Filed pursuant to Rule 424(b)(3)

Registration Nos. 333-138131

333-138131-01

333-138131-02

333-138131-03

333-138131-04

333-138131-05

$390,000,000

Warner Chilcott Corporation

8 3/4 Senior Subordinated Notes due 2015

The 8 3/4% Senior Subordinated Notes due 2015 (the “notes”) were issued on January 13, 2005 and will mature on February 1, 2015. Interest on the notes is paid on February 1 and August 1 of each year.

The notes are our unsecured senior subordinated obligations and rank junior to all our existing and future senior indebtedness, including indebtedness under our senior secured credit facility. The notes are guaranteed on a senior subordinated basis by Warner Chilcott Limited, Warner Chilcott Holdings Company III, Limited (“Holdings”), and Warner Chilcott Intermediate (Luxembourg) S.à r.l. (“Luxco”), our indirect and direct parent companies, respectively, and by Holdings’ U.S. and Puerto Rican subsidiaries.

We may redeem some or all of the notes at any time prior to February 1, 2010 at a redemption price equal to the make-whole amount set forth in this prospectus. We may also redeem some or all of the notes at any time on or after February 1, 2010 at the redemption prices set forth in this prospectus. There is no sinking fund for the notes.

You should consider carefully the “Risk Factors” beginning on page 16 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is to be used by Credit Suisse Securities (USA) LLC and J.P. Morgan Securities Inc. in connection with offers and sales related to market making transactions in the notes. Credit Suisse Securities (USA) LLC and J.P. Morgan Securities Inc. may act as principal or agent in such transactions. Such sales will be made at prices related to prevailing market prices at the time of sale.

July 6, 2007

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

INDUSTRY AND MARKET DATA

Industry and market data used throughout this prospectus were obtained through reports of IMS Health Incorporated (“IMS”). While we believe that the reports of IMS are reliable and appropriate, we have not independently verified such data.

TRADEMARKS

We have proprietary rights to a number of trademarks used in this prospectus which are important to our business, including Doryx®, Duricef®, Estrace®, Estrostep®, femhrt®, Femcon™, Femring®, Femtrace®, Loestrin®, Moisturel®, Ovcon®, Sarafem® and Warner Chilcott®. Dovonex®, Taclonex®, Dovobet® and Daivobet® are registered trademarks of LEO Pharma A/S (“LEO Pharma”). We have omitted the “®” and “™” trademark designation for such trademarks in this prospectus. Nevertheless, all rights to such trademarks named in this prospectus are reserved.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere, or incorporated by reference, in this prospectus. It may not contain all the information that is important to you. You should read this entire prospectus, including the information incorporated by reference herein, carefully, including “Risk Factors,” the consolidated financial statements and the related notes thereto, before making an investment decision. Unless otherwise noted or the context otherwise requires, references in this prospectus to “Warner Chilcott,” “the Company,” “our company,” “we,” “us” or “our” for periods after January 5, 2005 refer to Warner Chilcott Limited, and its direct and indirect subsidiaries (the “Successor”), following the consummation of the acquisition of Warner Chilcott PLC by Warner Chilcott Acquisition Limited on January 5, 2005 (the “Acquisition Date”) and the other transactions described in this summary under “The Transactions” and for periods prior to the Acquisition Date refer to the historical operations of Warner Chilcott PLC, the public company that was acquired in connection with the Transactions, together with its subsidiaries (the “Predecessor”). The Predecessor operated and reported using a fiscal year ending on September 30. After the acquisition of the Predecessor, we changed our fiscal year to a calendar year. Therefore, all references in this prospectus to “fiscal year 2002,” “fiscal year 2003” or “fiscal year 2004” are to the twelve months ended September 30 of the year referenced and all references in this prospectus to “year ended 2005” or “ year ended 2006” are to the twelve months ending December 31, 2005 and 2006, respectively.

Our Business

We are a leading specialty pharmaceutical company focused on segments of the U.S. pharmaceutical market, currently women’s healthcare and dermatology. We are a fully-integrated company with internal resources dedicated to product development, manufacturing and the promotion of our products. We have established strong franchises in these two areas through our precision marketing techniques and specialty sales forces which now comprise approximately 491 representatives. We believe that our proven product development capabilities, coupled with our ability to execute acquisitions and in-licensing transactions and develop partnerships, such as our relationship with LEO Pharma, will enable us to sustain and grow these franchises. We operate two manufacturing facilities located in Fajardo, Puerto Rico and Larne, Northern Ireland (UK).

Our franchises are comprised of complementary portfolios of established branded, development-stage and new products, including our recently introduced products, Loestrin 24 Fe, Taclonex and Femcon Fe (formerly Ovcon 35 Fe). Our women’s healthcare franchise is anchored by our strong presence in the hormonal contraceptive and hormone therapy (“HT”) categories and our dermatology franchise is built on our established positions in the markets for psoriasis and acne therapies. In April 2006, we launched Loestrin 24 Fe, an oral contraceptive with a novel patented 24-day dosing regimen, with the goal of growing the market share position we have achieved with our Ovcon and Estrostep products in the hormonal contraceptive market. In November 2006, we introduced Femcon Fe which is the first and only chewable oral contraceptive approved by the United States Food and Drug Administration (“FDA”). We also have a significant presence in the HT market, primarily through our products femhrt and Estrace Cream. In dermatology, our psoriasis product Dovonex enjoys the leading position in the United States for the non-steroidal topical treatment of psoriasis. We strengthened and extended our position in the market for psoriasis therapies with the April 2006 launch of Taclonex, the first once-a-day topical psoriasis treatment that combines betamethasone dipropionate, a corticosteroid, with calcipotriene, the active ingredient in Dovonex. Our product Doryx is the leading branded oral tetracycline in the United States for the treatment of acne. In 2005, we launched Doryx delayed-release tablets.

1

Our strategy is to grow our specialty pharmaceutical products business by focusing on therapeutic areas dominated by specialist physicians. We believe that we will continue to drive organic growth by employing our precision marketing techniques. Furthermore, we intend to supplement our growth and broaden our market position in our existing franchises through ongoing product development. Our internal product development is focused on new products, proprietary product improvements and new and enhanced dosage forms. We selectively review potential product in-licensing, acquisition and partnership opportunities within our franchises, such as our relationship with LEO Pharma, or in market segments that have characteristics similar to our current markets. We believe that our streamlined corporate organization and resulting ability to react rapidly to changing market dynamics enhances our ability to execute on our strategy.

In our development of new products and product enhancements, we have a track record of successful and cost-efficient internal product development with six new drug application (“NDA”) approvals from the FDA since March 2003. Our research and development team has significant experience and proven capabilities in specialty chemistry, pharmaceutical development and clinical development. We focus our research and development efforts primarily on developing new products that target therapeutic areas with established regulatory guidance, making proprietary improvements to our existing products and developing new and enhanced dosage forms. Through this focused approach to research and development, we seek to enhance the value of our franchises by investing in relatively low-risk projects.

The U.S. pharmaceutical market generated sales of approximately $286 billion in 2006 and has grown at a compound annual growth rate of approximately 7.6% since 2001, according to IMS. Large pharmaceutical companies have been consolidating and are focusing on developing and marketing “blockbuster” drugs that have the potential of generating more than $1 billion in annual revenues. The focus by large pharmaceutical companies on blockbuster products creates opportunities for specialty pharmaceutical companies like us to compete effectively in smaller but lucrative therapeutic markets.

Dovonex and Taclonex Transactions

In April 2003, our Predecessor, Warner Chilcott PLC, entered into a major strategic alliance in dermatology with LEO Pharma, the developer and owner of Dovonex and Taclonex (and owner of the patents covering these products), and Bristol-Myers Squibb Company (“Bristol-Myers”), the then-exclusive licensee of Dovonex in the United States.

Dovonex is the leading non-steroidal topical treatment for psoriasis. For each quarter over the last four years, Dovonex has had the number one share of both revenues and prescriptions in the non-steroidal topical treatment segment. Often prescribed as a combination therapy with a topical corticosteroid, we believe that Dovonex enjoys wide brand recognition and acceptance among dermatologists as a leading treatment for mild to moderate psoriasis. From April 2003 through December 2005, we promoted Dovonex in the United States under a co-promotion agreement with Bristol-Myers. Under the agreement, we promoted Dovonex and were compensated based upon levels of sales of Dovonex achieved by Bristol-Myers. On January 1, 2006, we acquired the exclusive U.S. sales and marketing rights to Dovonex from Bristol-Myers for a purchase price of $205.2 million (including inventory on hand) plus a 5% royalty on net sales of Dovonex through 2007. We funded the payment of the purchase price by borrowing $200.0 million in delayed-draw term loans under our senior secured credit facility. On January 1, 2006, our license and supply agreement with LEO Pharma for Dovonex became effective and our co-promotion agreement with Bristol-Myers was terminated. Our acquisition of the U.S. sales and marketing rights to Dovonex did not require any significant launch costs or an increase in the size of our sales forces as we had been promoting Dovonex since 2003.

2

Under the LEO Pharma license and supply agreement, we are required to pay LEO Pharma a supply fee for Dovonex equal to 20% of net sales and a royalty equal to 10% of net sales (each as calculated under the terms of the agreement). The royalty will be reduced to 5% if a generic equivalent is introduced.

Taclonex is a once-a-day topical psoriasis treatment that combines calcipotriene, the active ingredient in Dovonex, with the corticosteroid, betamethasone dipropionate, in a single treatment. In April 2003, we entered into agreements with LEO Pharma relating to the development and U.S. commercialization of Taclonex. Taclonex (also known in some countries as Dovobet or Daivobet is currently marketed by or on behalf of LEO Pharma in over 70 countries, including the United Kingdom, Canada and France. LEO Pharma’s New Drug Application (“NDA”) for Taclonex was approved by the FDA on January 9, 2006. Under our agreements with LEO Pharma for Dovonex and Taclonex, we paid LEO Pharma $2.0 million in December 2001, an additional $10.0 million in April 2003 and a final milestone payment of $40.0 million on February 6, 2006 that was triggered by FDA approval of Taclonex. As of September 14, 2005, we became the exclusive licensee of Taclonex in the United States, subject to the terms of our agreement with LEO Pharma. Under the agreement we are required to pay LEO Pharma a supply fee for Taclonex ranging from 20% to 25% of net sales and royalties ranging from 10% to 15% of net sales (each as calculated under the terms of the agreement).

Expansion of LEO Pharma Relationship

LEO Pharma has agreed to expand the scope of our Dovonex and Taclonex licenses to include exclusive U.S. sales and marketing rights to all of LEO Pharma’s product improvements, new and enhanced dosage forms and new products that contain calcipotriene or a combination of calcipotriene and a steroid until 2020. LEO Pharma also granted us a right of first refusal and last offer for the U.S. sales and marketing rights to all products developed by LEO Pharma principally for the treatment or prevention of dermatological diseases through 2010. In connection with these expanded agreements, we paid LEO Pharma an aggregate of $37.0 million during the year ended December 31, 2005. We may make additional payments under these agreements upon the achievement of various development milestones relating to certain identified products and product improvements. These payments could aggregate up to $150.0 million. In addition, we have agreed to pay a supply fee and royalties to LEO Pharma on the net sales of those products. We may also agree to make additional payments for products that have not been identified or that are covered under the right of first refusal and last offer.

3

Franchise Focus and Principal Marketed Products

We market a diversified portfolio of branded products in our women’s healthcare and dermatology franchises. Within these franchises, we compete primarily in four therapeutic categories: hormonal contraception and hormone therapy in women’s healthcare and psoriasis and acne in dermatology. The following chart presents our franchises and their respective therapeutic categories with revenues generated in 2006.

| (1) | Includes Sarafem, our product to treat premenstrual dysphoric disorder. |

4

| | | | | | | | |

Our Principal Products

|

| | | Product (Active Ingredient)

| | Indication

| | Patent

Expiry(1)

| | 2006 Revenue

($mm)

|

| | | Hormonal Contraception | | | | | | |

| | | Loestrin 24 FE (Norethindrone acetate and ethinyl estradiol) | | Prevention of pregnancy | | July 2014 | | $44.2(2) |

| | Ovcon 35 and Ovcon 50 (Norethindrone and ethinyl estradiol) | | Prevention of pregnancy | | Patent expired

prior to 2000 | | $73.8 |

| | | | |

| | | Femcon Fe (Norethindrone and ethinyl estradiol) | | Prevention of pregnancy | | June 2019 | | $7.5(3) |

| | | | |

| | | Estrostep Fe (Norethindrone acetate and ethinyl estradiol) | | Prevention of pregnancy and treatment of moderate acne in women who desire oral contraception | | April 2008(4) | | $103.0 |

| | | | |

| | | Hormone Therapy | | | | | | |

| | | femhrt 1/5 and .5/2.5 (Norethindrone acetate and ethinyl estradiol) | | Oral treatment of moderate to severe vasomotor symptoms and urogenital symptoms associated with menopause | | May 2010(4) | | $58.7 |

| | | | |

| | | Estrace Cream (17-beta estradiol) | | Vaginal cream for treatment of vaginal and vulvar atrophy | | Patent expired

March 2001 | | $65.8 |

| | | | |

| | | Psoriasis | | | | | | |

| | | Taclonex(5) (Calcipotriene and betamethasone dipropionate) | | Topical treatment of psoriasis | | January 2020 | | $60.1(2) |

| | | Dovonex (Calcipotriene) | | Topical treatment of psoriasis | | Ointment-December 2007 Cream and topical solution-June 2015(6) | | $146.9 |

| | | | |

| | | Acne | | | | | | |

| | | Doryx (Doxycycline hyclate) | | Oral adjunctive therapy for severe acne | | December 2022 | | $102.4 |

| | (1) | See “Risk Factors—Risks Relating to Our Business—If generic products that compete with any of our branded pharmaceutical products are approved, sales of our products may be adversely affected.” | |

| | (2) | We launched Loestrin 24 Fe and Taclonex in April 2006. | |

| | (3) | We introduced Femcon Fe in November 2006 (formerly Ovcon 35 Fe). | |

| | (4) | Pursuant to an agreement to settle patent litigation against Barr Laboratories, Inc. (“Barr”), we granted Barr a non-exclusive license to launch generic versions of the product six months prior to expiration of our patents. | |

| | (5) | Taclonex was previously referred to as “Dovobet.” The name was changed during the review by the FDA of the NDA for the product. | |

| | (6) | LEO Pharma has received notices of Paragraph IV certifications in respect of its patent on Dovonex solution which may result in a generic equivalent entering the market as early as January 2008. See Note 11 to the Notes to the Condensed Consolidated Financial Statements for the quarter ended March 31, 2007, incorporated by reference herein. | |

5

New Product Launches

In April 2006, we launched Loestrin 24 Fe, an oral contraceptive with a novel patented 24-day dosing regimen. The majority of oral contraceptive products currently used in the United States are based on a regimen of 21 days of active hormonal pills followed by seven days of placebo. By contrast, with Loestrin 24 Fe women take the active pills for 24 consecutive days followed by four days of placebo. The clinical data show that at the end of the sixth cycle, women who took Loestrin 24 Fe had periods that averaged 2.7 days, compared to 3.9 days with the traditional 21-day regimen. In a national survey of women aged 18 - 49 conducted by Harris Interactive® (funded by us), 85% of women who currently use or have ever used a birth control pill felt that having a shorter period would make a positive difference.

In April 2006, we launched Taclonex, the first and only dual-action therapy of its kind. Taclonex is a once-a-day topical psoriasis treatment that combines betamethasone dipropionate with calcipotriene, the active ingredient in Dovonex. In clinical trials, 81% of patients using Taclonex achieved a significant reduction in disease severity after only 4 weeks of use as compared to 49% of patients using Dovonex alone and 64% of patients using betamethasone dipropionate alone. Many patients with psoriasis have adopted complicated dosing regimens including daily and intermittent use of multiple products. The once-daily dosing of Taclonex provides an opportunity to enhance patient compliance.

In November 2006, we introduced Femcon Fe, the first and only chewable oral contraceptive to receive FDA approval. Femcon Fe’s chewable design provides a convenient, new option for women “on-the-go” taking oral contraceptives.

Our Competitive Strengths

We believe that we possess the following competitive strengths:

| | Ÿ | | Strong franchises in women’s healthcare and dermatology. We are well positioned to grow our franchises through our portfolio of established brands and the growth opportunities from our new products, particularly Loestrin 24 Fe and Taclonex. These franchises are supported by significant intellectual property. |

| | Ÿ | | Effective and efficient sales and marketing approach. We market products that are promotionally sensitive. Using our precision marketing techniques, we deploy our sales representatives and other marketing resources to consistently target physicians with the highest potential to prescribe our products. This approach enables us to optimize our promotional efforts. |

| | Ÿ | | Substantial development capabilities and pipeline. We use our proven internal product development expertise to maintain and grow our franchises. Our internal development efforts have yielded six NDA approvals since 2003. Our exclusive product development relationship with LEO Pharma also provides us with access to additional pipeline opportunities for dermatology products. |

| | Ÿ | | Integrated manufacturing capabilities. The manufacturing and packaging capabilities of our Puerto Rico operations provide us with a reliable source of supply for a number of our brands, including our hormonal products. The integration of our development efforts with our ability to scale up our manufacturing from pilot to production quantities allows us to more efficiently develop products. |

| | Ÿ | | Strong free cash flow generation. Our business generates strong free cash flow as a result of our high sales force productivity and efficient investment in product development activities, coupled with an attractive corporate tax rate and modest capital expenditure requirements. |

6

| | Ÿ | | Experienced management team. The members of our senior management team have an average of over 21 years of experience in the pharmaceutical industry. Through this experience we have gained a deep base of industry knowledge, and built a proven track record of growing market share for new and established products. |

Our Strategy

We intend to continue to develop our specialty pharmaceutical products business by focusing on smaller therapeutic markets, driving organic growth by employing our precision marketing techniques, developing and marketing new products, proprietary product improvements and new and enhanced dosage forms and selectively reviewing potential product in-licensing, acquisition and partnership opportunities within our franchises, such as our relationship with LEO Pharma, or in market segments that have characteristics similar to our current markets.

We believe that the following are risks we face in executing our business strategies:

| | Ÿ | | Generic competition with our branded products. Our branded pharmaceutical products are or may become subject to competition from generic equivalents because there is no proprietary protection for some of the branded pharmaceutical products we sell or our patents are not sufficiently broad or because we lose proprietary protection due to the expiration of a patent. |

| | Ÿ | | Infringement on our intellectual property. If we are unable to protect our trademarks, patents and other intellectual property from infringement, our business prospects may be harmed. We may not have adequate remedies for any infringement, and the expense of bringing lawsuits against infringers could cause us not to continue these suits and abandon the affected products. |

| | Ÿ | | Delays in production of our products. We may face delays in qualifying our manufacturing facility in Puerto Rico for the manufacture of new products or for our other products that are currently manufactured for us by third parties. In addition, we or our contract manufacturers may not be able to manufacture our products without interruption, and our contract manufacturers may not comply with their obligations under our various supply arrangements. |

| | Ÿ | | Downward pricing pressures. Pricing pressures from third-party payors, including managed care organizations, government sponsored health systems and regulations relating to Medicare and Medicaid, healthcare reform, pharmaceutical reimbursement and pricing in general could decrease our revenues. In addition, sales of our products may be adversely affected by the consolidation among wholesale drug distributors and the growth of large retail drug store chains. |

| | Ÿ | | Changes in laws and regulations. Our future operating results could be adversely affected by changes in laws and regulations, including changes in the FDA approval processes that may cause delays in, or prevent the approval of, new products, new laws, regulations and judicial decisions affecting product marketing, promotion or the healthcare field generally, and new laws or judicial decisions affecting intellectual property rights. |

| | Ÿ | | Product liability claims and/or product recalls. Unforeseen side-effects caused by, or manufacturing defects inherent in, the products sold by us could result in injury or death. The occurrence of such an event could result in product liability claims and/or recall of one or more of our products. |

For a discussion of these and other risks associated with our business, including risks related to our strategy and risks related to this offering, see “Risk Factors” beginning on page 16 of this prospectus.

7

Our Sponsors

Our sponsors, Bain Capital, LLC, DLJ Merchant Banking, J.P. Morgan Partners, LLC and Thomas H. Lee Partners are each leading global private equity firms with established track records of successful investments and extensive experience managing investments in the healthcare industry.

The Transactions

In November 2004, affiliates of Bain Capital, LLC, DLJ Merchant Banking, J.P. Morgan Partners, LLC and Thomas H. Lee Partners, who we refer to collectively in this prospectus as the “Sponsors,” reached an agreement to acquire Warner Chilcott PLC. The acquisition became effective on January 5, 2005, and thereafter, following a series of transactions, we acquired 100% of the share capital of Warner Chilcott PLC. We refer to this transaction in this prospectus as the “Acquisition.” To complete the Acquisition, the Sponsors, certain of their limited partners and certain members of our management, indirectly funded equity contributions to us and certain of our subsidiaries, the proceeds of which were used to purchase 100% of Warner Chilcott PLC’s share capital. On January 18, 2005, certain of our subsidiaries borrowed an aggregate of $2,020 million, consisting of an initial drawdown of $1,420 million under a $1,790 million senior secured credit facility and the issuance of the notes by Warner Chilcott Corporation. The proceeds from the acquisition financings, together with cash on hand at Warner Chilcott PLC, were used to pay the selling stockholders $3,014 million, to retire all of Warner Chilcott PLC’s outstanding share options for $70 million, to retire all of Warner Chilcott PLC’s previously outstanding funded indebtedness totaling $195 million and to pay related fees and expenses. In this prospectus, we refer to the Acquisition, together with the related financings, as the “Transactions.”

8

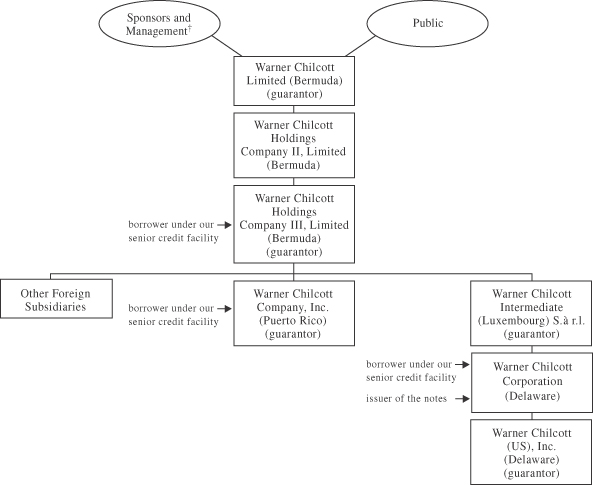

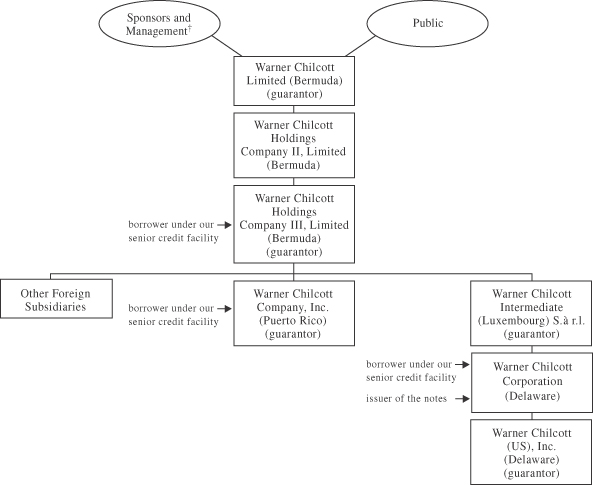

The following chart reflects our corporate structure following the Transactions, the completion of a series of internal restructuring transactions after the completion of the Acquisition and the initial public offering of Warner Chilcott Limited on September 20, 2006. Guarantor references designate guarantors of the notes. Not all guarantors of our senior secured credit facility are shown:

| † | The investment by the Sponsors, certain of their limited partners and certain members of our management was in equity interests in each of Warner Chilcott Limited and Warner Chilcott Holdings Company II, Limited. A portion of the equity interests in Warner Chilcott Holdings Company II, Limited were redeemed and the remainder converted into Class A common shares of Warner Chilcott Limited in connection with Warner Chilcott Limited’s initial public offering. |

The issuer of the notes is Warner Chilcott Corporation. At the time of the funding of the Transactions, Warner Chilcott Holdings Company III, Limited (which we refer to in this prospectus as “Holdings”) was capitalized with approximately $1,283 million of equity that was contributed to it, indirectly, by the Sponsors, certain of their limited partners and certain members of our management. Of that amount, $400.0 million was further contributed to the issuer of the notes. Following the completion of a series of internal restructuring transactions, Warner Chilcott Corporation became the direct 100% shareholder of Warner Chilcott (US), Inc. (our U.S. operating subsidiary which was previously a wholly-owned indirect subsidiary of Warner Chilcott PLC). The notes are guaranteed by Warner Chilcott Limited, Holdings, Warner Chilcott Intermediate (Luxembourg) S.à r.l., Warner Chilcott Company, Inc. and Warner Chilcott (US), Inc.

9

Corporate Information

Our registered office is located at Canon’s Court, 22 Victoria Street, Hamilton HM12, Bermuda. Our telephone number is (441) 295-2244. Our website is accessible throughwww.warnerchilcott.com. Information on, or accessible through, this website is not a part of, and is not incorporated into, this prospectus.

Summary of Terms of the Notes

The summary below describes the principal terms of the notes. Some of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Notes” section of this prospectus contains a more detailed description of the terms and conditions of the notes.

Issuer | Warner Chilcott Corporation |

Securities | $390,000,000 aggregate principal amount of 8 3/4% Senior Subordinated Notes due 2015 registered under the Securities Act. The notes were issued under an indenture dated January 18, 2005. |

Maturity | February 1, 2015. |

Interest Payment Dates | February 1 and August 1 of each year. |

Guarantees | The notes are guaranteed, jointly and severally, on a senior subordinated basis, by Warner Chilcott Limited, Warner Chilcott Holdings Company III, Limited and Warner Chilcott Intermediate (Luxembourg) S.à r.l., Warner Chilcott Corporation’s indirect and direct parent companies, respectively, and by Holdings’ U.S. and Puerto Rican subsidiaries. See “Description of the Notes—Guarantees.” |

Ranking | The notes and the guarantees are our and our guarantors’ unsecured senior subordinated obligations. The notes rank: |

| | • | | junior to all of our and our guarantors’ existing and future senior indebtedness, including borrowings under our senior secured credit facility; |

| | • | | equally in right of payment with all of our and our guarantors’ future unsecured senior subordinated indebtedness; |

| | • | | senior in right of payment to any of our or our guarantors’ future indebtedness that is expressly subordinated in right of payment to the notes; and |

| | • | | effectively junior to all of the existing and future indebtedness, including trade payables, of our subsidiaries that have not guaranteed the notes. |

10

As of March 31, 2007, the notes and the guarantees ranked junior to:

| | • | | $1,097.8 million of our senior indebtedness, all of which consisted of borrowings and guarantees under our senior secured credit facility; and |

| | • | | $15.5 million of total liabilities of our non-guarantor subsidiaries, including trade payables and accrual for taxes but excluding intercompany obligations and guarantees by them of borrowings under our senior secured credit facility. |

At December 31, 2006 and March 31, 2007, the subsidiaries of Holdings that are not guarantors accounted for approximately $322.4 million, or 10.2%, and $313.0 million, or 10.0%, respectively, of our total assets and a nominal amount of revenues (after intercompany eliminations).

Optional Redemption | We may redeem some or all of the notes at any time prior to February 1, 2010 at a redemption price equal to the make-whole amount set forth under “Description of the Notes—Optional Redemption.” We may also redeem some or all of the notes at any time on or after February 1, 2010 at the redemption price listed under “Description of the Notes—Optional Redemption.” |

Change of Control | If we experience a change of control (as defined in the indenture), we will be required to make an offer to repurchase the notes at a price equal to 101% of the principal amount thereof, plus accrued interest, if any, to the date of purchase. See “Description of the Notes—Repurchase at the Option of Holders—Change of Control.” |

Restrictive Covenants | The indenture governing the notes contains certain covenants that, among other things, limit the ability of Holdings and its restricted subsidiaries to: |

| | • | | incur or guarantee additional indebtedness or issue preferred stock; |

| | • | | pay dividends or make distributions to our stockholders; |

| | • | | repurchase or redeem capital stock or subordinated indebtedness; |

| | • | | incur restrictions on the ability of our subsidiaries to pay dividends or to make other payments to us; |

| | • | | enter into transactions with our affiliates; |

| | • | | enter into other lines of business; and |

| | • | | merge or consolidate with other companies or transfer all or substantially all of our assets. |

These limitations are subject to a number of exceptions and qualifications. See “Description of the Notes—Certain Covenants.”

11

Summary Historical Consolidated Financial Data

The following table sets forth our summary historical consolidated financial data. Except for the data relating to the years ended December 31, 2006 and 2005 and the three months ended March 31, 2007 and 2006, all data below reflects the consolidated financial data of the Predecessor. The year ended December 31, 2005 was our first fiscal year following the Acquisition. The financial statements relating to this period reflect the Acquisition as if the closing took place on January 1, 2005 and the operating results for the period January 1 through January 4, 2005 were ours. The period included only two business days and the impact on the results of operations during the period was not material. Our fiscal year ends on December 31 versus the Predecessor’s year-end of September 30.

The summary consolidated financial data as of and for the years ended December 31, 2006 and 2005, as of and for the quarter ended December 31, 2004, and as of and for the fiscal year ended September 30, 2004 presented in this table have been derived from our audited consolidated financial statements and related notes incorporated by reference in this prospectus. The summary consolidated financial data as of and for the quarter ended December 31, 2003 presented in this table have been derived from our unaudited consolidated financial statements and related notes, which are not included or incorporated by reference in this prospectus. The summary consolidated financial data as of and for the fiscal years ended September 30, 2003 and 2002 presented in this table are derived from our audited consolidated financial statements and related notes which are not included or incorporated by reference in this prospectus. Summary historical consolidated financial data for the three months ended March 31, 2007 and 2006 and the condensed consolidated balance sheet data as of March 31, 2007 and 2006, has been derived from our unaudited consolidated financial statements and related notes, which have been incorporated by reference in this prospectus.

The summary historical data included below and elsewhere in this prospectus are not necessarily indicative of future performance. This information is only a summary and should be read in conjunction with “Capitalization,” “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included, or incorporated by reference, in this prospectus.

12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended

September 30,

| | | Transition Period

Quarter Ended

December 31,

| | | Year Ended

December 31,

| | | Three Months

Ended March 31,

| |

| | | Predecessor

| | | Predecessor

| | | Successor

| | | Successor

| |

| | | 2002

| | | 2003

| | | 2004

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2006

| | | 2007

| |

| | | | | | | | | | | | (Unaudited) | | | | | | | | | | | | (Unaudited) | | | (Unaudited) | |

(dollars and share amounts in thousands, except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue(1)(2) | | $ | 172,231 | | | $ | 365,164 | | | $ | 490,248 | | | $ | 124,789 | | | $ | 136,893 | | | $ | 515,253 | | | $ | 754,457 | | | $ | 166,461 | | | $ | 218,421 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of sales (excluding amortization and impairments)(3) | | | 19,366 | | | | 42,042 | | | | 53,488 | | | | 11,408 | | | | 34,529 | | | | 95,224 | | | | 151,750 | | | | 31,807 | | | | 50,597 | |

Selling, general and administrative(3)(4) | | | 47,174 | | | | 124,786 | | | | 146,205 | | | | 37,745 | | | | 41,463 | | | | 162,670 | | | | 253,937 | | | | 38,286 | | | | 77,898 | |

Impairment of intangible assets | | | — | | | | — | | | | — | | | | — | | | | — | | | | 38,876 | | | | — | | | | — | | | | — | |

Research and development | | | 16,000 | | | | 24,874 | | | | 26,558 | | | | 6,692 | | | | 4,608 | | | | 58,636 | | | | 26,818 | | | | 9,571 | | | | 7,432 | |

Amortization of intangible assets(3)(5) | | | 18,252 | | | | 38,106 | | | | 52,374 | | | | 13,185 | | | | 21,636 | | | | 233,473 | | | | 253,425 | | | | 58,826 | | | | 57,553 | |

Acquired in-process research and development(3) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 280,700 | | | | — | | | | — | | | | — | |

Transaction costs(3) | | | — | | | | — | | | | — | | | | — | | | | 50,973 | | | | 35,975 | | | | — | | | | — | | | | — | |

Net interest expense(3) | | | 18,916 | | | | 7,686 | | | | 9,256 | | | | 3,152 | | | | 1,214 | | | | 147,934 | | | | 206,994 | | | | 45,092 | | | | 30,944 | |

Accretion on preferred stock of subsidiary(6) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 31,533 | | | | 26,190 | | | | 8,701 | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before taxes | | | 52,523 | | | | 127,670 | | | | 202,367 | | | | 52,607 | | | | (17,530 | ) | | | (569,768 | ) | | | (164,657 | ) | | | (25,822 | ) | | | (6,003 | ) |

Provision (benefit) for income taxes | | | 18,858 | | | | 41,380 | | | | 59,390 | | | | 12,312 | | | | 11,558 | | | | (13,122 | ) | | | (11,147 | ) | | | 1,434 | | | | (1,501 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) from continuing operations | | | 33,665 | | | | 86,290 | | | | 142,977 | | | | 40,295 | | | | (29,088 | ) | | | (556,646 | ) | | | (153,510 | ) | | | (27,256 | ) | | | (4,502 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Discontinued operations, net of tax(7) | | | 111,511 | | | | 9,865 | | | | 8,711 | | | | 2,405 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 145,176 | | | $ | 96,155 | | | $ | 151,688 | | | $ | 42,700 | | | $ | (29,088 | ) | | $ | (556,646 | ) | | $ | (153,510 | ) | | $ | (27,256 | ) | | $ | (4,502 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of earnings to fixed charges(12) | | | 2.7 | x | | | 11.8 | x | | | 18.5 | x | | | 14.7 | x | | | (12 | ) | | | (12 | ) | | | 0.1 | x | | | 0.4 | x | | | 0.8 | x |

Per Share Data(8): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) per share—basic | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | $ | (7.19 | ) | | $ | (1.63 | ) | | $ | (0.55 | ) | | $ | (0.02 | ) |

Class L | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | $ | 7.35 | | | $ | 6.33 | | | $ | 2.05 | | | $ | n.m. | |

Earnings (loss) per share—diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | $ | (7.19 | ) | | $ | (1.63 | ) | | $ | (0.55 | ) | | $ | (0.02 | ) |

Class L | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | $ | 7.34 | | | $ | 6.33 | | | $ | 2.05 | | | $ | n.m. | |

Weighted average shares outstanding—basic | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | 88,311 | | | | 133,897 | | | | 89,269 | | | | 248,619 | |

Class L | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | 10,642 | | | | 10,280 | | | | 10,671 | | | | n.m. | |

Weighted average shares outstanding—diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | 88,311 | | | | 133,897 | | | | 89,269 | | | | 248,619 | |

Class L | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | n.m. | | | | 10,668 | | | | 10,282 | | | | 10,672 | | | | n.m. | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 315,571 | | | $ | 88,571 | | | $ | 186,251 | | | $ | 167,500 | | | $ | 229,565 | | | $ | 11,502 | | | $ | 84,464 | | | $ | 20,809 | | | $ | 68,502 | |

Total assets(3)(9)(10) | | | 1,072,231 | | | | 1,456,419 | | | | 1,419,295 | | | | 1,614,403 | | | | 1,454,243 | | | | 3,041,877 | | | | 3,162,545 | | | | 3,246,964 | | | | 3,119,593 | |

Total long-term debt(3)(9)(10)(11) | | | 49,158 | | | | 341,078 | | | | 191,701 | | | | 341,582 | | | | 192,199 | | | | 1,989,500 | | | | 1,550,750 | | | | 2,226,000 | | | | 1,487,802 | |

Preferred stock in subsidiary(6) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 435,925 | | | | — | | | | 444,689 | | | | — | |

Shareholders’ equity(3) | | | 909,007 | | | | 997,125 | | | | 1,126,640 | | | | 1,051,701 | | | | 1,104,087 | | | | 332,510 | | | | 1,328,232 | | | | 307,945 | | | | 1,323,128 | |

| (1) | The increase in product revenues from fiscal year 2002 to fiscal year 2003 and from fiscal year 2003 to fiscal year 2004 was in part attributable to product acquisitions. |

13

| (2) | In March 2004, we sold the U.S. and Canadian rights to our then-marketed Loestrin products to a unit of Barr. Following this sale, we continued to earn revenue from supplying Loestrin under a supply agreement. Our total revenue for fiscal years 2004 and 2003, excluding revenue attributable to Loestrin product sales, were $464.0 million and $326.6 million, respectively. |

| (3) | Completing the Acquisition affected our financial condition, results of operations and cash flows in the following ways: |

| | a. | In the quarter ended December 31, 2004 we incurred $51.0 million of transaction costs and $3.7 million of incremental selling, general and administrative costs directly related to the closing of the Acquisition; and |

| | b. | During the year ended December 31, 2005 we completed the Acquisition for total consideration of $3,152.1 million, which was funded by approximately $1,282.8 million of equity contributions, $1,420.0 million of senior secured debt (including $20.0 million borrowed under the revolving credit facility at the time of acquisition), $600.0 million of the notes and cash on hand. We recorded adjustments to the fair value of our assets and liabilities as of the date of the Acquisition. During 2005, the following items were included in our operating results: |

| | • | a charge of $22.4 million in cost of sales representing the write-off of the purchase price allocated to the fair value of our opening inventory, |

| | • | $7.8 million of incremental selling, general and administrative costs directly related to the closing of the Acquisition, |

| | • | $4.9 million in selling, general and administrative expense for the management fee to our Sponsors, |

| | • | increased amortization expense resulting from the write-up of our identified intangible assets, |

| | • | a $280.7 million write-off of acquired in-process research and development, |

| | • | $36.0 million of transaction costs, and |

| | • | increased interest expense from the indebtedness we incurred to complete the Acquisition. |

| (4) | In 2006, SG&A costs include $42.1 million of expenses directly related to our IPO. |

| (5) | In January 2005 (at the time of the Acquisition), intangible assets were re-valued at fair market value increasing the amounts to be amortized from that of the Predecessor. |

| (6) | Our wholly-owned subsidiary, Warner Chilcott Holdings Company II, Limited, issued 404,439 Preferred Shares in connection with the Transactions. The Preferred Shares are entitled to cumulative preferential dividends at an accretion rate of 8% per annum, compounded quarterly. All of the Preferred Shares were either converted to Class A common shares or redeemed for cash at the time of the IPO in September 2006. |

| (7) | Discontinued operations represented our Pharmaceutical services businesses, which were Interactive Clinical Technologies, Inc. (sold in August 2002), our Clinical Trial Services business (sold in May 2002) and our Chemical Synthesis Services business (sold in December 2001). In addition, in December 2003, we sold our Pharmaceutical Development and Manufacturing Services business, in April 2004 we sold our U.K. Pharmaceutical Sales and Marketing business and in May 2004 we sold our U.K.-based sterile solutions business. We received $343.0 million of proceeds net of costs for the sale of these businesses. The high level of discontinued operations in 2002 is due to the gain on disposal of our above-mentioned Pharmaceutical services business of $101.1 million, net of taxes of $3.9 million. No business was divested in fiscal year 2003. The discontinued operations for fiscal year 2004 included a gain on disposal of $5.4 million, net of a tax charge of $11.8 million on the sale of our Pharmaceutical Development and Manufacturing Services business, our U.K. Pharmaceutical Sales and Marketing business and our U.K.-based sterile solutions business. |

| (8) | The Company purchased all outstanding shares of the Predecessor as part of the Acquisition, making the Predecessor’s earnings per share not comparable to the Successor’s earnings per share. The Successor was in a net loss position in both 2005 and 2006. The effect from the exercise of outstanding stock options and the vesting of restricted shares during the periods would have been anti-dilutive. Accordingly, the shares issuable upon exercise of such stock options and the restricted shares have not been included in the calculation of diluted earnings per share. The December 31, 2006 earnings per share of the Class L common shares is calculated through September 30, 2006 as there were no Class L common shares outstanding during the fourth quarter of 2006 or the first quarter of 2007. |

| (9) | During the year ended December, 2006 we completed the acquisition of the U.S. sales and marketing rights to Dovonex for $205.2 million and paid the final milestone payment for Taclonex of $40.0 million. We borrowed $240.0 million in connection with these transactions and recorded $238.5 million in intangible assets. |

| (10) | In 2002, we repurchased 2 million ordinary shares (0.5 million ADS equivalents). In 2004, we repurchased 2.8 million ordinary shares (0.7 million ADS equivalents). |

| (11) | Reflects the issuance of $350.0 million of long-term debt to finance a portion of the acquisition of products for approximately $650.0 million in 2003. |

| (12) | For purposes of these computations, earnings consist of income from continuing operations before income taxes plus fixed charges, plus the amortization of capitalized interest, less interest capitalized. Fixed charges include interest on indebtedness from both continuing and discontinued operations, amortization of debt issuance costs, capitalized interest and the portion of lease rental expense representative of interest. In the opinion of management, we estimate the interest component of lease rental expense to be one third of lease rental expense. For the quarter ended December 31, 2004 and the year ended December 31, 2005, our earnings were insufficient by $17.5 million and $569.8 million, respectively, to cover our fixed charges for such periods. |

14

RECENT DEVELOPMENTS

Legal Proceedings

Certain legal proceedings in which we are involved are discussed in Note 11 to the Condensed Consolidated Financial Statements included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2007. The following discussion is limited to recent developments concerning our legal proceedings with respect to the Federal Trade Commission lawsuits regarding the exercise of an option for a five-year exclusive license to Barr’s abbreviated new drug application (“ANDA”) referencing Ovcon 35. This section should be read in conjunction with our Quarterly Report and unless otherwise indicated, all proceedings discussed in our Quarterly Report remain outstanding.

Federal Trade Commission Lawsuits Regarding Exercise of Option for a Five-Year Exclusive License to ANDA Referencing Ovcon 35

In connection with the eight direct purchaser lawsuits filed against us and Barr in the U.S. District Court for the District of Columbia, on March 12, 2007, the direct purchaser class action plaintiffs filed a motion for class certification. Defendants filed a response in opposition on April 12, 2007. The direct purchaser class action plaintiffs filed a reply on May 21, 2007. The motion is fully briefed and is pending before the U.S. District Court.

With respect to the actions brought by the third-party payor plaintiffs and the consumer plaintiffs, we agreed to settlements in principle on April 9, 2007. We signed a settlement agreement with the third-party payor plaintiffs on May 15, 2007, and with the consumer plaintiffs on May 17, 2007. On April 16, 2007, we agreed to a settlement in principle with the state plaintiffs. Counsel for the consumer plaintiffs filed a motion for preliminary approval of the settlement on June 6, 2007, and counsel for the third-party payor plaintiffs filed a motion for preliminary approval of the settlement on June 12, 2007. We filed a joint motion with the state plaintiffs on June 12, 2007, asking the Court to approve our proposed final order. All three settlements remain subject to necessary approvals by the parties and the U.S. District Court.

15

RISK FACTORS

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before making an investment decision. Additional risks and uncertainties not currently known to us or those we currently deem to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially adversely affect our business, financial condition, results of operations or cash flows. In such cases, you may lose all or part of your original investment in our common stock.

Risks Related to the Notes

We have a substantial amount of indebtedness, which may adversely affect our cash flow and our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness, including the notes.

We have a significant amount of indebtedness. As of March 31, 2007, we had total indebtedness of $1,487.8 million.

Our substantial level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay, when due, the principal of, interest on or other amounts due in respect of our indebtedness. Our substantial indebtedness, combined with our lease and other financial obligations and contractual commitments could have other important consequences to you as a holder of the notes. For example, it could:

| | Ÿ | | make it more difficult for us to satisfy our obligations with respect to our indebtedness, including the notes, and any failure to comply with the obligations of any of our debt instruments, including financial and other restrictive covenants, could result in an event of default under the indenture governing the notes and the agreements governing such other indebtedness; |

| | Ÿ | | make us more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation; |

| | Ÿ | | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flows to fund working capital, capital expenditures, acquisitions and other general corporate purposes; |

| | Ÿ | | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| | Ÿ | | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| | Ÿ | | limit our ability to borrow additional amounts for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other purposes. |

Any of the above listed factors could materially adversely affect our business, financial condition and results of operations. Furthermore, our interest expense could increase if interest rates increase because debt under our senior secured credit facility bears interest at our option at either adjusted LIBOR plus an applicable margin or the alternate base rate plus an applicable margin. If we do not have sufficient earnings to service our debt, we may be required to refinance all or part of our existing debt, sell assets, borrow more money or sell securities, none of which we can guarantee we will be able to do.

In addition, the senior secured credit facility and the indenture governing the notes contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all our debt.

16

Despite current indebtedness levels, we and our subsidiaries may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial leverage.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. Although the indenture governing the notes and the senior secured credit facility contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions, and the indebtedness incurred in compliance with these restrictions could be substantial. Our senior secured credit facility and the indenture governing the notes permit the incurrence of additional borrowings of up to $150.0 million under our revolving credit facility, subject, in the case of our senior secured credit facility, to compliance with the covenants and conditions to borrowings under our senior secured credit facility. All of those borrowings would rank senior to the notes and the guarantees thereof. If new debt is added to our and our subsidiaries’ current debt levels, the related risks that we and they face would be increased. In addition, the indenture does not prevent us from incurring obligations that do not constitute indebtedness. Any additional borrowings could be senior to the notes and the related guarantees. If we incur additional debt above the levels that were in effect at the time of the closing of the Transactions, the risks associated with our substantial leverage will increase.

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations.

Our ability to pay interest on and principal of the notes and to satisfy our other debt obligations principally will depend upon our future operating performance. As a result, prevailing economic conditions and financial, business and other factors, many of which are beyond our control, will affect our ability to make these payments.

If we do not generate sufficient cash flow from operations to satisfy our debt service obligations, including payments on the notes, we may have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness, selling assets, reducing or delaying capital investments or seeking to raise additional capital. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition, the terms of existing or future debt instruments, including the senior secured credit facility, and the indenture governing the notes offered hereby, may restrict us from adopting some of these alternatives. Our inability to generate sufficient cash flow to satisfy our debt service obligations, or to refinance our obligations at all or on commercially reasonable terms, would have an adverse effect, which could be material, on our business, financial condition and results of operations, as well as on our ability to satisfy our obligations in respect of the notes.

Repayment of our debt, including the notes, is dependent on cash flow generated by our subsidiaries.

All of Warner Chilcott Limited, Holdings, Luxco and Warner Chilcott Corporation are holding companies, and since immediately following the Transactions, all of their operating assets have been owned by their subsidiaries. Repayment of our indebtedness, including the notes, is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are guarantors of the notes, our subsidiaries do not have any obligation to pay amounts due on the notes or to make funds available for that purpose. Our subsidiaries may not be able to, or be permitted to, make distributions to enable us to make

17

payments in respect of our indebtedness, including the notes. Each of our subsidiaries is a distinct legal entity and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. While the indenture governing the notes limits the ability of our subsidiaries to incur consensual restrictions on their ability to pay dividends or make other intercompany payments to us, these limitations are subject to certain qualifications and exceptions. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the notes.

Since each of Warner Chilcott Limited, Holdings and Luxco is a holding company with no significant operations, the guarantees by Warner Chilcott Limited, Holdings and Luxco provide little, if any, additional credit support for the notes and investors should not rely on these guarantees in evaluating an investment in the notes.

Only certain of the subsidiaries of Holdings guarantee the notes, and the assets of the non-guarantor subsidiaries may not be available to make payments on the notes.

Certain foreign subsidiaries of Holdings, other than Luxco and Warner Chilcott Company, Inc., do not guarantee the notes. As of March 31, 2007, the non-guarantor subsidiaries accounted for approximately $313.0 million, or 10.0%, of our total assets and a nominal amount of revenues (after intercompany eliminations). Certain of these non-guarantor subsidiaries are guarantors of the borrowers’ obligations under our senior secured credit facility. In addition, the indenture permits these subsidiaries to incur additional amounts of indebtedness in the future. In the event that any non-guarantor subsidiary becomes insolvent, liquidates, reorganizes, dissolves or otherwise winds up, holders of its indebtedness and its trade creditors generally will be entitled to payment on their claims from the assets of that subsidiary before any of those assets are made available to us. Consequently, your claims in respect of the notes will be effectively subordinated to all of the liabilities of the non-guarantor subsidiaries, including their obligations under or in respect of our senior secured credit facility, trade payables, and the claims, if any, of third party holders of preferred equity interests in the non-guarantor subsidiaries.

The terms of our senior secured credit facility and the indenture governing the notes restrict our current and future operations, particularly our ability to respond to changes in our business or to take certain actions.

Our senior secured credit facility and the indenture governing the notes contain, and any future indebtedness of ours would likely contain, a number of restrictive covenants that impose significant operating and financial restrictions on Warner Chilcott Corporation, Holdings and the other restricted subsidiaries of Holdings, including restrictions on our ability to engage in acts that may be in our best long-term interests. Our senior secured credit facility includes financial covenants, including requirements that we:

| | Ÿ | | maintain minimum interest coverage ratios; and |

| | Ÿ | | not exceed maximum total leverage ratios. |

Our senior secured credit facility limits the ability of Warner Chilcott Corporation, Holdings and their restricted subsidiaries to make capital expenditures and requires that they use a portion of excess cash flow and proceeds of certain asset sales that are not reinvested in their business and other dispositions to repay indebtedness under the senior secured credit facility.

Our senior secured credit facility also includes covenants restricting, among other things, the ability of Warner Chilcott Corporation, Holdings and its restricted subsidiaries to:

| | Ÿ | | incur or assume additional debt or guarantees or issue preferred stock; |

18

| | Ÿ | | pay dividends, or make redemptions and repurchases, with respect to capital stock; |

| | Ÿ | | prepay, or make redemptions and repurchases of, subordinated debt; |

| | Ÿ | | make loans and investments; |

| | Ÿ | | make capital expenditures; |

| | Ÿ | | engage in mergers, acquisitions, asset sales, sale/leaseback transactions and transactions with affiliates; |

| | Ÿ | | change the business conducted by us or our subsidiaries; and |

| | Ÿ | | amend the terms of subordinated debt. |

The indenture relating to the notes also contains numerous covenants including, among other things, restrictions on Warner Chilcott Corporation’s, Holdings’ and the restricted subsidiaries of Holdings’ ability to:

| | Ÿ | | incur or guarantee additional indebtedness or issue disqualified or preferred stock; |

| | Ÿ | | pay dividends or make other equity distributions; |

| | Ÿ | | repurchase or redeem capital stock; |

| | Ÿ | | make investments or other restricted payments; |

| | Ÿ | | sell assets or consolidate or merge with or into other companies; |

| | Ÿ | | create limitations on the ability of our restricted subsidiaries to make dividends or distributions to us; and |

| | Ÿ | | engage in transactions with affiliates. |

The operating and financial restrictions and covenants in these debt agreements and any future financing agreements may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. A breach of any of the restrictive covenants in the senior secured credit facility would result in a default under the senior secured credit facility. If any such default occurs, the lenders under the senior secured credit facility may elect to declare all outstanding borrowings, together with accrued interest and other fees, to be immediately due and payable, or enforce their security interest, any of which would result in an event of default under the notes. The lenders will also have the right in these circumstances to terminate any commitments they have to provide further borrowings.

Your right to receive payment on the notes and the guarantees are junior to the rights of the lenders under our senior secured credit facility and to all of our and the guarantors’ other senior indebtedness, including any of our or the guarantors’ future senior debt.

The notes and the guarantees rank in right of payment behind all of our and the guarantors’ existing senior indebtedness, including borrowings under our senior secured credit facility, and rank in right of payment behind all of our and the guarantors’ future borrowings, except any future indebtedness that expressly provides that it ranks equally or is junior in right of payment to the notes and the guarantees. See “Description of the Notes—Ranking.” As of March 31, 2007 the notes and the guarantees were contractually subordinated to approximately $1,097.8 million of senior debt. In addition, our senior secured credit facility and the indenture governing the notes permit us to incur up to $150.0 million in additional borrowings under our revolving credit facility (of which $0 was outstanding as of December 31, 2006 and March 31, 2007), subject, in the case of our senior secured credit facility, to compliance with the covenants and conditions to borrowings under the senior secured

19

credit facility, which borrowings would be senior to the notes and the guarantees. We are also permitted to incur substantial additional indebtedness, including senior indebtedness, in the future.

We and the guarantors may not pay principal, premium, if any, interest or other amounts on account of the notes or the guarantees in the event of a payment default or certain other defaults in respect of certain of our senior indebtedness, including debt under the senior secured credit facility, unless the senior indebtedness has been paid in full or the default has been cured or waived. In addition, in the event of certain other defaults with respect to the senior indebtedness, we or the guarantors may not be permitted to pay any amount on account of the notes or the guarantees for a designated period of time. See “Description of the Notes—Ranking—Payment of Notes.” Because of the subordination provisions in the notes and the guarantees, in the event of a bankruptcy, liquidation, reorganization or similar proceeding relating to us or a guarantor, our or the guarantor’s assets will not be available to pay obligations under the notes or the applicable guarantee until we have, or the guarantor has, made all payments in cash on its senior indebtedness. Sufficient assets may not remain after all these payments have been made to make any payments on the notes or the applicable guarantee, including payments of principal or interest when due.

Pursuant to the subordination provisions of the indenture governing the notes, all payments on the notes and the guarantees will be blocked in the event of a payment default on designated senior debt and may be blocked for up to 179 consecutive days in the event of certain non-payment defaults on designated senior debt.

In addition, in the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to us or the guarantors, holders of the notes will participate with trade creditors and all other holders of our and the guarantors’ senior subordinated indebtedness, as the case may be, in the assets, if any, remaining after we and the guarantors have paid all of the senior indebtedness. However, because the indenture requires that amounts otherwise payable to holders of the notes in a bankruptcy or similar proceeding be paid to holders of senior indebtedness instead, holders of the notes may receive less, ratably, than holders of trade payables or other unsecured, unsubordinated creditors in any such proceeding. In any of these cases, we and the guarantors may not have sufficient funds to pay all of our creditors, and holders of the notes may receive less, ratably, than the holders of senior indebtedness. See “Description of the Notes—Ranking.”

The notes are not secured by our assets and the lenders under our senior secured credit facility are entitled to remedies available to a secured lender, which gives them priority over you to collect amounts due to them.

In addition to being subordinated to all our and the guarantors’ existing and future senior debt, the notes and the guarantees are not secured by any of our or their assets. Loans under our senior secured credit facility are secured by a first priority security interest in substantially all of our, Holdings’, Warner Chilcott Company, Inc.’s and the subsidiary guarantors’ assets and in all of the capital stock held by us, Holdings, Warner Chilcott Company, Inc. and the subsidiary guarantors (but, other than in the case of Warner Chilcott Company, Inc., limited to 65% of the voting stock in the case of direct foreign subsidiaries and 0% in the case of indirectly held foreign subsidiaries). Loans under our senior secured credit facility are also secured by a non-recourse pledge of the capital stock of Holdings by its direct parent company, Warner Chilcott Holdings Company II, Limited. In addition, loans made to Holdings and Warner Chilcott Company, Inc. under the senior secured credit facility are also secured by a first priority security interest in substantially all the assets of our material foreign subsidiaries who guarantee loans under our senior secured credit facility. As of March 31, 2007, we had $1,097.8 million of senior secured indebtedness. If we become insolvent or are liquidated, or if payment under the senior secured credit facility or in respect of any other secured indebtedness is accelerated, the lenders under our senior secured credit facility or holders of other secured indebtedness will be entitled

20

to exercise the remedies available to a secured lender under applicable law (in addition to any remedies that may be available under documents pertaining to our senior secured credit facility or other senior debt). Upon the occurrence of any default under our senior secured credit facility (and even without accelerating the indebtedness under our senior secured credit facility), the lenders may be able to prohibit the payment of the notes and the guarantees either by limiting our ability to access our cash flow or under the subordination provisions contained in the indenture governing the notes.

We may not be able to repurchase the notes upon a change of control.

Upon the occurrence of certain change of control events, we will be required to offer to repurchase all notes that are outstanding at 101% of the principal amount thereof, plus any accrued and unpaid interest, and additional interest, if any. The senior secured credit facility provides that certain change of control events (including a Change of Control as defined in the indenture relating to the notes) constitute a default. Any future credit agreement or other agreements relating to senior indebtedness to which we become a party would likely contain similar provisions. If we experience a change of control that triggers a default under our senior secured credit facility, we could seek a waiver of such default or seek to refinance our senior secured credit facility. In the event we do not obtain such a waiver or refinance the senior secured credit facility, such default could result in amounts outstanding under our senior secured credit facility being declared due and payable. In the event we experience a change of control that results in our having to repurchase your notes, we may not have sufficient financial resources to satisfy all of our obligations under our senior secured credit facility and/or the notes. A failure to make the applicable change of control offer or to pay the applicable change of control purchase price when due would result in a default under the indenture.

In addition, the change of control covenant in the indenture governing the notes does not cover all corporate reorganizations, mergers or similar transactions and may not provide you with protection in a highly leveraged transaction. Furthermore, the definition of “Permitted Holders” under the indenture governing the notes includes a “group” in which the Sponsors, their affiliates and officers of our company collectively have beneficial ownership, directly or indirectly, of more than 50% of the total voting power of the voting stock of Holdings or any of its direct or indirect parent entities owned by such group. As a result, the Sponsors may be able to transfer a significant portion of their holdings in our company without triggering a change of control under the indenture. See “Description of the Notes—Certain Covenants,” “Description of the Notes—Repurchase at the Option of Holders—Change of Control” and “Description of the Notes—Certain Definitions—Permitted Holders.” The purchase offer requirements could also delay or make it more difficult for others to effect a change of control.

Federal and state statutes allow courts, under specific circumstances, to void the notes and the guarantees, subordinate claims in respect of the notes and the guarantees and require note holders to return payments received from us or the guarantors.

A portion of the proceeds from the sale of the notes was applied, together with the equity investment made by the Sponsors, certain of their limited partners and certain members of our management and borrowings under our senior secured credit facility, to make payments to holders of capital stock and options of Warner Chilcott PLC in connection with the Transactions. Luxco, Warner Chilcott Limited, Holdings, Holdings’ U.S. subsidiaries and Warner Chilcott Company, Inc. have guaranteed our obligations under the notes. Our issuance of the notes and the issuance of the guarantees by the guarantors may be subject to review under state and federal laws if a bankruptcy, liquidation or reorganization case or a lawsuit, including in circumstances in which bankruptcy is not involved, were commenced at some future date by, or on behalf of, our unpaid creditors or the unpaid creditors of a guarantor. Under the federal bankruptcy laws and comparable provisions of state fraudulent transfer laws, a court may void or otherwise decline to enforce the notes or a guarantor’s guaranty, or subordinate the notes or such guaranty to our or the applicable guarantor’s existing and future indebtedness. While the relevant laws may vary from state to state, a court might do so if it found that when we issued the notes or the applicable guarantor entered into its guaranty or, in some

21

states, when payments became due under the notes or such guaranty, we or the applicable guarantor received less than reasonably equivalent value or fair consideration and either:

| | Ÿ | | we or the applicable guarantor were or was insolvent, or rendered insolvent, by reason of such incurrence; |

| | Ÿ | | we or the applicable guarantor were or was engaged in a business or transaction for which our or the applicable guarantor’s remaining assets constituted unreasonably small capital; or |

| | Ÿ | | we or the applicable guarantor intended to incur, or believed that we or the applicable guarantor would incur, debts beyond our or such guarantor’s ability to pay such debts as they mature. |

The court might also void the notes or a guaranty, without regard to the above factors, if the court found that we issued the notes or the applicable guarantor entered into its guaranty with actual intent to hinder, delay or defraud our or its creditors. In addition, any payment by us under the notes or by a guarantor pursuant to its guarantee could be voided and required to be returned to us, such guarantor or to a fund for the benefit of our or such guarantor’s creditors. In the event of a finding that a fraudulent conveyance occurred, you may not receive any payment on the notes.

A court would likely find that we or a guarantor did not receive reasonably equivalent value or fair consideration for the notes or such guaranty if we or such guarantor did not substantially benefit directly or indirectly from the issuance of the notes or the applicable guarantee. Our use of proceeds from the Transactions, which included the distribution of a substantial portion of the proceeds from the offering of the notes to Warner Chilcott PLC’s shareholders, could increase the risk of such a finding. If a court were to void the notes or a guaranty, you would no longer have a claim against us or the applicable guarantor, as the case may be. Sufficient funds to repay the notes may not be available from other sources, including the remaining guarantors, if any. In addition, the court might direct you to repay any amounts that you already received from us or any guarantor, as the case may be.