Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-172009

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying base prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, PRELIMINARY PROSPECTUS SUPPLEMENT DATED JUNE 25, 2012

PRELIMINARY PROSPECTUS SUPPLEMENT

to Prospectus dated February 14, 2011

Units

MIDWAY GOLD CORP.

We are offering units (which we refer to as the “Units”) at a price of $ per Unit. Each Unit consists of one of our common shares (which we refer to as the “Offered Shares”) and one-half of one common share purchase warrant. Each whole common share purchase warrant (which we refer to as a “Warrant”) will entitle the holder to purchase one of our common shares (which we refer to as the “Warrant Shares”) at a price of $ per Warrant Share at any time until 5:00 p.m. (Vancouver time) on the date that is 18 months following the closing of the offering (which we refer to as the “Closing Date”). The expiry date of the Warrants is subject to acceleration in certain circumstances. See “Description of the Securities Distributed”. The offering is made pursuant to an underwriting agreement (which we refer to as the “Underwriting Agreement”) dated June , 2012, between us and RBC Dominion Securities Inc. and Haywood Securities Inc. (which we refer to together as the “Co-Lead Underwriters”) and (which we refer to, together with the Co-Lead Underwriters, as the “Underwriters”) as more fully described under the section entitled “Underwriting” in this prospectus supplement.

The outstanding common shares are listed and posted for trading on the TSX Venture Exchange (which we refer to as the “TSX.V”) and the NYSE MKT LLC (which we refer to as the “NYSE MKT”) in each case under the symbol “MDW”. We have applied to the TSX.V and NYSE MKT for the listing of the Offered Shares and the Warrant Shares. Listing of the Offered Shares and the Warrant Shares will be subject to us fulfilling all the listing requirements of the TSX.V and NYSE MKT, respectively. On June 22, 2012, the closing sale price of our common shares on the TSX.V and NYSE MKT was Cdn$1.38 and $1.38 per share, respectively. The offering price of the Units and the exercise price of the Warrants was determined by arm’s length negotiation between us and the Co-Lead Underwriters on behalf of the Underwriters with reference to the prevailing market price of our common shares.

There is no market through which the Warrants may be sold and purchasers may not be able to resell the Warrants purchased under this prospectus supplement. This may affect the pricing of the securities in the secondary market, the transparency and availability of trading prices, the liquidity of the securities and the extent of issuer regulation. See “Risk Factors”.

Investing in the Units involves significant risks. You should carefully read the “Risk Factors” section beginning on page S-19 of this prospectus supplement and the “Risk Factors and Uncertainties” section beginning on page 6 in the accompanying base shelf prospectus dated February 14, 2011, and in the documents incorporated by reference herein and therein.

| Price to Public | Underwriters’ Fee (1) | Net Proceeds to the Company (2) | ||||||||||

Per Unit(3) | $ | $ | $ | |||||||||

Total(4) | $ | $ | $ | |||||||||

| (1) | The Company has agreed to pay to the Underwriters a fee of $ , representing 6% of the aggregate gross proceeds of the offering, or $ per Unit sold, other than in respect of any sales of Units to any president’s list purchasers introduced to the Underwriters by us on which only a fee equal to 3% in respect of such sales or $ per Unit sold will be paid. See “Underwriting”. |

| (2) | After deducting the Underwriters’ fee (assuming no participation by president’s list purchasers), but before deducting the expenses of the offering, which, are estimated at $ . |

| (3) | From the price per Unit, we will allocate $ to each Offered Share and $ to each one-half of one Warrant comprising the Units. |

| (4) | We have granted to the Underwriters an option (which we refer to as the “Over-Allotment Option”) exercisable in whole or in part, to purchase up to an additional Units (which we refer to as the “Additional Units”) at the Offering Price per Additional Unit and/or up to an additional Warrants (which we refer to as the “Additional Warrants”) for a period of 30 days from and including the Closing Date (as defined herein) to cover over-allotments, if any, and for market stabilization purposes. The Over-Allotment Option may be exercisable by the Underwriters: (i) to acquire Additional Units at the Offering Price; or (ii) to acquire Additional Warrants at a price of $ per Additional Warrant; or (iii) to acquire any combination of Additional Units and Additional Warrants, so long as the aggregate number of additional Offered Shares and Additional Warrants which may be issued under the Over-Allotment Option does not exceed additional Offered Shares and Additional Warrants. If the Over-Allotment Option is exercised in full for Additional Units only, the Price to the Public, Underwriters’ Fee and Net Proceeds to the Corporation will be $ , $ and $ , respectively (assuming no participation by president’s list purchasers). This prospectus supplement also registers the grant of the Over-Allotment Option and the distribution of the Additional Units and/or Additional Warrants to be issued upon exercise of the Over-Allotment Option. See “Underwriting”. Unless the context otherwise requires, all references to the offering and the Units in this prospectus supplement assume the exercise of the Over-Allotment Option in full. Any purchaser who acquires securities forming part of the over-allocation position of the Underwriters pursuant to the Over-Allotment Option acquires such securities under this prospectus supplement, regardless of whether the over allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. |

The Underwriters may offer the Units at a price lower than the price indicated above. See “Underwriting”.

The Units are being offered in Canada by the Underwriters and in the United States by those Underwriters and members of the selling group, or their respective affiliates, that are U.S. registered broker-dealers.

Subscriptions will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. One or more certificates representing the Offered Shares and Warrants comprising the Units will be issued in registered or electronic form to Clearing and Depository Services (“CDS”) or nominees thereof and deposited with CDS on the Closing Date, which is expected to occur on or about , 2012, (and on the closing of the exercise of the Over-Allotment Option, if applicable), or such other date as may be agreed upon by us and the Underwriters, acting reasonably. A purchaser of Units will receive only a customer confirmation from the registered dealer through which the Units are purchased.

Neither the United States Securities and Exchange Commission (which we refer to as the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy of this prospectus supplement or the accompanying base prospectus. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| RBC Capital Markets | Haywood Securities (USA) Inc. |

The date of this prospectus supplement is June , 2012

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

IMPORTANT NOTICE ABOUT THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT | S-1 | |||

| S-2 | ||||

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES | S-3 | |||

| S-4 | ||||

| S-5 | ||||

| S-19 | ||||

| S-22 | ||||

| S-23 | ||||

| S-25 | ||||

| S-27 | ||||

| S-27 | ||||

| S-27 | ||||

| S-30 | ||||

| S-31 | ||||

| S-32 | ||||

| S-33 | ||||

| S-42 | ||||

| S-43 | ||||

| S-43 | ||||

BASE PROSPECTUS

ABOUT THIS PROSPECTUS | 1 | |||

SUMMARY | 2 | |||

RISK FACTORS AND UNCERTAINTIES | 6 | |||

DOCUMENTS INCORPORATED BY REFERENCE | 15 | |||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 16 | |||

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES | 17 | |||

PRESENTATION OF FINANCIAL INFORMATION AND EXCHANGE RATE DATA | 18 | |||

USE OF PROCEEDS | 18 | |||

DESCRIPTION OF COMMON SHARES | 18 | |||

DESCRIPTION OF WARRANTS | 18 | |||

DESCRIPTION OF UNITS | 20 | |||

PLAN OF DISTRIBUTION | 21 | |||

INTERESTS OF NAMED EXPERTS AND COUNSEL | 22 | |||

TRANSFER AGENT AND REGISTRAR | 22 | |||

LEGAL MATTERS | 23 | |||

EXPERTS | 23 | |||

WHERE YOU CAN FIND MORE INFORMATION | 23 | |||

S-i

Table of Contents

IMPORTANT NOTICE ABOUT THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the Units being offered and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated by reference herein and therein. The second part is the accompanying base prospectus, which gives more general information, some of which may not be applicable to this offering. This prospectus supplement is deemed to be incorporated by reference into the accompanying base prospectus solely for purposes of this offering.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying base prospectus and any free writing prospectus relating to this offering. We have not and the Underwriters have not authorized any other person to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are not, and the Underwriters are not, making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in or incorporated by reference in this prospectus supplement, the accompanying base prospectus, and any free writing prospectus is accurate as of any date other than the date of the document in which such information appears. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this prospectus supplement updates and modifies the information in the accompanying base prospectus and information incorporated by reference herein and therein. To the extent that any statement made in this prospectus supplement or any free writing prospectus (unless otherwise specifically indicated therein) differs from those in the accompanying base prospectus, the statements made in the accompanying base prospectus and the information incorporated by reference herein and therein are deemed modified or superseded by the statements made by this prospectus supplement or any free writing prospectus.

This prospectus supplement relates to a registration statement on Form S-3 that we filed with the SEC utilizing a shelf registration process. Under this shelf registration process, we may, from time to time, offer, sell and issue any of the securities or any combination of the securities described in the accompanying base prospectus in one or more offerings. You should read this prospectus supplement, the accompanying base prospectus and any free writing prospectus filed by us together with the information described under the sections entitled, “Where to Find Additional Information” and “Documents Incorporated by Reference” in this prospectus supplement and under the sections entitled, “Where You Can Find More Information” and “Documents Incorporated by Reference” in the accompanying base prospectus, and any additional information you may need to make your investment decision. We have also filed a prospectus supplement and a short form base shelf prospectus with the securities regulatory authorities in the provinces of British Columbia, Alberta and Ontario, Canada, (which Canadian-filed prospectus supplement and short form base shelf prospectus we refer to as the “Canadian Prospectus”). The securities qualified under the Canadian Prospectus may be offered and sold in each of the provinces of British Columbia, Alberta and Ontario, Canada, subject to any applicable securities laws.

Prospective investors should be aware that the acquisition of the Units described herein may have tax consequences in the United States and Canada. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. Investors should read the tax discussions in this prospectus supplement under the captions “Certain Canadian Federal Income Tax Considerations” and “Material United States Federal Income Tax Considerations” and should consult their own tax advisor with respect to their own particular circumstances.

We are incorporated under the laws of the Province of British Columbia, Canada. Consequently, it may be difficult for United States investors to effect service of process within the United States upon us, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the laws of the United States. A judgment of a U.S. court predicated solely upon such civil liabilities would probably be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter.

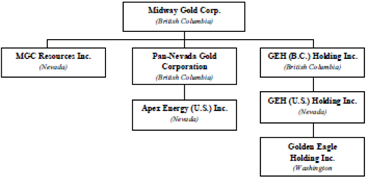

Unless stated otherwise or the context otherwise requires, references in this prospectus supplement and the accompanying base prospectus to the “Company,” “Midway,” “we, “ “our” or “us” includes Midway Gold Corp. and each of its subsidiaries.

S-1

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein contain “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

| • | the establishment and estimates of mineral reserves and resources; |

| • | the grade of mineral reserves and resources; |

| • | anticipated expenditures and costs in our operations; |

| • | planned exploration activities and the anticipated outcome of such exploration activities; |

| • | plans and anticipated timing for obtaining permits and licenses for our properties; |

| • | anticipated closure costs; |

| • | expected future financing and its anticipated outcome; |

| • | anticipated liquidity to meet expected operating costs and capital requirements; |

| • | estimates of environmental liabilities; |

| • | our ability to obtain financing to fund our estimated expenditure and capital requirements; |

| • | factors expected to impact our results of operations; and |

| • | the expected impact of the adoption of new accounting standards. |

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| • | risks related to our lack of operating history, which leaves investors with no basis to evaluate our ability to operate profitably; |

| • | risks related to our history of losses and our requirement for additional financing to fund exploration and, if warranted, development of our properties; |

| • | risks related to our lack of historical production from our mineral properties; |

| • | uncertainty and risks related to cost increases for our exploration and, if warranted, development projects; |

| • | uncertainty and risks related to the effect of a shortage of equipment and supplies on our ability to operate our business; |

| • | uncertainty and risks related to mining being inherently dangerous and subject to events and conditions beyond our control; |

| • | uncertainty and risks related to our mineral resource estimates being based on assumptions and interpretations and our properties yielding less mineral production under actual conditions than currently estimated; |

| • | risks related to changes in mineral resource estimates affecting the economic viability of our projects; |

| • | risks related to differences in U.S. and Canadian practices for reporting reserves and resources; |

| • | uncertainty and risks related to our exploration activities on our properties not being commercially successful; |

| • | uncertainty and risks related to encountering archaeological issues and claims in relation to our properties; |

| • | risks related to our Tonopah property being in close proximity to a municipal water supply, which may delay our ability to conduct further exploration or development activities; |

| • | uncertainty and risks related to fluctuations in gold, silver and other metal prices; |

| • | risks related to our lack of insurance for certain high-risk activities; |

| • | uncertainty and risks related to our ability to acquire necessary permits and licenses to place our properties into production; |

| • | risks related to government regulations that could affect our operations and costs; |

S-2

Table of Contents

| • | risks related to environmental regulations that may increase our costs of doing business or restrict our operations; |

| • | uncertainty and risks related to proposed legislation that may significantly affect the mining industry; |

| • | uncertainty and risks related to pending legislation governing issues involving climate change; |

| • | uncertainty and risks related to evolving corporate governance standards and public disclosure regulations that increase compliance costs and the risk of non-compliance; |

| • | risks related to land reclamation requirements on our properties; |

| • | risks related to competition in the mining industry; |

| • | risks related to our need for significant additional capital; |

| • | risks related to our possible entry into joint venture and option agreements on our properties; |

| • | risks related to our directors and officers having conflicts of interest; |

| • | risks related to our ability to attract qualified management to meet our expected needs in the future; |

| • | uncertainty and risks related to currency fluctuations; |

| • | uncertainty and risks related to title to our properties and our properties being subject to litigation or other claims; |

| • | risks related to our status as a passive foreign investment company which would likely result in materially adverse U.S. federal income tax consequences for U.S. investors; |

| • | risks related to our securities; |

| • | risks related to the listing criteria of the TSX.V and NYSE MKT; and |

| • | risks related to this offering, including the risk that an investor may lose all of his or her investment. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section entitled “Risk Factors” in this prospectus supplement, the section entitled “Risk Factors and Uncertainties” in the accompanying base prospectus and the section entitled “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2011, as filed with the SEC on March 9, 2012 and incorporated herein by reference. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

We qualify all the forward-looking statements contained in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein by the foregoing cautionary statements.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES

The mineral estimates in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”)—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the SEC Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are

S-3

Table of Contents

cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in the prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein contain descriptions of our mineral deposits that may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

FINANCIAL INFORMATION AND CURRENCY

Our financial information contained in the documents incorporated by reference in this prospectus supplement and in the accompanying base prospectus is presented in accordance with generally accepted accounting principles (which we refer to as “GAAP”) in the United States. Our financial information contained in the documents incorporated by reference is presented in Canadian dollars, unless otherwise indicated.

References in this prospectus supplement to “$” are to United States dollars. Canadian dollars are indicated by the symbol “Cdn$”. On June 22, 2012, the closing exchange rate for a Canadian dollar in terms of the United States dollar, as quoted by the Bank of Canada, was $0.9747 = Cdn$1.00 .

S-4

Table of Contents

The following summary provides an overview of certain information about us and may not contain all the information that is important to you. This summary is qualified in its entirety by, and should be read together with, the information contained in other parts of this prospectus supplement, the accompanying base prospectus and the documents incorporated herein and therein by reference. You should carefully read this entire prospectus supplement, the accompanying base prospectus and the documents that we incorporate herein and therein by reference before making a decision about whether to invest in the Units.

The Company

We are a development stage company engaged in the acquisition, exploration, and, if warranted, development of gold and silver mineral properties in North America. Our mineral properties are located in Nevada and Washington. The Tonopah (formerly referred to as “Midway”), Spring Valley, Gold Rock and Golden Eagle gold properties are exploratory stage projects and have identified gold mineralization and the Thunder Mountain project is an earlier stage gold and silver exploration project. Our Pan project is in the early development stage. We are working towards transitioning from a development stage company to a gold production company with plans to advance the Pan gold property located in White Pine County, Nevada through to production by as early as 2014. Prospective purchasers of the Units should read the description of the Company and our business under the heading “Item 1. Business” in the Form 10-K.

Our registered office in Canada is located at Suite 1700, Park Place, 666 Burrard Street, Vancouver, B.C. Canada V6C 2X8. Our corporate office in the United States is located at Point at Inverness, Suite 280, 8310 South Valley Highway, Englewood, Colorado 80112, telephone (720) 979-0900.

Recent Developments

On May 21, 2012, Mr. Daniel E. Wolfus resigned as our Chairman of the board of directors and Chief Executive Officer (“CEO”). Mr. Kenneth A. Brunk was appointed Chairman and CEO in addition to his present office as our President.

On May 11, 2012, we held our annual general and special meeting whereby our shareholders received our audited financial statements for the fiscal year ended December 31, 2011, together with the auditors’ report thereon, and passed resolutions to: (i) set the number of directors of the Company at five, (ii) elect the directors, (iii) approve executive compensation on an advisory basis, (iv) approve three years as the frequency of holding future advisory votes on executive compensation, (v) ratify the appointment of KPMG LLP as the our auditor for 2012, (vi) approve the renewal of our 2008 stock option plan, and (vii) approve an amendment to our authorized share structure to create a class of preferred shares.

On April 11, 2012, we announced that Barrick Gold Exploration Inc. informed us that it intends to conduct and fund an $11.5 million program at Midway’s Spring Valley Project, Pershing County, Nevada, in 2012 that includes both exploration drilling and development work in preparation for an internal pre-feasibility study. Exploration will be focused on in-fill drilling in the north resource area and expansion drilling of the south target area. The development work will include metallurgical, geotechnical and hydrological studies.

Pan Project

The summary below is a direct extract of the executive summary on pages 1-9 from our technical report entitled “NI 43-101 Technical Report, Feasibility Study for the Pan Gold Project, White Pine County, Nevada” dated effective November 15, 2011 (the “Pan Technical Report”) authored by William J. Crowl, R.G., MMSA, Donald E. Hulse, P.E., Terre A. Lane, MMSA, Donald J. Baker, PhD, MMSA and Jennifer J. Brown, P.G., SME, each of whom is a “qualified person” and “independent” as such terms are defined in National Instrument 43-101 –Standards of Disclosure for Mineral Projects (“NI 43-101”). The summary below is subject to all of the assumptions, qualifications, and procedures set out in the Pan Technical Report and is qualified in its entirety by reference to the full text of the Pan Technical Report. For full technical details, reference should be made to the complete text of the Pan Technical Report which is incorporated by reference herein and which has been filed with the applicable regulatory authorities and is available under the Company’s profile on SEDAR at www.sedar.com and was furnished to the SEC in a current report on Form 8-K, dated December 23, 2011, available at www.sec.gov.

S-5

Table of Contents

“Gustavson Associates, LLC (Gustavson) was commissioned by Midway Gold Corp to complete a Feasibility Study for the Pan Gold Project in White Pine County, Nevada, based on the Updated Mineral Resource Estimate dated September 1, 2011. The Feasibility Study is intended to provide a comprehensive technical and economic analysis of the selected development option for the mineral project. This study includes detailed assessments of realistically assumed mining, processing, metallurgical, economic, legal, environmental, social, and other relevant considerations which have successfully demonstrated the economic viability of the project. The purpose of this report is to document the results of the Feasibility Study in compliance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects.

The Pan gold deposit is a sediment-hosted, bulk tonnage Carlin-type gold deposit along the prolific Battle Mountain-Eureka gold trend in east-central Nevada. Midway Gold US Inc (hereafter referred to as MIDWAY) has drilled, sampled, and mapped the Pan deposit since acquiring the project in 2007. MIDWAY completed 61,875 ft of drilling in 162 holes in 2007and 2008, and released an updated mineral resource estimate in December 2009. Gustavson performed an independent audit of the 2009 mineral resource estimate as part of a Preliminary Economic Assessment in 2010, and MIDWAY conducted a 14-hole (5774 ft) diamond core drilling program to obtain additional metallurgical and geotechnical data during the latter half of that same year. Gustavson completed a mineral reserve and mine plan as part of the March 2011 Preliminary Feasibility Study, which included an updated geologic model and mineral resource based on data obtained through February 28, 2011. MIDWAY has since completed an additional 33 holes totaling 27,795 ft.

Property Description and Ownership

The Pan Project is located in White Pine County, Nevada, approximately 22 miles southeast of Eureka and 50 miles west of Ely. The project area consists of 10,373 acres on 550 contiguous, unpatented federal mining claims controlled by MIDWAY. The property is located in the rolling hills of the Pancake Range in the Basin and Range physiographic province. Terrain is gentle to moderate throughout most of the project area, with no major stream drainages. Elevation of the property ranges from 6,400 to 7,500 ft above mean sea level.

At present, no infrastructure or power is in place at the Pan site. A relatively low voltage distribution line crosses the valley floor near a local ranch approximately 5 miles away. A higher voltage transmission line, 69 kV, with capacity suitable for mining and processing operations, is located approximately 14 miles from the project site and six miles north of US 50. Water to support exploration drilling is available from ranch wells approximately 3 miles to the west of the property. Logistical support is available in Eureka, Ely, and Elko, all of which currently support large open pit mining operations. Mining personnel and resources for operations at Pan are expected to be available from Eureka, White Pine, and Elko Counties.

Geology and Mineralization

The geology of the Pan property is dominated by Devonian to Permian carbonate and clastic sedimentary rocks cut by the Pan fault, a steeply west dipping fault that trends north-south. The Pan fault juxtaposes gently west dipping sedimentary units on the west side of the fault with steeply northeast dipping sedimentary units on the east side. Post-mineral Tertiary volcanic rocks nonconformably overlie the faulted Devonian-Permian sedimentary units.

Gold mineralization at Pan occurs in a Carlin-style, epithermal, disseminated, sediment-hosted system. The distribution of the mineralization is controlled by structure, particularly with regard to the development of breccias, and by sedimentary bedding and alteration along unit contacts. Gold deposits within the project area generally occur as elongate bodies associated with structures and dissolution/hydrothermal breccia bodies hosted by the Pilot Shale and, to a lesser extent, the Devils Gate Limestone. Gold deposits also occur in a more tabular fashion within altered and mineralized sedimentary horizons.

Concept and Status of Exploration

MIDWAY’s exploration program includes core and reverse circulation drilling, geologic mapping, geochemical sampling, and geophysical surveys at the Pan property. This comprehensive program has helped to define the geologic occurrence of gold mineralization and identify additional exploration targets on the Pan property. The level of exploration in individual target areas varies from rock and soil sampling with anomalous results to drill holes which reveal anomalous to ore-grade gold values, as determined during the February 2011 Preliminary Feasibility Study. Geochemical and geophysical targets merit additional work, primarily drilling, to test anomalous rock and soil

S-6

Table of Contents

geochemical results. Additional drilling is needed in portions of the deposit to expand and better understand existing drill intercepts.

Mineral Resource Estimate

Gustavson completed an updated mineral resource estimate for the Pan Project in November 2011. As part of that study, Gustavson created a model to estimate the mineral resources at Pan based on data provided by MIDWAY as of September 1, 2011. No new drilling occurred at North Pan and the February 2011 resource model was not modified during the current study. Gold mineralization in Central and South Pan was re-evaluated during the course of this resource update. Drill hole data including collar coordinates, MIDWAY surveys, sample assay intervals, and geologic logs were provided in a secure Microsoft Access database. Surficial geology maps and cross-sections detailing alteration and lithology were also provided in electronic format. The database has been updated to include the additional 33 reverse circulation drill holes completed by MIDWAY in 2011

Gustavson modeled and estimated the mineral resource by constructing geologic, alteration, and mineral domains from the MIDWAY cross sections, and by geostatistically analyzing the drill data to define the parameters required to estimate gold grades in the 3-Dimensional (3D) block model. Leapfrog 3D® geological modeling software was used to create 3D stratigraphic, alteration, and mineral domain solids. MicroModel® software was used to estimate gold grades. MIDWAY defined the structure, stratigraphy, and alteration of the North, Central, and South Pan zones on 1 inch = 50 ft cross-sections spaced 200 feet apart and oriented east to west. Gustavson combined the MIDWAY subsurface interpretations with surface geology to create 3D stratigraphic and alteration models.

A block model was created for the Pan Deposit using blocks that are 20 feet wide, 20 feet long, and 20 feet high. Each of the blocks was assigned attributes of gold grade, mineral resource classification, rock density, tonnage factor, lithology, alteration, and a grade classification. The blocks were then assigned to a domain as appropriate to assist in estimation.

North Pan

All of the domains were estimated in 3 passes and each block was assigned a classification of measured, indicated, or inferred. The resource classification of each block was based on a factor of the average sample distance in an anisotropic direction as established by the second structure range from the variogram model for the domain being estimated. The measured class utilized a 1/2 ellipsoid variogram search distance. Indicated was set at a full variogram search distance and inferred was set at 2 times the variogram distance. As an additional requirement, Gustavson limited the measured and indicated estimation data to include only the fire assay intervals. Inferred resource was estimated using all available assay data. Ordinary Kriging was used to estimate grade for all domains.

Central and South Pan

All of the domains were estimated by using large search ellipses oriented in the direction of maximum continuity to provide an estimation of the gold grade within every block inside of the grade shells. The resource classification of each block was based on a factor of the closest sample distance in an anisotropic direction as established by the second structure range from the variogram model for the domain being estimated. The measured class utilized a 1/2 ellipsoid variogram search distance. Indicated resource was set at a full variogram search distance and inferred resource was set at 2 times the variogram distance. Each domain was estimated using a minimum of 5 composites with no more than 4 composites from a single drill hole. A maximum of 12 composites was allowed to better represent the local variability. Ordinary Kriging was used to estimate grade for all domains.

The mineral resource estimate is summarized in Tables 1-1 through 1-4 below. This mineral resource estimate includes all drill data obtained as of September 1, 2011, and has been independently verified by Gustavson.

S-7

Table of Contents

Table 1-1 North Pan Mineral Resource

Opt | Tons | Au Opt | oz | |||

| North Pan Measured Resource | ||||||

0.008 | 13,994,415 | 0.0168 | 234,844 | |||

0.006 | 15,592,007 | 0.0158 | 245,850 | |||

0.004 | 18,597,319 | 0.0140 | 260,404 | |||

| North Pan Indicated Resource | ||||||

0.008 | 10,565,126 | 0.0146 | 154,540 | |||

0.006 | 12,702,959 | 0.0133 | 169,135 | |||

0.004 | 17,006,845 | 0.0112 | 189,823 | |||

| North Pan Measured plus Indicated Resource | ||||||

0.008 | 24,559,541 | 0.0159 | 389,384 | |||

0.006 | 28,294,966 | 0.0147 | 414,985 | |||

0.004 | 35,604,164 | 0.0126 | 450,228 | |||

| North Pan Inferred Resource | ||||||

0.008 | 122,858 | 0.0112 | 1,376 | |||

0.006 | 233,476 | 0.0091 | 2,129 | |||

0.004 | 511,402 | 0.0067 | 3,427 | |||

Table 1-2 Central Pan Mineral Resource

Opt | Tons | Au Opt | OZ | |||

Central Pan Measured Resource | ||||||

0.008 | 2,329,227 | 0.0146 | 33,991 | |||

0.006 | 2,837,448 | 0.0132 | 37,482 | |||

0.004 | 3,802,537 | 0.0111 | 42,192 | |||

| Central Pan Indicated Resource | ||||||

0.008 | 1,895,266 | 0.0122 | 23,216 | |||

0.006 | 2,524,520 | 0.0109 | 27,623 | |||

0.004 | 4,053,056 | 0.0086 | 34,885 | |||

| Central Pan Measured plus Indicated Resource | ||||||

0.008 | 4,224,493 | 0.0135 | 57,207 | |||

0.006 | 5,361,968 | 0.0121 | 65,105 | |||

0.004 | 7,855,593 | 0.0098 | 77,077 | |||

| Central Pan Inferred Resource | ||||||

0.008 | 240,912 | 0.0103 | 2,470 | |||

0.006 | 290,465 | 0.0096 | 2,802 | |||

0.004 | 722,079 | 0.0066 | 4,741 | |||

S-8

Table of Contents

Table 1-3 South Pan Mineral Resource

Opt | Tons | Au Opt | oz | |||

| South Pan Measured Resource | ||||||

0.008 | 13,826,998 | 0.0182 | 251,350 | |||

0.006 | 15,584,480 | 0.0169 | 263,423 | |||

0.004 | 18,297,337 | 0.0151 | 276,641 | |||

| South Pan Indicated Resource | ||||||

0.008 | 17,440,794 | 0.0158 | 275,596 | |||

0.006 | 20,764,856 | 0.0144 | 298,599 | |||

0.004 | 26,469,130 | 0.0123 | 325,863 | |||

| South Pan Measured plus Indicated Resource | ||||||

0.008 | 31,267,792 | 0.0169 | 526,946 | |||

0.006 | 36,349,336 | 0.0155 | 562,022 | |||

0.004 | 44,766,467 | 0.0135 | 602,504 | |||

| South Pan Inferred Resource | ||||||

0.008 | 1,588,716 | 0.0184 | 29,274 | |||

0.006 | 1,933,540 | 0.0164 | 31,651 | |||

0.004 | 3,096,599 | 0.0120 | 37,093 | |||

Table 1-4 Total Pan Mineral Resource

Opt | Tons | Au Opt | oz | |||

| Pan Total Measured Resource | ||||||

0.008 | 30,150,640 | 0.0173 | 520,186 | |||

0.006 | 34,013,935 | 0.0161 | 546,756 | |||

0.004 | 40,697,193 | 0.0142 | 579,238 | |||

| Pan Total Indicated Resource | ||||||

0.008 | 29,901,186 | 0.0152 | 453,351 | |||

0.006 | 35,992,335 | 0.0138 | 495,357 | |||

0.004 | 47,529,031 | 0.0116 | 550,571 | |||

| Pan Total Measured plus Indicated Resource | ||||||

0.008 | 60,051,826 | 0.0162 | 973,537 | |||

0.006 | 70,006,270 | 0.0149 | 1,042,112 | |||

0.004 | 88,226,224 | 0.0128 | 1,129,809 | |||

| Pan Total Inferred Resource | ||||||

0.008 | 1,952,486 | 0.0170 | 33,120 | |||

0.006 | 2,457,481 | 0.0149 | 36,581 | |||

0.004 | 4,330,080 | 0.0105 | 45,261 | |||

S-9

Table of Contents

Mineral Reserve Estimate

The February 2011 Prefeasibility Study demonstrated that the Pan Project is economically viable, and this Feasibility Study has strengthened that conclusion. Based on the results of the Feasibility Study, Measured and Indicated Mineral Reserves within the designed pits are considered Proven and Probable Reserves as defined by the Canadian Institute of Mining, Metallurgy, and Petroleum. The final reserves are reported using a 0.008 Au opt cutoff for the North and Central pits, and a 0.006 Au opt cutoff for the South pit. Cutoffs were chosen to maximize the NPV of the project and do not necessarily represent the minimum economic cutoff. Pit designs are based on geologic criteria provided in the April 2011 Pit Slope Evaluation report produced by Golder Associates. Geologic solids created for each lithological unit were used as a guide during the pit design process. The limestone units were designed with a 50° inter-ramp wall angle assuming pre-split blasting in these units; all other lithological units were designed with a 45° inter-ramp wall angle.

Whittle Optimization

Gustavson generated a series of optimization shells on the South and North resource blocks, ranging from $236/oz to $2,360/oz. Forty six shells were generated separately for the North and South resource areas. Heap leach recoveries of 65% and 85%, for North and South Pan, respectively, were used in the optimization runs. The general parameters were based on preliminary estimates of operating cost, and incorporated recommendations from the April 2011 Pit Slope Evaluation report. Mining costs were estimated to be $1.09/ton of material moved for the pit optimization. Crushing, agglomeration, leaching, general and administration, and gold recovery costs were estimated at $3.71/ton of ore. Only Measured and Indicated Resources were considered in the evaluation; Inferred resources were treated as waste.

Calculation Parameters

The series of pit optimizations were graphed and evaluated to compare cash flows, net present values (NPV’s) and internal rates of return (IRR’s). The final South pit and the North pit optimizations are based on shells at a cost less than the three year trailing average price of $1,200/oz in order to achieve a higher NPV and overall lower cash cost per ounce. The option of mining the entire South Pan pit before the North Pan pit was evaluated during the scheduling process. Although the South Pan pit has a 20% higher recovery factor, mining the South Pan in phases results in a higher IRR by delaying the high strip of the Phase 2 South Pit until the end of the mine life. The option of mining the North pit first was also evaluated, but the higher recovery from the South Pan pit (85%, compared to 65% from North Pan) and shorter estimated leach times render the South pit the more favorable option to mine first.

Cutoff Grade Equations

The mineral reserve estimate for the Pan Project is based on designed open pits with maximized revenues at a gold price of $1,180 per ounce. Cutoff grades of 0.006 Au opt (0.21 gpt) in the South pit and 0.008 Au opt (0.27 gpt) in the North & Central pits provide the highest NPV for the project.

Mineral Reserve Estimate

Using the NI 43-101 Updated Mineral Resource Estimate filed in November 2011, Proven and Probable Reserves of 53,254,000 tons at a grade of 0.016 opt are contained in the mineral resource at Pan. A total of 864,000 oz of gold are contained in the Pan Project mineral reserves.

S-10

Table of Contents

Estimated mineral reserves for the Pan Project are presented in Table 1-5.

Table 1-5 Pan Project Mineral Reserves Estimate

North and Central Pan | Tons | Gold | ||||||||||

Cutoff Grade: 0.008 opt/0.274 g/tonnes | (x 1000) | opt | ounces (x 1000) | |||||||||

North Pan | ||||||||||||

Proven Reserves | 12,625 | 0.018 | 223.30 | |||||||||

Probable Reserves | 10,993 | 0.015 | 162.66 | |||||||||

Proven & Probable Reserves | 23,618 | 0.016 | 385.95 | |||||||||

Inferred within Designed Pit | 351 | 0.012 | 4.29 | |||||||||

Waste within Designed Pit | 27,823 | |||||||||||

Total tons within Designed Pit | 51,791 | |||||||||||

Central Pan | ||||||||||||

Proven Reserves | 1,799 | 0.015 | 27.78 | |||||||||

Probable Reserves | 1,125 | 0.013 | 15.00 | |||||||||

Proven & Probable Reserves | 2,924 | 0.015 | 42.78 | |||||||||

Inferred within Designed Pit | 75 | 0.010 | 0.77 | |||||||||

Waste within Designed Pit | 5,387 | |||||||||||

Total tons within Designed Pit | 8,386 | |||||||||||

Sub Total – North + Central | ||||||||||||

Proven Reserves | 14,423 | 0.017 | 251.08 | |||||||||

Probable Reserves | 12,119 | 0.015 | 177.66 | |||||||||

Proven & Probable Reserves | 26,542 | 0.016 | 428.74 | |||||||||

inferred within Designed Pit | 426 | 0.012 | 5.06 | |||||||||

Waste within Designed Pit | 33,210 | |||||||||||

Total tons within Designed Pit | 60,177 | |||||||||||

S-11

Table of Contents

Table 1-5 cont.

South Pan - Phases 1 and 2 | Tons | Gold | ||||||||||

Cutoff Grade: 0.006 opt/ 0.206 g/tonnes | (x 1000) | opt | ounces. (X1000) | |||||||||

South Pan – Phase 1 | ||||||||||||

Proven Reserves | 11,856 | 0.018 | 215.44 | |||||||||

Probable Reserves | 7,593 | 0.016 | 119.26 | |||||||||

Proven & Probable Reserves | 19,449 | 0.017 | 334.70 | |||||||||

Inferred within Designed Pit | 56 | 0.010 | 0.55 | |||||||||

Waste within Designed Pit | 31,887 | |||||||||||

Total tons within Designed Pit | 51,392 | |||||||||||

South Pan – Phase 2 | ||||||||||||

Proven Reserves | 1,548 | 0.014 | 21.01 | |||||||||

Probable Reserves | 5,716 | 0.014 | 79.80 | |||||||||

Proven & Probable Reserves | 7,263 | 0.014 | 100.81 | |||||||||

Inferred within Designed Pit | 212 | 0.016 | 3.39 | |||||||||

Waste within Designed Pit | 29,485 | |||||||||||

Total tons within Designed Pit | 36,961 | |||||||||||

Sub Total – Phase 1 + 2 | ||||||||||||

Proven Reserves | 13,404 | 0.018 | 236.46 | |||||||||

Probable Reserves | 13,308 | 0.015 | 199.05 | |||||||||

Proven &Probable Reserves | 26,713 | 0.016 | 435.51 | |||||||||

Inferred within Designed Pit | 269 | 0.015 | 3.94 | |||||||||

Waste within Designed Pit | 61,372 | |||||||||||

Total tons within Designed Pit | 88,353 | |||||||||||

Total Reserves | Tons | Gold | ||||||||||

| (x 1000) | apt | ounces (X1000) | ||||||||||

Proven Reserves | 27,827 | 0.018 | 487.51 | |||||||||

Probable Reserves | 25,427 | 0.015 | 376.71 | |||||||||

Proven &Probable Reserves | 53,254 | 0.016 | 864.22 | |||||||||

Inferred within Designed Pit | 695 | 0.013 | 9.0 | |||||||||

Waste within Designed Pit | 94,582 | |||||||||||

Total tons within Designed Pit | 148,531 | |||||||||||

S-12

Table of Contents

Conclusions and Recommendations

As a result of the work done as part of and resulting from the Feasibility Study, Gustavson concludes:

| • | The Pan deposit now contains over 1.1 million ounces of gold in Measured and Indicated Mineral Resource categories using a 0.004 opt cutoff. |

| • | There continues to be good potential for the discovery of additional Mineral Resources at Pan. |

| • | There is a proven and probable Mineral Reserve of 53,254,000 tons, containing 864,000 ounces of gold. |

| • | The Pan project is an economic mining project generating approximately $122 million net present value, and an internal rate of return of 32.4% at a gold price of $1,200. |

Based on the results of this Feasibility Study, Gustavson recommends:

| • | Continuation of drilling to fill-in areas that are promising development areas, specifically between the North and South pits. MIDWAY is planning on $1.5 million in drilling for the next two years. |

| • | Finalization of engineering for infrastructure, buildings, mining, and site facilities. This is currently estimated at $0.86 million (included in capital costs in the Feasibility Study) |

| • | Support for the EIS and permitting, estimated to be $0.4 million over the next 2 years. |

| • | Construction of the access road which is estimated at $1.7 million. |

| • | Drilling and testing of a water well, estimated at $0.1 million. |

| • | Purchase of long-lead equipment estimated at approximately $2.0 million.” |

Gold Rock Project

The summary below is a direct extract of the executive summary on pages 1-6 from our technical report entitled “NI 43-101 Technical Report on Resources Gold Rock Project, White Pine County, Nevada” dated effective February 29, 2012, (the “Gold Rock Technical Report”) authored by William J. Crowl, R.G., MMSA, Donald E. Hulse, P.E., SME and Donald J. Baker, PhD, MMSA, each of whom is a “qualified person” and “independent” as such terms are defined in NI 43-101. The summary below is subject to all of the assumptions, qualifications, and procedures set out in the Gold Rock Technical Report and is qualified in its entirety by reference to the full text of the Gold Rock Technical Report. For full technical details, reference should be made to the complete text of the Gold Rock Technical Report which is incorporated by reference herein and which has been filed with the applicable regulatory authorities and is available under the Company’s profile on SEDAR at www.sedar.com and was furnished to the SEC in a current report on Form 8-K, dated April 10, 2012, available at www.sec.gov.

“Midway Gold Corp., through its wholly owned subsidiary, Midway Gold US Inc. (collectively MGUS) retained Gustavson Associates, LLC (Gustavson) to prepare a Mineral Resource estimate for the Gold Rock Project in White Pine County, Nevada in compliance with Canadian National Instrument 43-101 (NI 43-101) Standards of Disclosure for Mineral Projects and Canadian Institute of Mining, Metallurgy and Petroleum ‘Best Practices and Reporting Guidelines’.

Property Description, Location and History

Midway Gold US Inc. (MGUS), a wholly-owned subsidiary of the Midway Gold Corp., has conducted exploration drilling, sampling, mapping, and geophysics since acquiring the project in 2007.

The Gold Rock gold deposit (formerly known as Easy Junior) is a bulk tonnage epithermal gold deposit found in Devonian-Mississippian limestone, shale, and sandstone. These rock types are exposed in a series of north-trending ridges that represent stacked, easterly-directed thrust sheets and low amplitude, open to tight folds.

S-13

Table of Contents

The Gold Rock property encompasses approximately 19 square miles (4,910 hectares) of the Battle Mountain-Eureka gold trend on the eastern side of the Pancake Range in east-central Nevada. The Gold Rock Project site is located approximately 30 miles southeast of the town of Eureka in White Pine County. Access to the Gold Rock Project site is provided by Green Springs road, an unpaved county road that intersects US Highway 50 approximately 30 miles southeast of Eureka, Nevada. It is approximately 16.5 miles, via road, from US 50 to the Gold Rock property.

The Gold Rock property has a long history of exploration and development, initiated in 1979 under Earth Resources, Inc. Earth Resources, Inc. was acquired by Houston Oil & Gas, which was in turn acquired by Tenneco in 1986. Echo Bay Mines acquired Tenneco in 1986 and thereafter discovered the Easy Junior gold deposit the same year. Alta Gold and Echo Bay formed the Alta Bay joint venture in 1988, with Alta Gold the operator. Open pit mining at Easy Junior was initiated in 1989, with production suspended in 1990 due to low gold prices. Alta Gold acquired the Echo Bay interest in the project in 1992 and initiated re-engineering of the project. Mining under Alta Gold re-started in June 1993 and was concluded in August 1994. Heap leach production continued into 1996. Alta Gold filed for bankruptcy in 1998. MGUS, through its acquisition of Pan-Nevada in 2007, and through additional property leases and claim staking, acquired control of the project in 2007.

Geology and Mineralization

The Gold Rock property is located on the east flank of the northern portion of the Pancake Range in east-central Nevada. This lobe of the Pancake Range is underlain by Devonian and Carboniferous carbonate and clastic sedimentary rocks which form the core of the range, and are exposed in bedrock outcrop in the area of the Gold Rock Project site. Although intrusive rocks are present regionally, no intrusive rocks have been mapped on the Gold Rock property. Devonian – Mississippian sedimentary bedrock geology in the vicinity of the Gold Rock Project area is locally nonconformably capped by post-mineral Tertiary volcanic rocks.

The Devonian through Mississippian limestone, shale, and sandstone units are exposed in a series of north-trending ridges that represent stacked, easterly-directed thrust sheets and low amplitude, open to tight folds. Gold mineralization is interpreted to postdate thrusting and folding. Bedrock geology is partially obscured by alluvial and colluvial gravels. Gold mineralization is preferentially hosted in the Mississippian upper Joana Limestone and lower Chainman Shale, especially in areas of tight anticlinal folding (Easy Junior Mine). Jasperoid with anomalous trace elements and locally anomalous gold occur throughout the Gold Rock Property at approximately this same stratigraphic level.

On the Gold Rock property, the primary gold feeder structure is presumed to be a steeply-dipping reverse fault reactivated with extensional dip-slip. This fault is present along the axial surface of the anticline that extends from Meridian Flats through the Easy Junior pit. Mineralization is focused where the steep feeder structure intercepts the Joana Limestone in the core of this anticline, and appears restricted to the Joana Limestone and the base of the overlying Chainman shale.

The Easy Junior deposit on the Gold Rock property is a Carlin-style, sediment-hosted, disseminated gold deposit hosted within the previously discussed Mississippian sedimentary units. Gold particles occur as micron size to sub-micron size disseminations. Free, coarse gold is not common in these types of deposits, and has not been observed at Gold Rock. Source and age of mineralization are uncertain at this time.

Alteration at Gold Rock is typical of Carlin systems in Nevada. Alteration styles include silicification, argillization, decalcification, and oxidation. Silicification occurs as zones of moderate to strong silica flooding along bedding and structures. Strong or complete replacement is commonly referred to as jasperoid by field workers. Silica alteration is found primarily in the Joana Limestone, with only minor small zones identified in shale units. Within the Gold Rock deposit, jasperoid within the Joana Limestone carries significant amounts of gold. In surface outcrops, Joana-hosted jasperoid occurs along strike both north and south of the deposit and is often found in association with anomalous gold values.

Clay alteration is generally associated with hydrothermal alteration of minerals. Clay along faults and bedding is common. Within limestones and calcareous shales, argillization is often accompanied by decalcification of the host rock. Black carbonaceous accumulations occur locally along the margins of gold mineralization zones. Oxidation is prevalent throughout the deposit, resulting in the formation of iron oxides (hematite and limonite).

S-14

Table of Contents

The mineralization along the anticline that hosts the mineralization at Gold Rock extends along strike to the south of the open pit of the Easy Junior Mine over 6,000 feet through the Meridian Flats prospect area. To the north of the Easy Junior open pit, the mineralization along the apex of the anticline was followed over 1,000 feet, but post-mineral faulting drops the Joana Limestone below the extent of the drilling, and therefore remains untested.

Status of Exploration

MGUS has secured and compiled historic project drilling results for 673 drill holes – primarily shallow, vertical reverse circulation holes, as well as 1,790 blast holes within the Easy Junior open pit. Historic soil grid and rock chip results are also compiled.

Since acquiring the Gold Rock Project in 2007, MGUS has completed additional geochemistry on 750 additional soil samples collected which add to the scope and magnitude of the regional sampling grid, and has collected and analyzed an additional 141 rock chip samples. Ground magnetic and gravity surveys have also been conducted over portions of the Property. In 2008, MGUS completed 11 reverse circulation holes in the Anchor Roc prospect at the southeast end of the property. Historic drilling in this area by Nevada Resources yielded a reported intercept of 120 feet of 0.014 opt gold. The best intercept encountered by MGUS was 85 feet at 0.014 opt gold. Results of this exploration by MGUS have not been reviewed and documented in detail by Gustavson, since this report is dedicated toward reviewing the historic data developed at and in the vicinity of the Easy Junior open pit for purposes of evaluating mineral resources. In 2011, MGUS completed a 31 drill hole program in the vicinity of the Easy Junior open pit and Meridian Flats areas, consisting of 25 reverse circulation holes (21,000 feet) and 6 diamond drill core holes (5,260 feet). This program was designed to confirm the geology and mineralization defined by historic drilling as well as to expand mineralization in areas with known historic intercepts.

Mineral Resource Estimate

A review of the assay and geologic drill hole data and MGUS database was conducted during the process of preparing this report. The review shows that the data is traceable to the original assay certificates of Echo Bay, Tenneco, Santa Fe Minerals, Inc. and Houston Oil and Gas. Assay certificates issued to Alta Gold, the operator of the Easy Junior mine and the Alta Bay joint venture with Echo Bay, were generated by the various mine laboratories that they operated (Illipah, Easy Junior, Ward and Robinson labs).

The Gold Rock mineral resource estimate is summarized below in Table 1-1. The resource estimate includes all drill data obtained and verified as of February, 2012. The summary below presents the Gold Rock resource at FOUR different cutoff grades.

Table 1-1 The Gold Rock Mineral Resource

Cutoff (opt) | Inferred Resource | Inferred Resource | ||||||||||

| Tons | Grade (opt) | Gold Ounces | Tons | Grade (opt) | Grade Ounces | |||||||

0.015 | 8,620,000 | �� | 0.029 | 247,000 | 8,670,000 | 0.024 | 210,000 | |||||

0.012 | 10,574,000 | 0.026 | 273,000 | 11,967,000 | 0.021 | 255,000 | ||||||

0.008 | 14,294,000 | 0.022 | 310,000 | 19,724,000 | 0.017 | 331,000 | ||||||

0.004 | 19,852,000 | 0.017 | 343,000 | 33,576,000 | 0.012 | 409,000 | ||||||

Conclusions and Recommendations

The Gold Rock deposit, formally known as Easy Junior, contains a substantial gold resource that warrants additional exploration and evaluation. The mineralization system is strong, with a known strike length of over 8,000 feet. The lithology, alteration, and mineralization of the Gold Rock deposit are similar to other sediment-hosted Carlin-type systems such as Alligator Ridge, Bald Mountain, Rain, and MGUS’ Pan Project. A portion of the Gold Rock deposit has been explored and mined, but drilling outside that area is very widely spaced, shallow and locally intercepts anomalous gold mineralization. Historic exploration has not cut off mineralization in any direction.

Gustavson has reviewed the historic information on the project and has verified drill hole locations, down-hole geology as compiled in geologic logs, and gold assays based on original assay certificates. Cross validation of the historic drill assay results was accomplished using a partially documented historic check assay program, twin drill holes and comparison with the geologic and assay results of recent drilling by MGUS in 2011. Certain assay types, specifically

S-15

Table of Contents

neutron activation analyses, were not considered comparable to the historic fire assays and have been excluded from the database for purposes of generation of the resource estimate contained in this report. Fire assay results from the Ward laboratory were determined as biased toward higher gold values and were also excluded from the database for the purposes of this report. CN AA analysis results were included in the database for assay intervals not also assayed by fire assay at the Robinson laboratory. The CN AA results, on average, understate gold values as compared with fire assay results, but are believed to represent a conservative component to the estimate of gold grade. It is the opinion of Gustavson that the historic and MGUS assay data used in the database are of sufficient high quality to support the generation of indicated and inferred mineral resource estimates reported herein.

Gustavson recommends the following:

| • | That MGUS continue a program of validation and verification of the historic drill hole assay database through an ongoing twin hole program primarily targeting historic drill holes assayed by the Robinson and Ward laboratories. This will enable MGUS to assess potential zones of additional gold mineralization that were previously only analyzed by CN AA. |

| • | A detailed 3-dimensional alteration model should be created to aide in the delineation of the mineralization in shale units in contact with the fault zone and/or Joana Limestone. |

| • | Continued drilling is recommended on an in-fill basis and to expand knowledge of potential mineralization beyond the limits of current drill patterns to potentially enable conversion of inferred resources to higher confidence categories, and to build the global inventory of gold resources. |

| • | A sufficient amount of specific gravity measurements should be collected on the individual lithologies and alteration types identified on the property. |

| • | A metallurgical program should be designed and implemented, targeting the well-known lithologic and alteration types, to characterize the potential range in ore types and to assess process type and metallurgical recoveries. |

| • | Baseline environmental studies should be initiated on a timeline compatible with MGUS corporate objectives and planning. |

| • | There is a significant amount of information in the files including historical metallurgy, geotechnical data, hydrology, and other environmental information. This data should be reviewed as a tool for planning the future needs of a new mining program. |

| • | The surface geology and alteration mapping should be completed and all the historical and modern data compiled as a tool for locating additional drill targets on the property. |

Gustavson considers the estimated budget of $3,200,000 to be sufficient for the designed program of continued historic data verification and in-fill, resource conversion to higher confidence levels, and initial metallurgical and environmental work to position the project for advancement to the pre-feasibility/feasibility level. Drilling is recommended to focus on a continued twin hole program with historic holes assayed by CN AA methods, in-fill drilling to move resources to a higher confidence level, and step-out drilling to potentially expand resources. The program should target the Resource Area outlined in this report; specifically the north and south extensions of the anticlinal trend from the Easy Junior open pit, the Meridian Flats area, and the down-dip projections of the limbs of the anticline and adjacent parallel structures. Holes should also be drilled to obtain samples for metallurgical testing to establish the potential process type and metallurgical recoveries of gold.”

Further Information

Prospective purchasers of Units should read the description of our business under the section entitled “Summary – The Company” in the accompanying base prospectus and under the sections entitled “Item 1. Description of Business” and “Item 2. Description of Properties” in our annual report on Form 10-K for the year ended December 31, 2011, incorporated herein by reference, see “Documents Incorporated by Reference” below.

S-16

Table of Contents

The Offering

The following is a brief summary of certain terms of this offering and is not intended to be complete. It does not contain all of the information that will be important to a holder of the Units. For a more complete description of our common shares, see the section entitled “Description of the Securities Distributed” in this Prospectus Supplement.

Offering: | Units Each Unit consists of one Offered Share and one-half of one Warrant. Each whole Warrant will entitle the holder to purchase a Warrant Share at a price of $ per Warrant Share at any time following the closing of the offering until 5:00 p.m. (Vancouver time) on the date that is 18 months after the Closing Date; provided that in the event our common shares trade at a closing price on the NYSE MKT of greater than $ per common share for a period of 20 consecutive trading days at any time following the Closing Date, we may accelerate the expiry date of the Warrants by providing notice to the holders thereof that the Warrants shall expire on the 30th day following the date on which such notice is given by us. The Warrants shall be issued pursuant to a warrant indenture to be entered into between us and Computershare Trust Company of Canada, as warrant agent. | |

Amount: | $ | |

Price to the Public: | $ per Unit | |

Common Shares Outstanding(1): | Prior to the offering: common shares | |

| After the offering: common shares(2) | ||

Underwriters’ Compensation: | We have agreed to pay to the Underwriters a fee of $ , representing 6% of the aggregate gross proceeds of the offering, or $ per Unit sold, other than in respect of Units sold to any president’s list purchasers on which only a fee of 3% of the proceeds in respect of such sales or $ shall be paid.

The Underwriters may appoint selling agents in the United States, which may be paid selling commissions not to exceed % of the gross proceeds of the offering in the United States. The commission paid to the US selling agents will be paid by the Underwriters from their commissions. | |

Use of Proceeds: | The net proceeds of the offering will be used to advance our projects, to fund our general and administrative costs (including property maintenance fees) and for general working capital purposes. See the section entitled “Use of Proceeds.” | |

Risk Factors: | Investing in the Units involves risks that are described in the “Risk Factors” section beginning on page S-19 of this prospectus supplement and on page 6 of the accompanying base prospectus and, to the extent applicable, the “Risk Factors” sections of our annual reports on Form 10-K and our quarterly reports on Form 10-Q as filed with the SEC and Canadian securities authorities. | |

Tax Considerations: | Purchasing the Units may have tax consequences in the United States and Canada. This prospectus supplement and the accompanying prospectus may not describe these consequences fully. Investors should read the tax discussions in this prospectus supplement and consult with their tax advisor. See the sections entitled “Certain Canadian Federal Income Tax Considerations” and “Material United States Federal Income Tax Considerations” in this prospectus supplement. | |

Stock Exchanges: | Our common shares are listed for trading on the TSX.V and NYSE MKT, in each case under the symbol “MDW”. There is currently no market through which the Warrants may be sold. We have applied for the listing of the | |

S-17

Table of Contents

Offered Shares and the Warrant Shares on the TSX.V and the NYSE MKT. Listing of the Offered Shares and Warrant Shares will be subject to us fulfilling all the listing requirements of the TSX.V and NYSE MKT, respectively.

We have not applied to list the Warrants. There is no market through which the Warrants may be sold and purchasers may not be able to resell the Warrants purchased under this prospectus supplement. |

Notes:

| (1) | These figures do not include: |

| • | 8,690,002 common shares reserved for issuance pursuant to outstanding stock options, at prices ranging from Cdn$0.56 to Cdn$3.36 |

To the extent any options are exercised, new options are issued under our equity incentive plans, or we otherwise issue additional common shares or securities exercisable for or convertible into common shares, there will be future dilution to new investors.

| (2) | Does not include up to Warrant Shares issuable upon exercise of Warrants issued pursuant to this offering. Assuming the exercise of all the Warrants, the aggregate common shares outstanding would be . |

S-18

Table of Contents

Investing in the Units involves a high degree of risk. Prospective investors should carefully consider the following risks, as well as the other information contained in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein before investing in the Units. If any of the following risks actually occurs, our business could be harmed. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those of which we are currently unaware or those that are deemed immaterial, may also adversely affect our business, financial condition, cash flows, prospects and the price of our common shares.

The following is a short description of the risks and uncertainties which are more fully described under the section entitled “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2011, as filed with the SEC on March 9, 2012 and incorporated by reference in this prospectus supplement (see the section entitled “Documents Incorporated by Reference” in this prospectus supplement):

| • | Since we have no operating history, investors have no basis to evaluate our ability to operate profitably; |

| • | We have a history of losses and will require additional financing to fund exploration and, if warranted, development; |

| • | Increased costs could affect our financial condition; |

| • | A shortage of equipment and supplies could adversely affect our ability to operate our business; |

| • | Mining and resource exploration is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business and plans; |

| • | The figures for our resources are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated; |

| • | Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital; |

| • | There are differences in U.S. and Canadian practices for reporting reserves and resources; |

| • | Our exploration activities on our properties may not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration; |

| • | We may encounter archaeological issues and claims relating to our Tonopah and Pan properties, which may delay our ability to conduct further exploration or developmental activities or could affect our ability to place the property into commercial production, if warranted; |

| • | Our Tonopah property is in close proximity to a municipal water supply, which may delay our ability to conduct further exploration or developmental activities or could affect our ability to place the property into commercial production, if warranted; |

| • | Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition; |

| • | We do not maintain insurance with respect to certain high-risk activities, which exposes us to significant risk of loss; |

| • | We may not be able to obtain all required permits and licenses to place any of our properties into production; |

| • | We are subject to significant governmental regulations, which affect our operations and costs of conducting our business; |

| • | Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations; |

| • | Legislation has been proposed that would significantly affect the mining industry; |

| • | Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business; |

S-19

Table of Contents

| • | Our business is subject to evolving corporate governance and public disclosure regulations that have increased both our compliance costs and the risk of noncompliance, which could have an adverse effect on our stock price; |

| • | Land reclamation requirements for our properties may be burdensome and expensive; |

| • | Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete; |

| • | We will require significant additional capital to fund our business plan; |

| • | Joint ventures and other partnerships may expose us to risks; |

| • | Our directors and officers may have conflicts of interest as a result of their relationships with other companies; |

| • | We may experience difficulty attracting and retaining qualified management to meet the needs of our anticipated growth, and the failure to manage our growth effectively could have a material adverse effect on our business and financial condition; |

| • | Our results of operations could be affected by currency fluctuations; |

| • | Title to our properties may be subject to other claims, which could affect our property rights and claims; |

| • | Our properties and operations may be subject to litigation or other claims; |

| • | We do not currently intend to pay cash dividends; |

| • | The market for our common shares has been volatile in the past, and may be subject to fluctuations in the future; |

| • | We have never paid dividends on our common shares; |

| • | We are subject to the continued listing criteria of the NYSE MKT and the TSX.V and our failure to satisfy these criteria may result in delisting of our common shares; and |

| • | If we raise additional funding through equity financings, then our current shareholders will suffer dilution. |

Additional Risks Related to the Company and this Offering

We believe that we may be a “passive foreign investment company” for the current taxable year which would likely result in materially adverse United States federal income tax consequences for United States investors.