SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| x | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended September 30, 2010 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33894

(Exact name of registrant as specified in its charter)

| British Columbia | | 98-0459178 |

| (State of other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| Unit 1 – 15782 Marine Drive | | |

White Rock, British Columbia, Canada White Rock, British Columbia, Canada V4B 1E6 | | V4B 1E6 |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant’s Telephone Number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. [Missing Graphic Reference] Yes [Missing Graphic Reference] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [Missing Graphic Reference] Yes [Missing Graphic Reference] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer [Missing Graphic Reference] Accelerated filer [Missing Graphic Reference] Non-accelerated filer [Missing Graphic Reference] Smaller Reporting Company [Missing Graphic Reference]

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) [Missing Graphic Reference] Yes [Missing Graphic Reference] No

Number of Shares outstanding at November 5, 2010 89,779,496

TABLE OF CONTENTS

| PART I – FINANCIAL INFORMATION | 1 |

| Item 1. | Financial Statements. | 1 |

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 13 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk. | 28 |

| Item 4. | Controls and Procedures. | 28 |

| PART II - OTHER INFORMATION | 29 |

| Item 1. | Legal Proceedings. | 29 |

| Item 1A. | Risk Factors. | 29 |

| Item 2. | Unregistered Sale of Equity Securities and Use of Proceeds. | 29 |

| Item 3. | Defaults Upon Senior Securities. | 29 |

| Item 4. | [Reserved] | 29 |

| Item 5. | Other information. | 29 |

| Item 6. | Exhibits. | 29 |

| SIGNATURES | 30 |

EXPLANATORY NOTE

All references to “$” in this report mean the Canadian dollar. All references to “US$” refer to the U.S. dollar, and unless otherwise indicated all currency amounts in this report are stated in Canadian dollars.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

MIDWAY GOLD CORP.

(An exploration stage company)

CONSOLIDATED INTERIM BALANCE SHEETS

(Expressed in Canadian dollars)

| | | | | | |

| | | | | | |

| | | | | | |

| Assets | | | | |

| | | | | | |

| Current assets: | | | | |

| | Cash and cash equivalents | | | | |

| | Amounts receivable (note 5) | | | | |

| | Prepaid expenses | | | | |

| | | | | | |

| Reclamation deposit (note 6) | | | | |

| Equipment (note 4) | | | | |

| Mineral properties (note 5) | | | | |

| | | | | | |

| | | | | | |

| Liabilities and stockholders' equity | | | | |

| | | | | | |

| Current liabilities | | | | |

| �� | Accounts payable and accrued liabilities | | | | |

| | | | | | |

| Future income tax liability | | | | |

| | | | | | |

| Stockholders' equity (note 7) | | | | |

| | Common stock authorized - unlimited, no par value | | | | |

| | Issued - 89,779,496 (2009 - 77,321,664) | | | | |

| | Additional paid in capital | | | | |

| | Deficit accumulated during the exploration stage | | | | |

| | | | | | |

| | | | | | |

Nature of operations and going concern (note 1)

Subsequent event (note 12)

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS

(Expressed in Canadian dollars) (unaudited)

| | | | | | | | | | | | |

| | | | Three months ended September 30, 2010 | | Three months ended September 30, 2009 | | Nine months ended September 30, 2010 | | Nine months ended September 30, 2009 | | Cumulative period from inception (May 14, 1996) to September 30, 2010 |

| | | | | | | | | | | | |

| Expenses | | | | | | | | | | |

| | Consulting (note 8) | | | | | | | | | | |

| | Depreciation | | | | | | | | | | |

| | Gain on sale of subsidiary | | | | | | | | | | |

| | Interest and bank charges | | | | | | | | | | |

| | Investor relations | | | | | | | | | | |

| | Legal, audit and accounting | | | | | | | | | | |

| | Management fees | | | | | | | | | | |

| | Management fees earned | | | | | | | | | | |

| | Mineral exploration expenditures (Schedule) | | | | | | | | | | |

| | Mineral property interests written off (note 5) | | | | | | | | | |

| | Office and administration (note 8) | | | | | | | | | | |

| | Salaries and benefits | | | | | | | | | | |

| | Transfer agent and filing fees | | | | | | | | | | |

| | Travel | | | | | | | | | | |

| Operating loss | | | | | | | | | | |

| | | | | | | | | | | | |

| Other income (expenses): | | | | | | | | | | |

| | Foreign exchange gain | | | | | | | | | | |

| | Interest income | | | | | | | | | | |

| | Gain (loss) on sale of equipment | | | | | | | | | | |

| | Gain on sale of investments (note 3) | | | | | | | | | | |

| | Investment write down (note 3) | | | | | | | | | | |

| | Other income | | | | | | | | | | |

| | | | | | | | | | | | |

| Net loss before income tax | | | | | | | | | | |

| | Income tax recovery | | | | | | | | | | |

| Net loss | | | | | | | | | | |

| Basic and diluted loss per share | | | | | | | | | | |

Weighted average number of shares outstanding | | | | | | | | | | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(Expressed in Canadian dollars) (unaudited)

| | | | | | | | | | | | | |

| | | | | Three months ended September 30, 2010 | | Three months ended September 30, 2009 | | Nine months ended September 30, 2010 | | Nine months ended September 30, 2009 | | Cumulative period from inception (May 14, 1996) to September 30, 2010 |

| Cash provided by (used in): | | | | | | | | | | |

| Operating activities: | | | | | | | | | | |

| | Net loss | | | | | | (3,731,246) | | | | |

| | Items not involving cash: | | | | | | | | | | |

| | | Depreciation | | | | | | 59,706 | | | | |

| | | Stock-based compensation | | | | | | 679,538 | | | | |

| | | Unrealized foreign exchange (gain) | | | | | | (168,280) | | | | |

| | | Unrealized loss on investment | | | | | | - | | | | |

| | | Non-cash interest expense | | | | | | | | | | |

| | | Income tax recovery | | | | | | (747,000) | | | | |

| | | Gain on sale of subsidiary | | | | | | - | | | | |

| | | Loss (gain) on sale of equipment | | | | | | (59) | | | | |

| | | Loss on sale of investments | | | | | | - | | | | |

| | | Write off of mineral property interests | | | | | | 119,980 | | | | |

| | Change in non-cash working capital items: | | | | | | | | | | |

| | | Amounts receivable | | | | | | 10,803 | | | | |

| | | Prepaid expenses | | | | | | (151,623) | | | | |

| | | Accounts payable and accrued liabilities | | | | | | 78,834 | | | | |

| | | Accrued interest payable | | | | | | - | | | | |

| | | | | | | | | (3,849,347) | | | | |

| | | | | | | | | | | | | |

| Investments activities: | | | | | | | | | | |

| | Proceeds on sale of subsidiary | | | | | | - | | | | |

| | Proceeds on sale of equipment | | | | | | 3,321 | | | | |

| | Proceeds on sale of mineral property | | | | | | - | | | | |

| | Proceeds on sale of investments | | | | | | - | | | | |

| | Mineral property acquisitions | | | | | | (398,689) | | | | |

| | Deferred acquisition costs | | | | | | - | | | | |

| | Purchase of equipment | | | | | | (163,735) | | | | |

| | Reclamation deposit | | | | | | 10,044 | | | | |

| | | | | | | | | (549,059) | | | | |

| | | | | | | | | | | | | |

| Financing activities: | | | | | | | | | | |

| | Advance from Red Emerald Ltd. | | | | | | - | | | | |

| | Common stock issued, net of issue costs | | | | | | 6,658,813 | | | | |

| | Promissory note | | | | | | - | | | | |

| | Repayment of promissory note | | | | | | - | | | | |

| | Convertible debenture | | | | | | - | | | | |

| | | | | | | | | 6,658,813 | | | | |

| Increase in cash and cash equivalents | | | | | | 2,260,407 | | | | |

| Cash and cash equivalents, beginning of period | | | | | | 1,740,322 | | | | |

| Cash and cash equivalents, end of period | | | | | | 4,000,729 | | | | |

| | | | | | | | | | | | | |

| Non-cash financing and investing activities: | | | | | | | | | | |

| | Fair value of agent's share purchase warrants issued | | | | | | 212,109 | | | | |

| | Fair value of share purchase warrants exercised | | | | | | 4,024 | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

(Expressed in Canadian dollars) (unaudited)

| | | | Three months ended September 30, 2010 | | Three months ended September 30, 2009 | | Nine months ended September 30, 2010 | | Nine months ended September 30, 2009 |

| | | | | | | | | | |

| Net loss for the period before other comprehensive loss | | 1,527,111 | | 835,905 | | 3,731,246 | | 2,573,862 |

| | Unrealized gain on investment | | - | | (54,540) | | - | | (53,850) |

| | Investment write down | | - | | - | | - | | (7,770) |

| | Realized gain on sale of investments | | - | | 72,540 | | - | | 61,620 |

| Comprehensive loss | | 1,527,111 | | 853,905 | | 3,731,246 | | 2,573,862 |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(Expressed in Canadian dollars) (unaudited)

| | | Number of shares | Common stock | Additional paid-in capital | Accumulated other comprehensive income | Accumulated deficit during the exploration stage | Total stockholders' equity |

| Balance, May 14, 1996 (date of inception) | | | | | | |

| Shares issued: | | | | | | |

| | Private placements | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 1996 | | | | | | |

| Shares issued: | | | | | | |

| | Initial public offering | | | | | | |

| | Principal shares | | | | | | |

| | Private placement | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Acquisition of mineral property interest | | | | | | |

| | Finders fee | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 1997 | | | | | | |

| Shares issued: | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Acquisition of mineral property interest | | | | | | |

| | Finders fee | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 1998 | | | | | | |

| Consolidation of shares on a two for one new basis | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 1999 | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2000 | | | | | | |

| Net earnings | | | | | | |

| Balance, December 31, 2001 | | | | | | |

| Shares issued: | | | | | | |

| | Private placement | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Exercise of stock options | | | | | | |

| | Financing shares issued | | | | | | |

| | Acquisition of mineral property interest | | | | | | |

| | Share issue costs | | | | | | |

| Stock based compensation | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2002 | | | | | | |

| Shares issued: | | | | | | |

| | Private placement | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Share issue costs | | | | | | |

| Stock based compensation | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2003 | | | | | | |

| Shares issued: | | | | | | |

| | Private placement | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Exercise of stock options | | | | | | |

| | Share issue costs | | | | | | |

| Stock based compensation | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2004 | | | | | | |

| | Private placement | | | | | | |

| | Exercise of stock options | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| Stock based compensation | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2005, carried forward | | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(Expressed in Canadian dollars) (unaudited)

| | | Number of shares | Common stock | Additional paid-in capital | Accumulated other comprehensive income | Accumulated deficit during the exploration stage | Total stockholders' equity |

| Balance, December 31, 2005, brought forward | | | | | | |

| Shares issued: | | | | | | |

| | Private placements | | | | | | |

| | Exercise of stock options | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Acquisition of mineral property interest | | | | | | |

| | Share issue costs | | | | | | |

| Stock based compensation | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2006 | | | | | | |

| Shares issued: | | | | | | |

| | Private placement | | | | | | |

| | Pan-Nevada acquisition | | | | | | |

| | Exercise of stock options | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Share issue costs | | | | | | |

| Stock based compensation | | | | | | |

| Unrealized loss on investment | | | | | | |

| Adjustment of future income tax liability to mineral properties (note 2(p)) | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2007 | | | | | | |

| Shares issued: | | | | | | |

| | Private placement | | | | | | |

| | Acquisition of mineral property interest | | | | | | |

| | Exercise of stock options | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| | Share issue costs | | | | | | |

| Stock based compensation | | | | | | |

| Unrealized loss on investments | | | | | | |

| Investment write-down | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2008 | | | | | | |

| Shares issued: | | | | | | |

| | Exercise of stock options | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| Stock based compensation | | | | | | |

| Unrealized (gain) loss on investment | | | | | | |

| Realized gain on sale of investments | | | | | | |

| Net loss | | | | | | |

| Balance, December 31, 2009 | | | | | | |

| Shares issued: | | | | | | |

| | Private placements | | | | | | |

| | Share issue costs | | | | | | |

| | Exercise of share purchase warrants | | | | | | |

| Stock based compensation | | | | | | |

| Net loss | | | | | | | |

| Balance, September 30, 2010 | | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

SCHEDULE OF MINERAL EXPLORATION EXPENDITURES

(Expressed in Canadian dollars) (unaudited)

| | | | Three months ended September 30, 2010 | Three months ended September 30, 2009 | Nine months ended September 30, 2010 | Nine months ended September 30, 2009 | Cumulative period from inception (May 14, 1996) to September 30, 2010 |

| Exploration costs incurred are summarized as follows: | | |

| Midway project | | | | | |

| | Assays and analysis | | | | | |

| | Communication | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Reproduction and drafting | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Spring Valley project | | | | | |

| | Assays and analysis | | | | | |

| | Communication | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Equipment rental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Operator fee | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Reproduction and drafting | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Pan project | | | | | |

| | Assays and analysis | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Reproduction and drafting | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| | Sub-total balance carried forward | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

SCHEDULE OF MINERAL EXPLORATION EXPENDITURES – CONTINUED

(Expressed in Canadian dollars) (unaudited)

| | | | Three months ended September 30, 2010 | Three months ended September 30, 2009 | Nine months ended September 30, 2010 | Nine months ended September 30, 2009 | Cumulative period from inception (May 14, 1996) to September 30, 2010 |

| | | | | | | | |

| | Sub-total balance brought forward | | | | | |

| Burnt Canyon project | | | | | |

| | Assays and analysis | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reproduction and drafting | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Gold Rock project | | | | | |

| | Assays and analysis | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Reproduction and drafting | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Golden Eagle project | | | | | |

| | Assays and analysis | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Thunder Mountain project | | | | | |

| | Assays and analysis | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| | Sub-total balance carried forward | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

SCHEDULE OF MINERAL EXPLORATION EXPENDITURES - CONTINUED

(Expressed in Canadian dollars) (unaudited)

| | | | Three months ended September 30, 2010 | Three months ended September 30, 2009 | Nine months ended September 30, 2010 | Nine months ended September 30, 2009 | Cumulative period from inception (May 14, 1996) to September 30, 2010 |

| | Sub-total balance brought forward | | | | | |

| Maggie Creek project | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | | | | | | | |

| Roberts Gold project | | | | | |

| | Assays and analysis | | | | | |

| | Communication | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Pioche/Mineral Mountain project | | | | | |

| | Acquisition costs and option payments | | | | | |

| | Assays and analysis | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Field office and supplies | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| Black Prince project | | | | | |

| | Communication | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Equipment rental | | | | | |

| | Field office and supplies | | | | | |

| | Geological and geophysical | | | | | |

| | Legal and accounting | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reproduction and drafting | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | Recoveries | | | | | |

| | | | | | | | |

| | Sub-total balance carried forward | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

MIDWAY GOLD CORP.

(An exploration stage company)

SCHEDULE OF MINERAL EXPLORATION EXPENDITURES - CONTINUED

(Expressed in Canadian dollars) (unaudited)

| | | | Three months ended September 30, 2010 | Three months ended September 30, 2009 | Nine months ended September 30, 2010 | Nine months ended September 30, 2009 | Cumulative period from inception (May 14, 1996) to September 30, 2010 |

| | | | | | | | |

| | Sub-total balance brought forward | | | | | |

| Ruby Violet project | | | | | |

| | Assays and analysis | | | | | |

| | Communication | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Equipment rental | | | | | |

| | Field office and supplies | | | | | |

| | Foreign exchange gain | | | | | |

| | Freight | | | | | |

| | Interest on convertible loans | | | | | |

| | Legal and accounting | | | | | |

| | Marketing | | | | | |

| | Mining costs | | | | | |

| | Processing and laboratory supplies | | | | | |

| | Property maintenance and taxes | | | | | |

| | Security | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | Utilities and water | | | | | |

| | | | | | | | |

| Property investigations | | | | | |

| | Assays and analysis | | | | | |

| | Drilling | | | | | |

| | Engineering and consulting | | | | | |

| | Environmental | | | | | |

| | Field office and supplies | | | | | |

| | Legal | | | | | |

| | Property maintenance and taxes | | | | | |

| | Reclamation costs | | | | | |

| | Reproduction and drafting | | | | | |

| | Salaries and labour | | | | | |

| | Travel, transportation and accommodation | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements.

| 1. | Nature of operations and going concern |

Midway Gold Corp. (the “Company” or “Midway”) was incorporated on May 14, 1996 under the laws of the Province of British Columbia and its principal business activities are the acquisition, exploration and development of mineral properties.

The Company is in the process of exploring and developing its mineral properties and has not yet determined whether its mineral properties contain ore reserves that are economically recoverable. The recoverability of amounts shown for mineral properties is dependent upon the discovery of economically recoverable ore reserves in its mineral properties, the ability of the Company to obtain the necessary financing to complete development, confirmation of the Company’s interest in the underlying mineral claims and upon future profitable production from, or proceeds from the disposition of, its mineral properties.

The Company has not generated revenues from operations. These consolidated financial statements have been prepared on the basis that the Company is a going concern, which contemplates the realization of its assets and the settlement of its liabilities in the normal course of operations. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, confirmation of the Company’s interests in the underlying properties, the attainment of profitable operations and/or realizing proceeds from the sale of one or more of the properties. As at September 30, 2010, the Company had an accumulated deficit of $59,998,849 and working capital of $3,794,520 which management believes is sufficient to fund ordinary operations through the next twelve months however the Company intends to raise additional equity funds as the opportunity presents itself.

As discussed in subsequent event note 12 the Company subsequently filed a preliminary prospectus supplement to its short form base shelf prospectus filed with the securities commissions in each of the provinces of British Columbia, Alberta and Ontario, and a corresponding shelf prospectus as part of an effective registration statement on Form S-3 filed with the U.S. Securities and Exchange Commission, pursuant to which it intends to offer up to 6,660,000 units at US$0.60 per unit for gross proceeds of US$3,996,000. The offering is subject to regulatory approvals.

| 2. | Significant accounting policies and change in accounting policy |

These consolidated interim financial statements for the Company have been prepared in accordance with United States generally accepted accounting principles (“US GAAP”). They do not include all of the information and disclosures required by US GAAP for annual financial statements. In the opinion of management, all adjustments considered necessary for fair presentation have been included in these financial statements. The interim consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements including the notes thereto for the year ended December 31, 2009 which may be found on the Company’s profile on SEDAR and EDGAR.

The accounting policies followed by the Company are set out in note 2 to the audited consolidated financial statements for the year ended December 31, 2009 and have been consistently followed in the preparation of these consolidated interim financial statements, except as follows:

Recently adopted accounting policies

In June 2009, the Financial Accounting Standards Board (“FASB”) issued new accounting standards to address the elimination of the concept of a qualifying special purpose entity which also replaces the quantitative-based risks and rewards calculation for determining which enterprise has a controlling financial interest in a variable interest entity with an approach focused on identifying which enterprise has the power to direct the activities of a variable interest entity and the obligation to absorb losses of the entity or the right to receive benefits from the entity. Additionally, this standard provides more timely and useful information about an enterprise’s involvement with a variable interest entity. The new standard became effective for the Company’s fiscal year beginning January 1, 2010. The adoption of t his standard did not have a material effect on the Company’s financial statements.

In January 2010, FASB issued an accounting standards update for fair value measurements and disclosure. This update requires additional disclosures related to transfers in and out of level 1 and 2 fair value measurements and enhanced detail in the level 3 reconciliation. The guidance was amended to clarify the level of disaggregation required for assets and liabilities and the disclosures required for inputs and valuation techniques used to measure the fair value of assets and liabilities that fall in either level 2 or level 3. The updated guidance became effective for the Company’s fiscal year beginning January 1, 2010 with the exception of the level disaggregation which becomes effective for the Company’s fiscal year beginning January 1, 2011. The adoption of the updated guidance did not h ave a material effect on the Company’s financial statements.

In January 2010, FASB issued accounting standards update for the deconsolidation of a subsidiary or derecognition of a group of assets. This update requires additional disclosure related to the valuation techniques used to measure the fair value of any retained investment in the former subsidiary or group of assets, the nature of the continuing involvement with the subsidiary or entity acquiring the group of assets and whether the transaction was with a related party or whether the former subsidiary or entity acquiring the group of assets will become a related party. This amendment clarifies but does not change the scope of current US GAAP. The updated guidance became effective for the Company’s fiscal year beginning January 1, 2010. The adoption of the updated guidance did not have a material effect on the CompanyR 17;s financial statements.

The Company has no remaining investments at September 30, 2010.

During the nine month period ended September 30, 2009, the Company realized a loss of $61,620 on the sale of 1,844,500 common shares of Rye Patch Gold Corp. (“Rye Patch”) for proceeds of $300,525. The Company recognized in other comprehensive income an unrealized gain of $18,000 on the common shares of Rye Patch for the difference in the fair value at September 30, 2009 and March 31, 2009. The Company recognized in earnings an impairment on the common shares of $7,770 of Rye Patch for the difference in the fair value at March 31, 2009 and December 31, 2008. The Company considered that the decline in market value of this investment met the characteristics of an “other than temporary impairment” and adjustments to fair value were recorded in earnings as investment write-down and reclassified from accumulated other comprehensive loss. The Company recognized a further unrealized loss on the warrants of $100,000 in the statement of operations for the nine months ended September 30, 2009.

| | | | | | | | |

| | September 30, 2010 | | December 31, 2009 |

| | Cost | Accumulated depreciation | Net book value | | Cost | Accumulated depreciation | Net book value |

| | | | | | | | |

| Computer equipment | | | | | | | |

| Office equipment | | | | | | | |

| Field equipment | | | | | | | |

| Trucks | | | | | | | |

| | | | | | | | |

Details on the Company’s mineral properties are found in note 6 to the audited consolidated financial statements for the year ended December 31, 2009.

| | | | | |

| Mineral property | December 31, 2009 | Additions | Written off | September 30, 2010 |

| Midway | | | | |

| Spring Valley | | | | |

| Pan | | | | |

| Roberts Gold | | | | |

| Gold Rock | | | | |

| Burnt Canyon | | | | |

| Golden Eagle | | | | |

| | | | | |

| (a) | Midway property, Nye County, Nevada |

On July 1, 2009, and amended on October 14, 2009, the Company agreed with the Town of Tonopah (“Tonopah”) and Lumos & Associates (“Lumos”) to fund a study to identify the best alternatives which maximize the treatment and dewatering at a possible mine at the Midway Project for municipal use and/or re-injection, to minimize the need for redundant facilities and over costs to benefit the Company and Tonopah. Tonopah contracted with Lumos to prepare a Preliminary Engineering Report to identify the best alternatives to which the Company agreed to fund up to US$105,120 of which the full amount has been paid or accrued by September 30, 2010 (December 31, 2009, US$74,294 ($79,120)).

| (b) | Spring Valley property, Nevada |

At September 30, 2010 the Company had an amounts receivable of $71,973 (US$69,945) (December 31, 2009 $80,078 (US$76,192)) for recoverable salaries and expenses, from Barrick Gold Exploration Inc. pursuant to the Spring Valley exploration option and joint venture agreement, which was subsequently paid.

| (c) | Roberts Gold property, Nevada |

On July 14, 2010 the Company terminated the August 27, 2007 mineral lease agreement with WFW Resources, LLC for unpatented lode mining claims in Eureka County, Nevada. The Company wrote-off the $119,980 in acquisition costs in the nine month period ended September 30, 2010.

The Company is required to post bonds with the Bureau of Land Management (“BLM”) for reclamation of planned mineral exploration programs work associated with the Company’s mineral properties located in the United States. For the Company’s mineral properties that are being actively explored under funding arrangement agreements, the funding partners are responsible for bonding for the surface disturbance created by the exploration programs funded by each of them on those projects.

At September 30, 2010 the Company had posted a total of $269,082 (US$261,499) reclamation deposits compared to $279,126 (US$265,581) at December 31, 2009.

| | (a) | The Company’s authorized to issue an unlimited number of common shares. |

| (i) | During 1996, the Company issued 420,000 common shares at $0.25 per share by way of a non-brokered private placement for proceeds of $98,722 net of issue costs. In addition the Company issued 280,000 flow-through common shares at $0.25 per share by way of a non-brokered private placement for proceeds of $70,000. |

| (ii) | During 1997, the Company completed an initial public offering of 2,000,000 common shares at $0.35 per share for proceeds of $590,570, net of issue costs. In connection with this offering, the Company’s agent received a selling commission of 10% or $0.035 per share and was issued 25,000 shares as a corporate finance fee. |

| (iii) | During 1997, the Company issued 1,000,000 units at $2.50 per unit by way of a private placement for proceeds of $2,253,793 net of issue costs. Each unit consisted of one common share and one non-transferable share purchase to purchase one additional common share at $3.00 per share until February 14, 1998. The proceeds of the financing of $2,500,000 were allocated $2,178,761 as to the common shares and $321,239 as to the warrants. During 1998 100,000 of the warrants were exercised and 900,000 expired. In connection with this private placement, the Company’s agent received a selling commission of 7.5% of the proceeds of the units sold or $0.1875 per unit and a corporate finance fee of $15,000. |

| (iv) | During 1997, the Company issued 750,000 common shares as performance shares for proceeds of $7,500 that were held in escrow in accordance with the rules of the regulatory authorities of British Columbia. The shares were released 25% in each of 1998, 1999, 2000 and 2001. |

| (v) | During 1997, pursuant to an equity participation agreement to acquire an interest in Gemstone Mining Inc. (“Gemstone”), a Utah Corporation that by agreement the creditors of Gemstone were issued 1,000,000 units of the Company on conversion of a debt of $2,065,500 (US$1,500,000). Each unit consisted of one common share and one non-transferable share purchase to purchase one additional common share at US$2.00 per share that was immediately exercised for proceeds of $2,803,205 (US$2,000,000). The first one-third tranche of a conditional finders’ fee was satisfied by the issue of 150,000 common shares in connection with the acquisition of Gemstone. |

| (vi) | During 1998, the Company issued 100,000 common shares pursuant to the exercise of share purchase warrants for proceeds of $300,000. |

| (vii) | During 1998, the Company issued 200,000 common shares in connection with the acquisition of Gemstone as well as the second tranche of finder’s fee in connection with that acquisition. The Company’s option to acquire Gemstone expired on January 31, 1998 and the remaining one-third tranche were not issued. |

| (viii) | During 1999, the Company consolidated its issued share capital on a two old for one new basis and changed its name from Neary Resources Corporation to Red Emerald Resource Corp. |

| (ix) | During 2002, the Company issued 3,500,000 units at $0.25 per unit for proceeds of $875,000 by way of a short form offering document under the policies of the TSX Venture Exchange. Each unit consists of one common share and one common share purchase warrant that entitled the holder to purchase one additional common share at $0.25 per share until October 19, 2002. The Company also issued 150,000 common shares as a finance fee in connection with this offering, and issued the agent 875,000 share purchase warrants exercisable at $0.25 per share until April 19, 2004. During 2002 the Company issued 1,134,500 special warrants at $1.25 per special warrant for proceeds of $1,418,125. Each Special Warrant automatically converted to a unit comprising one common share and one share purchase warrant that entitled the hold er to purchase one additional common share at $1.55 per share until November 6, 2003. The proceeds of the financing of $1,418,125 were allocated on a relative fair value basis as $1,171,286 to common shares and $246,839 as to the warrants. During 2003 all of the warrants expired unexercised. In connection with the offering the Company paid the agent a 10% commission totaling $113,450, issued the agent 40,000 common shares as a finance fee in connection with this offering, and issued the agent 170,175 share purchase warrant exercisable at $1.55 per share until July 5, 2003. |

| (x) | During 2002, the Company issued 4,028,000 common shares pursuant to the exercise of share purchase warrants for proceeds of $1,007,000. |

| (xi) | During 2002, the Company issued 32,000 common shares pursuant to the exercise of stock options for proceeds of $12,800. |

| (xii) | During 2002, the Company issued 31,250 common shares as additional consideration to a director who loaned the Company $780,000 bearing interest at 12% per annum. The loan and interest was repaid prior to December 31, 2002. |

| (xiii) | During 2002, the Company acquired Rex Exploration Corp. (“Rex”) in exchange for 4,500,000 common shares of the Company. |

| (xiv) | During 2003, the Company issued 700,000 units at $1.20 per unit for proceeds of $840,000 by way of a non-brokered private placement. Each unit consists of one common share and one share purchase warrant that entitled the holder to purchase one additional common share at $1.50 until May 25, 2004. The proceeds of the financing of $840,000 were allocated $638,838 as to common shares and $201,162 as to the warrants. During 2004 161,000 of the warrants were exercised and 539,000 expired. Share issue expenses were $19,932. |

| (xv) | During 2003, the Company issued 294,500 common shares pursuant to the exercise of share purchase warrants for proceeds of $73,625. |

| (xvi) | In January 2004, the Company issued 400,000 units at $2.00 per unit for proceeds of $800,000 by way of a private placement. Each unit consisted of one common share and one non-transferable share purchase warrant that entitled the holder to purchase one additional common share at $2.35 per share for a six month period. The proceeds of the financing of $800,000 were allocated on a relative fair value basis as $624,593 to common shares and $175,407 as to the warrants. All of the warrants expired unexercised in 2004. The Company issued 40,000 common shares as a finder’s fee for this private placement. |

| (xvii) | In August 2004, the Company issued 1,020,000 units at $0.75 per unit for proceeds of $765,000 by way of a private placement. Each unit consisted of one common share and one non-transferable share purchase warrant that entitled the holder to purchase one additional common share at $0.80 per share until August 25, 2005. All of the warrants were subsequently exercised. The Company issued 55,650 common shares as a finder’s fee for this private placement. |

| (xviii) | In December 2004, the Company issued 700,000 units at $0.85 per unit for proceeds of $595,000 by way of a private placement. Each unit consisted of one common share and one non-transferable share purchase warrant that entitled the holder to purchase one additional common share at $1.00 per share until December 20, 2005. All of the warrants were subsequently exercised. The Company issued 18,750 common shares as a finder’s fee for this private placement. |

| (xix) | In February 2005, the Company issued 2,500,000 units at $0.85 per unit for proceeds of $2,125,000 by way of a private placement. Each unit consisted of one common share and one non-transferable share purchase warrant that entitled the holder to purchase one additional common share at $1.00 per share until February 16, 2006. The proceeds of the financing of $2,125,000 were allocated on a relative fair value basis as $1,598,457 to common shares and $526,543 as to warrants. There were 23,000 warrants exercised in fiscal year 2005 and the balance exercised in fiscal year 2006. The Company issued 75,800 common shares for $64,430 and paid $69,700 in cash as a finder’s fee and incurred $26,709 in additional issue costs for this private placement. |

| (xx) | In July 2005, the Company issued 1,000,000 units at $1.15 per unit for proceeds of $1,150,000 by way of a private placement. Each unit consisted of one common share and one-half non-transferable share purchase warrant that entitled the holder to purchase one additional common share at $1.15 per share until July 27, 2006. The proceeds of the financing of $1,150,000 were allocated on a relative fair value basis as $995,193 to common shares and $154,807 as to warrants. All of the warrants were exercised in fiscal year 2006. The Company incurred $15,560 in issue costs. |

| (xxi) | In August 2005, the Company issued 500,000 units at $1.40 per unit for proceeds of $700,000 by way of a private placement. Each unit consisted of one common share and one-half nontransferable share purchase warrant that entitled the holder to purchase one additional common share at $1.45 per share until August 22, 2006. The proceeds of the financing of $700,000 were allocated on a relative fair value basis as $608,015 to common shares and $91,985 as to warrants. All of the warrants were exercised in fiscal year 2006. The Company incurred $8,261 in issue costs. |

| (xxii) | In January 2006, the Company issued 40,000 common shares at a value of $88,000 pursuant to a purchase and sale agreement to purchase mining claims for the Spring Valley project. |

| (xxiii) | In May 2006, the Company issued 3,725,000 units at $1.80 per unit for proceeds of $6,705,000 by way of a private placement. Each unit consisted of one common share and one-half nontransferable share purchase warrant. Each whole warrant entitled the holder to purchase one additional common share at $2.70 per share until May 16, 2007. The proceeds of the financing of $6,705,000 were allocated on a relative fair value basis as $5,998,846 to common shares and $706,154 as to warrants. The Company incurred $65,216 in issue costs. By May 16, 2007 1,725,000 of the warrants were exercised and 137,500 expired unexercised. |

| (xxiv) | In November 2006, the Company issued 2,000,000 units at $2.50 per unit for proceeds of $5,000,000 by way of a private placement. Each unit consisted of one common share and one-half nontransferable share purchase warrant. Each whole warrant entitles the holder to purchase one additional common share at $3.00 per share until November 10, 2007. The proceeds of the financing of $2,000,000 were allocated on a relative fair value basis as $1,761,509 to common shares and $238,491 as to warrants. The Company paid $88,750 in finders’ fees and incurred $94,546 in issue costs for this private placement. By November 10, 2007 908,782 of the warrants were exercised and 91,218 expired unexercised. |

| (xxv) | On April 16, 2007, the Company issued 7,764,109 common shares at a value of $25,000,431, 308,000 stock options at a value of $608,020 and 870,323 share purchase warrants at a value of $1,420,054 in connection with the acquisition of Pan-Nevada Gold Corporation. By December 31, 2007, 154,000 of the stock options had been exercised and 761,823 share purchase warrants had been exercised. By December 31, 2008 the remaining 108,500 share purchase warrants were exercised and 84,000 stock options had been exercised. On October 11, 2008 the final 70,000 stock options expired not exercised. |

| (xxvi) | On August 24, 2007, the Company issued 2,000,000 common shares at $2.70 per common share for proceeds of $5,400,000 by way of a private placement. The Company incurred $28,000 in share issue costs. |

| (xxvii) | On March 31, 2008, the Company issued 30,000 common shares at a value of $88,500 pursuant to a lease assignment of mining claims for the Gold Rock project. The Company incurred $1,489 in share issue costs. |

| (xxviii) | On June 12, 2008, the Company issued 1,421,500 common shares at $2.00 per common share for proceeds of $2,843,000 by way of a private placement. The Company incurred $75,371 in share issue costs. |

| (xxix) | On August 1, 2008 the Company issued 600,000 common shares at US$2.50 per common share for proceeds of $1,537,950 (US$1,500,000) by way of a private placement with Kinross Gold USA Inc. The Company incurred $39,450 in share issue costs. |

| (xxx) | On November 12, 2008 the Company issued 12,500,000 units at $0.22 per unit for proceeds of $2,750,000 by way of a private placement. Each unit consisted of one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share at $0.28 per share until May 12, 2009. The proceeds of the financing of $2,750,000 were allocated on a relative fair value basis as $1,793,491 to common shares and $956,509 as to warrants. The Company incurred $23,395 in issue costs for this private placement. In the year ended December 31, 2009 all of the 12,500,000 warrants were exercised for proceeds of $3,500,000. |

| (xxxi) | In addition to the 84,000 stock options reported exercised in paragraph xxv, during 2008, the Company issued a further 395,000 common shares pursuant to the exercise of stock options for proceeds of $613,250. |

| (xxxii) | During 2009, the Company issued 33,333 common shares pursuant to the exercise of stock options for proceeds of $21,651. |

| (xxxiii) | On April 9, 2010, the Company issued 1,333,000 units at $0.60 per unit for proceeds of $800,000 by way of a private placement. Each unit consisted of one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share until October 9, 2011 at an exercise price as follows: $0.70 if exercised on or before October 9, 2010; $0.80 if exercised after October 9, 2010 but on or before April 9, 2011; and $0.90 if exercised after April 9, 2011 but on or before October 9, 2011. The proceeds of the financing of $800,000 were allocated on a relative fair value basis as $514,365 to common shares and $285,635 as to warrants. The Company incurred $95,529 in issue costs for this private placement. |

| (xxxiv) | On June 16, 2010, the Company issued 11,078,666 units at $0.60 per unit for proceeds of $6,647,199 by way of a brokered offering in Canada and a non-brokered offering in the United States. Each unit consisted of one common share and one-half share purchase warrant. Each whole warrant entitles the holder to purchase one additional common share until June 16, 2012 at an exercise price of $0.80. The proceeds of the financing of $6,647,199 were allocated on a relative fair value basis as $5,142,202 to common shares and $1,504,997 as to warrants. The Company issued 658,840 agent’s warrants which entitle the holder to purchase one common share until June 16, 2010 at an exercise price of $0.80. These warrants have been recorded at the estimated fair value at the issue date of $212,109. The fa ir value of warrants was determined using a risk free interest rate of 1.82%, an expected volatility of 131%, an expected life of 2 years, and zero dividend for a fair value per warrant of $0.32. In addition, the Company paid finders’ fees in the amount of $395,304 and incurred other cash share issue costs of $307,553. |

| (xxxv) | On September 12, 2010, the Company issued 12,500 common shares pursuant to the exercise of share purchase warrants for proceeds of $10,000. |

The Company has an incentive share option plan (the “Plan”) that allows it to grant incentive stock options to its officers, directors, employees and consultants. The Plan was amended on May 12, 2008 to add an appendix called the 2008 Stock Incentive Plan for United States Resident Employees (the “U.S. Plan”) to supplement and be a part of the Plan. The purpose of the U.S. Plan is to enable the Company to grant Incentive Stock Options, as that term is used in Section 422 of the Internal Revenue Code of 1986, as amended from time to time, and any regulations promulgated thereunder to qualifying employees who are citizens or residents of the United States of America. This does not change the aggregate number of options that can be granted pursuant to the Plan.

The purpose of the Plan permits the Company’s directors to grant incentive stock options for the purchase of shares of the Company to persons in consideration for services. Stock options must be non-transferable and the aggregate number of shares that may be reserved for issuance pursuant to stock options may not exceed 10% of the issued

shares of the Company at the time of granting and may not exceed 5% to any individual (maximum of 2% to any consultant). The exercise price of stock options is determined by the board of directors of the Company at the time of grant and may not be less than the closing price of the Company’s shares on the trading day immediately preceding the date on which the option is granted and publicly announced, less an applicable discount, and may not otherwise be less than $0.10 per share. Options have a maximum term of ten years and terminate 90 days following the termination of the optionee’s employment, except in the case of death or disability, in which case they terminate one year after the event.

The continuity of stock options is as follows:

| | | | | | | |

| Expiry date | Exercise price per share | Balance December 31, 2009 | Granted | Forfeited | Expired/ Cancelled | Balance September 30, 2010 |

| | | | | | | |

| February 4, 2010 | $0.85 | | | | | |

| June 24, 2010 | $1.30 | | | | | |

| March 9, 2011 | $2.00 | | | | | |

| May 4, 2011 | $2.00 | | | | | |

| June 15, 2011 | $2.53 | | | | | |

| August 30, 2011 | $2.63 | | | | | |

| November 30, 2011 | $2.70 | | | | | |

| January 23, 2012 | $3.00 | | | | | |

| March 7, 2012 | $2.93 | | | | | |

| July 31, 2012 | $2.71 | | | | | |

| October 30, 2012 | $3.36 | | | | | |

| December 6, 2012 | $3.32 | | | | | |

| April 13, 2014 | $2.04 | | | | | |

| May 12, 2013 | $2.00 | | | | | |

| July 16, 2013 | $2.00 | | | | | |

| January 7, 2014 | $0.56 | | | | | |

| September 9, 2014 | $0.86 | | | | | |

| May 17, 2015 | $0.71 | | | | | |

| June 16, 2015 | $0.58 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average exercise price | | | | | | |

At September 30, 2010 all but 885,000 of the 6,110,000 stock options outstanding were exercisable. The intrinsic value of vested stock options outstanding at September 30, 2010 was $43,867. Intrinsic value for vested stock options is calculated on the difference between the exercise prices of the underlying options and the quoted price of $0.60 for our common stock as of September 30, 2010.

The Company recorded stock-based compensation expense, net of forfeitures, of $679,538 in the nine months ended September 30, 2010 (September 30, 2009 - $1,112,822) for options vesting in that period of which $651,923 (September 30, 2009 - $939,450) was included in salaries and benefits in the statement of operations and $27,615 (September 30, 2009 - $173,372) was included in salaries and labour in the schedule of mineral exploration expenditures. There is a balance of $227,845 that will be recognized in fiscal 2010, fiscal 2011 and fiscal 2012 as the options vest.

d) Share purchase warrants:

The continuity of share purchase warrants is as follows:

| Expiry date | Exercise price per share | Balance December 31, 2009 | Issued | Exercised | Expired | Balance September 30, 2010 |

| | | | | | | |

October 9, 2011* | | | | | | |

| June 16, 2012 | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average exercise price | | | | | | |

| * | Each warrant entitles the holder to purchase one additional common share until October 9, 2011 at an exercise price as follows: $0.70 if exercised on or before October 9, 2010; $0.80 if exercised after October 9, 2010 but on or before April 9, 2011; and $0.90 if exercised after April 9, 2011 but on or before October 9, 2011. |

| 8. | Related party transactions |

| (a) | The Company paid consulting fees of $67,500 (2009 - $76,207) to a company controlled by the Chief Financial Officer of the Company for accounting and corporate compliance services. |

| (b) | Recovery of office costs from Rocky Mountain Resources Corp., a company managed by common directors and officers, of $3,727 (2009 - $nil). |

Included in accounts payable and accrued liabilities at September 30, 2010 is $6,267 (December 31, 2009 - $8,819) payable to the companies referred to in this note and other directors and officers.

These transactions are in the normal course of operations and are measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties.

In all material respects, the carrying amounts for the Company’s cash and cash equivalents, amounts receivable, accounts payable and accrued liabilities approximate their fair values due to the short term nature of these instruments. There were no investments at September 30, 2010.

A civil complaint was filed in federal court in Nevada against the Company on May 9, 2009. On December 29, 2009 the federal court issued an order dismissing the negligence and unjust enrichment claims against the Company with prejudice and the wrongful attachment claim was dismissed without prejudice. ING Novex Insurance Company of Canada did not amend its claim against the Company and the statute of limitations has expired.

The Company considers itself to operate in a single segment, being mineral exploration and development, with all of the Company’s long lived assets being located in the United States at September 30, 2010 and December 31, 2009.

Subsequent to September 30, 2010 the Company:

| a) | granted 350,000 incentive stock options to employees at an exercise price of $0.61 for a term of five years on normal vesting terms; |

| b) | received 250,000 units of NV Gold Corporation (NVX:TSX.V) in consideration of certain area of interest obligations of NVX that apply to the Roberts Gold Property. Each unit is comprised of one share and one warrant exercisable at $0.40 per share for a period of two years. If the volume weighted average price of the common shares of NVX exceed C$0.60 for twenty consecutive trading days, NVX may notify the Company in writing that the warrants will expire 15 trading days from receipt of such notice unless exercised by the Company before such date. |

| c) | filed a preliminary prospectus supplement to its short form base shelf prospectus filed with the securities commissions in each of the provinces of British Columbia, Alberta and Ontario, and a corresponding shelf prospectus as part of an effective registration statement on Form S-3 filed with the U.S. Securities and Exchange Commission, pursuant to which it intends to offer up to 6,660,000 units at US$0.60 per unit, each unit comprising one common share and one half of one non-transferable common share purchase warrant. Each whole warrant will entitle the holder to purchase one common share of the Company at a price of US$0.90 per share for a period of 24 months from the closing date. The Company can accelerate the expiry of the warrants to a date 30 days after giving notice to the Warrantholders if the common shares of the Compa ny trade at a volume weighted average price of greater than $1.15 per share for a period of 20 consecutive trading days on the NYSE-Amex. The offering is subject to regulatory approvals. |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and related notes appearing elsewhere in this Quarterly Report filed on Form 10-Q. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under the heading “Risk Factors and Uncertainties” in our Form 10-K filed with the SEC on March 30, 2010, and elsewhere in this report.

This discussion and analysis should be read in conjunction with the accompanying unaudited interim consolidated financial statements and related notes. The discussion and analysis of the financial condition and results of operations are based upon the unaudited interim consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires Midway to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent liabilities at the financial statement date and reported amounts of revenue and expenses during the reporting period. On an on-going basis Midway reviews its estima tes and assumptions. The estimates were based on historical experience and other assumptions that Midway believes to be reasonable under the circumstances. Actual results are likely to differ from those estimates under different assumptions or conditions, but Midway does not believe such differences will materially affect our financial position or results of operations. Critical accounting policies, the policies Midway believes are most important to the presentation of its financial statements and require the most difficult, subjective and complex judgments, are outlined below in “Critical Accounting Policies,” and have not changed significantly.

Cautionary Note Regarding Forward-Looking Statements

In addition, certain statements made in this report may constitute “forward-looking statements”. These forward-looking statements involve known or unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of Midway to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Except for historical information, the matters set forth herein, which are forward-looking statements, involve certain risks and uncertainties that could cause actual results to differ. Potential risks and uncertainties include, but are not limited to, unexpected changes in business and economic conditions; significant increases or decreases in gold prices; changes in interest and currency exchange rates; unanticipated grade changes; metallurgy, processing, access, availability of materials, equipment, supplies and water; determination of reserves; results of current and future exploration activities; results of pending and future feasibility studies; joint venture relationships; political or economic instability, either globally or in the countries in which we operate; local and community impacts and issues; timing of receipt of government approvals; accidents and labor disputes; environmental costs and risks; competitive factors, including competition for property acquisitions; and availability of external financing at reasonable rates or at all. Forward- looking statements can be identified by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continues” or the neg ative of these terms or other comparable terminology. Although Midway believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Forward-looking statements are made based on management’s beliefs, estimates, and opinions on the date the statements are made, and Midway undertakes no obligation to update such forward-looking statements if these beliefs, estimates, and opinions should change, except as required by law.

Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates

The mineral estimates in this Form 10-Q have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in United States Securities and Exchange Commission (“SEC”) Industry Guide 7 under the Unite d States Securities Act of 1993, as amended. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian ru les, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Quarterly Report on Form 10-Q and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Overview

Company Overview

Midway is a precious metals exploration company focused on the creation of value for shareholders by exploring and developing quality precious metal resources in stable mining areas.

Midway’s corporate office is located at 15782 Marine Drive – Unit 1, White Rock, British Columbia, Canada V4B 1E6.

In the third quarter of 2010, Midway’s principal operations office was relocated from Helena, Montana to Denver, Colorado.

Midway maintains field offices in Lovelock, Tonopah and Ely Nevada. These offices support the Spring Valley, Midway and Pan Projects in Nevada respectively. These offices also support work on two other exploration projects, located on four of the major Nevada gold trends. Midway currently controls certain mineral rights on the Cortez, Humboldt and Round Mountain Gold Trends.

Business Strategy and Development

We have four advanced exploration projects: the Spring Valley, the Pan and the Midway projects in Nevada and the Golden Eagle project in Washington and two earlier stage exploration targets in Nevada. Midway plans to continue to attempt to expand these new gold discoveries through exploration.

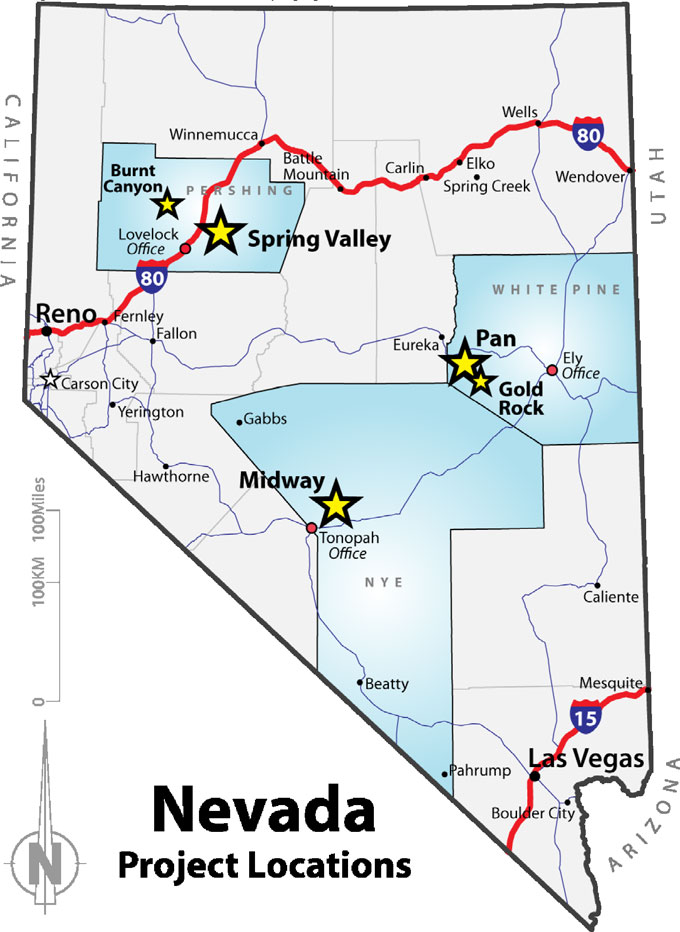

The map below shows the location of Midway’s properties located in Nevada, USA.

Highlights for the third quarter 2010 and up to November 5, 2010:

| · | On July 20, 2010 the Company announced the results of the preliminary economic assessment (“PEA”) for its 100% owned Pan project located in White Pine County, Nevada. The PEA, prepared by Gustavson Associates, is based on the July 1, 2009 resource estimate for the Pan project. This PEA demonstrates the robust economics and technical favorability of the Pan project. Midway expects that drilling planned in 2010 and 2011 may improve the grade and expand the mineral resource. |

| · | Barrick drilling at Spring Valley focused on continued expansion of the resource. |

| · | Update per new press releases |

Activities on Midway’s properties in the third quarter ended September 30, 2010 and up to November 5, 2010 the date of this Quarterly Report filed on Form 10-Q, are described in further detail below.

Spring Valley Property, Pershing County, Nevada

Midway and Barrick entered into an agreement on March 9, 2009 for the exploration and development of the Spring Valley property in Pershing County, Nevada, covering approximately 18.4 square miles. The Spring Valley project is located 20 miles northeast of Lovelock and approximately 3 miles north of the Coeur Rochester Open Pit Mine. Spring Valley is a diatreme/porphyry hosted gold system, and located on the Humboldt Gold Trend.

Under the terms of the agreement, Barrick may earn a 60% interest in the property by spending US$30,000,000 in work expenditures by December 31, 2013. Barrick has informed the Company that they expect to have completed the US$5,000,000 expenditure required in 2010 to maintain the cumulative venture earn-in schedule of US$9,000,000 by the end of October 2010 or shortly thereafter.

Assay results from the 34 holes drilled by Barrick at Spring Valley in 2009 expanded the gold mineralized zone hosted in and adjacent to a porphyry intrusion. In a November 30, 2009 press release, the Company reported significant intercepts of 339.5 feet of 0.037 ounce per ton (“opt”) gold (including 10 feet of 0.485 opt gold) and 156 feet of 0.028 opt gold in SV09-461C and high grade intercepts include a metallic screen assay of 5 feet of 9.101 opt gold in SV09-451C.

On March 23, 2010 the Company announced that Barrick had commenced its 2010 drilling program at Spring Valley, with a focus on continued expansion of the gold resource including both reverse circulation and core drilling. Drilling is expected to be completed by fall for this calendar year. In an August 26, 2010 press release, the Company announced significant intercepts from second quarter drilling of 103 feet of 0.097 opt gold (including 3.1 feet of 0.521 opt gold and 5.2 feet of 0.732 opt gold), 42.7 feet of 0.117 opt gold (including 5 feet of 0.653 opt gold), and 47.1 feet of 0.026 opt gold in drill hole SV10-478C. Drill hole SV10-478C was part of a fence of holes that tested extensions of mineralization perpendicular to the Basin Cross fault gold trend.

On October 6, 2010 the Company reported that test results report gold recoveries up to 98% with conventional oxide ore leaching treatment, and showed high gold recoveries across all the grade ranges tested. These tests were conducted at McClelland Laboratories Inc., Reno, Nevada, and were overseen by Barrick. The results show that several commonly used production options exist for processing and recovering the gold from Spring Valley and these include heap leaching, typical oxide leaching and recovery by gravity methods.

The Spring Valley project is without known reserves, as defined under SEC Guide 7, and the proposed program for the property is exploratory in nature.

Barrick is now funding the majority of the ongoing costs of this project. In the three months ended September 30, 2010, the Company incurred $10,939 primarily to fund property maintenance and taxes for the portion of the Seymork land that falls outside of the Barrick agreement area of interest.

Data reported to Midway by Barrick and disclosed in this Form 10-Q has been reviewed for Midway by Eric LeLacheur, (M.Sc., CPG), a “qualified person” as that term is defined in National Instrument 43-101.

Pan Project, White Pine County, Nevada

The Pan property is located at the northern end of the Pancake mountain range in western White Pine County, Nevada, approximately 22 miles southeast of Eureka, Nevada, and 50 miles west of Ely, Nevada. The Pan deposit is a Carlin-style, disseminated gold deposit, hosted along the Battle Mountain-Eureka Trend.

Key operations personnel now include Ken Brunk, President and Chief Operating Officer, Richard Moritz, Vice President of Project Development, William Neal, Vice President of Geological Services and the most recent appointment of H. Thomas Williams as Director of Environmental Affairs.

Since joining Midway in May 2010, Mr. Brunk has identified the critical path items and timeline to develop the Pan project to production. Key management personnel and consultants have been engaged and work has been underway since May to complete the environmental baseline studies and the design documents and permit applications.

On July 20, 2010 the Company reported the results of the PEA for the Pan project. The PEA, prepared by Gustavson Associates, is based on the July 1, 2009 resource estimate for the Pan project. This PEA demonstrates the robust economics and technical favorability of the Pan project.

| Total gold produced for sale | |

| Average gold grade | |

| Average annual gold production | |

| Peak annual production | |

| Mine life | |

| IRR (pre-tax) | |

| NPV (pre-tax) | |

| Discount rate | |

| Pay-back period | |

| Net cumulative cash flow (pre-tax) | |

| Direct cash costs | |

| Initial capital expenditures including mining pre-strip, equipment, process, infrastructure & buildings, owners and miscellaneous costs | |

| Metallurgical recovery rate | |

| Long-term gold price | |

Note: This PEA is preliminary in nature as it includes mineral resources and there is no certainty that the preliminary assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The PEA included an independent audit of the Company’s December 1, 2009 mineral resource estimate.

Using a 0.004 opt cut-off grade for both categories of resource there are 3,498,080 short tons at 0.019 opt containing 65,775 ounces of gold in the Measured Resource category and 39,252,272 short tons at 0.016 opt containing 616,473 ounces of gold in the Indicated Resource Category for a total of 42,750,352 short tons at 0.016 opt containing 682,248 ounces of gold of Measured plus Indicated Resource. There is an additional 3,622,368 short tons at 0.014 opt containing 50,876 ounces of gold in the Inferred Resources category that were not included in the PEA.

The PEA considers the Pan gold project to be developed as an open pit mine and heap leach operation. Three production scenarios were considered; In-pit Crush and Convey, Truck Haulage, and Contractor Mining. The In-pit crush and convey option has the highest capital cost, but lowest operating costs, a slightly higher IRR, and is considered the preferred option discussed here. The PEA utilized only Measured and Indicated Resources in the pit design. The base case utilizes a cutoff grade of 0.14 g/t. The average grade of mined material sent to leach was 0.62 g/t with ultimate recoveries of 70% for North Pan Mineralization, and 75% for South Pan Mineralization. The forecast mine life was 9 years with a total of 327,000 ounces of gold produced. Opportunities appear to exist to refine various aspects of the project and improve economics through cost reduction, optimization and through an increase in the size of the overall resource from the planned 2010/2011 drill programs. Initial project capital costs, as evaluated in the PEA, are estimated at $45 million plus working capital of $5 million and a 20% contingency totaling $9 million.

Operating costs and sensitivity analysis in US dollars are as follows:

| Items | Cost per ton processed | Cost per ounce |

| Mining cost | $2.02 | $155.24 |

| Processing and refining cost | $2.94 | $225.91 |

| G&A | $0.40 | $30.74 |

| Operating contingency | $0.54 | $41.19 |

The PEA was prepared to the standards of National Instrument 43-101 and was filed on SEDAR on July 21, 2010. The PEA was prepared under the supervision of Donald Hulse, Principal Mining Engineer and Terre Lane, Principal Mining Engineer of Gustavson, each of whom are independent of the Company and are qualified persons.

The critical path to commencing production at Pan by 2013 is directed towards completion of a feasibility study and permitting.

On October 13, 2010 the Company announced that it completed a total of 1,757 meters (5,764 feet) of diamond drilling in 14 core holes in the North and South Pan areas. In an October 28, 2010 press release, the Company announced results of six core holes drilled for metallurgical testing including significant intercepts of 266 feet of 0.033 opt gold in PN10-10c and 282 feet of 0.025 opt gold in PN10-02c. Additional assays are pending for the 8 core holes drilled for geotechnical and waste rock characterization studies.