UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement under Section 14(d)(4)

of the Securities Exchange Act of 1934

COLEY PHARMACEUTICAL GROUP, INC.

(Name of Subject Company)

COLEY PHARMACEUTICAL GROUP, INC.

(Names of Persons Filing Statement)

COMMON STOCK, PAR VALUE $0.01 PER SHARE

(Title of Class of Securities)

19388P 10 L

(CUSIP Number of Class of Securities)

Robert L. Bratzler, Ph.D.

President and Chief Executive Officer

(Principal Executive Officer)

93 Worcester Street, Suite 101

Wellesley, MA 02481

(781) 431-9000

(Name, address, and telephone number of person authorized to receive

notices and communications on behalf of the persons filing statement)

WITH COPIES TO:

William T. Whelan, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

One Financial Center

Boston, MA 02111

(617) 542-6000

x Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

The following are presentation slides and a transcript of the presentation given by Coley Pharmaceutical Group, Inc. at the Lazard Capital Markets Fourth Annual Healthcare Conference on November 27, 2007.

Lazard Capital Markets Fourth Annual Healthcare Conference Robert L. Bratzler, Ph.D. President & CEO November 27, 2007 |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 2 Safe Harbor This presentation contains certain “forward-looking” statements, including those relating to the progress of clinical development of the product candidates of Coley Pharmaceutical Group, Inc. (the “Company”) and its partners and collaborators, the Company’s ability to develop new products, earn future milestone payments, the Company’s strategy, the Company’s goals for 2007, and development of future therapies. These statements are based on the current estimates and assumptions of the management of the Company as of the date of this presentation and are subject to uncertainty and changes in circumstances. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Actual results may vary materially from the expectations contained herein. When used herein, the words “may,” “will,” “should,” “could,” “would,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “project,” “potential” and “expect” and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause the actual results of the Company to be materially different from those reflected in such forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward- looking statements include, among others, those set forth in the Company’s filings with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2006. Except to the extent required by applicable securities laws, the Company is not under any obligation (and expressly disclaims any such obligation) to update its forward-looking statements, whether as a result of new information, future events, or otherwise. All statements contained in this presentation are made only as of the date of this presentation. |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 3 Headline News: Pfizer to Acquire Coley Cash tender offer $8.00/share; $164M enterprise value Unanimous approval by Coley BOD; Management Anticipated close: Early 2008 Best opportunity for Coley constituents Shareholders, employees, patients Acquisition expands Pfizer’s investment in vaccines; Broadens scope in key therapeutic areas Alzheimer’s, Asthma, Oncology, Infectious Disease |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 4 Additional Information About the Tender Offer and Where to Find It The tender offer for the outstanding common stock of Coley referred to in these slides has not yet commenced. These slides are neither an offer to purchase nor a solicitation of an offer to sell any securities. The solicitation and the offer to buy shares of Coley common stock will be made pursuant to an offer to purchase and related materials that Pfizer intends to file with the U.S. Securities and Exchange Commission. At the time the Offer is commenced, Pfizer will file a Tender Offer Statement on Schedule TO with the U.S. Securities and Exchange Commission, and thereafter Coley will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the Offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully and considered before any decision is made with respect to the tender offer. These materials will be sent free of charge to all stockholders of Coley. In addition, all of these materials (and all other materials filed by Coley with the U.S. Securities and Exchange Commission) will be available at no charge from the U.S. Securities and Exchange Commission through its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the U.S. Securities and Exchange Commission by Coley at www.coleypharma.com. |

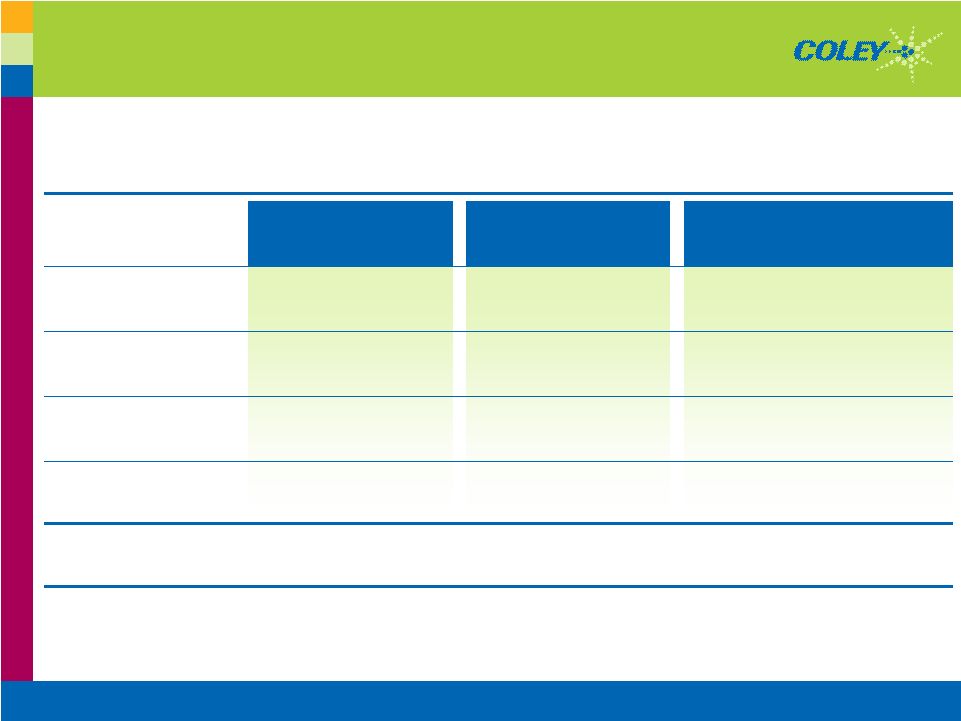

Copyright © 2007 Coley Pharmaceutical Group, Inc. 5 Autoimmune Disorders Cancer Allergy and Asthma Vaccines (Adjuvants) PRECLINICAL & DISCOVERY PHASE I PHASE II PHASE III Cancers Asthma / Allergy Lupus / RA Cancers Cancer Vaccines Dominant TLR9 IP Extensive TLR7, TLR8 IP Maximize Opportunities to Monetize IP TLR Pioneer with Multi-Product Platform Robust Pipeline Dominant Intellectual Property Broad Immunology Product Platform >$100M >$100M Received >$800M >$800M in Potential Milestones Partner Momentum |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 6 TLR Therapeutics™: Broad Platform; Many Opportunities Multiple Targets TLR7, TLR8, TLR9… TLR Platform Multiple Pharmacological Approaches Agonists and Antagonists Broad Range of Applications Vaccines (Adjuvants), Cancers, Allergy and Asthma, etc… |

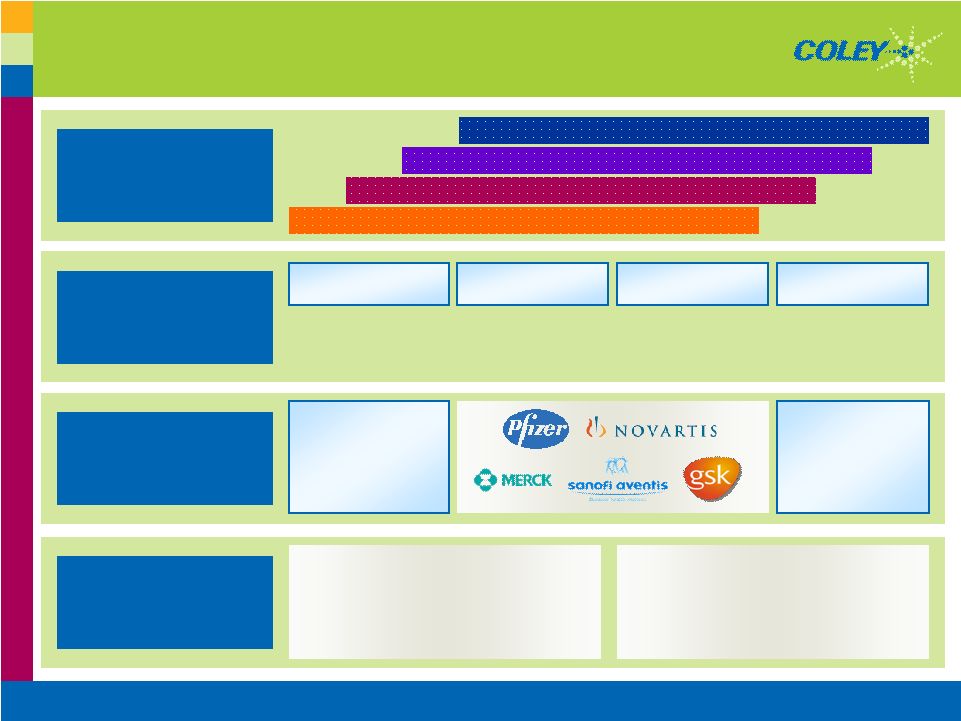

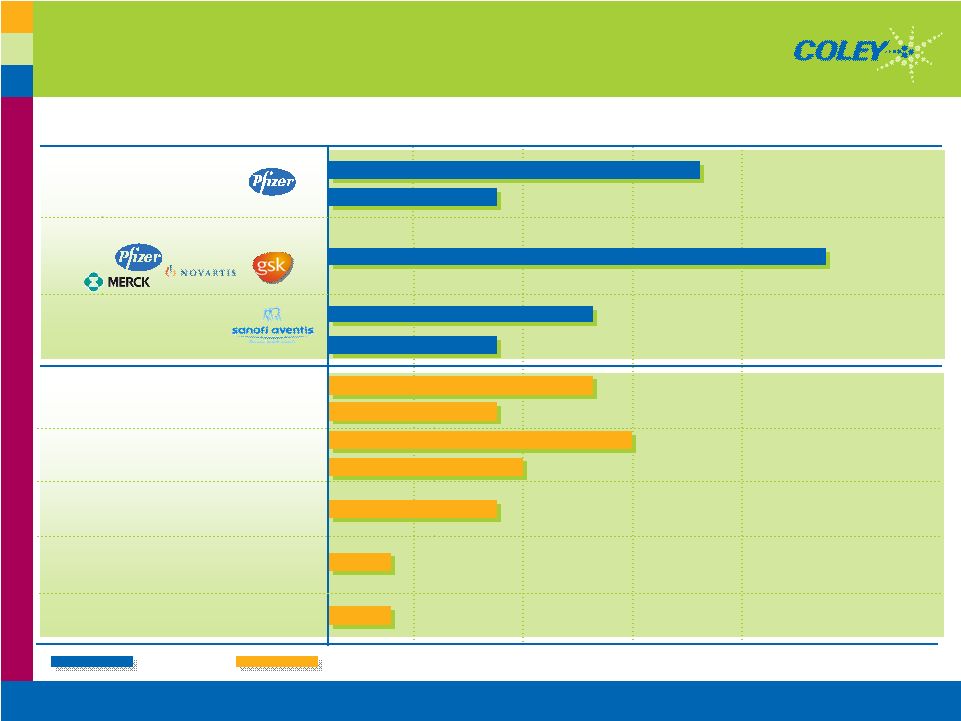

Copyright © 2007 Coley Pharmaceutical Group, Inc. 7 THERAPEUTICS VACCINE ADJUVANTS Strategy to Maximize TLR Platform Value IP (Dynavax/Merck) $10M VaxImmune (GSK, Merck, Novartis, Pfizer) $175M 2 nd and 3 rd Generation Adjuvants COLEY TLR7/8/9 Antagonists Lupus/RA COLEY TLR9 Agonists Cancer Pfizer $515M TLR9 Agonists Asthma sanofi-aventis $256M TLR7/8 Agonists (RNA) Cancer/ID/Asthma/COPD COLEY TLR7/8 Agonists (3M) Cancer/ID/Asthma COLEY TLR Platform Immune Modifying Agents IDO, RIG-I, IRAK4 COLEY |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 8 PRE- CLINICAL PHASE I PHASE II PROGRAMS DISCOVERY PHASE III A Broad Pipeline To Maximize Value CANCER TLR9 Agonists PF-3512676 (CPG 7909) VaxImmune TLR9 Adjuvant CANCER ID ASTHMA/ ALLERGY TLR9 Agonists LUPUS / RA / PSORIASIS (TLR 7/8/9 SMOL Antagonists) CANCER / ID / ALLERGY (RNA TLR7, TLR8 Agonists) = Partnered = Proprietary VaxImmune™ (CPG 7909) AVE 0675 Cancer Cancer ACQUIRED TLR TECHNOLOGY (TLR7, TLR7/8 Agonists) 2nd GENERATION ADJUVANTS (ODN TLR9 Agonists) 3rd GENERATION ADJUVANTS (RNA TLR7, TLR8 Agonists) Cancer, HCV, Asthma Cancer, HCV, Asthma CPG 52852 CPG 52854 CPG 52364 SAR 21609 |

Cancer PF-3512676 VaxImmune™ |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 10 ONGOING COMMITMENTS Strong, Multi-Indication Collaboration with Pfizer Immuno- Oncology Vaccines TLR9 Agonist Strategic Partnership & ‘676 Development New ‘676 Combinations and New Indications for Clinical Development 2nd Generation Candidate Nominated for Clinical Development FORWARD PROGRESS |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 11 Pfizer Clinical Progress PRE- CLINICAL PHASE I PHASE II PROGRAMS DISCOVERY PHASE III REFRACTORY NSCLC - w/ Tarceva ® ADVANCED MELANOMA - w/ Anti-CTLA-4 Other Cancer Indications (In Development) 2nd Generation Candidates Coley’s Independent Clinical Studies with TLR9 Agonists Have Shown Objective Responses in 5 Different Types of Cancer, Both Solid and Liquid Tumor Types Ongoing and Planned Trials ONGOING PLANNED |

Vaccine Adjuvants VaxImmune™ Cancer Cancer, ID & others |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 13 Leading Pharma Companies Committed to Vaccine Research Adjuvants Boost the Effectiveness of Vaccines Vaccine Market is Large and Growing The Role of Adjuvants in the Vaccine Market Fewer Shots and Faster Immunity Critical in Fast-Moving Disease or Bio-Warfare $10B Worldwide Vaccine Market in 2006; Growing to $24B by 20121 1 Decision Resources, Kalorama Information Research Report, Feb. 2007 |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 14 Collaborations Demonstrate Value of VaxImmune™ $4M $33M ID/Alzheimer’s Merck > $25 million > $175 million Totals: $2M $35M ID Novartis $12M $62M ID GSK $12M $44M Cancer GSK Milestones Received to Date Total Deal Indication PARTNER |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 15 Proof-of-Concept Demonstrated for VaxImmune Clinical Well Tolerated >35 Ongoing Clinical Studies — Dosed >800 Patients — Infection and Pandemic Disease — Bio-Warfare Defense Faster Sero-protection Stronger T cell response Higher antibody titers Preclinical Antigen-Agnostic Highly Synergistic with Other Adjuvants/ Delivery Systems MOA Antigen-Specific Immunity with Less Toxicity Advantageous PK Properties |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 16 VaxImmune™ for Lung Cancer in Phase III with GSK GSK’s MAGE-3 cancer immunotherapeutic Novel class of medicines to train immune system to recognize and eliminate cancer cells. Phase III trial started October ’07 triggering $3M milestone Trial Design – SPA Procedure Phase III clinical trial in resectable Stage I, II, IIIa lung cancer Randomized, double blind, placebo controlled Target enrollment of 2,270 patients 2 patient groups: +/- chemotherapy PRE- CLINICAL PHASE I PHASE II PROGRAMS DISCOVERY PHASE III VACCINES CANCER VaxImmune™ |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 17 Beyond VaxImmune Activity important for next generation of vaccines Prophylaxis or treatment of lifestyle and age related conditions – Anti-nicotine, Alzheimer’s For immune compromised populations – Cancer patients, chronically infected Second and third generation vaccine adjuvants in development Immunostimulatory RNA- and DNA-based Tailored immune responses for specific end-use applications IND-ready Opportunity to monetize IP |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 19 A Novel Immunomodulatory Approach for Pulmonary Diseases AVE-0675 Works at highest level of the immune cascade Rebalances immune response Unique TLR9 agonist Allergen-agnostic Delivery by inhalation Potential to be steroid-sparing Collaboration Update $256M preclinical deal + double digit royalty on sales Received $14M to date AVE-0675 US Phase I completed SAR 21609 Late preclinical |

AutoImmune Diseases CPG 52364 An orally available Toll-Like Receptor 7/8/9 antagonist for autoimmune disorders |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 21 Small Molecule TLR Antagonist Program—Phase I Underway CPG 52364 Potent TLR7, 8, & 9 antagonist discovered through state-of-the- art computational-aided drug design and SAR studies Orally-available, small molecule Phase I dose escalation safety and pharmacology trial started 2 nd generation antagonists in pre-clinical development Program partnership potential Opportunities: Lupus, RA, Psoriasis Multibillion $ market potential Diseases mediated by inappropriate activation of TLRs 7, 8, and 9 Lupus and RA therapies: current drug w/ no known MOA discovered to be a weak TLR9 and partial TLR7 & 8 antagonist Concept: block TLRs 7, 8, and 9 for reduced immune complex & TNF-alpha production |

TLR7 and TLR8 Therapeutic Programs Strategic Acquisition |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 23 Objectives for 3M Acquisition Strengthens & Diversifies Pipeline Extends and Protects TLR Leadership Provides for Long-Term Value Creation Through Product Development and IP Monetization Strategic Acquisition of 3M’s Small Molecule TLR7 and TLR8 Programs Clinical-stage and IND-ready candidates Extensive IP estate Small molecule library (>10,000 Compounds) Acquisition price: $20 million + contingency payments Clinical Plan in Development; Update in 1H ‘08 |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 24 Strong Cash Position $77-79 2007 Cash Balance Guidance 26.6M Shares Outstanding $28-30 2007 Estimated Cash Burn $35-37 2007 Estimated Net Loss $17 Purchased Technology (3M) $88 Cash and Marketable Securities September 30, 2007 $Millions |

Copyright © 2007 Coley Pharmaceutical Group, Inc. 25 Accomplishments to Date 2007 Building Value for Shareholders Objectives 2007 Pfizer to acquire Coley; $8.00/share Pfizer Collaboration Expanded; 2 nd Generation Candidate Nominated $37M VaxImmune License to Merck GSK Started Phase III Trial with VaxImmune sanofi-aventis Completed Phase I Safety Study with AVE-0675 Granted IP License to Dynavax (Merck) for HEPLISAV™ (Phase III) Acquired 3M’s TLR7 and TLR8 Programs Advanced proprietary small molecule Lupus/RA program into Phase I Advance Partnered and Proprietary Programs Broaden Clinical Pipeline into New Therapeutic Indications Continue Partner Momentum with New VaxImmune Collaborations Monetize Intellectual Property |

Good morning I’m Terrence Glenmore the biotech analyst at Lazard Capital Markets. This morning we are pleased to welcome Coley Pharmaceutical Group. Presenting for the company is Dr. Bob Bratzler, President and C.E.O. Bob-

Thanks Terrence. And thanks to Lazard for the opportunity to present. Today I’m pleased to present the progress Coley has made this year, culminating in the proposed acquisition by Pfizer. I will be making some forward looking statements; I refer you to the risk factors as articulated in our filings, at the US Securities and Exchange Commission.

So the big news of course with Coley, is the pending acquisition of Coley by Pfizer. We announced this proposed transaction on November 16th. The transaction is summarized here on this slide. We are very excited about the prospect of Pfizer acquiring all of Coley via a cash tender offer at 8 dollars per share translating to an enterprise value of 164 million dollars. Management and Coley’s board enthusiastically supports this transaction which we anticipate will close in 2008.

In thinking about making the best way forward for Coley we were struck by how best to achieve our mission of making a difference in the lives of our patients with the drugs we design to direct the immune system to fight disease and we think this is the best way forward. The space where we are pioneering will be well served by the resources and commitment of Pfizer. So not only will the patients benefit ultimately but we hope Coley employees and indeed shareholders alike. The future of TLR Therapeutics again we think is in good hands and Pfizer as you perhaps already know has an arrangement with Coley in the field of cancer and by virtue of this acquisition this expands their range of investment in TLR Therapeutics across a broad range of indications, some of which are mentioned here on this slide, notably in vaccines. It’s interesting to speculate but in five to ten years time in my view we will see increasing uses of therapeutic approaches involving vaccines to treat a wide range of diseases, some of them listed here, such as Alzheimer’s, allergy, asthma, auto-immune diseases as well as the more traditional diseases cancer and infectious diseases. In short we think this is a good deal for all concerned, just by way of mechanics. There is additional information that can be found about this cash tender offer at the filings at the Securities and Exchange Commission. Pfizer will make a filing in the near term with that agency, and this presentation today is no kind of an offer or solicitation of shares. When this tender is formally commenced as it will be in the next days, shareholders of Coley will be notified and then they will be given the opportunity to tender their shares to Pfizer at the 8 dollar share price. If you need more information I refer you not only to the SEC but as well to the Coley website. Thank you.

Now, Pfizer saw in Coley, an opportunity to acquire a broad, product oriented, immunology platform. We are pioneers as I said in this, in what we call Toll-like receptor therapeutics, TLR Therapeutics, which can be designed to drive and elicit immune responses to fight diseases across a broad range of indications in a very natural way. We have the tools and the technology to stimulate the immune system, to redirect the immune system, and or to suppress the immune system. Hence drugs for the potential treatment of autoimmune disorders on one hand, ranging all the way to fighting cancers on

the other. We have discovered from this platform, six different drugs that we have taken forward into clinical development. As shown here, all the way from, all the way out from our most advanced products for the treatment of cancers, to phase three. More about that in a moment.

We are particularly proud of our partners’ momentum. We have consummated five major license transactions for five different drug candidates with name players in the space, multinational pharmaceutical companies. Deals totaling close to a billion dollars of which as of today we have received some hundred million the rest achievable upon achieving regulatory milestones. This partnering has not only validated the scientific platform, we think. But as well provides enormous leverage, both financial and importantly product development leverage. The partnerships are all based on our proprietary intellectual partnership position. We have some 400 patents and close to 1000 patent applications. We are dominant, being the first to move forward in the Toll-like receptor 9 space and through recent acquisition of some technology and products from 3m, now having expanded and diversified into the Toll-like receptor 7 and 8 space. So this gives us many opportunities to monetize the IP in the form of partnerships while retaining ownership of programs for our own account.

So the strategy of Coley was one of risk diversification through broadening the pipeline, taking advantage of the fact that if you target Toll-like receptors 7, 8 and 9 with different compounds you can elicit different immunologic responses. And depending on how you target them, if you target them with an agonist you can stimulate an immune response, or if you target them with a molecule that will block the receptor you can induce pharmacological immune suppression effect. Antagonists and agonists provide diversity as well. And given that this is a natural response, that is to say harnessing the power of the immune system to fight disease naturally, it is clear that there are a wide range of indications and we today have shown activity in cancer, allergy, asthma, infectious disease and the like, so we think this whole field is just at the early embryonic stages of blossoming into something very important for future treatment paradigms.

Now, one way to look at this wealth of opportunity is to divide the world, the TLR world, that is to say, into vaccine adjuvant uses where we use out immune stimulants to boost our partner’s vaccines, and therapeutic applications where the immunologic agent is the active ingredient, if you will, to drive the desired disease specific response.

So let me just talk briefly about where we are in vaccine adjuvants. This, by the way, the vaccine adjuvants side of the house, is one of the drivers, I think, that propelled Pfizer toward making an acquisition of Coley. As you can see, we have in place agreements with generation one vaccine adjuvant Vaccinium, amongst Merck, Glaxo, Novartis, and Pfizer, totaling some 175 million dollars worth of deals. This year we licensed to Dynavax who in turn licensed to Merck, rights to our technology for the purposes of stimulating a hepatitis B vaccine that Merck now has in phase three.

What was going on behind the scenes while we were licensing Vaccinium was a development for second and third generation adjuvants based on both dna and rna that target not only TLR 9 but TLR 7 and 8 that afford additional opportunities to tailor vaccine immune responses according to the need of a particular

vaccine. We are one of the few companies, I think in the world, that has this sort of technology available for boosting the immune responses of vaccines.

Turning now to the other half of Coley if you will the therapeutic side, it is summarized here on the slide, the TLR-9 agonist program in cancer is partnered with Pfizer. There is a TLR-9 agonist program where we redirect immune responses with Sanofi Aventis. We recently announced the initiation of our phase one program with our antagonist for auto immune, lupus and rheumatory arthritis, and then unpartnered as well are the TLR-7,8 rna based agonists which we think have potential utility in cancer, infectious disease, asthma and chronic obstructive pulmonary diseases, as well as the agonist that we then licensed from 3m, TLR 7 and 8 small molecule agonists for cancer, infectious diseases and asthma, and last, a clinical program where we have discovered some other immune modifying agents to counteract the regulatory suppressive effects of the immune system.

So in short, a broad pipeline to maximize value. Shown on this slide is the pipeline view, which I think gives you an impression of a portfolio of compounds that perhaps you might think is associated with a company much larger than Coley. Risk diversification is one theme here. Six different compounds discovered. Second theme: both clinical and preclinical programs across a wide range of diseases.

Let me in the time that I have today give you a little sense of where some of these programs stand in a little more detail. First I want to talk about cancer, and a program with Pfizer and, subsequently to that, our program with GlaxoSmithKline. Needless to say our program with cancer with Pfizer is alive and very well. Pfizer has publically committed to the immune-oncology space. They are committed to the development of vaccines presumably in cancers and we are central, I think, to that strategic thrust of Pfizer.

In the last month, leading up the acquisition, Pfizer announced that they were not only expanding the development program for 676 to include new indications in cancer for clinical developments but as well they had selected and nominated a second generation TLR-9 agonist for clinical development in cancer enhanced immunological properties. 676 as you may recall is the compound that experienced a setback in phase three clinical trials this past summer. I think it is fair to say that Pfizer views that as an interesting result but not one that by any means limits the potential upside for use of 676, in fact in their program going forward they continue to look at use of 676 in a Phase 2 study with targeted therapy Tarceva and second line non small cell lung cancer. We are excited about the idea of combining 676, an immune stimulatory agent, with the anti – (Indescernable) 4 antibody addressing the regulatory, or the breaks of the immune system, hoping that if you push on the accelerator and release the brakes, even better anti-cancer effects might result.

There are other indications that Pfizer has in the works that are all based on the fact that Coley has previously independently demonstrated in clinical studies, single agent activity this TLR9 agonist in 5 different kinds of cancer, both solid and liquid tumors.

So this program with Pfizer is alive and well as I said and it will be interesting to see in the fullness of time how this turns out, and I’m quite optimistic.

The other major thrust of Coley that has advanced to phase three is the use of Vaccinium to stimulate our partner Glaxo’s vaccine for the treatment of lung cancer. Perhaps you have been made aware of the recent advances in the vaccine market . The market is quite large and is growing, and the exciting part moving forward into vaccines is not only to use vaccines to prevent disease, prophylactic use, which is the historic application, but now, to use the power of the immune system to actually treat diseases in an antigen or disease specific way. This would apply not only to infectious disease but move into cancer and other debilitating diseases as well.

Vaccinium has provided a financial base of support for our operations at Coley to date. We’ve done some 175 million dollars worth of deals, taking down over 25 million dollars in milestones with several major partners — Glaxo, Novartis, and Merck, as shown on this slide. So this clearly demonstrates that this emerging gold standard of immune stimulants can make a difference in the treatment of diseases. The fact that this has utility is not only manifest in the form of the partnerships and the money, but as well as a large body of scientific evidence, preclinical and clinical, to suggest that this indeed is a very powerful way to treat diseases. You can generate antigen specific immunity with less toxicity, pk properties are superior, it doesn’t matter it works perfectly well with virtually any antigen you might want to combine it with. 35 ongoing clinical studies having dosed close to 1000 patients across a range of diseases you get faster onset of antibody response, stronger t-cell therapeutic responses, higher antibody and more durable responses. So I think that quite a breakthrough is provided by Vaccinium over previous adjuvants and Vaccines. The most telling example is the Glaxo phase 2 and phase three results in cancers where Vaccinium has been used as part of the adjuvant mix.

Glaxo announced this year the largest phase three trial ever conducted in cancer, some 2200 patients, combining nag 3 peptide antigen with peptide 3 among which is Vaccinium. The trial started in October of this year, three million dollar milestone to Coley, and under the USFPA procedure, this trial qualifies as a registration quality trial such that when the results are read out in 2012, there is a good chance that this would represent the first positive, approved, hopefully approvable, therapeutic vaccine for the treatment of cancer. A real revolution in the oncology space. Beyond Vaccinium we have other agents that target Toll-like receptors 7 8 and 9 that can be tailored to elicit unique and highly desirable immune responses. Think about vaccines for smoking addiction, nicotine. Think about vaccines for Alzheimer’s. Think about vaccines for patients whose immune systems are somehow compromised. This is what is in store I think the next 5 to ten years, and I think we have to tools to help make that a reality but have the ability to tailor this immune response for specific applications. So that’s cancer, both in monotherapy as well as vaccines where we stimulate the immune response.

Now we turn to a novel and <indiscernable> approach for treatment of pulmonary diseases where we redirect an abhorrent or undesired immune response with our agent. This is a drug that we designed to work at the highest level of immune cascade given directly to the lung to rebalance an inappropriate

immune response. So if someone’s allergic to ragweed for example, they hyperreact when ragweed is presented, the idea is you give our drug and a more normal reaction occurs. No sneezing, no wheezing and you are not treating the symptoms you are addressing the underlying cause of the disease. And therefore has the potential not only to reduce the use of beta-agonists and also has the potential to be steroid sparing.

Sanofi Aventis our partner saw the potential to revolutionize the treatment of pulmonary diseases with this approach and in 2001 we entered into a substantial collaboration which of the 256 million dollar deal we received some 14 million to date. The compound 0675 has completed the U.S. phase ones and is now moving into European studies. A second generation compound 609 is in late pre clinical development.

So, stimulation, redirect5, and the third way to use our technology is to suppress undesired immune responses typically associated with auto immune disorders. We and others discovered that Toll-like receptors 7 8 and 9 are turned on inadvertently in diseases like lupus, rheumatoid arthritis and psoriasis and causes the immune system to attack itself. Clearly a huge unmet medical need here, multibillion dollar markets across all three of these indications.

One of the observations made was that a drug not known, mechanistically how it works, hydroxyclororquin, actually blocks the activation of TLR9 and to some extent TLR 7 and 8. We went to school on this and said if we could come up with a drug that is far more potent and more directed than the drug that has been used for 30 years to treat the disease , maybe we could have a positive impact moving forward, and so we threw state of the art computationally aided drug design and developed small molecules, actually a family of small molecules, the lead one being 364, orally available for treatment of mild to moderate lupus, R.A. and perhaps psoriasis.

We have initiated our phase one safety study dose escalation is underway and it is going well, and we have posted on its heels, second generation antagonists in preclinical development. This I think was also a driver in the transaction with Pfizer.

Part of our strategy has been to diversify our pipeline, as I mentioned earlier. Earlier this year we bought from 3m their TLR7 and 8 small molecule agonist. Programs encompassed therein were two clinical stage compounds one IND ready, the other one already having been in the clinic, and extensive IP estate, a library of tens of thousands of small molecules we can put to our screens, and we got all of this, basically 15 years worth of research and development for 20 million dollars, plus contingency payments. So this again solidified our position in the TLR space, diversified the pipeline, and provides us ways going forward that we’ll need to stay independent to monetize these assets to help underwrite our business.

We have traditionally been very judicious we think with our investment of cash. We will, as you see on this slide, end the year 2007 with 77 to 79 million dollars in cash, and a burn estimated in the 28 to 30 million dollar range. 2007 has been an exciting year for Coley.I would argue or submit that we have built significant shareholder value, obviously culminating in Pfizer’s acquisition of Coley should it close, and we think it will close in early 2008.

We licensed Vaccinium to Merck, Glaxo started phase three trials, Sanofi Aventis completed the phase one trials with 0675, we granted a license to Dynavax for what is now a phase three vaccine program heplasav, and acquired 3m technology and advanced our own internally discovered and developed proprietary small molecule program into the clinic for the potential treatment of Lupus.

So with that I’ll close, and I wish to thank each and every one of you, shareholders, and on behalf of all Coley employees, thank you for your support and I look forward to the Pfizer deal closing in early 2008 and continued progress in the advancement of this exciting new technology TLR therapeutics. So thank you very much.