FREE WRITING PROSPECTUS

Filed Pursuant to Rule 433

Supplementing the Prospectus dated May 6, 2010

Registration Statement No. 333-165842

Dated May 28, 2010

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may obtain these documents for free from the SEC Web site at www.sec.gov. Alternatively, the issuer, the agent or any dealer participating in the offering will arrange to send you the prospectus if you request it from Haywood Securities Inc. by telephone at 604-697-7126.

A copy of this preliminary prospectus supplement has been filed with the securities regulatory authorities in the provinces of British Columbia, Alberta and Ontario, but has not yet become final for the purpose of the sale of securities. Information contained in this preliminary prospectus supplement may not be complete and may be amended.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement, together with the short form base shelf prospectus dated May 4, 2010 to which it relates, as amended or supplemented, and each document incorporated or deemed to be incorporated by reference herein and therein, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this prospectus supplement from documents filed with the securities commissions or similar regulatory authorities in Canada. Copies of the documents incorporated by reference herein may be obtained on request without charge from the Corporate Secretary, Unit 1 - 15782 Marine Drive, White Rock, British Columbia, Canada, V4B 1E6, telephone (604) 536-2711, and are also available electronically at www.sedar.com.

PRELIMINARY PROSPECTUS SUPPLEMENT

To a Short Form Base Shelf Prospectus dated May 4, 2010

MIDWAY GOLD CORP.

CDN $0.60

up to 10,000,000 Units

Midway Gold Corp. ("Midway" or the "Company") is hereby qualifying for distribution up to 10,000,000 units (the "Units") at a price of $0.60 per Unit. Each Unit consists of one common share of the Company (an "Offered Share") and one half of one common share purchase warrant. Each whole common share purchase warrant (a "Warrant") will entitle the holder to purchase one common share of the Company (a "Warrant Share") at a price of $0.80 per Warrant Share at any time following the closing of this offering until 5:00 p.m. (Vancouver time) on the date that is 24 months after the closing of this offering.

The outstanding common shares of the Company (the "Common Shares") are listed and posted for trading on the TSX Venture Exchange (the "TSX.V") and NYSE Amex ("Amex") under the symbol "MDW", and on the Frankfurt Stock Exchange under the symbol "LXQ". The Warrants are non-transferrable. There is no market through which the Warrants may be sold and purchasers will not be able to resell Warrants purchased under this prospectus supplement (the "Prospectus Supplement"). On May 27, 2010, the closing sale price of the Common Shares on the TSX.V and Amex was $0.67 and US$0.65 per share, respectively. The offering price of the Units and the exercise price of the Warrants were determined by negotiation between Haywood Securities Inc. (the "Agent") and the Company.

Investing in the Units involves significant risks. You should carefully read the "Risk Factors" section beginning in the accompanying short form base shelf prospectus dated May 4, 2010 (the "Prospectus") beginning on page 3, and in the documents incorporated by reference therein and herein.

Price: CDN $0.60 Per Unit

| | | Price to Public | | Agent's Fee (1) | | Net Proceeds to the Company (2) |

Per Unit(3) | | $0.60 | | $0.042 | | $0.558 |

Total(4) | | $6,000,000 | | $420,000 | | $5,580,000 |

| (1) | The Company has agreed to pay to the Agent a commission of 7% of the aggregate gross proceeds, or $0.042 per Unit (the "Agent's Fee"), excluding proceeds from Units sold to purchasers introduced by the Company directly (the "President's List Investors"). As additional compensation, the Company has agreed to grant to the Agent up to 700,000 non-transferable common share purchase warrants with an exercise price of $0.80, exercisable for a period of 24 months after the closing of the offering (the "Agent's Warrants"). The Agent's Warrants will entitle the Agent to purchase that number of Warrant Shares which is equal to 7% of the number of Units sold under this offering, excluding the number of Units purchased by President's List Investors, in respect of which Agent's Warrants to purchase that number of Warrant Shares which is equal to 2% of the number of Units sold to such investors will be granted. See "Plan of Distribution". No commission will be payable by the Company to the Agent in connection with the distribution of Warrant Shares upon the exercise of the Warrants or the Agent's Warrants. This Prospectus Supplement also qualifies the distribution of the Agent's Warrants and the Warrant Shares issuable upon exercise thereof. |

| (2) | After deducting the Agent's Fee, but before deducting the expenses of the offering, which are estimated at $100,000. Excludes proceeds from the exercise of Warrants and Agent's Warrants. |

| (3) | From the price per Unit, the Company will allocate $l to each Offered Share and $l to each one-half of one Warrant comprising the Units. |

| (4) | Assuming the offering is fully subscribed and that no Units are sold to President's List Investors. |

| Agent's Position | Maximum Size | Exercise Period | Exercise Price |

| Agent's Warrants | Up to 700,000 Agent's Warrants | Exercisable at the sole discretion of the Agent at any time up to 24 months after closing | $0.80 per Common Share |

The Units are being offered by the Agent on a best efforts basis in accordance with the terms of the Agency Agreement referred to under "Plan of Distribution" and subject to the passing upon of certain legal matters on behalf of the Company by Stikeman Elliott LLP, with respect to Canadian legal matters, and by Dorsey & Whitney LLP, with respect to U.S. legal matters, and on behalf of the Agent by Blake, Cassels & Graydon LLP, with respect to Canadian legal matters.

Subscriptions will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is expected that definitive certificates representing the Offered Shares and the Warrants will be available for delivery at closing, which is expected to occur on or about June 18, 2010, or such other date as may be agreed upon. Definitive certificates for the Warrant Shares will be available for delivery upon exercise of the Warrants.

Investors should be aware that the acquisition of the Units described herein may have tax consequences. This Prospectus Supplement and the accompanying Prospectus may not describe fully all of the tax consequences that are relevant to you, given your particular circumstances. You should read the tax discussion contained in this Prospectus Supplement and consult your own tax advisor with respect to your own particular circumstances.

The financial information of the Company contained in the documents incorporated by reference herein is presented in Canadian dollars. References in this Prospectus Supplement to "$" are to Canadian dollars. United States dollars are indicated by the symbol "US$".

The Company’s head and registered office is located at Unit 1 - 15782 Marine Drive, White Rock, British Columbia, Canada, V4B 1E6.

TABLE OF CONTENTS

Prospectus Supplement

| Description | Page No. |

| | |

| IMPORTANT NOTICE ABOUT THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT | S-2 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | S-2 |

| FINANCIAL INFORMATION AND CURRENCY | S-3 |

| THE COMPANY | S-3 |

| RISK FACTORS | S-3 |

| USE OF PROCEEDS | S-3 |

| PLAN OF DISTRIBUTION | S-4 |

| DESCRIPTION OF THE SECURITIES DISTRIBUTED | S-6 |

| CONSOLIDATED CAPITALIZATION | S-7 |

| PRIOR SALES | S-7 |

| PRICE RANGE AND TRADING VOLUMES | S-7 |

| LEGAL MATTERS | S-8 |

| DOCUMENTS INCORPORATED BY REFERENCE | S-8 |

| CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | S-9 |

| INTEREST OF EXPERTS | S-12 |

| ELIGIBILITY FOR INVESTMENT | S-12 |

| AUDITORS' CONSENT | C-1 |

| CERTIFICATE OF THE AGENT | C-2 |

| | |

| Propectus |

| |

| THE CORPORATION | 1 |

| RISK FACTORS | 3 |

| DOCUMENTS INCORPORATED BY REFERENCE | 11 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 12 |

| FINANCIAL INFORMATION AND CURRENCY | 13 |

| RECENT DEVELOPMENTS | 14 |

| USE OF PROCEEDS | 14 |

| CONSOLIDATED CAPITALIZATION | 14 |

| DESCRIPTION OF SHARE CAPITAL | 14 |

| DESCRIPTION OF WARRANTS | 15 |

| DESCRIPTION OF UNITS | 16 |

| PRIOR SALES | 18 |

| PLAN OF DISTRIBUTION | 18 |

| INTEREST OF EXPERTS | 19 |

| TRANSFER AGENT AND REGISTRAR | 20 |

| LEGAL MATTERS | 20 |

| STATUTORY RIGHTS OF WITHDRAWAL AND RESCISSION | 20 |

| CONSENT OF AUDITOR | C-1 |

| CERTIFICATE OF THE COMPANY | C-2 |

IMPORTANT NOTICE ABOUT THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Units being offered and also adds to and updates information contained in the accompanying Prospectus. The second part, the Prospectus, gives more general information, some of which may not apply to the Units being offered under this Prospectus Supplement.

You should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Prospectus. If the description of the Units, or the Offered Shares and Warrants comprising the Units, varies between this Prospectus Supplement and the Prospectus, you should rely on the information in this Prospectus Supplement. The Company has not authorized anyone to provide investors with different or additional information. The Company is not making an offer of the Units in any jurisdiction where the offer is not permitted by law. If anyone provides you with any different or inconsistent information, you should not rely on it. You should not assume that the information contained in or incorporated by reference in this Prospectus Supplement is accurate as of any date other than the date on the front of this Prospectus Supplement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein contain "forward-looking statements" within the meaning of applicable Canadian securities legislation. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

| | § | our expected plans of operation to continue as a going concern; |

| | § | the establishment and estimates of mineral reserves and resources; |

| | § | the grade of mineral reserves and resources; |

| | § | anticipated expenditures and costs in our operations; |

| | § | planned exploration activities and the anticipated outcome of such exploration activities; |

| | § | plans and anticipated timing for obtaining permits and licenses for our properties; |

| | § | anticipated closure costs; |

| | § | expected future financing and its anticipated outcome; |

| | § | anticipated liquidity to meet expected operating costs and capital requirements; |

| | § | estimates of environmental liabilities; |

| | § | our ability to obtain financing to fund our estimated expenditure and capital requirements; |

| | § | factors expected to impact our results of operations; and |

| | § | the expected impact of the adoption of new accounting standards. |

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| | § | risks related to our ability to continue as a going concern; |

| | § | risks related to our history of losses and our requirement for additional financing to fund exploration and, if warranted, development of our properties; |

| | § | risks related to our lack of historical production from our mineral properties; |

| | § | uncertainty and risks related to cost increases for our exploration and, if warranted, development projects; |

| | § | uncertainty and risks related to the effect of a shortage of equipment and supplies on our ability to operate our business; |

| | § | uncertainty and risks related to mining being inherently dangerous and subject to events and conditions beyond our control; |

| | § | uncertainty and risks related to our mineral resource estimates being based on assumptions and interpretations; |

| | § | risks related to changes in mineral resource estimates affecting the economic viability of our projects; |

| | § | risks related to differences in U.S. and Canadian practices for reporting reserves and resources; |

| | § | uncertainty and risks related to our exploration activities on our properties not being commercially successful; |

| | § | uncertainty and risks related to encountering archaeological issues and claims in relation to our properties; |

| | § | uncertainty and risks related to fluctuations in gold, silver and other metal prices; |

| | § | risks related to our lack of insurance for certain high-risk activities; |

| | § | uncertainty and risks related to our ability to acquire necessary permits and licenses to place our properties into production; |

| | § | risks related to government regulations that could affect our operations and costs; |

| | § | risks related to environmental regulations; |

| | § | risks related to land reclamation requirements on our properties; |

| | § | risks related to increased competition for capital funding in the mining industry; |

| | § | risks related to competition in the mining industry; |

| | § | risks related to our possible entry into joint venture and option agreements on our properties; |

| | § | risks related to our directors and officers having conflicts of interest; |

| | § | risks related to our ability to attract qualified management to meet our expected needs in the future; |

| | § | uncertainty and risks related to currency fluctuations; |

| | § | risks related to our status as a passive foreign investment company; |

| | § | risks related to recent market events and general economic conditions; and |

| | § | risks related to our securities. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section titled "Risk Factors" in the Prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

We qualify all the forward-looking statements contained in this Prospectus Supplement by the foregoing cautionary statements.

FINANCIAL INFORMATION AND CURRENCY

The financial information of the Company contained in the documents incorporated by reference in this Prospectus Supplement and in the Prospectus is presented in accordance with generally accepted accounting principles ("GAAP") in the United States. There are no material differences between Canadian and U.S. GAAP which affect the Company. The financial information of the Company contained in the documents incorporated by reference is presented in Canadian dollars.

References in this Prospectus Supplement to "$" are to Canadian dollars. United States dollars are indicated by the symbol "US$". On May 27, 2010, the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was US$1.00 = $0.9524.

THE COMPANY

Midway is an exploration stage company engaged in the acquisition, exploration, and, if warranted, development of gold and silver mineral properties in North America. Midway is focused on exploring and developing high-grade, quality precious metal resources in stable mining areas. Midway's principal properties are the Spring Valley, Midway and Pan gold and silver mineral properties located in Nevada and the Golden Eagle gold mineral property located in the Washington. Midway holds certain other mineral exploration properties located in Nevada. Prospective purchasers of Units should read the description of the Company and its business under the heading "The Corporation" in the Prospectus.

RISK FACTORS

An investment in the Units is speculative and involves a high degree of risk due to the nature of the Company's business. In addition to other information contained in this Prospectus Supplement and the accompanying Prospectus, and in the documents incorporated by reference herein and therein, prospective purchasers of Units should read the discussion of certain risks affecting the Company in connection with its business that is provided under the heading "Risk Factors" in the Prospectus.

USE OF PROCEEDS

The Company expects to use the proceeds of the offering to advance its projects, to fund its general and administrative costs (including property maintenance fees) and for general working capital purposes.

The majority of the property expenditures (approximately $3.25 million) are expected to be focussed on advancing the Company's Pan Project, including a scoping study, development drilling, initiation of an environmental impact study, including metallurgical, testing, waste rock characterization, water rights and baseline studies. Drilling is expected to be conducted to support metallurgical testing, environmental baseline, geotechnical work and exploration/expansion of the resource. Work on the Golden Eagle project is expected to be focussed on a review of existing metallurgy work conducted and refining current geological model using existing information. This work, including supporting drilling for metallurgical samples, is expected to involve expenditures of approximately $325,000. The Company intends to conduct surface sampling and mapping to identify exploration targets on its Gold Rock project, including a 10,000 foot drill program involving expenditures of approximately $260,000. Finally, the Company intends to conduct a 10 hole exploration drill program at its Burnt Canyon, Nevada project at a cost of approximately $155,000.

Approximately $1 million of the proceeds of the offering will be used to fund the Company's general and administrative costs to be incurred in the following year.

The remainder of the proceeds of the offering will be used for general working capital purposes.

The actual amount that the Company spends in connection with each of the intended uses of proceeds may vary significantly from the amounts specified above, and will depend on a number of factors, including those described in the "Risk Factors" section of the Prospectus.

Although the Company intends to use the net proceeds from this offering for the purposes set forth above, we reserve the right to use such net proceeds for other purposes to the extent that circumstances, including unforeseen events, the outcome of further studies and other sound business reasons, make such use necessary or prudent.

PLAN OF DISTRIBUTION

Pursuant to an agency agreement dated l, 2010 between Midway and the Agent (the "Agency Agreement"), the Agent has agreed to act as agent in connection with the sale of up to 10,000,000 Units, subject to the terms and conditions stated in the Agency Agreement. The Agent is not purchasing any Units under this Prospectus Supplement, nor is the Agent required to arrange for the purchase or sale of any specific number or dollar amount of the Units, but it has agreed to use its best efforts to arrange for the sale of all of the Units in this offering. There is no requirement that any minimum number of Units or dollar amount of Units be sold in this offering and there can be no assurance that we will sell all of the Units being offered.

The Agency Agreement provides that the obligations of the Agent are subject to certain conditions precedent including, among other things, approval of legal matters by its counsel and certain conditions contained in the Agency Agreement, such as receipt by the Agent of officers’ certificates and legal opinions. While the Agent has agreed to use its best efforts to sell the Units offered hereby, it is not obligated to purchase any Units that are not sold. The obligations of the Agent under the Agency Agreement may be terminated at any time prior to the closing of this offering upon the occurrence of certain events stated in the Agency Agreement, including the Agent's assessment of the state of the financial markets.

Confirmations and a final Prospectus Supplement will be distributed to all investors who agree to purchase the Units in this offering, informing investors of the closing date. We currently anticipate that closing of the sale of the Units we are offering will take place on or about June 18, 2010. Investors will also be informed of the date and manner in which they must transmit the purchase price for their Units.

This offering is being made in the provinces of British Columbia, Alberta and Ontario pursuant to this Prospectus Supplement and the Company’s effective registration statement on Form S-3 filed with the U.S. Securities and Exchange Commission on April 1, 2010. Pursuant to General Instruction I.B.6. of Form S-3, we are permitted to utilize the registration statement of which this prospectus supplement and the accompanying base prospectus form a part to sell a maximum amount of securities equal to one-third of the aggregate market value of our outstanding voting and non-voting common equity held by our non-affiliates in any 12-month period.

We have agreed to pay the Agent an aggregate fee equal to 7% of the gross proceeds from the sale of the Units in this offering, or $0.042 per Unit, excluding proceeds from Units sold to President's List Investors. The Company will also grant non-transferable Agent's Warrants to the Agent entitling the Agent to purchase that number of Warrant Shares equal to 7% of the number of Units sold pursuant to this offering, excluding the number of Units sold to President's List Investors. The Agent will be granted Agent's Warrants to purchase that number of Warrant Shares equal to 2% of the number of Units sold to President's List Investors. The Agent's Warrants are exercisable for a period of 24 months after the closing of the offering at a price of $0.80. This Prospectus Supplement also qualifies the distribution of the Agent's Warrants and the Warrant Shares issuable upon exercise thereof. No commission will be payable by the Company to the Agent in connection with the distribution of Warrant Shares upon the exercise of the Warrants or the Agent's Warrants.

| Agent's fee per Unit (excluding Agent's Warrants) | | $ | 0.042 | |

| | | | | |

| Total Agent's fees (excluding Agent's Warrants and assuming that there are no President's List Investors) | | $ | 420,000 | |

We have also agreed to reimburse the Agent for the reasonable fees and expenses incurred by it in connection with this offering subject to certain limitations.

The estimated offering expenses payable by us, in addition to the aggregate fees of up to $420,000 due to the Agent and the fees of the Agent's legal counsel up to a maximum of $30,000, are approximately $70,000, which includes legal and filing fees, printing costs, various other fees associated with qualifying the securities for sale in British Columbia, Alberta and Ontario, registering the securities in the United States, and listing the Offered Shares and Warrant Shares on the TSX.V and Amex. After deducting certain fees due to the Agent and our estimated offering expenses, we expect the net proceeds from this offering to be approximately $5,480,000, if the maximum number of Units are sold (excluding proceeds we may receive upon exercise of the Warrants and Agent's Warrants and assuming that no Units are sold to President's List Investors). Because there is no minimum offering amount required as a condition to closing in this offering, the actual total offering fees and net proceeds are not presently determinable and may be substantially less than the maximum amounts set forth above.

We have agreed to indemnify the Agent against certain liabilities, including liabilities under the United States Securities Act of 1933, as amended, relating to or arising out of the Agent's activities in connection with this offering.

We have also agreed with the Agent that, except for Common Shares issued upon the exchange, exercise or conversion of securities of the Company outstanding on the date hereof, and subject to certain exceptions, including the issuance by the Company of shares representing up to 10% of the outstanding common stock as of the date of the Agency Agreement in connection with the acquisition of any business, property or asset that is consistent with the Company's business as presently conducted and as described in this Prospectus Supplement, the Prospectus and documents incorporated by reference herein and therein, the Company shall not issue, or agree to issue, any Common Shares or any securities exchangeable for, or convertible into, Common Shares during the 60 day period immediately following the closing of this offering without the consent of the Agent.

The purchase price per Unit and the exercise price for the Warrants and Agent's Warrants were determined based on negotiations with the Agent.

Pursuant to policy statements of certain Canadian securities regulators, the Agent may not, throughout the period of distribution, bid for or purchase Common Shares. The foregoing restriction is subject to certain exceptions for bids or purchases made through the facilities of the TSX.V, in accordance with the Universal Market Integrity Rules of the Investment Industry Regulatory Organization of Canada, including, (a) market stabilization or market balancing activities on the TSX.V where the bid for or purchase of securities is for the purpose of maintaining a fair and orderly market in the securities, subject to price limitations applicable to such bids or purchases, (b) a bid or purchase on behalf of a client, other than certain prescribed clients, provided that the client’s order was not solicited by the Agent, or if the client’s order was solicited, the solicitation occurred before the commencement of a prescribed restricted period, and (c) a bid or purchase to cover a short position entered into prior to the commencement of a prescribed restricted period.

Until the distribution of the Units is completed, SEC rules may limit the Agent from bidding for and purchasing Common Shares and Warrants. However, the Agent may engage in transactions that stabilize the price of the Common Shares, such as bids or purchases to peg, fix or maintain that price.

If the Agent creates a short position in the Common Shares in connection with this offering, the Agent may reduce that short position by purchasing Common Shares in the open market. Purchases of Common Shares to stabilize the price may cause the price of the Common Shares to be higher than it might be in the absence of such purchases.

Neither the Company nor the Agent make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of the Common Shares or Warrants. In addition, neither the Company nor the Agent make any representation that the Agent will engage in these transactions or that these transactions, once commenced, will not be discontinued without notice.

The Warrants are non-transferrable and will not be listed for trading on any national or foreign securities exchange.

DESCRIPTION OF THE SECURITIES DISTRIBUTED

This offering consists of up to 10,000,000 Units, each Unit consisting of one Offered Share and one half of one Warrant. Each whole Warrant will entitle the holder to purchase one Warrant Share at a price of $0.80 per share at any time following the closing of this offering until 5:00 p.m. (Vancouver time) on the date that is 24 months after the closing of this offering.

Offered Shares and Warrant Shares

The Offered Shares and the Warrant Shares (including the Warrant Shares issuable upon exercise of the Agent’s Warrants) will have all of the characteristics, rights and restrictions of the Common Shares. Midway is authorized to issue an unlimited number of Common Shares, without par value, of which 78,688,330 are issued and outstanding as at the date of this Prospectus Supplement. There are options outstanding to purchase up to 4,921,667 Common Shares at prices ranging from $0.56 to $3.36. There are warrants outstanding to purchase up to 1,333,333 Common Shares at $0.70 if exercised on or before October 9, 2010; $0.80 if exercised after October 9, 2010 but on or before April 9, 2011; and $0.90 if exercised after April 9, 2011 but on or before the expiry date of October 9, 2011. Holders of Common Shares are entitled to one vote per Common Share at all meetings of shareholders, to receive dividends as and when declared by the board of directors of the Company and to receive a pro rata share of the assets of the Company available for distribution to the shareholders in the event of the liquidation, dissolution or winding-up of the Company. There are no pre-emptive, conversion or redemption rights attached to the Common Shares.

Warrants

The Warrants will be issued under and be governed by the terms of an indenture dated as of the date hereof (the "Warrant Indenture") between the Company and Computershare Trust Company of Canada (the "Warrant Agent"), which will be filed with the applicable Canadian securities regulatory authorities on SEDAR at www.sedar.com. The Company has appointed the principal transfer offices of the Warrant Agent in Vancouver, British Columbia and Toronto, Ontario as the locations at which Warrants may be surrendered for exercise. The following summary of certain provisions of the Warrant Indenture does not purport to be complete and is qualified in its entirety by reference to the provisions of the Warrant Indenture.

Each Warrant will entitle the holder to purchase one Warrant Share at a price of $0.80. The exercise price and the number of Warrant Shares issuable upon exercise are both subject to adjustment in certain circumstances as more fully described below. Warrants will be exercisable at any time prior to 5:00 p.m. (Vancouver time) on the date which is 24 months after the closing of the offering, after which time the Warrants will expire and become null and void. The exercise price for the Warrants is payable in Canadian dollars.

The Warrant Indenture provides for adjustment in the number of Warrant Shares issuable upon the exercise of the Warrants and/or the exercise price per Warrant Share upon the occurrence of certain events, including: (i) the issuance of Common Shares or securities exchangeable for or convertible into Common Shares to all or substantially all of the holders of the Common Shares as a stock dividend or other distribution (other than a "dividend paid in the ordinary course", as defined in the Warrant Indenture); (ii) the subdivision, redivision or change of the Common Shares into a greater number of shares; (iii) the reduction, combination or consolidation of the Common Shares into a lesser number of shares; (iv) the issuance to all or substantially all of the holders of the Common Shares of rights, options or warrants under which such holders are entitled, during a period expiring not more than 45 days after the record date for such issuance, to subscribe for or purchase Common Shares, or securities exchangeable for or convertible into Common Shares, at a price per share to the holder (or at an exchange or conversion price per share) of less than 95% of the "current market price", as defined in the Warrant Indenture, for the Common Shares on such record date; and (v) the issuance or distribution to all or substantially all of the holders of the Common Shares of shares of any class other than the Common Shares, rights, options or warrants to acquire Common Shares or securities exchangeable or convertible into Common Shares, of evidences of indebtedness or cash, securities or any property or other assets.

The Warrant Indenture also provides for adjustment in the class and/or number of securities issuable upon the exercise of the Warrants and/or exercise price in the event of the following additional events: (1) reclassifications of the Common Shares; (2) consolidations, amalgamations, plans of arrangement or mergers of the Company with or into another entity (other than consolidations, amalgamations, plans of arrangement or mergers which do not result in any reclassification of the Common Shares or a change of the Common Shares into other shares); or (3) the transfer (other than to one of the Company’s subsidiaries) of the undertaking or assets of the Company as an entirety or substantially as an entirety to another corporation or other entity. No adjustment in the exercise price or the number of Warrant Shares purchasable upon the exercise of the Warrants is required to be made unless the cumulative effect of such adjustment or adjustments would change the exercise price by at least 1% or the number of Common Shares purchasable upon exercise by at least one one-hundredth of a Common Share. The Company also covenants in the Warrant Indenture that, during the period in which the Warrants are exercisable, it will give notice to holders of Warrants of certain stated events, including events that would result in an adjustment to the exercise price for the Warrants or the number of Warrant Shares issuable upon exercise of the Warrants, at least 14 days prior to the record date or effective date, as the case may be, of such event.

No fractional Warrant Shares will be issuable upon the exercise of any Warrants, and no cash or other consideration will be paid in lieu of fractional shares. Holders of Warrants will not have any voting or pre-emptive rights or any other rights which a holder of Common Shares would have. From time to time, the Company and the Warrant Agent, without the consent of the holders of Warrants, may amend or supplement the Warrant Indenture for certain purposes, including curing defects or inconsistencies, issuing additional Warrants thereunder or making any change that does not adversely affect the rights of any holder of Warrants. Any amendment or supplement to the Warrant Indenture that adversely affects the interests of the holders of the Warrants may only be made by "special resolution", which will be defined in the Warrant Indenture as a resolution either (1) passed at a meeting of the holders of Warrants at which there are holders of Warrants present in person or represented by proxy representing at least 10% of the aggregate number of the then outstanding Warrants and passed by the affirmative vote of holders of Warrants representing not less than 66⅔% of the aggregate number of all the then outstanding Warrants represented at the meeting and voted on the poll upon such resolution or (2) adopted by an instrument in writing signed by the holders of Warrants representing not less than 66⅔% of the aggregate number of all the then outstanding Warrants.

The Warrants are non-transferrable and will not be listed for trading on any national or foreign securities exchange.

CONSOLIDATED CAPITALIZATION

Other than as set out herein under "Prior Sales", there have been no material changes in the share capitalization of the Company since March 31, 2010.

As a result of the issuance of the Offered Shares which may be distributed under this Prospectus Supplement and the Warrant Shares that may be distributed upon exercise of the Warrants and the Agent's Warrants, the share capital of the Company may increase by up to a maximum of $l.

PRIOR SALES

In the 12 months prior to the date of this Prospectus Supplement, the Company has issued the following securities:

Date of Grant/ Issuance | | Price per Security ($) | Number of Securities Issued |

| Common Shares: | | | |

| 09-04-2010 | | 0.60 | 1,333,333 |

| 29-04-2010 to 11-05-2010 | | 0.28 | 12,500,000 |

| 18-12-2009 | | 0.56 | 33,333 |

| Options to purchase Common Shares: | | | |

| 10-09-2009 | | 0.86 | 1,000,000 |

| 18-05-2010 | | 0.71 | 500,000 |

| Warrants to purchase Common Shares: | | | |

| 09-04-2010 | | 0.70 | 1,333,333 |

PRICE RANGE AND TRADING VOLUMES

The Common Shares are listed and posted for trading on the TSX.V and Amex under the symbol "MDW". The following tables set forth the reported high, low and closing sale prices and the daily average volume of trading of the Common Shares during the 12 months preceding the date of this Prospectus Supplement.

| | TSX Venture Exchange (prices in Canadian dollars) | | NYSE Amex (prices in U.S. dollars) |

| 2009 | High | Low | Close | Daily Avg. Volume | | High | Low | Close | Daily Avg. Volume |

| May | 0.63 | 0.46 | 0.63 | 16,160 | | 0.60 | 0.42 | 0.60 | 216,576 |

| June | 0.92 | 0.62 | 0.80 | 12,403 | | 0.89 | 0.60 | 0.71 | 223,749 |

| July | 0.84 | 0.61 | 0.69 | 7,483 | | 0.75 | 0.59 | 0.65 | 98,944 |

| August | 0.75 | 0.64 | 0.72 | 7,567 | | 0.69 | 0.59 | 0.64 | 63,793 |

| September | 1.05 | 0.71 | 0.75 | 31,588 | | 0.94 | 0.65 | 0.72 | 341,740 |

| October | 0.88 | 0.66 | 0.66 | 13,467 | | 0.84 | 0.61 | 0.62 | 190,216 |

| November | 0.87 | 0.62 | 0.85 | 36,212 | | 0.84 | 0.61 | 0.82 | 210,098 |

| December | 1.06 | 0.80 | 0.81 | 35,416 | | 1.01 | 0.76 | 0.87 | 314,255 |

| 2010 | High | Low | Close | Daily Avg. Volume | | High | Low | Close | Daily Avg. Volume |

| January | 0.90 | 0.70 | 0.70 | 68,986 | | 0.87 | 0.65 | 0.65 | 223,950 |

| February | 0.70 | 0.63 | 0.63 | 21,471 | | 0.66 | 0.59 | 0.59 | 106,635 |

| March | 0.72 | 0.60 | 0.66 | 20,731 | | 0.67 | 0.59 | 0.64 | 118,478 |

| April | 0.70 | 0.60 | 0.70 | 103,655 | | 0.698 | 0.595 | 0.692 | 288,124 |

| May 1 to May 27 | 0.78 | 0.65 | 0.67 | 68,265 | | 0.77 | 0.60 | 0.65 | 344,953 |

Note: The Common Shares are also listed for trading on the Frankfurt Stock Exchange under the symbol "LXQ", but are not actively traded.

The closing price of the Common Shares on the TSX.V and Amex on May 27, 2010 was $0.67 and US$0.65, respectively.

LEGAL MATTERS

Certain legal matters relating to the offering of the Units will be passed upon on behalf of the Company by Stikeman Elliott LLP, Vancouver, British Columbia, with respect to Canadian legal matters, and by Dorsey & Whitney LLP, Denver, Colorado, with respect to U.S. legal matters, and for the Agent by Blake, Cassels & Graydon LLP, with respect to Canadian legal matters.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed, as of the date hereof, to be incorporated by reference into the accompanying Prospectus solely for the purposes of this offering. Other documents are also incorporated, or are deemed to be incorporated, by reference into the Prospectus, and reference should be made to the Prospectus for full particulars thereof.

The following documents which have been filed by the Company with securities commissions or similar authorities in Canada, are also specifically incorporated by reference into, and form an integral part of, the Prospectus, as supplemented by this Prospectus Supplement:

| (a) | the annual information, which is our Annual Report on Form 10-K of the Company, for the year ended December 31, 2009, which report contains the audited consolidated financial statements of the Company and the notes thereto as at December 31, 2009 and 2008 and for each of the years in the three year period ended December 31, 2009, together with the auditors’ report thereon, and the related management’s discussion and analysis of financial conditions and results of operations for the year ended December 31, 2009; |

| | |

| (b) | the Quarterly Report on Form 10-Q, which report contains the unaudited interim consolidated financial statements as at and for the three months ended March 31, 2010 and 2009, together with the notes thereto, and the related management’s discussion and analysis of financial conditions and results of operations for the three months ended March 31, 2010; |

| (c) | the material change report of the Company dated May 21, 2010 prepared in connection with the announcement of the appointment of Kenneth A. Brunk as President and Chief Operating Officer of the Company; |

| | |

| (d) | the material change report of the Company dated April 12, 2010 prepared in connection with the announcement of a private placement financing of $800,000; |

| | |

| (e) | the material change report of the Company dated December 23, 2009 prepared in connection with the announcement of director and officer appointments; |

| | |

| (f) | the material change report of the Company dated November 5, 2009 prepared in connection with the announcement of an updated mineral resource estimate for the Pan Project; |

| | |

| (g) | the material change report of the Company dated October 30, 2009 prepared in connection with the announcement of the deferral of a proposed financing due to market conditions; |

| | |

| (h) | the amended material change report of the Company dated October 16, 2009 prepared in connection with the announcement of a private placement financing of $10 million; |

| | |

| (i) | the material change report of the Company dated June 25, 2009 prepared in connection with the announcement of a National Instrument 43-101 compliant mineral resource estimate for the Golden Eagle Project, as amended by a news release on August 5, 2009; and |

| | |

| (j) | the Company’s Proxy Statement on Schedule 14A, dated March 11, 2010, in connection with the Company’s May 4, 2010 annual general and special meeting of shareholders. |

Any documents of the type referred to above (including material change reports but excluding confidential material change reports), or other disclosure documents required to be incorporated by reference into a prospectus filed under National Instrument 44-101, which are subsequently filed by the Company with securities commissions or similar authorities in the relevant provinces of Canada after the date of this Prospectus Supplement, and until all of this offering is complete, shall be deemed to be incorporated by reference into the Prospectus, as amended by this Prospectus Supplement. These documents are available through the internet on SEDAR at www.sedar.com.

Any statement contained in this Prospectus Supplement, the Prospectus or in a document (or part thereof) incorporated by reference herein or therein, or deemed to be incorporated by reference herein or therein, shall be deemed to be modified or superseded, for purposes of this Prospectus Supplement, to the extent that a statement contained in this Prospectus Supplement or in any subsequently filed document (or part thereof) that also is, or is deemed to be, incorporated by reference in this Prospectus Supplement or in the Prospectus modifies or replaces such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this Prospectus Supplement or the Prospectus. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document which it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following is, as of the date of this Prospectus Supplement, a summary of the principal Canadian federal income tax considerations generally applicable to a purchaser who acquires a Unit, consisting of one Offered Share and one-half of one Warrant, pursuant to this offering.

This summary applies only to a purchaser who is a beneficial owner of Offered Shares and Warrants acquired pursuant to this offering and who, for the purposes of the Income Tax Act (Canada) ("Tax Act"), and at all relevant times: (i) deals at arm's length and is not affiliated with the Company, and any subsequent purchaser of the Offered Shares, Warrant Shares or Warrants; and (ii) holds the Offered Shares, Warrant Shares and Warrants as capital property ("Holder"). Offered Shares, Warrant Shares and Warrants will generally be considered to be capital property to a Holder unless they are held in the course of carrying on a business or were acquired in one or more transactions considered to be an adventure or concern in the nature of trade.

This section of the summary is not applicable to a Holder: (i) that is a "financial institution" as defined in subsection 142.2(1) of the Tax Act; (ii) that is a "specified financial institution" as defined in subsection 248(1) of the Tax Act; (iii) who reports its "Canadian tax results", as defined in subsection 261(1) of the Tax Act, in a currency other than the Canadian currency; or (iv) an interest in which is, or for whom an Offered Share, Warrant Share or Warrant would be, a "tax shelter investment" for the purposes of the Tax Act. Such Holders should consult their own tax advisors.

This summary is based upon: (i) the current provisions of the Tax Act and the regulations thereunder ("Regulations") in force as of the date hereof; (ii) all specific proposals ("Proposed Amendments") to amend the Tax Act or the Regulations that have been publicly announced by, or on behalf of, the Minister of Finance (Canada) prior to the date hereof; and (iii) counsel's understanding of the current published administrative policies and assessing practices of the Canada Revenue Agency ("CRA"). No assurance can be given that the Proposed Amendments will be enacted or otherwise implemented in their current form, if at all. If the Proposed Amendments are not enacted or otherwise implemented as presently proposed, the tax consequences may not be as described below in all cases. This summary does not otherwise take into account or anticipate any changes in law, administrative policy or assessing practice, whether by legislative, regulatory, administrative, governmental or judicial decision or action, nor does it take into account the tax laws of any province or territory of Canada or of any jurisdiction outside of Canada.

This summary is of a general nature only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended to be, nor should it be construed to be, legal or tax advice to any particular Holder. Accordingly, Holders should consult their own tax advisors with respect to their particular circumstances.

Allocation of Cost

A Holder who acquires Units pursuant to this offering will be required to allocate the purchase price paid for each Unit on a reasonable basis between the Offered Share and the one-half Warrant comprising each Unit in order to determine their respective costs to such Holder for the purposes of the Tax Act.

For its purposes, the Company has advised counsel that, of the $0.60 subscription price for each Unit, it intends to allocate approximately $l to each Offered Share and $l to each one-half Warrant and believes that such allocation is reasonable. The Company's allocation, however, is not binding on the CRA or on a Holder.

The adjusted cost base to a Holder of each Offered Share comprising a part of a Unit acquired pursuant to this offering will be determined by averaging the cost of such Offered Share with the adjusted cost base to such Holder of all other Common Shares (if any) held by the Holder as capital property immediately prior to the acquisition.

Exercise of Warrants

No gain or loss will be realized by a Holder of a Warrant upon the exercise of such Warrant. When a Warrant is exercised, the Holder's cost of the Warrant Share acquired thereby will be equal to the adjusted cost base of the Warrant to such Holder, plus the amount paid on the exercise of the Warrant. For the purpose of computing the adjusted cost base to a Holder of each Warrant Share acquired on the exercise of a Warrant, the cost of such Warrant Share must be averaged with the adjusted cost base to such Holder of all other Common Shares (if any) held by the Holder as capital property immediately prior to the acquisition upon such exercise of a Warrant.

Holders Resident in Canada

This section of the summary applies to a Holder who, at all relevant times, is, or is deemed to be, resident in Canada for the purposes of the Tax Act ("Resident Holder"). A Resident Holder whose Offered Shares or Warrant Shares might not otherwise qualify as capital property may be entitled to make the irrevocable election provided by subsection 39(4) of the Tax Act to have the Offered Shares, Warrant Shares and every other "Canadian security" (as defined in the Tax Act) owned by such Resident Holder in the taxation year of the election and in all subsequent taxation years deemed to be capital property. Resident Holders should consult their own tax advisors for advice as to whether an election under subsection 39(4) of the Tax Act is available and/or advisable in their particular circumstances. Such election is not available in respect of Warrants.

Dividends

A Resident Holder will be required to include in computing its income for a taxation year any taxable dividends received or deemed to be received on the Offered Shares or Warrant Shares. In the case of a Resident Holder that is an individual (other than certain trusts), such dividends will be subject to the gross-up and dividend tax credit rules applicable to taxable dividends received from taxable Canadian corporations. Taxable dividends received from a taxable Canadian corporation which are designated by such corporation as "eligible dividends" will be subject to an enhanced gross-up and dividend tax credit regime in accordance with the rules in the Tax Act. In the case of a Resident Holder that is a corporation, the amount of any such taxable dividend that is included in its income for a taxation year will generally be deductible in computing its taxable income for that taxation year.

A Resident Holder that is a "private corporation" or a "subject corporation", as defined in the Tax Act, will generally be liable to pay a refundable tax of 33 1/3% under Part IV of the Tax Act on dividends received on the Offered Shares or Warrant Shares to the extent such dividends are deductible in computing the Resident Holder’s taxable income for the year.

Taxable Capital Gains and Losses

A Resident Holder who disposes of or is deemed to have disposed of an Offered Share, Warrant Share or Warrant (other than a disposition arising on the exercise of a Warrant) will generally realize a capital gain (or capital loss) in the taxation year of the disposition equal to the amount by which the proceeds of disposition, net of any reasonable costs of disposition, are greater (or are less) than the adjusted cost base to the Resident Holder of the Offered Share, Warrant Share or Warrant immediately before the disposition or deemed disposition. Generally, the expiry of an unexercised Warrant will give rise to a capital loss equal to the adjusted cost base to the Resident Holder of such expired Warrant.

A Resident Holder will generally be required to include in computing its income for the taxation year of disposition, one-half of the amount of any capital gain (a "taxable capital gain") realized in such taxation year. Subject to and in accordance with the provisions of the Tax Act, a Resident Holder will generally be required to deduct one-half of the amount of any capital loss (an "allowable capital loss") against taxable capital gains realized in the taxation year of disposition. Allowable capital losses in excess of taxable capital gains for the taxation year of disposition generally may be carried back and deducted in any of the three preceding taxation years or carried forward and deducted in any subsequent taxation year against net taxable capital gains realized in such taxation years, to the extent and under the circumstances specified in the Tax Act.

The amount of any capital loss realized on the disposition or deemed disposition of an Offered Share or Warrant Share by a Resident Holder that is a corporation may, in certain circumstances, be reduced by the amount of dividends received or deemed to have been received by it on such Offered Share or Warrant Share to the extent and under the circumstances specified in the Tax Act. Similar rules may apply where a Resident Holder that is a corporation is a member of a partnership or a beneficiary of a trust that owns Offered Shares or Warrant Shares or where a partnership or trust, of which a corporation is a member or a beneficiary, is a member of a partnership or a beneficiary of a trust that owns Offered Shares or Warrant Shares. Resident Holders to whom these rules may be relevant should consult their own tax advisors.

Other Income Taxes

A Resident Holder that is throughout the relevant taxation year a "Canadian-controlled private corporation" (as defined in the Tax Act) may be liable to pay a refundable tax of on its "aggregate investment income" (as defined in the Tax Act) for the year, including taxable capital gains, but excluding dividends or deemed dividends that are deductible in computing taxable income.

In general terms, a Resident Holder who is an individual (other than certain trusts) that receives or is deemed to have received taxable dividends on the Offered Shares or Warrant Shares or realizes a capital gain on the disposition or deemed disposition of Offered Shares, Warrant Shares or Warrants may be liable for a minimum tax under the Tax Act. Resident Holders that are individuals should consult their own tax advisors in this regard.

Holders Not Resident in Canada

This portion of the summary is generally applicable to a Holder who, at all relevant times, for purposes of the Tax Act: (i) is not, and is not deemed to be, resident in Canada; and (ii) does not use or hold the Offered Shares, Warrant Shares or Warrants in connection with carrying on a business in Canada ("Non-Resident Holder"). This summary does not apply to a Non-Resident Holder that carries on, or is deemed to carry on, an insurance business in Canada and elsewhere and such Holders should consult their own tax advisors.

Dividends

Dividends paid or credited or deemed under the Tax Act to be paid or credited by the Company to a Non-Resident Holder on an Offered Share or Warrant Share will generally be subject to Canadian withholding tax at the rate of 25%, subject to any reduction in the rate of withholding to which the Non-Resident Holder is entitled under any applicable income tax convention between Canada and the country in which the Non-Resident Holder is resident. For example, where a Non-Resident Holder is a resident of the United States, is fully entitled to the benefits under the Canada-United States Income Tax Convention (1980) and is the beneficial owner of the dividend, the applicable rate of Canadian withholding tax is generally reduced to 15%.

Dispositions

A Non-Resident Holder will not be subject to tax under the Tax Act in respect of any capital gain realized on a disposition or deemed disposition of an Offered Share, Warrant Share or Warrant unless the Offered Share, Warrant Share or Warrant (as applicable) is, or is deemed to be, "taxable Canadian property" of the Non-Resident Holder for the purposes of the Tax Act and the Non-Resident Holder is not entitled to an exemption under an applicable income tax convention between Canada and the country in which the Non-Resident Holder is resident.

Generally, based on the Proposed Amendments, an Offered Share, Warrant Share or Warrant (as applicable) will not constitute taxable Canadian property of a Non-Resident Holder provided that: (a) the Offered Shares or, in the case of a Warrant Share or Warrant, the Warrant Shares are listed on a "designated stock exchange" for the purposes of the Tax Act (which currently includes Tier 1 of the TSX.V) at the time of the disposition; (b) at no time during the 60 month period immediately preceding the disposition or deemed disposition of the Offered Share, Warrant Share or Warrant (as applicable): (i) were 25% or more of the issued shares of any class or series of the capital stock of the Company owned by, or belonged to, one or any combination of the Non-Resident Holder and persons with whom the Non-Resident Holder did not deal at arm's length (within the meaning of the Tax Act); and (ii) was more than 50% of the fair market value of a Common Share derived directly or indirectly from one or any combination of: (A) real or immovable property situated in Canada; (B) Canadian resource property (as defined in the Tax Act); (C) timber resource property (as defined in the Tax Act), or (D) options in respect of, or interests in, or for civil rights in, property described in any of (A) through (C) above, whether or not such property exists; and (c) the Offered Share, Warrant Share or Warrant (as applicable) is not otherwise deemed under the Tax Act to be taxable Canadian property.

In cases where a Non-Resident Holder disposes (or is deemed to have disposed) of an Offered Share, Warrant Share or Warrant that is, or is deemed to be, taxable Canadian property to that Non-Resident Holder, and the Non-Resident Holder is not entitled to an exemption under an applicable income tax convention, the consequences described under the heading "Holders Resident in Canada — Taxable Capital Gains and Losses" will generally be applicable to such disposition. Such Non-Resident Holders should consult their own tax advisors.

INTEREST OF EXPERTS

As at the date hereof, the partners and associates of Stikeman Elliott LLP, as a group, own, directly or indirectly, less than 1% of the Common Shares of the Company. As at the date hereof, the partners and associates of Blake, Cassels & Graydon LLP, as a group, own, directly or indirectly, less than 1% of the Common Shares of the Company. The Company's auditors, KPMG LLP, Chartered Accountants, have advised that they are independent of the Company within the meaning of the Rules of Professional Conduct/Code of Ethics of the Institute of Chartered Accountants of British Columbia. None of the aforementioned persons, and the directors, officers, employees and partners, as applicable, of each of the aforementioned persons received or has received a direct or indirect interest in a property of the Company or any associate or affiliate of the Company.

ELIGIBILITY FOR INVESTMENT

In the opinion of Stikeman Elliott LLP, Canadian counsel to the Company, and Blake, Cassels & Graydon LLP, Canadian counsel to the Agent: (a) the Offered Shares and Warrant Shares would, if issued on the date hereof and if listed at that time on a "designated stock exchange", as defined in the Tax Act, (which currently includes Tier 1 of the TSX.V), be qualified investments under the Tax Act for trusts governed by registered retirement savings plans, registered retirement income funds, registered education savings plans, deferred profit sharing plans, registered disability savings plans and tax-free savings accounts ("TFSAs" and collectively, "Registered Plans"), and (b) the Warrants would, if issued on the date hereof, be qualified investments for a Registered Plan provided that: (i) the Warrant Shares issuable on the exercise of the Warrants would, if issued on the date hereof, be listed at that time on a designated stock exchange, and (ii) the Company is not an annuitant, a beneficiary, an employer or a subscriber under, or a holder of, such Registered Plan and the Company deals at arm’s length (within the meaning of the Tax Act) with each person that is an annuitant, a beneficiary, an employer or a subscriber under, or a holder of, such Registered Plan.

Notwithstanding the foregoing, the holder of a TFSA will be subject to a penalty tax on an Offered Share, Warrant Share or Warrant held in the TFSA if such Offered Share, Warrant Share or Warrant is a "prohibited investment" for the TFSA. An Offered Share, Warrant Share or Warrant will generally not be a prohibited investment unless either: (i) the holder of the TFSA does not deal at arm’s length with the Company (within the meaning of the Tax Act), or (ii) the holder of the TFSA has a "significant interest" (within the meaning of the Tax Act) in the Company or a corporation, partnership or trust with which the Company does not deal at arm’s length for the purposes of the Tax Act. Prospective investors should consult their own tax advisers as to whether an Offered Share, Warrant Share or Warrant will be a ‘‘prohibited investment’’ in their particular circumstances.

STATUTORY RIGHTS OF WITHDRAWAL AND RESCISSION

Securities legislation in certain of the provinces of Canada provides purchasers with the right to withdraw from an agreement to purchase securities. This right may be exercised within two business days after receipt or deemed receipt of a prospectus and any amendment. In several of the provinces of Canada, the securities legislation further provides a purchaser with remedies for rescission or, in some jurisdictions, revision of the price or damages if the prospectus and any amendment contains a misrepresentation or is not delivered to the purchaser, provided that the remedies for rescission, revision of the price or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province.

The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province for the particulars of these rights or consult with a legal adviser.

AUDITORS' CONSENT

We have read the prospectus supplement dated l, 2010 of Midway Gold Corp. (the "Company") relating to the qualification for distribution of up to 10,000,000 units, each unit consisting of one common share of the Company and one half of one common share purchase warrant, for an aggregate offering price of up to $6,000,000. We have complied with Canadian generally accepted standards for an auditors’ involvement with offering documents.

We consent to the incorporation by reference in the above mentioned prospectus supplement of our report to the shareholders of the Company on the consolidated financial statements of the Company as at December 31, 2009 and 2008 and each of the years in the three year period ended December 31, 2009. Our report is dated February 19, 2010.

"l"

Chartered Accountants,

Vancouver, British Columbia

l, 2010

CERTIFICATE OF THE AGENT

Dated: May 28, 2010

To the best of our knowledge, information and belief, the short form prospectus, together with the documents incorporated in the prospectus by reference, as supplemented by the foregoing, constitutes full, true and plain disclosure of all material facts relating to the securities offered by the prospectus and this supplement as required by the securities legislation of the provinces of British Columbia, Alberta and Ontario.

| | HAYWOOD SECURITIES INC. | |

| | "Kevin Campbell" | |

| | | |

| | By: | | |

| | Kevin Campbell | |

| | Managing Director, Investment Banking | |

| | | | |

This short form base shelf prospectus has been filed under legislation in the provinces of British Columbia, Alberta and Ontario that permits certain information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar regulatory authorities in Canada. Copies of the documents incorporated by reference herein may be obtained on request without charge from the Corporate Secretary, Unit 1 - 15782 Marine Drive, White Rock, British Columbia, Canada, V4B 1E6, telephone (604) 536-2711, and are also available electronically at www.sedar.com.

SHORT FORM BASE SHELF PROSPECTUS

MIDWAY GOLD CORP.

US$25,000,000

Common Shares

Warrants

Units

Midway Gold Corp. ("Midway" or the "Company") may offer and issue from time to time common shares of the Company, without par value ("Common Shares"), warrants to purchase Common Shares ("Warrants"), or any combination of Common Shares and Warrants ("Units") (all of the foregoing collectively, the "Securities") up to an aggregate initial offering price of US$25,000,000 (or the equivalent thereof if the Securities are denominated in any other currency or currency unit) during the 25-month period that this short form base shelf prospectus (this "Prospectus"), including any amendments hereto, remains effective. Securities may be offered in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in one or more accompanying prospectus supplements (collectively or individually, as the case may be, a "Prospectus Supplement").

All information permitted under applicable law to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

The outstanding Common Shares are listed and posted for trading on the TSX Venture Exchange (the "TSX.V") and NYSE Amex ("Amex") under the symbol "MDW". Unless otherwise specified in the applicable Prospectus Supplement, Securities other than Common Shares will not be listed on any securities exchange. The listing of Warrants, if so specified in the applicable Prospectus Supplement, will be subject to the approval of the TSX.V and Amex, which approval will be conditional on, among other things, sufficient distribution of such Warrants. The offering of Securities hereunder is subject to approval of certain legal matters on behalf of the Corporation by Stikeman Elliott LLP, with respect to Canadian legal matters, and by Dorsey & Whitney LLP, with respect to U.S. legal matters.

Investing in the Securities involves significant risks. Investors should carefully read the "Risk Factors" section in this Prospectus beginning on page 3, in the documents incorporated by reference herein, and in the applicable Prospectus Supplement.

The specific terms of the Securities with respect to a particular offering will be set out in the applicable Prospectus Supplement and may include, where applicable: (i) in the case of Common Shares, the designation of the particular class and, if applicable, series, the number of shares offered, the offering price, dividend rate, if any, any terms for redemption or retraction, and any other terms specific to the Common Shares being offered; (ii) in the case of Warrants, the offering price, the designation, number and terms of the Common Shares issuable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the exercise price, dates and periods of exercise, the currency in which the Warrants are issued and any other specific terms; and (iii) in the case of Units, the designation, number and terms of the Common Shares and Warrants comprising the Units. A Prospectus Supplement may include specific variable terms pertaining to the Securities that are not within the alternatives and parameters set forth in this Prospectus. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the Securities will be included in the Prospectus Supplement describing the Securities.

Warrants will not be offered for sale separately to any member of the public in Canada unless the offering is in connection with, and forms part of, the consideration for an acquisition or merger transaction or unless the Prospectus Supplement describing the specific terms of the Warrants to be offered separately is first approved for filing by each of the securities commissions or similar regulatory authorities in Canada where the Warrants will be offered for sale.

Investors should be aware that the acquisition of the Securities described herein may have tax consequences. This Prospectus and the applicable Prospectus Supplement may not describe these tax consequences fully. You should read the tax discussion contained in the applicable Prospectus Supplement and consult your own tax advisor with respect to your own particular circumstances.

No underwriter has been involved in the preparation of this Prospectus nor has any underwriter performed any review of the contents of this Prospectus.

This Prospectus constitutes a public offering of the Securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell the Securities. The Company may offer and sell Securities to, or through, underwriters and also may offer and sell certain Securities directly to other purchasers or through agents pursuant to exemptions from registration or qualification under applicable securities laws. A Prospectus Supplement relating to each issue of Securities offered thereby will set forth the names of any underwriters or agents involved in the offering and sale of the Securities and will set forth the terms of the offering of the Securities, the method of distribution of the Securities including, to the extent applicable, the proceeds to the Company and any fees, discounts or any other compensation payable to underwriters or agents and any other material terms of the plan of distribution.

In connection with any offering of the Securities (unless otherwise specified in a Prospectus Supplement), the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See "Plan of Distribution".

The financial information of the Company contained in the documents incorporated by reference herein are presented in Canadian dollars. References in this Prospectus to "$" are to Canadian dollars. United States dollars are indicated by the symbol "US$".

The Corporation’s head and registered office is located at Unit 1 - 15782 Marine Drive, White Rock, British Columbia, Canada, V4B 1E6.

TABLE OF CONTENTS

| DESCRIPTION | PAGE NO. |

| | |

| THE CORPORATION | 1 |

| RISK FACTORS | 3 |

| DOCUMENTS INCORPORATED BY REFERENCE | 11 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 12 |

| FINANCIAL INFORMATION AND CURRENCY | 13 |

| RECENT DEVELOPMENTS | 14 |

| USE OF PROCEEDS | 14 |

| CONSOLIDATED CAPITALIZATION | 14 |

| DESCRIPTION OF SHARE CAPITAL | 14 |

| DESCRIPTION OF WARRANTS | 15 |

| DESCRIPTION OF UNITS | 16 |

| PRIOR SALES | 18 |

| PLAN OF DISTRIBUTION | 18 |

| INTEREST OF EXPERTS | 19 |

| TRANSFER AGENT AND REGISTRAR | 20 |

| LEGAL MATTERS | 20 |

| STATUTORY RIGHTS OF WITHDRAWAL AND RESCISSION | 20 |

| CONSENT OF AUDITOR | C-1 |

| CERTIFICATE OF THE COMPANY | C-2 |

THE CORPORATION

Midway Gold Corp. was incorporated under the Company Act (British Columbia) on May 14, 1996, under the name Neary Resources Corporation. On October 8, 1999, Midway changed its name to Red Emerald Resource Corp. On July 10, 2002, it changed its name to Midway Gold Corp. Midway became a reporting issuer in the Province of British Columbia upon the issuance of a receipt for a prospectus on May 16, 1997. Our common shares were listed on the Vancouver Stock Exchange (a predecessor of the TSX.V) on May 29, 1997. On July 1, 2001, Midway became a reporting issuer in the Province of Alberta pursuant to Alberta BOR#51-501. Our common shares are currently listed on Tier 1 of the TSX.V and Amex under the symbol "MDW."

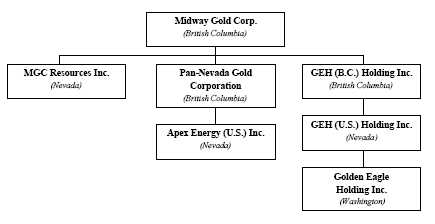

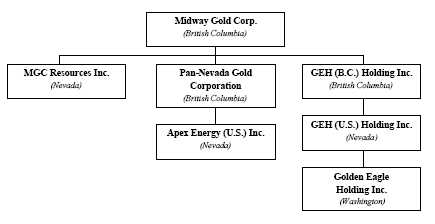

We are an exploration stage company engaged in the acquisition, exploration, and, if warranted, development of gold and silver mineral properties in North America. It is our objective to identify mineral prospects of merit, conduct preliminary exploration work, and if results are positive, conduct advanced exploration and, if warranted, development work. Our mineral properties are located in Nevada and Washington. The Midway, Spring Valley, Pan and Golden Eagle gold properties are exploratory stage projects and have identified gold mineralization and the Roberts Creek, Gold Rock and Burnt Canyon projects are earlier stage gold and silver exploration projects. The corporate organization chart for Midway as of the date of this Prospectus is as follows:

Our registered and corporate office in Canada is located at Unit 1 - 15782 Marine Drive, White Rock, B.C. V4B 1E6, and our corporate office phone number is 604-536-2711. Our operations office in the United States is located at 600 Lola Street, Suite 10, Helena, Montana 59601. We maintain a website at www.midwaygold.com. Information contained on our website is not part of this Prospectus.

Business of the Company

We are focused on exploring and developing high-grade, quality precious metal resources in stable mining areas. Our principal properties are the Spring Valley, Midway and Pan gold and silver mineral properties located in Nevada and the Golden Eagle gold mineral property located in the Washington. Midway holds certain other mineral exploration properties located in Nevada.

Spring Valley Property, Pershing County, Nevada

The Spring Valley project is located 20 miles northeast of Lovelock, Nevada. Spring Valley is a diatreme/porphyry hosted gold system covered by gravel. Gold has been intercepted continuously from a depth of 50 to 1400 feet, suggesting a large mineral system.

The Spring Valley project is under an exploration and option to joint venture agreement with Barrick Gold Corporation ("Barrick"). Barrick is funding 100% of the costs to earn an interest in this project. On March 2, 2009, we announced an updated Inferred Resource estimate as at December 31, 2008 of 87,750,000 tons at a grade of 0.021 ounces per ton ("opt") containing 1,835,000 ounces of gold using a cut off grade of 0.006 opt gold using a $715 Lerchs-Grossman shell. For further information on this project, please see the report entitled "Spring Valley Project, Nevada, NI 43-101 Technical Report" dated effective March 25, 2009, which is available under the Company's profile at www.sedar.com.

Midway Property, Nye County, Nevada

The Midway property is located in Nye County, Nevada, approximately 24 kilometers northeast of the town of Tonopah, 335 kilometers northwest of Las Vegas and 380 kilometers southeast of Reno. It is a high-grade epithermal quartz-gold vein system, on the Round Mountain – Goldfield gold trend. The claims maintained that were formally called the Thunder Mountain project are now consolidated within the Midway project.