stock Market, Inc. Messrs. Brame, Donovan and Gibson have all been determined to have the professional experience deemed necessary to qualify as an audit committee financial expert under Securities and Exchange Commission (the "SEC") rules. During 2005, the Audit/Compliance Committee of Bancorp met 5 times. The Report of the Audit/Compliance Committee for the year ended December 31, 2005 is set forth under "Election of Directors - - Report by the Audit/Compliance Committee."

The functions of the Loan Committee include examining, reviewing and approving loans, reviewing and approving loan policies and establishing appropriate levels of credit risk. The members of the Loan Committee are Mr. Biondi, Chairman, Messrs. Barnes, Brame, Donovan, McPhee, Messier, O'Brien and Preleski. During 2005, the Loan Committee met 25 times.

The functions of the Salary/Personnel Committee include developing Bancorp's overall compensation philosophy and recommending the compensation of Bancorp's executive officers to Bancorp's Board of Directors. The Committee is also responsible for administering Bancorp's Stock Plan subject to the approval of the Board of Directors. The members of the Salary/ Personnel Committee are currently Mrs. Crane, Chairman and Messrs. Barnes, McPhee and Pryor, all outside directors. Mr. Messier also participates in the Committee meetings except with respect to his own compensation. During 2005, the Salary/Personnel Committee met 3 times.

The functions of the Operations/Technology Committee include planning and review of Bancorp's and Bank's applications, information technology systems and projects in accordance with the Operations/Technology Policy. The members of the Operations/Technology Committee are Mrs. Crane and Mr. Donovan, Chairman, Messrs. Blum, Brame, Gibson, Messier and Preleski. The Committee met 4 times in 2005.

The functions of the Strategic Planning Committee include strategic and business planning of Bancorp and the Bank, analyzing and assessing opportunities for the development of the Bank's planning function, setting short and long-term business goals and recommending action plans to the Board of Directors to meet the goals. The Committee monitors Bank activity with respect to the strategic or business plan. The members of the Strategic Planning Committee are Mr. Barnes, Chairman, Messrs. Blum, Brame, Donovan, Messier and O'Brien. The Committee met 3 times during 2005.

Nomination Process

The process of reviewing and making recommendations for nominations and appointments to the Board of Directors is the responsibility of the Governance Committee. All members of the Governance Committee are considered "independent" directors under The NASDAQ Stock Market, Inc. rules. A copy of the Governance Committee Charter is attached to this Proxy Statement as Exhibit B. Under Bancorp's By-Laws, nominations for directors may be made by any shareholder of any outstanding class of capital stock of Bancorp who delivers notice along with the additional information and materials required by our charter to Bancorp's President not less than 20 days and no more than 130 days before the annual meeting. Shareholders may obtain a copy of our Certificate of Incorporation and By-Laws by writing to our Corporate Secretary, Four Riverside Avenue, Bristol, Connecticut 06010.

Our directors have a critical role in guiding our strategic direction and in overseeing management. The Governance Committee will consider candidates for the Board based upon several criteria, including their broad-based business and professional skills and experiences, concern for the long-term interests of shareholders, and personal integrity and judgment. Candidates should have reputations, both personal and professional, consistent with our image and reputation. The majority of directors on the Board of Directors should be "independent," not only as that term may be legally defined, but also without the appearance of any conflict in serving as a director. In addition, directors must have time available to devote to Board activities and to enhance their knowledge of the banking industry. Accordingly, the Board of Directors seeks to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities to Bancorp, and may be expected to contribute to an effective Board.

The Governance Committee utilizes the following process for identifying and evaluating nominees to the Board. In the case of incumbent directors, each year the Board of Directors informally reviews directors' overall service to Bancorp during their term, including the number of meetings attended, level of participation and quality of performance. In the case of new director candidates, the directors on the Board of Directors are polled for suggestions as to potential candidates that may meet the criteria above, discuss candidates suggested by our shareholders, and may also engage, if the Board of Directors deems appropriate, a professional search firm. To date, the Governance Committee has not engaged professional search firms to identify or evaluate potential nominees but has the right to do so in the future, if necessary. The Governance Committee then meets to discuss and consider these candidates' qualifications and then chooses a candidate by majority vote. Each of the nominees for director listed above were recommended by the Governance Committee in 2006.

Director Attendance at Annual Meetings

We have a policy encouraging attendance by members of the Board of Directors at Bancorp's annual meetings of shareholders. All of our directors attended the 2005 Annual Meeting of Shareholders with the exception of James G. Biondi.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below provides certain information about beneficial ownership of our Common Stock as of March 31, 2006. The table shows information for:

| · | each person, or group of affiliated persons, who is known to Bancorp to beneficially own more than 5% of our Common Stock; |

| · | each of our executive officers named in the Summary Compensation Table; and |

| · | all of our directors and executive officers as a group. |

Except as otherwise noted, the persons or entities in this table have sole voting and investing power with respect to all shares of common stock beneficially owned by them, subject to community property laws, where applicable. The address of each person is care of Bancorp at our principal executive office.

The percentage ownership column below is based on a total of 1,187,619 shares of Common Stock outstanding as of March 31, 2006. For purposes of the table below, we treat shares of common stock subject to options that are currently exercisable or exercisable within 60 days after March 31, 2006 to be outstanding and to be beneficially owned by the person holding the options for the purpose of computing the percentage ownership of the person, but we do not treat the shares as outstanding for the purpose of computing the percentage ownership of any other shareholder.

Name | Shares Beneficially Owned (1) | Percentage Ownership |

| | | |

5% Shareholders: | | |

| | | |

Leo G. Charette 244 Winding Ridge Road P.O. Box 384 Southington, CT 06489 | 62,147** | 5.2% |

| | | |

David W. Florian - Director 35 Copper Ridge Southington, CT 06489 | 73,505 | 6.1% |

| | | |

Edward T. McPhee, Jr. - Director 99 Beechwood Lane Bristol, CT 06010 | 76,158 | 6.4% |

| | | |

Directors and Executive Officers: | | |

| | | |

| | | |

Thomas O. Barnes Director | 42,892 | 3.6% |

Mark J. Blum Executive Vice President, Treasurer and Chief Financial Officer | 5,241 | 0.4% |

James G. Biondi Director | 54,478 | 4.6% |

J. Yancey Brame Director | 49,838 | 4.2% |

Bonnie Crane Director (and Director Nominee) | 17,108 | 1.4% |

Edmund D. Donovan Director | 17,727 | 1.5% |

Mark A. Gibson Director (and Director Nominee) | 4,740 | 0.4% |

Anthony M. Mattioli Executive Vice President and Senior Lending Officer | 4,350 | 0.4% |

Robert L. Messier, Jr. President, Chief Executive Officer and Director | 28,869 | 2.4% |

Thomas P. O'Brien Director | 39,690 | 3.3% |

David J. Preleski Director (and Director Nominee) | 12,243 | 1.0% |

James J. Pryor Chairman of the Board, Director (and Director Nominee) | 45,147 | 3.7% |

| | | |

All directors and executive officers as a group (14 persons)(2) | 471,986** | 36.5% |

__________

** Mr. Charette's stock and options are not included in above total as Mr. Charette is not a director or executive officer of First Valley Bancorp, Inc., or Valley Bank.

| (1) | "Beneficial ownership" is defined pursuant to regulations of the SEC as shares over which a person has direct or indirect sole or shared voting or investment (purchase and sale) power, and includes shares subject to options exercisable within sixty days. |

The table above includes certain shares owned by spouses, other immediate family members and others over which the persons named in the table possess shared voting and/or shared investment power as follows: Mr. Barnes, 363 shares; Mr. Blum, 363 shares; Mr. Biondi, 8,897 shares; Mr. Brame, 19,496 shares; Mrs. Crane, 965 shares; Mr. Donovan, 4,602 shares; Mr. Gibson, 3,386 shares; Mr. Mattioli, 242 shares; Mr. McPhee, 26,495 shares; Mr. Messier, 11,306 shares; Mr. O'Brien, 7,262 shares, Attorney Preleski, 3,346 shares; and Mr. Pryor, 20,281 shares.

Outstanding options reflected in the table are held as follows: Mr. Barnes, 8,228 shares; Mr. Biondi, 8,228 shares; Mr. Brame, 8,228 shares; Mrs. Crane, 8,228 shares; Mr. Donovan, 8,228 shares; Mr. Florian, 8,228 shares; Mr. McPhee, 8,228 shares; Mr. Messier, 7,623 shares; Mr. O'Brien, 8,228 shares; Attorney Preleski, 8,228 shares; and Mr. Pryor, 24,866 shares.

| (2) | This amount does not include shares beneficially owned by Mr. Leo G. Charette. |

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers and directors, and persons who own more than 10% of our Common Stock, to file reports of ownership and changes in ownership of our securities with the SEC. Based solely upon a review of the copies of the forms furnished to Bancorp, and written representations from reporting persons that no Forms 5 were required other than those timely filed, we believe that during 2005, filing requirements under Section 16(a) applicable to our executive officers and directors were complied with in a timely manner, except that late filings on Form 5 were made in 2006 for Edward T. McPhee, Jr., gifted stock, Mark J. Blum, acquired stock through Bancorp's Stock Plan, and Anthony M. Mattioli, acquired stock through Bancorp's Stock Plan.

EXECUTIVE COMPENSATION

Compensation of Directors

Bancorp's directors who are also officers do not receive any compensation for service as members of the Board of Directors or committees thereof. Non-officer directors receive a fee of $125 for each meeting of the Board of Directors attended, and $100 for each meeting of a standing committee of the Board of Directors attended. In addition, non-officer directors who serve as the chair of a Board committee receive an additional $50 for each meeting attended and non-officer directors who serve as chair of a standing committee receive an additional fee of $25 for each meeting attended. The compensation totaled approximately $40,000 for 2005.

Cash Compensation of Executive Officers

The following table sets forth certain information with respect to the compensation of our Chief Executive Officer and our two additional executive officers during the year ended December 31, 2005.

Summary Compensation Table

| | | | |

| | | | | | | | | | |

| | | | | Annual Compensation | | Long Term Compensation | |

(a) | | (b) | | (c)(1) | | (d) | | (e) | | (g) | | (i) | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($)(2) | | Other Annual Compensation ($)(3) | | All Other Options/ SARS (#) | | All Other Compensation ($) | |

| | | | | | | | | | | | | | |

| Robert L. Messier, Jr. | | | 2005 | | $ | 150,709 | | $ | 33,293 | | $ | -0- | | | -0- | | $ | 5,184 | |

| President and Chief | | | 2004 | | | 139,208 | | | 33,263 | | | -0- | | | -0- | | | 2,460 | |

| Executive Officer | | | 2003 | | | 129,747 | | | 37,000 | | | -0- | | | 3,300 | | | 2,995 | |

| | | | | | | | | | | | | | | | | | | | |

| Mark J. Blum | | | | | | | | | | | | | | | | | | | |

| Executive Vice President, | | | 2005 | | $ | 108,499 | | $ | 19,950 | | $ | -0- | | | -0- | | $ | 5,184 | |

| Chief Financial Officer and | | | 2004 | | | 100,859 | | | 19,706 | | | -0- | | | -0- | | | 2,268 | |

| Treasurer | | | 2003 | | | 99,908 | | | 28,504 | | | -0- | | | -0- | | | 2,417 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Anthony M. Mattioli | | | 2005 | | $ | 105,240 | | $ | 19,300 | | $ | -0- | | | -0- | | $ | 3,676 | |

| Executive Vice President | | | 2004 | | | 98,762 | | | 19,344 | | | -0- | | | -0- | | | 1,909 | |

| and Senior Lending Officer | | | 2003 | | | 97,810 | | | 27,501 | | | -0- | | | -0- | | | 1,930 | |

| | | | | | | | | | | | | | | | | | | | |

____________________

(1) Salary and bonus figures include amounts deferred under Valley Bank's 401K Profit-Sharing Plan.

(2) Bonuses may include both cash bonuses and/or the fair value of stock compensation on the date of the award. Adjusting all share numbers to give effect to stock splits, Mr. Messier was awarded 950 shares, 1,265 shares and 2,098 shares respectively, in 2005, 2004 and 2003. Mr. Blum was awarded 581 shares, 770 shares and 1,509 shares respectively, in 2005, 2004 and 2003. Mr. Mattioli was awarded 581 shares, 652 shares and 1,455 shares respectively, in 2005, 2004 and 2003. The stock and cash bonuses were awarded for meeting certain objectives of the Board of Directors.

(3) Perquisites and other personal benefits to Messrs. Messier, Blum and Mattioli did not exceed the lesser of either $50,000 or ten percent (10%) of the total of annual salary and bonuses reported under "Annual Compensation" for each individual for the year ended December 31, 2005 and, therefore, are not included in the table.

Employment Agreements

Valley Bank and Robert L. Messier, Jr., President and Chief Executive Officer of Valley Bank, are parties to a one-year employment agreement, which expires July 1, 2006, and which shall be renewed for an additional one-year period. It is expected Mr. Messier's employment with Valley Bank will be continued at such time. The agreement provides, among other things, for an annual review of Mr. Messier's salary, for merit increases at the discretion of Valley Bank's Board of Directors, and for participation in bonuses and employee benefit plans and fringe benefits which are or may be adopted by Valley Bank for its executive employees.

The Valley Bank Board of Directors may terminate Mr. Messier's employment agreement at any time with or without cause. If he were terminated without cause, Mr. Messier would be entitled to receive either a monthly payment over the remaining term of the agreement or a lump sum amount equal to six months of Mr. Messier's salary.

If Mr. Messier's employment is terminated within three years of a change in control of Valley Bank, either involuntarily by action of Valley Bank or by Mr. Messier, the agreement provides for a lump sum severance payment to Mr. Messier on or before his last day of employment with Valley Bank equal to three times the highest annual compensation paid or payable to Mr. Messier. Valley Bank and Mark J. Blum, Executive Vice President, Chief Financial Officer and Treasurer and Anthony M. Mattioli, Executive Vice President and Senior Lending Officer are also parties to Change of Control Agreements with terms that are generally similar to Mr. Messier's.

In June 2005, the Board of Directors approved a supplemental retirement benefit for Mr. Messier that will pay out $28,000 annually for a period of fifteen years beginning in July 2008.

Options and Stock Appreciation Rights

During 2005, Bancorp did not grant stock options to any of the named executive officers.

At December 31, 2005, Mr. Messier had 7,623 shares underlying unexercised options. The options, all of which are currently exercisable, are exercisable for a ten (10) year period from the effective date of the actual grant, at an average original exercise price of $8.26 per share.

In connection with the holding company reorganization in 2005, Bancorp assumed the Bank’s 1999 Stock Option and Stock Compensation Plan (the "Stock Plan"). Under the Stock Plan, an aggregate of 289,399 shares were available for issuance thereunder.

The following table sets forth information as to options exercised by the named executive officers during 2005 and the values of options and stock appreciation rights as of December 31, 2005.

| | | | | Aggregated Option Exercises in 2005 and Fiscal Year-End Option Values | |

Name | | Shares Acquired On Exercise (#) | | Value Realized ($) | | Number of Securities Underlying Unexercised Options at December 31, 2005 (#) Exercisable/Unexercisable | | Value of Unexercised In-the-Money Options at December 31, 2005 ($) Exercisable/Unexercisable (a) | |

| | | | | | | | | | |

| Robert L. Messier, Jr. | | | -0- | | | -0- | | | 7,623/0 | | $ | 54,800/0 | |

Note: Mr. Messier is the only named executive officer who holds Stock Options. Messrs. Blum and Mattioli have not been granted Stock Options to date.

(a) Value is based on the estimated fair market value of 6,930 shares of Bancorp common stock (7,623 shares after giving effect to the stock split in January 2006) of $17.00 at December 31, 2005, less the average exercise price of $9.09 ($8.26 after giving effect to the stock split in January 2006), of all unexercised stock options.

In June 2005, Messrs. Blum and Mattioli were each awarded 2,500 shares of common stock payable in July 2008. The stock awards are contingent upon the recipient's continued employment at the Bank and will not be awarded in the event that the recipient is not employed by the Bank through July 2008.

Securities Authorized for Issuance under Equity Compensation Plans

The following table presents information as of December 31, 2005 for Bancorp's equity compensation plans.

Equity Compensation Plan Information | |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future grant under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| Equity compensation plans | | | | | | | | | | |

approved by shareholders | | | 124,050 | | $ | 8.21 | | | 140,071 | |

| Equity compensation plans not | | | | | | | | | | |

| approved by shareholders | | | -0- | | | -0- | | | -0- | |

| | | | | | | | | | | |

| Total | | | 124,050 | | $ | 8.21 | | | 140,071 | |

Transactions with Management and Others

In the ordinary course of business, the Bank has made loans to officers and directors (including loans to members of their immediate families and loans to companies of which a director owns 10% or more). The total amount of loans to officers and directors outstanding as of December 31, 2005 was $3,436,000. In the opinion of management, all of such loans were made in the ordinary course of business of the Bank on substantially the same terms, including interest rates and collateral requirements, as those then prevailing for comparable transactions with other persons and did not involve more than the normal risk of collectibility or present other unfavorable features.

Mr. David J. Preleski, a Director of Bancorp and the Bank, is a partner of the law firm of Vitrano, Preleski & Wynne, LLC, which provides legal services to Bancorp and the Bank. In the opinion of the Board, the services of Attorney Preleski's firm to Bancorp and the Bank are provided on terms at least as favorable as could be obtained from independent parties. Bancorp and the Bank expect to continue to use the services of this firm in the future. In 2005, Bancorp and the Bank paid the firm $5,700 for services provided.

Mr. Thomas O. Barnes, a Director of the Bank, is a one-third owner of Bristol Holding, L.L.C. In 1999, the Bank entered into a fifteen-year lease with Carpenter Realty Corp., The S. Carpenter Construction Corp. and Bristol Holding, L.L.C. The lease is at market rates based on similar properties in this market area. The annual rent at December 31, 2005, was $162,000.

REPORT BY THE AUDIT/COMPLIANCE COMMITTEE

The Audit/Compliance Committee operates pursuant to a written charter, a copy of which is attached as Exhibit A.

Pursuant to the Audit/Compliance Committee charter, all directors who serve on the committee must be outside directors who satisfy the independence requirements set forth in Section 10A(m) of the Exchange Act and the rules adopted by the SEC thereunder. The Board of Directors, in its business judgment, has determined that each of the members of the Audit/Compliance Committee is independent under the rules and regulations of the Exchange Act and The NASDAQ Stock Market, Inc. The Board of Directors has determined that Messrs. Brame, Donovan and Gibson have the professional experience necessary to qualify as an audit committee financial expert within the meaning of the SEC rules.

In performing its function, the Audit/Compliance Committee has:

| · | reviewed and discussed our audited financial statements as of and for the year ended December 31, 2005 with management and with Whittlesey & Hadley, P.C. (successor in interest to Snyder & Haller, P.C.) our independent registered public accounting firm for 2005; |

| · | discussed with our independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect; and |

| · | received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as currently in effect, and has discussed with the independent registered public accounting firm the independent registered public accounting firm's independence. The Audit/Compliance Committee has considered whether the provision of non-audit services by the independent registered public accounting firm to Bancorp is compatible with maintaining the accountants' independence and has discussed with Whittlesey & Hadley, P.C. their independence. |

Based on the foregoing review and discussions, the Audit/Compliance Committee recommended to the Board of Directors that our audited financial statements be included in our Annual Report on Form 10-KSB for the year ended December 31, 2005 for filing with the SEC.

David W. Florian, Chairman

Edward T. McPhee, Jr., Vice Chairman

James G. Biondi

J. Yancey Brame

Mark A. Gibson

Edmund D. Donovan

James J. Pryor

Dated: March 27, 2006

THE REPORT OF THE AUDIT/COMPLIANCE COMMITTEE SHALL NOT BE DEEMED INCORPORATED BY REFERENCE INTO ANY FILING UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, EXCEPT TO THE EXTENT THAT WE SPECIFICALLY INCORPORATE IT BY REFERENCE, AND SHALL NOT OTHERWISE BE DEEMED TO BE FILED UNDER SUCH ACTS.

CODE OF ETHICS

Our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer are required to comply with the First Valley Bancorp, Inc. Code of Conduct for Senior Executive Financial Officers adopted by our Board of Directors. The Code of Conduct was adopted to deter wrongdoing and promote honest and ethical conduct; full, fair, accurate and timely disclosure in public documents; compliance with law; prompt internal reporting of Code violations, and accountability for adherence to the Code. The Code of Conduct is filed with the SEC as an exhibit to our Annual Report on Form 10-KSB for the fiscal year ended December 31, 2005. Shareholders may also request a copy of the Code, without charge, by contacting Mark J. Blum, First Valley Bancorp, Inc., Four Riverside Avenue, Bristol, Connecticut 06010.

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit/Compliance Committee has approved the engagement of Whittlesey & Hadley, P.C. (successor in interest to Snyder & Haller, P.C., hereinafter referred to from time to time collectively, as "Whittlesey & Hadley") independent registered public accounting firm, to audit the books, records and accounts of Bancorp for the year ending December 31, 2006. In accordance with a resolution of the Board of Directors, this selection is being presented to the shareholders for ratification at the Annual Meeting.

Snyder & Haller, P.C. were the Bank's independent registered public accounting firm since the Bank's formation in 1999 until that firm's merger with Whittlesey & Hadley, P.C., in January 2006. On the same date, Bancorp engaged Whittlesey & Hadley, P.C. as its successor independent registered public accounting firm. The Audit/Compliance Committee approved the engagement of Whittlesey & Hadley.

The reports of our independent registered public accounting firm on the financial statements of Bancorp and the Bank, as applicable, as of and for the fiscal years ended December 31, 2004 and 2005, did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

During Bancorp's and the Bank's fiscal years ended December 31, 2004 and 2005 and subsequent interim period preceding the resignation of Snyder & Haller, P.C., as applicable, there were no disagreements between the Bancorp or the Bank and its independent registered public accounting firm, on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of its independent registered public accounting firm, would have caused its independent registered public accounting firm to make reference to the subject matter of disagreements in connection with its audit reports on the Bank's financial statements or Bancorp's consolidated financial statements. During the Bank's fiscal years ended December 31, 2003 and 2004 and subsequent interim period preceding the engagement of Whittlesey & Hadley, P.C., neither the Bank nor Bancorp consulted with its independent registered public accounting firm regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Bank's financial statements or Bancorp's consolidated financial statements.

Whittlesey & Hadley, P.C. is considered to be well qualified. We have been advised by Whittlesey & Hadley, P.C. that it has no direct financial interest or any material indirect financial interest in Bancorp other than that arising from the firm's employment as independent registered public accounting firm.

Whittlesey & Hadley, P.C. performed and will perform both audit and non-audit professional services for Bancorp and on our behalf. During 2005, Whittlesey & Hadley, P.C.'s audit services included an audit of our consolidated financial statements and a review of certain filings with the SEC. All professional services rendered by Whittlesey & Hadley, P.C. during 2005 were furnished at customary rates and terms.

During the period covering the fiscal year ended December 31, 2005, Whittlesey & Hadley, P.C. performed the following professional services:

| | | 2005 | | 2004 | |

Audit Fees consist of fees for professional services rendered for the audit of the consolidated financial statements and review of financial statements included in quarterly reports on Form 10-QSB and services connected with statutory and regulatory filings or engagements. | | $ | 43,000 | | $ | 37,500 | |

Tax Service Fees consist of fees for tax return preparation, planning and tax advice. | | $ | 4,750 | | $ | 4,500 | |

Other Fees | | | -0- | | | -0- | |

Policy on Audit/Compliance Committee Pre-Approval of Audit and Non-Audit Services

The Audit/Compliance Committee's policy is to pre-approve all audit and non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The Audit/Compliance Committee has delegated pre-approval authority to its Chair when expedition of services if necessary. The Chair is required to report any decisions to pre-approve such services to the full Audit/Compliance Committee at its next meeting. The independent registered public accounting firm and management are required to periodically report to the full Audit/Compliance Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit/Compliance Committee approved all of the fees set forth in the table above.

A representative from Whittlesey & Hadley, P.C. will be present at the Annual Meeting and will be provided the opportunity to make a statement and to respond to appropriate questions that may be asked by shareholders.

If the shareholders do not ratify the selection of Whittlesey & Hadley, P.C., the selection of independent registered public accounting firm will be reconsidered by the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" PROPOSAL 2.

SHAREHOLDER PROPOSALS AND COMMUNICATIONS

Any shareholder who intends to present a proposal at the 2007 Annual Meeting is advised that, in order for such proposal to be included in the Board of Directors' proxy material for such meeting, the proposal must be received by Bancorp at our principal executive office no later than December 23, 2006 directed to Robert L. Messier, Jr., First Valley Bancorp, Inc., Four Riverside Avenue, Bristol, Connecticut 06010 to be considered timely for purposes of Rule 14a-4(c) under the Exchange Act.

If any shareholder proposes to make any proposal at the 2007 Annual Meeting which proposal will not be included in Bancorp's Proxy Statement for such meeting, such proposal must be received by our Secretary not less than 20 days nor more than 130 days from that date of the 2007 Annual Meeting. The form of proxy distributed by the Board of Directors for such meeting will confer discretionary authority to vote on any such proposal not received by such date. If any such proposal is received by such date, the Proxy Statement for the meeting will provide advice on the nature of the matter and how we intend to exercise our discretion to vote on each such matter.

We have not had a formal process for shareholder communications with the Board of Directors. We have, however, made an effort to ensure that the Board of Directors or individual Directors, if applicable, consider the views of our shareholders. We believe that our responsiveness to shareholder communications to the Board of Directors has been excellent. Shareholders may communicate with the Board of Directors by written communication to Robert L. Messier, Jr., First Valley Bancorp, Inc., Four Riverside Avenue, Bristol, Connecticut 06010.

COST OF SOLICITATION

We will bear the cost of preparing, assembling and mailing the notice, Proxy Statement and proxy for the Annual Meeting. Solicitation of proxies will be primarily through the use of the mails, but our regular employees may solicit proxies by personal contact, by telephone or by telegraph without additional remuneration therefor. Banks, brokerage houses and other institutions, nominees or fiduciaries will be notified and supplied with sufficient copies of proxies, proxy soliciting material and annual reports in order to obtain authorization for the execution of proxies by their beneficial holders. We will, upon request, reimburse banks, brokerage houses and other institutions, nominees and fiduciaries for their reasonable expenses in forwarding proxy material to their beneficial holders. All expenses associated with the solicitation of proxies in the form enclosed will be borne by Bancorp. We will also make arrangements with brokerage firms and other custodians, nominees and fiduciaries to send proxy materials to their principals and will reimburse those parties for their expenses in doing so.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors knows of no other matters to be voted upon at the Annual Meeting. Because we did not receive advance notice of any shareholder proposal in accordance with the time limit specified in Rule 14a-4(c) under the Exchange Act, we will have discretionary authority to vote on any shareholder proposal presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed proxy to vote said proxy in accordance with their judgment on such matters.

ANNUAL REPORT ON FORM 10-KSB

Copies of Bancorp's 2005 Annual Report to Shareholders accompany this Proxy Statement, which are not a part of the proxy solicitation materials. UPON WRITTEN REQUEST, WE WILL PROVIDE WITHOUT CHARGE TO EACH PERSON ENTITLED TO VOTE AT THE ANNUAL MEETING A COPY OF OUR ANNUAL REPORT ON FORM 10-KSB FOR THE YEAR ENDED DECEMBER 31, 2005, INCLUDING THE FINANCIAL STATEMENTS AND SCHEDULES. WRITTEN REQUESTS MUST BE DIRECTED TO:

Robert L. Messier, Jr.

First Valley Bancorp, Inc.

Four Riverside Avenue

Bristol, Connecticut 06010

COPIES OF SAID ANNUAL REPORT ON FORM 10-KSB WILL NOT INCLUDE THE EXHIBITS THERETO, BUT WILL INCLUDE A LIST DESCRIBING THE EXHIBITS NOT INCLUDED, COPIES OF WHICH WILL BE AVAILABLE AT A COST OF ONE DOLLAR PER PAGE.

By Order of the Board of Directors

/ s / Robert L. Messier, Jr.

ROBERT L. MESSIER, JR.

President and Chief Executive Officer

Bristol, Connecticut

April 21, 2006

EXHIBIT A

AUDIT/COMPLIANCE COMMITTEE CHARTER

The Audit/Compliance Committee is a joint committee of First Valley Bancorp, Inc. and its subsidiary Valley Bank. For purposes of this Charter, the term "Bank" shall include Valley Bank and First Valley Bancorp, Inc., its parent holding company, as appropriate.

| Committee Name: | Audit/Compliance Committee |

| Membership: | The Audit/Compliance Committee (the “Committee) shall be comprised of at least three (3) external directors. Each member of the Committee shall satisfy the independence requirements set forth in Section 10A(m) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules adopted by the Securities and Exchange Commission thereunder and The NASDAQ Stock Market, Inc. In addition, at least one member of the Committee shall be an “audit committee financial expert” within the meaning of the Securities and Exchange Commission rules. No member of the Committee shall be an employee of the Bank, and members shall be independent of management and free from any relationship that, in the opinion of the Board of Directors, would interfere with their independent judgment as a member of the Committee. The Executive Vice President/Chief Financial Officer may serve as a management liaison to the Committee. A quorum shall consist of three (3) external directors including alternates. |

| | |

| Chairperson: | David W. Florian |

| | |

| Vice Chairperson: | Edward T. McPhee, Jr. |

The Board of Directors of the Company and the Bank hereby sets forth a Charter for its Committee, with membership and specific responsibilities as outlined below:

Meeting Frequency and Timeframes

The Committee shall meet four (4) or more times per year.

Purpose of the Audit/Compliance Committee

The purpose of the Audit/Compliance Committee is to assist the Board of Directors in fulfilling its oversight responsibilities relating to the :

1. Integrity of the Bank’s financial statements;

2. Bank’s compliance with legal and regulatory requirements;

3. Independent auditor’s qualifications and independence;

4. Performance of the Bank’s internal audit function and independent auditors.

Responsibilities:

The primary responsibility of the Committee is to oversee the Bank’s financial reporting process on behalf of the Board and report the results of their activities to the Board. Management is responsible for preparing the Bank’s financial statements, and the independent accountants are responsible for auditing those statements.

Specifically, the Audit/Compliance Committee will:

| 1. | Hold at least four (4) regularly scheduled meetings each year, and other meetings, which may be scheduled from time to time. A majority shall constitute a quorum of the Committee. A majority of the members in attendance shall decide any question brought before any meeting of the Committee. |

| 2. | Report periodically to the Board of Directors including annually to recommend the appointment of a firm of independent public accountants as the Bank’s independent auditors to be selected to audit the financial statements of the Bank. |

| 3. | Have sole authority to hire, fire, and determine compensation of the independent accountants and internal auditors. |

| 4. | Meet with Bank management to review the external audit engagement letter, which will determine the scope of the proposed audit for the current year and audit procedures to be used. Upon conclusion of the audit, meet with representatives of the independent accountants to review audit findings, comments and recommendations, any recommendations with respect to internal controls and other financial matters, including any perceived weaknesses in internal controls, policies and procedures. In addition, review any significant changes proposed by management in the basic accounting principles and reporting standards used in preparing the Bank’s financial statements. |

| 5. | Meet with Bank management and the internal auditors to discuss the overall scope and plans for their annual audit including compliance. |

| 6. | Pre-approve all audit and permitted non-audit services. |

| 7. | Review the internal audit function at the Bank including the independence and authority of its reporting obligations, the proposed audit plan for the current year, coordination of such plans with the independent accountants, and management’s responses to recommendations made and plans for future audit coverage. |

| 8. | Review from time to time the financial impact of material litigation and related matters. |

| 9. | Review compliance by officers and employees with the Bank’s written Code of Conduct. |

| 10. | Consult with the independent accountants and internal auditors the integrity of the Bank’s financial reporting processes, both internal and external. |

| 11. | Inquire as to the independent accountant’s judgments about the quality and appropriateness of the Bank’s accounting principles as applied in its financial statements. |

| 12. | Consider and approve, if appropriate, major changes to the Bank’s auditing and accounting principles and practices as suggested by the independent accountants, management or the internal auditors. |

| 13. | Review and concur in the appointment, replacement, reassignment or dismissal of the internal auditor. |

| 14. | Conduct or authorize investigations into any matters within the Committee’s scope of responsibilities. The Committee shall be empowered to retain independent counsel and other professionals to assist in the conduct of any investigation. |

| 15. | Establish procedures for submission, receipt, retention and treatment of complaints and concerns regarding internal accounting controls, accounting and audit matters. |

| 16. | Review the interim financial statements (Form 10-QSB) with management and the independent accountants prior to filing. Discuss the results of the independent accountant’s quarterly review and any other matters required to be communicated by the independent accountants to the Committee under generally accepted auditing standards. The chair or another designated member of the Committee may represent the entire Committee for purposes of this review. |

| 17. | Review with management and the independent accountants the annual financial statements to be included in the Bank’s Annual Report (Form 10-KSB) including their judgment about the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements. |

| 18. | Make such other recommendations to the Board on such matters, within the scope of its functions, which may come to its attention and which in its discretion warrant consideration by the Board. |

| 19. | Review and update this Charter at least annually or as conditions dictate, and get approval of the Board of Directors. |

| | 20. | The Committee shall have a clear understanding with management and the independent accountants that the independent accountants are ultimately accountable to the Board and Committee, as representatives of the Bank’s Shareholders. The Committee shall have the ultimate authority and responsibility to evaluate and, where appropriate, recommend the replacement of the independent accountants. The Committee shall discuss with the independent accountants their independence from management and the Bank, and shall consider the compatibility of non-audit services with the accountant’s independence. |

| | 21. | The Audit/Compliance Committee shall be responsible for resolving disputes between Management and the Bank’s Independent Auditor regarding financial reporting. |

Compliance:

Specific to the area of regulatory compliance at the Bank, the Committee will:

| | 1. | Ensure that the Bank is meeting its regulatory compliance policy review of internal audit tests. |

| | 2. | Review the risks associated with the compliance policy. |

| | 3. | Recommend to the Board of Directors the Bank officers to be responsible for administering the various compliance policies (e.g. Bank Secrecy Act Officer, Community Reinvestment Act Officer, Security Officer, Privacy Officer, etc.). |

| | 4. | Review monitoring reports prepared by management for compliance policy adherence. |

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Bank’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the independent accountants.

Performance Standards:

| | 1. | The Audit/Compliance Committee keeps minutes of each meeting, which documents, discussions, recommendations, attendance and follow-up activities. |

2. Each Committee Member respects the confidentiality of the Committee.

| | 3. | Committee member votes, which are not in the majority, should be expressed at Board meetings for the purpose of voting on a Committee approved decision. |

| | 4. | Each Committee Member discloses any potential conflict of interest and removes him/herself from decisions where a potential conflict of interest arises. |

| | 5. | Each Committee Member respects management’s role in carrying out Audit and Compliance Policies and respects Management’s decisions regarding Policy Administration. |

Review and Reassessment of Charter:

The Committee shall review and reassess at least annually the adequacy of this Charter and shall recommend any changes it deems appropriate to the Board.

| Recommended by: | / s / David W. Florian __________________________________ | Dated____________ |

| | Chairperson: David W. Florian | |

| | Audit/Compliance Committee | |

| | | |

Approved by the Board of Directors: | / s / James J. Pryor __________________________________ | Dated____________ |

| | Chairman: James J. Pryor | |

| | Valley Bank and First Valley Bancorp, Inc. Board of Directors | |

| | | |

EXHIBIT B

GOVERNANCE COMMITTEE CHARTER

The Governance Committee is a joint committee of First Valley Bancorp, Inc. and its subsidiary Valley Bank. For purposes of this Charter, the term "Bank" shall include Valley Bank and First Valley Bancorp, Inc., its parent holding company, as appropriate.

| Committee Name: | Governance Committee |

| | |

Membership: | The Governance Committee shall be comprised of at least three (3) outside Directors. Two (2) members of the committee shall constitute a quorum. |

| Chairperson: | David J. Preleski |

| | |

Meeting Frequency and Timeframes

The Governance Committee shall meet during the first quarter each year or more often as required.

Purpose of the Governance Committee

The purpose of the Governance Committee of the Board of Directors is to recommend to the Board proposed Directors, renewal of Directors for terms to the Board of Directors, By-law review and revisions, other governance procedures and other matters as may be appropriate to the Board of Directors. Two (2) members of the committee shall constitute a quorum. A majority of the members in attendance shall decide any question brought before the Committee.

Responsibilities:

| 1. | Review, revise and recommend changes to the Bank’s By-laws to the Board of Directors. |

| 2. | Review Director performance and recommend to the Board of Directors renewal of a Director for the appropriate term during the first quarter each year. A Committee member who is standing for re-appointment must excuse himself/herself from the review and Committee approval process. |

| 3. | Review prospective Directors and make recommendations to the Board of Directors. |

| 4. | Review and recommend Committee Chairpersons and Committee Assignments to the Board of Directors. |

| 5. | Review and recommend Director compensation. |

Committee Performance Standards

| 1. | The Governance Committee keeps minutes of each meeting, which document discussions, recommendations, attendance and follow-up activities. |

| 2. | Each Committee member respects the confidentiality of Committee discussions. |

| 3. | Committee member votes, which are not in the majority, should be expressed at Board meetings for the purpose of voting on a Committee approved decision. |

| 4. | Each Committee member discloses any potential conflict of interest and removes him/herself from discussions where a potential conflict of interest exists. |

| 5. | Each Committee member respects Management’s role in carrying out decisions regarding decisions made by the majority vote of the Committee. |

| Recommended by: | / s / David J. Preleski __________________________________ | Dated____________ |

| | Chairperson: David J. Preleski | |

| | Governance Committee | |

| | | |

Approved by the Board of Directors: | / s / James J. Pryor __________________________________ | Dated____________ |

| Chairperson: James J. Pryor | |

| | Valley Bank and First Valley Bancorp, Inc. Board of Directors | |

| | | |