| John H. Lively The Law Offices of John H. Lively & Associates, Inc. A Member Firm of The 1940 Act Law GroupTM 11300 Tomahawk Creek Parkway, Suite 310 Leawood, KS 66211 Phone: 913.660.0778 Fax: 913.660.9157 john.lively@1940actlawgroup.com |

October 13, 2017

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | 360 Funds (the “Trust”) (File Nos. 811-21726 and 333-123290) |

Dear Ms. O’Neal-Johnson and Ms. Fettig:

On June 23, 2017, the Trust filed with the Securities and Exchange Commission (the “Commission”) Post-Effective Amendment No. 76 under the Securities Act of 1933, as amended (the “1933 Act”) and Amendment No. 77 under the Investment Company Act of 1940, as amended (collectively, the “Amendment”) to the Trust’s registration statement relating to the EAS Crow Point Alternatives Fund (the “Fund). The Amendment was filed for the purpose of adding the Fund as a series portfolio of the Trust. The Fund is being reorganized from a series of Northern Lights Fund Trust into the Trust and a Form N-14 was filed relating to this reorganization on July 31, 2017 (the “N-14 Filing”).

You recently provided both accounting and legal comments to us relating to the Amendment. This letter responds to those comments and they are set out separately below. For your convenience and reference, we have summarized your comments in this letter and provided the Trust’s response below each such comment. Contemporaneously, with this letter, which we are submitting to you in a correspondence filing, the Trust is filing a Post-Effective Amendment to the Registration Statement pursuant to Rule 485(b) under the 1933 Act (the “B-Filing”). The B-Filing is being made for the purpose of incorporating modifications to the Fund’s prospectus and statement of additional information in response to your comments on the Amendment as described in this letter, and to make other minor and conforming changes.

Accounting Comments

| 1. | Comment: Please confirm that the Trust will not sell shares of the Fund until the closing of the reorganization occurs. |

Response: The Trust confirms that no shares of the Fund will be sold prior to the closing of the reorganization.

| 2. | Comment: Please review the fee table information on “interest and dividends on securities sold short.” There should not be a difference in this fee among the classes and Class A is listed at 0.67% while Class C and I shares are listed at 0.74%. |

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

Response: The Trust has advised that the differences in expense ratios among the shares classes of the Existing Fund for the “Interest and Dividends on Securities Sold Short” among share classes is caused by the timing differences of accruals, changes in amounts of dividend/interest expense accruals and changes in allocation percentages to each share class between each accrual date. Over time, these differences eventually caused differences in the dividend/interest expense ratios between each share class.

| 3. | Comment: Please review the estimate of “other expenses” as it seems that this Fund has higher expenses overall following the reorganization and not lower expenses, whereas the other two funds that are part of the reorganization have lower expenses. |

Response: The Trust has reviewed the “other expenses” and made adjustments, as needed to reflect the expense following the reorganization.

| 4. | Comment: Please review and revise the terms of the expense limitation agreement disclosure. Please confirm that the Fund may only make repayments to the adviser if such repayment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed both: (1) the expense cap in place at the time such amounts were waived; and (2) the Fund’s current expense cap. |

Response: The Trust confirms that the Fund will only make repayments to the adviser if such repayment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed both: (1) the expense cap in place at the time such amounts were waived; and (2) the Fund’s current expense cap.

| 5. | Comment: Please review the first page of the SAI for the Fund as it does not seem to incorporate by reference the Fund’s annual report. |

Response: The Trust has revised the disclosure to address your comments.

| 6. | Comment: Please advise if there will be a change in accountant for the Fund from the predecessor fund. If so, please confirm that the Trust will include the required change in accountant disclosure in the Fund’s next annual or semi-annual report. The Staff reminds the Trust that while this reorganization is a “shell” reorganization, the Staff considers there to be a change in accountant if the predecessor fund utilized the services of one accounting firm and the new fund following the reorganization will utilize the services of a different accounting firm. |

Response: The Fund will have a new accountant following the reorganization – BBD, LLP. This change in auditor is part of an effort of the Trust to make uniform the three funds that are part of this conversion. Currently, the funds have two different auditors. BBD currently audits one of the other funds that is part of this conversion. The administrator of the Trust has confirmed to the Trust that it will include the appropriate change in accountant disclosure in the Fund’s next annual or semi-annual report.

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

| 7. | Comment: Please confirm that the fee estimates presented in the fee table will be consistent with the pro form fee estimates contained in the N-14 Filing. |

| | Response: | The Trust confirms that the fee estimates presented in the fee table will be consistent with the pro form fee estimates contained in the N-14 Filing. |

Legal Comments

Summary Prospectus – Fees and Expenses of the Fund

| 8. | Comment: As a follow-on to Accounting Comment #4 above, please also note that in addition to the requirement stated in Comment #4, the Fund also has an issue under FAS 5 in that the recoupment is only permitted if it is 3 years (36 months) from the date of the waiver. If a recoupment is not completed within this 36-month period then it raises the question of whether the recoupment is “probable” from an accounting perspective and whether the fund would need to book the recoupment as a “liability” or not. |

Response: The Trust respectfully disagrees with this comment. Under the operating expense limitation agreement, the Adviser has agreed to waive its fees or reimburse the Fund in order to limit the Fund’s annual operating expenses to the stated expense ratios applicable to the Fund, as calculated on a per annum basis. While the Fund attempts to estimate the amounts to be waived or reimbursed by the Adviser via accruals made throughout the year, the Fund’s expenses and asset levels will fluctuate, preventing a determination of the final annual expense ratios and, accordingly, the amounts required to be waived or reimbursed by the Adviser until the full fiscal year is completed. For example, a fund with minimal assets at the beginning of the year whose asset levels increase significantly during the year may accrue for an advisory fee waiver over the first few months of the year, but later determine that such advisory fee waiver is not actually required if the Fund’s expense ratio, as calculated on an annualized basis, is under the agreed upon limit. In this situation, despite the fact that the fund initially accrued for a fee waiver, the adviser would not actually waive any of its fees during the year.

Similarly, whether the Adviser may recoup its previously waived fees or Fund expenses paid cannot be determined until the full fiscal year is completed. Only if the Fund’s annual expense ratios are below the agreed upon limits is the Adviser eligible for recoupment of its previously waived fees/expenses reimbursed. Further, under the terms of the operating expense limitation agreement, such amounts are only eligible for recoupment if they are within the three fiscal years of the fiscal year that they were waived or reimbursed. As noted above, the actual waiver or reimbursement is always determined as of the end of the fiscal year. Therefore, any recoupment by the Adviser would occur within three years of that date.

The Trust also notes that it considers all applicable accounting standards for purposes of accruals and expense limitation arrangements. Additionally, the Trust confirms that it will perform periodic FAS 5 analyses in the context of administering expense limitation arrangements.

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

| 9. | Comment: The Staff notes that this Fund discusses numerous times in its strategy that it may make investments in ETFs and hedge funds. Please confirm that the amount listed in the fee table under “acquired fund fees and expenses” of 0.04% is accurate. |

Response: The Trust has reviewed and updated the fee table and the “acquired fund fees and expenses” as necessary.

Summary Prospectus – Principal Investment Strategies of the Fund

| 10. | Comment: Please provide in your correspondence letter the percentage of the Fund’s assets that would be invested in asset backed securities. |

Response: The Adviser has advised that no more than 30% of the Fund’s assets would be invested in asset backed securities. The Adviser has confirmed that to the extent that the Fund invests in asset backed securities, the Fund will be able to meet the liquidity standards.

| 11. | Comment: Please disclose in the investment strategies section the market capitalization targets for the global equities component for the Fund, if any. |

Response: The Adviser has advised that the market capitalization target is $250 million to $300 billion. As such, the Trust has revised the disclosure as you have requested.

| 12. | Comment: Please disclose the credit quality and maturity standard for the Fund’s fixed income portion of its investments, if any. |

Response: The Adviser has advised that the Fund is not limited by maturity or credit quality for fixed income investments and, as such, the Trust has revised the disclosure as you have requested.

| 13. | Comment: Please add to the disclosure the types of derivatives the Fund may invest in as well as how they will be used and any particular risks associated with those derivatives. |

Response: The Adviser has advised that the Fund may invest in listed equity and index options and that it utilizes such options selectively to hedge individual stock exposure. The Trust has revised the disclosure to this effect.

| 14. | Comment: Please move the disclosure in the summary portion of the prospectus on the multi-manager exemptive order to the Item 9 portion of the prospectus. |

Response: The Trust has revised the disclosure as you have requested.

Summary Prospectus – Principal Risks of Investing in the Fund

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

| 15. | Comment: Please add to the disclosure in “Lower-Rated Securities Risk” the speculative nature of junk bonds. |

Response: The Trust has revised the disclosure as you have requested.

Summary Prospectus – Performance

| 16. | Comment: Please update the performance information to reflect 2016 returns. The performance information is presented in the Attachment to this letter. |

Response: The Trust has revised the disclosure as you have requested.

| 17. | Comment: Please explain why Class I returns are used for the total returns table. Should the bar chart reflect sales loads or be adjusted in any way. |

Response: The Trust notes that all three classes of the Predecessor Fund commenced operations on August 14, 2008 and, as such, pursuant to Instruction 3(a) to Item 4(b) the Trust believes that the selection of Class I returns are appropriate.

| 18. | Comment: Please explain why the Trust believes the HFRI Fund of Funds Index is a broad-based securities market index and can be used alone rather than as a secondary index measure for the Fund’s performance. |

Response: While the Trust believes that the HFRI Fund of Funds Index may constitute a broad-based securities market index for purposes of Form N-1A, the Trust will nonetheless add another index that conforms to more traditional and prevalently utilized broad based securities market indices for purposes of Form N-1A.

| 19. | Comment: Please confirm that the April 30, 2017 financial highlights have been added to the prospectus. |

Response: The Trust has included the April 30, 2017 financial highlights in the B-Filing.

* * * * * *

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

October 13, 2017

Please contact me at (913) 660-0778 regarding the responses contained in this letter.

| | Sincerely, |

| | |

| | /s/ John H. Lively |

| | |

| | John H. Lively |

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

October 13, 2017

ATTACHMENT

Performance. The Fund was reorganized on October 13, 2017 from a series of Northern Lights Fund Trust, a Delaware statutory trust (the “Predecessor Fund”), to a series of 360 Funds, a Delaware statutory trust (the “Reorganization”). While the Fund is substantially similar to the Predecessor Fund and theoretically would have invested in the same portfolio of securities, the Fund’s performance may be different than the performance of the Predecessor Fund due to, among other things, differences in fees and expenses.

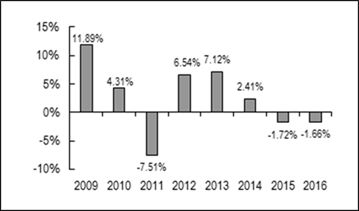

The bar chart and performance table below show the variability of the Predecessor Fund’s returns, which is some indication of the risks of investing in the Fund. The bar chart shows performance of the Predecessor Fund’s Class I shares for each full calendar year since the Predecessor Fund’s inception. The performance table compares the performance of the Predecessor Fund’s Class A, Class C and Class I shares over time to the performance of a broad-based securities market index. You should be aware that the Predecessor Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the future. Updated performance information will be available at no cost by calling (877) 244-6235.

Performance Bar Chart For Class I Shares

Calendar Years Ended December 31

| Best Quarter: | 6/30/09 | 5.72% |

| Worst Quarter: | 9/30/11 | (9.12)% |

The total return for Class I shares for the quarter ended June 30, 2017 was 3.23%.

Performance Table

Average Annual Total Returns

(For periods ended December 31, 2015)

| | One Year | Five Years | Since Inception (8-14-08) |

| Class I Return before taxes | (1.72)% | 1.22% | 1.06% |

| Class I Return after taxes on distributions | (2.00)% | 0.44% | 0.48% |

| Class I Return after taxes on distributions and sale of Fund shares | (0.74)% | 0.95% | 0.83% |

| Class A Return before taxes with load | (7.24)% | (0.16)% | 0.07% |

| Class C Return before taxes | (2.60)% | 0.23% | 0.13% |

| Barclay’s Aggregate U.S. Bond Index | 2.65% | 2.23% | 4.22% |

| HFRI Fund-of-Funds Conservative Index*** | 1.89% | 3.43% | 1.00%** |

| * | The Fund’s current adviser has managed the Fund since March 1, 2013. |

| ** | 8/31/08 used in calculation. The index only prices monthly which is the reason for using the month-end for this calculation. |

| *** | The HFRI Fund-of-Funds Conservative index is included because it shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives. |

Ms. Deborah O’Neal-Johnson

Ms. Christina DiAngelo Fettig

U.S. Securities and Exchange Commission

After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. The after-tax returns are not relevant if you hold your Fund shares in tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRA”). Class A returns before taxes include maximum possible sale load. After-tax returns for Class A and Class C shares, which are not shown, will vary from those of Class I shares. The Fund’s broad based securities market index (benchmark) has been changed to the HFRI Fund-of-Funds Conservative Index from the S&P 500® Index to better reflect the securities and strategies used by the Fund’s Adviser.

It is important to note that the Predecessor Fund’s name was changed and the strategy of the EAS Crow Point Alternatives Fund was modified, effective March 1, 2013 and the strategy was updated again, effective August 29, 2016. Under the investment approach prior to March 1, 2013, the EAS Crow Point Alternatives Fund, formerly known as the “EAS Alternatives Fund” and the “EAS Genesis Fund,” had a broader mandate and the Predecessor Fund was managed by a different investment adviser and portfolio manager. The Fund’s current investment adviser, Crow Point Partners, LLC, began managing the Predecessor Fund in March, 2013. The historical performance information illustrated above includes that of the Predecessor Fund’s former strategy, run by the former portfolio management team.

Current performance of the Fund may be lower or higher than the performance quoted above. Updated performance information may be obtained by calling (877) 244-6235.