UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-21726

Pope Family of Funds

(Exact name of registrant as specified in charter)

| 5100 Poplar Avenue, Suite 805 Memphis, TX | | 38137 |

| (Address of principal executive offices) | | (Zip code) |

Matrix Capital Group, Inc.

630 Fitzwatertown Road

Building A, Second Floor

Willow Grove, PA 19090-1904

(Name and address of agent for service)

Registrant's telephone number, including area code: 877.244.6235

Date of fiscal year end: 04/30/2007

Date of reporting period: 04/30/2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO SHAREHOLDERS |

A copy of the annual report to shareholders for the period ended April 30, 2007 pursuant to rule 30e-1 under the Investment Company Act of 1940, as amended (17 CFR 270.30e-1) is filed herewith.

HALTER/POPE USX

CHINA FUND

ANNUAL REPORT

April 30, 2007

For additional information call Toll Free: | (877) -CHINA35 |

| | (877) - 244-6235 |

Pope Family of Funds | ANNUAL REPORT |

May 24, 2007

Dear Halter Pope USX China Fund Shareholders:

I am pleased to present the Annual Report for the Halter Pope USX China Fund (the “Fund”) for the year ended April 30, 2007. The Fund’s average annual total returns since inception were 26.32%* and 22.92% for Class A and Class C shares, respectively. Class A shares commenced operations on September 23, 2005 while Class C shares commenced operations on July 1, 2005. The average annual total returns for the S&P 500 Total Return Index** for those same periods were 15.34% and 14.62%, respectively. The Fund’s returns during the year were 22.09%* and 21.48% for Class A and Class C shares, respectively. The return for the S & P 500 Total Return Index during the year was 15.24%. During the past six months the Fund has experienced a positive gain and a rapid build up of assets reaching $33 million.

* The Class A returns shown above do not take into account any sales charges (“loads”). The Class A returns adjusted for sales loads were 22.74% and 16.60% for the since inception and one year returns, respectively.

China has been trying to slow their economy during the last six months by raising interest rates, capital reserves of banks and taxes on real estate gains, but so far without success as the 1st quarter GDP ending March 31, 2007 showed a gain of 11.3% versus a gain of 0.7% GDP in the USA. Furthermore, the U.S. Dollar has deteriorated and the Chinese Yuan has strengthened due to a larger than expected trade deficit between the two countries. We still believe that a dramatic consumer oriented portfolio of PRC companies will outperform the U.S. in both the short-term and long-term. Healthcare and infrastructure are Chinese Government priorities and we will invest accordingly.

The Fund’s top five holdings as of April 30, 2007 were as follows:

| 1. China Security and Surveillance Technology, Inc. | 8.40% | |

| 2. Fushi International, Inc. | 5.95% | |

| 3. Benda Pharmaceutical, Inc. | 5.54% | |

| 4. Qiao Xing Universal Telephone, Inc. | 5.26% | |

| 5. The9, Ltd. | 4.34% | |

As of April 30, 2007 the industry areas of the Fund’s portfolio reflected domestic companies with the following weightings:

| 1. Computer & Internet Related Services & Technology | 17.94% | |

| 2. Education, Healthcare, Biotechnology & Pharmaceuticals | 17.73% | |

| 3. Electronics & Electrical Equipment & Components | 16.99% | |

| 4. Telecommunications plus Wireless & Wireless Equipment | 15.99% | |

| 5. Energy & Natural Resources | 15.82% | |

| 6. Transportation | 2.75% | |

| 7. Chemicals | 2.59% | |

| 8. Machinery | 2.42% | |

| 9. Rubber & Plastic | 1.97% | |

| 10. Agriculture | 1.31% | |

| 11. Food & Beverage | 0.85% | |

| 12. Advertising & Media | 0.67% | |

The percentages in the above tables are based on net assets of the Fund as of April 30, 2007 and are subject to change.

Pope Family of Funds | ANNUAL REPORT |

We believe that there has developed a global fear around China, both politically and financially, that will accomplish little on trying to pressure the Chinese to allow a quick rise in the currency as a panacea to the Western World’s debt, lack of savings and slow GDP growth. Paramount to China is for its current government to stay in power by creating a more “harmonious society” and to create 300 million additional jobs. To do so will require GDP growth remaining at 8 to 10% growth per year for the next 15 years. Excess cash can still be invested back into U.S. Treasuries but at a lower rate, as China has begun to take a small percentage of their trade surplus and $1.2 trillion in currency reserves to be diversified into other assets other than U.S. dollars. We predict that the dollar will remain on a gradual but steady decline as to render the Yuan’s value at 7.4 to 1 by 12/31/07 and 6.7 to 1 by 12/31/08. We believe that interest rates in both countries will continue to rise and price earnings ratios will decline. Our portfolio on average has a sharp peak of 17x 2007 EPS estimates and 13x 2008 EPS estimates. Our Fund’s PEG ratio is less than 0.5x while the S&P 500 PEG ratio is approximately 1.5x. Very few of our companies have any debt and the free cash flow is good. Capacity additions are financed by equity and growth rates on EPS are high at 30 - 50% annually.

We will continue to focus on the large growing middle class of “Chuppies” (Chinese Young Urban Professionals) as a driving force for domestic consumption. We predict that the Chinese economy, now the 4th largest in the world, should overtake the German economy during the next twelve months and become #3. Our objective remains to provide greater returns than the S & P 500’s return. This is being met and we still believe that mainland China will grow faster than the U.S. and deserves a larger allocation of managed assets worldwide.

Thank you for your support and continuing faith in our ability to offer good results to all investors and shareholders.

Your Mainland Chinese Fund Manager,

Stephen L. Parr

Senior Portfolio Manager and President of the Halter Pope USX China Fund

This report is intended for the shareholders of the Halter Pope USX China Fund. It may not be distributed to prospective investors unless it is preceded or accompanied by the Fund’s current prospectus, a copy of which may be obtained at www.halterpopechinafund.com/index.html.

Investment in the Fund is subject to investment risks, including the possible loss of some or all of the principal amount invested. Please consider the Fund’s objective, risk, charges and expenses carefully before investing in the Fund. The prospectus contains information about those and other important matters relating to the Fund. Please read the prospectus carefully before you invest.

The performance information quoted in this annual report represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

The maximum sales charge for Class A shares is 4.50%. Class A shareholders pay a 0.50% contingent deferred sales charge (“CDSC”) if Class A purchases exceeding $3 million are redeemed within one year of purchase. Class C shareholders pay a 1.00% CDSC if shares are redeemed within one year of purchase.

Pope Family of Funds | ANNUAL REPORT |

The total annual fund operating expense ratios, gross of any fee waivers or expense reimbursements, as stated in the fee table of the current prospectus dated August 29, 2006 are 7.96% and 5.69% for Class A and Class C shares, respectively. The Adviser has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, extraordinary expenses and payments, if any, under the Rule 12b-1 Plan) for the fiscal year ending April 30, 2007 to 2.25% and 3.00% of average daily net assets of the Fund for Class A and Class C shares, respectively. Please see Information About Your Fund’s Expenses, the Financial Highlights and Notes to the Financial Statements (Note 4) sections of this Report for gross and net expense related disclosure for the year ended April 30, 2007.

** The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do no take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Halter Pope USX China Fund, which will not invest in certain securities comprising this index.

Pope Family of Funds | ANNUAL REPORT |

Information About Your Fund’s Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The table below illustrates an example investment of $1,000 at the beginning of the period (10/31/06) and held for the entire period of 10/31/06 through 04/30/07. Please note that this table is unaudited. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made on 10/31/06). You may use the information in this row, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

Expenses and Value of a $1,000 Investment for the six month period ended April 30, 2007 |

Actual Fund Return (in parentheses) | | Beginning Account Value 10/31/06 | | Ending Account Value 04/30/07 | | Expenses Paid During Period* | |

| Halter Pope USX China Fund Class A (25.43%) | | $ | 1,000.00 | | $ | 1,254.30 | | $ | 12.52 | |

| Halter Pope USX China Fund Class C (25.13%) | | | 1,000.00 | | | 1,251.30 | | | 16.69 | |

Hypothetical 5% Fund Return | | | Beginning Account Value 10/31/06 | | | Ending Account Value 04/30/07 | | | Expenses Paid During Period* | |

| Halter Pope USX China Fund Class A | | $ | 1,000.00 | | $ | 1,013.69 | | $ | 11.18 | |

| Halter Pope USX China Fund Class C | | | 1,000.00 | | | 1,009.97 | | | 14.90 | |

*Expenses are equal to the Fund’s expense ratios of 2.24% and 2.99 % for the Halter Pope USX China Fund Class A and Class C shares, respectively; multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

For more information on Fund expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 877-244-6235. Please read it carefully before you invest or send money.

Pope Family of Funds | ANNUAL REPORT |

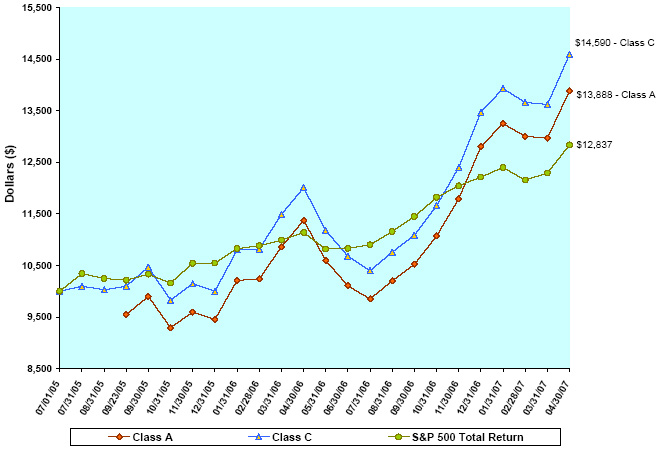

COMPARISON OF A $10,000 INVESTMENT IN THE HALTER POPE USX CHINA FUND AND THE S&P 500 TOTAL RETURN INDEX

Average Annual Total Return

| | | |

| | April 30, 2007 | Commencement of Operations through April 30, 2007 |

S&P 500 Total Return | 15.24% | 14.62% |

Class A(1) | With sales charge | 16.60% | 22.74% |

| Without sales charge | 22.09% | 26.32% |

Class C(2) | With contingent deferred sales charge | 21.48% | 22.92% |

| Without contingent deferred sales charge | 21.48% | 22.92% |

| (1) | Halter Pope USX China Fund Class A shares commenced operations on September 23, 2005. |

| (2) | Halter Pope USX China Fund Class C shares commenced operations on July 1, 2005. |

Past performance cannot guarantee future results. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Halter Pope USX China Fund versus the S&P 500 Total Return Index. The S&P 500 Total Return Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Halter Pope USX China Fund, which will not invest in certain securities comprising this index.

POPE FAMILY OF FUNDS |

HALTER POPE USX CHINA FUND |

SCHEDULE OF INVESTMENTS |

April 30, 2007 | ANNUAL REPORT |

COMMON STOCK - (93.72%) | | Shares | | Value | |

| | | | | | |

ADVERTISING (0.67%) | | | | | |

| Focus Media Holding, Ltd. - ADR * | | | 6,000 | | $ | 222,000 | |

| | | | | | | | |

AGRICULTURE (1.31%) | | | | | | | |

| Origin Agritech, Ltd. * | | | 50,000 | | | 432,500 | |

| | | | | | | | |

AUTO PARTS & EQUIPMENT (1.08%) | | | | | | | |

| Wonder Auto Technology, Inc. * | | | 50,000 | | | 355,000 | |

| | | | | | | | |

BIOTECHNOLOGY (3.09%) | | | | | | | |

| American Oriental Bioengineering, Inc. * | | | 40,000 | | | 398,000 | |

| China-Biotics, Inc. * | | | 68,700 | | | 621,735 | |

| | | | | | | 1,019,735 | |

| | | | | | | | |

CHEMICALS (2.59%) | | | | | | | |

| Sinopec Shanghai Petrochemical Co., Ltd. - ADR | | | 15,000 | | | 852,000 | |

| | | | | | | | |

COMPUTERS & COMPUTER SERVICES (3.72%) | | | | | | | |

| China Expert Technology, Inc. * | | | 75,500 | | | 554,925 | |

| Comtech Group, Inc. * | | | 10,000 | | | 176,400 | |

| PacificNet, Inc. * | | | 120,000 | | | 495,600 | |

| | | | | | | 1,226,925 | |

| | | | | | | | |

E-COMMERCE/SERVICES (1.08%) | | | | | | | |

| Ctrip.com International, Ltd. - ADR | | | 5,000 | | | 354,600 | |

| | | | | | | | |

ELECTRICAL COMPONENTS & EQUIPMENT (7.33%) | | | | | | | |

| China BAK Battery, Inc. * | | | 125,000 | | | 447,500 | |

China Ritar Power Corp. * F | | | 46,729 | | | 191,589 | |

| Fushi International, Inc. * | | | 136,813 | | | 1,436,537 | |

Fushi International, Inc. * F | | | 33,187 | | | 341,826 | |

| | | | | | | 2,417,452 | |

| | | | | | | | |

ELECTRONICS (8.43%) | | | | | | | |

| China Security & Surveillance Technology, Inc. * | | | 160,000 | | | 2,558,400 | |

| NAM TAI Electronics, Inc. | | | 17,000 | | | 220,320 | |

| | | | | | | 2,778,720 | |

| | | | | | | | |

ENERGY-ALTERNATE SOURCES (2.61%) | | | | | | | |

| JA Solar Holdings Co., Ltd. - ADR * | | | 13,000 | | | 317,070 | |

| Suntech Power Holdings Co., Ltd. - ADR * | | | 15,000 | | | 544,200 | |

| | | | | | | 861,270 | |

| | | | | | | | |

FOOD (0.85%) | | | | | | | |

| New Dragon Asia Corp. * | | | 200,000 | | | 274,000 | |

| Zhongpin, Inc. * | | | 1,000 | | | 7,340 | |

| | | | | | | 281,340 | |

| | | | | | | | |

HEALTHCARE - PRODUCTS (4.42%) | | | | | | | |

| China Medical Technologies, Inc. - ADR * | | | 45,000 | | | 1,087,200 | |

| Mindray Medical International, Ltd. - ADR | | | 16,000 | | | 368,160 | |

| | | | | | | 1,455,360 | |

| | | | | | | | |

INSURANCE (0.56%) | | | | | | | |

| China Life Insurance Co., Ltd. - ADR | | | 4,000 | | | 185,360 | |

POPE FAMILY OF FUNDS |

HALTER POPE USX CHINA FUND |

SCHEDULE OF INVESTMENTS |

April 30, 2007 | ANNUAL REPORT |

COMMON STOCK - (93.72%) (continued) | | Shares | | Value | |

| | | | | | |

INTERNET CONTENT ENTERTAINMENT (2.05%) | | | | | |

| Shanda Interactive Entertainment, Ltd. - ADR * | | | 15,000 | | $ | 375,600 | |

| Tom Online, Inc. - ADR * | | | 20,000 | | | 299,600 | |

| | | | | | | 675,200 | |

| | | | | | | | |

MACHINERY (2.40%) | | | | | | | |

| Wuhan General Group China, Inc. * | | | 3,600 | | | 12,600 | |

Wuhan General Group China, Inc. * F | | | 300,000 | | | 780,000 | |

| | | | | | | 792,600 | |

| | | | | | | | |

MINING (6.75%) | | | | | | | |

| Aluminum Corp. of China, Ltd. - ADR | | | 25,000 | | | 726,250 | |

| Puda Coal, Inc. * | | | 200,000 | | | 392,000 | |

| Yanzhou Coal Mining Co., Ltd. - ADR | | | 21,500 | | | 1,105,960 | |

| | | | | | | 2,224,210 | |

| | | | | | | | |

OIL & GAS (4.00%) | | | | | | | |

| China Petroleum & Chemical Corp. - ADR | | | 6,000 | | | 523,260 | |

| CNOOC, Ltd. - ADR | | | 8,000 | | | 684,560 | |

| PetroChina Co., Ltd. - ADR | | | 1,000 | | | 112,140 | |

| | | | | | | 1,319,960 | |

| | | | | | | | |

PHARMACEUTICALS (7.60%) | | | | | | | |

| Benda Pharmaceutical, Inc. * | | | 24,800 | | | 49,600 | |

Benda Pharmaceutical, Inc. * F | | | 757,218 | | | 1,097,966 | |

| China Pharma Holdings, Inc. * | | | 72,500 | | | 138,475 | |

China Pharma Holdings, Inc. * F | | | 400,000 | | | 688,000 | |

| Tongjitang Chinese Medicines Co. - ADR * | | | 50,000 | | | 532,500 | |

| | | | | | | 2,506,541 | |

| | | | | | | | |

RUBBER & PLASTIC PRODUCTS (1.97%) | | | | | | | |

| Fuwei Films Holdings Co., Ltd. * | | | 65,000 | | | 648,050 | |

| | | | | | | | |

SEMICONDUCTORS (2.74%) | | | | | | | |

| Actions Semiconductor Co., Ltd. - ADR * | | | 125,000 | | | 902,500 | |

| | | | | | | | |

SOFTWARE (4.34%) | | | | | | | |

| The9, Ltd. - ADR * | | | 35,000 | | | 1,431,850 | |

| | | | | | | | |

TELECOMMUNICATIONS (15.99%) | | | | | | | |

| China Mobile, Ltd. - ADR | | | 25,000 | | | 1,125,250 | |

| China Netcom Group Corp. Hong Kong, Ltd. - ADR | | | 14,000 | | | 686,840 | |

| China Techfaith Wireless Communication Technology, Ltd. - ADR * | | | 65,000 | | | 526,500 | |

| Hurray! Holding Co., Ltd. - ADR * | | | 100,000 | | | 512,000 | |

| KongZhong Corp. - ADR * | | | 50,000 | | | 333,500 | |

| Linktone, Ltd. - ADR * | | | 100,000 | | | 354,000 | |

| Qiao Xing Universal Telephone, Inc. * | | | 105,000 | | | 1,732,500 | |

| | | | | | | 5,270,590 | |

| | | | | | | | |

TRANSPORTATION (1.67%) | | | | | | | |

| Guangshen Railway Co., Ltd. - ADR * | | | 15,000 | | | 548,850 | |

| | | | | | | | |

UTILITIES (2.46%) | | | | | | | |

| Huaneng Power International, Inc. - ADR | | | 20,000 | | | 811,800 | |

| | | | | | | | |

WEB PORTALS/ISP (4.01%) | | | | | | | |

| Netease.com, Inc. - ADR * | | | 10,000 | | | 180,800 | |

| Sohu.com, Inc. * | | | 45,000 | | | 1,139,400 | |

| | | | | | | 1,320,200 | |

TOTAL COMMON STOCK (Cost $24,704,810) | | | | | | 30,894,613 | |

POPE FAMILY OF FUNDS |

HALTER POPE USX CHINA FUND |

SCHEDULE OF INVESTMENTS |

April 30, 2007 | ANNUAL REPORT |

| | | | | Shares | | Value | |

WARRANTS - (3.31%) | | Expiration Date- Exercise Price | | | | | |

Benda Pharmaceutical, Inc. * F | | | 11/15/11 - 0.555 | | | 757,218 | | $ | 677,710 | |

China Pharma Holdings, Inc. * F | | | 02/01/10 - 2.38 | | | 400,000 | | | - | |

China Ritar Power Corp. * F | | | 02/21/10 - 2.78 | | | 9,345 | | | 12,335 | |

| China Security & Surveillance Technology, Inc. * | | | 07/31/11 - 5.40 | | | 20,000 | | | 211,800 | |

| Fushi International, Inc. * | | | 12/13/10 - 3.67 | | | 26,562 | | | 181,420 | |

Wuhan General Group China, Inc. * F | | | 02/08/12 - 2.563 | | | 180,000 | | | 6,660 | |

TOTAL WARRANTS (Cost $103,267) | | | | | | | | | 1,089,925 | |

| | | | | | | | | | | |

SHORT TERM INVESTMENTS (3.62%) | | | | | | | | | | |

Fifth Third Institutional Money Market Fund, 5.17% ** (Cost $1,193,833) | | | | | | 1,193,833 | | | 1,193,833 | |

| | | | | | | |

TOTAL INVESTMENTS (Cost $26,001,910) - 100.65% | | | | | 33,178,371 | |

LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.65)% | | | | | (215,582 | ) |

NET ASSETS - 100% | | | | $ | 32,962,789 | |

| * | Non-income producing security. |

| ** | Rate shown represents the rate at April 30, 2007, is subject to change and resets daily. |

| ADR | American Depositary Receipt |

F These securities were valued at fair value as determined by the Adviser using procedures approved by the Board of Trustees. The total fair value of such securities at April 30, 2007 is $3,796,086 which represents 11.52% of total net assets. Sales of shares of these securities are restricted until certain regulatory filings are approved.

216,348 shares and 216,348 warrants of Benda Pharmaceutical, Inc. were acquired on 11/08/06 at prices of $0.4622 per share and $0.00 per warrant. 108,174 shares and 108,174 warrants of Benda Pharmaceutical, Inc. were acquired on 01/25/07 at prices of $0.5919 per share and $0.1477 per warrant. 108,174 shares and 108,174 warrants of Benda Pharmaceutical, Inc. were acquired on 01/31/07 at prices of $0.6201 per share and $0.2009 per warrant. 324,522 shares and 324,522 warrants of Benda Pharmaceutical, Inc. were acquired on 02/07/07 at prices of $0.6207 per share and $0.2020 per warrant. The current fair values of such securities are $1.45 per share and $0.895 per warrant which are 72.50% and 61.94%, respectively, of the market values of unrestricted securities of the same issuer.

400,000 shares and 400,000 warrants of China Pharma Holdings, Inc. were acquired on 01/29/07 at prices of $1.70 per share and $0.00 per warrant. The current fair values of such securities are $1.72 per share and $0.00 per warrant which are 90.05% and 100%, respectively, of the market values of unrestricted securities of the same issuer.

46,729 shares and 9,345 warrants of China Ritar Power Corp. were acquired on 02/16/07 at prices of $2.14 per share and $0.00 per warrant. The current fair values of such securities are $4.10 per share and $1.32 per warrant which are 74.55% and 48.53%, respectively, of the market values of unrestricted securities of the same issuer.

30,000 shares of Fushi International, Inc. was acquired on 09/15/06 at a price of $6.25 per share. An additional 3,187 shares were received as payment of a penalty by the company for failing to meet the deadline for filing their SB-1 registration statement with the SEC. The current fair value of such security is $10.30 per share which is 98.10% of the market value of unrestricted securities of the same issuer.

300,000 shares and 180,000 warrants of Wuhan General Group China, Inc. were acquired on 02/05/07 at prices of $2.33 per share and $0.00 per warrant. The current fair values of such securities are $2.60 per share and $0.037 per warrant which are 74.29% and 3.95%, respectively, of the market values of unrestricted securities of the same issuer.

The accompanying notes are an integral part of these financial statements.

Pope Family of Funds STATEMENT OF ASSETS AND LIABILITIES - April 30, 2007 | ANNUAL REPORT |

| | | Halter Pope USX China Fund | |

Assets: | | | |

| Investments, at market (cost: $26,001,910) | | $ | 33,178,371 | |

| Receivables: | | | | |

| Fund shares sold | | | 77,818 | |

| Dividends and interest | | | 37,958 | |

| Prepaid expenses | | | 15,196 | |

| Total assets | | | 33,309,343 | |

| | | | | |

Liabilities: | | | | |

| Payables: | | | | |

| Investments purchased | | | 262,549 | |

| Due to Adviser | | | 34,006 | |

| Other liabilities and accrued expenses | | | 23,816 | |

| Distribution fees | | | 17,417 | |

| Due to Administrator | | | 8,766 | |

| Total liabilities | | | 346,554 | |

Net Assets | | $ | 32,962,789 | |

| | | | | |

Net Assets consist of: | | | | |

| Common stock | | $ | 2,254 | |

| Additional paid-in capital | | | 26,020,048 | |

| Accumulated net realized loss on investments | | | (235,974 | ) |

| Net unrealized appreciation on investments | | | 7,176,461 | |

| | | | | |

| Total Net Assets (2,254,450 shares outstanding; unlimited shares of $0.001 par value | | | | |

| authorized) | | $ | 32,962,789 | |

| | | | | |

Class A shares: | | | | |

| Net Assets applicable to 2,192,154 shares outstanding | | $ | 32,054,023 | |

| Net Asset Value per share | | $ | 14.62 | |

| | | | | |

| Offering price per share Class A * | | $ | 15.31 | |

| | | | | |

| Redemption price per share Class A ** | | $ | 14.55 | |

| | | | | |

Class C shares: | | | | |

| Net Assets applicable to 62,296 shares outstanding | | $ | 908,766 | |

| Net Asset Value and offering price per share | | $ | 14.59 | |

| | | | | |

| Redemption price per share Class C *** | | $ | 14.44 | |

| | | | | |

| * | A maximum sales charge of 4.50% is imposed on Class A shares. |

| ** | Class A shareholders pay a 0.50% contingent deferred sales charge ("CDSC") if Class A share purchases exceeding $3 million are redeemed within one year of purchase. |

| *** | A CDSC of 1.00% is imposed in the event of certain redemption transactions within twelve months following such investments. |

The accompanying notes are an integral part of these financial statements.

Pope Family of Funds | ANNUAL REPORT |

| | | Halter Pope USX China Fund | |

| | | | |

| | | For the year ended April 30, 2007 | |

| | | | |

Investment income: | | | |

| Interest | | $ | 39,704 | |

| Dividends | | | 156,100 | |

| Total investment income | | | 195,804 | |

| | | | | |

Expenses: | | | | |

| Investment advisory fees | | | 244,398 | |

| Distribution fees - Class A | | | 35,823 | |

| Distribution fees - Class C | | | 4,216 | |

| Accounting and transfer agent fees | | | 82,174 | |

| Registration fees | | | 31,168 | |

| Insurance fees | | | 30,663 | |

| Legal fees | | | 27,035 | |

| Audit fees | | | 20,615 | |

| Miscellaneous | | | 18,216 | |

| Compliance officer compensation | | | 18,111 | |

| Custody fees | | | 14,461 | |

| Out of pocket expenses | | | 13,653 | |

| Trustee fees | | | 11,068 | |

| Printing fees | | | 2,819 | |

| Total expenses | | | 554,420 | |

| Less: fees waived and expenses absorbed | | | (122,728 | ) |

| Net expenses | | | 431,692 | |

| | | | | |

| Net investment loss | | | (235,888 | ) |

| | | | | |

Realized and Unrealized gains (losses) on investments: | | | | |

| Net realized loss on investments | | | (235,975 | ) |

| Net change in unrealized appreciation on investments | | | 6,177,281 | |

| Net gain on investments | | | 5,941,306 | |

| | | | | |

Net increase in net assets resulting from operations | | $ | 5,705,418 | |

The accompanying notes are an integral part of these financial statements.

Pope Family of Funds STATEMENTS OF CHANGES IN NET ASSETS | ANNUAL REPORT |

| | | Halter Pope USX China Fund * | |

| | | | | | |

| | | For the year ended April 30, 2007 | | For the period July 1, 2005 to April 30, 2006 | |

| | | | | | |

Increase in Net Assets | | | | | | | |

| Operations: | | | | | | | |

| Net investment loss | | $ | (235,888 | ) | $ | (19,968 | ) |

| Net realized gain (loss) on investments | | | (235,975 | ) | | 137,870 | |

| Net change in unrealized appreciation on investments | | | 6,177,281 | | | 999,180 | |

| Net increase in net assets resulting from operations | | | 5,705,418 | | | 1,117,082 | |

| | | | | | | | |

| Distributions to shareholders from: | | | | | | | |

| Net realized gain | | | (117,901 | ) | | - | |

| | | | | | | | |

| Increase in net assets from Fund share transactions (Note 2) | | | 15,764,500 | | | 10,393,690 | |

| | | | | | | | |

| Total increase in net assets | | | 21,352,017 | | | 11,510,772 | |

| | | | | | | | |

Net Assets: | | | | | | | |

| Beginning of period | | | 11,610,772 | | | 100,000 | |

End of period (including undistributed net investment income of $0 and $0, respectively) | | $ | 32,962,789 | | $ | 11,610,772 | |

| | | | | | | | |

| * The Halter Pope USX China Fund commenced operations on July 1, 2005. | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Pope Family of Funds FINANCIAL HIGHLIGHTS Per Share Data For a Share Outstanding Throughout Each Period | ANNUAL REPORT |

| | | Class A * | |

| | | For the year ended April 30, 2007 | | For the Period September 23, 2005 to | |

Net Asset Value, Beginning of Period | | $ | 12.03 | | $ | 10.10 | |

| | | | | | | | |

Investment Operations: | | | | | | | |

Net investment income (loss) (a) | | | (0.15 | ) | | 0.01 | |

| Net realized and unrealized gain on investments | | | 2.80 | | | 1.92 | |

| Total from investment operations | | | 2.65 | | | 1.93 | |

| | | | | | | | |

Distributions: | | | | | | | |

| From net realized capital gain | | | (0.06 | ) | | - | |

| Total distributions | | | (0.06 | ) | | - | |

| | | | | | | | |

Net Asset Value, End of Period | | $ | 14.62 | | $ | 12.03 | |

| | | | | | | | |

Total Return | | | 22.09 | % | | 19.11 | %(b) |

| | | | | | | | |

Ratios/Supplemental Data | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 32,054 | | $ | 11,409 | |

| | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | |

| Before fees waived and expenses absorbed | | | 2.80 | % | | 9.46 | %1 |

| After fees waived and expenses absorbed | | | 2.18 | % | | 1.99 | %1 |

| | | | | | | | |

Ratio of net investment income (loss) to average net assets: | | | | | | | |

| Before fees waived and expenses absorbed | | | (1.80 | )% | | (7.38 | )%1 |

| After fees waived and expenses absorbed | | | (1.18 | )% | | 0.09 | %1 |

| | | | | | | | |

| Portfolio turnover rate | | | 40.84 | % | | 14.52 | % |

(a) | Per share amounts were calculated using the average shares method. |

(b) | Aggregate total return, not annualized. |

1 | Annualized. |

| * | The Halter Pope USX China Fund Class A commenced operations on September 23, 2005. |

The accompanying notes are an integral part of these financial statements.

Pope Family of Funds FINANCIAL HIGHLIGHTS Per Share Data For a Share Outstanding Throughout Each Period | ANNUAL REPORT |

| | | Class C ** | |

| | | For the year ended April 30, 2007 | | For the Period July 1, 2005 to | |

Net Asset Value, Beginning of Period | | $ | 12.01 | | $ | 10.00 | |

| | | | | | | | |

Investment Operations: | | | | | | | |

Net investment loss (a) | | | (0.26 | ) | | (0.10 | ) |

| Net realized and unrealized gain on investments | | | 2.80 | | | 2.11 | |

| Total from investment operations | | | 2.54 | | | 2.01 | |

| | | | | | | | |

Paid-in capital from CDSC fees | | | 0.04 | | | - | |

| | | | | | | | |

Net Asset Value, End of Period | | $ | 14.55 | | $ | 12.01 | |

| | | | | | | | |

Total Return | | | 21.48 | % | | 20.10 | %(b) |

| | | | | | | | |

Ratios/Supplemental Data | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 909 | | $ | 202 | |

| | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | |

| Before fees waived and expenses absorbed | | | 3.85 | % | | 7.94 | %1 |

| After fees waived and expenses absorbed | | | 3.00 | % | | 1.67 | %1 |

| | | | | | | | |

Ratio of net investment loss to average net assets: | | | | | | | |

| Before fees waived and expenses absorbed | | | (2.89 | )% | | (7.40 | )%1 |

| After fees waived and expenses absorbed | | | (2.04 | )% | | (1.12 | )%1 |

| | | | | | | | |

| Portfolio turnover rate | | | 40.84 | % | | 14.52 | % |

(a) | Per share amounts were calculated using the average shares method. |

(b) | Aggregate total return, not annualized. |

1 | Annualized. |

| ** | The Halter Pope USX China Fund Class C commenced operations on July 1, 2005. |

The accompanying notes are an integral part of these financial statements.

Pope Family of Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2007

1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Pope Family of Funds, (the “Trust”) was organized on February 25, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The sole series of shares of the Trust is the Halter Pope USX China Fund (the “Fund”). The Fund is a non-diversified Fund. The Fund’s investment objective is long term growth of capital. The Fund was registered to offer two classes of shares, Class A and Class C shares. The Class C shares commenced operations on July 1, 2005. The Class A shares commenced operations on September 23, 2005. Each class differs as to sales and redemption charges and ongoing fees. Income and realized/unrealized gains or losses are allocated to each class based on relative share balances.

The following is a summary of significant accounting policies consistently followed by the Funds. The policies are in conformity with accounting principles generally accepted in the United States of America.

a) Investment Valuation—Common stocks and other equity securities listed on a securities exchange or quoted on a national market system are valued at 4:00 p.m., New York time, on the day of valuation. Price information on listed stocks is taken from the exchange where the security is primarily traded. Equity securities that are traded on the NASDAQ National Market System, for which quotes are readily available, are valued at the official closing price. Securities that are listed on an exchange but which are not traded on the valuation date are valued at the most recent bid quotation. Short-term instruments (those with remaining maturities of 60 days or less) are valued at amortized cost, which approximates fair market value. Securities and assets for which representative market quotations are not readily available or which cannot be accurately valued using the Fund's normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. Fair value pricing may be used, for example, in situations where (i) a portfolio security, such as a small-cap stock, is so thinly traded that there have been no transactions for that stock over an extended period of time or the validity of a market quotation received is questionable; (ii) the exchange on which the portfolio security is principally traded closes early; (iii) trading of the particular portfolio security is halted during the day and does not resume prior to the Fund's net asset value calculation; or (iv) the security was purchased in a private placement and is an illiquid investment (e.g., “restricted securities” that are not freely tradable because they are not registered under federal securities laws). Consistent with the foregoing, the Fund has adopted guidelines and instructions for the valuation of restricted securities held by the Fund focusing on such important factors, among others, as valuation, liquidity and availability of relevant information. These guidelines are implemented by the Fund’s Fair Value Committee, which reviews relevant market conditions for any restricted security held by the Fund on a daily basis to determine the appropriate value for such restricted security. Because a fair value determination is based on an assessment of the value of the security pursuant to the policies approved by the Fund's Board of Trustees rather than a market price, the fair value price may differ substantially from the price at which the security may ultimately be traded or sold. At April 30, 2007, nine (9) securities were valued as determined by the Board of Trustees.

b) Restricted Securities—The investments in 757,218 shares and 757,218 warrants of Benda Pharmaceutical, Inc., 400,000 shares and 400,000 warrants of China Pharma Holdings, Inc., 46,729 shares and 9,345 warrants of China Ritar Power Corp., 33,187 shares of Fushi International, Inc., and 300,000 shares and 180,000 warrants of Wuhan General Group China, Inc. were initiated by Pope Asset Management, LLC (the “Adviser”) as private placement offerings. Other clients of the Adviser also participated in the private placement. The securities that are part of the private placement offerings are restricted from sale until such time as their registrations become effective and the restrictions are lifted.

These securities have been valued based upon fair value pricing procedures approved by the Board of Trustees after considering certain pertinent factors including but not limited to the restriction from sale, the results of operations, economic news and expectations and currency changes. The securities have been priced at a discount from market quotations available for these securities. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material. The total fair value of these securities at April 30, 2007 is $3,796,086, which represents 11.52% of total net assets

c) Federal Income Taxes—The Trust’s policy is to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all its taxable income to its shareholders. Therefore, no federal income tax provision is required.

d) Distributions to Shareholders—Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. Accounting principles generally accepted in the United States of America require that permanent financial reporting differences relating to shareholder distributions be reclassified to paid in capital or net realized gains.

Pope Family of Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2007

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

e) Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Other—Investment and shareholder transactions are recorded on trade date. The Funds determine the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required no later than June 29, 2007 and is to be applied to all open tax years as of the effective date. At this time, management is evaluating the implication of FIN 48 and its impact in the financial statements has not yet been determined.

In September 2006, FASB issued Statement on Financial Accounting Standards (SFAS) No. 157 “Fair Value Measurements”. This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosure about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of April 30, 2007, the Fund does not believe the adoption of SFAS No. 157 will impact the amounts reported in the financial statements, however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements reported on the statement of changes in net assets for a fiscal period.

2. CAPITAL SHARE TRANSACTIONS

Transactions in shares of capital stock for the Halter Pope USX China Fund Class A shares for the year ended April 30, 2007 were as follows:

| | | Class A | |

| | | Shares | | Amount | |

| Sold | | | 1,406,249 | | $ | 17,346,504 | |

| Reinvested | | | 7,589 | | $ | 102,610 | |

| Redeemed | | | (170,068 | ) | | (2,271,439 | ) |

| Net Increase | | | 1,243,770 | | $ | 15,177,675 | |

Transactions in shares of capital stock for the Halter Pope USX China Fund Class C shares for the year ended April 30, 2007 were as follows:

| | | Class C | |

| | | Shares | | Amount | |

| Sold | | | 55,958 | | $ | 719,111 | |

| Redeemed | | | (10,442 | ) | | (132,286 | ) |

| Net Increase | | | 45,516 | | $ | 586,825 | |

Pope Family of Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2007

| 2. | CAPITAL SHARE TRANSACTIONS (continued) |

Transactions in shares of capital stock for the Halter Pope USX China Fund Class A shares for the period September 23, 2005 through April 30, 2006 were as follows:

| | | Class A | |

| | | Shares | | Amount | |

| Sold | | | 995,063 | | $ | 10,931,867 | |

| Redeemed | | | (46,679 | ) | | (550,823 | ) |

| Net Increase | | | 948,384 | | $ | 10,381,044 | |

Transactions in shares of capital stock for the Halter Pope USX China Fund Class C shares for the period July 1, 2005 through April 30, 2006 were as follows:

| | | Class C | |

| | | Shares | | Amount | |

| Sold | | | 647,948 | | $ | 6,807,023 | |

| Redeemed | | | (641,168 | ) | | (6,794,377 | ) |

| Net Increase | | | 6,780 | | $ | 12,646 | |

| 3. | INVESTMENT TRANSACTIONS |

For the period ended April 30, 2007, aggregate purchases and sales of investment securities (excluding short-term investments) for the Halter Pope USX China Fund were as follows:

Purchases | Sales |

| $22,424,901 | $7,816,040 |

There were no government securities purchased or sold during the period.

4. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

Effective April 28, 2005, the Fund has entered into an Advisory Agreement with Pope Asset Management, LLC (the “Adviser”) to provide investment management services to the Fund in accordance with its investment objectives, policies and restrictions. Pursuant to the Advisory Agreement, the Adviser is entitled to receive a fee, calculated daily and payable monthly at the annual rate of 1.25% as applied to the Fund’s average daily net assets. For the year ended April 30, 2007, the Halter Pope USX China Fund incurred $244,398 of advisory fees. For the year ended April 30, 2007, the Adviser waived advisory fees of $115,758.

The Adviser and the Fund have entered into an Expense Limitation Agreement under which the Adviser has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, and extraordinary expenses and payments, if any, under the Rule 12b-1 Plan). It is expected that the contractual agreement will continue from year-to-year provided such continuance is approved by the Board of Trustees of the Fund. Pursuant to the Agreement, the Adviser has agreed to reimburse the Fund to the extent that total annualized expenses exceed 2.00% of the Fund's average daily net assets. For the year ended April 30, 2007, the Adviser reimbursed $6,970 of Fund expenses.

One trustee of the Fund is also an officer of the Adviser.

The Fund has entered into an Investment Company Services Agreement (“ICSA”) with Matrix Capital Group, Inc. (“Matrix”). Pursuant to the ICSA, Matrix will provide day-to-day operational services to the Funds including, but not limited to, accounting, administrative, transfer agent, dividend disbursement, registrar and record keeping services. For its services, Matrix receives a minimum fee of $6,250 per month. In addition, the following asset based fees will apply at the following breakpoints: 0.10% on assets between $20 million and $50 million; 0.075% on the next $50 million; 0.05% on the next $100 million; 0.03% in excess of $200 million of daily net assets. For the year ended April 30, 2007, Matrix earned $79,030, with $7,266 remaining payable at April 30, 2007.

Pope Family of Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2007

| 4. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

Pursuant to the ICSA, Matrix will provide chief compliance officer services to the Fund. For these services Matrix will receive a fee of $18,000 per year. For the year ended April 30, 2007, Matrix earned $18,111, with $1,500 remaining payable at April 30, 2007.

Certain officers of the Fund are also employees of Matrix

The Fund and Adviser have entered into a Distribution Agreement with Matrix Capital Group, Inc. Pursuant to the Distribution Agreement, Matrix will provide distribution services to the Funds. Matrix serves as underwriter/distributor of the Funds. Pursuant to the Distribution Agreement, Matrix receives $7,200 per year from the Fund. For the period from May 1, 2006 to September 30, 2006, Matrix received $3,144 of distribution fees. Beginning in October 2006, distribution fees paid to Matrix were paid from accruals made pursuant to Rule 12b-1 under the 1940 Act. For the period from October, 1 2006 to April 30, 2007, Matrix received $4,200 from accruals made pursuant to Rule 12b-1, with $600 remaining payable at April 30, 2007.

A separate plan of distribution has been adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940 for each class of shares. With respect to Class A shares, the plan provides that the Fund may pay a servicing or Rule 12b-1 fee of up to 0.25% annually of the Fund’s average net assets, and up to 1.00% annually of the Fund’s average net assets attributable to Class C shares to persons or institutions for performing certain servicing functions for the Fund’s shareholders. Under the plan the Fund may pay for any activity primarily intended to result in the sale of shares of the Fund and the servicing of shareholder accounts, provided that the Trustees have approved the category of expenses for which payment is being made.

The distribution plans for the Class A and Class C shares in the Halter Pope USX China Fund took effect September 23, 2005 and July 1, 2005, respectively. For the year ended April 30, 2007, the Fund accrued $35,823 and $4,216 in 12b-1expenses attributable to Class A and Class C shares, respectively.

During the year ended April 30, 2007, The Halter Pope USX China Fund distributed ordinary income in the amount of $117,901. There were no distributions paid during the period July 1, 2005 to April 30, 2006.

As of April 30, 2007, the components of distributable earnings on a tax basis were as follows:

| | | Halter Pope USX China Fund | |

| Cost of investments for tax purposes | | $ | 26,170,369 | |

| Unrealized Appreciation / (Depreciation): | | | | |

| Gross Appreciation | | | 9,060,279 | |

| Gross Depreciation | | | (2,052,277 | ) |

| Net Unrealized Appreciation | | $ | 7,008,002 | |

| Capital Loss Carryforward: | | | (67,515 | ) |

| Distributable Earnings, Net | | $ | 6,940,487 | |

The difference between book basis and tax-basis unrealized appreciation is attributable primarily to the tax deferral of losses on wash sales and post-October losses.

As of April 30, 2007, the Fund had a capital loss carryforward of $67,515 available for federal income tax purposes which expire in 2016.

6. | RECLASS OF CAPITAL ACCOUNTS |

In accordance with accounting pronouncements, the Fund has recorded reclassifications in the capital accounts. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present undistributed net investment income and paid in capital on a tax basis which is considered to be more informative to the shareholder. As of April 30, 2007, the Fund recorded reclassifications to increase (decrease) the capital accounts as follows:

Pope Family of Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2007

| 6. | RECLASS OF CAPITAL ACCOUNTS (continued) |

| | Undistributed Net Investment Loss | Paid-in Capital |

| Halter Pope USX China Fund | $ 235,888 | $ (235,888) |

The Halter Pope USX China Fund will primarily invest 80% of its assets in equity securities issued by companies listed on the Halter USX China Index which is mainly comprised of U.S. listed companies doing business in China. Investing in the companies from one geographic region may pose additional risks inherent to a region's economical and political situation.

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of April 30, 2007, there were no shareholders having beneficial ownership, either directly or indirectly of more than 25% of the voting securities of Class A Halter Pope USX China Fund. As of April 30, 2007, ADP Clearing & Outsourcing Services, Inc. held 27.39% of Class C Halter Pope USX China Fund in an omnibus account for the sole benefit of its customers.

Additional Information (Unaudited)

The Fund files its complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commissions website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 877-244-6235; and on the Commissions website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2006 is available without charge, upon request, by calling 877-244-6235; and on the Commission’s website at http://www.sec.gov.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Shareholders and

Board of Trustees of

Halter Pope USX China Fund

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Halter Pope USX China Fund (the “Fund”), a series of the Pope Family of Funds, as of April 30, 2007 and the related statement of operations for the year then ended, the statements of changes in net assets for the year then ended and for the period July 1, 2005 (commencement of operations) through April 30, 2006, and financial highlights for each of the two periods then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2007 by correspondence with the Fund’s custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Halter Pope USX China Fund, a series of the Pope Family of Funds as of April 30, 2007, the results of its operations for the year then ended, the changes in its net assets for the year then ended and for the period July 1, 2005 (commencement of operations) through April 30, 2006, and financial highlights for each of the two periods then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

(f.k.a. Cohen McCurdy, Ltd.)

Westlake, Ohio

June 13, 2007

| Registered with the Public Company Accounting Oversight Board | |

TRUSTEES AND OFFICERS (Unaudited)

Name, Address and Age | Position(s) Held with Trust | Length of Service | Principal Occupation(s) During Past 5 Years | Number of Funds Overseen | Other Directorships Held |

Independent Trustees |

Donald G. Wood 13940 Lake Mahogany Blvd, Unit 112 Fort Myers, FL 33907 Age 55 | Trustee | Since Inception | Mr. Wood has provided business consulting services as a private consultant since February 2000. | One | None |

| | | | | | |

James W. McDowell, Jr. 1400 Willow, No. 804 Louisville, KY 40257 Age 65 | Trustee | Since Inception | Mr. McDowell has been the sole Principal and President of McDowell Associates, a business consulting firm, since 1993. | One | Mr. McDowell is a director of Fifth Third Bank Kentucky, a subsidiary of Fifth Third Bank. |

Interested Trustees and Officers |

Stephen L. Parr * 5100 Poplar Avenue, Suite 805 Memphis, TN 38137 Age 53 | Trustee and President | Since Inception | Mr. Parr is currently a portfolio manager for the Adviser, and has been vice president and a portfolio management consultant for the Adviser since 2001. | One | None |

| | | | | | |

Casey McCandless 5100 Poplar Avenue, Suite 805 Memphis, TN 38137 Age 32 | Treasurer | Since Inception | Mr. McCandless worked at Putnam Investments from 1998 to 2001. He graduated from Amos Tuck Business School at Dartmouth College in 2003. He has been an analyst with the Adviser since 2003. | N/A | None |

| | | | | | |

Trent Curry 5100 Poplar Avenue, Suite 805 Memphis, TN 38137 Age 31 | Secretary | Since May 2006 | Mr. Curry has been an analyst with the Adviser since 2005. He was previously employed by Prudential Capital Group from 2000 to 2004. Mr. Curry graduated from Kellogg School of Management at Northwestern University in 2005. | N/A | None |

| | | | | | |

David Ganley 630 Fitzwatertown Road Willow Grove, PA 19090 Age 60 | Chief Compliance Officer Assistant Secretary | Since Inception Since March 2007 | Mr. Ganley has been the Senior Vice President of Matrix Capital Group since January 2005. He was previously President of InCap Securities, Inc. and Chief Administrative Officer of Incap Service Co. from 2001to 2005. | N/A | None |

| |

Larry Beaver 630 Fitzwatertown Road Willow Grove, PA 19090 Age 38 | Assistant Treasurer | Since March 2007 | Mr. Beaver has been with Matrix Capital Group since February 2005 and currently is the Director of Fund Administration. He was previously the Fund Accounting Manager at InCap Service Co. from May 2003 to January 2005. From October 2001 to April 2003, Mr. Beaver was the Fund Accounting Supervisor at Declaration Group/InCap Service Co. | N/A | None |

| |

| * Stephen L. Parr is deemed an interested trustee because he is employed by Pope Asset Management, LLC, the Adviser to the Fund. |

Pope Family of Funds

5100 Poplar Avenue

Suite 805

Memphis, TN 38137

INVESTMENT ADVISER

Pope Asset Management, LLC

5100 Poplar Avenue

Suite 805

Memphis, TN 38137

ADMINISTRATOR & TRANSFER AGENT

Matrix Capital Group, Inc.

630 Fitzwatertown Road

Building A, Second Floor

Willow Grove, PA 19090-1904

DISTRIBUTOR

Matrix Capital Group, Inc.

335 Madison Avenue

11th Floor

New York, NY 10017

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

800 Westpoint Parkway

Suite 1100

Westlake, OH 44145-1524

LEGAL COUNSEL

Kilpatrick Stockton LLP

3737 Glenwood Avenue

Suite 400

Raleigh, NC 27612

CUSTODIAN BANK

Fifth Third Bank

Fifth Third Center

38 Fountain Square Plaza

Cincinnati, OH 45263

a. The registrant has, as of the end of the period covered by this report, adopted a Code of Ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

b. During the period covered by this report, there were no amendments to any provision of the Code of Ethics.

c. During the period covered by this report, there were no waivers or implicit waivers of a provision of the Code of Ethics.

d. The registrant’s Code of Ethics is filed herewith.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

The registrant’s Board of Trustees has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offer the registrant adequate oversight for the registrant’s level of financial complexity.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

a. Audit Fees

The aggregate fees billed for the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $14,800 and $16,605 respectively.

b. Audit related fees

There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item.

c. Tax Fees

The aggregate fees billed during the for the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $750 and $1,550 respectively.

d. All other fees

There were no other fees billed for the last two fiscal years for products and services provided by the principal accountant, other then the services reported in paragraph (a) through (c) of this item.

e. The Trust has pre approval policies and procedures. 100% of services described in (b) through (d) were pre-approved by the Audit Committee.

f. All work is performed by permanent employees of Cohen Fund Audit Services, Ltd.

g. There were no non-audit fees billed by the registrant’s accountant for services rendered to the registrant and rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the adviser, that provides ongoing services to the registrant during the last two fiscal years.

h. There were no non-audit services rendered to the registrant’s investment adviser.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable

| ITEM 6. | SCHEDULE OF INVESTMENT |

Included in annual report to shareholder filed under item 1 of this form.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable Fund is an open-end management investment company

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES |

Not applicable Fund is an open-end management investment company

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable Fund is an open-end management investment company

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable at this time.

| ITEM 11. | CONTROLS AND PROCEDURES. |

(a) The registrant’s principal executive office and principal financial officer has concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this document.

(b) There were so significant changes in the registrant’s internal controls or in other factors that could affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

| (1) | Code of Ethics for Principal executive and Senior Officers of the Pope Family of funds is filed herewith. |

| (2) | Certificationspursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are filed herewith. |

| (3) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 are filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Pope Family of Funds

/s/ Stephen L. Parr

By Stephen L. Parr, President

Date: June 19, 2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the Following persons on behalf of the registrant and in the capacities and on the dates indicated.

By Stephen L. Parr, President

Date: June 19, 2007

By Casey McCandless, Treasurer

Date: June 19, 2007