FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2021

Commission File Number: 001-32458

DIANA SHIPPING INC.

(Translation of registrant's name into English)

Pendelis 16, 175 64 Palaio Faliro, Athens, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ].

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ].

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached to this Report on Form 6-K as Exhibit 99.1 is a press release dated June 1, 2021 of Diana Shipping Inc. (the "Company") announcing that it has mandated Arctic Securities AS and Nordea Bank Abp, Filial i Norge to arrange a series of investor calls that, subject to inter alia market conditions, may be followed by a USD denominated senior unsecured bond issue with five year tenor.

Attached as Exhibit 99.2 is an investor presentation relating to the Company’s previously announced bond offering pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended, redacted to omit certain information pertaining solely to the bond offering transaction.

The information contained in this Report on Form 6-K is hereby incorporated by reference into the Company's registration statement on Form F-3 (File No. 333-225964), filed with the U.S. Securities and Exchange Commission with an effective date of July 26, 2018.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| DIANA SHIPPING INC. | ||

| (registrant) | ||

| Dated: June 1, 2021 | By: | /s/ Anastassis Margaronis |

| Anastassis Margaronis | ||

| President | ||

Exhibit 99.1

| Corporate Contact: | |

| Ioannis Zafirakis | |

| Director, Chief Financial Officer, | |

| Chief Strategy Officer, Treasurer and Secretary | |

| Telephone: + 30-210-9470-100 | |

Email: izafirakis@dianashippinginc.com | |

Website: www.dianashippinginc.com | |

| Investor and Media Relations: | |

| Edward Nebb | |

| Comm-Counsellors, LLC | |

| Telephone: + 1-203-972-8350 | |

Email: enebb@optonline.net | |

DIANA SHIPPING INC. ANNOUNCES FIXED INCOME INVESTOR CALLS

ATHENS, GREECE, June 1, 2021 – Diana Shipping Inc. (NYSE:DSX), (the “Company”), a global shipping company specializing in the ownership of dry bulk vessels, has mandated Arctic Securities AS and Nordea Bank Abp, Filial i Norge to arrange a series of investor calls. Subject to inter alia market conditions, a USD denominated senior unsecured bond issue with five year tenor may follow.

The proceeds from the potential bond issue will be used for refinancing of DIASH01 and for general corporate purposes. In conjunction with the potential bond issue, the Company will consider a conditional buyback of DIASH01 (ISIN: NO0010832868) maturing 27 September 2023.

The senior unsecured bonds, if issued, will be offered in the United States or its territories only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The bonds, if issued, will not be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of Diana Shipping Inc., nor shall it constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

About the Company

Diana Shipping Inc. is a global provider of shipping transportation services through its ownership of dry bulk vessels. The Company’s vessels are employed primarily on medium to long-term time charters and transport a range of dry bulk cargoes, including such commodities as iron ore, coal, grain and other materials along worldwide shipping routes.

Cautionary Statement Regarding Forward-Looking Statements

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words “believe,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect,” “pending” and similar expressions identify forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, Company management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements include the severity, magnitude and duration of the COVID-19 pandemic, including impacts of the pandemic and of businesses’ and governments’ responses to the pandemic on our operations, personnel, and on the demand for seaborne transportation of bulk products; the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand for dry bulk shipping capacity, changes in the Company’s operating expenses, including bunker prices, drydocking and insurance costs, the market for the Company’s vessels, availability of financing and refinancing, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, vessel breakdowns and instances of off-hires and other factors. Please see the Company’s filings with the U.S. Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties. The Company undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Exhibit 99.2

We create to share USD 100 million Senior Unsecured Bond IssueInvestor Presentation June 2021

We create to share 2 Forward Looking Statement Cautionary statement regarding onward-looking statements Matters discussed in this presentation may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.The words “believe,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect,” “pending” and similar expressions identify forward-looking statements.The forward-looking statements in this presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, Dianna Shipping Inc.’s (the “Company”) management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. In addition to these important factors and matters discussed elsewhere herein, important factors that, in its view, could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to the strength of world economies, fluctuations in currencies and interest rates, general market conditions, including fluctuations in charter hire rates and vessel values, changes in demand in the dry-bulk shipping industry, changes in the supply of vessels, including when caused by new newbuilding vessel orders or changes to or terminations of existing orders, and vessel scrapping levels, changes in the Company's operating expenses, including bunker prices, crew costs, drydocking and insurance costs, the Company’s future operating or financial results, availability of financing and refinancing and changes to the Company’s financial condition and liquidity, including the Company’s ability, to pay amounts that it owes and obtain additional financing to fund capital expenditures, acquisitions and other general corporate activities and the Company’s ability to obtain financing and comply with the restrictions and other covenants in the Company’s financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, compliance with governmental, tax, environmental and safety regulation, any non-compliance with the U.S. Foreign Corrupt Practices Act of 1977 (FCPA) or other applicable regulations relating to bribery, the impact of the discontinuance of LIBOR after 2021 on interest rates of any of the Company’s debt that reference LIBOR, the failure of counter parties to fully perform their contracts with the Company, the Company’s dependence on key personnel, adequacy of insurance coverage, the volatility of the price of the Company’s common shares, the Company’s incorporation under the laws of the Marshall Islands and the different rights to relief that may be available compared to other countries, including the United States, general domestic and international political conditions or labor disruptions, acts by terrorists or acts of piracy on ocean-going vessels, the length and severity of the recent COVID-19 outbreak and its impact in the dry-bulk shipping industry, potential disruption of shipping routes due to accidents or political events, and other important factors described from time to time in the reports filed by the Company with the Securities and Exchange Commission, or the SEC, and the New York Stock Exchange, or the NYSE.We have based these statements on assumptions and analyses formed by applying our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. All future written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation, and specifically decline any obligation, except as required by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation supplement might not occur.See the section entitled "Risk Factors" in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, filed with the SEC on March 12, 2021 (the “Annual Report”) for a more complete discussion of these risks and uncertainties and for other risks and uncertainties. The risk factors described in the Annual Report are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. Consequently, there can be no assurance that actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

We create to share 3 Disclaimer ABOUT THIS PRESENTATIONBy reading this presentation (the "Presentation") or attending any meeting or oral presentation held in relation thereto, you (the "Recipient") will be deemed to have (i) agreed to all of the following restrictions and made the following undertakings and (ii) acknowledged that you understand the legal and regulatory sanctions attached to the misuse, disclosure or improper circulation of the Presentation.This Presentation has been prepared by Diana Shipping Inc. ("Diana", the "Company" or "Issuer") solely for the use at an investor presentation related to a contemplated senior unsecured bond issue (the "Issue"). For the purposes of this notice, the Presentation shall mean and include the slides that follow, any oral presentation of the slides by the Company, any question-and-answer session that follows that oral presentation, hard copies of this document and any materials distributed at, or in connection with, that presentation. Nordea Bank AB (publ), filial i Norge and Arctic Securities AS are acting on behalf of the Company as lead arrangers and bookrunners (collectively the "Arrangers").THIS PRESENTATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY THE BONDS TO WHICH THIS PRESENTATION RELATES OR ANY OTHER SECURITIES, NOR SHALL THERE BE ANY OFFER, SOLICITATION OR SALE OF SECURITIES, IN ANY STATE OR OTHER JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL. Neither the U.S. Securities and Exchange Commission, any U.S. state securities commission nor any non-U.S. securities authority or other authority has approved or disapproved of the bonds to which this presentation relates or determined if this Presentation is truthful or complete. Any representation to the contrary is a criminal offense. CONFIDENTIALITYThis Presentation is intended solely for use by the Recipient and is not intended for public use or distribution. By receiving and accepting these materials, the Recipient agrees not to circulate the materials to anyone other than recipient’s counsel, accountants and financial advisers for the purpose of evaluating the information contained in this Presentation and to keep the contents of the materials confidential. LIMITED DUE DILIGENCE INVESTIGATIONSNo formal due diligence investigations have been carried out by or on behalf of the Arrangers. The Arrangers have only carried out certain limited independent investigations in relation to the Company and the Issue. The investigations carried out by or on behalf of the Arrangers have been limited to a confirmatory review of the Company's financial statement, publicly available information and a bring down due diligence call. In particular, no technical verifications, legal, tax or financial due diligence investigations or third party verification of the Company’s financial or legal position, prospects, forecasts and budgets have been carried out by or on behalf of the Arrangers.The Recipient acknowledges and accepts the risks associated with the fact that only limited investigations have been carried out. The Recipient will be required to conduct its own analysis and acknowledges and accepts that it will be solely responsible for its own assessment of the Company, the Issue, the market, the market position of the Company, the Company's funding position, and the potential future performance of the Company's business and securities.U.S. Selling Restrictions: The offer of the bonds to which this presentation relates have not been, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state of the United States or other jurisdiction, and may not be offered or sold absent registration or an applicable exemption from registration requirements under the Securities Act or any state or other jurisdiction’s securities laws. Any such securities will be sold only to qualified institutional buyers in the United States in reliance on Rule 144A under the Securities Act and to persons outside the United States in reliance on Regulation S under the Securities Act. Purchasers of such securities will be deemed to have made certain acknowledgments, representations and warranties, including, in the case of purchasers in the United States, that such purchaser is a qualified institutional buyer. Prospective purchasers should be aware that they may be required to bear the financial risks of this investment for an indefinite period of time.NO REPRESENTATION OR WARRANTY / DISCLAIMER OF LIABILITYNone of the Company or the Arrangers, or any of their respective parent or subsidiary undertakings or affiliates, or any directors, officers, employees, advisors or representatives of any of the aforementioned (collectively "Representatives") make any representation or warranty (express or implied) whatsoever as to the accuracy, completeness or sufficiency of any information contained herein, and nothing contained in this Presentation is or can be relied upon as a promise or representation by the Company or the Arrangers, or any of their respective Representatives.

We create to share 4 Disclaimer (cont.) None of the Company or the Arrangers, or any of their respective Representatives shall have any liability whatsoever (in negligence or otherwise) arising directly or indirectly from the use of this Presentation or its contents or otherwise arising in connection with the Issue, including but not limited to any liability for errors, inaccuracies, omissions or misleading statements in this Presentation.Neither the Company nor the Arrangers have authorised any other person to provide investors with any other information related to the Issue or the Company, and neither the Company nor the Arrangers will assume any responsibility for any information other persons may provide.None of the Company or the Arrangers, or any of their respective Representatives, has taken any actions to allow the distribution of this Presentation in any jurisdiction where action would be required for such purposes. The Presentation has not been registered with, or approved by, any public authority, stock exchange or regulated market. The distribution of this Presentation, as well as any subscription, purchase, sale or transfer of securities of the Company may be restricted by law in certain jurisdictions, and the recipient of this Presentation should inform itself about, and observe, any such restriction. Any failure to comply with such restrictions may constitute a violation of the laws of any such jurisdiction. None of the Company or the Arrangers, or any of their respective Representatives, shall have any responsibility or liability whatsoever (in negligence or otherwise) arising directly or indirectly from any violations of such restrictions. Neither the Company nor the Arrangers have authorised any offer of securities to the public, or has undertaken or plans to undertake any action to make an offer of securities to the public requiring the publication of an offering prospectus in any member state of the European Economic Area which has implemented the EU Prospectus Directive 2003/71/EC, other than as specifically addressed in this Presentation.In the event that this Presentation is distributed in the United Kingdom, it shall be directed only at persons who are either "investment professionals" for the purposes of Article 19(5) of the UK Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or high net worth companies and other persons to whom it may lawfully be communicated in accordance with Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "Relevant Persons"). Any person in the United Kingdom who is not a Relevant Person must not act or rely on this Presentation or any of its contents. Any investment or investment activity to which this Presentation relates will in the United Kingdom be available only to Relevant Persons and will be engaged in only with Relevant Persons. This Presentation is not a prospectus for the purposes of Section 85(1) of the UK Financial Services and Markets Act 2000, as amended ("FSMA"). Accordingly, this Presentation has not been approved as a prospectus by the UK Financial Conduct Authority ("FCA") under Section 87A of FSMA and has not been filed with the FCA pursuant to the UK Prospectus Rules nor has it been approved by a person authorised under FSMA.The Recipient warrants and represents that (i) if it is located within the United States and/or is a U.S. person, it is a QIB, (ii) if it is a resident of or otherwise located in the United Kingdom, it is a Relevant Person. NEITHER THIS PRESENTATION NOR ANY COPY OF IT MAY BE TAKEN, TRANSMITTED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, HONG KONG OR SOUTH AFRICA. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF UNITED STATES, AUSTRALIAN, CANADIAN, JAPANESE, HONG KONG OR SOUTH AFRICAN SECURITIES LAWS. THE PRESENTATION IS ALSO NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION IN ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION NOR SHOULD IT BE TAKEN OR TRANSMITTED INTO SUCH JURISDICTION AND PERSONS INTO WHOSE POSSESSION THIS PRESENTATION COMES SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH RELEVANT LAWS. GOVERNING LAW AND JURISDICTIONThis Presentation is subject to Norwegian law, and any dispute arising in respect of this Presentation is subject to the exclusive jurisdiction of Norwegian courts.

We create to share 5 Summary of Risk Factors The below bullets summarize some of the principal risk factors related to an investment in our Company. Industry Specific Risk Factors Charter hire rates for dry bulk carriers are volatile, which may adversely affect our earnings, revenue and profitability and our ability to comply with our loan covenants. The current state of the global financial markets and current economic conditions may adversely impact our results of operation, financial condition, cash flows, and ability to obtain additional financing or refinance our existing and future credit facilities on acceptable terms which may negatively impact our business. The U.K.’s withdrawal from the European Union may have a negative effect on global economic conditions, financial markets and our business. Regulations relating to ballast water discharge may adversely affect our revenues and profitability. An over-supply of dry bulk carrier capacity may prolong or further depress the current low charter rates and, in turn, adversely affect our profitability. Outbreaks of epidemic and pandemic diseases, including COVID-19, and governmental responses thereto could adversely affect our business. Our operating results are subject to seasonal fluctuations, which could affect our operating results. An increase in the price of fuel may adversely affect our profits. We are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business. The operation of dry bulk carriers has certain unique operational risks which could affect our earnings and cash flow. If our vessels call on ports located in countries or territories that are the subject of sanctions or embargoes imposed by the U.S. government, the European Union, the United Nations, or other governmental authorities, it could lead to monetary fines or penalties and may adversely affect our reputation and the market for our securities. We conduct business in China, where the legal system is not fully developed and has inherent uncertainties that could limit the legal protections available to us. Failure to comply with the U.S. Foreign Corrupt Practices Act could result in fines, criminal penalties and an adverse effect on our business. Changing laws and evolving reporting requirements could have an adverse effect on our business. Company Specific Risk Factors The market values of our vessels have declined in recent years and may further decline, which could limit the amount of funds that we can borrow and could trigger breaches of certain financial covenants contained in our loan facilities, which could adversely affect our operating results, and we may incur a loss if we sell vessels following a decline in their market values. We charter some of our vessels on short-term time charters in a volatile shipping industry and a decline in charter hire rates could affect our results of operations and our ability to pay dividends. Our investment in Diana Wilhelmsen Management Limited may expose us to additional risks. A cyber-attack could materially disrupt our business. Climate change and greenhouse gas restrictions may adversely impact our operations and markets. Increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks. Our earnings may be adversely affected if we are not able to take advantage of favorable charter rates. We cannot assure you that we will be able to refinance indebtedness incurred under our loan facilities. We are subject to certain risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations could cause us to suffer losses or otherwise adversely affect our business. In the highly competitive international shipping industry, we may not be able to compete for charters with new entrants or established companies with greater resources, and as a result, we may be unable to employ our vessels profitably. We recently underwent a transition with respect to certain of our directors and executive officers and this transition, along with the possibility that we may in the future be unable to retain and recruit qualified key executives, key employees or key consultants, may delay our development efforts or otherwise harm our business. Technological innovation and quality and efficiency requirements from our customers could reduce our charterhire income and the value of our vessels. We may not have adequate insurance to compensate us if we lose our vessels or to compensate third parties. Our vessels may suffer damage and we may face unexpected drydocking costs, which could adversely affect our cash flow and financial condition. We are exposed to U.S. dollar and foreign currency fluctuations and devaluations that could harm our reported revenue and results of operations. Volatility of LIBOR and potential changes of the use of LIBOR as a benchmark could affect our profitability, earnings and cash flow. We depend upon a few significant customers for a large part of our revenues and the loss of one or more of these customers could adversely affect our financial performance. Because we are organized under the laws of the Marshall Islands, it may be difficult to serve us with legal process or enforce judgments against us, our directors or our management. We may have to pay tax on U.S. source income, which would reduce our earnings. U.S. federal tax authorities could treat us as a “passive foreign investment company”, which could have adverse U.S. federal income tax consequences to U.S. shareholders.

We create to share 6 Summary of Risk Factors Risks Relating to Our Common Stock Our board of directors has suspended the payment of cash dividends on our common stock. We cannot assure you that our board of directors will reinstate dividend payments in the future, or when such reinstatement might occur. The market price of our common stock has fluctuated widely and may fluctuate widely in the future, and there is no guarantee that there will continue to be an active and liquid public market for you to resell our common stock in the future. Since we are incorporated in the Marshall Islands, which does not have a well-developed body of corporate law, you may have more difficulty protecting your interests than shareholders of a U.S. corporation. Certain existing shareholders will be able to exert considerable control over matters on which our shareholders are entitled to vote. Future sales of our common stock could cause the market price of our common stock to decline. Anti-takeover provisions in our organizational documents could make it difficult for our shareholders to replace or remove our current board of directors or have the effect of discouraging, delaying or preventing a merger or acquisition, which could adversely affect the market price of our common stock. Our Series B Preferred Shares are senior obligations of ours and rank prior to our common shares with respect to dividends, distributions and payments upon liquidation, which could have an adverse effect on the value of our common shares. Risks Relating to Our Series B Preferred Stock We may not have sufficient cash from our operations to enable us to pay dividends on our Series B Preferred Shares following the payment of expenses and the establishment of any reserves. The Series B Preferred Shares represent perpetual equity interests. Our Series B Preferred Shares are subordinate to our indebtedness, and your interests could be diluted by the issuance of additional preferred shares, including additional Series B Preferred Shares, and by other transactions. We may redeem the Series B Preferred Shares, and you may not be able to reinvest the redemption price you receive in a similar security. Market interest rates may adversely affect the value of our Series B Preferred Shares. As a holder of Series B Preferred Shares you have extremely limited voting rights.

We create to share 7 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

We create to share 8 Leading pure play dry bulk carrier company Leading dry bulk company with scale and track record through shipping cyclesModern fleet of 37 dry bulk carriers (~4.7 million DWT) with a weighted average age of ~10.2 yearsThe fleet comprises of 11 groups of sister ships (Panamax - Newcastlemax) providing flexibility and cost efficienciesIn-house commercial operations and fleet management through wholly owned Diana Shipping Services S.A. and the joint venture Diana Wilhelmsen Management LimitedDiana has established strong relationships with high quality charterers and leading shipping banks Conservative balance sheet strategy leading to solid financial position Book Equity Ratio of 49%Low overall gearing on vessels (net LTV 38%)** – net debt to recycling value of 91%**No speculative charter-in and no committed expansion capex – low cash break even compared to peers7*** vessels (19% of the fleet) with a total market value** of USD 106 million are currently unencumbered, providing flexibility and comfort to senior unsecured debt holdersLong term and disciplined balance sheet strategy resulting in no restructuring at any point in the cycle nor any dilution to shareholdersPrudent debt management with recent refinancing pushing maturities out in time as most recently demonstrated by a USD 91 million Sustainability-Linked refinancing with ABN AMRO Continued improving market fundamentals Positive market fundamentals becoming evident through a strong recovery in the chartering market with rates well above cash break even levelsCharters on legacy low(er) COVID rates will expire during the next quarters and new charters are likely to set at higher rates given the current market conditionOperating a high-quality, diversified fleet in the most liquid secondhand shipping market Experienced management team with proven access to capital markets Listed on NYSE since March 2005 with a market capitalization of USD ~404 million*Experienced management team with long term approach and average of more than 32 years of industry experienceOfficers and directors has a substantial ownership with around 34% Proven track record in the capital markets exemplified through raising gross proceeds of USD 309 million through Preferred Shares, Unsecured Notes and Common Share issuance during the last downcycle (since 2014) 1 2 3 4 5 6 7 Credit Highlights Note(*): Factset May 27, 2021Note (**) Net debt per March 31, 2021 // recycling value and market value from Vesselsvalue.com as per May 27, 2021Note (***) unencumbered vessel, MV Naias, has been sold and is expected to be delivered to her new owners at the latest by July 30, 2021

We create to share 9 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

AnastasiosMargaronis SemiramisPaliou IoannisZafirakis Eleftherios Papatrifon Director & President Director &Chief Executive Officer Director,Chief Financial Officer,Chief Strategy Officer, Secretary & Treasurer Chief Operating Officer Company’s confidence stems from our established track record We create to share 10 Presenting Team

inspires our people and creates value for the future… 1999 2001 2005 2007 2020 Creating a purposelybuilt companyto fit public shareholders needs Fosteringthe transitionto public listing …partnering with major European bank NYSE IPO…access to capital markets Highest marketcapitalization …$3.33 bn on October 29, 2007 Solid base to take advantageof the challenges ahead We create to share 11 1972 1986 Founding yearback in 1972 by ourDirector and Chairman,Symeon Palios Successfully survived the deepest and longest post war shipping crisis Strong capital market track record combined with immaculate track with all financing providers - Diana Shipping Inc. has not failed on a single debt obligation Our legacy preserves our culture Source: Company Information

Diana’s key points 37 vesselsON THE WATER 7 vesselsMORTGAGE FREE* 11 Groups OF SISTER VESSELS 98.6% AVERAGE FLEET UTILIZATION (Q1-2021) CARRYINGCAPACITY MIL DWT 4.7 OF CARGO CARRIED IN 2020 MIL TONES 38.8 USDm 135.2 SECURED REVENUES*** USDm 86.0 OF CASH AT BANK** 91% NET DEBT/RECYCLING VALUE** We create to share 12 Source: Company InformationNote (*) As of May 14, 2021; 1 unencumbered vessel, MV Naias, has been sold and is expected to be delivered to her new owners at the latest by July 30, 2021 Note (**) Net debt per March 31, 2021 // Recycling value and market value from Vesselsvalue.com as per May 27, 2021Note (***) As of May 18, 2021 38% NET DEBT/MARKET VALUE**

Focusing on a high-quality fleet to ensure operational excellence 37 vessels with a weighted average age of 10.2 years* 4.7 MIL DWTCARRYING CAPACITY Top quality operational platform even in a down market ...with a strategic joint venture to ensure best-in-class operations We create to share 13 3rd Party Benchmark Average Utilisation (2005-2020) = 99.1% Source: Company Information, Clarksons SINNote (*) As of May 14, 2021 No. of vessels operated 8,0007,0006,0005,0004,0003,0002,0001,0000

Chartering Activity year-to-date FY 2021 VESSEL TYPE BUILT RATE Q2/20 Q3/20 Q4/20 Q1/21 Q2/21 Q3/21 Q4/21 Q1/22 Q2/22 Salt Lake City Capesize 2005 $13,000 Protefs Panamax 2004 $10,650 Philadelphia Newcastlemax 2012 $28,500 Electra Post-Panamax 2013 $19,575*** San Francisco Newcastlemax 2017 $22,541*** Aliki Capesize 2005 $20,500 Santa Barbara Capesize 2015 $17,250 Astarte Kamsarmax 2013 $25,000 Myrsini Kamsarmax 2010 $27,750 Ismene Panamax 2013 $16,500 Semirio Capesize 2007 $13,500 Calipso Panamax 2005 $10,400 Naias Panamax 2006 $13,154** Secured charters on 13 vessels*7 Panamax/Kamsarmax/Post-Panamax vessels chartered at a weighted average daily rate of $16,571 for a remaining average period of 169 days per vessel.**6 Capesize/Newcastlemax vessels chartered at a weighted average daily rate of $18,896 for a remaining average period of 244 days per vessel.** We create to share 14 Note (*) As of May 18, 2021Note (**) Earliest redelivery dateNote (***) Average rate of consecutive charters YTDSource: Company’s filings with the U.S. Securities and Exchange Commission

VESSEL TYPE BUILT RATE CHARTERER Q3/20 Q4/20 Q1/21 Q2/21 Q3/21 Q4/21 Q1/22 New York Capesize 2010 $14,000 EGPN Bulk Carrier Salt Lake City Capesize 2005 $13,000 C Transport Protefs Panamax 2004 $10,650 Reachy Philadelphia Newcastlemax 2012 $28,500 Classic Electra Post-Panamax 2013 $21,000 Tongli New Orleans Capesize 2015 $15,500 NYK Line Aliki Capesize 2005 $20,500 Solebay San Francisco(1) Newcastlemax 2017 $24,700 Olam Medusa Kamsarmax 2010 $11,000 Cargill Santa Barbara Capesize 2015 $17,250 Cargill Artemis Panamax 2006 $10,250 Glencore Astarte Kamsarmax 2013 $25,000 MOL Newport News Newcastlemax 2017 $18,400 Koch Polymnia Post-Panamax 2012 $12,100 CLdN Cobelfret SA Ismene Panamax 2013 $16,500 Tongli Myrsini Kamsarmax 2010 $27,750 Bocimar Semirio Capesize 2007 $13,500 SwissMarine Pte. Los Angeles Newcastlemax 2012 $14,250 Engelhart CTP G. P. Zafirakis Capesize 2014 $13,200 Koch Seattle Capesize 2011 $12,300 Pacbulk Shipping Calipso Panamax 2005 $10,400 Viterra Baltimore Capesize 2005 $13,000 Koch Leto Panamax 2010 $9,000 Cargill Atalandi Panamax 2014 $9,300 Uniper Selina Panamax 2010 $11,000 ST Shipping Houston Capesize 2009 $12,400 C Transport Maera Panamax 2013 $8,600 Glencore Myrto Kamsarmax 2013 $10,000 Cargill Crystalia Panamax 2014 $8,750 Glencore Naias(2) Panamax 2006 $25,000 Nasshipping Boston Capesize 2007 $15,300 Oldendorff P.S. Palios Capesize 2013 $12,050 C Transport Phaidra Post-Panamax 2013 $9,400 Uniper Amphitrite Post-Panamax 2012 $10,250 SwissMarine Pte. Melia Panamax 2005 $10,000 Cargill Maia Kamsarmax 2009 $11,200 Aquavita Alcmene Post-Panamax 2010 $8,500 Cargill Oceanis(3) Panamax 2001 $9,200 Phaethon Sideris GS(4) Capesize 2006 $12,700 Oldendorff Coronis(5) Panamax 2006 $8,000 Koch Average 2010 $14,085 Employment Strategy Source: Company Information Non-speculative & disciplined employment (1)The charter rate is $17,750 per day for the first one hundred five (105) days of the charter period. (2)Vessel sold and expected to be delivered to her new owners at the latest by July 30, 2021.(3)Vessel sold and delivered to her new owners on March 15, 2021.(4)Vessel sold and delivered to her new owners on January 20, 2021.(5)Vessel sold and delivered to her new owners on January 13, 2021.(6)As of May 18, 2021 Fixed Period Previous Charter Period Average contract duration1.01 years Secured Revenues $135.2m(6) for the year 2021 We create to share 15 Committed to a conservative chartering strategy since inception Medium to long-term time charters which are spread out to avoid clustered maturitiesThe strategy provides earnings visibility and strengthens resilience to market downturns Average Daily TC Rate of Fixed Revenues$13,936(6) For FY 2021

Strong relationships with members of the shipping and financial industry We create to share 16 Source: Company Information & others: Flag administrations | Investors | Recognized organizations | P&I Clubs | Port authorities | Manning agents Financial institutions Charterers Shipyards Classification Societies

Diana ESG Framework We create to share 17 Prioritising Sustainable Development GoalsDiana Shipping Inc. uses double materiality assessments of ESG topics to ensure diligent follow-up of issues relevant to our business and to the areas of the world we operate in, i.e. SDG 4, 5, 13, and 14. Transparent and market leading reporting of ESG issuesDiana Shipping Inc. applies the Marine Transportation framework of the Sustainability Accounting Standards Board when reporting its ESG performance by publishing an annual Sustainability report as well as following the Poseidon principles reporting rulesJoint action and trainingDiana Shipping Inc. is an active member of the Hellenic Marine Environment Protection Association (HELMEPA) – promoting education and initiatives involving ship owners and seafarers to prevent ship-generated pollution and promote safety at seaRobust governance practicesDiana Shipping Inc. has voluntarily adopted several NYSE governance practices, such as having a majority of independent directors, establishing audit, compensation, sustainability and nominating committees and adopting a Code of Ethics.Recent initiativesImplement digital sustainability solutions across its managed fleet through and agreement with American Bureau of ShippingSigned as Sustainability-Linked loan for 6 vessels demonstrating Company’s commitment towards its long-term sustainability goalsModernized its fleet through sale of older vessels improving the fleets emission efficiencyMateriality assessment with The Governance Group (“TGG”): Since October 2020 TGG assists Diana Shipping Inc. in preparing its ESG reports. Lately, on April 26, 2021 we also engaged TGG to conducted stakeholder interviews and prepare a materiality analysis based on the GRI standard to be used in Diana Shipping‘s prioritization of ESG issues. Source: Company Information

We create to share 18 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

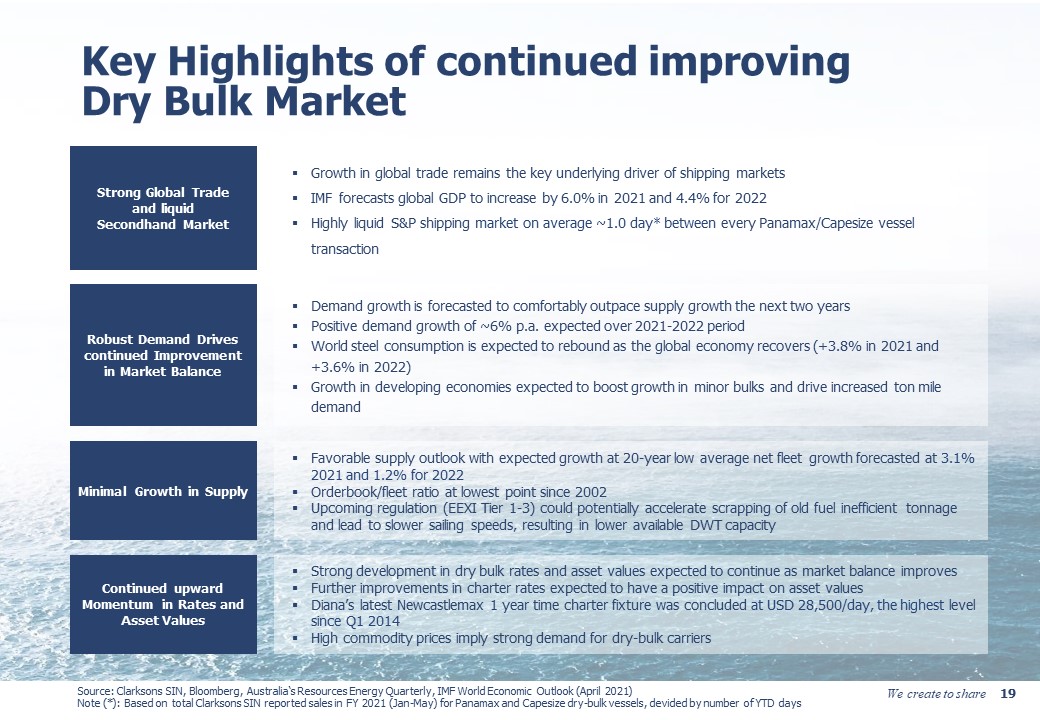

We create to share 19 Strong Global Tradeand liquidSecondhand Market Growth in global trade remains the key underlying driver of shipping marketsIMF forecasts global GDP to increase by 6.0% in 2021 and 4.4% for 2022Highly liquid S&P shipping market on average ~1.0 day* between every Panamax/Capesize vessel transaction Robust Demand Drives continued Improvement in Market Balance Demand growth is forecasted to comfortably outpace supply growth the next two yearsPositive demand growth of ~6% p.a. expected over 2021-2022 periodWorld steel consumption is expected to rebound as the global economy recovers (+3.8% in 2021 and +3.6% in 2022) Growth in developing economies expected to boost growth in minor bulks and drive increased ton mile demand Minimal Growth in Supply Favorable supply outlook with expected growth at 20-year low average net fleet growth forecasted at 3.1% 2021 and 1.2% for 2022Orderbook/fleet ratio at lowest point since 2002Upcoming regulation (EEXI Tier 1-3) could potentially accelerate scrapping of old fuel inefficient tonnage and lead to slower sailing speeds, resulting in lower available DWT capacity Continued upward Momentum in Rates and Asset Values Strong development in dry bulk rates and asset values expected to continue as market balance improvesFurther improvements in charter rates expected to have a positive impact on asset valuesDiana’s latest Newcastlemax 1 year time charter fixture was concluded at USD 28,500/day, the highest level since Q1 2014High commodity prices imply strong demand for dry-bulk carriers Key Highlights of continued improving Dry Bulk Market Source: Clarksons SIN, Bloomberg, Australia‘s Resources Energy Quarterly, IMF World Economic Outlook (April 2021)Note (*): Based on total Clarksons SIN reported sales in FY 2021 (Jan-May) for Panamax and Capesize dry-bulk vessels, devided by number of YTD days

We create to share 20 Dry Bulk – Time Charter Earnings Source: Clarksons SIN Strong momentum in time charter rates post COVID-19 dip 5,0004,5004,0003,5003,0002,5002,0001,5001,0005000 30,00025,00020,00015,00010,0005,0000

Dry Bulk - Asset Prices Source: Arctic Securities Research, Bloomberg Strong momentum in time charter rates is also reflected in rising asset prices We create to share 21

We create to share 22 5.0% 8.5% 4.2% 11.6% CAGR (2000-f2021) Dry Bulk – Demand long-term growth Source: Clarksons SIN Commodity demand tends to correlate with economic growth 50,00045,00040,00035,00030,00025,00020,00015,00010,0005,0000

Dry Bulk – Demand drivers, short-term Source Arctic Securities Research, Bloomberg as of May 31, 2021 Commodity prices have recorded significant gains since Q4/20 as a rebound in economic growth has spurred demand for energy, steel and other commodity-related economic drivers For shipping, strong commodity prices reflect strong demand We create to share 23

Dry Bulk - Supply Source: Clarksons SIN orderbook is at a historical low The dry bulk orderbook is at a 20-year low point, total orderbook in % of total fleet is <6% Limited fleet growth going forward; estimated dry bulk fleet growth of 3.1% in 2021 and 1.2% in 2022 We create to share 24

Dry Bulk – Fleet Age and Scrapping Source: Arctic Securities Research, Bloomberg Average dry-bulk world fleet is around 10 years; new regulation will accelerate scrapping We create to share 25 3.02.52.01.51.00.50.0

Dry Bulk – FFAs Source: Braemar Atlantic Securities as of May 31, 2021 - mid FFA Attractive supply & demand picture is reflected in firm FFAs We create to share 26 40,00035,00030,00025,00020,00015,00010,0005,0000 January 2021 FFA levels Capesize: USD 14,500 per dayPanamax: USD 12,138 per day

We create to share 27 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

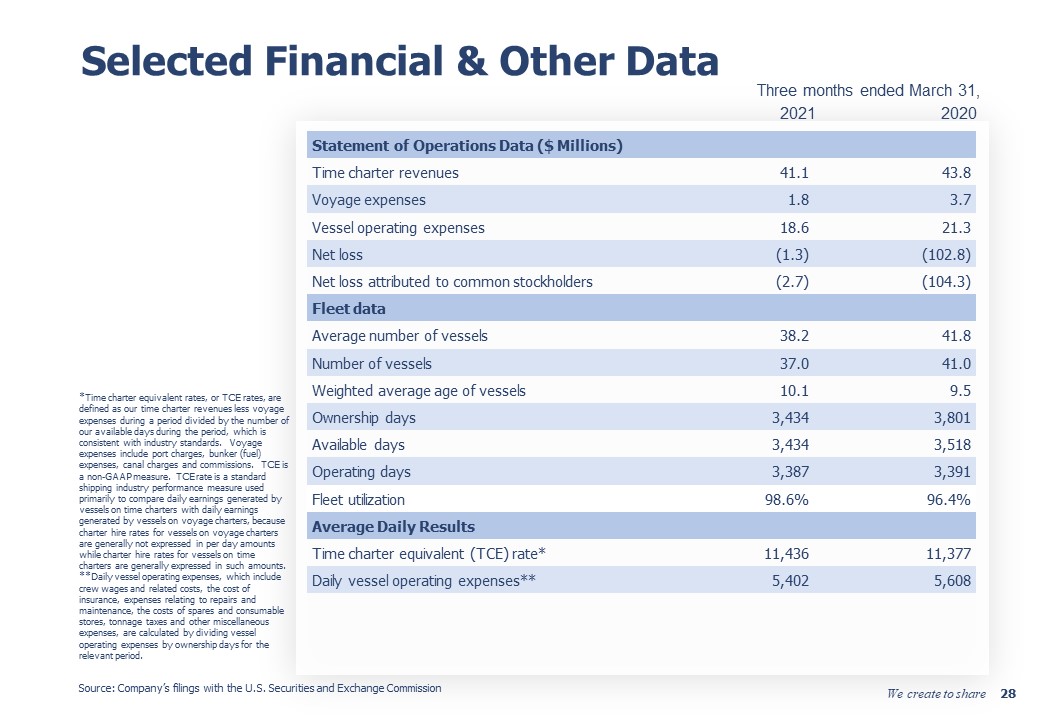

We create to share 28 Statement of Operations Data ($ Millions) Time charter revenues 41.1 43.8 Voyage expenses 1.8 3.7 Vessel operating expenses 18.6 21.3 Net loss (1.3) (102.8) Net loss attributed to common stockholders (2.7) (104.3) Fleet data Average number of vessels 38.2 41.8 Number of vessels 37.0 41.0 Weighted average age of vessels 10.1 9.5 Ownership days 3,434 3,801 Available days 3,434 3,518 Operating days 3,387 3,391 Fleet utilization 98.6% 96.4% Average Daily Results Time charter equivalent (TCE) rate* 11,436 11,377 Daily vessel operating expenses** 5,402 5,608 Three months ended March 31, 2021 2020 Selected Financial & Other Data Source: Company’s filings with the U.S. Securities and Exchange Commission *Time charter equivalent rates, or TCE rates, are defined as our time charter revenues less voyage expenses during a period divided by the number of our available days during the period, which is consistent with industry standards. Voyage expenses include port charges, bunker (fuel) expenses, canal charges and commissions. TCE is a non-GAAP measure. TCE rate is a standard shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per day amounts while charter hire rates for vessels on time charters are generally expressed in such amounts. **Daily vessel operating expenses, which include crew wages and related costs, the cost of insurance, expenses relating to repairs and maintenance, the costs of spares and consumable stores, tonnage taxes and other miscellaneous expenses, are calculated by dividing vessel operating expenses by ownership days for the relevant period.

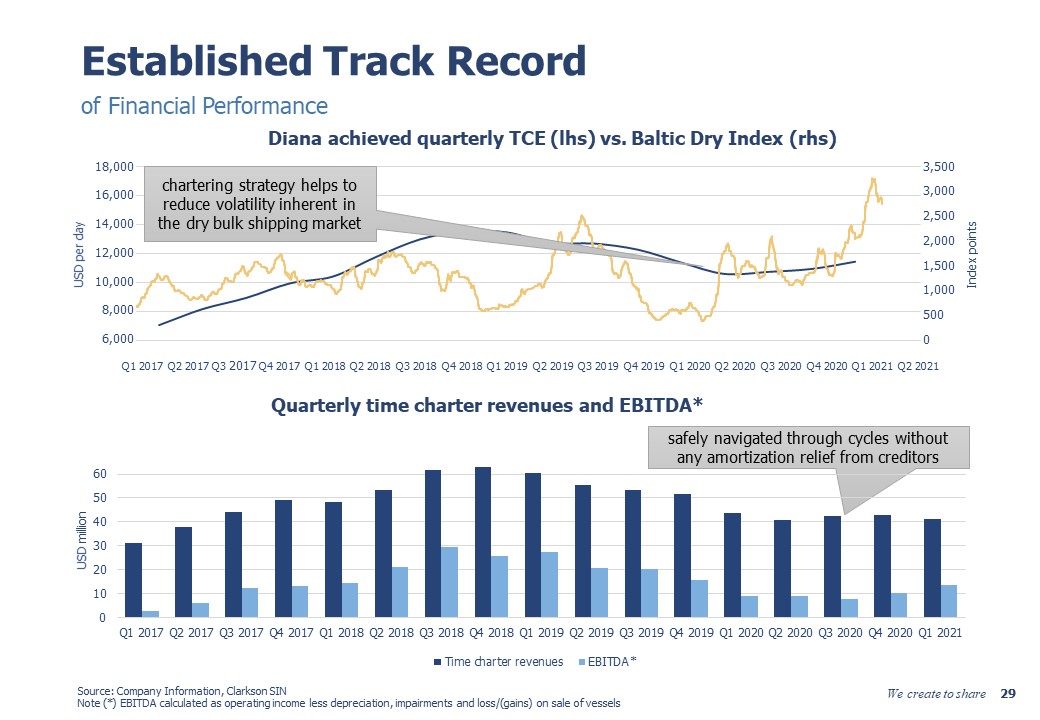

We create to share 29 Diana achieved quarterly TCE (lhs) vs. Baltic Dry Index (rhs) Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Quarterly time charter revenues and EBITDA* Established Track Record Source: Company Information, Clarkson SINNote (*) EBITDA calculated as operating income less depreciation, impairments and loss/(gains) on sale of vessels chartering strategy helps to reduce volatility inherent in the dry bulk shipping market safely navigated through cycles without any amortization relief from creditors of Financial Performance * 18,00016,00014,00012,00010,0008,0006,000 3,5003,0002,5002,0001,5001,0005000

Loan amortization profile as of Q1 2021 adjusted for ABN AMRO sustainability-linked loan and Senior Unsecured bond refinancing 2nd Nordea extension option Note(*): If 1st extension option of Nordea facility is exercisedNote (**) If 2nd extension option of Nordea facility is exercisedNote (***) As per 2020 20-F Proven track record in the capital markets exemplified through raising gross proceeds of USD 309 million through Preferred Shares, Unsecured Notes and Common Share issuance from 2014-2018Prudent debt management with recent refinancing pushing maturities out in time as most recently demonstrated by a USD 91 million Sustainability-Linked refinancing with ABN AMROStaggered debt maturity profile and no committed expansion capexEstablished strong relationships with leading international shipping banks and export credit agenciesMargin under the secured bank facilities range from 1.65% - 2.50%*** Borrowing split per 31st May 2021 (includes ABN AMRO sustainability linked loan) Senior Secured debt Senior Unsecured debt Conservative Financial Profile We create to share 30 Prudent debt management with recent refinancing pushing maturities out in time as most recently demonstrated by a USD 91 million Sustainability-Linked refinancing with ABN Amro 1st Nordea extension option

Note (*) Net debt per 31st March and market value from Vesselsvalue.com as per May 27, 2021Source: Clarksons SIN & Company Has utilized strong markets to reduce leverage and strengthen the balance sheetStrong focus on liquidity during the downturnWith a firming market, credit metrics are set to rebound rapidly on the back of market improvement and overall low financial gearing Cash vs. debt through the cycles As of Q1 2021, net debt/market value of38%* Consistently prudent Capital Management Maintaining a sound financial profile through the cycle We create to share 31 60,00050,00040,00030,00020,00010,0000 Net debt to vessels’ net value vs. Diana TCE and Baltic Dry Index

We create to share 32 Modest All-in Breakeven Costs Wholly-owned ship management company, providing cost-efficient in-house technical managementStrategic joint venture with Wilhelmsen ensuring best-in-class operations and effectively serves as a benchmarkCombination of Greek and Filipino officers, and mainly Filipino crew, keep operating efficiency high and costs lowNo substantial fuel exposure: bunker expenses paid by the charterer under time charter agreements Low OPEX with quality operational platform Free Cash Flow Breakeven of $12,350 Note (*) As of March 31, 2021Note (**) For the remaining of the year, also includes water ballast treatment system capital expenditures.Note (***) As of March 31, 2021, adjusted for non-cash items. Includes management fees to Diana Wilhelmsen Management Limited.Source: Company Information 7,0006,0005,0004,0003,0002,0001,0000

We create to share 33 Note (*) From May 18, 2021Note (**) As of March 31, 2021 (reference slide Free Cash Flow Breakeven)Note (***) Assumes vessels fixed for 12 months upon redelivery to owners from previous charterNote (****) As of May 10, 2021Note (*****) As of May 18, 2021Source: Company Information Estimated Cash Uses vs. TC Revenues Daily Estimated Cash Uses vs. Daily TC Revenues Panamax Kamsarmax Post-Panamax Capesize Newcastlemax Q2 2021 $26,204 $27,540 $26,204 $41,214 $49,457 Q3 2021 $23,873 $25,209 $23,873 $33,595 $40,314 Q4 2021 $20,929 $22,265 $20,929 $27,821 $33,385 Q1 2022 $15,650 $16,986 $15,650 $16,264 $19,517 Q2 2022 $17,164 $18,500 $17,164 $20,286 $24,343 Q3 2022 $16,021 $17,357 $16,021 $24,429 $29,315 Q4 2022 $15,671 $17,007 $15,671 $23,507 $28,208 FFA rates**** used for the unfixed revenues calculation Average Daily TC Rate of Fixed Revenues$13,936***** for 72% of 2021 Breakeven vs Estimated Revenue for the remaining of 2021* Several existing COVID legacy charters will expire during the next quarters and new charters are likely to set at higher rates given the current market conditions 20,00018,00016,00014,00012,00010,0008,0006,0004,0002,0000

�� We create to share 34 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

Leading pure play dry bulk carrier company … with a disciplined strategy We create to share 35 Legacy Experienced and creative management team, energetic and ready to deliver on the challenges of the shipping industry Solid balance sheet High reputation in the shipping community Strong relationships in the shipping cluster Listed on NYSE since March 2005 Consistent non-speculative and disciplined employment strategy targeting quality counterparts Managing the fleet growth and composition in a disciplined manner Utilizing strong markets to reduce leverage and strengthen the balance sheet, no restructuring at any time in the cycle Focusing on a modernhigh quality fleet to ensure efficient operations Excellent ongoing engagement with our stakeholders Source: Company Information Diana Shipping Inc.’s Summary

We create to share 36 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

Risk Factors (1/7) We create to share 37 General Investing in bonds and other securities issued by the Issuer involves inherent risks. As the Issuer is the parent company of the Group, the risk factors for the Issuer and the Group are deemed to be equal for the purpose of this Presentation. Prior to any decision to invest in the Bonds, potential investors should carefully read and assess the following specific risks and the other information contained in this presentation. An investment in the bonds is suitable only for investors who understand the risk factors associated with this type of investment and who can afford a loss of all or part of their investment. The risks and uncertainties described in this section "Risk Factors" are the material known risks and uncertainties faced by the Group as of the date hereof that the Issuer believes are the material risks associated with this type of investment. The primary risk factors in connection with an investment in the Bonds are described below. The description below is not exhaustive and the sequence of the risk factors is not set out according to importance. A prospective investor should carefully consider the factors set out below and elsewhere in this Presentation, including but not limited to the cost structure for both the Issuer and the investors, as well as the investors' current and future tax position.The absence of negative past experience associated with a given risk factor does not mean that the risks and uncertainties in that risk factor are not genuine and potential threats, and they should therefore be considered prior to making an investment decision. The Issuer’s risk exposure is analyzed and evaluated to ensure sound internal control and appropriate risk management based on the Issuer’s values, policies and code of ethics. If any of the following risks were to materialize, either individually, cumulatively or together with other circumstances, it could have a material adverse effect on the Group and/or its business, results of operations, cash flows, financial condition and/or prospects, which may cause a decline in the value and trading price of the Bonds, resulting in loss of all or part of an investment in the Bonds. The factors affecting the supply and demand for vessels are outside of the Issuer’s control, and the nature, timing and degree of changes in industry conditions are unpredictable.The below described risk factors are supplemented by the risks described under the heading “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2020 that summarize the risks that may materially affect the Issuer's business.

Risk Factors (2/7) We create to share 38 Industry Specific Risk Factors Charter hire rates for dry bulk carriers are volatile, which may adversely affect our earnings, revenue and profitability and our ability to comply with our loan covenants. The current state of the global financial markets and current economic conditions may adversely impact our results of operation, financial condition, cash flows, and ability to obtain additional financing or refinance our existing and future credit facilities on acceptable terms which may negatively impact our business. The U.K.’s withdrawal from the European Union may have a negative effect on global economic conditions, financial markets and our business. Regulations relating to ballast water discharge may adversely affect our revenues and profitability. An over-supply of dry bulk carrier capacity may prolong or further depress the current low charter rates and, in turn, adversely affect our profitability. Outbreaks of epidemic and pandemic diseases, including COVID-19, and governmental responses thereto could adversely affect our business. Our operating results are subject to seasonal fluctuations, which could affect our operating results. An increase in the price of fuel may adversely affect our profits. We are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business. The operation of dry bulk carriers has certain unique operational risks which could affect our earnings and cash flow. If our vessels call on ports located in countries or territories that are the subject of sanctions or embargoes imposed by the U.S. government, the European Union, the United Nations, or other governmental authorities, it could lead to monetary fines or penalties and may adversely affect our reputation and the market for our securities. We conduct business in China, where the legal system is not fully developed and has inherent uncertainties that could limit the legal protections available to us. Failure to comply with the U.S. Foreign Corrupt Practices Act could result in fines, criminal penalties and an adverse effect on our business. Changing laws and evolving reporting requirements could have an adverse effect on our business.

Risk Factors (3/7) We create to share 39 Issuer Specific Risk Factors The market values of our vessels have declined in recent years and may further decline, which could limit the amount of funds that we can borrow and could trigger breaches of certain financial covenants contained in our loan facilities, which could adversely affect our operating results, and we may incur a loss if we sell vessels following a decline in their market values.We charter some of our vessels on short-term time charters in a volatile shipping industry and a decline in charter hire rates could affect our results of operations and our ability to pay dividends.Our investment in Diana Wilhelmsen Management Limited may expose us to additional risks.A cyber-attack could materially disrupt our business.Climate change and greenhouse gas restrictions may adversely impact our operations and markets.Increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks.Our earnings may be adversely affected if we are not able to take advantage of favorable charter rates.We cannot assure you that we will be able to refinance indebtedness incurred under our loan facilities.We are subject to certain risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations could cause us to suffer losses or otherwise adversely affect our business.In the highly competitive international shipping industry, we may not be able to compete for charters with new entrants or established companies with greater resources, and as a result, we may be unable to employ our vessels profitably.We recently underwent a transition with respect to certain of our directors and executive officers and this transition, along with the possibility that we may in the future be unable to retain and recruit qualified key executives, key employees or key consultants, may delay our development efforts or otherwise harm our business.Technological innovation and quality and efficiency requirements from our customers could reduce our charterhire income and the value of our vessels.We may not have adequate insurance to compensate us if we lose our vessels or to compensate third parties.Our vessels may suffer damage and we may face unexpected drydocking costs, which could adversely affect our cash flow and financial condition.

Risk Factors (4/7) We create to share 40 Issuer Specific Risk Factors, cont. We are exposed to U.S. dollar and foreign currency fluctuations and devaluations that could harm our reported revenue and results of operations.Volatility of LIBOR and potential changes of the use of LIBOR as a benchmark could affect our profitability, earnings and cash flow.We depend upon a few significant customers for a large part of our revenues and the loss of one or more of these customers could adversely affect our financial performance.Because we are organized under the laws of the Marshall Islands, it may be difficult to serve us with legal process or enforce judgments against us, our directors or our management.We may have to pay tax on U.S. source income, which would reduce our earnings.U.S. federal tax authorities could treat us as a “passive foreign investment company”, which could have adverse U.S. federal income tax consequences to U.S. shareholders.

Risk Factors (5/7) We create to share 41 Bond Specific Risk Factors The Company's ability to make payments on and to refinance its indebtedness, including the Bonds, and to fund planned capital expenditures and other general corporate purposes will depend, among other things, on its ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond its control. The Company cannot assure you that its business will generate sufficient cash flow from operations or that future capital will be available to it in an amount sufficient to enable the Company to make payments on or to refinance its indebtedness, including the Bonds, or to fund its other liquidity needs. If the Company's cash flow and capital resources are insufficient to allow it to make payments on its indebtedness, the Company may need to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance all or a portion of its indebtedness, including the Bonds, on or before maturity. The Company cannot assure that it will be able to refinance any of its indebtedness, including the Bonds, on commercially reasonable terms or at all or that the terms of such indebtedness will allow any of the above alternative measures or that these measures would satisfy its debt service obligations. If the Company is unable to generate sufficient cash flow or refinance its indebtedness on favourable terms, it would significantly adversely affect the Company's financial condition, the value of its outstanding indebtedness and its ability to make any required cash payments under its indebtedness.The Bonds will, and the Company's potential future loan facilities might, impose, operating and financial restrictions on the Company. These restrictions may inter alia limit the Company's ability to pay dividends, incur additional indebtedness, create liens on its assets, and additional actions which may otherwise be beneficial for the Company. The Bond Terms will contain, inter alia, significant restrictions, including dividend restrictions, financial covenants and various covenants as to the operations of the business.The rights of the Bond Trustee, on behalf of the bondholders to enforce remedies and recover under the Bonds may be significantly impaired by applicable bankruptcy, insolvency and other restructuring legislation in the event that the Company becomes insolvent, bankrupt or receivership or other restructuring or corporate arrangement proceedings are commenced pursuant to which enforcement proceedings are initiated against the Company.

Risk Factors (6/7) We create to share 42 Bond Specific Risk Factors cont. The Bond Terms will provide that the Bonds shall be subject to optional redemption by the Company at their outstanding principal amount, plus accrued and unpaid interest to the date of redemption, plus in some events a premium calculated in accordance with the Bond Terms. This is likely to limit the market value of the Bonds. It may not be possible for bondholders to reinvest proceeds at an effective interest rate as high as the interest rate on the Bonds.If a Change of Control Event (as defined in the Term Sheet) occurs, holders of the Bonds will have the right to require the Company to repurchase the Bonds, in whole or in part, at a purchase price equal to 101% of the principal amount of the Bonds, plus accrued and unpaid interest, if any, to the date of repurchase. The Company's ability to repurchase the Bonds upon a Change of Control would be limited by its access to funds at the time of the repurchase and the terms of agreements governing the Company's other indebtedness.The Bond Terms will contain provisions for calling for meetings of the holders of the Bonds in the event that the Company wishes to amend any of the terms and conditions applicable to the Bonds. These provisions permit defined majorities to bind all holders of the Bonds, including holders who did not attend and vote at the relevant meeting and holders who vote in a manner contrary to the required majority. The Bond Trustee may, without the consent of the bondholders, agree to certain non-material modifications of the Bond Terms and other finance documents that, in the opinion of the Bond Trustee, are not detrimental to the rights and benefits of the bondholders in any material respect, or is made solely for the purpose of rectifying obvious errors and mistakes. Such modifications will be binding upon the bondholders.The terms and conditions of the Bond Terms will impose significant operating and financial restrictions, which may prevent the Issuer from capitalizing on business opportunities and taking some actions.The Bonds are a new issue of securities, and there are currently no active public trading markets for the Bonds. Even though the Company shall apply for listing of the Bonds on Oslo Børs, the Company has not entered into any market-making scheme to ensure liquidity of the Bonds. There can be no assurance as to: (i) the liquidity of any market that may develop; (ii) the bondholders' ability to sell the Bonds; or (iii) the price at which bondholders would be able to sell the Bonds. If such a market were to exist, the Bonds could trade at prices that may be lower than the principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar bonds and the Company's financial performance and outlook. If an active market does not develop or is not maintained, the price and liquidity of the Bonds may be adversely affected.Under the terms of the Bond issue the Issuer is permitted to incur liabilities that will rank senior in priority to the Bonds, including, inter alia, senior secured bank debt.

Risk Factors (7/7) We create to share 43 Bond Specific Risk Factors cont. The Bonds are being issued by the Company pursuant to exemptions from the prospectus requirements under applicable securities laws and furthermore have not been, and will not be, registered under the U.S. Securities Act or any United States state securities laws. The Company has not undertaken to register the Bonds, and although the Bonds are to be listed on Oslo Børs, the holders of bonds may not be able to resell the Bonds for a period of time. The holders of bonds may not offer the Bonds for resale in the United States except pursuant to an exemption from, or in transactions not subject to, the registration requirements of the U.S. Securities Act and applicable United States state securities laws. Furthermore, the Company has not registered the Bonds under any other country's securities laws. It is holders of bonds' obligation to ensure that any offers and sales of the Bonds by the holders of bonds comply with applicable securities laws.As the Company is relying upon exemptions from registration under applicable securities laws in the placement of the Bonds, in the future the Bonds may be transferred or resold only in a transaction registered under or exempt from the registration requirements of such legislation. Therefore, bondholders may not be able to sell their Bonds at their preferred time or price. The Company cannot assure bondholders as to the future liquidity of the Bonds and as a result, bondholders bear the financial risk of their investment in the Bonds.

We create to share 44 1 Transaction Summary 2 Company Overview 3 Market Fundamentals 4 Financial Highlights 5 Summary 6 Risk Factors 7 Appendix 1 2 3 4 5 6 7 Agenda

We create to share 45 Revenues $ Millions $ Millions Time charter revenues 41.1 43.8 Expenses Voyage expenses 1.8 3.7 Vessel operating expenses 18.6 21.3 Depreciation and amortization of deferred charges 10.0 11.6 General and administrative expenses 6.7 9.6 Management fees to related party 0.5 0.5 Vessel impairment charges 93.1 Loss on sale of vessels 0.2 1.1 Other income (0.1) (0.2) Operating Income/(Loss) 3.4 (96.9) Interest expense and finance costs (4.6) (6.4) Interest income 0.0 0.4 Loss from equity method investment (0.1) (0.0) Total other expenses, net (4.7) (6.0) Net Loss (1.3) (102.8) Dividends on series B preferred shares (1.4) (1.4) Net loss attributed to common stockholders (2.7) (104.3) Loss per common share, basic and diluted (0.03) (1.21) Three months ended March 31, 2021 2020 Income statement Source: Company’s filings with the U.S. Securities and Exchange Commission

We create to share 46 March 31, 2021 December 31, 2020 Assets $ Millions $ Millions Cash, cash equivalents and restricted cash 86.0 82.9 Other current assets 27.4 41.8 Vessels, net 698.7 716.2 Other fixed assets, net 21.7 21.7 Other non-current assets 8.9 9.9 Total Assets 842.7 872.4 Liabilities and Stockholders’ Equity Long-term debt, net of deferred financing costs 411.4 420.3 Other liabilities 19.2 23.5 Total stockholders’ equity 412.1 428.6 Total Liabilities and Stockholders’ Equity 842.7 872.4 Balance Sheet Note(*) Net of deferred financing costs of $2.4 million.Note (**) Includes $18.5 million restricted cash.Source: Company’s filings with the U.S. Securities and Exchange Commission As of March 31, 2021$411.4 million Total Debt*$86.0 million of Cash**Net Debt of $325 million*

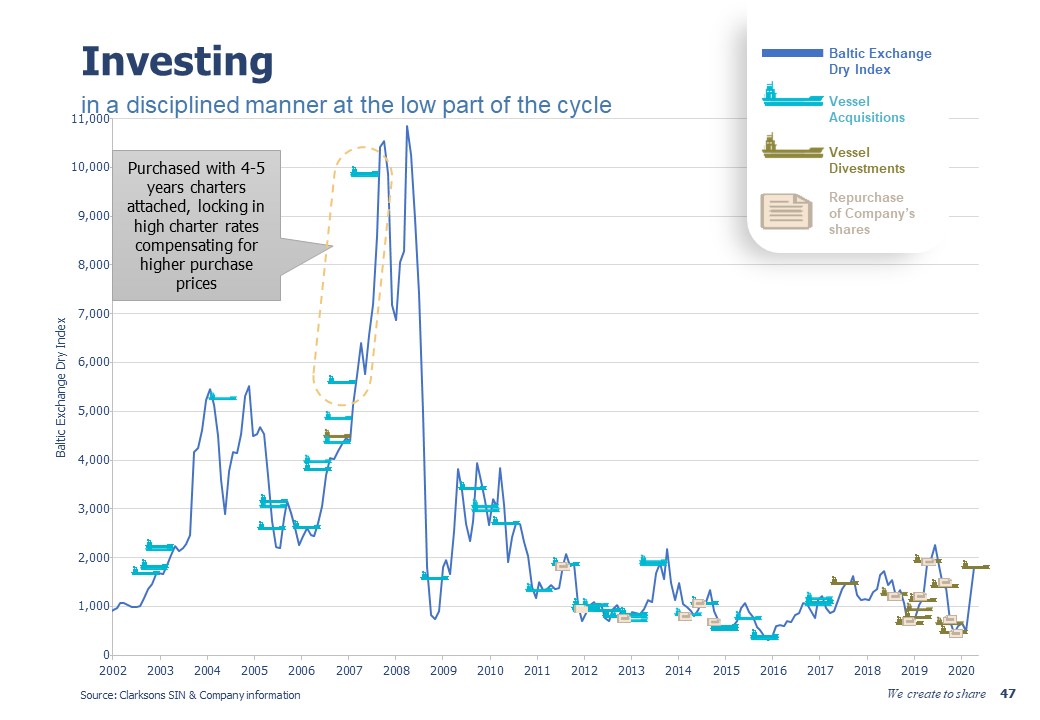

We create to share 47 Investing Vessel Acquisitions Vessel Divestments Repurchase of Company’s shares Baltic Exchange Dry Index Purchased with 4-5 years charters attached, locking in high charter rates compensating for higher purchase prices Source: Clarksons SIN & Company information 11,00010,0009,0008,0007,0006,0005,0004,0003,0002,0001,0000 in a disciplined manner at the low part of the cycle 2002