UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

John H. Lively

Practus, LLP

11300 Tomahawk Creek Parkway, Suite 310

Leawood, KS 66211

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 09/30/2018

Date of reporting period: 09/30/2018

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the EAS Crow Point Alternatives Fund (the “EAS Fund”), Crow Point Global Tactical Allocation Fund (the “Global Fund”) and Crow Point Alternative Income Fund (the “Income Fund”), each a series of the 360 Funds (the “registrant”), for the fiscal periods/year ended September 30, 2018 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

EAS Crow Point Alternatives Fund

Class A Shares (Ticker Symbol: EASAX)

Class C Shares (Ticker Symbol: EASYX)

Class I Shares (Ticker Symbol: EASIX)

Crow Point Global Tactical Allocation Fund

Investor Class Shares (Ticker Symbol: CGHAX)

Institutional Class Shares (Ticker Symbol: CGHIX)

Crow Point Alternative Income Fund

Investor Class Shares (Ticker Symbol: AAIFX)

Series of the

360 Funds

ANNUAL REPORT

September 30, 2018

Investment Adviser:

Crow Point Partners, LLC

25 Recreation Drive, Suite 206

Hingham, MA 02043

1-877-327-0757

www.crowpointfunds.com

Distributed by Matrix 360 Distributors, LLC

Member FINRA

This report is authorized for distribution only to shareholders and to others who have received a copy of the Fund’s prospectus.

TABLE OF CONTENTS

Dear Investor:

Your EAS Crow Point Alternatives Fund (the “Fund”) just completed a very strong year. For the year ended September 30, 2018, the Fund’s Class I shares returned 10.93% versus (1.22)% and 3.62% for its benchmarks, the Bloomberg Barclays U.S. Aggregate Bond Index (the “Barclays Index”) and HFRI Fund-of-Funds Conservative Index (the “HFRI Index”), respectively. For the most recently completed quarter ended September 30, 2018 the Fund returned 5.49% versus (0.02)% and 0.47% for the Barclays Index and HFRI Index, respectively. The Fund ended the year ranked in the fourth Morningstar percentile, a performance about which we are quite happy. Recent performance continued a string of strong quarterly performances relative to our peer group. The Fund has now outperformed its Morningstar peer group for six consecutive quarters. Most importantly, we are happy to report that Morningstar awarded the Fund its fifth star, the highest possible Morningstar rating. We know we will be on the other side of this performance curve from time-to-time, and we have had exceptional performance from some select sectors, meanwhile, we remain focused on the Fund’s core mandate: consistent low volatility returns.

Two positions drove a good portion of our performance in the second half of 2018. As many of you know, the Fund has been short Tesla for quite some time and that position paid off quite well during 3Q 2018 as Tesla was one of the worst performing stocks in the market. With Tesla being a volatile stock, we always hedge that position with calls to protect against surprise rallies, and we managed to trade that hedge very effectively. We also owned $4 calls in Amarin Pharmaceuticals at the time Amarin announced a very successful trial result of its most important drug. We expected an announcement in September, did not know in which direction the FDA ruling would go, and so also owned puts with our calls. Upon announcing the successful result, AMRN stock traded up to almost $19 per share resulting in a significant gain for the Fund.

Our broader asset allocation moves also yielded benefits in the last year. While many investors were concerned about the sharp uptick in volatility in February 2018, our models kept us overweight equities and that paid off. Furthermore, our models kept us in small caps and that has really paid off. Basically, for the past twelve months, we have favored small caps over large, growth stocks over value, the U.S. over the Rest of the World, cash and alternatives over bonds. Additionally, while we overallocated to growth, our small cap managers also outperformed their benchmarks by wide margins, which helped performance even more. We expect there to be a reversion to the mean soon, and we are adding value stocks to the Fund’s portfolio and will likely continue to do so.

Going forward, we are exploring adding a managed futures sleeve as we believe that is the best and most efficient way to hedge against broad market declines. While our models continue to tilt in favor of risk assets, we are as jumpy as everyone else now and are watching the data closely. So far, the correct positioning has been to stay with the risk trade.

As we indicated in the last quarterly letter, our proprietary risk tools identify three kinds of markets: (1) low-risk bull, characterized by low levels of market volatility and high returns (what we exited in 2017); (2) high-risk bull, where volatility spikes but return potential remains high; and (3) high-risk bear, where volatility and return potential works against the investor. A high-risk bull market, where we are now in our opinion, means that optimal portfolio positions will be smaller than normal. With more names in the portfolio, diversification becomes an ally.

We continue to minimize long exposure to bonds (less than 10% of net Fund assets), and what bonds we do own are of a short duration, hedged in some manner, or highly credit sensitive where we have a high degree of confidence in the underlying credit. We will likely be rolling into more floating rate notes going forward. Right now, the Fund’s portfolio construction is as follows: approximately 60% of the Fund’s net assets are invested in various long/short strategies, primarily equity based; 21% in global macro; 19% in various arbitrage strategies (mostly through our investment in an outside limited partnership); and the remainder in other opportunistic situations.

That’s it for now. We thank you for being a shareholder. We are honored by the privilege. As always, please reach out to us at any time if you have questions.

Sincerely,

Peter J. DeCaprio

Crow Point Partners

See following for important disclosures.

Before investing in EAS Crow Point Alternatives Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. For a current Prospectus, which contain this and other important information, visit cppfunds.com. Please read the Prospectus carefully before investing.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Call 1-877-244-6235 for current month end performance.

Positive performance of holdings does not indicate positive portfolio returns.

The Barclay’s US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS and CMBS (agency and non-agency).

HFRI Fund of Funds Conservative Index (the “Index”) is an unmanaged index. Funds in the Index generally seek consistent returns by primarily investing in funds that generally engage in more conservative strategies such as equity market neutral, fixed income arbitrage and convertible arbitrage. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Fund’s returns, the Index does not reflect any fees or expenses.

The Fund’s portfolio may differ significantly from the securities held in the Index. You cannot invest directly in an Index, therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

As of September 30, 2018, the top ten holdings for the EAS Crow Point Alternatives Fund: Crow Point Growth Fund, 20.96%; Crow Point Alternative Income Fund, 12.55%; ACA Master Select Fund LP, 12.02%; RVX Emerging Markets Equity Fund, 9.12%; Eagle Rock Floating Rate Fund, 6.85%; LS Opportunity Fund, 3.03%; Mainstay Medical International PLC, 1.14%; Amarin Corp. PLC, 12/21/18, $4.00 Call Option, 1.11%; SVB Financial Group, 1.10% and Amarin Corp. PLC, 01/18/19, $4.00 Call Option, 1.06%. Fund holdings are subject to change and holding discussions are not recommendations to buy or sell any security. Current and future holdings are subject to risk.

Fund distributed by Matrix 360 Distributors, LLC.

Dear Investor:

The Crow Point Global Tactical Allocation Fund (the “Fund”) posted strong results over the third quarter of 2018, rising approximately 5.22% versus 7.71% and (0.02)% for the S&P 500® Total Return Index (the “S&P 500”) and the Bloomberg Barclays U.S. Aggregate Bond Index (the “Barclays Index”), the Fund’s benchmarks. Year to date through September 30, the portfolio was up 3.92% versus 10.56% for the S&P 500 and (1.60)% the Barclays Index, respectively, and over 1 year is up 8.36% versus 17.91% for the S&P 500 and (1.22)% for the Barclays Index. These investment returns place the Fund in the top quartile of funds in the Morningstar Tactical Allocation category, over the 1 year time period.

Over the course of this year, despite several bouts of market volatility and uncertainty, the portfolio team maintained a constructive viewpoint on economic growth driven by simulative fiscal policy in the United States. This economic growth coupled with reasonable valuations and high degrees of corporate profit growth led to overweighted positions in U.S. equities, particularly small cap companies. Over the course of the third quarter, the portfolio maintained roughly 25% of all holdings in small cap companies, small cap exchange-traded and closed-end funds. These small cap positions were the greatest contributor to the Fund’s strong performance.

Although the Fund’s investment opportunity set is global, the portfolio has focused almost exclusively on investment opportunities in the United States. Avoiding non-U.S. investments was beneficial as foreign markets have posted negative returns through the third quarter and throughout 2018. The Fund maintained tactical short positions in Emerging Markets, which contributed positively to total returns.

Lastly, over the course of 2018, given the team’s constructive viewpoint on the domestic economy coupled with tightening policy on behalf of the Federal Reserve, the Fund generally avoided interest rate risk and minimized positions in fixed income. Avoiding fixed income additionally proved to be beneficial to Fund returns as bond returns have been negative this year.

Going forward, markets may continue to be volatile yet overall, we remain constructive on economic growth and on risk assets broadly. Given large valuation differences between U.S. and international markets as well as a reduction in policy risks overseas, the Fund has begun increasing non-U.S. exposures, particularly in Emerging Markets.

Sincerely,

Peter J. DeCaprio

Crow Point Partners

See following for important disclosures.

Before investing in Crow Point Global Tactical Allocation Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. For a current Prospectus, which contain this and other important information, visit cppfunds.com. Please read the Prospectus carefully before investing.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Call 1-877-244-6235 for current month end performance.

Positive performance of holdings does not indicate positive portfolio returns.

The S&P 500® Total Return Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Barclay’s US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS and CMBS (agency and non-agency).

The Fund’s portfolio may differ significantly from the securities held in the index. You cannot invest directly in an index, therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

As of September 30, 2018, the top ten holdings for the Crow Point Global Tactical Allocation Fund: SPDR S&P 500 ETF Trust, 9.12%; iShares MSCI Emerging Markets ETF, 7.09%; Technology Select Sector SPDR Fund, 6.39%; Consumer Discretionary Select Sector SPDR Fund, 6.15%; Eagle Rock Floating Rate Fund, 5.54%; iShares Russell 3000 ETF, 4.74%; Financial Select Sector SPDR Fund, 4.56%; Industrial Select Sector SPDR Fund, 4.49%; iShares Core S&P Small-Cap ETF, 3.84% and RVX Emerging Markets Equity Fund, 3.69%. Fund holdings are subject to change and holding discussions are not recommendations to buy or sell any security. Current and future holdings are subject to risk.

Fund distributed by Matrix 360 Distributors, LLC.

Dear Investor:

The Crow Point Alternative Income Fund (the “Fund”) posted relatively strong performance for the third quarter of 2018, rising by 0.48% versus (0.92)% for the Bloomberg Barclays Global Aggregate Bond Index (the “Barclays Index”) and (0.04)% for the HFRX Absolute Return Index (the “HFRX Index”). Year to date through September 30, 2018, the Fund had a modest negative return of (0.12)% versus (2.37)% for the Barclays Index and 1.00% for the HFRI Index; and over 1 year posted a return of 1.93% versus (1.32)% for the Barclays Index and 1.13% for the HFRI Index. These returns compare favorably to bond market returns as fixed income as an asset class has had negative returns over all recent periods. The Fund’s one-year performance placed it in the top half of Non-Traditional bond funds, according to Morningstar.

Given the U.S. economy’s strong performance, the Federal Reserve has continued its policy of raising the Federal Funds rate thus limiting attractive investment opportunities in the fixed income marketplace. Over the quarter and throughout most of 2018, the investment team has looked to minimize interest rate risk in portfolio construction in lieu of more economically cyclical investments including credit, both high yield and high grade, convertible bonds and dividend-oriented equities.

Over the past 10 years, money market investments, very short-term bonds and floating rate bank debt have all been very unattractive investments given the extraordinarily accommodative posture of the Federal Reserve which resulted short term rates that hovered around zero. Yet, since 2015, the Fed has begun a very gradual but steady process of normalizing interest rates, pushing the Fed Funds target rate to a more normal 2.25%. As such, the investment team has found investments in short term paper increasingly attractive and beneficial to the portfolio.

Going forward, the investment team anticipates an environment similar to what we’ve experienced recently as the Fed continues a gradual increase in short rates thus resulting in a challenging investment environment for traditional fixed income securities. As such, the Fund will continue to minimize interest rate risks and look to make opportunistic investments which benefit both from rising short rates and a positive economic environment.

Sincerely,

Peter J. DeCaprio

Crow Point Partners

See following for important disclosures.

Before investing in Crow Point Alternative Income Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. For a current Prospectus, which contain this and other important information, visit cppfunds.com. Please read the Prospectus carefully before investing.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Call 1-877-244-6235 for current month end performance.

Positive performance of holdings does not indicate positive portfolio returns.

The Bloomberg Barclays Global Aggregate Bond Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. As a component of the optimization process, the index selects constituents which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance.

The Fund’s portfolio may differ significantly from the securities held in the index. You cannot invest directly in an index, therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

As of September 30, 2018, the top ten holdings for the Crow Point Alternative Income Fund: iShares Core U.S. Aggregate Bond ETF, 15.86%; SPDR S&P 500 ETF Trust, 11.65%; iShares 20+ Year Treasury Bond ETF, 7.05%; SPDR Bloomberg Barclays High Yield Bond ETF, 5.06%; Eagle Rock Floating Rate Fund, 5.05%; Invesco Senior Loan ETF, 4.87%; Eaton Vance Limited Duration Income Fund, 4.51%; SPDR Bloomberg Barclays Short Term High Yield Bond ETF, 4.15%; Structured Asset Securities Corp. Mortgage Loan Trust 2006-WF1, 1 mo. LIBOR plus 0.16%, 2.556%, due 02/25/2036, 4.01%;and Vemo Education, Inc., 3.66%. Fund holdings are subject to change and holding discussions are not recommendations to buy or sell any security. Current and future holdings are subject to risk.

Fund distributed by Matrix 360 Distributors, LLC.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

EAS Crow Point Alternatives Fund

September 30, 2018 (Unaudited) | |

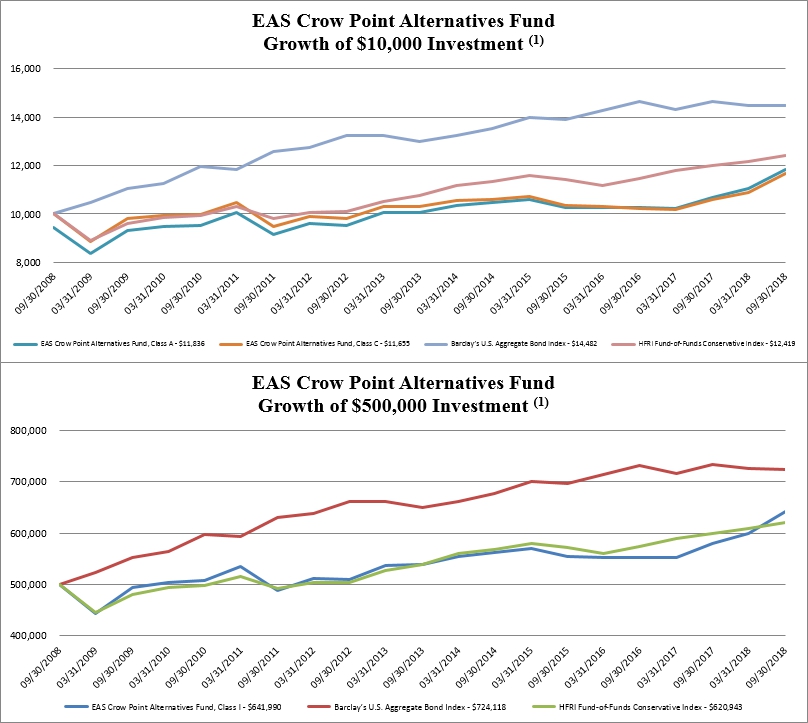

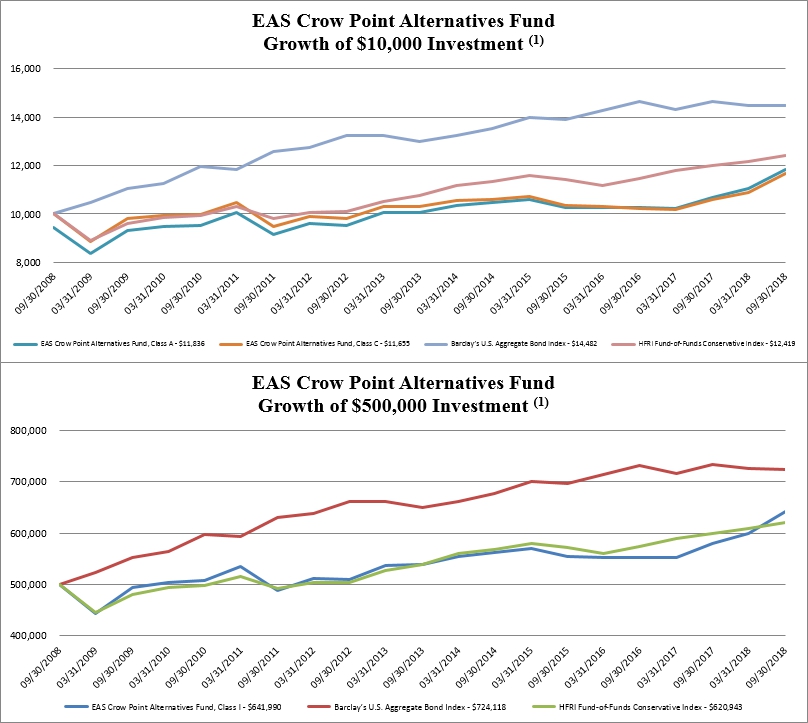

(1) The Class A shares includes the deduction of the current maximum initial sales charge of 5.50%. The minimum initial investment for the Class I shares is $500,000.

| Returns as of September 30, 2018 | One year ended | Five years ended | Ten years ended |

| | September 30, 2018 | September 30, 2018 | September 30, 2018 |

| EAS Crow Point Alternatives Fund Class A without sales charge | 10.75% | 3.28% | 2.28% |

| EAS Crow Point Alternatives Fund Class A with sales charge | 4.66% | 2.12% | 1.70% |

| EAS Crow Point Alternatives Fund Class C without CDSC | 9.91% | 2.52% | 1.54% |

| EAS Crow Point Alternatives Fund Class I | 10.93% | 3.55% | 2.53% |

| Bloomberg Barclay’s U.S. Aggregate Bond Index | (1.22)% | 2.16% | 3.77% |

| HFRI Fund-of-Funds Conservative Index | 3.62% | 2.92% | 2.19% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

EAS Crow Point Alternatives Fund

September 30, 2018 (Unaudited) | |

The above graph depicts the performance of the EAS Crow Point Alternatives Fund versus the Bloomberg Barclay’s U.S. Aggregate Bond Index (the “Barclays Index”) and the HFRI Fund-of-Funds Conservative Index (the “HFRI Index”). The Barclays Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities, and asset-backed securities that are publicly offered for sale in the United States. The securities in the Barclays Index must have at least 1 year remaining to maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed-rate, nonconvertible and taxable. The HFRI Index is an unmanaged index. Funds in the HFRI Index generally seek consistent returns by primarily investing in funds that generally engage in more conservative strategies such as equity market neutral, fixed income arbitrage and convertible arbitrage. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Fund’s returns, the Index does not reflect any fees or expenses.

The investment objective of the EAS Crow Point Alternatives Fund (the “Fund”) is preservation and growth of capital.

Crow Point Partners, LLC’s (the “Adviser”) investment philosophy centers on the preservation and growth of capital through both good and bad markets. The Adviser believes that for most shareholders, investment success is about growing capital over time while protecting it at all times, not about beating a market index which can frequently involve losses while still meeting the objective. Thus, the Adviser follows an absolute return approach in managing the Fund, as defined below. In executing its strategy, the Adviser attempts to generate consistent, positive returns regardless of market conditions by allocating the Fund’s investments among multiple alternative investment asset classes and strategies.

The Fund’s investments will be allocated among multiple alternative investment classes using primarily liquid instruments. The Fund may, generally, pursue investments among the following alternative investment classes or strategies: Arbitrage; Commodities; Convertibles; Floating Rate Debt; Currencies; Emerging Markets Bonds; Emerging Market Equities; High Yield; Long-Short Equity; Long-Short Credit; Managed Futures; Capital Structure Arbitrage; and Real Estate (primarily through real estate investment trusts (“REITs”). The Fund may invest in securities directly, or through other mutual funds, ETFs, closed-end funds, and private funds (“Underlying Funds”) across these alternative investment styles. An ETF is an investment company that typically seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. The Adviser may invest a portion of the Fund’s assets in other mutual funds that are also advised by the Adviser. Investments in private funds such as hedge funds will be limited to no more than 15% of the Fund’s net assets at the time of purchase. The Adviser will periodically adjust the asset allocation among each alternative investment class based on its assessment of market conditions and investment opportunities.

Allocation of Portfolio Holdings

| Asset Class | | Percentage of Net Assets |

| Mutual Funds | | 52.83 | % |

| Common Stock | | 26.64 | % |

| Hedge Funds | | 12.02 | % |

| Call Options | | 2.24 | % |

| Corporate Bond | | 0.82 | % |

| Asset Backed Securities | | 0.09 | % |

| Put Options | | 0.01 | % |

| Exchange-Traded Funds | | (22.82 | )% |

| Other, Cash and Cash Equivalents | | 28.17 | % |

| | | 100.00 | % |

The percentages in the above table are based on the portfolio holdings of the Fund as of September 30, 2018 and are subject to change. For a detailed break-out of holdings by industry and investment type, please refer to the Schedule of Investments.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

Crow Point Global Tactical Allocation Fund

September 30, 2018 (Unaudited) | |

| Returns as of September 30, 2018 | One year ended

September 30, 2018 | Five years ended

September 30, 2018 | Commencement of

Operations through

September 30, 2018* |

| Crow Point Global Tactical Allocation Fund Investor Class | | | |

| without sales charge | 7.98% | 2.56% | 2.72% |

| S&P 500 Total Return Index | 17.91% | 13.94% | 16.30% |

| Bloomberg Barclays U.S. Aggregate Bond Index | (1.22)% | 2.16% | 1.64% |

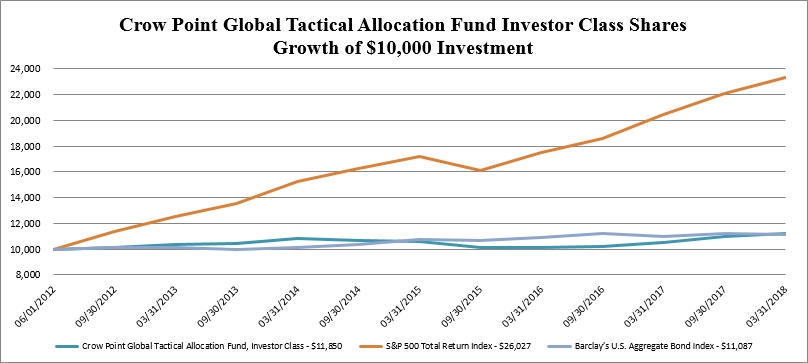

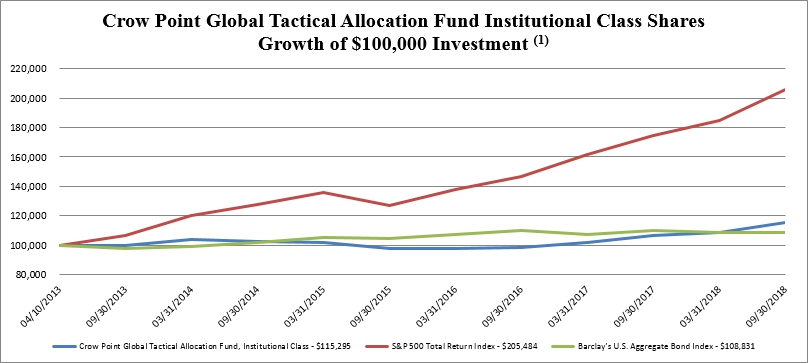

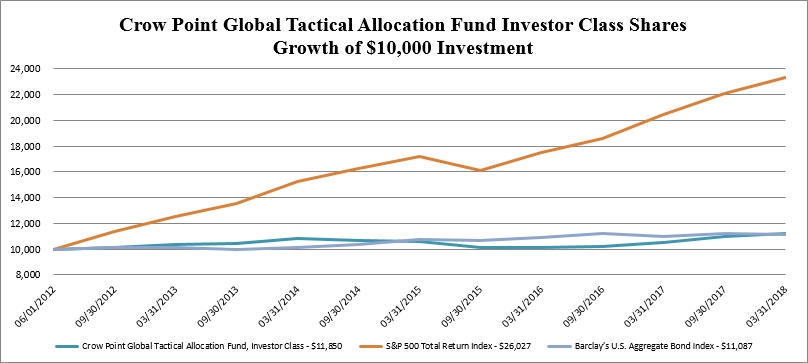

* The Crow Point Global Tactical Allocation Fund Investor Class shares commenced operations on June 1, 2012. Effective September 28, 2018, the Fund's Class A shares and Class I shares were re-designated as the Investor Class shares and the Institutional Class shares, respectively.

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

Crow Point Global Tactical Allocation Fund

September 30, 2018 (Unaudited) | |

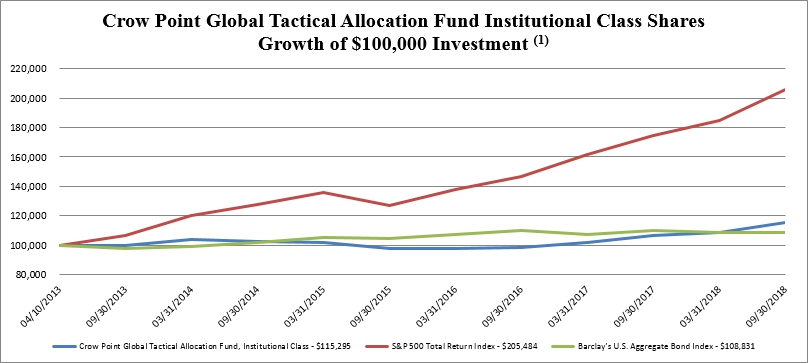

(1) The minimum initial investment for the Class I shares is $100,000.

| Returns as of September 30, 2018 | One year ended

September 30, 2018 | Five years ended

September 30, 2018 | Commencement of

Operations through

September 30, 2018* |

| Crow Point Global Tactical Allocation Fund | | | |

| Institutional Class | 8.36% | 2.86% | 2.63% |

| S&P 500 Total Return Index | 17.91% | 13.94% | 14.05% |

| Bloomberg Barclays U.S. Aggregate Bond Index | (1.22)% | 2.16% | 1.56% |

* The Crow Point Global Tactical Allocation Fund Institutional Class shares commenced operations on April 10, 2013. Effective September 28, 2018, the Fund's Class A shares and Class I shares were re-designated as the Investor Class shares and the Institutional Class shares, respectively.

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

Crow Point Global Tactical Allocation Fund

September 30, 2018 (Unaudited) | |

The above graphs depict the performance of the Fund versus the S&P 500 Total Return Index (“S&P 500”) and the Bloomberg Barclays U.S. Aggregate Bond Index (the “Barclays Index”). The S&P 500 is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Index returns assume reinvestment of dividends. The Barclays Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities, and asset-backed securities that are publicly offered for sale in the United States. The securities in the Barclays Index must have at least 1 year remaining to maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed-rate, nonconvertible and taxable. Investors may not invest in any index directly; unlike the Fund’s returns, the Index does not reflect any fees or expenses. The Fund will generally not invest in all the securities comprising each index.

The investment objective of the Fund is to seek income with long-term growth of capital as a secondary objective.

Crow Point Partners, LLC’s (the “Adviser”) fundamentally-driven investment process is used to identify companies with attractive and growing franchises, sustainable and high dividend yields, and low correlations to the broader equity markets. Long dated put options will be employed to hedge individual stock positions. Call options will be sold when possible to reduce the costs of the put protection and to offer additional yield support. Individual position concentration will be low to help reduce risk. In addition, options will be purchased and sold on selected U.S. and non-U.S.-based securities indices, on exchange-traded funds providing returns based on certain indices, countries, or market sectors for the purpose of hedging the portfolio against losses.

The Fund expects normally to invest at least 80% of its total assets in equity securities (including securities convertible into equity securities) of U.S. and non-U.S. companies that pay attractive dividends or that the Fund’s Adviser believes have the potential to increase dividends over time. The Fund has the flexibility to invest up to 20% of its net assets in preferred securities. Securities will be chosen using a proprietary fundamental investment process by which the Fund’s Adviser seeks to identify quality companies around the world with a proven track record of delivering consistent or rising dividends and companies likely to raise their dividends meaningfully or to pay a significant special dividend.

Allocation of Portfolio Holdings

| Asset Class/Industry Sector | | Percentage of Net Assets* |

| Exchange-Traded Funds | | 58.31 | % |

| Mutual Funds | | 9.24 | % |

| Closed-End Funds | | 4.24 | % |

| Common Stock | | 3.55 | % |

| Put Options | | 0.22 | % |

| Asset Backed Securities | | 0.10 | % |

| Call Options | | (0.13 | )% |

| Cash and Cash Equivalents | | 24.47 | % |

| | | 100.00 | % |

* The percentages in the above table are based on the portfolio holdings of the Fund as of September 30, 2018 and are subject to change. For a detailed break-out of holdings by industry and investment type, please refer to the Schedule of Investments.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

Crow Point Alternative Income Fund

September 30, 2018 (Unaudited) | |

| Returns as of September 30, 2018 | One year ended

September 30, 2018 | Five years ended

September 30, 2018 | Commencement of

Operations through

September 30, 2018* |

| Crow Point Alternative Income Fund Investor Class | 1.93% | 0.75% | 0.27% |

| Bloomberg Barclay’s Global Aggregate Bond Index | (1.32)% | 0.75% | 0.92% |

| HFRX Absolute Return Index | 1.13% | 2.01% | 1.85% |

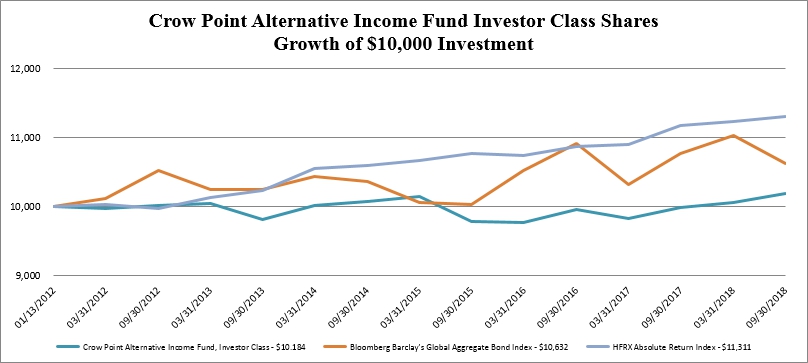

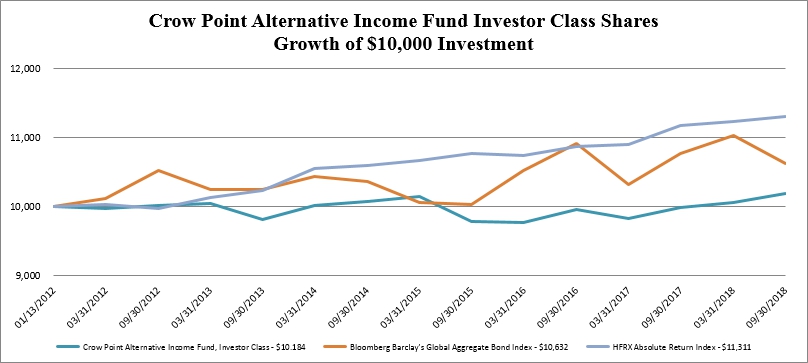

* The Crow Point Alternative Income Fund Investor Class shares commenced operations on January 13, 2012.

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

| Crow Point Funds | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

Crow Point Alternative Income Fund

September 30, 2018 (Unaudited) | |

The above graph depicts the performance of the Crow Point Alternative Income Fund versus the Bloomberg Barclays Global Aggregate Bond Index (the “Barclays Global Index”) and the HFRX Absolute Return Index (the “HFRX Index”). The Barclays Global Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The HFRX Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. As a component of the optimization process, the index selects constituents which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Fund’s returns, the Index does not reflect any fees or expenses.

The investment objective of the Crow Point Alternative Income Fund (the “Fund”) is to seek above-average total returns over a complete market cycle primarily through capital appreciation and income generation. Crow Point Partners, LLC (the “Adviser”) serves as the Fund’s investment adviser.

The Fund seeks to achieve its investment objective under normal market conditions of providing shareholders with above-average total returns over a complete market cycle primarily through capital appreciation and income generation by allocating assets among credit related instruments such as corporate bonds, municipal bonds, mortgage and asset-backed securities, and floating rate securities. The Fund considers “above-average total returns” to be returns that are uncorrelated to, and greater than, the Fund’s primary benchmark. The Fund may invest in investment grade as well as below investment grade securities (also known as “junk bonds”). The Fund may invest without regard to maturity. The Fund may also invest in equity securities including those of private issuers, debt securities of private issuers, non-publicly traded real estate investments trusts (“REITs”), exchange-traded-notes (ETNs”), exchange-traded funds (“ETFs”), mutual funds and publicly traded and non-publicly traded business development companies (“BDCs”). In regard to investments in equity securities, the Fund may invest without regard to market capitalization.

Allocation of Portfolio Holdings

| Asset Class/Industry Sector | | Percentage of Net Assets |

| Exchange-Traded Funds | | 58.02 | % |

| Bonds & Notes | | 7.47 | % |

| Closed-End Funds | | 7.05 | % |

| Mutual Funds | | 5.05 | % |

| Private Investment | | 3.66 | % |

| Preferred Stock | | 0.60 | % |

| Put Options | | 0.12 | % |

| Call Options | | (0.05 | )% |

| Common Stock | | (0.80 | )% |

| Other, Cash and Cash Equivalents | | 18.88 | % |

| | | 100.00 | % |

The percentages in the above table are based on the portfolio holdings of the Fund as of September 30, 2018 and are subject to change. For a detailed break-out of holdings by industry and investment type, please refer to the Schedule of Investments.

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| COMMON STOCK - 32.09% | | Shares | | | Value | |

| | | | | | | |

| Airlines - 0.20% | | | | | | | | |

| JetBlue Airways Corp. (a) (b) | | | 3,377 | | | $ | 65,379 | |

| | | | | | | | | |

| Apparel - 2.51% | | | | | | | | |

| Columbia Sportswear Co. (b) | | | 2,322 | | | | 216,108 | |

| Michael Kors Holdings Ltd. (a) - British Virgin Islands | | | 2,962 | | | | 203,075 | |

| Ralph Lauren Corp. (b) | | | 2,446 | | | | 336,447 | |

| VF Corp. (b) | | | 783 | | | | 73,171 | |

| | | | | | | | 828,801 | |

| Auto Manufacturers - 0.42% | | | | | | | | |

| PACCAR, Inc. (b) | | | 2,048 | | | | 139,653 | |

| | | | | | | | | |

| Banks - 2.09% | | | | | | | | |

| Capital One Financial Corp. (b) | | | 2,831 | | | | 268,747 | |

| IBERIABANK Corp. (b) | | | 708 | | | | 57,596 | |

| SVB Financial Group (a) (b) | | | 1,171 | | | | 363,982 | |

| | | | | | | | 690,325 | |

| Biotechnology - 2.93% | | | | | | | | |

| Alnylam Pharmaceuticals, Inc. (a) (b) | | | 926 | | | | 81,043 | |

| BioMarin Pharmaceutical, Inc. (a) (b) | | | 1,013 | | | | 98,231 | |

| Bluebird Bio, Inc. (a) (b) | | | 432 | | | | 63,072 | |

| Exact Sciences Corp. (a) (b) | | | 1,973 | | | | 155,709 | |

| Illumina, Inc. (a) (b) | | | 266 | | | | 97,638 | |

| Mainstay Medical International PLC (a) - Ireland | | | 21,429 | | | | 378,129 | |

| PolarityTE, Inc. (a) (b) | | | 5,000 | | | | 95,500 | |

| | | | | | | | 969,322 | |

| Chemicals - 0.70% | | | | | | | | |

| Albemarle Corp. (b) | | | 795 | | | | 79,325 | |

| Celanese Corp. - Class A (b) | | | 1,348 | | | | 153,672 | |

| | | | | | | | 232,997 | |

| Commercial Services - 0.90% | | | | | | | | |

| CoStar Group, Inc. (a) (b) | | | 253 | | | | 106,473 | |

| Quanta Services, Inc. (a) (b) | | | 2,253 | | | | 75,205 | |

| Worldpay, Inc. - Class A (a) (b) | | | 1,155 | | | | 116,967 | |

| | | | | | | | 298,645 | |

| Computers - 0.78% | | | | | | | | |

| CyberArk Software Ltd. (a) | | | 983 | | | | 78,483 | |

| Lumentum Holdings, Inc. (a) (b) | | | 1,487 | | | | 89,146 | |

| Nutanix, Inc. - Class A (a) (b) | | | 2,140 | | | | 91,421 | |

| | | | | | | | 259,050 | |

| Distribution & Wholesale - 0.14% | | | | | | | | |

| WW Grainger, Inc. | | | 131 | | | | 46,821 | |

| | | | | | | | | |

| Diversified Financial Services - 0.82% | | | | | | | | |

| Affiliated Managers Group, Inc. | | | 333 | | | | 45,528 | |

| LPL Financial Holdings, Inc. (b) | | | 3,399 | | | | 219,269 | |

| Mastercard, Inc. - Class A (b) | | | 29 | | | | 6,456 | |

| | | | | | | | 271,253 | |

| Electric - 0.18% | | | | | | | | |

| DTE Energy Co. (b) | | | 554 | | | | 60,458 | |

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| COMMON STOCK -32.09% (continued) | | Shares | | | Value | |

| | | | | | | |

| Engineering & Construction - 0.18% | | | | | | | | |

| Dycom Industries, Inc. (a) | | | 714 | | | $ | 60,404 | |

| | | | | | | | | |

| Entertainment - 0.25% | | | | | | | | |

| IMAX Corp. (a) (b) - Canada | | | 3,246 | | | | 83,747 | |

| | | | | | | | | |

| Healthcare - Products - 2.65% | | | | | | | | |

| Align Technology, Inc. (a) (b) | | | 817 | | | | 319,627 | |

| Bio-Techne Corp. (b) | | | 464 | | | | 94,707 | |

| Intuitive Surgical, Inc. (a) (b) | | | 578 | | | | 331,772 | |

| Nevro Corp. (a) (b) | | | 824 | | | | 46,968 | |

| Penumbra, Inc. (a) (b) | | | 554 | | | | 82,934 | |

| | | | | | | | 876,008 | |

| Healthcare - Services - 0.81% | | | | | | | | |

| Molina Healthcare, Inc. (a) (b) | | | 1,594 | | | | 237,028 | |

| Teladoc, Inc. (a) | | | 367 | | | | 31,690 | |

| | | | | | | | 268,718 | |

| Home Builders - 0.37% | | | | | | | | |

| PulteGroup, Inc. | | | 1,921 | | | | 47,583 | |

| Toll Brothers, Inc. (b) | | | 2,260 | | | | 74,648 | |

| | | | | | | | 122,231 | |

| Insurance - 0.94% | | | | | | | | |

| Progressive Corp. (b) | | | 4,376 | | | | 310,871 | |

| | | | | | | | | |

| Internet - 2.30% | | | | | | | | |

| Expedia Group, Inc. (b) | | | 1,727 | | | | 225,339 | |

| Palo Alto Networks, Inc. (a) (b) | | | 1,203 | | | | 270,988 | |

| TripAdvisor, Inc. (a) (b) | | | 2,491 | | | | 127,215 | |

| Twilio, Inc. - Class A (a) (b) | | | 1,593 | | | | 137,444 | |

| | | | | | | | 760,986 | |

| Iron & Steel - 0.10% | | | | | | | | |

| Nucor Corp. | | | 512 | | | | 32,486 | |

| | | | | | | | | |

| Leisure Time - 0.27% | | | | | | | | |

| Norwegian Cruise Line Holdings Ltd. (a) | | | 1,563 | | | | 89,763 | |

| | | | | | | | | |

| Machinery - Construction & Mining - 0.45% | | | | | | | | |

| Caterpillar, Inc. (b) | | | 985 | | | | 150,203 | |

| | | | | | | | | |

| Media - 0.20% | | | | | | | | |

| AMC Networks, Inc. - Class A (a) (b) | | | 995 | | | | 66,008 | |

| | | | | | | | | |

| Metal Fabricate & Hardware - 0.28% | | | | | | | | |

| RBC Bearings, Inc. (a) (b) | | | 623 | | | | 93,674 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 0.26% | | | | | | | | |

| Hexcel Corp. (b) | | | 1,271 | | | | 85,221 | |

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| COMMON STOCK - 32.09% (continued) | | Shares | | | Value | |

| | | | | | | |

| Oil & Gas - 1.43% | | | | | | | | |

| ConocoPhillips (b) | | | 2,388 | | | $ | 184,831 | |

| EOG Resources, Inc. (b) | | | 1,458 | | | | 185,997 | |

| Whiting Petroleum Corp. (a) (b) | | | 1,956 | | | | 103,746 | |

| | | | | | | | 474,574 | |

| Packaging & Containers - 0.22% | | | | | | | | |

| Berry Global Group, Inc. (a) (b) | | | 1,515 | | | | 73,311 | |

| | | | | | | | | |

| Pharmaceuticals - 0.66% | | | | | | | | |

| Neurocrine Biosciences, Inc. (a) (b) | | | 1,776 | | | | 218,359 | |

| | | | | | | | | |

| Pipelines - 0.41% | | | | | | | | |

| Cheniere Energy, Inc. (a) (b) | | | 1,944 | | | | 135,089 | |

| | | | | | | | | |

| REITS - 0.98% | | | | | | | | |

| CyrusOne, Inc. (b) | | | 1,263 | | | | 80,074 | |

| Prologis, Inc. (b) | | | 3,599 | | | | 243,976 | |

| | | | | | | | 324,050 | |

| Retail - 0.57% | | | | | | | | |

| Five Below, Inc. (a) (b) | | | 892 | | | | 116,013 | |

| Ulta Beauty, Inc. (a) (b) | | | 253 | | | | 71,376 | |

| | | | | | | | 187,389 | |

| Semiconductors - 2.64% | | | | | | | | |

| Integrated Device Technology, Inc. (b) | | | 2,531 | | | | 118,982 | |

| Maxim Integrated Products, Inc. (b) | | | 5,864 | | | | 330,671 | |

| Micron Technology, Inc. (a) (b) | | | 4,898 | | | | 221,537 | |

| Monolithic Power Systems, Inc. (b) | | | 781 | | | | 98,039 | |

| Qorvo, Inc. (a) (b) | | | 1,348 | | | | 103,648 | |

| | | | | | | | 872,877 | |

| Software - 2.69% | | | | | | | | |

| Adobe Systems, Inc. (a) (b) | | | 832 | | | | 224,598 | |

| Atlassian Corp. PLC - Class A (a) - Australia | | | 2,102 | | | | 202,086 | |

| Splunk, Inc. (a) (b) | | | 1,274 | | | | 154,039 | |

| Tableau Software, Inc. - Class A (a) (b) | | | 944 | | | | 105,483 | |

| Take-Two Interactive Software, Inc. (a) (b) | | | 589 | | | | 81,276 | |

| Ultimate Software Group, Inc. (a) (b) | | | 380 | | | | 122,432 | |

| | | | | | | | 889,914 | |

| Telecommunications - 0.46% | | | | | | | | |

| CenturyLink, Inc. (b) | | | 4,588 | | | | 97,266 | |

| LogMeIn, Inc. | | | 626 | | | | 55,777 | |

| | | | | | | | 153,043 | |

| Textiles - 0.14% | | | | | | | | |

| Mohawk Industries, Inc. (a) | | | 253 | | | | 44,364 | |

| | | | | | | | | |

| Transportation - 1.17% | | | | | | | | |

| CSX Corp. | | | 2,340 | | | | 173,277 | |

| JB Hunt Transport Services, Inc. | | | 771 | | | | 91,703 | |

| XPO Logistics, Inc. (a) (b) | | | 1,076 | | | | 122,847 | |

| | | | | | | | 387,827 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $10,116,740) | | | | | | | 10,623,821 | |

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| CLOSED-END FUND - 0.00% | | Shares | | | Value | |

| | | | | | | |

| Royce Value Trust, Inc. | | | 52 | | | $ | 850 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUND (Cost $816) | | | | | | | 850 | |

| | | | | | | | | |

| HEDGE FUND - 12.02% | | | | | | | | |

| ACA Master Select Fund LP (a) (e) | | | 36,932 | | | | 3,981,142 | |

| | | | | | | | | |

| TOTAL HEDGE FUND (Cost $3,771,057) | | | | | | | 3,981,142 | |

| | | | | | | | | |

| MUTUAL FUNDS - 52.83% | | | | | | | | |

| | | | | | | | | |

| Asset Allocation Funds - 12.88% | | | | | | | | |

| Crow Point Alternative Income Fund - Investor Class (c) | | | 492,449 | | | | 4,156,271 | |

| Wells Fargo Utility and Telecommunications Fund - Class A | | | 4,921 | | | | 106,545 | |

| | | | | | | | 4,262,816 | |

| Debt Fund - 6.85% | | | | | | | | |

| Eagle Rock Floating Rate Fund - Institutional Class (a) (c) | | | 225,125 | | | | 2,267,010 | |

| | | | | | | | | |

| Equity Fund - 33.10% | | | | | | | | |

| Crow Point Growth Fund - Institutional Class (a) (c) | | | 703,680 | | | | 6,938,283 | |

| LS Opportunity Fund | | | 69,528 | | | | 1,003,290 | |

| RVX Emerging Markets Equity Fund - Institutional Class (a) (c) | | | 330,915 | | | | 3,017,945 | |

| | | | | | | | 10,959,518 | |

| | | | | | | | | |

| TOTAL MUTUAL FUNDS (Cost $16,778,915) | | | | | | | 17,489,344 | |

| ASSET BACKED SECURITIES - 0.09% | | Principal Amount | | | Value | |

| | | | | | | |

| Commercial MBS - 0.08% | | | | | | | | |

| Morgan Stanley Capital I Trust 2006-IQ11, 6.367%, due 10/15/2042 (b) (d) | | $ | 27,261 | | | $ | 27,197 | |

| | | | | | | | | |

| Home Equity ABS - 0.01% | | | | | | | | |

| RASC Series 2003-KS4 Trust, 3.87%, due 05/25/2033 (b) | | | 1,625 | | | | 1,636 | |

| | | | | | | | | |

| TOTAL ASSET BACKED SECURITIES (Cost $29,466) | | | | | | | 28,833 | |

| | | | | | | | | |

| CORPORATE BOND - 0.82% | | | | | | | | |

| Frontier Communications Corp., 10.500%, due 09/15/2022 (b) | | | 300,000 | | | | 272,700 | |

| | | | | | | | | |

| TOTAL CORPORATE BOND (Cost $272,700) | | | | | | | 272,700 | |

OPTIONS PURCHASED - 2.27%

| CALL OPTIONS PURCHASED - 2.26% | | | | | Notional | | | Exercise | | | | | | | |

| | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| Amarin Corp. PLC | | | 300 | | | $ | 120,000 | | | $ | 4.00 | | | | 12/21/2018 | | | | 369,000 | |

| Amarin Corp. PLC | | | 300 | | | $ | 120,000 | | | $ | 4.00 | | | | 1/18/2019 | | | | 349,500 | |

| CVS Health Corp. | | | 50 | | | $ | 387,500 | | | $ | 77.50 | | | | 11/16/2018 | | | | 17,500 | |

| Tesla, Inc. | | | 12 | | | $ | 342,000 | | | $ | 285.00 | | | | 10/19/2018 | | | | 11,148 | |

| TOTAL CALL OPTIONS PURCHASED (Cost $111,048) | | | | | | | | | | | | | | | | | | | 747,148 | |

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

OPTIONS PURCHASED - 2.27% (continued)

| PUT OPTIONS PURCHASED - 0.01% | | | | | Notional | | | Exercise | | | | | | | |

| | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| Amarin Corp. PLC | | | 300 | | | $ | 90,000 | | | $ | 3.00 | | | | 10/19/2018 | | | $ | 600 | |

| Amarin Corp. PLC | | | 300 | | | $ | 90,000 | | | $ | 3.00 | | | | 12/21/2018 | | | | 900 | |

| Amarin Corp. PLC | | | 300 | | | $ | 90,000 | | | $ | 3.00 | | | | 1/18/2019 | | | | 1,200 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $110,682) | | | | | | | | | | | | | | | | | | | 2,700 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $221,730) | | | | | | | | | | | | | | | | | | | 749,848 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS (Cost $31,191,424) – 100.12% | | | | | | | | | | | | | | | | | | | 33,146,538 | |

| | | | | | | | | | | | | | | | | | | | | |

| SECURITIES SOLD SHORT (Proceeds $9,354,426) - (28.27%) | | | | | | | | | | | | | | | | | | | (9,359,404 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $3,800) - (0.02%) | | | | | | | | | | | | | | | | | | | (6,400 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 28.17% | | | | | | | | | | | | | | | | | | | 9,327,240 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS - 100% | | | | | | | | | | | | | | | | | | $ | 33,107,974 | |

(a) Non-income producing security.

(b) All or a portion of the security is segregated as collateral for call options written and securities sold short.

(c) Affiliated investment company.

(d) Variable rate security - Interest rate shown represents the rate on September 30, 2018.

(e) Private equity fund purchased on March 1, 2016 that invests in the DCM Multi-Manager Fund, LLC (Series A) and the DCM Multi-Manager Fund, LLC (Series D). Redemptions may be made monthly upon 30 days written notice. There were no unfunded commitments as of September 30, 2018. This investment is valued using the practical expedient. For more information on the practical expedient, please refer to the security valuation section on Note 3 of the accompanying notes to the financial statements.

1 Each option contract is equivalent to 100 shares of the underlying common stock. All options are non-income producing.

LP - Limited Partnership

PLC - Public Limited Company

The accompanying notes are an integral part of these financial statements.

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS - SECURITIES SOLD SHORT | |

| September 30, 2018 | ANNUAL REPORT |

SECURITIES SOLD SHORT - (28.27)%

| COMMON STOCK - (5.45)% | | Shares | | | Value | |

| | | | | | | |

| Auto Manufacturers - (1.44)% | | | | | | | | |

| Tesla, Inc. (a) | | | 1,800 | | | $ | 476,586 | |

| | | | | | | | | |

| Auto Parts & Equipment - (0.26)% | | | | | | | | |

| BorgWarner, Inc. | | | 2,044 | | | | 87,442 | |

| | | | | | | | | |

| Commercial Services - (0.09)% | | | | | | | | |

| Laureate Education, Inc. - Class A (a) | | | 1,937 | | | | 29,907 | |

| | | | | | | | | |

| Diversified Financial Services - (0.77)% | | | | | | | | |

| American Express Co. | | | 548 | | | | 58,356 | |

| Legg Mason, Inc. | | | 4,698 | | | | 146,719 | |

| Navient Corp. | | | 3,778 | | | | 50,927 | |

| | | | | | | | 256,002 | |

| Electronics - (0.31)% | | | | | | | | |

| Agilent Technologies, Inc. | | | 1,447 | | | | 102,071 | |

| | | | | | | | | |

| Forest Products & Paper - (0.55)% | | | | | | | | |

| International Paper Co. | | | 3,703 | | | | 182,003 | |

| | | | | | | | | |

| Internet - (0.57)% | | | | | | | | |

| SINA Corp. - China (a) | | | 2,693 | | | | 187,110 | |

| | | | | | | | | |

| Media - (0.23)% | | | | | | | | |

| Houghton Mifflin Harcourt Co. (a) | | | 11,035 | | | | 77,245 | |

| | | | | | | | | |

| Pharmaceuticals - (0.61)% | | | | | | | | |

| CVS Health Corp. | | | 2,560 | | | | 201,523 | |

| | | | | | | | | |

| Retail - (0.62)% | | | | | | | | |

| Barnes & Noble Education, Inc. (a) | | | 6,627 | | | | 38,172 | |

| McDonald’s Corp. | | | 1,000 | | | | 167,290 | |

| | | | | | | | 205,462 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Proceeds $1,907,199) | | | | | | | 1,805,351 | |

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS - SECURITIES SOLD SHORT | |

| September 30, 2018 | ANNUAL REPORT |

SECURITIES SOLD SHORT - (28.27)% (continued)

| EXCHANGE TRADED FUNDS - (22.82)% | | Shares | | | Value | |

| | | | | | | |

| Equity Fund - (22.82)% | | | | | | | | |

| iShares MSCI Emerging Markets ETF | | | 15,000 | | | $ | 643,800 | |

| iShares MSCI India ETF | | | 1,721 | | | | 55,881 | |

| iShares MSCI Italy ETF | | | 1,000 | | | | 27,660 | |

| iShares MSCI Mexico ETF | | | 2,000 | | | | 102,460 | |

| iShares Russell 2000 Growth ETF | | | 10,904 | | | | 2,345,232 | |

| iShares Russell Mid-Cap Growth ETF | | | 13,000 | | | | 1,762,540 | |

| SPDR S&P 500 ETF Trust | | | 9,000 | | | | 2,616,480 | |

| | | | | | | | 7,554,053 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS (Proceeds $7,447,227) | | | | | | | 7,554,053 | |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT (Proceeds $9,354,426) | | | | | | $ | 9,359,404 | |

(a) Non-income producing security.

ETF - Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

| EAS CROW POINT ALTERNATIVES FUND | |

| SCHEDULE OF INVESTMENTS - WRITTEN OPTIONS | |

| September 30, 2018 | ANNUAL REPORT |

OPTIONS WRITTEN - (0.02)%

| CALL OPTIONS WRITTEN - (0.02)% | | Contracts 1 | | | Notional

Amount | | | Exercise

Price | | | Expiration | | | Value | |

| | | | | | | | | | | | | | | | |

| CVS Health Corp. | | | 50 | | | $ | 412,500 | | | $ | 82.50 | | | | 11/16/2018 | | | $ | 6,400 | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $3,800) | | | | | | | | | | | | | | | | | | | 6,400 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $3,800) | | | | | | | | | | | | | | | | | | $ | 6,400 | |

1 Each option contract is equivalent to 100 shares of the underlying common stock. All options are non-income producing.

The accompanying notes are an integral part of these financial statements.

| CROW POINT GLOBAL TACTICAL ALLOCATION FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| COMMON STOCK - 5.30% | | Shares | | | Fair Value | |

| | | | | | | |

| Biotechnology - 2.13% | | | | | | | | |

| Alnylam Pharmaceuticals, Inc. (a) | | | 750 | | | $ | 65,640 | |

| Exact Sciences Corp. (a) | | | 2,100 | | | | 165,732 | |

| HTG Molecular Diagnostics, Inc. (a) | | | 20,000 | | | | 101,000 | |

| PolarityTE, Inc. (a) | | | 2,800 | | | | 53,480 | |

| | | | | | | | 385,852 | |

| Computers - 0.33% | | | | | | | | |

| Lumentum Holdings, Inc. (a) | | | 1,000 | | | | 59,950 | |

| | | | | | | | | |

| Healthcare - Products - 1.16% | | | | | | | | |

| CytoSorbents Corp. (a) | | | 6,000 | | | | 77,400 | |

| Novocure Ltd. (a) | | | 2,550 | | | | 133,620 | |

| | | | | | | | 211,020 | |

| Internet - 0.44% | | | | | | | | |

| RingCentral, Inc. - Class A (a) | | | 850 | | | | 79,092 | |

| | | | | | | | | |

| Semiconductors - 0.25% | | | | | | | | |

| Qorvo, Inc. (a) | | | 600 | | | | 46,134 | |

| | | | | | | | | |

| Software - 0.99% | | | | | | | | |

| New Relic, Inc. (a) | | | 850 | | | | 80,095 | |

| Rapid7, Inc. (a) | | | 2,700 | | | | 99,684 | |

| | | | | | | | 179,779 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $689,718) | | | | | | | 961,827 | |

| | | | | | | | | |

| CLOSED-END FUNDS - 4.24% | | | | | | | | |

| Eaton Vance Limited Duration Income Fund | | | 30,570 | | | | 387,628 | |

| MFS Multimarket Income Trust | | | 69,300 | | | | 383,229 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS (Cost $840,452) | | | | | | | 770,857 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS - 59.79% | | | | | | | | |

| | | | | | | | | |

| Debt Funds - 3.12% | | | | | | | | |

| iShares Floating Rate Bond ETF (b) | | | 11,100 | | | | 566,322 | |

| | | | | | | | | |

| Equity Funds - 56.67% | | | | | | | | |

| Consumer Discretionary Select Sector SPDR Fund | | | 9,530 | | | | 1,117,107 | |

| Financial Select Sector SPDR Fund | | | 30,000 | | | | 827,400 | |

| Industrial Select Sector SPDR Fund | | | 10,408 | | | | 815,987 | |

| iShares China Large-Cap ETF | | | 12,000 | | | | 513,840 | |

| iShares Core S&P Small-Cap ETF (b) | | | 8,000 | | | | 697,920 | |

| iShares MSCI ACWI ETF | | | 6,800 | | | | 504,968 | |

| iShares MSCI Brazil ETF | | | 5,500 | | | | 185,515 | |

| iShares MSCI Emerging Markets ETF | | | 30,000 | | | | 1,287,600 | |

| iShares Russell 3000 ETF | | | 5,000 | | | | 861,500 | |

| SPDR S&P 500 ETF Trust (b) | | | 5,700 | | | | 1,657,104 | |

| Technology Select Sector SPDR Fund | | | 15,400 | | | | 1,160,082 | |

| Vanguard Total Stock Market ETF (b) | | | 4,430 | | | | 662,950 | |

| | | | | | | | 10,291,973 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $10,226,713) | | | | | | | 10,858,295 | |

| | | | | | | | | |

| MUTUAL FUNDS - 9.24% | | | | | | | | |

| | | | | | | | | |

| Debt Fund - 5.55% | | | | | | | | |

| Eagle Rock Floating Rate Fund - Institutional Class (a) (d) | | | 100,000 | | | | 1,007,000 | |

| CROW POINT GLOBAL TACTICAL ALLOCATION FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| MUTUAL FUNDS - 9.24% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Equity Fund - 3.69% | | | | | | | | |

| RVX Emerging Markets Equity Fund - Institutional Class (a) (d) | | | 73,539 | | | $ | 670,676 | |

| | | | | | | | | |

| TOTAL MUTUAL FUNDS (Cost $1,734,783) | | | | | | | 1,677,676 | |

| ASSET BACKED SECURITIES - 0.10% | | Principal Amount | | | Fair Value | |

| | | | | | | |

| Commercial MBS - 0.04% | | | | | | | | |

| Banc of America Funding 2006-2 Trust, 5.750%, due 03/25/2036 (b) | | $ | 3,324 | | | $ | 3,211 | |

| WaMu Mortgage Pass-Through Certificates Series 2003-S12 Trust, 4.750%, due 11/25/2018 (b) | | | 418 | | | | 417 | |

| Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-7 Trust, 4.400%, 09/25/2036 (b) (e) | | | 8,565 | | | | 4,148 | |

| | | | | | | | 7,776 | |

| Home Equity ABS - 0.03% | | | | | | | | |

| Countrywide Asset-Backed Certificates, 5.216%, due 10/25/2017 (b) (e) | | | 2,484 | | | | 2,516 | |

| RASC Series 2003-KS4 Trust, 3.870%, due 06/25/2033 (b) | | | 2,031 | | | | 2,045 | |

| | | | | | | | 4,561 | |

| Other ABS - 0.03% | | | | | | | | |

| Equity One Mortgage Pass-Through Trust 2003-4, 5.869%, 10/25/2034 (b) (e) | | | 5,950 | | | | 5,877 | |

| | | | | | | | | |

| TOTAL ASSET BACKED SECURITIES (Cost $17,491) | | | | | | | 18,214 | |

OPTIONS PURCHASED - 0.27%

| PUT OPTIONS PURCHASED - 0.27% | | | | | Notional | | | Exercise | | | | | | | |

| | | Contracts 1 | | | Amount | | | Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| Financial Select Sector SPDR Fund | | | 300 | | | $ | 870,000 | | | $ | 29.00 | | | | 10/19/2018 | | | | 43,200 | |

| iShares MSCI Emerging Markets ETF | | | 120 | | | $ | 420,000 | | | $ | 35.00 | | | | 10/19/2018 | | | | 120 | |

| SPDR S&P 500 ETF Trust | | | 57 | | | $ | 1,618,800 | | | $ | 284.00 | | | | 10/19/2018 | | | | 5,700 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $52,611) | | | | | | | | | | | | | | | | | | | 49,020 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $52,611) | | | | | | | | | | | | | | | | | | | 49,020 | |

| | | | | | | | | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 17.07% | | | | | | | | | | | | | | | | | | | | |

| Federated Government Obligations Fund - Institutional Class, 1.89% (c) | | | | | | | | | | | | | | | 3,099,946 | | | | 3,099,946 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $3,099,946) | | | | | | | | | | | | | | | | | | | 3,099,946 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS (Cost $16,661,714) – 96.01% | | | | | | | | | | | | | | | | | | $ | 17,435,835 | |

| | | | | | | | | | | | | | | | | | | | | |

| SECURITIES SOLD SHORT (Proceeds $609,673) - (3.23%) | | | | | | | | | | | | | | | | | | | (585,974 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $50,389) - (0.18%) | | | | | | | | | | | | | | | | | | | (33,339 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 7.40% | | | | | | | | | | | | | | | | | | | 1,344,388 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS - 100% | | | | | | | | | | | | | | | | | | $ | 18,160,910 | |

(a) Non-income producing security.

(b) All or a portion of the security is segregated as collateral for options written and securities sold short.

(c) Rate shown represents the 7-day effective yield at September 30, 2018, is subject to change and resets daily.

(d) Affiliated investment company.

(e) Variable coupon security - Interest rate shown represents the rate on September 30, 2018.

1 Each option contract is equivalent to 100 shares of the underlying ETF. All options are non-income producing.

ETF - Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

| CROW POINT GLOBAL TACTICAL ALLOCATION FUND | |

| SCHEDULE OF INVESTMENTS - SECURITIES SOLD SHORT | |

| September 30, 2018 | ANNUAL REPORT |

SECURITIES SOLD SHORT - (3.23)%

| COMMON STOCK - (1.75)% | | Shares | | | Fair Value | |

| | | | | | | |

| Auto Manufacturers - (1.75)% | | | | | | | | |

| Tesla, Inc. (a) | | | 1,200 | | | $ | 317,724 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Proceeds $353,629) | | | | | | | 317,724 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS - (1.48)% | | | | | | | | |

| | | | | | | | | |

| Equity Fund - (1.48)% | | | | | | | | |

| iShares MSCI South Africa ETF | | | 5,000 | | | | 268,250 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS (Proceeds $256,044) | | | | | | | 268,250 | |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT (Proceeds $609,673) | | | | | | $ | 585,974 | |

(a) Non-income producing security.

ETF - Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

| CROW POINT GLOBAL TACTICAL ALLOCATION FUND | |

| SCHEDULE OF INVESTMENTS - WRITTEN OPTIONS | |

| September 30, 2018 | ANNUAL REPORT |

OPTIONS WRITTEN - (0.18)%

| CALL OPTIONS WRITTEN - (0.13)% | | Contracts 1 | | | Notional

Amount | | | Exercise

Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| iShares MSCI Brazil ETF | | | 55 | | | $ | 192,500 | | | $ | 35.00 | | | | 10/19/2018 | | | $ | 4,840 | |

| SPDR S&P 500 ETF Trust | | | 57 | | | $ | 1,653,000 | | | $ | 290.00 | | | | 10/19/2018 | | | | 18,240 | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $18,603) | | | | | | | | | | | | | | | | | | | 23,080 | |

| PUT OPTIONS WRITTEN - (0.05%) | | Contracts 1 | | | Notional

Amount | | | Exercise

Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| iShares MSCI Brazil ETF | | | 55 | | | $ | 225,500 | | | $ | 41.00 | | | | 10/19/2018 | | | | 4,730 | |

| iShares MSCI Emerging Markets ETF | | | 120 | | | $ | 390,000 | | | $ | 32.50 | | | | 10/19/2018 | | | | 2,280 | |

| SPDR S&P 500 ETF Trust | | | 57 | | | $ | 1,596,000 | | | $ | 280.00 | | | | 10/19/2018 | | | | 3,249 | |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $31,786) | | | | | | | | | | | | | | | | | | | 10,259 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $50,389) | | | | | | | | | | | | | | | | | | $ | 33,339 | |

1 Each option contract is equivalent to 100 shares of the underlying ETF. All options are non-income producing.

ETF - Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

| CROW POINT ALTERNATIVE INCOME FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

PREFERRED STOCK - 0.60%

| Banks - 0.49% | | | | | | |

| Bank of America Corp., 6.20% | | | 1,900 | | | $ | 49,210 | |

| | | | | | | | | |

| Diversified Financial Services - 0.11% | | | | | | | | |

| Legg Mason, Inc., 6.375% | | | 400 | | | | 10,348 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost $60,843) | | | | | | | 59,558 | |

| | | | | | | | | |

| CLOSED-END FUNDS - 7.05% | | | | | | | | |

| | | | | | | | | |

| Eaton Vance Limited Duration Income Fund | | | 35,475 | | | | 449,823 | |

| MFS Multimarket Income Trust | | | 45,969 | | | | 254,209 | |

| | | | | | | | 704,032 | |

| | | | | | | | | |

| TOTAL CLOSED END FUNDS (Cost $771,177) | | | | | | | 704,032 | |

| | | | | | | | | |

| MUTUAL FUNDS - 5.05% | | | | | | | | |

| | | | | | | | | |

| Debt Fund - 5.05% | | | | | | | | |

| Eagle Rock Floating Rate Fund - Institutional Class (a) (c) | | | 50,000 | | | | 503,500 | |

| | | | | | | | | |

| TOTAL MUTUAL FUNDS (Cost $500,000) | | | | | | | 503,500 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS - 58.02% | | | | | | | | |

| | | | | | | | | |

| Asset Allocation Fund - 2.70% | | | | | | | | |

| SPDR Barclays Convertible Securities ETF | | | 5,000 | | | | 269,700 | |

| | | | | | | | | |

| Debt Funds - 36.98% | | | | | | | | |

| iShares 20+ Year Treasury Bond ETF | | | 6,000 | | | | 703,620 | |

| iShares Core U.S. Aggregate Bond ETF | | | 15,000 | | | | 1,582,800 | |

| Invesco Senior Loan ETF | | | 21,000 | | | | 486,570 | |

| SPDR Bloomberg Barclays High Yield Bond ETF | | | 14,000 | | | | 504,700 | |

| SPDR Bloomberg Barclays Short Term High Yield Bond ETF | | | 15,000 | | | | 413,850 | |

| | | | | | | | 3,691,540 | |

| Equity Funds - 18.34% | | | | | | | | |

| Consumer Discretionary Select Sector SPDR Fund | | | 1,500 | | | | 175,830 | |

| Financial Select Sector SPDR Fund | | | 7,800 | | | | 215,124 | |

| Industrial Select Sector SPDR Fund | | | 2,000 | | | | 156,800 | |

| SPDR S&P 500 ETF Trust | | | 4,000 | | | | 1,162,880 | |

| Technology Select Sector SPDR Fund | | | 1,600 | | | | 120,527 | |

| | | | | | | | 1,831,161 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $5,772,875) | | | | | | | 5,792,401 | |

| CROW POINT ALTERNATIVE INCOME FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| BONDS & NOTES - 7.47% | | Principal Amount | | | Fair Value | |

| | | | | | | |

| Asset Backed Securities - 5.91% | | | | | | | | |

| Ameriquest Mortgage Securities, Inc. Asset-Backed Pass-Through Certificates Series 2003-11, 5.066%, due 12/25/2033 (d) | | $ | 2,514 | | | $ | 2,599 | |

| Countrywide Asset-Backed Certificates, 4.554%, due 10/25/2017 (d) | | | 7,451 | | | | 7,548 | |

| Equity One Mortgage Pass-Through Trust 2003-4, 4.509%, due 10/25/2034 (e) | | | 17,851 | | | | 17,632 | |

| Fremont Home Loan Trust 2005-B, 1 mo. LIBOR plus 0.71%, 2.921%, due 04/25/2035 (d) | | | 57,575 | | | | 57,738 | |

| GE Capital Mortgage Services, Inc. 1999-HE1 Trust, 6.265%, due 04/25/2029 | | | 1,283 | | | | 1,302 | |

| Option One Mortgage Loan Trust 2005-1, 1 mo. LIBOR plus 0.80%, 3.016%, due 02/25/2035 (e) | | | 3,206 | | | | 3,205 | |

| RAMP Series 2005-RS1 Trust, 4.713%, due 11/25/2034 | | | 2,824 | | | | 2,825 | |

| | | | | | | | | |

| RASC Series 2003-KS4 Trust, 3.870%, due 05/25/2033 (d) | | | 6,093 | | | | 6,134 | |

| | | | | | | | | |

| RASC Series 2004-KS2 Trust, 4.300%, due 03/25/2034 (d) | | | 1,869 | | | | 1,869 | |

| | | | | | | | | |

| Structured Asset Securities Corp. Mortgage Loan Trust 2006-AM1, 1 mo. LIBOR plus 0.34%, 2.376%, due 04/25/2036 (d) | | | 89,399 | | | | 89,143 | |

| | | | | | | | | |

| Structured Asset Securities Corp. Mortgage Loan Trust 2006-WF1, 1 mo. LIBOR plus 0.16%, 2.556%, due 02/25/2036 (d) | | | 399,874 | | | | 400,057 | |

| | | | | | | | 590,052 | |

| Mortgage Backed Securities - 1.56% | | | | | | | | |

| Adjustable Rate Mortgage Trust 2005-5, 1 mo. LIBOR plus 0.28%, 2.625%, due 09/25/2035 (d) | | | 25,680 | | | | 25,540 | |

| Banc of America Funding 2006-2 Trust, 5.750%, due 03/25/2036 | | | 9,971 | | | | 9,633 | |

| JP Morgan Chase Commercial Mortgage Securities Trust 2012-CIBX, 3.139%, due 06/15/2045 | | | 107,186 | | | | 107,155 | |

| WaMu Mortgage Pass-Through Certificates Series 2003-S12 Trust, 4.750%, due 11/25/2018 | | | 1,253 | | | | 1,251 | |

| | | | | | | | | |

| Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-7 Trust, 4.400%, due 09/25/2036 (d) | | | 25,696 | | | | 12,445 | |

| | | | | | | | 156,024 | |

| | | | | | | | | |

| TOTAL BONDS & NOTES (Cost $693,307) | | | | | | | 746,076 | |

| PRIVATE INVESTMENT - 3.66% | | Shares | | | Fair Value | |

| | | | | | | |

| Finance - 3.66% | | | | | | | | |

| Vemo Education, Inc. (a) (e) | | | 2,250,000 | | | | 365,826 | |

| | | | | | | | | |

| TOTAL PRIVATE INVESTMENT (Cost $300,000) | | | | | | | 365,826 | |

OPTIONS PURCHASED - 0.13%

| PUT OPTIONS PURCHASED - 0.13% | | Contracts 1 | | | Notional

Amount | | | Exercise

Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| Financial Select Sector SPDR Fund | | | 78 | | | $ | 226,200 | | | $ | 29.00 | | | | 10/19/2018 | | | | 11,232 | |

| iShares MSCI Emerging Markets ETF | | | 25 | | | $ | 87,500 | | | $ | 35.00 | | | | 10/19/2018 | | | | 25 | |

| SPDR S&P 500 ETF Trust | | | 15 | | | $ | 426,000 | | | $ | 284.00 | | | | 10/19/2018 | | | | 1,500 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $15,296) | | | | | | | | | | | | | | | | | | | 12,757 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $15,296) | | | | | | | | | | | | | | | | | | | 12,757 | |

| CROW POINT ALTERNATIVE INCOME FUND | |

| SCHEDULE OF INVESTMENTS | |

| September 30, 2018 | ANNUAL REPORT |

| SHORT-TERM INVESTMENT - 7.66% | | Shares | | | Fair Value | |

| | | | | | | |

| Federated Government Obligations Fund - Institutional Class, 1.89% (b) | | | 764,051 | | | $ | 764,051 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENT (Cost $764,051) | | | | | | | 764,051 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $8,877,549) - 89.64% | | | | | | | 8,948,201 | |

| | | | | | | | | |

| SECURITIES SOLD SHORT (Proceeds $88,410) - (0.80%) | | | | | | | (79,431 | ) |

| | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $11,240) - (0.06%) | | | | | | | (6,250 | ) |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 11.22% | | | | | | | 1,120,235 | |

| | | | | | | | | |

| NET ASSETS - 100% | | | | | | $ | 9,982,755 | |

(a) Non-income producing security.

(b) Rate shown represents the 7-day effective yield at September 30, 2018, is subject to change and resets daily.

(c) Affiliated investment company.

(d) Variable or step coupon security - Interest rate shown represents the rate on September 30, 2018.

(e) The value has been determined under the policies of the Board of Trustees. The value of such securities is $365,826 or 3.66% of net assets.

1 Each option contract is equivalent to 100 shares of the underlying ETF. All options are non-income producing.

ETF - Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

| CROW POINT ALTERNATIVE INCOME FUND | |

| SCHEDULE OF INVESTMENTS - SECURITIES SOLD SHORT | |

| September 30, 2018 | ANNUAL REPORT |

SECURITIES SOLD SHORT - (0.80)%

| COMMON STOCK - (0.80)% | | Shares | | | Fair Value | |

| | | | | | | |

| Auto Manufacturers - (0.80)% | | | | | | | | |

| Tesla, Inc. (a) | | | 300 | | | $ | 79,431 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Proceeds $88,410) | | | | | | $ | 79,431 | |

(a) Non-income producing security.

The accompanying notes are an integral part of these financial statements.

| CROW POINT ALTERNATIVE INCOME FUND | |

| SCHEDULE OF INVESTMENTS - WRITTEN OPTIONS | |

| September 30, 2018 | ANNUAL REPORT |

OPTIONS WRITTEN - (0.06)%

| CALL OPTIONS WRITTEN - (0.05)% | | Contracts 1 | | | Notional

Amount | | | Exercise

Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| SPDR S&P 500 ETF Trust | | | 10 | | | $ | 292,000 | | | $ | 292.00 | | | | 10/1/2018 | | | $ | 120 | |

| SPDR S&P 500 ETF Trust | | | 15 | | | $ | 435,000 | | | $ | 290.00 | | | | 10/19/2018 | | | | 4,800 | |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $7,565) | | | | | | | | | | | | | | | | | | | 4,920 | |

| PUT OPTIONS WRITTEN - (0.01%) | | Contracts 1 | | | Notional Amount | | | Exercise

Price | | | Expiration | | | Fair Value | |

| | | | | | | | | | | | | | | | |

| iShares MSCI Emerging Markets ETF | | | 25 | | | $ | 102,500 | | | $ | 41.00 | | | | 10/19/2018 | | | $ | 475 | |

| SPDR S&P 500 ETF Trust | | | 15 | | | $ | 420,000 | | | $ | 280.00 | | | | 10/19/2018 | | | | 855 | |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $3,675) | | | | | | | | | | | | | | | | | | | 1,330 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $11,240) | | | | | | | | | | | | | | | | | | $ | 6,250 | |

1 Each option contract is equivalent to 100 shares of the underlying ETF. All options are non-income producing.

ETF - Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

| EAS CROW POINT ALTERNATIVES FUND | |

| STATEMENT OF ASSETS AND LIABILITIES | |

| | |

| September 30, 2018 | ANNUAL REPORT |

| Assets: | | | |

| Investment securities: | | | | |

| Unaffiliated Securities at Cost | | $ | 15,472,509 | |

| Affiliated Securities at Cost | | | 15,718,915 | |

| Total Securities at Cost | | | 31,191,424 | |

| Unaffiliated Securities at Value | | | 16,767,029 | |

| Affiliated Securities at Value | | | 16,379,509 | |

| Deposits at broker | | | 8,788,462 | |

| Due from adviser | | | 14,876 | |

| Receivables: | | | | |

| Interest | | | 3,175 | |

| Dividends | | | 4,132 | |

| Tax reclaims | | | 8,613 | |

| Investment securities sold | | | 543,074 | |

| Fund shares sold | | | 67 | |

| Prepaid expenses and other assets | | | 62,492 | |

| Total assets | | | 42,571,429 | |

| | | | | |

| Liabilities: | | | | |

| Securities sold short and options written: | | | | |

| Proceeds from securities sold short | | | 9,354,426 | |

| Proceeds from options written | | | 3,800 | |

| Total proceeds from securities sold short and options written | | | 9,358,226 | |

| Securities sold short at value | | | 9,359,404 | |

| Options written at value | | | 6,400 | |

| Total securities sold short and options written at value | | | 9,365,804 | |

| Payables: | | | | |

| Dividend expense from securities sold short | | | 16,803 | |

| Accrued distribution (12b-1) fees | | | 2,005 | |

| Due to administrator | | | 13,998 | |

| Cash overdraft due to custodian | | | 60,470 | |

| Accrued expenses | | | 4,375 | |

| Total liabilities | | | 9,463,455 | |

| Net Assets | | $ | 33,107,974 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in capital | | $ | 32,173,899 | |

| Total distributable earnings | | | 934,075 | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 34,042,049 | |

| | | | | |

| Class A Shares: | | | | |

| Net assets | | $ | 2,056,030 | |

| Shares Outstanding ($0 par value, Unlimited shares of beneficial interest authorized) | | | 207,303 | |

| Net Asset Value Per Share | | $ | 9.92 | |

| | | | | |

| Maximum Offering Price Per Share (a) | | $ | 10.50 | |

| Minimum Redemption Price Per Share (b) | | $ | 9.82 | |

| | | | | |

| Class C Shares: | | | | |

| Net assets | | $ | 891,655 | |

| Shares Outstanding ($0 par value, Unlimited shares of beneficial interest authorized) | | | 93,004 | |

| Net Asset Value and Offering Price Per Share | | $ | 9.59 | |

| | | | | |

| Minimum Redemption Price Per Share (c) | | $ | 9.49 | |

| | | | | |

| Class I Shares: | | | | |

| Net assets | | $ | 30,160,289 | |

| Shares Outstanding ($0 par value, Unlimited shares of beneficial interest authorized) | | | 3,014,737 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 10.00 | |

| (a) A maximum sales charge of 5.50% is imposed on Class A shares. |