EXHIBIT 99.1

Midway Announces Close of Public Comment for Pan Draft EIS

May 9, 2013

Denver, Colorado – Midway Gold Corp. (MDW: TSX-V & NYSE-MKT) announces the public comment period for the Draft Environmental Impact Statement (EIS) on the Pan Project is complete. The comments received by the BLM were overwhelmingly positive and in support of the mine plan.

“The Pan project is on track for a final Record of Decision in the fall of 2013. We were very pleased by the enthusiastic support for Midway from families, individuals and the business community both at the local and regional level,” said Ken Brunk, Midway’s President and CEO. “Midway is proud to be working in Ely and White Pine County, Nevada and is excited to be building our business in an area eager for investment.”

Permitting Status at Pan

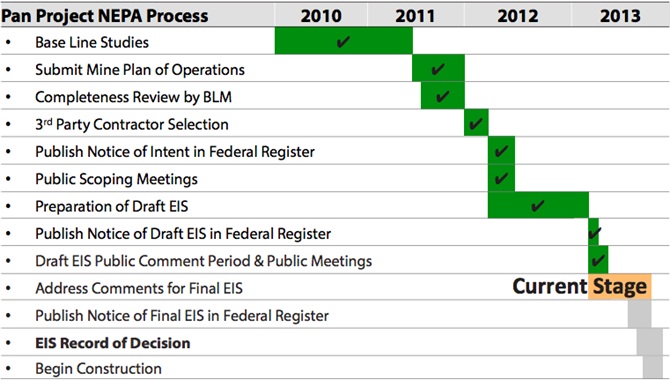

The BLM published the Draft EIS for Pan in the Federal Register on March 22nd. The EIS for Pan is conducted under the National Environmental Policy Act (NEPA). The required public comment period ended on May 6th. Public comments will be addressed and incorporated in the Final EIS. Figure 1 shows the NEPA progress to date and steps remaining to a Record of Decision.

Figure 1. Pan Permitting Calendar

Pan Gold Project, Nevada – The Pan Project represents nearly a US$100 million capital investment in a part of Nevada that welcomes new investment and associated economic opportunities (see Feasibility Study dated December 19, 2011). Once in operation, the Pan mine is projected to provide 150 workers with stable, high-paying jobs. In addition to direct employment, Midway expects the mine will have a multiplier effect by creating support jobs in surrounding communities.

Geologically, the Pan project is an oxidized, Carlin-style gold deposit mineable by shallow open pit methods and treatable by heap leaching. A Feasibility Study was completed in November 2011. It shows the NPV5% of the project is robust at a range of gold prices, ranging from $123 million at $1,200/oz gold to $344M at $1,900/oz gold. The IRR grows from 32% to 79% using the same gold price range. Both are after-tax figures (see press release dated November 15, 2011).

Figure 2. Pan Gold Project Feasibility Projections (After Tax)

| Gold Price | $1,200/oz | $1,550/oz | $1,725/oz | $1,900/oz |

NPV5% | $123 mm | $235 mm | $290 mm | $344 mm |

| IRR | 32% | 56% | 67% | 79% |

| Payback | 2.6 yrs | 1.7 yrs | 1.4 yrs | 1.2 yrs |

This release has been reviewed and approved for Midway by William S. Neal (M.Sc., CPG), Vice President of Geological Services of Midway, a "qualified person" as that term is defined in NI 43-101.

About Midway Gold Corp.

Midway Gold Corp. is a precious metals company with a vision to explore, design, build and operate gold mines in a manner accountable to all stakeholders while assuring return on shareholder investments. For more information about Midway, please visit our website at www.midwaygold.com or contact Jaime Wells, Investor Relations Analyst, at (877) 475-3642 (toll-free).

Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) nor the NYSE MKT accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include, but are not limited to, statements about Barrick’s intended work plans and resource estimates and future expenditures at the Company’s Spring Valley Project.. Information regarding the anticipated work plans and expenditures is derived from information provided by Barrick to the Company. The forward-looking statements in this press release are subject to various risks, uncertainties and other factors that could cause actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation, risks related to the timing and completion of the intended work plans, risks related to fluctuations in gold prices; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Spring Valley Project; uncertainties involved in the interpretation of drilling results and other tests and the estimation of resources; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, should change.

2