UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrantx

Filed by a Party other than the Registranto

Check the appropriate box:

| | |

o | | Preliminary Proxy Statement |

| | |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

x | | Definitive Proxy Statement |

| | |

o | | Definitive Additional Materials |

| | |

o | | Soliciting Material Pursuant to Rule 14a-12 |

Midway Gold Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| (1) | | Title of each class of securities to which transaction applies: |

| | | |

| (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| (4) | | Proposed maximum aggregate value of transaction: |

| | |

o | | Fee paid previously with preliminary materials. |

| | |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| (1) | | Amount Previously Paid: |

| | | |

| (2) | | Form, Schedule or Registration Statement No.: |

MIDWAY GOLD CORP.

Suite 280, 8310 South Valley Highway

Englewood, Colorado 80112

Notice of Annual and Special Meeting of Shareholders

To all Shareholders of Midway Gold Corp.:

You are invited to attend the 2011 Annual and Special Meeting (the “Meeting”) of Shareholders of Midway Gold Corp. (the “Company” or “Midway”) to be held on May 5, 2011 at 10:00 a.m. (Vancouver time) at the offices of Stikeman Elliott, Suite 1700 Park Place, 666 Burrard Street, Vancouver, BC, Canada V6C 2X8. The purposes of the Meeting are:

§

to have placed before the Meeting the audited financial statements of the Corporation for the fiscal year ended December 31, 2010 together with the auditors’ report thereon;

§

to set the number of directors at 5;

§

The election of the nominees to the Company’s Board of Directors are to serve until the Company’s 2012 Annual Meeting of Shareholders or until successors are duly elected and qualified. The following are nominees for election as Directors: Daniel E. Wolfus, Kenneth A. Brunk, George T. Hawes, Frank S. Yu and Roger A. Newell;

§

To ratify the appointment of KPMG LLP as the Company’s auditor for the fiscal year 2011 and to authorize the Board of Directors to fix the remuneration to be paid to KPMG LLP;

§

To approve the renewal of the Company’s Stock Option Plan; and

§

Any other business that may properly come before the Meeting.

The Board of Directors has fixed March 31, 2011 as the record date for the Meeting. Only shareholders of the Company of record at the close of business on that date will be entitled to notice of, and to vote at, the Meeting. A list of shareholders as of March 31, 2011 will be available at the Meeting for inspection by any shareholders.

Shareholders will need to register at the Meeting to attend the Meeting. If your shares are not registered in your name, you will need to bring proof of your ownership of those shares to the meeting in order to register. You should ask the broker, bank or other institution that holds your shares to provide you with either a copy of an account statement or letter that shows your ownership of Midway Gold Corp. shares as of March 31, 2011. Please bring that documentation to the Meeting to register.

IMPORTANT

Whether or not you expect to attend the Meeting, please sign and return the enclosed proxy promptly. If you decide to attend the meeting you may, if you wish, revoke the proxy and vote your shares in person.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on May 5, 2011. The proxy statement and annual report to shareholders are available atwww.midwaygold.com and www.sedar.com.

By Order of the Board of Directors,

Daniel Wolfus, Chairman and Chief Executive Officer

Englewood, Colorado

March 31, 2011

- 1 -

MIDWAY GOLD CORP.

Suite 280, 8310 South Valley Highway

Englewood, Colorado 80112

Proxy Statement

for

Annual and Special Meeting of Shareholders

to be Held May 5, 2011

Unless the context requires otherwise, references in this statement to “Midway Gold,” “Midway,” the “Company,” “we,” “us,” or “our” refer to Midway Gold Corp.

The Annual and Special Meeting of Shareholders of Midway Gold Corp. will be held on May 5, 2011 at 10:00 a.m. (Vancouver time) at the offices of Stikeman Elliott, Suite 1700 Park Place, 666 Burrard Street, Vancouver, BC, Canada V6C 2X8. We are providing the enclosed proxy materials and form of proxy in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies for this Meeting. The Company anticipates that this Proxy Statement and the form of proxy will first be mailed to holders of the Company’s shares on or about April 11, 2011.

Under our Articles, at least two shareholders who are, or who represent by proxy, shareholders who, in the aggregate, hold at least 5% of the issued shares entitled to be voted at the Meeting must be present before any action may validly be taken at the Meeting. If such a quorum is not present in person or by proxy, we will reschedule the Meeting.

The information contained in this Proxy Statement, unless otherwise indicated, is as of March 31, 2011.

References to dollars ($) in this Proxy Statement shall mean Canadian dollars unless otherwise indicated. The average exchange rate for the fiscal year ended December 31, 2010 for the conversion of US dollars to Canadian dollars was 1.03.

The solicitation of proxies will be primarily by mail. Certain employees or directors of Midway may also solicit proxies by telephone or in person. The cost of solicitation will be borne by the Company.

PART 1 – VOTING

HOW A VOTE IS PASSED

Except for election of directors, all of the matters that will come to a vote at the Meeting as described in the Notice of Meeting are ordinary resolutions and can be passed by a simple majority – that is, if more than half of the votes that are cast are in favor, then the resolution is approved. Abstentions will not be counted for or against a proposal.

The nominees for election as directors at the Meeting will be elected by a plurality of the votes cast at the meeting. The nominees with the most votes will be elected. A properly executed proxy card markedWITHHELD with respect to the election of directors will not be voted and will not countFOR orAGAINST any of the nominees for which the vote was withheld.

WHO CAN VOTE?

If you are a registered shareholder of Midway as at March 31, 2011, you are entitled to attend the Meeting and cast a vote for each share registered in your name on all resolutions put before the Meeting. If the shares are registered in the name of a corporation, a duly authorized officer of the corporation may attend on its behalf but documentation indicating such officer’s authority should be presented at the Meeting. If you are a registered shareholder but do not wish to, or cannot, attend the Meeting in person you can appoint someone who will attend the Meeting and act as your proxyholder to vote in accordance with your instructions (see “Voting by Proxy”). If yourshares are registered in the name of a “nominee” (usually a bank, trust company, securities dealer or other financial institution) you should refer to the section entitled “Non-registered Shareholders” set out below.

2

It is important that your shares be represented at the Meeting regardless of the number of shares you hold. If you will not be attending the Meeting in person, we invite you to complete, date, sign and return your form of proxy as soon as possible so that your shares will be represented.

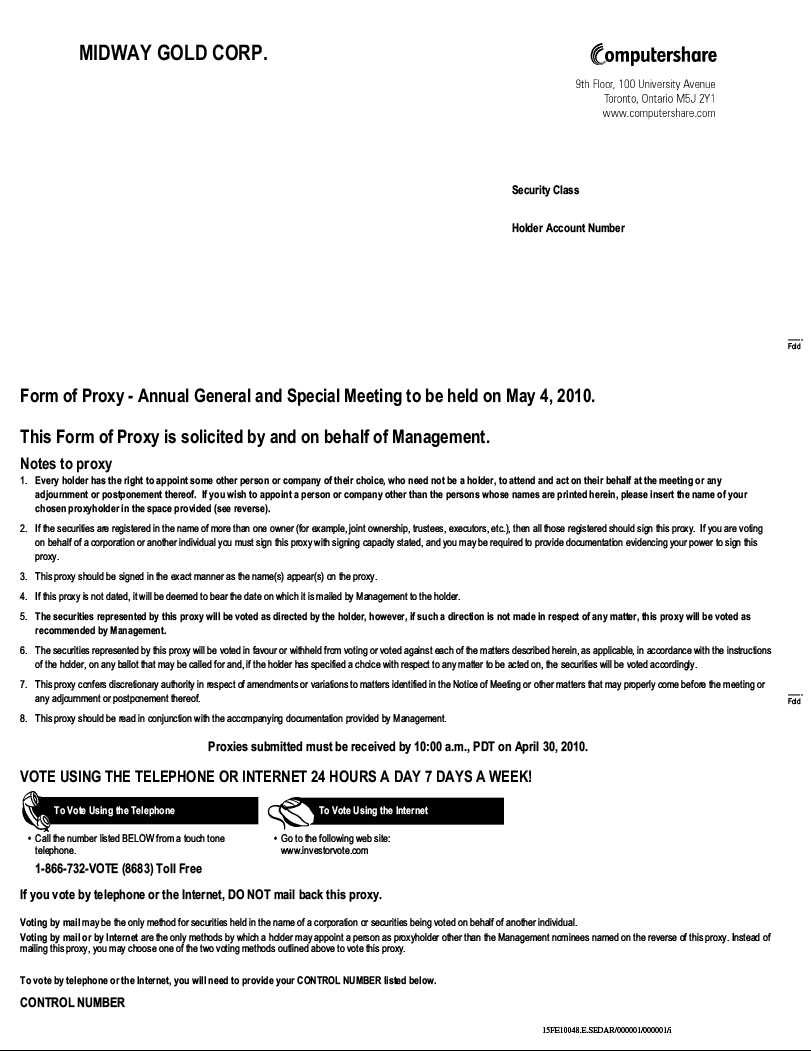

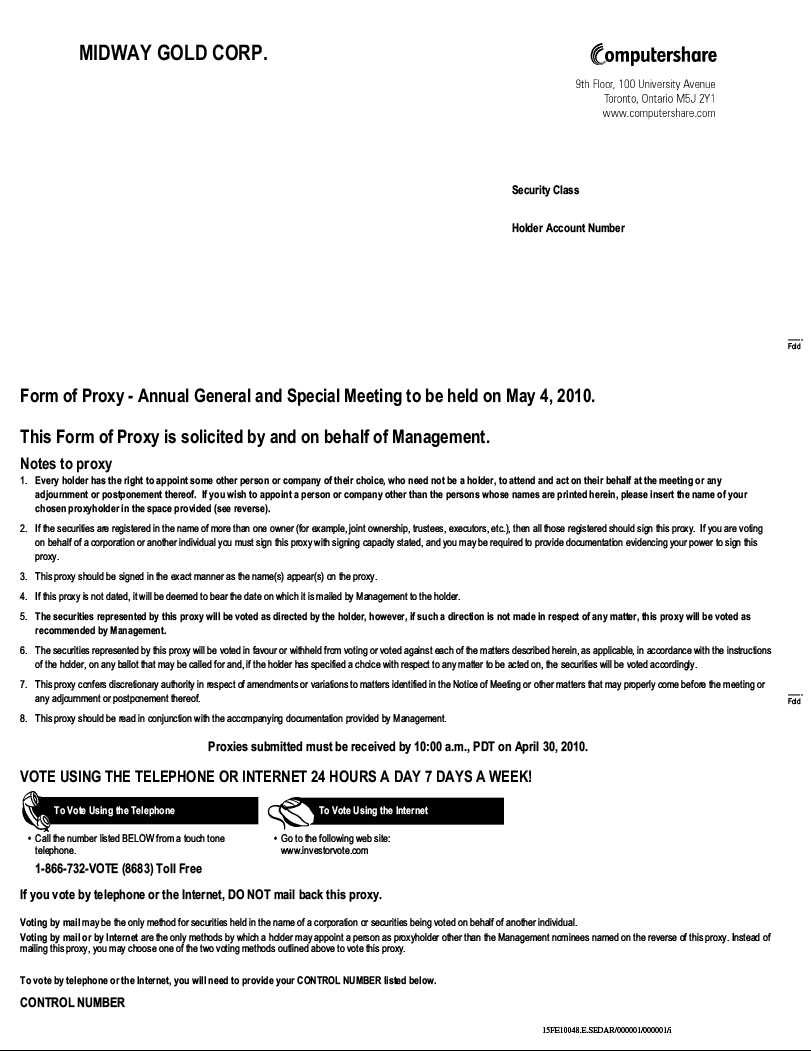

VOTING BY PROXY

If you do not come to the Meeting, you can still make your votes count by appointing someone who will be there to act as your proxyholder. You can either tell that person how you want to vote or you can let him or her decide for you. You can do this by completing a form of proxy accompanying this Proxy Statement.

In order to be valid, you must return the completed form of proxy forty-eight hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting, or adjournment thereof to our Transfer Agent, Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1 or by toll free North American fax number 1-866-249-7775 or by international fax number (416) 263-9524.

What is a proxy?

A form of proxy is a document that authorizes someone to attend the Meeting and cast your votes for you. We have enclosed a form of proxy with this Proxy Statement. You should use it to appoint a proxyholder, although you can also use any other legal form of proxy.

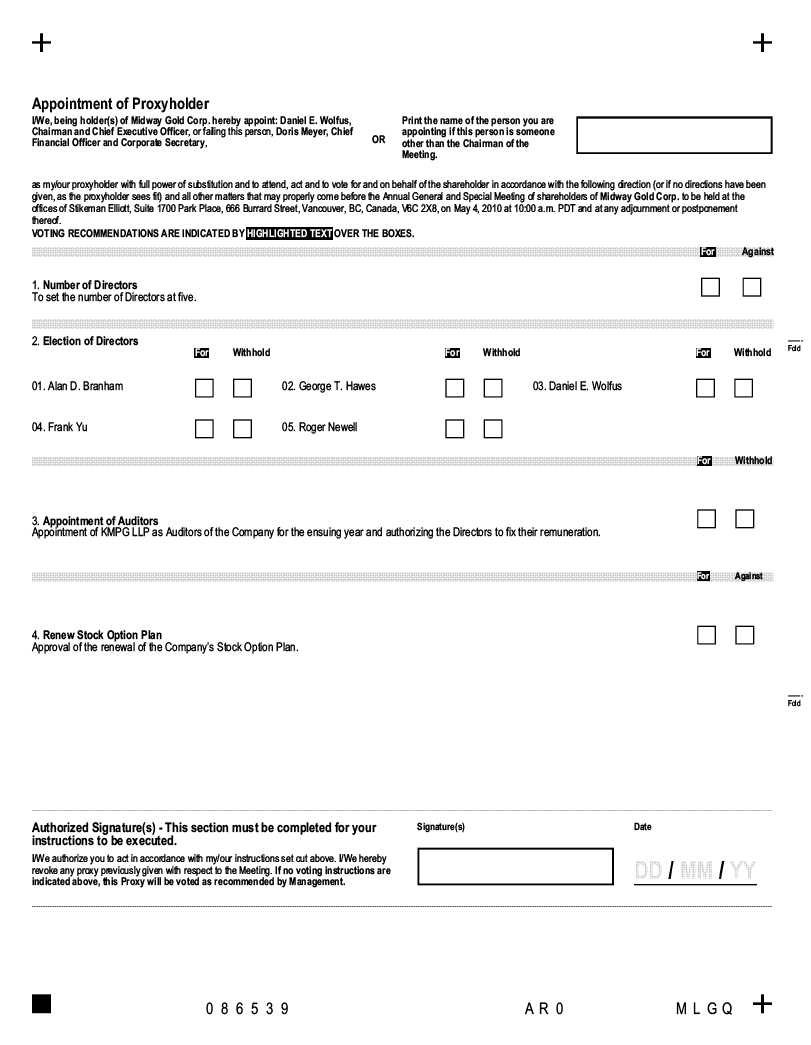

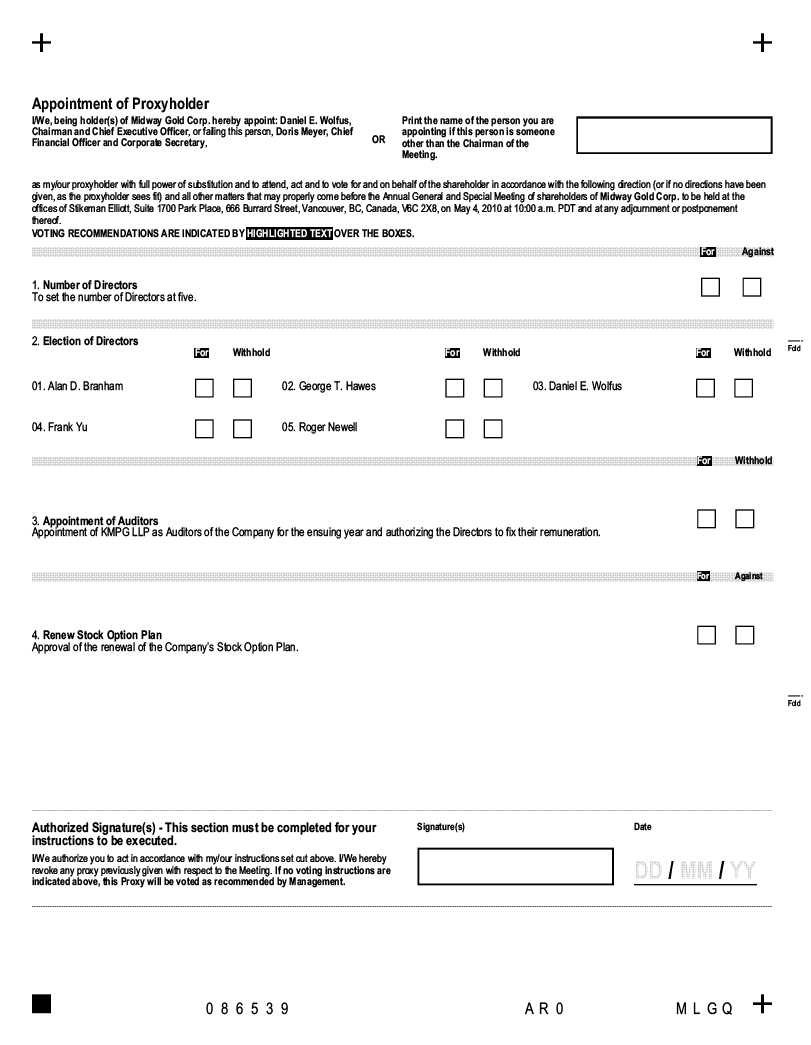

Appointing a proxyholder

You can choose any individual to be your proxyholder. It is not necessary for the person whom you choose to be a shareholder. To make such an appointment, simply fill in the person’s name in the blank space provided in the enclosed form of proxy. To vote your shares, your proxyholder must attend the Meeting. If you do not fill a name in the blank space in the enclosed form of proxy, the persons named in the form of proxy are appointed to act as your proxyholder. Those persons are directors and/or officers of Midway.

Instructing your proxyholder

You may indicate on your form of proxy how you wish your proxyholder to vote your shares. To do this, simply mark the appropriate boxes on the form of proxy. If you do this, your proxyholder must vote your shares in accordance with the instructions you have given.

If you do not give any instructions as to how to vote on a particular issue to be decided at the Meeting, your proxyholder can vote your shares as he or she thinks fit. If you have appointed the persons designated in the form of proxy as your proxyholder they will, unless you give contrary instructions, vote your shares at the Meeting as follows:

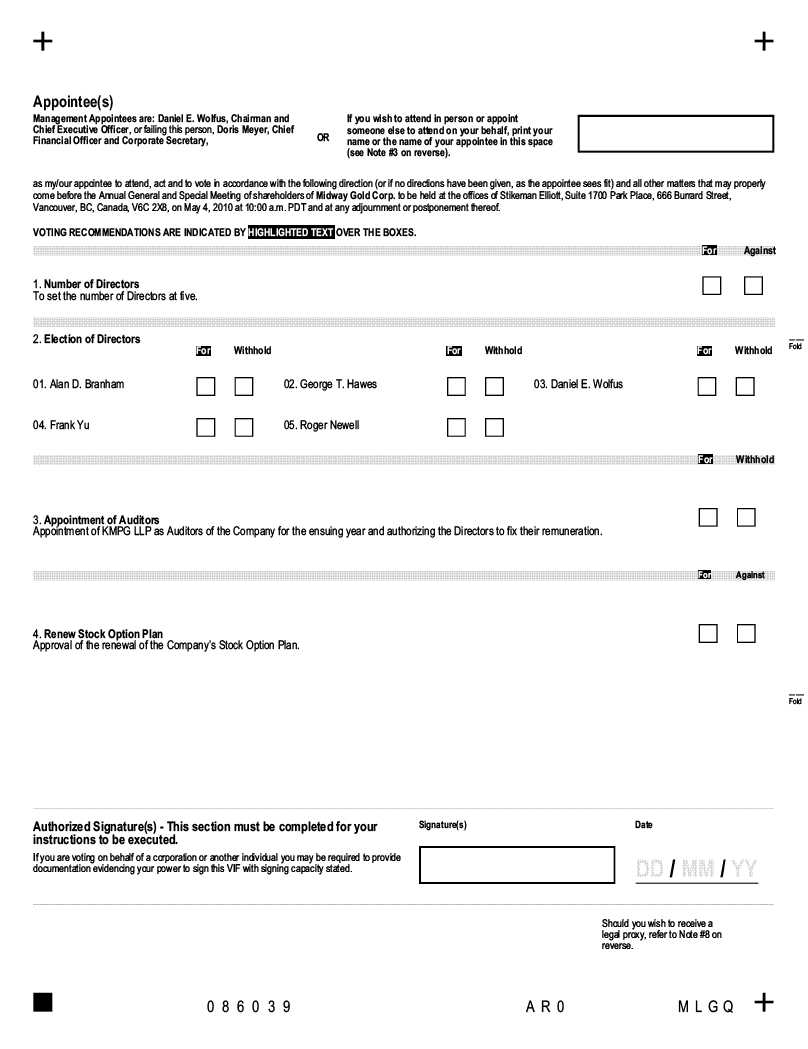

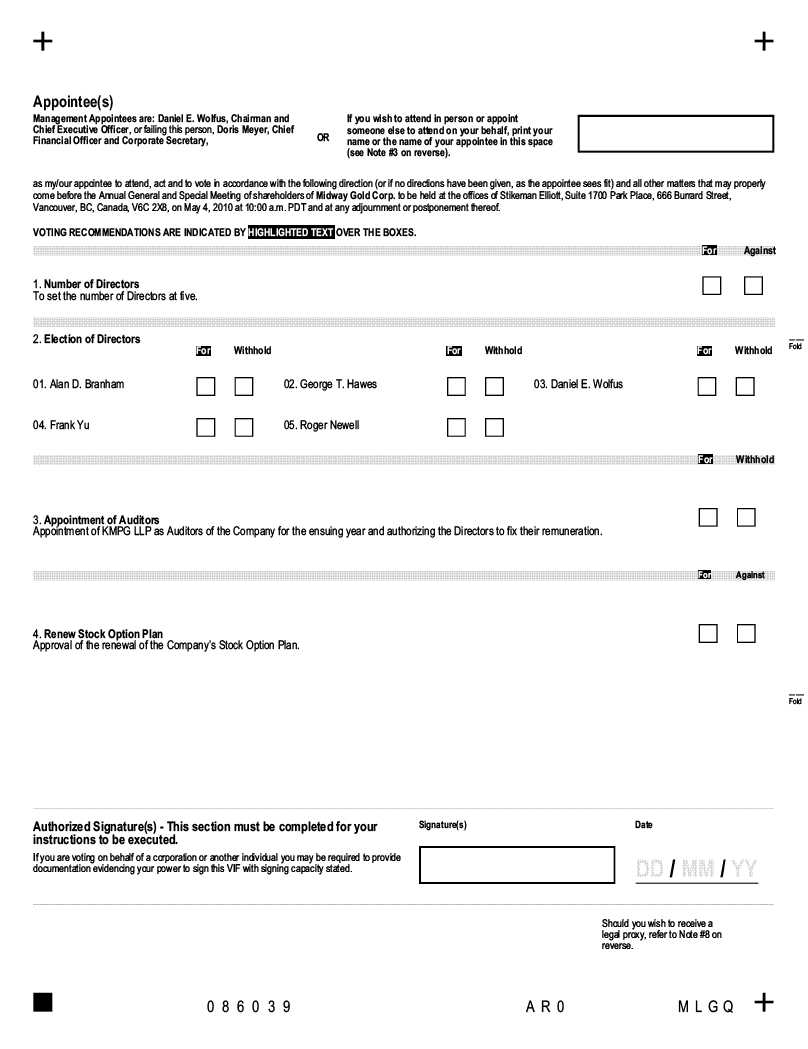

FOR setting the number of directors at 5;

FOR the election of the proposed nominees as directors;

FOR the re-appointment of KPMG LLP as the Company’s auditor for the fiscal year 2011 and to authorize the Board of Directors to fix the remuneration to be paid to KPMG LLP; and

FOR the resolution to approve the renewal of the Company’s Stock Option Plan.

For more information about these matters, see Part 3 - The Business of the Meeting. The enclosed form of proxy gives the persons named on it the authority to use their discretion in voting on amendments or variations to matters identified on the Notice of Meeting. At the time of printing this Proxy Statement, the management of Midway is not aware of any other matter to be presented for action at the Meeting. If, however, other matters do properly come before the Meeting, the persons named on the enclosed form of proxy will vote on them in accordance with their best judgment, pursuant to the discretionary authority conferred by the form of proxy with respect to such matters and in accordance with applicable law.

3

Changing your mind

If you want to revoke your proxy after you have delivered it, you can do so at any time before it is used. You may do this by (a) attending the Meeting and voting in person; (b) signing a proxy bearing a later date; (c) signing a written statement which indicates, clearly, that you want to revoke your proxy and delivering this signed written statement to the Corporate Office of Midway Gold Corp. at Suite 280, 8310 South Valley Highway, Englewood, Colorado 80112; or (d) in any other manner permitted by law.

Your proxy will only be revoked if a revocation is received by 4:00 in the afternoon (Englewood time) on the last business day before the day of the Meeting, or any adjournment thereof, or delivered to the person presiding at the Meeting before it (or any adjournment) commences. If you revoke your proxy and do not replace it with another that is deposited with us before the deadline, you can still vote your shares but to do so you must attend the Meeting in person.

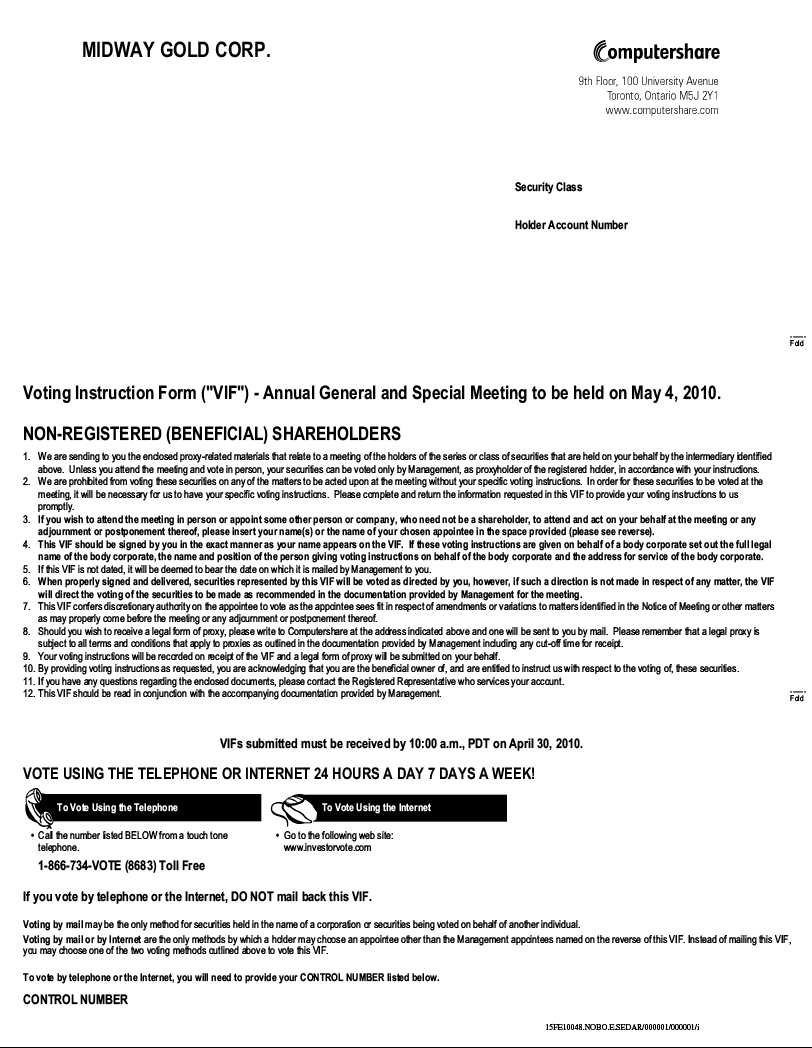

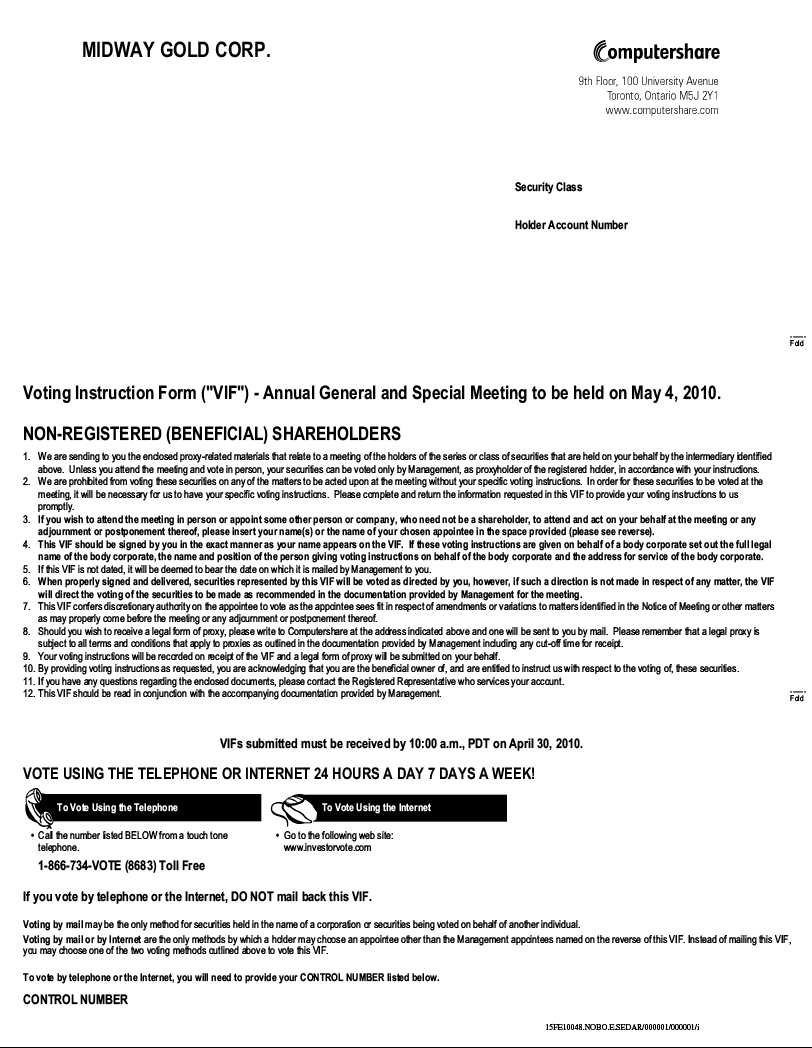

NON-REGISTERED SHAREHOLDERS

If your shares are not registered in your own name, they will be held in the name of a “nominee,” usually a bank, trust company, securities dealer or other financial institution and, as such, your nominee will be the entity legally entitled to vote your common shares and must seek your instructions as to how to vote your shares.

Accordingly, unless you have previously informed your nominee that you do not wish to receive material relating to shareholders’ meetings, you will have received this Proxy Statement from your nominee, together with a form of proxy or a request for voting instruction form. If that is the case,it is most important that you comply strictly with the instructions that have been given to you by your nominee on the voting instruction form. If you have voted and wish to change your voting instructions, you should contact your nominee to discuss whether this is possible and what procedures you must follow.

If your shares are not registered in your own name, Midway’s Transfer Agent will not have a record of your name and, as a result, unless your nominee has appointed you as a proxyholder, will have no knowledge of your entitlement to vote. If you wish to vote in person at the Meeting, therefore, please insert your own name in the space provided on the form of proxy or voting instruction form that you have received from your nominee. If you do this, you will be instructing your nominee to appoint you as proxyholder. Please adhere strictly to the signature and return instructions provided by your nominee. It is not necessary to complete the form in any other respect, since you will be voting at the Meeting in person. Please register with the Transfer Agent, Computershare Investor Services Inc., upon arrival at the Meeting.

The Notice of Meeting, this Proxy Statement and our Annual Report filed on Form 10-K for the fiscal year ended December 31, 2010 are being sent to both registered and non-registered owners of our common shares. If you are a non-registered owner and we have sent these materials to you directly, your name and address and information about your holdings of common shares of Midway have been obtained in accordance with applicable securities regulatory requirements from the nominee holding the securities on your behalf. By choosing to send these materials to you directly, Midway (and not your nominee) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions form.

Broker Non-Votes

In the United States, brokers and other intermediaries, holding shares in street name for their customers, are generally required to vote the shares in the manner directed by their customers. If their customers do not give any direction, brokers may vote the shares at their discretion on routine matters, but not on non-routine matters. Since the election of directors under this Proxy Statement is uncontested, the election of directors is considered a non-routine matter and brokers may not vote shares held in street name for their customers in relation to this item of business without direction from their customers. Brokers may also not vote shares held in street name for their customers in relation to the stock option plan renewal without direction from their customers. The appointment of the Company's auditors for the 2011 fiscal year is considered a routine matter and brokers will be permitted to vote shares held in street name for their customers in relation to this item of business.

4

The absence of a vote on a non-routine matter is referred to as a broker non-vote. Any shares represented at the Meeting but not voted (whether by abstention, broker non-vote or otherwise) will have no impact in the election of directors, except to the extent that the failure to vote for an individual results in another individual receiving a larger proportion of votes cast for the election of directors.

PART 2 - VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

Midway has authorized capital of an unlimited number of common shares. Each shareholder is entitled to one vote for each common share registered in his or her name at the close of business on March 31, 2011, the date fixed by our directors as the record date for determining who is entitled to receive notice of and to vote at the Meeting. No cumulative rights are authorized, and dissenters’ rights are not applicable to any of the matters being voted upon.

At the close of business on March 31, 2011, 101,655,246 of our common shares were outstanding. To the knowledge of our directors and officers, there is no one person or company who or which beneficially own, directly or indirectly, or exercised control or direction over common shares carrying more than 10% of the voting rights attached to all outstanding common shares.

PART 3 - THE BUSINESS OF THE MEETING

PROPOSALS 1 & 2 – NUMBER AND ELECTION OF DIRECTORS

What am I voting on?

Under the Articles of the Company, the number of directors may be fixed or changed from time to time by ordinary resolution but shall not be fewer than three. There are currently five directors and five nominees are proposed by management for election as directors at the Meeting.

Unless you give other instructions, the persons named in the enclosed form of proxy intend to voteFOR setting the number of directors at five.

The Board of Directors has nominated five (5) of the current Board members for election at the 2011 Annual Meeting, to hold office until the 2012 Annual Meeting:

§

Daniel E. Wolfus

§

Kenneth A. Brunk

§

George T. Hawes,

§

Frank S. Yu, and

§

Roger A. Newell

Each of the nominees has agreed to stand for election and we are not aware of any intention of any of them not to do so. Directors of Midway are elected for a term of one year. The term of office of each of the nominees proposed for election as a director will expire at the Meeting, and each of them, if elected, will serve until the close of the next annual general meeting, unless he or she resigns or otherwise vacates office before that time. The persons named above will be presented for election at the Meeting as management’s nominees for the Board of Directors, and the persons named in the enclosed instrument of Proxy intend to vote for the election of these nominees.

The Board of Directors recommends a vote FOR each of the nominees.

5

INFORMATION ON THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to Midway’s directors and executive officers at December 31, 2010. The term for each director expires at Midway’s next annual meeting or until his or her successor is appointed. The ages of the directors and executive officers are shown as of December 31, 2010.

| | | |

Name, Current Position and Province or State of Residence(1) | Principal Occupation | Director or Officer Since | Age |

Daniel E. Wolfus(5) Chairman, Chief Executive Officer and Director

California, USA | Executive Chairman and Chief Executive Officer of the Company since December 23, 2009 | November 21, 2008 | 65 |

Kenneth A. Brunk(5) President, Chief Operating Officer and Director Colorado, USA | President and Chief Operating Officer of the Company from May 12, 2010 to the present. From March 25, 2008 to May 11, 2009 Senior Vice President and Chief Operating Officer of Romarco Minerals Inc.; from December 2001 to January 2007 President and Chief Executive Officer of Harrison Western Group which provided engineering services, process technology, mining and construction services to the mining industry. | May 12, 2010 | 64 |

George T. Hawes (2) (3) (4) Director New York, USA | President of G.T. Hawes & Co., a private New York real estate and investment company | June 12, 2003 | 64 |

Frank S. Yu (2) (3) (4) (5) Director

Nevada, USA | Retired Businessman | November 21, 2008 | 61 |

Roger A. Newell, PhD(2)(3)(4) (5) Director Colorado, USA | Chairman of Lake Victoria Mining Company since August 2010. President and director of Lake Victoria Mining from June 2008 to August 2010. | December 23, 2009 | 68 |

6

| | | |

Name, Current Position and Province or State of Residence(1) | Principal Occupation | Director or Officer Since | Age |

Doris A. Meyer(5) Chief Financial Officer and Corporate Secretary British Columbia, Canada | Certified General Accountant and President and Chief Executive Officer of Golden Oak Corporate Services Ltd., a private financial reporting and corporate compliance firm. | December 1, 2006 | 58 |

Richard D. Moritz(6) Vice President of Project Development Colorado, USA | Vice President of Project Development of the Company | July 1, 2010 | 54 |

William S. Neal(7) Vice President of Geological Services Montana, USA | Vice President of Geological Services of the Company since June 17, 2010. | June 17, 2010 | 57 |

(1)

The information as to residence and principal occupation, not being within the knowledge of Midway, has been furnished by the respective directors and officers individually.

(2)

Member of the Audit Committee

(3)

Member of the Compensation Committee

(4)

Member of the Corporate Governance and Nominating Committee

(5)

Member of the Disclosure Committee

(6)

Mr. Moritz was hired on June 17, 2010

(7)

Mr. Neal has worked for the Company since March 15, 2007, and he was appointed to an executive role on June 17, 2010.

The following is a description of the business background of the directors and executive officers of the Company.

Daniel E. Wolfus – Chairman, Chief Executive Officer and a Director. Mr. Wolfus gained over 28 years of investment banking experience, firstly with E.F. Hutton & Co., where Mr. Wolfus became a partner and Senior Vice President in charge of the West Coast Corporate Finance Department, followed by his tenure as Chairman, CEO and chief organizer of Hancock Savings Bank in Los Angeles. During his term with Hancock Savings the bank grew to $225 million in assets before its sale in 1997. Mr. Wolfus earned a MBA in Finance and a BA-Economics at the University California, Los Angeles. From 1997 until it was dissolved in May 2008, Mr. Wolfus was the owner, president and publisher of a nationwide publication named “Estylo” for the Hispanic Market. He is currently a director of Melkior Resources Inc. (TSX-V) and EMC Metals Corp. (TSX). Mr. Wolfus also serves in various charitable and non-profit organizations in the United States. Mr. Wolfus has served as a director of Midway since November 21, 2008 and on December 16, 2009 Mr. Wolfus was appointed as a full time Chairman and Chief Executive Officer of Midway.

For the following reasons the Board concluded that Mr. Wolfus should serve as a director of Midway in light of its business and structure, at the time it files this Proxy Statement. Mr. Wolfus’ extensive experience in the finance and banking industry give him a unique skill set that is important to the Company’s financial management and financing activities. Further, Mr. Wolfus’ experience on the board of directors of several other small mining companies, gives him the management experience necessary to be the Company’s Chairman and Chief Executive Officer.

Kenneth A. Brunk – President, Chief Operating Officer and Director. Mr. Brunk is our President and Chief Operating Officer since May 12, 2010 when he replaced Alan Branham in that role. Mr. Brunk dedicates 100% of his working time to the business of Midway. Mr. Brunk, a Qualified Person, holds a degree in Metallurgical Engineering from Michigan Technological University and throughout his forty-two year career has conducted numerous feasibility studies and has as well been responsible for designing, constructing, staffing and operating multiple mining operations and improving process efficiencies around the world. Prior to joining Midway, he served as Chief Operating Officer of Romarco Minerals Inc., where he led Romarco through the feasibility study on its Haile Gold Mine project. Mr. Brunk’s efforts aided in elevating Haile from a prospective exploration effort to a successful world-class mine development project. Previously, as Senior Vice President and Senior Technical Officer at Newmont, Mr. Brunk was responsible for all of the technical functions of the operating, mine planning, metallurgical development, projects, and engineering groups within Newmont. Mr. Brunk has been an officer since May 12, 2010 and a director since December 6, 2010.

For the following reasons the Board concluded that Mr. Brunk should serve as a director of Midway in light of its business and structure, at the time it files this Proxy Statement. Mr. Brunk’s extensive management experience in mining operations in the United States enables him to provide operating insights to the Board. Further, his training and experience as a metallurgical engineer allow him to bring technical expertise in regard to mine development and operations to the Board. Mr. Brunk has experience on the boards of other development and production mining companies, technology companies, professional organizations and charitable groups.

7

George T. Hawes – Director. Mr. Hawes has served as President of G.T. Hawes & Co., a private New York real estate and investment company, from 1979 to present. He is a director American Vanadium Corp. (formerly Rocky Mountain Resources Corp. (TSX-V)) since 2007. Mr. Hawes has served as a director of Midway since June 12, 2003 and he is chairman of our audit committee.

For the following reasons the Board concluded that Mr. Hawes should serve as a director of Midway in light of its business and structure, at the time it files this Proxy Statement. Mr. Hawes’s experience as the President of an investment company brings specialized insight to the Board regarding financial management and financing activities. Further, his financial expertise and experience with other small public companies provides the Board with financial oversight capabilities that is crucial to the Board’s risk management role in the Company and to his role as Chairman of the Company’s Audit Committee.

Frank S. Yu – Director. Outside of his directorship for Midway, Mr. Yu has been retired and acting as a private investor since 2001. Before retirement, Mr. Yu was a senior engineering executive with over 20 years of technical and management positions in major, and start-up computer and communication companies. He earned a Ph.D. in Computer Science at Stanford University and he has been involved with both communication and computer server companies which were later taken public or acquired. Mr. Yu has served as a director of Midway since November 21, 2008.

For the following reasons the Board concluded that Mr. Yu should serve as a director of Midway in light of its business and structure, at the time it files this Proxy Statement. Mr. Yu’s background as an engineering executive with years of technical and management experience in start-up companies brings to the Board a unique skill set regarding small company growth and management issues.

Roger A. Newell, PhD – Director. Dr. Newell holds a Ph.D. in mineral exploration from Stanford University, and has more than forty years of experience in the mining industry. Dr. Newell also holds a M.Sc. in geology from the Colorado School of Mines and is a past president of the Alumni Association. Dr. Newell is renowned internationally for recognizing the potential of the Carlin Trend in Nevada. Under his direction Newmont Mining Company established new exploration programs in Nevada, which ultimately lead to Newmont Mining becoming the world’s largest gold producer and with Nevada operations yielding over 1,000,000 ounces per year. Dr. Newell served as Vice President of Development for Capital Gold Corp (US ticker symbol CGLD) from 2000 to 2007. He was President of CGLD’s Mexican subsidiary, Minera Santa Rita, where he was responsible for bringing the company’s El Chanate gold mine into production. He continued to serve as a member of Capital Gold’s Board of Directors until November 2009. Prior to his time at Capital Gold, he served as Exploration Manager/Senior Geologist for the Newmont Mining Company; Exploration Manager for Gold Fields Mining Company; and Vice President - Development, for Western Exploration Company. He joined Kilimanjaro Mining Company in October, 2007 as a Director and Vice President of Exploration and is Chairman and a Director of Lake Victoria Mining Company Inc.

For the following reasons the Board concluded that Mr. Newell should serve as a director of Midway in light of its business and structure, at the time it files this Proxy Statement. Mr. Newell’s experiences at Newmont Mining Company in establishing exploration programs in Nevada bring to the Board extensive insight to the proper management and direction of the Company’s Nevada properties. Further, Mr. Newell’s experience in management of several other mining companies, both large and small, brings essential risk management skills to the Board.

Doris A. Meyer, CGA – Chief Financial Officer and Corporate Secretary. Ms. Meyer is a Canadian Certified General Accountant and Chief Financial Officer and Corporate Secretary of Midway. Ms. Meyer gained her experience in the mining industry as Vice President, Finance of Queenstake from 1985 to 2003 and Corporate Secretary until 2004. Since 1996, Ms Meyer has owned and served as President of Golden Oak Corporate Services Ltd., which provides publicly traded mineral exploration companies with administrative, accounting and corporate and regulatory compliance services. Ms. Meyer serves as an officer and/or director of: Crescent Resources Corp. (TSX-V), Chief Financial Officer and Corporate Secretary; Kalimantan Gold Corporation Limited (TSX-V; AIM), Director and Chief Financial Officer; Miranda Gold Corp. (TSX-V), Chief Financial Officer and Corporate Secretary; Regency Gold Corp. (TSX.V), Director, and Chief Financial Officer, Corporate Secretary; Santa Barbara Resources Limited (TSX-V), Chief Financial Officer and Corporate Secretary; Sunridge Gold Corp. (TSX-V), Director, Chief Financial Officer and Corporate Secretary, and Tournigan Energy Ltd, (TSX-V), Chief Financial Officer and Corporate Secretary. Ms. Meyer has served as the Chief Financial Officer and Corporate Secretary of Midway since December 1, 2006 and she devotes approximately 10% of her professional time on Midway business with approximately another 20% of time spent on Midway business by other Golden Oak employees.

8

Richard D. Moritz, Vice President of Project Development. Mr. Moritz holds a B.S. in Mining Engineering and M.S. in Business Administration, both from the University of Nevada, Reno.Mr. Moritz joins Midway from Gustavson Associates, LLC, where he conducted feasibility studies, process engineering, mine planning, and technical evaluation services. His 30-year career spans technical and management positions with Royal Gold, Bateman Engineering, Nerco Minerals, and Falcon Exploration. His specialty is the engineering and optimization of mines and processing plants, including start-up efforts in North and South America, Central Asia, and Australia. He is responsible for the oversight of engineering, technical personnel, permitting, and construction at the Company’s projects.

William S. Neal, Vice President of Geological Services. Mr. Neal earned a Master of Science Degree from Washington State University and a Bachelor of Science degree from Colorado State University. In November 2007, Mr. Neal began working for Midway and on June 17, 2010, he was named Vice President of Geological Services. Mr. Neal is charged with developing the discovery process on Midway's exploration projects and identifying new opportunities though discovery and acquisition. Mr. Neal, a geologist for over 30 years, served as a senior geologist for Battle Mountain Gold in the Northwestern United States and Vice President of Exploration for Hanover Gold. Mr. Neal was instrumental in four of Midway's discoveries at the Spring Valley project, Nevada.

Family Relationships

None of our Directors are related by blood, marriage, or adoption to any other Director, executive officer, or other key employees.

Arrangements between Officer and Directors

To our knowledge, there are no arrangements or understandings between any of our officers and any other person, including Directors, pursuant to which the officer was selected to serve as an officer.

Legal Proceedings, Cease Trade Orders and Bankruptcy

As of the date of this Proxy Statement, no director or executive officer of Midway and no shareholder holding more than 5% of any class of voting securities in Midway, or any associate of any such director, officer or shareholder is a party adverse to Midway or any of our subsidiaries or has an interest adverse to Midway or any of our subsidiaries.

No director or executive officer of Midway is, as at the date of this Proxy Statement, or was within 10 years before the date of this Proxy Statement, a director, chief executive officer or chief financial officer of any company (including Midway), that:

(a)

was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer; or

(b)

was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

No director or executive officer of Midway, and no shareholder holding a sufficient number of securities of Midway to affect materially the control of Midway:

(a)

is, as at the date of this Proxy Statement, or has been within the 10 years before the date of this Proxy Statement, a director or executive officer of any company (including Midway) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets;

9

(b)

has, within 10 years before the date of this Proxy Statement, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director, executive officer or shareholder;

(c)

has, within 10 years before the date of this Proxy Statement, been the subject of, or a party to, any U.S. federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (i) any U.S. federal or state securities or commodities law or regulation; or (ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(d)

has, within 10 years before the date of this Proxy Statement, been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C.78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C.1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

No director or executive officer of Midway, and no shareholder holding a sufficient number of securities of Midway to affect materially the control of Midway has been subject to:

(a)

any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

(b)

any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

CORPORATE GOVERNANCE

Regulation 14A under the United States Securities Exchange Act of 1934, as amended, and National Instrument 58-101 (“NI 58-101”)Disclosure of Corporate Governance Practicesof the Canadian Securities Administrators requires the Company to annually disclose certain information regarding its corporate governance practices. Those practices are as follows:

Structure of Board of Directors

The Articles of the Company require the Board of Directors to have at least three directors. The current Board is comprised of five directors.

Director Independence

We had five directors as of December 31, 2010, including three independent directors that constitute the majority of the board of directors:

§

Daniel E. Wolfus;

§

Kenneth A. Brunk;

§

George T. Hawes (independent);

§

Frank S. Yu (independent); and

§

Roger A. Newell (independent).

10

The Company’s Board of Directors has determined that George T. Hawes, Frank S. Yu and Roger A. Newell are independent directors of the Company based on the definition of independence under NI 58-101 and section 803A of the NYSE Amex Equities Company Guide and that Daniel E. Wolfus and Ken Brunk, being officers and employees of the Company are not independent.

Meetings of the Board and Board Member Attendance of Annual Meeting

During the fiscal year ended December 31, 2010, the Board held twelve (12) meetings of the Board. None of the incumbent directors attended fewer than 80% of the Board meetings.

Directors are not required to attend the annual meeting. Five directors attended last year’s Annual and Special Meeting of the Shareholders.

Communications to the Board

Shareholders who are interested in communicating directly with members of the Board, or the Board as a group, may do so by writing directly to the individual Board member c/o Secretary, at Midway Gold Corp., Suite 280, 8310 South Valley Highway, Englewood, Colorado 80112; telephone 720-979-0900; fax 720-979-0898. The Company’s Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. The Company’s Secretary will review all communications before forwarding them to the appropriate Board member.

Orientation and Continuing Education

The Board has not established a formal orientation policy for new members of the Board but ensures that new directors are briefed with the policies of the Board and other relevant corporate and business information. The current directors are experienced in boardroom procedures and corporate governance and have a good understanding of the Company's business. The Board will provide continuing education opportunities for all directors as such needs arise so that individuals may maintain or enhance their skills and abilities as directors, as well as to ensure their knowledge and understanding of the Company's business remains current.

Nomination of Directors

Based on recommendations from the Corporate Governance and Nominating Committee (see “Board Committees” below), the Board determines new nominees to the Board; although a formal process has not been adopted. The nominees are generally the result of recruitment efforts by the Board members, including both formal and informal discussions among Board members and the Chairman and President of Midway. The Board monitors but does not formally assess the performance of individual Board members or committee members on their contributions.

Diversity of the Board

The Company does not have a formal policy regarding diversity in the selection of nominees for directors. The Corporate Governance and Nominating Committee do however consider diversity as part of its overall selection strategy. In considering diversity of the Board as a criteria for selecting nominees, the Corporate Governance and Nominating Committee takes into account various factors and perspectives, including differences of viewpoint, professional experience, education, skills and other individual qualities and attributes that contribute to Board heterogeneity, as well as race, gender and national origin. The Corporate Governance and Nominating Committee seek persons with leadership experience in a variety of contexts and, among public company leaders, across a variety of industries. The Corporate Governance and Nominating Committee believe that this expansive conceptualization of diversity is the most effective means to implement Board diversity. The Corporate Governance and Nominating Committee will assess the effectiveness of this approach as part of its annual review of its charter.

11

BOARD COMMITTEES

Our Board of Directors has established three board committees: a Compensation Committee, an Audit Committee, and a Corporate Governance and Nominating Committee. The Chief Executive Officer, the Chief Operating Officer and the Chief Financial Officer and two independent directors sit on the Company’s Disclosure Committee. The information below sets forth the current members of each of Midway’s board committees and summarizes the functions of each of the committees in accordance with their mandates.

Compensation Committee

The Board has established a Compensation Committee, currently comprised of Frank Yu (Chairman), George Hawes and Roger Newell, each an independent director under the rules of NI 58-101 and the NYSE Amex Equities.

Under a charter adopted by the Board that complies with the requirements of NI 58-101 and the NYSE Amex Equities, the Compensation Committee is a committee of the Board of Directors with the primary function of assisting the Board of Directors in fulfilling its oversight responsibilities by establishing appropriate performance criteria for the senior management team, and approving the compensation of the senior management team and the directors. Additionally, the Committee is responsible for:

·

reviewing and approving and then recommending to the Board of Directors salary, bonus, and other benefits, direct or indirect, and any change control packages of the Chairperson of the Board of Directors, the President, the Chief Financial Officer and other members of the senior management team;

·

recommendation of salary guidelines to the Board of Directors; and

·

administration of the Company’s compensation plans, including stock option plans, outside director’s compensation plans, and such other compensation plans or structures as are adopted by the Company from time-to-time.

The Compensation Committee shall be comprised at all times of three or more directors as determined by the Board of Directors, each of whom shall be independent directors. The Compensation Committee does not and cannot delegate its authority to determine director and executive officer compensation.

During the fiscal year ended December 31, 2010, the Compensation Committee met once. A copy of the Compensation Committee charter can be found on the Company’s website atwww.midwaygold.com.

Audit Committee

Audit Committee and Audit Committee Financial Experts

We have a standing audit committee and audit committee charter, which complies with Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and the requirements of the NYSE Amex Equities Company Guide. Our audit committee was established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Our audit committee is comprised of three “independent” directors (in accordance with NI 58-101, Rule 10A-3 and the requirements of section 803B of the NYSE Amex Equities Company Guide): George T. Hawes (Chairman), Roger Newell and Frank Yu. George T. Hawes satisfies the requirement of a “financial expert” as defined under Item 407(d)(5) of Regulation S-K and is, in the opinion of the Company’s Board of Directors, “independent” as that term is used in the NYSE Amex Equities Company Guide and Rule 10A-3 of the Securities Exchange Act of 1934, as amended.

During the fiscal year ended December 31, 2010, the Audit Committee met four (4) times. A copy of the Audit Committee charter is attached hereto as Schedule A and can be found on the Company’s website at www.midwaygold.com.

Audit Committee Report

The Company's Board of Directors has adopted a Charter for the Audit Committee which sets out the Committee's mandate, organization, powers and responsibilities. The complete Charter is attached as Schedule "A" to this Proxy Statement. The Company’s Audit Committee Charter complies with Rule 10A-3 and the requirements of the NYSE Amex Equities.

12

The Audit Committee is principally responsible for:

§

recommending to the Company's Board of Directors the external auditor to be nominated for election by the Company's shareholders at each annual general meeting and negotiating the compensation of such external auditor;

§

overseeing the work of the external auditor;

§

reviewing the Company's annual and interim financial statements, Management Discussion & Analysis (MD&A) and press releases regarding earnings before they are reviewed and approved by the Board of Directors and publicly disseminated by the Company; and

§

reviewing the Company's financial reporting procedures and internal controls to ensure adequate procedures are in place for the Company's public disclosure of financial information extracted or derived from its financial statements, other than disclosure described in the previous paragraph, and periodically assessing the adequacy of those procedures.

In the course of providing its oversight responsibilities regarding the 2010 financial statements, the Audit Committee reviewed the 2010 audited financial statements which appear in the Annual Report to the Securities and Exchange Commission on Form 10-K to shareholders, with management and the Company’s independent auditors. The Audit Committee reviewed accounting principles, practices and judgments as well as the adequacy and clarity of the notes to the financial statements.

Since the commencement of the Company’s most recently completed fiscal year, the Company’s Board of Directors has not failed to adopt a recommendation of the Audit Committee to nominate or compensate an external auditor. The Audit Committee has adopted specific policies and procedures for the engagement of non-audit services as described in section 7 “Powers and Responsibilities – Performance & Completion by Auditor of its Work” of the Audit Committee Charter.

The Audit Committee reviewed the independence and performance of the independent auditors who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, and such other matters as required to be communicated by the independent auditors in accordance with Statement on Auditing Standards 61, as superseded by Statement of Auditing Standard 114 – the Auditor’s Communication with Those Charged with Governance.

The Committee meets with the independent auditors to discuss their audit plans, scope and timing on a regular basis, with or without management present. The Committee has received the written disclosures and the letter from the independent auditors required by applicable standards of the Public Company Accounting Oversight Board for independent auditor communications with Audit Committees concerning independence as may be modified or supplemented, concerning its independence as required under applicable standards for auditors of public companies.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in the Annual Report to the Securities and Exchange Commission on Form 10-K for the year ended December 31, 2010. The Committee and the Board have also recommended the selection of KPMG LLP as independent auditors for the Company for the fiscal year ending December 31, 2011.

Submitted by the Audit Committee Members

George T. Hawes (Chairman)

Roger A. Newell

Frank S. Yu

13

Corporate Governance and Nominating Committee

Midway has created a Corporate Governance and Nominating Committee comprised of Roger A. Newell (Chairman), George T. Hawes and Frank S. Yu, each an independent director under the rules of NI 58-101 and the NYSE Amex Equities. A Corporate Governance and Nominating Committee charter was adopted by the Board of Directors.

The primary purpose of the Corporate Governance and Nominating Committee is to:

?

identify individuals qualified to become Board members;

?

recommend candidates to fill Board vacancies and newly created Director positions;

?

recommend whether incumbent Directors should be nominated for re-election to the Board upon expiration of their terms; and

?

make recommendations to the Board with respect to developments in the areas of corporate governance and the practices of the Board. It will also assume responsibility for developing the Company’s approach to governance issues.

The Corporate Governance and Nominating Committee shall be comprised at all times of three or more directors as determined by the Board of Directors, each of whom shall be independent directors.

Based on recommendations from the Corporate Governance and Nominating Committee, the Board determines new nominees to the Board; although a formal process has not been adopted. The nominees are generally the result of recruitment efforts by the Board members, including both formal and informal discussions among Board members and the Chairman and the President of Midway. The Board monitors but does not formally assess the performance of individual Board members or committee members on their contributions.

Shareholder nominees are subject to the same consideration as nominees selected by the Committee or the Board. The Committee does not have a set policy for whether or how shareholders are to recommend nominees for consideration by the Board. No shareholder or shareholders holding 5% or more of the Company’s outstanding stock, either individually or in aggregate, recommended a nominee for election to the Board.

There have been no changes in the Company’s procedures by which shareholders of the Company may recommend nominees to the Company’s Board of Directors.

On March 16, 2011 the Corporate Governance and Nominating Committee held its annual review meeting including the disclosure in this Proxy Statement. A copy of the Corporate Governance and Nominating Committee charter can be found on the Company’s website atwww.midwaygold.com.

Disclosure Committee

Due to the rapid growth of the Company and its dual listing on the NYSE Amex Equities in the United States and the TSX-V in Canada, the Board has adopted a formal Communications Policy and has established a Disclosure Committee responsible for the implementation of this policy. Currently the Disclosure Committee members are Daniel E. Wolfus, Kenneth A. Brunk, Doris A. Meyer, Roger A. Newell and Frank S. Yu. The purpose of the Disclosure Committee is to ensure that the Company complies with its timely disclosure obligations as required under applicable Canadian and United States securities laws.

Assessments

The Board does not, at present, have a formal process in place for assessing the effectiveness of the Board as a whole, its committees or individual directors but will consider implementing one in the future should circumstances warrant. Based on the Company’s small size, its stage of development and the limited number of the Board, the Board considers a formal assessment process to be inappropriate at this time. The Board will annually review its own performance and effectiveness as well as review annually the Audit Committee Charter and recommend revisions to the Board as necessary. Effectiveness is subjectively measured by comparing actual corporate results with stated objectives. The contributions of an individual director are informally monitored by the other Board members, having in mind the business strengths of the individual and the purpose of originally nominating the individual to the Board. The Board intends to continue evaluating its own effectiveness and the effectiveness of its committees through informal discussions amongst the Board members.

14

OTHER GOVERNANCE MATTERS

Quorum Exemption under Section 110 of the NYSE Amex Equities Company Guide

Section 110 of the NYSE Amex Equities Company Guide recognizes that the Company must operate in accordance with the laws and customary practices of its country of incorporation, to the extent not contrary to US federal securities laws. In respect to certain matters, the Company follows Canadian practices that differ from the requirements of the NYSE Amex Equities Company Guide. The Company posts on its website atwww.midwaygold.com the ways in which the Company’s practices differ from those of the NYSE Amex Equities Company Guide.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended, requires any person who is our Director or executive officer or who beneficially holds more than 10% of any class of our securities which have been registered with the Securities and Exchange Commission, to file reports of initial ownership and changes in ownership with the Securities and Exchange Commission. These persons are also required under the regulations of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) reports they file. Under Canadian National Instrument 55-102 for Electronic Disclosure by Insiders (SEDI),these same persons are required to register and file reports of initial ownership and changes in ownership with the TSX-V and applicable securities commissions on SEDI.

To our knowledge, based solely on our review of the copies of the Section 16(a) reports furnished to us, all Section 16(a) filing requirements applicable to our directors, executive officers and holders of more than 10% of any class of our registered securities were timely complied with during the year ended December 31, 2010.

Code of Ethics

Each director, officer and employee is expected to comply with relevant corporate and securities laws and, where applicable, the terms of their employment agreements in a manner that enhances shareholder value and is consistent with the highest level of integrity. The Board monitors on an ongoing basis the activities of management and ensures that the highest standard of ethical conduct is maintained. One of the ways the Board monitors the activities is by posting the contact information of the Chairman of the Audit Committee to report any complaints regarding accounting, internal accounting controls or audit related complaints. No complaints have been made.

The Board has adopted a formal written code of ethical business conduct for its directors, officers and employees. The Code of Ethics relates to written standards that are reasonably designed to deter wrongdoing and to promote:

§

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

§

Full, fair, accurate, timely and understandable disclosure in reports and documents that are filed with, or submitted to, the Commission and in other public communications made by an issuer;

§

Compliance with applicable governmental laws, rules and regulations;

§

The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

§

Accountability for adherence to the code.

No waivers were granted from the requirements of our Code of Ethics during the year ended December 31, 2010.

15

The Code of Ethics is available on our website atwww.midwaygold.com. A copy of the Company’s Code of Ethics will be provided, without charge, upon written request to the Corporate Office of Midway Gold Corp. at Suite 280, 8310 South Valley Highway, Englewood, Colorado 80112.

Board Leadership Structure

The Board has reviewed our company’s current Board leadership structure — which consists of a combined Chairman and Chief Executive Officer— in light of the composition of the Board, the company’s size, the nature of the company’s business, the regulatory framework under which the company operates, the company’s shareholder base, the Company’s peer group and other relevant factors, and has determined that a combined Chairman and Chief Executive Officer position is currently the most appropriate Board leadership structure for our company. The Board noted the following factors in reaching its determination:

| | | |

| • | | The Board acts efficiently and effectively under its current structure, where the Chief Executive Officer also acts as Chairman. |

| | | |

| • | | A combined Chairman/Chief Executive Officer is in the best position to be aware of major issues facing the company on a day-to-day and long-term basis, and is in the best position to identify key risks and developments facing the company to be brought to the Board’s attention. |

| | | |

| • | | A combined Chairman/Chief Executive Officer position reduces the potential for confusion and duplication of efforts, including among employees. |

| | | |

| • | | A combined Chairman/Chief Executive Officer position reduces the potential for confusion as to who leads the company, providing the company with a single public “face” in dealing with shareholders, employees, regulators, analysts and other constituencies. |

| | | |

| • | | A substantial majority of the Company’s peer group utilizes a Board structure with a combined Chairman and Chief Executive Officer. |

The Company does not have a lead independent director. Given the size of the Board, the Board believes that the presence of three independent directors out of the five directors on the Board, each of whom sits on the Board’s committees, is sufficient independent oversight of the Chairman/Chief Executive Officer. The independent directors work well together in the current board structure and the Board does not believe that selecting a lead independent director would add significant benefits to the Board oversight role.

The Role of the Board in Risk Oversight

The understanding, identification and management of risk are essential elements for the successful management of the Company.

Risk oversight begins with the Board of Directors and the Audit Committee. The Audit Committee is chaired by George Hawes and all of the Company’s three independent directors sits on the Audit Committee.

The Audit Committee reviews and discusses policies with respect to risk assessment and risk management. The Audit Committee also has oversight responsibility with respect to the integrity of the Company’s financial reporting process and systems of internal control regarding finance and accounting, as well as its financial statements.

At the management level, an internal audit provides reliable and timely information to the Board and management regarding the company’s effectiveness in identifying and appropriately controlling risks. Annually, management presents to the Audit Committee a report summarizing the review of the company’s methods for identifying and managing risks.

The company also has a comprehensive internal risk framework, which facilitates performance of risk oversight by the Board and the Audit Committee. Our risk management framework is designed to:

| | | |

| • | | Provide that risks are identified, monitored, reported, and priced properly; |

| | | |

| • | | Define and communicate the types and amount of risk the Company is willing to take; |

| | | |

| • | | Communicate to the appropriate management level the type and amount of risk taken; |

| | | |

| • | | Maintain a risk management organization that is independent of the risk-taking activities; and |

| | | |

| • | | Promote a strong risk management culture that encourages a focus on risk-adjusted performance. |

16

EXECUTIVE COMPENSATION

Summary Compensation Table

Daniel E. Wolfus served as Chairman and Chief Executive Officer and Doris Meyer served as Chief Financial Officer throughout the financial year ended December 31, 2010. Alan D. Branham served as President and Chief Operating Officer from January 1, 2010 to May 17, 2010 and Kenneth A. Brunk served as President and Chief Operating Officer from May 18, 2010 to December 31, 2010 with Richard D. Moritz and William Neal serving as executives since June 2010 (together, the “Named Executive Officers”) of Midway. There are no other executive officers of Midway and there are no other officers who were paid more than $150,000 in compensation during that financial year. A summary of cash and other compensation paid for our Named Executive Officer and other named executive officers for the last three fiscal years is as follows:

| | | | | | | | | |

| | | | | | | | | |

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards(5) ($) | Non-Equity Incentive Plan Compensation

($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings

($) |

All other Compensation ($) |

Total ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

Daniel E. Wolfus – Chairman, Chief Executive Officer and Director since December 23, 2009(1)

|

2010 2009 |

$132,245 $2,500 |

Nil Nil |

Nil Nil |

$100,000 $640,000 |

Nil Nil |

Nil Nil |

Nil $42,824 |

$232,245 $685,324 |

| | | | | | | | | |

Kenneth A. Brunk - President, Chief Operating Officer and Director since May 18, 2010 (1) |

2010 | $95,513 | Nil | Nil | $345,050 | Nil | Nil | Nil | $440,563 |

| | | | | | | | | |

Alan D. Branham -President, Chief Operating Officer and Director until May 17, 2010(1) |

2010 2009 2008 | $120,662 $171,297 $159,902 | Nil Nil Nil | Nil Nil Nil | $80,000 $66,000 Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | $200,662 $237,297 $159,902 |

| | | | | | | | | |

Doris A. Meyer - Chief Financial Officer and Corporate Secretary(2) | 2010 2009 2008 | $96,750 $90,000 $90,000 | Nil $15,000 Nil | Nil Nil Nil | $50,000 $33,000 Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | $146,750 $148,000 $90,000 |

| | | | | | | | | |

Richard D. Moritz(3) – Vice President of Project Development | 2010 | $72,191 | Nil | Nil | $40,000 | Nil | Nil | Nil | $112,191 |

| | | | | | | | | |

William S. Neal(4) Vice President of Geological Services | 2010 2009 2008 | $123,756 $137,037 $128,052 | Nil Nil Nil | Nil Nil Nil | $50,000 $49,500 Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | $173,756 $186,537 $128,052 |

| | | | | | | | | |

(1)

Mr. Wolfus, Mr. Brunk and Mr. Branham are paid an annual salary or fees in US dollars by MGC Resources Inc., a subsidiary of the Company. These amounts have been translated into Canadian dollars at the average respective exchange rates for each year.

(2)

Ms. Meyer was appointed Chief Financial Officer and Corporate Secretary of the Company on November 30, 2006. Consulting fees are paid to Golden Oak Corporate Services Ltd., a company owned by Ms. Meyer.

(3)

Mr. Moritz was appointed Vice President of Project Development on June 17, 2010 and he is paid an annual salary in US dollars by MGC Resources Inc. a subsidiary of the Company. These amounts have been translated into Canadian dollars at the average respective exchange rates for the period.

(4)

Mr. Neal was hired on March 15, 2007 and on June 17, 2010 was appointed Vice President of Geological Services and he is paid an annual salary in US dollars by MGC Resources Inc. a subsidiary of the Company. These amounts have been translated into Canadian dollars at the average respective exchange rates for each year.

(5)

This amount represents the theoretical fair value, on the date of grant, of stock options granted under the Plan during the fiscal year ended December 31, 2010. There was no cash compensation paid to any of the NEOs disclosed in the above table in connection with “option-based awards”. The grant date fair value has been calculated using the Black Scholes Merton model according to FASB ASC Topic 718 and Section 3870 of the CICA Handbook and will be recognized over the vesting term of the option. The key assumptions and estimates used for the calculation of the grant date fair value under this model include the risk-free interest rate, expected stock price volatility, expected life and expected dividend yield.

17

Compensation Discussion and Analysis

Compensation Philosophy

Our overall compensation philosophy is to provide a compensation package that enables us to attract, retain and motivate named executive officers to achieve our short-term and long-term business goals. Consistent with this philosophy, the following goals provide a framework for our named executive officers compensation program:

§

Pay competitively to attract, retain, and motivate named executive officers;

§

Relate total compensation for each named executive officer to overall company performance as well as individual performance;

§

Aggregate the elements of total compensation to reflect competitive market requirements and to address strategic business needs;

§

Expose a portion of each named executive officer’s compensation to risk, the degree of which will positively correlate to the level of the named executive officer’s responsibility and performance; and

§

Align the interests of our named executive officers with those of our stockholders.

Oversight of Executive Compensation Program

The Compensation Committee is responsible for establishing a compensation policy and administering the compensation programs of our executive officers. The members of the Compensation Committee are Frank Yu, Chairman, George Hawes, and Roger Newell, each an independent director under the rules of the NYSE Amex Equities.

The amount of compensation paid by us to each of our directors and named officers and the terms of those persons’ employment is determined solely by the Compensation Committee. We believe that the compensation paid to its directors and officers is fair to Midway.

Executive Compensation Program Overview

The executive compensation package available to our named executive officers is comprised of:

§

base salary;

§

equity based compensation; and

§

other welfare and health benefits.

18

Base Salary

The base salary currently paid to our named executive officers is commensurate with the nature of our business and their individual experience, duties and scope of responsibilities. In the future, we intend to pay competitive base salaries required to recruit and retain executives of the quality that we must employ to ensure our success.

In making determinations of salary levels for the named executive officers, the Compensation Committee is likely to consider the entire compensation package for named executive officers, including the equity compensation provided under stock option plans. We intend for the salary levels to be consistent with competitive practices of comparable institutions and each executive’s level of responsibility. The Compensation Committee is likely to determine the level of any salary increase after reviewing the qualifications, experience, and performance of the particular executive officer and the nature of our business, the complexity of its activities, and the importance of the executive’s contribution to the success of the business.

The Compensation Committee may also take into consideration salaries paid to others in similar positions in the Company’s industry based on the experience of the Compensation Committee members and publicly available information. The Company’s peer group for the purposes of the 2010 salary comparison included Sunridge Gold Corp., Miranda Gold Corp. and AuEx Ventures, Inc. The discussion of the information and factors considered and given weight by the Compensation Committee is not intended to be exhaustive, but it is believed to include all material factors considered by the Compensation Committee. In reaching the determination to approve and recommend the base salaries the Compensation Committee did not assign any relative or specific weight to the factors which were considered, and individual directors may have given a different weight to each factor. The Compensation Committee will review and adjust the base salaries of our executive officers when deemed appropriate.

Equity Awards

Equity awards for our named executive officers are and will be granted from our Stock Option Plan, adopted by the Board of Directors on May 6, 2003 as amended on May 12, 2008. The Company grants awards under the Stock Option Plan in order to align the interests of the named executive officers with our stockholders, and to motivate and reward the named executive officers to increase the stockholder value of the Company over the long term.

The use of stock options and other awards is intended to strengthen the alignment of interests of executive officers and other key employees with those of our stockholders.

Under the terms of the current Stock Option Plan, the number of common shares that may be issued or allotted and reserved for issuance from time to time upon the exercise of options granted under the Stock Option Plan cannot exceed 10% of the issued and outstanding common shares and may not exceed 5% to any individual (maximum of 2% to any consultant).

We believe that equity compensation is necessary to advance the interests of the Company and its shareholders by enhancing the ability of the Company to attract and retain the best available talent and to encourage the highest level of performance by senior officers, key employees, directors and consultants of the Company and of its subsidiaries through ownership of common shares in the Company.

Employment and Consulting Agreements

Alan D. Branham, our former President and Chief Operating Officer, had been operating under an employment agreement dated May 1, 2004 (amended on January 31, 2007). On June 1, 2010 the Company and Mr. Branham entered into a change of status agreement where Mr. Branham was paid US$12,500 a month until June 30, 2010 after which he will continue as a consultant to Midway at the rate of US$7,000 a month until February 7, 2011 after which he will be engaged at the rate of US$100 per month until June 30, 2015 unless terminated sooner.

Midway, Doris A. Meyer and her wholly owned private British Columbia company, Golden Oak Corporate Services Ltd. entered into a contract on July 1, 2010 replacing a November 15, 2006 contract whereby Ms. Meyer agreed to be Midway’s Chief Financial Officer and Corporate Secretary and Golden Oak provides bookkeeping, accounting, financial reporting, corporate and regulatory compliance services to Midway. Golden Oak shall be paid an annual service fee of $103,500 payable in equal monthly instalments in consideration for its services under the consulting agreement. Golden Oak is paid additional service fees for services provided that is outside of the ordinary compliance services as negotiated between Golden Oak and the Company. The Company consented to Ms. Meyer and Golden Oak engaging in business with companies that operate in the same field of activities as the Company and its subsidiaries. Golden Oak and Ms. Meyer may also accept employment with or render services to other mining companies, subject to Ms. Meyer’s fiduciary obligations as an officer of the Company. The agreement may be terminated by Golden Oak upon 60 days’ written notice. On a defined change of control event and if Golden Oak terminates its services within 90 days following the event, or if Golden Oak’s services are terminated by Midway without cause, Golden Oak will be entitled to be paid by Midway one-half of the annual service fee in effect at the time of the change of control event.

19

The Company has not entered into any other employment or consulting agreements with the other named executive officers.

Disclosure Relating to Grants of Plan-Based Awards

The Board of Directors granted stock options at the market price of the Company’s stock on the date prior to the grant date of the options for a five year term: in May 2010, 500,000 options at an exercise price of $0.71 to Kenneth A. Brunk; in June 2010, 1,175,000 options to directors and the Chief Financial Officer at an exercise price of $0.58 and 530,000 options to employees and in October 2010, 350,000 options to employees at an exercise price of $0.61. Options granted vest immediately, except that options granted to employees vest as to one-third on the date of grant, one-third on the first anniversary date and the final one-third on the second anniversary date.

Outstanding Equity Awards at Fiscal Year End

| | | | | | | | | |

Option Awards | Stock Awards |

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

| | | | | | | | | |

Daniel E. Wolfus – Chairman, Chief Executive Officer and Director | 200,000 1,000,000 250,000 | Nil Nil Nil | Nil Nil Nil | $0.56 $0.86 $0.58 | 01/07/2014 09/10/2014 06/17/2015 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| | | | | | | | | |

Kenneth A. Brunk – President, Chief Operating Officer and Director | 166,666 83,333 | 333,334 166,667 | Nil Nil | $0.71 $0.61 | 05/18/2015 10/22/2015 | Nil Nil | Nil Nil | Nil Nil | Nil Nil |

| | | | | | | | | |

Alan D. Branham - Former President, Chief Operating Officer and Director | 400,000 50,000 133,334 66,666 200,000 | Nil Nil 66,666 133,334 Nil | Nil Nil Nil Nil Nil | $2.04 $2.53 $2.71 $0.56 $0.58 | 04/13/2014 06/15/2011 07/31/2012 01/07/2014 06/17/2015 | Nil Nil Nil Nil Nil | Nil Nil Nil Nil Nil | Nil Nil Nil Nil Nil | Nil Nil Nil Nil Nil |

| | | | | | | | | |

Doris A. Meyer Chief Financial Officer and Corporate Secretary | 100,000 50,000 100,000 125,000 | Nil Nil Nil Nil | Nil Nil Nil Nil | $2.70 $2.71 $0.56 $0.58 | 11/30/2011 07/31/2012 01/07/2014 06/17/2015 | Nil Nil Nil Nil | Nil Nil Nil Nil | Nil Nil Nil Nil | Nil Nil Nil Nil |

| | | | | | | | | |

Richard D. Moritz – Vice President of Project Development | 33,333 | 66,667 | Nil | $0.58 | 06/17/2015 | Nil | Nil | Nil | Nil |

| | | | | | | | | |

William S. Neal – Vice President of Geological Services | 75,000 50,000 20,000 100,000 41,666 | Nil Nil Nil 50,000 83,334 | Nil Nil Nil Nil Nil | $2.00 $2.71 $3.36 $0.56 $0.58 | 03/09/2011 07/31/2012 10/30/2012 01/07/2014 06/17/2015 | Nil Nil Nil Nil Nil | Nil Nil Nil Nil Nil | Nil Nil Nil Nil Nil | Nil Nil Nil Nil Nil |

20

Option Exercises and Stock Vested in 2010

| | | | | |

Name | Option Awards | Stock Awards | Option-based Awards – Value Vested during the year(1) |

Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) |

($) |

Daniel E. Wolfus | Nil | Nil | Nil | Nil | Nil |

Kenneth A. Brunk | Nil | Nil | Nil | Nil | Nil |

Alan D. Branham | Nil | Nil | Nil | Nil | 19,333 |

Doris A. Meyer | Nil | Nil | Nil | Nil | Nil |

Richard D. Moritz | Nil | Nil | Nil | Nil | Nil |