| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL FOCUSED VALUE FUND | | | |

| | | Shares | | | Fair Value | |

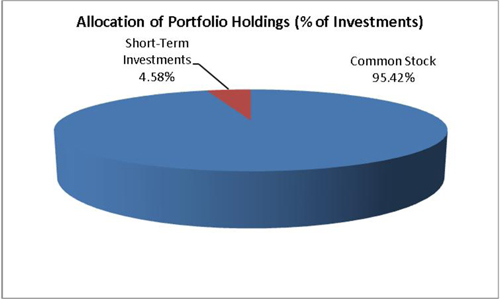

| COMMON STOCK - 95.92% | | | | | | |

| | | | | | | |

| Aerospace & Defense - (3.82%) | | | | | | |

| General Dynamics Corp. | | | 125 | | | $ | 10,406 | |

| | | | | | | | | |

| Banks - (8.22%) | | | | | | | | |

| JPMorgan Chase & Co. | | | 325 | | | | 16,422 | |

| KeyCorp | | | 510 | | | | 5,952 | |

| | | | | | | | 22,374 | |

| Electronics - (6.47%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 175 | | | | 8,162 | |

| Avnet, Inc. | | | 245 | | | | 9,447 | |

| | | | | | | | 17,609 | |

| Hand & Machine Tools - (4.53%) | | | | | | | | |

| Kennametal, Inc. | | | 290 | | | | 12,331 | |

| | | | | | | | | |

| Healthcare Services - (9.24%) | | | | | | | | |

| Community Health Systems, Inc. | | | 315 | | | | 12,367 | |

| WellPoint, Inc. | | | 150 | | | | 12,771 | |

| | | | | | | | 25,138 | |

| Insurance - (15.87%) | | | | | | | | |

Genworth Financial, Inc. (a) | | | 955 | | | | 11,269 | |

| Hartford Financial Services Group, Inc. | | | 485 | | | | 14,356 | |

| MetLife, Inc. | | | 380 | | | | 17,552 | |

| | | | | | | | 43,177 | |

| Leisure Time - (3.24%) | | | | | | | | |

| Royal Caribbean Cruises Ltd | | | 240 | | | | 8,806 | |

| | | | | | | | | |

| Machinery - (1.97%) | | | | | | | | |

Terex Corp. (a) | | | 185 | | | | 5,365 | |

| | | | | | | | | |

| Mining - (4.31%) | | | | | | | | |

| Rio Tinto PLC - ADR | | | 260 | | | | 11,729 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - (6.59%) | | | | | | | | |

| Eaton Corp. PLC | | | 160 | | | | 10,131 | |

| Textron, Inc. | | | 290 | | | | 7,813 | |

| | | | | | | | 17,944 | |

| Oil & Gas - (11.23%) | | | | | | | | |

| BP PLC - ADR | | | 370 | | | | 15,281 | |

| Chesapeake Energy Corp. | | | 395 | | | | 10,195 | |

| Nabors Industries Ltd. | | | 330 | | | | 5,082 | |

| | | | | | | | 30,558 | |

| Oil & Gas Services - (4.02%) | | | | | | | | |

| Baker Hughes, Inc. | | | 235 | | | | 10,925 | |

| | | | | | | | | |

| Retail - (8.23%) | | | | | | | | |

Big Lots, Inc. (a) | | | 335 | | | | 11,866 | |

| Kohl's Corp. | | | 205 | | | | 10,518 | |

| | | | | | | | 22,384 | |

| Software - (8.18%) | | | | | | | | |

| Microsoft Corp. | | | 420 | | | | 14,028 | |

VeriFone Systems, Inc. (a) | | | 415 | | | | 8,225 | |

| | | | | | | | 22,253 | |

| | | | | | | | | |

| TOTAL COMMON STOCK COST (Cost $242,891) | | | | | | | 260,999 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL FOCUSED VALUE FUND | | | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| SHORT TERM INVESTMENTS - (5.69%) | | | | | | |

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.08% (b) (Cost $15,490) | | | 15,490 | | | | 15,490 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $258,381) - 101.61% | | | | | | $ | 276,489 | |

| LIABILITIES IN EXCESS OTHER ASSETS, NET - (1.61%) | | | | | | | (4,394 | ) |

| NET ASSETS - (100%) | | | | | | $ | 272,095 | |

Percentages are stated as a percent of net assets.

(a) Non-Income producing security.

(b) Rate shown represents the rate at August 31, 2013, is subject to change and resets daily.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL HEDGED EQUITY FUND | | | |

| | | Shares | | | Fair Value | |

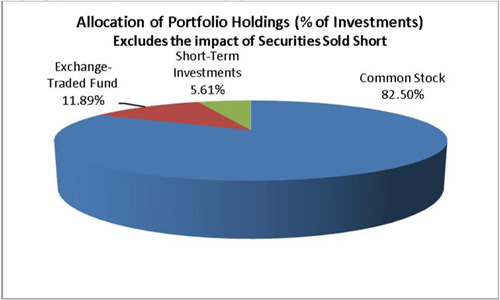

| COMMON STOCK - 82.02% | | | | | | |

| | | | | | | |

| Aerospace & Defense - (2.72%) | | | | | | |

| General Dynamics Corp. | | | 170 | | | $ | 14,152 | |

| | | | | | | | | |

| Banks - (5.70%) | | | | | | | | |

| JPMorgan Chase & Co. | | | 520 | | | | 26,276 | |

| KeyCorp | | | 290 | | | | 3,384 | |

| | | | | | | | 29,660 | |

| Electronics - (4.98%) | | | | | | | | |

| Agilent Technologies Inc.. | | | 10 | | | | 466 | |

| Avnet, Inc. | | | 660 | | | | 25,450 | |

| | | | | | | | 25,916 | |

| Hand & Machine Tools - (3.19%) | | | | | | | | |

| Kennametal, Inc. | | | 390 | | | | 16,583 | |

| | | | | | | | | |

| Healthcare Services - (12.18%) | | | | | | | | |

| Community Health Systems, Inc. | | | 790 | | | | 31,015 | |

| WellPoint, Inc. | | | 380 | | | | 32,353 | |

| | | | | | | | 63,368 | |

| Insurance - (15.41%) | | | | | | | | |

Genworth Financial, Inc. (a) | | | 2,560 | | | | 30,208 | |

| Hartford Financial Services Group, Inc. | | | 750 | | | | 22,200 | |

| MetLife, Inc. | | | 600 | | | | 27,714 | |

| | | | | | | | 80,122 | |

| Leisure Time - (3.88%) | | | | | | | | |

| Royal Caribbean Cruises Ltd. | | | 550 | | | | 20,179 | |

| | | | | | | | | |

| Machinery - (0.56%) | | | | | | | | |

Terex Corp. (a) | | | 100 | | | | 2,900 | |

| | | | | | | | | |

| Mining - (3.12%) | | | | | | | | |

| Rio Tinto PLC - ADR | | | 360 | | | | 16,240 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - (4.60%) | | | | | | | | |

| Eaton Corp. PLC | | | 250 | | | | 15,830 | |

| Textron, Inc. | | | 300 | | | | 8,082 | |

| | | | | | | | 23,912 | |

| Oil & Gas - (7.42%) | | | | | | | | |

| BP PLC - ADR | | | 510 | | | | 21,063 | |

| Chesapeake Energy Corp. | | | 620 | | | | 16,002 | |

| Nabors Industries Ltd. | | | 100 | | | | 1,540 | |

| | | | | | | | 38,605 | |

| Oil & Gas Services - (2.86%) | | | | | | | | |

| Baker Hughes Inc. | | | 320 | | | | 14,877 | |

| | | | | | | | | |

| Retail - (7.27%) | | | | | | | | |

Big Lots, Inc. (a) | | | 430 | | | | 15,231 | |

| Kohl's Corp. | | | 440 | | | | 22,576 | |

| | | | | | | | 37,807 | |

| Software - (8.13%) | | | | | | | | |

| Microsoft Corp. | | | 1,040 | | | | 34,736 | |

VeriFone Systems, Inc. (a) | | | 380 | | | | 7,532 | |

| | | | | | | | 42,268 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $416,006) | | | | | | | 426,589 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUND - 11.83% | | | | | | | | |

| Equity Funds - (11.83%) | | | | | | | | |

| Consumer Staples Select Sector SPDR Fund | | | 700 | | | | 27,657 | |

| SPDR S&P Telecom ETF | | | 360 | | | | 17,802 | |

| Utilities Select Sector SPDR Fund | | | 430 | | | | 16,039 | |

| TOTAL EXCHANGE-TRADED FUND (Cost $62,739) | | | | | | | 61,498 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL HEDGED EQUITY FUND | | | |

| | | Shares | | | Fair Value | |

| SHORT TERM INVESTMENTS - 5.58% | | | | | | |

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.08% (b) (Cost $29,019) | | | 29,019 | | | $ | 29,019 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - (Cost $507,764) - 99.43% | | | | | | $ | 517,106 | |

| OTHER ASSETS LESS LIABILITIES, NET - 32.05% | | | | | | | 166,704 | |

| SECURITIES SOLD SHORT (Proceeds, $164,657) - (31.48)% | | | | | | | (163,714 | ) |

| Net Assets - 100% | | | | | | $ | 520,096 | |

| | | | | | | | | |

| SECURITIES SOLD SHORT - (-31.48)% | | | | | | | | |

| COMMON STOCK - (-4.93)% | | Shares | | | Fair Value | |

| | | | | | | | | |

| Beverages - (-0.52%) | | | | | | | | |

Constellation Brands, Inc. (a) | | | 50 | | | $ | 2,713 | |

| | | | | | | | | |

| Building Materials - (-0.46%) | | | | | | | | |

| Vulcan Materials Co. | | | 50 | | | | 2,390 | |

| | | | | | | | | |

| Electric - (-0.45%) | | | | | | | | |

Dynegy, Inc. (a) | | | 120 | | | | 2,332 | |

| | | | | | | | | |

| Electronics - (-0.48%) | | | | | | | | |

| National Instruments Corp. | | | 90 | | | | 2,498 | |

| | | | | | | | | |

| Insurance - (-0.57%) | | | | | | | | |

| Erie Indemnity Co. | | | 40 | | | | 2,950 | |

| | | | | | | | | |

| Oil & Gas - (-0.48%) | | | | | | | | |

Cheniere Energy, Inc. (a) | | | 90 | | | | 2,519 | |

| | | | | | | | | |

| Pharmaceuticals - (-0.49%) | | | | | | | | |

| AbbVie, Inc. | | | 60 | | | | 2,557 | |

| | | | | | | | | |

| Retail - (-0.42%) | | | | | | | | |

Krispy Kreme Doughnuts, Inc. (a) | | | 110 | | | | 2,169 | |

| | | | | | | | | |

| Telecommunications - (-0.53%) | | | | | | | | |

Crown Castle International Corp. (a) | | | 40 | | | | 2,777 | |

| | | | | | | | | |

| Transportation - (-0.53%) | | | | | | | | |

| Landstar System, Inc. | | | 50 | | | | 2,732 | |

| | | | | | | | | |

| TOTAL COMMON STOCK SOLD SHORT (Proceeds $26,868) | | | | | | | 25,637 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUND - (-26.55%) | | | | | | | | |

| Equity Fund - (-26.55%) | | | | | | | | |

| Consumer Discretionary Select Sector SPDR Fund | | | 350 | | | | 20,188 | |

| Energy Select Sector SPDR Fund | | | 240 | | | | 19,577 | |

| Financial Select Sector SPDR Fund | | | 1,000 | | | | 19,440 | |

| Health Care Select Sector SPDR Fund | | | 410 | | | | 20,180 | |

| Industrial Select Sector SPDR Fund | | | 450 | | | | 19,818 | |

| Materials Select Sector SPDR Fund | | | 480 | | | | 19,406 | |

| Technology Select Sector SPDR Fund | | | 620 | | | | 19,468 | |

| TOTAL EXCHANGE-TRADED FUNDS SOLD SHORT (Cost $137,789) | | | | | | | 138,077 | |

| TOTAL SECURITIES SOLD SHORT (Proceeds $164,657) | | | | | | $ | 163,714 | |

Percentages are stated as a percent of net assets.

(a) Non-Income producing security.

(b) Rate shown represents the rate at August 31, 2013, is subject to change and resets daily.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL MARKET PLUS FUND | | | |

| | | Shares | | | Fair Value | |

| | | | | | | |

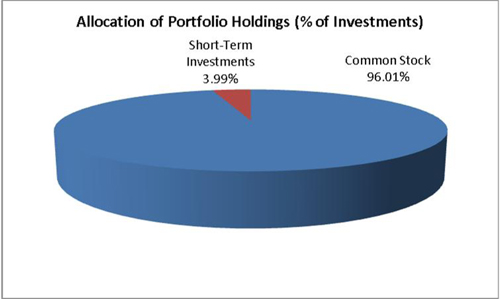

| COMMON STOCK - 96.94% | | | | | | |

| | | | | | | |

| Aerospace & Defense - (2.48%) | | | | | | |

| General Dynamics Corp. | | | 80 | | | $ | 6,660 | |

| | | | | | | | | |

| Agriculture - (0.46%) | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 35 | | | | 1,232 | |

| | | | | | | | | |

| Banks - (15.69%) | | | | | | | | |

| Bank of America Corp. | | | 385 | | | | 5,436 | |

| Citigroup, Inc. | | | 100 | | | | 4,833 | |

| Goldman Sachs Group, Inc. | | | 15 | | | | 2,282 | |

| JPMorgan Chase & Co. | | | 290 | | | | 14,654 | |

| KeyCorp | | | 305 | | | | 3,559 | |

| Morgan Stanley | | | 65 | | | | 1,674 | |

| PNC Financial Services Group, Inc. | | | 30 | | | | 2,168 | |

| US Bancorp | | | 50 | | | | 1,806 | |

| Wells Fargo & Co. | | | 140 | | | | 5,751 | |

| | | | | | | | 42,163 | |

| Computers - (1.81%) | | | | | | | | |

| Apple, Inc. | | | 10 | | | | 4,870 | |

| | | | | | | | | |

| Cosmetics & Personal Care - (1.16%) | | | | | | | | |

| Procter & Gamble Co. | | | 40 | | | | 3,116 | |

| | | | | | | | | |

| Electric - (2.46%) | | | | | | | | |

| Dominion Resources, Inc. | | | 25 | | | | 1,459 | |

| Duke Energy Corp. | | | 35 | | | | 2,296 | |

| NextEra Energy, Inc. | | | 20 | | | | 1,607 | |

| Southern Co. | | | 30 | | | | 1,249 | |

| | | | | | | | 6,611 | |

| Electronics - (4.05%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 105 | | | | 4,897 | |

| Avnet, Inc. | | | 155 | | | | 5,977 | |

| | | | | | | | 10,874 | |

| Food - (0.91%) | | | | | | | | |

| Mondelez International, Inc. | | | 80 | | | | 2,454 | |

| | | | | | | | | |

| Hand & Machine Tools - (2.69%) | | | | | | | | |

| Kennametal, Inc. | | | 170 | | | | 7,228 | |

| | | | | | | | | |

| Healthcare Products - (1.13%) | | | | | | | | |

| Johnson & Johnson | | | 35 | | | | 3,024 | |

| | | | | | | | | |

| Healthcare Services - (5.86%) | | | | | | | | |

| Community Health Systems, Inc. | | | 180 | | | | 7,067 | |

| UnitedHealth Group, Inc. | | | 20 | | | | 1,435 | |

| WellPoint, Inc. | | | 85 | | | | 7,237 | |

| | | | | | | | 15,739 | |

| Insurance - (11.32%) | | | | | | | | |

| American International Group, Inc. | | | 40 | | | | 1,858 | |

Berkshire Hathaway, Inc. (a) | | | 35 | | | | 3,893 | |

Genworth Financial, Inc. (a) | | | 565 | | | | 6,667 | |

| Hartford Financial Services Group, Inc. | | | 280 | | | | 8,288 | |

| MetLife, Inc. | | | 210 | | | | 9,700 | |

| | | | �� | | | | 30,406 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL MARKET PLUS FUND | | | |

| | | Shares | | | Fair Value | |

| COMMON STOCK - 96.94% (continued) | | | | | | |

| | | | | | | |

| Leisure Time - (1.77%) | | | | | | |

| Royal Caribbean Cruises Ltd. | | | 130 | | | $ | 4,770 | |

| | | | | | | | | |

| Machinery - Construction & Mining - (1.08%) | | | | | | | | |

| Terex Corp. | | | 100 | | | | 2,900 | |

| | | | | | | | | |

| Media - (0.45%) | | | | | | | | |

| Walt Disney Co. | | | 20 | | | | 1,217 | |

| | | | | | | | | |

| Mining - (2.60%) | | | | | | | | |

| Rio Tinto PLC - ADR | | | 155 | | | | 6,992 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - (5.67%) | | | | | | | | |

| Eaton Corp. PLC | | | 90 | | | | 5,699 | |

| General Electric Co. | | | 220 | | | | 5,091 | |

| Textron, Inc. | | | 165 | | | | 4,445 | |

| | | | | | | | 15,235 | |

| Oil & Gas - (14.38%) | | | | | | | | |

| BP PLC - ADR | | | 215 | | | | 8,879 | |

| Chesapeake Energy Corp. | | | 230 | | | | 5,936 | |

| Chevron Corp. | | | 55 | | | | 6,624 | |

| ConocoPhillips | | | 35 | | | | 2,320 | |

| Exxon Mobil Corp. | | | 85 | | | | 7,409 | |

| Nabors Industries Ltd. | | | 330 | | | | 5,082 | |

| Occidental Petroleum Corp. | | | 15 | | | | 1,323 | |

| Valero Energy Corp. | | | 30 | | | | 1,066 | |

| | | | | | | | 38,639 | |

| Oil & Gas Services - (2.42%) | | | | | | | | |

| Baker Hughes, Inc. | | | 140 | | | | 6,509 | |

| | | | | | | | | |

| Pharmaceuticals - (3.54%) | | | | | | | | |

| Merck & Co., Inc. | | | 85 | | | | 4,020 | |

| Pfizer, Inc. | | | 195 | | | | 5,501 | |

| | | | | | | | 9,521 | |

| Retail - (5.77%) | | | | | | | | |

Big Lots, Inc. (a) | | | 190 | | | | 6,730 | |

| CVS Caremark Corp. | | | 45 | | | | 2,612 | |

| Kohl's Corp. | | | 120 | | | | 6,157 | |

| | | | | | | | 15,499 | |

| Semiconductors - (1.43%) | | | | | | | | |

| Intel Corp. | | | 175 | | | | 3,847 | |

| | | | | | | | | |

| Software - (4.73%) | | | | | | | | |

| Microsoft Corp. | | | 235 | | | | 7,849 | |

VeriFone Systems, Inc. (a) | | | 245 | | | | 4,856 | |

| | | | | | | | 12,705 | |

| Telecommunications - (3.08%) | | | | | | | | |

| AT&T, Inc. | | | 110 | | | | 3,721 | |

| Cisco Systems, Inc. | | | 195 | | | | 4,545 | |

| | | | | | | | 8,266 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $246,269) | | | 7,225 | | | | 260,477 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 4.65% | | | | | | | | |

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.08% (b) (Cost $12,508) | | | 12,508 | | | | 12,508 | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $258,777) - 101.59% | | | | | | $ | 272,985 | |

| LIABILITIES IN EXCESS OTHER ASSETS, NET - (1.59)% | | | | | | | (4,282 | ) |

| NET ASSETS - 100% | | | | | | $ | 268,703 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Rate shown represents the rate at August 31, 2013, is subject to change and resets daily.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these schedule of investments.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL INFLATION ADVANTAGED EQUITIES FUND | | | |

| | | Shares | | | Fair Value | |

| COMMON STOCK - 97.68% | | | | | | |

| | | | | | | |

| Agriculture - (3.69%) | | | | | | |

| Archer-Daniels-Midland Co. | | | 270 | | | $ | 9,507 | |

| | | | | | | | | |

| Auto Parts & Equipment - (3.30%) | | | | | | | | |

| Johnson Controls, Inc. | | | 210 | | | | 8,511 | |

| | | | | | | | | |

| Banks - (9.62%) | | | | | | | | |

| Bank of America Corp. | | | 590 | | | | 8,331 | |

| Goldman Sachs Group, Inc. | | | 55 | | | | 8,367 | |

| JPMorgan Chase & Co. | | | 160 | | | | 8,085 | |

| | | | | | | | 24,783 | |

| Chemicals - (5.72%) | | | | | | | | |

| EI du Pont de Nemours & Co. | | | 150 | | | | 8,493 | |

| Mosaic Co. | | | 150 | | | | 6,247 | |

| | | | | | | | 14,740 | |

| Cosmetics & Personal Care - (2.42%) | | | | | | | | |

| Procter & Gamble Co. | | | 80 | | | | 6,231 | |

| | | | | | | | | |

| Electronics - (2.44%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 135 | | | | 6,296 | |

| | | | | | | | | |

| Food - (3.10%) | | | | | | | | |

| Mondelez International, Inc. | | | 260 | | | | 7,974 | |

| | | | | | | | | |

| Forest Products & Paper - (2.93%) | | | | | | | | |

| International Paper Co. | | | 160 | | | | 7,554 | |

| | | | | | | | | |

| Hand & Machine Tools - (3.14%) | | | | | | | | |

| Kennametal, Inc. | | | 190 | | | | 8,079 | |

| | | | | | | | | |

| Healthcare Products - (3.18%) | | | | | | | | |

Hospira, Inc. (a) | | | 210 | | | | 8,196 | |

| | | | | | | | | |

| Healthcare Services - (2.06%) | | | | | | | | |

| Community Health Systems, Inc. | | | 135 | | | | 5,300 | |

| | | | | | | | | |

| Insurance - (14.24%) | | | | | | | | |

| Aspen Insurance Holdings Ltd. | | | 210 | | | | 7,470 | |

| Hartford Financial Services Group, Inc. | | | 340 | | | | 10,064 | |

| MetLife, Inc. | | | 235 | | | | 10,855 | |

| XL Group PLC | | | 280 | | | | 8,277 | |

| | | | | | | | 36,666 | |

| Machinery - Construction & Mining - (2.77%) | | | | | | | | |

| Joy Global, Inc. | | | 145 | | | | 7,122 | |

| | | | | | | | | |

| Mining - (9.49%) | | | | | | | | |

| Alcoa, Inc. | | | 530 | | | | 4,081 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 200 | | | | 6,044 | |

| Newmont Mining Corp. | | | 195 | | | | 6,195 | |

| Rio Tinto PLC - ADR | | | 180 | | | | 8,120 | |

| | | | | | | | 24,440 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL INFLATION ADVANTAGED EQUITIES FUND | | | |

| | | Shares | | | Fair Value | |

| COMMON STOCK - 97.68% (Continued) | | | | | | |

| | | | | | | |

| Miscellaneous Manufacturing - (4.76%) | | | | | | |

| Eaton Corp. PLC | | | 115 | | | $ | 7,282 | |

| General Electric Co. | | | 215 | | | | 4,975 | |

| | | | | | | | 12,257 | |

| Oil & Gas - (13.76%) | | | | | | | | |

| BP PLC - ADR | | | 215 | | | | 8,879 | |

| Devon Energy Corp. | | | 140 | | | | 7,993 | |

| Nabors Industries Ltd. | | | 400 | | | | 6,160 | �� |

| Noble Corp. | | | 180 | | | | 6,696 | |

| Phillips 66 | | | 100 | | | | 5,710 | |

| | | | | | | | 35,438 | |

| Oil & Gas Services - (3.34%) | | | | | | | | |

| Baker Hughes, Inc. | | | 185 | | | | 8,601 | |

| | | | | | | | | |

| Packaging & Containers - (3.31%) | | | | | | | | |

| Sealed Air Corp. | | | 300 | | | | 8,520 | |

| | | | | | | | | |

| Retail - (2.27%) | | | | | | | | |

| Wal-Mart Stores, Inc. | | | 80 | | | | 5,838 | |

| | | | | | | | | |

| Software - (2.14%) | | | | | | | | |

| Microsoft Corp. | | | 165 | | | | 5,511 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $247,943) | | | | | | | 251,564 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 4.06% | | | | | | | | |

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.08% (b) (Cost $10,460) | | | 10,460 | | | | 10,460 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $258,403) - 101.74% | | | | | | $ | 262,024 | |

| LIABILITIES IN EXCESS OTHER ASSETS, NET - (1.74)% | | | | | | | (4,478 | ) |

| NET ASSETS - 100% | | | | | | $ | 257,546 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Rate shown represents the rate at August 31, 2013, is subject to change and resets daily.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL DIVIDEND PLUS FUND | | | |

| | | Shares | | | Fair Value | |

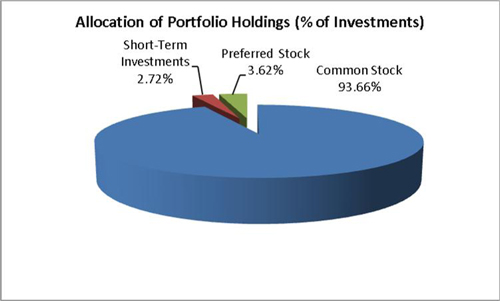

| COMMON STOCK - 95.26% | | | | | | |

| | | | | | | |

| Aerospace & Defense - (2.05%) | | | | | | |

| General Dynamics Corp. | | | 65 | | | $ | 5,411 | |

| | | | | | | | | |

| Agriculture - (3.65%) | | | | | | | | |

| Archer-Daniels-Midland Corp. | | | 165 | | | | 5,810 | |

| Lorillard, Inc. | | | 90 | | | | 3,807 | |

| | | | | | | | 9,617 | |

| Banks - (8.79%) | | | | | | | | |

| Banco Santander SA - ADR | | | 740 | | | | 5,261 | |

| Capital One Financial Corp. | | | 70 | | | | 4,519 | |

| JPMorgan Chase & Corp. | | | 265 | | | | 13,390 | |

| | | | | | | | 23,170 | |

| Chemicals - (3.64%) | | | | | | | | |

PetroLogistics LP (a) | | | 800 | | | | 9,608 | |

| | | | | | | | | |

| Computers - (1.78%) | | | | | | | | |

| Hewlett-Packard Co. | | | 210 | | | | 4,691 | |

| | | | | | | | | |

| Diversified Financial Services - (2.32%) | | | | | | | | |

| Federated Investors, Inc. | | | 225 | | | | 6,111 | |

| | | | | | | | | |

| Electric - (2.36%) | | | | | | | | |

| Duke Energy Corp. | | | 55 | | | | 3,608 | |

| FirstEnergy Corp. | | | 70 | | | | 2,623 | |

| | | | | | | | 6,231 | |

| Hand & Machine Tools - (2.98%) | | | | | | | | |

| Kennametal, Inc. | | | 185 | | | | 7,866 | |

| | | | | | | | | |

| Healthcare Services - (5.09%) | | | | | | | | |

| Select Medical Holdings Corp. | | | 630 | | | | 5,336 | |

| WellPoint, Inc. | | | 95 | | | | 8,088 | |

| | | | | | | | 13,424 | |

| Insurance - (6.16%) | | | | | | | | |

| Hartford Financial Services Group, Inc. | | | 245 | | | | 7,252 | |

| MetLife, Inc. | | | 195 | | | | 9,007 | |

| | | | | | | | 16,259 | |

| Iron & Steel - (1.81%) | | | | | | | | |

| Nucor Corp. | | | 105 | | | | 4,776 | |

| | | | | | | | | |

| Leisure Time - (3.06%) | | | | | | | | |

| Royal Caribbean Cruises Ltd. | | | 220 | | | | 8,072 | |

| | | | | | | | | |

| Media - (1.60%) | | | | | | | | |

| Gannett Co., Inc. | | | 175 | | | | 4,216 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - (1.92%) | | | | | | | | |

| Eaton Corp. PLC | | | 80 | | | | 5,066 | |

| | | | | | | | | |

| Oil & Gas - (14.57%) | | | | | | | | |

| BP PLC - ADR | | | 185 | | | | 7,640 | |

| Chesapeake Energy Corp. | | | 255 | | | | 6,582 | |

| ConocoPhillips | | | 45 | | | | 2,983 | |

| Devon Energy Corp. | | | 135 | | | | 7,707 | |

| Noble Corp. | | | 125 | | | | 4,650 | |

| Phillips 66 | | | 155 | | | | 8,850 | |

| | | | | | | | 38,412 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL DIVIDEND PLUS FUND | | | |

| | | Shares | | | Fair Value | |

| COMMON STOCK - 95.26% (Continued) | | | | | | |

| | | | | | | |

| Oil & Gas Services - (5.33%) | | | | | | |

| Baker Hughes, Inc. | | | 145 | | | $ | 6,741 | |

Suburban Propane Partners LP (a) | | | 160 | | | | 7,328 | |

| | | | | | | | 14,069 | |

| Packaging & Containers - (1.62%) | | | | | | | | |

| Sealed Air Corp. | | | 150 | | | | 4,260 | |

| | | | | | | | | |

| Pharmaceuticals - (3.70%) | | | | | | | | |

| Teva Pharmaceutical Industries Ltd. - ADR | | | 255 | | | | 9,746 | |

| | | | | | | | | |

| Real Estate Investment Trust - (3.03%) | | | | | | | | |

| Annaly Capital Management, Inc. | | | 685 | | | | 7,994 | |

| | | | | | | | | |

| Retail - (3.11%) | | | | | | | | |

| Kohl's Corp. | | | 160 | | | | 8,210 | |

| | | | | | | | | |

| Savings & Loans - (3.89%) | | | | | | | | |

| First Niagara Financial Group, Inc. | | | 1,015 | | | | 10,252 | |

| | | | | | | | | |

| Semiconductors - (5.40%) | | | | | | | | |

| Intel Corp. | | | 405 | | | | 8,902 | |

| Intersil Corp. | | | 240 | | | | 2,489 | |

| Marvell Technology Group Ltd. | | | 235 | | | | 2,846 | |

| | | | | | | | 14,237 | |

| Software - (5.69%) | | | | | | | | |

| Microsoft Corp. | | | 270 | | | | 9,018 | |

| Quality Systems, Inc. | | | 290 | | | | 6,000 | |

| | | | | | | | 15,018 | |

| Telecommunications - (1.71%) | | | | | | | | |

| Verizon Communications, Inc. | | | 95 | | | | 4,501 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $243,311) | | | | | | | 251,217 | |

| | | | | | | | | |

| PREFERRED STOCK - 3.68% | | | | | | | | |

| Banks - (3.68%) | | | | | | | | |

| Bank of America Corp., 7.25%, Series L | | | 9 | | | | 9,710 | |

| TOTAL PREFERRED STOCK (Cost $11,381) | | | | | | | 9,710 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - (2.77%) | | | | | | | | |

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.08% (b) (Cost $7,288) | | | 7,288 | | | | 7,288 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $261,980) - 101.71% | | | | | | $ | 268,215 | |

| LIABILITIES IN EXCESS OTHER ASSETS, NET - (1.71%) | | | | | | | (4,500 | ) |

| NET ASSETS - 100% | | | | | | $ | 263,715 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Rate shown represents the rate at August 31, 2013, is subject to change and resets daily.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL MID CAP VALUE FUND | | | |

| | | Shares | | | Fair Value | |

| COMMON STOCK - 95.63% | | | | | | |

| | | | | | | |

| Aerospace & Defense - (4.07%) | | | | | | |

| General Dynamics Corp. | | | 100 | | | $ | 8,325 | |

Spirit Aerosystems Holdings, Inc. (a) | | | 120 | | | | 2,710 | |

| | | | | | | | 11,035 | |

| Agriculture - (2.47%) | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 190 | | | | 6,690 | |

| | | | | | | | | |

| Airlines - (1.32%) | | | | | | | | |

| Southwest Airlines Co. | | | 280 | | | | 3,587 | |

| | | | | | | | | |

| Autoparts & Equipment - (5.25%) | | | | | | | | |

| Johnson Controls, Inc. | | | 215 | | | | 8,714 | |

TRW Automotive Holdings Corp. (a) | | | 80 | | | | 5,526 | |

| | | | | | | | 14,240 | |

| Banks - (4.43%) | | | | | | | | |

| KeyCorp | | | 625 | | | | 7,294 | |

| TCF Financial Corp. | | | 335 | | | | 4,707 | |

| | | | | | | | 12,001 | |

| Electronics - (5.59%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 180 | | | | 8,395 | |

| Avnet, Inc. | | | 175 | | | | 6,748 | |

| | | | | | | | 15,143 | |

| Engineering & Construction - (1.38%) | | | | | | | | |

| KBR, Inc. | | | 125 | | | | 3,732 | |

| | | | | | | | | |

| Forest Products & Paper - (1.91%) | | | | | | | | |

| International Paper Co. | | | 110 | | | | 5,193 | |

| | | | | | | | | |

| Hand & Machine Tools - (3.53%) | | | | | | | | |

| Kennametal, Inc. | | | 225 | | | | 9,567 | |

| | | | | | | | | |

| Healthcare Products - (2.81%) | | | | | | | | |

Hospira, Inc. (a) | | | 195 | | | | 7,611 | |

| | | | | | | | | |

| Healthcare Services - (6.24%) | | | | | | | | |

| Community Health Systems, Inc. | | | 55 | | | | 2,159 | |

Health Management Associates, Inc. (a) | | | 485 | | | | 6,237 | |

| WellPoint, Inc. | | | 100 | | | | 8,514 | |

| | | | | | | | 16,910 | |

| Insurance - (9.78%) | | | | | | | | |

| Assurant, Inc. | | | 115 | | | | 6,100 | |

Genworth Financial, Inc. (a) | | | 435 | | | | 5,133 | |

| Hartford Financial Services Group, Inc. | | | 300 | | | | 8,880 | |

| Protective Life Corp. | | | 65 | | | | 2,716 | |

| XL Group PLC | | | 125 | | | | 3,695 | |

| | | | | | | | 26,524 | |

| Leisure Time - (2.10%) | | | | | | | | |

| Royal Caribbean Cruises Ltd. | | | 155 | | | | 5,687 | |

| | | | | | | | | |

| Machinery - Construction & Mining - (1.50%) | | | | | | | | |

Terex Corp. (a) | | | 140 | | | | 4,060 | |

| | | | | | | | | |

| Mining - (2.10%) | | | | | | | | |

| Alcoa, Inc. | | | 740 | | | | 5,698 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - (1.99%) | | | | | | | | |

| Textron, Inc. | | | 200 | | | | 5,388 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| SCHEDULES OF INVESTMENTS | | | |

| AUGUST 31, 2013 (Unaudited) | | | |

| | | | |

| SNOW CAPITAL MID CAP VALUE FUND | | | |

| | | | |

| COMMON STOCK - 95.63% (Continued) | | | |

| | | Shares | | | Fair Value | |

| Oil & Gas - (14.48%) | | | | | | |

| Chesapeake Energy Corp. | | | 245 | | | $ | 6,323 | |

| Devon Energy Corp. | | | 130 | | | | 7,422 | |

| Nabors Industries Ltd. | | | 330 | | | | 5,082 | |

| Noble Corp. | | | 230 | | | | 8,556 | |

| Patterson-UTI Energy, Inc. | | | 210 | | | | 4,114 | |

Ultra Petroleum Corp. (a) | | | 375 | | | | 7,762 | |

| | | | | | | | 39,259 | |

| Oil & Gas Services - (2.31%) | | | | | | | | |

| Baker Hughes, Inc. | | | 135 | | | | 6,276 | |

| | | | | | | | | |

| Packaging & Containers - (2.15%) | | | | | | | | |

| Sealed Air Corp. | | | 205 | | | | 5,822 | |

| | | | | | | | | |

| Pharmaceuticals - (3.03%) | | | | | | | | |

Endo Health Solutions, Inc. (a) | | | 200 | | | | 8,218 | |

| | | | | | | | | |

| Retail - (9.29%) | | | | | | | | |

Big Lots, Inc. (a) | | | 210 | | | | 7,438 | |

| Kohl's Corp. | | | 190 | | | | 9,749 | |

| Macy's, Inc. | | | 180 | | | | 7,997 | |

| | | | | | | | 25,184 | |

| Savings & Loans - (3.69%) | | | | | | | | |

| First Niagara Financial Group, Inc. | | | 990 | | | | 9,999 | |

| | | | | | | | | |

| Semiconductors - (1.07%) | | | | | | | | |

| Marvell Technology Group Ltd. | | | 240 | | | | 2,906 | |

| | | | | | | | | |

| Software - (3.14%) | | | | | | | | |

VeriFone Systems, Inc. (a) | | | 430 | | | | 8,523 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $242,253) | | | 10,170 | | | | 259,253 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 6.21% | | | | | | | | |

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.08% (b) (Cost $16,850) | | | 16,850 | | | | 16,850 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $259,103) - 101.84% | | | | | | $ | 276,103 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (1.84)% | | | | | | | (4,992 | ) |

| NET ASSETS - 100% | | | | | | $ | 271,111 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Rate shown represents the rate at August 31, 2013, is subject to change and resets daily.

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | | SEMI-ANNUAL REPORT |

| STATEMENTS OF ASSETS AND LIABILITIES | | |

| AUGUST 31, 2013 (Unaudited) | | |

| | | Snow Capital | | | | Snow Capital | | | Snow Capital | |

| | | Focused Value Fund | | | | Hedged Equity Fund | | | Market Plus Fund | |

| Assets: | | | | | | | | | | |

| Investments, at value | | $ | 276,489 | | | | $ | 517,106 | | | $ | 272,985 | |

| Deposits at broker | | | - | | | | | 170,309 | | | | - | |

| Due from advisor | | | 4,304 | | | | | 4,074 | | | | 4,650 | |

| Receivables: | | | | | | | | | | | | | |

| Interest | | | 1 | | | | | 2 | | | | 1 | |

| Dividends | | | 713 | | | | | 1,136 | | | | 776 | |

| Prepaid expenses | | | 930 | | | | | 930 | | | | 930 | |

| Total assets | | | 282,437 | | | | | 693,557 | | | | 279,342 | |

| | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | |

| Securities sold short, at value | | | - | | | | | 163,714 | | | | - | |

| Payables: | | | | | | | | | | | | | |

| Dividends on securities sold short | | | - | | | | | 18 | | | | - | |

| Accrued distribution (12b-1) fees | | | 11 | | | | | 11 | | | | 11 | |

| Due to administrator | | | 4,660 | | | | | 4,692 | | | | 4,659 | |

| Accrued expenses | | | 5,671 | | | | | 5,026 | | | | 5,969 | |

| Total liabilities | | | 10,342 | | | | | 173,461 | | | | 10,639 | |

| Net Assets | | $ | 272,095 | | | | $ | 520,096 | | | $ | 268,703 | |

| | | | | | | | | | | | | | |

| Sources of Net Assets: | | | | | | | | | | | | | |

| Paid-in capital | | $ | 250,000 | | | | $ | 500,000 | | | $ | 250,000 | |

| Undistributed net realized gain on investments | | | 3,109 | | | | | 10,167 | | | | 2,827 | |

| Undistributed (accumulated) net investment income (loss) | | | 878 | | | | | (356 | ) | | | 1,668 | |

| Net unrealized appreciation on investments | | | 18,108 | | | | | 9,342 | | | | 14,208 | |

| Net unrealized appreciation on securities sold short | | | - | | | | | 943 | | | | - | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 272,095 | | | | $ | 520,096 | | | $ | 268,703 | |

| | | | | | | | | | | | | | |

| Total Investments, at cost | | | 258,381 | | | | | 507,764 | | | | 258,777 | |

| Proceeds from securities sold short | | | - | | | | | 164,657 | | | | - | |

| | | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | | |

| Net assets | | $ | 10,872 | | | | $ | 10,391 | | | $ | 10,737 | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 500 | | | | | 500 | | | | 500 | |

| Net Asset Value Per Share | | $ | 21.74 | | | | $ | 20.78 | | | $ | 21.47 | |

| | | | | | | | | | | | | | |

| Maximum Offering Price Per Share (a) | | $ | 22.94 | | | | $ | 21.93 | | | $ | 22.66 | |

| | | | | | | | | | | | | | |

| Minimum Redemption Price Per Share (b)(c) | | $ | 21.52 | | | | $ | 20.57 | | | $ | 21.26 | |

| | | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | | |

| Net assets | | $ | 261,223 | | | | $ | 509,705 | | | $ | 257,966 | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 12,000 | | | | | 24,500 | | | | 12,000 | |

| Net Asset Value and Offering Price Per Share | | $ | 21.77 | | | | $ | 20.80 | | | $ | 21.50 | |

| | | | | | | | | | | | | | |

| Minimum Redemption Price Per Share (c) | | $ | 21.66 | | | | $ | 20.70 | | | $ | 21.39 | |

(a) A maximum sales charge of 5.25% is imposed on Class A shares.

(b) Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 0.50% contingent deferred sales charge ("CDSC") on shares redeemed within one year from the date of purchase.

(c) A redemption fee of 0.50% will be assessed on shares of the Fund that are held for 30 days or less.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | | SEMI-ANNUAL REPORT |

| STATEMENTS OF ASSETS AND LIABILITIES | | |

| AUGUST 31, 2013 (Unaudited) | | |

| | | Snow Capital | | | | | | | |

| | | Inflation Advantaged Equities Fund | | | Plus Fund | | | Value Fund | |

| Assets: | | | | | | | | | |

| Investments, at value | | $ | 262,024 | | | $ | 268,215 | | | $ | 276,103 | |

| Due from advisor | | | 4,369 | | | | 4,480 | | | | 4,446 | |

| Receivables: | | | | | | | | | | | | |

| Interest | | | - | | | | - | | | | 1 | |

| Dividends | | | 710 | | | | 656 | | | | 190 | |

| Prepaid expenses | | | 930 | | | | 930 | | | | 930 | |

| Total assets | | | 268,033 | | | | 274,281 | | | | 281,670 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Accrued distribution (12b-1) fees | | | 11 | | | | 11 | | | | 11 | |

| Due to administrator | | | 4,658 | | | | 4,659 | | | | 4,660 | |

| Accrued expenses | | | 5,818 | | | | 5,896 | | | | 5,888 | |

| Total liabilities | | | 10,487 | | | | 10,566 | | | | 10,559 | |

| Net Assets | | $ | 257,546 | | | $ | 263,715 | | | $ | 271,111 | |

| | | | | | | | | | | | | |

| Sources of Net Assets: | | | | | | | | | | | | |

| Paid-in capital | | $ | 250,000 | | | $ | 250,000 | | | $ | 250,000 | |

| Undistributed net realized gain on investments | | | 2,703 | | | | 5,070 | | | | 3,887 | |

| Undistributed net investment income | | | 1,222 | | | | 2,410 | | | | 224 | |

| Net unrealized appreciation on investments | | | 3,621 | | | | 6,235 | | | | 17,000 | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 257,546 | | | $ | 263,715 | | | $ | 271,111 | |

| | | | | | | | | | | | | |

| Total Investments, at cost | | | 258,403 | | | | 261,980 | | | | 259,103 | |

| | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | |

| Net assets | | $ | 10,291 | | | $ | 10,538 | | | $ | 10,833 | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 500 | | | | 500 | | | | 500 | |

| Net Asset Value Per Share | | $ | 20.58 | | | $ | 21.08 | | | $ | 21.67 | |

| | | | | | | | | | | | | |

| Maximum Offering Price Per Share (a) | | $ | 21.72 | | | $ | 22.25 | | | $ | 22.87 | |

| | | | | | | | | | | | | |

| Minimum Redemption Price Per Share (b)(c) | | $ | 20.37 | | | $ | 20.87 | | | $ | 21.45 | |

| | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | |

| Net assets | | $ | 247,255 | | | $ | 253,177 | | | $ | 260,278 | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 12,000 | | | | 12,000 | | | | 12,000 | |

| Net Asset Value and Offering Price Per Share | | $ | 20.60 | | | $ | 21.10 | | | $ | 21.69 | |

| | | | | | | | | | | | | |

| Minimum Redemption Price Per Share (c) | | $ | 20.50 | | | $ | 20.99 | | | $ | 21.58 | |

(a) A maximum sales charge of 5.50% is imposed on Class A shares.

(b) Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 0.50% contingent deferred sales charge ("CDSC") on shares redeemed within 12 months of purchase.

(c) A redemption fee of 0.50% will be assessed on shares of the Fund that are held for 30 days or less.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | | SEMI-ANNUAL REPORT |

| STATEMENTS OF OPERATIONS | | |

| AUGUST 31, 2013 (Unaudited) | | |

| | | Snow Capital | | | Snow Capital | | | Snow Capital | |

| | | Focused Value Fund | | | Hedged Equity Fund | | | Market Plus Fund | |

| | | | | | | | | | |

| | | For the | | | For the | | | For the | |

| | | Period Ended | | | Period Ended | | | Period Ended | |

| | | August 31, 2013 (a) | | | August 31, 2013 (a) | | | August 31, 2013 (a) | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Investment income: | | | | | | | | | |

| Dividends | | $ | 2,199 | | | $ | 3,379 | | | $ | 2,529 | |

| Interest | | | 5 | | | | 31 | | | | 4 | |

| Total investment income | | | 2,204 | | | | 3,410 | | | | 2,533 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Management fees | | | 1,029 | | | | 2,223 | | | | 569 | |

| Distribution (12b-1) fees - Class A | | | 11 | | | | 11 | | | | 11 | |

| Administration, Accounting and transfer agent fees and expenses | | | 12,533 | | | | 12,691 | | | | 12,532 | |

| Miscellaneous | | | 3,039 | | | | 3,046 | | | | 3,041 | |

| Audit fees | | | 2,428 | | | | 2,428 | | | | 2,428 | |

| Legal fees | | | 1,460 | | | | 1,460 | | | | 1,460 | |

| Custodian fees | | | 1,048 | | | | 1,048 | | | | 1,048 | |

| Pricing fees | | | 907 | | | | 1,048 | | | | 2,137 | |

| Trustee fees and expenses | | | 765 | | | | 765 | | | | 765 | |

| Registration and filing fees | | | 214 | | | | 214 | | | | 214 | |

| Insurance | | | 33 | | | | 33 | | | | 33 | |

| Dividends on securities sold short | | | - | | | | 735 | | | | - | |

| Interest expense | | | - | | | | 241 | | | | - | |

| Total expenses | | | 23,467 | | | | 25,943 | | | | 24,238 | |

| Less: fees waived and expenses absorbed | | | (22,141 | ) | | | (22,177 | ) | | | (23,373 | ) |

| Net expenses | | | 1,326 | | | | 3,766 | | | | 865 | |

| | | | | | | | | | | | | |

| Net investment income (loss) | | | 878 | | | | (356 | ) | | | 1,668 | |

| | | | | | | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 3,109 | | | | 12,507 | | | | 2,827 | |

| Securities sold short | | | - | | | | (2,340 | ) | | | - | |

| Net realized gain on investments | | | 3,109 | | | | 10,167 | | | | 2,827 | |

| | | | | | | | | | | | | |

| Net change in unrealized appreciation on: | | | | | | | | | | | | |

| Investments | | | 18,108 | | | | 9,342 | | | | 14,208 | |

| Securities sold short | | | - | | | | 943 | | | | - | |

| Net change in unrealized appreciation | | | 18,108 | | | | 10,285 | | | | 14,208 | |

| | | | | | | | | | | | | |

| Net gain on investments | | | 21,217 | | | | 20,452 | | | | 17,035 | |

| | | | | | | | | | | | | |

| Net increase in net assets resulting from operations | | $ | 22,095 | | | $ | 20,096 | | | $ | 18,703 | |

(a) The Funds commenced operations on March 28, 2013.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | | SEMI-ANNUAL REPORT |

| STATEMENTS OF OPERATIONS | | |

| AUGUST 31, 2013 (Unaudited) | | |

| | | Snow Capital | | | | | | | |

| | | Inflation Advantaged Equities Fund | | | Plus Fund | | | Value Fund | |

| | | | | | | | | | |

| | | For the | | | For the | | | For the | |

| | | Period Ended | | | Period Ended | | | Period Ended | |

| | | August 31, 2013 (a) | | | August 31, 2013 (a) | | | August 31, 2013 (a) | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Investment income: | | | | | | | | | |

Dividends (b) | | $ | 2,609 | | | $ | 3,542 | | | $ | 1,367 | |

| Interest | | | 4 | | | | 3 | | | | 5 | |

| Total investment income | | | 2,613 | | | | 3,545 | | | | 1,372 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Management fees | | | 1,104 | | | | 843 | | | | 853 | |

| Distribution (12b-1) fees - Class A | | | 11 | | | | 11 | | | | 11 | |

| Administration, Accounting and transfer agent fees and expenses | | | 12,527 | | | | 12,530 | | | | 12,532 | |

| Miscellaneous | | | 3,040 | | | | 3,040 | | | | 3,039 | |

| Audit fees | | | 2,428 | | | | 2,428 | | | | 2,428 | |

| Legal fees | | | 1,460 | | | | 1,460 | | | | 1,460 | |

| Custodian fees | | | 1,048 | | | | 1,048 | | | | 1,048 | |

| Pricing fees | | | 1,279 | | | | 1,571 | | | | 1,426 | |

| Trustee fees and expenses | | | 765 | | | | 765 | | | | 765 | |

| Registration and filing fees | | | 214 | | | | 214 | | | | 214 | |

| Insurance | | | 33 | | | | 33 | | | | 33 | |

| Total expenses | | | 23,909 | | | | 23,943 | | | | 23,809 | |

| Less: fees waived and expenses absorbed | | | (22,518 | ) | | | (22,808 | ) | | | (22,661 | ) |

| Net expenses | | | 1,391 | | | | 1,135 | | | | 1,148 | |

| | | | | | | | | | | | | |

| Net investment income | | | 1,222 | | | | 2,410 | | | | 224 | |

| | | | | | | | | | | | | |

| Realized and unrealized gain: | | | | | | | | | | | | |

| Net realized gain on: | | | | | | | | | | | | |

| Investments | | | 2,703 | | | | 5,070 | | | | 3,887 | |

| Net realized gain on investments | | | 2,703 | | | | 5,070 | | | | 3,887 | |

| | | | | | | | | | | | | |

| Net change in unrealized appreciation on: | | | | | | | | | | | | |

| Investments | | | 3,621 | | | | 6,235 | | | | 17,000 | |

| Net change in unrealized appreciation | | | 3,621 | | | | 6,235 | | | | 17,000 | |

| | | | | | | | | | | | | |

| Net gain on investments | | | 6,324 | | | | 11,305 | | | | 20,887 | |

| | | | | | | | | | | | | |

| Net increase in net assets resulting from operations | | $ | 7,546 | | | $ | 13,715 | | | $ | 21,111 | |

(a) The Funds commenced operations on March 28, 2013.

(b) Includes foreign taxes withheld of $9, $73, and $0, respectively.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | | SEMI-ANNUAL REPORT |

| STATEMENTS OF CHANGES IN NET ASSETS | | |

| AUGUST 31, 2013 (Unaudited) | | |

| | | Snow Capital | | | Snow Capital | | | Snow Capital | |

| | | Focused Value Fund | | | Hedged Equity Fund | | | Market Plus Fund | |

| | | | | | | | | | |

| | | For the | | | For the | | | For the | |

| | | Period Ended | | | Period Ended | | | Period Ended | |

| | | August 31, 2013 (a) | | | August 31, 2013 (a) | | | August 31, 2013 (a) | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Increase in net assets from: | | | | | | | | | |

| Operations: | | | | | | | | | |

| Net investment income (loss) | | $ | 878 | | | $ | (356 | ) | | $ | 1,668 | |

| Net realized gain on investments | | | 3,109 | | | | 10,167 | | | | 2,827 | |

| Net unrealized appreciation on investments | | | 18,108 | | | | 10,285 | | | | 14,208 | |

| Net increase in net assets resulting from operations | | | 22,095 | | | | 20,096 | | | | 18,703 | |

| | | | | | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | | | | | |

| Increase in net assets from capital share transactions | | | 250,000 | | | | 500,000 | | | | 250,000 | |

| | | | | | | | | | | | | |

| Increase in net assets | | | 272,095 | | | | 520,096 | | | | 268,703 | |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

| Beginning of period | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| End of period | | $ | 272,095 | | | $ | 520,096 | | | $ | 268,703 | |

| Undistributed (accumulated) net investment income (loss) | | $ | 878 | | | $ | (356 | ) | | $ | 1,668 | |

(a) The Funds commenced operations on March 28, 2013.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | | SEMI-ANNUAL REPORT |

| STATEMENTS OF CHANGES IN NET ASSETS | | |

| AUGUST 31, 2013 (Unaudited) | | |

| | | Snow Capital | | | | | | | |

| | | Inflation Advantaged Equities Fund | | | Plus Fund | | | Value Fund | |

| | | | | | | | | | |

| | | For the | | | For the | | | For the | |

| | | Period Ended | | | Period Ended | | | Period Ended | |

| | | August 31, 2013 (a) | | | August 31, 2013 (a) | | | August 31, 2013 (a) | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Increase in net assets from: | | | | | | | | | |

| Operations: | | | | | | | | | |

| Net investment income | | $ | 1,222 | | | $ | 2,410 | | | $ | 224 | |

| Net realized gain on investments | | | 2,703 | | | | 5,070 | | | | 3,887 | |

| Net unrealized appreciation on investments | | | 3,621 | | | | 6,235 | | | | 17,000 | |

| Net increase in net assets resulting from operations | | | 7,546 | | | | 13,715 | | | | 21,111 | |

| | | | | | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | | | | | |

| Increase in net assets from capital share transactions | | | 250,000 | | | | 250,000 | | | | 250,000 | |

| | | | | | | | | | | | | |

| Increase in net assets | | | 257,546 | | | | 263,715 | | | | 271,111 | |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

| Beginning of period | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| End of period | | $ | 257,546 | | | $ | 263,715 | | | $ | 271,111 | |

| Undistributed net investment income | | $ | 1,222 | | | $ | 2,410 | | | $ | 224 | |

(a) The Funds commenced operations on March 28, 2013.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| FINANCIAL HIGHLIGHTS | |

| AUGUST 31, 2013 (Unaudited) | |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Focused Value Fund | | | | Snow Capital Hedged Equity Fund | | |

| | | | | | | | | | | | | | | | | |

| | | Class A | | | | Class I | | | | Class A | | | | Class I | | |

| | | For the | | | | For the | | | | For the | | | | For the | | |

| | | Period Ended | | | | Period Ended | | | | Period Ended | | | | Period Ended | | |

| | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | |

| | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 20.00 | | | | $ | 20.00 | | | | $ | 20.00 | | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.05 | | | | | 0.07 | | | | | (0.04 | ) | | | | (0.01 | ) | |

Net realized and unrealized gain on investments | | | 1.69 | | | | | 1.70 | | | | | 0.82 | | | | | 0.81 | | |

| Total from investment operations | | | 1.74 | | | | | 1.77 | | | | | 0.78 | | | | | 0.80 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 21.74 | | | | $ | 21.77 | | | | $ | 20.78 | | | | $ | 20.80 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (b) | | | 8.70 | % | (c) | | | 8.85 | % | (c) | | | 3.90 | % | (c) | | | 4.00 | % | (c) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 11 | | | | $ | 261 | | | | $ | 10 | | | | $ | 510 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 20.77 | % | (d) | | | 20.52 | % | (d) | | | 11.91 | % | (d) (e) | | | 11.66 | % | (d) (e) |

| After fees waived and expenses absorbed | | | 1.40 | % | (d) | | | 1.15 | % | (d) | | | 1.94 | % | (d) (e) | | | 1.69 | % | (d) (e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (18.85 | )% | (d) | | | (18.59 | )% | (d) | | | (10.38 | )% | (d) (e) | | | (10.13 | )% | (d) (e) |

| After fees waived and expenses absorbed | | | 0.53 | % | (d) | | | 0.78 | % | (d) | | | (0.40 | )% | (d) (e) | | | (0.16 | )% | (d) (e) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 22.26 | % | (c) | | | 22.26 | % | (c) | | | 119.37 | % | (c) | | | 119.37 | % | (c) |

(a) The Funds commenced operations on March 28, 2013.

(b) Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

(c) Not annualized.

(d) Annualized.

(e) The ratios include 0.44% for dividends on securities sold short and interest expense.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| FINANCIAL HIGHLIGHTS | |

| AUGUST 31, 2013 (Unaudited) | |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | | | | | | | | | Snow Capital | | |

| | | Snow Capital Market Plus Fund | | | | Inflation Advantaged Equities Fund | | |

| | | | | | | | | | | | | | | | | |

| | | Class A | | | | Class I | | | | Class A | | | | Class I | | |

| | | For the | | | | For the | | | | For the | | | | For the | | |

| | | Period Ended | | | | Period Ended | | | | Period Ended | | | | Period Ended | | |

| | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | |

| | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 20.00 | | | | $ | 20.00 | | | | $ | 20.00 | | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | | | | 0.13 | | | | | 0.08 | | | | | 0.10 | | |

| Net realized and unrealized gain on investments | | | 1.36 | | | | | 1.37 | | | | | 0.50 | | | | | 0.50 | | |

| Total from investment operations | | | 1.47 | | | | | 1.50 | | | | | 0.58 | | | | | 0.60 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 21.47 | | | | $ | 21.50 | | | | $ | 20.58 | | | | $ | 20.60 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (b) | | | 7.35 | % | (c) | | | 7.50 | % | (c) | | | 2.90 | % | (c) | | | 3.00 | % | (c) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 11 | | | | $ | 258 | | | | $ | 10 | | | | $ | 247 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 21.53 | % | (d) | | | 21.28 | % | (d) | | | 21.90 | % | (d) | | | 21.65 | % | (d) |

| After fees waived and expenses absorbed | | | 1.00 | % | (d) | | | 0.75 | % | (d) | | | 1.50 | % | (d) | | | 1.25 | % | (d) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (19.31 | )% | (d) | | | (19.06 | )% | (d) | | | (19.53 | )% | (d) | | | (19.28 | )% | (d) |

| After fees waived and expenses absorbed | | | 1.23 | % | (d) | | | 1.48 | % | (d) | | | 0.87 | % | (d) | | | 1.12 | % | (d) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 20.87 | % | (c) | | | 20.87 | % | (c) | | | 20.79 | % | (c) | | | 20.79 | % | (c) |

(a) The Funds commenced operations on March 28, 2013.

(b) Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

(c) Not annualized.

(d) Annualized.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

| FINANCIAL HIGHLIGHTS | |

| AUGUST 31, 2013 (Unaudited) | |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Dividend Plus Fund | | | | Snow Capital Mid Cap Value Fund | | |

| | | | | | | | | | | | | | | | | |

| | | Class A | | | | Class I | | | | Class A | | | | Class I | | |

| | | For the | | | | For the | | | | For the | | | | For the | | |

| | | Period Ended | | | | Period Ended | | | | Period Ended | | | | Period Ended | | |

| | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | | | August 31, 2013 (a) | | |

| | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 20.00 | | | | $ | 20.00 | | | | $ | 20.00 | | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.17 | | | | | 0.19 | | | | | - | | (b) | | | 0.02 | | |

| Net realized and unrealized gain on investments | | | 0.91 | | | | | 0.91 | | | | | 1.67 | | | | | 1.67 | | |

| Total from investment operations | | | 1.08 | | | | | 1.10 | | | | | 1.67 | | | | | 1.69 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 21.08 | | | | $ | 21.10 | | | | $ | 21.67 | | | | $ | 21.69 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (c) | | | 5.40 | % | (d) | | | 5.50 | % | (d) | | | 8.35 | % | (d) | | | 8.45 | % | (d) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 11 | | | | $ | 253 | | | | $ | 11 | | | | $ | 260 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 21.53 | % | (e) | | | 21.29 | % | (e) | | | 21.17 | % | (e) | | | 20.92 | % | (e) |

| After fees waived and expenses absorbed | | | 1.25 | % | (e) | | | 1.00 | % | (e) | | | 1.25 | % | (e) | | | 1.00 | % | (e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (18.38 | )% | (e) | | | (18.13 | )% | (e) | | | (19.96 | )% | (e) | | | (19.71 | )% | (e) |

| After fees waived and expenses absorbed | | | 1.91 | % | (e) | | | 2.16 | % | (e) | | | (0.04 | )% | (e) | | | 0.21 | % | (e) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 34.44 | % | (d) | | | 34.44 | % | (d) | | | 13.03 | % | (d) | | | 13.03 | % | (d) |

(a) The Funds commenced operations on March 28, 2013.

(b) Net investment income resulted in less than $0.01 per share.

(c) Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

(d) Not annualized.

(e) Annualized.

The accompanying notes are an integral part of these financial statements.

August 31, 2013 (Unaudited)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Snow Family of Funds (the “Funds”) are a series of 360 Funds (the “Trust”). The Trust was organized on February 25, 2005 as a Delaware statutory trust. The Trust is registered as an open end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Trust currently offers eight series of shares. The following series of the Snow Family Funds: (i) Snow Capital Focused Value Fund (“Focused Value Fund”), (ii) Snow Capital Hedged Equity Fund (“Hedged Equity Fund”), (iii) Snow Capital Market Plus Fund (“Market Plus Fund”), (iv) Snow Capital Inflation Advantaged Equities Fund (“Inflation Advantaged Equities Fund”), (v) Snow Capital Dividend Plus Fund (“Dividend Plus Fund”), and (vi) Snow Capital Mid Cap Value Fund (“Mid Cap Value Fund”) (each a “Fund” and collectively, the Funds) are each an open end management investment company and separate series of the Trust. All of the Funds, except Snow Capital Dividend Plus Fund, are non-diversified Funds. As non-diversified Funds, they may invest a significant portion of its assets in a small number of companies. The Funds’ investment adviser is Snow Capital Management, L.P (the “Adviser”). Each Fund offers two classes of shares, Class A and Class I shares. Each class of shares commenced operations on March 28, 2013. Each class differs as to sales and redemption charges and ongoing fees. Income and realized/unrealized gains or losses are allocated to each class based on relative share balances. Each Fund’s investment objectives are as follows:

| Focused Value Fund | Long-term growth of capital |

| Hedged Equity Fund | Long-term growth of capital and protection of investment principal with lower volatility than the U.S. equity market |

| Market Plus Fund | Long-term growth of capital |

| Inflation Advantaged Equities Fund | Long-term growth of capital and protection of investment principal |

| Dividend Plus Fund | Long-term growth of capital and income |

| Mid Cap Value Fund | Long-term growth of capital |

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

a) Investment Valuation - Equity securities, including Exchange Traded Funds (“ETFs”), listed on a securities exchange or quoted on a national market system are valued at 4:00 p.m., New York time, on the day of valuation. Price information on listed securities is taken from the exchange where the security is primarily traded. Equity securities that are traded on the NASDAQ National Market System, for which quotes are readily available, are valued at the official closing price. Securities that are listed on an exchange but which are not traded on the valuation date are valued at the most recent bid quotation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy described below. When an equity security is valued by an independent pricing service using factors other than market quotations or the market is considered inactive, they will be categorized in Level 2. Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1. Securities with maturities of 60 days or less may be valued at amortized cost, which approximates fair value and would be categorized as Level 2. The Funds normally use pricing services to obtain market quotations. Securities and assets for which representative market quotations are not readily available or which cannot be accurately valued using the Funds’ normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Board of Trustees (the “Board”). Depending on the relative significance of valuation inputs, fair valued securities may be classified in either Level 2 or Level 3 of the fair value hierarchy. Fair value pricing may be used, for example, in situations where (i) a portfolio security, such as a small-cap stock, is so thinly traded that there have been no transactions for that stock over an extended period of time or the validity of a market quotation received is questionable; (ii) the exchange on which the portfolio security is principally traded closes early; (iii) trading of the particular portfolio security is halted during the day and does not resume prior to the Fund’s net asset value calculation; or (iv) the security or warrant is a restricted security not registered under federal securities laws purchased through a private placement not eligible for resale. Because a fair value determination is based on an assessment of the value of the security pursuant to the policies approved by the Fund’s Board, the fair value price may differ substantially from the price at which the security may ultimately be traded or sold. The differences could be material. As of August 31, 2013, no securities were fair valued as determined by the Board.

| Snow Family of Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2013 (Unaudited)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under ASC 820 are described below:

| Level 1 – | Quoted prices in active markets for identical securities. |

| Level 2 – | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used, as of August 31, 2013, in valuing the Fund’s investments carried at fair value:

Security Classification (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Focused Value Fund: | | | | | | | | | | | | |

Common Stock (b) | | | 260,999 | | | | - | | | | - | | | | 260,999 | |

| Short-Term Investments | | | 15,490 | | | | - | | | | - | | | | 15,490 | |

| Total Investments in Securities | | | 276,489 | | | | - | | | | - | | | | 276,489 | |

| Hedged Equity Fund: | | | | | | | | | | | | | | | | |

Common Stock (b) | | | 426,589 | | | | - | | | | - | | | | 426,589 | |

Exchange-Traded Funds (b) | | | 61,498 | | | | - | | | | - | | | | 61,498 | |

| Short-Term Investments | | | 29,019 | | | | - | | | | - | | | | 29,019 | |

| Total Investments in Securities | | | 517,106 | | | | - | | | | - | | | | 517,106 | |

Common Stock – Sold Short (b) | | | 25,637 | | | | - | | | | - | | | | 25,637 | |

Exchange-Traded Funds – Sold Short (b) | | | 138,077 | | | | - | | | | - | | | | 138,077 | |

| Total Investments in Securities Sold Short | | | 163,714 | | | | - | | | | - | | | | 163,714 | |

| Market Plus Fund: | | | | | | | | | | | | | | | | |

Common Stock (b) | | | 260,477 | | | | - | | | | - | | | | 260,477 | |

| Short-Term Investments | | | 12,508 | | | | - | | | | - | | | | 12,508 | |

| Total Investments in Securities | | | 272,985 | | | | - | | | | - | | | | 272,985 | |

| Inflation Advantaged Equities Fund: | | | | | | | | | | | | | | | | |

Common Stock (b) | | | 251,564 | | | | - | | | | - | | | | 251,564 | |

| Short-Term Investments | | | 10,460 | | | | - | | | | - | | | | 10,460 | |

| Total Investments in Securities | | | 262,024 | | | | - | | | | - | | | | 262,024 | |

| Dividend Plus Fund: | | | | | | | | | | | | | | | | |

Common Stock (b) | | | 251,217 | | | | - | | | | - | | | | 251,217 | |

Preferred Stock (b) | | | 9,710 | | | | - | | | | - | | | | 9,710 | |

| Short-Term Investments | | | 7,288 | | | | - | | | | - | | | | 7,288 | |

| Total Investments in Securities | | | 268,215 | | | | - | | | | - | | | | 268,215 | |

| Mid Cap Value Fund: | | | | | | | | | | | | | | | | |

Common Stock (b) | | | 259,253 | | | | - | | | | - | | | | 259,253 | |

| Short-Term Investments | | | 16,850 | | | | - | | | | - | | | | 16,850 | |

| Total Investments in Securities | | | 276,103 | | | | - | | | | - | | | | 276,103 | |

| Snow Family of Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2013 (Unaudited)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

(a) At August 31, 2013, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(b) All common stock and exchange traded funds held in the Funds are Level 1 securities. For a detailed break-out of common stock by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

The Fund recognizes transfers, if any, between fair value hierarchy levels at the reporting period end. There were no transfers between levels as of May 31, 2013, from the valuation input levels used on March 28, 2013 (inception date).

b) Federal Income Taxes - The Funds intend to qualify as a regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Funds to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of their net investment company taxable income and net capital gains. Therefore, no provisions for federal income taxes are required.

As of and during the period since inception of March 28, 2013 through August 31, 2013, the Funds did not have any liabilities for any unrecognized tax expenses. The Funds recognize interest and penalties, if any, related to unrecognized tax liability as income tax expense in the statements of operations. During the period since inception of March 28, 2013 through August 31, 2013, the Funds did not incur any interest or penalties. The Funds identify their major tax jurisdictions as U.S. Federal and the state of Delaware.

c) Distributions to Shareholders - Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains.

e) Use of Estimates - The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Other - Investment and shareholder transactions are recorded on trade date. The Funds determine the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Funds and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

g) Short Sales of Securities – A Fund may make short sales, which are transactions in which a Fund sells a security it does not own in anticipation of a decline in the market value of that security. To complete a short sale transaction, a Fund will borrow the security from a broker-dealer, which generally involves the payment of a premium and transaction costs. A Fund then sells the borrowed security to a buyer in the market. A Fund will then cover the short position by buying shares in the market either (i) at its discretion; or (ii) when called by the broker-dealer lender. Until the security is replaced, a Fund is required to pay the broker-dealer lender any dividends or interest that accrues during the period of the loan. In addition, the net proceeds of the short sale will be retained by the broker to the extent necessary to meet regulatory or other requirements, until the short position is closed out.

A Fund will incur a loss as a result of the short sale if the price of the security increases between the date of the short sale and the date on which a Fund replaces the borrowed security. A Fund will realize a gain if the security declines in price between those dates. The amount of any gain will be decreased, and the amount of any loss increased, by the amount of the premium, dividends, interest or expenses a Fund may be required to pay in connection with a short sale. When a Fund makes a short sale, a Fund will segregate liquid assets (such as cash, U.S. government securities, or equity securities) on a Fund’s books and/or in a segregated account at a Fund’s custodian in an amount sufficient to cover the current value of the securities to be replaced as well as any dividends, interest and/or transaction costs due to the broker-dealer lender. In determining the amount to be segregated, any securities that have been sold short by a Fund will be marked to market daily. To the extent the market price of the security sold short increases and more assets are required to meet a Fund’s short sale obligations, additional assets will be segregated to ensure adequate coverage of a Fund’s short position obligations.

| Snow Family of Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2013 (Unaudited)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

In addition, a Fund may make short sales “against the box”, i.e., when a Fund sells a security short when a Fund has segregated securities equivalent in kind and amount to the securities sold short (or securities convertible or exchangeable into such securities) and will hold such securities while the short sale is outstanding. A Fund will incur transaction costs, including interest, in connection with opening, maintaining, and closing short sales against the box.

h) Exchange Traded Funds – A Fund may invest in Exchange Traded Funds (“ETFs”). ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustees fees, and marketing expenses, and ETF shareholders, such as a Fund, pay their proportionate share of these expenses. Your cost of investing in a Fund will generally be higher than the cost of investing directly in ETFs. By investing in a Fund, you will indirectly bear fees and expenses charged by the underlying ETFs in which a Fund invests in addition to a Fund's direct fees and expenses.

i) Redemption fees - Shareholders that redeem shares within 30 days of purchase will be assessed a redemption fee of 0.50% of the amount redeemed. The redemption fee is paid directly to and retained by the Funds, and is designed to deter excessive short-term trading and to offset brokerage commissions, market impact and other costs that may be associated with short-term money movement in and out of the Funds. No redemption fees were paid to the Funds during the period since inception of March 28, 2013 through August 31, 2013.

| 2. | CAPITAL SHARE TRANSACTIONS |

Transactions in shares of capital stock for the Funds for the period since inception of March 28, 2013 through August 31, 2013 were as follows:

| Focused Value Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Class A | | | | | | | | | | | | |

| Shares | | | 500 | | | | - | | | | - | | | | 500 | |

| Value | | $ | 10,000 | | | | - | | | | - | | | $ | 10,000 | |

| Class I | | | | | | | | | | | | | | | | |

| Shares | | | 12,000 | | | | - | | | | - | | | | 12,000 | |

| Value | | $ | 240,000 | | | | - | | | | - | | | $ | 240,000 | |

| Hedged Equity Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Class A | | | | | | | | | | | | |